Download the Best Audio Engineer Invoice Template for Your Business

Managing financial transactions is crucial for anyone providing professional audio services. Whether you are working on a freelance basis or running a larger business, having a structured approach to payments is essential for maintaining good relationships with clients and ensuring timely compensation for your work. A well-organized billing system not only saves time but also enhances your professional image.

One of the most effective ways to achieve this is by using a well-designed document that clearly outlines services rendered, payment amounts, and deadlines. This allows both parties to understand the terms of the agreement and ensures transparency in every financial exchange. In this article, we will explore the benefits of using pre-made documents and how they can simplify your accounting process.

By adopting the right tools, you can easily manage your finances, track outstanding payments, and stay on top of your business operations. With a variety of customizable options available, finding the right solution for your needs has never been easier.

Why Sound Professionals Need Structured Billing Documents

For anyone offering sound services, managing payments effectively is key to maintaining a healthy business. Without a proper system in place, tracking fees, ensuring timely payment, and handling disputes can become time-consuming and complex. A well-organized document that outlines all the necessary financial details not only helps in avoiding confusion but also ensures smooth transactions between the service provider and the client.

Clarity and Transparency in Financial Transactions

Using a formalized document to detail the scope of work and payment expectations helps to establish clear terms from the start. It outlines the agreed-upon amounts, payment deadlines, and any additional fees or charges that might arise. This clarity benefits both parties and reduces the chances of misunderstandings or disagreements once the project is completed.

Efficiency and Professionalism

Having a standardized way to document financial transactions makes billing much more efficient. It saves time by eliminating the need to manually write out payment requests or calculate totals from scratch each time. Moreover, presenting clients with a professional, neatly formatted document can improve your reputation and foster trust, which is essential in competitive industries.

In short, using an effective billing document is a crucial step in building a reputable and organized business. It simplifies the financial side of your work, allowing you to focus more on your craft while ensuring you are paid promptly and fairly for your services.

How to Create an Effective Billing Document

Creating a professional and effective financial document is essential for any service provider. It not only ensures you get paid on time but also reflects your professionalism and attention to detail. An effective billing record should be clear, organized, and comprehensive, providing all the necessary information for both you and your client to understand the terms of payment.

