Downloadable Excel Invoice Template for Easy Billing

Managing financial transactions efficiently is crucial for businesses of all sizes. One of the most essential tasks is creating accurate, professional documents for payment requests. With the right tools, this process can be streamlined, saving you valuable time and reducing the risk of errors.

Pre-made, editable spreadsheets offer an easy solution for crafting personalized documents that suit your specific needs. These documents allow for quick adjustments, whether you are a freelancer, a small business owner, or managing a larger company. The flexibility of such sheets ensures they can accommodate various industries and billing scenarios.

By using these ready-to-use files, you can focus on the core aspects of your business while maintaining a high level of professionalism. The ability to customize these sheets ensures you are always in control of your financial records, enabling smoother transactions and improved client relationships.

Downloadable Invoice Template Excel for Small Businesses

For small businesses, managing financial records efficiently is key to maintaining cash flow and ensuring smooth operations. Having a structured and easily customizable system for creating billing documents helps business owners save time and focus on growing their ventures. With the right tools, small business owners can easily track payments, issue professional-looking statements, and maintain clear financial records with minimal effort.

Why Small Businesses Benefit from Customizable Billing Sheets

Customizable sheets provide flexibility for small business owners who need to adjust their billing documents to suit their unique needs. Whether you are invoicing clients for services rendered, goods sold, or recurring payments, these ready-to-use files can be tailored to match your brand and business model. With features like automated calculations and clear sections for payment details, you can ensure accuracy while also presenting a professional image to your clients.

Key Features for Small Business Billing Efficiency

When selecting a tool for billing, it’s important to consider the specific features that will make the process easier. Look for files that offer easy customization options for your business name, logo, and contact information. Additionally, ensure that the document includes essential fields like item descriptions, quantities, prices, and taxes. A good file will also allow you to track outstanding payments, making it easier to follow up on overdue amounts and keep your cash flow on track.

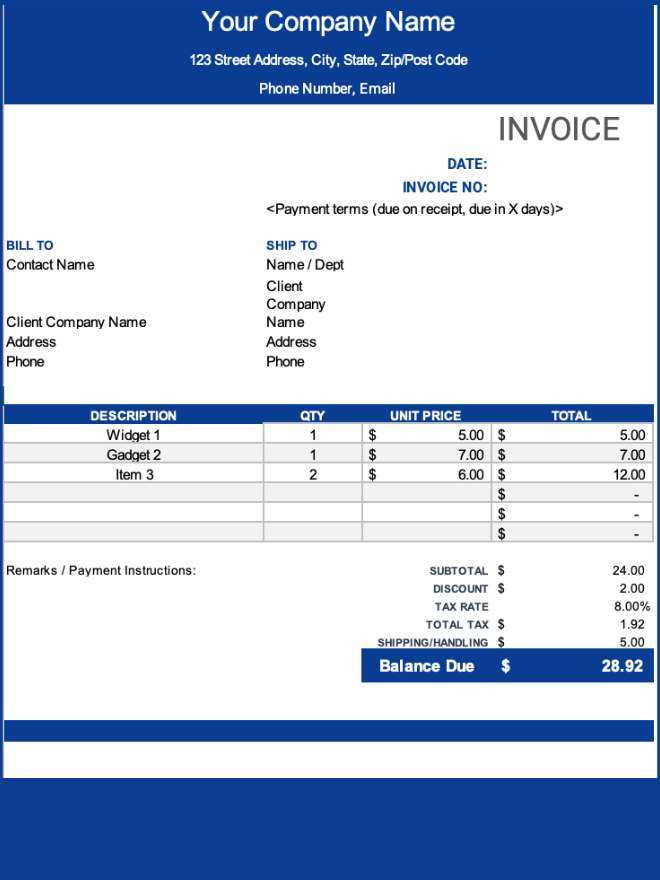

How to Create an Invoice in Excel

Creating a professional billing document is a straightforward process that can be done efficiently with the right software. By using a spreadsheet program, you can quickly set up a clear and organized record of your transactions, ensuring that all the necessary information is included for proper payment requests. This method allows you to customize your document and track payments, all while maintaining a high level of professionalism.

