Download Free Excel Invoice Template for Easy Billing

Managing financial transactions can be a time-consuming task, but with the right tools, it becomes a lot easier to stay organized and professional. Using structured documents to track payments, issue receipts, and calculate totals is essential for smooth business operations. A well-designed document can save you time and reduce errors, allowing you to focus on what matters most–growing your business.

Spreadsheets offer an ideal solution for businesses of all sizes. With customizable features, you can tailor these documents to fit your needs, whether you’re working with individual clients or managing a large number of transactions. By creating a structured format, it becomes simpler to include all the necessary details such as amounts, dates, and client information.

For those who prefer a quick and easy setup, there are numerous options available to help you get started without the need for complex software or additional costs. These solutions can be downloaded and adjusted to your specific requirements, offering a streamlined approach to financial management that anyone can use with ease.

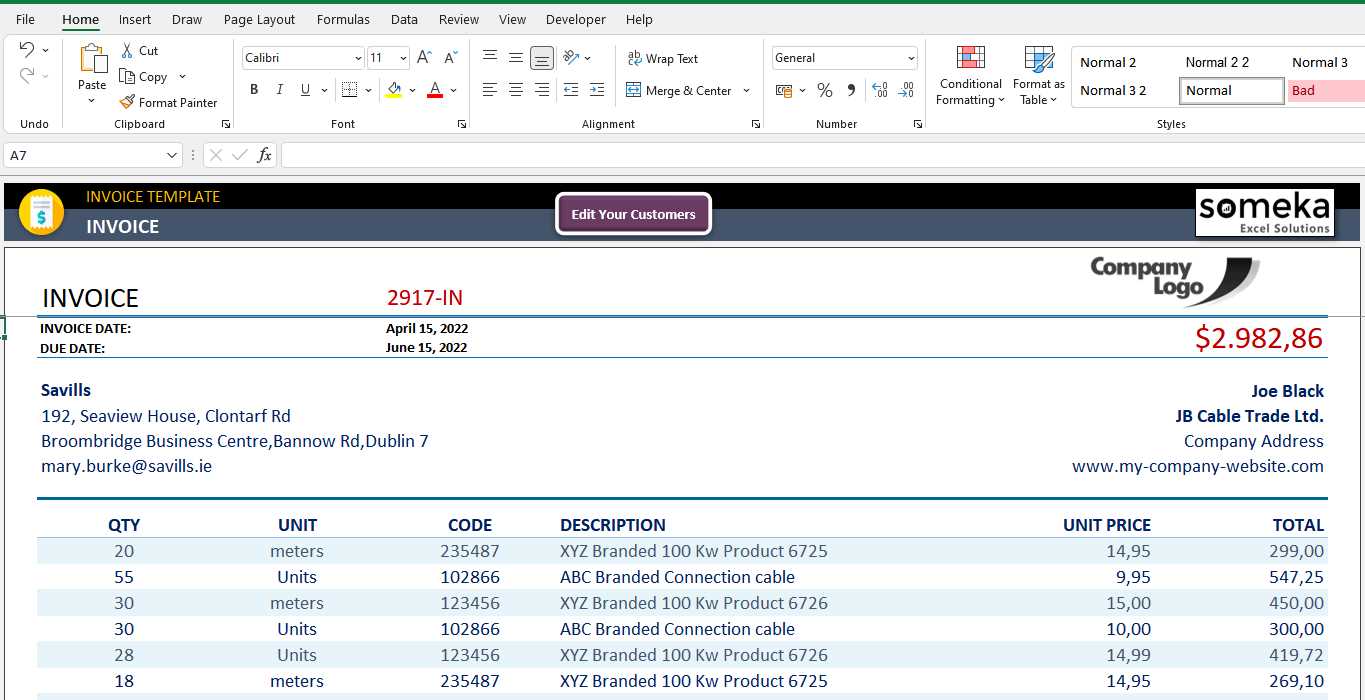

Why Use an Excel Invoice Template

Using an organized document for managing financial transactions offers significant advantages in terms of accuracy and efficiency. The ability to quickly input data, calculate totals, and keep track of payments simplifies the entire billing process. A well-structured system minimizes human error and ensures all necessary information is included, providing both you and your clients with clear records.

Spreadsheets are an excellent choice for this task due to their versatility and ease of use. They allow you to create a professional-looking record without requiring advanced software or specialized skills. With a few simple formulas and basic formatting, you can customize the structure to suit your unique needs and ensure consistency across all documents.

Another key benefit is the ability to quickly adjust or update the document. Whether you need to modify client information, change pricing details, or add additional fields, the flexibility of a spreadsheet allows you to make changes on the fly. This reduces the time spent on administrative tasks and lets you focus more on your business operations.

Benefits of Free Invoice Templates

Utilizing a pre-designed document for billing purposes offers numerous advantages, especially for small business owners and freelancers. These ready-made solutions help streamline the entire process, making it easier to create accurate and professional records without needing to start from scratch. With minimal effort, you can produce clean and organized financial statements that reflect your business’s professionalism.

One of the main benefits is the time-saving factor. By using a pre-structured format, you eliminate the need to manually design each detail, allowing you to focus on the core aspects of your business. It also ensures consistency across all your financial documents, creating a cohesive look that clients will recognize and trust.

