Subcontractor Invoice Template Excel for Easy Billing

Managing payments and organizing financial records is essential for smooth business operations. Having a well-structured document to track services rendered and payments due can save time and prevent errors. Using a customizable sheet for this purpose can streamline the process and improve accuracy in billing.

Creating a comprehensive billing record requires attention to detail, such as specifying job descriptions, payment terms, and contact information. With the right tools, this task becomes much easier, allowing for quick adjustments and updates when necessary.

By adopting a structured approach to managing financial data, contractors can ensure clarity and maintain professionalism with every transaction. Whether it’s for a single client or multiple projects, organizing your billing system in a digital format brings efficiency and convenience.

Subcontractor Invoice Template Excel Guide

Managing payments for work completed is crucial for maintaining financial clarity. A well-organized document helps keep track of charges, due dates, and payment status. By utilizing a digital format, you can quickly update, store, and share financial records with clients, ensuring a smooth transaction process every time.

To get started, it’s important to understand the key elements that should be included in any billing sheet. The layout should clearly represent essential details like the work description, payment terms, and contact information. These components ensure that both parties are on the same page regarding the work performed and the associated costs.

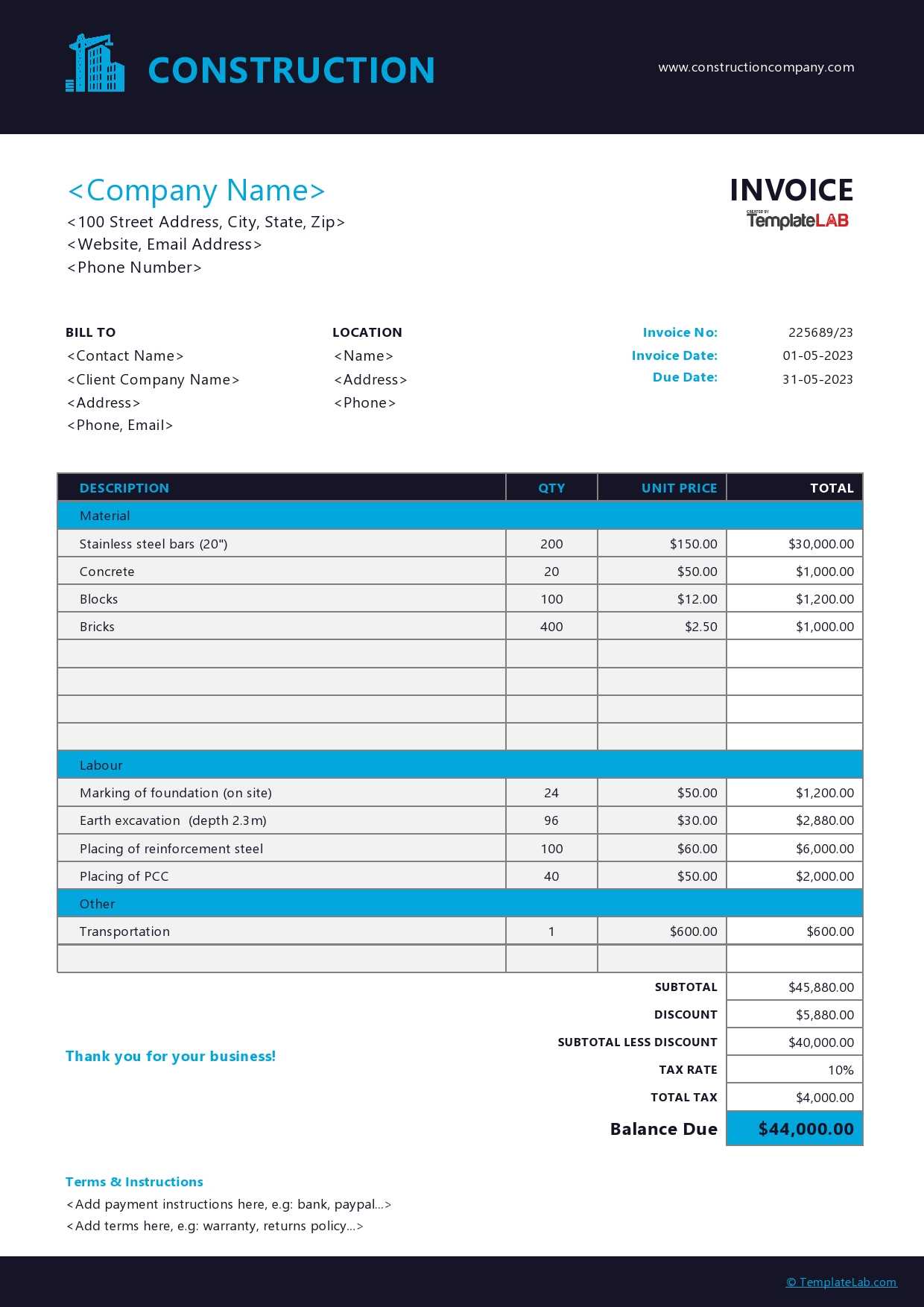

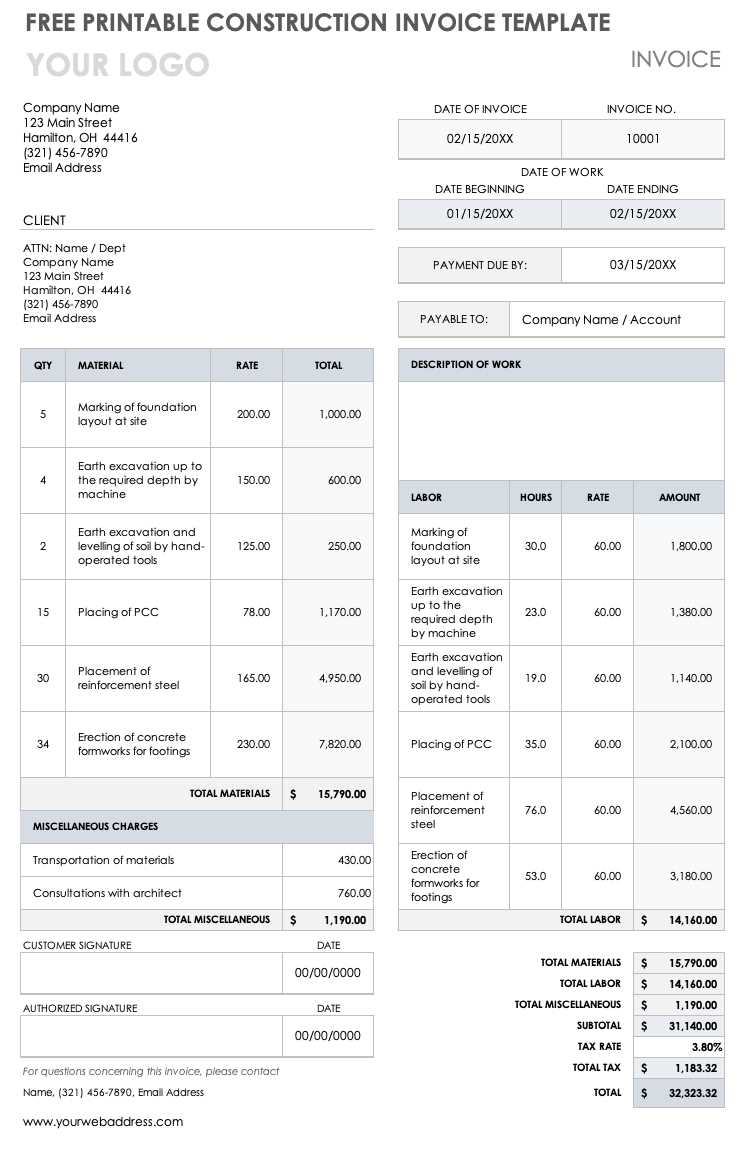

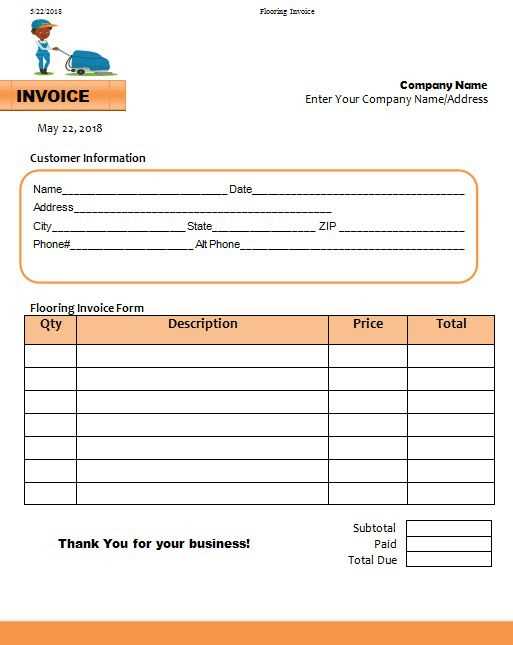

