How to Create and Customize Sage Intacct Invoice Template

When managing financial transactions, presenting a polished and professional appearance is essential. Businesses need to have efficient methods for generating consistent and clear payment requests. Customizing your financial documents ensures that all necessary details are included and tailored to your company’s needs. This process streamlines billing and helps maintain a professional image with clients.

In this guide, we will explore how to design and customize your billing layouts, focusing on essential features such as payment terms, company details, and overall design. By adjusting the structure of your documents, you can improve clarity and organization, making it easier for both your team and clients to process payments. A well-structured billing form also enhances the credibility of your business.

Whether you’re new to setting up these documents or looking to refine your current system, this article will guide you through the necessary steps and tips for creating the perfect document that suits your business style and requirements.

What is a Billing Document in Financial Systems?

A billing document is a key tool in the financial management process, serving as a formal request for payment. It outlines the products or services provided, the agreed-upon costs, and the terms for settlement. These documents are essential for maintaining clear communication between businesses and their clients, ensuring that both parties have a mutual understanding of the amount owed and the payment schedule.

Key Features of a Financial Request Form

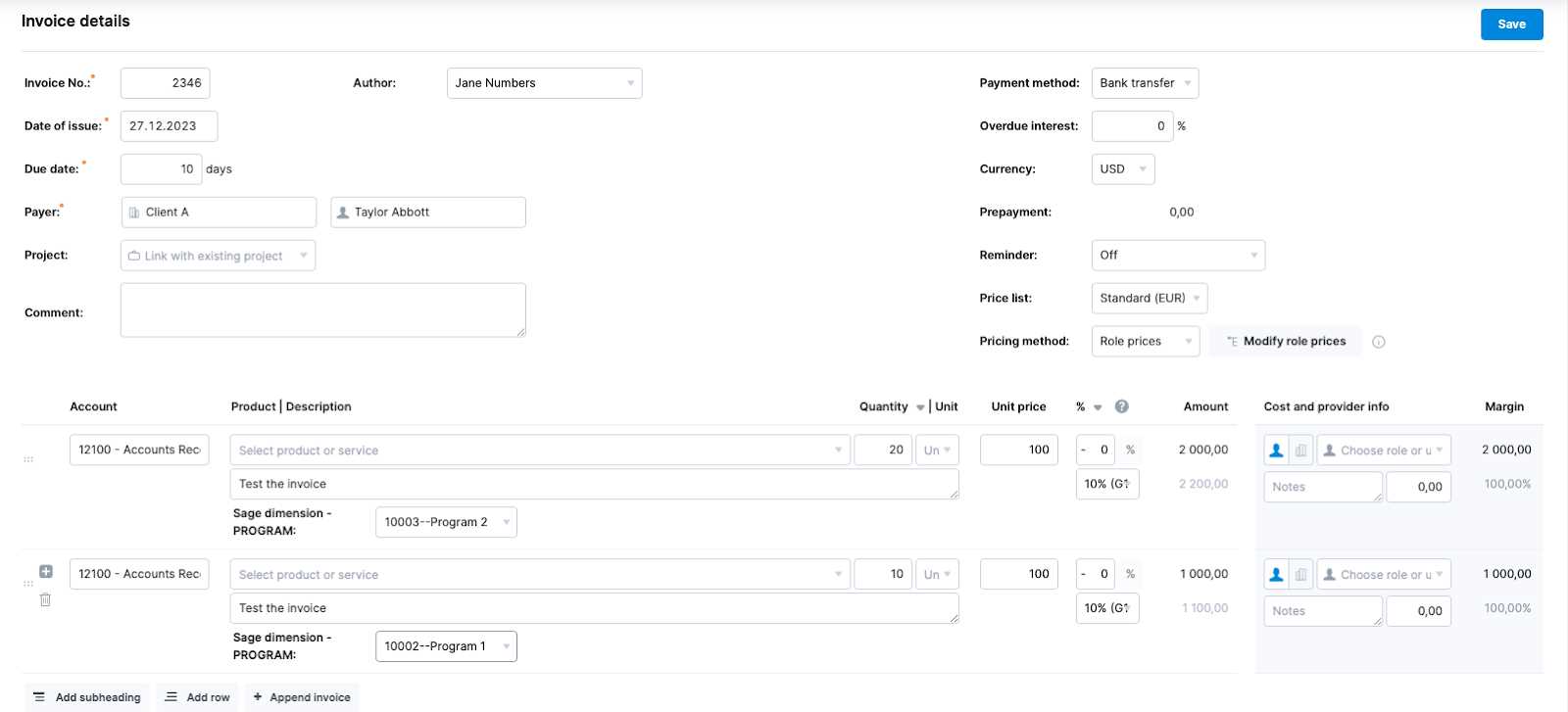

Typically, a financial request form includes several important sections. First, it details the items or services delivered, including a description and corresponding prices. It also includes fields for payment terms, such as deadlines and any applicable taxes or discounts. The overall layout is designed to make the payment process as simple and transparent as possible for all involved.

Why Customizing Your Billing Format Matters

Customizing the structure of these documents allows businesses to align them with their brand and operational needs. By adjusting the layout, businesses can highlight essential information such as payment deadlines or special instructions, ensuring that important details stand out. A well-designed form not only improves clarity but also helps in fostering a professional relationship with clients, making it easier to process payments efficiently.

Key Features of Billing Document Designs

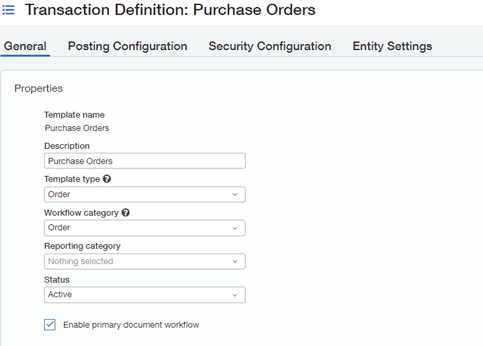

Customizing your financial request forms involves a range of features that ensure functionality, flexibility, and professionalism. These elements are designed to help businesses streamline their billing process while maintaining consistency and clarity. The right structure not only ensures that important information is communicated effectively but also that the process of creating and sending requests remains efficient.

