Free Invoice Template for UK in Word Format

Managing financial records efficiently is essential for any business, whether you are just starting out or have years of experience. One of the most important aspects of this process is ensuring you have the right tools to maintain clear and accurate records. Using simple, customizable documents can help streamline this task and maintain a professional appearance with clients and partners.

Customized templates offer a practical solution for generating documents that are both professional and tailored to your needs. With the right format, you can quickly prepare paperwork without needing to start from scratch each time. These ready-to-use solutions help save time and reduce the chance of making mistakes while ensuring your documents meet necessary standards.

In this article, we will explore how easy it is to create well-structured financial documents using easy-to-edit formats. We will guide you through the benefits of choosing the right formats for your business, as well as provide tips on how to adjust them to fit your unique requirements. Whether you’re invoicing clients or keeping records for your own reference, these customizable solutions will help simplify the process.

Free Invoice Templates for UK Businesses

For any business in the UK, maintaining accurate financial records is crucial. One of the most effective ways to manage payments and track transactions is by using customizable documents. These ready-to-use formats allow you to create professional-looking records without the need to design them from scratch each time. Whether you are a freelancer, a small business owner, or part of a larger organisation, having access to the right resources can save time and help you stay organised.

When running a business, it’s essential to have access to tools that help maintain professionalism while reducing administrative workload. Pre-made forms, available in a variety of styles and formats, are perfect for this. They can be tailored to meet the specific requirements of your business and ensure that every transaction is documented in a clear and consistent way.

Why UK Businesses Need Customizable Documents

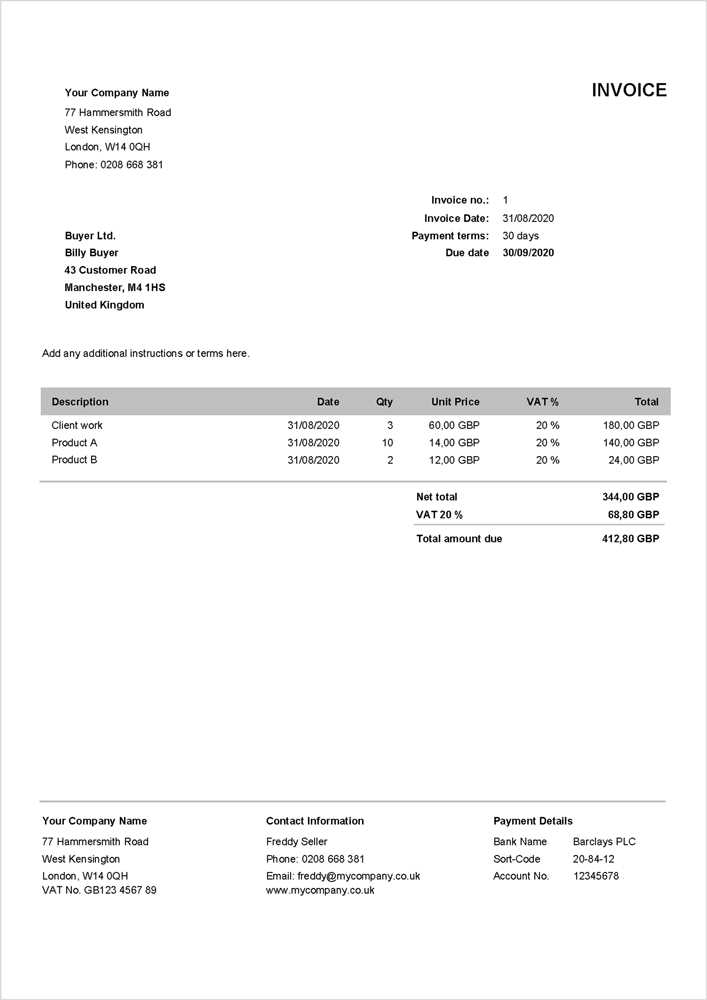

In the UK, businesses must adhere to certain legal requirements when creating records. Whether it’s adding VAT, listing business details, or incorporating payment terms, these documents must meet specific standards. Customisable forms allow you to adjust your paperwork according to these needs, ensuring compliance with UK regulations and offering a professional presentation to clients.

Where to Find Useful Resources

There are many online platforms offering editable files that are suitable for UK businesses. These resources allow easy modification to match your business name, logo, and unique payment terms. By choosing the right platforms, you can download well-organised documents that require minimal setup, enabling you to focus more on growing your business rather than spending time on administrative tasks.

Why Use a Free Invoice Template?

Creating professional financial documents can be a time-consuming and sometimes daunting task. However, using pre-made formats offers a simple solution to this challenge. With the right tools, you can generate clear and accurate records in no time, saving effort while maintaining a polished appearance for your business. These tools are designed to help you focus on the important aspects of running your company, such as growing your client base and providing excellent service.