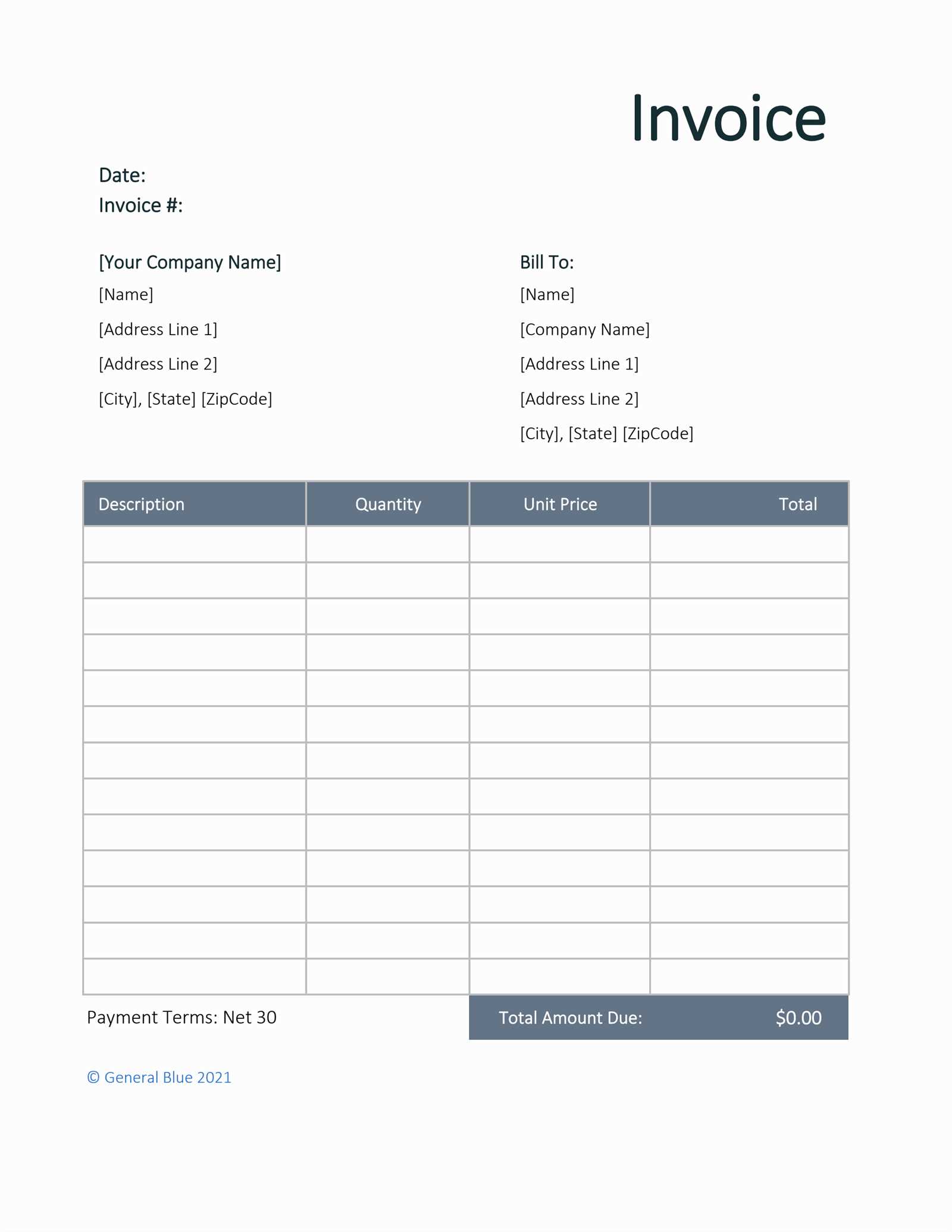

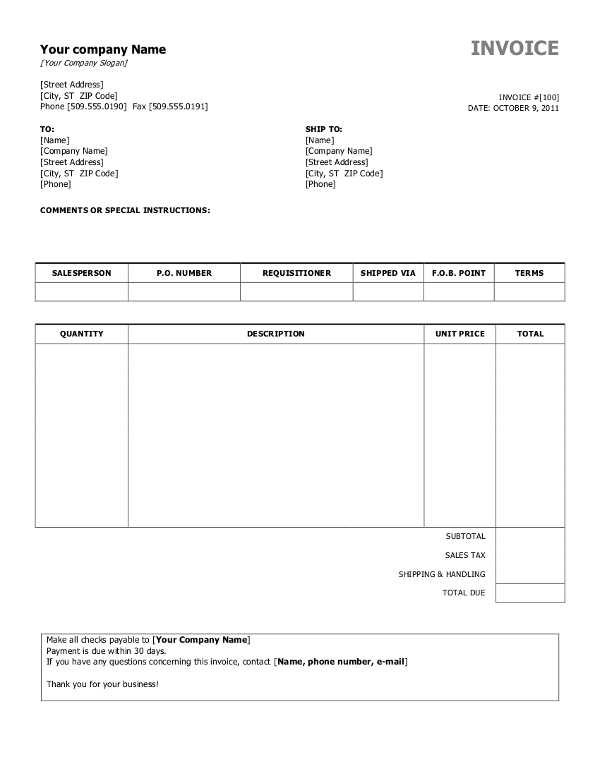

The first step is to open a new blank spreadsheet and set up your basic structure. In the header, include your business name, contact information, and logo (if applicable). You should also provide details such as the date of issue, due date, and a unique reference number to easily identify the document. These key elements will help both you and your clients keep track of the transaction.

Next, create sections for itemizing products or services provided. For each entry, include columns for descriptions, quantities, unit prices, and totals. It’s important to use formulas to calculate totals automatically to avoid any errors. Finally, don’t forget to add a section for payment terms, including accepted payment methods and any relevant notes about late fees or discounts.

Benefits of Using Excel Invoice Templates

Using a customizable spreadsheet for billing offers numerous advantages for businesses of all sizes. It allows for easy management of financial records while saving time and reducing the risk of mistakes. By relying on a pre-designed document, you can ensure consistency across all transactions, making the billing process smoother and more efficient.

Time-Saving and Efficiency

One of the primary benefits of using a spreadsheet for billing is the amount of time it saves. Instead of manually creating a document from scratch every time, you can quickly adjust an existing structure to match each new transaction. With built-in formulas and fields, calculations are automated, reducing the chances of errors and allowing you to focus on other important tasks in your business.

Easy Customization and Flexibility

Spreadsheets offer high levels of flexibility, allowing you to modify documents to reflect your unique business needs. Whether you need to change the layout, add custom fields, or incorporate specific branding, the ability to personalize the document ensures that it aligns with your company’s image. Additionally, you can easily make updates to pricing, payment terms, or other details as your business evolves.

Customizing Your Excel Invoice Template

Tailoring your billing document to suit your specific needs is essential for maintaining professionalism and ensuring clarity in your transactions. Customizing the layout, design, and content of your financial documents allows you to align them with your brand and make them more functional. A well-customized document not only reflects your business identity but also helps streamline communication with clients.

Here are a few key areas to consider when personalizing your billing document:

- Business Information: Ensure that your business name, logo, address, and contact details are prominently displayed. This adds a professional touch and helps clients easily reach you with any questions.

- Itemized List: Clearly break down the products or services provided, including descriptions, quantities, and prices. This transparency helps avoid confusion and sets clear expectations.

- Payment Terms: Customize sections related to payment methods, due dates, and late fees to reflect your business policies. Make sure these terms are easy to read and understand.

- Branding: Incorporate your company’s colors and font styles into the document for a consistent brand experience. This helps make the billing document feel like an extension of your business identity.

By adjusting these elements, you can ensure that your billing document not only looks professional but is also perfectly suited to your business operations. Additionally, these customizations can save time in the future, as they will be readily available for reuse with each new transaction.

