Free Tradesman Invoice Template for Easy Billing and Professionalism

Managing billing is a crucial aspect of running any service-based business. Ensuring that clients receive clear and professional statements for the work performed helps maintain cash flow and establishes trust between service providers and their customers. With a well-structured document, you can easily outline the scope of services, payment terms, and other essential details to prevent misunderstandings and ensure timely compensation.

Using a standardized document that can be customized to fit specific needs not only saves time but also contributes to a more organized and professional approach to financial transactions. This method eliminates the risk of errors and ensures that each payment request includes all necessary information in a clear and concise format. It’s a simple yet effective way to streamline your business operations.

Whether you are a contractor, consultant, or any other professional offering services, creating a precise and accurate statement is essential. The process doesn’t have to be complicated or time-consuming. By using a flexible and easy-to-adapt solution, you can create professional documents that reflect your business standards while simplifying your administrative tasks.

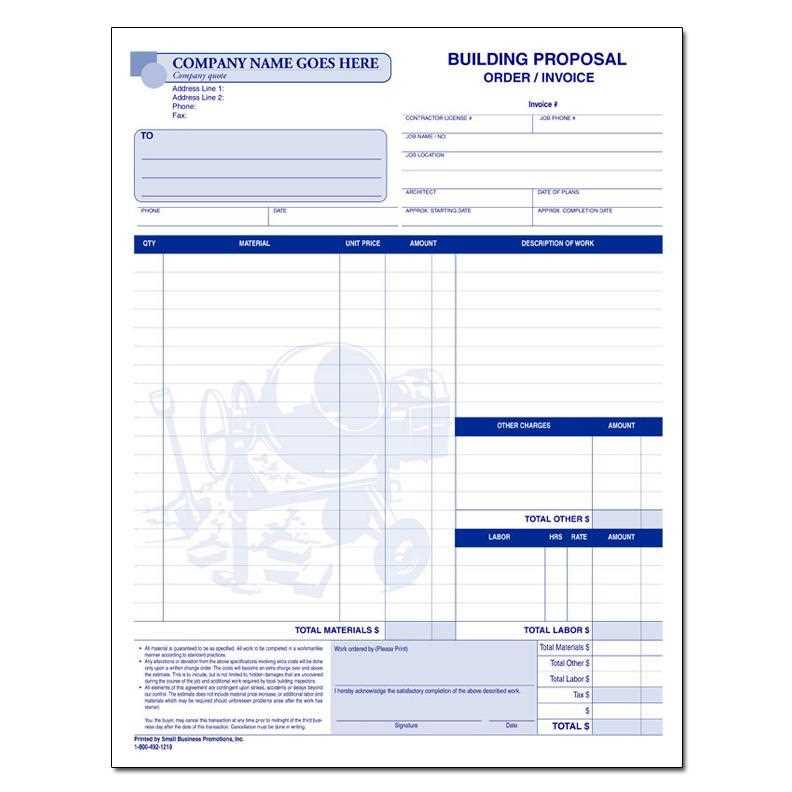

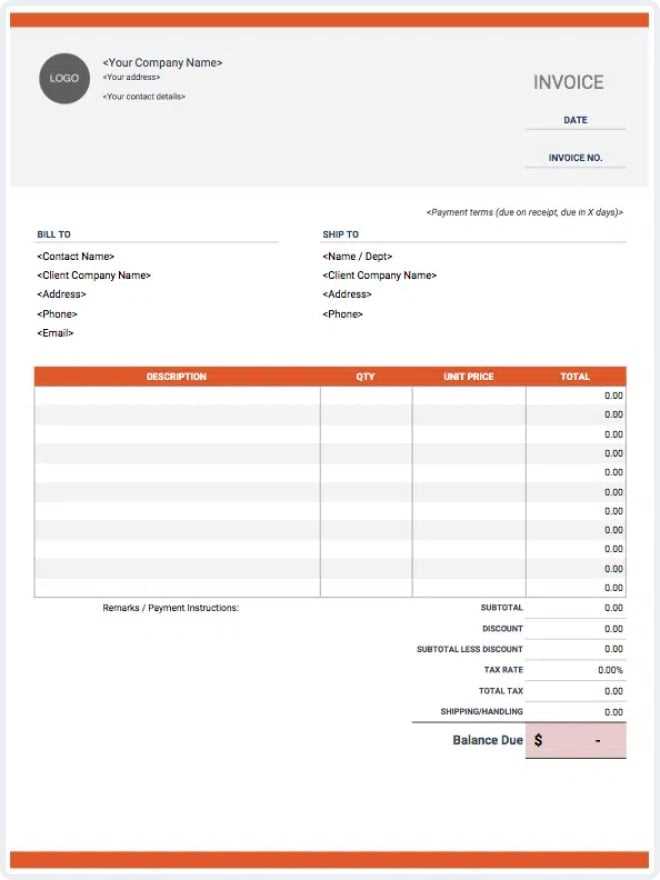

Tradesman Invoice Template Overview

For any service-based professional, clear and accurate billing is vital to ensure proper payment for work completed. A structured document allows you to present your services in a professional manner, providing clients with a transparent breakdown of what they are paying for. This type of document serves as an official request for payment and helps avoid misunderstandings between service providers and their clients.

Incorporating essential information, such as contact details, work performed, and payment terms, is crucial. By using a pre-designed format, professionals can create consistent and error-free statements with ease. This approach streamlines the billing process, saving time and effort while maintaining professionalism.

Key Features of a Well-Structured Billing Document

- Service Details: A clear description of the work performed, including hours worked and materials used.

- Payment Terms: Specifics regarding payment deadlines, late fees, and accepted payment methods.

- Client Information: Contact details for both the service provider and the customer.

- Invoice Number: A unique reference number to track the document and ensure accurate record-keeping.

Why You Need a Professional Billing Solution

- Consistency: Having a standardized format for all billing ensures that every client receives the same level of service and professionalism.

