How to Create a Professional Price Invoice Template

Efficient billing is a crucial part of any business. Having a well-structured document for requesting payment ensures that you communicate clearly with clients while maintaining a professional image. Whether you’re a freelancer, small business owner, or part of a larger organization, having the right format for your financial transactions can save time and prevent misunderstandings.

In this guide, we’ll explore how to design and use customizable billing forms that simplify the payment process. From the essential components to customization tips, you’ll learn how to create a professional document that suits your specific needs. With the right tools, you can generate documents that not only look polished but also help you stay organized and on track with your finances.

By understanding the key elements of these financial documents and learning how to adapt them to your business style, you can improve the overall efficiency of your billing system. Whether you’re handling taxes, discounts, or payment terms, mastering this process can have a significant impact on your cash flow and customer satisfaction.

Understanding the Importance of Billing Documents

Having a well-organized document for requesting payment is essential for any business transaction. It serves as a formal record, providing clarity and transparency for both the business and the client. Properly structured financial documents are key to maintaining professional relationships and ensuring smooth cash flow management.

Such documents not only outline the amount due but also provide critical information that helps in tracking payments, managing taxes, and preventing disputes. Without them, businesses risk confusion and delayed payments, which can impact their overall operations. Here’s why these financial forms are indispensable:

- Clear Communication: A detailed billing statement ensures both parties understand the terms of the agreement and the amount owed.

- Legal Protection: These documents act as evidence in case of any disputes, providing a clear record of what was agreed upon.

- Professional Image: A well-designed and accurate document reflects positively on your business, showing that you are organized and trustworthy.

- Efficient Payment Tracking: A properly formatted document helps in monitoring outstanding payments and preventing errors in financial records.

Overall, effective billing forms streamline operations and foster trust between businesses and clients, making them an essential tool for success.

What Is a Billing Document Format

A billing document format is a structured layout designed to clearly present the details of a financial transaction between a business and its client. It serves as an official record that outlines the amount due, services provided, and payment terms. This format ensures consistency and clarity in all transactions, making it easier for businesses to manage their financial records and for clients to understand their obligations.

Such a document typically includes various sections such as contact information, itemized services or products, taxes, payment due dates, and terms of payment. The primary function of this format is to present these elements in an organized and professional manner, reducing confusion and helping both parties keep track of the transaction.