Additionally, these ready-to-use documents are often designed with key calculations built in, reducing the likelihood of errors. With preset formulas for taxes, totals, and discounts, you can be confident that your calculations are accurate every time. This accuracy not only helps maintain smooth operations but also builds trust with clients who expect clear and precise billing information.

How to Create an Invoice in Excel

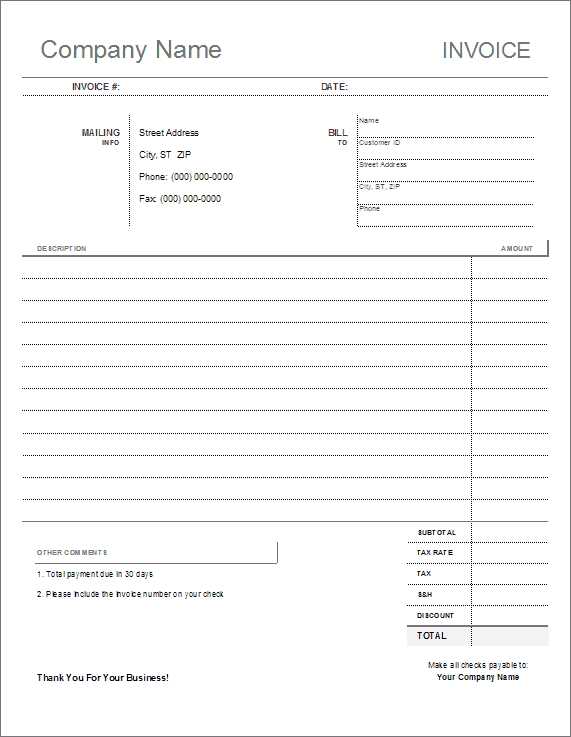

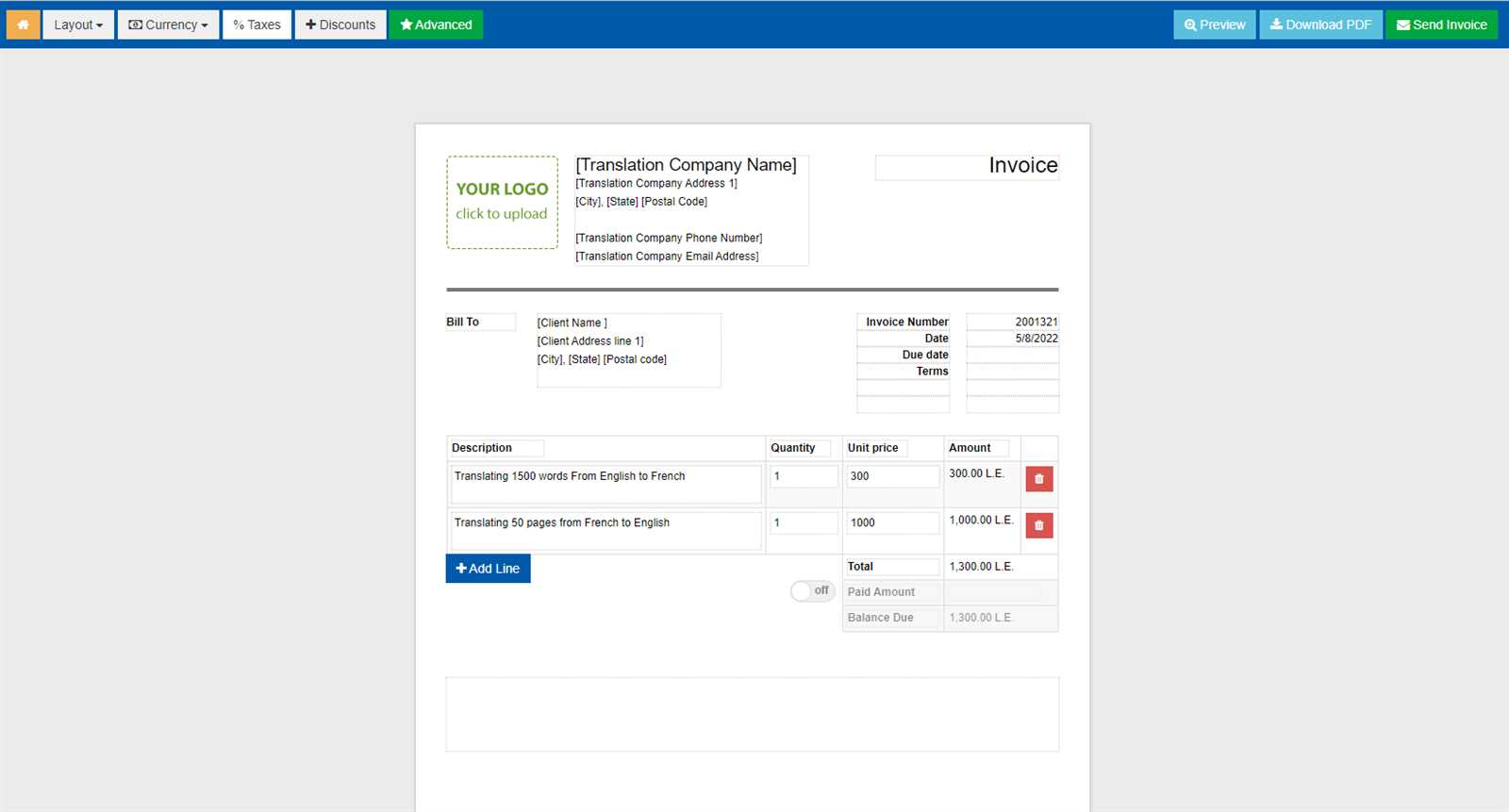

Creating a billing document using a spreadsheet program is a straightforward process that offers flexibility and precision. By following a few simple steps, you can quickly generate a clear and professional document to send to your clients. The following guide will walk you through the key elements of creating a custom record to track payments and services provided.