- Efficiency: Reduces the time spent creating invoices from scratch and avoids potential mistakes in calculations or missing information.

- Improved Cash Flow: A properly designed document can encourage timely payments, which helps maintain healthy business finances.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for billing brings several advantages to service-based businesses. It simplifies the process of requesting payment, ensures consistency across all transactions, and helps avoid common mistakes that can lead to delayed payments or confusion with clients. By adopting a standard format, professionals can save time and maintain a high level of organization in their financial management.

Moreover, this approach allows for quick adjustments based on the nature of the work or specific client needs, while still maintaining a professional appearance. These documents are customizable, meaning they can reflect the unique terms of each project or agreement without requiring a complete overhaul for every job.

Time and Efficiency Savings

One of the primary benefits of using a structured billing document is the significant amount of time saved in the billing process. Instead of starting from scratch for each new payment request, a ready-made layout allows for quick updates and customization, freeing up time for other tasks. The use of a standardized format ensures that all necessary information is included, reducing the likelihood of forgetting critical details.

Accuracy and Consistency

With a pre-designed layout, the risk of errors is minimized. All relevant fields are clearly defined, reducing the chances of omissions or incorrect calculations. This consistency not only enhances the professional image but also helps avoid confusion with clients, leading to faster payment processing.

| Benefit | Description |

|---|---|

| Time Efficiency | Quick customization and reduced preparation time for each billing cycle. |

| Professional Appearance | Consistent formatting enhances the perception of your business’s professionalism. |

| Reduced Errors | Pre-set fields and organized sections minimize the risk of mistakes. |

| Better Client Relationships | Clear and transparent billing improves trust and communication with clients. |

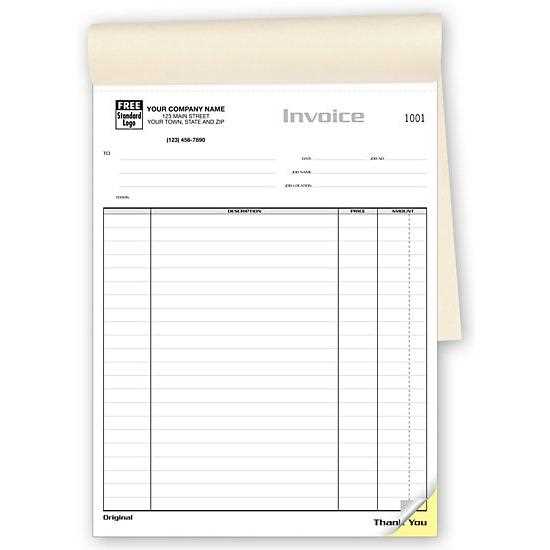

How to Create a Professional Invoice

Creating a clear, accurate, and professional document for requesting payment is an essential part of running any service-oriented business. A well-crafted bill not only ensures that clients understand the services provided and the amount due but also reflects the credibility and reliability of your business. Follow these steps to create a polished document

