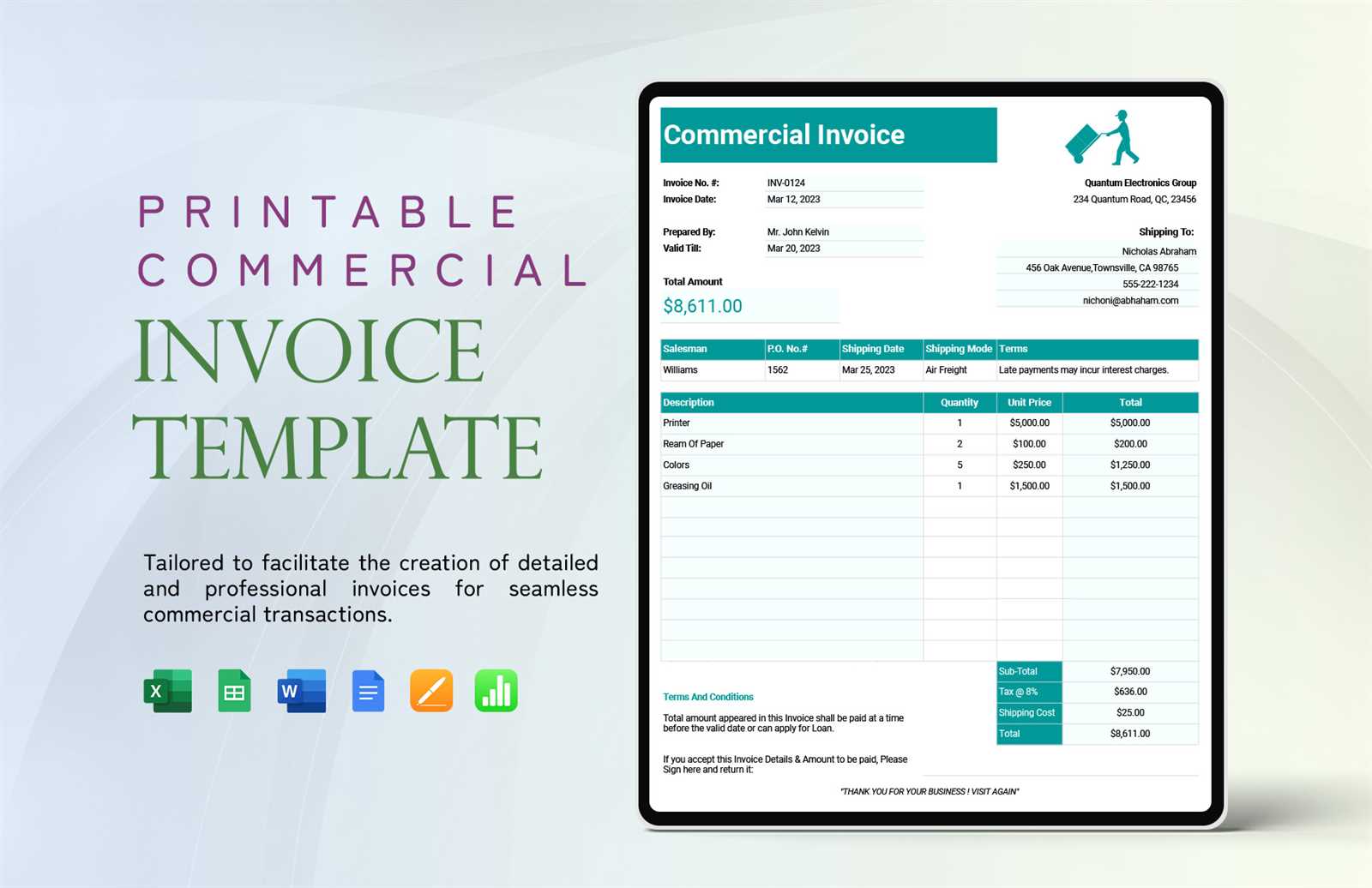

Free Commercial Invoice Template Word Doc for Easy Customization

In today’s business world, clear and accurate billing is essential for smooth transactions. Whether you are running a small company or managing a larger enterprise, having an organized structure for invoicing helps maintain professionalism and avoids misunderstandings with clients. A well-designed document can ensure that all necessary details are included, making the payment process more efficient.

