Music Production Invoice Template for Easy Billing

In any creative industry, managing financial transactions can be a complex task. Ensuring clarity, professionalism, and accuracy in billing is essential for maintaining positive client relationships and efficient business operations. Streamlining the process with the right documents is key to avoiding confusion and delays in payments.

One of the most important aspects of handling payments is having a well-organized structure that clearly outlines the services provided and the amounts due. A properly designed document can save time, reduce errors, and ensure that both parties are on the same page when it comes to terms and expectations.

Whether you’re a freelancer or part of a larger team, adopting a standardized approach for requesting payments helps maintain consistency and credibility. In this section, we will explore how to create, customize, and use a suitable document for your financial needs, ensuring that every transaction is handled professionally.

Music Production Invoice Template Overview

When managing payments for creative projects, having a structured document to outline services rendered is crucial. This document helps to clearly present the work completed, the fees associated, and the payment terms agreed upon. A well-organized record not only simplifies transactions but also ensures that both parties are aligned in terms of expectations and obligations.

For those working in creative fields, such as sound design or composition, having a standardized format for financial requests is essential. This format typically includes sections for detailing the scope of work, any additional charges, and due dates. By using a consistent approach, you can reduce misunderstandings and improve the overall efficiency of the payment process.

The goal of such a document is to ensure that the entire billing process runs smoothly and professionally. A comprehensive and easy-to-read structure will facilitate faster payments and help maintain strong client relationships.

Why Use an Invoice Template

Having a structured document to request payments brings clarity and professionalism to any business transaction. It ensures that both parties understand what is being billed, how much is owed, and when payments are due. This approach reduces confusion, minimizes errors, and helps streamline financial processes.

Benefits of Using a Standardized Document

- Time-saving: With a ready-made format, you don’t have to start from scratch each time you need to bill a client.

- Consistency: Using the same structure for every transaction ensures that important details are not overlooked.

- Professionalism: A clean, organized format makes your business appear more polished and trustworthy to clients.

- Accuracy: With pre-defined fields for all necessary information, errors in billing are less likely.

When to Use a Standardized Format

- When you want to clearly define the scope of services provided.

- If you need to keep track of multiple transactions for different clients.

- When you want to avoid back-and-forth regarding unclear payment terms.

- For ensuring timely payments and proper documentation of financial exchanges.

