Commercial Invoice Template for Australia to Simplify Your Business Transactions

Managing business transactions efficiently requires accurate documentation that reflects the terms of your agreements. Having a reliable and well-structured document for sales or service payments is crucial for maintaining clarity and professionalism. This type of document not only serves as a formal request for payment but also provides key details that protect both the buyer and seller.

In this guide, we will explore how to craft a document that includes all necessary components for smooth transactions. Whether you’re handling local deals or international agreements, knowing what to include and how to format it can prevent confusion and potential disputes. With the right structure, you ensure that both parties are on the same page and transactions are processed seamlessly.

Understanding the key elements of these documents is the first step to creating a clear and effective financial request. The information included will help establish the value of goods or services provided, outline payment terms, and ensure compliance with relevant standards. We’ll also discuss how to customize this document to suit your business needs and ensure accuracy.

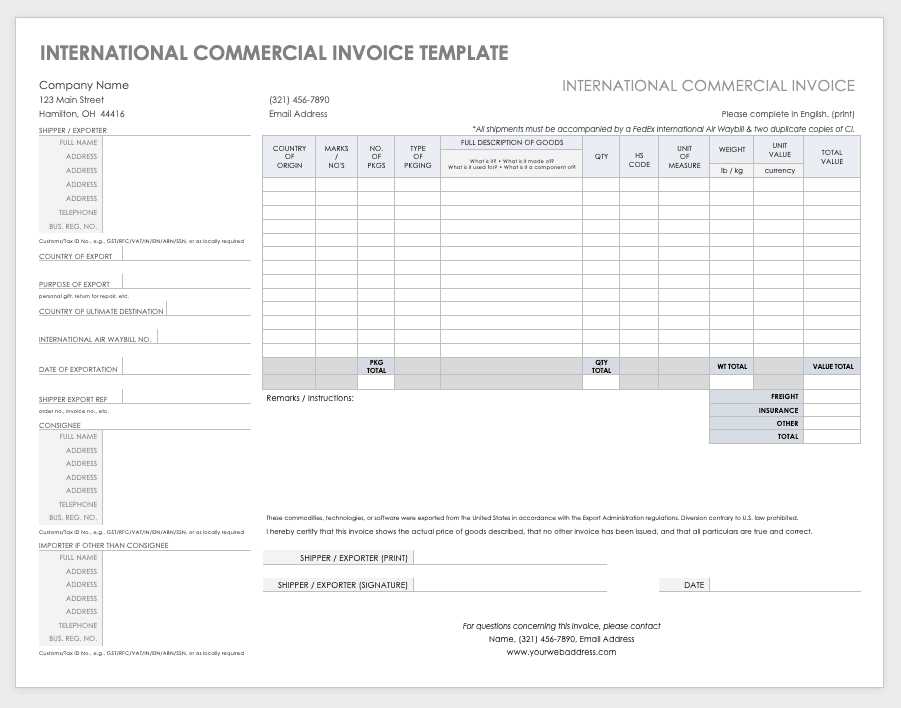

Commercial Invoice Template Australia Explained

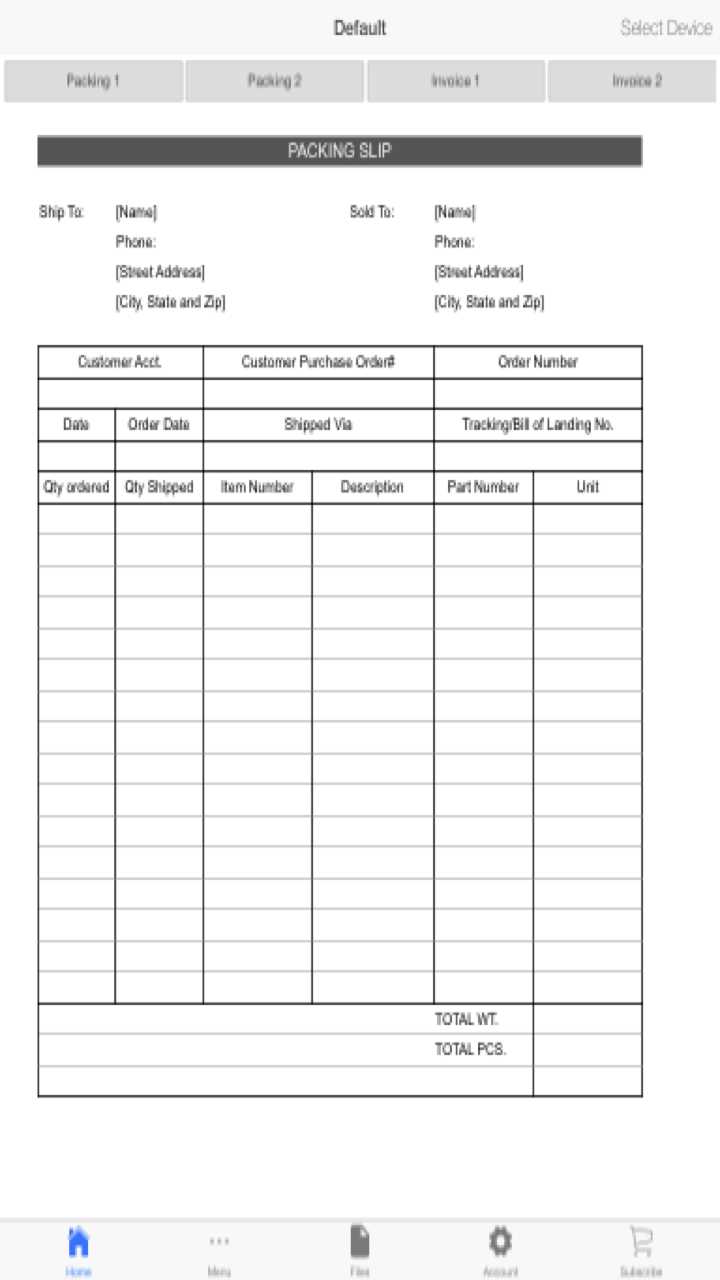

For businesses involved in transactions, having a well-structured payment document is essential for clarity and legal compliance. This document acts as a formal record that outlines the terms of a transaction, ensuring both parties are clear about the goods or services provided, the payment due, and other relevant details. It helps in organizing financial interactions, both for local and international dealings, and serves as a reference for any future disputes or queries.

The key to a functional document lies in its layout. An effective structure includes important fields that ensure all necessary information is captured in a clear and professional manner. Understanding what details to include and how to format them is vital for businesses looking to streamline their operations and maintain proper records.

| Field | Description |

|---|---|

