Invoice Template Australia ABN for Easy and Compliant Billing

As a business owner, generating clear and accurate payment requests is essential for smooth operations and maintaining financial order. Crafting a well-structured document ensures both you and your clients understand the terms of payment and what is being billed. Whether you’re a freelancer or a large business, using a reliable structure can save time and avoid confusion.

Understanding the requirements for a properly formatted request is crucial. This includes knowing what details to include, how to present them, and the rules that apply to your specific location. By following a consistent approach, you not only stay compliant but also project professionalism to your clients.

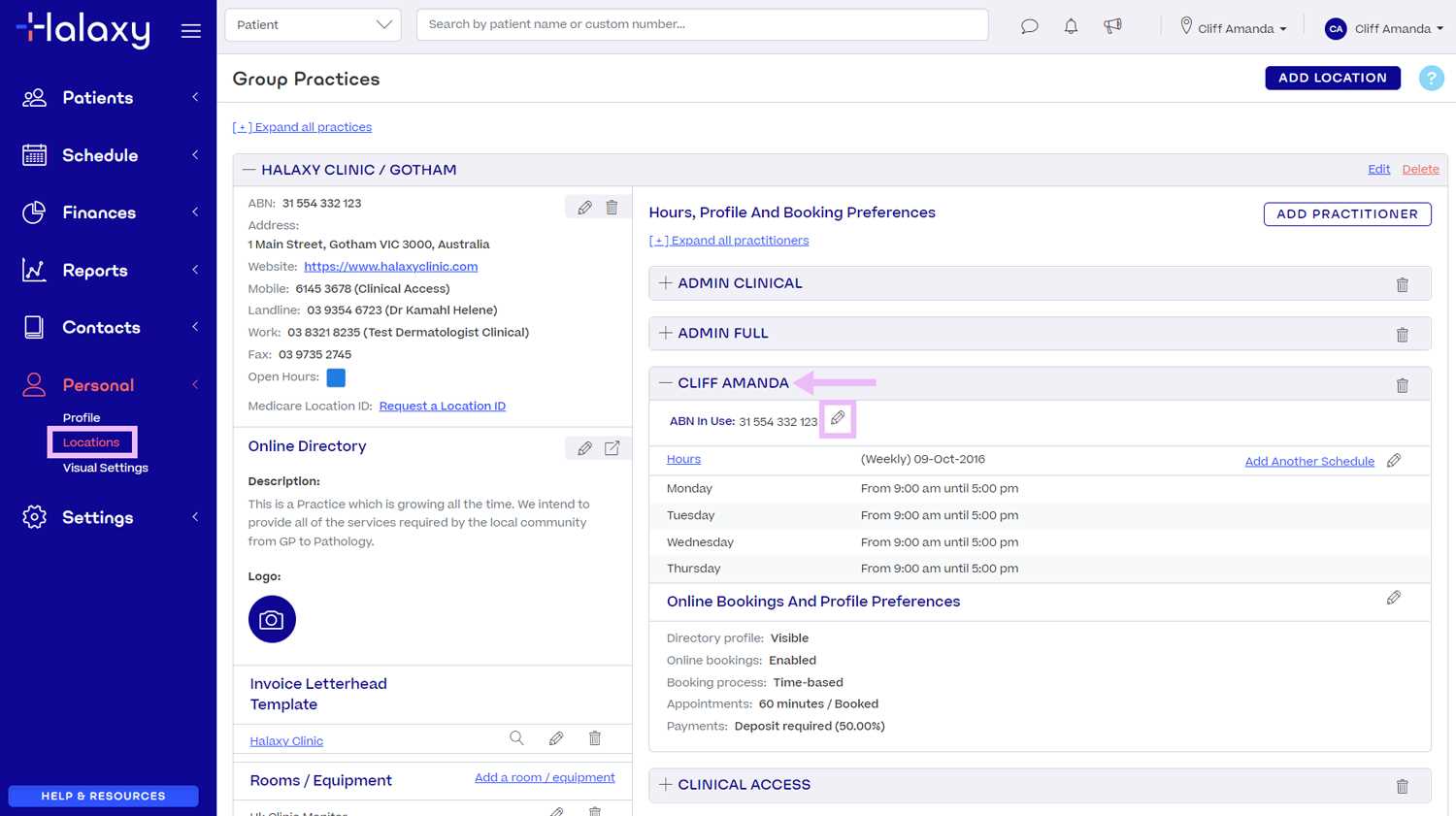

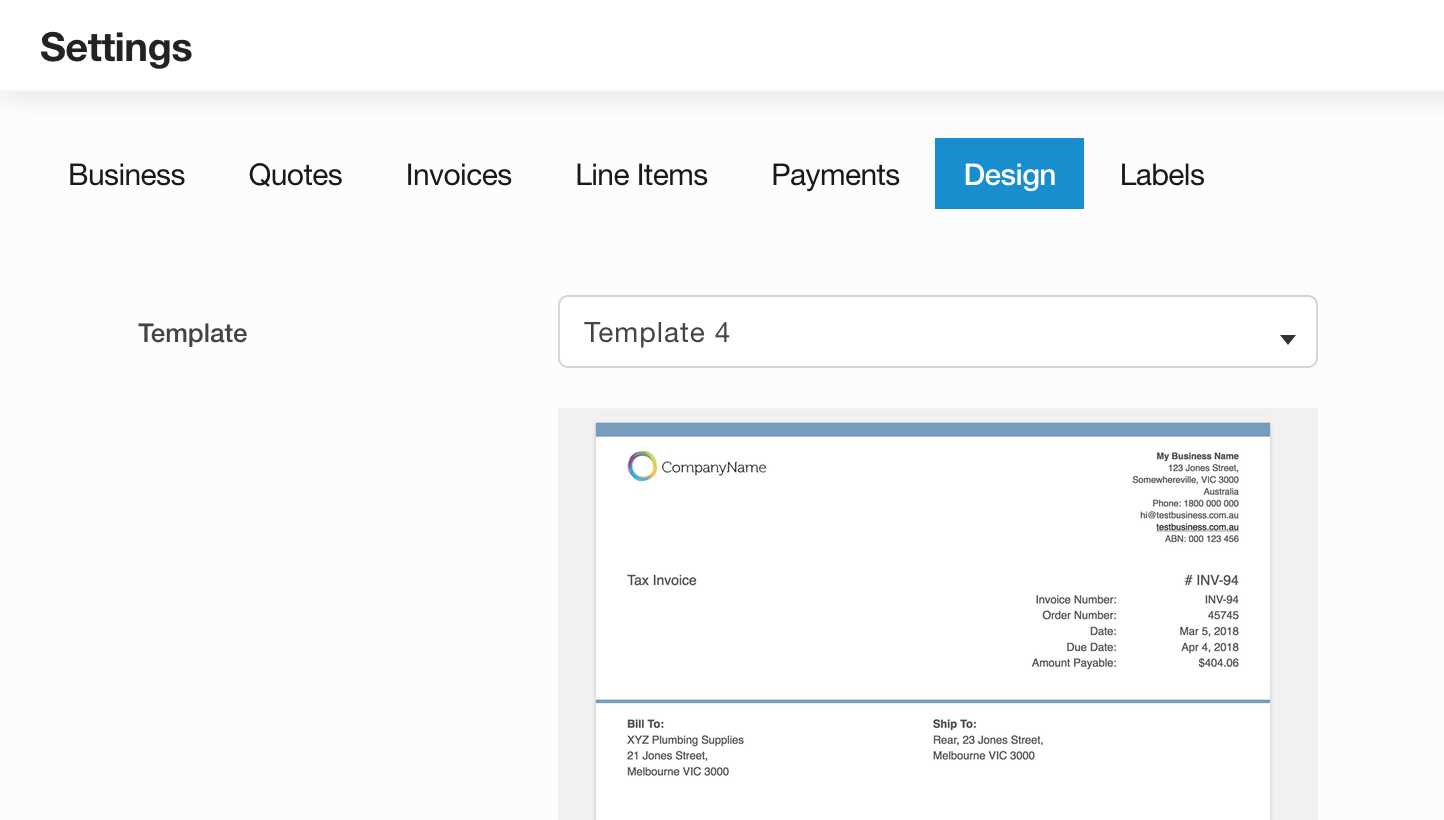