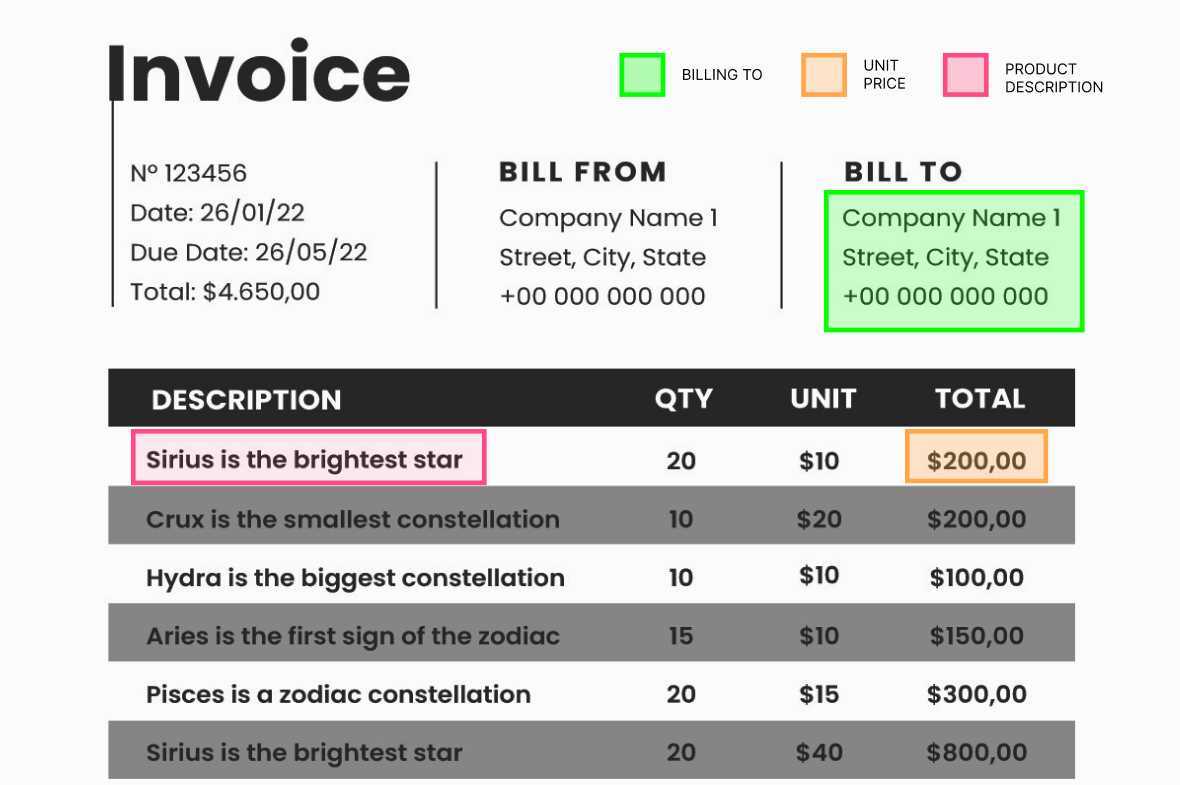

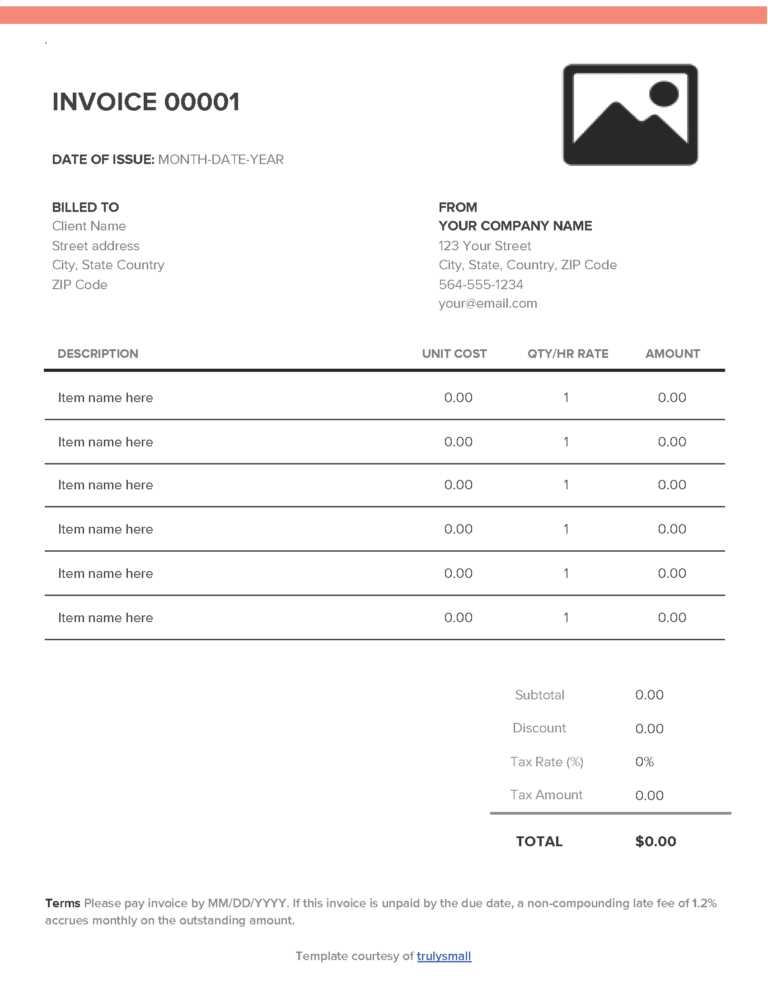

Key Elements to Include

To ensure your document is complete and effective, make sure to include the following essential elements:

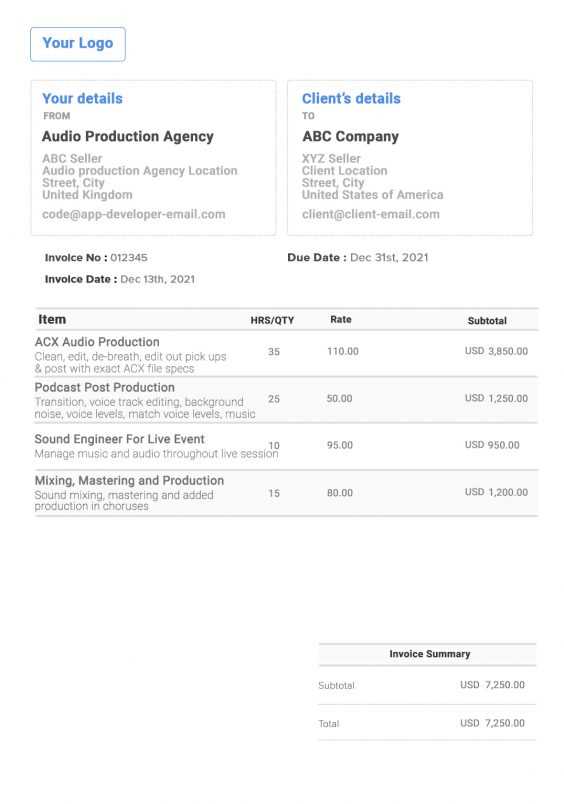

- Service Provider and Client Information: Include your name, contact details, and your client’s name and contact information.

- Project Details: Describe the services provided in detail, including dates, locations, or any specific conditions that apply.

- Breakdown of Charges: Clearly list each service or product, with individual costs, to avoid confusion.

- Total Amount Due: Sum all charges to indicate the total amount payable.

- Payment Terms: Specify the payment deadline and accepted methods (e.g., bank transfer, credit card, etc.).

- Unique Invoice Number: Include a unique reference number for record-keeping and easy tracking.

Formatting for Professionalism

In addition to the content, the appearance of your document is just as important. A clean, well-structured layout enhances readability and demonstrates professionalism. Use clear headings, bullet points, and enough white space to make it easy for clients to find relevant information quickly.

Finally, ensure that your document is free from errors, both in terms of spelling and calculations. A small mistake can undermine your credibility and cause delays in payment.

Key Elements of a Sound Professional’s Billing Record

When creating a financial document for services rendered, it’s essential to ensure that all necessary details are included. A well-crafted billing statement helps both the service provider and the client understand the terms of the transaction, ensuring smooth and transparent financial exchanges. The following elements are crucial for making sure your document is complete and professional.

Important Information to Include

- Service Provider’s Contact Details: Clearly list your name, business name (if applicable), phone number, email, and address for easy communication.

- Client’s Contact Details: Include the client’s name and contact information to ensure proper identification of the recipient.

- Description of Services: Break down the tasks or services provided, listing each one with sufficient detail to clarify what was performed.

