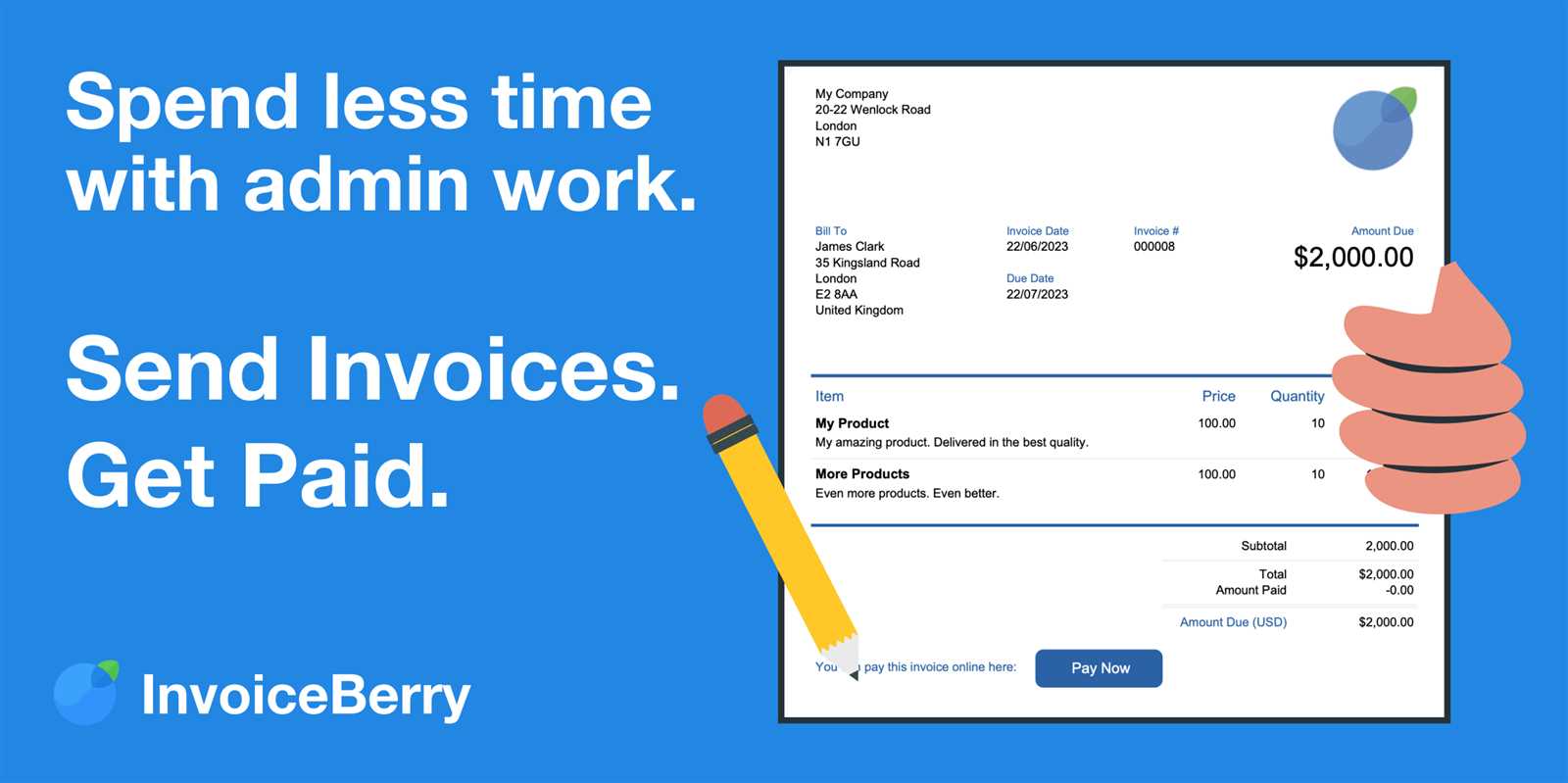

Download Bill Invoice Template for Word and Create Professional Invoices

Managing financial transactions efficiently is crucial for any business or freelancer. One of the simplest yet most essential tools for handling payments is a well-designed document that outlines the details of a transaction. Whether you’re a small business owner or an independent contractor, having a clear and professional format for requesting payment can save you time and ensure clarity in your communication.

With the right document structure, you can easily customize the details to fit various needs, from listing services provided to specifying due dates and amounts. Using a pre-designed format allows for quick editing and ensures consistency across all of your financial records. These formats are particularly useful for those who may not have advanced design or accounting software, making them an accessible choice for many users.

In this article, we will explore how you can leverage a simple, customizable document format to streamline your payment processes. Whether you’re looking for an easy way to track your transactions or need to present a professional appearance to clients, this solution can help you maintain organization and clarity.

Bill Invoice Template for Word

Creating a professional payment document can be quick and easy when you use a well-designed format. By choosing a pre-built structure, you eliminate the need to start from scratch, saving valuable time while maintaining a polished look. This option provides flexibility to adapt the document for various purposes, from simple transactions to more complex billing details.

