Free Commercial Invoice Template for Your Business Needs

Running a business requires clear and organized financial paperwork. One of the most important documents for any transaction is the one that outlines the details of a sale or service rendered. These records are essential not only for maintaining transparency but also for ensuring smooth communication with clients and meeting legal requirements.

In this section, we will explore how to create well-structured billing forms that can be easily customized for your business needs. Whether you’re a freelancer, a small business owner, or part of a larger company, using an organized format simplifies both your workflow and customer interactions.

Having the right format can save you time and effort, reducing the likelihood of errors. It also provides a professional touch that can strengthen client trust. By choosing the right layout and fields, you can ensure your records are both accurate and easy to understand. With the right tools, creating these documents becomes much more efficient and accessible for anyone looking to streamline their financial transactions.

Free Billing Document Overview

Efficiently managing business transactions requires reliable documentation that can be easily tailored to specific needs. The ability to access ready-made structures for these records allows business owners and professionals to focus on the content rather than the design. These pre-made formats ensure consistency, accuracy, and speed when preparing essential paperwork.

In this section, we will provide an overview of a readily available structure that simplifies the process of creating professional records for business transactions. By utilizing such a tool, users can save time, reduce errors, and maintain a polished appearance in their documents.

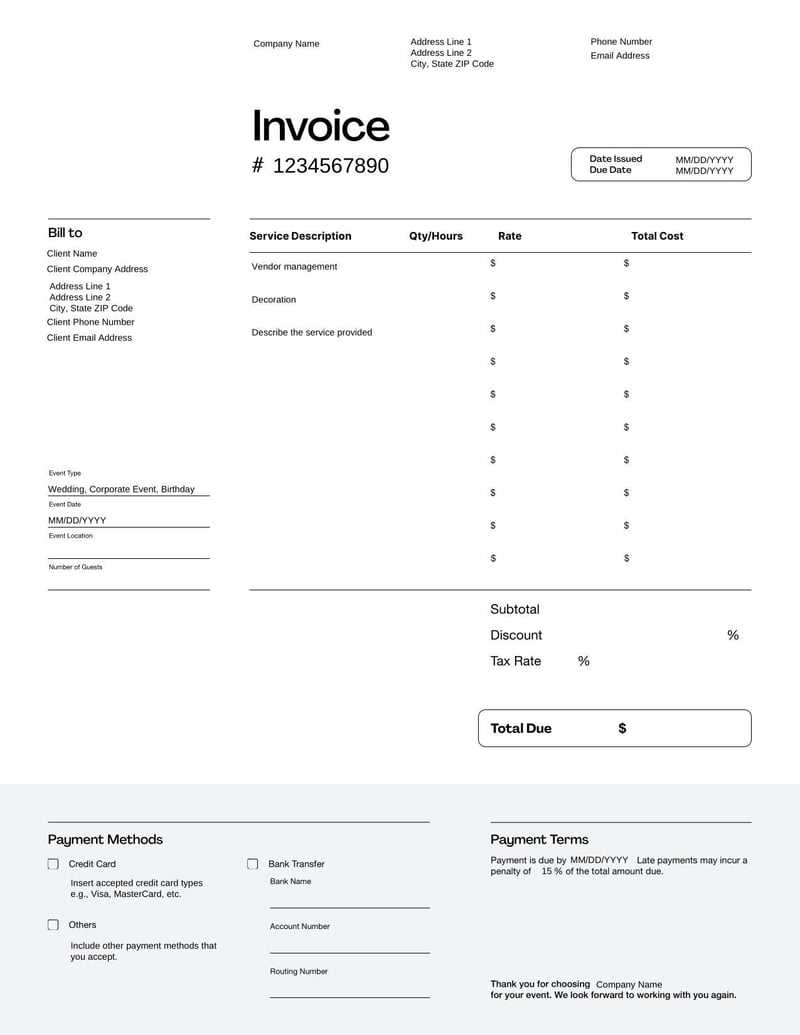

Key features of a standard billing document include:

- Clear Sections: The document should contain specific sections such as buyer and seller information, items or services, quantities, pricing, and payment terms.

- Customizability: The format should allow users to adapt various fields based on their particular business requirements.

- Ease of Use: An ideal document structure should be straightforward and simple to fill in, even for those with little experience in document preparation.

- Professional Design: A clean and organized appearance boosts the credibility of the business and enhances customer relations.