Step-by-Step Guide

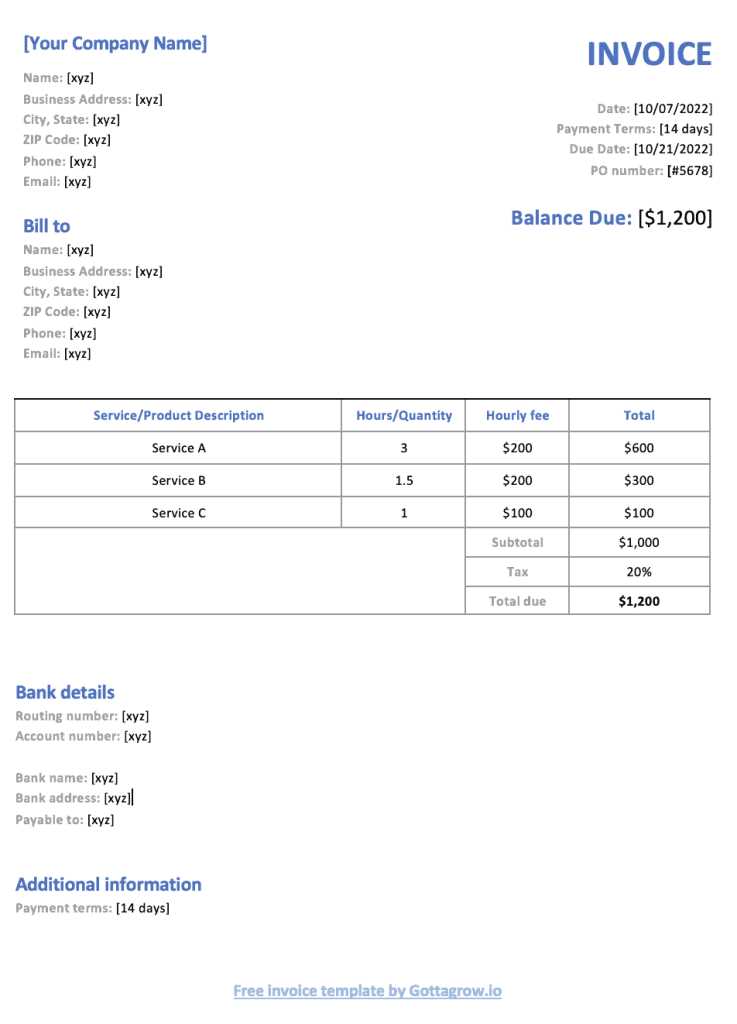

- Set up the header: Include your business name, contact details, and the document title.

- Client information: Add the client’s name, address, and contact info to ensure proper identification.

- List of services or products: Detail each item or service provided along with corresponding prices and quantities.

- Calculate totals: Use basic formulas to calculate the subtotal, taxes, and any discounts applied.

- Payment terms: Clearly state the due date and payment instructions.

- Finalize the document: Ensure everything is formatted correctly and check for accuracy before saving or sending.

Additional Tips

- Use bold fonts and clear borders to separate sections and enhance readability.

- Save the document in a standard format such as PDF for easy sharing with clients.

- Customize the layout as needed, including adding your logo or specific payment terms.