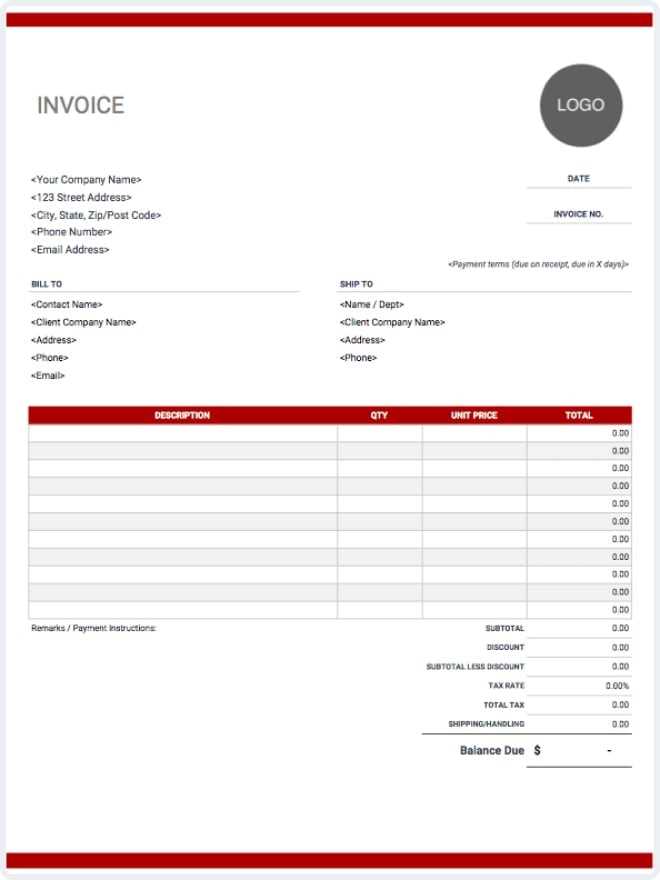

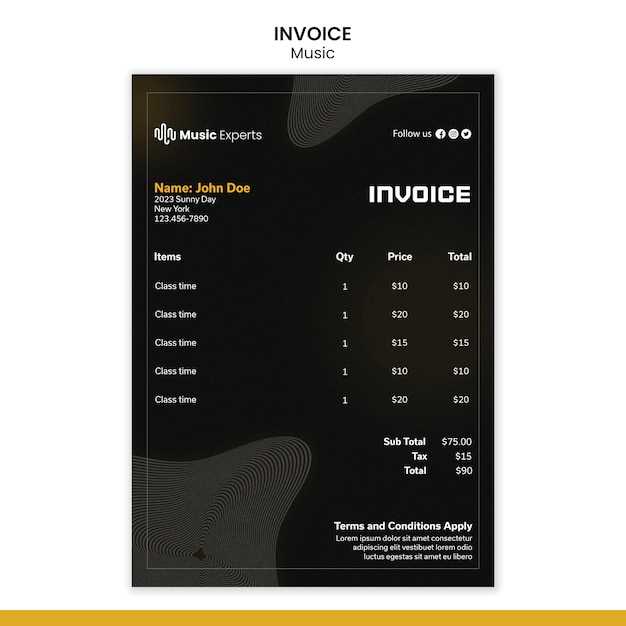

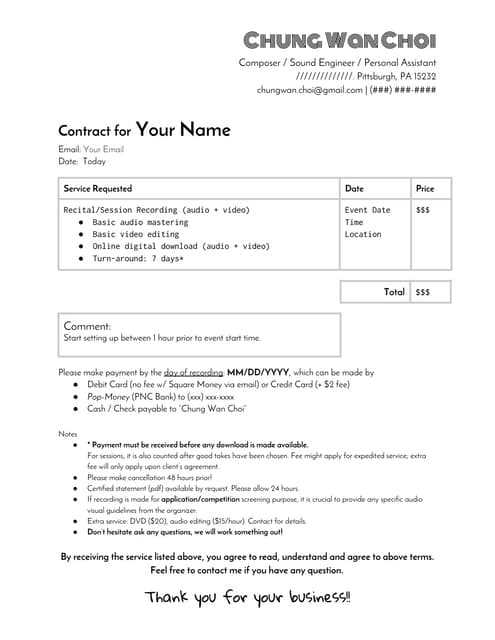

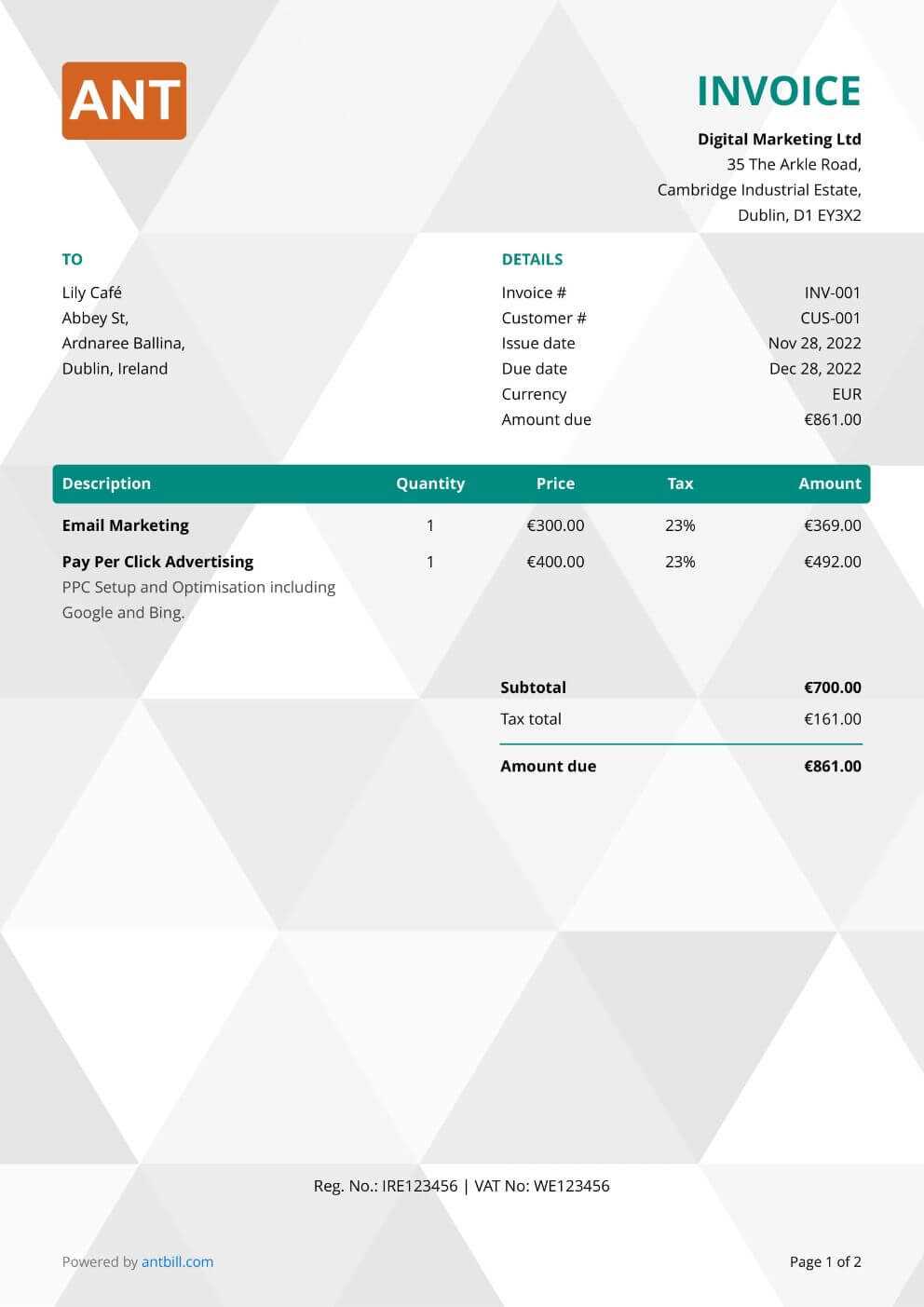

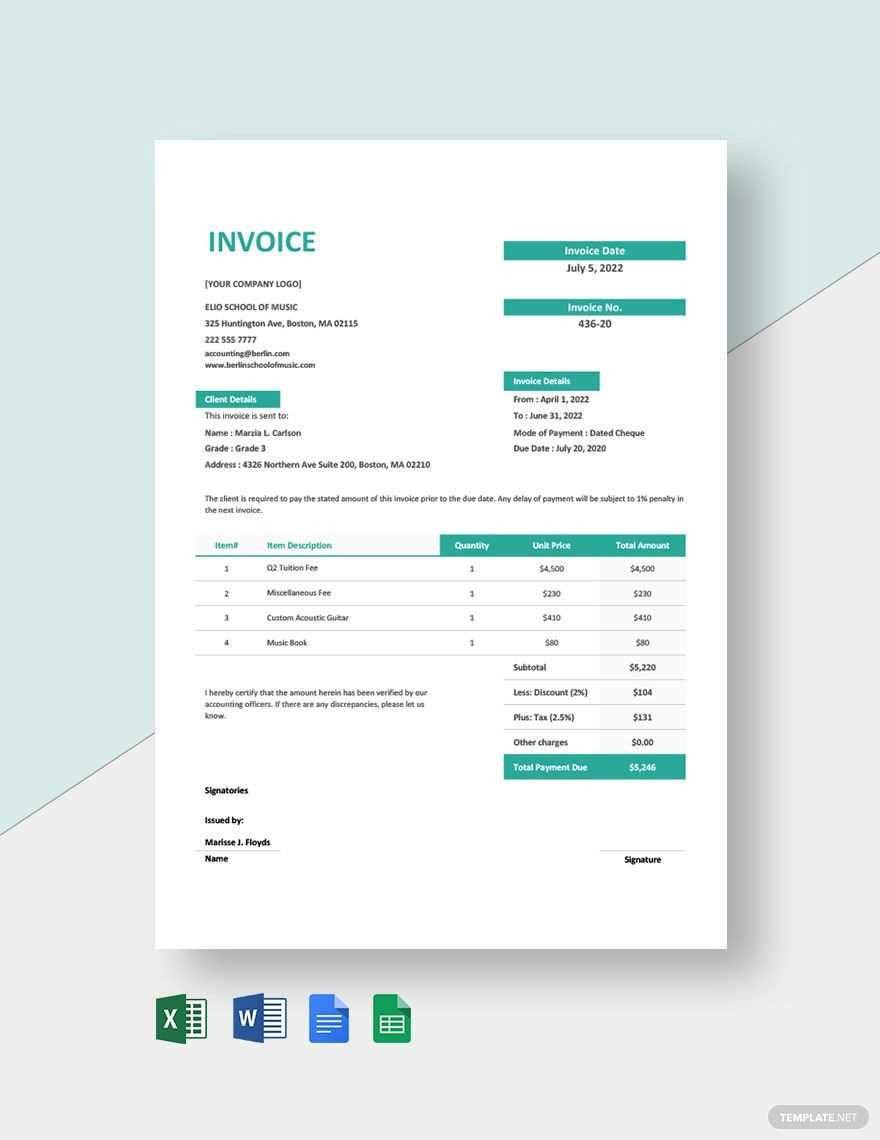

Essential Components of an Invoice

To ensure smooth transactions, it’s important to include specific details in any billing document. These key elements provide clarity for both the client and the service provider, helping avoid misunderstandings and delays. A well-structured document should cover all the necessary information while being clear and easy to read.

Each section of the document serves a particular purpose, from identifying the parties involved to outlining the services rendered and payment terms. By incorporating these essential components, you can ensure that your billing process is efficient and professional.

- Header Information: This section should include the name, address, and contact information for both the service provider and the client.

- Description of Services: A clear list or breakdown of the services offered, including any relevant details like dates, rates, and hours worked.

- Payment Terms: Specify the amount due, payment methods, and any applicable deadlines for when the payment should be made.

- Unique Reference Number: A tracking number for each document helps maintain organization and makes it easier to reference specific transactions.

- Additional Charges: If there are any extra fees or taxes, they should be listed separately for transparency.

Customizing Your Billing Document

Personalizing a financial document allows you to better reflect your brand and meet the specific needs of your business. By adjusting the format and layout, you can make the document more suited to your particular style and professional requirements. Customization not only adds a personal touch but also ensures that the content is relevant and clear for each client.

Adjusting the Layout and Design

One of the easiest ways to make your document stand out is by modifying its visual layout. This can include adding your logo, choosing a color scheme that fits your brand, and adjusting fonts for readability. A clean and consistent design enhances professionalism and makes it easier for your clients to follow the details.

Including Personalized Information

Adding custom fields like specific project details, hourly rates, or personalized notes can make the document more relevant to each transaction. This ensures that the client understands exactly what they are being charged for and provides them with all the necessary details for smooth payment processing.

