Church Invoice Template for Streamlined Billing and Record Keeping

Managing financial transactions within a religious community requires careful organization and accuracy. When it comes to documenting donations, services, and other contributions, having a structured approach ensures transparency and accountability. A well-organized billing system simplifies the entire process, making it easier to track and manage all monetary exchanges.

Using an organized document for financial records provides clarity for both the congregation and the administration. It helps avoid confusion, prevents errors, and enables smoother communication between all parties involved. Whether it’s for regular offerings or special events, ensuring that each transaction is properly recorded is vital for maintaining trust and ensuring compliance with legal requirements.

By adopting a streamlined method for keeping track of monetary contributions and services, religious organizations can focus more on their mission and less on administrative tasks. A personalized approach to handling these records enhances efficiency, saves time, and supports the overall financial health of the community.

Why You Need a Church Invoice Template

Proper documentation of monetary transactions is essential for any organization, especially when it comes to managing finances within a religious community. Having a standardized system for recording contributions, donations, and payments ensures clarity, accountability, and smooth operations. This system provides a clear structure for both the organization and its supporters, making it easier to track funds and maintain accurate records.

One of the key reasons to adopt a structured financial record system is to promote transparency. By offering a consistent way to document and manage transactions, you can avoid confusion and ensure that everyone involved is aware of their contributions. Whether it’s for recurring donations or one-time gifts, using a structured approach helps maintain trust and prevents any misunderstandings.

Here are some benefits of using a well-organized financial record system:

- Accuracy: Minimizes the chances of errors by having a consistent format for all entries.

- Efficiency: Saves time and effort when it comes to generating reports or reviewing past records.

- Accountability: Enhances transparency and allows for easy tracking of all monetary contributions.

- Legal Compliance: Ensures that financial records are properly documented for tax and legal purposes.

- Professionalism: Presents a more organized and professional image to supporters and donors.

Incorporating a standardized system into your operations allows you to focus more on your mission and less on administrative tasks. It streamlines the process of tracking and managing funds, ultimately contributing to the overall health and growth of the community.

Benefits of Using Customizable Templates

Having the ability to personalize financial documents allows for greater flexibility and efficiency in managing records. By tailoring the format to fit specific needs, organizations can ensure that all essential information is included, while also maintaining a professional and consistent appearance. Customizable systems adapt to the unique requirements of each organization, improving workflow and reducing the risk of errors.

Enhanced Personalization and Branding

One of the key advantages of using customizable solutions is the ability to align the document’s design with the organization’s branding. This creates a more professional look and reinforces the identity of the organization. Logos, color schemes, and contact details can be easily incorporated, helping to make the records instantly recognizable and consistent with the organization’s overall image.

Increased Efficiency and Time Savings

By creating a document that fits the organization’s specific needs, it eliminates the need to manually adjust formats or fill out unnecessary fields each time. This streamlined approach saves valuable time and increases efficiency, especially when handling multiple records. Custom solutions can be saved and reused, allowing for quick generation of new documents without the need to start from scratch.

Overall, using customizable solutions makes financial record-keeping simpler and more organized. With the ability to make adjustments as needed, it supports smoother operations and reduces the likelihood of mistakes, while also providing a professional and cohesive experience for all involved parties.

Essential Features in an Invoice Template

To ensure smooth financial record-keeping, certain elements must be included in any documentation system. These features help make transactions clear, reduce errors, and provide a standardized approach that can be easily understood by both the organization and its supporters. Key components of an effective system ensure that all necessary details are captured and presented in an organized manner.

Basic Information and Contact Details

Every record must include essential identification details such as the name and contact information of the organization, as well as that of the recipient. This ensures that both parties are easily identifiable and any follow-up communication can be streamlined. Including accurate contact information is critical for resolving any issues or answering questions related to a transaction.

Clear Itemization of Services or Contributions

Another crucial feature is the clear breakdown of all goods, services, or donations received. An organized list makes it easy for the recipient to see exactly what was provided and the corresponding amounts. This level of detail helps prevent misunderstandings and ensures that all contributions are properly accounted for, whether for regular offerings or special events.