Customizable Layouts for Specific Business Needs

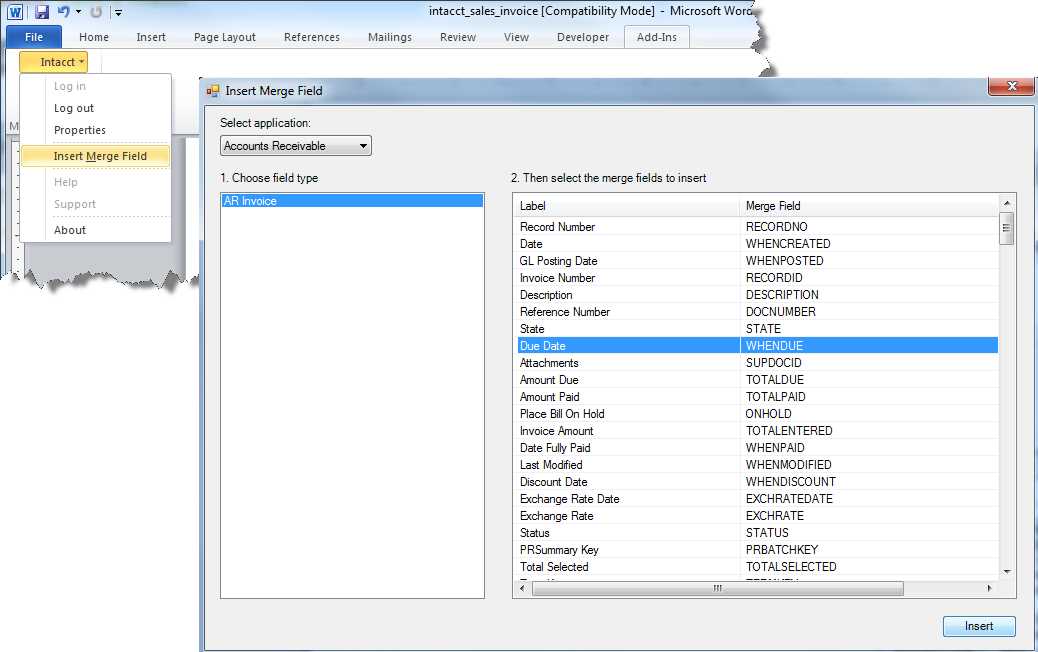

One of the most valuable aspects of these forms is the ability to tailor the layout to suit different business requirements. Companies can modify sections to highlight specific details, such as customer information, payment terms, or itemized charges. This flexibility ensures that each document meets the unique demands of different industries and client preferences.

