Download E Invoice Template for Simple and Efficient Billing

In today’s fast-paced business world, automating financial documents is essential for improving efficiency and reducing errors. Instead of manually creating payment requests or receipts from scratch, using pre-designed forms can save valuable time and effort. These documents can be easily customized to fit your business needs, allowing for a seamless experience in managing transactions.

With the right tools, you can quickly create professional and accurate statements that adhere to industry standards. Whether you are a small business owner or part of a larger organization, these pre-built forms can help simplify your billing procedures, ensure consistency, and improve your overall workflow. Accessing and using these forms doesn’t require extensive technical knowledge, making them ideal for businesses of all sizes.

Ready-to-use forms not only speed up the documentation process but also ensure that your financial records are organized and up to date. By choosing the most suitable format and customizing it according to your requirements, you can avoid the hassle of starting from scratch each time you need to generate a new document.

Why You Need an E Invoice Template

In the modern business landscape, having a streamlined method for generating financial documents is crucial for maintaining efficiency and accuracy. Manual processes can be time-consuming and prone to errors, which is why many businesses opt for pre-designed forms that simplify the creation of professional payment requests. These ready-made documents provide a structured framework, making it easier to manage transactions and ensure compliance with legal standards.

Using a standardized form for billing allows businesses to save time and reduce the risk of mistakes. Instead of designing each document from scratch, you can focus on the key details, such as payment amounts and due dates, while the format remains consistent and reliable. This not only improves workflow but also enhances professionalism and trust with clients and customers.

Consistency is another major advantage. By using a uniform document structure, you ensure that all records are uniform across your organization. This can be especially important for businesses that manage large volumes of transactions. Automation also plays a key role, as digital forms can be filled out quickly and efficiently, reducing manual input and speeding up the overall process.

Benefits of Using E Invoice Templates

Adopting pre-designed forms for financial documentation offers numerous advantages that can significantly improve your business processes. By using structured layouts, you can simplify the task of creating accurate and professional records, reducing the chances of errors and inconsistencies. The availability of these forms eliminates the need to manually create each document, allowing you to focus on other essential tasks in your business.

Time and Cost Efficiency

One of the primary benefits of using ready-made formats is the time saved during the document creation process. These tools enable you to quickly fill in the necessary details without worrying about formatting or layout. This not only speeds up your work but also cuts down on the resources needed to produce each financial record. By automating repetitive tasks, you can allocate more time to higher-value activities in your business.

Professionalism and Accuracy

Using pre-designed forms ensures that every document you generate maintains a high level of consistency and professionalism. The standard structure guarantees that all required fields are included, and the formatting follows best practices. This reduces the risk of missing critical details and enhances your company’s reputation by delivering well-organized and error-free records to clients or partners.

How to Download E Invoice Templates

Acquiring ready-made financial document layouts is a straightforward process that can significantly improve your business’s billing workflow. These documents are available from various online sources, offering a wide range of formats to suit different business needs. Whether you need a simple format or a more advanced design, there are plenty of options to choose from, each with its own set of features.

Finding Reliable Sources

To get started, it’s essential to find a trustworthy website or platform offering professional forms. Many online resources provide free or paid access to downloadable layouts, some of which are customizable to fit specific business requirements. Here are some popular options:

| Website | Features | Cost |

|---|---|---|

| Example1.com | Customizable formats, simple design | Free |

| Example2.com | Advanced features, multiple designs | Paid |

| Example3.com | Pre-built layouts, easy-to-use | Free |

Steps for Obtaining Forms

Once you’ve identified a reliable platform, the next step is simple. Follow these steps to obtain the desired document layout:

- Browse the available options and select the one that best meets your needs.

- Click on the download or access button to retrieve the file in your preferred format (usually .PDF, .XLS, or .DOCX).

- Customize the document by entering your business details, payment terms, and other necessary information.