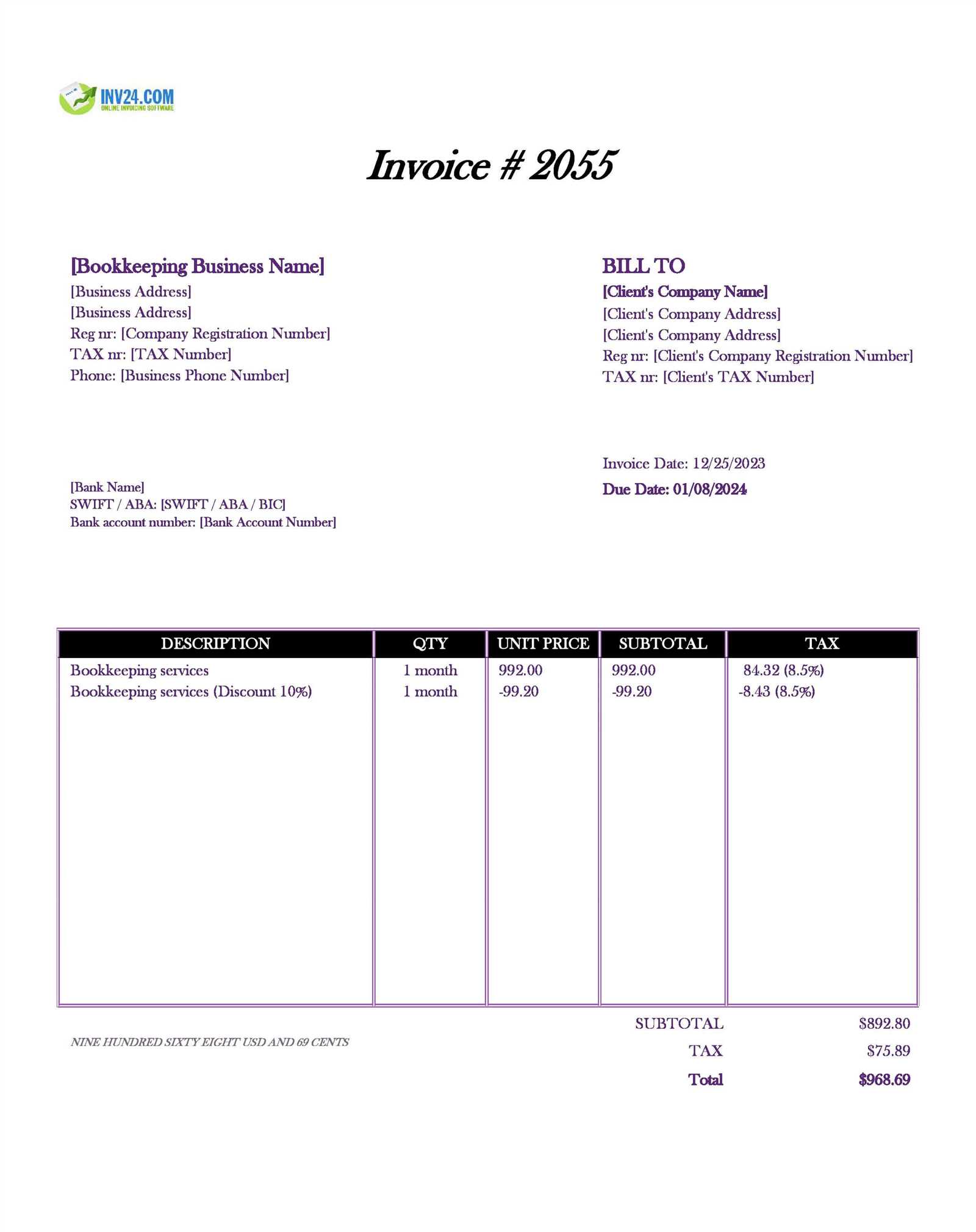

Best Free Invoice Templates for Excel

For anyone managing their own business or freelance work, having a professional and efficient way to create payment requests is essential. There are various resources available to help you generate clean, clear, and well-organized bills, without needing to invest in expensive software. Using pre-made solutions allows you to save time, reduce errors, and ensure that every document looks polished.

Many free options are designed to meet diverse needs, whether you’re running a small service-based business, a large corporation, or working on freelance projects. These resources typically offer customizable layouts, allowing you to add your company logo, personalize sections, and adjust the design to fit your brand’s style.

Some templates come with features like automatic calculations for totals and taxes, making the entire billing process smoother and faster. With the right solution, you can streamline your accounting workflow while maintaining a professional appearance for all your financial correspondence.

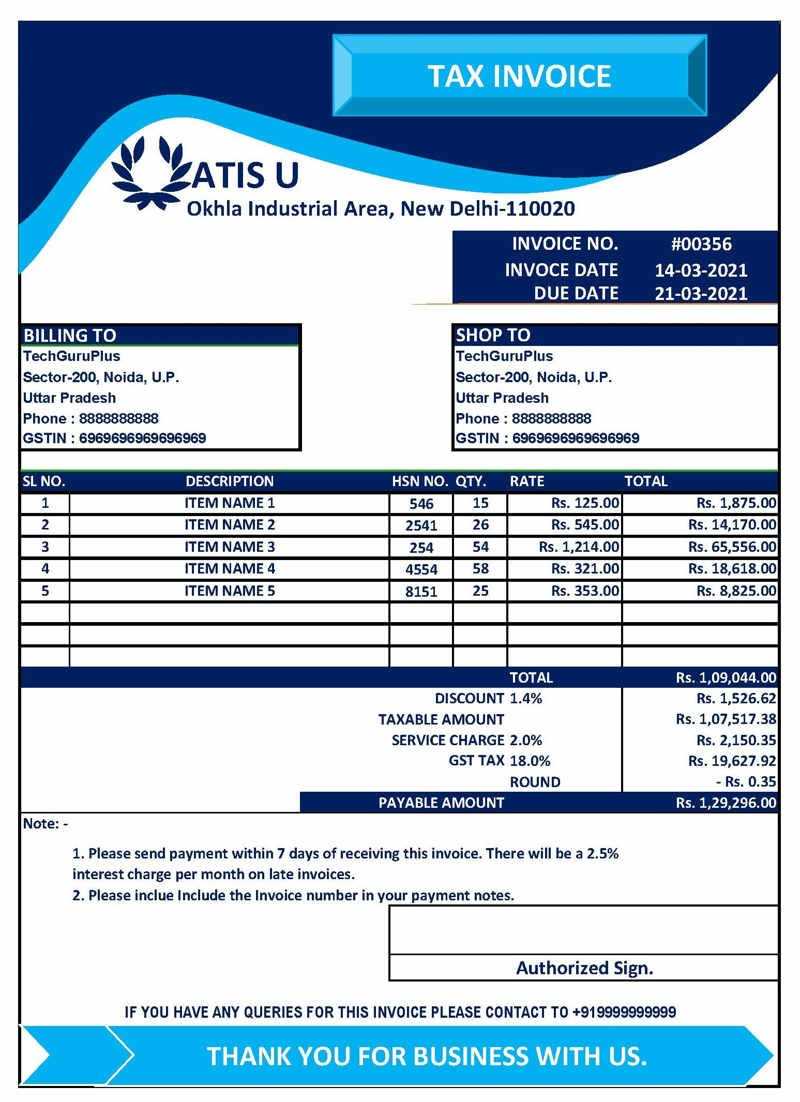

Here are a few top-rated, free resources:

