Software Consulting Invoice Template for Easy Billing

When running a service-based business, having a clear and effective way to request payment is essential for maintaining cash flow and ensuring smooth financial operations. A well-structured billing document helps both the service provider and client stay on the same page regarding the work completed and the amount due. Whether you’re providing technical solutions, offering expertise, or delivering custom projects, a properly designed billing document can make all the difference in getting paid on time.

Clear communication and professional appearance are the keys to a successful billing process. The document should outline all necessary details, from services rendered to payment terms, to avoid confusion and disputes. With the right format, you can reduce administrative headaches and enhance your professionalism, helping to build long-term client relationships.

Creating such a document doesn’t have to be a complicated task. By using an adaptable format, you can easily customize the details for each client and project while ensuring consistency and accuracy. Whether you’re working on one-off projects or long-term engagements, a solid framework for billing will streamline your business operations and save you time.

Creating a Billing Document for Professional Services

Designing an effective billing structure for your business is crucial to ensuring timely payments and maintaining smooth financial operations. A well-constructed document not only serves as a formal request for payment but also establishes professionalism and clarity between you and your clients. The goal is to create a reliable, easy-to-use format that can be customized for each project while remaining consistent and professional.

Key Components of a Professional Billing Document

When developing a billing document for your services, there are several important elements to include. These components ensure that all necessary information is conveyed to your client and that the payment process runs smoothly:

- Client Information: Include the client’s name, address, and contact details for easy identification and communication.

- Services Rendered: Clearly list the work performed, including descriptions and relevant time frames.

- Payment Terms: Define the total amount due, due date, and accepted payment methods.

- Taxes and Additional Fees: If applicable, include any taxes, discounts, or extra charges related to the service provided.

- Invoice Number: A unique identifier for each document to help track payments and maintain organization.

Steps to Build a Reliable Billing Document

Once you know the essential elements, follow these steps to create a billing document that suits your needs:

- Choose the right software or platform that suits your workflow (spreadsheets, document processors, or specialized invoicing tools).

- Start with a simple layout, ensuring the document is easy to read and free from clutter.

- Include all necessary client and service details, ensuring there are no missing or unclear sections.

- Specify payment terms and deadlines, making sure they are fair and clear to the client.

- Save the document in a reusable format that you can easily adjust for future clients.

By following these steps, you can create a streamlined and professional billing structure that will not only make it easier for clients to understand your charges but also help ensure that your payments are received on time.

Why Use a Billing Document Format for Professional Services

Having a predefined structure for requesting payment is a practical solution that saves time, reduces errors, and enhances professionalism. When you’re providing specialized expertise, a standardized approach to documenting work and payments ensures clarity and helps maintain positive client relationships. This structured format eliminates confusion and ensures all relevant details are included in every transaction.

Efficiency and Consistency

A well-designed billing format streamlines the entire payment process. With a ready-to-use structure, you can quickly input necessary information without worrying about formatting issues or missing crucial details. It allows you to focus on the core of your work while ensuring all transactions are recorded consistently, regardless of client or project type. This level of efficiency ultimately saves you time, especially when handling multiple clients or projects simultaneously.

Professionalism and Trust

Using a formal billing document also builds trust with clients. A polished, clear, and structured document reflects well on your business, showing that you are organized and detail-oriented. Clients are more likely to take your work seriously and pay promptly when they see a professional approach to billing. The document not only serves as a request for payment but also acts as a record of the agreement, ensuring both parties are on the same page.

Standardized formats offer an easy way to maintain accuracy across projects, ensuring that all essential information–such as services rendered, payment terms, and deadlines–are included every time. Whether you’re working on short-term tasks or long-term collaborations, this structured approach helps foster trust and timely payments, ensuring smoother operations for your business.

