How to Create an Invoice Template in Word

When managing a business, it’s essential to have a reliable and clear way to request payments from clients. Crafting an organized and easy-to-read billing statement can help maintain professionalism and ensure smooth financial transactions. The process can be simplified by using a commonly available text editor that offers flexibility and customization.

In this guide, we will walk you through the steps to design a functional and visually appealing payment request form. Whether you are a freelancer or running a small business, setting up a structured document that aligns with your needs will save you time and effort in the long run. By following a few straightforward steps, you’ll be able to create a document that looks professional and meets all your requirements.

Mastering this task will allow you to streamline your billing process, reduce errors, and present your services to clients in a polished manner. Plus, once you have your structure set up, it can be reused for every transaction, helping to standardize your financial communications.

How to Create a Billing Form in Word

Creating a customized payment request document from scratch can be a great way to ensure that all necessary information is clearly presented. By using a versatile text editing program, you can quickly design a professional-looking form that meets the specific needs of your business. Whether you’re invoicing for services or products, setting up a functional structure will allow you to efficiently collect payments and track your financial transactions.

Setting Up the Basic Structure

Start by opening a blank document. You’ll want to begin by adding key sections, such as your business name, contact information, and a section for the client’s details. Additionally, create a place for a unique reference number for each entry, as well as space for the billing date and due date. These fields are crucial for keeping track of multiple requests and avoiding confusion.

Designing for Clarity and Professionalism

Once the basic fields are in place, focus on the layout. Use tables to align data clearly, making sure that each item has its own row with proper headers. You can also add lines to separate sections and create visual balance. This helps the document appear organized and ensures your clients will easily understand the details of the payment request. Don’t forget to include a section for the total amount due, including any taxes or discounts, if applicable.

Once your form is complete, save it as a template so you can reuse it for future billing tasks. With this approach, you’ll save time on every transaction while maintaining a consistent and professional appearance for your business communications.

Why Use Word for Billing Documents

Choosing the right software for creating and managing financial documents is crucial for ensuring efficiency and professionalism. One of the most popular tools for generating these forms is a widely-used text editor, which offers a balance of flexibility, ease of use, and accessibility. This program allows you to design clean, customizable forms without needing specialized software or a steep learning curve.

Benefits of Using a Text Editor

- Accessibility: Most people already have access to this software, making it easy for small business owners, freelancers, and individuals to create documents without additional costs.

- Customization: You can easily modify existing structures or create new ones from scratch to suit your business needs, including adjusting fonts, layout, and fields.

- Ease of Use: With its intuitive interface, even those with minimal design experience can quickly create a professional document.

- Standardization: Reuse the same document for all transactions, ensuring consistency in your financial communications.

Practical Features for Billing

- Tables: Built-in table features help organize information clearly, making it easier for both you and your clients to understand the details.

- Formatting Tools: Easily adjust fonts, colors, and alignment to enhance readability and create a polished look.

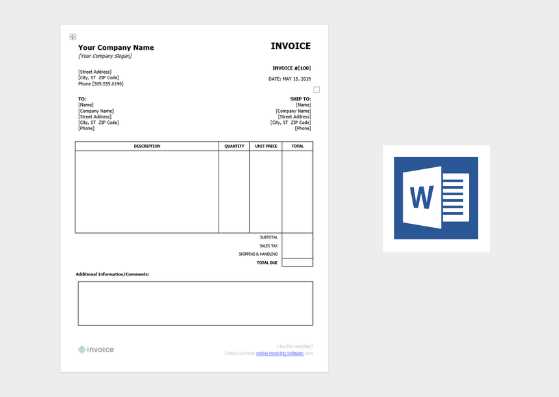

- Templates: Pre-made designs can be easily modified, allowing for quick creation without starting from scratch.

- Cross-Platform Compatibility: Documents created in this software can be opened and edited on most devices, making it convenient for both users and recipients.

Overall, using this type of program for your billing documents offers a practical and efficient solution that meets the needs of most small businesses and independent professionals.

Step-by-Step Guide to Creating Invoices

Creating a professional payment request involves a few essential steps to ensure clarity and accuracy. By following a structured process, you can produce a clear, comprehensive document that provides all the necessary details for your client. Whether you are invoicing for products, services, or a combination of both, the format should be easy to read and consistent with your business’s branding.