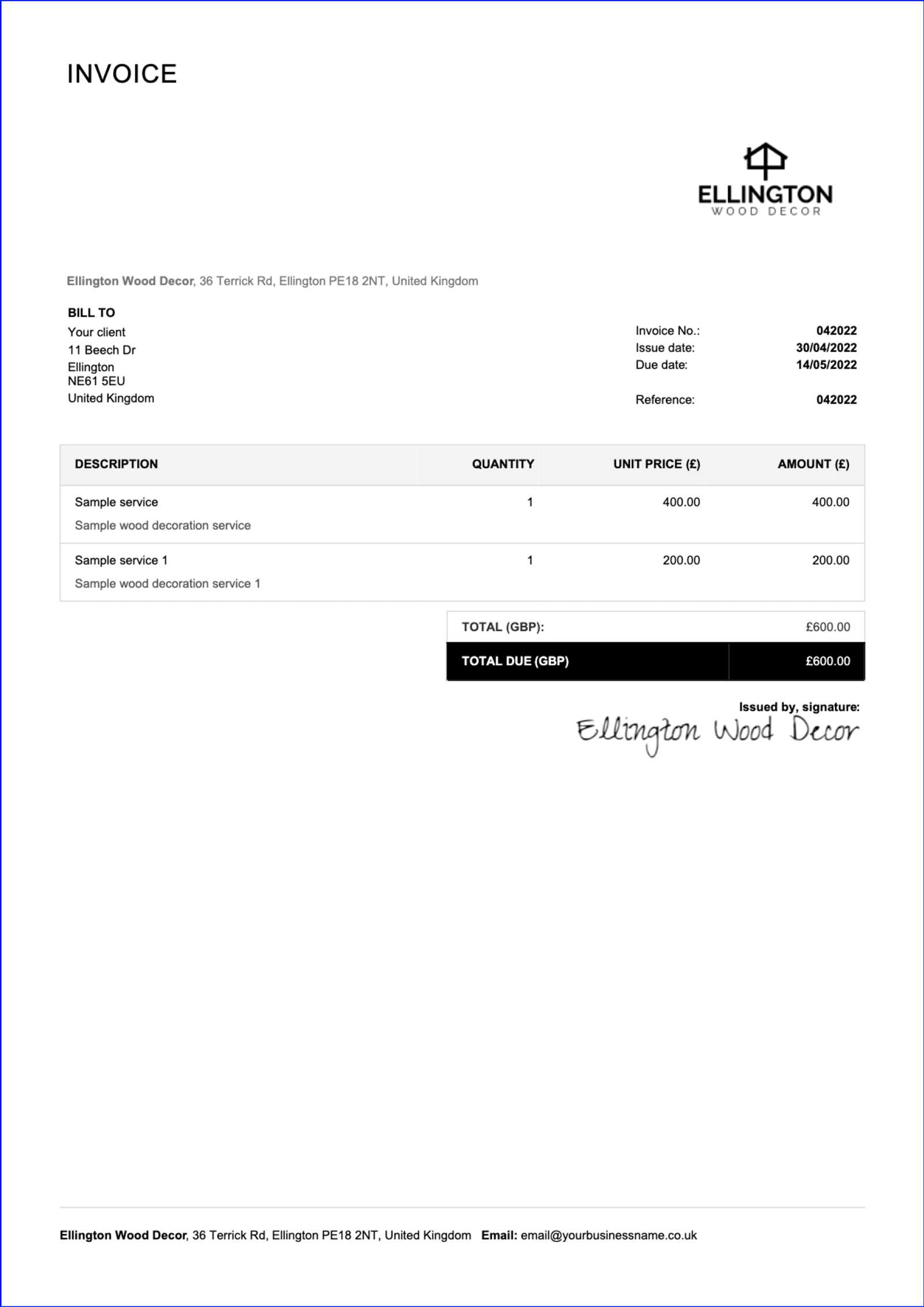

- Simple & Clean Design: This is ideal for those who prefer a minimalist layout with all essential information clearly presented.