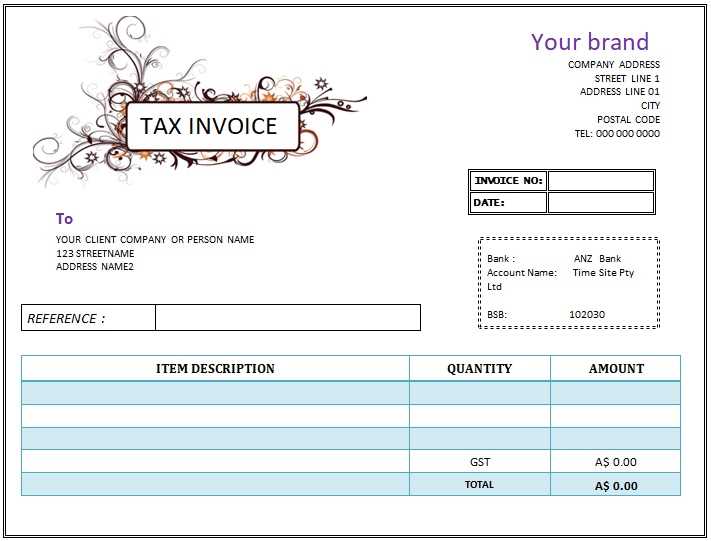

With the right tools at your disposal, customizing these documents becomes a straightforward task. You can choose a layout that reflects your brand and meets your business needs while ensuring you follow necessary legal and tax guidelines. This article will guide you through the process of creating the perfect billing document for your needs.

Invoice Template Australia ABN Guide

Creating a billing document that aligns with local regulations is essential for any business looking to maintain financial transparency and compliance. In certain regions, specific identifiers are required on these documents to confirm your business registration and tax obligations. Knowing what to include and how to structure this information can streamline the process, saving you time and effort while ensuring you meet legal standards.

