Open Office Invoice Template for Easy and Professional Invoicing

Managing financial transactions effectively is a key part of running any business. One of the most essential documents for tracking payments and services rendered is a billing statement. Having a well-organized, easy-to-use format is crucial for both businesses and clients. With the right tools, you can ensure accuracy and clarity in all your billing communications.

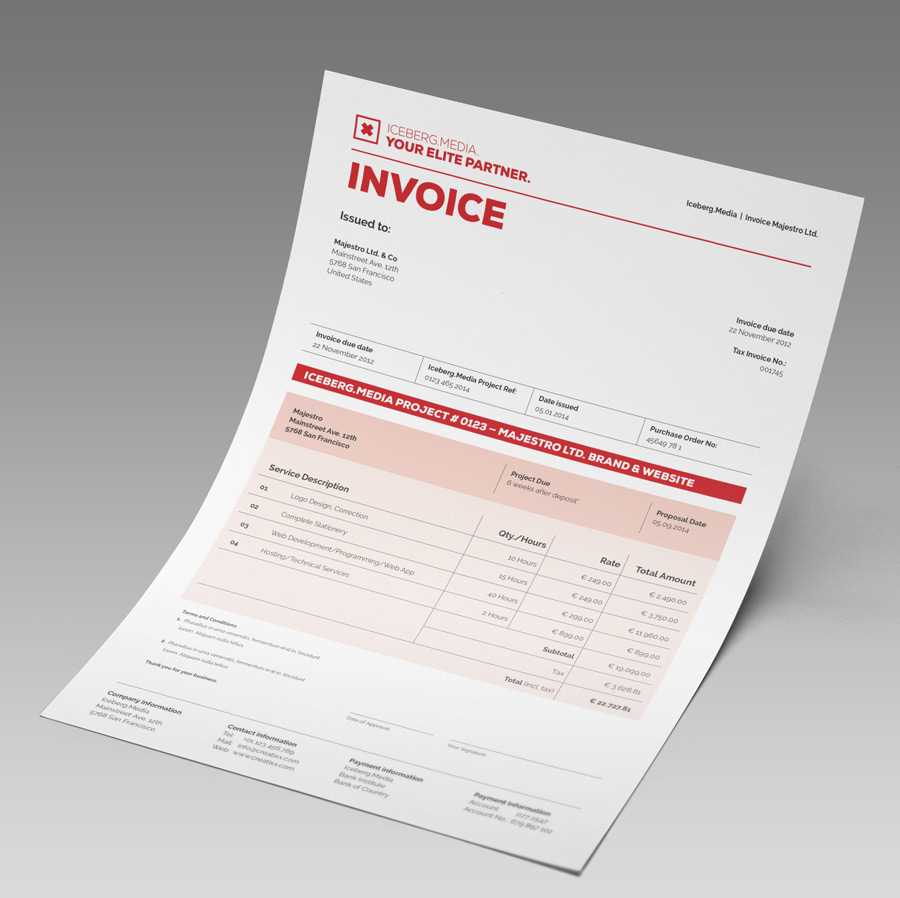

Customizable solutions are available to meet a wide variety of business needs, offering flexibility while maintaining a professional appearance. These pre-designed documents allow you to input your details and adjust layout features without needing complex software or advanced technical skills. This makes it easier for individuals and companies to maintain consistent, clear records of financial interactions.

With simple steps, you can create high-quality documents that include all the necessary information for payments, due dates, and services provided. Whether you’re a freelancer or a large organization, adopting a digital format can save time and reduce errors while keeping your records organized and accessible.

Billing Document Creation Guide

Creating a professional billing statement doesn’t have to be complex. With the right tools, you can design a clear, organized document that meets all your business needs. This section will guide you through the process of creating customized financial records that are both functional and visually appealing.

To start, it’s important to understand the key elements that should be included in any billing record. These typically include your business information, payment terms, itemized services or products, and total amount due. The structure should be simple yet comprehensive, ensuring that both you and your clients can easily understand the document’s contents.

Step-by-step guides are available to help you configure your document from scratch or customize an existing design. Using a customizable system, you can adjust fields, text sizes, and layouts to suit your preferences. This allows for a seamless experience in creating high-quality billing statements without the need for specialized knowledge or software.

By following a few simple steps, you’ll be able to produce clean, accurate documents ready for use. This process saves time and reduces errors, enabling your business to maintain a professional and efficient billing system.

Why Use a Free Office Suite for Billing

Choosing the right software for creating professional billing records can make a significant difference in the efficiency of your business. A free office suite provides an excellent alternative to expensive software, offering flexibility, ease of use, and various customization options. Here are some reasons why this tool is a great choice for managing your financial documents:

- Cost-effective solution: It’s free to use, making it ideal for small businesses, freelancers, or anyone looking to save on software costs without compromising on functionality.