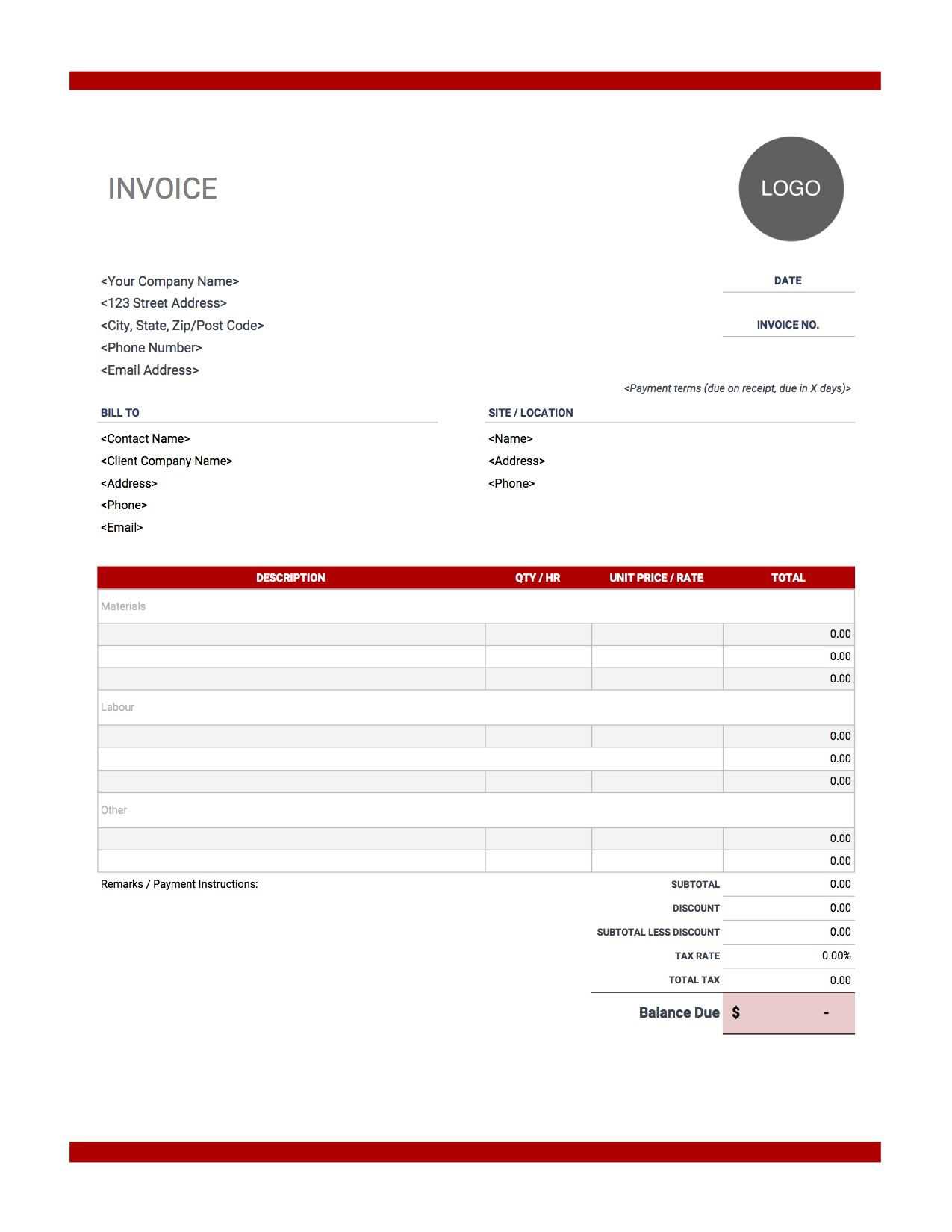

Essential Elements in a Tradesman Invoice

A well-prepared document for requesting payment should contain all the necessary details to ensure transparency and avoid confusion. Each section of the bill plays a crucial role in providing a complete overview of the services performed, the amount owed, and the terms of payment. Including the right elements ensures that both the client and the service provider are on the same page and helps streamline the payment process.