Pre-designed formats allow you to skip the complicated process of building documents from the ground up. By simply entering the necessary details, you can quickly produce standardised records that adhere to business norms. This not only saves time but also reduces the risk of errors, ensuring that each document is professionally formatted and contains all essential information.

Benefits of Word Format Invoices

Using a flexible, editable document format for your business records offers numerous advantages, especially when it comes to ease of use and customisation. A popular choice for many business owners is a format that can be quickly edited and tailored to meet specific needs. These benefits extend beyond just convenience, providing a range of features that help streamline the process of managing financial transactions while ensuring professionalism and accuracy.

One of the most significant advantages of using a commonly used document format is its versatility. With simple tools for editing text, adding logos, and adjusting layout, you can ensure your documents match your branding and are appropriate for different clients and transactions. Furthermore, this format is widely accessible, meaning that both you and your clients can open and view the documents without any compatibility issues.

Key Advantages

| Advantage | Description |

|---|---|

| Easy to Edit | Modify text, add images, and adjust the layout with minimal effort to fit specific needs. |

| Professional Appearance | Ensure that your documents are formatted clearly and consistently, helping to create a professional impression. |

| Universal Compatibility | Most clients can easily open and view the documents, regardless of the software they use. |

| Time-Saving | Quickly create and modify documents, reducing the time spent on administrative tasks. |

By using an editable document format, businesses can enjoy greater control over their financial record-keeping, ensuring that each transaction is documented accurately and professionally. This approach allows you to focus more on your core activities while maintaining efficient, well-organised paperwork.