- Customization options: You can tailor your billing documents to match your business’s branding, adjusting layouts, fonts, and content fields easily.

- User-friendly interface: With a simple interface, it’s easy to create, edit, and manage your records, even for those with little to no technical expertise.

- Compatibility: Documents created with this software are compatible with multiple formats, including PDF, making it easy to share and store your records securely.

- Comprehensive functionality: It includes all the essential features you need for financial record-keeping, such as automatic calculations and the ability to track multiple entries.

These features combined with the software’s accessibility make it an excellent option for creating detailed, professional-looking documents without the need for specialized programs or skills.

Benefits of Customizable Billing Formats

Having the ability to customize your billing documents provides significant advantages for businesses of all sizes. Customization allows for more personalized communication with clients, ensuring that your documents not only reflect your brand but also meet your specific needs. This flexibility enhances both professionalism and efficiency in managing transactions.

Enhanced Professional Appearance

By tailoring the layout, design, and content, you can create documents that align with your brand identity. This level of customization helps maintain a cohesive and polished look across all business correspondence. A well-designed billing statement communicates reliability and attention to detail, which can positively impact your reputation with clients.

Time-Saving and Efficient Management

With adjustable fields and reusable layouts, customizable formats allow you to generate multiple records quickly without needing to create a new document from scratch each time. This efficiency is particularly beneficial for businesses that handle large volumes of transactions, as it minimizes the time spent on repetitive tasks and reduces errors.

Increased Flexibility is another key benefit. Customizable formats let you adapt your documents to different industries, services, or product offerings, ensuring that every billing statement is suited to the specific transaction it represents.

How to Download the Document Layout

Downloading a pre-designed billing format is a simple process that can save you time and effort. These ready-made layouts provide an efficient starting point for creating professional records without the need for advanced design skills. Here’s how you can easily download and start using these customizable documents.

First, search for a reliable source that offers free or paid versions of billing formats. Once you’ve found the document that suits your needs, make sure to check if it is compatible with your software. Most formats are available in universal file types such as .odt or .pdf, making them easy to access and edit. Simply click the download link to save the file to your device.

After downloading, you can open the document in your preferred program and begin customizing it with your business details. Modify the text, adjust the layout, and add any additional fields you require for your specific needs.

