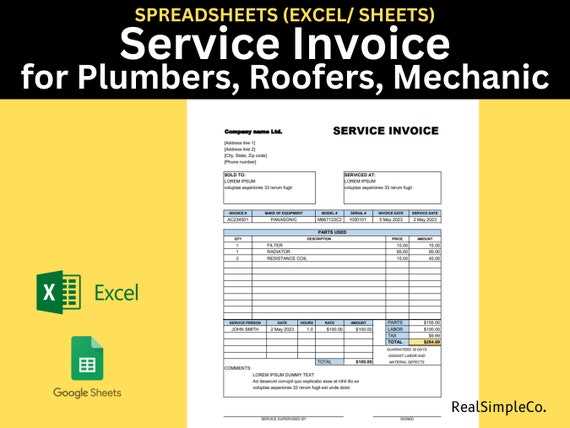

Labor Invoice Template Excel for Easy Billing

Managing payments for services rendered can be a time-consuming task, especially when tracking hours and calculating charges manually. The process can be simplified by using a structured document that helps streamline billing and ensures accuracy. With the right tool, service providers can easily organize their charges and keep track of every detail, from hourly rates to overall costs.

Customized formats make it easy to input data specific to each project, whether it’s hourly work or fixed rates. A well-designed document helps professionals avoid errors, reduce the time spent on administrative tasks, and maintain a professional image with their clients.

By incorporating built-in calculations and organized fields, users can automatically compute totals, taxes, and discounts. This eliminates the need for manual calculations and ensures consistency across multiple transactions. Whether you’re managing a small business or freelance work, this tool can save valuable time while ensuring all aspects of billing are clearly documented.

Labor Invoice Template Excel

Creating a document to track services provided and corresponding charges is a crucial step for many professionals. By using a customizable format, you can ensure that all necessary details are included and accurately presented. A structured approach to recording work hours, rates, and other important data helps in managing finances efficiently and professionally.

Simple to use and flexible, this tool allows users to input key information like job descriptions, hours worked, and payment terms. The format can be adjusted to suit the unique needs of each project, making it ideal for freelancers, contractors, and small business owners. By organizing everything in one place, you can streamline your administrative tasks and maintain clear records.

Automated calculations further enhance the efficiency of this approach. Instead of relying on manual math, the format allows for the automatic addition of totals and taxes, reducing the chances of human error. With an easy-to-read structure, both professionals and clients can quickly understand the breakdown of charges, ensuring transparency and clarity.

How to Create a Labor Invoice in Excel

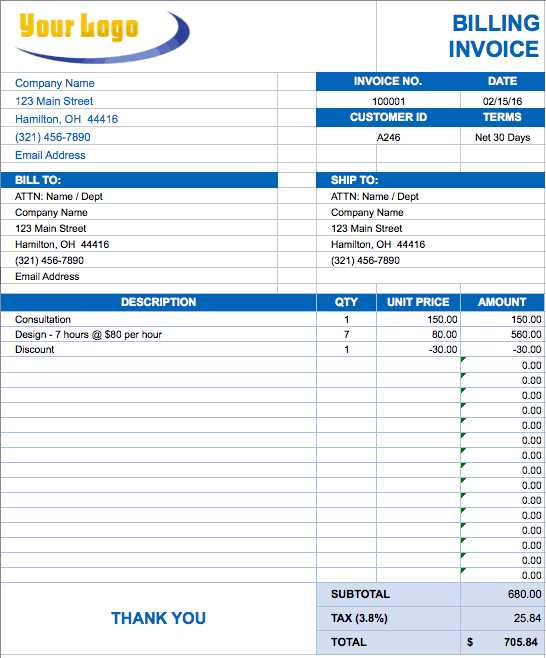

To create an effective billing document, start by structuring a clear and organized layout that captures all essential details of the services provided. Begin by including sections for client information, work descriptions, and the total amount due. Each section should be easy to read and follow, ensuring that both the service provider and the client can quickly understand the charges and payment terms.

Next, focus on adding fields for work hours or completed tasks, along with corresponding rates or fees. Use simple formulas to calculate totals automatically, ensuring that you avoid manual errors. It’s important to leave space for any additional charges, taxes, or discounts that may apply, providing a transparent breakdown of costs.

Finally, make sure your document is visually appealing and professional by using clear headings and well-aligned data. By keeping the layout simple and uncluttered, you will make it easier for clients to process the payment quickly and without confusion.

