Invoice Installments Template for Flexible Payment Plans

Managing payments over time is a key aspect of maintaining healthy business operations. When offering customers the option to pay in smaller amounts, it’s essential to have clear and structured documentation to ensure smooth transactions. This guide will explore how to set up such payment arrangements effectively, helping businesses cater to clients while maintaining financial stability.

Breaking down payments into manageable segments can significantly enhance customer satisfaction and increase the likelihood of on-time payments. By creating a clear framework for these arrangements, businesses can ensure transparency and avoid potential disputes. The process is streamlined when a well-organized format is in place to outline the terms and expectations for both parties.

In this article, we will delve into the steps to design an effective agreement system for distributing payments, focusing on key components, customization options, and the best practices to follow. Whether for small businesses or large enterprises, implementing this type of system can lead to long-term benefits in managing client relationships and cash flow.

Invoice Installments Template Overview

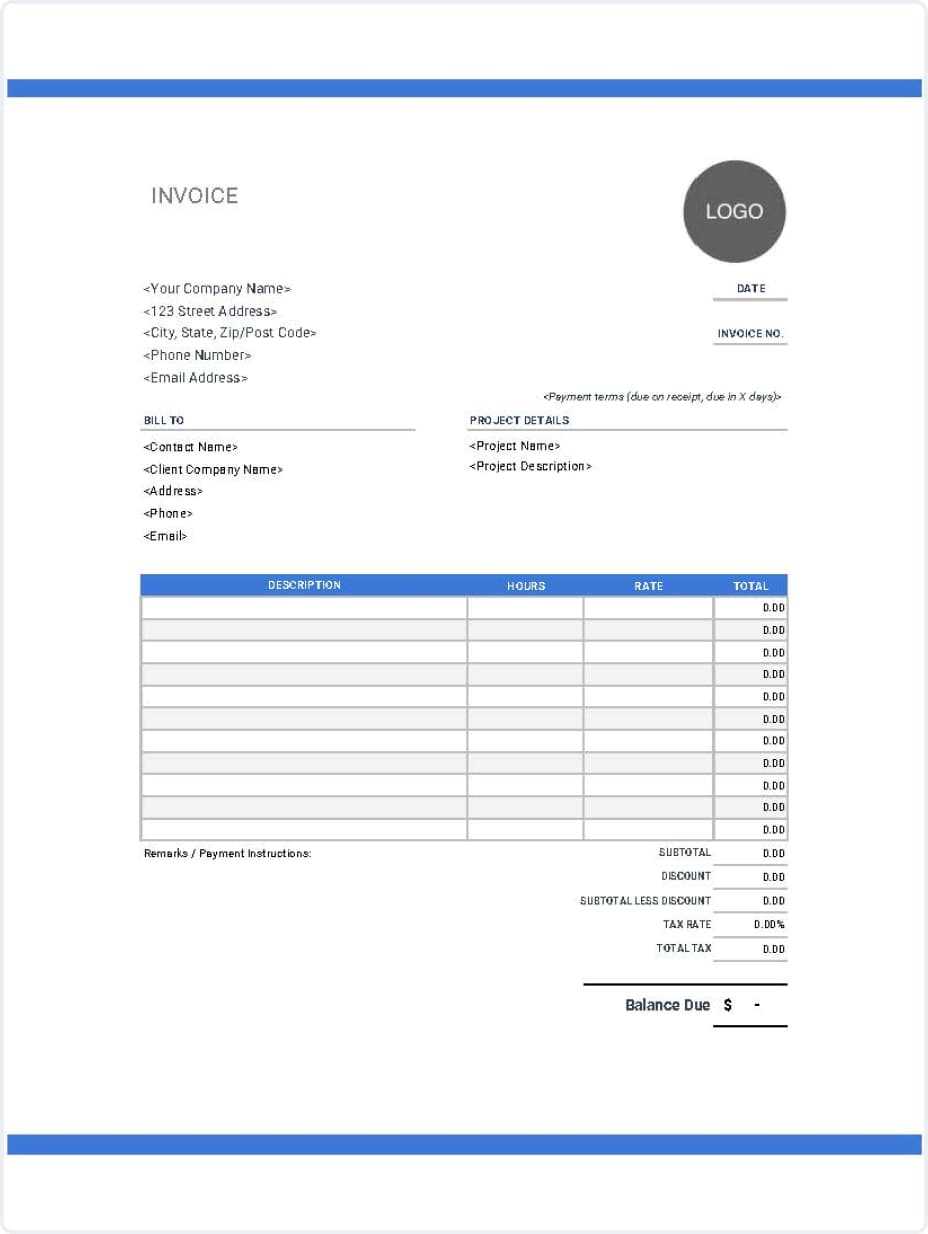

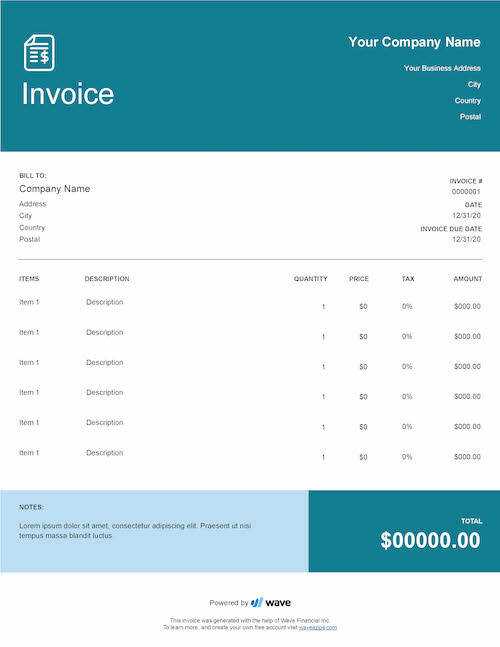

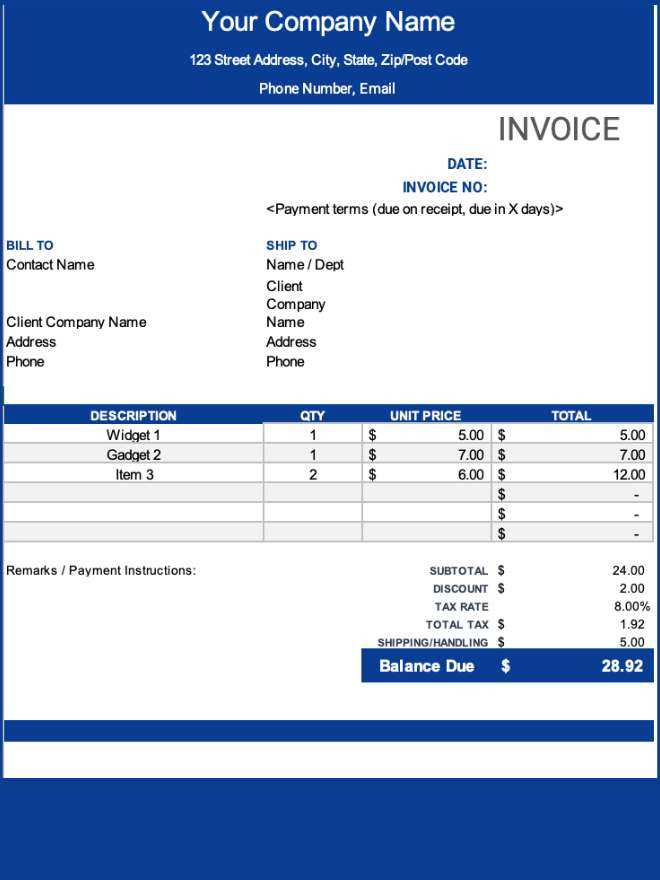

