Car Storage Invoice Template for Efficient Billing

Managing payments and ensuring timely collection is a crucial aspect of running a business that offers vehicle holding services. A well-organized system for documenting transactions can help both service providers and clients maintain transparency and avoid confusion. This guide will explore how a structured document can simplify the billing process and improve business efficiency.

From detailing service charges to establishing payment deadlines, creating a clear and professional document for each transaction ensures smooth financial operations. This approach not only fosters trust with clients but also makes tracking income and expenses easier for business owners. In this section, we will cover various strategies for designing a reliable payment statement and the importance of key components to include in it.

Car Storage Invoice Template Guide

In any business that involves vehicle holding services, it’s essential to have a standardized approach for documenting financial transactions. A well-designed document helps both service providers and customers understand the charges, deadlines, and terms involved. It not only simplifies the payment process but also promotes professionalism and ensures that all necessary details are captured clearly.

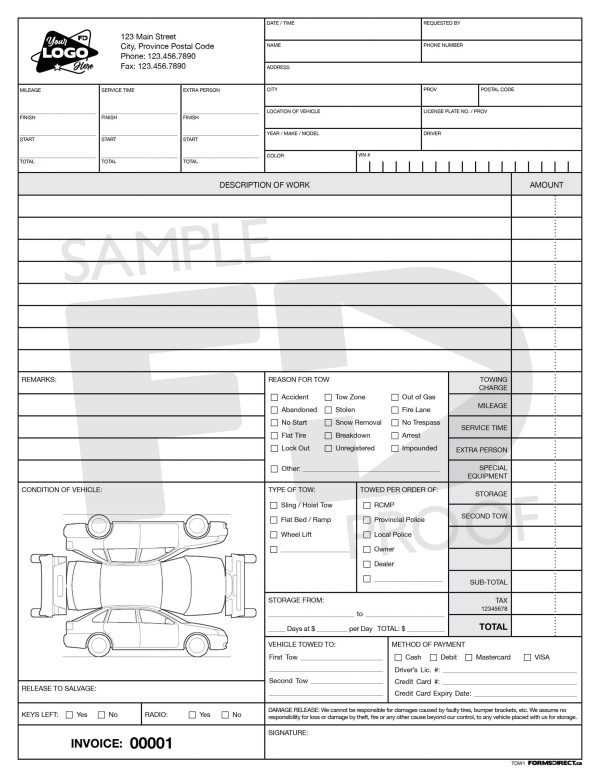

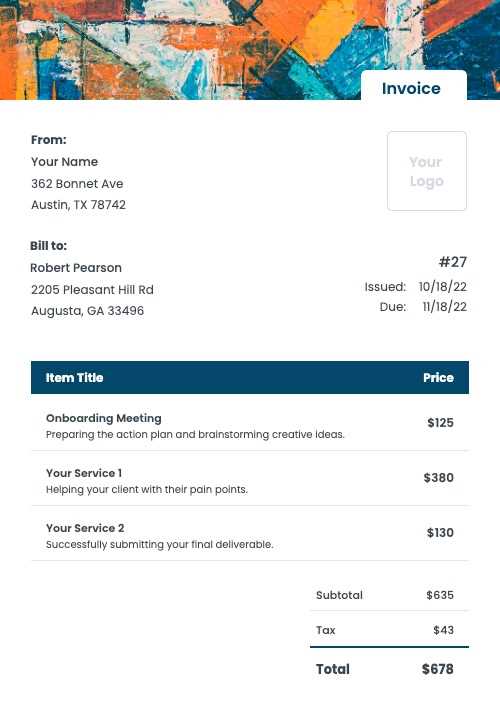

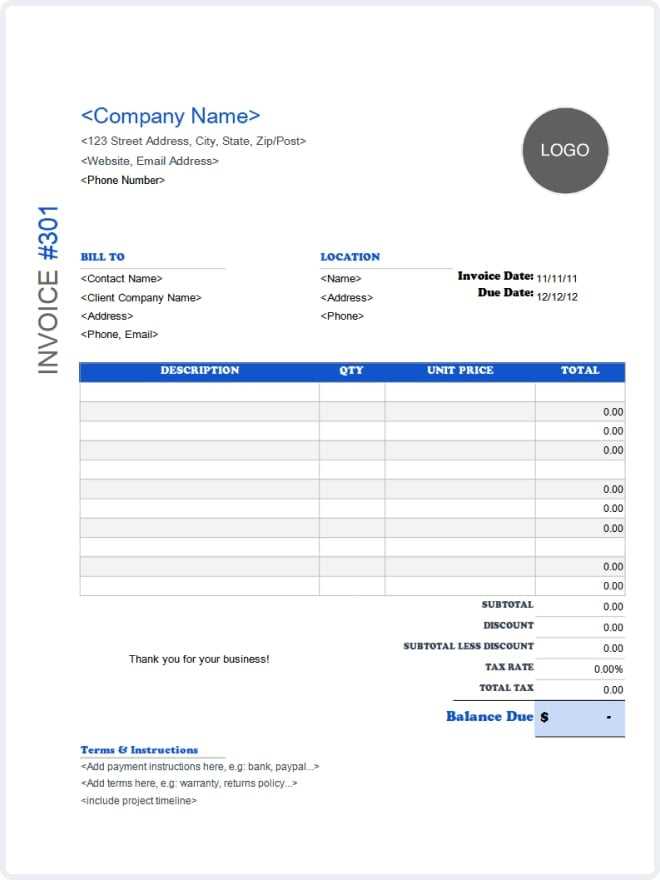

Creating such a document involves including specific sections that highlight the core details of the transaction. These include service descriptions, pricing, payment terms, and contact information, all laid out in a clear and easy-to-read format. Below is an example structure to guide the creation of a professional document for your business:

| Section | Description |

|---|---|

| Header | Include business name, contact details, and unique reference number. |

| Client Information | Include client name, address, and other relevant details. |

| Service Details | List services provided along with individual charges and dates. |

| Payment Terms | Specify payment due date, any late fees, and accepted payment methods. |

| Summary | Total amount due and any applicable taxes or additional fees. |

| Footer | Include thank you note, payment instructions, and legal disclaimers. |

By organizing these key elements, businesses can ensure consistency in their billing process and improve communication with clients. Additionally, using an effective format reduces the likelihood of disputes and enhances overall customer satisfaction.

Understanding Car Storage Invoices