Including these key elements ensures that the financial documentation process remains professional, transparent, and efficient. It also makes it easier to track contributions, reconcile accounts, and manage ongoing financial needs with greater accuracy.

What Makes a Template Effective

An effective financial record-keeping system combines clarity, organization, and adaptability. It must ensure that all critical information is captured in a straightforward, understandable manner. The format should not only serve its purpose of documenting transactions but also make the process as efficient as possible, reducing the chance for mistakes and simplifying review or reporting tasks.

Clarity and Simplicity

A well-structured document should present all the necessary details without overwhelming the user. Simple, clear headings and sections make it easy for both the sender and recipient to understand the contents. By avoiding clutter and focusing on essential elements, the system minimizes confusion and helps both parties stay on the same page regarding financial transactions.

Flexibility for Customization

Another key aspect is flexibility. Every organization may have unique needs when it comes to recording and managing funds. An effective system allows for easy customization, enabling adjustments to suit specific requirements, such as adding custom fields for special projects, donations, or recurring payments. This adaptability ensures that the system remains useful as the organization grows or changes over time.

The combination of these features helps make financial record-keeping more efficient, reducing the potential for errors while maintaining a professional and organized approach to managing funds.

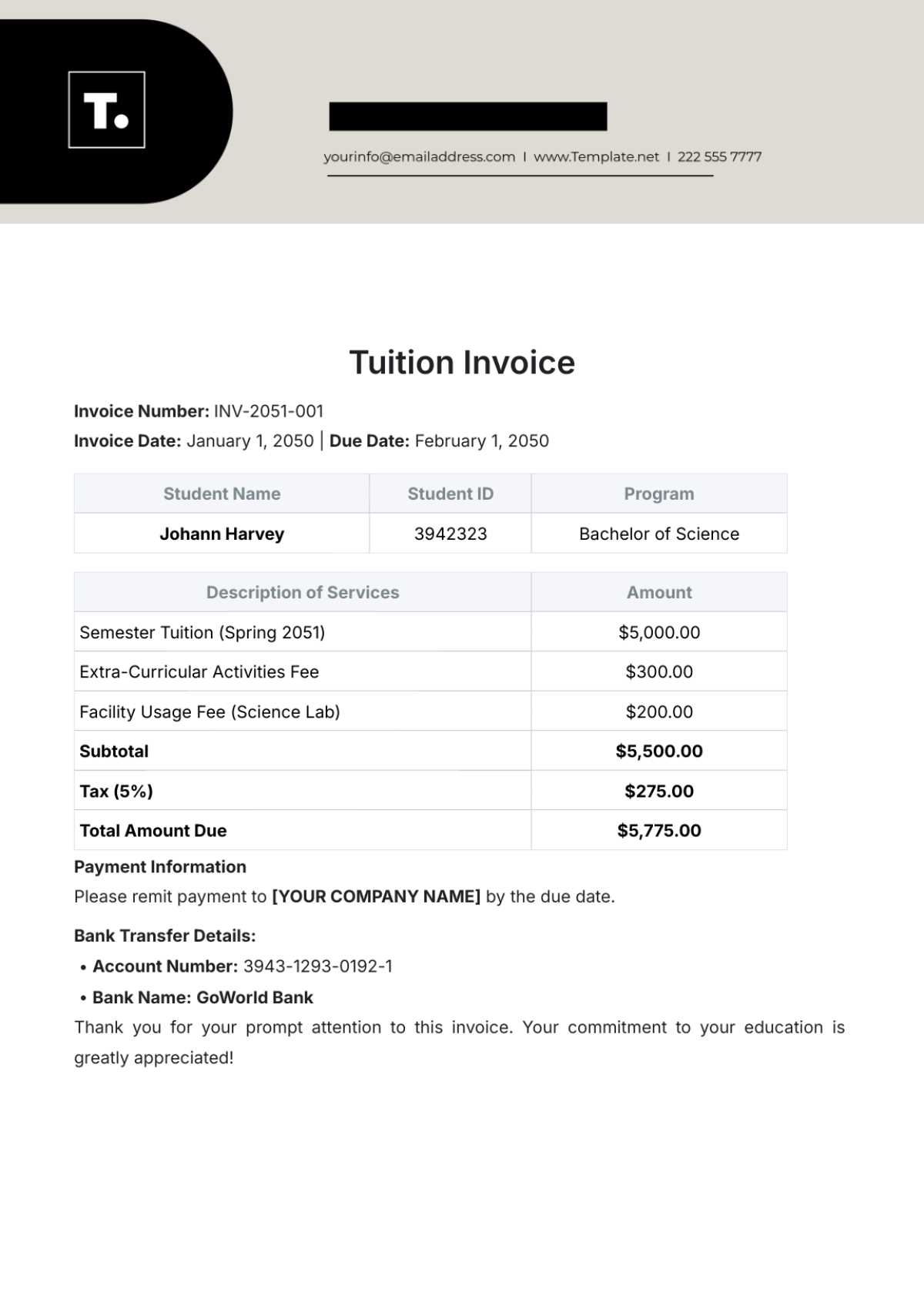

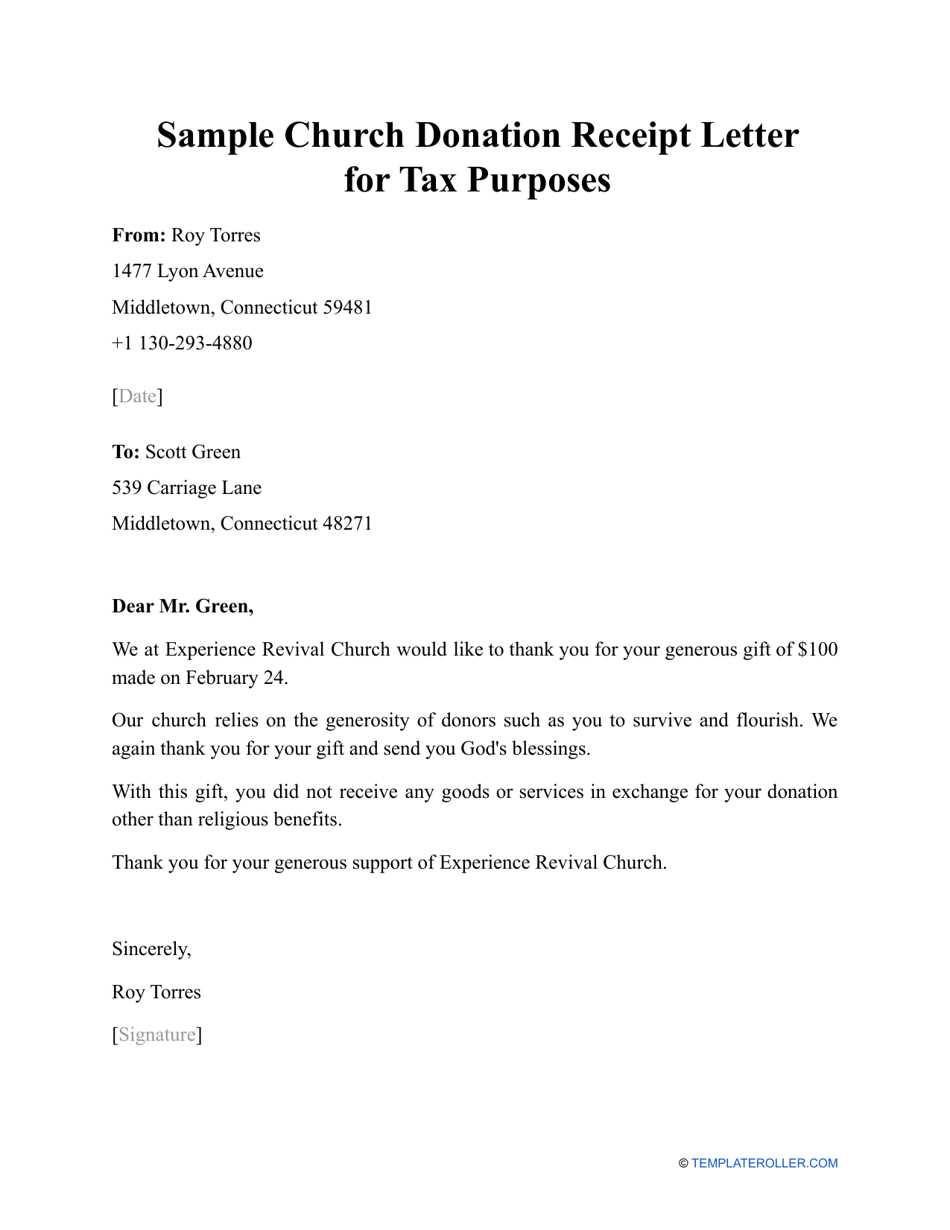

How to Create a Church Invoice

Creating a structured document for recording transactions is essential for ensuring transparency and accuracy. Whether you are documenting donations, fees, or other contributions, the process should be clear, consistent, and easy to understand. The following steps outline the necessary components for constructing an efficient and effective financial record.