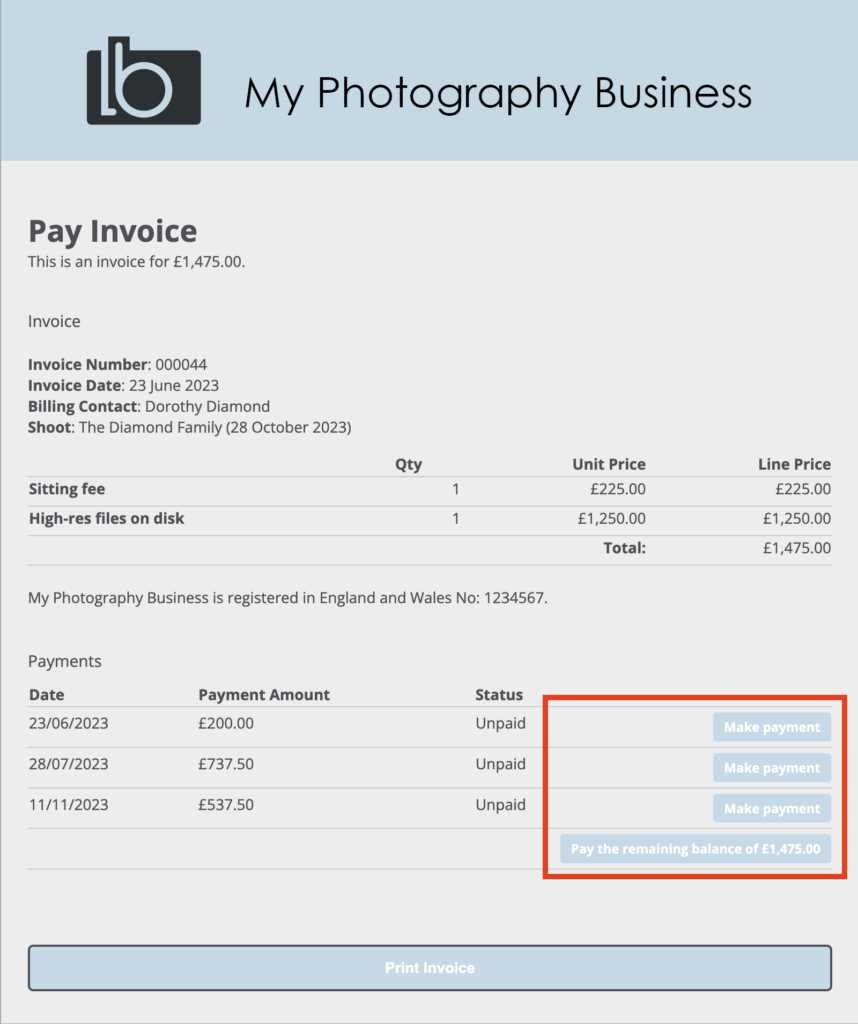

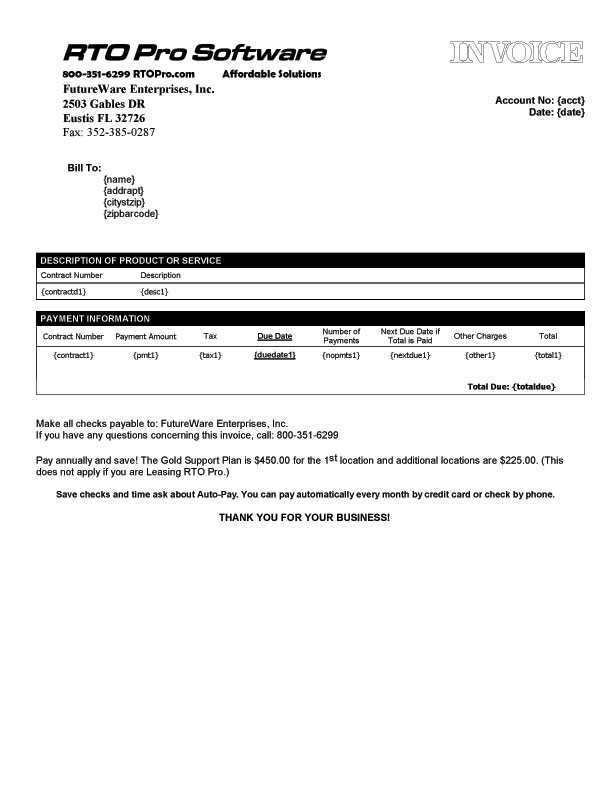

When offering flexible payment plans to clients, it’s essential to have a structured document that clearly defines the terms and expectations. A well-organized document ensures that both parties understand the agreed-upon schedule, payment amounts, and deadlines, helping to maintain financial clarity and minimize misunderstandings. This section will provide an overview of how to design such a system effectively.

Using a clear, consistent format allows businesses to present detailed payment terms in an easily digestible way. With the right structure, customers can see the breakdown of costs, any applicable fees, and the total amount due over time. This approach also supports improved communication and creates a professional image for your business.

Having an organized payment plan system in place not only simplifies the process but also builds trust with customers. A well-drafted agreement reduces the chances of late payments and disputes. This overview will help you understand the key components that should be included in any payment plan framework and why they matter to both the business and the client.

Benefits of Using Payment Installment Plans

Offering clients the option to divide payments into smaller, manageable amounts can be an effective strategy for both businesses and customers. This approach not only improves cash flow but also enhances customer satisfaction by making larger purchases more accessible. Below are some key advantages of adopting this method.

- Improved Cash Flow: Breaking up payments allows businesses to receive partial payments over time, helping to maintain steady revenue while providing flexibility for customers.

- Increased Sales: When customers can pay over a longer period, they are more likely to make larger purchases, leading to higher sales volume.

- Customer Retention: Offering flexible payment options can foster long-term customer loyalty, as clients appreciate businesses that understand their financial needs.

- Reduced Financial Barriers: Smaller, periodic payments make it easier for customers to afford products or services, reducing the likelihood of them walking away due to upfront costs.

- Lower Risk of Payment Delays: Clear terms and deadlines help ensure that payments are made on time, reducing the risk of overdue balances.

These benefits not only enhance customer experience but also help businesses manage their financial operations more efficiently. By making it easier for customers to commit to purchases, businesses can build stronger relationships and improve their overall profitability.