In any business dealing with vehicle parking or preservation, ensuring a clear and well-organized record of financial transactions is essential. This helps both the service provider and the customer stay on the same page about the agreed charges, due dates, and other relevant details. A well-structured document acts as an official agreement, outlining the terms of the service and ensuring that payment expectations are clear and fair.

Key Elements of a Billing Record

Each record should capture several crucial pieces of information to make it complete. These include a description of services rendered, the period of service, individual charges, and payment deadlines. Clear terms regarding any additional fees or taxes should also be outlined to prevent any misunderstandings. By organizing these details, businesses can ensure that the document serves as a reliable reference for both parties.

Why Clear Documentation is Important

Proper documentation helps build trust with customers and minimizes the chance of payment disputes. When everything is laid out in a straightforward manner, clients can easily verify the details of the service and ensure there are no errors. This transparency not only simplifies the financial aspect of the business but also contributes to long-term customer satisfaction.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for billing purposes brings several advantages to businesses in the vehicle storage sector. These tools help streamline administrative tasks, ensuring that all necessary details are captured in a consistent and organized manner. By using a structured format, service providers can save time, reduce errors, and maintain professionalism with minimal effort.

Efficiency and Consistency are two of the biggest benefits. A ready-to-use structure means businesses don’t need to start from scratch with each new transaction. All required sections are already included, which speeds up the process of preparing and sending out payment records. This consistency also ensures that clients receive clear and reliable documentation every time, minimizing confusion.

Time and Cost Savings come from eliminating the need to manually design each document. By relying on a predefined format, companies save valuable time, allowing them to focus on other essential tasks. In addition, this approach reduces the risk of costly errors or omissions, further improving the efficiency of the entire billing process.

Professionalism is enhanced as well. A well-organized, uniform document helps establish credibility with customers and fosters a sense of trust. It shows that the business is serious and organized, which can lead to better client relationships and more timely payments.