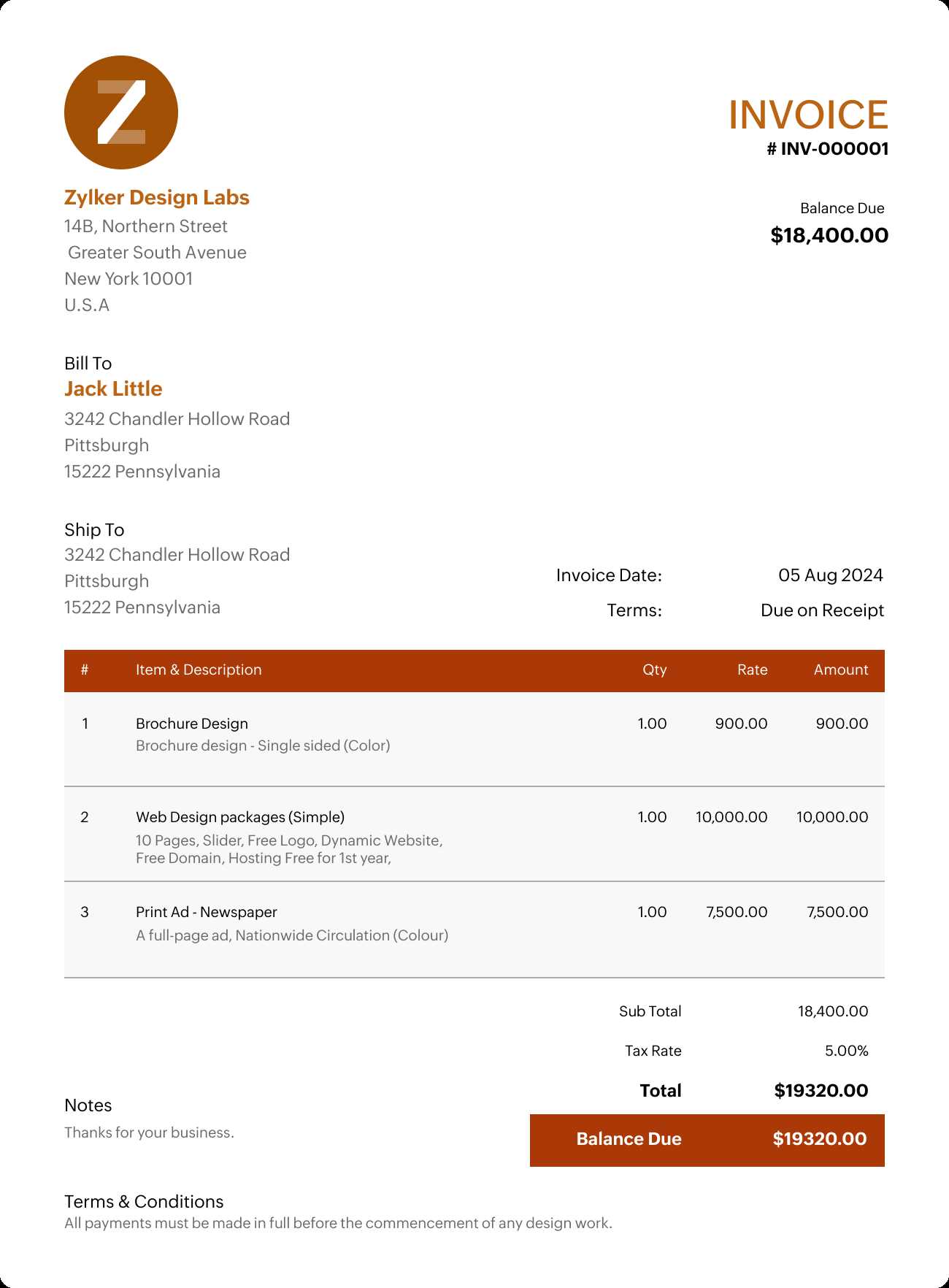

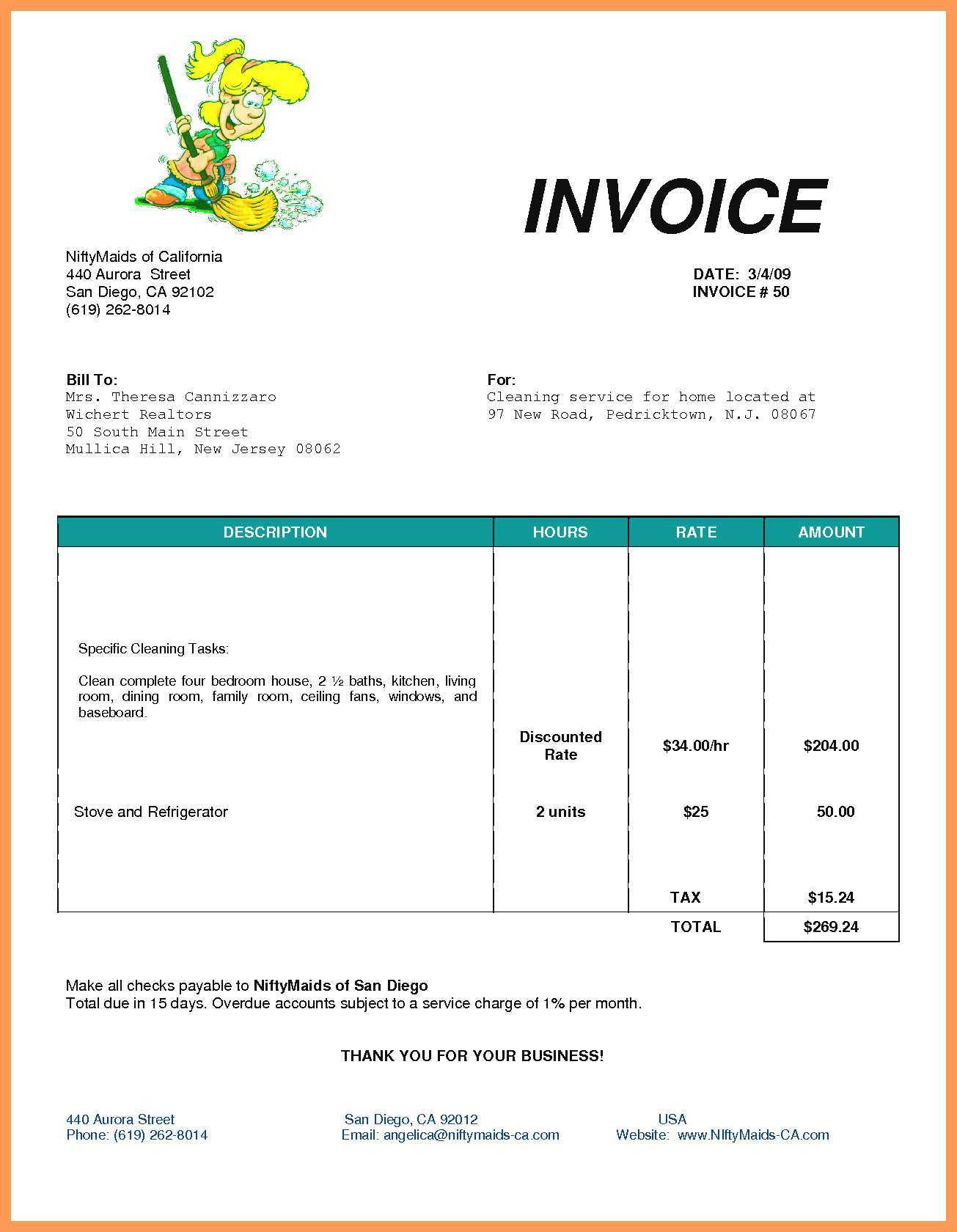

Basic Features of the Billing Document

When using a pre-designed billing document, several essential features should be included to ensure the document meets business requirements and provides clear communication with clients. These features make the document not only functional but also professional in appearance and easy to use.