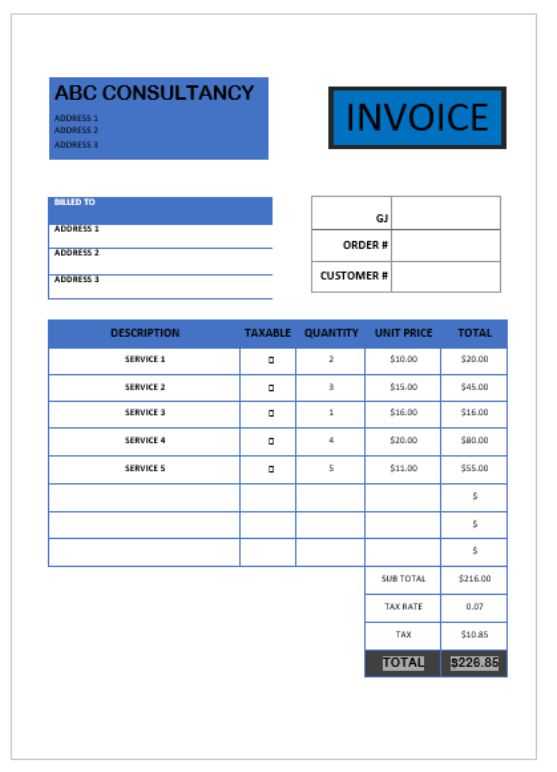

Essential Elements of a Billing Document

To ensure smooth transactions and clear communication with clients, it’s crucial to include certain key details in every request for payment. A well-organized document should contain all the necessary information to avoid confusion and help both parties understand the work completed and the amount due. These essential elements serve as the foundation for a transparent and efficient billing process.

Core Components of a Payment Request

When creating a billing document, there are specific details that must be included to ensure accuracy and professionalism:

- Client Information: Clearly display the client’s name, address, and contact details to identify the recipient and facilitate communication.

- Your Information: Include your business name, address, and contact information to ensure your client knows who the document is coming from.

- Unique Identifier: Assign a distinct reference number to the document, which helps track payments and organizes your records.

- Description of Services: Provide a clear breakdown of the services provided, including hours worked, tasks completed, and any specific details of the work.

- Total Amount Due: Include the total amount to be paid, breaking down the costs if needed (e.g., hourly rates, fixed fees, or product prices).

- Payment Terms: Specify the payment due date, methods of payment accepted, and any late fees or discounts that may apply.

Additional Information to Include

Beyond the core elements, there are a few other details that can help provide more clarity and keep things professional:

- Taxes and Fees: If applicable, add any taxes or additional charges to the total amount due, ensuring that the client knows exactly what they’re paying for.

- Payment Instructions: Include clear instructions on how the client should make the payment, such as bank account details or payment platform links.

- Due Date and Late Fees: Make sure to set a clear deadline for payment and mention any late fees that might apply if the payment is delayed.

By incorporating these essential elements, you can create a professional and efficient document that helps ensure clear communication, prompt payments, and organized financial records.

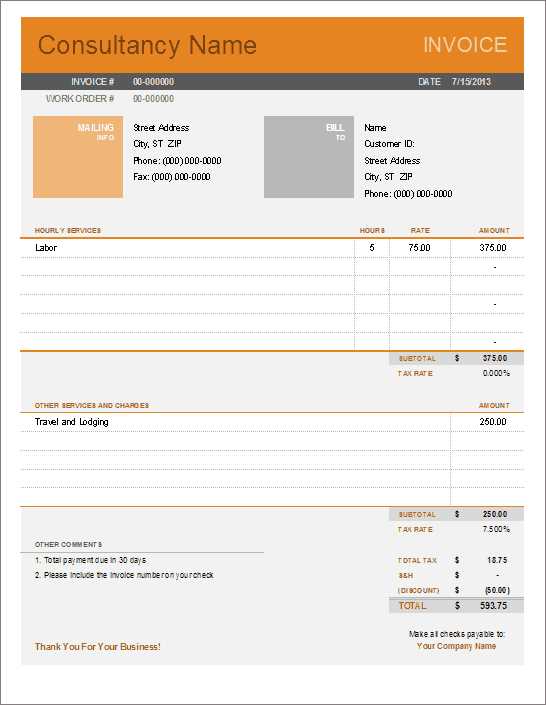

Customizing Your Billing Document

Tailoring your billing document to meet the specific needs of each client or project can make the payment process more efficient and professional. Customization ensures that the details you provide are relevant and specific to the work completed, helping to avoid confusion and ensuring clients understand exactly what they are paying for. By adjusting the format to fit various projects, you can create a more streamlined workflow and maintain consistency across your business operations.