Such tools are invaluable for any business aiming to streamline its billing process, providing a quick and simple way to generate consistent, accurate, and well-organized documents for every transaction.

What is a Billing Document

A billing document is an essential record that outlines the details of a transaction between a seller and a buyer. It serves as both a request for payment and a summary of the goods or services exchanged. This document is crucial for tracking sales, ensuring accurate payments, and maintaining proper business records.

Typically, a well-organized record will include specific information that helps both parties confirm the details of the transaction and proceed with payment processing. Below is a general overview of the components commonly found in such a document:

| Section | Description |

|---|---|

| Seller Information | Includes the business name, contact details, and address of the seller. |

| Buyer Information | Includes the business or individual receiving the goods or services, along with contact details. |

| Transaction Details | A list of items or services provided, including quantities, prices, and total amounts. |

| Payment Terms | Describes the terms of payment, such as due date and accepted payment methods. |

| Dates | Includes the date the document was issued and the due date for payment. |

These documents are often required for legal and accounting purposes, ensuring businesses have an accurate record of all transactions. They also help clarify payment expectations and avoid any confusion between parties involved.

Importance of Using an Invoice Structure

Utilizing a well-organized format for billing and transaction records is essential for maintaining smooth business operations. These structured documents ensure that all necessary information is clearly presented, reducing the chances of errors and misunderstandings between the seller and buyer. By adopting a consistent layout, businesses can streamline their processes and improve efficiency when handling financial transactions.

Here are some reasons why having a predefined structure is important:

| Benefit | Explanation |

|---|---|

| Consistency | Using a set format ensures all records are presented in the same manner, making them easy to read and process. |

| Time Efficiency | Having a ready-made structure reduces the time spent on formatting, allowing more focus on the content. |

| Professional Appearance | Consistently well-structured documents help convey professionalism and reliability to clients. |

| Legal Compliance | A properly formatted document ensures that all required details are included, helping businesses meet regulatory requirements. |

| Error Reduction | By following a standard format, the likelihood of omitting crucial information or making errors decreases. |

Incorporating a consistent layout into your financial documentation process not only saves time but also contributes to smoother communication with clients and helps establish a more organized system overall.

How to Customize a Billing Document Structure

Personalizing a billing document for your business needs is a straightforward process that allows you to tailor essential fields while maintaining a professional appearance. Customizing ensures that all relevant details are included, such as company branding, specific transaction terms, and any necessary legal disclaimers. A well-adjusted document can improve clarity and ensure all required information is easily accessible.

Follow these simple steps to make the most of an editable format:

- Insert Business Information: Begin by including your company name, address, and contact details at the top. This helps establish your brand and ensures recipients know where to direct inquiries.

- Add Client Details: Enter the name, address, and contact information of the person or organization you are dealing with. Accurate client data ensures smooth communication and invoicing.

- Customize Item or Service Descriptions: Adjust the descriptions of the products or services provided to reflect your business offerings clearly. Include quantities, unit prices, and total costs.

- Set Payment Terms: Include your payment terms, such as the due date and accepted methods, to make it clear when and how payment should be made.

- Adjust Formatting: Modify the layout and font style if necessary to suit your branding. Keeping a clean and simple design improves readability.

- Save for Future Use: Once customized, save the structure as a reusable document that can be easily adapted for future transactions.

By adjusting these sections, you can create a customized billing document that matches your business needs, enhances client communication, and ensures professionalism in every transaction.

Common Fields in Billing Documents

Billing documents contain several key fields that ensure clarity and accuracy in business transactions. These fields provide both the seller and buyer with important details about the products or services exchanged, payment terms, and the involved parties. Having these fields organized and properly filled out helps avoid confusion and ensures smooth processing of the transaction.

Here are the most common fields you will find in a typical billing document:

- Seller Information: This includes the name, address, and contact details of the business providing the goods or services.

- Buyer Information: The recipient’s name, address, and contact information are essential for identifying the party receiving the products or services.

- Document Number: A unique identifier for the record, which helps both parties track the transaction for reference or future correspondence.

- Date: The date the document is issued is important for tracking payment deadlines and record-keeping purposes.

- Item or Service Description: A detailed list of the products or services provided, including quantities, unit prices, and total amounts.

- Payment Terms: Details about the payment deadline, methods, and any specific conditions related to the transaction.

- Total Amount Due: The total sum that needs to be paid for the transaction, including applicable taxes and fees.