Begin by including all necessary identifying information, such as the organization’s name, contact details, and the recipient’s name. Then, list each contribution or service provided in a clear, organized manner, along with corresponding amounts. This will ensure all details are documented properly for future reference.

| Description | Amount | Date |

|---|---|---|

| Donation for event | $50.00 | 01/01/2024 |

| Regular contribution | $20.00 | 01/01/2024 |

After completing the breakdown, include payment terms and instructions, such as methods of payment and due dates. This step is essential to ensure both parties are on the same page regarding when and how payment will be made.

Finally, review the document for accuracy before saving or sending it. Having a standardized format in place makes the process faster and more reliable each time it is used, ensuring smooth operations for both the organization and the supporters involved.

Step-by-Step Guide to Customization

Customizing your financial record system allows you to tailor it to your organization’s specific needs, ensuring it is both functional and professional. This process involves adjusting various sections, adding necessary details, and modifying the layout to suit your workflow. The following guide outlines the steps you need to take to create a personalized document that reflects your organization’s requirements.

Step 1: Gather Necessary Information

Before making any adjustments, ensure you have all the necessary information that will appear in the document. This includes:

- Organization name and contact details

- Recipient’s name and contact information

- A detailed list of services, contributions, or donations

- Payment instructions and due dates

Step 2: Adjust Layout and Design

Once you have the required information, you can start customizing the layout. Some essential adjustments include:

- Incorporating the organization’s logo and color scheme

- Choosing a clean, easy-to-read font