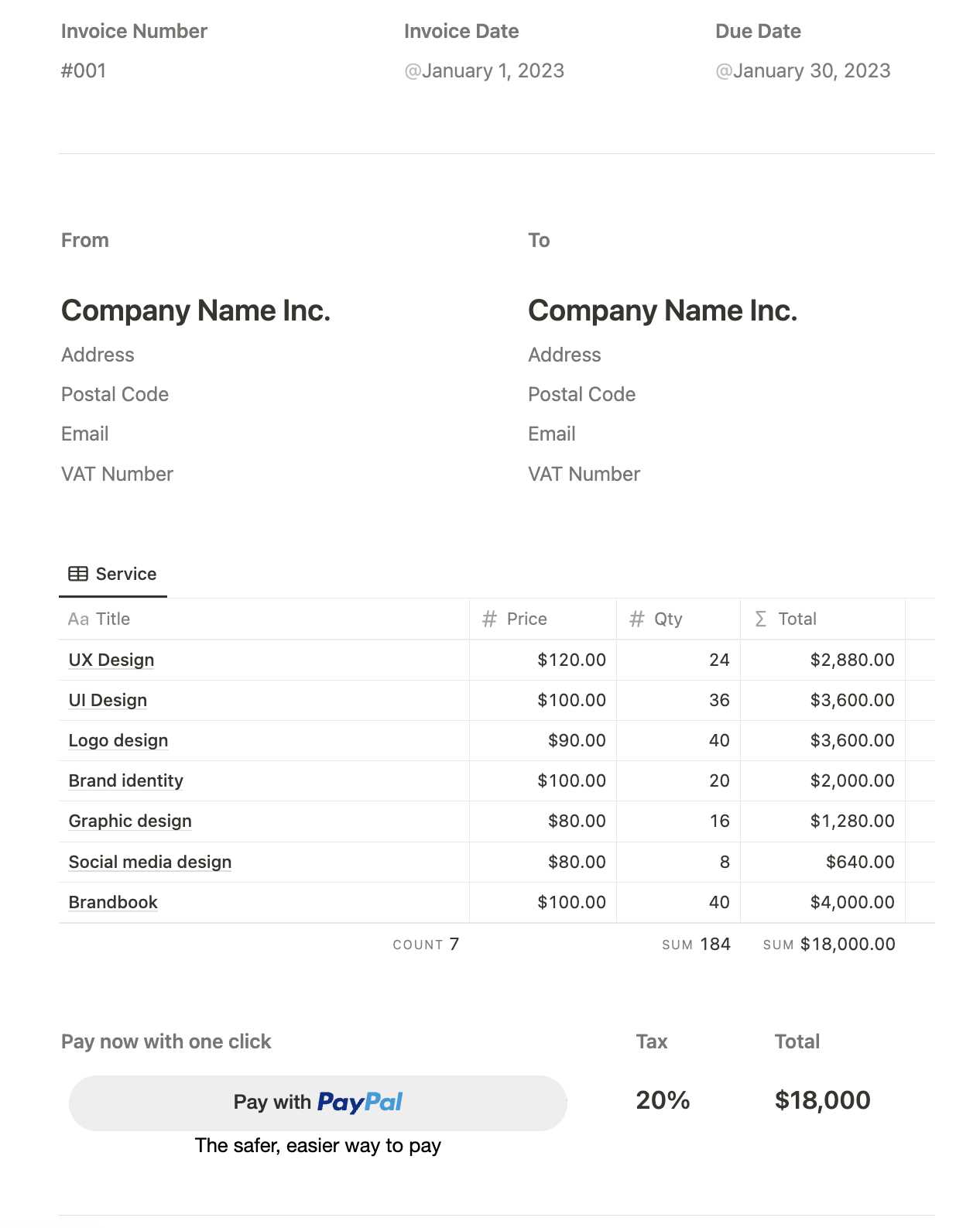

Key Elements of a Billing Document

A well-structured billing document should contain several essential components to ensure clarity and accuracy in financial transactions. These elements help both the business and the client understand the details of the services or products provided, the amount due, and the terms of payment. The main sections of a formal financial document are designed to ensure all the necessary information is presented clearly and professionally.

1. Contact Information

The contact details of both the business and the client are essential for identifying the parties involved. This section includes names, addresses, phone numbers, and email addresses, making it easy to follow up on any issues or clarifications regarding the transaction.

2. Itemized Breakdown

An itemized list of services or products helps clients understand what they are paying for. Each item should include a description, quantity, unit price, and the total cost for that item. This breakdown ensures transparency and reduces the possibility of misunderstandings.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 10 hours | $50 | $500 |

| Website Design | 1 project | $1,000 | $1,000 |

| Total | $1,500 | ||

Having a clear and precise itemized breakdown helps ensure that both parties are on the same page regarding the products or services rendered, as well as the corresponding fees.