Key Elements for Legal Compliance

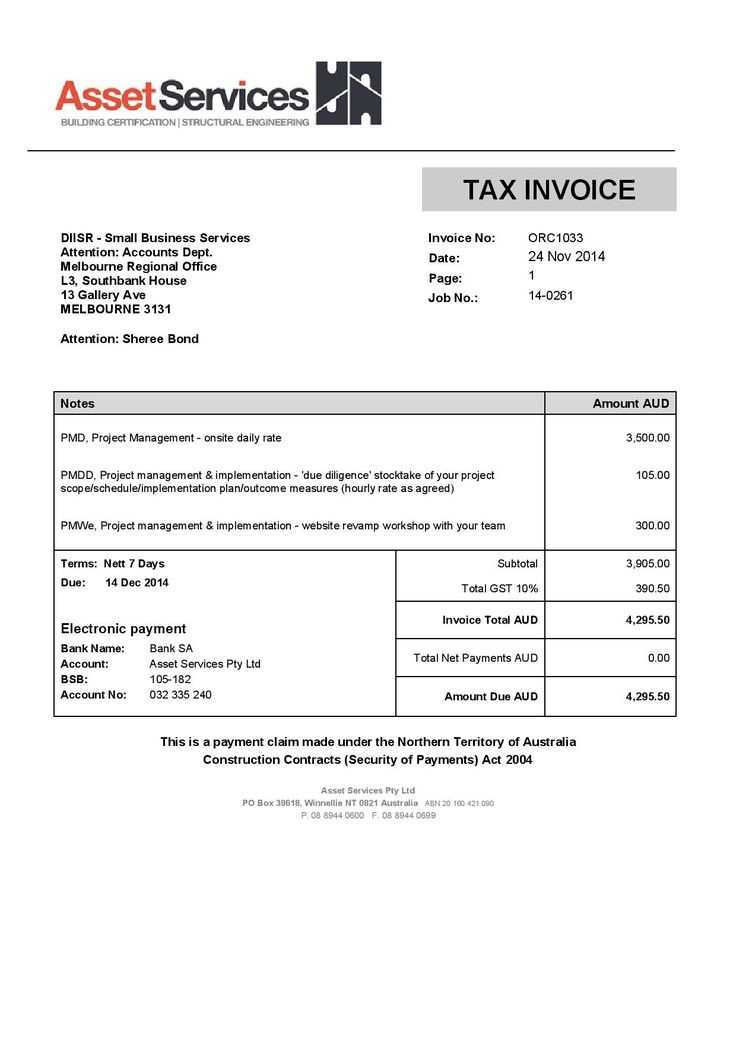

To avoid potential legal issues, it’s crucial to include mandatory details in your billing requests. These include your business registration number, contact information, a clear description of the goods or services provided, and the total amount due. Additionally, you must specify any applicable tax rates and how these are calculated, especially when working with clients within the same jurisdiction.

Customizing for Different Industries

Different businesses may have unique needs when it comes to structuring their payment requests

What is an ABN and Why it Matters

In order to operate a business legally and efficiently, certain identifiers are required to ensure compliance with tax and regulatory requirements. These identifiers serve as proof that your business is registered with the appropriate authorities, enabling you to interact professionally with clients, suppliers, and other entities. Understanding these requirements is essential for both small and large businesses to avoid penalties and establish trust with customers.

Understanding the Role of a Business Identifier

A business registration number is a unique identifier that links your business to the national registry. This number is required when dealing with various tax-related matters, including the collection of certain taxes and reporting to government agencies. It also helps distinguish your business from others, which is crucial when sending payment requests or making financial transactions.

Why This Identifier is Crucial for Businesses

Having the correct registration number is important for many reasons. It allows you to legally conduct transactions, ensures you’re paying the correct amount of tax, and helps establish credibility in the eyes of clients and partners. Without it, your business may not be recognized by tax authorities, leading to complications down the line.