Customizable and Flexible Formats

Using a ready-made structure for financial documents offers significant customization options. You can easily modify the text, add logos, change fonts, and adjust the layout to suit your needs. This ensures that each document aligns with your business identity while providing all the necessary information clearly. Whether you’re dealing with multiple clients or a single customer, such a format can streamline your billing process.

Why Choose a Pre-Designed Solution

For many businesses, especially smaller ones or freelancers, access to professional software may be limited. In these cases, using a simple yet effective format for generating payment requests becomes essential. A pre-designed structure ensures that your documents not only look professional but also include all the required details for proper record-keeping. With the right design, you can easily create and send invoices without the hassle of formatting or worrying about missing key information.

Why Use a Bill Invoice Template

Adopting a pre-designed structure for payment documents offers numerous benefits, especially for businesses and individuals who want to save time and maintain consistency. Instead of creating a new document from scratch each time, a ready-to-use format simplifies the process while ensuring professional results. It helps avoid errors, maintains clarity, and streamlines the overall billing workflow.

Here are some key advantages of using a pre-designed document structure:

| Advantage | Description |

|---|---|

| Time-Saving | Pre-made designs eliminate the need to start from scratch, allowing for quick document creation. |

| Consistency | Using the same layout for every transaction ensures uniformity and professionalism in your financial documents. |

| Accuracy | Pre-built structures typically include essential fields, reducing the chances of forgetting important details. |

| Customizability | These formats can be easily adjusted to fit your specific needs, whether it’s for services, products, or other billing requirements. |

| Professional Appearance | A well-designed document helps to create a positive impression and builds trust with your clients or customers. |

By utilizing a structured format, you ensure that your billing documents are efficient, reliable, and visually appealing, providing an overall better experience for both you and your clients.

How to Customize Your Invoice Template

Customizing a pre-designed document structure is a simple yet effective way to create a professional and tailored billing experience. By adjusting the content and layout, you can ensure that the document meets your specific needs and aligns with your business identity. This flexibility allows you to add personalized elements, such as logos, payment terms, or specific item details, while keeping the core design intact.

Key Customization Elements

To make the most of a pre-built structure, focus on the following areas for customization:

| Element | Customization Tip |

|---|---|

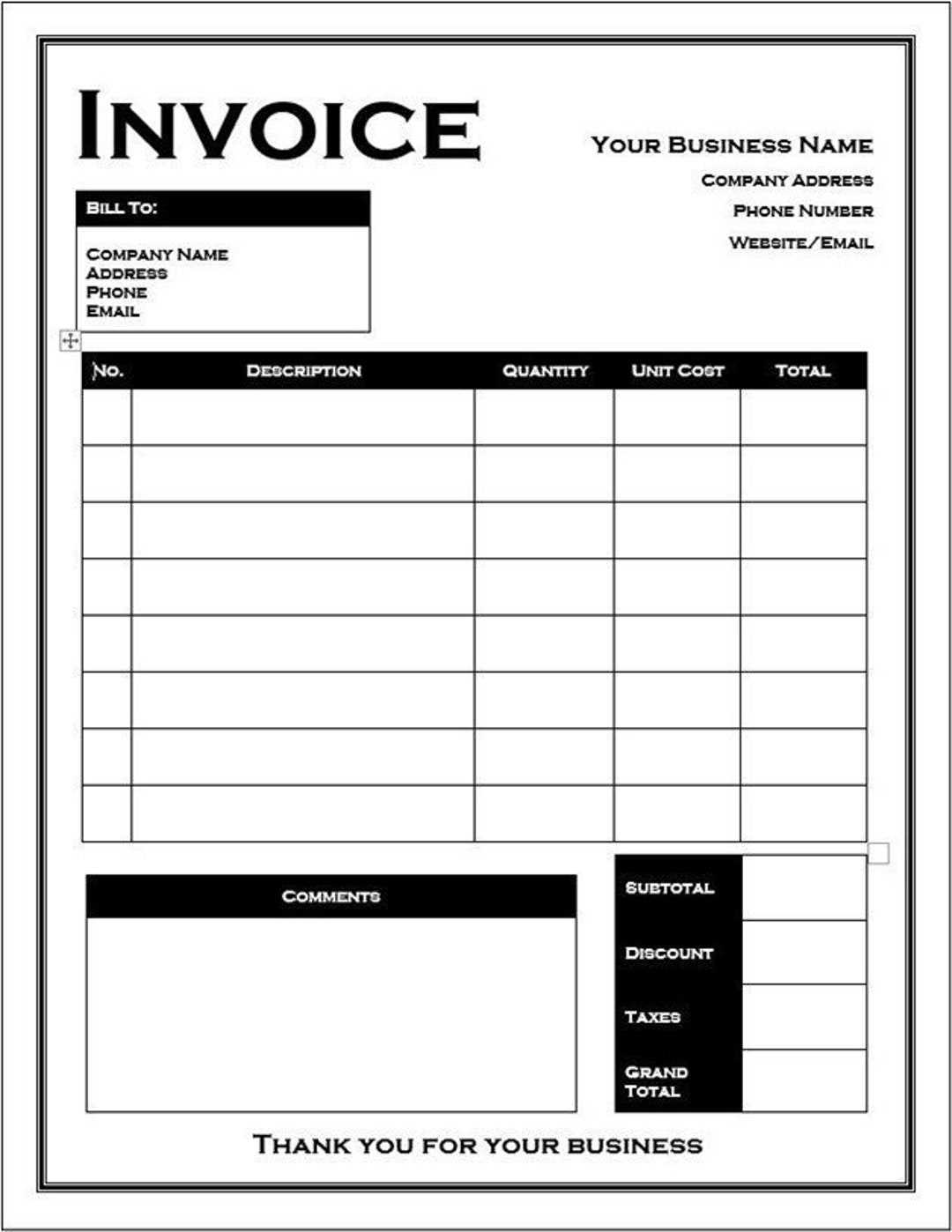

| Header Section | Include your company logo, contact information, and a title that reflects your business. |

| Payment Terms | Specify due dates, late fees, or discounts to ensure clients understand the payment expectations. |

| Itemized List | Break down products or services with descriptions, quantities, and prices for clear communication. |

| Footer | Add a thank you note, payment instructions, or any legal disclaimers necessary for your transactions. |

Adjusting Design and Layout

Besides modifying the content, it’s important to consider the layout and design. Ensure that the document is easy to read by maintaining consistent fonts and spacing. Adjust margins, align text properly, and use tables or lines for organization. A clean, structured layout not only enhances readability but also leaves a lasting impression on your clients.

Top Features of Word Invoice Templates

Using a structured document design for financial transactions provides a wide range of valuable features. These formats are designed to simplify the billing process, ensuring that all necessary details are included and that the final document looks professional. Here are some key features that make these formats especially useful for businesses and freelancers alike.

Customization Options

One of the most significant advantages of these pre-designed structures is their flexibility. Users can easily customize various aspects to meet specific needs, such as adding business logos, changing fonts, or adjusting the layout. Here are a few options for customization:

- Add your company name, address, and logo.

- Modify payment terms and due dates.

- Change color schemes to align with your brand.

- Insert specific service or product details with pricing.