Key Components of a Billing Statement

To create an effective and professional payment request, there are several key elements that should always be included:

| Element | Description | |||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Details | Include your company name, contact information, and any relevant licensing or registration numbers to establish credibility. | |||||||||||||||||||||||||||||||||||||||||||||

| Client Information | Provide the client’s name, address, and contact details for easy reference and communication. |

| Formatting Tip | Explanation | |||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Use Clear Headings | Organize the document into distinct sections with bold headings, such as “Services Provided,” “Payment Terms,” and “Total Amount Due” to help guide the reader. | |||||||||||||||||||||||||||||||||||||||||||||

| Keep It Simple | Avoid clutter by using minimal text and focusing only on the essential information. Too much detail can make the document overwhelming. | |||||||||||||||||||||||||||||||||||||||||||||

| Use Bullet Points for Lists | For services provided or other itemized details, bullet points help make the information easier to scan and digest quickly. | |||||||||||||||||||||||||||||||||||||||||||||

| Ensure Proper Alignment | Align numbers (e.g., charges, taxes, totals) to the right and text to the left to enhance readability and help clients find key figures easily. | |||||||||||||||||||||||||||||||||||||||||||||

| Leave White Space | Ensure enough space between sections and lines to prevent the document from looking crowded. White space improves readability and makes the document feel less overwhelming. |

| Tax Component | Description | Amount |

|---|---|---|

| Sales Tax | Percentage charged based on the total amount for services or products provided. | $15.00 |

| Tax Rate | Percentage rate applied to the subtotal (e.g., 10%). | 10% |

| Tax Total | Total amount of tax charged based on the subtotal. | $15.00 |

Best Practices for Including Tax Details

- Clearly State the Tax Rate: Always include the applicable tax rate, such as “Sales Tax (10%)” so that clients understand how the total amount is calculated.

- Separate Tax from Service Charges: List tax charges separately from the main service fees or costs to make it clear how the total is broken down.

- Show Subtotal and Tax Amounts: Include both the subtotal before tax and the tax amount clearly to ensure full transparency.

- Use Standard Tax Codes: If applicable, ensure you’re using the correct tax codes or classifications as required by your local tax authority to avoid issues with tax reporting.

Best Practices for Sending Invoices

Sending a payment request is not just about completing a document; it’s about ensuring that your client receives it in a timely and professional manner. The way you deliver a billing statement can impact how quickly you get paid and how your business is perceived. By following the best practices for sending, you can ensure that your clients have all the information they need and that the process is as smooth as possible for both parties.

Here are some key steps and best practices for effectively sending your billing documents to ensure clarity, efficiency, and professionalism:

Key Practices for Sending Billing Requests

| Step | Best Practice | Description |

|---|---|---|

| Use Professional Email | Send via business email | Ensure that your client receives the document in a professional manner by using your business email address rather than a personal one. |

| Double-Check Details | Verify accuracy | Before sending, review the document to ensure all details such as client information, services rendered, and payment terms are correct. |

| Include a Clear Subject Line | Make it clear | Use a subject line that clearly states the purpose, such as “Payment Request for [Your Service], Due [Due Date].” This makes it easier for the client to locate the document in their inbox. |

| Send in Multiple Formats | Attach as PDF and other formats | Send the document in a commonly accepted format like PDF to ensure that it is easily accessible and readable by the client. |

| Follow Up if Necessary | Send reminders | If payment is not received by the due date, send a polite follow-up message as a reminder with a copy of the original document attached. |

Additional Tips for Efficiency

- Use an Online Payment Link: Consider adding a direct payment link in your email to make it easier for the client to pay immediately.