Using a customizable document format allows businesses to create personalized billing records quickly. By adapting pre-made designs, you can ensure that each document meets the specific needs of your business, including detailed descriptions of services, payment terms, and client information. These formats are easy to adjust, making them suitable for various industries and transaction types.

Having a professional format not only streamlines the billing process but also helps to establish trust with clients. Whether you’re issuing a single transaction or managing recurring billing, choosing the right layout can simplify your workflow and improve your overall business efficiency.

What is a Billing Document Format

A billing document format is a pre-designed structure used by businesses to create clear, organized records of transactions with clients. These records typically include key information about the sale, such as product descriptions, quantities, pricing, and payment terms. Using a consistent structure helps to ensure that all necessary details are covered and presented in a professional manner.

Such formats are particularly useful for streamlining the billing process, as they allow businesses to easily input relevant data without needing to design a new document each time. By using a standard format, businesses can maintain consistency, reduce errors, and save time on document creation.

Key features of a well-structured billing document format include:

- Contact details of both the seller and the buyer

- Clear descriptions of goods or services provided

- Pricing and tax calculations

- Payment terms and due dates

- Unique reference numbers for tracking purposes

Overall, this type of format simplifies the process for both businesses and their clients, ensuring that all essential information is included and easily accessible. It also provides a professional appearance, which can help build trust and improve communication between parties.

Benefits of Using Pre-designed Billing Formats

Utilizing pre-designed billing formats offers numerous advantages for businesses. These ready-to-use structures provide a simple way to generate accurate and professional documents without the need for complex design work. By adopting such formats, companies can streamline their financial processes, reduce errors, and improve the overall efficiency of their operations.

Time-saving and convenient, pre-made formats allow users to focus on the essential details of the transaction rather than spending time on document design. The layout is already set up, so all that’s needed is to fill in the specific details of the sale. This speeds up the billing process, especially when dealing with multiple clients or transactions.

Consistency in presentation is another major benefit. Using the same format for every transaction ensures uniformity, which helps clients recognize the document quickly and reduces confusion. A consistent design also reflects professionalism, which can enhance the reputation of your business and build trust with clients.

Other advantages include:

- Ease of customization – Adapting the format to specific business needs is quick and simple.

- Accurate calculations – Built-in sections for pricing, taxes, and totals help avoid human errors.

- Professional appearance – A polished format makes a strong impression on clients, conveying reliability and attention to detail.

Overall, using pre-designed formats for billing simplifies the process, ensures accuracy, and helps maintain a high standard of professionalism in your business transactions.

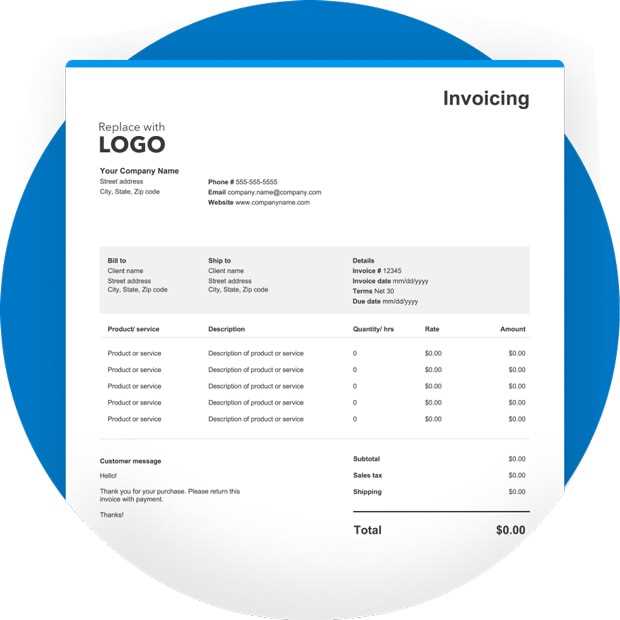

How to Create an Invoice in Word

Creating a billing record in a document editor can be quick and straightforward. By using a simple layout, you can design a professional-looking document that includes all the essential details of a transaction. This process can be done manually or by adapting an existing layout to fit your specific needs.

Step 1: Set Up the Document

Start by opening a blank file in your document editor. Ensure that the page is properly formatted with the correct margins and spacing. You can use built-in formatting tools to adjust the size of the page to fit your content, whether you’re sending a physical copy or an electronic one.