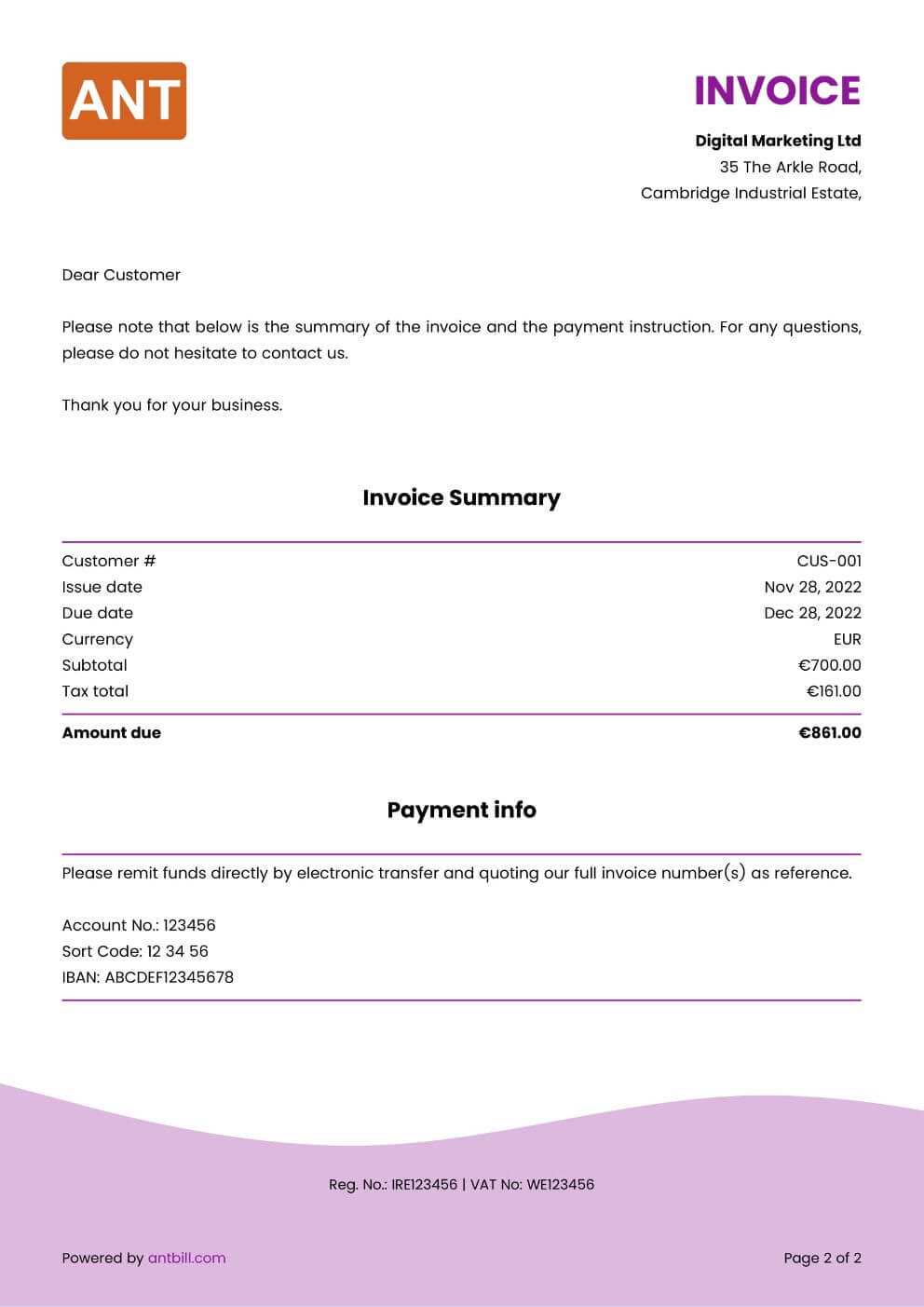

Understanding Payment Terms in Invoices

Clearly defined payment conditions are a vital part of any financial agreement. These terms establish expectations regarding when and how the payment should be made, ensuring that both the service provider and the client are on the same page. A lack of clarity around payment terms can lead to delays and misunderstandings.

Key Elements of Payment Terms

To avoid confusion, it’s important to include specific details in the payment section of the document. This may include the following:

- Due Date: Clearly state when the payment is expected, whether it’s due immediately or within a set period.

- Late Fees: Specify any additional charges that will apply if payment is not received by the due date.

- Accepted Payment Methods: Indicate the types of payments you accept, such as bank transfer, credit card, or online payment services.

Flexible Payment Terms for Clients

In some cases, offering flexible terms may be beneficial, especially for long-term clients. For example, you can offer installment options or extend the due date if necessary. This can help maintain good relationships while ensuring that both parties are still clear on the payment structure.

How to Track Project Payments

Efficiently tracking payments for completed work is crucial for maintaining financial stability and ensuring timely compensation. A well-organized system for monitoring payments helps you stay on top of what’s owed and when, making it easier to manage cash flow and avoid overdue balances. By keeping detailed records, you can quickly identify any discrepancies and follow up on outstanding amounts.

Using Digital Tools for Payment Tracking

Many tools are available to simplify the process of tracking payments. From spreadsheets to specialized accounting software, these tools allow you to enter key details such as payment dates, amounts, and client information. Digital tools can also generate reminders for upcoming due dates or late fees, ensuring you never miss a payment.

Manual Tracking Methods

If you prefer a more hands-on approach, manually tracking payments in a ledger or spreadsheet can also be effective. For each completed transaction, be sure to record the client’s name, the amount due, the date paid, and any outstanding balances. This method can be time-consuming but allows for complete control over the tracking process.