- Set a Reminder for Yourself: Set reminders to check on payments and follow up after the due date

Tracking Payments with Your Invoice

Keeping track of payments is essential for maintaining accurate financial records and ensuring timely cash flow. When you issue a billing document, it’s important to have a clear system for monitoring when payments are received and which are still outstanding. This helps you avoid confusion, stay on top of overdue payments, and maintain good financial management practices. A well-organized system for tracking payments also provides clarity for your clients, ensuring that they understand their current balance and due dates.

Below are some useful tips and methods for tracking payments effectively using your billing statements:

Methods for Tracking Payments

Method Description Benefits Payment Tracking Section Include a dedicated section on the document where you can mark the payment status, such as “Paid,” “Pending,” or “Overdue.” Clear tracking directly on the document makes it easy for both you and your client to see the payment status at a glance. Record Payment Dates For each payment received, record the payment date in a log or on the document itself. Helps in keeping track of when payments were made, ensuring there are no discrepancies in payment history. Use Digital Tools Leverage accounting software or online platforms to track payments automatically when documents are sent or payments are made. Automates the process, reducing the chance of manual errors and making it easier to monitor multiple transactions. Payment Reference Number Assign a reference number for each payment and match it with the corresponding payment request. Helps in keeping a consistent and organized record of each transaction, making it easy to reference past payments. Additional Tips for Effective Payment Tracking

- Set Up Payment Reminders: Use your payment system to send automated reminders to clients for upcoming or overdue payments.

- Regularly Reconcil

Common Mistakes to Avoid in Invoicing

Billing errors can lead to delays in payments, misunderstandings with clients, and even legal complications. It’s crucial to ensure that all the details in your payment requests are accurate and clear. Common mistakes, such as incorrect calculations or missing information, can create unnecessary confusion and slow down the payment process. Avoiding these errors not only ensures timely payment but also helps in maintaining a professional relationship with your clients.

Top Mistakes to Watch Out For

- Incorrect Amounts: Double-check all calculations, including service fees, taxes, and totals. An incorrect amount can cause disputes and delay payments.

- Missing or Wrong Client Information: Ensure that the client’s name, address, and contact details are correct. This will prevent any confusion and help with proper record-keeping.

- Omitting Payment Terms: Always include clear payment terms, such as the due date, accepted payment methods, and late fees, to avoid misunderstandings.

- Failure to Itemize Services: Be sure to list all services provided, along with their costs, to give a complete breakdown. This helps clients understand exactly what they are paying for.

- Missing Dates: Include both the date the document is issued and the payment due date. This ensures both parties are aligned on when payment is expected.

Additional Common Pitfalls

- Using Unprofessional Language: Keep the tone of your payment request formal and polite. Avoid slang or overly casual language that might diminish the professionalism of the document.

- Not Following Up on Overdue Payments: If payment is not received by the due date, don’t hesitate to send a polite reminder. It’s important to follow up to ensure timely payments.

- Using Complex Language or Jargon: Use simple, clear language that your clients can easily understand. Avoid technical terms or industry jargon that may confuse them.

- Forgetting to Include a Thank-You Note: While it’s important to focus on payment details, don’t forget to thank your clients for their business. A polite note can foster a positive relationship.