Customizing Your Invoice for Business Needs

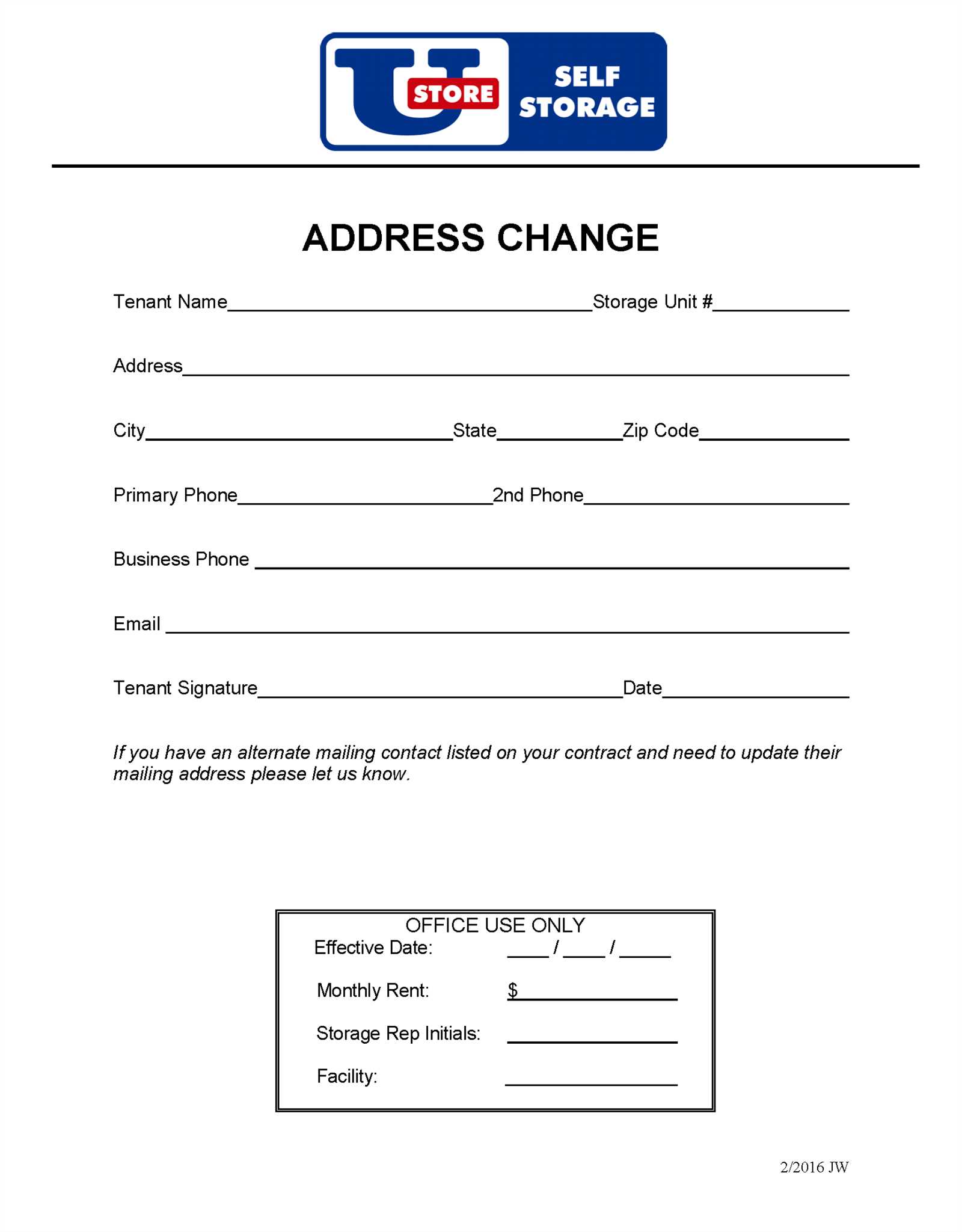

Tailoring billing documents to suit the specific needs of your business can significantly improve the overall customer experience and streamline financial management. Customization allows you to add business-specific details, ensuring the document reflects your company’s unique requirements while maintaining clarity and professionalism. This flexibility helps cater to various business models, enhancing both internal processes and client satisfaction.