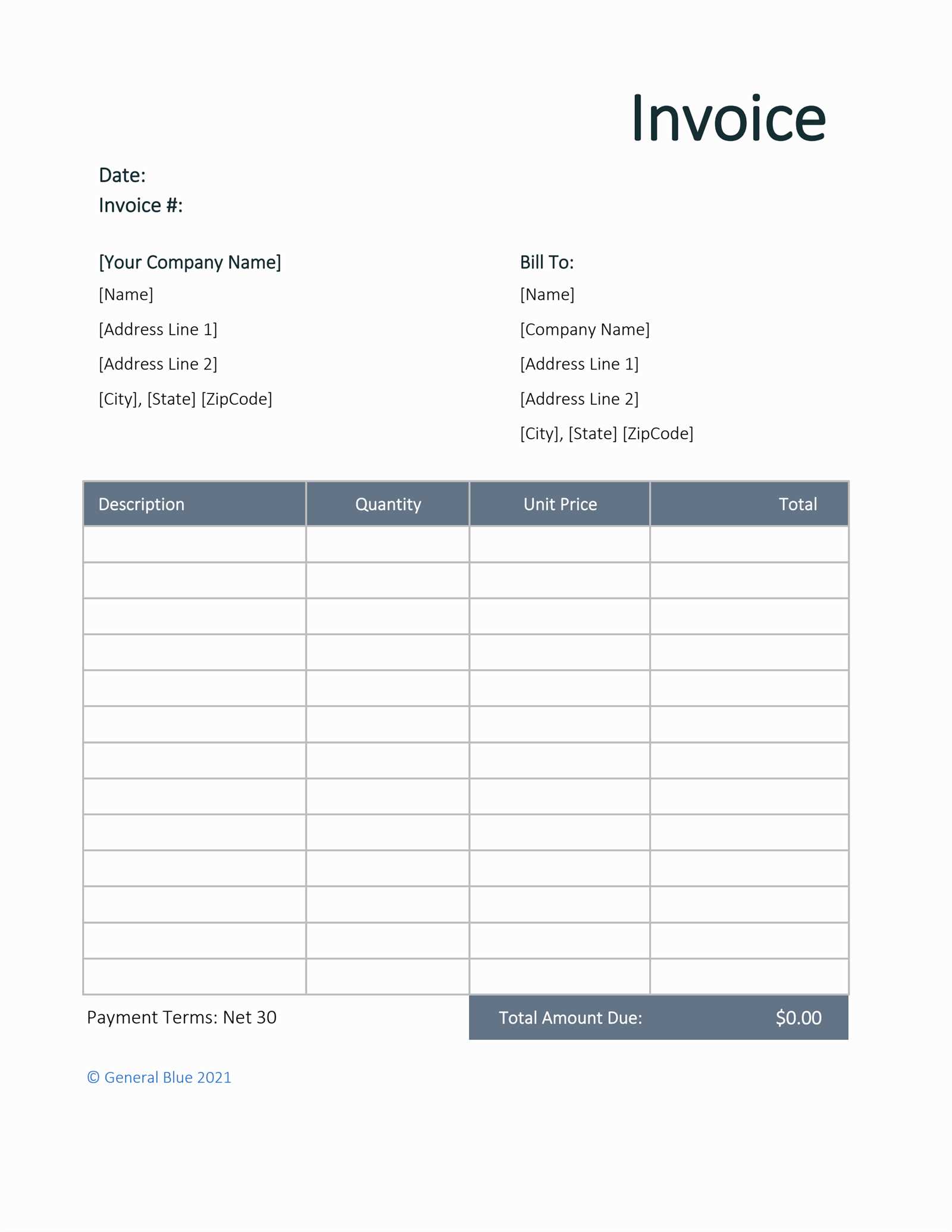

Customizing Your Invoice Template

Tailoring your billing document to suit your specific needs can greatly enhance its effectiveness and ensure that it aligns with your brand. Customization allows you to modify both the layout and content, making it easier to present accurate details in a professional manner. By adjusting certain elements, you can create a document that not only fits your business but also meets your clients’ expectations.

Modify headers and footers: You can start by adjusting the top section, where your company name, logo, and contact details appear. This area should clearly represent your business, making a strong first impression. Similarly, you can add additional contact or payment information in the footer for easy reference.

Adjust item descriptions and quantities: Depending on the products or services you offer, you can tailor the fields to provide more specific details. For example, instead of a generic “item description,” you might include fields for hours worked, project milestones, or other pertinent data. This customization ensures clients receive the most relevant information.

Incorporate personalized payment terms: Different businesses have different payment policies. Whether you offer discounts for early payments or charge late fees, ensure your document reflects these terms clearly. You can add customized sections for payment methods, due dates, or other specific conditions related to your transactions.

By personalizing the layout and content, you create a document that speaks to your unique business practices, making your communication clearer and more professional.

Top Features of Excel Invoice Templates

When it comes to managing your billing, certain features can make a significant difference in how efficiently and accurately you handle payments. The right tool can streamline the process, reducing the chance of errors and saving you valuable time. Below are some of the standout elements that make using a well-designed document particularly useful for your business.