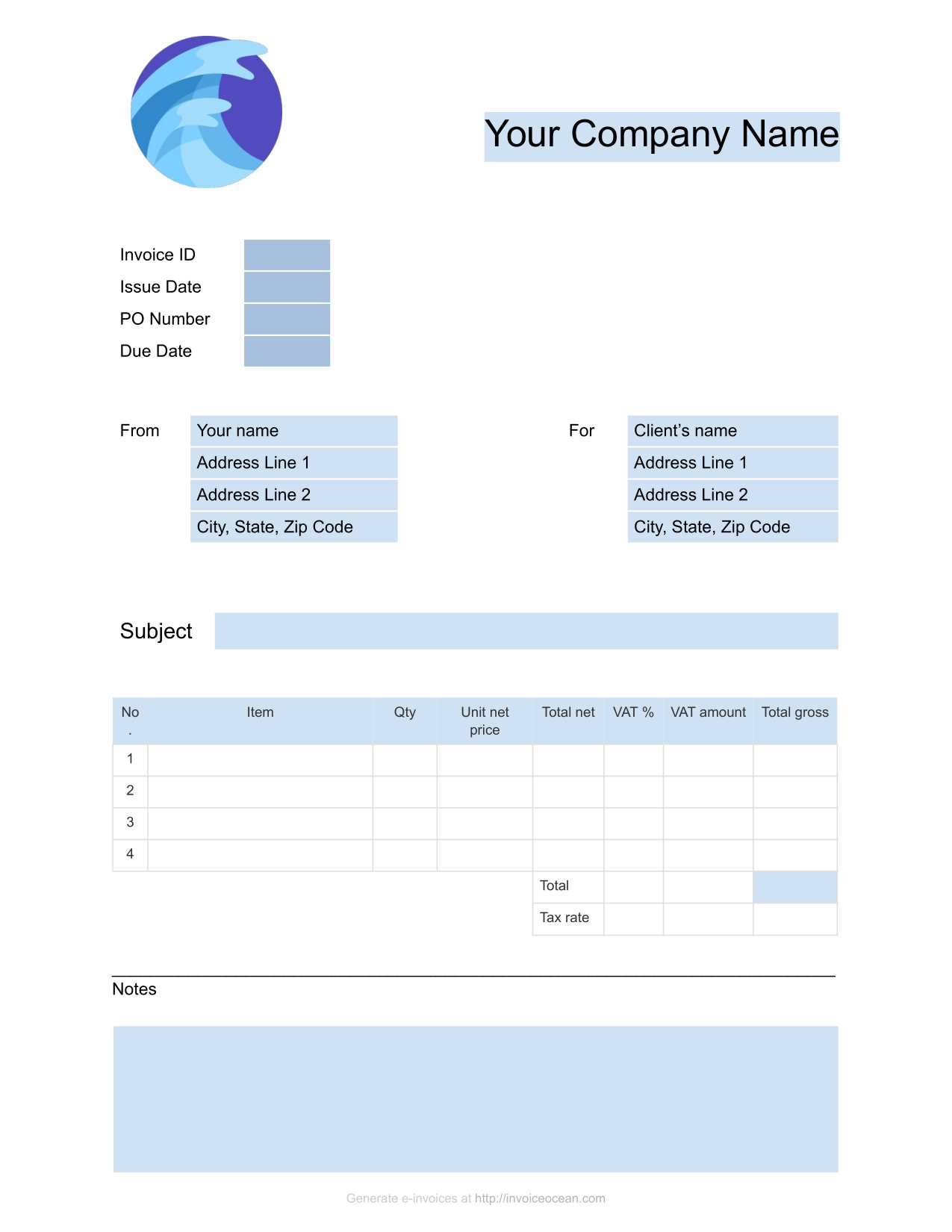

Types of E Invoice Templates Available

When choosing a pre-designed document for billing and payment requests, it’s important to understand the different types available. Each format offers distinct features tailored to various business needs, from simple, basic structures to more complex and detailed designs. Depending on your requirements, you can find a layout that suits everything from one-time transactions to recurring payments.

| Type | Description | Best For |

|---|---|---|

| Basic Form | Simple design with essential fields like amount, date, and description | Small businesses or freelancers |

| Professional Layout | More sophisticated design with branding options and advanced sections | Companies looking for a polished, corporate look |

| Recurring Payment Form | Pre-configured for regular transactions, with subscription details | Businesses with subscription-based models |

| Multicurrency Layout | Supports multiple currencies and international transactions | Global businesses or those with international clients |

| Detailed Report Format | Includes additional sections for itemized costs and taxes | Service-based industries and larger businesses |

Each type offers unique features, so choosing the right one can help streamline your billing processes and ensure you meet both business and legal requirements efficiently.