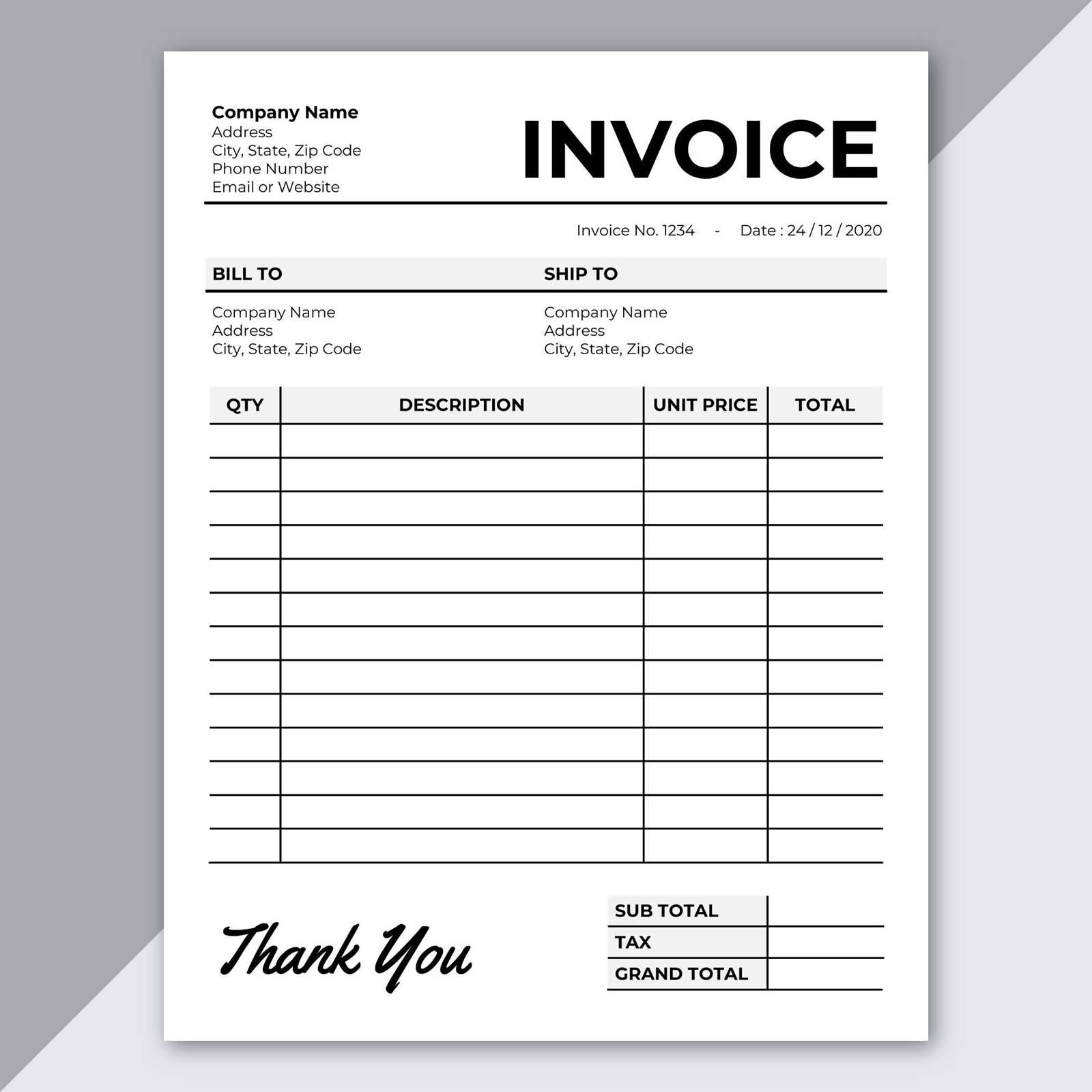

Professional Formatting

These formats are built with a clear and clean structure that enhances readability and professionalism. With predefined sections for each part of the transaction, it ensures that all critical details are covered, making it easy for clients to understand their obligations. Some key features include:

- Preformatted sections for itemizing charges and adding descriptions.

- Clear, consistent font styles and spacing for easy reading.

- Columns for quantity, unit price, and totals to ensure accurate calculations.

These features work together to create a seamless and efficient billing process that reflects well on your business and helps maintain organized financial records.

Creating a Professional Invoice with Word

Designing a professional payment document doesn’t have to be complex. By leveraging a simple, pre-built structure, you can produce a polished and functional file that effectively communicates all the necessary details of a transaction. A well-designed document helps ensure clarity for both parties and reinforces your business’s professionalism.

Essential Elements for a Professional Design

To create a document that looks professional and includes all the required information, certain sections must be clearly defined. These elements ensure that the document is both functional and visually appealing:

- Header: Include your company’s name, contact details, and logo for a personalized touch.

- Client Information: List the client’s name, address, and contact information for clear identification.

- Transaction Details: Provide item descriptions, quantities, prices, and total amounts to ensure transparency.

- Payment Terms: Clearly state the due date, payment methods, and any applicable late fees.

- Footer: Add additional information such as your business’s tax ID, website, or legal disclaimers.

Formatting Tips for a Clean Look

Beyond the content, the layout and formatting of your document are essential for readability. Here are a few tips to ensure your design is clean and organized:

- Use consistent font styles and sizes throughout the document for a uniform appearance.

- Ensure enough spacing between sections to avoid a cluttered look.

- Align text and tables properly to maintain a neat and structured layout.

- Make use of bold or highlighted text for important details, like totals or payment due dates.

By incorporating these elements and focusing on readability, you can create a professional document that is both practical and polished, leaving a lasting impression on your clients.

Benefits of Using Word for Invoices

Using a simple text processor for generating payment requests offers several key advantages. It combines ease of use with flexibility, allowing you to create professional documents quickly and efficiently. The accessibility of this tool ensures that even those without advanced software can produce clear, organized, and visually appealing payment records. Here are the main benefits of using this platform for your transaction needs:

| Benefit | Description |

|---|---|

| Easy Accessibility | Available on most computers, making it a widely accessible tool for businesses of all sizes. |

| Customization | Offers flexible design options, allowing users to tailor their documents with logos, colors, and specific formatting. |

| Cost-Effective | No need for expensive specialized software; many people already have this program installed on their devices. |

| Professional Appearance | Helps create well-structured, easy-to-read documents that reflect your business’s professionalism. |

| Time-Saving | Pre-designed structures allow for quick customization and faster document creation compared to building from scratch. |

With these advantages, using a simple word processor becomes an efficient and effective way to manage your financial transactions, ensuring clarity and professionalism in every document you create.

Free Bill Invoice Templates for Word

For many businesses and freelancers, creating a clear and professional payment document doesn’t need to come at a high cost. There are a variety of free, pre-designed structures available online that allow you to create customized billing records without any expense. These resources are perfect for small businesses or individuals who need an efficient solution for handling payments.

| Source | Details |

|---|---|

| Microsoft Office Templates | Free templates are available directly from the Office website, with a wide range of designs and formats suitable for various needs. |

| Online Resources | Numerous websites offer downloadable designs for free, with options for simple or detailed layouts that can be easily customized. |

| Google Docs | Google Docs provides free templates that can be used for creating and managing payment requests online, allowing for easy collaboration and sharing. |

| Freelancer Platforms | Freelance websites often offer free downloadable designs as part of their toolkit to help users manage financial documents efficiently. |

These free resources provide a convenient and cost-effective solution for generating professional documents. By using these structures, you can ensure that your financial communication is clear, precise, and well-organized without investing in expensive software or tools.

Step-by-Step Guide to Word Invoices

Creating a professional payment document from a pre-designed structure can be straightforward and efficient. With just a few simple steps, you can produce a clean, clear, and well-organized record for any transaction. Follow this step-by-step guide to ensure that your payment requests are both accurate and visually appealing.