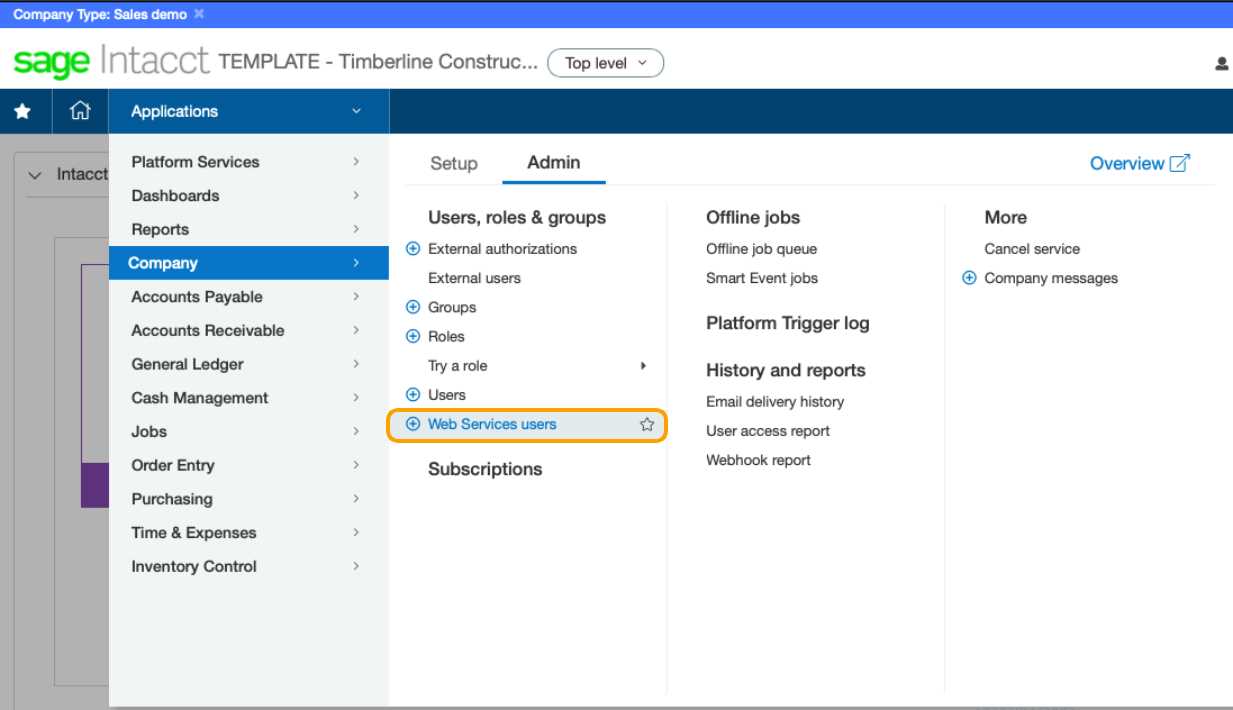

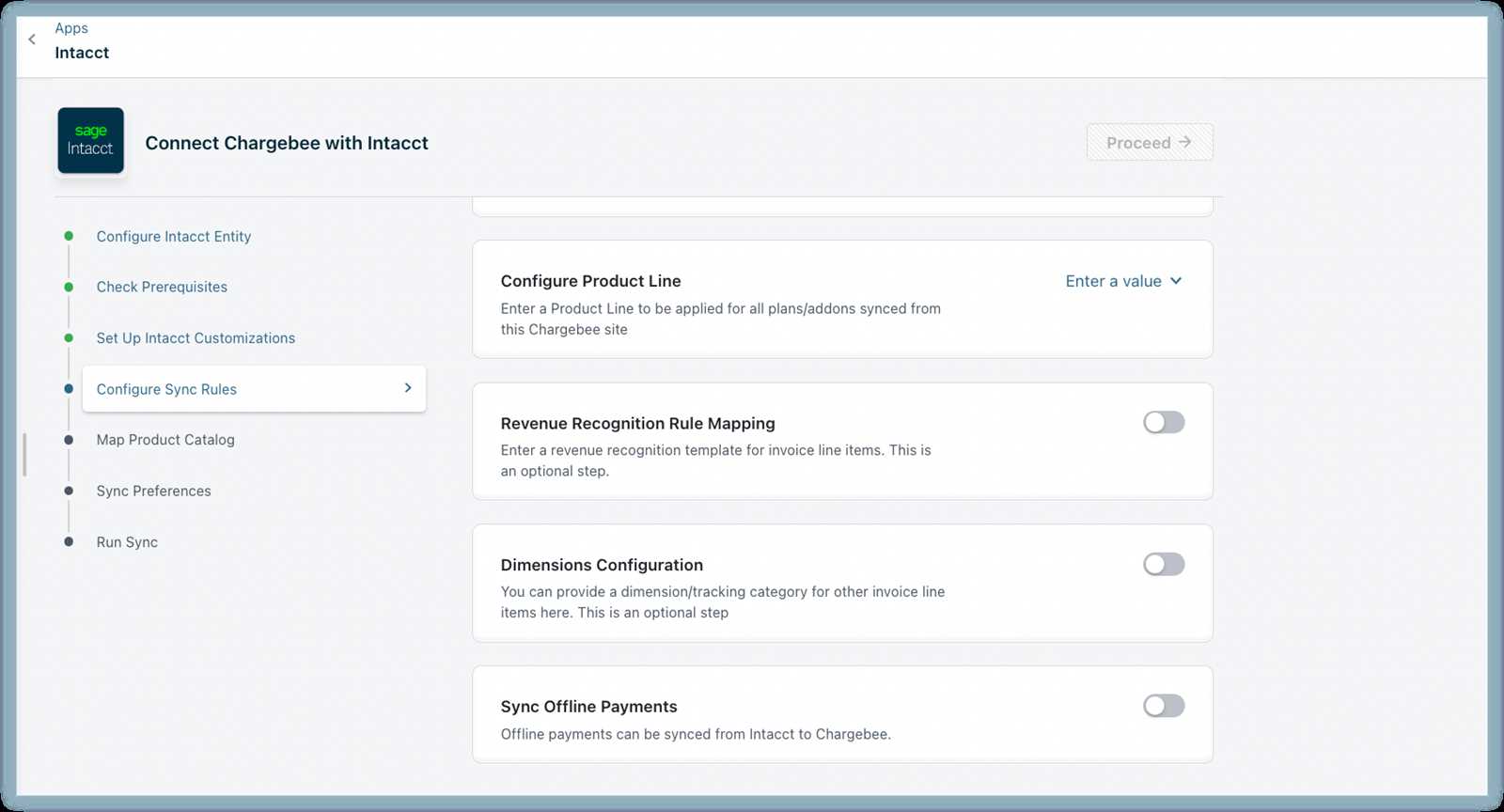

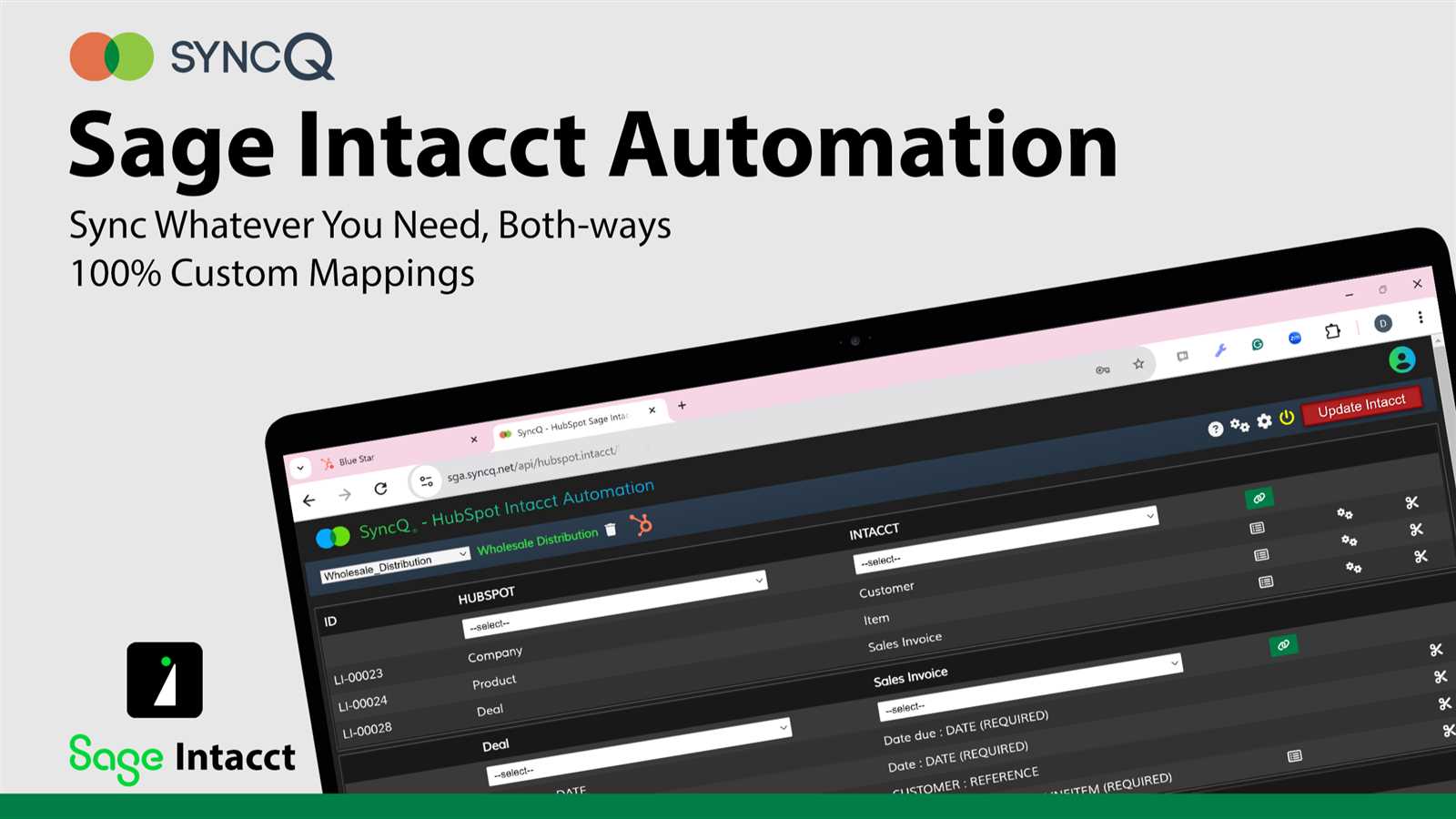

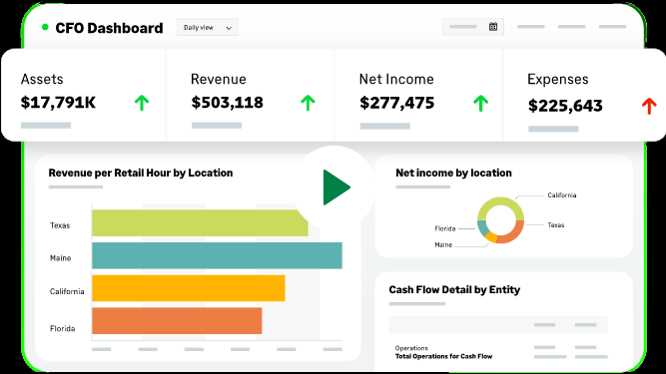

Integration with Financial Data Systems

Another key feature is seamless integration with accounting and financial management systems. These designs allow businesses to automatically populate fields with accurate data from their internal systems, such as customer details, pricing, and payment history. This integration minimizes errors and reduces the time spent on manual data entry, making the billing process more efficient.

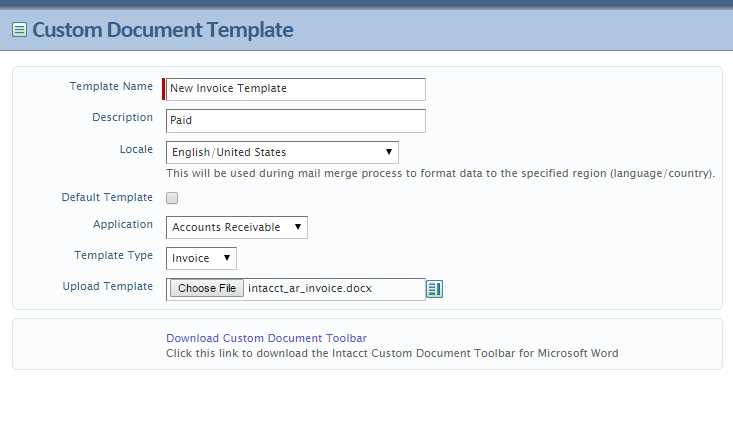

Setting Up Your First Billing Document

Creating your first billing document is a crucial step in managing your business’s financial transactions. The process involves structuring a clear, accurate request for payment that includes all relevant details, such as products or services provided, payment terms, and the total amount due. By setting up an effective form, you ensure that clients receive all the necessary information for processing payments quickly and correctly.

Start by selecting the appropriate layout that fits your business needs, whether you’re billing for one-time services or recurring payments. Ensure that fields such as company name, client information, and dates are easily customizable. Then, add essential items like pricing details, discounts, and applicable taxes. Once your basic structure is in place, check for clarity and consistency to avoid confusion and minimize errors.

Finally, always test your document by generating a preview before sending it to clients. This step helps you confirm that all information is displayed correctly and that the document functions as intended. By following these steps, you’ll ensure that your billing process is professional, efficient, and accurate from the very start.

Customizing Layout for Your Business

Customizing the layout of your financial documents is an essential step in ensuring that your billing process aligns with your company’s specific needs and branding. A well-structured document not only makes it easier for clients to understand the payment terms but also reinforces your professionalism and attention to detail. By modifying the design, you can highlight important information and create a cohesive look that matches your business identity.