Adapting for Different Projects

When working on various projects, each may require unique billing details. You can easily modify the structure of your document to fit the scope of work, client preferences, or specific contractual agreements. Consider these customizations:

- Project-Based Information: For one-time projects, include details such as milestones or deliverables, and link the payment to the completion of specific tasks.

- Hourly or Fixed Pricing: Adjust the layout to reflect either hourly rates or fixed project prices, depending on your pricing model.

- Service Categories: If your work spans multiple service areas, break down the costs for each category, allowing clients to see the value of each segment separately.

Including Client-Specific Details

Personalizing the document for each client not only helps clarify the terms of payment but also shows that you are paying attention to their specific needs. You can customize the following elements:

- Client Branding: Include the client’s logo or other branding elements to make the document feel more tailored and professional.

- Payment Preferences: If your client prefers a particular method of payment, such as direct bank transfers or digital platforms, make sure to reflect this in the document.

- Discounts or Special Terms: If you’ve agreed to special terms with a client, such as discounts for early payment or bulk service packages, be sure to note this clearly.

Customizing your billing document helps create a more personalized experience for your clients, fostering positive relationships and improving the likelihood of timely payments. By adapting the format to suit both your business model and client preferences, you maintain professionalism and clarity with every transaction.

How to Add Client Information

When preparing any professional document, it is essential to clearly identify the client to whom the service is being provided. Including accurate and comprehensive client details helps ensure smooth communication and prevents misunderstandings. This section outlines the steps for adding relevant client data, ensuring that all important contact information and billing details are correctly included.

Required Client Details

Start by collecting basic but necessary information about the client. Typically, you should include the full name or business name, address, and phone number. This helps establish a clear identity for the recipient and facilitates easy communication if follow-up is needed. You may also want to include an email address for digital correspondence or updates.

Optional Information

Additional information such as the client’s job title, department, or specific reference number can be useful for larger organizations. Including these details can help direct the communication to the correct department or individual. If the client prefers certain communication methods or has specific invoicing requirements, be sure to include those as well to streamline the process.

Including Service Descriptions in Invoices

Providing detailed descriptions of the services rendered is crucial for clarity and transparency. Including a clear explanation of what was done ensures that both parties are on the same page regarding expectations and results. This section highlights the importance of adding specific, accurate descriptions for each service or task provided, helping to avoid confusion and potential disputes.

Be Clear and Specific

Each service should be described in a way that leaves no room for ambiguity. Instead of using broad terms, provide clear details about what was delivered, such as the duration of work, the specific tasks completed, or any milestones achieved. For example, instead of simply listing “project work,” specify “developed website homepage with responsive design and integrated contact form.” This helps the client understand exactly what they are being charged for.

Break Down Complex Services

If the work involves multiple stages or components, break it down into smaller parts. This not only helps the client see the value of each phase but also demonstrates transparency in how time and resources were spent. If applicable, include additional notes on any changes made during the project, adjustments to scope, or unexpected challenges that were addressed, so the client is fully informed about the work completed.

Setting Hourly Rates and Payment Terms

Clearly defining payment expectations is essential for a smooth working relationship. Establishing hourly rates and outlining payment terms not only ensures transparency but also helps avoid misunderstandings regarding compensation. This section explains the process of determining rates and setting clear guidelines for when and how payments should be made.

Determining Your Hourly Rate

Your hourly rate should reflect the value of your expertise, the complexity of the tasks, and the market standards in your field. Consider factors such as experience, industry, and the level of service provided when deciding on your rate. It’s important to be transparent with your clients about how this rate is calculated and to ensure it aligns with the scope and duration of the work involved. You may also want to provide a brief explanation if the rate varies based on the type of task or project.

Defining Payment Terms

Setting clear payment terms is crucial to ensure timely compensation. Specify the due date for payments, whether they should be made upon completion or in installments, and outline any penalties for late payments. It is also important to indicate the accepted payment methods, such as bank transfers, credit cards, or digital payment platforms. Including this information in your agreement helps both parties avoid confusion and ensures a smooth financial transaction.