- Service Dates: Specify the dates when the services were provided to track the timeline of the project.

- Individual Pricing: List the price for each service or item provided. If multiple services were rendered, break down the charges clearly.

- Total Amount Due: Include the total amount owed, clearly calculated based on the listed services or products.

- Payment Terms: Define the expected payment date, late fees (if any), and acceptable payment methods.

- Unique Identifier: Include an invoice or reference number for easy tracking and future reference.

Additional Considerations

Besides the basic details, consider adding any extra information that could help facilitate smoother transactions. For instance, you might include your business logo, payment instructions, or even a short note of appreciation for the client’s business.

Ensuring these elements are clearly outlined will prevent any confusion and encourage timely payments. A complete and accurate record also fosters professionalism and trust in your services.

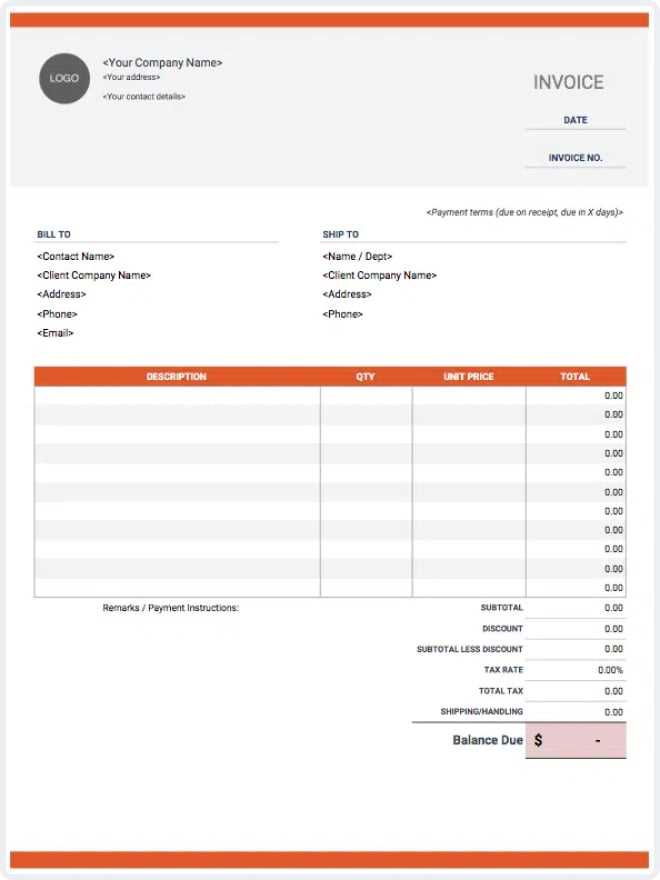

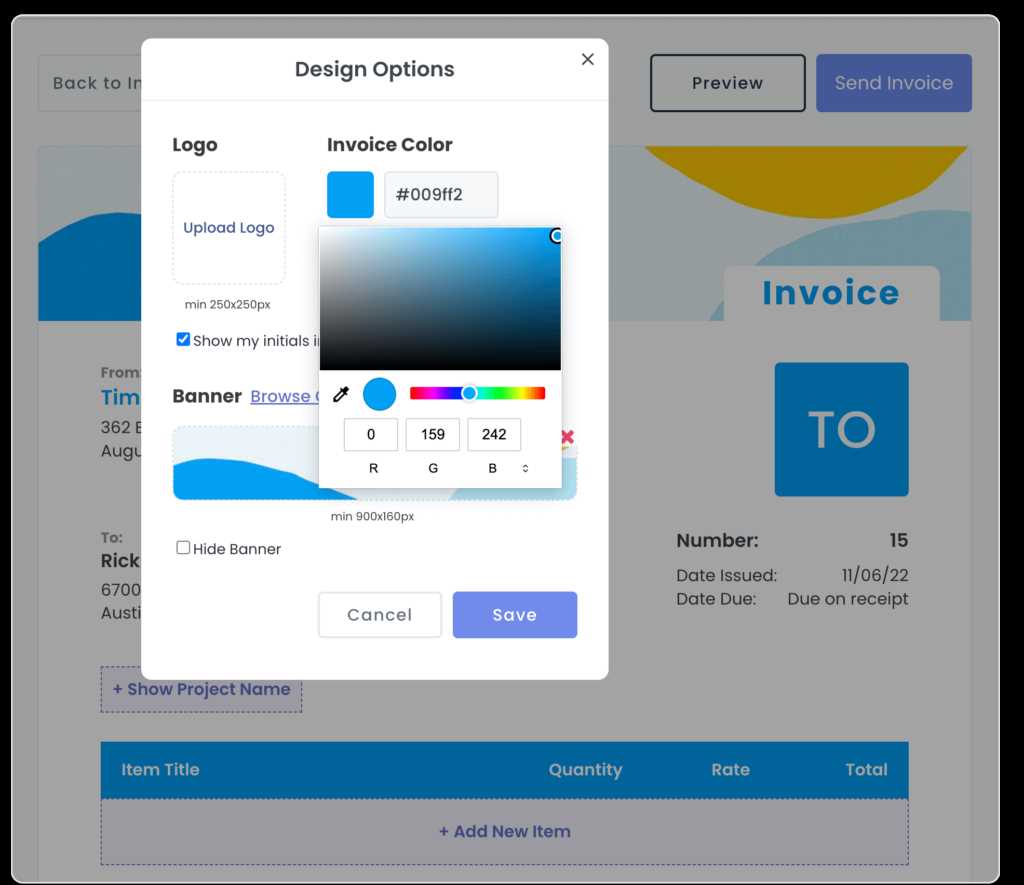

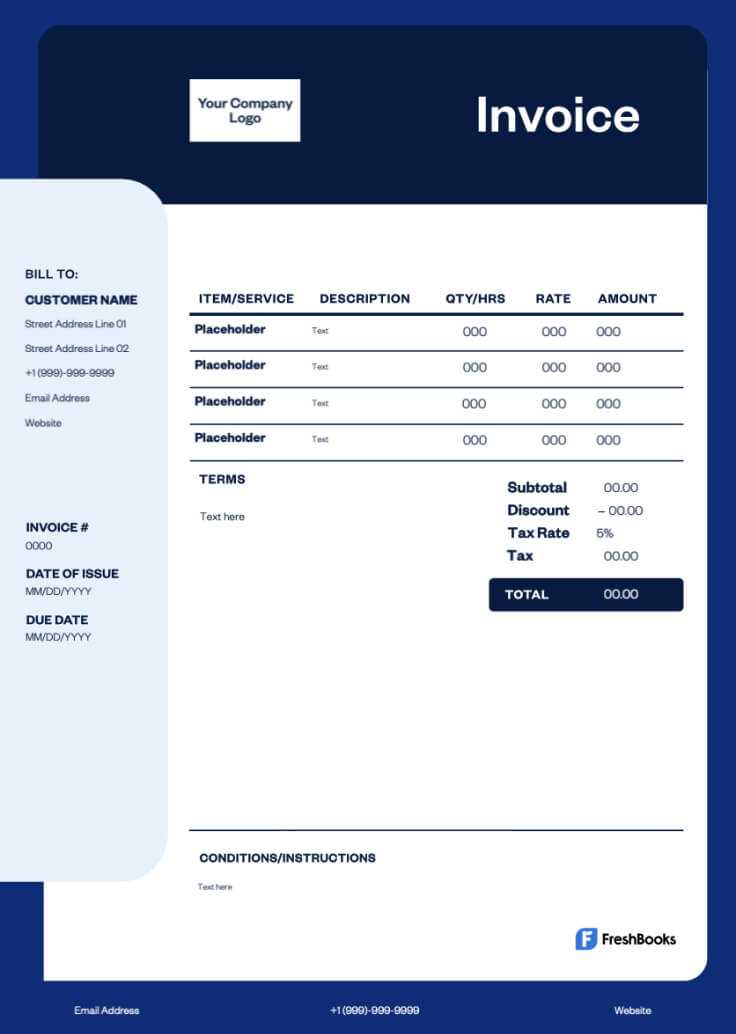

Customizing Your Billing Document for Branding

Your financial records are not only a tool for managing payments but also an opportunity to showcase your business identity. A well-designed document that reflects your branding can help reinforce professionalism and make a lasting impression on clients. Customizing the layout and content of your billing statements can enhance the client’s experience and promote brand recognition.

Incorporating Your Business Identity

Start by adding your company logo and business name at the top of the document. This ensures that the client immediately associates the statement with your brand. Additionally, consider using your brand’s color palette and fonts to give the document a consistent look that aligns with your other marketing materials, such as your website or business cards.

Personalizing the Document Layout