Step 2: Add Essential Information

In the main body of the document, include the following details:

- Your business name and contact information – Make it easy for clients to reach you.

- Client’s name and address – Ensure that this is correct to avoid any delivery issues.

- A description of products or services – Clearly list what is being charged for.

- Pricing and totals – Include all amounts, taxes, and discounts, if applicable.

- Payment terms – Specify the due date and accepted methods of payment.

Once all the details are filled in, review the document for accuracy. After confirming that everything is correct, you can save and share the document with your client.

Why Choose a Billing Document Format

Selecting a standardized billing document structure can significantly streamline your business processes. It offers a structured way to present transaction details clearly, helping both businesses and clients to manage payments efficiently. Using a recognized format ensures that all critical information is included and reduces the risk of errors or omissions.

Advantages of Using a Standard Format

One of the primary reasons for choosing a structured billing format is consistency. By always using the same format, businesses create a familiar document for clients, making it easier for them to process payments quickly and accurately. This consistency can also enhance your company’s professional image, as clients are more likely to trust an organized and well-designed record.

Key Benefits of a Standardized Billing Document

- Clarity and accuracy – Predefined sections for pricing, taxes, and descriptions help reduce mistakes.

- Time efficiency – Reusing a format allows you to quickly create new documents without starting from scratch.

- Compliance with regulations – Standard formats often include necessary legal details, such as tax identification numbers or terms and conditions, ensuring you stay compliant with local laws.

- Improved client trust – A professional format helps build confidence and encourages timely payments.

Ultimately, choosing a well-established billing format helps businesses save time, avoid errors, and maintain a high level of professionalism in every transaction.

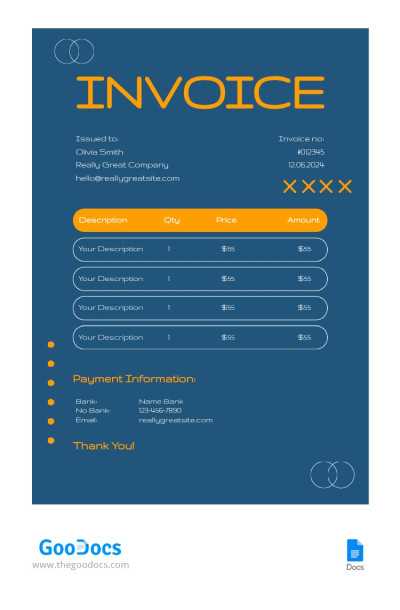

Customizing Your Billing Document Format

Personalizing your billing document allows you to align it with your business’s branding and specific requirements. By customizing a pre-made layout, you can make sure the design reflects your company’s style, while also including the exact details you need for each transaction. This flexibility ensures that every document you create is tailored to meet both your operational needs and client expectations.

To customize your billing record, focus on modifying key sections such as business contact information, layout structure, and item descriptions. You can also adjust fonts, colors, and other elements to match your corporate identity.

Here’s an example of how you might structure your billing document:

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Product A | 1 | $50 | $50 |

| Service B | 2 | $30 | $60 |

In addition to the itemized list, you can add sections for payment terms, taxes, and discounts, ensuring all relevant details are clearly visible. Customizing your billing record in this way helps ensure clarity and professionalism for both your business and your clients.

Essential Elements of a Billing Record

A well-structured billing document includes several key components that ensure both clarity and accuracy. These elements are critical for providing all necessary details about a transaction, making it easier for both businesses and clients to process payments and avoid misunderstandings. Whether you’re dealing with goods or services, a comprehensive record should cover a range of information to ensure smooth business operations.

Key Components of a Billing Document

Here are the essential elements that should be included in every billing document:

- Business and Client Information – This includes the names, addresses, and contact details of both parties involved in the transaction. It ensures that the record can be traced back to the correct parties if any issues arise.

- Unique Reference Number – A reference number or ID for each transaction makes it easier to track payments and manage records.

- Description of Goods or Services – A clear breakdown of the products or services provided, including quantities and unit prices.

- Price Breakdown – This includes individual item prices, applicable taxes, discounts, and the total amount due.

- Payment Terms – Clearly stated terms regarding when and how payment is due, as well as any penalties for late payments.

- Dates – The date of the transaction and the due date for payment are essential for tracking timelines and managing cash flow.