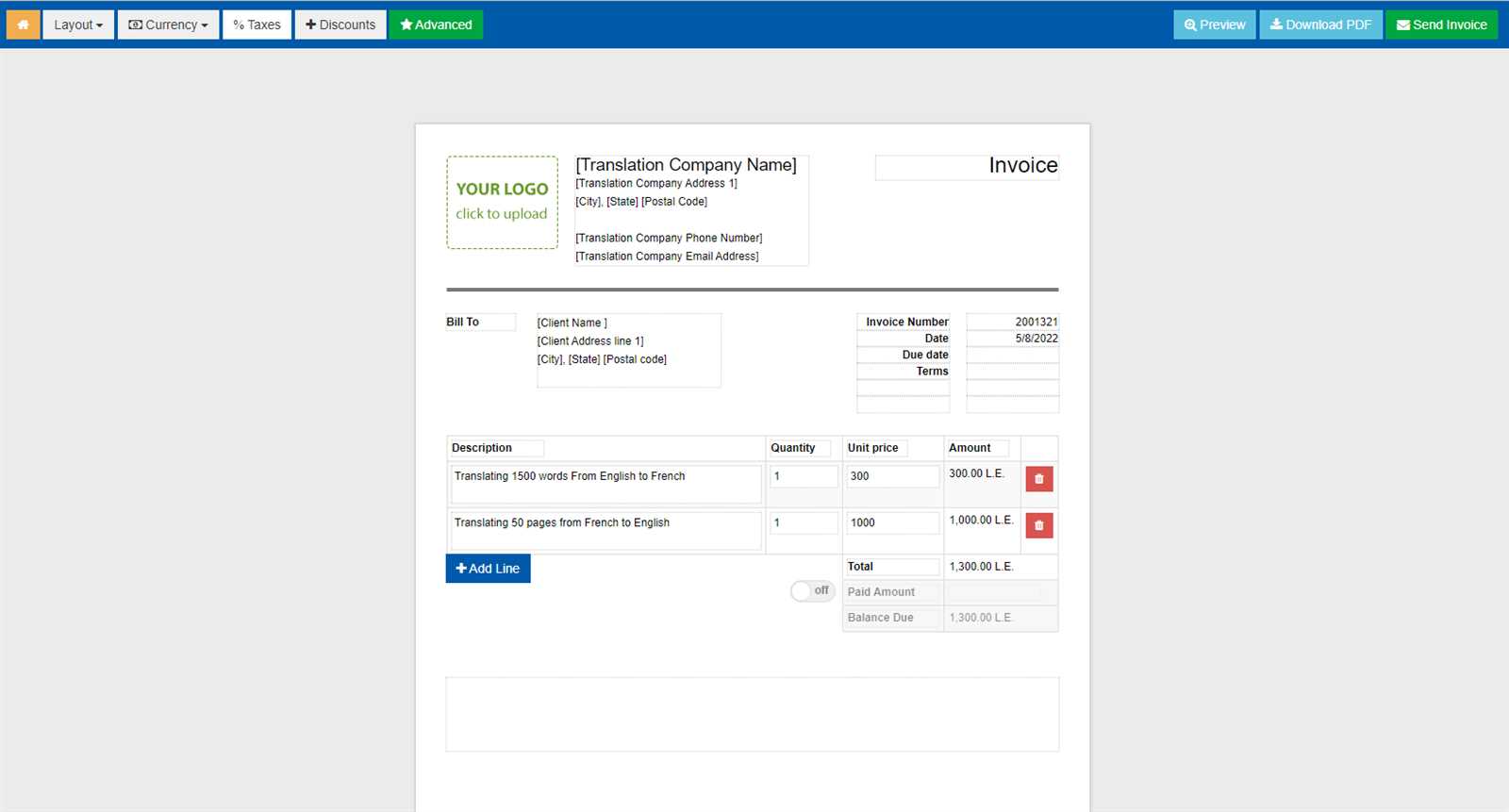

Customizing Your E Invoice Template

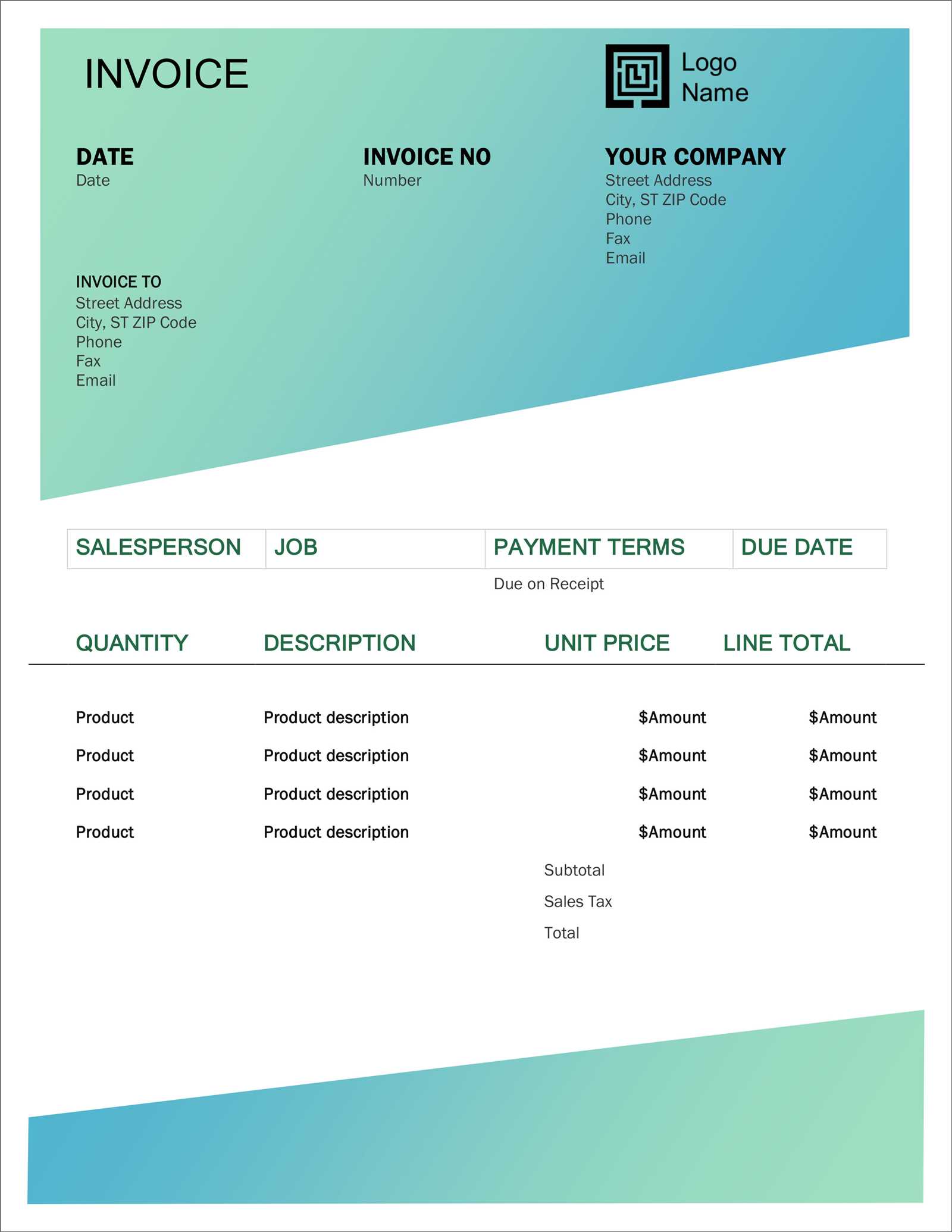

Once you’ve selected a suitable document format, personalizing it to match your business needs is crucial for creating a professional and branded experience. Customization ensures that every financial document you issue reflects your company’s identity and communicates all necessary details in a clear and concise manner. Whether you’re adjusting text, colors, or layout, personalizing the document makes it more relevant to your operations and ensures consistency across all your records.

Branding is one of the first things to consider when customizing a form. You can incorporate your company’s logo, color scheme, and contact information to make the document easily recognizable and aligned with your overall brand identity. Additionally, including terms and conditions or specific notes can help set the tone and provide clarity to your clients or customers.

Another important customization option is adjusting the fields and sections to suit the specific nature of your transactions. For example, if your business deals with multiple product categories or services, you can add itemized sections that outline each product or service provided, along with associated costs. This ensures that your document not only looks professional but also contains all the necessary details for proper financial tracking.

How E Invoices Improve Efficiency

Switching to electronic forms for billing and payment tracking can significantly boost the efficiency of your business processes. By replacing manual, paper-based methods with automated digital solutions, you can streamline your workflow and reduce the time spent on administrative tasks. These digital documents are designed to simplify the entire billing cycle, from creation to delivery, and can help businesses minimize delays and human errors.

- Faster Processing: With pre-designed forms, the time needed to fill out and send documents is drastically reduced. You can generate a document within minutes, speeding up the entire billing process.

- Reduced Errors: Automation helps prevent mistakes that often occur when creating documents manually. Pre-built sections and fields ensure consistency and accuracy every time.

- Quick Delivery: Digital formats can be instantly emailed or uploaded to client portals, removing the need for mailing and reducing the wait time for payment processing.

Moreover, these electronic solutions make it easier to track and manage transactions, helping businesses stay organized and reduce administrative overhead. By using digital forms, you eliminate the need for physical storage, enabling easy access and retrieval of documents whenever necessary.

- Centralized Management: All records are stored digitally, making it easy to search and manage your business’s financial documents from a single platform.

- Integration with Other Tools: Many digital solutions can be integrated with accounting software or payment systems, further enhancing your ability to track and process payments efficiently.