How to Design a Billing Document Layout

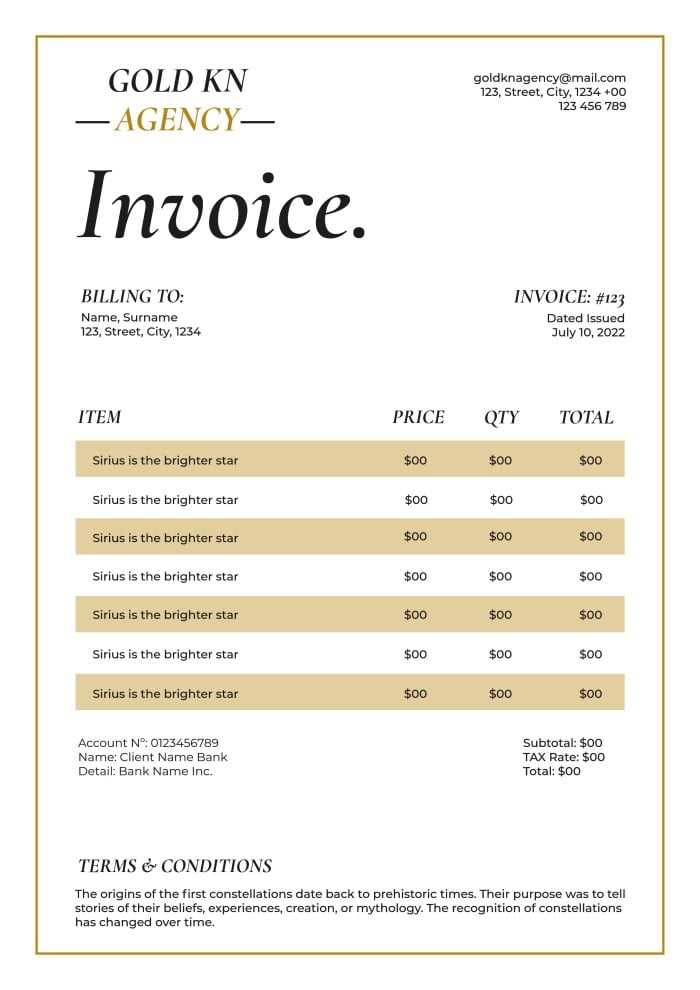

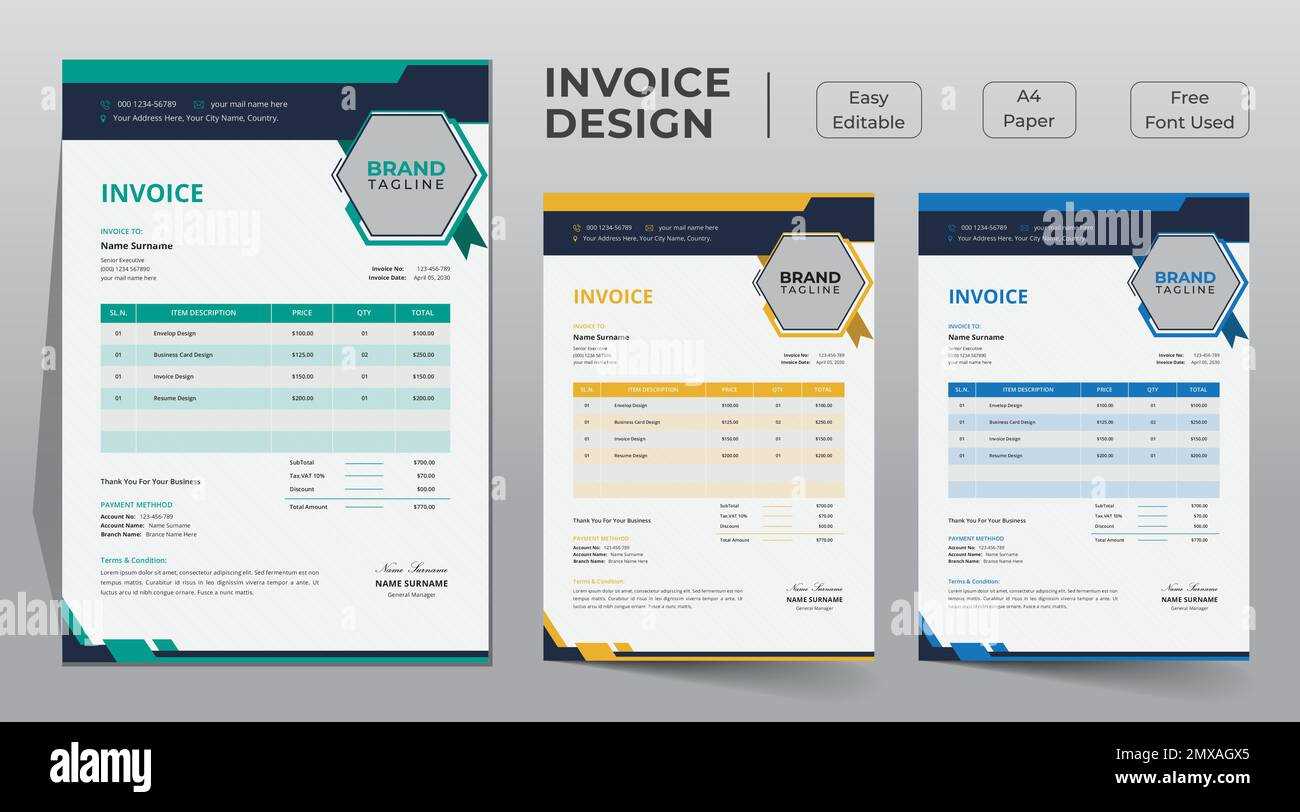

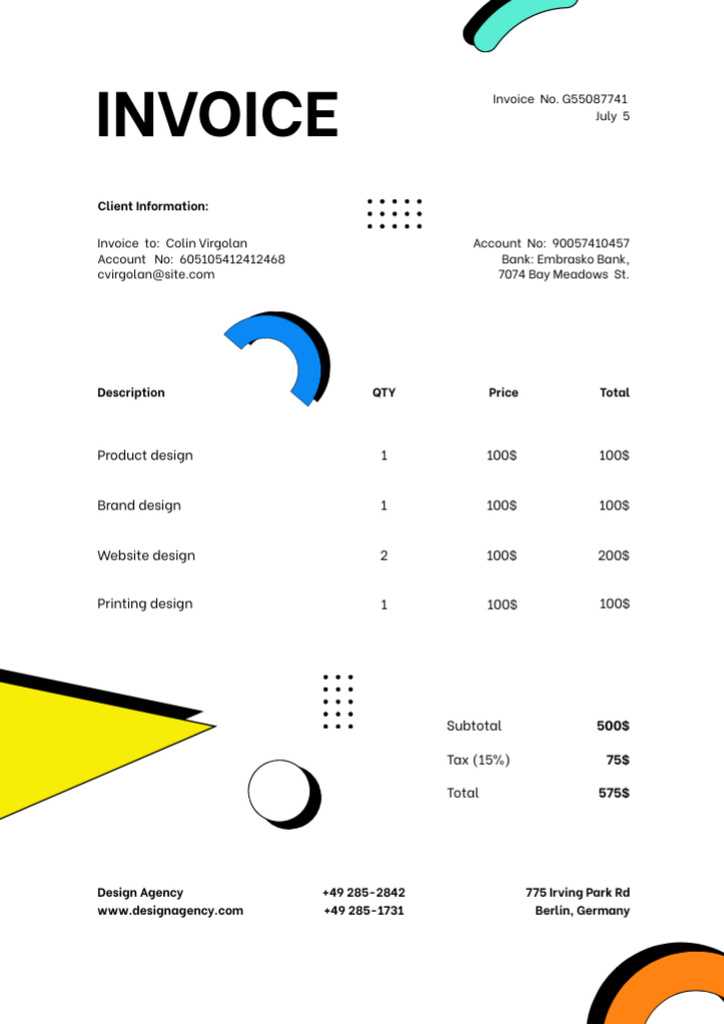

Designing an effective billing document layout is key to creating clear and professional financial records. A well-designed format not only ensures that all necessary details are included but also makes it easy for clients to review and understand their charges. The goal is to present the information in a visually appealing and organized way that reflects your business’s professionalism.

To create an effective layout, focus on structure and simplicity. Start by organizing the document into clearly defined sections: contact details, item descriptions, payment terms, and totals. Use headings and bold text to highlight important information, and make sure the design is consistent and clean. Avoid clutter and excessive information that could confuse or overwhelm the reader.

Additionally, consider the aesthetic elements, such as fonts, spacing, and colors. A clean, minimalist design with plenty of white space can make the document easier to read and more professional-looking. By following these design principles, you’ll ensure that your financial documents make a positive impression and facilitate smooth transactions.

