Invoice Consulting Services Template to Optimize Your Billing Process

Efficient financial documentation is key to maintaining smooth operations in any business. A well-structured approach to creating and managing payment records helps avoid errors, saves time, and ensures clear communication with clients. Having a clear and easy-to-follow framework for generating financial documents is crucial for both large and small businesses alike.

Customizable solutions for creating detailed records can be a game changer. These tools offer flexibility, enabling businesses to tailor the layout and content according to their needs. Whether you are managing multiple projects or handling various clients, a system that simplifies billing can reduce administrative workload and increase productivity.

Using these efficient tools also contributes to professionalism. A well-designed and consistent format not only improves accuracy but also strengthens relationships with clients by ensuring transparency. Clear financial documents reflect a business’s commitment to organization and reliability, making them a vital part of successful operations.

Understanding Invoice Consulting Services

Managing financial documentation is an essential task for any business, ensuring clear communication of amounts due and providing transparency to clients. The process of preparing accurate records for payments involves more than just basic number crunching; it requires a structured approach that aligns with business goals and client needs. In this section, we will explore how effective management of billing procedures can improve business operations.

One of the main objectives of optimizing financial document creation is to streamline operations and reduce administrative burden. This can be achieved through systematic tools that guide users in producing consistent and error-free records. These solutions offer businesses the ability to:

- Enhance accuracy and consistency across all financial communications

- Save time by automating the creation of detailed documents

- Ensure compliance with industry standards and regulations

- Provide flexibility to cater to unique client requirements

By adopting a well-structured system for generating payment records, businesses can not only improve their internal workflows but also build trust with their clients. The clarity and professionalism of the documents help prevent misunderstandings and promote smooth transactions.

Moreover, these tools can be easily tailored to fit different industries, ensuring that the specific needs of each business are met. Whether you operate in a creative field, technical industry, or offer specialized expertise, customized financial documents can support your business’s unique requirements and client expectations.

Why Use Billing Documents for Consulting

When managing client relationships and business finances, creating detailed and professional payment requests is essential. Having a standardized approach for generating these documents can save time, improve accuracy, and reduce potential errors. A pre-structured format offers many advantages, especially for businesses that need to maintain a consistent approach while meeting client needs efficiently.

For professionals in advisory roles, using ready-made formats to create detailed records helps avoid manual errors and ensures all required information is included. The flexibility of such formats allows businesses to tailor the documents to their unique requirements while maintaining a professional appearance. The ability to generate clear and precise payment requests simplifies financial management and enhances business efficiency.

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed structures allow faster creation of billing documents without starting from scratch. |

| Consistency | Standardized layouts ensure uniformity across all financial communications, improving professionalism. |

| Accuracy | Pre-set fields help avoid missing or incorrect information, reducing errors in financial records. |

| Customization | Flexible design options allow businesses to adjust documents for different client needs. |

By using a structured system for creating these records, businesses can ensure that all critical details are included, making transactions smoother and less prone to disputes. It allows professionals to focus on their core activities while maintaining organization and transparency with clients.

Key Benefits of Structured Billing Documents

Having a well-organized system for creating payment records offers numerous advantages for businesses, especially in industries where accurate financial documentation is essential. Structured formats help streamline administrative tasks, reduce human error, and maintain a professional appearance in all client communications. By adopting these solutions, businesses can save time, increase efficiency, and improve their financial management processes.

Improved Efficiency and Time Savings

Using predefined structures allows businesses to generate documents quickly and easily. Instead of starting from scratch each time, professionals can focus on customizing essential details, ensuring accuracy and reducing the time spent on manual tasks. This can be particularly beneficial for businesses with frequent transactions or numerous clients.

Enhanced Professionalism and Consistency

Pre-designed formats maintain a consistent look and feel across all documents, enhancing the company’s professional image. Whether the business is handling a single client or a large volume of work, using a uniform layout ensures that clients receive clear, easy-to-read documents that reflect the business’s commitment to quality and organization.

| Benefit | Impact |

|---|---|

| Time Efficiency | Quick document creation speeds up the billing process and reduces administrative workload. |

| Accuracy | Pre-filled fields minimize errors and ensure all required information is included. |

| Customization | Flexible layouts allow businesses to adjust documents based on specific needs and client preferences. |

| Professional Appearance | Uniform design enhances the business’s credibility and helps build client trust. |

By adopting structured formats for creating financial records, businesses not only streamline their operations but also provide a higher level of service and clarity to their clients. These solutions offer an easy way to maintain organization and transparency in all financial communications.

How Billing Documents Improve Workflow

Efficient workflows are the backbone of any successful business. Streamlining repetitive tasks, especially those related to financial documentation, allows teams to focus on more strategic activities. By implementing structured systems for creating payment requests, businesses can minimize manual work, reduce errors, and improve overall operational efficiency.

Standardized formats help eliminate the need for repetitive setup every time a document needs to be created. Instead of starting from scratch, professionals can use pre-designed layouts that already include necessary fields. This consistency speeds up the process and ensures that all required information is captured accurately without the need for constant oversight.

Additionally, these systems help reduce human error. By offering pre-filled fields and standardized sections, businesses can prevent common mistakes such as missing details or incorrect calculations. This not only improves accuracy but also ensures that clients receive clear and professional communication on every occasion.

The automation and consistency offered by structured systems also foster better collaboration within teams. For example, when multiple team members are involved in managing financial documentation, having a unified approach means that each person knows exactly what to expect, ensuring a seamless handoff and reducing the potential for miscommunication.

Ultimately, using efficient tools to create payment records enables businesses to process financial documentation faster, more accurately, and with greater confidence, allowing them to focus on core business tasks and enhancing client relationships.

Customizing Billing Documents for Clients

Every client has unique requirements, and tailoring financial communications to fit these needs is essential for building strong business relationships. Customizing payment documents allows businesses to provide a personalized experience that aligns with client expectations. Whether adjusting the layout, adding specific details, or incorporating client branding, offering a custom approach shows professionalism and enhances client satisfaction.