Incorporating Business-Specific Information

Including unique identifiers such as your business logo, contact information, and service descriptions is crucial for a professional touch. You can also adjust the layout to highlight the most important details for your clients, such as pricing, terms, or additional fees. Customizing sections such as payment methods or special terms ensures that your clients have all the relevant information to process payments smoothly.

Adapting Terms and Conditions

Each business has its own set of policies regarding payment schedules, discounts, or penalties for late payments. By customizing the document, you can clearly state your terms in a way that is easy for clients to understand. This reduces the chances of confusion and ensures that clients are aware of their responsibilities from the outset. Whether it’s a discount for early payment or a late fee for overdue balances, adjusting the terms to fit your business model can improve cash flow and reduce misunderstandings.

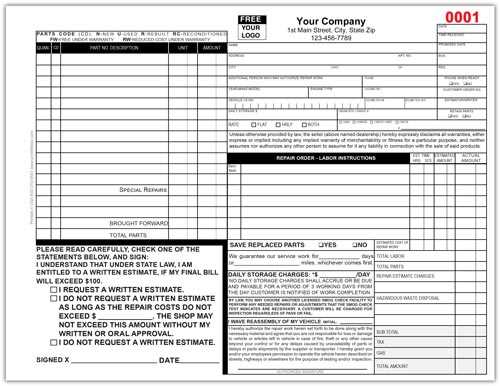

Key Elements of a Car Storage Invoice

For any business that provides vehicle holding services, ensuring a comprehensive and accurate billing document is essential. A well-structured statement should clearly outline the charges, services rendered, and payment details to avoid confusion and ensure timely payments. Including all necessary elements helps both businesses and clients maintain transparency, providing clear documentation of the transaction.

The most important aspects to include are a unique reference number for tracking, detailed service descriptions, and the applicable pricing for each service provided. Additionally, it’s crucial to list the payment due date, accepted methods of payment, and any additional fees or taxes. These elements, when combined, create a clear and professional document that sets expectations and encourages prompt payment.

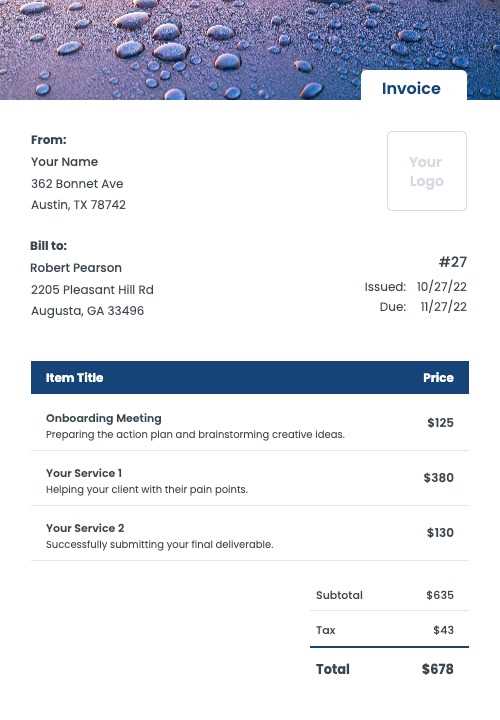

How to Create a Simple Storage Invoice

Creating a straightforward document for billing is easy and can be done in just a few simple steps. The goal is to provide a clear record of the services provided and the corresponding charges, ensuring that clients understand exactly what they are being billed for. By following a simple structure, you can streamline the billing process and ensure accuracy with every transaction.

Here are the basic steps to create a simple payment document:

- Include Business Information: Start by adding your company name, contact details, and any other relevant information such as your address or business number.

- Client Details: Include the customer’s name, contact information, and their specific service reference number if applicable.

- Describe Services Provided: List each service that was offered, including any special requirements or features, with clear pricing for each one.

- Specify Payment Terms: State the due date for payment, available payment methods, and any penalties for late payments.

- Summarize Total Charges: Add up all services provided and clearly state the total amount due, including taxes or additional fees.