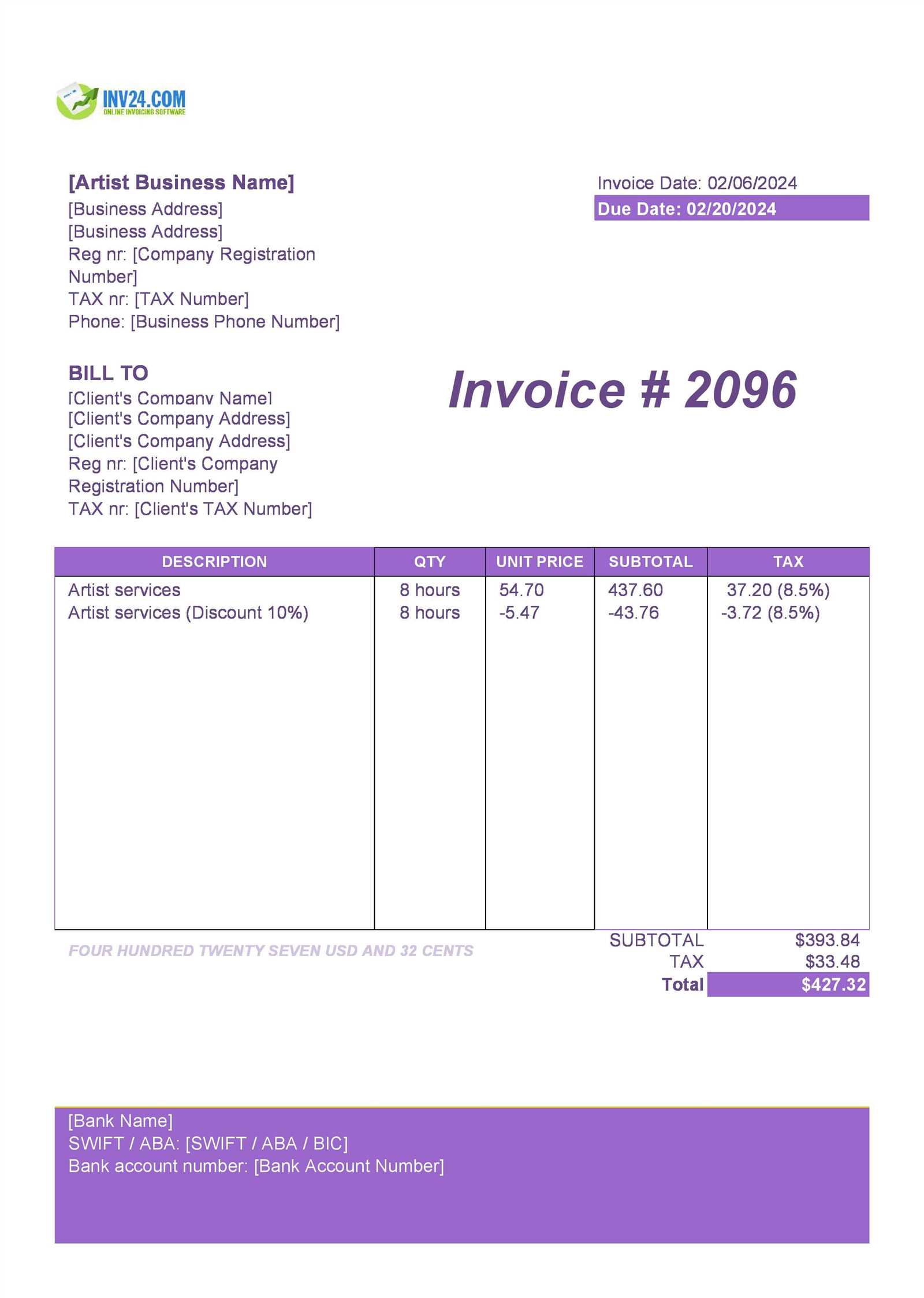

- Comprehensive Invoice with Tax Calculation: Perfect for businesses that need to factor in taxes and different pricing structures.

- Service-Based Format: Tailored for freelance professionals or small businesses offering hourly services or flat-rate pricing.

- Creative & Artistic Layouts: Best for creative industries where a unique and visually appealing design makes a difference in client perception.

With so many free options available, it’s easier than ever to find a solution that fits your needs and helps you stay on top of your finances without any hassle.

Why Choose Excel for Invoicing

For many businesses, managing financial documents efficiently is crucial to maintaining smooth operations. Using a popular spreadsheet application for creating and managing billing statements offers numerous advantages that streamline the process. It provides flexibility, customization, and control, making it a top choice for professionals and small businesses alike.

Here are some key reasons why this software is an excellent choice for preparing payment requests:

- Ease of Use: The program is widely familiar, making it easy for users to get started. You don’t need specialized knowledge to create and manage financial documents effectively.

- Customizability: The software allows for complete control over the layout and content, so you can tailor each document to suit your business needs or client preferences.

- Cost-Effective: Most people already have access to the application, either through personal licenses or through work, which means there are no additional costs for a dedicated billing system.

- Automatic Calculations: With built-in functions for totals, taxes, and discounts, you can automate many calculations to avoid errors and speed up the process.

- Data Tracking: It makes it easy to keep track of payments and outstanding balances. By organizing your records in a simple spreadsheet, you can manage client history and monitor overdue amounts with minimal effort.

- Professional Appearance: With a variety of free or customizable designs available, you can create polished documents that reflect your business’s professionalism.

Whether you’re just starting out or managing a growing company, using this tool for financial documentation offers a practical and efficient solution for tracking your transactions.

Steps to Download an Invoice Template

If you’re looking to streamline your billing process, using a ready-made design can save you time and effort. There are many sources online where you can easily find pre-designed documents that meet your needs. Once you’ve identified the best format for your business, downloading and setting it up for use is a simple process. Here’s a step-by-step guide to help you get started.

Step 1: Find a Trusted Source

The first step is to search for reliable websites offering free or paid document designs. Make sure the source is reputable and provides quality files that are safe to download. Popular platforms, such as business websites, online marketplaces, and software forums, typically offer a wide selection of customizable designs suitable for various industries.

Step 2: Choose Your Design

Once you’ve located a trusted platform, browse through the available options. Consider what features are most important for your business needs, such as space for itemized details, payment terms, or the inclusion of tax rates. Some designs may be specifically suited for freelancers, while others may be more fitting for product-based businesses. After selecting the one that best matches your requirements, click on the download link.

After downloading, you can open the document in your preferred software and begin customizing it with your business information, logo, and specific client details. This simple process can quickly transform your financial workflows and enhance your professionalism.