| Seller Information | Name, address, and contact details of the seller or service provider. |

| Buyer Information | Name, address, and contact details of the buyer or recipient. |

| Transaction Date | The date when the goods or services were delivered or the agreement was finalized. |

| Itemized List | A detailed description of the goods or services provided, including quantity and unit price. |

| Total Amount | The total amount due, including applicable taxes and fees. |

| Payment Terms | Clear instructions on how and when payment should be made. |

By using a well-organized layout, businesses can avoid confusion and ensure all relevant information is presented in an easily accessible format. This simplifies the payment process and contributes to smoother transactions overall.

Why Use a Commercial Invoice Template

Using a structured document for billing and payments offers businesses the advantage of consistency and accuracy. This type of document streamlines the process, ensuring all required information is included and formatted correctly every time. With a pre-designed format, errors are minimized, and the chances of missing critical details are greatly reduced, saving time and effort for both the seller and the buyer.

Moreover, having a predefined format provides a professional appearance that can enhance a company’s credibility. It helps ensure that transactions are clear and transparent, which is especially important for international deals or when dealing with large sums of money. Having a standard document also makes it easier to track payments, maintain records, and stay compliant with tax regulations.

| Advantage | Benefit |

|---|---|

| Consistency | Ensures all necessary details are included in every transaction. |

| Time-saving | Reduces the need for manual formatting and repetitive data entry. |

| Professionalism | Creates a polished, organized appearance for clients and partners. |

| Accuracy | Minimizes errors by providing clear sections for all required information. |

| Record keeping | Facilitates easy tracking and management of transactions over time. |

Ultimately, using such a document helps ensure smooth, hassle-free transactions, contributing to the long-term success of your business.