Adjusting Sections to Fit Your Workflow

The first step in customizing your document is determining which sections are most relevant to your business. For example, if your company offers a variety of products or services, you may want to dedicate extra space to detailing each item and its cost. Additionally, you can modify how payment terms are displayed to ensure that they are clear and prominent, making it easier for clients to know when payments are due.

Enhancing Design for Clarity and Impact

Beyond functional adjustments, the visual appeal of your document plays a key role in making a lasting impression. Customizing fonts, colors, and logos can help strengthen your brand identity while making the document easier to read. It’s important to balance aesthetics with practicality; the form should still maintain a professional appearance and ensure that all key details are easy to locate.

Adding Company Information on Billing Documents

Including your company’s details on financial documents is vital for both identification and communication with clients. Clear and accurate business information ensures that recipients know exactly who the document is from, as well as how to contact you for any inquiries or concerns. A well-organized layout of company details fosters professionalism and transparency.

Here are the key elements to include:

| Company Name | Your Business Name |

|---|---|

| Address | 123 Business St., City, Country |

| Phone Number | (123) 456-7890 |

| Email Address | [email protected] |

| Website | www.yourbusiness.com |

By including this information in a clear and easy-to-find section of your document, you ensure that clients can reach you with any questions regarding the transaction. It’s essential to keep this information up-to-date to avoid any confusion and maintain smooth communication.

How to Insert Payment Terms in Billing Documents

Inserting payment terms into your financial documents is essential for ensuring clear expectations between you and your clients. Payment terms specify when and how payments should be made, helping to prevent misunderstandings and late payments. These terms typically include the payment due date, any early payment discounts, and late fees for overdue amounts.

Steps to Include Payment Terms

To begin, locate the section of your document where payment information will be displayed. This is typically at the bottom or in a prominent spot near the total amount due. Start by stating the due date clearly, such as “Due within 30 days from the date of issue.” You may also want to specify a discount for early payment, such as “2% discount if paid within 10 days.” Additionally, be sure to outline any penalties for late payments, such as “1.5% late fee after 30 days.”

Formatting Payment Terms for Clarity

It’s important to format these terms in a way that is easy to read and understand. Use bold or italicized text to make key information, like the due date or discount offers, stand out. Keep the language simple and direct, ensuring there is no ambiguity regarding the payment schedule. Clear payment terms help establish a professional relationship and encourage timely payments from clients.

Using Multiple Currency Options in Billing Documents

When working with international clients or businesses, it’s essential to accommodate different currencies in your financial documents. This feature allows you to present accurate amounts in the currency of your client’s location, making the payment process smoother and clearer. Including multiple currency options ensures that clients understand the exact value of the charges and can process payments in their preferred currency.

How to Add Multiple Currency Options

To include multiple currency options, first, ensure that your document structure allows for the inclusion of currency symbols and values. You can set up separate fields for currency conversion rates or allow the system to automatically calculate the exchange based on real-time data. If you’re working with clients from different countries, be sure to specify the exact exchange rate used and the date of conversion to avoid any confusion regarding the amount owed.

Ensuring Accurate Currency Conversion

It’s important to regularly update the exchange rates used in your documents. Most systems provide integration with financial data sources that can automatically update exchange rates in real time. Additionally, make sure that all fees, taxes, and totals reflect the correct values after currency conversion, as even minor discrepancies can lead to payment issues or disputes.

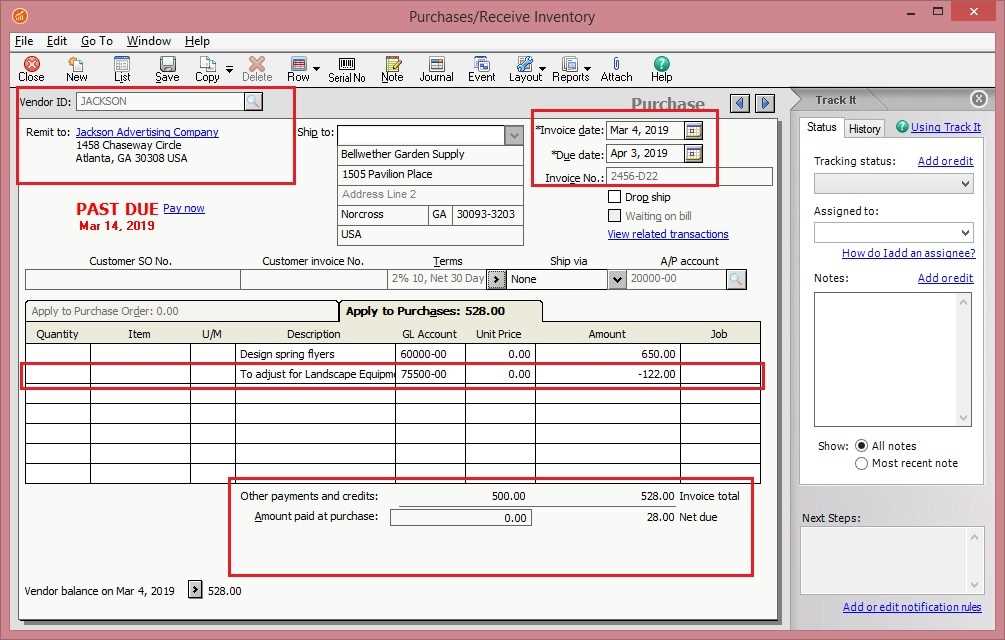

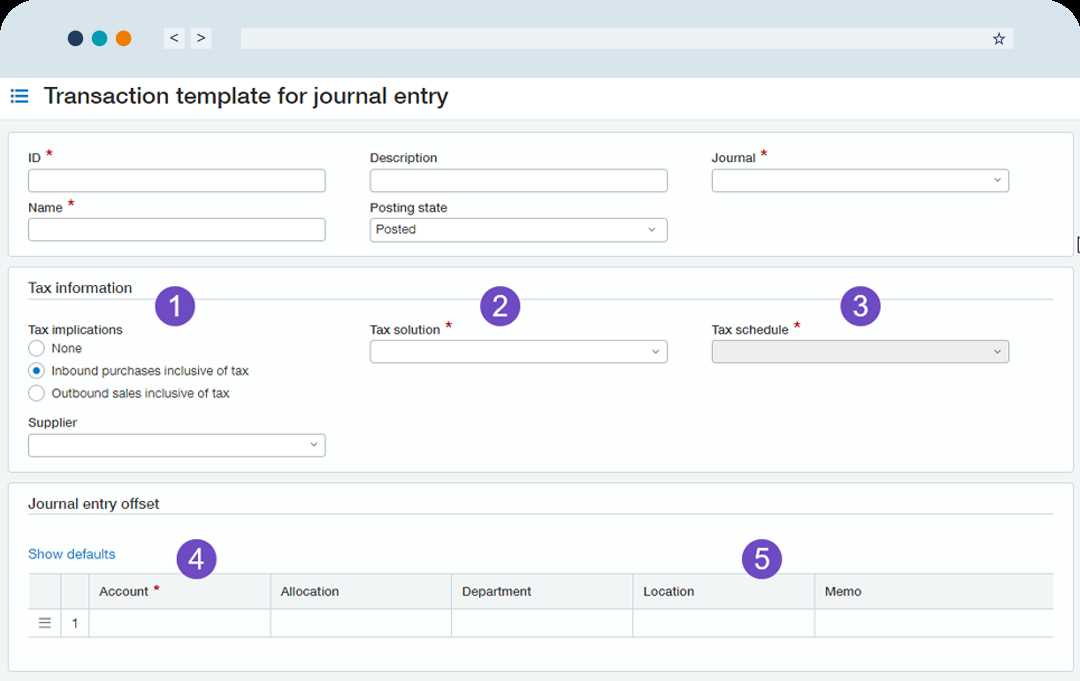

Integrating Taxes and Discounts in Billing Documents

Incorporating taxes and discounts into your financial documents is essential for ensuring accurate calculations and transparency. These elements can significantly impact the final amount due, and it’s crucial to include them in a clear and understandable format. By properly integrating these factors, you provide clients with the information they need to process payments correctly, while also ensuring compliance with tax regulations.