Why These Elements Matter

Each of these components plays a vital role in ensuring that both the buyer and the seller have a clear understanding of the transaction. A well-documented record provides protection for both parties and helps prevent disputes. It also ensures compliance with financial regulations and simplifies accounting processes.

How to Add Payment Terms to a Billing Record

Including clear payment terms in a billing document is essential for managing expectations between businesses and their clients. Payment terms outline the conditions under which the transaction will be paid, such as deadlines, accepted methods of payment, and any penalties for delays. These terms help avoid confusion and ensure that both parties are on the same page regarding payment schedules.

To add payment terms to your billing document, follow these steps:

Step 1: Determine Key Payment Details

Start by deciding on the following key elements:

- Due Date – Specify the date by which the payment should be made. This is often a set number of days after the transaction date (e.g., 30 days, 60 days).

- Accepted Payment Methods – Indicate the forms of payment you accept, such as credit cards, bank transfers, checks, or online payment platforms.

- Late Payment Fees – If applicable, define the penalties for overdue payments, such as interest charges or fixed late fees.

Step 2: Clearly Display Payment Terms

Once you’ve established the details, add the payment terms in a prominent section of the billing document. It’s important that these terms are easy to locate, typically near the bottom or in a dedicated “Payment Terms” section. You can phrase them clearly, for example:

- “Payment is due within 30 days from the date of this document.”

- “A late fee of 1.5% will be charged for payments received after the due date.”

- “We accept payments via bank transfer, credit card, and PayPal.”

Including these details helps prevent misunderstandings and ensures that your clients are aware of their financial obligations. It also facilitates timely payments and improves cash flow management for your business.

Best Practices for Billing Document Formatting

Properly formatting your billing documents ensures clarity, professionalism, and accuracy. An organized layout allows clients to quickly understand the details of the transaction, reducing the chance of errors or confusion. Following best practices for formatting not only enhances your business’s image but also helps streamline your internal processes.

Key Elements to Focus On

When formatting your billing record, make sure to consider the following:

- Consistency – Use the same font, size, and layout for all your documents. This helps maintain a uniform appearance across your transactions.

- Clear Headings – Use bold headings to separate sections, such as “Client Information,” “Description of Goods,” or “Payment Terms.” This improves readability and ensures important details are easy to find.

- Logical Flow – Organize the information in a logical order. Typically, start with your business details, followed by the client’s information, transaction items, totals, and payment terms.

Additional Formatting Tips

Here are some more formatting tips to improve your documents:

- White Space – Ensure there is enough white space between sections. This avoids clutter and helps the reader focus on key details.

- Highlight Key Numbers – Use bold or larger text for important figures, like total amounts due, taxes, or due dates, to make them stand out.

- Footer Information – Include your business contact details and payment instructions in the footer for easy access.

By following these formatting best practices, you can create clear, professional documents that promote effective communication with your clients and improve payment processing efficiency.

Free Billing Document Formats for Business

For businesses looking to streamline their financial processes, using a pre-designed billing record can be a valuable resource. These free formats are easily accessible and can be customized to fit the specific needs of any business, helping to maintain professionalism while saving time. By utilizing ready-made designs, you can ensure accuracy and consistency across all your transactions.

Here are some benefits of using free billing document formats for your business:

- Cost-effective – Free formats eliminate the need for expensive accounting software or design services.

- Ease of Use – These formats are simple to fill out, requiring only the essential transaction details.

- Customizable – You can modify the design to match your business’s branding or specific requirements.

- Time-Saving – Pre-designed layouts allow you to quickly generate accurate records without starting from scratch.

- Professional Appearance – Ready-made formats offer a clean, organized look that enhances your business’s credibility.

Many websites offer a variety of free formats tailored to different industries. These resources can provide you with a wide range of options, from basic to more complex designs. By choosing the right one for your business, you can create consistent and accurate records every time, helping to build trust with clients and improve your overall workflow.

Common Mistakes in Billing Document Creation

Creating a billing record might seem straightforward, but there are several common mistakes that businesses often make, which can lead to delays in payments, misunderstandings, or even legal complications. Avoiding these errors is crucial for maintaining a smooth financial process and ensuring a professional relationship with clients.

One of the most common mistakes is incomplete or incorrect information. Missing details, such as client addresses or payment terms, can delay payment processing and create confusion. Similarly, errors in the item descriptions, quantities, or prices can cause disputes that may harm your business reputation.