How to Create a Payment Plan Agreement

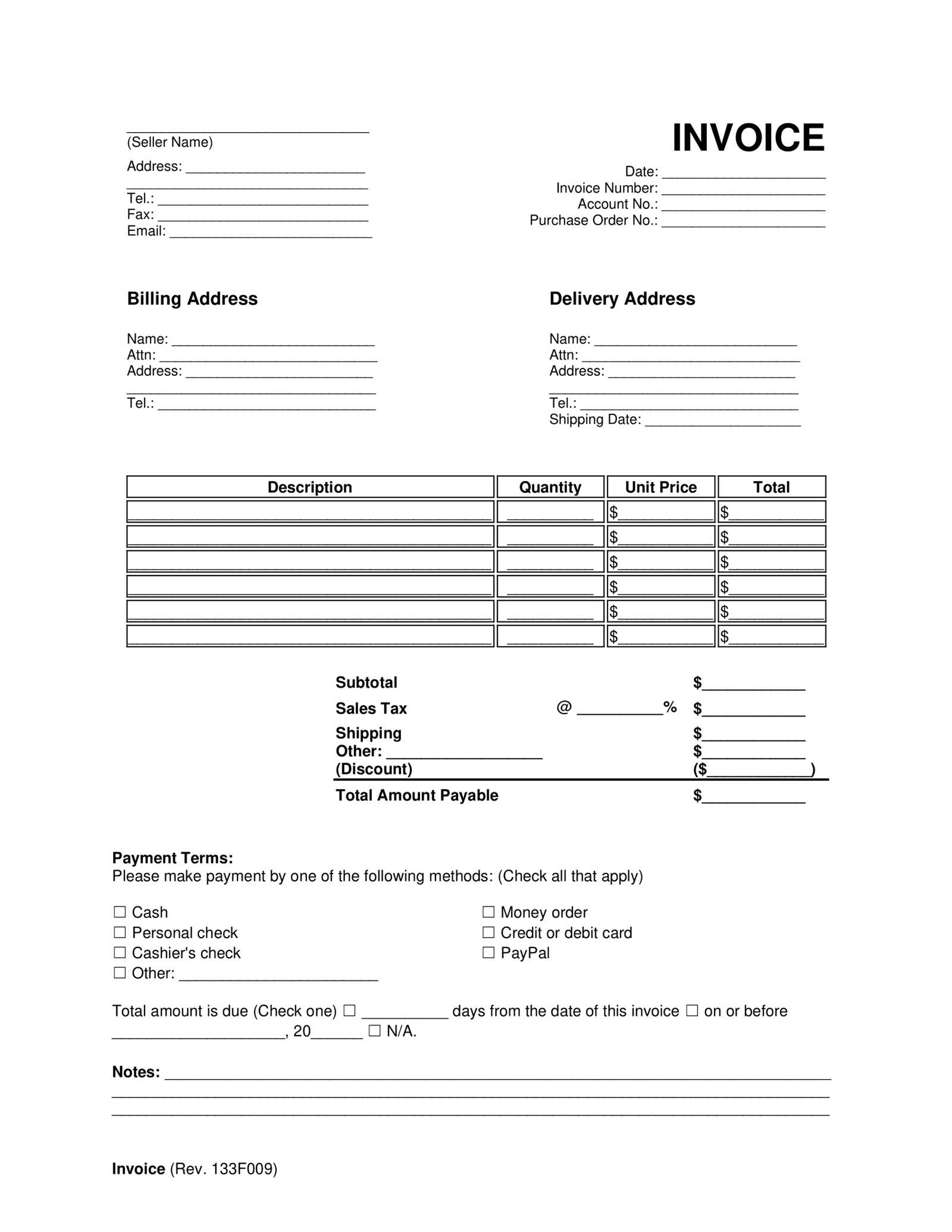

Designing a structured agreement for dividing payments requires careful attention to detail and clarity. The goal is to ensure that both the business and the customer understand the terms, including the total amount due, the payment schedule, and any additional fees. Below are the essential steps for creating a well-organized plan for managing payments over time.

1. Define the Payment Terms

Start by outlining the payment schedule. Specify the total amount, the number of payments, and the amount due for each installment. Be clear about the payment frequency, whether it’s weekly, bi-weekly, or monthly. Also, make sure to mention the due dates for each payment and any grace periods that may apply.

2. Include Payment Methods and Late Fees

Detail the accepted payment methods, such as credit cards, bank transfers, or checks. If applicable, include any fees for late payments or returned transactions. Additionally, it’s important to clarify any consequences of non-payment, such as penalties or suspension of services.

Clear communication is essential when creating a payment plan agreement. Ensure that all terms are easy to understand, leaving no room for confusion. This helps build trust and ensures that both parties are on the same page regarding expectations and responsibilities.

Key Elements to Include in Your Payment Plan Agreement

Creating an effective document for managing split payments requires including several important details to ensure both parties understand the expectations and responsibilities. These key elements provide clarity, help prevent misunderstandings, and ensure smooth transactions. Below are the essential components to consider when crafting your payment arrangement.