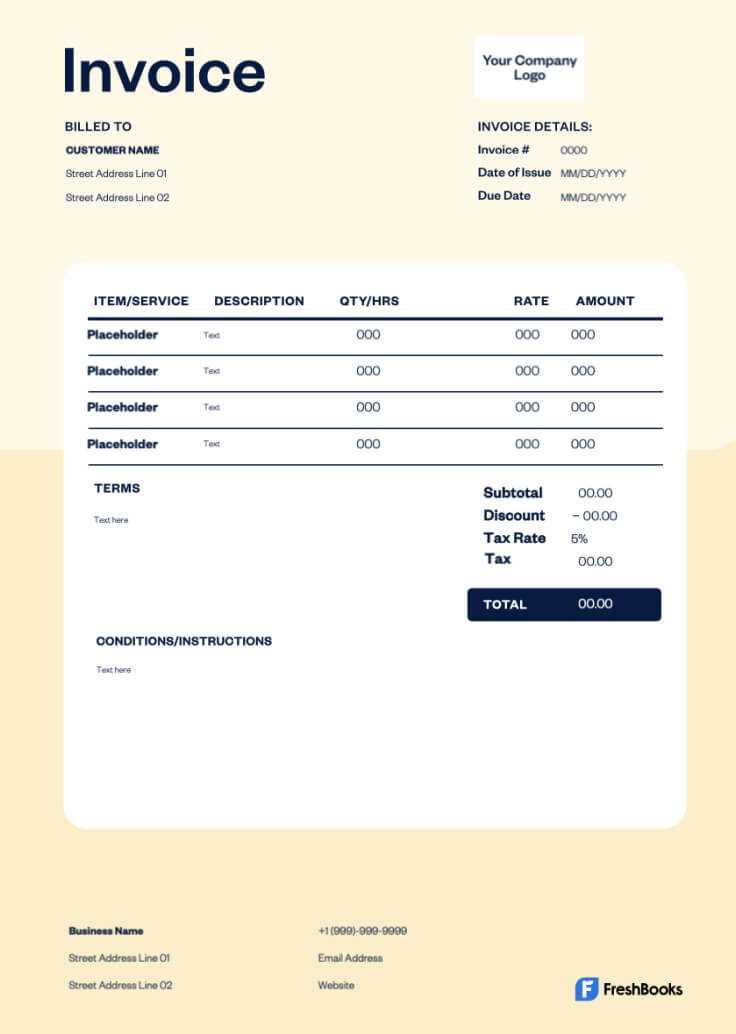

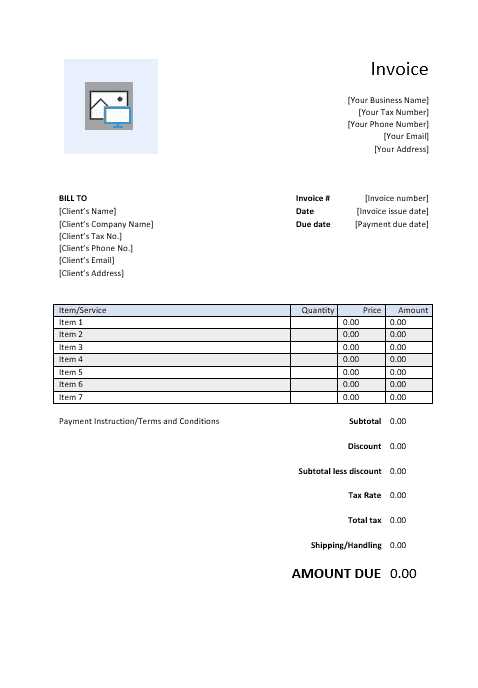

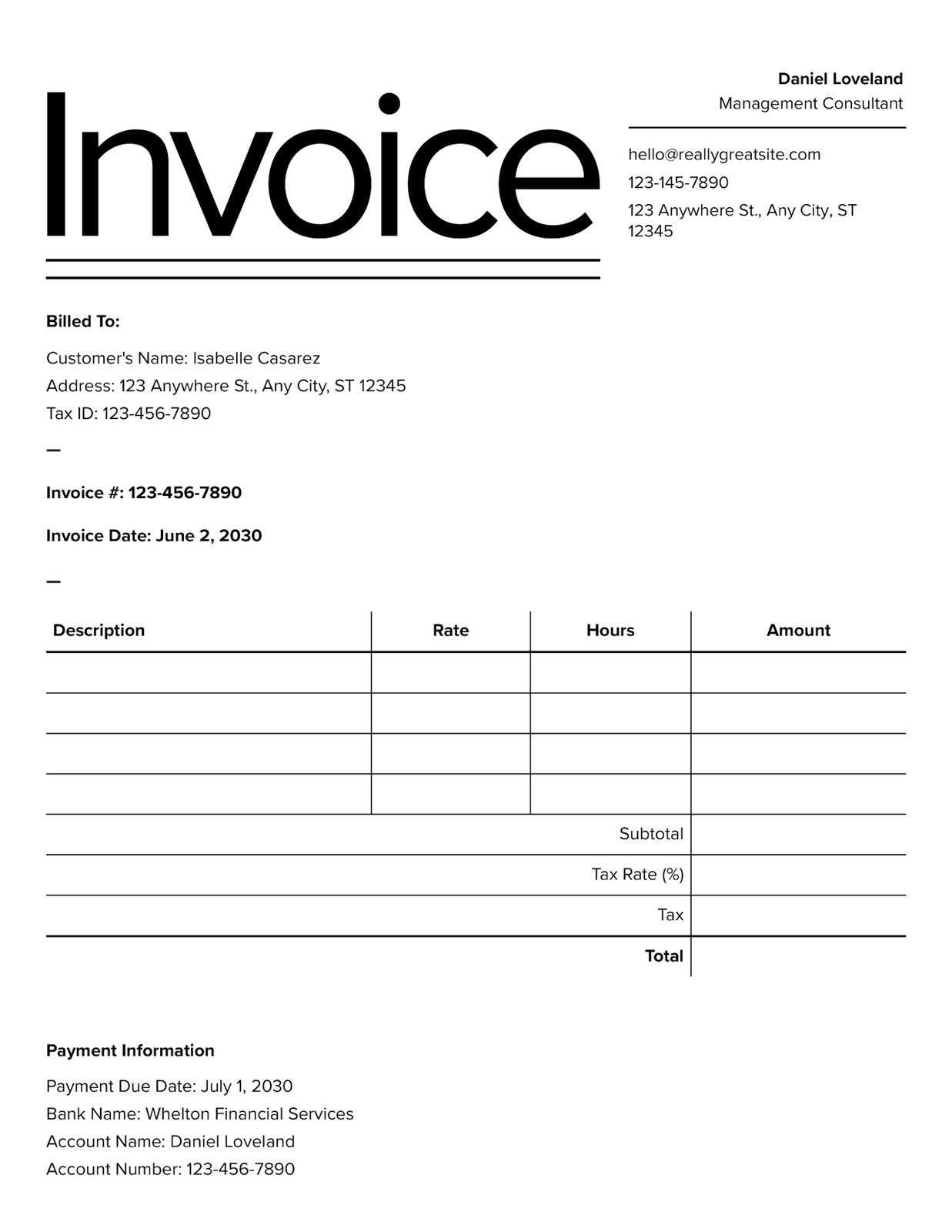

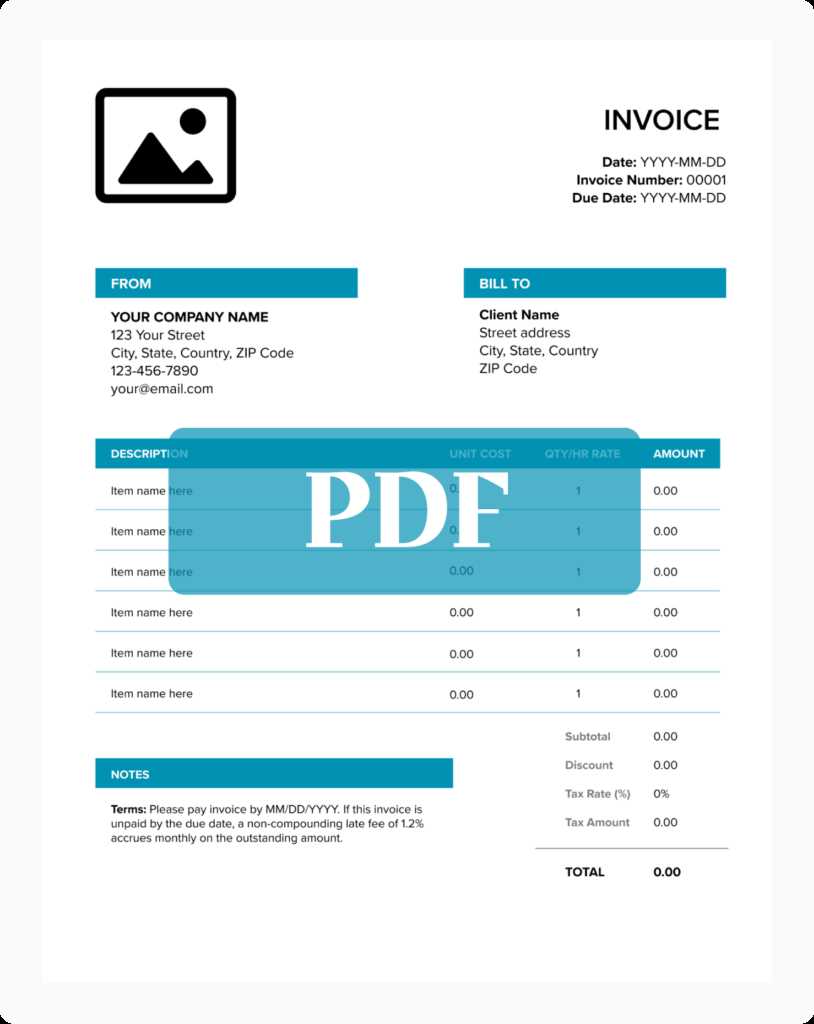

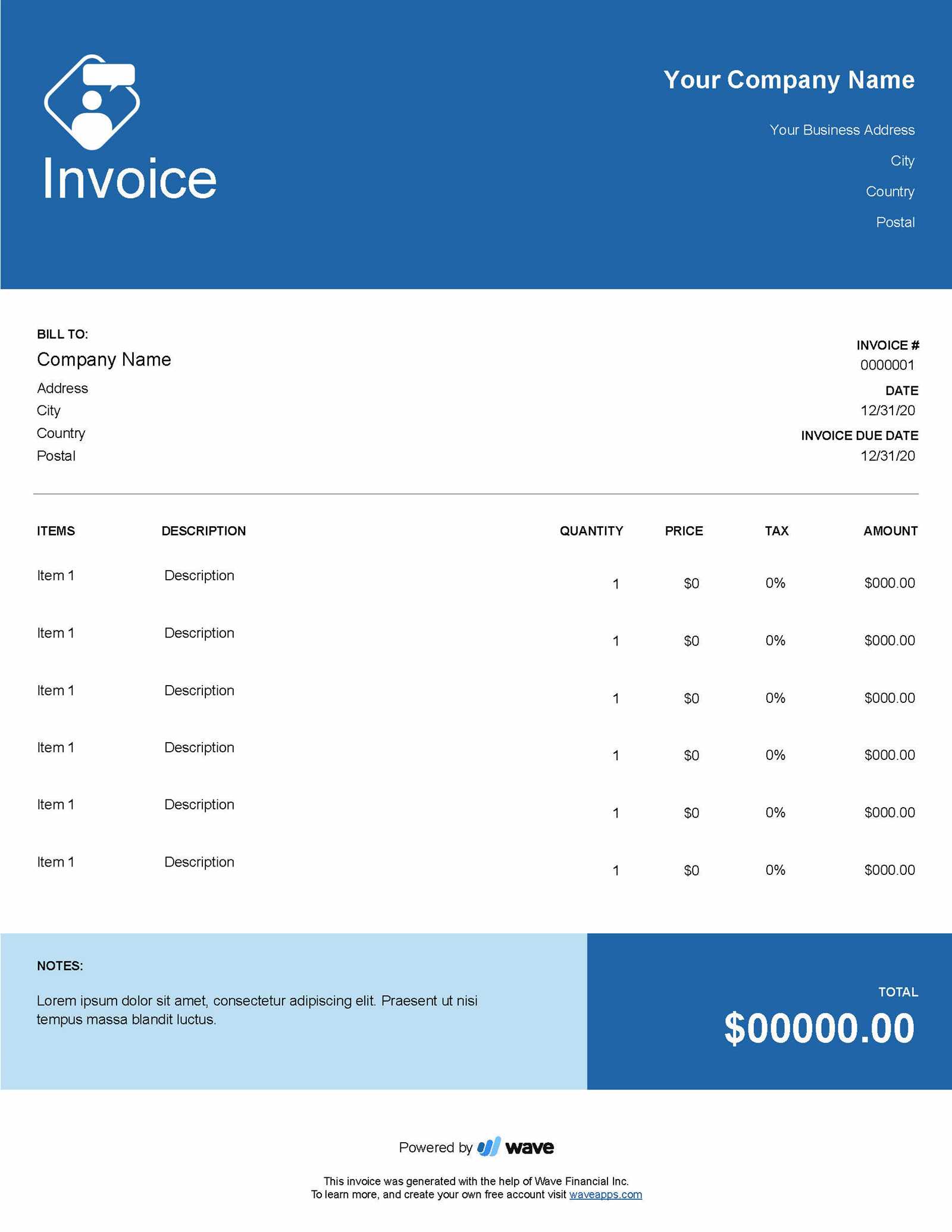

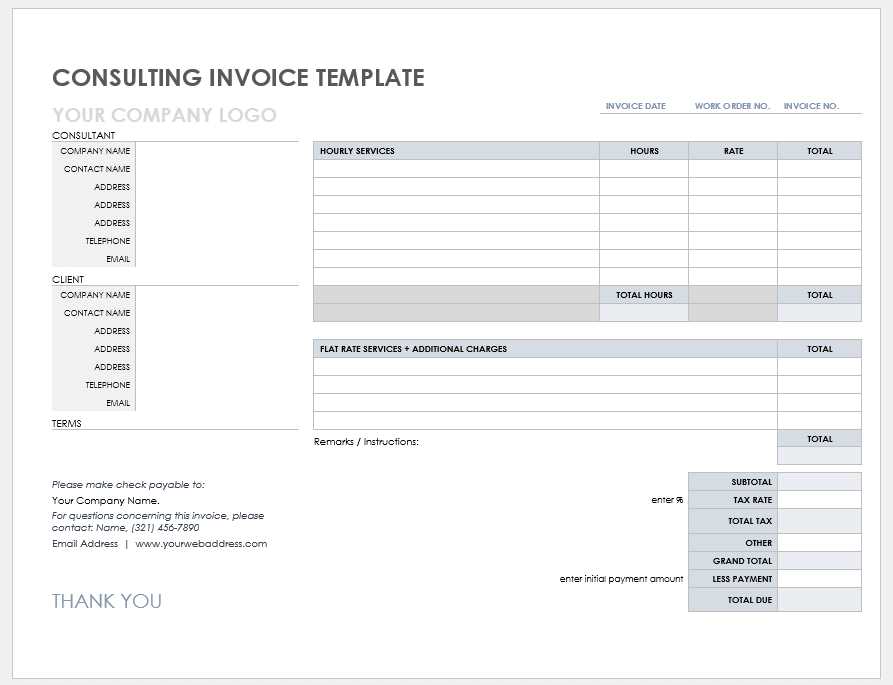

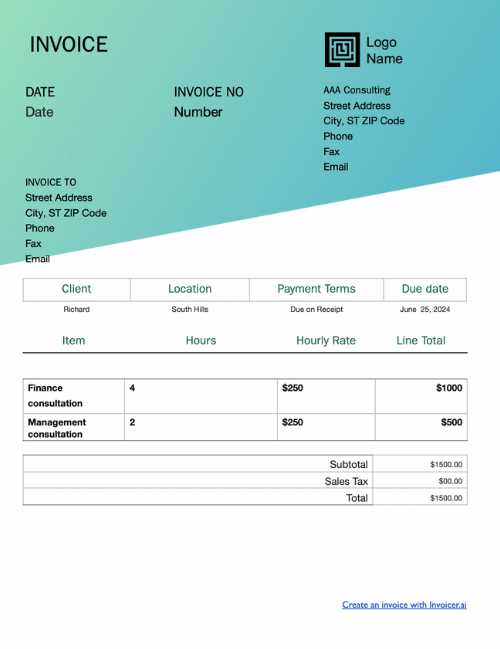

Adapting Layouts and Design

One of the key ways to customize financial documents is by adjusting the design and layout. Clients may have preferences regarding how information is presented, such as where certain data points appear or how they are categorized. Customizable formats allow businesses to make these adjustments easily, providing a document that suits each client’s style and requirements. For example, adding a client’s logo or incorporating their preferred color scheme can help reinforce their branding and make the document feel more personalized.

Incorporating Specific Client Information

Beyond design, another way to tailor documents is by including client-specific details. This can include payment terms, project-specific notes, or unique billing instructions that cater to a particular client’s needs. Personalization can go a long way in fostering better communication and ensuring there are no misunderstandings about terms or expectations. Including a clear breakdown of charges or offering specific payment instructions shows attention to detail and a commitment to transparency.

Customizing financial communications not only improves the client experience but also strengthens trust and clarity between both parties. By taking the time to tailor each document, businesses can create more positive, lasting impressions with clients and encourage smoother financial transactions.