Benefits of Using Excel for Labor Invoices

Utilizing a spreadsheet program to manage billing offers numerous advantages, especially for small business owners and freelancers. The flexibility of such a tool allows for easy customization of the layout, enabling users to create documents that fit their specific needs. Whether you’re working on multiple projects or managing ongoing services, a well-organized spreadsheet helps track all necessary information in one place.

Another major benefit is the built-in calculation capabilities. With simple formulas, you can automate complex calculations, reducing the risk of human error and saving time. The ability to update data in real-time means that any changes, whether in pricing or hours worked, are instantly reflected in the totals, ensuring accurate and up-to-date billing.

Additionally, the accessibility and ease of sharing are key advantages. Files can be easily saved, shared via email, or even stored in the cloud for quick access from any device. This not only enhances productivity but also helps maintain a professional appearance when dealing with clients. The simplicity of the program also ensures that anyone, regardless of their technical expertise, can create and manage these documents efficiently.

Key Elements of a Labor Invoice

When creating a billing document, it’s important to include all the essential information that both the service provider and the client need for a clear understanding of the charges. A well-structured layout ensures that all relevant details are easily accessible and that no crucial information is overlooked. Each component of the document should work together to provide a transparent and accurate breakdown of the service costs.

Essential Information to Include

Client and service provider details are fundamental, such as names, addresses, and contact information. It’s also important to clearly state the service period and a description of the work completed. This helps both parties keep track of the transaction and eliminates any confusion regarding the work performed.

Charges and Payment Terms

The most critical section includes the breakdown of costs, whether it’s based on hourly rates, fixed fees, or a combination of both. Additionally, clearly specifying payment terms such as due dates and accepted methods ensures clarity. Including tax calculations and any potential discounts further helps create a complete and accurate financial record.

How to Customize Your Excel Invoice

Personalizing your billing document allows you to tailor it to your specific business needs, ensuring it reflects your branding and provides all the necessary information for clients. Customization can involve adjusting the layout, changing colors, or adding specific fields to better suit your services. This makes the document not only functional but also professional and aligned with your company’s identity.

Adjusting Layout and Design

Start by modifying the layout to suit the type of work you do. If you offer multiple services, adding separate sections for each one can help organize the document. Consider adjusting column widths, using borders for clear separation, and adding your logo for a personal touch. A clean and structured design enhances readability and professionalism.

Incorporating Specific Information

One of the key features of customization is the ability to add unique fields. Including specific details like job numbers, project references, or notes for the client ensures that your document captures all necessary data. Custom fields can also be added for discounts, taxes, and any other factors relevant to the transaction, making it easier to track payments and maintain accurate records.

Common Mistakes in Labor Invoices

Even with a well-structured billing document, small errors can lead to confusion, delays, or disputes. It’s essential to be mindful of common mistakes that could impact the clarity and accuracy of your charges. These errors are often easily overlooked but can create unnecessary issues for both the service provider and the client.

Missing or Inaccurate Client Details

One of the most common mistakes is failing to include complete or accurate client information. Missing details, such as the client’s name, contact information, or billing address, can lead to miscommunication and delayed payments. It’s crucial to double-check that all fields are filled out correctly before sending the document.

Calculation Errors and Omitted Charges

Another frequent issue is errors in the calculation of fees. This can include incorrect hourly rates, missed hours worked, or miscalculated taxes. Ensure that all totals are verified and, when necessary, automated to avoid mistakes. Additionally, leaving out any applicable charges, like materials or travel fees, can cause confusion and result in unpaid amounts.

Tracking Hours and Payments in Excel

Effective tracking of work hours and payments is crucial for managing finances and ensuring timely compensation. By using an organized system, you can easily record the number of hours worked, calculate fees, and monitor outstanding payments. This approach simplifies the billing process and helps maintain transparency between the service provider and client.

Tracking work hours accurately is the first step. Using a spreadsheet, you can create columns to log start and end times, total hours worked, and applicable rates. With basic formulas, these hours can be multiplied by the rate to automatically calculate the total cost for each job. This reduces the risk of errors and ensures you’re billing for all the time spent on a project.

Monitoring payments is equally important. A simple system that tracks payments received, outstanding amounts, and due dates helps keep finances in order. With clear, real-time updates, you can quickly identify overdue payments and follow up accordingly, ensuring timely cash flow and financial organization.

Best Practices for Invoice Formatting

When creating a billing document, the layout and structure play a significant role in ensuring clarity and professionalism. A well-organized format helps both the service provider and the client easily navigate through the details of the charges, minimizing confusion and reducing the chances of errors. Clear headings, proper spacing, and well-defined sections contribute to a seamless and effective billing process.