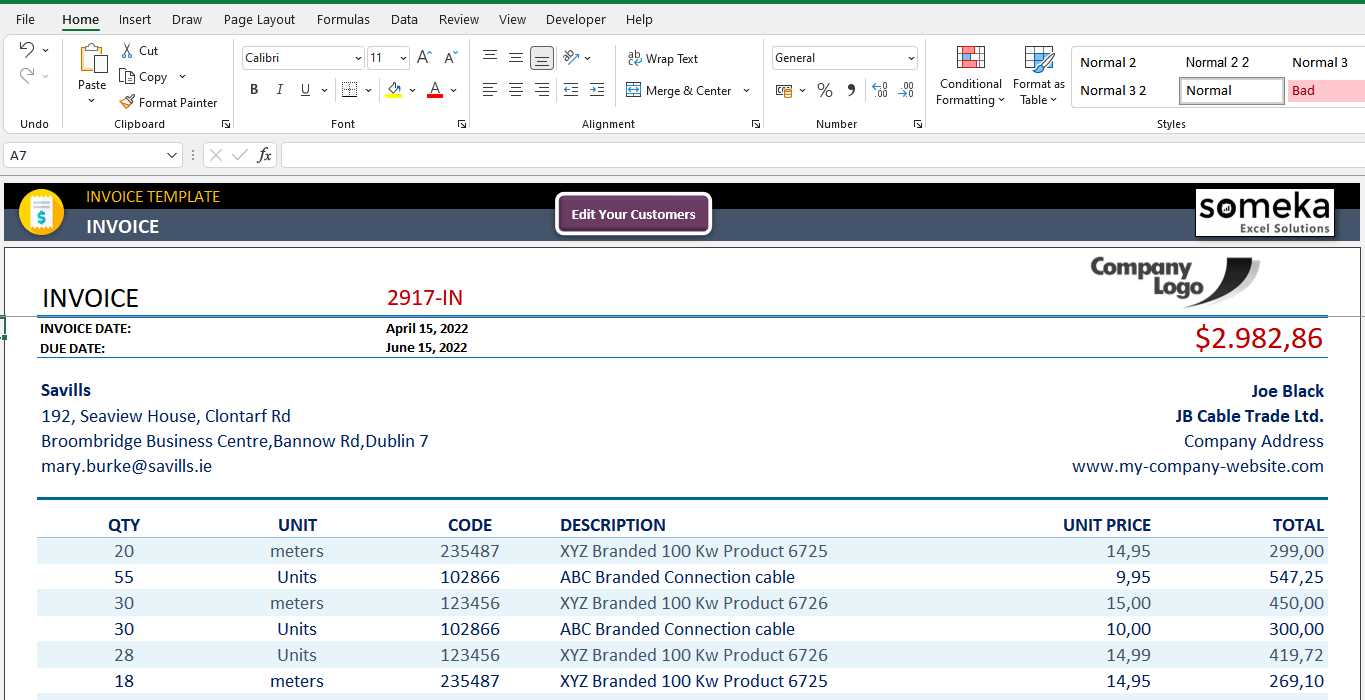

How to Edit Excel Invoice Templates

Once you’ve selected and downloaded a pre-designed document for your billing needs, the next step is to personalize it. Customizing these documents allows you to tailor them to your specific business requirements and ensure they reflect your brand. The process is straightforward, and with a few simple steps, you can create professional and polished financial statements in no time.

Step 1: Open the File

Begin by opening the document in your preferred spreadsheet application. Most templates are designed to be compatible with commonly used software, so you should be able to access the file with ease. Once opened, you’ll see pre-defined fields ready for editing, such as your business name, address, and client information.

Step 2: Add Your Business Information

Start by inserting your company details. This typically includes your business name, contact information, and logo (if applicable). If your template includes placeholders for these items, simply replace them with your own. Ensure the font style and size align with your brand’s design for a cohesive look.

Step 3: Update Client Information

Next, input your client’s details in the designated fields. This includes their name, address, and any other relevant contact information. If the document includes a unique ID or order number, ensure it matches the specific transaction or project you are billing for.

Step 4: Adjust Line Items

One of the main features of a billing document is the section where you list the goods or services provided. Depending on your needs, update the descriptions, quantities, and unit prices for each item. Many of these fields will automatically calculate totals, but double-check the formulas to ensure everything is correct.

Step 5: Finalize Payment Terms

Review the payment terms section, including due dates, late fees, and any discounts you may want to offer. Customizing these fields helps ensure clarity and avoids confusion with your clients. If your template includes a payment method section, you can also specify how you prefer to receive payments (e.g., bank transfer, PayPal, etc.).

Step 6: Save and Send

Once you’ve made all the necessary changes, save the document. You can either keep it in the original format or convert it to a PDF for a more professional appearance. After saving, the document is ready to be sent to your client, ensuring a smooth and organized transaction process.