Key Mistakes to Avoid

- Incorrect or Missing Client Information – Ensure that both your business and the client’s contact details are accurate, including email addresses, phone numbers, and billing addresses.

- Omitting Important Dates – Always include the transaction date and payment due date. Missing this information can lead to payment delays and confusion about when payments are expected.

- Failure to Specify Payment Terms – Not clearly stating when payment is due or what methods of payment are accepted can create confusion and delay the process.

- Unclear Descriptions – Be specific when describing goods or services to avoid misunderstandings. Vague descriptions may lead clients to question what they are being charged for.

- Not Including Tax Details – Failing to clearly show applicable taxes or discounts can result in discrepancies and customer dissatisfaction.

Other Common Issues

- Inconsistent Formatting – Using inconsistent fonts, headings, or layouts can make the document harder to read and less professional.

- Not Double-Checking Calculations – Always verify that your pricing, taxes, and totals are correct before sending the document to the client.

By avoiding these mistakes, you can ensure that your billing records are accurate, professional, and clear, leading to smoother transactions and better relationships with your clients.

How to Save and Share Your Billing Record

Once you have completed your billing document, it’s important to save and share it correctly to ensure it reaches your client securely and in a timely manner. Proper file management and communication are essential for maintaining smooth business operations and ensuring clients receive the necessary information to process payments.

Here are the key steps to save and share your billing record:

Step 1: Save Your Document

After filling out the document, save it in a file format that is easy to access and read. Common formats include PDF and Excel, as these are universally accepted and can be opened on most devices. Saving your document in a secure location on your computer or cloud storage is important for easy retrieval and for maintaining records for future reference.

| File Format | Benefits |

|---|---|

| Universally accessible, preserves formatting, more secure for sharing | |

| Excel | Allows for easy updates and editing, especially for recurring transactions |

Step 2: Share Your Document

Once your document is saved, you can share it with your client in a way that ensures it is received promptly and securely:

- Email – Sending the file as an attachment via email is the most common and quickest method. Ensure the subject line is clear and the email body briefly explains the attached document.

- Online Payment Platforms – If your business uses online platforms for invoicing, you can upload the document directly through their system. This ensures secure delivery and tracking.

- Cloud Storage Links – For larger documents, you can upload the file to a cloud storage service (such as Google Drive or Dropbox) and share a link with your client for easy access.

After sharing the document, follow up with your client if necessary to confirm that the document was received and to answer any questions they might have. Keeping open communication ensures a smooth payment process.

Updating Your Billing Record for Different Clients

When dealing with a diverse range of clients, it’s essential to customize your billing records to meet specific needs. Different clients may have varying requirements for the format, information, or layout of the document. Customizing your records for each client ensures clarity, improves the professional image of your business, and helps avoid any confusion or payment delays.

Updating your billing record for each client involves modifying key sections, such as payment terms, contact information, or the itemization of goods or services. This can be easily done by adjusting a pre-designed layout to reflect the unique aspects of each transaction.

Common Updates for Different Clients

Here are some common updates you may need to make when creating billing records for different clients:

| Client-Specific Element | Reason for Update |

|---|---|

| Client Contact Information | Ensure accurate details for proper delivery and communication. |

| Payment Terms | Different clients may have unique payment deadlines or methods. |

| Product or Service Descriptions | Customize descriptions based on the client’s specific order or service. |

| Tax Rates and Discounts | Some clients may be entitled to special pricing or tax exemptions. |

Tips for Efficient Updates

- Use Fields for Flexibility – If you’re using software that allows for field entry, consider adding placeholders for client-specific details that can be easily updated with each new record.

- Save Variants – For clients with recurring orders or agreements, save a version of the record format tailored to them, making it easy to reuse in future transactions.

- Standardize Layouts – While certain elements may change, maintain a consistent layout to ensure that the billing document remains professional and easy to read.

By keeping your records adaptable and client-specific, you ensure smooth business operations and a better client experience, while also promoting timely payments and professional rapport.