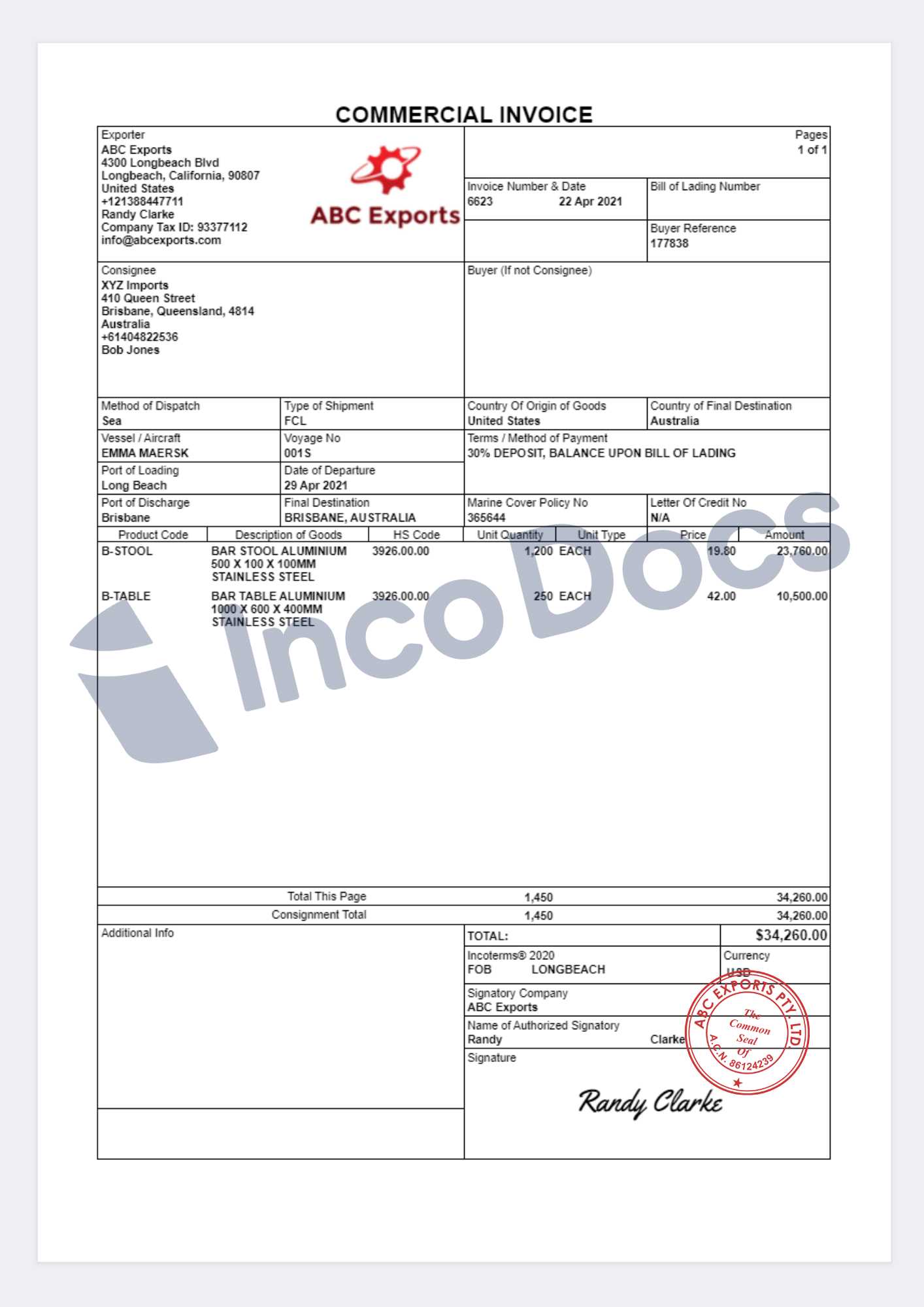

Key Elements of an Australian Invoice

When preparing a payment request, it’s important to include specific details to ensure clarity and legal compliance. A well-structured document not only ensures that both parties understand the terms of the transaction, but it also serves as a reference point for future financial or legal matters. Several critical fields must be filled in to create a complete and accurate record of the transaction.

Essential Information

The foundation of any payment document starts with the essential information of both the seller and the buyer. This includes the full name, address, and contact details of both parties. Additionally, the document should include the unique transaction or reference number, which helps identify the specific agreement or purchase in case of future inquiries or disputes.

Transaction Details

It’s important to itemize the goods or services provided, along with the quantities, unit prices, and any applicable taxes or discounts. The total amount due should be clearly stated, along with the payment terms, such as the due date or any early payment discounts. Having these details outlined clearly reduces misunderstandings and sets expectations for both parties. Finally, including the transaction date and payment method options will complete the document, ensuring all aspects of the agreement are covered.

By including these critical details, businesses ensure that their financial records are clear, transparent, and compliant with local standards, making it easier to manage transactions and maintain professionalism.

How to Create a Commercial Invoice

Creating a clear and effective document for business transactions is essential for both the buyer and the seller. The process is straightforward if you know the key elements to include and follow the right structure. A well-prepared document ensures that both parties are on the same page regarding the goods or services provided, the amount due, and the terms of payment.

Step-by-Step Guide

Follow these simple steps to create a clear and professional payment document:

- Gather Seller and Buyer Information: Include the full name, address, and contact details of both the seller and the buyer.

- Assign a Unique Reference Number: This helps identify the transaction and track the payment.

- Detail the Goods or Services: List each item provided, including the quantity, description, and price per unit.

- Calculate the Total Amount: Add up the cost for all items, include applicable taxes, and any additional fees.

- Specify Payment Terms: State the payment due date, any early payment discounts, and acceptable payment methods.

- Include the Transaction Date: Clearly state when the transaction took place or when the goods or services were delivered.

Additional Considerations

- Use Professional Formatting: A clean, easy-to-read format enhances the credibility of the document.

- Ensure Accuracy: Double-check all calculations and contact details to avoid errors.

- Include Your Business Logo: Adding a logo can help personalize the document and build trust with clients.

By following these simple steps, you can create a document that is clear, organized, and professionally presented, ensuring smooth transactions and proper record-keeping.