| Requirement | Importance |

|---|---|

| Legal Registration | Ensures business legitimacy and compliance |

| Tax Compliance | Facilitates accurate tax reporting and collection |

| Client Trust | Shows professionalism and credibility in transactions |

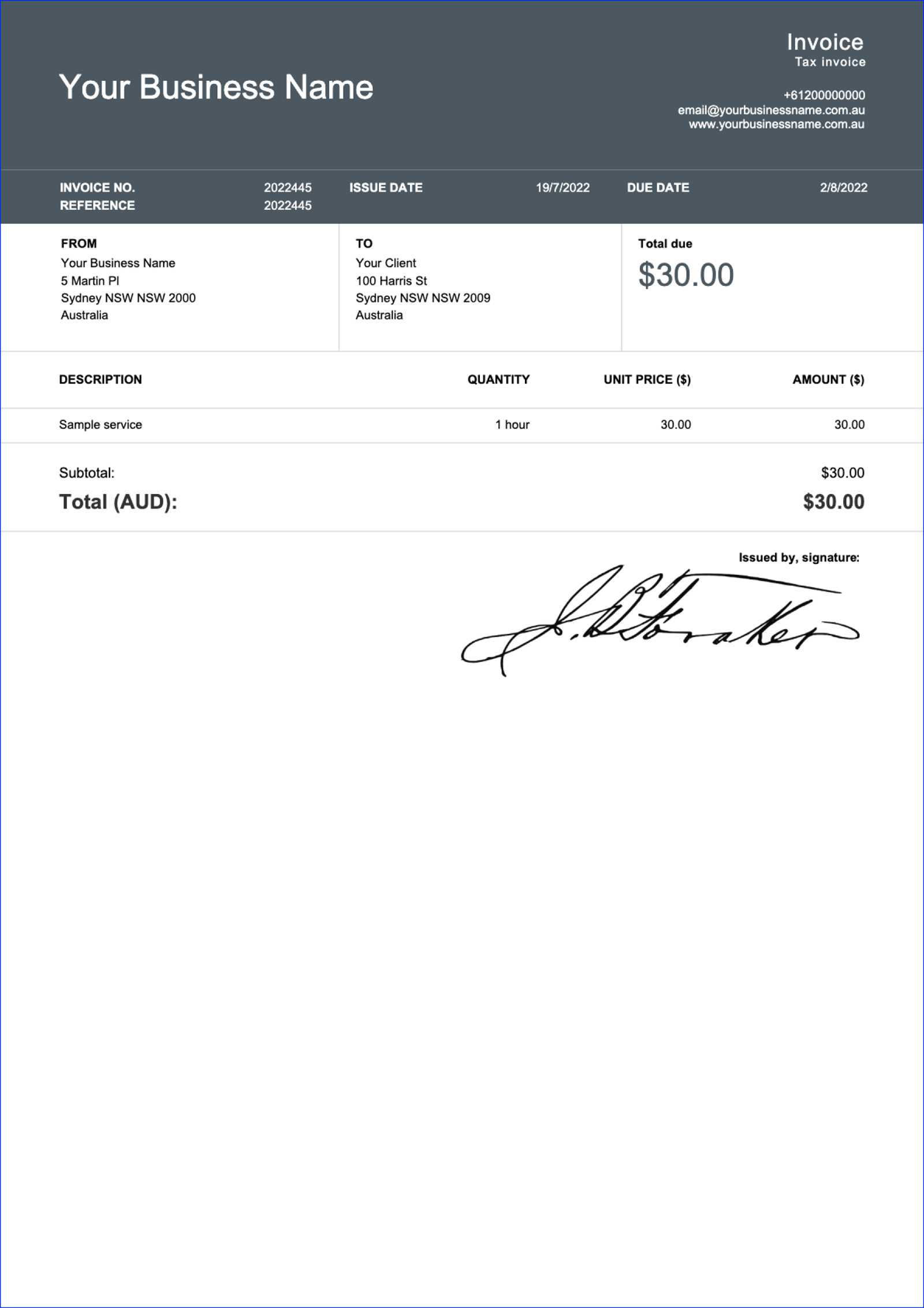

How to Create an Invoice with ABN

Creating a formal payment request that includes all the necessary information is essential for smooth business operations. This ensures that both parties are clear on the services or goods provided, the amounts due, and the terms of payment. To make sure your request meets legal standards, certain details must be included, especially when you’re working in a specific jurisdiction where business identification is required.

Follow these steps to create a professional document:

- Start by including your business details, such as your name, address, and contact information.

- Include the date the document was created and a unique reference number for tracking purposes.

- Provide a clear breakdown of the products or services provided, with descriptions, quantities, and individual prices.

- Ensure that you specify any applicable taxes and how they are calculated.

- List the total amount due, including taxes, and specify the payment terms, such as due dates and accepted payment methods.

- Make sure to include your business registration number in the appropriate section for legal purposes.

Once these details are included, double-check for accuracy before sending it to your client to ensure a smooth transaction process.

Important Considerations

- Clarity: Ensure all charges and terms are easy to understand.

- Professional Design: A clean, organized format enhances your business image.

- Legality: Including your business number is a legal requirement for many transactions.

Benefits of Using an Invoice Template

Using a structured document for billing purposes can significantly streamline your business operations. By relying on pre-designed layouts, you can save time, reduce errors, and maintain consistency in your payment requests. This organized approach helps ensure that all required details are included while reflecting your business’s professionalism.

Time-Saving Advantages

When you use a ready-made structure, you eliminate the need to start from scratch with every transaction. This not only speeds up the process but also allows you to focus on other important tasks. Here are some key time-saving benefits:

- Quick Setup: Pre-designed documents let you plug in the details without formatting from the ground up.

- Consistency: Each document is formatted the same way, reducing the time spent making adjustments.

- Automation: Some tools allow you to generate multiple requests with just a few clicks.

Accuracy and Professionalism

Having a predefined layout minimizes the chances of missing important details, such as business identification numbers or tax calculations. This ensures that your financial records are accurate and meet legal standards. Additionally, a well-organized design enhances the perception of your business and builds trust with clients.

- Consistency in Details: Ensure all necessary information is included every time.

- Brand Image: A clean, professional document improves your company’s image.

- Reduced Risk of Mistakes: A structured approach reduces the chance of forgetting key details or making errors.

Choosing the Right Template for Your Business

Selecting the right format for your billing documents is a crucial step for ensuring efficiency and professionalism. The layout you choose should reflect the nature of your business while also adhering to necessary legal and financial standards. With numerous options available, it’s important to evaluate which structure best suits your workflow, client interactions, and industry-specific needs.

When deciding on a structure, consider the following factors:

- Industry Needs: Different sectors require different levels of detail. For example, service-based businesses may need to emphasize hours worked, while product-based businesses should focus on quantities and itemized costs.

- Branding: A customized design that matches your company’s style can help establish a professional image and reinforce your brand identity.

- Ease of Use: Choose a layout that is simple to update and manage. Complex formats may waste time and increase the risk of mistakes.

By considering these elements, you can select the most suitable document structure that meets both your business needs and legal obligations, ensuring smooth and effective financial management.

ABN Requirements for Australian Invoices

For businesses operating in certain regions, including the appropriate registration number on your billing documents is a legal necessity. This identifier ensures that your business is officially registered and complies with relevant tax laws. Without it, your documents may not be considered valid for tax purposes, which could lead to complications with both clients and tax authorities.

Why the Registration Number is Essential

The registration number serves as proof that your business is officially recognized by the governing authorities. It allows you to legally collect taxes from clients, claim deductions, and report earnings. Not including this number could result in delayed payments or penalties for non-compliance. It also reassures your clients that you are a legitimate and registered entity.

When to Include the Registration Number

Typically, you should include this number on all official financial documents, especially when engaging in transactions involving goods or services that are subject to tax. This helps ensure your dealings are transparent and adhere to the legal standards required for business operations.