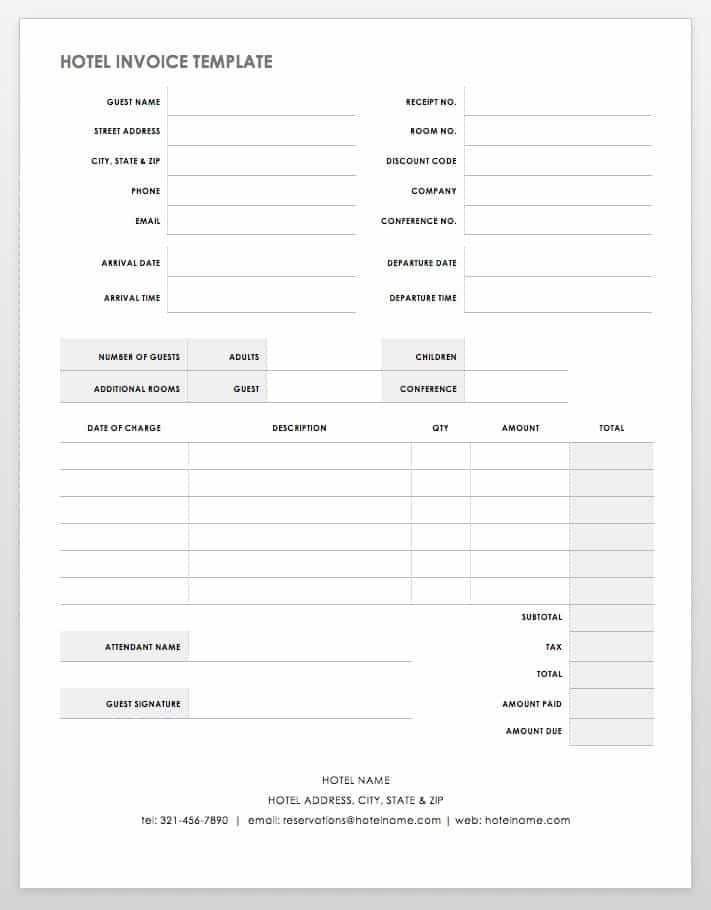

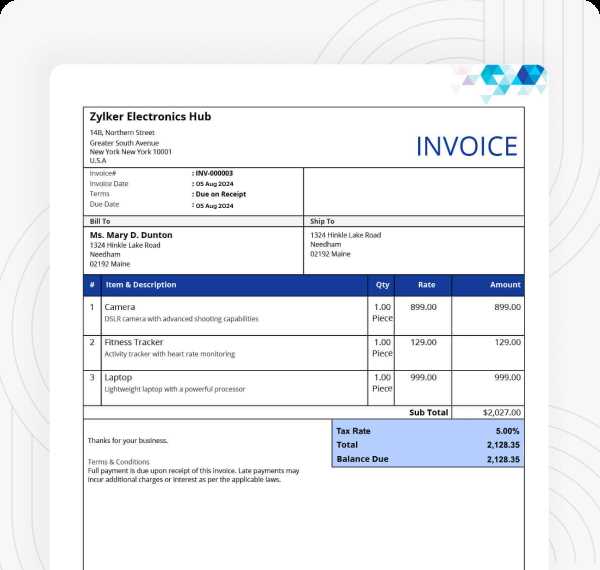

Start by preparing a clean document with all the essential fields. These include your business name, the client’s details, and a unique reference number for each request. It is also crucial to include the date of issuance, along with the payment terms and the due date. These elements are fundamental for tracking and organizing your transactions.