Key Functionalities

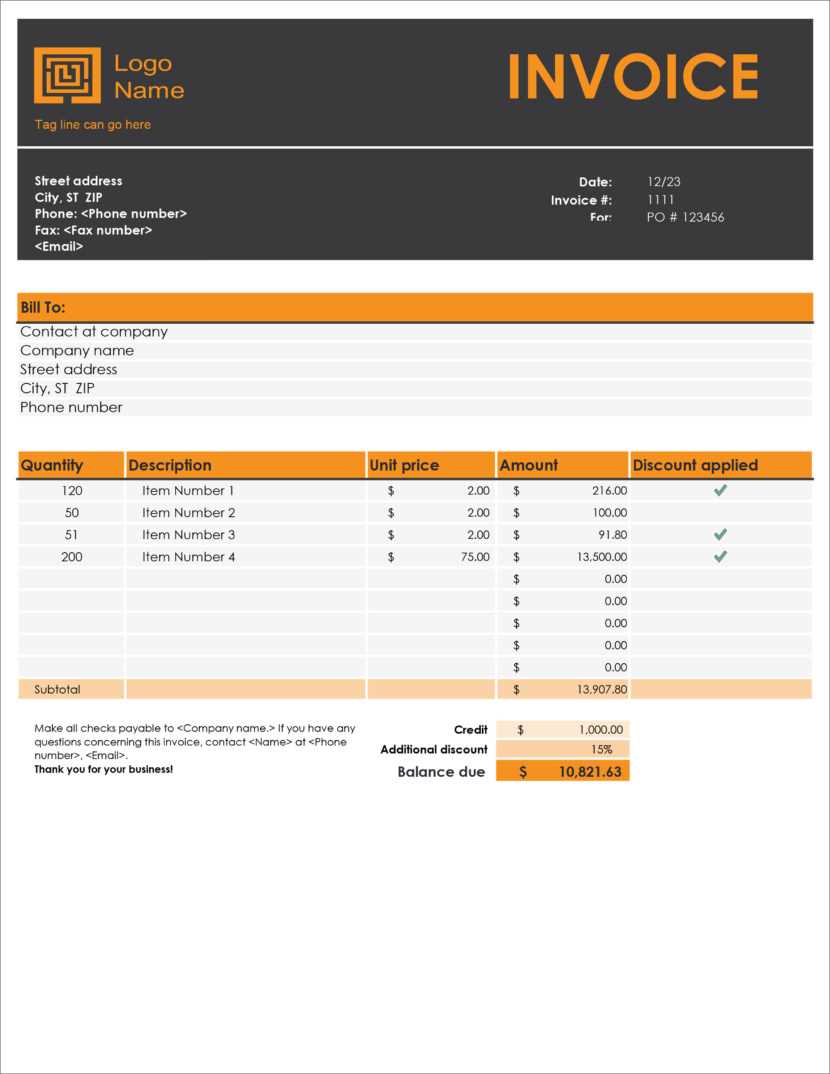

- Automatic Calculations: Built-in formulas help you calculate totals, taxes, and discounts without manual effort.

- Customizable Layouts: Easily adjust sections to match your specific needs, from item descriptions to payment terms.

- Client Tracking: Efficiently manage multiple clients and track payment history using organized fields and columns.

- Professional Design: Clean and structured formatting ensures a professional appearance, enhancing your business credibility.

- Easy-to-Use Interface: No advanced software knowledge required, making it accessible for everyone from freelancers to small business owners.

Example Layout

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Service | 1 | $500 | $500 |

| Hosting Service (6 months) | 1 | $100 | $100 |

| Total | $600 |

These features not only enhance the functionality of your billing but also improve the overall client experience, making transactions smoother and more transparent.

Choosing the Right Template for Your Business

Selecting the appropriate document layout for your financial transactions is essential to ensure clarity, professionalism, and efficiency. The right design can help you present accurate data, manage client relationships, and streamline your billing process. With various options available, it’s important to choose one that aligns with the specific needs of your business, whether you are a freelancer, small business owner, or large enterprise.

When choosing a layout, consider factors such as the complexity of your services, the number of items or transactions you handle, and your client’s expectations. You may require a simple design for basic services or a more detailed layout if your offerings involve multiple products, discounts, or payment terms.

Factors to Consider

- Business Type: Different industries may require different formats. For example, a consulting business may need to break down hourly rates, while a product-based business will need a more detailed itemized list.

- Transaction Complexity: If you often deal with multiple items, taxes, or discounts, choose a layout that accommodates these complexities while maintaining simplicity.

- Branding: Customizing the layout to reflect your company’s logo, colors, and design aesthetic can help enhance your professional image and consistency across client communications.

Example Layouts for Different Needs

| Business Type | Recommended Layout Features |

|---|---|

| Freelancers | Simple format with hourly rate, total hours, and payment terms |

| Product-Based Business | Itemized list, quantities, prices, and subtotal calculations |

| Service Providers | Breakdown of services, rates, and discounts or additional charges |

By selecting the right format, you can create a streamlined and professional billing experience for both you and your clients, ensuring clear communication and timely payments.

How to Track Payments with Excel

Monitoring and recording payments is a crucial aspect of managing your business’s financial health. A well-organized system for tracking what clients owe and what has been paid helps prevent errors and ensures that you stay on top of your cash flow. By using a simple spreadsheet, you can efficiently track outstanding balances, payment dates, and other important financial details.

Steps to Set Up a Payment Tracking System

- Create a New Spreadsheet: Start by setting up a new document with clearly labeled columns for essential information such as client name, amount due, payment date, and status (paid or unpaid).

- Record Payment Details: As payments come in, update the relevant fields with the payment date, amount, and method of payment (e.g., bank transfer, credit card, cash).

- Track Outstanding Balances: For each client or transaction, calculate the remaining balance by subtracting paid amounts from the total amount due.

- Use Conditional Formatting: Highlight overdue payments or unpaid balances using color codes or alerts, making it easy to identify clients who need follow-up.

Additional Tips for Managing Payments

- Include columns for payment terms and due dates to remind clients of upcoming deadlines.

- Set up automatic calculations to keep track of totals and outstanding amounts without manual intervention.

- Regularly update the spreadsheet to ensure it remains accurate and reflects any changes or new payments received.

With this system in place, you can efficiently manage your accounts receivable, reducing the risk of missed payments and maintaining a steady cash flow for your business.