- Organizing sections clearly (e.g., using bold for headings)

- Ensuring that key details such as amounts and dates stand out

Step 3: Personalize Fields for Specific Needs

Depending on your organization’s activities, you may need to modify certain fields or add new ones. This could include:

- Fields for specific event names or fundraisers

- Custom categories for donations (e.g., tithes, special projects)

- Options to specify recurring or one-time payments

Step 4: Review and Save

After making all necessary changes, review the document for accuracy. Ensure all information is correct and that the layout is professional. Once you’re satisfied, save the customized format for future use.

By following these steps, you can easily create a personalized system that meets your organization’s needs, saves time, and

Types of Church Invoices

There are several variations of financial records used by organizations to track transactions, each suited to different needs. These records can differ in format, purpose, and the type of transactions they document. Understanding the different types available helps ensure that the right method is used for each situation, from regular contributions to special events or projects.

1. Regular Contribution Records

This type of document is used for tracking ongoing contributions, such as donations or membership fees. It’s typically issued on a recurring basis and serves to acknowledge the donor’s contribution for record-keeping purposes. These are often the most common type used for regular, predictable financial support.

- Designed for weekly or monthly donations

- Simple structure with amount, date, and donor details

- May include fields for preferred donation methods

2. Special Event or Project Records

When an organization hosts a special event or fundraiser, this type of record is used to document contributions related specifically to that event. These records provide clear details about the event or project and are useful for tracking one-time donations or payments made in support of the specific cause.