Beyond the visual elements, you can personalize the layout to make the billing process more efficient and engaging. For example, include a message of appreciation or a short note thanking the client for their business. This personal touch helps strengthen client relationships. You can also add a section that highlights your services, making it clear what value you bring and encouraging repeat business.

In summary, customizing your financial documentation with your brand elements is a simple yet effective way to enhance client perception and stand out in a competitive market. A unique and professional document can help establish your brand identity while improving communication with clients.

Top Tools for Designing Billing Documents

When creating professional financial records, having the right tools can make the process more efficient and visually appealing. Several software and online platforms offer customization options, templates, and design features that help you produce polished, professional documents. These tools provide an easy way to create and manage your financial paperwork, ensuring accuracy while reflecting your brand identity.

Below are some of the most popular tools for designing and managing billing records:

| Tool | Key Features | Best For |

|---|---|---|

| Canva | Customizable designs, drag-and-drop editor, templates | Visually appealing and easy-to-use custom layouts |

| QuickBooks | Automated billing, payment tracking, client management | Businesses looking for full financial management software |

| FreshBooks | Invoice tracking, time tracking, custom designs | Freelancers and small businesses needing simple invoicing tools |

| Zoho Invoice | Recurring billing, multi-currency support, mobile app | Companies with international clients or recurring billing needs |

| Microsoft Word/Excel | Custom formatting, calculation tools, flexibility | Users seeking basic, customizable documents without extra features |

In summary, the right tool depends on your specific needs. Whether you’re looking for simple customization options or more advanced features like recurring payments and client management, these platforms offer various solutions to help streamline your billing process.