The following table illustrates a basic structure for a billing document:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Labor | Work completed on site | 10 hours | $50/hour | $500 |

| Materials | Supplies used | 5 units | $30/unit | $150 |

| Total | $650 |

Using this structure allows for easy adjustments and quick calculations. With digital tools, you can easily automate these processes and ensure accurate billing for any project.

Why Use an Excel Invoice Template

Utilizing a digital system to manage billing is an efficient way to streamline the payment process and maintain clear records. With the right tools, creating and updating billing documents becomes quick and simple. The flexibility of a digital spreadsheet allows for customization, ensuring it fits the unique needs of any project or business.

One of the key benefits of using a digital sheet is its ease of use. You can quickly input data, calculate totals automatically, and adjust for various conditions such as tax rates or discounts. This minimizes the risk of human error and ensures the accuracy of every transaction.

Another significant advantage is the ability to store and share your documents digitally. Whether you’re working with a single client or managing multiple projects, having access to these files on your computer or cloud storage provides convenience and security. You can easily track outstanding balances, monitor due dates, and even set up reminders for payments.

How to Customize Your Invoice Template

Customizing your billing document is essential for ensuring that it meets the specific needs of your business and your clients. By adjusting the layout and structure, you can make sure that all necessary details are included and presented in a professional manner. A well-organized and personalized sheet not only saves time but also improves communication with your clients.