Keep the Design Simple and Clear

Maintain a straightforward design that prioritizes readability. Avoid cluttering the document with unnecessary details or complex graphics. Stick to a clean and structured layout where the most important information stands out. Proper use of headings, borders, and consistent font styles ensures that the document looks professional and is easy to understand.

Ensure Accurate and Transparent Data

Accuracy in presenting the services rendered and the corresponding charges is crucial. Use tables to clearly organize the work details, time spent, and rates. A well-formatted table not only makes the document visually appealing but also allows for easy reading and comparison. Below is an example of how to structure these details in a table:

| Description of Work | Hours Worked | Rate | Total |

|---|---|---|---|

| Consultation | 5 | $50 | $250 |

| Design Work | 8 | $60 | $480 |

| Total | $730 |

Using clear tables like the one above ensures that each component of the transaction is easy to follow and reduces the likelihood of confusion for the client.

How to Calculate Labor Costs Automatically

Automating the calculation of service costs can save time and reduce errors. By setting up a system that calculates charges based on hourly rates and time worked, you can streamline the billing process. Using built-in formulas allows for easy updates and ensures that all calculations are accurate, regardless of changes in rates or the number of hours worked.

To calculate costs automatically, start by defining the key components: the hourly rate and the total number of hours worked. In a spreadsheet, you can set up simple formulas that multiply these values to calculate the total cost for each task. This removes the need for manual calculations, reducing the risk of mistakes and ensuring consistency across multiple projects.

For added functionality, consider using formulas that adjust totals based on specific conditions, such as overtime rates or discounts for early payments. For instance, you can set up conditional formulas that apply a different rate after a certain number of hours worked, automatically adjusting the final amount. This flexibility ensures that your calculations remain accurate, even as the variables change.

Template Features for Freelancers

For independent professionals, having an efficient billing system is essential to managing projects and ensuring timely payment. A well-designed billing document can help freelancers keep track of hours worked, services provided, and outstanding payments. Certain features are particularly useful for freelancers to create clear, professional, and customizable billing records.

Customizable Fields for Different Services

Freelancers often provide a range of services that vary in scope and pricing. Customizable fields allow for flexibility in listing different types of work, whether it’s hourly rates for consulting, fixed fees for projects, or special charges for additional tasks. Having the ability to modify the document to match specific project details makes it easier to tailor each billing document according to the nature of the work.

Automated Calculations and Totals

Automating the calculation of charges can save freelancers time and reduce the risk of errors. By using built-in formulas, the system can automatically calculate the total cost based on the time worked and the agreed-upon rate. Additionally, automatic tax calculations or discounts based on payment terms can also be included, making the overall process faster and more efficient.

How to Share and Send Excel Invoices

Once your billing document is completed, sharing it with clients in a professional and efficient manner is crucial for timely payments. There are several ways to send your billing records, ensuring that the client receives the correct information in a format that’s easy to review. Whether you’re sending a digital file or sharing it via an online platform, it’s important to choose the right method based on the client’s preferences.

One of the most common ways to share completed documents is through email. After saving your document in a suitable format, such as PDF, you can attach it to an email and send it directly to your client. It’s also a good idea to include a brief message in the email to ensure clarity. Below is an example of a table layout that can be included in a simple email to summarize charges:

| Description of Work | Hours Worked | Hourly Rate | Total |

|---|---|---|---|

| Consultation | 4 | $50 | $200 |

| Design Work | 6 | $60 | $360 |

| Total | $560 |

For clients who prefer using cloud services, documents can be uploaded to platforms such as Google Drive, Dropbox, or OneDrive, where you can share a link to the file. This method also provides easy access for the client to download and review the document at any time. Be sure to set the appropriate permissions to allow the client to view or download the file securely.

Integrating Time Tracking with Invoices

Combining time tracking with billing ensures that all charges are accurately calculated based on the actual hours worked. By integrating these two processes, professionals can streamline their workflows, reduce errors, and create more transparent and reliable billing records. With this approach, the transition from tracking time to generating payment requests becomes seamless, allowing for quicker and more efficient financial management.

To integrate time tracking with your billing process, consider using digital tools that automatically record the hours worked and then transfer this data into your payment records. This eliminates the need for manual entry, ensuring that the time billed matches exactly with the services provided. Below is an example of how time tracking can be represented in a billing document:

| Description of Work | Time Tracked (Hours) | Hourly Rate | Total Cost |

|---|---|---|---|

| Consulting Session | 5 | $50 | $250 |

| Development Work | 8 | $60 | $480 |

| Total | $730 |

In this example, time tracking directly influences the total cost, making it easier for both the provider and the client to understand how the final amount is derived from the hours worked. By automating this integration, you can minimize the chances of miscalculations and ensure that each billing document reflects the exact effort expended on a project.