By organizing these elements into a simple, easy-to-read format, you’ll have a professional document ready to send to your clients, helping to ensure clarity and timely payments.

Setting Up Payment Terms in Invoices

Establishing clear payment terms in your billing documents is essential for ensuring that both parties understand when and how payments are expected. Setting precise terms helps avoid confusion and delays, and it can also improve cash flow by making payment expectations clear from the start. A well-defined payment structure contributes to the smooth operation of any business by maintaining consistency and professionalism in financial dealings.

Here are key components to consider when setting up payment terms:

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which payment is expected, typically within 30, 60, or 90 days of the transaction date. |

| Late Fees | Define any penalties for overdue payments, such as a fixed fee or interest rate applied after the due date. |

| Accepted Payment Methods | List all the payment options available, such as bank transfer, credit card, or online payment platforms. |

| Discount for Early Payment | Offer a percentage discount if payment is made before the due date as an incentive for early settlement. |

By clearly outlining these terms, you ensure that your clients know exactly when and how to pay, which reduces delays and improves financial management for your business.

Best Practices for Sending Invoices

Efficiently sending billing documents is crucial to maintaining smooth operations and ensuring prompt payments. Following best practices when preparing and delivering payment requests not only enhances your professionalism but also improves the chances of timely financial transactions. Proper communication, clear formatting, and timely delivery all contribute to the effectiveness of the payment process.

Timely Delivery is essential. Send payment records as soon as services are completed or products are delivered. This allows clients to have a clear understanding of the charges and avoid delays in processing payments. Generally, it is best to send the document within 24–48 hours to keep the payment process moving smoothly.

Clear and Organized Presentation is another key aspect. Ensure that all relevant details, such as services rendered, pricing, and payment due dates, are clearly outlined. This helps reduce confusion and avoids any potential disputes. A well-organized record with easy-to-read fonts and logical layout contributes to professionalism and client trust.

Digital Delivery is increasingly becoming the standard. Sending documents via email or through secure online platforms speeds up the process and allows for quick access by the client. Additionally, digital methods often come with tracking features, helping ensure that the document has been received and reviewed by the recipient.

Follow-up Communication is important for late or missed payments. A gentle reminder can help prompt clients who may have overlooked the payment. Being polite but firm in your follow-up communication can help maintain a good relationship while ensuring you are compensated promptly.

Using Digital Tools for Invoice Creation

Leveraging digital tools to generate billing documents has become a standard practice for businesses aiming to streamline their financial processes. These platforms allow for quick creation, customization, and management of payment records, which saves time and reduces errors. By automating many of the steps involved, businesses can focus on providing excellent service rather than spending excessive time on administrative tasks.

Benefits of Digital Platforms

One of the primary advantages of using digital tools is efficiency. Many software solutions offer pre-designed structures and automatic calculations, allowing you to generate accurate and professional documents with minimal effort. These tools also allow for easy customization, so you can tailor the document to reflect your business’s unique needs while maintaining consistency in your communications with clients.

Integration with Other Business Systems

Digital tools also often integrate seamlessly with other business systems, such as accounting software or client management platforms. This integration reduces the need for manual data entry and ensures that all records are automatically updated across platforms. The result is a more organized workflow that minimizes the chances of mistakes, ensures accuracy, and keeps everything aligned with your financial records.

How to Include Taxes in Your Invoice

Including taxes in your billing documents is crucial to ensure compliance with local tax regulations and to provide transparency for your clients. It is essential to clearly state any applicable tax amounts so that customers are aware of what they are paying for, beyond the base service or product cost. Properly calculating and presenting taxes can help prevent misunderstandings and maintain smooth financial transactions.

Steps for Including Taxes

Follow these steps to include taxes accurately in your billing documents:

- Identify Applicable Tax Rates: Research and determine which tax rates apply to your services or products, based on your location and industry. This could include sales tax, VAT, or other regional taxes.

- Calculate Tax Amount: Multiply the cost of the service by the applicable tax rate to find the tax amount. Be sure to use the correct rate to avoid overcharging or undercharging your client.

- List Tax Separately: Clearly break down the tax amount in your billing document. This helps customers see exactly how much they are being charged for taxes, separate from the base price.