Best Practices for Effective Billing

Efficient and clear financial communication is essential for maintaining smooth business operations and healthy client relationships. Establishing best practices for creating and managing payment records helps ensure accuracy, professionalism, and consistency. By following a set of proven guidelines, businesses can streamline their billing process and reduce the risk of errors or disputes.

Key Elements for Clear Financial Documents

To ensure that payment records are both clear and effective, businesses should include the following key elements in every document:

- Accurate Client Information: Make sure that the client’s name, contact details, and any relevant account numbers are clearly stated.

- Clear Payment Terms: Define payment deadlines, late fees, and any other important conditions in a simple, understandable format.

- Itemized Charges: Provide a detailed breakdown of services or products rendered to avoid confusion and ensure transparency.

- Unique Reference Numbers: Assign a unique reference or transaction number to each document for easy tracking and reference.

- Professional Design: Use a clean and consistent layout that reflects your business’s professionalism.

Strategies for Timely and Accurate Payments

Beyond the document itself, ensuring timely payments is another crucial aspect of effective billing. The following practices can help businesses collect payments on time:

- Send Early and Often: Issue payment records promptly after completing work or delivering goods. Remind clients of upcoming due dates well in advance.

- Set Clear Deadlines: Establish firm deadlines and clearly communicate them to clients to avoid misunderstandings.

- Offer Multiple Payment Methods: Providing several payment options–such as bank transfers, online payment platforms, or credit card options–can speed up the payment process.

- Follow Up on Late Payments: Politely follow up with clients whose payments are overdue to ensure timely collection.

By implementing these best practices, businesses can improve their financial processes, reduce the chances of disputes, and ensure that payments are made efficiently and on time.

Common Mistakes in Payment Document Creation

Creating accurate and professional financial documents is crucial for maintaining strong business relationships and ensuring smooth transactions. However, even small errors in these records can lead to confusion, delays, and payment issues. Understanding common mistakes can help businesses avoid them and streamline their billing processes for greater efficiency and clarity.

Missing or Incorrect Client Information

One of the most common mistakes is failing to accurately capture client details. Missing or incorrect information, such as names, addresses, or contact information, can delay payment processing and lead to unnecessary back-and-forth. Always double-check that client data is up to date and correctly displayed on the document.

