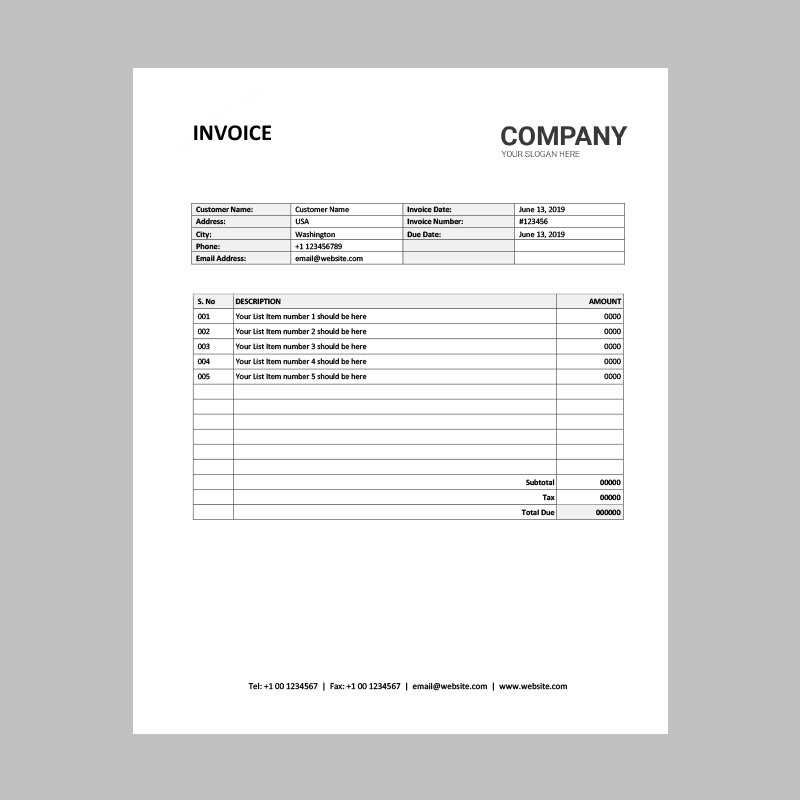

Download Free Invoice Templates for Easy Billing

Creating accurate and professional billing documents is essential for maintaining a smooth transaction process. With the right tools, you can easily generate well-organized forms that help streamline your financial records. Whether you are a small business owner or a freelancer, having access to customizable formats can significantly reduce the time spent on paperwork.

Efficiency is key when managing finances, and with the right documents, you can save valuable time. These resources allow you to personalize each file to suit your needs, ensuring that your details are consistently presented in a professional manner. The ability to quickly fill in necessary information and share it with clients will keep your operations running smoothly.

Accessing the right forms doesn’t have to be a complex or expensive task. Many solutions are available online, providing a variety of styles and formats to meet different business needs. By utilizing these ready-made documents, you can focus more on growing your business and less on administrative tasks.

Download Free Invoice Templates

Accessing ready-made business forms can greatly improve your workflow. These essential documents help organize your financial records and ensure all necessary details are included when you need to send them to clients. Having a variety of pre-designed options available can save you time, allowing you to focus more on running your business.

Why These Documents Matter

These forms serve as a professional way to keep track of transactions, clearly outlining the services provided and their respective costs. Properly formatted records can help prevent confusion, ensuring that both parties understand the agreed-upon terms. With just a few clicks, you can create an organized and accurate report for your clients.

How to Choose the Best Option

When selecting the right form, consider the following factors:

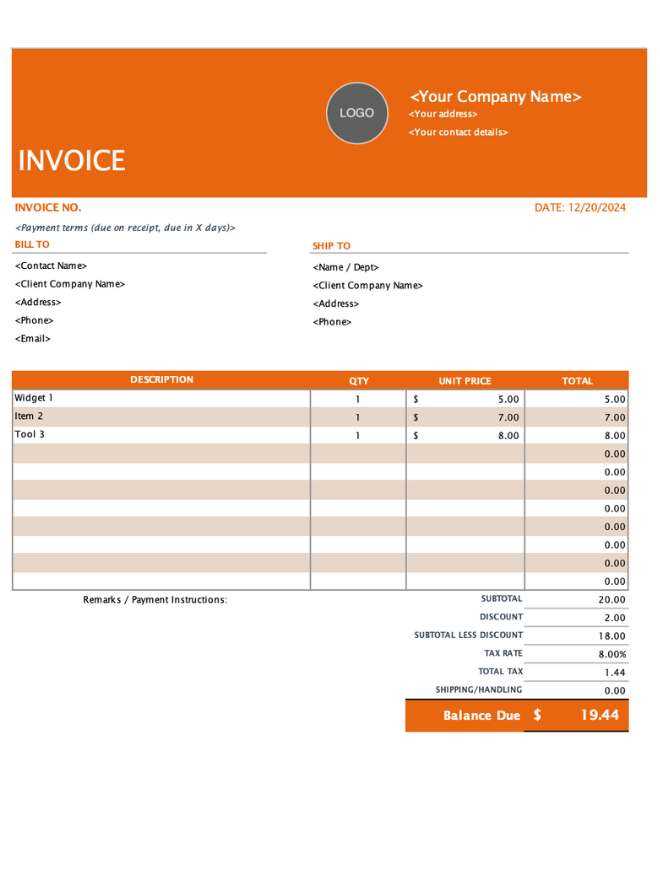

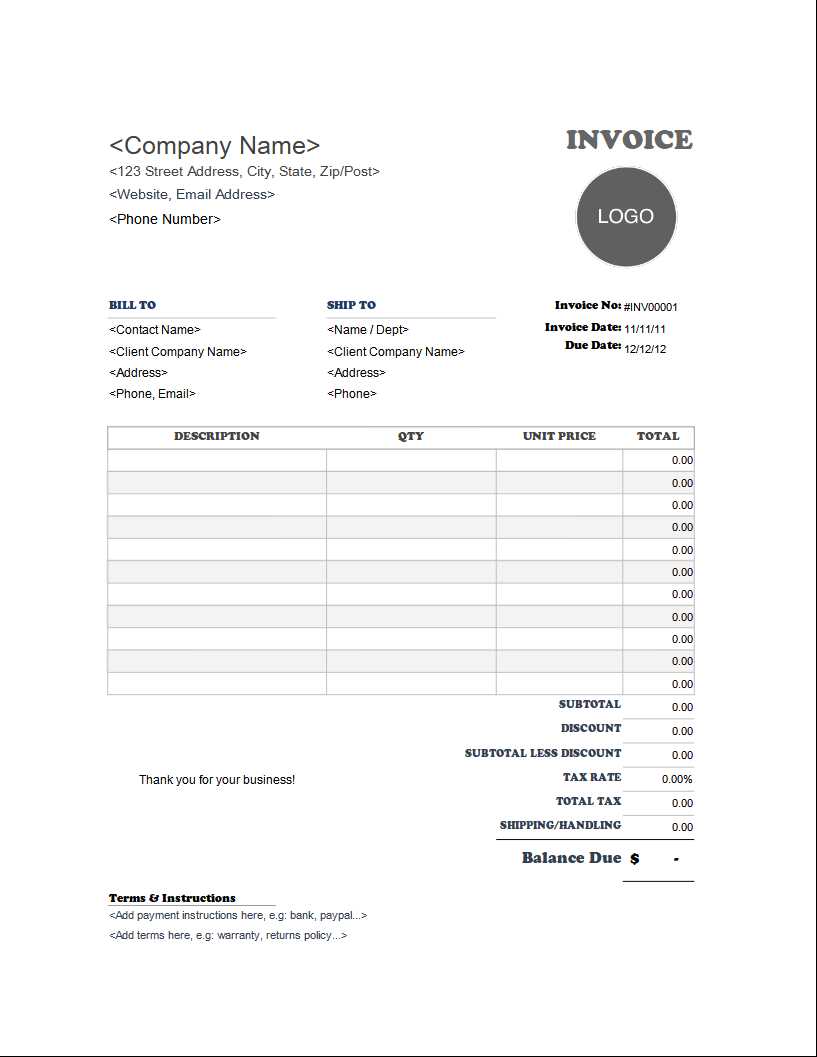

- Customization – Choose a document that allows you to adjust fields such as payment terms, dates, and personal details.