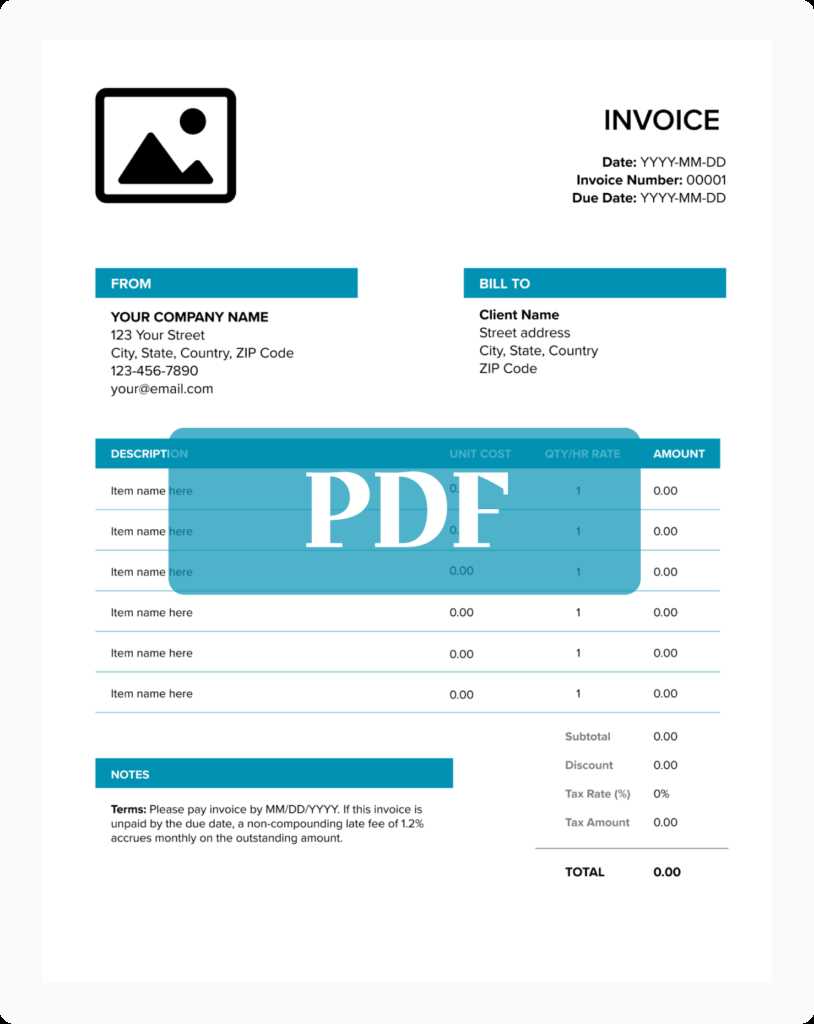

Adding Taxes to Your Invoice Template

When billing clients for your services, it’s important to include any applicable taxes to ensure compliance with local regulations and provide an accurate total. Taxation can vary based on location, industry, and the type of services rendered, so understanding how to properly calculate and add taxes is essential for both you and your clients.

Understanding Tax Rates

Before adding taxes, make sure you’re familiar with the relevant tax rates that apply to your services. These rates differ depending on where you operate and the type of work you perform. Generally, taxes can fall into the following categories:

- Sales Tax: Applied to the sale of goods and services, often varying by region or state.

- Value-Added Tax (VAT): Common in many countries, it applies to services and goods at each stage of production or delivery.

- Service Tax: Sometimes levied specifically on certain types of services, such as professional or consulting work.

How to Calculate and Add Taxes

To correctly add taxes to your billing statement, follow these basic steps:

- Identify the tax rate that applies to your services.

- Multiply the applicable rate by the total amount for the services provided.

- Clearly list the tax amount separately, showing both the subtotal and the total due, including taxes.

- If you are required to collect tax in multiple jurisdictions, ensure the correct rates are applied based on the client’s location.

Always ensure that taxes are calculated accurately and that clients can easily see the breakdown of the total charges, including the taxes added. This not only promotes transparency but also helps prevent any confusion or disputes about the final payment amount.