Adjusting Tax Rates in Excel Templates

Adjusting tax rates within billing documents is a crucial part of the invoicing process, ensuring compliance with current laws and maintaining accuracy in financial records. As tax laws change or vary by region, it’s important to easily update these rates to reflect the latest standards. By automating tax calculations in your financial documents, you can simplify this process and avoid errors that may arise from manual adjustments.

In many digital accounting tools, such as spreadsheets, tax rates can be adjusted quickly by changing a single value in a formula. Once the new tax rate is set, the system will automatically apply the updated value to all relevant charges. This not only saves time but also ensures that each transaction reflects the correct tax percentage. Below is an example of how the tax rate might be adjusted in a document:

| Description | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Consulting Service | $200 | 10% | $20 | $220 |

| Web Design | $500 | 10% | $50 | $550 |

| Total | $70 | $770 |

As seen in the example, adjusting the tax rate can easily modify the tax amount and the total due. This flexibility ensures that your billing documents always reflect the correct amount based on the latest tax regulations.

Organizing and Storing Labor Invoices

Proper organization and storage of payment records are essential for both legal compliance and efficient business management. Maintaining a well-structured system allows you to quickly retrieve any document when needed, whether for audits, tax filings, or client inquiries. By categorizing and securely storing these records, you can ensure smooth financial operations and avoid unnecessary complications.

One effective way to organize such documents is by categorizing them according to various criteria, such as date, client, or project type. Digital tools can further enhance this process by providing searchable databases, automated reminders, and secure cloud storage options. This allows you to easily track payments and monitor overdue balances.

Additionally, it’s important to regularly back up these documents and protect them with strong security measures. By keeping a digital copy in a secure cloud environment, you ensure that your records are both safe and easily accessible, even if physical copies are lost or damaged.

In the next section, we will explore how to effectively categorize and store these files to maintain an organized record-keeping system.

Using Excel Templates for Different Projects

Using predefined digital sheets to manage various tasks within a project can significantly improve efficiency and accuracy. These sheets are designed to handle specific types of data, making it easy to track progress, costs, and other important details. Whether for construction, consulting, or event planning, customized digital documents can streamline the management process and help ensure nothing is overlooked.

Benefits of Customizing Digital Sheets for Projects

- Efficiency: Pre-set fields and formulas automate calculations, saving time and reducing the risk of manual errors.

- Consistency: Templates ensure that all necessary data is included, maintaining a uniform structure across various projects.

- Flexibility: These digital documents can be easily adapted to suit the unique needs of different projects.

- Easy Tracking: Automated features such as progress bars or cost breakdowns allow you to track project details in real-time.

Types of Projects and How Templates Help

Here are a few examples of how structured sheets can be applied to different industries:

- Construction Projects: Track materials, labor hours, and expenses with detailed breakdowns for each phase of the project.

- Consulting Services: Organize client information, service details, and billing with clear categories for easy access and updates.

- Event Planning: Manage vendor details, event schedules, and expenses with visual timelines and checklists.

- Freelance Work: Keep track of hours worked, rates, and payments to ensure accurate billing and client communication.

Incorporating structured digital sheets tailored to each project can help you stay organized, streamline communication, and ensure financial transparency. These tools can be easily customized to meet the specific demands of any project, regardless of its size or complexity.

Advanced Excel Tips for Labor Invoices

Mastering advanced features in digital spreadsheets can greatly enhance the efficiency of managing payment records and other project-related details. Leveraging these features allows you to automate repetitive tasks, perform complex calculations, and analyze data more effectively. With a deeper understanding of spreadsheet functionalities, you can improve accuracy and reduce time spent on manual data entry and management.

One of the key advantages of using advanced spreadsheet techniques is the ability to set up dynamic templates that automatically adjust based on input. This can help you generate complex reports or track changes without the need for manual updates every time a figure changes.

Here are some useful advanced tips to help you get the most out of your spreadsheets:

- Conditional Formatting: Highlight specific data points based on criteria, such as overdue payments or completed tasks, to make important information stand out.

- VLOOKUP and INDEX-MATCH: These functions allow you to search and retrieve specific information from large datasets, saving time when managing multiple records.

- Data Validation: Restrict input to certain values or ranges to ensure data consistency and prevent errors.

- Pivot Tables: Summarize large volumes of data in a compact, easily digestible format for quick analysis and decision-making.

- Automated Calculations: Use formulas to automatically calculate totals, taxes, or discounts based on predefined rules, ensuring consistency across documents.

By incorp