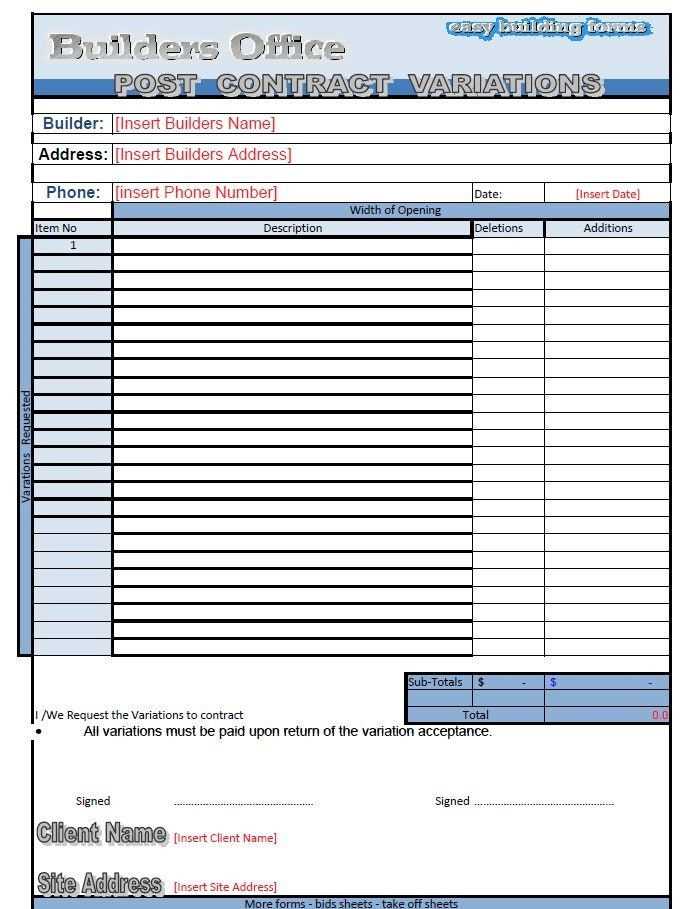

Invoice Templates for Different Trades

Each profession has its own unique requirements when it comes to creating a payment request. Whether you’re offering plumbing services, electrical work, or carpentry, it’s important that your billing document reflects the specifics of your trade. Customizing your payment request ensures that all necessary details are included, from materials used to the complexity of the work performed. By tailoring the format to your particular industry, you not only make the process more efficient but also present a professional image to your clients.

Examples of Common Templates by Profession

- Plumbing Services: Typically, plumbing billing statements include details about the type of service (e.g., repairs, installations), materials used, and hourly rates. It’s also helpful to include any emergency service charges if applicable.

- Electrical Work: For electricians, invoices often break down labor charges, the type of electrical installations, and any safety inspections completed. The statement should clearly state any additional charges for special equipment or permits required.

- Construction and Carpentry: Carpentry invoices generally list detailed work performed (e.g., custom furniture, home repairs), materials used, and project timelines. Accurate measurement of the materials and clear descriptions of the tasks ensure that the client fully understands the scope of the project.

- HVAC Services: For HVAC professionals, the payment request should include a breakdown of services such as installations, repairs, or maintenance, along with the equipment provided (e.g., air conditioners, heating units), and a detailed labor cost.

Tailoring the Document for Your Specific Industry

Regardless of the trade, it’s essential to include key details like:

- Hourly rates or flat fees

- Materials or equipment used, with clear pricing

- Any additional charges, such as travel fees or emergency service costs

- A breakdown of labor costs for different tasks or hours worked

- Clear payment terms and methods

By customizing your billing statement to the unique needs of your trade, you’ll provide greater clarity for your clients while ensuring smooth and timely payments.