Unclear Payment Terms and Details

Unclear payment terms can cause confusion and lead to payment delays. Ambiguities regarding due dates, late fees, or payment methods can result in clients misunderstanding their obligations. Clearly state all payment terms, including the due date, accepted payment methods, and any late fees. Being specific helps prevent future disputes and ensures both parties are on the same page.

Incomplete itemization is another common issue. When the charges are not broken down into clear, understandable categories, clients may question the validity of certain items or services. Always provide a detailed, itemized list that accurately reflects what is being charged and for what reasons. Transparency is key to building trust and preventing misunderstandings.

Failing to Use Consistent Formatting

Consistency in formatting is also crucial. Using inconsistent fonts, sizes, or layouts can make the document appear unprofessional and difficult to read. A clean, organized design with clear sections for key details–such as contact information, payment terms, and charges–helps ensure that the document is easy to follow and understand.

By being mindful of these common mistakes and implementing best practices, businesses can improve the accuracy and professionalism of their financial communications, leading to smoother transactions and better relationships with clients.

How to Choose the Right Document Format

Selecting the appropriate format for creating financial documents is crucial to ensuring both efficiency and professionalism. The right system should meet the specific needs of your business while offering flexibility, ease of use, and consistency. Whether you’re managing multiple clients, handling large projects, or simply need a more streamlined process, choosing the best option can significantly improve your workflow and reduce the potential for errors.

When choosing a solution, it’s important to consider several factors that can affect both your internal processes and your client interactions. The following table outlines key features to look for when evaluating different options:

| Feature | Consideration |

|---|---|

| Customization | Ensure the layout can be adjusted to fit your business’s specific needs, such as adding branding or unique fields. |

| Ease of Use | Choose a system that is user-friendly, with minimal training required to get started and create professional documents quickly. |

| Compatibility | Check that the solution integrates well with your existing software, whether it’s accounting tools or project management platforms. |

| Flexibility | Look for a format that can be adapted for different types of projects or clients while maintaining consistency in design. |

| Automation | Consider options that allow you to automate common tasks, such as setting up payment terms or automatically populating client details. |

By evaluating these features carefully, you can ensure that the system you choose meets the needs of your business, reduces administrative overhead, and improves communication with clients. Ultimately, the right document format will help your team stay organized, boost professionalism, and streamline the billing process for better overall efficiency.

Automating Your Billing Process

In today’s fast-paced business environment, efficiency is key to maintaining smooth operations. Automating financial documentation tasks can save valuable time, reduce human error, and ensure consistency across all client communications. By implementing automation in your billing workflow, you can streamline repetitive processes, allowing your team to focus on higher-value tasks and reducing the chances of mistakes.

Benefits of Automation

Automation brings numerous advantages to businesses of all sizes. Some of the most significant benefits include:

- Time Savings: Automatically populating client details, payment terms, and service descriptions can significantly reduce the time spent on each document.

- Consistency: Standardized formatting ensures that every document adheres to the same layout, making communication clear and professional.

- Accuracy: Reducing manual data entry minimizes the risk of errors, ensuring that all payment records are correct and complete.

- Timely Updates: Automation ensures that documents are generated and sent to clients as soon as possible, preventing delays in the billing cycle.

How to Automate Your Billing Process

There are several ways to integrate automation into your billing workflow. Here are a few methods to consider:

- Automated Data Entry: Use tools that automatically pull client information from your database or CRM, reducing the need for manual input.

- Recurring Billing: Set up systems that automatically generate documents for recurring charges, ensuring clients are billed on time every cycle.

- Payment Reminders: Automate reminders for upcoming or overdue payments, ensuring that clients are notified without requiring manual follow-up.

- Integration with Accounting Software: Lin

Legal Aspects of Billing Documents

When creating financial records for clients, it’s essential to consider the legal requirements that govern these documents. Properly formatted and compliant records not only help maintain transparency but also protect both businesses and clients in case of disputes. Ensuring that all legal aspects are addressed can prevent future complications and enhance the credibility of your business.

Essential Legal Information

There are several key components that must be included in every financial document to comply with legal standards:

- Business Information: Always include your business name, legal structure, and contact details, including a registered address. This establishes the authenticity of the document.

- Client Details: Make sure to include the client’s full name, address, and other relevant contact information for proper identification.

- Clear Payment Terms: Define payment deadlines, late fees, and accepted methods of payment. It’s important to outline any terms regarding non-payment or overdue balances.

- Tax Identification Numbers: Depending on jurisdiction, businesses may need to include tax IDs (e.g., VAT or EIN) for both the provider and the client, ensuring compliance with tax laws.

- Legal Disclaimers: Certain businesses, such as those in regulated industries, may need to include specific disclaimers or references to contracts and agreements in their financial documentation.

Compliance with Tax Regulations

Legal compliance is not only about proper documentation but also about adhering to local tax regulations. Different jurisdictions may require specific forms of taxation to be included, such as VAT or sales tax. Failure to account for these taxes can result in penalties or legal disputes. Here are some tax-related considerations to keep in mind:

- Accurate Tax Rates: Ensure that the correct tax rates are applied to all items or services and that the total amount reflects the proper calculations.

- Tax Exemptions: If the client is tax-exempt or the transaction is subject to special tax rules, this must be clearly indicated on the document.

- Tax Filing: Keep detailed records of all financial transactions for tax filing purposes. Depending on the country, you may need to submit regular tax reports based on the financial records provided to

Ensuring Accuracy in Your Billing Documents

Accurate financial documentation is essential for maintaining clear communication with clients and ensuring timely payments. Errors in these documents can lead to confusion, delayed payments, or disputes that could damage your professional reputation. By adopting a systematic approach and implementing checks and balances, businesses can significantly reduce the chances of mistakes and improve overall efficiency.