Benefits of Digital Invoices for Creators

Switching to digital billing documents offers numerous advantages, particularly in terms of convenience, speed, and efficiency. By moving away from paper-based systems, you can streamline your financial processes and improve the overall experience for both you and your clients. Digital formats allow for easier tracking, quick adjustments, and faster payments, which are crucial in the fast-paced world of creative work.

Efficiency and Time-Saving

One of the primary benefits of using digital documents is the time saved. With just a few clicks, you can create, send, and track payments without needing to print or manually mail any paperwork. Digital records are automatically saved and organized, which simplifies follow-ups and reduces the risk of misplaced documents.

Improved Accuracy and Record-Keeping

Digital tools often come with built-in error-checking features that help ensure accuracy in your billing. Automated calculations reduce the risk of human error, and the ability to quickly modify or update information means that any necessary changes can be made instantly. Additionally, digital records are easily searchable, making it simple to review past transactions and maintain a thorough financial history.

Choosing the Right Billing Software

Selecting the right software to manage your financial transactions can significantly improve the efficiency of your business operations. With various options available, it’s important to consider your specific needs, such as ease of use, features, and integration with other tools. The right solution can help streamline your billing process, reduce errors, and save valuable time.

Key Features to Consider

- User-Friendly Interface: Choose software with a simple, intuitive design to make it easy for you to create, send, and manage documents.

- Customization Options: Look for software that allows you to customize the layout and content of your documents, so they align with your brand.

- Automation: Automation features, such as recurring billing and automatic reminders, can save you time and ensure that payments are made on time.

- Payment Integration: Consider software that supports direct payment processing, so clients can pay quickly and conveniently.

How to Choose the Best Software

To choose the best software for your needs, start by evaluating your business size, transaction volume, and specific requirements. You may want to start with a free trial or demo to get a sense of how well it fits into your workflow. Additionally, look for reviews and testimonials from other users in your industry to get an idea of the software’s reliability and customer support.

Including Client Details in Your Billing Document

Properly documenting client information is essential for clear communication and accurate record-keeping. Including all necessary contact and business details in your financial documents ensures that both parties are easily identifiable and that the transaction can be tracked without confusion. This also helps maintain a professional appearance and ensures that there are no issues with payment processing.

Here are the key client details to include in your financial document:

| Client Name | Client Address | Contact Information | Client ID or Account Number |

|---|---|---|---|

| John Doe | 1234 Example St, Cityville | [email protected] | 123456789 |

| Jane Smith | 5678 Sample Rd, Townsville | [email protected] | 987654321 |

Including this information helps to ensure smooth communication between you and the client and prevents delays caused by missing or incorrect details. It also serves as a reference in case of any disputes or clarifications needed during the payment process.