Including Taxes

Taxes are a necessary component of many transactions, and ensuring they are correctly included in your billing documents helps avoid discrepancies. You can apply various tax rates depending on the location or product type, and it’s important to display the tax breakdown clearly. Here’s how you can structure it:

- Specify the tax rate (e.g., 5% sales tax).

- Indicate the total amount of tax charged.

- Show the subtotal before taxes and the final amount after tax.

Adding Discounts

Discounts can be offered to clients as incentives for early payment or as part of promotional offers. Including discounts clearly on your documents ensures that clients are aware of any reductions in the total amount due. You can integrate discounts in the following ways:

- State the discount percentage (e.g., 10% off for early payment).

- Clearly calculate and display the discount amount.

- Show the adjusted total after applying the discount.

By making these elements visible and understandable, you help clients easily determine how taxes and discounts affect their final payment, ensuring a smooth transaction process.

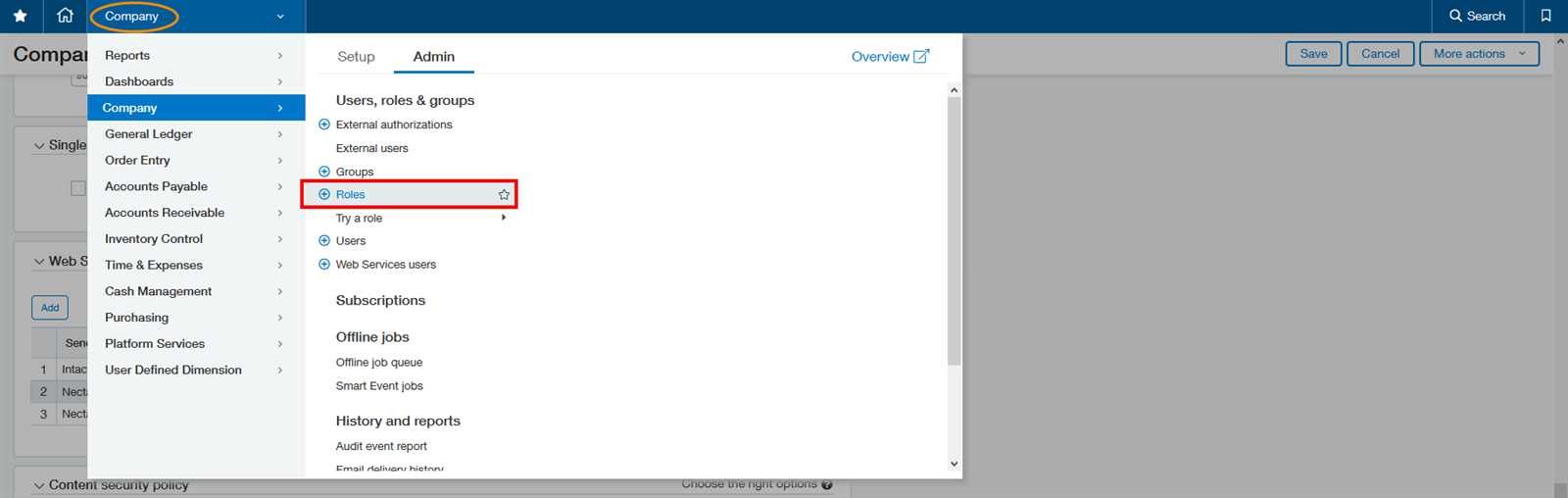

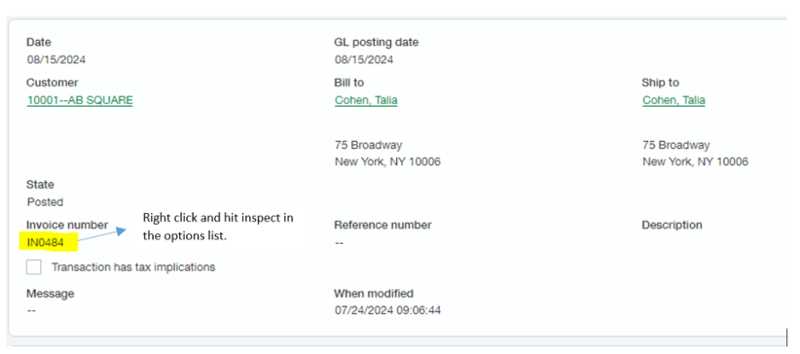

Automating Billing Document Numbering

Managing document numbers manually can be time-consuming and prone to errors, especially as your business grows. Automating the numbering process streamlines this task, ensuring that each document is assigned a unique, sequential number without the risk of duplication. This system improves organization, reduces the potential for confusion, and makes tracking transactions more efficient.

Automated numbering systems typically allow you to set the starting number, define a prefix or suffix (such as “INV” or the year), and automatically increment the number with each new document. This feature can also handle gaps in numbering for missed or voided documents, maintaining a logical sequence.

How Automated Numbering Works

When you enable an automated numbering system, the platform typically follows a simple process. Each time a new document is created, the system generates the next available number in the sequence, ensuring that all records remain unique and properly ordered.

| Document Type | Invoice |

|---|---|

| Starting Number | 1000 |

| Prefix | INV- |

| Number Increment | 1 |

| Next Number | INV-1001 |

By automating the numbering, you reduce human error and ensure consistent, accurate documentation for both internal tracking and client records. It also enhances the overall professionalism of your business by providing easily identifiable and well-organized billing documents.

Choosing the Right Document Format for Billing

Selecting the proper format for your financial documents is crucial for ensuring clarity and professionalism. The format should align with your business needs, client expectations, and ease of use. A well-structured layout enhances communication and helps clients easily understand the charges, terms, and other relevant details.

There are several factors to consider when choosing the right format. These include the level of detail required, the need for customization, and how the document will be delivered–whether electronically or on paper. The format should also be flexible enough to accommodate various payment methods, multiple line items, and any applicable taxes or discounts.

Considerations for Selecting the Right Format

When deciding on a format, here are some things to consider:

- Clarity: Choose a design that makes it easy to read and understand. Key information like total amounts, due dates, and company contact details should be easy to locate.

- Customizability: Your format should allow for adjustments, such as adding or removing specific fields, to suit different types of transactions or client requirements.

- Consistency: Make sure the format aligns with your overall brand identity. Consistency across all documents will help reinforce your business image.

- Digital Accessibility: If sending documents electronically, ensure the format is compatible with various devices and software used by clients.

By selecting the right format, you create an efficient, professional document that fosters trust and makes it easier for clients to process payments and maintain their records.

Previewing Your Custom Billing Document Layout

Before finalizing your financial document layout, it’s essential to preview how it will look in practice. This step helps ensure that all information is displayed clearly and in the correct format. Previewing gives you an opportunity to check for any formatting errors, missing details, or alignment issues that may affect the document’s readability and professionalism.