Customizing Your Billing Document for Clients

Personalizing your financial documents for each client not only enhances professionalism but also ensures that all relevant details are tailored to their specific needs. A customized approach can help improve client relationships, reduce confusion, and ensure smoother transactions. By adapting the layout and content, you can provide clear, accurate information that matches the nature of the work or products provided.

Adapting the Layout and Design

While consistency is important, customizing the layout for different clients can create a more personalized experience. For example, you may want to adjust the document’s style based on your client’s preferences or the complexity of the project. Some clients may need more detailed descriptions, while others might prefer a simpler format. Here are a few considerations:

- Client Branding: If working with larger companies, incorporating their logo or preferred color scheme can enhance the visual appeal.

- Detailed Descriptions: For clients who require more detailed billing, make sure to break down the services or items in an easy-to-read format.

- Payment Terms: Tailor the payment terms to match the agreements made with the client, such as discounts for early payment or extended payment periods.

Important Fields to Include

When tailoring a document for a client, ensure that all necessary fields are included for clarity and legal compliance. These fields should reflect the specific requirements of your business and the client’s needs. Some key elements to consider are:

| Field | Purpose |

|---|---|

| Client Information | Helps identify the recipient and ensures proper communication. |

| Itemized List | Provides a breakdown of goods or services, offering transparency. |

| Payment Instructions | Clearly outlines how and when the payment is expected. |

| Custom Notes | Allows space for any special notes, such as agreements or terms. |

By customizing these sections for each client, you can create a document that meets both their expectations and your business requirements, leading to smoother transactions and a stronger professional relationship.

Common Mistakes in Document Creation

When preparing financial documents for clients, it’s easy to overlook important details that could lead to confusion or payment delays. Even small errors can create issues with processing payments or may cause your document to be legally invalid. Understanding the most common mistakes in document creation will help you avoid these pitfalls and ensure smoother transactions.

Here are some of the frequent errors that businesses should be mindful of:

- Missing Business Information: Failing to include essential details such as your business name, address, and contact information can cause delays in communication and reduce your professional credibility.

- Incorrect or Incomplete Amounts: Not accurately listing the amounts due or omitting taxes can cause confusion and disputes with clients, potentially delaying payments.

- Failure to Include Payment Terms: Not specifying clear payment instructions, deadlines, or accepted methods can lead to missed or late payments.

- Lack of Unique Reference Number: Without a reference number, it becomes difficult to track payments and manage financial records efficiently.

- Omitting Legal Information: In some regions, it’s required to include certain legal identifiers or business numbers. Not doing so can render your document invalid for tax or legal purposes.

By being aware of these common mistakes, you can create more accurate and professional documents, leading to fewer misunderstandings and a more efficient billing process.