- Total Tax Amount: Add the tax to the original service amount to calculate the total due. This ensures your client is aware of the full amount they need to pay.

Common Tax Considerations

There are a few things to keep in mind when applying taxes:

- Local Tax Laws: Tax laws vary by region, so make sure to apply the correct rates based on where your business and clients are located.

- Exemptions: Some products or services may be exempt from taxes. Be sure to verify whether your offerings fall under any tax exemptions.

- Multiple Tax Rates: If multiple tax rates apply (for example, state and federal taxes), list each rate separately to ensure clarity.

By following these steps and considering local tax regulations, you ensure that your billing records are accurate and transparent, helping to avoid confusion and ensuring timely payments.

What Information Should Be On Each Invoice

To ensure smooth and clear transactions, it’s essential that every billing document contains specific information. Including the right details helps both businesses and customers understand the charges and avoids confusion. Clear and accurate records also ensure compliance with legal requirements and provide a professional appearance for your business.

Basic Contact Information is crucial. The document should list the names and contact details of both the business and the client. This includes the business’s name, address, phone number, and email, along with the client’s corresponding details. This allows for easy communication in case any issues arise.

Unique Identification Number should be included to help track the transaction. This can be a specific billing number that serves as a reference for both the business and client. It simplifies record-keeping and provides an easy way to identify a specific transaction when reviewing past records.

Clear Description of Services or Products is essential to avoid confusion. Be sure to outline what was provided, along with any applicable details such as quantity, duration, or specifications. This transparency helps the customer understand what they are being charged for and ensures accuracy.

Payment Terms should be stated clearly. These include the due date for payment, late fees (if applicable), and accepted payment methods. Stating this upfront ensures that both parties are on the same page about when and how payment should be made.

Tax Information should be clearly listed if applicable. Specify the tax rates used and any exemptions that may apply, helping clients understand how taxes are being calculated and included in the total amount due.

Including these key elements ensures that the document is clear, professional, and legally compliant, fostering trust and efficient communication between the business and its clients.

Common Mistakes to Avoid in Invoicing

When generating billing documents, small mistakes can lead to confusion, delays in payment, or legal complications. Ensuring that the necessary details are accurate and clear is key to maintaining positive relationships with clients and ensuring timely compensation for services rendered. Below are some of the most common errors businesses make and how to avoid them.

Common Billing Errors

- Missing or Incorrect Contact Information: Failing to include accurate contact details for both parties can lead to misunderstandings or delays. Ensure both the business and client’s name, address, phone number, and email are correct.

- Not Including a Unique Reference Number: Without a reference number, it can be challenging to track transactions. Always include a unique identifier to facilitate easy reference and future follow-ups.

- Omitting Service or Product Descriptions: Clients need to clearly understand what they are being billed for. Not providing a detailed breakdown of the service or product can lead to disputes and confusion. Always include a clear description of each item or service provided.

- Incorrect Tax Calculations: Errors in tax calculations can result in undercharging or overcharging. Always double-check the tax rates and apply them correctly based on the client’s location or industry standards.

- Missing Payment Terms: Not specifying when the payment is due or what methods are accepted can delay payments. Always outline clear payment terms, including the due date, acceptable payment methods, and any late fees.

- Not Including Discounts or Promotions: If any discounts or special offers apply, they should be clearly indicated. Failing to include this information can cause clients to feel misled or confused about the total amount due.

How to Avoid These Mistakes

- Double-Check Details: Before finalizing any billing document, review the contact information, amounts, and calculations for accuracy.

- Use Software or Tools: Consider using digital platforms to generate billing documents. Many tools are designed to reduce human error by automating calculations and offering templates.

- Clear and Transparent Communication: Be sure to communicate any changes or additional fees to your clients ahead of time to avoid misunderstandings when they receive the final document.

Avoiding these common mistakes ensures smoother transactions, faster payments, and a professional image for your business.

How to Track Payments Effectively

Managing payments efficiently is crucial for maintaining a steady cash flow and ensuring that your business operations run smoothly. Keeping track of all incoming funds allows you to stay on top of your financial health and avoid any missed payments or accounting discrepancies. In this section, we’ll explore effective strategies for tracking payments and ensuring you have accurate records at all times.