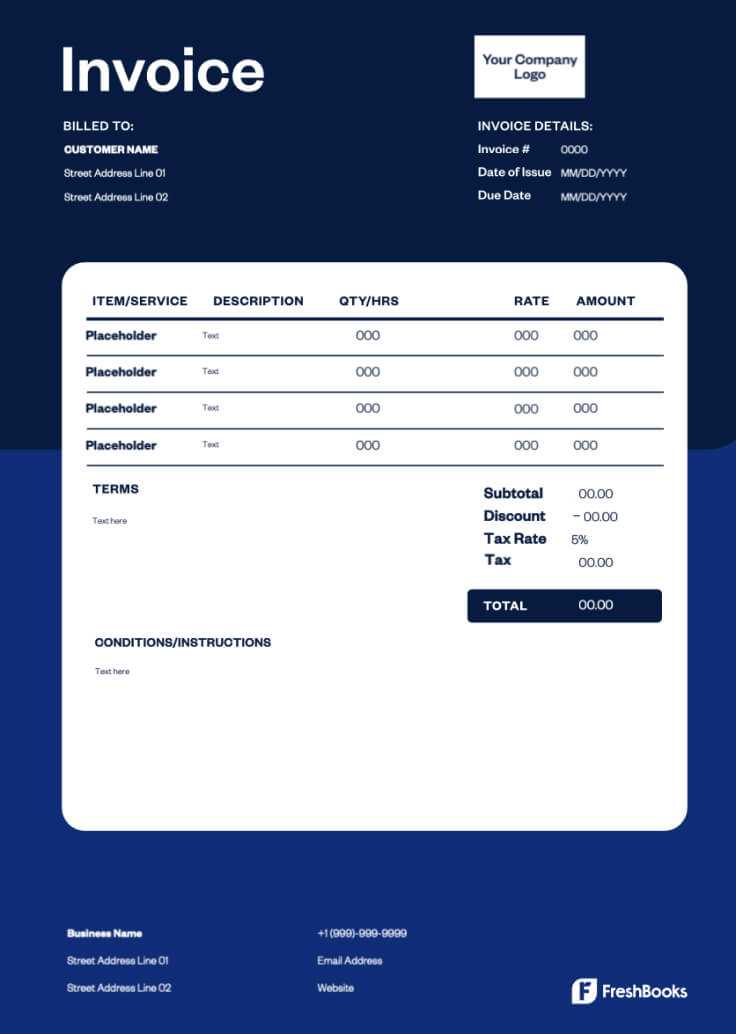

Invoice Formatting Tips for Clarity

Creating a document that is easy to read and understand is crucial when requesting payment for services rendered. Proper formatting not only improves the professional appearance of your document but also ensures that your client can quickly review the details and identify any key information, such as the total amount due and specific services provided. Here are some practical tips to improve the clarity and structure of your billing statements.

Organizing the Information

To make sure your client can easily navigate through the document, it’s important to organize the information logically. Consider the following structure:

- Header: Include your business name, contact details, and the recipient’s information at the top.

- Breakdown of Services: List the services provided along with their associated costs, making it clear what is being charged.

- Tax and Additional Charges: Clearly separate any taxes, discounts, or other fees that apply to the total amount.

- Payment Information: Provide details on how to pay, including bank account information, payment methods, or any online platforms accepted.

Making the Document Readable

To enhance readability, use simple and clean formatting. Here are a few suggestions:

- Use Clear Headings: Each section should have a bold or highlighted title to make it easy for the reader to scan the document.

- Choose a Legible Font: Opt for a clean, professional font such as Arial or Times New Roman, and use an appropriate font size (10–12pt) for readability.

- Utilize Tables: Present service details, costs, and taxes in an organized table to help break up the text and improve clarity.

- Leave White Space: Avoid clutter. Use margins and spacing between sections to give the document a well-structured and balanced look.

By following these formatting guidelines, you will create a document that is not only professional but also easy for your clients to read and understand, leading to quicker payments and fewer questions about charges.

How to Handle Late Payments in Invoices

Late payments can be a challenge for any business, impacting cash flow and creating unnecessary delays. It’s essential to handle overdue payments professionally and efficiently to maintain a positive relationship with your clients while ensuring that you are compensated for your work. This section outlines strategies for addressing late payments and preventing future delays.

Establish Clear Payment Terms

Preventing late payments starts with setting clear expectations at the outset. Be sure to define payment terms in the agreement, such as the due date, accepted payment methods, and any applicable late fees. Including these details in your documentation ensures that clients are aware of the terms and have no ambiguity regarding when payment is expected. Consider offering early payment discounts or penalties for overdue payments as an incentive for timely settlement.

Dealing with Late Payments

If a payment is delayed, follow a professional and structured approach to address the issue:

- Send a Reminder: Politely remind the client of the overdue payment, including the amount due and the original due date. This can be done through email or a formal letter.