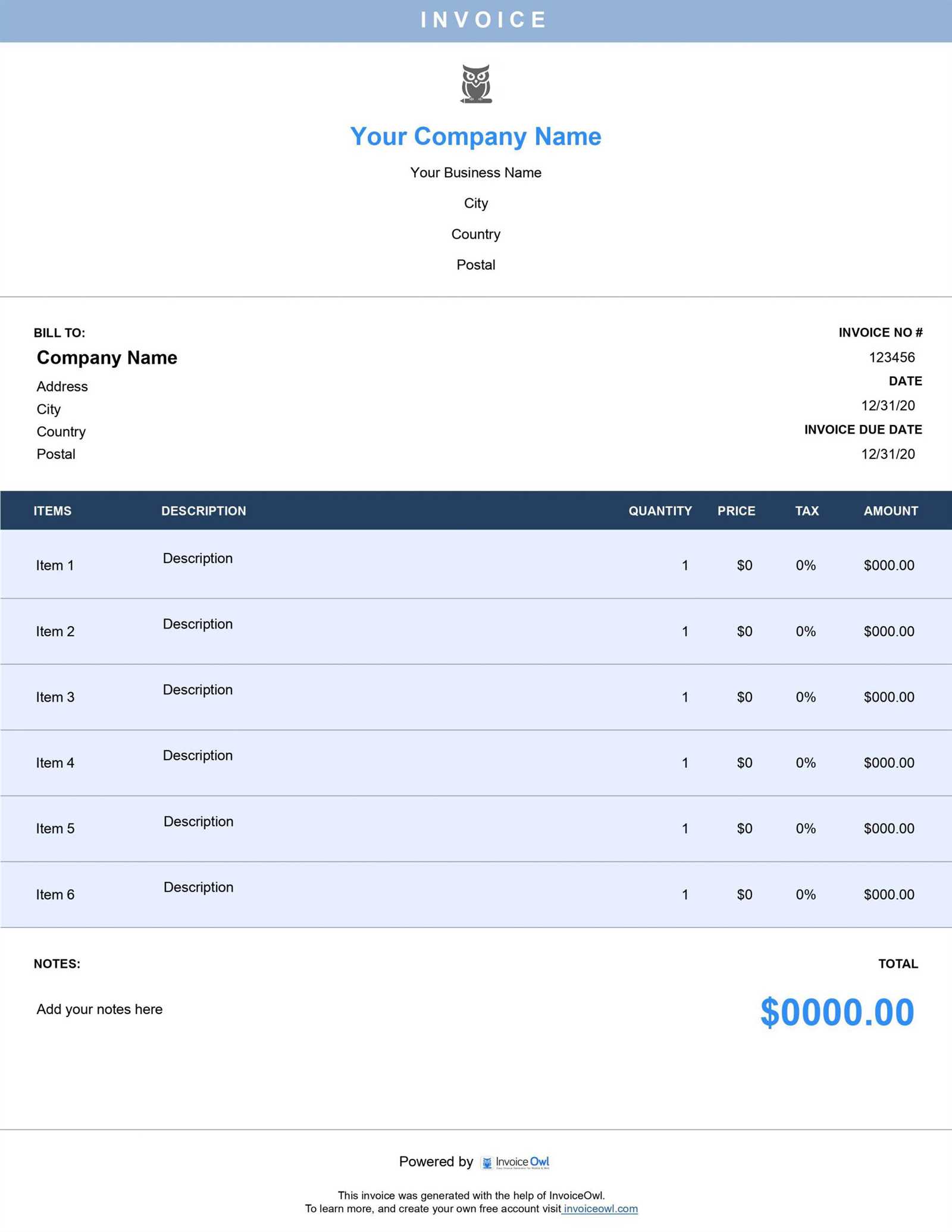

Excel Invoice Templates for Freelancers

Freelancers often need a simple, efficient way to manage their billing process. A well-designed financial document helps maintain professionalism, track payments, and keep things organized. For freelancers, having a flexible and customizable billing solution is crucial to ensure that all relevant information is clear and accurate. Using a ready-made design in spreadsheet software can simplify this process and save time.

Here are the key features freelancers should look for in a billing layout:

| Feature | Description |

|---|---|

| Client Information | Customizable sections to enter client name, contact details, and project specifics. |

| Project Details | Space to list the tasks completed, hours worked, and rates for services rendered. |

| Payment Terms | Clear sections to specify payment due dates, late fees, and accepted payment methods. |

| Tax Calculation | Automated fields to calculate applicable taxes based on the project’s total value. |

| Total Calculation | Easy-to-use formulas that automatically tally totals and display the final amount due. |

These features can be customized to suit various freelance industries, whether you’re a designer, writer, developer, or consultant. By using a well-structured design, freelancers can ensure their documents are professional and easy to understand, providing clear terms for their clients and simplifying payment tracking.

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is essential for maintaining smooth business operations. However, even small mistakes in your billing statements can lead to confusion, delayed payments, or disputes. It’s crucial to pay attention to detail and avoid common errors that can impact your business’s reputation and cash flow. Here are several key mistakes to watch out for when preparing your documents.

- Missing Client Information: Always ensure that the client’s name, address, and contact details are correct. Omitting this information or listing it incorrectly can cause delays in payment or issues with tracking your transactions.

- Incorrect Dates: Double-check the dates listed on your documents, including the issue date and due date. Incorrect dates can lead to confusion regarding payment terms and may make it seem like you’ve failed to meet deadlines.

- Unclear Payment Terms: Clearly define when and how you expect to receive payment. Including vague terms such as “ASAP” or “when possible” can create misunderstandings. Be specific about due dates, late fees, and any discounts offered for early payment.

- Uncalculated or Incorrect Totals: Always verify the accuracy of your totals. Errors in calculating amounts, taxes, or discounts can result in clients questioning your professionalism and lead to disputes. Utilize automatic formulas to reduce the risk of mistakes.

- Lack of Detailed Descriptions: Provide clear descriptions of the products or services rendered. Failing to list enough details can cause confusion for clients who may not remember exactly what was agreed upon, especially in long-term projects or recurring services.

- Failure to Include Unique Identifiers: Every document should have a unique reference number or ID. This helps in tracking and organizing your records, especially when managing multiple clients or projects. Without it, you risk losing important financial information.

- Not Including Your Business Details: Ensure that your company name, logo, and contact information are visible. Not having this information on your document makes it look unprofessional and can lead to confusion for clients when they need to reach you.

Avoiding these common mistakes will help ensure that your billing process runs smoothly, keeping clients happy and reducing administrative hassles. By paying attention to the details, you present a polished and professional image that fosters trust and timely payments.

How to Automate Invoices in Excel

Automating the creation of financial documents can save significant time and reduce the risk of errors. With the right setup, you can streamline the process of generating professional billing statements by using built-in functions and features of spreadsheet software. By automating key elements such as calculations, date entries, and client information, you can create documents that update themselves with minimal manual effort.

Step 1: Set Up Templates with Key Fields

The first step in automating your billing documents is to create a structure with all necessary fields. Include sections for client information, service descriptions, payment terms, and totals. Use placeholder cells for data that will change from one document to the next, such as the client’s name, services rendered, and amounts due.

Step 2: Use Formulas for Calculations

Automating calculations is one of the most important steps. Use built-in functions like SUM, SUMIF, and VLOOKUP to automatically calculate totals, taxes, discounts, or any other required financial figures. These formulas will update the amounts based on the data you enter, eliminating the need for manual calculations and reducing errors.

Step 3: Implement Date Functions

Set up date-related fields that will automatically adjust based on the issue date. You can use formulas like =TODAY() to populate the current date, and =EDATE() to calculate the due date based on the payment terms (e.g., 30 days from the issue date). This ensures that the dates are always accurate, without the need for manual updates each time.

Step 4: Create Dropdown Menus for Common Selections

To make your documents more user-friendly, you can create dropdown menus for repeated selections such as payment methods, tax rates, or service categories. Use the “Data Validation” feature to generate a list of options, allowing you to quickly select the appropriate choice without having to type it in each time.

Step 5: Link Client Information

If you work with regular clients, you can set up a database within the same file that stores their contact details, payment history, and standard service offerings. By using VLOOKUP or INDEX-MATCH functions, you can automatically pull this information into your billing documents by simply entering the client ID or name, saving you the effort of manually inputting the data each time.

Step 6: Save and Reuse Your Automated Setup

Once you’ve set up your automated billing process, save the document as a master copy. Each time you need to generate a new document, simply duplicate the sheet,

Using Excel for Professional Invoicing

Managing payments and financial records is crucial for any business. For many entrepreneurs, freelancers, and small companies, using a spreadsheet application to generate formal billing documents provides a simple, cost-effective, and efficient solution. By customizing a spreadsheet to fit your needs, you can maintain a high level of professionalism without the need for expensive software.