Key Components

The primary sections that should be included in any billing document are:

| Feature | Description |

|---|---|

| Business Information | Your company’s name, address, phone number, and email for easy contact. |

| Client Information | Details of the person or company being billed, including name and address. |

| Services or Products | A list of the items or services provided, including descriptions and quantities. |

| Payment Terms | Details of payment deadlines, methods, and any late fees if applicable. |

| Total Amount Due | The final amount payable, including taxes or discounts. |

Additional Features

Aside from the essential components, a good document layout also allows for customization of other details, such as adding your logo, changing fonts, and adjusting the document layout to fit different billing needs. The flexibility to tailor the format ensures the document works for a variety of businesses and transaction types.

Creating Professional Billing Documents

Designing a professional document for financial transactions requires attention to detail, consistency, and clarity. By following a few simple steps, you can create a polished and accurate document that represents your business well and ensures smooth communication with your clients. Here’s how to craft a professional billing document that meets all necessary requirements.

Key Steps to Create a Professional Document

Follow these basic steps to ensure your billing records are effective and visually appealing:

- Start with a clean layout: Choose a simple, organized layout that clearly separates each section, such as business details, client information, and payment terms.

- Use your business logo: Including your logo at the top adds a professional touch and reinforces your brand identity.

- Include detailed descriptions: Ensure that each item or service is described accurately, including quantities and prices, to avoid confusion later on.

- Clearly state payment terms: Define the payment deadline, acceptable methods, and any penalties for late payments.

- Double-check calculations: Ensure all totals, taxes, and discounts are calculated correctly to maintain accuracy.

Design Tips for a Clean Appearance

A clean, easy-to-read design enhances the user experience. Here are a few tips:

- Keep fonts consistent: Choose one or two professional fonts, and avoid cluttering the document with multiple font styles.

- Use proper spacing: Ensure there is enough space between sections to make the document easy to navigate.

- Align text and numbers: Align text to the left and numbers to the right for better readability, especially when listing prices or quantities.

By following these guidelines, you’ll be able to create clear, professional billing documents that foster trust with your clients and help ensure smooth transactions.

How to Add Your Business Details

Incorporating your business information into financial documents is an essential step to ensure your clients can easily contact you and verify the legitimacy of the transaction. Providing accurate and complete details creates a professional image and helps avoid confusion. Here’s how to properly include your business information in billing records.

Essential Information to Include

When adding your business details, make sure to include the following key pieces of information:

- Business Name: Use your full legal business name for clarity.

- Address: Include the physical address of your business or your registered office location.

- Phone Number: Provide a phone number where clients can reach you for inquiries or clarifications.

- Email Address: Include an email address for quick, direct communication.

- Website (Optional): If applicable, add your website address to provide clients with additional resources or contact forms.

Formatting Your Business Details

For a polished and organized look, format your business details consistently. Align the text to the left or center, depending on the overall document design, and ensure that the information is easily legible. Additionally, consider using bold or larger text for your business name to make it stand out.

By adding these key details to your financial documents, you ensure your clients have all the necessary information to process payments or reach out for further inquiries, making your business appear more reliable and professional.

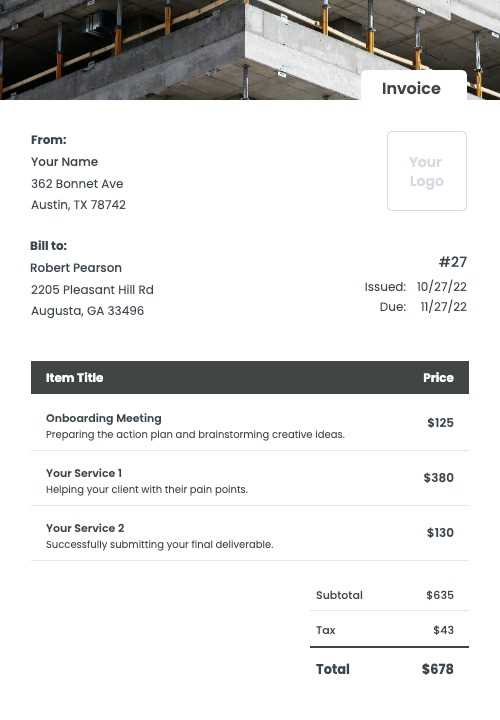

Customizing Your Billing Document Layout

Customizing the layout of your billing records allows you to create a document that best fits your business style and specific needs. A well-designed layout improves the overall readability of the document and enhances its professional appearance. Below are some tips for personalizing your document layout effectively.