- Includes event name and specific goals

- Details one-time contributions or project-related payments

- Can include additional details such as ticket sales or merchandise

3. Purchase or Service Records

Sometimes an organization may provide goods or services in exchange for compensation. These types of records document the exchange and ensure transparency in the financial transaction. This could include things like purchasing religious materials, renting facilities, or offering classes or seminars.

- Documents goods or services provided by the organization

- Includes payment terms and pricing for specific items

- Often includes terms of service or usage agreements

Each of these different financial records serves a unique purpose, making it crucial to select the right type for each transaction. Whether documenting regular donations or special contributions, choosing the appropriate record ensures accuracy and helps maintain a sm

Choosing the Right Template for Your Needs

Selecting the right document structure for your organization is essential for maintaining clear and consistent records. The layout you choose should meet your specific requirements while ensuring that all necessary details are easily captured and presented. Whether you’re dealing with regular donations, special projects, or payments for services, understanding your needs will guide you in picking the most suitable format.

1. Consider the Frequency of Transactions

Think about how often you need to document financial transactions. For ongoing, regular contributions, you may need a simple, straightforward format that highlights recurring amounts and donor information. For one-time events or special projects, a more detailed structure may be necessary to track specific contributions or payments tied to those initiatives.

- Regular transactions: Keep it simple with clear dates and amounts.

- One-time payments: Include event-specific details, goals, and contribution types.

2. Evaluate the Level of Customization Needed

Some organizations require a higher level of customization to capture specific data related to their activities. If you need fields for additional information such as event names, special fundraisers, or personalized categories, opt for a format that offers flexibility and allows you to easily add or modify sections. This ensures you can tailor the document to suit your unique needs without unnecessary complexity.

- Custom fields for special categories or events

- Ability to modify sections as per organizational requirements

By carefully considering both the frequency and the level of customization, you can choose a structure that makes your financial tracking process more efficient and better suited to your specific needs.

How to Track Donations with Invoices

Tracking donations effectively is essential for organizations to maintain transparency and ensure proper record-keeping. Using structured documents for each contribution helps to organize the information and allows for easy reference when needed. Proper tracking ensures that all donations are accounted for and helps in reporting and auditing processes.

The first step in tracking donations is ensuring that every contribution is documented correctly. Each document should contain the following key details:

- Donor’s name and contact information

- Date of the contribution

- Amount donated

- Purpose or designation of the donation (if applicable)

- Payment method (e.g., cash, check, credit card)

Additionally, it is important to assign a unique reference number to each document for easy tracking. This can help differentiate between individual donations and make sorting and searching through records more efficient.

Organizing Donations into Categories

For organizations that receive donations for different purposes (e.g., general funds, specific projects, or special events), categorizing them is essential. Each category should have its own section on the record, ensuring that the donation is properly allocated. Here are some suggestions:

- General Contributions: For regular, ongoing donations.

- Special Project Donations: For donations aimed at specific events or causes.

- Event Fundraisers: For one-time donations made during specific events or drives.

Generating Reports and Analyzing Donations

Once the donations have been tracked, it is crucial to generate regular reports to assess trends and overall financial health. These reports can be used to provide transparency to stakeholders and make informed decisions regarding future campaigns or programs.

- Track total contributions over a specific time period (monthly, quarterly, etc.)

- Identify major donors and recurring contributions

- Analyze patterns in donation amounts for better planning

By following these steps and organizing your donations properly, you can ensure that all contributions are tracked efficiently, providing clear insights and maintaining accountability within your organization.