- Reduced Costs: By eliminating paper, postage, and manual processing, businesses can cut costs associated with traditional billing methods.

Overall, switching to electronic forms for billing offers a wide range of benefits, from faster operations to improved accuracy, leading to a more efficient and streamlined business workflow.

Steps to Create an E Invoice

Creating a professional billing document is a straightforward process when you use the right tools. The digital approach eliminates the need for manually designing each record, allowing you to focus on the essential details. By following a few simple steps, you can quickly generate a well-structured and accurate payment request, ensuring that all necessary information is included.

The first step is to choose the appropriate layout or structure. Whether you’re using a pre-designed form or starting from scratch, it’s important to ensure that the document includes all the necessary fields, such as company details, client information, and payment terms. A clean and organized layout enhances readability and helps avoid confusion.

Once you’ve chosen the right structure, follow these steps to create your financial document:

- Enter Business Information: Include your company name, address, contact details, and tax identification number. This is essential for both legal compliance and client recognition.

- Add Client Information: Enter the client’s name, address, and contact details. Ensure this section is accurate to avoid any miscommunication.

- Specify Products or Services: List the goods or services provided, along with their quantities, individual prices, and any applicable discounts.

- Calculate Totals: Add up the costs and include taxes or additional fees. Make sure the final amount is clearly stated and easy to understand.

- Set Payment Terms: Include the due date, payment methods accepted, and any late payment penalties or discounts for early payment.

- Review and Finalize: Double-check all the information for accuracy. Once you’re confident that everything is correct, save the document and prepare to send it to your client.

Once completed, the digital document can be shared quickly via email or uploaded to client portals, ensuring fast and efficient communication. Customizing each section of the document ensures that it is tailored to your business needs and client expectations.

Best Practices for E Invoices

When using digital forms for billing and payment requests, following best practices is essential for ensuring accuracy, professionalism, and compliance. By adopting a few key strategies, businesses can optimize their billing processes, minimize errors, and maintain a smooth workflow. These practices are designed to help you maximize the benefits of automated document creation while ensuring consistency and clarity for your clients.

Key Practices for Accuracy and Professionalism

- Standardize Your Format: Use a consistent structure for all financial documents to avoid confusion. A uniform format ensures that all necessary information is included and easily understood by clients and stakeholders.