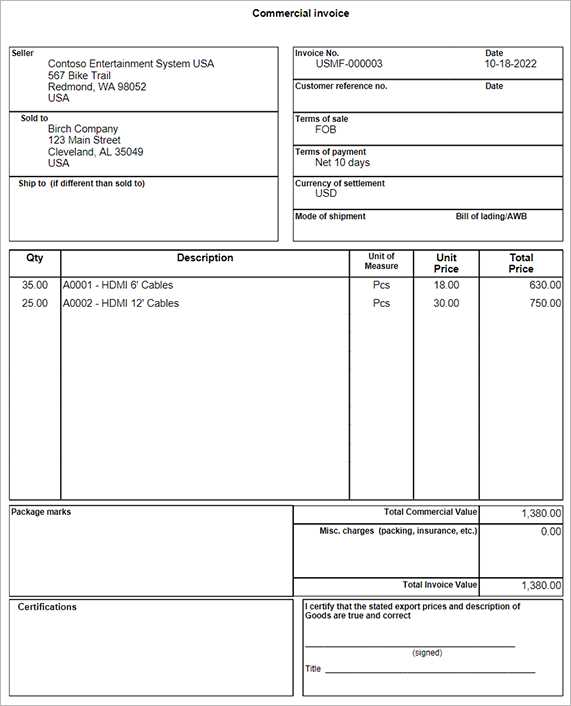

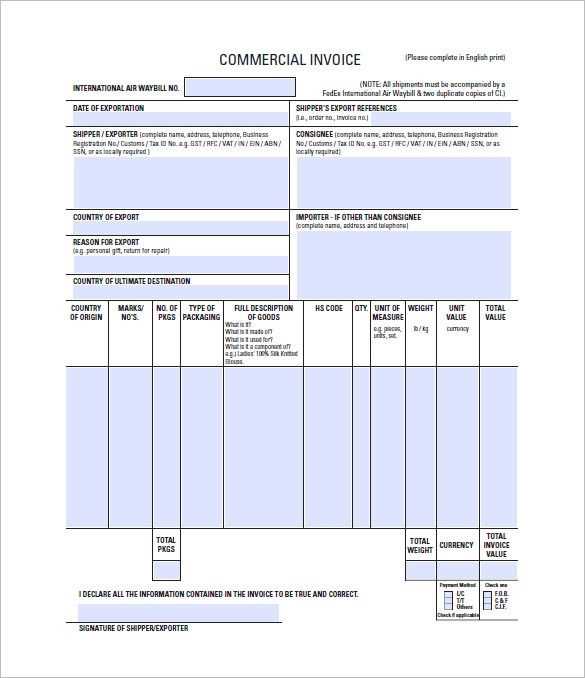

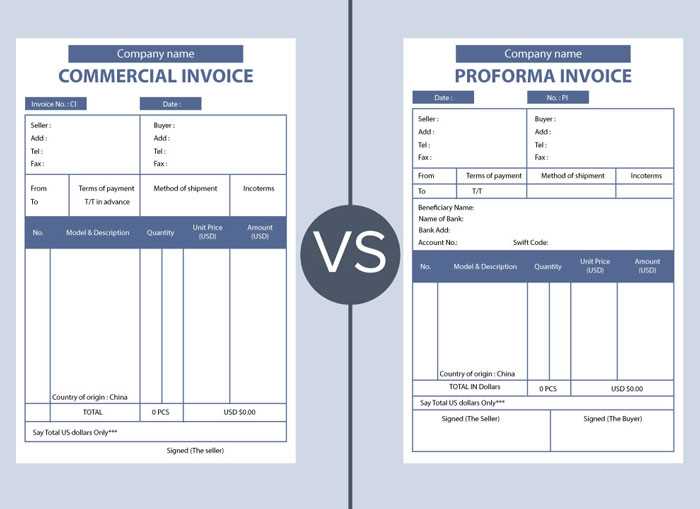

Using Billing Records for International Transactions

When conducting business across borders, it’s crucial to ensure that your financial documents comply with international regulations and are easily understood by both parties involved. Billing records for international transactions must include additional details to accommodate varying currencies, tax laws, and customs requirements. Properly structured documents can help streamline the process and avoid delays or misunderstandings during payment processing and shipment.

International transactions often require specific information to ensure clarity and legal compliance. These details may vary depending on the country of the buyer and seller, but there are several key components to include for smooth cross-border operations.

Essential Information for International Billing

- Currency and Payment Methods – Specify the currency in which the payment is due and mention the acceptable payment methods, such as international bank transfers or online payment services.