Essential Layout Adjustments

Here are a few important elements you can adjust to customize the layout of your billing document:

- Header Section: Place your business name, logo, and contact information at the top of the document to ensure they are immediately visible.

- Client Information: Ensure the client’s details are clearly listed beneath the header, with fields for the name, address, and contact information.

- Itemized List: Create a clean and well-organized table for listing products or services provided. Include columns for description, quantity, unit price, and total cost.

- Total Calculation: Clearly show the subtotal, taxes, discounts (if any), and final total. This ensures transparency and helps avoid confusion.

Design and Aesthetic Choices

While the structure is important, the design also plays a key role in how professional and readable the document appears. Consider the following:

- Consistent Font Usage: Choose one or two professional fonts that are easy to read, ensuring consistency throughout the document.

- Color Scheme: If appropriate, use your brand colors to enhance the design without overwhelming the document.

- Spacing and Alignment: Ensure there is enough space between sections and that the text and numbers are aligned properly for easy readability.

By taking the time to customize the layout, you’ll create billing records that reflect your business identity and maintain a professional appearance, while also making the document easier to navigate for your clients.

Managing Document Numbers and Dates

Properly organizing and tracking the numbering and dates on your financial records is essential for maintaining order and ensuring smooth accounting. By keeping these elements consistent and clear, you not only stay compliant with business regulations but also improve the efficiency of your billing system. Here’s how to effectively manage these critical details.

Numbering Your Records

Every financial document should have a unique identification number to prevent confusion and maintain accurate records. Follow these guidelines to set up an effective numbering system:

- Start with a sequential numbering system: Begin with a unique number for the first document and increment each subsequent one to avoid duplication.

- Include a prefix or suffix: Add a custom prefix or suffix that represents your business or document type. For example, “INV-001” or “BILL-2024” can help categorize records easily.

- Avoid skipping numbers: Skipping numbers can cause confusion when tracking records. Ensure all document numbers are consecutive and properly logged.

Setting Dates

Including accurate and consistent dates on your financial documents is vital for record-keeping and payment tracking. These tips will help you set the correct dates:

- Issue Date: The issue date represents when the document is created and sent to the client. It should be placed near the top of the document for easy reference.

- Due Date: Clearly indicate the payment due date to ensure clients understand when payments should be made. This helps avoid late payments and ensures timely transactions.

- Standardize the format: Use a consistent date format throughout all documents, such as “DD/MM/YYYY” or “MM/DD/YYYY,” to maintain clarity.

By effectively managing the document numbers and dates, you create a more organized and professional billing process that is easier for both your business and your clients to follow.

How to Add Payment Terms

Including clear payment terms in your financial documents is crucial for setting expectations with your clients. These terms outline the conditions under which payment should be made, providing both you and your client with a mutual understanding of the transaction timeline and payment procedures. Here’s how to add payment terms that are easy to understand and enforceable.

Key Elements to Include

When specifying payment terms, make sure to include the following important details:

- Payment Due Date: Specify the exact date when payment is expected. For example, “Due upon receipt” or “30 days from the issue date.”

- Accepted Payment Methods: List the available methods for payment, such as bank transfer, credit card, or online payment services.

- Late Fees or Penalties: Clearly state if there will be any penalties for late payments, such as a percentage charge added for each overdue day.

- Early Payment Discounts: If applicable, include any discounts offered for early payments, such as “2% discount for payment within 10 days.”

Formatting Your Payment Terms

For clarity and professionalism, position your payment terms in a prominent place on the document, typically near the total amount section or at the bottom of the page. Use bold text or a separate section to make them stand out, ensuring that the client can easily locate and review them.

By including these terms, you establish clear expectations, reduce the chance of misunderstandings, and improve cash flow for your business.

Inserting Product and Service Information

Accurately detailing the products and services provided is essential for creating clear and professional billing documents. This section serves as a comprehensive summary of what has been delivered to the client, making it easier for both parties to verify the items and ensure transparency in the transaction. Below are the key components to include when inserting this information.

Item Descriptions: Each product or service should be described in a clear and concise manner. Include important details such as size, model, or any distinguishing features that differentiate the item or service from others. This helps avoid confusion and ensures the client understands exactly what they are being charged for.

Quantity and Unit Price: List the quantity of each item or service provided, followed by the unit price. This breakdown allows the client to easily calculate the total cost of each item or service based on their quantity. Be sure to ensure the accuracy of these figures to avoid errors in billing.

Line Total: After specifying the unit price and quantity, calculate the line total for each item or service. This will be the result of multiplying the unit price by the quantity. Clearly displaying these figures ensures clients can quickly verify the charges for each item.