Setting Up a Payment Tracking System

To track payments effectively, it’s essential to have a reliable system in place. Whether you choose to use software tools, spreadsheets, or manual logs, consistency and organization are key. A few important steps include:

- Use a Centralized System: Keeping all payment records in one location helps prevent confusion. You can utilize accounting software or spreadsheets to log and categorize payments for easy tracking.

- Record Payment Dates: Always note the date when payments are received. This helps you keep track of whether payments are on time and easily identify any overdue transactions.

- Attach Payment References: Whenever possible, attach payment reference numbers or transaction IDs to ensure that you can trace and verify each payment quickly.

Automating Payment Tracking

Automation is one of the most effective ways to track payments accurately and reduce the risk of human error. Many businesses use accounting software or payment processors that automatically update payment records in real-time. Some features to look for in payment tracking tools include:

- Real-Time Updates: Payment tracking software can sync with your bank account or payment gateways to provide instant updates when funds are received.

- Automated Reminders: Set up automatic reminders for clients to pay before the due date. This feature can reduce overdue payments and help you stay on top of your cash flow.

- Comprehensive Reporting: Many tools provide detailed reports, allowing you to quickly see which payments have been made, which are outstanding, and what your overall financial status looks like.

By utilizing these strategies, you can ensure that your payment tracking is both accurate and efficient, reducing administrative workload and improving your financial management.

Invoice Templates for Small Storage Businesses

For small businesses that offer storage solutions, having an effective method for documenting and managing transactions is crucial. Providing clear, professional records ensures smooth operations, enhances client trust, and helps in managing finances. The use of specialized documents to outline services, fees, and payment terms can significantly simplify the administrative side of your business.

Why Use Professional Templates?

Using well-structured forms for your billing process offers several benefits, especially for small businesses. Professional templates save time and ensure that all necessary details are captured. Here are a few key advantages:

- Consistency: Templates provide a consistent format, making it easy for clients to understand charges and payment schedules.

- Time Efficiency: Customizable templates reduce the time spent creating each document from scratch, allowing you to focus on other aspects of your business.

- Legal Protection: Properly formatted documents can protect your business in case of disputes, ensuring that all parties have a clear understanding of the terms of service.

What to Include in Your Billing Document

When creating billing forms for your small business, it’s essential to include the necessary details to avoid confusion and ensure transparency. Here are the key components that should be on every document:

- Business Information: Include your business name, contact details, and any necessary license or tax identification numbers.

- Client Information: The client’s name, address, and contact information should be clearly stated for proper record-keeping.

- Description of Services: A detailed breakdown of the services provided, including any specific items stored or the duration of the service.

- Pricing and Fees: Clearly list the charges, including any taxes, discounts, or additional fees for services.

- Payment Terms: Outline payment deadlines, accepted payment methods, and any late payment penalties if applicable.

- Invoice Number and Date: Every document should have a unique identifier and the date issued to track transactions efficiently.

By including these details in your billing records, you can ensure that the process is smooth for both you and your clients, while also streamlining your administrative tasks.

Legal Considerations When Issuing Invoices

When creating billing documents for your business, it’s important to consider the legal aspects that govern the transaction process. These records not only ensure that you are paid for the services or products provided but also protect both parties involved in the agreement. Understanding the legal requirements can help prevent misunderstandings, disputes, and potential legal issues in the future.

Key Legal Aspects to Consider

There are several crucial factors that must be included in any billing document to ensure compliance with the law and maintain a transparent business operation. Here are the main considerations to keep in mind:

- Accurate Business Information: Always include your full legal business name, registered address, and relevant tax ID numbers. This ensures your business is correctly identified and can be held accountable for the transaction.

- Client Information: Properly recording your client’s name and address ensures that there is no ambiguity about the recipient of the service or product. This is crucial for establishing a formal business relationship.

- Clear Terms of Service: Make sure that all terms related to the services offered, payment schedule, and refund policy are clearly stated. This provides both you and your client with a clear understanding of expectations.