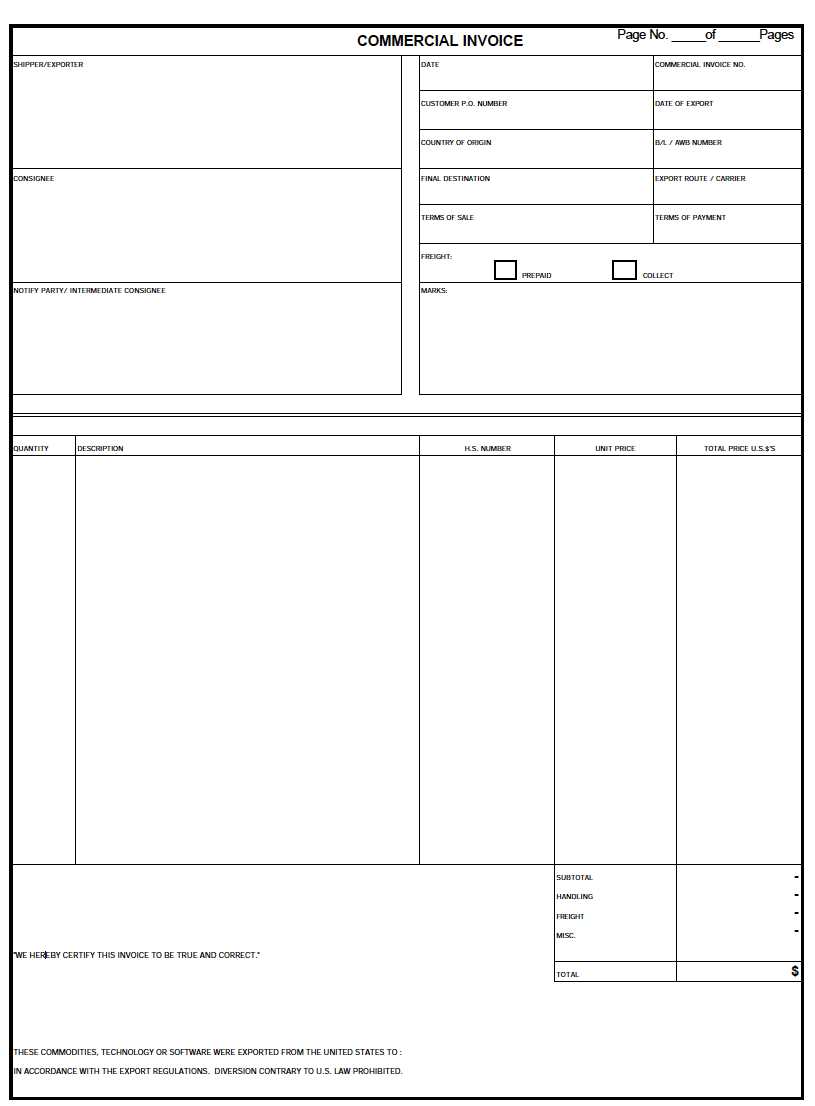

Legal Requirements for Invoices in Australia

When preparing a payment request, it’s essential to ensure that the document complies with local laws and regulations. In many countries, including Australia, certain legal requirements must be met for the document to be considered valid. These requirements help protect both businesses and consumers, ensuring transparency and fairness in financial transactions.

To ensure compliance, it’s important to include specific details that are outlined by the Australian Taxation Office (ATO). These details help establish the legitimacy of the transaction, assist in tax reporting, and serve as proof of sale in case of disputes or audits.

Mandatory Information

- Seller’s Details: The full name, address, and Australian Business Number (ABN) or Australian Company Number (ACN) of the seller.

- Buyer’s Details: The buyer’s name and contact information. While not always legally required, it’s good practice to include this.

- Transaction Date: The date when the goods or services were provided or the agreement was finalized.

- Description of Goods or Services: Clear details about the products or services provided, including quantities, unit price, and any applicable discounts.

- Total Amount: The total amount due, including applicable taxes like the Goods and Services Tax (GST), if relevant.

- GST Information: If GST applies, it must be separately listed, and the total amount must include GST (if applicable). The GST amount must also be clearly visible.

- Payment Terms: Include payment due dates, payment methods, and any early payment discounts, if applicable.

- Unique Reference Number: Each document should have a unique identification number to help track transactions.

Additional Considerations

- Currency: Ensure the currency used is clearly stated, particularly if dealing with international clients.

- Electronic Records: If the transaction is handled electronically, ensure that the document can be accessed and stored in a manner that complies with legal record-keeping requirements.