Additional Information: If applicable, include any relevant details such as warranties, delivery terms, or special instructions for the product or service. Providing this information enhances the professionalism of the document and gives the client all the necessary details in one place.

By following these guidelines, you can create a detailed, organized, and professional account of the products and services provided, which helps both you and your clients keep track of transactions more easily.

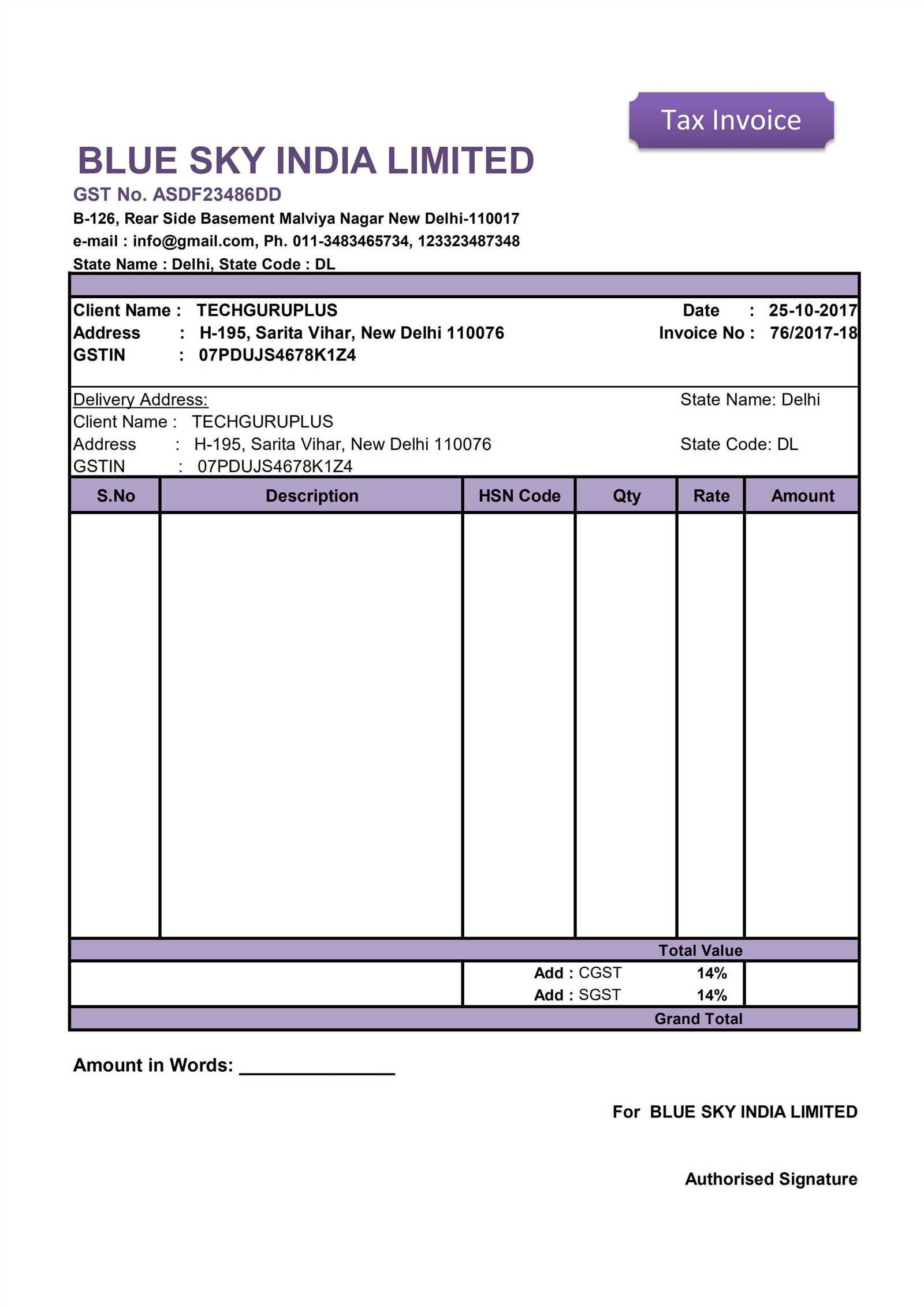

How to Include Taxes on Invoices

Accurately calculating and displaying taxes on financial documents is an essential part of professional business practices. Taxes are often required to be added to the total amount, and how you present them can impact both your compliance with local regulations and your client’s understanding of the charges. Below is a step-by-step guide on how to properly include taxes in your billing records.

Step-by-Step Process for Including Taxes

- Determine the Applicable Tax Rate: Identify the tax rate that applies to the products or services being sold. This will vary depending on your location, the type of item, or the client’s tax status. Ensure that the rate is up-to-date to remain compliant with local laws.

- Calculate the Tax Amount: Multiply the taxable amount (the total cost before tax) by the tax rate. This gives you the tax value that should be added to the subtotal.