- Format – Make sure the file is in a compatible format, such as Word or PDF, that fits your business needs.

- Design – Select a layout that aligns with your brand’s identity, reflecting a professional image.

Once you have selected a suitable form, you can customize it with your company’s logo, payment methods, and other relevant information. This will ensure that the document looks professional and is easy for your clients to read and understand.

Why Use Invoice Templates

Utilizing pre-designed documents for financial transactions can bring significant benefits to businesses of all sizes. These tools streamline the billing process by providing a structured format that ensures all necessary details are included. By relying on well-organized forms, you can avoid errors and present a professional image to your clients.

One of the key advantages of using ready-made formats is efficiency. They eliminate the need to create a new document from scratch each time a transaction occurs. With customizable options, you can quickly adjust the details to fit your needs, saving time on administrative tasks and allowing you to focus on your core business activities.

Additionally, these resources help maintain consistency. Every document will follow the same layout, ensuring that your business operations are organized and that you present a unified image to clients. This consistency can build trust, as it shows that you pay attention to detail and handle financial matters with professionalism.

How Templates Save Time and Effort

Using pre-built forms for managing financial records significantly reduces the time spent on creating documents from scratch. By having a set structure in place, you can quickly input the necessary details without worrying about formatting or layout. This helps you streamline the process, ensuring that all essential information is captured accurately and efficiently.

Quick and Easy Customization

Once you have selected a suitable design, adjusting the content to fit your specific needs becomes a fast and straightforward task. Whether you need to change dates, amounts, or services provided, the layout remains consistent, saving you time with each new entry.

Eliminating Errors

By using well-organized forms, you minimize the risk of missing important information or making formatting mistakes. This ensures that the final document is clear, complete, and professional, reducing the effort needed to double-check and correct errors.

Types of Invoice Templates Available

There are various pre-designed documents available to suit different business needs. Each type offers specific features and layouts that cater to particular industries or preferences. Depending on the nature of your transactions, you can choose from simple, detailed, or customized forms to ensure clear communication with your clients.

| Type | Description |

|---|---|

| Basic Format | Simple layout with essential fields for itemizing services or products and their costs. |

| Detailed Format | Includes additional sections for tax calculations, discounts, and payment terms. |