- C

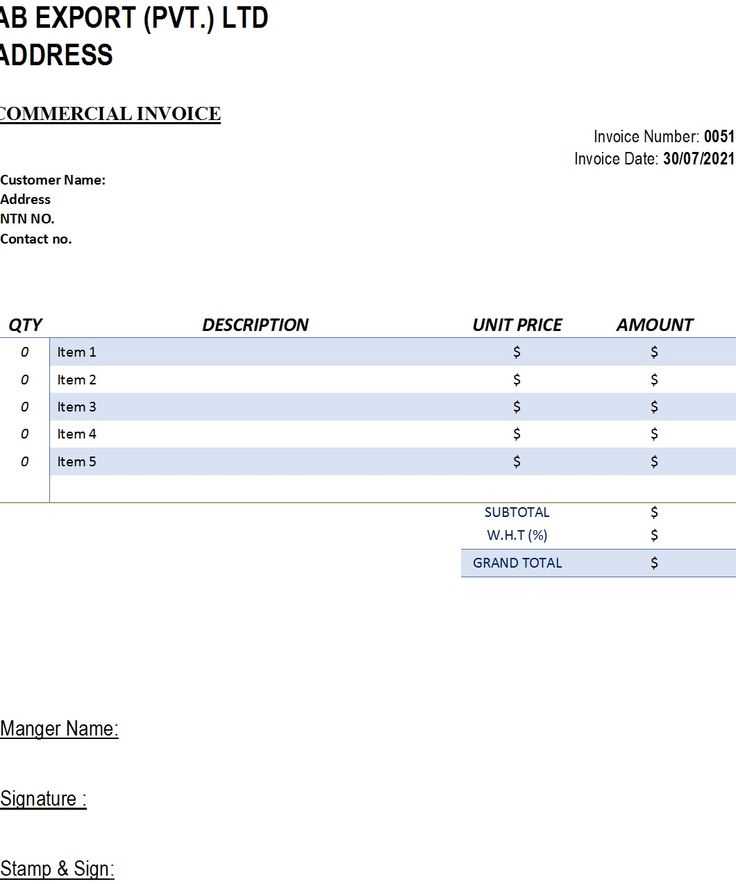

Benefits of Customizing Your Invoice Template

Customizing your billing document offers several advantages that can enhance both your business operations and your client relationships. A tailored document ensures that your branding is consistent and that all relevant information is included in a format that best suits your company’s needs. Customization allows you to convey professionalism while making the payment process as clear and efficient as possible for your clients.

One of the key benefits is the ability to reflect your brand identity. By adding your company logo, colors, and unique design elements, you create a cohesive and recognizable presentation that reinforces your business image. This small touch can make a significant difference, helping your business stand out and appear more established.

Another important advantage is increased accuracy. A customized format ensures that all necessary fields are included and organized in a way that suits your specific business model. Whether you need to highlight specific payment terms, list complex pricing details, or provide additional notes for your clients, customization allows you to make sure every document is complete and error-free.

Furthermore, personalizing your billing document can improve communication with your clients. By adding custom fields or specific instructions, you can guide your clients through the payment process more easily. This clarity can reduce confusion, speed up the payment process, and minimize the chances of misunderstandings.

Overall, customization not only strengthens your business’s professional image but also streamlines the billing process, making it easier for both you and your clients to manage transactions smoothly and efficiently.

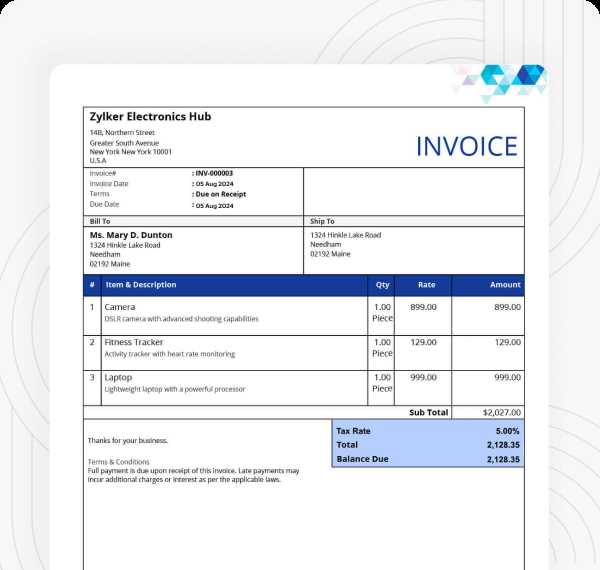

Top Features of a Good Invoice Template

A well-designed billing document is essential for any business transaction. It serves as a formal request for payment and should provide all the necessary details in a clear and organized manner. A good document not only ensures accuracy and professionalism but also makes it easier for both the seller and buyer to understand the terms of the transaction. Certain features make a payment document stand out and help streamline the entire process.

Clarity and Simplicity

The most important feature of any payment document is clarity. The layout should be simple, with distinct sections that are easy to navigate. Information should be presented in a logical order, ensuring that the buyer can quickly find essential details such as the items or services provided, the total amount due, and the payment terms. The font should be legible, and the design should avoid unnecessary clutter, allowing the focus to remain on the critical details.

Essential Fields and Customization Options

A good document includes all the necessary fields to ensure completeness and legal compliance. This includes fields for seller and buyer information, a clear description of the goods or services, pricing, taxes, and payment instructions. It should also allow for customization, such as adding your business logo, modifying payment terms, or including special instructions. This flexibility helps create a document that is not only legally sound but also tailored to your specific business needs.

Additionally, important features such as a unique reference number for tracking purposes and clear due dates can help both parties manage their records and payments more efficiently. A professional, well-organized payment document will leave a positive impression on clients, reduce the chances of disputes, and ensure a smoother transaction process overall.