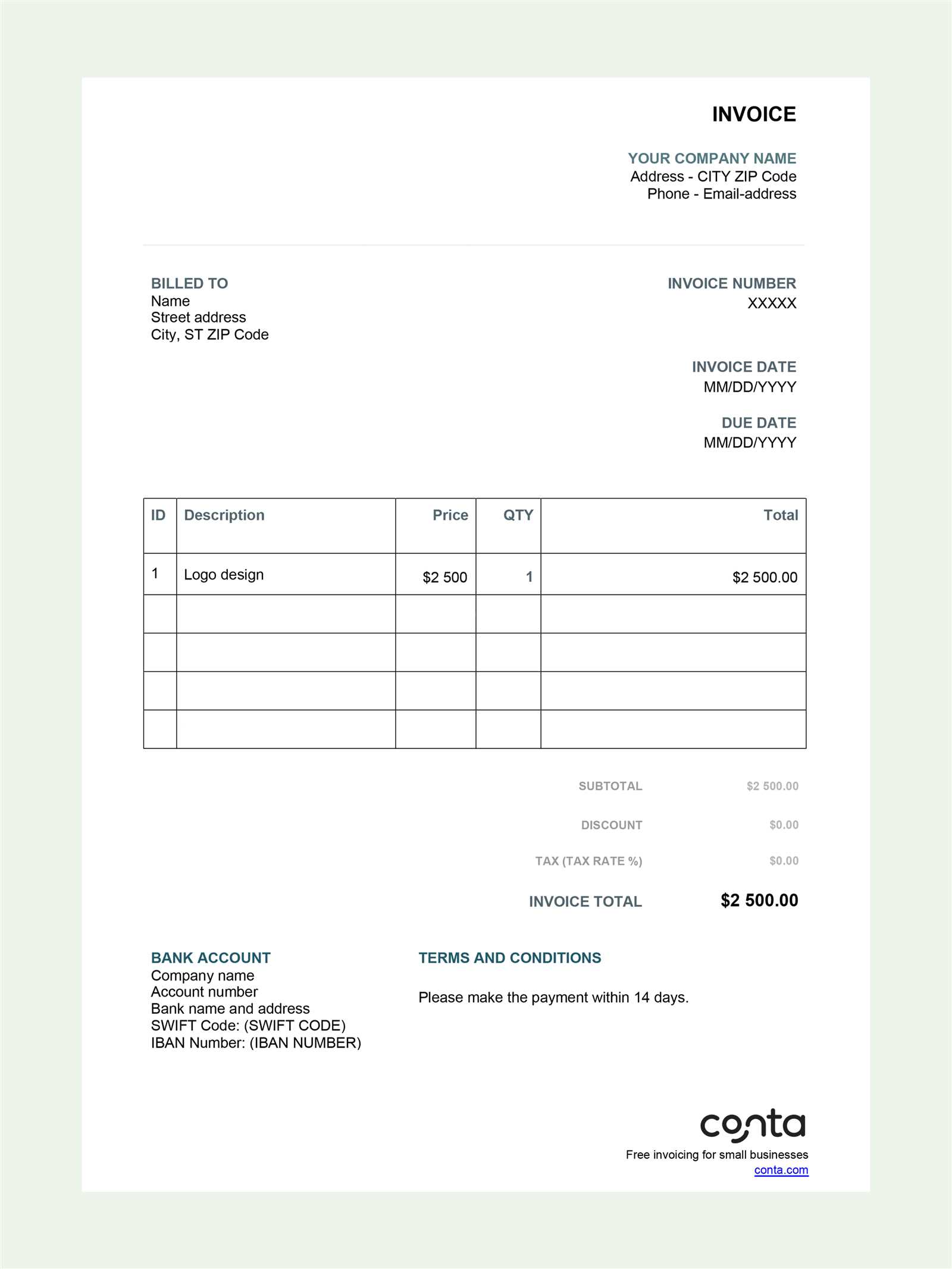

Key Information to Include

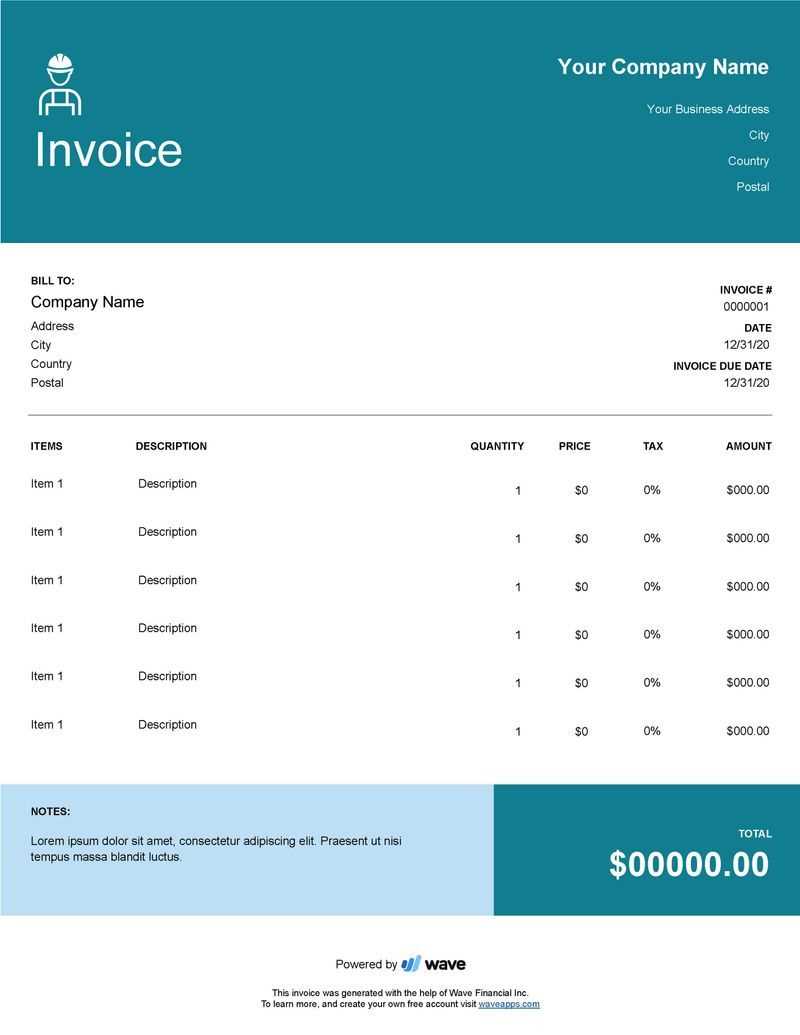

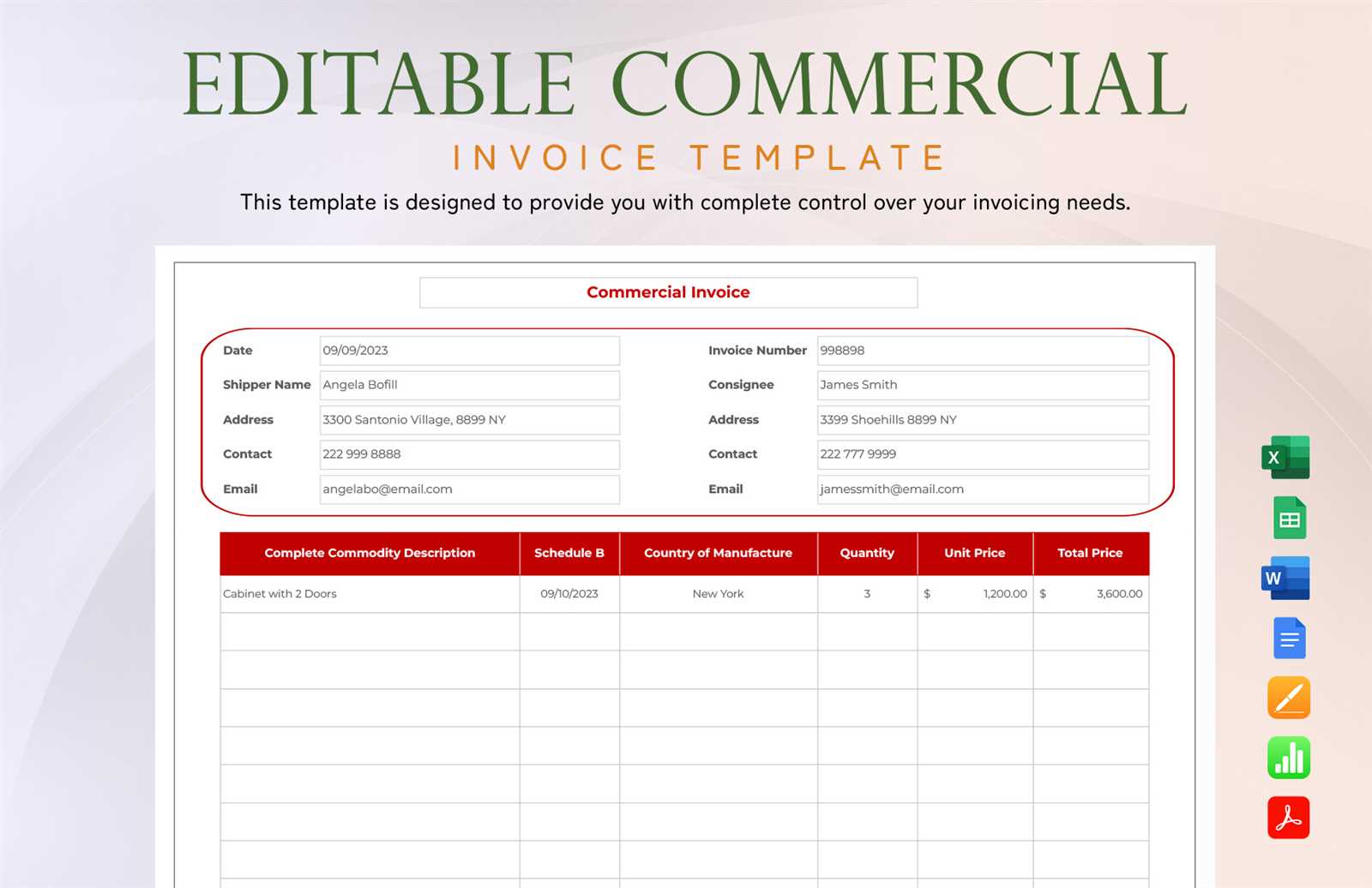

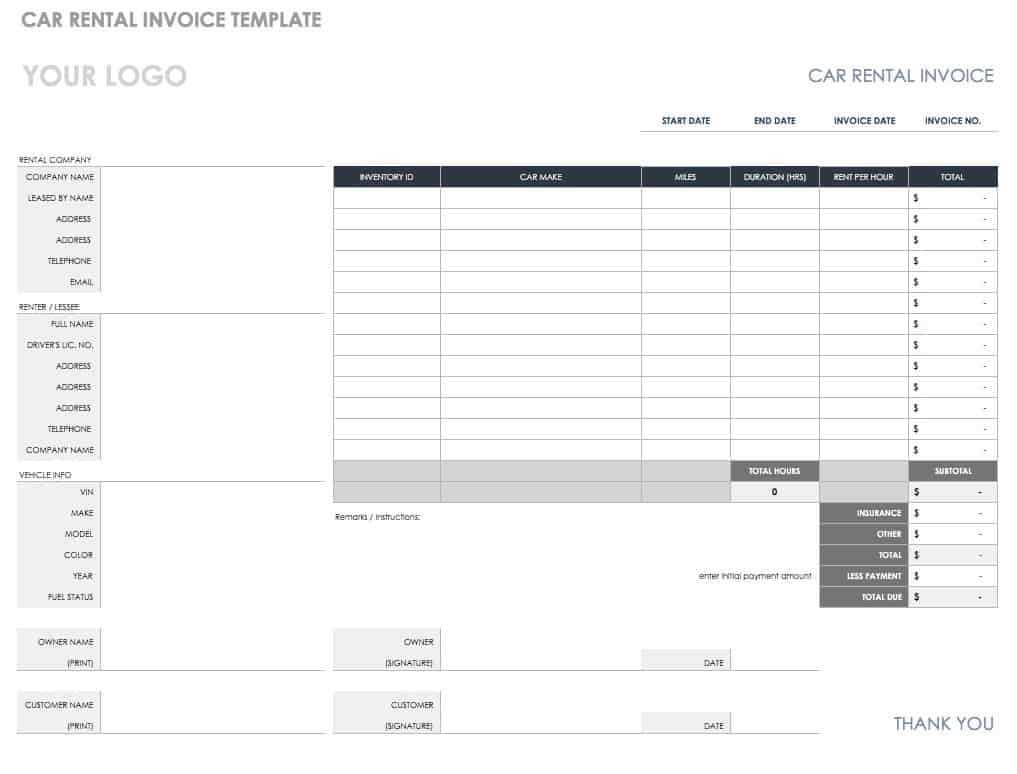

When customizing your billing sheet, it’s important to make sure it includes all relevant information, such as contact details, service descriptions, and payment terms. You may also want to add company branding, such as logos or colors, to maintain a professional appearance. Below is an example of the basic sections you should consider:

| Section | Description |

|---|---|

| Header | Include your company name, address, and contact information |

| Work Details | Provide descriptions of the tasks or services provided |

| Payment Terms | Specify payment due date, methods, and any late fees |

| Total Amount | Sum up all charges and any applicable taxes |

Additional Customization Options

Beyond basic information, you can also adjust the appearance of the sheet to align with your business style. Customizing font styles, colors, and row heights can make your document more readable and visually appealing. Additionally, you can create fields for recurring billing, discounts, or any other unique terms specific to your projects.

Key Features of a Good Invoice Template

A well-designed billing document plays a crucial role in ensuring smooth transactions and clear communication between you and your clients. A good sheet should be functional, easy to read, and tailored to the specific needs of your business. It must effectively communicate the details of the services provided, the amount due, and the payment terms in a way that is both professional and straightforward.

Essential Elements of a Billing Document

Here are some key features that should be included in every effective billing sheet:

- Clear Identification: The document should clearly identify both the service provider and the client with names, addresses, and contact details.

- Service Breakdown: List each service or product provided with descriptions, quantities, and individual prices. This helps ensure transparency.

- Payment Terms: Specify the due date, payment methods, and any applicable late fees or discounts for early payment.

- Subtotal and Total: Provide a detailed summary of charges, taxes, and the final amount due.

- Unique Invoice Number: Use a unique reference number for each document to help with tracking and organization.

Design and Usability Features

Besides the essential information, the layout and structure of the sheet play a significant role in its effectiveness:

- Easy Navigation: Organize the document logically, so that clients can easily locate key information such as totals, descriptions, and payment terms.

- Professional Appearance: Use consistent fonts, colors, and spacing to create a clean and polished look. Branding elements like logos can also be included to maintain consistency with your business identity.

- Automated Calculations: Built-in formulas or features that automatically calculate totals or taxes can save time and reduce errors.