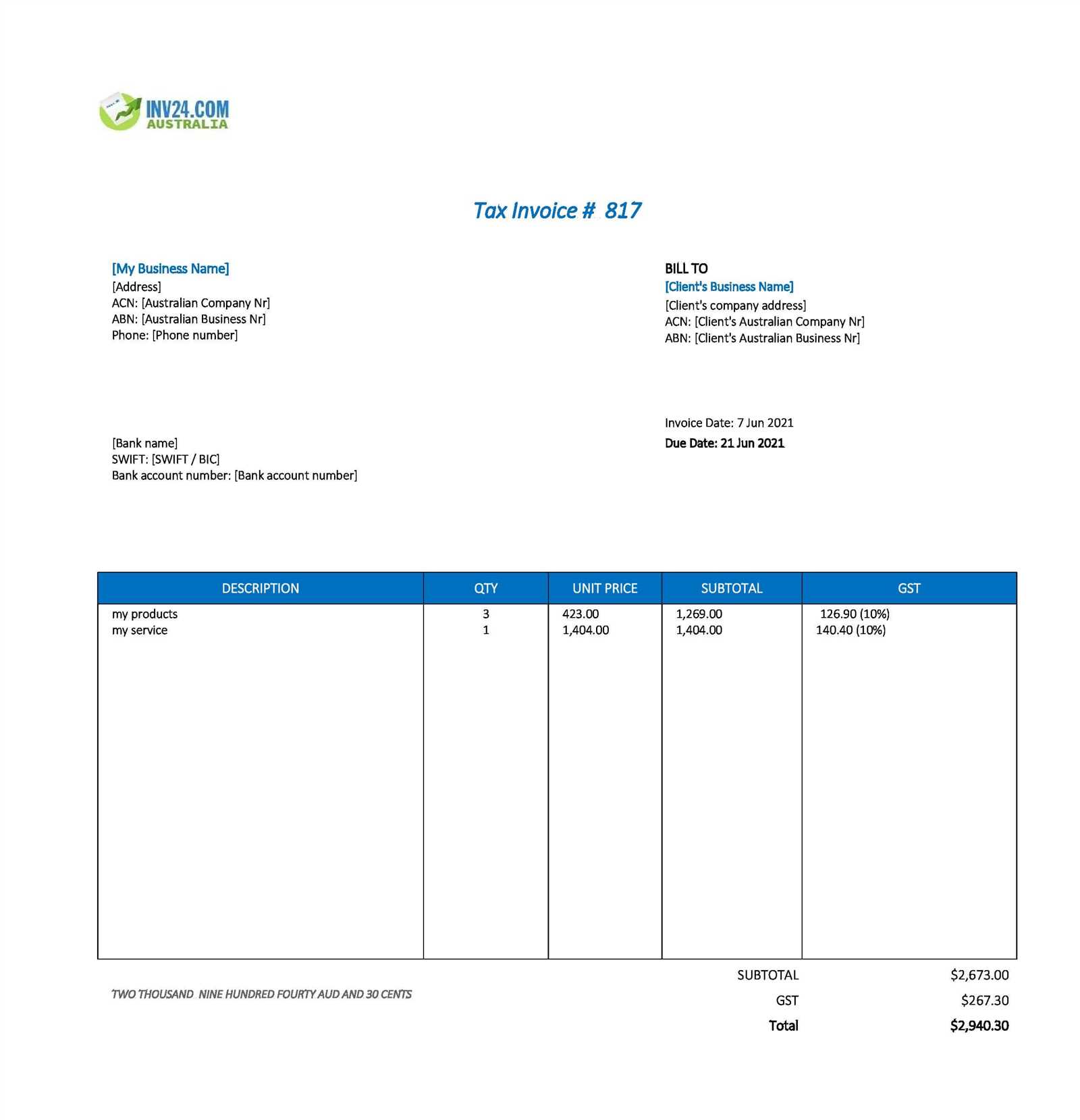

How to Include GST on Documents

When providing goods or services that are subject to tax, it’s essential to ensure that the correct tax amount is clearly indicated on your financial documents. Including the Goods and Services Tax (GST) accurately helps to comply with regulations and ensures transparency between your business and your clients. Properly calculating and displaying the tax amount is crucial for maintaining good financial practices.

Here’s how to correctly incorporate GST into your documents:

- Determine the Taxable Amount: First, calculate the total value of the goods or services being provided before applying GST. This is the base amount that the tax will be calculated on.

- Calculate the GST: Apply the applicable GST rate (usually 10% in many regions) to the taxable amount. For example, if the taxable amount is $100, the GST would be $10.

- Show the Total Amount: The total amount due should include both the taxable amount and the GST. Make sure this is clearly displayed to avoid confusion.

- Breakdown of Charges: Clearly show the breakdown on the document. Specify the tax amount separately so that your client can easily see how the total was calculated. This adds transparency to the transaction.

By correctly including GST on your documents, you ensure compliance with tax laws and make it easier for your clients to understand the total cost of the goods or services being provided.

Best Practices for Document Numbering

Numbering your financial documents consistently and correctly is crucial for keeping organized records, ensuring efficient tracking, and maintaining a professional standard. A well-structured numbering system helps you quickly identify and refer to specific documents, while also complying with business and tax requirements. Below are some best practices to follow when creating a numbering system for your documents.

Key Considerations for Numbering

Having a systematic approach to numbering can prevent confusion and avoid duplicate entries. Here are the main points to consider:

- Sequential Numbers: Always use a sequential order for each document. This helps avoid duplication and provides a clear history of your business transactions.

- Include Prefix or Year: Adding a prefix or year code (e.g., “2024-001”) helps categorize and identify documents by year, making it easier to manage records for tax purposes.

- Avoid Gaps in Sequence: Ensure there are no gaps in the numbering sequence. Skipping numbers may lead to confusion and potential legal issues if you cannot account for all issued documents.

- Consistency: Stick to the same format across all your records. Whether it’s a number or combination of numbers and letters, consistency ensures clarity and makes it easier to search for and track documents.

Suggested Numbering Format

Below is a suggested numbering format that can be customized for your business needs:

| Format Example | Description |

|---|---|

| 2024-001 | Year + sequential number, perfect for businesses that want to organize documents by year. |

| INV-001 | Simple sequential numbering with a prefix, ideal for straightforward tracking. |

| SA-2024-001 | Prefix + year + sequential number, useful for identifying specific types of documents, like sales or services. |

By following these best practices, you can create a clear and effective numbering system that streamlines your business operations, ensures compliance, and improves your ability to track and manage documents efficiently.

What Information to Include on Documents

When creating a financial document for your clients, it’s essential to provide clear and accurate details to ensure smooth transactions and compliance with regulations. A well-structured document not only helps in tracking payments but also serves as a professional representation of your business. Including the necessary elements is crucial for both you and your client to avoid misunderstandings or disputes.

Here are the key pieces of information you should always include:

- Your Business Information: Include your business name, address, contact details, and any relevant registration or tax numbers. This establishes your identity and facilitates easy communication with your client.

- Client’s Information: The recipient’s name, address, and contact details should be clearly stated. This ensures that the document is directed to the correct party and prevents errors in billing.

- Unique Reference Number: Each document should have a unique identifier for tracking purposes. This number helps to prevent duplication and makes it easier to reference in the future.

- Details of Goods or Services: A clear description of what was provided, including quantities, unit prices, and any other relevant details. This ensures transparency and accuracy in the transaction.

- Total Amount Due: Clearly list the total amount payable, including any applicable taxes. This is essential for your client to understand the exact amount they are expected to pay.

- Payment Terms: Specify payment deadlines, acceptable payment methods, and any late fees or penalties for overdue payments. This helps to avoid confusion and ensures timely payments.

- Tax Information: If applicable, include the relevant tax breakdown, showing the amount of tax charged. This is essential for both your records and your client’s accounting purposes.

By including these key elements, you ensure that your financial documents are both professional and legally compliant, helping to build trust with your clients and prevent payment issues.

How to Send Documents Electronically

In the digital age, sending financial documents electronically has become the most efficient and secure method of communication. It saves time, reduces paper waste, and allows for faster processing and payments. Ensuring your documents are sent in a professional and secure manner is essential for maintaining trust with your clients and adhering to business standards.