1. Payment Amount and Schedule

Clearly outline the total amount due and how it will be divided into smaller payments. Specify the payment frequency, whether it is weekly, bi-weekly, or monthly, and provide the due dates for each installment. This ensures that the customer knows exactly when to pay and how much to pay at each interval.

2. Payment Methods and Terms

Specify the acceptable methods for making payments, such as credit cards, direct transfers, or checks. Additionally, include any terms regarding how payments can be made–whether online, by phone, or in person–and ensure that the customer understands the process for submitting payments.

Late payment penalties should also be clearly outlined in this section, including any additional charges or interest that may apply if payments are not made on time. This ensures accountability and encourages timely payments.

By incorporating these essential details, you can create a comprehensive and professional payment plan agreement that sets clear expectations and fosters trust between your business and clients.

Customizing Payment Plans for Different Businesses

Every business has unique needs and customer expectations, which means payment agreements should be tailored accordingly. Customizing your payment structure to match the specific nature of your products or services can improve both customer satisfaction and business efficiency. The following steps will guide you through adjusting payment arrangements to suit different types of businesses.

1. Understand Your Industry’s Requirements

Different industries may have varying standards when it comes to payment practices. For example, service-based businesses like consulting firms might offer different payment schedules compared to retail businesses that sell physical products. Understanding these industry norms will help you set realistic and appropriate terms that appeal to your target audience.

2. Adjust Terms Based on Product or Service Complexity

If your business offers high-ticket or complex items, consider offering longer payment periods or more flexible terms. Customizing the payment schedule based on the nature of the product can make it easier for customers to commit without feeling financially overwhelmed. Conversely, for low-cost items, shorter payment plans may be more appropriate.

Tailoring the structure to your business model can not only help you meet customer expectations but also foster long-term relationships by offering convenient and suitable payment options.

Common Mistakes to Avoid with Payment Plans

When setting up a system for dividing payments over time, it’s important to avoid certain pitfalls that can lead to confusion, missed payments, or customer dissatisfaction. Being aware of these common errors can help you streamline your processes and create a more effective structure for both your business and your clients. Below are some key mistakes to watch out for.

1. Lack of Clear Terms

- Unclear Payment Schedule: Failing to specify exact due dates and amounts can lead to confusion and missed payments.

- Ambiguous Fees: Not outlining any additional charges or penalties for late payments can result in misunderstandings and frustration.

2. Overcomplicating the Agreement

- Excessive Terms: Including too many conditions or overly complex language can overwhelm customers and discourage them from agreeing to the payment plan.

- Unrealistic Payment Amounts: Setting high payment amounts that customers can’t afford may lead to payment delays or cancellations.

By keeping the structure simple, clear, and fair, businesses can avoid these common issues, ensuring smoother transactions and stronger customer relationships.

Best Practices for Setting Up Payment Terms

Establishing clear and fair payment conditions is essential for both businesses and clients. Well-structured terms not only help ensure timely payments but also build trust and transparency between parties. The following best practices will guide you in creating effective payment conditions that benefit both your business and your customers.

1. Set Clear and Reasonable Payment Deadlines

- Define Payment Due Dates: Be specific about when each payment is due, whether it’s weekly, bi-weekly, or monthly.

- Allow for Flexibility: Offer a reasonable grace period to accommodate clients who may need extra time without incurring penalties.

2. Communicate Payment Methods and Processes

- Provide Multiple Payment Options: Make it easier for clients by offering different payment methods, such as credit cards, bank transfers, or online payment systems.

- Clarify the Process: Ensure that customers understand how to make payments, whether it’s through an online portal, by phone, or via check.

3. Outline Late Payment Consequences

- Specify Late Fees: Clearly state any additional charges that will apply if payments are delayed, so customers understand the consequences upfront.

- Offer Incentives for Early Payments: Consider offering discounts or rewards for early payments to encourage prompt transactions.

By following these practices, you can create payment terms that are clear, fair, and easy to understand. This will foster positive relationships with your clients while ensuring that your business maintains steady cash flow and reduces the risk of overdue payments.

Legal Considerations for Payment Plans

When setting up agreements to divide payments over time, it’s essential to consider the legal implications to ensure that both parties are protected. A well-drafted agreement not only prevents potential disputes but also ensures compliance with relevant laws. This section highlights key legal factors to keep in mind when offering payment arrangements.

1. Contract Clarity and Enforceability

Clear Terms and Conditions: Ensure that all terms of the payment arrangement are clearly defined in writing. This includes payment amounts, due dates, and any penalties for late payments. Having a written agreement makes it easier to enforce the terms if disputes arise.

Legally Binding Agreement: Ensure the agreement is legally binding by obtaining the necessary signatures from both parties. This creates an enforceable contract that can be used in case of non-payment or other legal issues.

2. Consumer Protection Laws

Different regions may have specific consumer protection laws that govern payment arrangements, such as the maximum allowable interest rate or grace periods for payments. It’s important to familiarize yourself with these laws to avoid violating them. Additionally, always ensure that the terms are fair and transparent to protect your business from potential legal challenges.