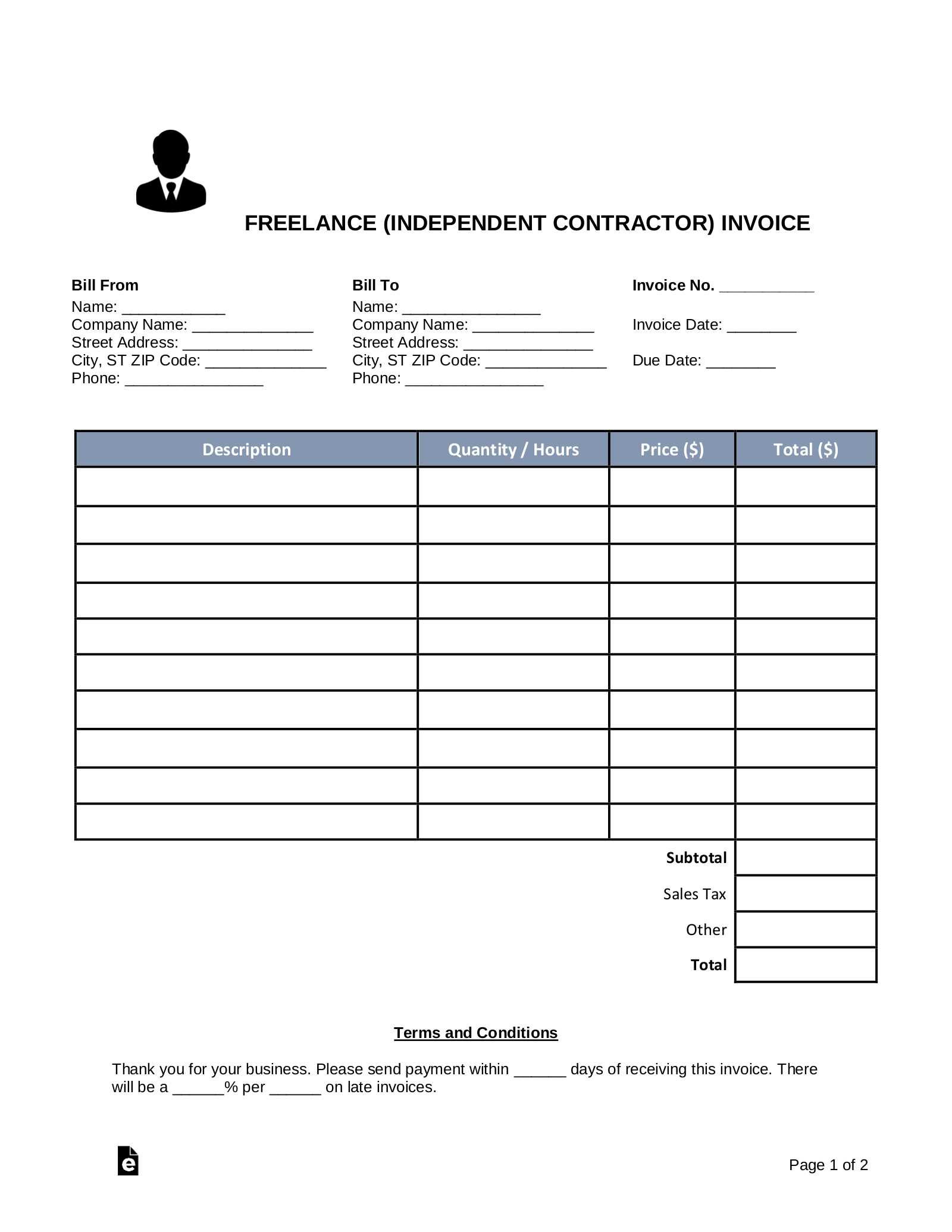

Steps to Create Your Own Invoice

Creating your own billing document from scratch is a simple process that helps you tailor the format to your needs while ensuring all essential information is included. By following a few key steps, you can produce a professional and organized record that meets your business requirements and keeps your financial dealings clear and transparent.

Step-by-Step Guide to Building Your Document

Follow these steps to create a customized billing record:

- Open a New File: Start by opening a new spreadsheet or document. Choose a platform that allows easy editing and formatting, such as a spreadsheet software or a word processor.

- Enter Your Information: Add your business details at the top of the document, including your name, address, phone number, and email. Then, include the client’s contact information below.

- Include a Unique Identifier: Assign a unique reference number to the document for easy tracking. This can be a sequential number or a combination of numbers and letters.

- List Services or Products: In a detailed table, list each service or product provided along with descriptions, quantities, and prices. Make sure to calculate the totals accurately.

- Include Payment Details: Clearly state the payment terms, such as the due date, payment methods accepted, and any penalties for late payments.

- Final Review: Double-check all information for accuracy and ensure all relevant data is included, such as tax calculations and the final total amount due.

- Save and Share: Save the document and, if necessary, share it with your client via email or an online platform.

Additional Customization Options

You can also add personalized features to your billing record, such as branding elements, a clear and readable layout, or automated formulas to calculate totals. Customizing your sheet to reflect your business style and improve usability can make the process more efficient and professional.