- Shipping Information: If applicable, details about shipping methods, dates, and costs are provided for clarity.

- Notes or Additional Information: Any relevant comments or disclaimers about the transaction, such as late fees or warranties, may be included here.

These essential fields ensure that both the seller and buyer have the necessary information to proceed with the transaction smoothly, minimizing the potential for errors or misunderstandings.

Top Benefits of Free Document Formats

Using pre-made formats for business records offers a variety of advantages that help streamline operations and save time. These ready-to-use designs come with all the necessary sections and are easy to adapt to any specific business needs. Whether you’re a small business owner or managing a larger operation, these formats can improve your document processing, making tasks quicker and more efficient.

Here are the main benefits of using these types of documents:

- Cost Savings: The most obvious benefit is that these structures are available at no cost, allowing businesses to save on professional design or software expenses.

- Time Efficiency: With a pre-made format, there is no need to start from scratch, reducing the time spent on creating documents.

- Professional Appearance: Pre-designed documents often come with a polished, clean look that enhances the professional image of your business.

- Customization: Despite being pre-made, these structures are flexible and can be easily customized to fit specific business requirements.

- Accuracy: Using a structured design helps ensure that all necessary fields and details are included, reducing the chances of missing important information.

- Consistency: Using the same format for all transactions ensures consistency, making it easier to track and manage records over time.

- Ease of Use: Many of these formats are user-friendly and compatible with common software, allowing for quick and easy editing and updates.

By utilizing these ready-to-go documents, businesses can streamline their processes, minimize errors, and maintain a more organized approach to their transactions.

Choosing the Right Structure for Your Business

When it comes to selecting a format for managing your business records, it’s important to consider several factors that align with your specific needs. A well-chosen design not only streamlines the process but also ensures that all critical information is clearly communicated. Different industries and business types may require unique features, so choosing the right layout can significantly impact your document management efficiency.

Assess Your Business Needs

Start by evaluating the nature of your transactions and the information you need to include. For example, if your business involves frequent sales of physical products, a structure that allows for easy listing of item descriptions, quantities, and prices is crucial. Alternatively, if your business deals with services, you might need a format that focuses more on time-based billing or service descriptions.

Consider Customization Options

Another important factor to consider is how much flexibility the structure offers. Look for a design that allows you to make adjustments as needed. Whether it’s adding or removing fields, adjusting layout, or incorporating your branding elements, customization ensures the document fits your specific requirements and reflects your business identity. Flexibility in design ensures your records evolve with your business as your needs change.

By carefully considering your business requirements and choosing a format that can be easily adapted, you’ll ensure your transaction records are both efficient and professional, contributing to smoother operations and improved client interactions.

Formatting Your Billing Document for Clarity

Properly organizing and formatting your business documents is crucial for ensuring they are easy to read and understand. A well-structured document not only reduces the chance of errors but also makes it easier for your clients to process the information. Clear formatting allows for quick identification of essential details, improving communication between parties and helping to maintain professionalism.

Here are some formatting tips to ensure clarity in your records:

- Use Headings and Subheadings: Organize sections with clear headings to separate different parts of the document, such as product details, payment terms, and client information.

- Align Information Properly: Ensure that all numbers and text are aligned correctly. Use tables for itemized lists, aligning quantities, unit prices, and totals in columns for easy readability.

- Keep Text Simple: Avoid cluttering the document with too much information. Stick to the essential details to maintain clarity and focus.

- Highlight Important Sections: Use bold or larger font sizes for key pieces of information, such as the total amount due or payment deadlines, to make them stand out.

Here is an example of how a well-structured billing document might look:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $15.00 | $30.00 |

| Product 2 | 1 | $25.00 | $25.00 |

| Total Amount Due | $55.00 | ||

By following these formatting principles, you can create documents that are not only professional in appearance but also easy for clients to review and process without confusion.

How to Calculate Billing Totals Correctly

Accurately calculating totals is a crucial aspect of managing business records. Ensuring that your final sum reflects all items, taxes, discounts, and additional charges helps prevent mistakes that could lead to confusion or disputes. Whether you’re billing for products, services, or both, understanding how to properly calculate the total is essential for maintaining trust and transparency with clients.

Here are the key steps to calculate totals correctly:

- List all items: Begin by itemizing every product or service being charged. This includes the quantity, price per unit, and total for each line item.