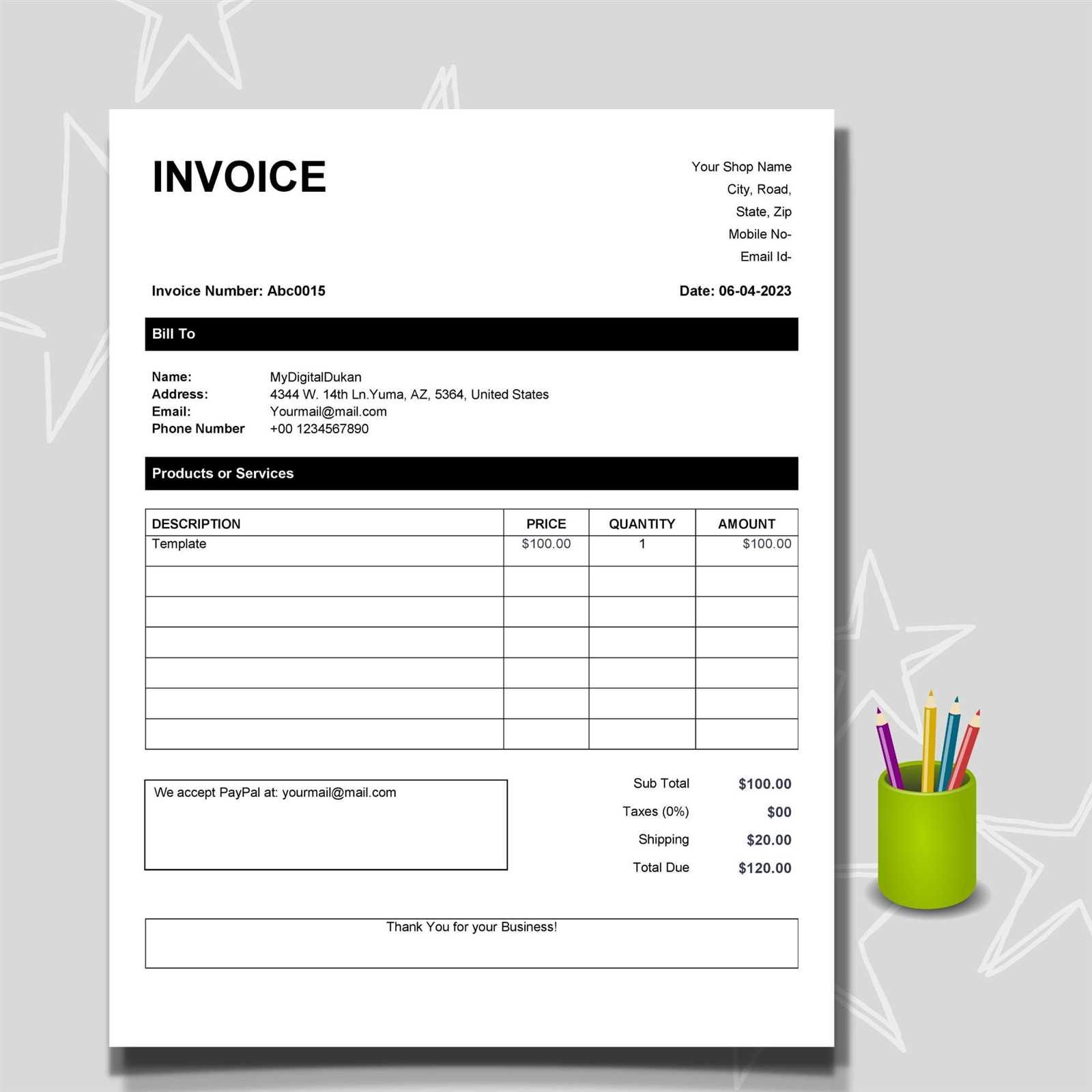

How to Customize Your Invoice Template

Customising your financial documents is an essential step in ensuring they align with your brand and meet your specific business needs. By adjusting the layout, content, and design, you can create documents that not only look professional but also reflect the unique aspects of your business. This flexibility helps to make each record clear, personalised, and in compliance with legal or industry standards.

The first step in customising your documents is to add your business details. This includes your company name, logo, contact information, and tax registration number. Having these elements prominently displayed at the top of the document helps establish credibility and provides your clients with easy access to your details should they need to get in touch.

Key Customisation Elements:

- Company Information: Include your business name, address, phone number, email, and website URL to ensure clients know how to reach you.

- Logo: Adding your company’s logo can enhance branding and make the document look more official.

- Payment Terms: Clearly specify the terms of payment, including the due date, late fees, and accepted payment methods.

- Item Description: Tailor the description section to include specific products or services provided, ensuring clarity for both parties.

Next, adjust the design and layout to suit your preferences. This could involve changing font styles, colours, or section headings. Personalising these aspects allows your documents to remain consistent with your branding and maintain a professional appearance. You can also adjust the spacing and order of information to make it more intuitive and easier for your clients to understand.

Finally, it’s important to save your customised file for future use. By doing this, you’ll have a ready-to-use document every time you need to generate a record, which helps save time and ensures consistency across all your business communications.

Top Free Invoice Template Sources

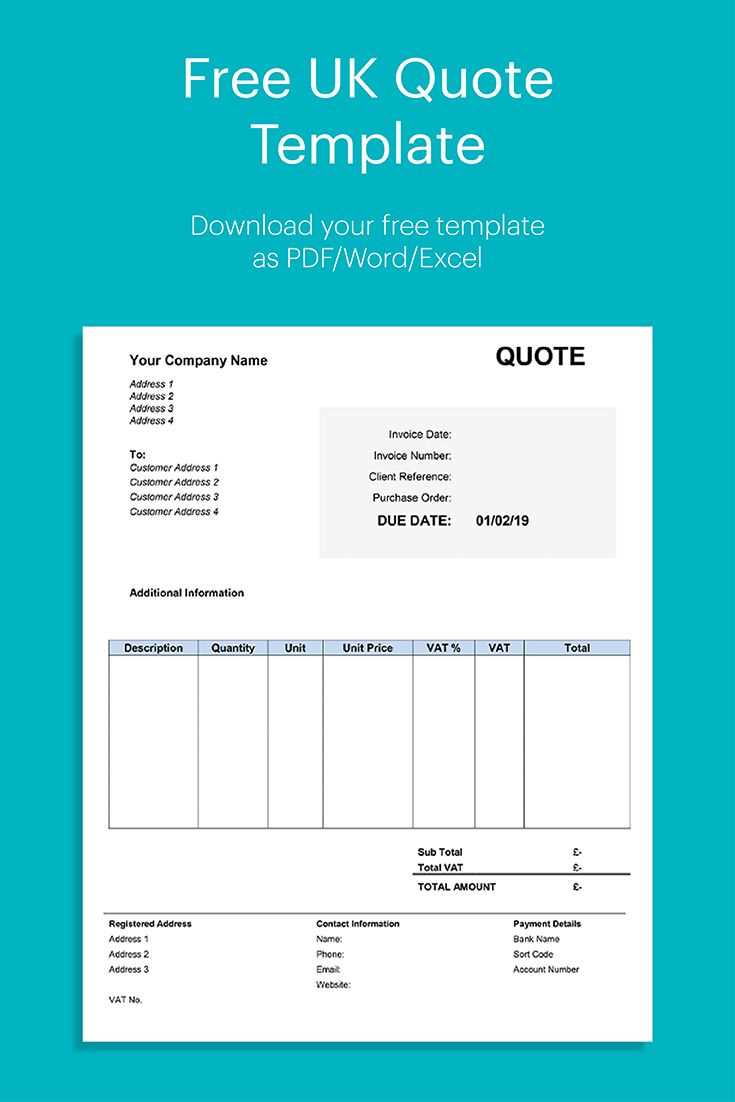

When looking for ready-made documents to manage your business transactions, there are numerous online platforms that provide high-quality, customisable formats. These resources offer a variety of options, making it easy for you to find the right document style that fits your needs. Whether you are a freelancer or a small business owner, accessing these templates can save time and help ensure your financial records are professionally structured.