How to Include Tax Information on Invoices

Incorporating accurate tax details in your payment request is crucial for both compliance and transparency. Tax information ensures that the buyer knows exactly how much they are paying in taxes and how the total amount was calculated. Whether it’s Goods and Services Tax (GST) or other local taxes, including these details clearly helps avoid confusion and ensures that your business adheres to legal requirements.

Showcasing Tax Breakdown

It’s important to display the tax amount separately from the price of the goods or services. A clear breakdown allows the buyer to see how the tax is applied to the total price. If applicable, list the tax rate used, along with the specific amount charged. For example, if the tax rate is 10%, make sure to calculate and list the amount charged for tax, then show the total, including both the cost of goods or services and the tax amount.

Example Format for Tax Information

Here’s an example of how to format tax information:

- Goods/Services Total: $500.00

- Tax Rate (GST): 10%

- Tax Amount: $50.00

- Total Due: $550.00

Additionally, if your business is registered for tax purposes, you should include your tax identification number (e.g., ABN or TIN), as it may be required by tax authorities or your clients for their own record-keeping and tax reporting.

By clearly presenting tax details, businesses ensure that transactions are fully transparent, minimizing the risk of misunderstandings and maintaining compliance with tax regulations.

Common Mistakes to Avoid When Invoicing

Billing errors can lead to confusion, delayed payments, or even disputes with clients. It’s essential to create a clear and accurate payment document to avoid misunderstandings and ensure a smooth transaction process. By being mindful of common mistakes, businesses can improve efficiency and maintain professional relationships with their clients.

Frequent Errors to Watch Out For

- Incorrect or Missing Details: Ensure that all necessary information, such as the buyer’s and seller’s details, is included and accurate. Failing to provide contact information, business identification numbers, or delivery details can cause delays.

- Not Including a Unique Reference Number: Always assign a unique reference number to each document. This helps both parties track the transaction and avoids confusion, especially when dealing with multiple invoices.

- Forgetting to Specify Payment Terms: Clearly outline when payment is due, the accepted methods of payment, and any penalties for late payments. This ensures that both parties are aware of the expectations.

- Failure to Itemize Charges: Always break down the cost of goods or services provided. Without clear itemization, clients may question the charges, leading to delays in payment.

- Not Calculating Taxes Properly: Ensure the correct tax rate is applied, and clearly separate the tax amount from the total due. Errors in tax calculations can create compliance issues.

- Using Unprofessional Formatting: Poor formatting can make it difficult for clients to read and understand the document. Always use a clean, organized layout with legible fonts and logical structure.

Additional Tips for Avoiding Mistakes

- Double-Check Calculations: Always verify that the totals, taxes, and any discounts are accurate before sending the document.

- Review Before Sending: Take the time to review the document for errors before submitting it to the client. A fresh look may help you spot mistakes you missed initially.

By avoiding these common mistakes, you can ensure that your payment documents are accurate, professional, and clear, leading to smoother transactions and better client relationships.

Choosing the Right Invoice Template for Your Business

Selecting the right billing document layout is a key step in streamlining your financial operations. A well-designed format helps ensure that all necessary information is included and presented clearly, making transactions smooth for both your business and your clients. The ideal format will depend on your industry, the complexity of your transactions, and your business’s specific needs.

Factors to Consider When Choosing a Format

- Business Size: If you run a small business with relatively simple transactions, a basic, straightforward layout may suffice. Larger businesses or those with more complex transactions might need a more detailed format that can accommodate additional fields like purchase orders, multiple taxes, and complex pricing structures.

- Branding Needs: Customizing the layout to reflect your brand can make a strong impression on clients. Adding your company logo, colors, and other design elements helps create a professional and cohesive image for your business.

- Compliance Requirements: Ensure the document includes all the necessary details to meet legal and regulatory requirements, such as tax information, payment terms, and any relevant identification numbers.

Functionality and Customization

- Flexibility: Choose a format that allows for customization. Whether you need to add specific discount fields, specify terms for international transactions, or include custom notes, a flexible layout will make it easier to adapt to your business’s changing needs.

- Ease of Use: The layout should be easy to fill out, both for you and your clients. A clean design that organizes key information logically helps avoid mistakes and confusion.

- Automation Capabilities: If you handle a high volume of transactions, look for a format that integrates with accounting software or offers automation features to speed up the process.

Choosing the right format ultimately depends on balancing functionality with professionalism. The better your billing document is tailored to your business, the more efficiently you can manage payments and maintain strong client relationships.

Free vs Paid Invoice Templates

When choosing a format for your billing documents, one of the first decisions you’ll face is whether to use a free or paid solution. Both options come with their own advantages and disadvantages, and selecting the right one depends on your business needs, budget, and the level of customization you require. While free solutions may seem like an attractive option, paid formats often offer enhanced features and greater flexibility.

Advantages of Free Formats

- Cost-Effective: The most obvious benefit of free layouts is that they come at no cost. For small businesses or startups with limited budgets, this can be a significant advantage.