- Display Tax Breakdown: Clearly list the tax as a separate line item on the document. This ensures that your client can easily see the amount of tax being charged. If multiple tax rates apply, list each one separately.

- Show the Total Amount: After calculating and adding the tax, include the final total. This should include both the subtotal and the tax, so that the client can see the final amount due at a glance.

Tips for Accurate Tax Inclusion

- Be Clear and Transparent: Use simple language such as “Sales Tax,” “VAT,” or the specific tax type relevant to your business. Avoid jargon that could confuse your client.

- Provide Tax Identification Number: If required, include your business’s tax identification number (TIN) or VAT number on the document. This helps ensure that your records are compliant with tax authorities.

- Check Local Tax Laws: Tax regulations vary by location, so it’s crucial to stay informed about the rates and rules applicable to your business and your customers.

Including taxes properly ensures that your financial documents are professional, transparent, and legally compliant. It also avoids misunderstandings with your clients regarding the final amount due.

Sending Invoices Directly from Open Office

Efficiently sending billing documents directly from your software can save time and streamline communication with clients. Instead of manually saving, attaching, and sending each file via email, some programs allow you to send documents directly from within the application. This feature is particularly useful for businesses that regularly generate billing statements and need a faster, more organized approach to sending them.

Steps to Send Documents Directly from the Program

- Set Up Your Email Account: Before you can send documents, ensure your email account is properly set up within the program. This typically involves adding your email address and configuring the SMTP server settings for your email provider.

- Complete the Document: Finalize the billing document you wish to send, ensuring all necessary details are included and accurate. Double-check the amounts, client information, and any other important fields.

- Select the Send Option: Once your document is ready, select the option to send it via email. Most programs will have a “Send” or “Email” option in the file menu or under the “File” tab.

- Choose the Recipient: Input the recipient’s email address. If this is a recurring client, the address may already be saved in the system, or you can manually type it in.

- Attach Files: If necessary, you can attach additional documents along with the main billing file. This could include receipts, terms, or any supplementary information that your client might need.

- Review and Send: Double-check the details one last time before clicking “Send.” Once confirmed, your document will be sent directly to the client’s inbox, providing a quick and professional way to communicate billing details.

Benefits of Sending Documents Directly from the Program

- Increased Efficiency: Sending documents directly saves the time of switching between programs and eliminates the need to save files manually before sending them.

- Reduced Errors: Since the document is sent directly from the software, there is less risk of forgetting attachments or misplacing files.

- Professional Appearance: Sending documents directly from your billing software can create a more seamless and professional experience for your clients.

- Instant Confirmation: You’ll receive immediate confirmation that the document has been sent, which can be helpful for keeping track of your communications.

By utilizing the built-in email features of your software, you can simplify the process of sending billing documents, ensuring a smooth and professional workflow that benefits both you and your clients.

Saving and Exporting Your Invoice

Once you’ve completed creating your billing document, it is important to save and export it in a format that is both secure and easily accessible for future use. This ensures that you can share the document with clients or store it in your records for reference. Various formats allow for easy distribution, and understanding how to save and export the document correctly can streamline your workflow.

How to Save Your Billing Document

- Choose a File Name: Before saving, ensure that the file name clearly reflects the contents of the document, such as the client’s name or a specific project identifier.

- Select the Location: Choose the folder where you want to store the document for easy access. Consider organizing your files into specific folders for better file management.

- Save in Native Format: It’s always a good idea to save the document in the program’s native format first, so you can make future edits if necessary. This ensures that the document is not permanently altered and retains its original structure.

How to Export Your Billing Document

- Choose Export Options: Once your document is saved, select the export option to convert it into a universally accepted format like PDF. PDFs are widely used and are less likely to be altered by recipients.

- Set Export Preferences: If exporting to PDF or another format, check the preferences to ensure that the quality, layout, and security settings (such as password protection) meet your needs.

- Export and Confirm: After selecting the export settings, confirm the action. Once exported, review the document to ensure it appears as intended before sharing with clients.

By saving and exporting your documents in the right formats, you not only keep your records organized but also ensure that your billing statements are presented professionally and securely to your clients.

Tips for Designing Clear Invoices

A well-designed billing document is essential for maintaining professionalism and clarity. When clients receive a clear and easy-to-understand statement, it reduces confusion and ensures timely payments. The layout, structure, and content play a crucial role in delivering an efficient and effective document. Here are some key tips to create a billing document that communicates all necessary details without overwhelming the reader.

1. Keep the Layout Simple

Minimize clutter and focus on a clean, organized design. A simple layout with clearly defined sections makes it easier for clients to find important information. Use adequate spacing between sections such as contact details, payment terms, and product/service descriptions. A well-spaced document promotes readability and reduces the chance of mistakes.