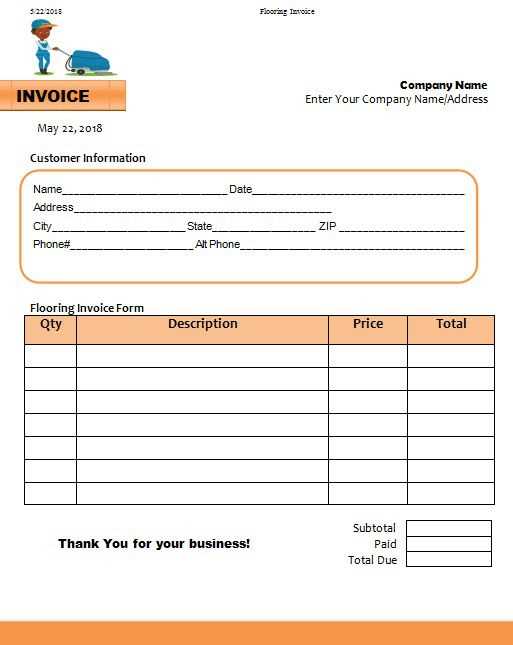

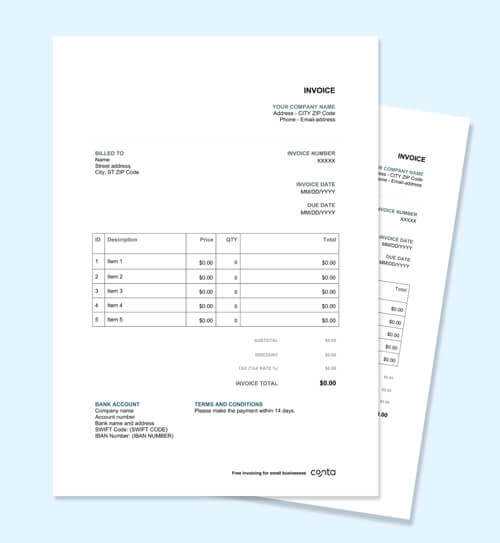

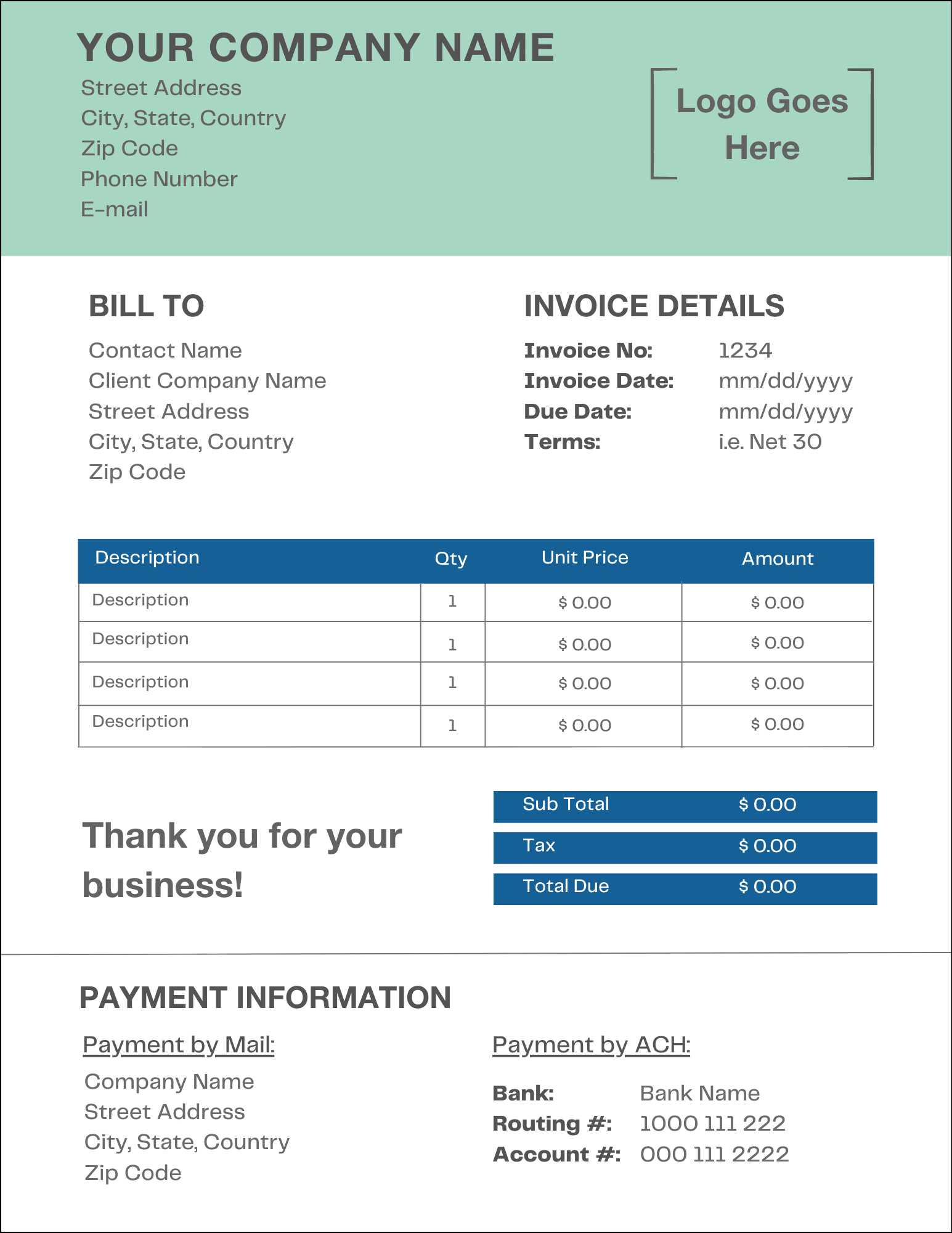

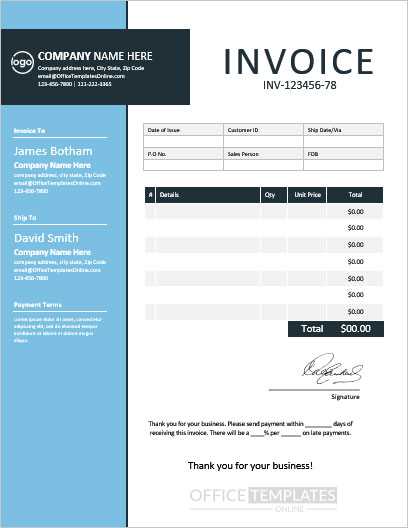

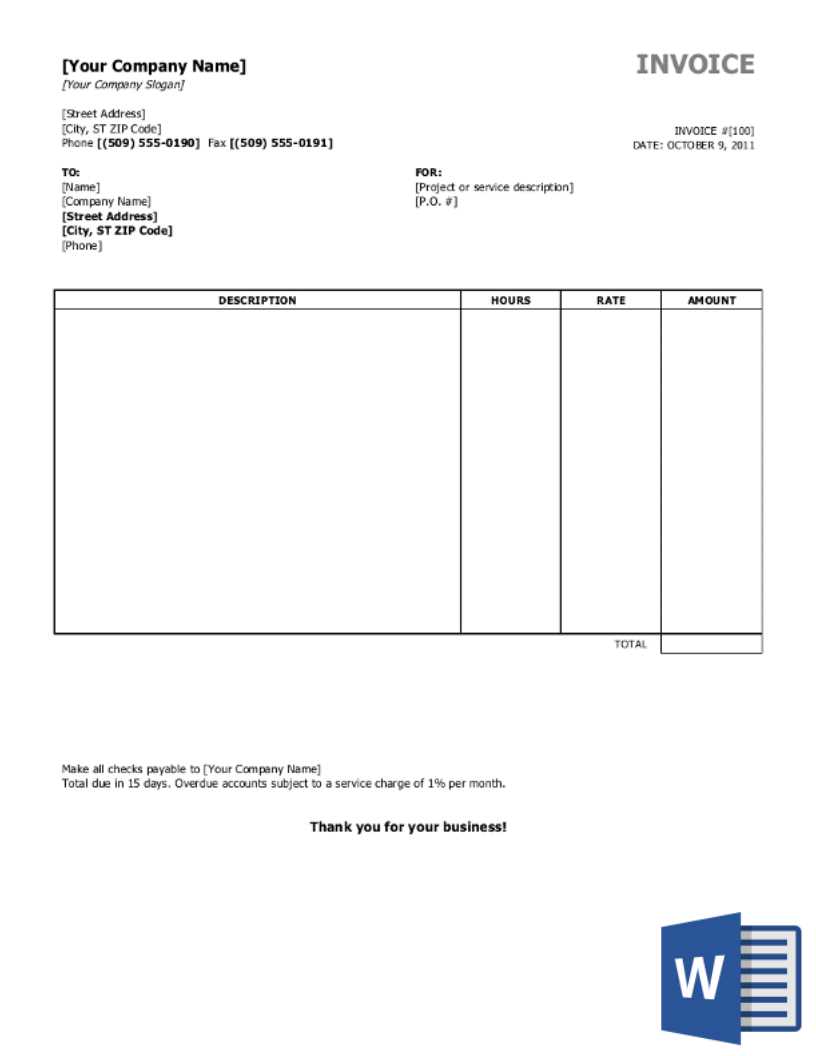

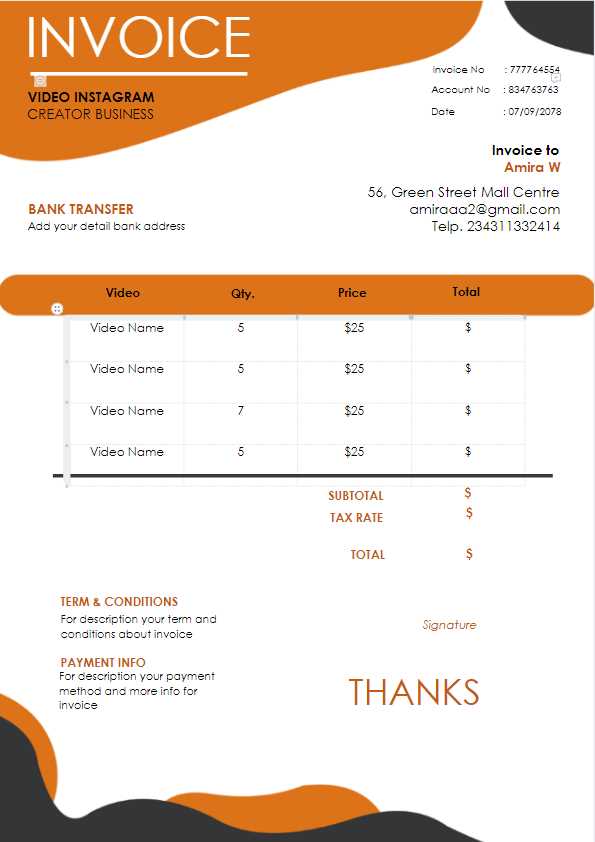

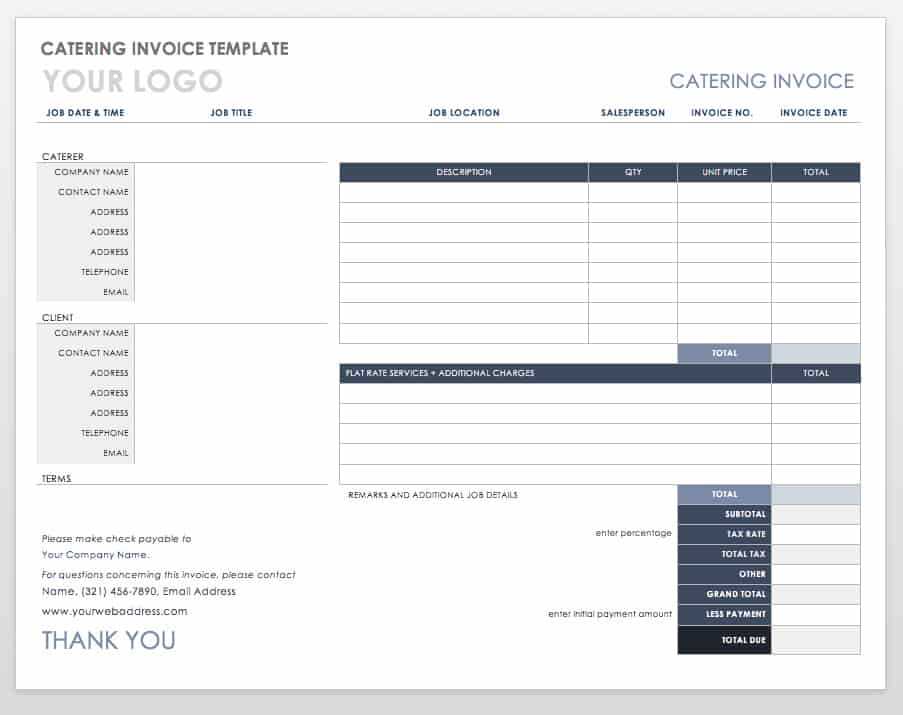