By understanding and implementing these legal considerations, you can create payment plans that are both effective and compliant, reducing the risk of legal disputes and building trust with your clients.

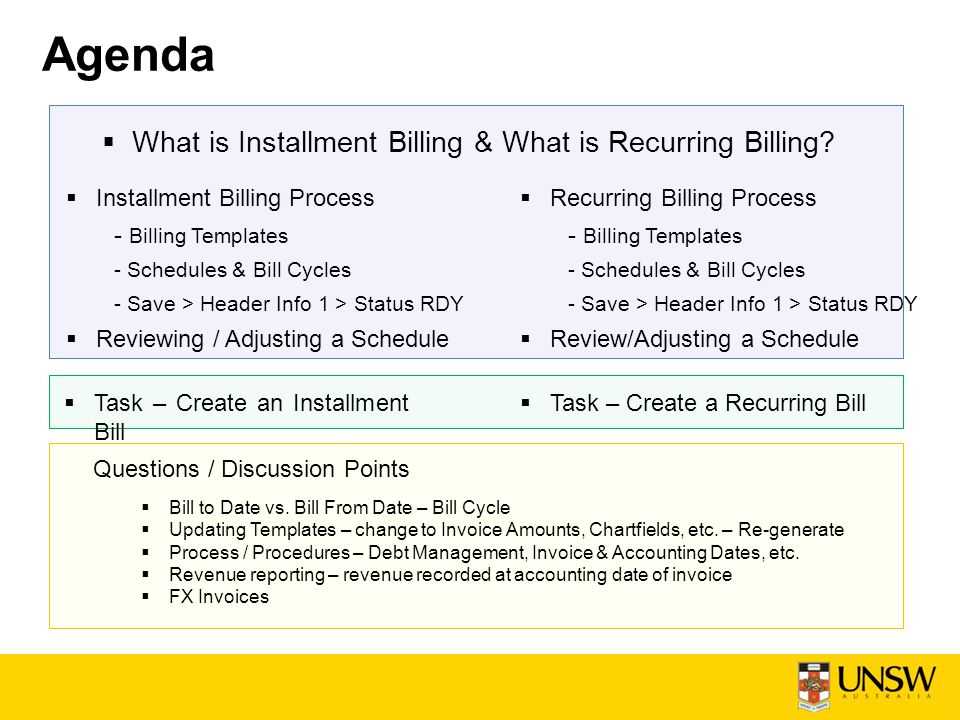

Integrating Payment Plans with Accounting Software

Integrating your payment arrangements with accounting software can significantly streamline your financial management processes. Automation reduces the risk of errors, ensures accurate record-keeping, and saves time. This section explores how integrating your structured payment plans into accounting systems can improve efficiency and provide better insights into your business’s cash flow.

1. Benefits of Integration

By linking payment structures with accounting software, businesses can easily track transactions and maintain real-time updates of their financial status. Key benefits include:

- Automated Record Keeping: Payment schedules and amounts are automatically recorded, reducing manual data entry.

- Improved Cash Flow Management: Automated reports help track outstanding payments and forecast future cash flow.

- Accurate Tax Reporting: The integration helps maintain accurate records, which are essential for tax compliance.

2. Steps to Integrate Payment Plans

To successfully integrate your payment structures with accounting software, follow these steps:

| Step | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Step 1 | Select Compatible Software: Choose accounting software that supports integration with your payment systems. | ||||||||

| Step 2 | Set Up Payment Terms: Configure your payment arrangements, including due dates and amounts, within the software. | ||||||||

| Step 3 | Link Customer Data: Ensure that customer accounts are properly connected to track payments accurately. | ||||||||

| Step 4 | Monitor and Adjust: Regularly review the

Tracking Payment Schedules Effectively

Efficiently tracking payment schedules is essential for managing cash flow and ensuring timely collections. By keeping a clear record of each payment due and received, businesses can prevent missed payments, reduce administrative work, and maintain financial accuracy. This section covers strategies and tools to help you effectively monitor and manage customer payment arrangements. 1. Importance of Tracking PaymentsProperly tracking payments ensures that businesses can easily see which customers have fulfilled their obligations and which are behind. This clarity allows for quick action, whether it’s sending a reminder or following up with clients who have not paid as agreed. Accurate tracking also helps prevent confusion and errors in financial reports. 2. Tools for Tracking PaymentsThere are several tools and methods available to help businesses monitor payment schedules, ranging from manual tracking sheets to fully integrated software systems. Here are a few common options:

3. Best Practices for Monitoring Payments

By using these methods and tools, businesses can ensure that payment schedules are tracked accurately, allowing for better financial planning and customer relationship management. How Payment Plans Improve Cash FlowIntroducing structured payment arrangements can significantly enhance a business’s cash flow by providing a predictable income stream. Rather than waiting for a single lump-sum payment, breaking down amounts into smaller, manageable payments allows businesses to receive funds consistently over time. This approach helps balance expenses, support operational costs, and maintain financial stability. Steady Revenue Stream: One of the primary benefits of dividing payments is the creation of a steady cash flow. Instead of relying on one-time payments, businesses can count on regular incoming funds, making it easier to forecast cash needs and plan for future expenses. Improved Financial Planning: With regular payments coming in, businesses can allocate funds more effectively, covering operating costs, inventory restocks, and employee salaries. This predictability is especially important for small businesses that need to ensure liquidity for daily operations. Reduced Financial Pressure: A steady flow of payments also reduces the pressure on businesses to cover large costs upfront, which can be a significant challenge when revenue is unpredictable. This can help avoid the need for external financing or high-interest loans, as regular payments gradually cover outstanding balances. By implementing payment plans, businesses can improve their financial health, avoid cash shortages, and ensure long-term sustainability. The consistency and reliability of payments lead to better financial decisions, allowing businesses to focus on growth and operational efficiency. Setting Up Automatic Reminders for PaymentsAutomating payment reminders is a highly effective way to ensure timely collections and reduce the risk of overdue balances. By setting up reminders, businesses can automatically notify customers when a payment is due, keeping cash flow steady and minimizing the need for manual follow-ups. This section outlines how to implement an automatic reminder system to streamline payment collection processes. Benefits of Automatic Reminders: Automated reminders help maintain a consistent and professional communication channel with customers. They reduce the workload of staff by eliminating the need for manual reminders and follow-ups, while ensuring that clients are informed of upcoming or overdue payments without delay. How to Set Up Automatic Reminders: Most accounting or financial management software offers built-in tools for setting up automatic payment reminders. Here’s how to configure them effectively:

Tracking and Adjusting Reminders: Once automatic reminders are set up, it’s important to track their effectiveness. Monitor customer responses and payment patterns to determine whether any adjustments are needed, such as modifying the frequency of reminders or changing the content of the messages. By implementing automatic reminders, businesses can significantly reduce the number of overdue payments, improve cash flow, and maintain stronger relationships with their clients by ensuring clear and timely communication. Managing Late Payments in Payment PlansManaging delayed payments effectively is crucial to maintaining a healthy cash flow and avoiding financial disruption. When clients miss payment deadlines, it can affect a business’s liquidity and operational efficiency. This section discusses strategies to handle late payments in a structured manner, ensuring that your payment agreements remain on track. 1. Clear Payment Terms

One of the best ways to minimize late payments is to establish clear, well-communicated payment terms from the start. Make sure that clients fully understand the dates, amounts, and penalties (if any) for missed payments. Clear agreements help prevent confusion and give both parties a point of reference in case of delays. 2. Effective Follow-Up Procedures

When payments are overdue, prompt action is necessary to avoid further delays. Below are some effective follow-up steps:

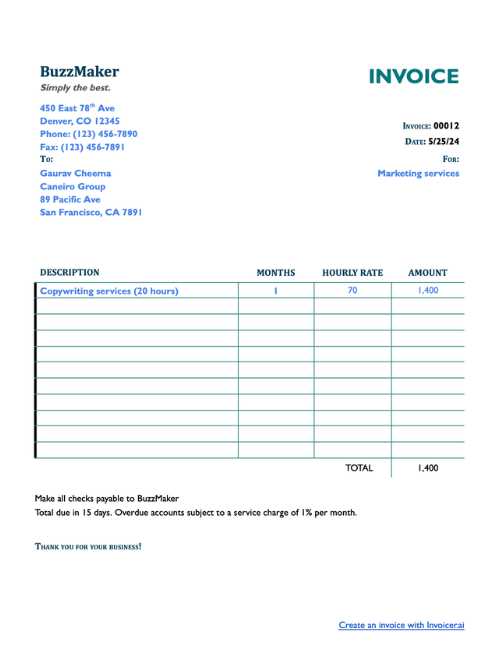

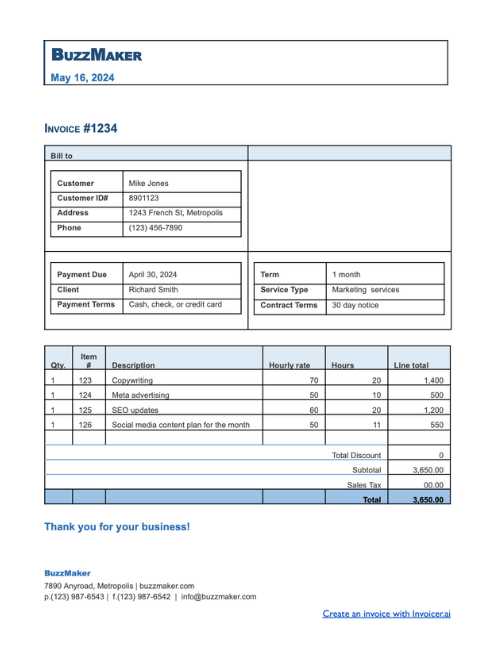

3. Penalties and InterestIncorporating penalties or interest charges into your payment agreements can serve as an incentive for timely payments. Clearly state the penalties for overdue payments, such as a fixed late fee or a percentage of the outstanding amount. This can help deter customers from delaying payments and encourage them to settle their balances promptly. By implementing clear terms and effective follow-up procedures, businesses can manage late payments more efficiently, maintaining a steady cash flow while ensuring customer relationships remain intact. Creating Professional Templates for ClientsDesigning professional documents for clients is a key aspect of maintaining a positive business relationship and ensuring clarity in transactions. A well-crafted document can enhance the perceived professionalism of your business, improve communication, and streamline the payment process. This section explores how to create effective and polished documents tailored to your client’s needs. When developing these documents, it’s important to focus on clarity, organization, and customization. The layout should be clean, with clear headings, easy-to-read fonts, and sections that are logically structured. Providing clients with a straightforward and transparent document increases their confidence in your business and reduces the likelihood of misunderstandings. Furthermore, personalizing the document to reflect your client’s specific details–such as payment schedules, amounts, and due dates–helps to establish a more tailored approach, making clients feel valued and understood. Always ensure that the design aligns with your brand’s identity, keeping your documents professional yet accessible. By taking the time to create professional and tailored documents, you not only streamline the administrative process but also build trust and enhance your business reputation. Payment Plans vs Full Payment MethodsWhen choosing between different payment options, businesses often weigh the advantages and disadvantages of offering flexible payment plans versus requiring full payment upfront. Both methods have their own set of benefits depending on the nature of the transaction and the relationship with the client. Understanding the key differences between these two approaches can help businesses decide which option best suits their needs and objectives. Payment Plans: Benefits and ConsiderationsPayment plans allow customers to break down the total amount due into smaller, more manageable installments. This approach can be especially beneficial for larger purchases, as it provides customers with greater flexibility and accessibility. Some of the advantages of this method include:

However, this method also comes with certain risks, such as late payments or defaults. To mitigate these issues, businesses must have clear payment terms, monitoring systems, and follow-up procedures in place. Full Payment Methods: Benefits and Considerations

On the other hand, requiring full payment upfront can help businesses avoid some of the risks associated with payment plans. The benefits of full payments include:

However, requiring full payment may deter some potential customers who cannot afford the full amount upfront, potentially limiting the business’s market reach. Ultimately, the choice between payment plans and full payment methods depends on the nature of the product or service, the business’s financial goals, and the preferences of the target market. Each option has its place, and businesses must carefully assess which method will provide the best balance between custome Optimizing Your Document for Mobile DevicesIn today’s digital world, ensuring that your documents are easily readable and functional on mobile devices is essential. With an increasing number of people accessing content through smartphones and tablets, optimizing for smaller screens can enhance the user experience. By making your files mobile-friendly, you improve accessibility and increase the chances that your clients or customers will interact with the document efficiently and effectively. Responsive Design: Key to Mobile OptimizationResponsive design is a technique that allows your content to adapt to various screen sizes automatically. This ensures that your document looks great whether it’s viewed on a large desktop monitor or a compact smartphone screen. Some important factors to consider for a mobile-optimized document include:

Streamlined Content and NavigationMobile users often prefer quick and easy navigation. Simplifying the content and structure of your document can significantly enhance the user experience. Consider the following tips for improving mobile usability:

By focusing on responsiveness and usability, you can create documents that work well on any device, providing a smooth and user-friendly experience for your audience. Why You Should Use a Structured Document for Payment PlansUtilizing a structured document for outlining payment arrangements can bring numerous advantages to both businesses and clients. A clear and organized approach ensures that both parties are aligned on terms, deadlines, and amounts, which can prevent misunderstandings and improve overall cash flow management. Whether for recurring purchases or long-term agreements, a well-crafted document can provide transparency and reliability in your financial transactions. Clarity and ConsistencyOne of the main benefits of using a predefined format is the consistency it offers. Having a standard way to present the payment schedule helps ensure that the terms are clear and that no important details are overlooked. Key aspects such as amounts, dates, and conditions are organized in a way that’s easy to follow, promoting trust between businesses and clients.

Time and Efficiency SavingsUsing a template also saves time by eliminating the need to recreate documents for each new agreement. Instead of starting from scratch, you can customize an existing layout to fit specific details, significantly speeding up the process.

By adopting a standardized approach, businesses can increase efficiency, reduce errors, and ensure smooth transactions, all while maintaining a professional appearance in their dealings. |