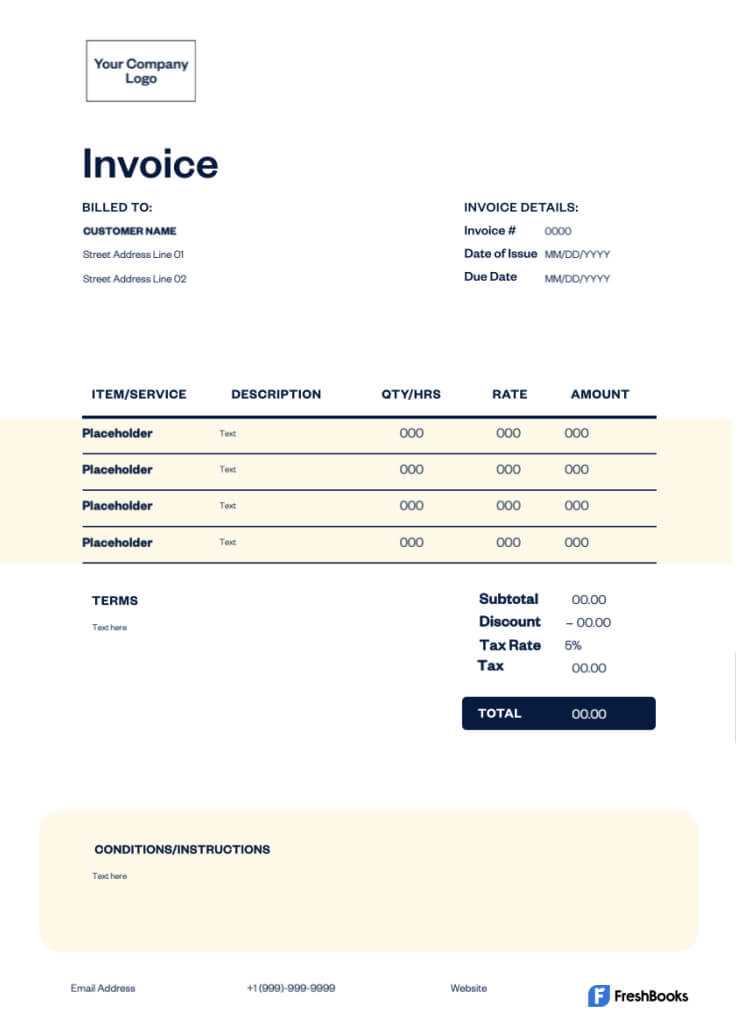

Free vs Paid Invoice Templates

When it comes to choosing the right document layout for managing transactions, businesses have two main options: free solutions and premium, paid options. Both offer distinct advantages and disadvantages depending on the needs of your business. Understanding the differences between these options can help you decide which one is best suited for your financial processes and long-term goals.

Advantages of Free Options

- Cost-effective: No upfront cost, making it ideal for startups or small businesses with a limited budget.

- Easy to Use: Many free solutions are straightforward, requiring minimal setup and customization.

- Availability: Numerous free layouts are available online, so you can quickly find one that fits your basic needs.

- Customizable: Though basic, free formats often allow for some degree of personalization to meet your specific needs.

Advantages of Paid Options

- Advanced Features: Paid layouts often include advanced functionalities such as automatic tax calculation, multi-currency support, or integration with accounting software.

- Professional Design: Premium options often come with more polished, professionally designed layouts that enhance your brand’s image.

- Customer Support: Paid options typically offer customer service, providing assistance with any issues or customization requirements.

- Greater Customization: These options often offer more flexibility in design, fields, and features, allowing you to tailor the layout more precisely to your business needs.

While free solutions are suitable for simple billing tasks, paid options are more robust and scalable, making them a better choice for businesses with complex needs or a growing client base.

How to Add Tax to Your Invoice

Including tax in your billing documents is essential for accurate record-keeping and ensuring compliance with local regulations. Adding taxes not only ensures you charge clients the correct amount, but it also helps avoid errors when managing finances. In most cases, taxes are calculated as a percentage of the total amount due, and it’s important to apply the correct rate for your location and industry.

Determine the Tax Rate: Before adding tax to your financial records, you need to know the applicable tax rate. This can vary depending on your country, state, or region. Businesses may also have to apply different rates depending on the product or service provided. Ensure that you research the correct rate to apply in order to stay compliant with tax laws.

Calculate the Tax Amount: Once you have the tax rate, you can calculate the tax on each item or the overall total. To calculate the tax, simply multiply the cost by the tax rate percentage. For example, if an item costs $100 and the tax rate is 10%, the tax would be $10.

Add the Tax to Your Total: After calculating the tax, add it to the subtotal of the products or services. This new amount will be your total due, including the tax. If applicable, make sure to list the tax amount separately for clarity, so your clients can easily see how much they are being charged in taxes.

For accurate billing, ensure the tax is clearly displayed and calculated correctly. Additionally, provide details about the tax rate and applicable jurisdiction, especially if different rates apply to different products or services. This transparency helps foster trust and avoids confusion for your clients.

How to Add Discounts in Excel Invoices

Offering discounts to your clients can be a great way to incentivize early payments, encourage larger purchases, or build long-term relationships. However, it’s important to apply discounts correctly to ensure the accuracy of your billing documents. By using a simple calculation within your records, you can easily reduce the total amount due and clearly show the discount applied.