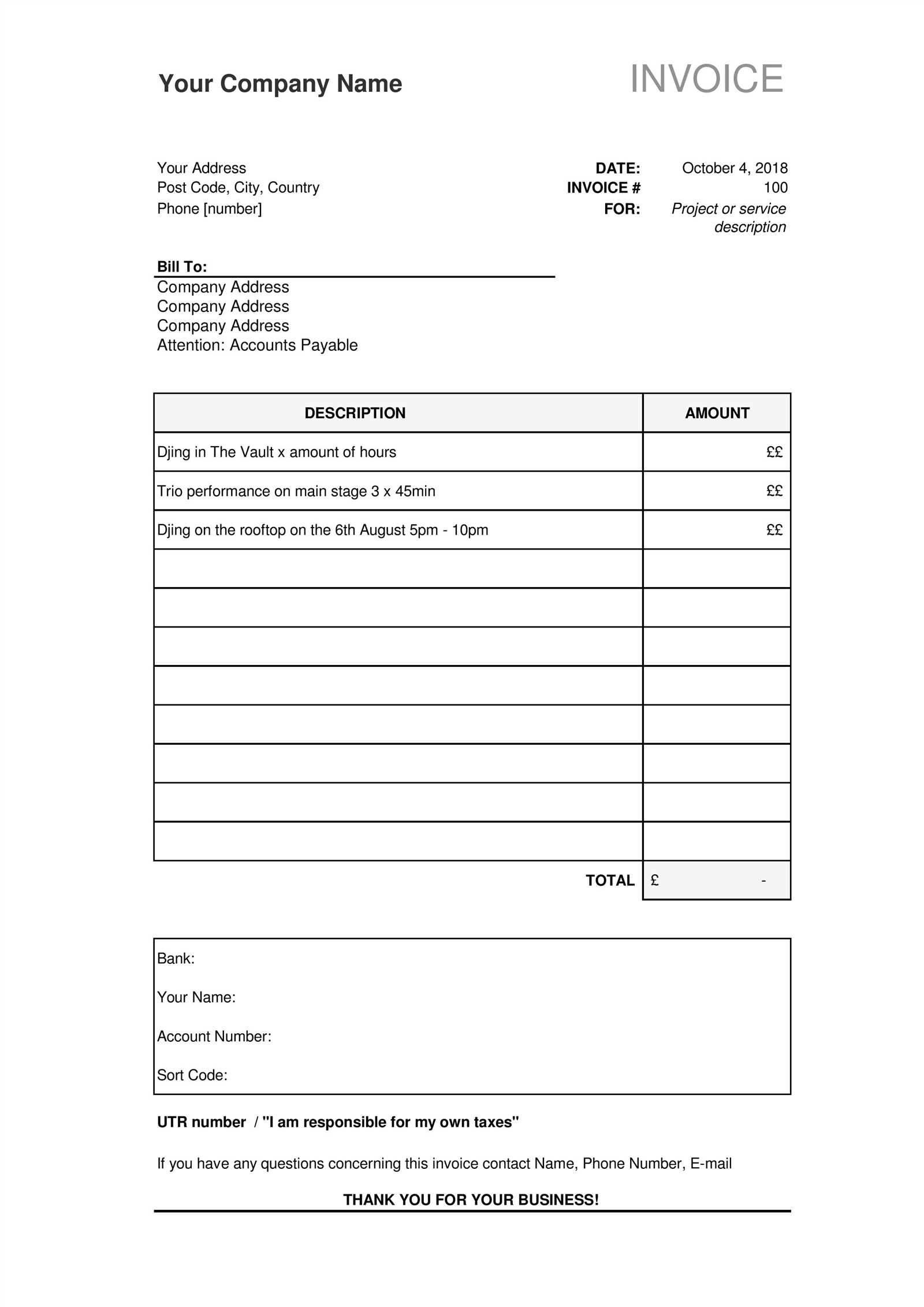

How to Format a Billing Statement

Creating a well-organized financial document is crucial for maintaining clear communication and professionalism. The format of your billing record should be simple, easy to read, and logically structured. A clean format not only improves clarity but also ensures that all necessary details are included to avoid misunderstandings and delays in payments.

Essential Formatting Tips

- Clear Header: Start by placing your business name, contact details, and logo (if applicable) at the top of the document. This makes it easy for your client to recognize the source of the statement at a glance.

- Client Information: Just below the header, list your client’s name, company (if relevant), and contact information. This ensures there’s no confusion about who the bill is intended for.

- Unique Document Number: Assign a unique reference or identification number to the document for easy tracking and record-keeping. This is particularly useful for accounting and future reference.

- Service Breakdown: Use a table or bullet points to list the services provided, along with individual prices, hours worked, and dates. Break down the details clearly so your client can easily see what they are being charged for.

- Total Due: At the bottom of the breakdown, clearly state the total amount due. Ensure the calculation is accurate and easy to verify.

- Payment Terms: Specify the payment due date, any late fees, and the accepted methods of payment (e.g., bank transfer, PayPal, etc.).

Maintaining a Professional Appearance

Once the content is arranged, focus on the visual layout. Keep the design simple and clean. Use consistent fonts, bold headings, and enough white space between sections to make the document easy to read. Avoid clutter or unnecessary graphics that could distract from the main information.

Formatting your financial documents in this manner ensures professionalism and helps build trust with clients. It also streamlines the billing process and reduces the likelihood of errors or confusion.

Common Mistakes to Avoid in Billing Documents

When preparing financial records for clients, it’s essential to ensure everything is accurate and clear. Small mistakes can lead to misunderstandings, delayed payments, or even damage your professional reputation. By being aware of common errors, you can take steps to avoid them and streamline the billing process.

Key Mistakes to Watch Out For

- Missing or Incorrect Contact Information: Always double-check both your and your client’s contact details. Incorrect information can cause confusion and delays in communication.

- Unclear Service Descriptions: Vague or incomplete descriptions of the services provided can lead to misunderstandings. Be specific about what was done, when, and any relevant details.

- Failure to Include Payment Terms: Not specifying due dates, late fees, or payment methods can create uncertainty for clients. Be sure to clearly outline when and how payments should be made.