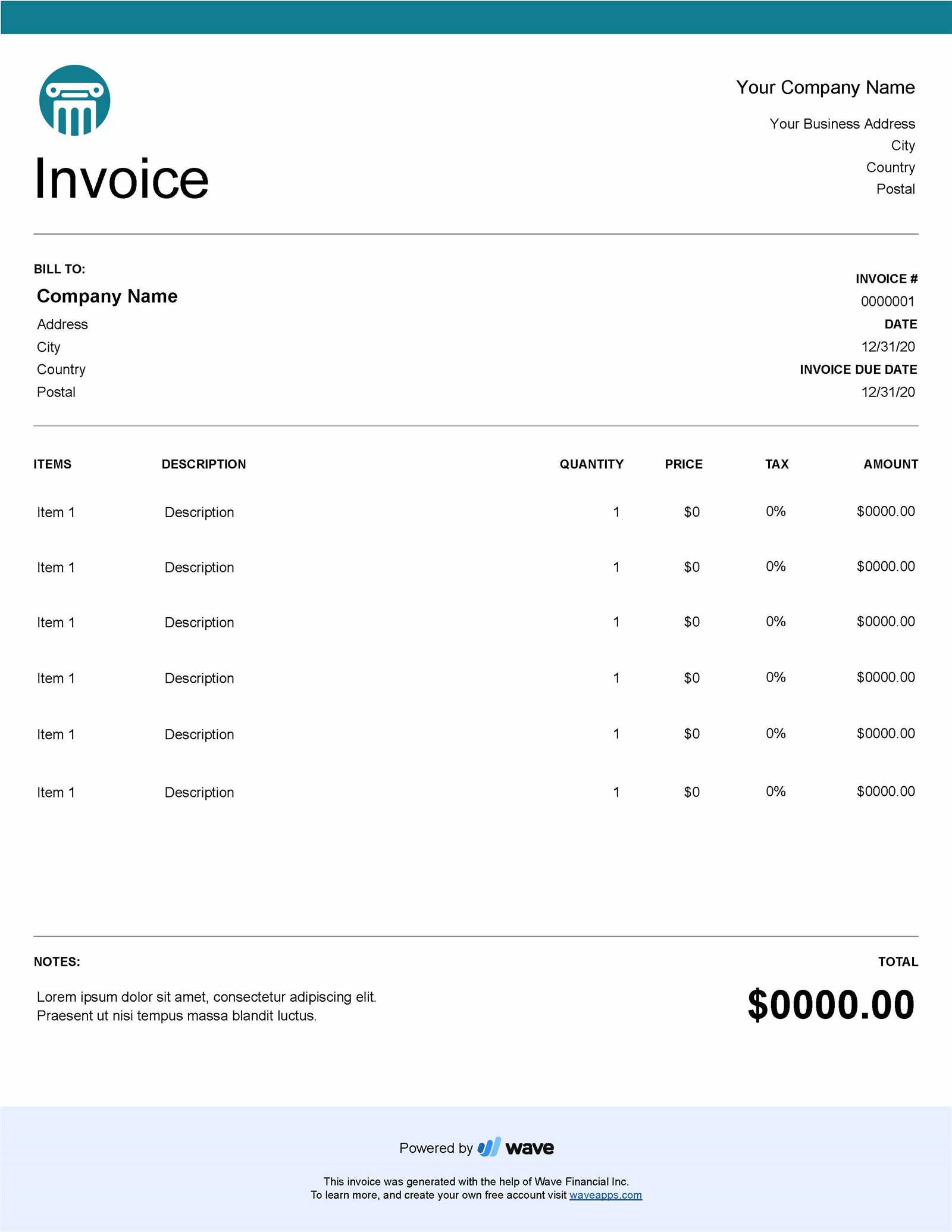

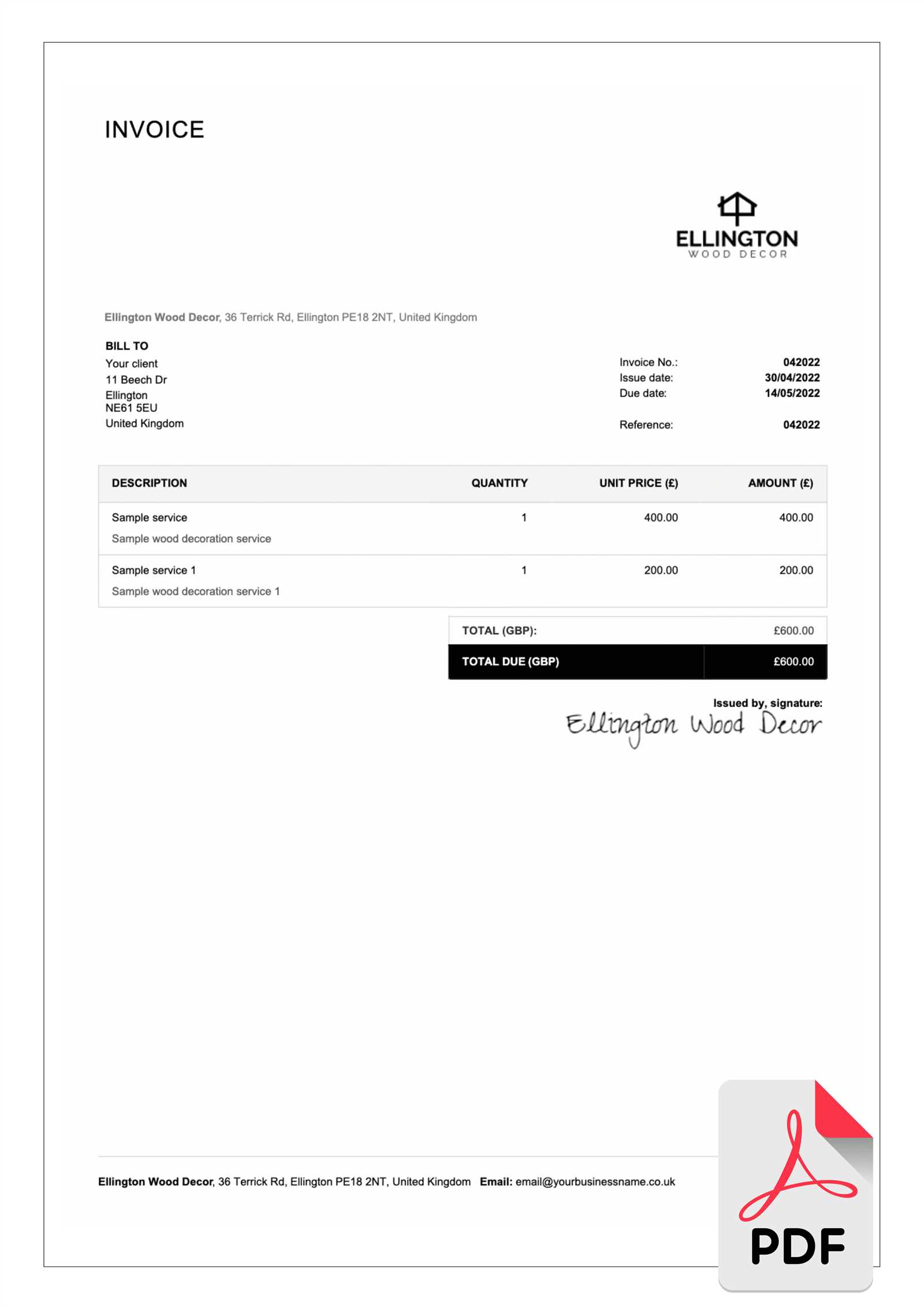

| Professional Layout | Offers a more polished design, often with company branding and a structured format. |

| Itemized Format | Designed for businesses that need to break down products or services into detailed entries. |

| Service-Based Format | Focused on billing for services rendered, typically with space for hourly rates and work descriptions. |

Benefits of Customizable Invoice Forms

Having the ability to modify business documents offers numerous advantages, especially for companies with specific billing needs. Customizable forms allow businesses to tailor each record according to their unique requirements, ensuring that the final document reflects both professionalism and accuracy.

Personalization is one of the key benefits. With editable fields, you can easily incorporate your business’s logo, adjust colors, and modify layouts to align with your brand identity. This creates a cohesive look across all your client communications, enhancing your company’s image.

Flexibility is another major advantage. Whether you need to add additional sections for detailed descriptions, tax information, or payment terms, customizable documents let you adjust the format without limitations. This ensures that your records are as comprehensive as needed, regardless of the complexity of the transaction.

How to Choose the Right Template

Selecting the appropriate document format for your business needs is essential for maintaining organization and professionalism. With various options available, it’s important to consider what features are necessary to meet your requirements. A suitable layout will help ensure that all relevant information is presented clearly and accurately, which enhances your credibility with clients.

Consider Your Business Type

The first step in choosing the right format is to think about the nature of your transactions. If you provide services, you may need a layout that includes space for hourly rates, project descriptions, or work timelines. For product-based businesses, a detailed list of items with prices and quantities may be required. Understanding the specific needs of your business will help guide your decision.

Focus on Simplicity and Functionality

While a visually appealing design is important, functionality should be prioritized. Choose a document that is easy to edit, ensuring you can quickly adjust the details for each new transaction. Look for layouts with clear sections, such as pricing, payment terms, and contact information, to avoid confusion and ensure all necessary details are included.

Free vs Paid Invoice Templates

When it comes to selecting a format for financial documents, businesses often face a choice between using no-cost options or investing in premium designs. Both approaches offer their own set of advantages and drawbacks, depending on your business needs. Understanding the differences can help you make a more informed decision on which option suits you best.

Advantages of No-Cost Formats

- Cost-effective: Obviously, the primary benefit of using no-cost options is that they don’t require any financial investment, making them ideal for small businesses or startups on a tight budget.

- Easy Access: These formats are widely available online and can be downloaded instantly, providing quick solutions without the need to wait.

- Basic Features: While simple, they typically cover the essential fields necessary for most transactions, making them a practical choice for basic billing purposes.