Choosing the Right Format for Your Billing Document

When creating a financial document for your business, selecting the right format is essential for ensuring clarity and efficiency. A suitable layout allows you to present all necessary information in an easy-to-read manner, which helps both you and your clients avoid misunderstandings. The format should reflect the nature of your business, the services offered, and the preferences of your clients.

1. Simplicity vs. Detail

The first decision to make is whether to choose a simple or a more detailed layout. If your business provides straightforward services or products with fixed prices, a simple format with essential details (such as item descriptions, total amount, and payment terms) will work well. However, for businesses offering customized or complex services, a more detailed breakdown of each component might be necessary. Tailor your format based on the complexity of the transaction.

2. Digital or Paper Format

Another consideration is whether to use a digital or paper layout. Digital formats are often preferred for ease of editing and quick transmission, especially if you’re sending documents via email or using an online billing system. However, if you primarily work with clients who prefer physical copies, a printable format is more appropriate. Consider your client base and choose the format that best suits their needs.

Ultimately, the right format enhances professionalism and helps ensure your transactions are processed smoothly. Whether you opt for a simple digital layout or a detailed printed version, make sure your design is user-friendly and easy to navigate.

Customizing Your Billing Document for Your Business

Customizing your billing document allows you to tailor it to the specific needs and branding of your business. A personalized document not only enhances your professional image but also makes your transactions more efficient by clearly reflecting the details relevant to your services or products. Customization can include adding your business logo, adjusting the layout to suit your industry, or including specific terms that apply to your operations.

One of the first steps in customization is ensuring that your company’s branding is consistent across all documents. This can involve incorporating your company’s logo, colors, and fonts, which helps strengthen your brand identity. Additionally, you may want to adjust the layout to accommodate the unique structure of your offerings, whether you provide one-time services, subscriptions, or customized products.

Here’s an example of how a customized billing document might look for a service-based business:

| Service Description | Hours Worked | Rate | Total |

|---|---|---|---|

| Web Development | 15 | $80/hr | $1,200 |

| Monthly Maintenance | 5 | $60/hr | $300 |

| Grand Total | $1,500 | ||

By adding relevant details like payment terms, discount offers, or special client notes, you further personalize the document and make it more applicable to your business needs. Customizing the format ensures that every document you send is both professional and aligned with your brand’s image, leading to stronger client relationships and smoother transactions.

Free vs Paid Billing Document Formats

When choosing a format for your billing documents, you’ll likely encounter two main options: free and paid versions. Both types offer their own advantages and disadvantages, depending on your business needs, the complexity of your transactions, and your budget. Understanding the differences between free and paid options can help you make an informed decision about which one best suits your workflow.

Free Formats

Free billing document formats are widely available online and can be a great option for small businesses or freelancers who have basic needs. These formats typically offer a simple structure that covers the essentials, such as item descriptions, amounts due, and payment terms. The primary advantage is that they come at no cost, allowing you to get started without an initial investment.

However, free options may have limitations, such as a lack of customization, fewer design choices, and the potential for fewer features. Some may include watermarks or ads, which could detract from the professionalism of your documents. Additionally, updates and support may be limited, making it harder to address any issues that arise.

Paid Formats

Paid billing document formats often provide more advanced features, better customization options, and a higher degree of professionalism. These formats typically allow you to add branding elements, such as logos and specific fonts, and offer more robust functionality, such as tax calculations, multi-currency support, and recurring billing options. Paid options usually come with customer support and regular updates, ensuring that your documents remain up to date with the latest legal or tax requirements.

While paid formats involve an upfront cost, the added functionality and customization can make them more worthwhile for businesses that handle large volumes of transactions or require more detailed reporting. Ultimately, the choice between free and paid formats depends on your business’s size, complexity, and long-term needs.

Best Platforms for Downloading Billing Document Formats

When looking to download a professional billing document format, several platforms offer high-quality options that cater to different business needs. These platforms provide ready-to-use files that can save you time and effort in designing your own, while also offering customization features to match your specific requirements. Choosing the right platform is crucial to ensure that you get the format that fits your business style and legal requirements.