- Apply discounts (if applicable): If there are any discounts or promotional offers, subtract the appropriate amount from the subtotal. Ensure you specify the discount percentage or amount clearly on the document.

- Include taxes: After calculating the subtotal, apply the relevant tax rate. This is typically calculated as a percentage of the subtotal, and the final amount should reflect both the subtotal and taxes.

- Account for additional fees: If there are any shipping charges, handling fees, or other costs, make sure to add them to the total before reaching the final amount due.

Here’s an example of how the calculation might look:

| Item Description | Quantity | Unit Price | Line Total |

|---|---|---|---|

| Product 1 | 2 | $10.00 | $20.00 |

| Product 2 | 1 | $15.00 | $15.00 |

| Subtotal | $35.00 | ||

| Sales Tax (10%) | $3.50 | ||

| Total Amount Due | $38.50 | ||

By carefully following these steps and double-checking your calculations, you ensure that your records are both accurate and professional, making the billing process smoother for both you and your clients.

Including Taxes in Your Billing Document

When preparing your business records, it is essential to correctly account for taxes to ensure transparency and avoid legal complications. Different regions and types of goods or services may be subject to varying tax rates. Including these charges accurately in your documents not only keeps your operations compliant but also ensures your clients understand the total cost of their transaction.

Types of Taxes to Consider

There are several types of taxes that may apply depending on your location and the nature of your business. Common taxes include:

- Sales Tax: This is a percentage added to the sale price of goods or services. It is typically imposed by state or local governments.

- Value Added Tax (VAT): Often used internationally, VAT is applied incrementally at each stage of production or distribution.

- Service Tax: In certain industries, a tax may be levied on services rather than physical goods.

Calculating and Displaying Taxes

To include taxes in your document, first identify the applicable tax rate for your products or services. Multiply the total amount before tax by the rate to calculate the tax amount. Then, add this amount to the subtotal to arrive at the total amount due. It’s important to clearly show both the subtotal and tax amount separately so clients can easily see how the final total was calculated.

Here is an example of how taxes might be displayed:

| Item Description | Quantity | Unit Price | Line Total |

|---|---|---|---|

| Product 1 | 3 | $20.00 | $60.00 |

| Service Charge | 1 | $50.00 | $50.00 |

| Subtotal | $110.00 | ||

| Sales Tax (8%) | $8.80 | ||

| Total Amount Due | $118.80 | ||

Clearly itemizing taxes ensures that both you and your client have a clear understanding of how the final amount was determined, fostering trust and clarit

Adding Shipping and Handling Information

Including details about delivery and associated fees in your business documentation is essential for providing clients with a clear breakdown of costs. Shipping and handling charges are often a separate component of the total amount due, and it’s important to specify these costs to avoid any confusion or disputes. Accurately reflecting these charges ensures both transparency and professionalism in your transactions.

Shipping Costs

Shipping fees are typically based on the weight, dimensions, or destination of the goods being sent. Different carriers and shipping methods may affect the final charge. To ensure accuracy, it’s important to:

- Specify the shipping method (e.g., ground, express, overnight).

- List the exact cost for the chosen shipping method.

- Include the expected delivery date or estimated arrival window.

Handling Fees

In addition to shipping, handling fees may apply for packaging, processing, or special requests related to the delivery. These charges should be listed clearly and separately to avoid misunderstandings. When calculating handling fees, consider:

- Packaging materials required for safe delivery.

- Additional labor costs for handling fragile or large items.

- Any special requests, such as expedited processing or gift wrapping.

Here’s an example of how to present these costs:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $30.00 | $60.00 |

| Product 2 | 1 | $20.00 | $20.00 |

| Shipping Cost | $15.00 | ||

| Handling Fee | $5.00 | ||

| Total Amount Due | $100.00 | ||

By clearly displaying shipping and handling charges, clients can easily see how these costs are calculated and what to expect in terms of delivery timelines, helping to maintain a positive business relationship.

Free Templates vs Paid Invoice Services

When managing billing processes, businesses often face the choice between using no-cost document formats or investing in professional services. Both options offer unique advantages and drawbacks depending on the size and needs of the business. It’s important to weigh the benefits of simplicity and cost-effectiveness against the convenience and added features that paid services provide.

Free options often provide a straightforward solution, with pre-designed layouts that allow users to quickly create documents without spending any money. These templates are generally easy to use and can be found online or built using basic word processing software. However, they may lack advanced features such as automatic calculations, customization options, or integration with other business systems.