- Check for Accuracy: Double-check the details, including amounts, client information, and payment terms. Accuracy reduces the risk of disputes and delays.

- Include Clear Payment Terms: Ensure that payment due dates, methods, and late fees (if applicable) are clearly stated. This helps prevent misunderstandings and promotes timely payments.

Optimizing for Efficiency

- Automate Recurring Documents: For businesses with subscription-based services, set up automation for recurring billing. This saves time and ensures consistency in every transaction.

- Utilize Digital Delivery: Send financial records electronically to speed up the process and ensure that clients receive them promptly. This eliminates the need for physical mail and the associated delays.

- Integrate with Accounting Software: Linking your digital forms with accounting tools can streamline the reconciliation process, reducing manual data entry and increasing overall efficiency.

By following these best practices, businesses can enhance their billing process, improve cash flow, and maintain stronger client relationships through clear, timely, and efficient financial communication.

Free vs Paid E Invoice Templates

When choosing between free and paid options for automated billing documents, it’s important to consider your business’s needs and the level of customization required. While both options provide efficient solutions for creating digital payment requests, there are key differences in terms of features, flexibility, and support. Understanding these differences can help you make an informed decision that best suits your company’s requirements.

Comparing Free and Paid Options

Free solutions are often a good starting point, especially for small businesses or freelancers with basic billing needs. However, they might come with limitations in terms of design, customization, and advanced features. On the other hand, paid options typically offer more robust tools, professional templates, and additional functionalities that can improve efficiency and branding.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization, limited design options | Full customization, advanced design features |

| Support | Limited or no customer support | Dedicated customer support and assistance |

| Advanced Features | Limited functionality (e.g., no recurring payments) | Advanced features like automation, integrations, and analytics |

| Cost | Free | Subscription or one-time payment required |

Which Option Is Right for You?

If you’re just starting out and need basic functionality, free tools can provide a quick and easy solution without financial investment. However, as your business grows, you may find that paid options offer the additional features and flexibility required for scaling operations. Consider factors such as the number of clients, volume of transactions, and need for recurring billing when deciding between free and paid options.