2. Use Clear Fonts and Hierarchy

- Readable Fonts: Choose a font that is easy to read, even in smaller sizes. Avoid using overly decorative fonts, as they can make the document hard to decipher.

- Font Size Hierarchy: Use varying font sizes to establish a clear visual hierarchy. For example, make the header text larger to distinguish it from the details and use bold for headings like “Total Amount” to make them stand out.

- Consistent Formatting: Ensure consistency in font styles and sizes throughout the document. This consistency enhances readability and presents a professional appearance.

By focusing on these key design aspects, you can create a billing document that is both functional and professional, ensuring a smooth communication process with your clients.

Ensuring Accuracy in Invoice Details

Accurate details in a billing document are crucial for maintaining professionalism and avoiding misunderstandings. When all the information is correct, both the service provider and the client are on the same page, ensuring smooth transactions. Focusing on accuracy reduces the risk of errors, disputes, and delays in payment. Below are some key points to ensure that your details are precise and well-presented.

1. Verify Client Information

Always double-check the client’s contact information, including their name, address, and email. Mistakes in this section can lead to delays or confusion. If possible, confirm the details with the client before finalizing the document.

2. Double-Check Pricing and Quantities

Review the pricing and quantities of each product or service provided. Ensure that the unit prices and totals are calculated correctly. Any discrepancy in this section can affect the overall amount due and create trust issues with clients.

3. Include Accurate Dates

- Issue Date: Make sure the issue date is correctly recorded to reflect when the document was created.

- Due Date: The due date should be clear and accurate, giving the client a specific timeframe for payment.

By paying attention to these details, you help foster transparent, error-free transactions and enhance your business’s reputation.

How to Print and Share Invoices

Once you’ve created a billing document, sharing it with clients in a professional and timely manner is essential. Whether you’re delivering it in paper form or electronically, the process should be seamless. Printing and sharing can be done in just a few steps, ensuring that the client receives the information they need without delay. Below are practical methods to efficiently distribute your completed documents.

1. Printing the Document

For clients who prefer physical copies, printing is a straightforward option. Here’s how to do it:

- Check Formatting: Before printing, review the layout to ensure that all text is clearly visible and aligned properly on the page.

- Choose Printer Settings: Select the appropriate paper size (typically A4) and ensure your printer is set to high-quality print for the best results.

- Preview Before Printing: Always use the “Print Preview” feature to check how the document will appear once printed.

2. Sharing Electronically

Many clients prefer receiving documents via email or other digital channels. Here’s how to share your document electronically:

- Save as PDF: Convert the document into a PDF format for easy sharing. This ensures that the layout remains consistent across different devices and operating systems.

- Email the File: Attach the PDF file to an email with a polite message indicating the purpose of the document and any relevant deadlines.

- Cloud Storage: Alternatively, you can upload the document to a cloud service like Google Drive or Dropbox and share the link with your client.

By using these methods, you can efficiently distribute your billing documents to clients in a professional manner that suits both their preferences and your business needs.

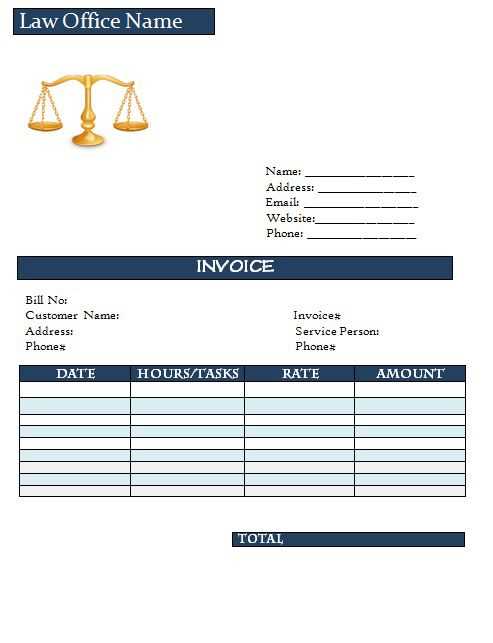

Using Templates for Different Businesses

Different types of businesses require distinct formats for their billing documents to cater to their specific needs. Whether you run a small consultancy, a retail shop, or a service-based company, having a well-organized document format can streamline transactions and improve communication with clients. By customizing standard layouts, businesses can present a professional image while ensuring that all essential information is included for easy understanding and processing.

For instance, service-based companies might require detailed descriptions of services rendered, including hourly rates and work performed, while retail businesses could benefit from more straightforward documents that focus on product descriptions and quantities. Freelancers may prefer to highlight payment terms and deadlines more clearly, while large corporations may need to include tax information and payment instructions in specific formats.

Regardless of the industry, utilizing a flexible document structure can save time, reduce errors, and enhance the customer experience. Businesses can select from various designs and adapt them to reflect their branding, making sure that they meet the unique requirements of their specific field while maintaining clarity and professionalism.