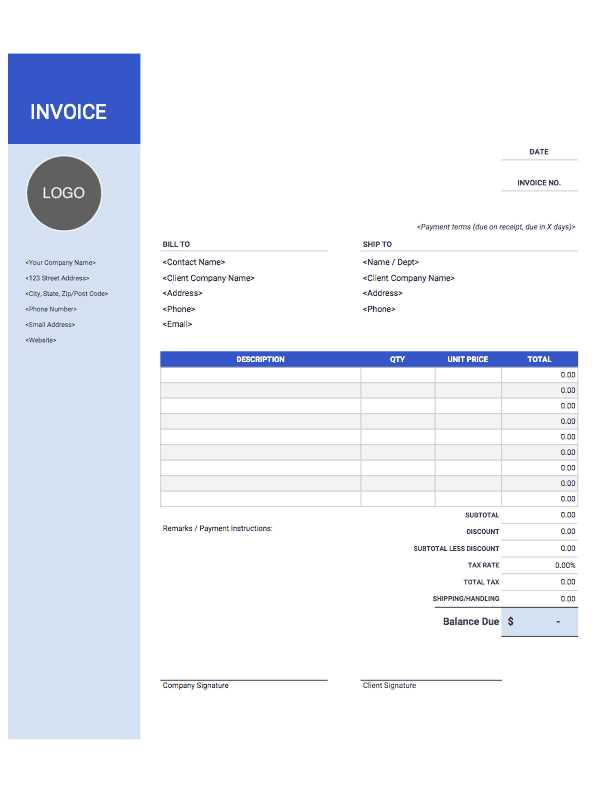

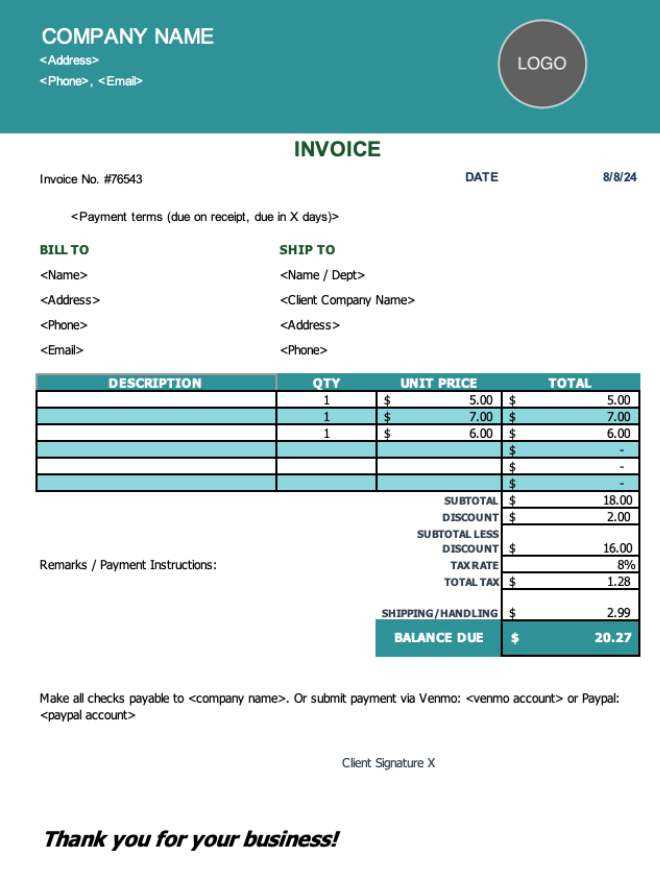

Step 1: Begin by adding your business details at the top of the document. This should include your company name, address, phone number, and email. Including a logo is also a good idea