Steps for Sending Documents Electronically

To send your financial documents electronically, follow these steps:

- Prepare the Document: Ensure that your document is complete and accurate before sending it. Double-check that all necessary information is included and formatted correctly.

- Choose the Right Format: Save the document in a widely accepted file format such as PDF. This ensures that your client can easily open and view the document regardless of their device or software.

- Use Professional Email: Always use your business email address when sending documents to clients. This maintains a professional image and ensures that the email reaches the intended recipient.

- Include a Clear Subject Line: The subject line should be concise and informative, such as “Payment Due for Services Rendered – [Document Number].” This makes it easy for your client to identify the email among others.

- Attach the Document: Attach the document to the email, ensuring that the file size is manageable for both you and your client. If the document is too large, consider compressing it or using a file-sharing service.

- Provide Payment Instructions: In the body of the email, briefly explain the payment terms, including due dates, accepted payment methods, and any other relevant information. This ensures that your client has everything they need to make the payment.

- Set Follow-up Reminders: If necessary, set reminders to follow up with your client after a specified period. This will help keep payments on track and avoid delays.

Benefits of Electronic Sending

Sending documents electronically offers several advantages:

- Speed: Emailing a document is immediate, which allows your client to receive it and take action right away.

- Security: When sent via email, your document can be encrypted or password-protected for added security, ensuring that sensitive information remains private.

- Efficiency: By eliminating physical mailing processes, you reduce time and costs associated with printing and postage.

- Tracking: Sending d

Tracking Payments with Your Document

Effective management of payments is crucial for maintaining cash flow and ensuring that your business operations run smoothly. One of the best ways to keep track of payments is by using a structured approach that allows you to easily monitor the status of outstanding amounts and identify any overdue payments. By incorporating the right fields and organization into your documents, you can streamline this process and stay on top of your financials.

How to Track Payments

Tracking payments becomes much easier when you include the following key elements in your document:

- Payment Due Date: Clearly state the due date for each payment to avoid confusion and ensure that your client knows when to make the payment.

- Payment Status Field: Add a section or checkbox to indicate whether the payment has been received, is pending, or is overdue. This allows you to quickly identify the status of each transaction.

- Partial Payments: If a client makes a partial payment, document the amount received and update the balance due. This ensures you can track progress and keep both parties informed.

- Payment Reference Number: If applicable, include a space for a payment reference number or transaction ID. This helps you track payments more efficiently and resolve any disputes if necessary.

- Amount Received: As payments are made, record the exact amount received and adjust the balance due accordingly. This keeps your financial records up to date and accurate.

Benefits of Tracking Payments Effectively

By including these tracking elements, you can enjoy several key benefits:

- Improved Cash Flow: Monitoring payments closely ensures you are aware of what has been paid and what is still outstanding, allowing you to better manage your cash flow.

- Less Time Spent on Follow-ups: When you have a clear record of payment statuses, you can reduce the time spent chasing overdue payments.

- Better Client Relationships: Clients appreciate transparency and clarity in financial matters. A well-managed payment process fosters trust and professionalism.

- Easy Reporting: Keeping track of payments within each document simplifies financial reporting and makes it easier to assess the overall health of your business.

By integrating these practices into your document structure, you can ensure that payment tracking becomes a seamless part of your business operations, improving both efficiency and client satisfaction.

Invoice Templates for Different Industries

Every industry has its unique requirements when it comes to documenting financial transactions. Customizing your financial documents to fit the specific needs of your sector ensures that the necessary information is provided clearly and professionally. Whether you’re in construction, retail, or consulting, understanding the nuances of your industry can help you create more efficient records and streamline your billing process.

Customizing Documents for Various Sectors

Different sectors require specific elements to be included in the documentation for accuracy and compliance. Below are examples of industry-specific needs:

- Construction: In the construction industry, detailed descriptions of work done, materials supplied, and labor charges are essential. Additionally, specifying progress payments and retention amounts may be necessary.

- Retail: Retail businesses typically deal with high-volume transactions. Including product descriptions, quantities, prices, and any applicable discounts ensures clarity in each transaction.

- Consulting and Professional Services: For services like consulting or legal work, it’s essential to break down the hours worked, hourly rate, and a brief description of the service provided to ensure transparency for the client.

- Freelancers and Creatives: Freelancers in graphic design, writing, or photography should include the scope of the project, milestones, and final deliverables. Clear payment terms and expectations help avoid misunderstandings.

- Health and Wellness: Professionals in this field need to include services rendered, session times, and any associated fees. It’s also important to clarify whether the services are covered by insurance.

Industry-Specific Features to Include

While each industry has its own unique requirements, there are some common features that should be included in all documents:

- Clear Descriptions: Regardless of industry, clear and precise descriptions of products or services ensure that the customer knows exactly what they are paying for.

- Payment Terms: Include the agreed-upon payment terms, such as net 30, net 60, or installment payments, to avoid confusion and delays.

- Tax Information: Depending on the nature of your business, tax rates and applicable discounts should be indicated to ensure compliance with local regulations.

- Contact Information: Having both the client’s and service provider’s contact details clearly visible is essential for follow-up questions or disputes.

By understanding the specific needs of your industry and tailoring

Free vs Paid Invoice Templates

When choosing a document format for your financial transactions, you’ll find both free and paid options available. While both types can serve the same primary purpose of facilitating clear and organized record-keeping, the features and benefits they offer can vary significantly. It’s important to weigh the advantages and drawbacks of each to determine which will best meet your needs.

Free options are often a good starting point for individuals or small businesses on a tight budget. These can be easily found online and can cover basic requirements. However, they might lack advanced customization features or support. On the other hand, paid options often provide additional functionality, including professional designs, automation features, and premium support services, making them a better fit for businesses that require more robust solutions.