- Inaccurate Calculations: Ensure all charges are calculated correctly. Mistakes in pricing or totals can lead to disputes and erode trust with clients.

- Lack of a Unique Reference Number: Skipping a unique document number makes it difficult to track or reference past transactions. This can be especially problematic for both you and your client when managing multiple projects.

- Unprofessional Appearance: A cluttered or disorganized document can leave a poor impression. Keep the layout clean, easy to read, and aligned with your branding.

How to Avoid These Mistakes

Double-check all the information before sending out your billing records. Using a checklist or template can help ensure that all necessary details are included. Additionally, investing time in formatting the document clearly can prevent confusion and show professionalism, making it easier for your clients to process the payment smoothly.

By avoiding these common mistakes, you can maintain a smooth workflow, ensure timely payments, and build stronger relationships with your clients.

Benefits of Using a Digital Billing Record

Switching from paper-based to digital billing methods offers numerous advantages for businesses and service providers. Digital tools not only streamline the process but also enhance efficiency, accuracy, and professionalism. By adopting a digital approach, you can simplify the way you manage financial transactions while saving time and resources.

One of the primary benefits of digital billing is the ability to automate many aspects of the process. With pre-built layouts, you can quickly generate customized documents with all the necessary details, eliminating manual errors and reducing the time spent on administrative tasks. Additionally, digital records are easy to store and access, reducing clutter and ensuring that your documents are securely backed up and readily available when needed.

Another advantage is the ability to integrate payment options directly into your documents. Many digital platforms allow clients to pay with just a click, making the transaction process more seamless and faster. Moreover, you can track payments in real time, reducing the chance of overdue payments and providing better insights into your cash flow.

Lastly, digital formats allow for easy customization, enabling you to match the design of your financial records with your branding. This not only strengthens your business identity but also enhances the overall client experience. In summary, moving to a digital system offers time-saving, efficiency, and increased professionalism, ultimately benefiting both you and your clients.

Understanding Payment Terms for Sound Services

When providing professional services, it’s crucial to set clear payment terms to ensure both parties are on the same page. Payment terms define the expectations for when and how payments should be made, helping to avoid misunderstandings and ensuring that you are compensated fairly for your work. Establishing clear terms not only protects your business but also helps maintain good relationships with your clients.

Key Payment Terms to Consider

- Due Date: Specify when the payment is expected, whether it’s immediately upon completion, within 30 days, or on another agreed-upon date.

- Late Fees: Include any penalties for overdue payments, such as a percentage of the total amount due for each day the payment is late.

- Deposits: If applicable, consider requesting a deposit upfront, especially for larger projects. This ensures that the client is committed to the agreement and provides partial payment before work begins.

- Accepted Payment Methods: Clearly state which payment methods you accept (e.g., bank transfer, credit card, PayPal, etc.), making it easier for your client to complete the transaction.

- Payment Milestones: For larger projects, it may be helpful to break down payments into installments, with each payment due at specific project milestones (e.g., 50% upfront, 50% upon completion).

Why Payment Terms Matter

Having well-defined payment terms helps avoid delays and ensures a smoother transaction process. It establishes expectations upfront, so there is no confusion about when and how payment should be made. It also provides a sense of professionalism and helps protect you from potential non-payment or late payment issues.

In conclusion, setting clear payment terms is essential for ensuring timely and consistent compensation, reducing the risk of financial disputes, and maintaining positive client relationships.

How to Calculate Service Fees

Calculating the right fees for your services is essential for maintaining profitability while ensuring you remain competitive in your industry. To determine a fair and accurate fee structure, you need to consider several factors, including the time spent, the complexity of the tasks, and any additional costs incurred during the project. By establishing a clear and consistent pricing model, you can avoid misunderstandings with clients and ensure you are compensated adequately for your expertise and time.

Factors to Consider When Setting Your Rates

- Hourly Rate: If you charge by the hour, calculate how long the project will take and multiply by your hourly rate. This method is useful for projects with variable time requirements.

- Flat Fees: For specific services, such as mixing or mastering, you may prefer to set a flat fee. This provides clarity for the client and ensures you are compensated for the value of the work, regardless of time spent.

- Project Complexity: More complex projects may require higher rates due to the additional skill and effort involved. For example, working with larger or more intricate setups may justify a premium fee.

- Additional Expenses: Consider any extra costs incurred during the project, such as equipment rentals, travel expenses, or third-party services. These should be clearly outlined and added to the total fee.

- Market Rates: Research industry standards in your area to ensure your rates are competitive. Undercharging may lead to burnout, while overcharging can deter potential clients.

How to Calculate Your Final Fee

Once you’ve determined the appropriate pricing structure, follow these steps to calculate the final fee for a project:

- Estimate the total time or scope of the project based on the client’s needs.

- Apply your hourly rate or flat fee for each service or task to be performed.

- Include any additional costs, such as travel, materials, or equipment rental.

- Ensure the total is clearly broken down and presented to the client for approval.

By considering all relevant factors, you can set a fair price that accurately reflects the value of your services while maintaining profitability.

Legal Requirements for Billing Records

When creating financial documents for services rendered, it’s essential to ensure that your records comply with legal standards and local regulations. Properly formatted billing statements are not only crucial for clarity and professionalism, but also to protect both the service provider and the client. Adhering to legal requirements ensures that your documents are enforceable, transparent, and meet the necessary tax and business laws.