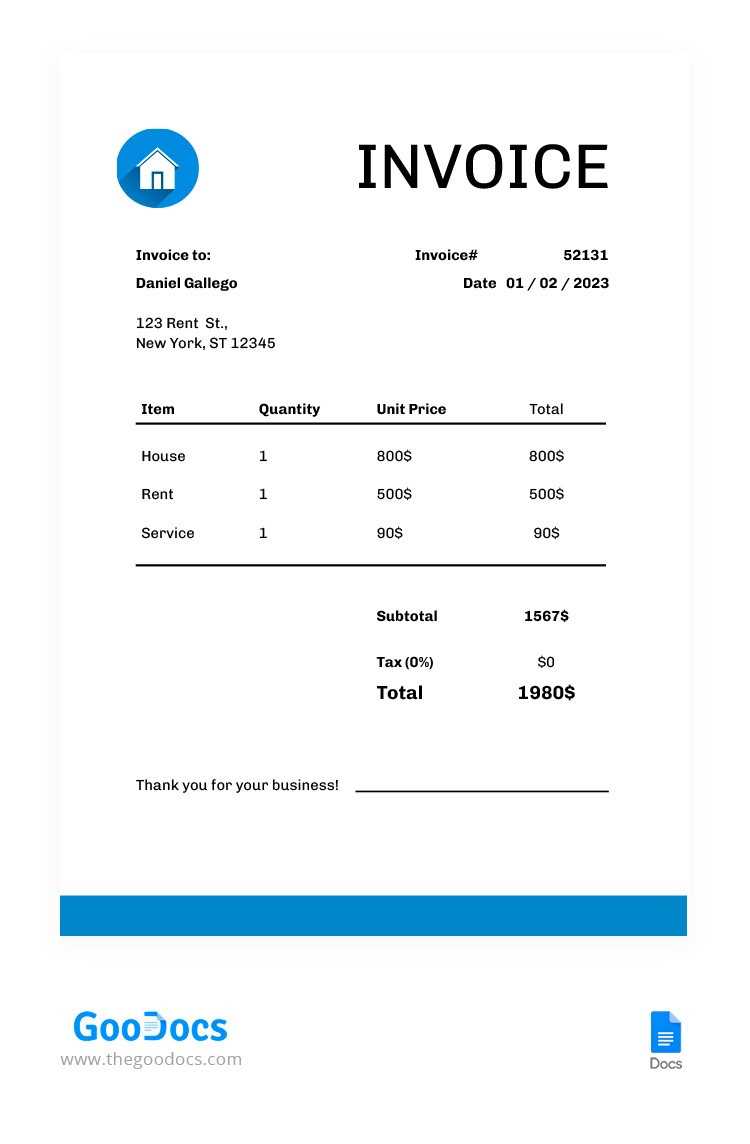

Incorporating Donation Records in Invoices

Integrating donation information within financial records is a vital practice for organizations aiming to maintain accurate documentation of contributions. When properly included, this data can help with transparency, tracking, and generating reports. It ensures that all donations are recorded with the necessary details and that donors receive proper acknowledgment for their support.

To effectively incorporate donation details, it is important to include specific information on each document. This allows for easy tracking and clear communication with donors regarding their contributions.

Key Information to Include

- Donor Information: Name, address, and contact details of the person making the donation.

- Contribution Date: The exact date when the donation was made.

- Amount Donated: The total amount contributed by the donor.

- Designation: Whether the donation is for general use or earmarked for a specific project or event.

- Payment Method: Document the method of payment (e.g., check, credit card, cash, online transfer).

Formatting Donation Records Clearly

It’s crucial that donation records are presented in a way that is easy to read and understand. Clear sectioning of information on the document can help both the organization and the donor quickly identify key details. Here are some best practices for organizing donation data:

- Use a separate section dedicated to donation details to make them stand out.

- Provide a summary of the total amount donated and any tax-deductible elements.

- Ensure that the purpose of the donation is clearly labeled, especially if it is allocated to a specific project.

By incorporating donation information directly into financial records, organizations can ensure that every contribution is accurately documented, making it easier to provide receipts, manage finances, and maintain transparency for stakeholders.

Setting Up Payment Terms in Invoices

Establishing clear payment terms is essential for maintaining smooth financial transactions and ensuring that both parties understand their obligations. By defining when payments are due, what payment methods are acceptable, and any potential late fees, you can reduce confusion and improve cash flow management. Clear terms also help in fostering transparency and trust between your organization and its supporters.