To ensure accuracy, it’s essential to pay attention to several key aspects during the creation process. Below are common areas where errors can occur and tips to avoid them:

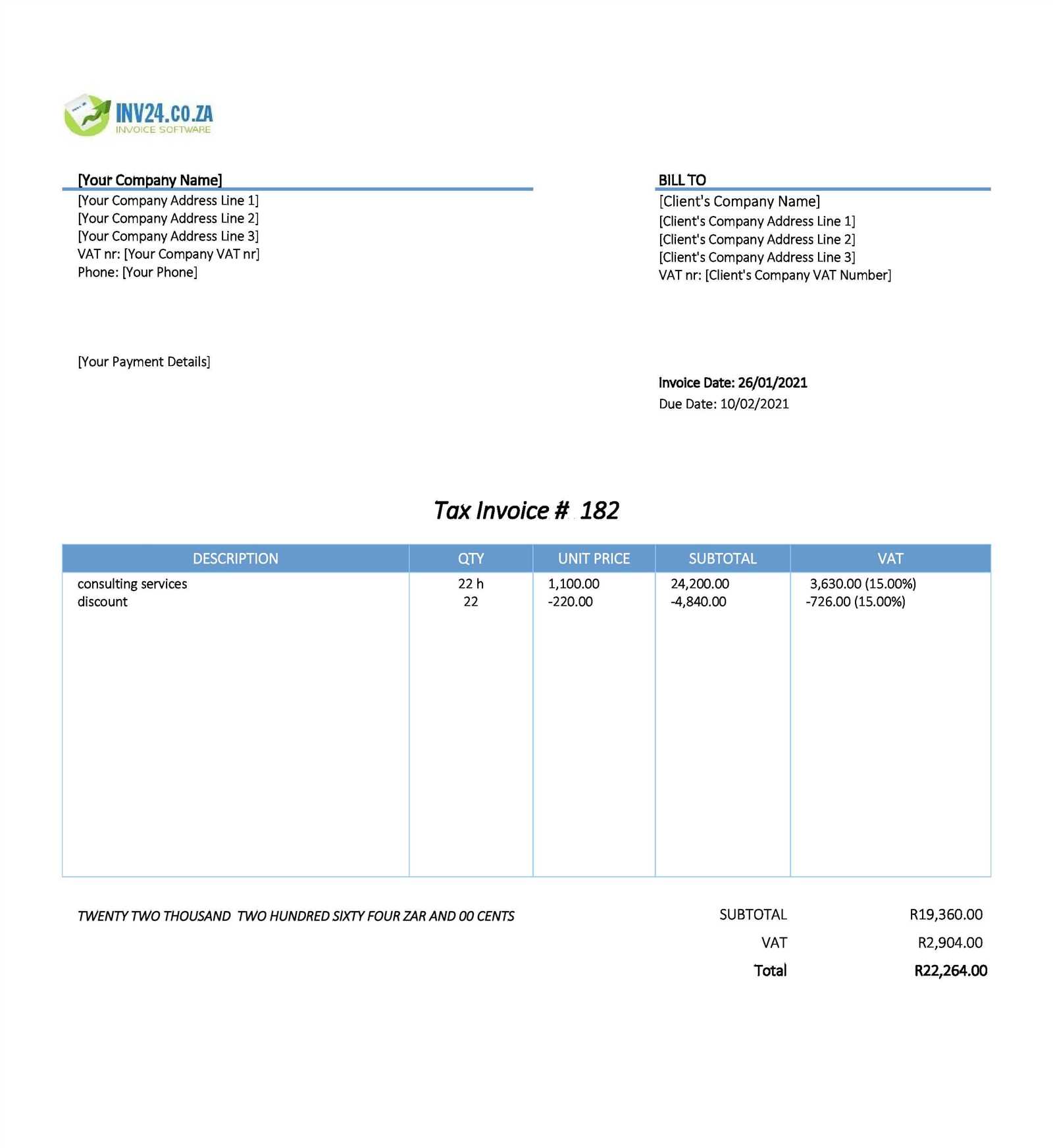

Area of Focus Tips for Accuracy Client Information Always verify that the client’s name, address, and contact details are correct. Double-check before sending any document to ensure accuracy. Charges and Fees Review all items, including quantities, rates, and total costs. Ensure all charges are accounted for and calculated correctly. Payment Terms Clearly define the payment due date, accepted payment methods, and any penalties for late payments. Misunderstandings can be avoided by stating these terms explicitly. Tax Calculations Ensure that applicable taxes (e.g., sales tax, VAT) are calculated accurately and listed separately. Use up-to-date tax rates and verify calculations before finalizing. Discounts and Adjustments If discounts or adjustments are applied, clearly state the amount deducted and the reason for it. Verify the math to avoid errors. By carefully reviewing each section of the document and utilizing available tools (e.g., software that automatically calculates totals), businesses can ensure that all information is correct before sending the document to clients. Additionally, implementing a review process where another team member double-checks the document can further reduce errors and improve overall quality.

Accuracy is crucial not only for financial clarity but also for maintaining trust with clients. By ensuring that all information is precise and transparent, businesses can reduce the risk of misunderstandings and foster stronger professional relationships.

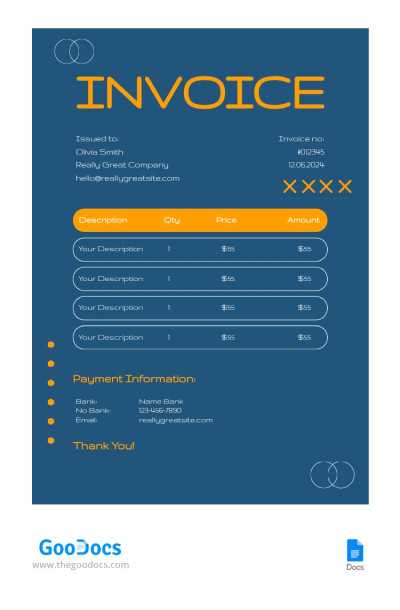

Design Tips for Professional Billing Documents

The design of financial documents plays a significant role in how your business is perceived. A well-designed document not only conveys professionalism but also ensures that important information is clear and easy to understand. Simple, clean layouts and thoughtful design choices can make a positive impression on your clients and make it easier for them to process and pay their bills on time.

Keep the Layout Clean and Simple

A cluttered or complicated document can confuse clients and make it difficult to find key details. Stick to a clean, minimalist design that focuses on readability. Use ample white space to separate sections, and ensure there is a logical flow of information. A few design tips to keep in mind:

- Use bold headings to clearly define sections such as client details, services provided, and payment terms.

- Align text consistently, and use a readable font like Arial or Helvetica to ensure clarity.

- Make sure your logo and business name are prominently displayed at the top to reinforce your branding.

Highlight Key Information

It’s essential to emphasize critical information to avoid confusion. Important details such as payment deadlines, amount due, and taxes should stand out. Here are a few ways to draw attention to key points:

- Use larger or bold fonts for headings like “Amount Due” or “Payment Terms.”

- Consider using a shaded box or color for the total amount due to make it easily identifiable at a glance.

- Separate the payment instructions from the rest of the content to avoid clutter and ensure that clients can easily find them.

A professional, well-designed document not only enhances the client experience but also reduces the likelihood of miscommunication. By following these design principles, businesses can create billing documents that are both effective and visually appealing, helping to maintain a strong, trustworthy reputation with clients.