Popular Platforms for Business Documents

Several websites offer a wide range of downloadable formats, allowing you to easily adjust them for your business requirements. These platforms often provide multiple layout options, from simple to detailed designs, ensuring that there is something for every business type. Most of these sources also allow you to download the files without any cost or registration, making them highly accessible.

Where to Find High-Quality Editable Documents

Microsoft Office Templates: Microsoft offers a variety of professionally designed documents that can be easily customised. You can find a wide selection directly in the program or through their online template library. These formats are compatible with most devices and allow for quick editing.

Canva: Canva offers an intuitive design platform with various document layouts, including ones for professional records. The drag-and-drop interface makes it simple to personalise the design, and once you’re done, you can download the file in multiple formats, including editable options.

Template.net: This site offers a variety of document layouts for all types of business needs. Whether you need something simple or more complex, you can find various styles to suit your brand, with the ability to customise text, colours, and sections easily.

These platforms allow you to quickly generate the necessary documents with minimal effort, saving you time and ensuring that your business transactions are well-organised and professionally presented.

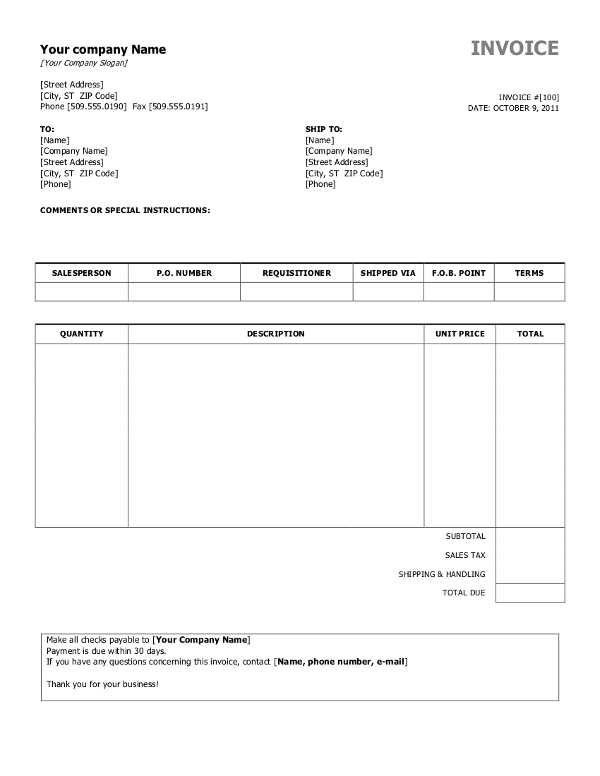

How to Create an Invoice in Word

Creating professional documents to track payments and charges for services or products is a key part of managing any business. Using an easily accessible document editing program, you can quickly generate clear, structured records without needing advanced design skills. The process of creating such documents is simple and allows for significant flexibility in customisation, ensuring they meet your business’s specific needs.

The first step in generating your document is to open the editing software and start with a blank page. While the layout can be entirely customised, there are a few basic sections that should always be included. These sections ensure that your document includes all necessary details and maintains a professional structure. It is also important to keep the design clean and easy to follow to ensure the recipient can quickly understand the content.

Key Sections to Include:

- Business Information: Include your business name, contact details, and any relevant tax or registration numbers.

- Recipient Information: Add the name, address, and contact details of the person or business you are charging.

- Transaction Details: List the services or products provided, their quantity, and the agreed-upon price.

- Total Amount Due: Include a subtotal, applicable taxes, and the final amount that the recipient owes.

- Payment Terms: Specify the due date for payment, late fees, or any other terms related to the payment process.

Once the content is filled in, you can further adjust the format. Using headers and bold text will help to distinguish key sections and improve readability. You may also add your company logo, adjust the font to match your branding, and apply your preferred colour scheme to give the document a professional appearance.

After customising the content and design, save the document for future use. It’s a good practice to save it in a format that can be easily shared with clients, such as a PDF, to ensure the layout remains intact when viewed by others.

Important Information to Include on an Invoice

When preparing financial documents for transactions, it’s crucial to include all necessary details that ensure clarity and professionalism. Each record should contain specific information that not only helps with accurate accounting but also protects both parties involved by clearly outlining the terms of the agreement. A well-structured document can prevent confusion and avoid potential disputes regarding payments or services rendered.