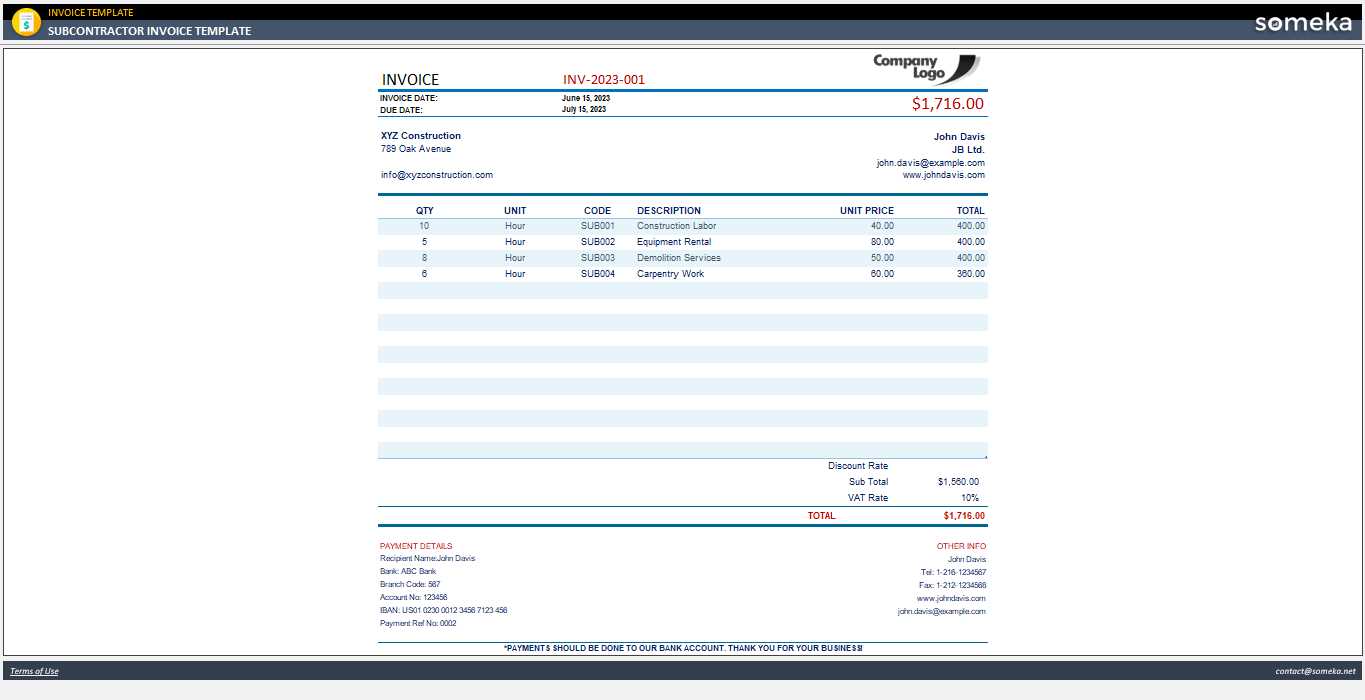

Managing Subcontractor Billing with Excel

Efficiently managing payments for work completed by external contractors requires a well-organized system. A digital platform allows for streamlined tracking of tasks, costs, and payment statuses. By setting up a clear and customized billing record, you can ensure all charges are accurately reflected and payments are processed smoothly.

Benefits of Using Digital Spreadsheets for Billing

Here are some of the main advantages of using a digital system for managing external contractor billing:

- Quick Updates: Easily make adjustments to rates, quantities, or other details without needing to recreate the entire document.

- Automatic Calculations: Built-in formulas allow for automatic totals, tax calculations, and other adjustments, reducing the risk of errors.

- Centralized Tracking: Keep all records in one place for easy access and comparison, making it easier to track payment histories and outstanding balances.

- Multiple Client Management: Manage multiple contractors or projects in separate tabs or files, streamlining the process for all your billing needs.

Steps to Effectively Manage Billing

To manage payments efficiently, follow these steps:

- Create Separate Sections: Organize the document by creating separate sections for each contractor or project, allowing for clearer tracking of tasks and costs.

- Use Clear Descriptions: Include detailed descriptions of work completed, rates, and quantities to avoid any confusion.

- Set Payment Terms: Clearly state due dates, payment methods, and any late fees or discounts to ensure prompt payments and avoid disputes.

- Track Payment Status: Add a column to track payment status (e.g., paid, pending, overdue) to ensure you stay on top of outstanding balances.

- Review Regularly: Regularly review the document to ensure all information is up to date, and adjust for any changes in rates or new projects.

Common Mistakes to Avoid in Invoices

When preparing a billing record, it is easy to overlook small details that can lead to misunderstandings or delays in payment. Common errors can range from simple typos to missing information, all of which can affect the professionalism and effectiveness of the document. Avoiding these mistakes will help maintain a smooth relationship with clients and ensure timely payment processing.

Frequent Errors to Watch For

Here are some of the most common mistakes that can occur when preparing a billing document:

- Incorrect Contact Information: Double-check the client’s name, address, and contact details to avoid confusion.

- Missing Dates: Always include the date of issue and the due date to avoid any ambiguity regarding payment deadlines.

- Unclear Descriptions: Provide detailed and accurate descriptions of the services or products provided to avoid misunderstandings or disputes.

- Omitted Taxes or Discounts: Ensure that all applicable taxes and discounts are clearly stated to prevent surprises for the client.

- Incorrect Total Amounts: Always verify that the subtotal, taxes, and total amount due are correct, and ensure any calculations are accurate.

How to Correct and Prevent Mistakes

To avoid errors, consider using the following strategies:

- Use Templates or Digital Tools: Consider using pre-made formats or digital spreadsheets that automatically calculate totals and taxes, reducing the risk of human error.

- Review Everything: Always review the document before sending it to ensure that all necessary information is included and accurate.

- Implement Checklists: Create a checklist to ensure that all essential fields (like client information, dates, and payment details) are completed before sending.