Here’s a breakdown of the differences:

- Cost: Free options come with no monetary cost, while paid choices require a one-time payment or subscription. However, the free versions might come with limited functionality or hidden fees for certain features.

- Customization: Free versions may be more basic in terms of design, leaving little room for personalization. Paid solutions typically allow for greater flexibility, enabling you to tailor the documents to your brand’s needs.

- Support: Free versions often come without customer support or troubleshooting assistance. Paid versions usually offer customer service and technical support, ensuring you can resolve any issues quickly.

- Features: Paid options often include additional features such as automated calculations, integration with accounting software, and advanced reporting tools that streamline business processes. Free solutions are more limited in this regard.

- Security: For businesses handling sensitive client information, paid options may offer more robust security features, such as password protection and secure cloud storage. Free solutions may not always prioritize security as highly.

Ultimately, the choice between free and paid options comes down to your specific needs and business size. While free solutions are great for small businesses or individuals just starting out, larger or more established businesses may find the investment in a paid option worthwhile due to the additional features and support offered.

How to Update Your Invoice Template

Maintaining an up-to-date document format for financial records is crucial to ensure that your transactions are always clear, professional, and compliant with any relevant regulations. Over time, you may find that certain aspects of your format need to be adjusted–whether it’s a change in business details, payment terms, or a desire for a more streamlined design. Keeping your documents fresh not only helps your business present a modern image, but it also ensures that you avoid confusion with outdated information.

Here are some simple steps to help you keep your financial documents up to date:

- Review Business Information: Double-check that all your contact details, such as address, phone number, and email, are correct. If any business information has changed, update it immediately across all your documents.

- Adjust Payment Terms: Reassess your payment terms to ensure they reflect current policies or industry standards. If you’ve adjusted your payment deadlines or introduced new methods, make sure they are clearly indicated.

- Change Branding Elements: If you’ve rebranded your business, it’s essential to update logos, color schemes, or fonts to maintain consistency across all customer communications.

- Add or Remove Fields: If there are new elements you need to track or display (e.g., a purchase order number, delivery information, or applicable taxes), include them. Conversely, remove any unnecessary fields to keep the document concise and easy to read.

- Ensure Legal Compliance: Regularly check any legal requirements that may affect the contents of your document, such as taxes or required disclosures. Ensure that your documents are in compliance with current laws and regulations.

By periodically revisiting and refining your document format, you’ll keep your business running smoothly and avoid any potential miscommunications with clients. Updating your documents is an important part of professional business management, and doing so will help you stay organized and prepared for any financial transactions ahead.

Maintaining Legal Compliance with Invoices

When conducting business transactions, it is essential to ensure that your financial documents meet all relevant legal requirements. Legal compliance not only helps avoid costly penalties but also promotes transparency and trust between you and your clients. In some regions, specific details must be included on every financial record, and failing to comply with these regulations can lead to complications during audits or legal disputes.

Here are several key considerations to ensure your documents remain legally compliant:

- Include Required Business Information: Always include your business name, legal structure, and any relevant registration numbers. This establishes your identity clearly and allows clients to verify your business credentials.

- Correct Tax Information: Ensure that you display the correct tax rate on your records if applicable. Many regions require businesses to list taxes such as sales tax or VAT separately, with a clear indication of the tax percentage applied.

- Clear Payment Terms: Specify your payment terms, including due dates and any late fees or discounts for early payment. Having clear terms can help avoid misunderstandings and potential disputes over payment expectations.

- Legal Disclaimers and Terms: Depending on your industry, there may be specific legal disclaimers or conditions that need to be included. This could include return policies, warranties, or disclaimers regarding services provided.

- Record Retention: Understand the legal requirements for storing financial records in your jurisdiction. Most regions have a mandatory retention period for business documents, often ranging from 5 to 10 years.

By ensuring that your financial documents align with local legal requirements, you safeguard your business from potential fines or legal challenges. Keeping up with compliance not only protects you but also helps establish credibility and reliability in the eyes of your customers.

Improving Cash Flow with Proper Invoicing

Managing cash flow effectively is crucial for the success and sustainability of any business. One of the key components of ensuring a steady cash flow is issuing clear and timely financial records. When these documents are accurately prepared and promptly sent to clients, businesses can improve their payment cycles, minimize delays, and ensure that they have the funds they need to operate smoothly.

Here are several ways that accurate financial documentation can positively impact cash flow:

- Timely Issuance: Issuing financial records as soon as a product is delivered or a service is rendered ensures quicker payment. Delaying this process can lead to late payments, affecting your business’s ability to cover expenses.

- Clear Payment Terms: Including clear payment terms such as due dates and any late fees can encourage clients to pay on time. When customers know exactly when and how much they owe, there’s less confusion and fewer payment delays.

- Accurate Amounts: Ensuring that all amounts are correctly calculated and free of errors helps avoid disputes and delays. Discrepancies can cause clients to question the charges, leading to longer payment processing times.

- Flexible Payment Options: Offering clients multiple ways to pay can speed up the process. The easier you make it for them to pay, the faster you are likely to receive your funds.

- Regular Follow-ups: A well-structured follow-up system for overdue payments ensures that clients are reminded before the payment becomes a significant issue. Regular reminders increase the likelihood of on-time payments.

By streamlining and enhancing the way you manage financial records, you create an environment where clients are more likely to pay promptly. In turn, this improves your overall cash flow and allows your business to operate witho