1. Open a New Document

Start by opening your preferred text processing software and selecting a blank document or a pre-designed structure. If you’re using an online resource, download the format that suits your needs.

2. Insert Your Company Information

In the header section, add your business name, address, phone number, and email. This helps establish your identity and ensures the recipient knows how to contact you.

3. Enter Client Details

Under your company’s information, include the client’s name, address, and other necessary contact details. This ensures that there is no confusion about who is receiving the payment request.

4. List Services or Products

Provide a detailed breakdown of the goods or services you provided. Include descriptions, quantities, unit prices, and totals to make the request as clear as possible.

5. Specify Payment Terms

Clarify the payment due date, preferred payment methods, and any late fees or discounts if applicable. This ensures both parties are on the same page regarding the financial terms.

6. Add Additional Information

If necessary, include any other information such as tax identification numbers, business registration details, or legal disclaimers that may be relevant to the transaction.

7. Finalize and Save

Once you’ve reviewed the document for accuracy and completeness, save it in the desired format. You can either save it as a regular document or export it to a PDF for easier sharing with clients.

By following these steps, you’ll have a professional, easy-to-read document ready for any payment transaction. This process ensures clarity and organization, helping to avoid misunderstandings while maintaining professionalism in all your business dealings.

How to Add Company Logo to Invoice

Incorporating your company’s logo into payment documents is a great way to enhance professionalism and reinforce your brand identity. By adding a logo, you not only make the document visually appealing but also ensure that your clients easily recognize your business. Here’s how you can seamlessly add your logo to any payment request format.

Step 1: Prepare Your Logo

Before inserting the logo, make sure it is in a high-quality image format, such as PNG or JPEG. The image should be clear and sized appropriately for the document–typically a width of 2 to 3 inches works best for most layouts.

Step 2: Open Your Document

Open the payment record file you want to edit. Whether you’re starting from a blank page or using an existing structure, make sure you are working in a clean, editable version of the document.

Step 3: Insert the Logo

Place your cursor in the header section or the top left corner where you want the logo to appear. To add the logo, click on the “Insert” tab in the toolbar and select “Picture.” Browse your computer files and choose the logo image you’ve prepared.

Step 4: Resize and Position the Logo

Once the image is inserted, you can resize it by clicking on the logo and dragging the corners. Be sure the logo isn’t too large or overwhelming; it should fit neatly without crowding other information. Use alignment tools to position the logo to the left, center, or right as needed.

Step 5: Adjust the Layout

Ensure that the logo does not interfere with text or other important elements. Use the text wrapping options to choose the most suitable layout. For example, setting the logo to “Square” or “Tight” can make sure the text flows around the image, keeping everything neat and readable.

Step 6: Save Your Document

Once your logo is properly placed, save the document. If you’re sending it electronically, consider saving it as a PDF to preserve the layout and ensure your logo displays correctly across different devices and platforms.

By following these steps, you can easily add your company’s logo to any payment document, creating a more professional and personalized appearance that leaves a lasting impression on your clients.

What Information to Include in an Invoice

For a payment request to be clear and effective, it’s essential to include all the necessary details that ensure transparency and proper communication between both parties. A well-structured document not only serves as a formal record but also helps avoid confusion or misunderstandings regarding the transaction. Below are the key pieces of information that should always be included in a payment document.

1. Business Information

At the top of the document, include your business name, address, phone number, and email. This information makes it easy for clients to reach you if they have questions or need further details.

2. Client Information

Clearly list the client’s name, address, and any other relevant contact details. This ensures the payment request is directed to the correct recipient and adds a personal touch to the document.

3. Document Title

Use a clear heading like “Payment Request” or “Statement of Charges” to identify the document’s purpose. This helps the recipient understand the content at a glance.

4. Date and Reference Number

Always include the date when the request is being issued, as well as a unique reference number or order ID for easy tracking. This number serves as a quick way to reference the transaction for both you and the client.

5. Detailed List of Goods or Services

Provide a breakdown of the goods or services rendered, including descriptions, quantities, and unit prices. This section helps ensure clarity regarding what the client is being charged for and minimizes confusion.

6. Total Amount Due

At the end of the document, clearly state the total amount due, including any applicable taxes, discounts, or additional fees. Make sure this is easy to locate to avoid misunderstandings over payment expectations.

7. Payment Terms

Specify the payment due date, accepted payment methods, and any penalties for late payments. If applicable, include any early payment discounts or other special terms that the client should be aware of.

8. Additional Notes

Include any other relevant information such as delivery instructions, thank you notes, or legal disclaimers. This is also a good place to add any personalized messages that can strengthen your relationship with the client.

By including these essential elements in your payment document, you can ensure that your transaction is clear, professional, and easy to process for both you and your client.

Choosing the Right Template for Your Business

Selecting the right structure for your payment records is an essential step in managing your business finances. A well-designed document not only helps maintain professionalism but also ensures accuracy in billing. The correct format can make your transactions more efficient and create a better experience for your clients. Here are key factors to consider when choosing the ideal structure for your business.