Essential Details for Your Document

Business Information: Always include your company name, address, and contact information. If applicable, add your business registration or VAT number. This ensures the recipient knows who issued the document and can easily contact you if needed.

Client Information: Include the recipient’s name, address, and any relevant contact details. This ensures the document is properly addressed and avoids confusion if there are multiple clients or parties involved.

Key Transaction Details

Description of Goods or Services: Clearly list the items or services provided, including any quantities, unit prices, and individual item descriptions. This section is essential for both you and the recipient to track what is being charged.

Amount Due: Include a breakdown of the charges, including any discounts, taxes, or additional fees. Be sure to clearly state the total amount due, as well as any applicable payment terms, such as the due date and penalties for late payment.

Payment Instructions: Specify how the recipient can make the payment, including bank account details, online payment links, or any other methods you accept. Additionally, it’s important to mention the due date for the payment and any late fees that may apply if the payment is not made on time.

By including these essential details, you ensure that your financial documents are clear, professional, and legally sound, helping to maintain smooth transactions with clients and providing all the necessary information for accurate record-keeping.

How to Save and Send Your Invoice

Once your financial document is ready, it’s essential to save it properly and send it to the recipient in a way that ensures it remains professional and secure. Choosing the right file format and delivery method is important for both convenience and record-keeping. By following the right steps, you can avoid errors and make the process of sending documents quick and efficient.

Start by saving your completed document in a format that preserves its layout and is easily accessible to your clients. The most common and reliable format is PDF, as it ensures the document will appear the same on any device, regardless of software. Other formats may be acceptable depending on the recipient’s preferences, but PDF is typically the safest and most widely accepted option.

Steps for Saving and Sending Your Document

| Step | Action |

|---|---|

| 1 | Save your document in PDF format to ensure the layout remains consistent across all devices. |

| 2 | Include a clear file name that references the transaction or client name, for example, “John_Doe_Payment_March2024”. |

| 3 | Check the document for accuracy before sending. Ensure that all the necessary details, such as amounts and payment terms, are correct. |

| 4 | Attach the file to an email or upload it to a secure cloud storage platform for sharing with the recipient. |

| 5 | Write a polite and professional message in the email, briefly outlining the purpose of the document and any actions the recipient needs to take. |

After sending, keep a copy of the document saved in your records for future reference. This is important for accounting purposes and ensures you can easily track past transactions. If the document is sent via email, it’s also a good idea to request a confirmation of receipt to make sure the recipient has received the file and understands the terms outlined.

Understanding UK Invoice Requirements

In the UK, there are specific guidelines that must be followed when preparing financial records for transactions. These guidelines ensure that the document is legally compliant and that both parties involved in the transaction have clear and accurate records. Whether you’re a small business owner or a freelancer, understanding these requirements is crucial for smooth operations and to avoid potential legal issues.

While the format and design of these documents can vary depending on the type of business, there are certain mandatory elements that must be included in every document. Ensuring these details are present not only helps you stay compliant with UK regulations but also promotes professionalism and transparency with your clients.

Essential Information to Include

- Your Business Name and Contact Information: Include your full legal business name, address, phone number, and email. If you’re VAT-registered, make sure to add your VAT number as well.

- Client Information: Include the recipient’s name and address to ensure the document is properly addressed and can be referenced easily in the future.

- Unique Identification Number: Every document should have a unique reference or ID number to track the transaction and for accounting purposes.

- Date of Issue: Clearly state the date the document is issued to establish the timeline for payment terms.

- Detailed List of Products or Services: Provide a clear description of the goods or services rendered, including quantities, unit prices, and total amounts for each item.

- Total Amount Due: Specify the total amount payable, including any applicable taxes, fees, or discounts. This helps avoid confusion for the recipient.

- Payment Terms: Include payment due dates, methods of payment accepted, and any late payment fees or penalties for overdue amounts.

Additional Considerations

- VAT Details: If your business is VAT-registered, make sure to show the VAT rate applied to the products or services, along with the total VAT amount charged.

- Legal Disclaimers: Certain industries may require additional legal clauses or terms to be included. Make sure you are familiar with any specific industry regulations or terms that must appear on your records.

- Bank Account Information: If applicable, include your bank account details or payment links for easy processing of the transaction.

By ensuring that these elements are included in your documents, you not only comply with UK regulations but also create a clear, professional record for both you and your clients. Keeping accurate records is essential for efficient accounting and financial management, and helps avoid potential issues with tax authorities or disput

How to Format Your Invoice for Clarity

Formatting your financial documents properly is crucial for ensuring that both you and your client can easily understand the terms and details of the transaction. A well-organised layout not only helps prevent misunderstandings but also makes the document more professional and easier to navigate. Proper formatting enhances readability and allows for quick reference to key sections such as amounts due, services provided, and payment instructions.