When setting payment terms, it’s important to cover several key aspects that ensure all expectations are clear from the outset. These terms can vary depending on the nature of the donation or service, but they should always be easy to understand and enforceable.

Common Payment Term Elements

- Due Date: Specify the exact date by which payment should be made. Common terms include “Net 30” (payment due in 30 days), “Due on Receipt,” or “Due by the end of the month.”

- Accepted Payment Methods: Indicate which payment methods are acceptable, such as checks, credit cards, bank transfers, or online payment systems.

- Late Fees: State any fees that will be applied if payment is not made by the due date. These can be fixed amounts or percentages, depending on your policy.

Clarifying Special Payment Arrangements

If there are any special arrangements, such as installment payments or discounts for early settlement, these should be outlined in detail. This ensures there is no ambiguity about the terms of the agreement.

- Installment Plans: If payments are to be made in installments, clearly state the amounts and due dates for each installment.

- Early Payment Discounts: Offer discounts for early payments by specifying the percentage discount and the time frame within which the payment must be made.

By carefully setting and communicating payment terms, you ensure that both your organization and the donor or client are aligned on financial expectations, helping to prevent delays and misunderstandings.

Guidelines for Clear Payment Instructions

Providing precise and straightforward payment instructions is crucial for ensuring smooth transactions. Clear directions reduce confusion, prevent delays, and ensure that payments are made promptly and accurately. By detailing the steps required for completing payments, you make it easier for the payer to fulfill their obligations and for your organization to receive the funds on time.

Effective payment instructions should be easy to understand and follow, leaving no room for ambiguity. Whether the payment is being made via check, bank transfer, or online method, clear guidelines are necessary for a smooth process.

Essential Elements of Payment Instructions

- Payment Methods: Clearly list the accepted methods of payment. Specify whether payments can be made through check, credit card, bank transfer, or online systems like PayPal or others.

- Payment Address/Details: Include the necessary information for sending payments, such as a physical address for checks or bank account details for transfers.

- Reference Information: If a reference number or description is needed to match the payment to the correct account, ensure that this is clearly communicated.

- Payment Deadline: State the exact date by which payment should be received to avoid any penalties or delays.

Tips for Effective Payment Communication

- Keep it Simple: Avoid overly complex or legalistic language. Use clear and concise terms that the payer will easily understand.

- Highlight Important Information: Make key details such as due dates, account numbers, and required reference information stand out to prevent any overlooked points.

- Provide Contact Information: Include a contact number or email address for any questions or concerns about the payment process.

By following these guidelines, you can ensure that the payment process is clear, simple, and straightforward for all parties involved. This reduces the likelihood of mistakes or delays and helps maintain positive relationships with those making payments.

Design Tips for Church Invoices

Creating well-designed financial documents is crucial for ensuring clarity and professionalism. A thoughtfully designed form helps recipients quickly grasp important information, making the payment process more efficient and effective. Good design can also enhance your organization’s image, presenting a polished and trustworthy appearance.

When designing such documents, it’s important to balance aesthetics with functionality. The layout should be clean, organized, and easy to navigate, ensuring that all necessary details are clearly visible. Here are some key design tips to consider:

- Keep It Simple: A clutter-free layout is essential. Avoid overloading the document with excessive details. Focus on the essentials, such as contact information, payment terms, and amounts due.

- Use Readable Fonts: Select legible fonts and use appropriate font sizes. Ensure that key details, like amounts and due dates, stand out. Sans-serif fonts are often easier to read, especially for online versions.

- Include Clear Section Headings: Break the document into clearly defined sections. Use headings like “Details,” “Payment Instructions,” and “Summary” to guide the reader through the form.

- Brand Consistency: Incorporate your organization’s branding, such as logo and color scheme, to maintain consistency with other communications. This adds to your organization’s professional appearance.

- Use White Space Effectively: Don’t overcrowd the document. White space improves readability and makes the content feel less overwhelming. It also helps draw attention to the most important details.

- Highlight Important Information: Key elements, such as payment amounts and due dates, should be prominently displayed. Use bold text, larger font sizes, or colored accents to make these details stand out.