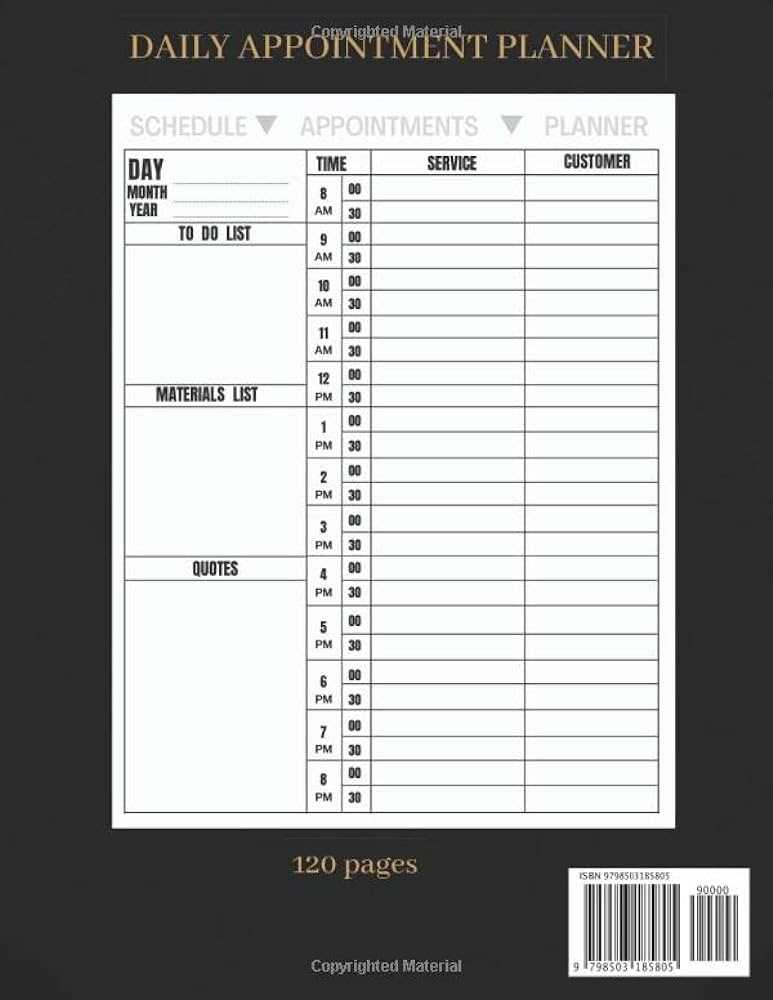

How to Create Recurring Invoices

For businesses that offer ongoing services or subscription-based models, creating recurring payment requests is a vital part of maintaining a steady cash flow. These documents are used for services provided on a regular basis, such as weekly, monthly, or annually. Setting up a recurring billing system helps ensure that both you and your clients have a clear understanding of payment schedules and expectations, reducing the risk of missed payments and ensuring consistency in revenue.

Steps for Setting Up Recurring Billing

- Determine the Frequency: Decide how often the payment request will be issued. It could be weekly, monthly, or annually, depending on the service you offer.

- Define Payment Terms: Clearly state the amount due for each cycle and the due date. Make sure to include any late payment penalties if applicable.

- Include Detailed Descriptions: Outline the services provided in each billing cycle, specifying whether there are any variations in the amount due each time (e.g., fluctuating charges based on usage or additional work).

- Automate Recurring Payments: If using billing software or an online payment platform, set up automatic billing. This can save time for both you and your clients and reduce administrative effort.

- Communicate with Clients: Inform your clients about the recurring nature of the billing and provide clear instructions on how to cancel or modify the agreement if necessary.

Tips for Effective Recurring Billing

- Keep Records Organized: Maintain a clear log of all recurring billing agreements, including client details, billing cycles, and payment history, to ensure accuracy.

- Offer Multiple Payment Methods: Provide clients with several options for payment, such as credit card, bank transfer, or online payment systems, to make the process easier for them.

- Send Payment Reminders: Set up automated reminders to be sent a few days before each payment is due. This can help reduce late payments and ensure timely receipts.

- Review Terms Regularly: Periodically review and update the terms and pricing of your recurring services to ensure they align with your business needs and market conditions.

By setting up a clear, well-organized recurring billing system, you can streamline the process, maintain cash flow, and strengthen your client relationships through transparency and consistency.