Advantages of Premium Formats

- Customization: Paid options often allow for greater flexibility, enabling you to adjust and personalize the design to better fit your business needs.

- Professional Appearance: Premium formats tend to have more polished designs, which can enhance your company’s image and build trust with clients.

- Advanced Features: These formats may include additional fields for tracking payments, taxes, discounts, or providing itemized details, which can be beneficial for businesses with more complex needs.

Top Features of Invoice Templates

When choosing a format for billing records, several key features can greatly enhance the document’s usefulness and ensure that all important details are included. Whether you’re a freelancer, small business owner, or large corporation, these features will help streamline the process and create a professional, easy-to-understand statement for your clients.

- Customizable Layout: The ability to adjust sections like branding, layout, and text fields is crucial for making the document reflect your business identity.

- Clear Itemization: A well-organized list of products or services with detailed descriptions and prices allows clients to easily understand what they are paying for.

- Automated Calculations: Some formats include automatic calculation fields for taxes, discounts, and totals, reducing the risk of errors and saving time on manual calculations.

- Payment Terms: Clear sections for specifying due dates, payment methods, and late fees are essential for setting expectations with clients.

- Professional Design: A clean, polished look enhances your business image and helps build trust with clients, making the payment process smoother.

- Multiple Currency Support: If your business deals with international clients, the ability to display amounts in various currencies can be incredibly helpful.

- Space for Notes: A section for additional comments, terms, or instructions ensures that clients have all the necessary information, including special requests or project details.

Easy Steps to Download Templates

Accessing ready-made formats for billing can be a simple and efficient process. Whether you need a document for one-time use or a long-term solution, the process of obtaining these formats is straightforward. By following a few easy steps, you can quickly get a template that suits your business needs.

Step 1: Choose the Right Source

Start by selecting a reliable platform that offers various document formats. Make sure the site is trustworthy and provides templates that match your requirements. Look for options that offer flexibility and customization to ensure that you can modify the document to suit your business style.

Step 2: Select a Suitable Format

Once you’ve chosen the right platform, browse through the available options. Look for designs that align with the type of services or products you offer. Choose one that includes all necessary fields and is easy to navigate for both you and your clients.

Step 3: Save and Customize

After selecting your desired format, save it to your device. From there, you can make any changes required, such as adding your business logo, adjusting the layout, or including specific payment terms. Personalizing the document helps maintain a professional and consistent image for your company.

Best Formats for Invoice Templates

When choosing the right format for creating billing documents, it’s important to consider compatibility, ease of use, and customization options. Different formats offer varying levels of flexibility, and selecting the best one depends on the needs of your business and the software you use. Below are some of the most popular formats available, each offering unique benefits for creating professional documents.

Popular Document Formats

| Format | Advantages | Best For |

|---|---|---|

| Universal compatibility, professional appearance, easy to send and print | Businesses needing a polished and easily shareable format | |

| Excel | Allows for calculations, customizable fields, easy to edit | Companies that need automated calculations and ongoing customization |

| Word | Flexible layout, easy to modify, widely accessible | Small businesses that need a simple format with customization options |

| Google Docs/Sheets | Collaborative, accessible from anywhere, cloud-based | Teams or businesses requiring real-time updates and collaboration |

Choosing the Right Format

Each format has its strengths, so it’s important to choose the one that aligns with your workflow. For example, if you need to send a polished document quickly, a PDF is an excellent choice. If you’re managing complex calculations and need flexibility, Excel might be more suitable. Consider the needs of your business and how you plan to use the document when selecting the format that works best for you.

Where to Find Quality Free Templates

Finding reliable and professional resources for creating business documents is essential for efficiency and accuracy. Many websites offer templates designed to suit a wide range of needs, from simple layouts to more complex structures. It’s important to choose a platform that provides a variety of options while ensuring that the templates meet your specific requirements.

Trusted Websites for Business Documents

- Template.net – A website that offers a large selection of customizable forms for various industries. It provides both free and premium options.

- Canva – Known for its user-friendly interface and vast library of designs, Canva offers free editable documents suitable for businesses.