Steps to Add a Discount

- Determine the Discount Type: Decide whether you want to apply a fixed amount or a percentage discount. A fixed discount could be a specific dollar amount, while a percentage discount is based on the total cost.

- Calculate the Discount: For a percentage discount, multiply the total amount by the discount rate. For example, a 10% discount on a $200 subtotal would result in a $20 discount. For a fixed discount, simply subtract the set amount from the total.

- Adjust the Total: Once the discount is calculated, subtract it from the subtotal to arrive at the final amount due. This amount should be clearly displayed in your billing document to avoid confusion.

Example Calculation

- Subtotal: $500

- Discount Rate: 15%

- Discount Amount: $75

- Final Amount Due: $425

Including a discount in your records not only reduces the amount due for the client, but also strengthens your business relationships. Always ensure that the discount is clearly stated, and be sure to include the reason for the discount, such as early payment or a promotional offer, to keep the billing transparent and professional.

Setting Up Automatic Invoice Numbering

Automatic numbering of your billing documents helps maintain a consistent and organized record-keeping system. By using sequential numbers for each document, you ensure that each transaction is uniquely identifiable and easily traceable. This practice not only simplifies your workflow but also helps with compliance, especially when you need to refer back to specific records or track payment histories.

Steps to Set Up Automatic Numbering

- Choose a Starting Number: Decide on the first number in your sequence. Most businesses start at 1 or use a higher number if they’ve been in operation for some time.

- Set a Sequential Format: Choose a numbering format that works for your business. For example, you might want to include the year, month, or client name in the number sequence for easier identification.

- Use a Formula: In a spreadsheet, you can use an automatic numbering formula that increments by 1 with each new document. This ensures no duplicate numbers and reduces the risk of human error.

- Ensure Consistency: Check that all numbers are applied consistently across your records to prevent any confusion or overlap between transactions.

Example of Automatic Numbering Setup

| Document Number | Client | Date | Amount |

|---|---|---|---|

| INV-2024-001 | Client A | 01/10/2024 | $200 |

| INV-2024-002 | Client B | 03/10/2024 | $350 |

| INV-2024-003 | Client C | 05/10/2024 | $150 |

Setting up automatic numbering will help your business stay organized and ensure you never miss a transaction. Whether you’re a freelancer or a larger company, a clear, consistent numbering system improves efficiency and helps you stay on top of your finances.

How to Format Excel Invoice for Professional Use

Formatting your billing document correctly is crucial to making a professional impression on clients. A well-organized document not only presents your business as reliable and trustworthy but also ensures that all necessary details are clearly visible. Proper formatting also makes it easier to track payments and prevent errors, saving you time and effort in the long run.

Key Elements of Professional Document Layout

- Company Information: At the top of the document, clearly display your business name, logo, contact information, and any relevant legal details. This ensures clients know exactly who the billing is from and how to contact you if needed.

- Client Details: Include your client’s name, address, and contact information so that there is no ambiguity about who the payment is for. This is essential for both record-keeping and addressing any potential issues.

- Transaction Details: Provide a detailed list of products or services provided. Be specific with descriptions, including quantities, unit prices, and total amounts. This transparency helps avoid confusion and ensures the client understands exactly what they are being charged for.

- Payment Information: Make sure to clearly outline the total amount due, applicable taxes, discounts, and any other additional charges. Include payment terms, such as due dates and methods of payment, to make the process clear and straightforward.

Additional Formatting Tips

- Consistent Font and Style: Use a professional, easy-to-read font and ensure consistency in font sizes, colors, and styles. Stick to one or two fonts for readability and avoid using excessive color.

- Alignment and Spacing: Proper alignment of text, numbers, and columns ensures that the document looks neat and organized. Leave enough spacing between sections to avoid clutter.

- Use of Borders and Lines: Simple borders around sections or totals help visually separate different areas of the document, making it easier to follow.

By formatting your documents in a clear and professional way, you not only make a great impression on your clients but also ensure smooth financial transactions. A well-designed document improves readability, reduces errors, and builds trust in your business.

Managing Multiple Clients with One Template

When you manage a growing business or freelance operation, handling multiple clients and their transactions efficiently becomes essential. Using a single document design to handle all your billing needs can save you time and effort while keeping everything organized. The key is to create a structure that allows for easy customization, so each client receives a unique record without the need for creating a new document each time.

How to Organize Client Information

- Client-Specific Sections: Use distinct rows or tabs for each client’s data. This ensures that every transaction is grouped by client, making it easy to navigate between records.

- Use Unique Identifiers: Label each section with a unique client ID or name to avoid confusion. This will also help with sorting and locating client-specific details quickly.

- Flexible Formatting: Ensure the design allows for quick modifications, such as adjusting amounts or adding discounts. Fields should be customizable to accommodate different service packages or payment terms for each client.

Efficiently Track Multiple Transactions

- Itemized Lists: For each client, maintain a list of services or products provided. This makes it easier to track what has been delivered, along with any changes in pricing or additional charges.

- Automated Calculations: Use built-in functions to automatically calculate totals, taxes, or discounts, ensuring that each entry is accurate without manual re-entry of data.

- Organize Payment Status: Track the payment status for each client–whether they’ve paid, owe money, or are under review–by adding a column or note indicating their payment history.