Consider Your Business Type

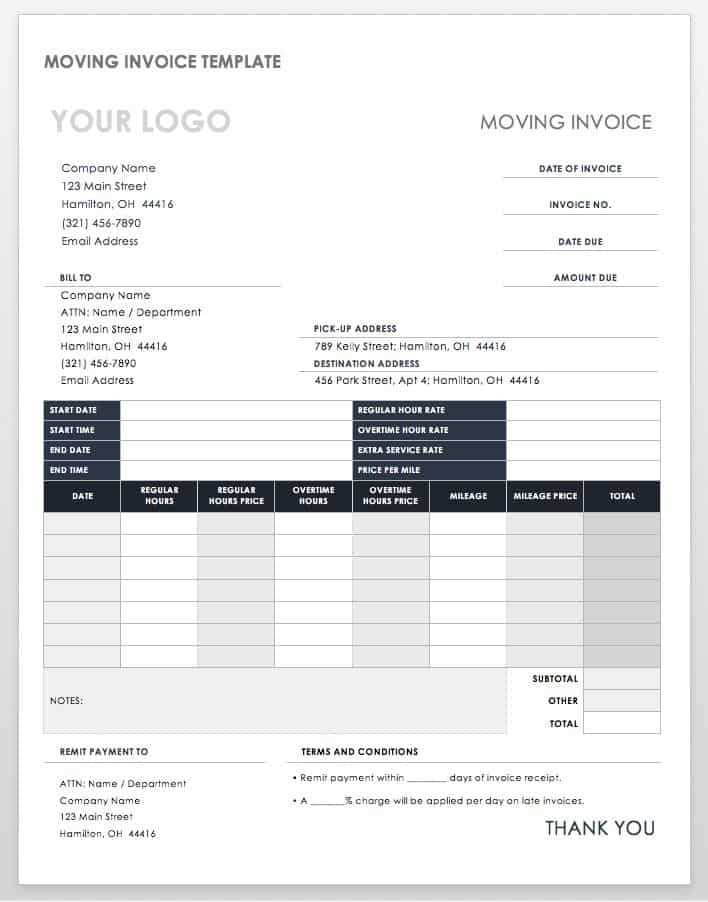

The first step in selecting the right format is to consider your industry and business needs. Different sectors may require different layouts or sections to be included. For example:

- Freelancers and Consultants: Simple structures with space for hourly rates or project fees might be most effective.

- Retailers: A layout that accommodates multiple product items, quantities, and prices is crucial.

- Service Providers: Look for a format that allows you to list services rendered with detailed descriptions and labor hours.

Customization and Flexibility

Another important factor is the level of customization offered by the structure. The more flexible the format, the better it can align with your specific business needs. Look for the following features:

- Editable Fields: Choose a structure that lets you easily adjust sections, such as payment terms or itemized lists.

- Branding Options: Ensure that the format allows you to add your logo, business colors, and other branding elements.

- Clear Layout: A clean, well-organized design will improve readability and create a more professional appearance.

By understanding your business’s specific needs and looking for flexibility, you can find a format that enhances your financial processes and strengthens your client relationships.

Common Mistakes to Avoid in Invoices

Creating a payment document may seem straightforward, but there are several common errors that can lead to confusion, delays, or even disputes. These mistakes not only affect your professionalism but can also result in missed payments or strained client relationships. By being aware of these pitfalls, you can ensure your documents are accurate, clear, and effective. Below are some key mistakes to avoid when creating any transaction record.

1. Missing Contact Information

It’s crucial to include both your business and the client’s contact details. Leaving out important information such as phone numbers, emails, or addresses can make it difficult for your client to reach you for any clarifications or issues.

2. Incorrect or Missing Dates

Always ensure that the date of issue and the payment due date are correct. Missing or incorrect dates can lead to confusion over payment deadlines and can affect your cash flow.

3. Lack of Detailed Descriptions

Vague descriptions of products or services can lead to misunderstandings. Make sure to clearly describe each item or service, including quantities, rates, and any relevant details. This helps avoid disputes and ensures transparency in the transaction.

4. No Unique Reference Number

Every payment document should include a unique reference or order number. This helps both you and your client track the payment and simplifies record-keeping for both parties.

5. Failing to Specify Payment Terms

Clearly outlining your payment terms–such as due dates, accepted payment methods, and late fees–is essential. Without these details, clients may delay payments or misunderstand the conditions, leading to frustration.

6. Overlooking Taxes and Discounts

Ensure that any applicable taxes or discounts are properly calculated and displayed. Neglecting to include these can lead to discrepancies between the amount charged and what the client expects to pay.

7. Unclear Total Amount

The total due should be easy to find and clearly labeled. Avoid having the total hidden in the document or incorrectly calculated, as this could lead to disputes over payment amounts.

By carefully reviewing your payment documents for these common mistakes, you can avoid unnecessary complications and ensure smooth transactions. A clear, accurate, and professional payment request builds trust with your clients and helps maintain strong business relationships.