On the other hand, paid services offer a more comprehensive set of tools. These platforms often provide customizable solutions that allow businesses to tailor documents to their specific needs. Additionally, paid services may include advanced functionalities, such as automatic tax calculations, seamless payment tracking, and professional design features. For larger businesses or those with more complex billing needs, these services can save time and reduce human error, while offering enhanced professionalism.

In the end, the decision largely depends on the scale and specific requirements of the business. Smaller operations or those with basic billing needs may find free solutions adequate, while larger businesses may benefit more from the extra features provided by paid services. The key is to select the option that best aligns with your operational needs and long-term business goals.

How to Save and Print Your Invoice

Once you’ve completed creating your billing document, the next step is to save it properly for future reference and ensure you can easily print it when necessary. This process involves selecting the right file format and organizing it in a way that maintains the document’s integrity while making it easily accessible.

Saving the Document: The most common file formats for saving billing records are PDF, Word, or Excel. Each format has its own advantages. PDFs are universally accessible and ensure that the document’s layout remains unchanged across different devices. Word and Excel files, on the other hand, are better suited for ongoing edits or calculations, but they may not preserve the original design when opened on different platforms. Once you choose your preferred format, ensure that the document is saved in an organized folder with an easily recognizable name for future retrieval.

Printing the Document: Printing your completed record is a simple task, but it’s important to ensure the layout appears as intended. Before printing, review the document’s appearance on screen, ensuring that the text is properly aligned and that no essential information is cut off. Adjust the page margins if necessary, and check that all amounts, addresses, and product details are clearly visible. When printing, choose a high-quality setting for a professional finish, and consider printing on letterhead for additional professionalism.

In summary, saving and printing your billing document is an essential step in completing the billing process. Whether for personal records, sharing with clients, or preparing for audits, ensuring the file is correctly saved and printed helps maintain a professional image and ensures easy access to all necessary information when needed.

Integrating Templates with Accounting Software

Linking your billing records with accounting tools can streamline financial management and reduce manual data entry. This integration helps automate processes, keeping your financial records organized and up-to-date. By connecting your formatted documents to accounting software, you can easily track payments, generate reports, and maintain accurate records for tax or auditing purposes.

Benefits of Integration

Integrating your billing documents with accounting software provides several key advantages:

- Automation: Automatically import transaction details, reducing the need for manual entry.

- Accuracy: Prevents errors that can occur when transferring information between different systems.

- Time-saving: Speeds up the overall billing and record-keeping process.

- Reporting: Facilitates easier generation of financial reports and statements for business analysis.

Steps to Integrate

To successfully integrate your formatted records with accounting software, follow these steps:

- Select the right software: Ensure your chosen accounting tool supports the import of billing files in your preferred format (PDF, Excel, etc.).

- Upload your document: Many accounting platforms allow you to upload or link your formatted documents directly to transactions.

- Map fields correctly: Ensure that key fields such as amounts, tax rates, and dates are properly matched in the software for accurate processing.

- Test the integration: Before fully relying on the system, run a few test transactions to ensure everything is correctly synced.

By following these steps, you can enhance your workflow, reduce errors, and keep your financial data aligned across all platforms. Integration with accounting software is a powerful tool for businesses looking to manage their finances more efficiently.

Best Practices for Invoice Documentation

Maintaining clear and organized records of transactions is essential for any business. Proper documentation ensures that all parties involved have accurate details about the exchange, facilitates easy reconciliation of accounts, and aids in tax compliance. By following best practices, businesses can avoid common errors, improve financial management, and establish trust with clients and partners.

Key Guidelines for Effective Documentation

To ensure that your financial records are both clear and professional, consider these best practices:

- Use Clear and Consistent Formats: Ensure that the format of your documents is standardized, with consistent fonts, headers, and layout.

- Include All Necessary Details: Make sure each record contains all relevant information, such as the date, payment terms, and detailed descriptions of the products or services provided.

- Number Documents Sequentially: Assign a unique identifier to each document, following a numbering system to help track and manage records easily.

- Keep a Detailed Record of Payments: Record each payment received and note any outstanding balances to help with tracking financials and ensuring accurate account balances.

Storage and Security Tips

Once your documents are created, proper storage and security measures are crucial to ensure they are easily accessible and protected:

- Digital Storage: Store records in a secure digital format, such as PDF or Excel, on a reliable cloud platform or backed-up drive.