By following these design tips, you can create visually appealing and highly functional financial documents that help ensure timely payments and enhance your organization’s professionalism.

Creating Visually Appealing and Professional Invoices

Designing well-structured and aesthetically pleasing financial documents is essential for maintaining a professional image and ensuring clear communication. A well-crafted document not only conveys essential details but also reinforces trust and credibility with the recipient. By using a clean layout, proper fonts, and consistent branding, you can make a lasting positive impression.

Here are some tips for creating documents that are both visually appealing and professional:

- Use a Clean and Structured Layout: Organize the document into distinct sections with clear headings. Ensure each section, such as the payment summary, due dates, and contact information, is easy to navigate. Avoid clutter to improve readability.

- Incorporate Consistent Branding: Use your organization’s logo, color scheme, and font choices to reflect your brand identity. Consistent branding ensures that the document looks cohesive with other communications.

- Choose Easy-to-Read Fonts: Select fonts that are legible both in print and digital formats. Stick to basic, professional fonts, and avoid overly decorative styles that could distract from the important information.

For added clarity, here is an example of a well-organized structure for such documents:

| Section | Details |

|---|---|

| Header | Include your organization’s logo, name, and contact information at the top of the document. |

| Payment Summary | Clearly list the payment amount, due date, and any applicable fees or discounts. |

| Recipient Information | Provide the recipient’s name, address, and contact details for clarity. |

| Payment Instructions | Outline clear instructions on how to make the payment, including methods and necessary account de

Common Mistakes to Avoid in InvoicesCreating accurate and clear financial documents is crucial for maintaining professionalism and ensuring timely payments. However, many individuals or organizations make common errors that can lead to confusion or delayed transactions. By being aware of these pitfalls, you can ensure that your documents are effective and efficient. Here are some common mistakes to avoid when preparing such documents:

By avoiding these mistakes, you can create a more streamlined and professional process, which will improve both communication and payment efficiency. Ensuring Accuracy and ClarityWhen creating financial documents, it’s essential to prioritize precision and simplicity. Clear and accurate details not only ensure that the recipient understands the terms, but they also help prevent misunderstandings and disputes down the line. Inaccurate or unclear information can lead to confusion and delay payments, making it vital to be meticulous in your approach. Double-Check Key InformationAlways verify the core components of your document, such as the dates, amounts, and contact information. A simple typo or an overlooked detail can cause problems, so it’s essential to double-check everything before finalizing the document. Ensure that the contact information of both parties is correct, and confirm any financial details, such as totals and taxes, are accurate. Simplify Language and StructureUsing straightforward language and a clean structure enhances clarity. Avoid jargon or overly complex wording that might confuse the reader. A well-organized document, with clear labels and a logical flow, will make it easier for recipients to understand the information and take the necessary actions promptly. Integrating Documents with Accounting SystemsEfficient financial management relies on seamless integration between documents and accounting processes. When all financial records are properly synchronized, it makes tracking income, managing expenses, and preparing reports much simpler. By ensuring that all records are linked to an accounting system, churches can maintain accuracy and streamline their bookkeeping efforts. Key Benefits of IntegrationIntegrating financial documents with an accounting system provides several advantages:

Setting Up the IntegrationTo integrate financial records with your accounting system, follow these steps:

By automating this process, you can save valuable time while ensuring that financial records remain accurate and up-to-date. Linking Data to Financial RecordsConnecting transactional data to a financial system is crucial for maintaining accurate records. This process ensures that all monetary exchanges, whether they are donations, payments, or other types of income, are properly accounted for and can be easily tracked for future reporting and auditing. When data is effectively linked to financial systems, it reduces the risk of errors and enhances overall transparency in financial management. Importance of Proper Data LinkageLinking the data from each transaction to financial records provides several key benefits:

Steps to Link Data to Financial RecordsTo ensure that data is effectively linked to your financial system, follow these steps:

By implementing this process, you create a more organized and accurate financial management system that supports informed decision-making and long-term financial stability. |