How to Save and Share Your Invoice

Once your payment document is ready, the next step is to save and share it with your client. Ensuring that the file is properly saved and shared in an accessible format is essential for smooth communication and prompt payment. Here’s a simple guide on how to save and send your completed document.

Saving Your Document

Before sharing, it’s important to save your document in a format that is easy to access and read. Consider the following options:

- PDF Format: This is the most common and professional format for sharing. It preserves the layout and ensures your document looks the same on all devices.

- Editable Document: If you want to allow your client to make changes, save it in an editable format (e.g., .docx). However, this is less secure as it allows alterations.

- Cloud Storage: If you’re saving it online, make sure to choose a reliable cloud storage service (e.g., Google Drive, Dropbox) for easy access and sharing.

Sharing Your Document

Once the document is saved, you need to share it efficiently and securely. Here are the most common methods:

- Email: Attach the saved file to an email. Make sure to include a clear subject line and a brief message explaining the contents of the document.

- File Sharing Platforms: For large files or when multiple people need access, use file sharing services like Dropbox or Google Drive. Share the link with the recipient for easy access.

- Printed Copy: If necessary, print the document and mail it to the client. This is often used for formal or legal transactions that require a physical copy.

By saving your payment request in a professional format and using the appropriate sharing methods, you can ensure that your client receives the document quickly and without any issues, making the entire process more efficient.

Formatting Tips for Clean Invoice Design

A well-organized and visually appealing payment document is essential for making a good impression and ensuring clarity in your transactions. Proper formatting can help your client easily read and understand the details, reducing the chances of confusion or mistakes. Here are some formatting tips to ensure your payment requests are clean, professional, and easy to follow.

1. Use Clear and Simple Fonts

Choose fonts that are easy to read and professional in appearance. Avoid overly decorative fonts, as they can make the document hard to interpret. A simple, clean font like Arial or Calibri is often the best choice for readability.

2. Organize with Headings and Subheadings

Break your document into clear sections with bold headings. Group similar information together, such as payment details, client information, and services provided. This organization allows the recipient to quickly find what they need.

3. Keep Adequate White Space

Don’t overcrowd the document with too much information. Leave sufficient space between sections, text, and tables to make the content easier to read. White space can enhance the document’s professionalism and help your client focus on key details.

4. Align Text Properly

Ensure that your text is consistently aligned. Generally, aligning headings to the left and numbers (like amounts) to the right creates a clean and structured layout. Consistent alignment helps create a polished look and prevents clutter.

5. Use Tables for Detailed Information

If your document includes itemized lists or price breakdowns, tables are a great way to organize this information clearly. Keep the table simple with clear column headings for quantities, descriptions, rates, and totals. This structure makes it easier for your client to see all the necessary details at a glance.

6. Limit Color Use

While it’s important to add your branding, don’t overdo the use of color. Stick to one or two colors for headings or important details, and use them sparingly. Too many colors can distract from the information and create a cluttered appearance.

7. Highlight Important Information

Make critical details stand out by using bold text, larger fonts, or different colors (within reason). For instance, the total amount due should be bolded or highlighted so that it’s easily noticeable at the end of the document.

By following these formatting tips, you can ensure that your payment documents are not only professional and easy to read but also leave a positive impression on your clients. A clean, well-designed document can help strengthen your business relationships and streamline the payment process.

Using Word Templates for Different Industries

Different industries have unique needs when it comes to documenting transactions, and choosing the right structure can make the billing process more efficient and tailored to specific business requirements. Whether you are in retail, consulting, or the service industry, using a customizable format can simplify how you present charges and help maintain consistency in your records. Below is a look at how various industries can benefit from a well-designed document structure.

Industry-Specific Needs

Depending on the type of business you run, there are specific elements that need to be incorporated into your payment documents. Some industries require detailed breakdowns, while others focus on simplicity or hourly rates. Here’s a look at how different sectors can benefit from using a tailored layout:

| Industry | Key Features to Include |

|---|---|

| Consulting & Freelancing | Hourly rates, project milestones, and specific services provided. |

| Retail | Product descriptions, quantities, unit prices, and discounts. |

| Construction & Contracting | Labor hours, materials costs, and payment schedules. |

| Healthcare | Services rendered, medical codes, insurance details, and patient information. |

| Event Planning | Event dates, venue details, and service packages. |

Benefits of Industry-Specific Structures

Customizing your payment document to your industry offers numerous advantages:

- Clarity and Precision: Including the right details for your industry helps prevent confusion and ensures that all charges are understood upfront.

- Professionalism: A well-designed document that aligns with industry standards enhances your business’s credibility and fosters trust with your clients.

- Time-Saving: Having a pre-set structure saves time by eliminating the need to recreate documents from scratch for every transaction.

- Consistency: A standardized format across all your documents creates a sense of order and reliability in your business communications.