- Microsoft Office Online – A trusted source for professional document designs, offering both free and premium choices through its online platform.

- Google Docs – A reliable tool for collaboration with several pre-made layouts that can be easily adapted to your needs.

How to Ensure Quality

While searching for business document designs, it’s important to assess the quality of the available resources. Look for clear, well-structured documents that are easy to personalize. Ensure that the platforms offer flexible customization options so that you can adjust the layout and content to fit your brand and business needs.

How to Personalize Your Invoice Template

Customizing your business document layout helps create a professional look that reflects your brand identity. Whether you’re adjusting the color scheme, adding your logo, or changing the font style, personalizing your document allows you to maintain consistency across your materials. It’s essential to ensure that the changes enhance the document’s clarity and professionalism.

Key Areas to Customize

| Customization Area | How to Personalize |

|---|---|

| Header Section | Add your business name, logo, and contact information for easy recognition. |

| Colors and Fonts | Match the colors and fonts with your branding for consistency across all documents. |

| Payment Terms | Adjust payment due dates, fees, or discounts based on your business policies. |

| Line Items | Customize descriptions, quantities, and prices to fit your specific offerings. |

Best Practices for Personalization

When personalizing your document layout, always prioritize readability and professionalism. Avoid cluttering the design with unnecessary details, and ensure that the essential information is clear and easily accessible. Using consistent fonts and simple color schemes can help maintain a clean and polished appearance for your business documents.

Design Tips for Professional Invoices

Creating a visually appealing and well-organized document is essential for ensuring clarity and professionalism. A clean and structured layout can enhance your client’s experience while reflecting positively on your business. The design choices you make will play a significant role in how your business is perceived.

Use Clear and Simple Layouts

Opt for a straightforward layout that makes it easy for your clients to navigate through the document. A well-structured design with clearly defined sections for services, pricing, and contact information helps avoid confusion. Make sure there’s enough spacing between sections to ensure readability.

Focus on Branding

Incorporate your business’s colors, logo, and font style into the document. A consistent branding approach not only makes your documents instantly recognizable but also reinforces your professional identity. Always make sure the design complements your overall branding strategy.

Highlight Key Information

Ensure that essential details, such as the total amount due and due dates, stand out. This can be achieved through bold text, a larger font size, or using a different color. By drawing attention to the most important aspects, you make it easier for clients to process the information quickly.

Keep It Professional

Avoid overly decorative elements that could distract from the content. Stick to simple, clean lines and fonts that maintain the professionalism of your documents. Focus on creating an organized and easy-to-read layout that conveys trustworthiness and competence.

Common Mistakes to Avoid in Invoices

While creating financial documents, it’s easy to overlook certain details, which can lead to misunderstandings or delays. Small errors in the content or layout can make it harder for clients to understand the terms of payment, potentially affecting your cash flow. Here are some common pitfalls to avoid.

Incorrect or Missing Details

One of the most significant mistakes is leaving out critical information or providing incorrect details. Ensure that all necessary fields, such as the service description, payment terms, dates, and amounts, are accurate. Missing or erroneous information can lead to delays or disputes. Always double-check the document before sending it out.

Unclear Payment Instructions

Clearly stating how payments should be made is essential. Avoid vague instructions that can cause confusion. Include all necessary details, such as bank account information or online payment links. Make sure the payment method is easy to understand and accessible for your clients.

Overcomplicating the Design

Excessive design elements or overly complicated layouts can make a financial document harder to read. Stick to a simple and clean layout that emphasizes the important details. The goal is to make the document functional and professional, not distracting.

Failing to Include Terms and Conditions

It’s crucial to outline the terms of the agreement clearly. This includes payment due dates, late fees, and other important conditions. Failure to mention these terms can lead to misunderstandings later on. Always ensure that the client is aware of the terms before the transaction is completed.

How to Use Templates for Multiple Clients

Managing financial records for various clients can become a time-consuming task without a streamlined system. Using pre-designed formats for multiple clients helps maintain consistency while saving time. By customizing these documents, you can handle different needs without starting from scratch each time.