Why Previewing is Important

Previewing allows you to make adjustments before sending the document to clients or printing it. It ensures that the layout meets your expectations and provides a chance to identify any discrepancies or errors that could create confusion or misinterpretation. Checking how elements like logos, contact details, and payment terms appear in the final version is crucial for a polished presentation.

What to Look for During a Preview

Here are some key aspects to focus on when previewing your document:

- Alignment: Ensure that all text, numbers, and logos are properly aligned for a clean, organized look.

- Readability: Confirm that the text is legible, with appropriate font sizes and spacing.

- Completeness: Double-check that all necessary fields, such as item descriptions, totals, and payment details, are included and correct.

- Branding: Make sure that your company’s logo and branding elements are clearly visible and consistent with your business image.

Once you are satisfied with the preview, you can proceed to finalize the layout and begin using it for your business transactions.

Best Practices for Professional Billing Documents

Creating professional billing documents is essential for maintaining a positive relationship with clients and ensuring smooth financial transactions. A well-designed document conveys trustworthiness, clarity, and attention to detail. By following best practices, you can ensure that your documents are not only functional but also leave a lasting impression on your clients.

Key Elements of a Professional Document

To create a professional document, it’s important to include several key elements that make the billing process transparent and easy to understand. These elements include:

- Clear Identification: Your business name, contact details, and logo should be prominently displayed at the top.

- Unique Identifier: Each document should have a unique identifier, such as a number or reference code, to avoid confusion.

- Itemized Breakdown: Clearly list the products or services provided, including quantities, rates, and total amounts for each line item.

- Payment Terms: State the payment due date, late fees (if applicable), and accepted payment methods.

Additional Tips for Consistency and Clarity

In addition to the basic elements, there are other strategies you can use to enhance the readability and consistency of your billing documents:

- Use Professional Language: Always maintain a formal tone and use clear, concise language.

- Ensure Legibility: Choose a clean font and maintain appropriate text size and spacing.

- Stay Organized: Group related information together, and use sections or tables to separate line items, totals, and payment details.

- Brand Consistency: Ensure that your branding is consistent across all documents, from the logo to the color scheme, to reinforce your business identity.

By incorporating these best practices, you ensure that your billing documents reflect your professionalism and make the payment process clear and straightforward for your clients.

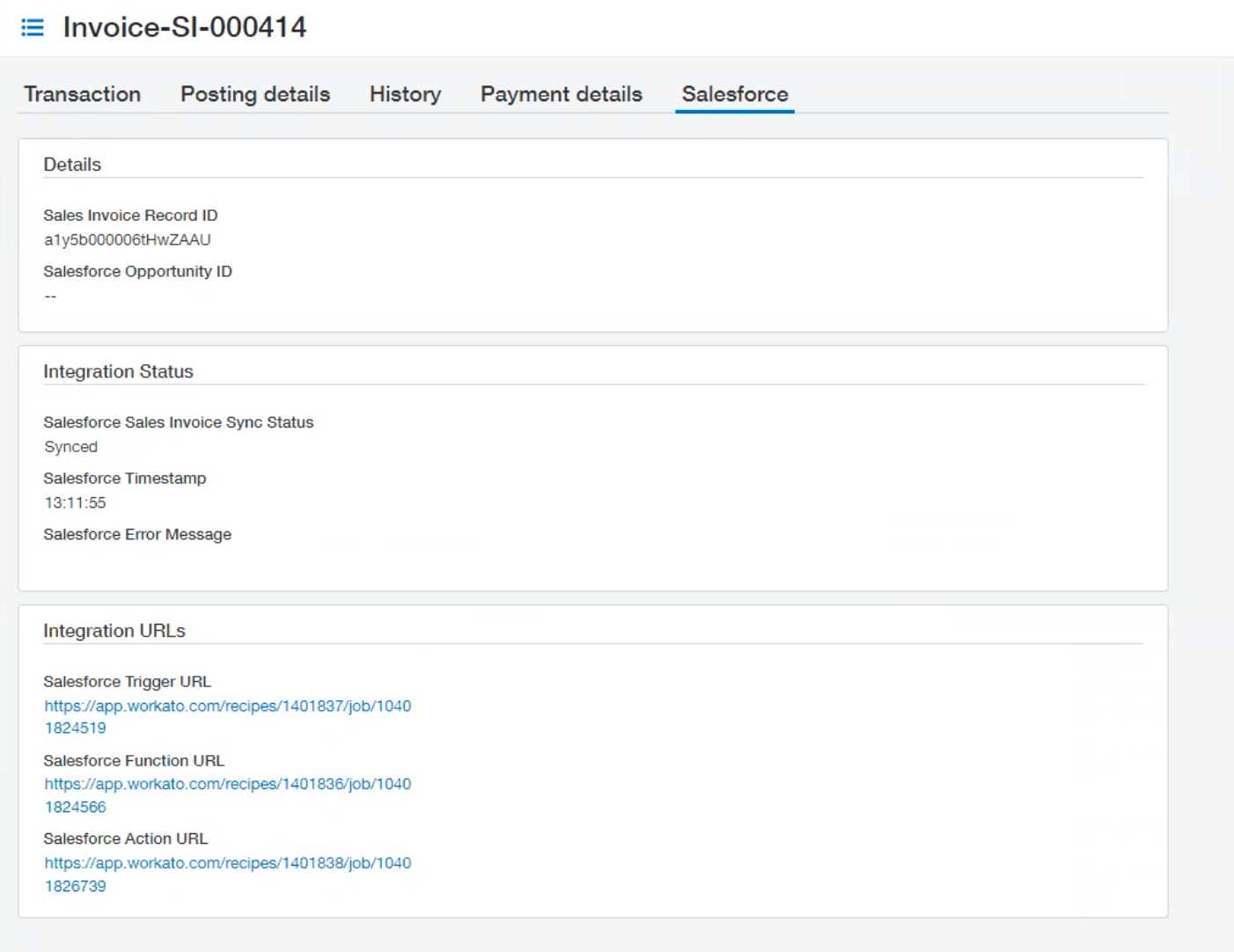

Ensuring Layout Compatibility with Your Financial Software

When setting up your financial documents, ensuring compatibility with the software you use is crucial for seamless integration and efficiency. This ensures that the document functions correctly within the system, with all features working as expected. Without compatibility, errors may arise, leading to issues in generating, tracking, or processing documents. Understanding the system’s requirements and adjusting your layout to meet them is essential for smooth operations.

Key Factors for Compatibility

To ensure that your financial layout works seamlessly with your software, consider the following key factors:

- File Format Support: Ensure the document format is supported by your system, such as PDF, CSV, or other compatible formats.

- Data Fields Mapping: Verify that all relevant fields, such as item descriptions, payment terms, and client information, align with the fields in your software.

- Field Size and Layout: Ensure that the layout of fields on the document fits within the system’s designated areas without truncation or overlap.

- System-Specific Customizations: Take advantage of any software-specific customization options to match the layout to your business’s needs while maintaining compatibility.

Testing and Validation

Before fully implementing the layout, it’s important to conduct testing and validation. Here are some steps to follow:

- Test Runs: Run test documents through the system to verify that they are processed correctly and that all fields display properly.

- Check Formatting: Double-check the formatting after importing the document into the software to ensure that spacing, fonts, and field alignments are correct.

- Feedback from Users: Ask your team to review the document in the system to identify any potential issues that might have been overlooked during the setup process.

By ensuring that your document layout is fully compatible with your financial software, you can avoid disruptions and maintain an efficient, error-free workflow.