to enhance the visual appeal and professionalism of the document.

Step 2: Below your details, add a section for the client’s information. Make sure to include their name, address, and contact details, so that the payment request is correctly associated with them.

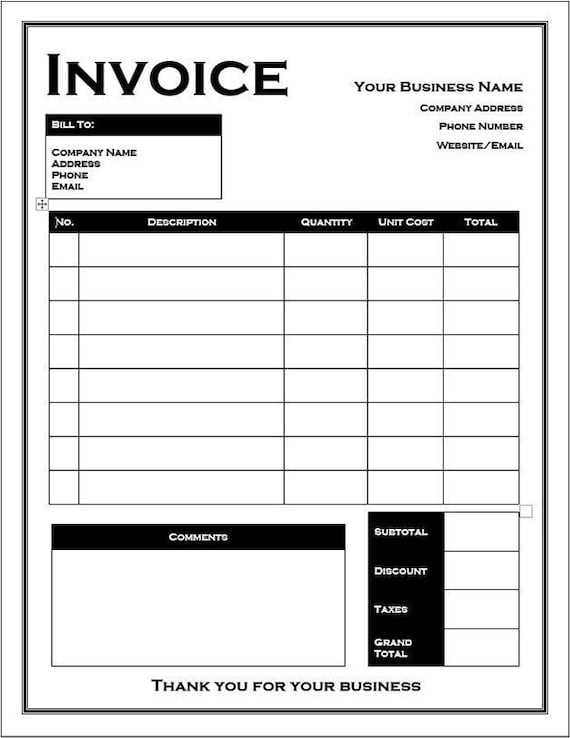

Step 3: Create a clear section to list the items or services being billed. This section should include a description, quantity, unit price, and total cost for each entry. This allows your client to understand exactly what they are being charged for.