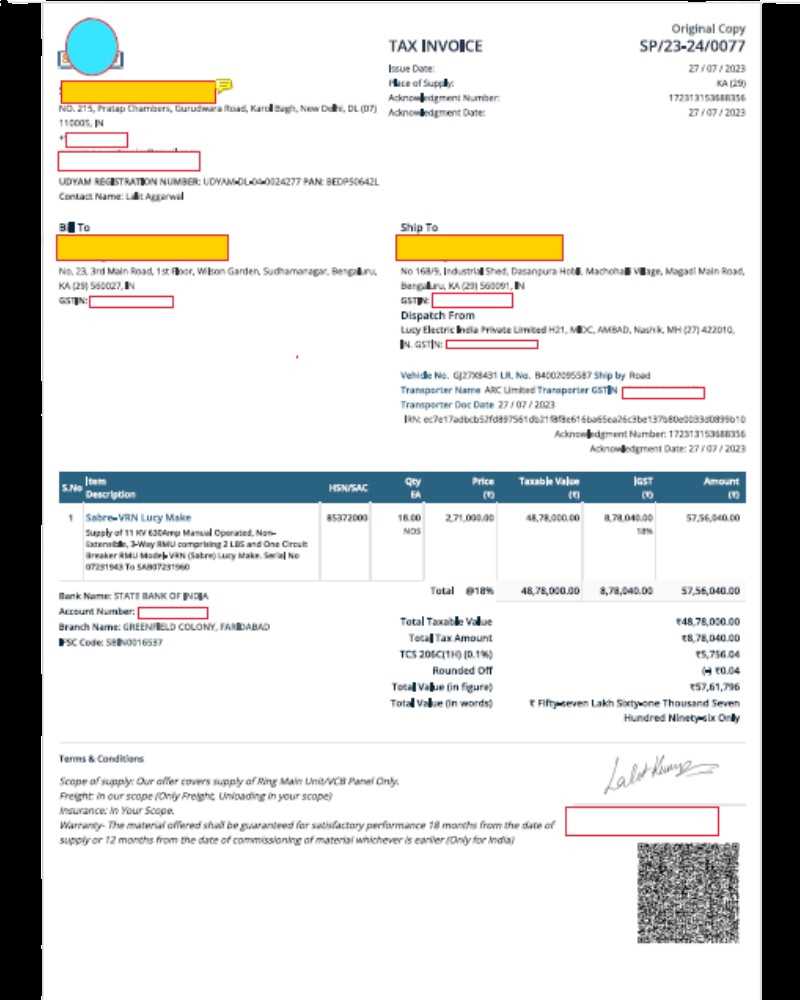

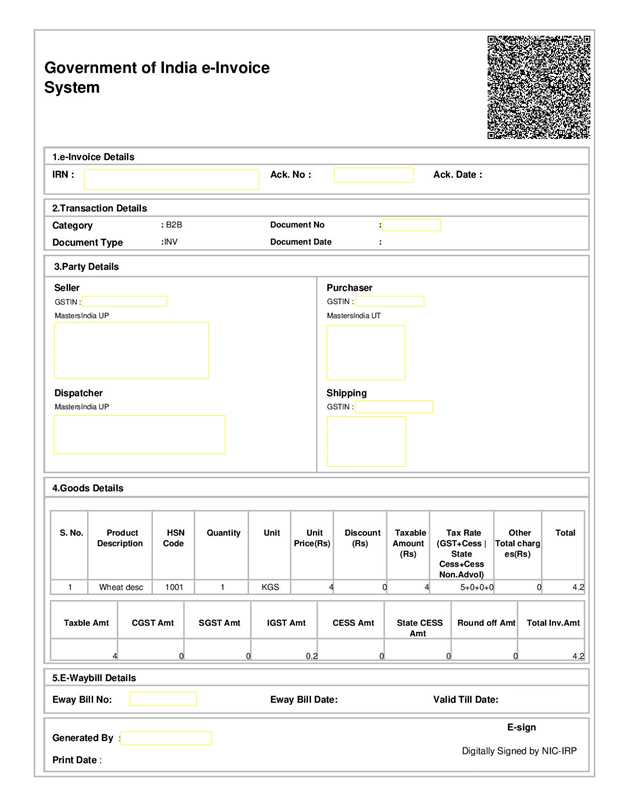

Legal Requirements for E Invoices

When using digital forms for financial transactions, it’s essential to ensure that your documents comply with the legal standards set by local and international authorities. These regulations often specify the information that must be included in a billing document, the format in which it should be issued, and how it should be stored. Adhering to these legal requirements helps avoid disputes, ensures tax compliance, and protects both your business and your clients.

Depending on your country or region, specific rules may apply to electronic records, including requirements for digital signatures, data retention, and transmission security. It’s important to stay updated on these regulations to avoid legal penalties and to maintain your business’s credibility.

Some common legal aspects include:

- Document Identification: Most jurisdictions require that each document includes a unique identification number to ensure traceability.

- Tax Information: The correct tax rate, tax ID numbers, and other relevant details must be clearly stated to comply with tax reporting laws.

- Electronic Signatures: In many countries, a secure digital signature may be required to authenticate the document and confirm its legitimacy.

- Data Retention: Legal requirements often dictate how long financial documents must be stored. In some cases, businesses are required to keep records for several years.

By understanding and following these requirements, businesses can ensure they are operating within the law, avoiding unnecessary fines or audits, and building trust with clients and regulatory authorities alike.

Top Tools for E Invoice Creation

Creating digital billing documents efficiently requires the right tools. Whether you’re looking for simple solutions for occasional transactions or robust platforms for managing high-volume payments, the right software can save you time and ensure accuracy. The best tools offer a range of features, from customizable layouts to automated functions, making the billing process faster, easier, and more professional.

Essential Features to Look For

When choosing a tool for creating electronic payment requests, consider the following essential features:

- Customization: The ability to tailor the design to your brand and business needs.

- Automation: Features like recurring payments and automatic calculations save time and reduce errors.

- Integration: Compatibility with accounting software, payment gateways, and CRM systems can streamline your workflow.

- Security: Ensuring that your data and your clients’ information are protected is crucial.

Top Platforms to Consider

Here are some of the most popular tools for creating digital billing documents:

- Zoho Invoice: A versatile and user-friendly platform with customizable layouts, automation features, and integration options.

- FreshBooks: Designed for small businesses and freelancers, it offers simple tools for creating professional documents and tracking payments.

- QuickBooks: Known for its powerful accounting features, QuickBooks also allows for easy generation of billing records and integrates seamlessly with other financial software.

- Invoice Ninja: A free and open-source option that provides a variety of customizable templates, including support for recurring billing and online payments.

- Bill.com: An efficient solution for larger businesses, featuring automation for accounts payable and receivable along with secure digital record keeping.

Each of these tools has its strengths, so selecting the best one depends on your specific business needs and the volume of transactions you manage. With the right platform, you can streamline your processes, enhance your professional image, and improve client satisfaction.

How E Invoices Save Time and Money

Using digital solutions for generating and managing billing documents offers significant benefits for businesses in terms of efficiency and cost savings. By automating manual tasks and eliminating the need for paper-based systems, digital records streamline processes and reduce administrative overhead. This leads to faster transactions, fewer errors, and a more organized workflow.

Here are some ways that electronic financial documents can help save both time and money:

Time Savings

- Instant Creation and Delivery: Generate and send financial records instantly without waiting for printing or postal delays.

- Automation: Features like recurring billing and automatic calculations reduce the time spent on routine tasks, allowing businesses to focus on more strategic activities.

- Quick Updates: Any changes made to your document can be updated immediately and sent out, without the need for manual adjustments or reprints.

- Faster Payments: With digital delivery, clients receive documents in real time, speeding up payment cycles and improving cash flow.

Cost Savings

- Elimination of Paper Costs: No need for paper, ink, postage, or physical storage, which significantly reduces operating expenses.

- Reduced Manual Labor: Automating document generation and payment tracking frees up employees from repetitive tasks, allowing them to focus on higher-value work.