1. Microsoft Office Templates

Microsoft Office offers a wide selection of pre-designed formats that can be easily customized in programs like Word or Excel. These documents are simple to use and include templates for various business needs, from service billing to product sales. The benefit of using Office templates is the ease of editing, and most users are already familiar with these programs, making them a convenient option for many businesses.

Advantages:

- Easy to edit and customize

- Integrates well with other Microsoft Office tools

- Variety of options for different business types

2. Canva

Canva is a popular design platform that offers a range of visually appealing document layouts, including billing formats. With its user-friendly drag-and-drop interface, Canva makes it easy for even those with no graphic design experience to create professional-looking documents. You can start with a template and customize it with your company’s logo, colors, and fonts, or create a completely unique design from scratch.

Advantages:

- Highly customizable with design flexibility

- Free and paid versions available

- Cloud-based, making it easy to access documents anywhere

These platforms provide accessible and easy-to-use solutions, ensuring that businesses of all sizes can find the right format to suit their needs.

How to Edit Billing Document Formats Easily

Editing a billing document is a simple process if you choose the right tools and follow a clear structure. Whether you’re customizing a pre-designed format or creating your own, the key is to make sure all necessary details are easily accessible and well-organized. With the right approach, updating and personalizing your documents can be quick and hassle-free.

The first step is to select a format that is easy to modify. Most digital tools and platforms offer user-friendly interfaces that allow you to edit text, change layouts, and add custom elements such as logos or payment terms. Popular software such as Microsoft Word, Excel, or design tools like Canva provide a variety of options for quickly adjusting the content of your document.

Here’s a simple guide to editing a billing document:

| Step | Action | Details |

|---|---|---|

| 1 | Open the Document | Start by opening your chosen format in a word processor or design tool. |

| 2 | Update Contact Information | Replace placeholders with your company’s details and the client’s contact info. |

| 3 | Adjust the Item List | Change or add new items to reflect the services or products provided, including quantities, rates, and totals. |

| 4 | Customize Payment Terms | Update the payment due date, method, and any specific terms or discounts. |

| 5 | Save and Export | Save your changes and export the document in your preferred file format, such as PDF. |

By following these simple steps, you can easily make edits to your billing document, ensuring it’s always up to date and tailored to each transaction.

Common Mistakes to Avoid in Billing Documents

Creating a professional billing document is crucial for maintaining clear communication with your clients and ensuring timely payments. However, even small mistakes can lead to confusion, delays, or even disputes. By understanding common errors and knowing how to avoid them, you can make sure your financial records are accurate and effective.

Here are some of the most frequent mistakes people make when preparing billing documents:

- Missing or Incorrect Contact Information – Always double-check that both your business and the client’s contact details are accurate. An incorrect email or phone number could lead to delayed payments or miscommunication.

- Failure to Specify Payment Terms – Clearly stating the payment due date, method, and any penalties for late payments helps set expectations. Leaving these details vague can create confusion and affect cash flow.

- Unclear Descriptions of Products or Services – It’s important to provide a detailed breakdown of what is being charged. Vague or generic descriptions may lead to misunderstandings, with clients questioning the charges.

- Omitting Taxes or Fees – Always account for taxes, shipping fees, or any other additional charges. Leaving them out or failing to calculate them correctly can lead to discrepancies between what was agreed upon and what is due.

- Incorrect Totals – One of the most critical errors to avoid is miscalculating the total amount. Double-check all math and ensure that each item or service is correctly added up, including any discounts or additional charges.

- Not Using a Unique Reference Number – Using a unique reference number for each billing document makes it easier to track payments and resolve any issues that arise. Avoid using generic titles like “Invoice 1” or “Payment Request.”

By paying attention to these details and reviewing your documents carefully before sending them, you can avoid costly mistakes and maintain a smooth and professional billing process.