- Shipping Terms and Delivery Details – Clearly outline the shipping terms (e.g., Incoterms) and include the expected delivery timeline. This helps both parties understand who is responsible for shipping costs and customs duties.

- Customs Information – Include any necessary customs codes or details related to the goods being shipped, as this information is essential for clearing international customs.

- Tax and Duties – Indicate any applicable taxes or duties that the buyer or seller may need to pay. Be clear about who will cover these costs to avoid disputes.

- Language and Translation – Ensure that the billing document is understandable to both parties. In some cases, it may be necessary to provide translations of key sections to avoid miscommunication.

Best Practices for International Billing

- Double-Check Regulatory Requirements – Research the specific billing requirements and regulations for the countries involved to ensure your document complies with local laws.

- Use Clear and Universal Terminology – Avoid using jargon that may not be understood internationally. Stick to common terms for quantities, descriptions, and payment details.

- Maintain Accurate Record Keeping – For international transactions, it’s important to maintain a detailed record of all communications and documents related to the transaction for legal and tax purposes.

By taking these extra steps to include the necessary information and ensuring compliance with international standards, businesses can ensure that their cross-border transactions are executed smoothly and without unnecessary delays.

Billing Record Compatibility with Other Software

When managing your business’s financial documents, it’s essential to ensure that the files you create can be seamlessly integrated with other software tools you may be using. Whether it’s accounting software, payment systems, or inventory management platforms, compatibility between your billing records and these tools can significantly improve efficiency, accuracy, and ease of use. Ensuring smooth interoperability helps streamline workflows and reduces manual input, saving time and minimizing errors.

Many businesses rely on specialized software to manage various aspects of their operations, and it’s important that the format of your billing records is compatible with these tools. From generating reports to syncing payment statuses, having the right file formats and layout compatibility can make the entire process smoother and more effective.

Common Software Integrations

- Accounting Software – Most accounting platforms like QuickBooks or Xero require certain file formats or data structures. Ensuring that your billing document can easily be uploaded or imported into these systems can save time on manual data entry and improve financial tracking.

- Payment Systems – If you use platforms like PayPal, Stripe, or Square, it’s important to check if they support the file formats you’re working with, so you can generate payment links directly from your billing record.

- Inventory Management Tools – For businesses that deal with large inventories, your billing documents may need to sync with inventory software to update stock levels automatically once a transaction is completed.

Ensuring Compatibility

- Use Common File Formats – Save your billing record in widely accepted formats like PDF or CSV, which are supported by most software tools. This will make it easier to integrate with various systems without compatibility issues.

- Test Integration Before Full Use – Before relying on a new system for managing your financial records, run a test to ensure your billing format works well with your other tools. This can help you avoid potential disruptions or errors.

- Leverage Software Features – Some platforms allow you to customize or map fields to align with your existing documents. Take advantage of these features to ensure seamless data transfer.

By ensuring compatibility between your billing documents and the software tools you use, you can simplify your business processes, enhance productivity, and maintain accurate records with less effort.

How to Print and Distribute Billing Records

Once your billing document is finalized, it’s important to ensure it is printed and shared with clients in a way that is both professional and efficient. Properly distributing your financial documents ensures timely payments, maintains good business relations, and avoids confusion. Whether you’re sending physical copies or electronic versions, the method of distribution plays a key role in the process.

There are various ways to print and distribute your billing documents, depending on your preferences and the needs of your clients. From traditional mail to digital methods, the following guidelines can help you choose the best distribution channels for your business.

Printing Billing Records

- Choose the Right Paper – Select high-quality paper to print your billing records for a more professional appearance. White or off-white paper is commonly used for business documents.

- Ensure Readability – Make sure that the font size and layout of the document are clear and easy to read. Print a test page to check for any formatting issues.

- Include a Cover Letter (if necessary) – For formal or large transactions, consider including a cover letter with the printed record, providing a brief summary and additional instructions, if needed.

- Print in Multiple Copies – If you require multiple copies (e.g., one for your records and one for the client), make sure to print the necessary amount before distribution.

Distributing Your Billing Documents

- Mailing Physical Copies – If your client prefers to receive a physical copy, use a secure mailing method such as registered or certified mail to ensure safe delivery.

- Emailing Digital Copies – Send the billing document as an attachment via email. Make sure to use a clear subject line, such as “Billing Record for [Client Name],” and include a brief message summarizing the key details.