- Simplicity: Free formats are typically simple and straightforward, making them easy to use for businesses with basic needs or fewer transactions.

- Quick Setup: Many free solutions are ready to use right away. There’s no need to spend time customizing or setting up advanced features.

Benefits of Paid Solutions

- Customization: Paid formats often offer more customization options, allowing you to add your logo, adjust layout elements, and tailor the document to your business’s specific requirements.

- Advanced Features: Paid options may come with additional features such as automatic tax calculations, integration with accounting software, and recurring billing functionalities.

- Professional Design: Paid layouts tend to be more polished and professionally designed, which can enhance your business’s image and impress clients.

- Customer Support: With a paid option, you often have access to customer service and support, which can be valuable when you encounter issues or need assistance.

While free layouts are sufficient for some businesses, paid solutions provide more advanced functionality, greater customization, and better support. The choice between free and paid formats ultimately comes down to the complexity of your needs and your willingness to invest in more robust features for improved efficiency.

How to Format Your Australian Invoice Properly

Proper formatting is essential when creating a payment document, as it ensures clarity, accuracy, and compliance with local regulations. A well-organized layout not only makes it easier for your clients to understand the charges but also helps protect your business by making sure all legal requirements are met. In Australia, there are specific details and formatting guidelines that need to be followed to ensure your document is both professional and legally compliant.

The key to formatting your payment document effectively is maintaining a logical and consistent structure. Start with the essential information, such as the seller’s details, buyer’s information, and the unique reference number. Ensure that the breakdown of costs, taxes, and the total amount due are clearly visible and easy to understand. A clean and well-organized layout will prevent confusion and help your client process the payment promptly.

Steps to Properly Format Your Document

- Include Seller and Buyer Information: Clearly state the full names, addresses, and contact details of both the buyer and seller. This ensures that both parties are correctly identified in the document.

- Provide Transaction Details: The date of the transaction or delivery, along with a unique reference number, should be included. This is crucial for tracking purposes and should be prominently displayed.

- Breakdown of Charges: Clearly itemize the goods or services provided, including quantities, unit prices, and total amounts. Each item should be listed on its own line for easy reference.

- Tax Information: If applicable, list the tax rate (such as GST) and the amount charged. Tax should be displayed separately from the total amount to maintain transparency.

- State the Total Amount Due: Make sure the total amount, including taxes and any other charges, is clearly displayed at the bottom of the document. This should be easy to locate and easily understood.

- Payment Instructions: Clearly state the due date and available payment methods. If there are any penalties for late payments or early payment discounts, be sure to include those as well.

By following these formatting guidelines, you can ensure that your payment document is professional, easy to read, and compliant with local requirements. A well-formatted document not only reflects positively on your business but also helps avoid misunderstandings and delays in payments.

Handling Multiple Currencies in Invoices

When your business deals with international clients or conducts cross-border transactions, managing multiple currencies on payment documents becomes essential. Properly handling different currencies ensures transparency, prevents confusion, and helps both parties understand the exact amounts due. It’s important to follow certain best practices when dealing with various currencies to maintain professionalism and accuracy.

Key Considerations for Multi-Currency Transactions

- Currency Symbols and Codes: Always use the correct currency symbol or code (e.g., USD for US dollars, EUR for Euros) next to the amount. This ensures that both you and your client are clear about the currency being used.

- Exchange Rate Clarity: If applicable, state the exchange rate used to convert the amount to the desired currency. This can help avoid misunderstandings, especially if the exchange rate fluctuates.

- Dual Currency Format: For international clients, consider listing both the local and international amounts. For example, you could list the total in your local currency and then provide the equivalent in the client’s currency based on the current exchange rate.

- Additional Fees: Some businesses add extra charges for currency conversion or international transactions. Make sure to include these fees clearly in the document if applicable.

How to Display Multiple Currencies on the Document

- Clearly Separate Amounts: If you’re listing amounts in different currencies, separate them into distinct columns or sections. This makes it easier for your client to track each currency and ensures there are no errors when converting between them.

- State the Payment Method: If you are accepting payment in a foreign currency, provide clear instructions on how the payment should be made (e.g., bank transfer, PayPal, or credit card) and indicate any currency conversion fees associated with the payment method.

Handling multiple currencies correctly in your payment documents demonstrates professionalism and ensures smooth transactions with clients from different countries. Always double-check the conversion rates and clarify any additional fees to keep everything transparent and straightforward for your customers.

How to Send Commercial Invoices to Clients

Sending billing documents to clients is a crucial step in the payment process, and doing so in a professional and organized manner can help speed up the transaction and reduce the risk of misunderstandings. Whether you’re sending a document for a one-time transaction or as part of an ongoing business relationship, it’s important to follow a consistent process that ensures the document reaches the client in a timely and secure manner. Here’s how to send your payment request efficiently and effectively.