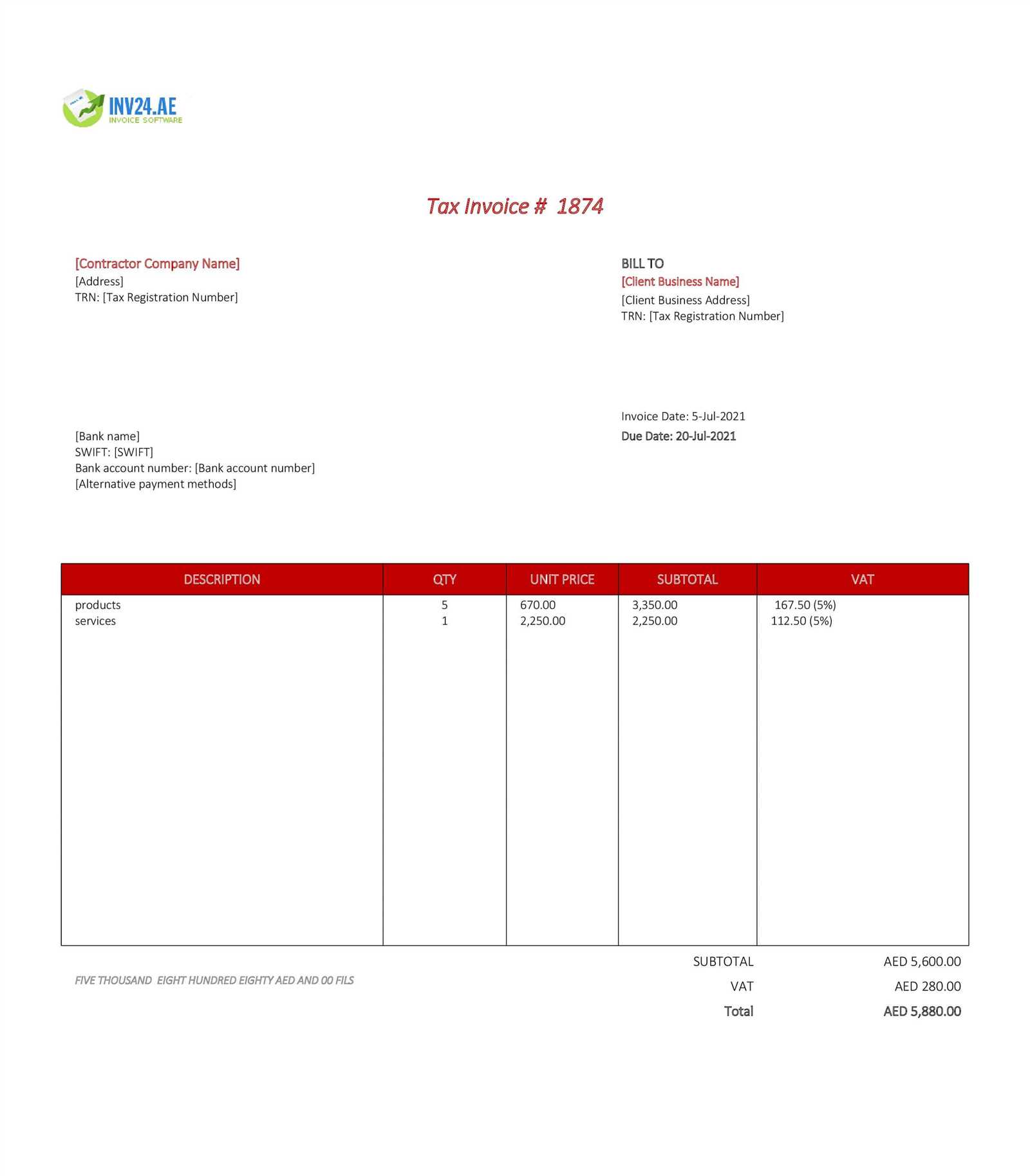

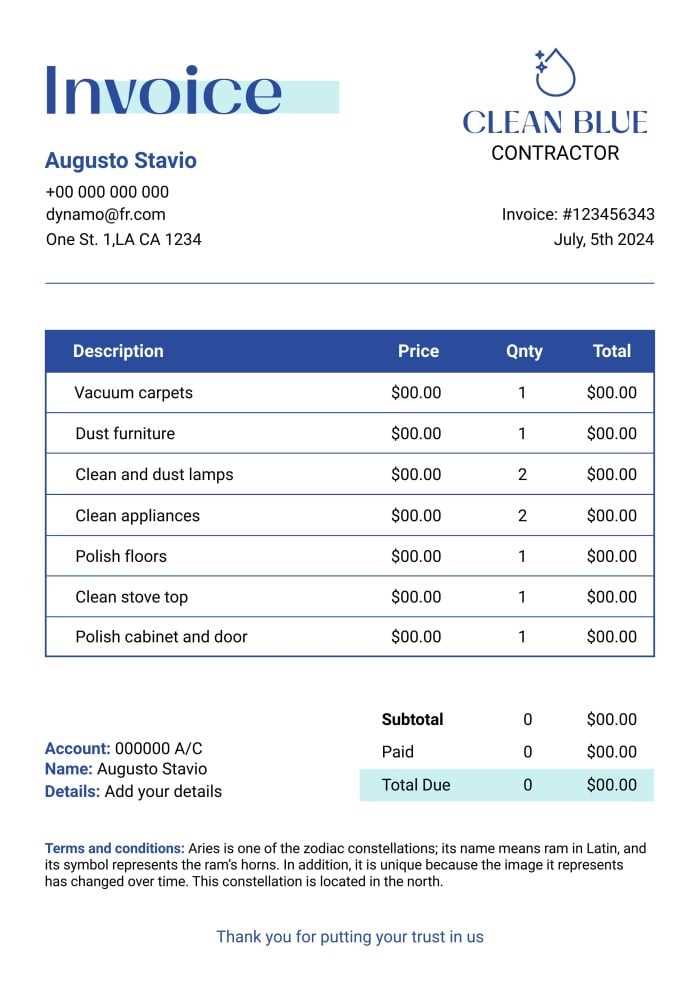

Example of Proper Format

Below is an example of how a well-organized billing document might look, minimizing errors and ensuring clarity:

| Section | Details | |||

|---|---|---|---|---|

| Client Information | Ensure the client’s name, address, and contact number are correct | |||

| Date | Include both the issue date and the payment due date | |||

| Description of Services | Provide detailed descriptions of the work completed or goods provided | |||

| Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Service Provided | $100.00 | 10% | $10.00 |

| Material Costs | $50.00 | 10% | $5.00 |

| Total | $150.00 | $15.00 |

This breakdown makes it clear what the base amounts are and how much tax is being charged, ensuring that everything is transparent and easily understood by both parties.

Automating Your Invoice Process

Streamlining your payment management process can save time, reduce human error, and increase efficiency. By automating routine tasks such as generating documents, sending reminders, and tracking payments, you can free up valuable resources to focus on other aspects of your business. Automation not only ensures accuracy but also helps maintain a consistent workflow that minimizes the chances of missing deadlines or forgetting important details.

Benefits of Automation

Automating your payment process provides numerous advantages:

- Time Savings: Automation reduces the time spent manually preparing documents, sending emails, and following up on payments.

- Consistency: Automated systems ensure that each document is generated in the same format and includes all necessary details every time, eliminating inconsistencies.

- Error Reduction: By minimizing manual entry, automation helps reduce the risk of human error in calculations and data entry.

- Timely Follow-ups: Automated reminders for overdue payments can help ensure that clients pay on time, without requiring constant manual oversight.

How to Implement Automation

To implement automation effectively, consider using the following tools and strategies:

- Automated Billing Software: There are various software options that can automate the creation and delivery of billing documents based on predefined settings.

- Set Up Payment Reminders: Use automated systems to send payment reminders to clients a few days before the due date, and follow up if payments are overdue.

- Integrate with Accounting Systems: Linking your automated process with accounting software ensures that all transactions are recorded automatically, keeping your financial records up-to-date.

By automating the payment management process, you can enhance operational efficiency and improve client relations while reducing the chances of mistakes or delays in the payment cycle.

Formatting Tips for Professional Invoices

Presenting billing documents in a clear and organized format reflects professionalism and helps build trust with clients. A well-structured document not only enhances the client’s understanding of the charges but also ensures that all necessary details are easily accessible. Proper formatting makes it easier to avoid confusion and ensures that payments are processed smoothly and on time.

Essential Formatting Guidelines

To create a professional-looking document, follow these key formatting tips:

- Use Clear Headers: Include a bold header at the top with the document type, such as “Billing Statement” or “Payment Summary.” This immediately informs the client of the document’s purpose.

- Organize Information Logically: Break down the content into sections. Key details such as client information, services provided, and amounts should be clearly separated for easy reading.

- Include a Summary Section: A brief summary at the end, showing the total amount due, tax charges, and any discounts, helps clients quickly understand their financial obligations.

Make the Document Easy to Read

Besides the content structure, the design and readability of the document are equally important:

- Keep Text Simple: Use simple fonts and ensure that text size is large enough to be legible. Avoid too many fonts or colors that might distract the reader.