Step 4: Add a summary area that totals the charges. Include any taxes or discounts, ensuring that the final amount is clearly presented. This should be easy to identify at the bottom of the document.

Step 5: Finally, include payment instructions and terms, such as the method of payment (e.g., bank transfer, PayPal) and the due date. Make sure to highlight any late fees or interest charges that may apply if payment is not made on time.

By following these simple steps, you can create a professional and functional document that helps keep your financial communications organized and transparent.

Choosing the Right Layout for Your Invoice

When creating a payment request document, the layout plays a significant role in ensuring clarity and professionalism. A well-structured form makes it easier for both you and your client to understand the details of the transaction, helping to avoid misunderstandings. Selecting the right layout can also enhance the visual appeal of the document and contribute to the overall experience of your business interactions.

Key Considerations for Layout Design

- Clarity: The information should be organized logically, allowing for quick reference. Sections like item descriptions, pricing, and payment terms must be clearly separated for ease of use.

- Balance: Make sure there is enough white space around the text to prevent the document from feeling overcrowded. A balanced layout makes it easier for the reader to focus on important details.

- Branding: Incorporating your business’s branding elements–such as your logo, colors, and fonts–can make the document more personalized and professional.

- Functionality: The layout should allow easy addition of new items or services, while maintaining consistency for every payment request. Consider how the layout will adapt to different types of transactions.

Popular Layout Options

- Classic Single-Column: A simple and straightforward layout, often featuring sections in a vertical format, one after another. This style is particularly effective for businesses with a smaller number of items or services to list.

- Two-Column Layout: This design allows for a more compact format, with item details on the left side and corresponding pricing and totals on the right. It’s ideal for more complex requests where multiple items are being billed.

- Table-Based Layout: Using tables to organize itemized lists can be very effective for clarity. The rows and columns help separate individual components of the transaction, making it easier to follow and track costs.

By selecting the layout that best suits your needs, you can ensure your document is both professional and functional, while also making it easier for your clients to process payments.

Customizing Your Template Design

Once you’ve created the basic structure of your payment request document, it’s time to personalize it to reflect your brand and make it visually appealing. Customization not only improves the overall look of the document but also helps it stand out and feel more professional. By adjusting design elements such as fonts, colors, and layout, you can create a document that aligns with your business’s identity and improves client engagement.

Personalizing Key Design Elements

- Business Branding: Incorporate your company’s logo, brand colors, and fonts to create a cohesive look across all your documents. This reinforces your brand identity and makes your communication more recognizable.

- Fonts: Choose fonts that are easy to read and align with your business style. Avoid using too many different fonts; instead, opt for two complementary ones–one for headings and another for body text.

- Color Scheme: Stick to a consistent color palette. Use contrasting colors for important details such as totals or payment terms, but ensure the overall design remains balanced and professional.

- Spacing: Proper spacing between sections and text ensures that the document is not crowded. Ample white space increases readability and gives the content room to breathe.

Enhancing Functionality and Visual Appeal

- Tables: Use tables to neatly organize details like item descriptions, quantities, and costs. You can adjust the borders, shading, and text alignment to create a clean and well-structured appearance.

- Headers and Footers: Including a header with your business name and a footer with your contact information can make the document look polished and complete.

- Images: Adding a small logo or a watermark can further personalize your document without overwhelming the content. Make sure the images are subtle and do not distract from the important information.

By customizing these elements, you can create a document that not only communicates important details clearly but also reinforces your business’s professionalism and branding. A well-designed payment request can leave a lasting impression on your clients.

Adding Essential Invoice Information

To ensure that your payment request is clear and complete, it’s important to include all the necessary details that both you and your client will need. These elements not only provide clarity but also help with record-keeping and future reference. Each piece of information plays a specific role in making sure that the transaction is understood and processed correctly.

Key Information to Include

- Business and Client Details: Your name, address, and contact information should appear at the top of the document, followed by your client’s corresponding details. This ensures the correct identification of both parties.

- Unique Reference Number: Every document should have a unique identification number to avoid confusion, especially when dealing with multiple transactions.

- Date of Issuance: Always include the date the payment request was issued. This will help both parties track the timeline of the transaction.

- Due Date: Clearly state when the payment is expected. This helps set expectations and prevents delays.

- Description of Goods/Services: List the items or services being billed in detail, ensuring that each is clearly described with quantities, rates, and totals.