Each jurisdiction may have different legal expectations regarding the information that must be included in a billing statement. However, there are some common elements that generally apply to all billing records. Ensuring that these elements are present can help avoid any potential issues with audits, disputes, or compliance challenges.

Here are some of the key legal requirements you should be aware of when creating financial documents for your services:

- Business Information: Most legal systems require you to include your business name, address, and contact information. If applicable, you may also need to include your tax identification number or business registration number.

- Client Details: Include the name and contact information of the client receiving the services. This ensures that both parties are properly identified on the document.

- Description of Services: Clearly outline the services provided, along with dates and specific details. This helps both you and your client understand what was delivered and ensures that there is no ambiguity in the agreement.

- Payment Terms: Clearly specify the agreed-upon payment due date, any late fees, and the accepted methods of payment. This is essential for both enforcing timely payments and for tax purposes.

- Tax Information: Depending on your location, you may need to include applicable sales tax, VAT, or other tax-related information on the bill. This ensures that your documents meet legal requirements for tax reporting.

- Invoice Number: A unique identifier is often required for each document. This helps with tracking and maintaining accurate records for tax filings or legal purposes.

By following these legal guidelines, you ensure that your financial documentation remains compliant and protects both your business and your clients. Regularly reviewing local laws and regulations can help ensure that your documents remain up-to-date and legally sound.

Tracking Payments and Billing Records Efficiently

Effectively tracking payments and financial documents is crucial for maintaining a smooth cash flow and ensuring that no payments are missed or delayed. A well-organized system allows you to keep track of which clients have paid, which still owe, and the status of each transaction. Using efficient methods for tracking payments can save time, reduce errors, and help maintain positive relationships with clients.

Best Practices for Tracking Financial Documents

- Use Digital Tools: Leverage software or online platforms designed for managing transactions and records. Tools like QuickBooks, FreshBooks, or Xero can automate the tracking process and help you stay organized.

- Assign Unique Reference Numbers: Ensure each document has a unique ID. This makes it easier to search and track individual records, especially when dealing with multiple clients or projects.

- Track Due Dates: Keep track of when payments are due. Setting reminders for upcoming payments or overdue accounts ensures that nothing is missed and that you can follow up promptly with clients who have not paid.

- Record Payments Immediately: Update your system as soon as a payment is received. This helps you avoid confusion and ensures that all records are up to date.

- Keep Detailed Notes: Record any relevant details about each payment or transaction. This could include payment method, any discrepancies, or special agreements made with clients.

Automating the Process

Automation can help reduce manual tracking and prevent errors. Many accounting software tools allow you to set up automated reminders, generate recurring billing, and even track when a payment has been processed. By automating these tasks, you can focus more on providing quality service to your clients while ensuring that your records remain accurate and up-to-date.

Efficient tracking of payments and billing documents not only helps you stay organized but also improves cash flow and client communication. By setting up clear processes and utilizing digital tools, you can minimize administrative work and avoid unnecessary delays or confusion.

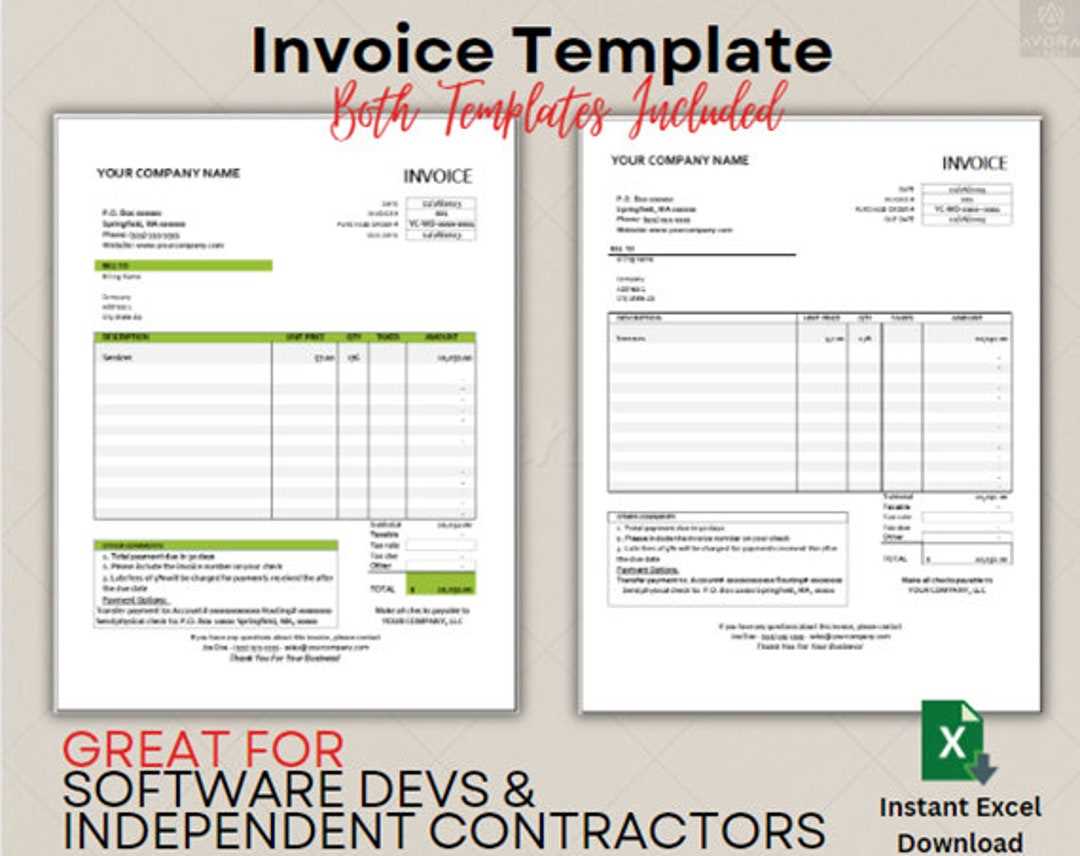

Using Pre-Designed Documents for Streamlined Billing

Using pre-designed forms for billing purposes can significantly simplify the process of creating professional financial records. By utilizing ready-made layouts, you can quickly generate accurate documents that ensure consistency and save time. Streamlining this process reduces the likelihood of errors, enhances efficiency, and ensures that all essential information is included every time.