Creating a Standardized Format

The first step is to establish a consistent structure that suits all your clients. This allows you to make minimal adjustments each time while ensuring uniformity across the documents. Make sure to include all essential fields such as client name, service details, and payment terms. Once the base structure is set, it can be reused with ease for different clients.

Personalizing for Each Client

Even though you are using a standardized format, personalizing each document for your client is crucial. Customizing details like the client’s name, services rendered, and specific terms ensures that each document is accurate and relevant. This makes the process efficient while maintaining professionalism.

| Client | Customization Needed |

|---|---|

| Client A | Service details, payment method |

| Client B | Specific payment terms, service description |

| Client C | Discount applied, project details |

By following this simple approach, you can effectively manage multiple clients while ensuring that each document meets their unique needs. This method reduces the chance of errors and improves overall efficiency.

Invoice Template Tools for Small Businesses

For small businesses, managing financial documents efficiently is essential. Using specialized tools can help automate the creation of professional documents, saving time and minimizing errors. These tools offer a variety of customization options to tailor each document to the specific needs of your business while maintaining consistency and a professional image.

Automated Tools are a great option for small business owners looking to streamline their workflow. These tools often allow you to create and manage multiple documents with ease, providing pre-set fields for essential information such as client details, amounts, and payment terms. Some platforms even allow integration with accounting software, making it easier to keep everything organized in one place.

Cloud-Based Solutions are another excellent choice for small businesses. By storing documents online, you can access them from anywhere, ensuring that you can send and manage them on the go. Many cloud-based tools offer collaboration features, making it easier to work with teams or clients remotely.

Finally, some businesses may prefer customizable document creators that offer more flexibility. These tools allow for detailed design adjustments, ensuring that each document meets the unique branding and style requirements of your business.

Overall, choosing the right tool depends on your specific needs, whether it’s simplicity, flexibility, or advanced integration with other business systems.

Tips for Efficient Invoice Management

Efficient management of billing documents is crucial for maintaining smooth cash flow and staying organized. By implementing streamlined processes and using the right tools, businesses can ensure timely payments, reduce errors, and save valuable time. Below are some strategies to help you manage your financial documents more effectively.

1. Organize Documents Clearly

It’s essential to maintain a clear and consistent structure when organizing your billing documents. Categorize them by client, date, or due date, and ensure all necessary information is easily accessible. Using a digital filing system can simplify document retrieval and minimize the risk of misplaced or lost records.

2. Automate Routine Processes

Automating the creation and sending of billing documents can save you a lot of time. Many tools offer features that automatically generate and send documents based on predefined parameters, reducing manual work and ensuring consistency in each document.

Track Payment Status is another important aspect of managing financial documents efficiently. Use tools that allow you to monitor the payment status of each client, send reminders, and even set up automated follow-ups for overdue payments.

Consistency and timeliness are key in building trust with clients and ensuring that your business runs smoothly. By setting clear procedures and utilizing helpful tools, you can enhance the efficiency of your financial document management system.

Legal Aspects of Using Invoice Templates

When creating and utilizing billing documents, it’s essential to be aware of the legal requirements associated with them. These documents are not only a tool for managing transactions but also serve as a legal record in case of disputes or audits. Understanding the legal obligations can help ensure compliance and prevent potential issues. Here are some important factors to consider:

- Correct Information: Always include accurate and complete information, such as the company name, contact details, transaction date, and a breakdown of the goods or services provided. Missing or incorrect information can lead to complications during legal proceedings.

- Tax Compliance: Ensure that your documents meet the requirements for tax purposes, including any applicable sales tax or VAT details. Misreporting taxes or failing to include them could result in fines or penalties.

- Payment Terms: Clearly define the payment terms, including due dates, late fees, and interest rates for overdue payments. This provides clarity for both parties and can prevent misunderstandings.

- Legal Validity: Depending on your jurisdiction, the format and content of financial documents may be subject to specific laws. For example, certain countries require specific language or declarations for the document to be legally enforceable.

- Record Retention: Always retain copies of your billing documents for the required period set by law. This is essential for audit purposes or in the event of legal disputes.

By ensuring that your documents meet these legal standards, you can protect your business from future complications and maintain professional, legally binding transactions. Always consult a legal expert if you have concerns about specific regulations that apply to your business.