Integrating Billing Formats with Accounting Software

Integrating your financial documents with accounting software can drastically improve the efficiency of your business operations. By automating the flow of information between your billing system and financial tools, you can reduce the risk of errors, speed up the invoicing process, and ensure consistency across all your financial records. This integration allows for seamless tracking of payments, tax calculations, and overall financial reporting, making it easier to manage business finances.

Benefits of Integration

When you connect your billing system with accounting software, several advantages arise:

- Automation: Automatically sync data between the billing and accounting systems, reducing the need for manual data entry and minimizing human errors.

- Real-time Updates: As soon as a document is created or payment is made, your accounting software is updated in real time, ensuring you always have accurate financial data.

- Efficiency: Streamline processes like generating reports, reconciling payments, and tracking outstanding balances, saving time for your team.

- Accuracy: Automated integration ensures that all financial data is correctly reflected across systems, reducing discrepancies and improving data integrity.

How to Integrate Your Systems

Integrating your financial document creation system with accounting software typically involves the following steps:

- Choose Compatible Software: Ensure that the software you use for creating billing documents is compatible with your accounting system. Many popular accounting platforms offer integration options for common document management tools.

- Set Up API or Integration Tools: Depending on the software, you may need to use an API (Application Programming Interface) or a plugin to link the two systems. This setup is often straightforward with modern platforms, but some customization may be required.

- Map Data Fields: Configure the fields to be transferred between systems, ensuring that all essential information–such as client details, payment amounts, and due dates–is shared correctly.

- Test the Integration: Before going live, thoroughly test the integration to make sure that everything functions as expected and data is transferred accurately.

- Monitor and Adjust: Regularly check the integration for any issues and make adjustments as necessary, especially if either system updates or changes functionality.

By taking these steps, businesses can create a smooth, automated process that links their financial documentation with accounting software, improving overall workflow and reducing the potential for costly mistakes.

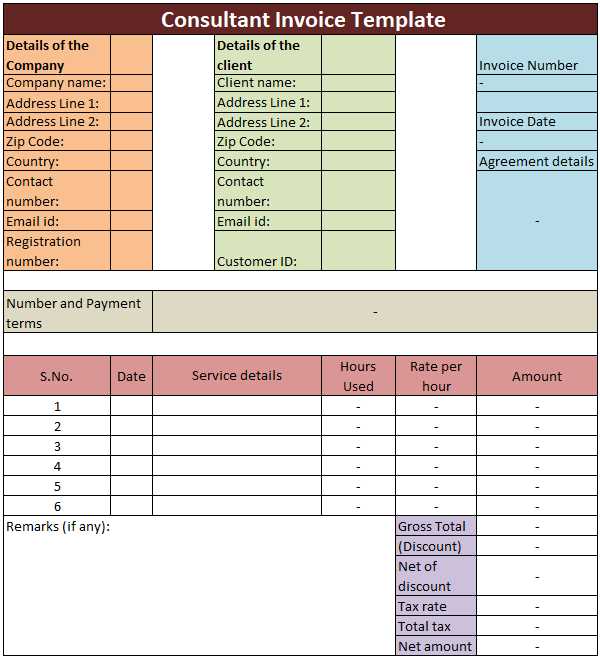

Free vs Paid Billing Formats

When choosing the right system for creating financial documents, businesses often face the decision between using free or paid solutions. Both options have their own advantages and limitations, and the right choice depends on the specific needs of the business. Free solutions are typically a great starting point for small businesses or startups, but paid options often offer more features and customization to suit growing needs. Understanding the differences between these two can help make a more informed decision.

Below is a comparison of the key features of free and paid systems to help you evaluate which option is best for your business:

Feature Free Options Paid Options Customization Limited customization, often with predefined layouts and basic elements. Extensive customization, allowing for brand-specific designs and advanced formatting. Functionality Basic functions like filling in client details, service descriptions, and pricing. Advanced features like automated calculations, recurring billing, and integrations with other software. Support Limited or no customer support, relying on forums or online resources. Dedicated customer support with direct access to help when needed. Branding Limited branding options, often featuring the platform’s logo or branding. Full control over branding, including logos, fonts, and overall look and feel of documents. Security Basic security, but may not offer features like encryption or secure data storage. Higher security, including encryption and secure data handling, ideal for sensitive client information. For businesses with simple needs, free options may be sufficient, especially when just starting out. However, as your business grows and your document creation needs become more complex, investing in a paid solution may provide a better return on invest

Improving Client Relationships with Clear Billing Statements

Effective communication is key to building strong relationships with clients, and the clarity of financial documents plays a major role in this. When clients receive clear, well-organized records, it demonstrates professionalism and attention to detail, fostering trust and confidence. Ensuring that clients understand exactly what they are being charged for, how much they owe, and when payments are due can lead to better collaboration and stronger, long-lasting partnerships.

Why Clarity Matters

Clear financial documents serve several important purposes in client relations:

- Transparency: When charges, payment terms, and other details are clearly outlined, it reduces the potential for misunderstandings and disputes.

- Trust: Clients are more likely to trust a business that provides straightforward, easy-to-understand records. This trust can lead to repeat business and referrals.

- Timely Payments: When the payment terms and amounts are unambiguous, clients are more likely to pay on time, helping your business maintain healthy cash flow.

How to Enhance Clarity in Financial Documents

Here are several strategies for ensuring that your documents are clear and effective:

- Use Simple Language: Avoid jargon and overly technical terms. Keep your descriptions of products or services straightforward and concise.

- Organize Information Logically: Group related items together, such as client details, charges, and payment terms, to make it easy for clients to navigate the document.

- Highlight Key Details: Make important information, such as the total due and payment deadline, stand out. Use bold text or shading to draw attention to these areas.

- Provide Clear Payment Instructions: Outline how clients can make payments and include necessary details, such as bank account information or online payment links, to avoid confusion.

- Double-Check for Accuracy: Ensure that all figures are correct and that no items are missing. Mistakes in amounts or missing details can lead to frustration and erode trust.

By prioritizing clarity in your financial documents, you help ensure that your clients have a positive experience. Clear, professional records not only make payments smoother but also enhance overall client satisfaction, fostering long-term relationships that benefit both parties.

Tracking Payments Through Billing Documents

Keeping track of payments is an essential aspect of managing cash flow and ensuring the financial health of your business. Properly documenting payment details helps prevent missed payments, reduces administrative work, and ensures that all financial records are accurate. By using structured billing documents that include payment tracking features, businesses can streamline the payment monitoring process, making it easier to follow up on outstanding balances and ensure timely payments.