First, make sure the document is complete and accurate before sending. Double-check the details such as payment terms, tax rates, and any additional charges. Once you’ve confirmed that everything is correct, you can choose the appropriate method for sending the document, depending on your client’s preferences and the nature of the transaction.

Methods for Sending Billing Documents

- Email: The most common and quickest method is sending the document as an attachment via email. Make sure to use a professional email subject line and include a brief message explaining the attached document. PDF format is ideal, as it ensures the layout and information remain intact.

- Postal Mail: For clients who prefer physical copies or for international transactions where email may not be secure, you can send the payment request through postal mail. Make sure to use a reliable service, and consider using a trackable shipping option for added security.

- Online Payment Portals: If your business uses an online payment platform (such as PayPal, Stripe, or other invoicing software), you can generate and send the document directly through the platform. Many systems allow you to customize and automate the billing process, saving you time and effort.

- Hand Delivery: In some cases, especially for local or high-value transactions, personally delivering the document can add a layer of trust and professionalism to your business relationship. It’s also a great opportunity to discuss any details or answer any questions your client may have.

Tips for Ensuring Successful Delivery

- Include Clear Instructions: If you’re sending the document electronically, ensure that the email or message includes clear instructions on how to view or process the document. For postal or hand delivery, ensure the recipient knows where to direct any questions.

- Follow Up: After sending the document, it’s always a good idea to follow up with your client to confirm receipt and to ask if they have any questions. This helps ensure the payment process moves forward smoothly.

- Secure Communication: If you’re sending sensitive financial information, be sure to use secure methods, such as encrypted email or password-protected files, to protect your a

Commercial Invoice Template Australia for Easy Business Transactions How to Track Payments Using Invoices

Tracking payments effectively is a critical part of managing your business’s cash flow. By keeping an accurate record of each transaction, you can ensure that all payments are processed on time and that any outstanding balances are followed up promptly. One of the most efficient ways to track payments is by utilizing detailed billing documents. These documents can help you monitor payment status, identify overdue amounts, and maintain a clear record of transactions.

Steps to Track Payments Using Billing Documents

- Assign Unique Reference Numbers: Each billing document should have a unique identifier, often called a reference or document number. This helps both you and your clients track the transaction easily and ensures that no payments are overlooked.

- Record Payment Dates: Keep track of when each payment is due, as well as when it is actually received. Recording these dates can help you quickly identify overdue payments and plan follow-up actions.

- Note Payment Methods: It’s important to record how each payment was made (e.g., bank transfer, credit card, cheque). This will help you match payments to specific transactions and detect any discrepancies in your financial records.

- Mark Paid and Unpaid Amounts: Clearly mark whether the amount has been paid in full or if there is still an outstanding balance. This distinction helps you prioritize which payments need to be followed up on and which are complete.

Using Software for Payment Tracking

- Integrate Accounting Software: Many businesses use accounting software that allows you to automatically track payments. These systems can help you update payment statuses and generate reports without needing to manually track each payment.

- Set Up Payment Reminders: If you’re using software or digital tools, set up automatic reminders for both you and your clients. This ensures that both parties stay on track with payment deadlines.

- Generate Reports: Most accounting systems provide reports that summarize payment statuses, inclu

How to Keep Your Invoices Organized

Staying organized is essential for managing financial documents efficiently, ensuring that you can quickly find and track all transactions. A well-organized system not only helps you stay on top of payments but also makes it easier to handle taxes, resolve disputes, and maintain an accurate record of your business’s financial history. Whether you’re dealing with a small number of clients or large volumes of transactions, implementing an effective organizational system is crucial.

The key to maintaining order is consistency and discipline. Setting up a clear system for storing and categorizing documents will save you time and reduce the chances of losing important paperwork. Here are a few best practices to help you organize your financial records effectively:

Tips for Keeping Financial Documents Organized

- Use a Naming Convention: Establish a consistent naming format for each document. Include key information such as the client’s name, date of the transaction, and a unique reference number. For example, “ClientName_Date_ReferenceNumber.” This will make it easier to search and sort documents later.

- Separate by Category: Organize documents by client, date, or status (paid, unpaid, overdue). This categorization makes it much easier to locate specific records and keep track of outstanding payments.

- Digital Storage: Storing documents digitally offers several advantages, such as easier searchability and reduced physical clutter. Use cloud storage services or accounting software to keep your documents secure, accessible, and backed up.

- Set Up Folders: Whether you store documents on your computer or physically, create folders for different categories (e.g., client name, month, payment status). Having a logical folder structure will allow you to quickly navigate and find the relevant document when needed.

- Track with Spreadsheets: For better control over your records, consider creating a spreadsheet to track payment dates, amounts, and the status of each transaction. This will give you a comprehensive overview of your financial records at a glance.

- Regularly Update Your System: Make it a habit to update your organization system frequently. Add new transactions promptly and remove outdated records, keeping your documents current and accurate.

By establishing a solid organization system and following these best practices, you can ensure that your financial records are always in order. An organized approach not only improves efficiency but also helps you maintain better control over your business’s financial health.