Common Mistakes to Avoid in Document Layouts

When creating business documents, it is essential to avoid common pitfalls that can affect both their professionalism and functionality. A poorly designed document can lead to confusion, delayed payments, and a negative impression on clients. Understanding common errors and knowing how to avoid them is crucial for maintaining smooth business operations and improving your overall workflow.

Key Mistakes to Watch Out For

Here are some of the most common mistakes to avoid when designing your business documents:

- Unclear Information: Failing to include all the necessary details, such as client names, amounts, or payment terms, can cause confusion and delays in processing.

- Inconsistent Formatting: Using different fonts, font sizes, or spacing can make the document look unprofessional and harder to read. Consistency is key to a clean and organized appearance.

- Lack of Proper Alignment: Misaligned fields or text can lead to an unorganized layout, making it difficult for clients to find the information they need quickly.

- Ignoring Mobile and Digital Compatibility: Many clients may view your document on various devices. Ensuring that the layout is mobile-friendly and easy to read on any screen is vital.

How to Correct These Mistakes

To avoid these common mistakes, consider the following recommendations:

- Review Your Document: Always double-check that all required fields are present and correct before finalizing the layout.

- Test on Multiple Devices: Preview the document on different screens and ensure it appears professional and readable on mobile, tablet, and desktop devices.

- Use Template Guidelines: If you are working with a pre-designed layout or software, stick to the provided guidelines for consistency and ease of use.

- Seek Feedback: Before fully implementing a new document style, ask a colleague or team member to review it for clarity and visual appeal.

By paying attention to these details and avoiding common mistakes, you can ensure that your documents look professional and are easy to process, benefiting both your business and your clients.

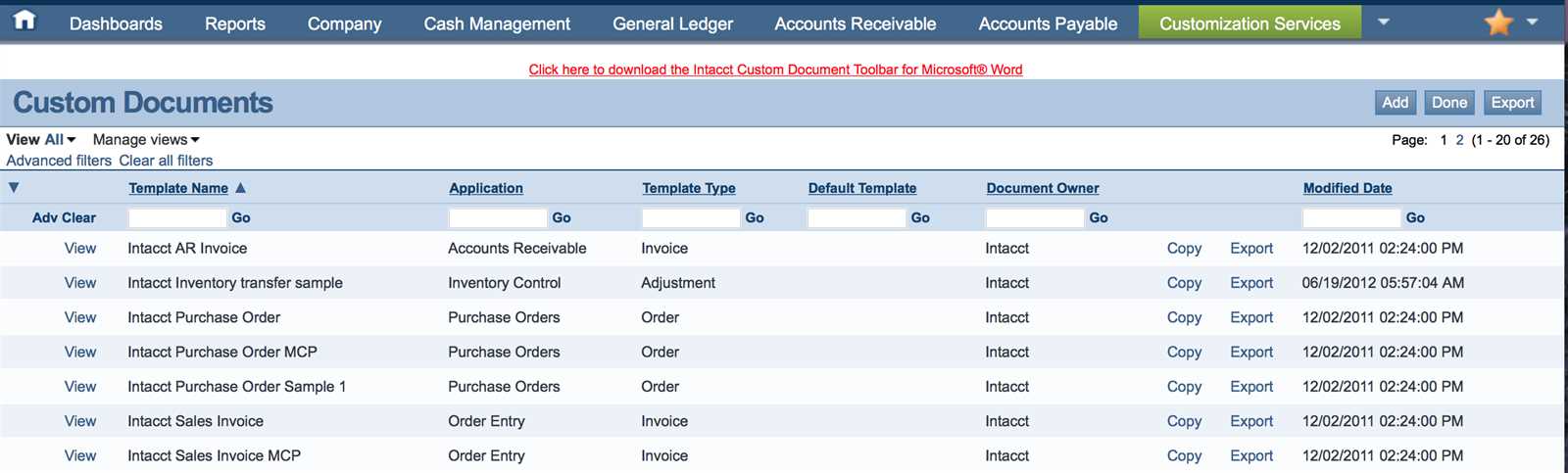

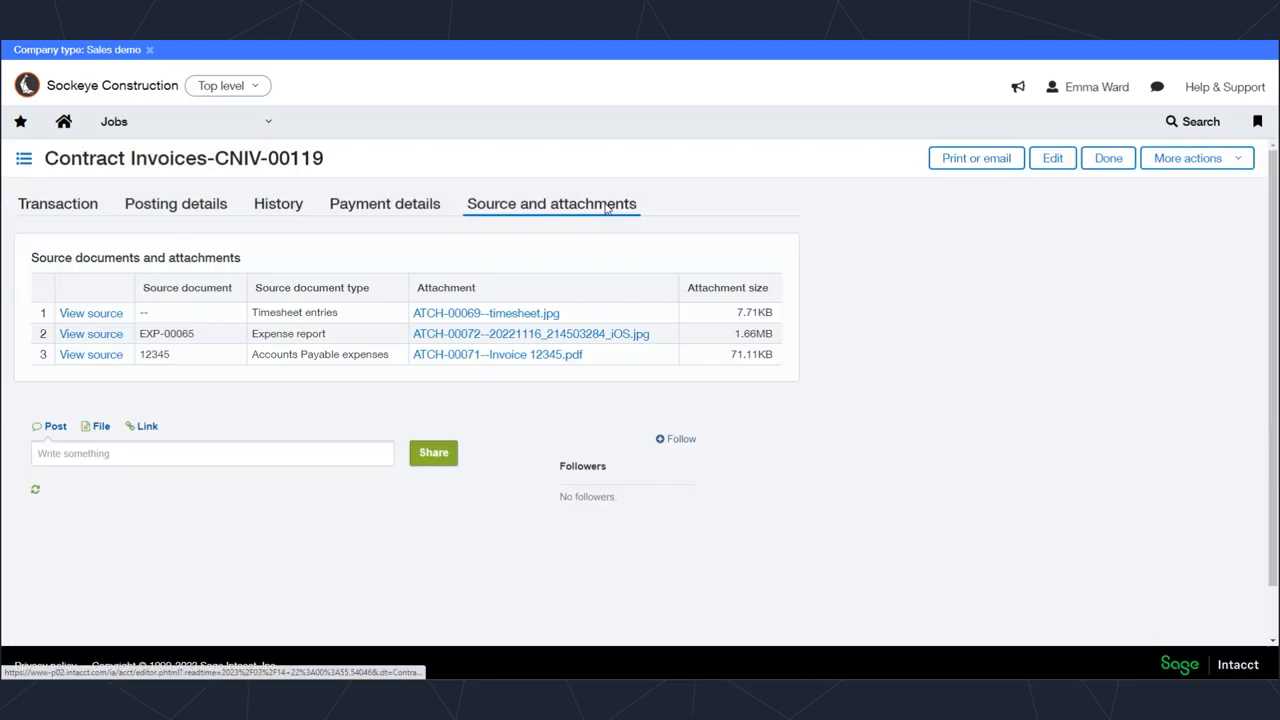

Exporting and Sharing Document Layouts

Once a business document has been created, it’s essential to be able to export and share it effectively with clients, team members, or other stakeholders. Whether you are sending a finalized version or sharing a draft for feedback, having the right format and options for distribution is crucial for smooth collaboration and record-keeping. Understanding how to properly export and share these files can help you maintain professionalism and improve workflow efficiency.