By managing multiple clients with one system, you reduce the time spent on repetitive tasks and enhance your business’s efficiency. A streamlined approach ensures that you never lose track of any important client data and can easily retrieve any record whenever needed.

Common Mistakes to Avoid in Invoices

Accurate and professional billing is essential for smooth business operations. Small errors in your billing documents can lead to misunderstandings, delayed payments, or even lost revenue. It’s important to carefully review your records to avoid common mistakes that could affect your cash flow or client relationships.

Frequent Mistakes in Billing

- Incorrect Client Details: Ensure that your client’s name, address, and contact information are accurate. Sending a document to the wrong person or address can delay payments and cause confusion.

- Missing Payment Terms: Always include clear payment terms, such as the due date, payment methods accepted, and any late fees that may apply. Failing to do so can result in delayed payments.

- Wrong Calculation of Totals: Errors in calculating the subtotal, tax, or total amount due can lead to overcharging or undercharging. Double-check all formulas to ensure correctness.

- Not Specifying Taxes: If applicable, make sure to list the tax rate and amount separately, with clear descriptions. Failure to itemize taxes can confuse clients and cause disputes.

- Unclear Descriptions of Services: Vague or missing descriptions of the services or products provided can lead to misunderstandings. Be specific and detailed about each item to ensure clarity.

Example of a Correct Billing Document

| Item Description | Unit Price | Quantity | Subtotal |

|---|---|---|---|

| Consulting Services – 5 hours | $100 | 5 | $500 |

| Software License Fee | $150 | 1 | $150 |

| Total Before Tax | $650 | ||

| Sales Tax (10%) | $65 | ||

| Total Due | $715 | ||

By avoiding these common mistakes, you can create more professional and accurate billing documents that help streamline your financial processes and build trust with your clients. Always take the time to check for errors before sending out any documents to ensure smooth and timely transactions.

How to Protect Your Excel Invoices

When handling sensitive financial data, it’s essential to safeguard your records to prevent unauthorized access or alterations. Protecting your billing documents ensures that your transactions remain secure and that your clients’ information is kept confidential. By taking simple yet effective steps, you can secure your files against potential risks and unauthorized changes.

Steps to Protect Your Documents

- Password Protection: Set a strong password for your files to restrict access. This ensures that only authorized individuals can view or modify your documents. Always use a combination of letters, numbers, and symbols to enhance security.

- Restrict Editing Rights: Use Excel’s built-in features to limit who can make changes to the document. You can allow only certain fields or cells to be edited, protecting the core financial data from accidental modifications.

- Encrypt Your Files: Use encryption to protect the contents of your document. This adds an extra layer of security by ensuring that even if someone gains access to your file, they cannot read its contents without the decryption key.

- Backup Your Files: Regularly back up your files to prevent data loss. Store backups in secure cloud storage or external drives to ensure that you can recover your records in case of system failures or data corruption.

Additional Security Tips

- Use Read-Only Options: If you need to send a document to a client or colleague for review, consider sending a read-only version. This prevents unauthorized changes while still allowing them to view the details.

- Regularly Update Your Passwords: Change your passwords periodically to prevent unauthorized access. This ensures that even if a password is compromised, the window for access is limited.

- Track Changes: Enable tracking of changes in your documents to monitor any modifications made. This feature allows you to review edits and restore the original version if necessary.

By following these best practices, you can protect your financial documents and maintain confidentiality, ensuring that your business runs smoothly and securely. Proper protection helps you avoid costly mistakes or data breaches that can compromise your reputation and client trust.

Where to Download Free Invoice Templates

Finding the right document format for billing is essential for streamlining your financial processes. There are many sources available where you can find customizable, ready-to-use documents that suit the needs of your business. These resources provide convenient and easy-to-use designs, allowing you to focus on providing services rather than creating documents from scratch.

Top Sources for Downloading Documents

- Online Template Libraries: Websites like Microsoft Office, Google Docs, and other online document providers offer a wide selection of ready-made formats. You can search through their libraries to find templates that fit your business style and industry.

- Specialized Business Sites: Many websites focus specifically on small business solutions. These sites often have customizable formats that you can download for free or with minimal cost. Examples include sites like Invoice Generator or Invoicely.

- Open-Source Platforms: Open-source communities often share free resources for entrepreneurs. Platforms like GitHub or similar forums may have contributions from other professionals who share documents that have worked for their businesses.

- Accounting Software Websites: Some accounting software providers offer downloadable resources to complement their tools. These can be excellent options if you’re looking for professional formats tailored to accounting needs.

Choosing the Best Format for Your Business

When selecting a document format, consider the following factors to ensure it meets your needs:

| Source | Features | Customization Options |

|---|---|---|

| Microsoft Office | Variety of styles, cross-platform use | Highly customizable with color schemes, logos |

| Google Docs | Cloud-based, easy sharing | Moderate customization, simple design |

| Invoice Generator | Simple, fast, automated | Limited customization, quick setup |

| Open-Source Platforms | Community-based, often free | Full customization, but may require editing skills |

Choosing the right source depends on your business needs, technical skills, and how much customization you require. Whether you’re just starting or looking to improve your billing processes, these resources provide a variety of options that can help you create professional, organized financi