- Paper Copies: For businesses that still use physical documents, ensure they are stored in a safe and organized manner to prevent loss or damage.

- Access Control: Limit access to sensitive documents by implementing password protection or other access control measures.

By following these practices, businesses can create well-organized, secure, and professional transaction records that streamline financial management and reduce the risk of errors or discrepancies.

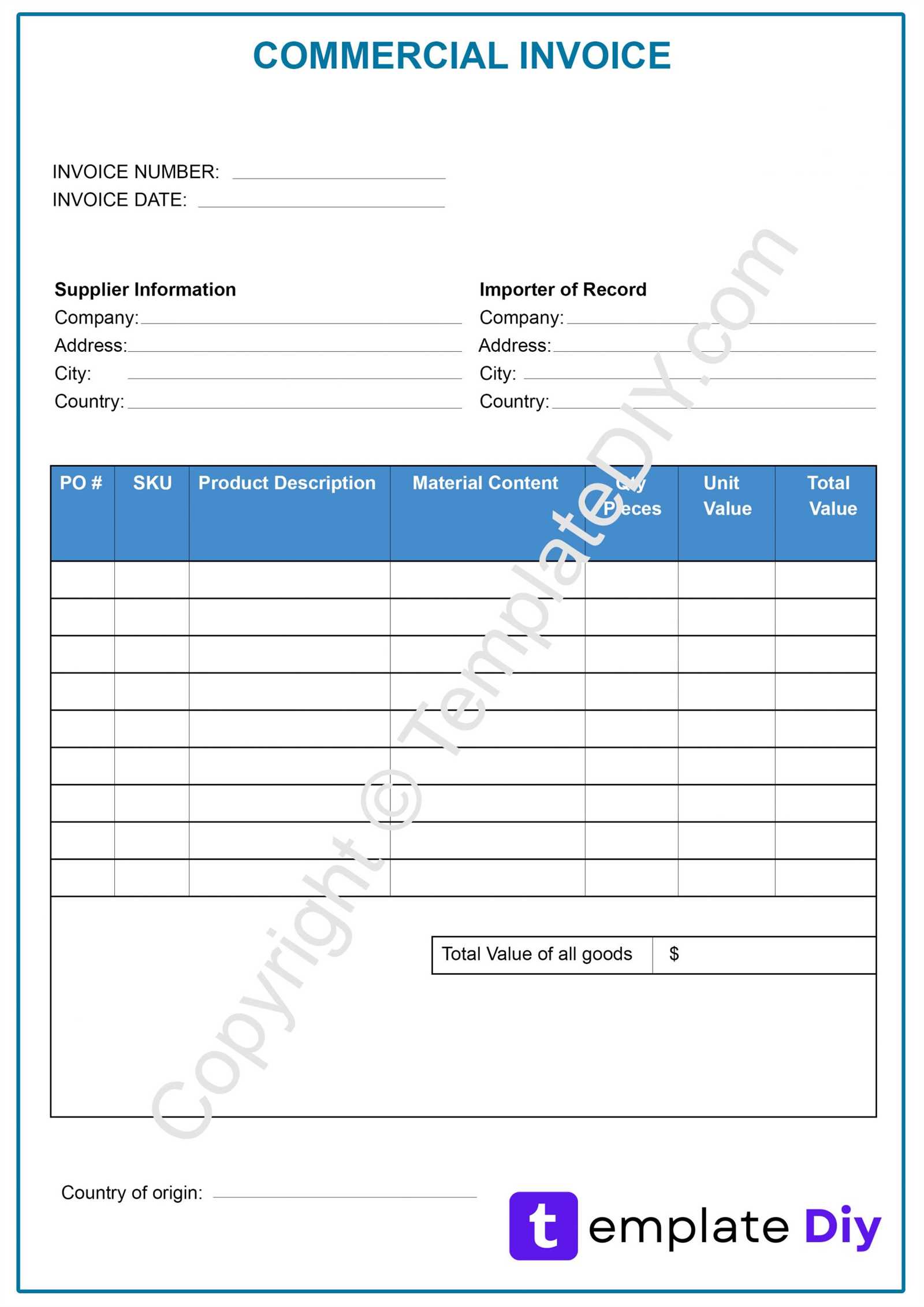

Legal Requirements for Commercial Invoices

When preparing documentation for transactions, it is important to comply with local and international regulations. Legal requirements often stipulate the necessary details and structure that such records must include. Adhering to these rules ensures that businesses meet their obligations and avoid potential legal issues, taxes, or customs complications.