Advantages of Using Pre-Designed Forms

- Consistency: Pre-designed formats ensure that each document follows the same structure, making your records easier to understand and maintain. This consistency is crucial for both you and your clients.

- Time Savings: With a template in place, you no longer need to start from scratch with each new billing statement. This speeds up the process and reduces the administrative workload.

- Professional Appearance: Ready-made documents typically follow industry standards and look polished, which enhances your business’s professionalism and client perception.

- Reduces Errors: Pre-designed forms typically include all necessary fields and sections, which reduces the chances of missing critical information or making mistakes in calculations.

- Easy Customization: Most pre-designed documents are customizable, allowing you to adjust them as needed to fit the specifics of each client or project.

How to Use Pre-Designed Forms Effectively

To get the most out of pre-designed billing records, follow these steps:

- Choose a layout that aligns with your business’s branding and the type of services you offer.

- Fill in all required fields accurately, including client information, service descriptions, and payment terms.

- Customize the document for each project by adding specific details or adjustments as needed.

- Review the final document before sending it to ensure all information is correct and complete.

By leveraging pre-designed forms, you can streamline the billing process, enhance your professionalism, and improve client satisfaction. These tools provide a practical solution for managing finances more efficiently, giving you more time to focus on delivering quality work.

Integrating Billing Documents with Accounting Software

Integrating pre-designed financial documents with accounting software can greatly simplify your billing and bookkeeping processes. This integration allows for seamless data transfer between your financial records and the accounting system, reducing manual entry, minimizing errors, and enhancing overall efficiency. By combining these tools, you can ensure that all your transactions are tracked accurately and that your accounting remains up-to-date with minimal effort.

Many accounting platforms now offer the ability to link custom billing forms directly to their systems. This integration enables you to generate professional documents that automatically populate with relevant client and project details. It also helps in tracking payments, reconciling accounts, and providing real-time financial insights. With this streamlined approach, you can focus more on your core work while maintaining control over your finances.

Key Benefits of Integration

- Automation: Data is automatically transferred from your financial documents into your accounting software, eliminating the need for manual input and reducing the chance of errors.

- Efficiency: With integrated systems, the process of creating and managing documents becomes much faster, allowing you to generate records with just a few clicks.

- Real-Time Updates: Your financial data is always up-to-date, giving you accurate insights into your cash flow and project status at any given moment.

- Improved Accuracy: By linking your records directly to your accounting software, you reduce the risk of discrepancies between your billing documents and financial accounts.

- Better Organization: Integration helps keep all your financial documents in one place, making it easier to manage, store, and retrieve them when needed.

How to Set Up Integration

Setting up this integration typically involves choosing an accounting software that supports customizable financial forms and linking it to your existing document management system. Many modern platforms offer easy-to-follow instructions for integration, and some even allow for direct synchronization with cloud storage solutions. Once integrated, you can customize the layout of your forms and ensure they automatically update with new data from your accounting software.

Integrating your billing records with accounting software not only saves time but also enhances the accuracy and reliability of your financial management. By automating these processes, you ensure that your records are always aligned, which allows you to focus on what matters most – providing exceptional service to your clients.

How Billing Statements Help Build Professional Relationships

Billing records are not just about collecting payments; they play a vital role in establishing trust, professionalism, and transparency between service providers and clients. By creating clear, detailed, and consistent billing documents, you communicate your professionalism and attention to detail. These documents can help foster stronger business relationships by setting expectations, ensuring clarity, and maintaining mutual respect throughout a project.

When both parties understand the financial terms and the specifics of the services rendered, it minimizes the potential for misunderstandings or disputes. This level of transparency not only promotes trust but also strengthens long-term collaborations. A well-structured document reflects your organizational skills and commitment to a seamless working relationship.

Building Trust and Transparency

- Clear Communication: Providing a detailed record of services, costs, and payment terms ensures there are no surprises for your clients, which fosters trust and reliability.

- Setting Expectations: By outlining the specifics of what’s been delivered and the agreed-upon payment schedule, you help prevent confusion and ensure everyone is on the same page.

- Professionalism: Consistently using professional-looking documents shows that you take your business seriously, which in turn encourages clients to treat the partnership with respect.

- Accountability: When clients see that you’ve taken the time to document every transaction clearly, they are more likely to view you as an accountable and responsible partner.

Fostering Long-Term Business Relationships

When clients feel confident in the way you handle financial matters, they are more likely to return for future projects or refer you to others. Clear billing documents help establish a long-term partnership by ensuring that there are no financial disputes or misunderstandings that could strain the relationship.

Additionally, offering flexible payment terms or personalized billing options can make your clients feel more valued and respected, leading to stronger connections. By using billing records as a tool for transparency and professional communication, you create a solid foundation for ongoing success in your business relationships.