By following a clear and structured approach, you can create a document that communicates all the necessary details without overwhelming the recipient. Key sections should be logically arranged, and important information should stand out for easy identification. Below are some tips on how to format your documents for maximum clarity.

Key Formatting Tips

- Use Clear Section Headers: Divide the document into clearly labelled sections, such as “Business Information,” “Client Information,” “Transaction Details,” and “Payment Terms.” This helps the reader quickly locate specific information.

- Employ Consistent Font and Size: Use a professional and legible font, such as Arial or Times New Roman, in a readable size (usually between 10pt and 12pt). Consistent font styles and sizes throughout the document ensure that it looks clean and uniform.

- Highlight Important Information: Bold key details such as the total amount due, due date, and payment terms. This draws the reader’s attention to the most critical aspects of the document.

- Align Text Properly: Ensure that text is aligned neatly. For example, use left alignment for contact details and right alignment for amounts and totals. Consistent alignment improves readability.

- Use Tables for Itemisation: When listing items or services, use tables with clear columns for descriptions, quantities, unit prices, and totals. This makes it easy for your client to follow the breakdown of charges.

Final Checks for Clarity

- Check for Typos: Always proofread your document to ensure that there are no spelling or grammatical errors, as these can affect the professionalism of the document.

- Ensure All Key Information Is Present: Double-check that all necessary details, such as the client’s information, item descriptions, amounts, and payment terms, are included and correctly listed.

- Consider Adding a Summary: If the document is lengthy or contains multiple items, consider adding a summary or recap at the bottom to briefly state the total amount due and any important payment instructions.

By following these formatting guidelines, you will create clear, professional documents that are easy for your clients to understand. A well-formatted document not only fosters trust and transparency but also reduces the likelihood of payment delays or disputes.

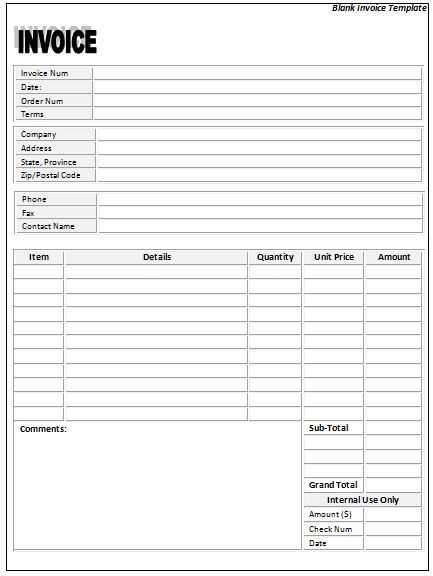

Choosing the Right Invoice Template

Selecting the right document format for your financial transactions is a key factor in ensuring that your communications are clear, professional, and legally compliant. With various options available, it’s important to choose a layout that not only suits your business style but also meets your clients’ expectations. The right document helps you stay organised, track payments effectively, and avoid confusion on both sides of the transaction.

When considering which format to use, you need to think about factors such as your business type, the complexity of your transactions, and the level of detail required. A simple, straightforward design might work best for small businesses with few products or services, while a more detailed format may be necessary for those offering complex services or working with large orders.

Key Considerations When Choosing a Format

- Business Type: Choose a format that reflects your industry. For example, freelancers and consultants often need a simple layout, while product-based businesses might require a more detailed document with itemisation and taxes.

- Design and Branding: Look for a design that allows you to incorporate your brand’s logo, colour scheme, and fonts. A well-branded document adds a professional touch and builds trust with your clients.

- Complexity of Transactions: If you offer multiple services or products, select a layout that can accommodate a detailed breakdown of each item, quantity, price, and applicable taxes.

- Legal and Tax Compliance: Ensure that the format you choose allows you to easily include necessary legal information, such as VAT numbers, tax rates, and payment terms. This is especially important for businesses operating in the UK, where tax compliance is strictly enforced.

Choosing the Best Layout for Your Needs

- Simple Layouts: These are ideal for smaller businesses or individual contractors who only need to list a few items or services. The layout is typically minimalistic and easy to customise.

- Itemised Layouts: Best suited for businesses with multiple products or services, this format allows you to clearly list each item along with its description, quantity, unit price, and total cost.

- Detailed Layouts with Terms: For larger projects or businesses dealing with long-term contracts, this layout can include additional sections such as payment schedules, project milestones, or detailed terms and conditions.

Choosing the right document layout is essential for smooth business operations. A well-selected format can save time, reduce errors, and improve your overall client experience. Take the time to explore different options and select the one that best aligns with your business needs.

Free Invoice Templates vs Paid Services

When choosing the right solution for creating your financial documents, businesses often face the dilemma of selecting between free and paid options. Both have their advantages and drawbacks, and the right choice depends on factors like business size, frequency of transactions, and the level of customisation required. Understanding the key differences between these two options can help you make an informed decision that best suits your needs.