- Fewer Errors and Disputes: By minimizing manual input, you reduce the chances of errors that could lead to costly disputes or delays.

- Lower Administrative Overhead: With all records stored digitally, businesses can access, organize, and track documents more efficiently, cutting down on time spent managing paper files.

By implementing digital solutions for managing your financial documents, your business can operate more efficiently, reduce costs, and ultimately improve profitability. The time saved through automation and streamlined processes translates into faster payments, while the cost savings come from eliminating physical materials and reducing manual labor.

Common Mistakes with E Invoices

While digital billing documents offer numerous advantages, businesses may encounter a range of pitfalls when using them. These mistakes can lead to confusion, delayed payments, or even legal complications. By understanding and avoiding common errors, you can ensure a smoother, more efficient billing process. Below are some of the most frequent issues businesses face when creating and sending electronic records.

1. Incomplete or Missing Information

One of the most common mistakes is failing to include all the necessary details. Omitting essential information can lead to delays or disputes with clients. Here are some key areas to pay attention to:

- Client Details: Ensure that the recipient’s name, address, and contact information are correct and up to date.

- Itemized List: Always list the products or services provided with quantities, prices, and applicable taxes. Leaving this out can lead to confusion.

- Payment Terms: Clearly specify the payment due date, method, and any discounts or late fees to avoid misunderstandings.

2. Errors in Calculations

Manual errors in calculations, such as incorrect totals, tax rates, or discounts, are another common issue. This can lead to inaccurate records, which may affect cash flow and cause discrepancies in financial reporting. To avoid this:

- Use Automatic Calculations: Whenever possible, use software that automatically calculates totals, taxes, and discounts.

- Double-check Math: If you do the math manually, always verify the calculations before finalizing the document.

3. Ignoring Legal Requirements

Each region or country may have specific legal requirements for digital records, including the need for unique identifiers, tax numbers, or specific document formats. Ignoring these regulations can result in compliance issues. To avoid this:

- Stay Informed: Regularly check the legal requirements for billing in your country or industry to ensure compliance.

- Use Trusted Software: Many billing tools are designed to help ensure that your documents meet legal standards and include the necessary information.

4. Not Storing Records Properly

Another mistake businesses make is failing to store their financial documents securely or in an organized manner. This can make retrieving past records difficult and lead to potential legal issues if you’re required to produce them. To avoid this:

- Use Cloud Storage: Cloud-based systems provide a secure, easily accessible place to store your digital records.

- Organize by Date or Client: Categorize and tag your documents to make it easy to find them when needed.

5. Lack of Clear Communication with Clients

Sometimes businesses assume that sending a document electronically automatically ensures the recipient understands it fully. Th

Integrating E Invoices with Accounting Software

Integrating electronic billing records with accounting software can greatly improve financial management and streamline business operations. By automating the flow of information from your billing system to your accounting tools, you can reduce manual data entry, minimize errors, and gain real-time insights into your financial status. This integration ensures that all transactions are accurately recorded and allows for seamless tracking of payments, taxes, and other financial data.

Here are the key benefits and considerations when integrating digital billing systems with your accounting software:

Benefits of Integration

- Reduced Manual Entry: Automatically transferring data from your billing documents to your accounting system eliminates the need for duplicate data entry, saving time and reducing the risk of mistakes.

- Real-time Financial Updates: Integration ensures that your accounting system is updated in real time, providing you with up-to-date financial information and improving decision-making.

- Improved Accuracy: Automating data transfer helps reduce human error, ensuring that financial records are consistent and accurate across all platforms.

- Faster Reconciliation: With all transactions seamlessly synced, reconciling accounts becomes faster and easier, leading to more efficient financial reporting and auditing processes.

Considerations for Integration

- Choose Compatible Software: Ensure that your billing system and accounting software are compatible. Many modern platforms offer built-in integrations or APIs that simplify this process.

- Secure Data Transmission: Protect sensitive financial information by using secure channels for data transfer. Encryption and secure login protocols are essential for safeguarding client and business data.

- Customization Options: Depending on your business’s needs, you may want to customize how data is transferred between systems. Look for software that offers flexible integration options to match your specific workflow.

Integrating digital payment requests with accounting systems not only enhances efficiency but also strengthens overall financial management. By automating key processes and ensuring real-time accuracy, businesses can reduce overhead costs, minimize errors, and improve cash flow management.

How to Ensure E Invoice Security

With the growing reliance on digital tools for managing financial records, ensuring the security of electronic documents is critical. Sensitive information, including payment details and personal data, must be protected from unauthorized access, fraud, and data breaches. By implementing best practices and utilizing secure technologies, businesses can safeguard their digital transactions and maintain the trust of their clients.

Key Security Measures for Digital Billing Documents

- Encryption: Always encrypt your electronic records both in transit and at rest. This ensures that even if data is intercepted, it remains unreadable without the proper decryption key.

- Secure Storage: Use secure servers or cloud storage solutions with robust access controls. Make sure that sensitive files are stored in a protected environment to prevent unauthorized access.

- Digital Signatures: Implement digital signatures to authenticate and verify the origin of your documents. A valid signature assures recipients that the document has not been tampered with during transmission.