Ensuring Accuracy in Your Billing Document

Accurate billing is essential for maintaining professional relationships and ensuring timely payments. Any errors in a financial document can lead to confusion, disputes, or delays, which can ultimately affect your business’s cash flow and reputation. To avoid these issues, it’s crucial to carefully check every detail in your document before sending it to clients.

Here are several key practices to ensure the accuracy of your billing document:

- Double-check Calculations: Always verify the math, including unit prices, quantities, discounts, taxes, and totals. Mistakes in calculations are among the most common errors and can lead to payment discrepancies.

- Ensure Correct Client Information: Make sure the client’s contact details are up-to-date and accurate. This includes the correct name, address, and any other relevant information, such as a specific department or contact person.

- Clear and Accurate Descriptions: Provide a detailed description of the products or services being billed. Avoid vague terms and ensure each line item is well-defined so there is no confusion about what the client is being charged for.

- Consistent Format: Keep a consistent layout throughout the document. This includes using the same font, structure, and terminology. Consistency reduces the chance of missing information and helps maintain a professional appearance.

- Check Payment Terms: Clearly specify payment terms, including due dates, late fees (if applicable), and accepted payment methods. Any ambiguity in payment terms can lead to misunderstandings and delayed payments.

- Use Unique Reference Numbers: Assign a unique reference number to each billing document to easily track and manage payments. This is especially important for recurring transactions or larger projects with multiple invoices.

By following these steps and reviewing your document thoroughly, you can ensure that your financial records are accurate and reflect the terms agreed upon with your clients. Accuracy not only helps avoid conflicts but also strengthens your professional reputation.

How to Add Taxes and Discounts

Including taxes and discounts in your billing documents is essential for accurate financial reporting and clear communication with clients. Taxes ensure compliance with local laws, while discounts can be used to incentivize prompt payments or reward loyal customers. Adding these elements properly helps maintain transparency and avoids misunderstandings regarding the final amount due.

Here’s a step-by-step guide to adding taxes and discounts to your financial documents:

- Determine Applicable Tax Rates: The first step is to identify the tax rates that apply to your products or services. Depending on your location and the nature of your offerings, the tax rate could vary. Make sure to check local tax regulations to ensure compliance.

- Calculate Tax Amounts: Once you know the applicable tax rate, calculate the tax for each item. Typically, you multiply the item’s total by the tax rate (expressed as a percentage). For example, if a service costs $100 and the tax rate is 10%, the tax will be $10, bringing the total to $110.

- Include Discounts Before Tax Calculation: If you offer discounts, apply them before calculating taxes. This ensures that taxes are calculated on the reduced amount, not the original price. For instance, if an item costs $200 and you offer a 10% discount, the new price is $180, and the tax is calculated on $180, not $200.

- Clearly List Taxes and Discounts: It’s important to itemize both taxes and discounts on the billing document, showing their individual amounts. This transparency allows your clients to see exactly how the final amount is determined. You can use separate lines for taxes and discounts under the subtotal to make it clear.

Here’s an example of how to structure this information:

| Item | Amount | Discount | Tax | Total |

|---|---|---|---|---|

| Web Design Service | $500 | -10% ($50) | $45 (10%) | $495 |

By following these steps, you can ensure that your billing documents reflect the correct amounts, including taxes and discounts, and maintain clear communication with your clients about how their total was calculated.

Legal Considerations for Billing Documents

When creating financial documents, it’s important to ensure that they comply with legal requirements to avoid potential issues or disputes. These documents are not just a means of requesting payment but also serve as legal records that may be used in case of conflicts, audits, or regulatory scrutiny. Understanding the legal obligations surrounding these documents is key to maintaining a professional and compliant business operation.

Here are several legal considerations to keep in mind when preparing your financial documents:

- Include Required Information: Depending on your jurisdiction, certain details may be legally required on every billing document. These typically include your business name, registration number, tax identification number, and contact information. The client’s information, such as their name and address, should also be included.

- Accurate Tax Reporting: It’s crucial to ensure that taxes are calculated and reported correctly. Failing to include the correct tax rates or omitting taxes entirely can lead to fines or legal complications. Make sure to follow local tax laws and include the applicable tax rates clearly in the document.