Free document formats often provide a simple and quick solution for businesses with basic needs. However, while they may be cost-effective, they might lack advanced features or customisation options that paid services typically offer. On the other hand, paid platforms can provide additional tools, professional designs, and automated features that can streamline the billing process, especially for larger or more complex businesses.

Advantages of Free Document Formats

- Cost-effective: The primary benefit of using free options is, of course, that they cost nothing. This is an attractive feature for small businesses or freelancers just starting out.

- Easy to Use: Most free formats are straightforward and easy to navigate. They typically require minimal setup and can be customised quickly to suit your basic needs.

- Accessible: Many free tools are readily available online, so you can download and start using them immediately without any subscription or hidden fees.

Advantages of Paid Services

- Professional Customisation: Paid options often provide greater flexibility, allowing you to personalise your documents with your company logo, custom colour schemes, and detailed design features.

- Advanced Features: Paid services often include additional features like automated payment reminders, recurring billing, integrated payment gateways, and advanced tracking tools.

- Time-saving: Automation features, such as invoice generation based on predefined schedules, can save valuable time for businesses with high volumes of transactions.

- Enhanced Support: Paid services generally offer customer support, ensuring that if you encounter any issues or need assistance, help is available.

While free options may suffice for small-scale operations, businesses that require more sophisticated features or that deal with a high volume of transactions may find paid services to be a better fit. Ultimately, the choice comes down to how much you value customisation, time efficiency, and additional functionality for your business operations.

Tips for Efficient Invoice Management

Managing financial records effectively is crucial for maintaining smooth business operations. A well-organised system for handling transactions ensures that payments are processed on time, reduces errors, and helps with financial planning. Streamlining the process allows businesses to stay on top of outstanding payments, track progress, and maintain professional relationships with clients.

To achieve efficiency in handling these documents, businesses need to implement systems that make it easy to generate, send, and track payments. By following a few key strategies, you can simplify your workflow and ensure that your financial records are well-organised and accurate.

Key Strategies for Streamlining Your Process

- Use Consistent Formats: Always use a consistent layout for your documents. This reduces the risk of errors and ensures that both you and your clients can easily read and understand the information.

- Automate Reminders: Set up automated reminders to notify clients of upcoming or overdue payments. This helps you avoid having to manually follow up on each transaction.

- Track Payment Status: Keep a record of which documents have been paid, which are outstanding, and which are overdue. This will help you identify any payment delays and manage your cash flow more effectively.

Organising Your Records

| Action | Description |

|---|---|

| 1. Create a Filing System | Organise all documents by client name or transaction date. This makes it easier to locate specific records when needed. |

| 2. Implement a Digital System | Use cloud-based storage to keep all your records in one place, making them accessible from any device and ensuring they are backed up securely. |

| 3. Regularly Review Records | Periodically check your transaction logs to ensure all payments have been accounted for, and follow up on any discrepancies. |

By adopting these efficient management strategies, businesses can save time, reduce stress, and ensure their financial operations run smoothly. A structured approach will help you stay on top of your finances and keep your clients satisfied with prompt and accurate transactions.

How to Track Payments Using Invoices

Effectively tracking payments is essential for maintaining a healthy cash flow and ensuring that you are paid on time. One of the most efficient ways to do this is by using detailed records of your transactions. These records not only provide a clear breakdown of services rendered and amounts due, but also serve as a reference for both you and your clients to monitor the status of payments.

By incorporating a simple tracking system, you can stay organised and reduce the risk of missed payments or errors. Below are a few strategies to help you manage your payment process efficiently and keep accurate records of outstanding and completed payments.

Steps to Track Payments Effectively

- Assign Unique Identifiers: Each document should have a unique reference number or ID. This makes it easier to track payments and link them to specific transactions, especially if you manage multiple clients.

- Clearly State Payment Terms: Include clear payment due dates and terms in your documents. This ensures both parties are on the same page regarding the timeline for payments and prevents confusion later.

- Set Up a Tracking System: Maintain a simple tracking system, either digitally or on paper, where you can mark payments as “Paid,” “Pending,” or “Overdue.” This allows you to quickly review the status of all transactions at a glance.

Tracking Tools and Methods

- Spreadsheets: Use a spreadsheet program (such as Excel or Google Sheets) to create a payment tracker. Include columns for reference numbers, client names, due dates, payment status, and amounts received. This method is simple and can be customised to suit your needs.

- Accounting Software: Invest in accounting software that allows you to track payments automatically. Many platforms offer features like invoicing, reminders, and real-time updates on payment status, making tracking more efficient.