- Access Control: Limit access to sensitive documents based on roles within your organization. Ensure that only authorized personnel can view or edit financial records.

- Two-Factor Authentication: Use two-factor authentication (2FA) for accessing systems that handle digital billing records. This adds an additional layer of security by requiring both a password and a secondary verification method.

Staying Compliant with Security Standards

- Compliance with Regulations: Ensure your digital records comply with relevant regulations, such as GDPR or PCI-DSS, which include specific security requirements for handling sensitive data.

- Regular Security Audits: Conduct regular audits to assess the effectiveness of your security protocols and identify potential vulnerabilities before they can be exploited.

- Software Updates: Keep your software and systems up to date with the latest security patches. Many cyberattacks exploit outdated software, so timely updates are essential for maintaining a secure environment.

By focusing on these security measures and staying informed about evolving threats, businesses can confidently manage their digital financial records and protect their sensitive data from potential breaches. Strong security practices not only protect your company but also build trust with clients, ensuring smooth and secure transactions.

Choosing the Right E Invoice Format

When it comes to managing digital billing documents, selecting the right format is essential to ensure compatibility, ease of use, and security. Different formats offer varying levels of flexibility and functionality, making it important to choose one that aligns with your business needs, industry standards, and client preferences. The format you choose will determine how the document is viewed, processed, and stored, so it’s crucial to make an informed decision.

Popular Formats for Digital Billing Documents

- PDF (Portable Document Format): One of the most widely used formats, PDF is easily viewable across devices and platforms without altering the layout. It’s ideal for businesses that need to create professional-looking, secure documents that can be easily shared and printed.

- XML (eXtensible Markup Language): XML is often used for structured data exchange, particularly when integration with accounting software or automated systems is necessary. It allows for easy parsing and processing of data but may require technical knowledge to set up.

- CSV (Comma-Separated Values): This format is useful for businesses that need to handle large amounts of raw data, such as transaction histories or detailed financial reports. It’s easy to generate and edit but lacks formatting and security features like PDF or XML.

- HTML (HyperText Markup Language): HTML is suitable for online billing systems and client portals. It allows for interactive features, such as clickable links or embedded payment options, but requires a web browser for viewing and may not be suitable for offline use.

Factors to Consider When Choosing a Format

- Compatibility: Ensure the format you choose is compatible with the systems your clients and accounting software use. For example, if your clients prefer receiving documents in PDF format, using that format ensures smoother transactions.

- Security: If security is a priority, choose formats like PDF with encryption or XML with secure transmission options to protect sensitive financial data.

- Ease of Use: Consider how easy it is to create, edit, and send documents in your chosen format. Formats like PDF are often simpler for non-technical users, while XML may require more technical expertise for customization.

- Automation: If you’re looking to automate processes, XML or CSV formats might be better options as they can be easily integrated with accounting or ERP systems.

Choosing the right format for your digital billing documents ensures that your business operates efficiently, maintains high security standards, and provides a smooth experience for your clients. Take into account your industry, the preferences of your clients, and the technical capabilities of your team when making your decision.

Why E Invoices Are Future-Proof

The future of financial transactions is digital, and adopting electronic billing documents ensures that businesses remain relevant and adaptable to evolving technological and regulatory changes. As the world continues to shift toward automation and paperless systems, digital records not only streamline workflows but also provide the flexibility to grow with emerging trends. By integrating electronic solutions, businesses are investing in long-term sustainability and efficiency.

Key Factors That Make E Billing Systems Future-Proof

- Adaptability to Technological Advancements: Digital billing solutions are constantly evolving to integrate with the latest technologies. As new software, applications, or tools emerge, electronic records can be easily updated or integrated with these systems, ensuring businesses stay ahead of the curve.

- Regulatory Compliance: Many regions are moving toward mandating electronic records, as they improve transparency and accuracy. E-billing systems can be quickly updated to comply with changing legal requirements, making them more adaptable than traditional methods.

- Environmental Sustainability: As businesses and governments seek to reduce their carbon footprint, the shift to paperless systems helps minimize waste and energy consumption. This aligns with growing sustainability goals and global environmental initiatives.

- Cost-Effectiveness: The shift to digital reduces the cost of printing, paper, and physical storage. As businesses continue to seek cost-saving measures, adopting an electronic approach offers long-term financial benefits.

Benefits for Future Business Models

- Automation and Efficiency: With the rise of artificial intelligence and machine learning, digital billing can be easily automated. This reduces manual effort and speeds up business processes, leading to enhanced productivity and fewer errors.

- Global Reach: As businesses expand into new markets, electronic records make it easier to operate globally. Digital documents can be easily shared across borders, overcoming language and timezone barriers while ensuring consistency in billing practices.

- Integration with Emerging Platforms: E-billing systems can be seamlessly integrated with emerging technologies, such as blockchain for secure transactions, or Internet of Things (IoT) devices for automatic billing triggers. This opens up new opportunities for innovation and growth.

Adopting digital billing solutions today ensures that businesses are prepared for the challenges and opportunities of tomorrow. By staying aligned with technological advancements, regulatory changes, and sustain