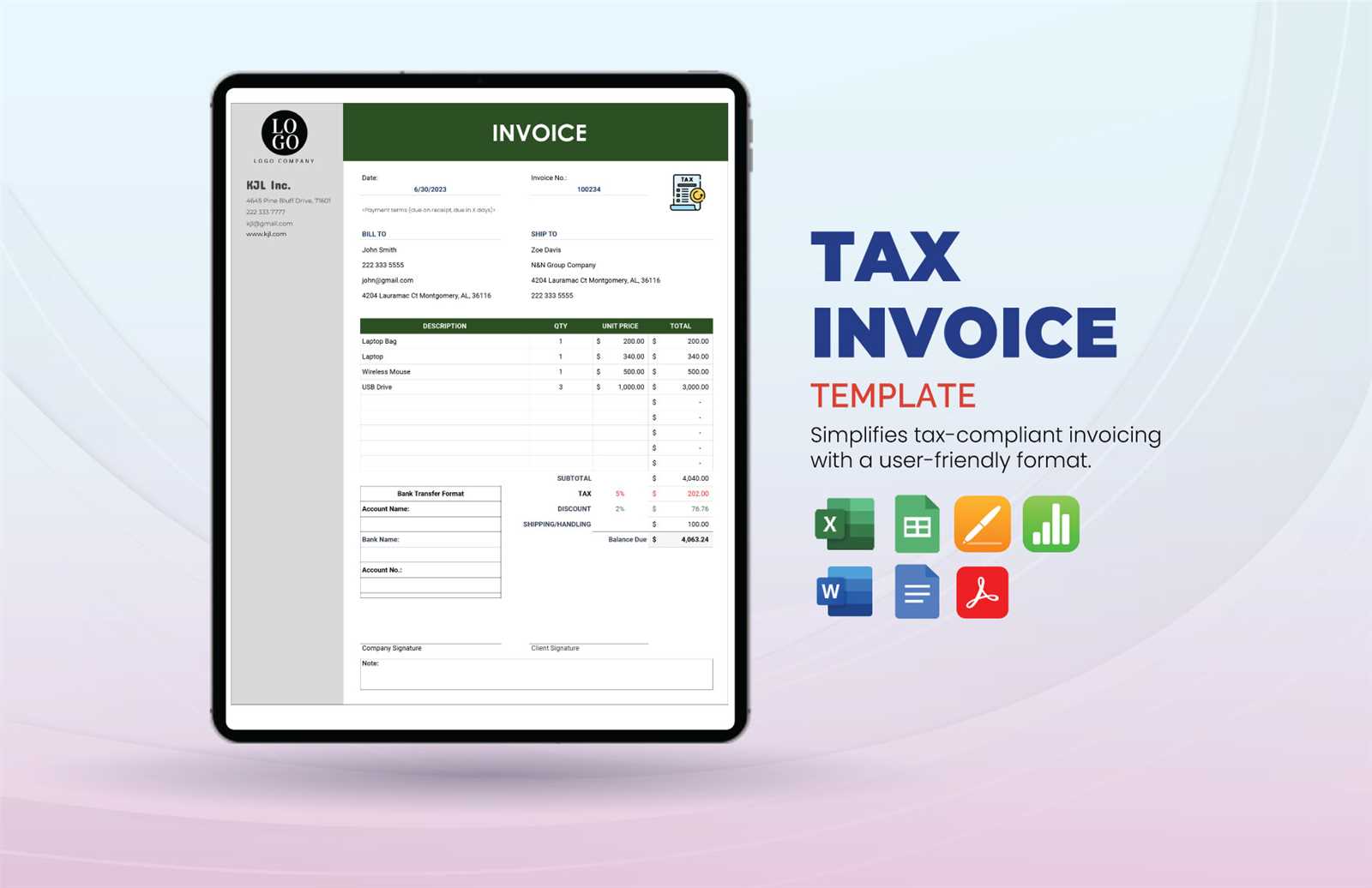

Tradesman Invoice Template Free Download and Easy Customization Invoice Templates for Small Businesses

For small businesses, keeping finances organized and ensuring timely payments is essential for success. A well-structured billing document not only facilitates smooth transactions but also helps maintain professionalism and transparency with clients. Having a ready-to-use format for all your payment requests can save you time, reduce errors, and improve cash flow. Whether you’re a freelancer, contractor, or service provider, using a clear and consistent structure for your requests will set you apart and make your financial processes more efficient.

Why Small Businesses Need Customized Billing Documents

Small businesses often have limited resources, so it’s crucial to optimize processes and reduce unnecessary overhead. By using customized payment requests, you can ensure that each document includes the relevant details, such as:

- Accurate Service Descriptions: Clearly state the products or services provided to avoid confusion.

- Clear Payment Terms: Indicate payment due dates, late fees, and acceptable methods of payment.

- Branding: Incorporate your business logo and contact information to create a professional and recognizable image.

- Tax Details: Ensure that any necessary taxes are itemized and easy to understand for both you and your clients.

Benefits of Using Pre-Formatted Billing Documents

Using pre-designed billing formats brings several advantages to small businesses:

- Time Efficiency: Quickly generate billing requests without needing to start from scratch each time.

- Consistency: Maintain uniformity in all your financial documents, which helps reinforce your brand identity.

- Reduced Errors: Minimize mistakes in calculations, client details, or payment terms, reducing the likelihood of payment delays.

- Improved Professionalism: A well-designed document creates a more professional image and fosters trust with clients.

By implementing well-structured payment requests, small business owners can streamline their operations, enhance cash flow, and ensure a higher level of client satisfaction.