- Payment Terms and Conditions: Clearly stating your payment terms, including due dates, late fees, and accepted payment methods, helps prevent misunderstandings. In some regions, it is also required to outline the consequences of late payment or non-payment.

- Retention Period: Many jurisdictions require businesses to keep records of all transactions for a certain period, often ranging from 5 to 7 years. Ensure that you retain copies of all documents and maintain them in an organized manner to comply with record-keeping regulations.

- Dispute Resolution Clause: Including a dispute resolution clause can be beneficial in case any disagreements arise. This clause typically outlines the process for resolving issues, such as through mediation or arbitration, and can help avoid lengthy legal battles.

By following these guidelines and staying informed about local regulations, you can ensure that your billing documents are legally sound and protect both you and your clients in the event of any disputes or audits.

Understanding Payment Terms and Deadlines

Clear payment terms and deadlines are essential elements of any business transaction. They ensure that both parties understand when and how payments should be made, helping to prevent misunderstandings or delays. Whether you’re dealing with one-time projects or ongoing services, setting clear expectations is crucial to maintaining a smooth cash flow and healthy business relationships.

Payment terms typically include information about the due date, any late fees, accepted payment methods, and any early payment discounts. It’s important to be specific and unambiguous in order to avoid any potential confusion. Below, we’ll look at some common types of payment terms and how to effectively communicate them to your clients.

Common Payment Terms

Payment terms can vary depending on your business model and client agreements. Here are some of the most common types:

- Net 30: Payment is due within 30 days of the billing date.

- Net 15: Payment is due within 15 days of the billing date.

- Due on Receipt: Payment is expected as soon as the client receives the document.

- Partial Payments: The client pays a portion upfront, with the remaining balance due at a later time.

- Advance Payment: The client is required to pay the full amount before services or products are delivered.

Setting Deadlines and Managing Late Payments

Deadlines are essential for ensuring timely payments and maintaining a steady cash flow. Make sure to clearly state the due date on your documents and remind clients in advance if necessary. In some cases, you may also want to include details about late payment fees to encourage prompt payments.

| Payment Terms | Due Date | Late Fee |

|---|---|---|

| Net 30 | 30 days from the billing date | 2% of the total amount per month after the due date |

| Due on Receipt | Immediately upon receipt | No late fee unless specified |

| Advance Payment | Prior to service delivery | No late fee as payment is upfront |

By clearly outlining payment terms and deadlines, and being transparent about late fees and other conditions, you can minimize delays and

How to Use Billing Document Formats for Your Business

For any business, managing financial records effectively is essential for maintaining a smooth workflow and ensuring timely payments. Using pre-designed formats for your billing documents can help streamline this process, save time, and ensure that you never miss an important detail. By utilizing these formats, you can ensure consistency, accuracy, and professionalism in all your transactions with clients.

Here’s a guide on how to use billing document formats to make your business processes more efficient:

Selecting the Right Format for Your Needs

Not all billing document formats are created equal. Depending on your industry, client needs, and the complexity of your services or products, you may require a basic, minimalistic design or something more detailed with multiple line items. The key is to select a format that suits your business and provides all necessary information in a clear and professional manner.

- Simple Service Providers: If you offer straightforward services, a simple format with basic information like service description, date, and total cost might be sufficient.

- Product-Based Businesses: If you’re selling products, a more detailed format might be needed to include itemized lists, quantities, unit prices, and taxes.

- Ongoing Contracts: For businesses with ongoing or recurring services, choose a format that accommodates recurring charges, payment terms, and frequency of billing.

Customizing the Format for Your Business

Once you’ve chosen the right format, customizing it to reflect your business’s identity is crucial. Include your logo, business name, contact information, and any additional branding elements that will make the document look professional and unique to your company. Many platforms allow you to customize fonts, colors, and even layout to fit your needs.

Here’s an example of how to structure your billing document:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 1 | $150 | $150 |