- Payment Instructions: Provide clear payment methods and account details to make the transaction process as easy as possible for the client.

- Total Amount Due: The final amount due should be highlighted, including any applicable taxes or discounts, so the client knows exactly how much to pay.

Organizing Information in Tables

| Description | Quantity | Unit Price | Total | |||||

|---|---|---|---|---|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 | |||||

| Website Development | 1 | $1,000 | $1,000 | |||||

| Subtotal: | $1,500 | |||||||

| Tax (10%): | $150 | |||||||

Tot

Formatting Your Invoice for ClarityPresenting a clean and well-organized document is essential for ensuring that all the information is easy to understand and process. Proper formatting plays a crucial role in making sure that your payment request is clear, professional, and free of confusion. By adjusting elements such as alignment, spacing, and emphasis, you can create a document that guides the reader’s attention to the most important details. Key Formatting Techniques

Emphasizing Key Information

By paying attention to these formatting details, you create a document that is both functional and easy to read. Clear and organized presentation ensures that your client can quickly process and understand the payment request, leading to smoother transactions and fewer misunderstandings. Using Tables to Organize Invoice DetailsOne of the most effective ways to present transaction information in a clear and structured way is by using tables. This layout method allows for easy comparison and reading, especially when dealing with multiple items or services. Organizing your details into rows and columns ensures that each piece of information–such as descriptions, quantities, prices, and totals–is easy to locate and understand, reducing the likelihood of errors or confusion. Benefits of Using Tables

Best Practices for Table Layout

By utilizing tables to organize the details of the transaction, you improve both the usability and professionalism of your document. This simple formatting technique enhances readability, streamlines information presentation, and contributes to a smoother experience for both parties involved. Incorporating Your Business LogoIncluding your business logo in financial documents is an important step in creating a professional, branded experience for your clients. A well-placed logo enhances the visual appeal of the document and reinforces your business’s identity. It also helps establish trust and recognition, making your communication feel more polished and consistent with your overall brand image. Why Your Logo Matters

Best Practices for Logo Placement

Example Layout

By thoughtfully incorporating your logo, you add a layer of professionalism and branding to your financial documents. A well-positioned logo can also enhance your client’s overall experience and make a lasting impression. Setting Up Payment Terms and DatesEstablishing clear payment terms and due dates is essential for ensuring smooth transactions and avoiding misunderstandings. This information helps both parties know exactly when the payment is expected and under what conditions. By setting clear expectations from the start, you can minimize delays and maintain positive business relationships. The payment terms outline how and when the payment should be made, while the due date specifies the exact day the payment is expected. These two elements should be clearly defined in every transaction document to ensure clarity and prevent confusion. Key Payment Terms to Include

Formatting Payment Information

By establishing clear payment terms and dates, you ensure that both parties are aligned and that payments are made promptly. This simple step can contribute to better cash flow management and improv Saving Your Template for Future Use

Once you’ve created a professional document that suits your business needs, it’s important to save it in a way that allows for easy access and reuse. Storing your design as a reusable file ensures that you won’t have to start from scratch each time you need a new copy. This can save you valuable time and ensure consistency across all your communication. Steps for Saving Your Document

Accessing and Reusing Your Document

By saving your file for future use, you streamline your workflow and reduce the effort required for each new document. This makes your administrative tasks more efficient, while also ensuring a consistent and professional presentation each time. How to Adjust the Template for Different NeedsEvery business has unique requirements when it comes to documenting transactions. Sometimes, you may need to modify your standard design to suit specific situations, such as adding additional services or changing payment terms. Customizing the layout allows you to adapt the document to different client needs while maintaining consistency and professionalism. This flexibility ensures your records are always clear and relevant to the specific transaction at hand. Common Adjustments for Specific Situations

Maintaining Flexibility While Keeping Consistency

Customizing your documents for different needs helps keep your communication clear and specific, while also reducing errors and saving time. By making minor adjustments, you ensure that each document reflects the unique details of a particular transaction, while still adhering to your business’s overall style and branding. Common Mistakes to Avoid in InvoicesWhen preparing transaction documents, it’s important to be mindful of potential errors that could lead to confusion or delayed payments. Even small mistakes can create misunderstandings between you and your clients, potentially affecting your cash flow and professional reputation. By avoiding common pitfalls, you can ensure that your documents are accurate, clear, and legally sound. Frequent Errors to Watch Out For

How to Prevent These Mistakes

|

||||||||