Here are several advantages of using a spreadsheet application for preparing professional financial documents:

- Customizability: You have full control over the design and layout. Whether you want a minimalist style or a detailed format, you can adjust each section to suit your business’s needs.

- Cost-Effective: Most people already have access to spreadsheet software, making it a free or low-cost option for businesses of all sizes.

- Ease of Use: The application is user-friendly and offers many built-in features, such as formulas and data validation, to make the process of creating and managing documents much simpler.

- Professional Appearance: With customizable fields, fonts, and colors, you can create clean, professional-looking documents that reflect the quality of your work.

- Automated Calculations: Built-in formulas can automatically calculate totals, taxes, discounts, and balances, ensuring accuracy and saving time.

- Efficient Record Keeping: You can use the same spreadsheet to track multiple clients, projects, and payments, creating a centralized system for your financial records.

To make the most of the features available, here’s how you can use this software for billing:

- S

Top Features of Excel Invoice Templates

When it comes to creating professional billing documents, the right features can make the process much easier and more efficient. Using a pre-designed layout for payment requests offers a wide range of advantages, especially when it comes to automation, customization, and consistency. Here are some of the most useful features that make these documents an essential tool for businesses of all sizes.

Key Features for Efficiency

- Automated Calculations: Built-in formulas like SUM and TAX functions automatically calculate totals, taxes, and discounts. This reduces manual input and ensures accurate financial records.

- Customizable Fields: The ability to easily update or modify fields such as client names, item descriptions, or service details ensures that each document meets your specific needs.

- Predefined Layouts: A structured layout makes it easy to organize your data. Predefined sections for client information, payment terms, and services provided ensure that you don’t miss any important details.

- Currency Formatting: These documents allow for easy currency formatting, ensuring your amounts are clearly presented and comply with the preferred currency format for both you and your client.

- Due Date Alerts: Some designs automatically highlight overdue payments, helping you keep track of when payment is due and when follow-ups may be necessary.

Customization and Professionalism

- Branding Opportunities: With customizable sections for your logo, company name, and colors, you can ensure that every document reflects your brand identity and looks professional.

- Client History: Some layouts allow for the addition of client-specific notes or a history of past payments, making it easy to track long-term clients and ongoing relationships.

- Integrated Payment Methods: Many designs include fields where you can specify payment methods (e.g., bank transfer, PayPal), allowing clients to quickly see how they can settle their balance.

- Recurring Billing Options: For businesses with subscription-based services or regular billing cycles, some layouts offer features for recurring charges, saving you time on generating new documents every cycle.

By incorporating these features, you can streamline your billing process, improve accuracy, and enhance your professionalism, all while saving time and effort on manual calculations and design work.

How to Track Payments with Excel

Monitoring transactions and managing financial records efficiently is crucial for both businesses and freelancers. Using a spreadsheet can help you maintain a clear overview of all incoming and outgoing payments, ensuring that nothing is missed and financial status is always up-to-date. With the right structure, you can easily track every payment, from the due date to the amount received and outstanding balances.

To begin, set up a structured sheet that includes essential information for each transaction. Typically, this would include columns such as the payment date, client or vendor details, invoice number, amount due, amount paid, and balance remaining. This approach ensures you can quickly assess which payments have been made and which are still pending.

Date Client Invoice Number Amount Due Amount Paid Balance 2024-10-01 John Doe 1001 $500 $500 $0 2024-10-05 Jane Smith 1002 $750 $400 $350 2024-10-10 ABC Corp. 1003 $1,000 $1,000 $0 By entering payment data regularly, you create a comprehensive record that helps you manage your financial health and avoid confusion. The remaining balance can be calculated automatically through simple formulas, offering a real-time update on outstanding debts. Additionally, conditional formatting can be used to highlight overdue payments or amounts still to be collected.

Save Time with Excel Invoice Templates

Creating financial documents from scratch every time can be a time-consuming task. By using pre-designed structures, you can significantly reduce the effort involved in preparing these records, ensuring that they are consistent, professional, and accurate. This streamlined approach allows you to focus on other important aspects of your business, rather than spending unnecessary time on administrative work.

A well-organized structure for billing allows you to quickly fill in the necessary details such as the client name, payment amount, and due dates. Many systems also allow for automatic calculations of totals, taxes, or balances, eliminating the need for manual entry. This not only saves time but also reduces the risk of errors, which can be costly in the long run.

Item Description Quantity Price Total Product A High-quality gadget 2 $50 $100 Service B Consultation services 1 $200 $200 Product C Accessory 3 $15 $45 Total Amount $345 Having a pre-built structure with formulas also makes it easy to handle recurring clients or similar products and services, as the majority of the work is already done for you. Simply adjust the quantities or prices, and the system will update the totals automatically. This saves you valuable time on each project or transaction, allowing you to allocate more resources to growing your business.

Invoice Templates for Different Business Types

Different industries and business models require unique approaches to documenting financial transactions. Whether you’re a freelancer, small business owner, or part of a larger enterprise, customizing your financial documents to suit your specific needs can enhance both efficiency and professionalism. Tailoring these records ensures that you capture all the necessary details relevant to your industry while making them easier to manage and process.

For instance, a service-based business might need to focus on hours worked, rate per hour, and project details, while a retail business would need to include product descriptions, quantities, and unit prices. Adapting these structures to your business type ensures clarity and accuracy in your financial documentation. Likewise, businesses in sectors like construction or consulting may need additional fields to account for deposits, progress payments, or specific project milestones.

Freelancers typically prefer a straightforward approach, listing hourly rates or fixed project fees, along with the dates services were rendered. This simplicity keeps things clear and ensures that clients understand exactly what they are being charged for, without unnecessary complexity.

Small businesses in retail or wholesale may have more intricate structures, needing to account for bulk items, discounts, taxes, and delivery fees. These financial documents should efficiently manage large volumes of product sales and provide a clear breakdown for both customers and accounting purposes.

Corporations may require more advanced financial documentation, often with fields for multiple items, payment terms, and detailed tax calculations. These records should be structured to handle high volumes of transactions and potentially involve multiple departments or locations, streamlining internal processes and keeping everything organized.