- Apply Late Fees: If agreed upon in your terms, apply the late fee after the specified grace period has passed. Be transparent about the fee and provide a breakdown if necessary.

- Offer Payment Options: If the client is experiencing financial difficulty, consider offering flexible payment terms, such as installments or extended deadlines, to help them fulfill their obligation.

- Take Further Action if Needed: If the payment remains unpaid after reminders, consider escalating the matter by involving a collections agency or pursuing legal action as a last resort.

By being proactive and professional in handling overdue payments, you can minimize disruptions to your cash flow and maintain a positive working relationship with your clients.

Benefits of Digital Invoicing for Consultants

Switching to digital methods for billing offers a range of advantages, especially for those providing professional services. Digital invoicing streamlines the payment process, reduces administrative tasks, and enhances accuracy, allowing for quicker transactions and better financial management. This section highlights the key benefits of using electronic billing systems for service providers.

Improved Efficiency and Time Savings

One of the most significant benefits of digital billing is the time saved. Creating, sending, and tracking payments becomes much faster with automated systems. No more manually printing or mailing paper documents–digital tools allow you to generate and deliver statements with just a few clicks. This frees up valuable time that can be spent on other important tasks, helping to boost overall productivity.

Better Accuracy and Fewer Errors

Manual processes are prone to human error, whether it’s a typo in a figure or a mistake in the billing details. With digital systems, data is entered once and automatically formatted, reducing the chances of mistakes. Many tools also feature built-in validation checks, such as ensuring that totals add up correctly, which further minimizes the risk of errors.

Faster Payments and Improved Cash Flow

Digital billing makes it easier for clients to pay on time. With integrated payment systems, clients can settle their accounts via credit card, bank transfer, or digital platforms in a matter of minutes. Faster processing leads to quicker access to funds, improving cash flow and reducing the time spent chasing payments.

Enhanced Professionalism and Transparency

Sending polished, well-organized electronic documents reflects a higher level of professionalism. Clients are more likely to appreciate the clarity and convenience of a digital bill, which can include all the necessary details such as service descriptions, payment options, and deadlines. Additionally, digital systems often allow clients to track payment statuses, offering more transparency and reducing confusion.

By adopting digital billing practices, service providers can streamline their administrative tasks, improve payment speed, and maintain a higher standard of professionalism–all contributing to a smoother and more efficient business operation.

Tracking Payments and Invoice History

Keeping track of payments and maintaining a detailed history of transactions is essential for effective financial management. By tracking each payment, you ensure that no outstanding balances are overlooked and that both you and your clients are always on the same page. This section explores methods for monitoring payments and maintaining a clear record of past transactions.

Organizing Payment Records

One of the best ways to stay organized is by maintaining a centralized system for recording all transactions. This can be done through:

- Digital tools: Many accounting and billing platforms allow you to automatically log each payment made, including details such as the date, amount, and method of payment.

- Spreadsheets: For those who prefer a more manual approach, a well-organized spreadsheet can serve as a simple yet effective way to track payments and monitor any overdue balances.

- Paper records: While not as efficient as digital methods, some prefer keeping physical records for easy reference. If you go this route, ensure the files are clearly labeled and stored in a safe location.

Reviewing Payment History

Having access to a clear payment history is invaluable for resolving disputes, preparing for tax season, and evaluating the financial health of your business. Keeping detailed records allows you to:

- Track outstanding balances: Quickly identify clients who have unpaid or overdue amounts.

- Ensure accurate reporting: Easily prepare financial summaries or reports by reviewing historical payment data.

- Assess client reliability: Understand which clients consistently pay on time and which may need additional follow-ups.

By systematically tracking payments and maintaining a clear history of past transactions, you can improve cash flow management, minimize errors, and maintain strong relationships with your clients.

Creating Recurring Invoices for Clients

For service providers with clients on subscription-based or ongoing agreements, automating billing through recurring payment schedules can save time and reduce administrative effort. Recurring billing allows you to set up regular payment cycles, ensuring that payments are collected on time without needing to manually generate and send statements for each period. This section outlines the benefits and process of creating such payment arrangements.

Setting Up Recurring Payment Schedules

To create an efficient recurring payment system, start by determining the frequency of payments. Common options include:

- Weekly: Suitable for short-term services or subscriptions that renew frequently.