Benefits of Tracking Payments

Incorporating payment tracking into your billing process offers several advantages:

- Improved Cash Flow Management: By monitoring when payments are received and when they are due, businesses can better forecast their cash flow and plan for upcoming expenses.

- Reduced Risk of Late Payments: Keeping track of payment deadlines and sending reminders helps reduce the risk of late payments, ensuring you receive funds on time.

- Accurate Financial Reporting: Having a clear record of payments made against issued documents ensures that your financial statements and reports are always up to date.

- Better Client Communication: When both you and your client can easily see which payments have been made and which are outstanding, it encourages transparency and trust.

How to Track Payments Effectively

Here are a few ways to effectively track payments through your billing documents:

- Include Payment Status Fields: Add a section that clearly indicates whether the payment has been received or is still pending. You can also include a space to note the payment date once received.

- Set Payment Terms Clearly: Clearly outline payment deadlines and any late payment penalties to avoid confusion and ensure clients know when payments are due.

- Use Unique Reference Numbers: Assign a unique reference number to each document, which can help you track payments in your accounting system and easily match them with the corresponding documents.

- Monitor Partial Payments: If clients make partial payments, make sure to update the document with the remaining balance and adjust your follow-up schedule accordingly.

- Follow Up with Reminders: If payments are overdue, send reminders with clear information on the outstanding amount, due date, and instructions for completing the payment.

By incorporating these tracking features into your financial documents, you can maintain better control over your payments and ensure smooth and efficient financial operations for your business.

Adapting Billing Documents for Different Offerings

When running a business that offers various products or services, it’s essential to customize your financial documents to reflect the specific nature of each offering. Different offerings often come with distinct pricing structures, terms, and details that need to be clearly communicated to clients. Customizing your documents to fit these variations ensures that clients understand exactly what they are being billed for, reducing the potential for confusion and promoting smoother transactions.

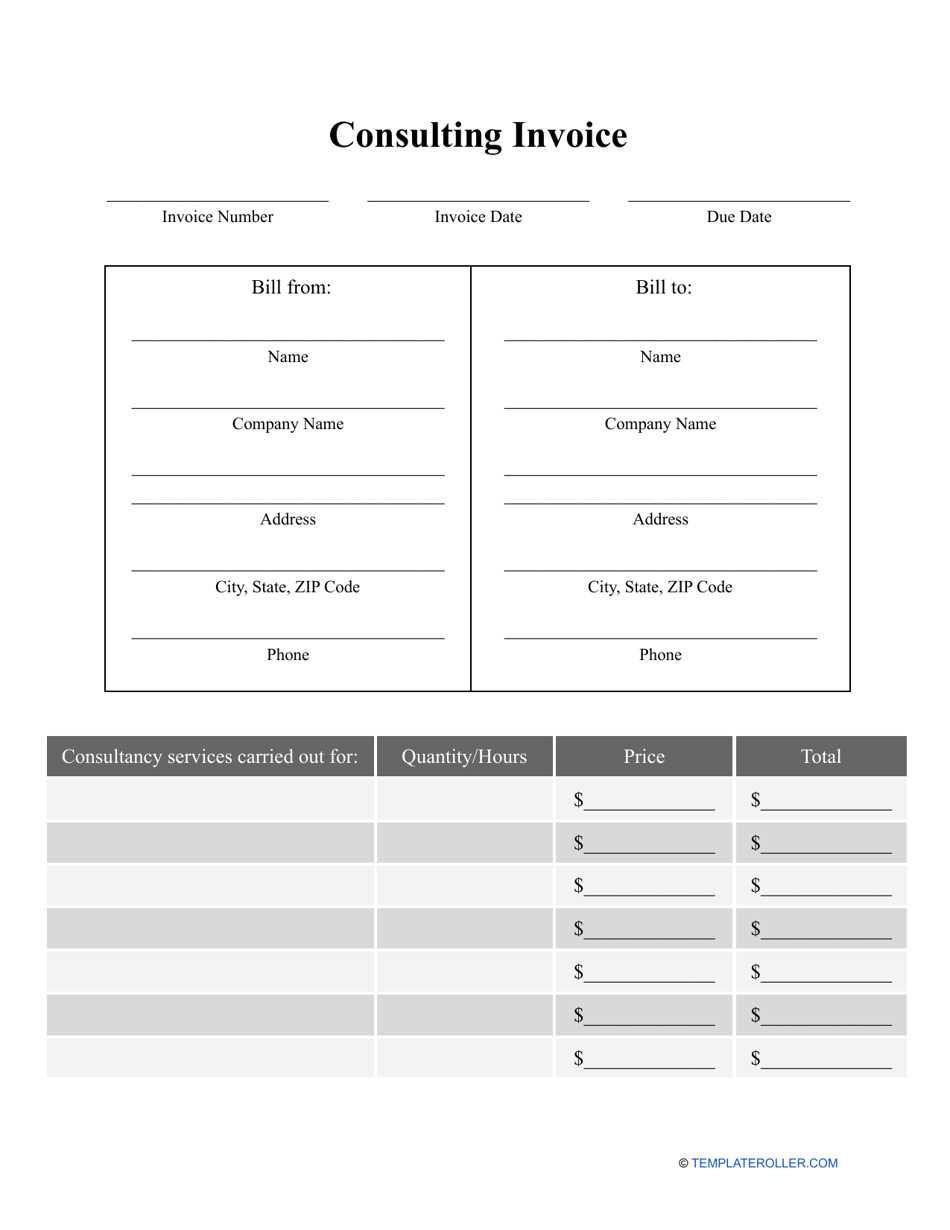

Below is a comparison of how billing documents can be adapted for different types of offerings:

Feature Product-Based Offerings Service-Based Offerings Itemization Detailed list of products, including quantity, unit price, and total cost. Descriptions of services provided, including hourly rates, project phases, or deliverables. Taxes and Discounts Taxes based on the product category, potential bulk purchase discounts, or promotional offers. Service-related discounts (e.g., retainer agreements) or tax exemptions related to specific service categories. Payment Terms Clear instructions on payment deadlines, delivery terms, and shipping fees (if applicable). Specific milestones, progress payments, or hourly billing structures for ongoing work. Delivery Information Shipping or delivery details, including tracking numbers or estimated delivery dates. Project timelines, deadlines for work completion, and progress updates. Adapting billing documents based on the type of product or service you offer ensures clarity for clients and helps avoid any misunderstandings. Whether you are selling a tangible product, offering a one-time service, or engaging in long-term projects, customizing the structure and content of your financial documents to fit the unique aspects of each offering is essential for maintaining