- Tax Compliance: Ensure that any applicable taxes are included

Improving Client Communication Through Invoices

Effective communication with clients is essential to maintaining positive relationships and ensuring smooth transactions. One of the most powerful tools for facilitating this communication is the document used to request payment for services rendered. By crafting clear, professional, and informative records, you can not only streamline the payment process but also enhance your communication with clients. These documents can serve as a reminder of the services provided, reinforce expectations, and build trust.

Clear and Concise Information

The primary function of a billing record is to provide detailed information regarding the services or products offered. However, it can also be an opportunity to reinforce key messages and create a transparent line of communication between you and your client. Here’s how you can improve communication:

- Detailed Descriptions: Providing a clear breakdown of services or products ensures there’s no confusion about what was delivered. Clients appreciate transparency, and clear descriptions prevent misunderstandings.

- Payment Instructions: Clearly stating how payments should be made, the acceptable methods, and the due dates helps avoid delays and confusion.

- Personalized Messages: Including a personalized note or thank-you message shows clients that you value their business and can help foster goodwill and loyalty.

- Terms and Conditions: Clearly outlining payment terms, late fees, and cancellation policies helps manage expectations and provides a reference point in case of future questions.

Using Invoices as a Communication Tool

Beyond their primary financial function, billing records can also serve as a subtle form of ongoing communication. They are an effective way to engage clients and encourage timely follow-ups, while also reinforcing your professional image. Here are some ways to use them effectively:

- Regular Updates: Send updates on services completed or upcoming work to keep clients informed about the status of ongoing projects. This fosters a sense of trust and reduces the chances of confusion.

- Encourage Early Payment: Use your billing document to subtly encourage prompt payment by offering discounts for early settlements or by reminding clients of their obligations in a polite manner.

- Record of Past Communication: Including a reference to previous conversations or agreements can make your billing document more personal and show clients that you are keeping track of your ongoing relationship.

By integrating clear, concise, and professional communication into your billing process, you enhance client satisfaction, reduce misunderstandings, and promote a more efficient and transparent business environment. Remember that every document you send is an opportunity to reinforce your professionalism and maintain strong relationships with your clients.

Free vs Paid Billing Templates

When it comes to creating payment requests for your services, one of the first decisions you’ll face is whether to use free or paid tools. Both options offer distinct advantages, and the choice between them depends on the specific needs of your business. Free solutions often provide basic functionality, while paid options may come with more features and customization, helping you create more professional documents and streamline your workflow. In this section, we’ll explore the differences between free and paid billing tools to help you make an informed decision.

Advantages of Free Billing Tools

Free tools are often the go-to choice for businesses just starting or those with minimal billing needs. These resources can help you get started without any financial investment, allowing you to focus on your core business operations. Some key benefits include:

- No Upfront Cost: The most obvious advantage is that they come at no cost, which can be particularly helpful for small businesses or startups with limited budgets.

- Basic Functionality: Most free tools offer the essential features needed to generate and send billing documents, such as basic formatting options and payment tracking.

- Ease of Use: Free tools tend to have a user-friendly interface, allowing anyone to create and manage their billing requests quickly.

- Quick Setup: These tools often require minimal setup and are ready to use right away, making them ideal for businesses that need a fast solution.

Benefits of Paid Billing Tools

While free tools are great for basic needs, paid tools often offer advanced features and greater flexibility. Investing in a paid solution can be especially beneficial if your business requires more professional-looking documents or more complex functionalities. Here are some of the advantages:

- Customization: Paid tools often allow for more detailed customization, including personalized logos, layouts, and fields, to match your brand identity.

- Integration with Other Tools: Many paid options integrate with accounting software, CRM systems, and payment gateways, streamlining the entire billing process and saving time.

- Advanced Features: These tools often include features like recurring billing, automated reminders, and analytics, which can improve efficiency and provide deeper insights into your financials.

- Better Support: With a paid plan, you often get access to customer support, which can be crucial if you encounter issues or need guidance on how to use the system effectively.

Choosing between free and paid options largely depends on the complexity of your billing process and the level of professionalism you want to convey. While free tools can be a good starting point, investing in a paid solution may offer long-term benefits that help improve your business’s financial management and client experience.