- Monthly: Ideal for long-term agreements, memberships, or ongoing services provided on a consistent basis.

- Quarterly or Annually: Often used for annual contracts, subscriptions, or longer-term projects that require periodic payments.

Once the payment frequency is established, ensure that the amounts are clearly defined, and that any additional charges (such as taxes or late fees) are included. This allows both you and your client to anticipate each billing cycle and avoid confusion.

Automating Recurring Billing

Many modern billing systems allow you to automate the entire process, reducing the chance for human error and ensuring payments are processed on schedule. Automated systems can:

- Generate invoices automatically: Set the system to create and send the payment requests at the desired intervals, with all necessary details included.

- Send reminders: Notify clients in advance of upcoming payments, reducing the risk of missed payments.

- Track payments: Automatically record payments as they are received, keeping you informed of outstanding balances or overdue amounts.

By setting up automated recurring payments, you can focus more on providing services and less on manual administrative tasks, improving efficiency and ensuring predictable cash flow.

Using Invoice Software for Automation

Automating the process of generating and managing financial documents can significantly improve efficiency and reduce errors. By leveraging digital tools, businesses can streamline repetitive tasks, ensure consistency, and save valuable time. Instead of manually creating each document, automated systems can handle everything from calculations to formatting, allowing professionals to focus on their core responsibilities.

Benefits of Automation

- Time-saving: Automates repetitive tasks like data entry, reducing the need for manual work.

- Accuracy: Automation minimizes human error by using pre-set formulas and templates.

- Consistency: Ensures every document follows the same format and structure, enhancing professionalism.

- Faster Processing: Speeds up the generation and sending of documents, leading to quicker payments.

Key Features to Look For

- Customization: Ability to adjust document formats according to your business needs.

- Integration: Seamless connection with other tools like accounting systems or customer management platforms.

- Tracking and Reporting: Tools to monitor the status of each document and generate reports on payment history.

- Cloud Storage: Cloud-based systems ensure that your records are always accessible and securely stored.

Legal Requirements for Consulting Invoices

When creating financial documents for services rendered, it is essential to follow certain regulations to ensure compliance with tax laws and business practices. These documents must contain specific details that validate the transaction and protect both the service provider and the client. Proper documentation can prevent legal disputes and ensure timely payments, while also satisfying regulatory obligations.

Essential Information typically includes the full name and contact details of both parties involved, a unique document identifier, a description of the services provided, the agreed-upon rates, and the total amount due. In many jurisdictions, tax identification numbers or VAT registration details are required, along with the applicable tax rate.

Timely Submission is another crucial aspect, as delays in issuing financial records may lead to penalties or complications. The deadlines for providing these documents can vary based on local regulations, but generally, they should be issued promptly after services are completed.

Lastly, it’s important to ensure the accuracy of all details in order to prevent any legal or financial issues down the line. Double-checking the amounts, dates, and terms can save time and resources in the long run.

Best Practices for Professional Invoicing

Maintaining a high level of professionalism in financial documentation is crucial for building trust and ensuring smooth transactions between businesses and clients. Clear, accurate, and well-organized records help prevent misunderstandings and ensure that payments are processed efficiently. Adhering to best practices not only supports timely payment but also upholds a company’s reputation.

One of the most important practices is to ensure clarity in every detail. Each document should clearly state the services provided, the agreed-upon rates, and the payment terms. This helps clients understand what they are being charged for and avoids confusion. Using consistent formatting and professional language further enhances readability and demonstrates attention to detail.

Timeliness is equally essential. Always send the financial documents as soon as the service is rendered, or within the agreed-upon timeframe. Late submissions can delay payments and potentially harm business relationships. Similarly, setting clear payment terms–such as net 30 or due on receipt–helps manage expectations and facilitates prompt processing.

Another best practice is to double-check for accuracy. Ensure that all amounts, dates, and client details are correct before sending any document. Mistakes, even minor ones, can create delays and erode trust. Additionally, keeping a consistent numbering system for each document helps with organization and tracking.

Lastly, consider offering multiple payment options to make it easier for clients to settle balances. Providing various methods, such as credit card payments, bank transfers, or online payment platforms, can speed up the payment process and improve the overall client experience.