Essential Information to Include

There are several key elements that must be included in any business transaction document to ensure it is legally compliant:

- Transaction Date: The exact date when the goods or services were provided or the transaction took place.

- Unique Identifier: Each document should have a unique reference number for tracking purposes.

- Buyer and Seller Details: Clearly list the names, addresses, and contact information of both the buyer and the seller.

- Detailed Description: A precise description of the items or services involved in the transaction, including quantities and unit prices.

- Payment Terms: The agreed-upon payment conditions, including due dates and any discounts or penalties.

- Tax Information: The applicable taxes or duties, including the rate and amount, should be clearly stated.

- Currency: Indicate the currency used for the transaction and its exchange rate, if relevant.

International Considerations

For businesses dealing with cross-border transactions, there are additional legal requirements to consider:

- Customs Declarations: Some transactions may require specific documentation for customs clearance, including Harmonized System (HS) codes or origin certificates.

- Incoterms: The terms of delivery, such as EXW (Ex Works) or DDP (Delivered Duty Paid), should be included to clarify the responsibilities of each party.

- Language Requirements: Some countries require that the documentation be provided in a specific language for legal or customs reasons.

By ensuring that all legal requirements are met, businesses can avoid disputes, delays, and legal complications, while also maintaining a transparent and professional reputation.

How to Send Your Invoice Effectively

Properly sending a financial record is crucial to ensure timely payments and maintain professionalism. It’s important to consider both the method of delivery and the presentation of the document to ensure that the recipient can easily process the details and make the necessary payment. A well-sent record not only helps with faster processing but also reflects positively on your business.

Choosing the Right Delivery Method

When sending financial documentation, there are a few delivery methods to consider based on your client’s preferences and your business model:

- Email: This is the most common and efficient way to send documents. Ensure that the file is in a widely accessible format, like PDF, and that the email includes a clear subject line and any relevant details.

- Postal Mail: For clients who prefer hard copies, sending documents through postal services might be necessary. Use a reliable service that offers tracking to ensure the document is delivered safely.

- Online Payment Platforms: Some platforms allow you to send records directly through the payment system, which may offer automatic tracking and notifications.

Best Practices for Sending Your Record

Here are several key points to follow to ensure that your financial record is sent clearly and effectively:

- Clear Subject and Body: When sending via email, always include a subject line that clearly indicates the purpose of the email, such as “Payment Request for [Service/Product] – [Date].” In the body, briefly explain the contents of the document and any important payment instructions.

- Attachment Format: Use a format that is universally accessible, such as PDF. This ensures that the recipient can open the document without issues, regardless of their operating system or software.

- Confirmation of Receipt: Request confirmation from the recipient that they’ve received the document and can access all the details. This can help avoid any confusion later on.

By taking these steps, you can ensure that your records are received promptly and processed without unnecessary delays.

Improving Payment Collection with Templates

Efficient payment collection is key to maintaining cash flow and financial stability for any business. By utilizing structured and consistent documents, you can ensure that customers receive clear payment instructions, reducing confusion and delays. A well-designed record not only outlines the due amount but also reinforces professionalism, prompting timely settlements.

Benefits of Using Well-Structured Documents

Implementing organized formats offers several advantages when it comes to collecting payments:

- Clarity: Clear and well-organized details on amounts, due dates, and payment methods reduce misunderstandings between you and your clients.

- Efficiency: Pre-designed documents streamline the process, allowing you to quickly generate and send out requests without missing critical information.

- Professionalism: A professional appearance helps build trust with clients, ensuring they feel confident in processing the payment.

Key Features for Optimizing Payment Collection

For maximum effectiveness in payment collection, consider including the following elements in your financial documents:

- Due Dates and Terms: Clearly state the due date for payment and any associated terms, such as late fees or discounts for early payment, to encourage prompt action.

- Multiple Payment Options: Offering a variety of payment methods–bank transfer, online payments, checks, etc.–can accommodate the preferences of different clients, increasing the likelihood of timely payments.

- Easy-to-Follow Instructions: Make it easy for clients to understand how to submit their payment by including step-by-step instructions or a direct link to online payment platforms.

By utilizing organized, clear, and professional documents, businesses can improve their payment collection process, ensuring timely and accurate transactions.