- Online Platforms – If you use online billing systems or platforms, you can upload your documents directly for clients to access, which allows for easy tracking and quick processing.

- Cloud Storage Links – For larger documents or to provide your client with easy access, you can upload the file to a cloud storage service (like Google Drive or Dropbox) and share a link via email or message.

Ensuring Successful Distribution

- Confirm Receipt – Whether you’re sending physical or digital copies, always follow up to confirm that the client has received the docume

Importance of Accurate Billing Data

Ensuring the accuracy of the data in your billing records is essential for maintaining smooth business operations and fostering positive relationships with clients. Mistakes or discrepancies in financial documents can lead to misunderstandings, delays in payment, or even legal issues. Accurate information not only helps in preventing these problems but also enhances your professionalism and credibility.

Inaccurate billing data can cause unnecessary confusion, making it difficult for clients to process payments promptly. Furthermore, incorrect records may result in missed revenue or the need for corrections, both of which take up valuable time and resources. By prioritizing accuracy in your financial documents, you create a more streamlined process for both your business and your clients.

Consequences of Inaccurate Billing Data

- Delayed Payments – If clients notice errors in the billing record, they may delay payment while seeking clarification or requesting corrections.

- Legal Disputes – Errors in financial documents, especially those related to tax or contractual terms, can lead to legal challenges that may result in fines or damaged business relationships.

- Financial Loss – Inaccurate records can cause you to undercharge or overcharge clients, leading to lost revenue or dissatisfied customers.

- Customer Dissatisfaction – Clients may feel frustrated or distrustful if they encounter repeated errors in their billing records, damaging your reputation and potentially driving them to seek services elsewhere.

Best Practices for Ensuring Accuracy

- Double-Check All Information – Always review the details of each billing record, including client names, addresses, product descriptions, and pricing, to ensure everything is correct.

- Automate Where Possible – Use software tools that can automatically populate repetitive fields, such as contact information or pricing, reducing the risk of human error.

- Standardize Your Processes – Create a consistent process for generating financial documents, including using pre-designed layouts and checklists to ensure all necessary fields are filled out accurately.

- Keep Records Up to Date – Ensure that client information, payment terms, and other essential details are regularly updated in your system to reflect any changes.

By focusing on the accuracy of your financial documents, you protect your business from unnecessary complications, improve efficiency, and maintain trust with your clients. Precise and professional billing not only helps in timely payments but also enhances your business reputation.

How to Manage Multiple Billing Record Formats

For businesses that work with a wide range of clients or offer various services, managing multiple billing record formats can become a challenge. Each type of transaction may require different information or layouts to meet specific client needs or industry standards. Organizing and streamlining these formats helps maintain consistency, accuracy, and efficiency in your business operations.

Efficiently managing multiple billing formats ensures that each document is tailored to the client’s requirements without sacrificing quality or professionalism. With the right system in place, you can easily access, modify, and distribute various formats without confusion or unnecessary delays.

Organizing Multiple Billing Formats

- Create a Naming Convention – Implement a clear and consistent naming system for your different formats. For example, use client names or service types as part of the file name to make it easy to identify the correct document.

- Organize Files in Folders – Create specific folders for each client or service category to store relevant documents. This way, you can quickly locate and manage the formats you need without sifting through unrelated files.

- Version Control – Keep track of the version history for each billing document to ensure that you’re always using the most up-to-date format. This is especially important if you frequently make adjustments to your records or layouts.

Best Practices for Managing Multiple Formats

- Use Software for Automation – Consider using specialized software that allows you to create, store, and manage various billing formats easily. These tools often come with features that streamline the process and prevent errors from manual handling.

- Standardize Core Information – Even when using multiple formats, try to standardize key details (e.g., business name, tax information, payment terms) across all documents. This ensures consistency and reduces the risk of mistakes.

- Regularly Review and Update – As business needs evolve or regulations change, periodically review your billing formats to ensure that they remain accurate, relevant, and aligned with client expectations.

- Integrate with Accounting Systems – For greater efficiency, integrate your various formats with accounting software to automate the data entry and reporting process, minimizing manual work and reducing errors.

By creating a well-organized system for managing multiple billing formats, you can improve workflow efficiency, reduce errors, and ensure that your business is always ready to provide clients with the correct documentation in a timely manner.