By selecting the right format for your specific business sector, you can make the billing process smoother, faster, and more professional, while al

How to Track Payments with Invoices

Keeping track of payments is crucial for any business, as it ensures that all financial transactions are recorded, monitored, and followed up on if necessary. By using a well-structured payment document, you can easily manage outstanding balances, track payment due dates, and ensure that all funds are received on time. Below are effective methods to use your transaction records for payment tracking.

One of the most efficient ways to track payments is to maintain detailed records within each document. This allows you to easily match payments with specific transactions, which helps avoid confusion and errors. Here are some key features to include when tracking payments:

| Field | Purpose |

|---|---|

| Unique Reference Number | Helps identify and track the payment request for future reference. |

| Payment Due Date | Clarifies when payment is expected, helping you keep track of overdue payments. |

| Payment Status | Indicates whether the payment has been received, partially paid, or is still outstanding. |

| Amount Paid | Shows the exact amount that has been received, making it easier to match payments with the total due. |

| Balance Due | Displays the remaining amount that needs to be paid. |

Using these fields to track the payment status in each document provides clarity and allows you to follow up promptly if payments are overdue. Here are some other best practices for effective payment tracking:

- Maintain a Payment Log: Keep a separate record of all paid and outstanding amounts, including dates and reference numbers. This can be done digitally or on paper, but a digital version allows for easier updates and searches.

- Follow Up on Overdue Payments: If a payment is overdue, send a polite reminder to your client. Be sure to reference the unique number on the document for easy identification.

- Use Accounting Software: Consider integrating your transaction records with accounting software that can automatically update payment statuses, send reminders, and generate reports on outstanding balances.

By keeping track of payments in a structured and organized manner, you can ensure smooth cash flow and avoid unnecessary confusion, making it easier to run your business effectively and professionally.

Automating Invoice Generation in Word

Creating payment documents manually for every transaction can be time-consuming and prone to errors. Automating this process allows you to generate consistent, professional-looking documents quickly, saving both time and effort. By setting up automation features within your software, you can streamline your billing process and ensure accuracy with minimal intervention.

How Automation Improves Efficiency

Automating the generation of payment documents offers several advantages for businesses of all sizes. It reduces repetitive tasks, minimizes human error, and ensures consistency across all your financial records. Here’s how it works:

| Benefit | How It Helps |

|---|---|

| Time Savings | Automating repetitive tasks frees up time, allowing you to focus on more important aspects of your business. |

| Consistency | Using predefined fields and formats ensures that each document follows the same structure and style, maintaining professionalism. |

| Accuracy | Automated systems help reduce human error, such as incorrect calculations or missing information. |

| Customization | Predefined templates can be personalized for each customer or transaction, while keeping a consistent layout. |

Setting Up Automated Generation

To automate the process of generating payment documents, you can use built-in features in your software or integrate third-party tools. Here are some basic steps:

- Use Built-in Fields: Many programs offer fields for customer information, dates, itemized lists, and totals. You can set up these fields to automatically populate when you input basic data.

- Create Macros: A macro can be set up to automate repetitive tasks, such as applying your company logo, formatting the document, or filling in specific details like payment terms and amounts.

- Link to Accounting Software: Integrating your document generation process with accounting software or CRM tools allows for automatic population of customer details, transaction history, and amounts due.

- Automate Emailing: With the right setup, your system can even automatically send the completed documents to clients upon creation, saving time and ensuring timely delivery.

By automating your payment document generation, you can reduce the administrative burden, improve the accuracy of your financial records, and maintain a professional appearance with every document you send.

How to Convert Word Invoices to PDF

Converting your payment documents to PDF format is a crucial step in ensuring that they are universally accessible, secure, and easy to share with clients. PDFs preserve the formatting and layout of your documents, making them ideal for professional communication. Here’s a simple guide on how to convert your payment requests into a PDF format, while keeping all the details intact.

There are several methods available to convert your payment documents into a PDF, depending on the software you use. Below are some common approaches to help streamline the process:

- Using Built-in Export Options: Many software programs, such as Microsoft applications, include a built-in feature to export or save files directly as PDFs. Simply open your document and select the “Save As” or “Export” option, then choose PDF as the desired format.

- Print to PDF: If your software doesn’t offer a direct “Save As PDF” option, you can use the “Print” function. Select “Microsoft Print to PDF” or another virtual PDF printer from the printer options. This will create a PDF file instead of printing the document on paper.

- Using Online Converters: There are numerous free online tools that allow you to upload your document and convert it to a PDF in a few easy steps. Simply search for “Word to PDF converter,” upload the file, and download the converted PDF.

- Using PDF Software: Dedicated PDF software like Adobe Acrobat provides advanced features for converting and editing documents. You can open your document in the software, choose “Create PDF,” and select the file you wish to convert.

Once your document is converted to PDF, you can easily send it via email, upload it to client portals, or store it securely. Additionally, PDF files are less likely to be altered or corrupted compared to other file formats, providing an extra layer of security for your financial transactions.

By converting your documents into PDFs, you ensure that they maintain their formatting, making it easier for clients to read and understand the payment details. This format is widely accepted and looks professional, making it an ideal choice for business correspondence.