- Align Information Properly: Align the columns and rows neatly, especially when listing items or services. Consistent alignment improves readability and looks more polished.

- Highlight Key Information: Use bold text or shading to highlight essential details, such as totals or due dates, so they stand out.

Adhering to these formatting tips helps you create professional billing documents that are easy for your clients to understand, ensuring clarity and accuracy in every transaction.

Best Practices for Invoice Layout

Creating a clear and professional layout for billing documents ensures that your clients can easily understand the charges and payment details. The layout not only affects how the information is presented but also impacts the overall professionalism of the document. A well-organized design leads to better communication, minimizes misunderstandings, and helps clients process payments efficiently.

Key Elements of a Clear Layout

When designing your document, it’s important to structure the content in a way that makes sense and is easy to navigate. Below are some best practices for organizing the layout:

- Header Section: Begin with a clear header that includes the document title (e.g., “Payment Statement”), your company name, and contact details. This ensures the client knows exactly what the document is at first glance.

- Client and Business Information: Include a section for both your business and the client’s details, such as names, addresses, and contact information. Make sure these are clearly separated for easy reference.

- Services or Products Provided: List the items or services rendered with a brief description, quantity, rate, and total cost in a well-aligned table format. This ensures that each charge is transparent and easy to review.

Organizing Payment Details

Once the service information is outlined, the next section should highlight the payment terms and total charges:

- Payment Summary: Create a simple summary at the bottom of the document that lists the total due, taxes, discounts, and any outstanding balances.

- Due Date: Make the due date stand out clearly. This helps the client prioritize the payment and prevents confusion.

- Additional Notes or Terms: If necessary, include a small section for terms and conditions, payment methods, or other relevant details.

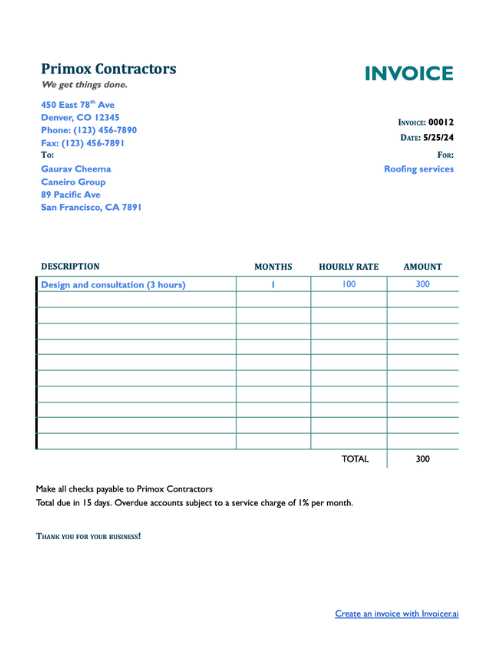

Example Layout

| Item | Description | Quantity | Rate | Total |

|---|---|---|---|---|

| Consulting Service | Business analysis and strategy session | 5 hours | $100/hour | $500 |

| Web Design | Website layout design | 1 | $300 | $300 |

| Total | $800 | |||

By follow

Saving and Sharing Your Invoice Files

Once your billing documents are prepared, it’s essential to save and share them in a way that ensures security, accessibility, and ease of use. By organizing your files properly and choosing the right method for sharing, you can maintain professionalism while streamlining the payment process. This section outlines some best practices for storing and distributing your billing documents effectively.

Saving Your Billing Documents

To ensure that your files are easily accessible and secure, consider the following tips for saving your documents:

- Use Standard File Formats: Save your billing documents in widely accepted formats like PDF or CSV. These formats are easy to open, print, and share without worrying about compatibility issues.

- Organize Your Files: Create a dedicated folder on your computer or cloud storage service to keep all billing-related files. Use clear file names that include the client’s name, the billing date, and other relevant information for easy retrieval.

- Backup Your Files: Regularly back up your files to ensure they are not lost due to technical issues. Cloud storage services, external hard drives, and other backup systems can safeguard your documents.

Sharing Your Billing Documents

After saving your files, it’s time to send them to your clients. Here are some effective ways to share your billing documents:

- Email: Send your files as email attachments, ensuring that the subject line is clear (e.g., “Billing Statement for [Client Name]”). Include a brief message outlining the key details of the document and the payment terms.

- Secure File Sharing Services: Use services like Google Drive, Dropbox, or OneDrive to upload and share your documents with clients. These services allow you to grant access via links or set permissions to maintain control over the document.

- Online Payment Platforms: If you use an online payment system like PayPal or Stripe, you can often send billing statements directly through the platform. This ensures the client can quickly review and pay the amount due.

By following these best practices for saving and sharing your billing files, you can enhance both the security and convenience of your billing process, making it easier for clients to receive and settle payments.

Ensuring Invoice Accuracy and Compliance

Maintaining precision and adherence to legal requirements in billing documents is essential for avoiding misunderstandings and ensuring smooth financial transactions. This section outlines how to avoid errors and ensure your documents are compliant with industry standards and local regulations, helping you maintain professional integrity and build trust with your clients.

Key Aspects of Accuracy

Accuracy in your billing documents not only helps in avoiding disputes but also ensures that all details are correct for prompt payment processing. Here are the main elements to focus on:

- Correct Client Information: Always verify the client’s name, address, and other details before finalizing the document. Simple errors in contact information can cause unnecessary delays.

- Accurate Charges: Double-check the amounts for each product or service provided. Ensure the correct quantities, rates, and any applicable discounts or taxes are reflected accurately.

- Clear Payment Terms: Clearly state the payment due date and acceptable payment methods. This will prevent confusion and set proper expectations for both parties.

Ensuring Compliance with Regulations

Compliance with industry regulations is critical to ensure your documents meet legal requirements. The following points can help you stay compliant:

- Include Necessary Tax Information: Make sure you list the required tax identification numbers, including VAT, GST, or sales tax, depending on your location and industry.

- Adhere to Local Laws: Understand the specific billing requirements for your country or region, as tax rates and documentation rules may differ.

- Proper Record-Keeping: Maintain organized records of your documents for tax reporting purposes. This can include keeping copies of all your billing statements for a set number of years as per local tax regulations.

Using a Standard Format

Using a consistent structure across all your billing documents helps ensure accuracy and makes it easier to verify and maintain compliance. A standard format should include:

| Section | Details |

|---|---|

| Client Information | Full name, address, and contact details |

| Services/Products | Description, quantities, rates, and amounts |

| Payment Terms | Due date, accepted payment methods |

| Tax Information | Applicable tax rates and identification numbers |