- Manual Record-Keeping: For smaller operations or those who prefer traditional methods, a well-organised paper filing system can also work. Keep physical records of all transactions and use colour-coded tags or stamps to indicate payment status.

By staying organised and keeping track of every transaction, you can ensure a smooth payment process, reduce the likelihood of late payments, and maintain a clear financial overview of your business.

Common Mistakes in Invoices and How to Avoid Them

When preparing financial documents for your clients, it’s crucial to avoid errors that could lead to confusion or delays in payment. Even small mistakes can create misunderstandings, leading to disputes or payment delays. Whether it’s miscalculating amounts, missing important details, or failing to follow proper formatting, these mistakes can significantly impact your business operations.

To ensure smooth and efficient transactions, it’s important to be aware of common errors and know how to avoid them. By being vigilant and implementing some best practices, you can create clear, accurate, and professional documents every time.

Common Errors and How to Prevent Them

- Incorrect Calculations: Double-check all calculations, including unit prices, quantities, and totals. A simple math error can cause confusion and delay payments.

- Missing Client Information: Always include the correct name, address, and contact details of the client. Missing information can cause confusion and may result in non-payment.

- Unclear Payment Terms: Be specific about payment due dates, methods, and penalties for late payments. Vague terms can lead to misunderstandings and delays.

- Failure to Include a Reference Number: Ensure every document has a unique reference number. This makes tracking and managing records much easier and helps avoid confusion in future correspondence.

- Omitting Tax Information: If your business is VAT-registered, always include the tax rate, VAT number, and total tax amounts to comply with regulations and ensure clarity.

How to Avoid These Mistakes

| Error | Solution |

|---|---|

| Incorrect Calculations | Double-check all amounts and use built-in calculation tools, either in spreadsheet software or accounting systems. |

| Missing Client Information | Keep an updated database of your clients’ contact details to ensure accuracy when preparing your records. |

| Unclear Payment Terms | Clearly state payment terms, including deadlines, methods, and penalties, in each document you send out. |

| Failure to Include a Reference Number | Always assign and record a unique reference number for each document. This will help with tracking and future queries. |

| Omitting Tax Information | Ensure all r

How to Use Invoices for Tax PurposesAccurate financial records are essential for complying with tax regulations and ensuring that you are paying the correct amount of tax. One of the most important tools in managing your financial records for tax purposes is keeping detailed records of all transactions. These records provide the necessary information for tax calculations, and they can be crucial if your business is audited or if you need to submit documents to tax authorities. Using well-organised transaction records not only helps you track your earnings and expenses but also supports your efforts to deduct eligible business expenses and claim tax credits. By understanding the key elements to include in your records and how to use them for tax purposes, you can streamline your accounting process and remain compliant with tax laws. Key Information to Include for Tax Purposes

How to Organise Your Records for Tax Filing

By accurately recording and organising your financial documents, you can avoid costly mistakes Creating Professional Invoices with Microsoft WordWhen running a business, it’s essential to maintain a professional image, especially when handling financial transactions. One of the most important aspects of this is creating clear, well-organised records for each sale or service provided. Microsoft Word is an excellent tool for generating these records, offering a range of features to customise and format your documents effectively. With its simple interface and versatility, Word allows you to create professional-looking documents without needing specialised software. Creating these records in Microsoft Word is straightforward, and you can easily add personalised elements such as your logo, company details, and payment terms. By using the right structure and formatting, you can ensure that your documents look polished and meet the necessary business standards. Steps to Create a Professional Document in Microsoft Word

Essential Elements to Include

By following these steps, you can create documents that not only convey professionalism but also ensure that all the necessary information is included for both parties. Microsoft Word offers enough flexibility to allow you to personalise your documents, while still maintaining consistency and clarity in your business dealings. Free UK Invoice Templates for FreelancersAs a freelancer, it’s important to ensure that your financial records are clear, accurate, and professional. Whether you’re working on short-term contracts, offering consulting services, or providing creative work, having a structured document for each project helps streamline the payment process and builds trust with your clients. The good news is that creating such documents doesn’t need to be complicated or costly. There are many resources available that allow freelancers to generate well-structured records, specifically designed to meet UK business standards, without having to pay for expensive software or hire an accountant. These resources can help you create custom documents that reflect your personal brand while adhering to UK-specific tax and business regulations. From simple layouts to more advanced designs, these documents help ensure your payments are processed quickly and accurately. By using an organised format, freelancers can manage their finances more efficiently and avoid delays in receiving payments from clients. Where to Find Reliable Templates for Freelancers

Key Features to Look for in Freelance Documents

By using these tools, freelancers can create professional-looking documents that ensure clarity and consistency in all financial transactions. Whether you are just starting out or are a seasoned professional, having access to reliable and well-designed documents helps maintain a smooth workflow and facilitates timely |