Popular File Formats for Export

When exporting a document layout, it’s important to choose the right file format for your specific needs. Here are some of the most commonly used formats for sharing business documents:

| File Format | Best Used For |

|---|---|

| Universal compatibility, professional presentation, and easy sharing across devices. | |

| Excel | Documents that require further data manipulation or analysis. |

| Word | Documents that may require editing or comments before finalizing. |

| CSV | Simple data export for spreadsheets or databases. |

Best Practices for Sharing Documents

Sharing business documents requires careful consideration to ensure they are sent securely and effectively. Here are some best practices to keep in mind:

- Use Secure Methods: Always choose secure channels for sharing sensitive documents, such as encrypted email services or cloud storage platforms with password protection.

- Consider Access Permissions: Ensure that only the intended recipients can access the document by using password protection or sharing via links with restricted access.

- Provide Clear Instructions: When sharing documents for feedback, always specify what actions you expect from the recipient, such as reviewing, editing, or approving the document.

- Maintain Version Control: Keep track of different versions of the document to avoid confusion and ensure the most recent version is being used by all parties.

By following these guidelines and choosing the right export format, you can ensure that your documents are shared securely and professionally, allowing for seamless collaboration and maintaining an efficient workflow.

Using Document Layouts for Recurring Billing

Managing regular payments can be a time-consuming process, especially when invoices need to be generated periodically for the same clients. However, automating this task can save both time and effort. By using pre-set document formats designed for recurring transactions, businesses can streamline their billing cycles, ensuring consistency and reducing human error. This approach allows for the efficient handling of regular charges without needing to create new documents each time.

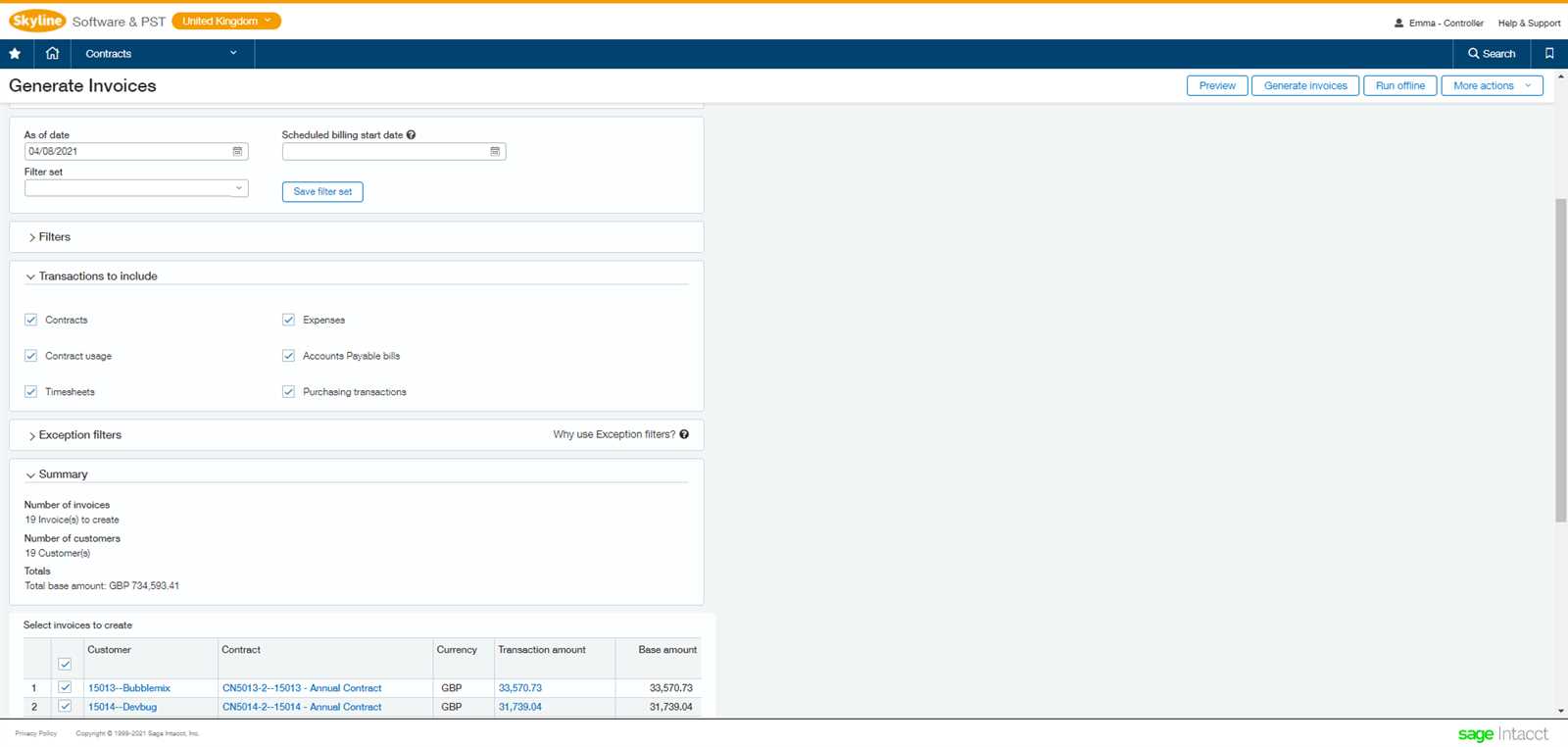

Setting Up Recurring Billing Schedules

To effectively manage repeated payments, it’s crucial to establish a clear schedule for when and how each document will be generated. Most systems allow for custom scheduling, so you can choose to create documents on a daily, weekly, monthly, or yearly basis. Once the schedule is set, the document format will automatically adjust based on the time frame, reducing the manual input required from users.

Key Features of Recurring Billing Layouts

When setting up a recurring billing system, there are several essential features to consider to ensure smooth operation:

- Automated Reminders: Set up automated reminders for both the sender and the recipient to ensure timely payments and document delivery.

- Customizable Payment Terms: Adapt payment terms to accommodate different billing cycles or unique client needs, such as offering discounts for early payments or adjusting due dates.

- Recurring Charge Setup: Easily add recurring charges, such as subscriptions or memberships, to ensure consistency across all documents.

- Audit Trail: Maintain a record of past transactions, helping both the business and clients track payments and resolve any issues that may arise.

By leveraging automated billing formats for regular transactions, businesses can save valuable time, improve accuracy, and create a seamless experience for both their teams and customers.

Updating and Maintaining Your Document Layouts

Over time, your business needs and preferences may evolve, requiring adjustments to the design and functionality of the documents you send to clients. Regular updates ensure that these records remain accurate, professional, and aligned with current branding or legal requirements. Whether it’s updating contact information, modifying payment terms, or adjusting for tax regulations, keeping your layouts current is essential for smooth operations.

When to Update Your Layouts

It’s important to review your document formats periodically to ensure they remain relevant and effective. Here are some key moments when an update may be necessary:

- Changes in Business Information: When your company’s address, contact details, or branding undergoes changes, it’s crucial to reflect these updates on all relevant documents.

- Regulatory Changes: If local tax laws, industry standards, or payment terms change, adjust your formats to stay compliant.

- Customer Feedback: Clients may provide valuable feedback regarding the clarity or layout of the documents, prompting adjustments for improved user experience.

Maintaining Consistency Across Documents

As your layouts evolve, it’s important to maintain a consistent style and structure across all records. This ensures your documents are easy to read and follow, presenting a unified professional image. Standardizing elements such as fonts, logos, and section layouts can help reinforce your brand identity and make documents more user-friendly. Regular audits can also identify any discrepancies between different layouts, allowing you to ensure all versions remain consistent.

By updating and maintaining your formats regularly, you not only ensure that they stay functional and legally compliant but also improve the overall quality of your business communications.