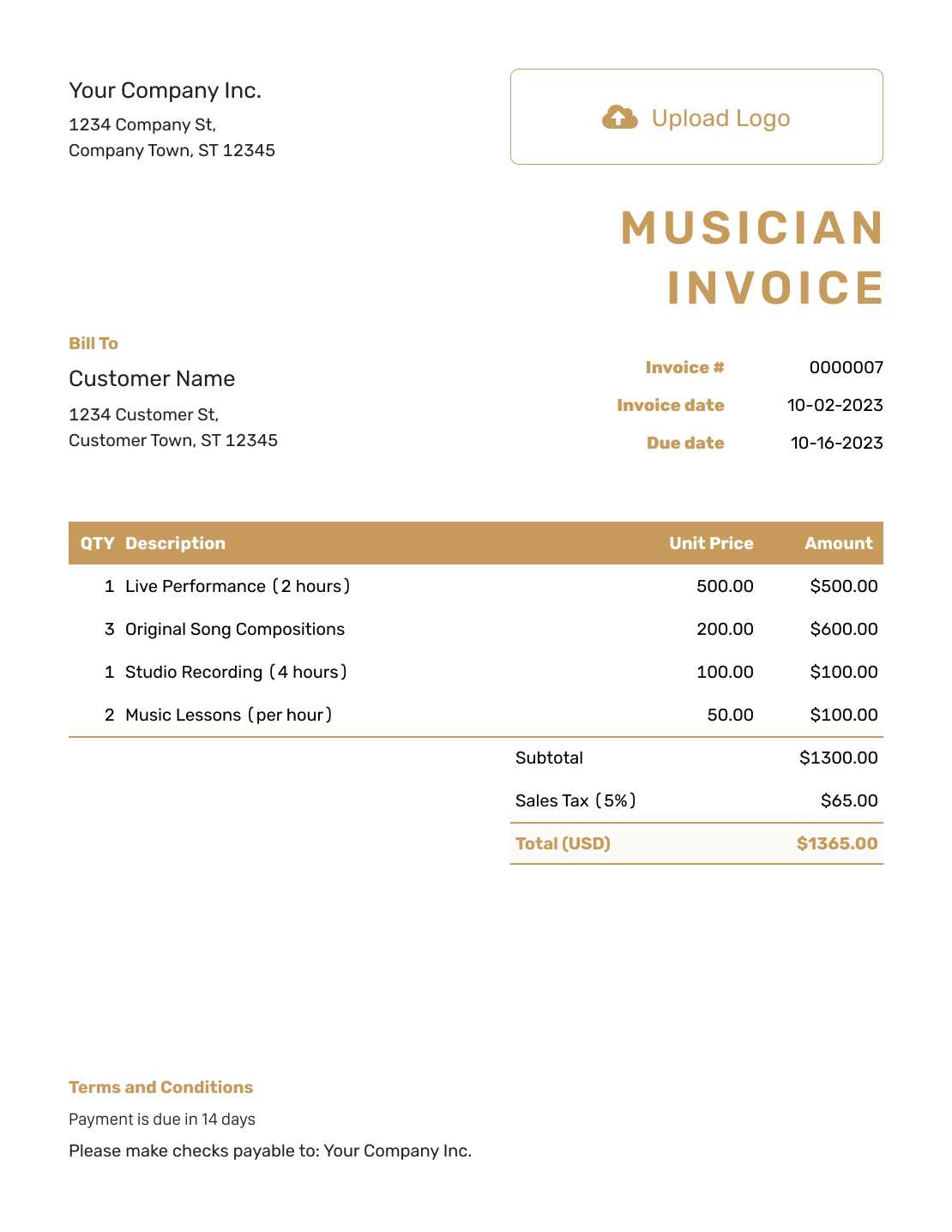

How to Calculate Service Fees

Accurately calculating service charges is essential for maintaining transparent and fair business practices. Whether you’re charging by the hour, project, or another method, it’s important to ensure that the pricing reflects the value of the work provided while also covering your costs. Here are some key steps to help you determine the appropriate service fees.

Factors to Consider When Setting Service Fees

- Hourly Rates: If you’re charging based on time, calculate how much you want to earn per hour and multiply that by the number of hours worked.

- Flat Rate: For specific projects, you can set a fixed price based on the complexity and scope of the work. This method works well for predictable tasks.

- Additional Costs: Don’t forget to factor in extra costs such as software, materials, or any outsourced services. These should be added to the total charge to ensure you’re covering all expenses.

- Market Rates: Research what others in your industry are charging. This ensures your fees are competitive but also reflective of your skills and experience.

Methods for Calculating Fees

- Determine your baseline hourly or project rate.

- Estimate the time or effort required to complete the work.

- Add any additional expenses, such as materials or software costs.

- Consider including a contingency for unforeseen challenges or delays.

- Finally, apply your desired profit margin to arrive at the final fee.

By following these steps, you can ensure that your service fees are both fair and sustainable, while also protecting your business interests.

Common Mistakes to Avoid in Billing

Errors in billing can lead to misunderstandings, delayed payments, and loss of trust with clients. To ensure smooth transactions and maintain a professional image, it’s essential to be mindful of common mistakes that can easily be avoided. A small oversight can cause significant problems in your cash flow and client relationships, so it’s crucial to get it right the first time.

Frequent Billing Errors to Watch Out For

- Incorrect Client Details: Always double-check the client’s name, address, and contact information to avoid confusion and ensure that the document reaches the right person.

- Missing or Incorrect Payment Terms: Clearly specify payment deadlines, late fees, and acceptable payment methods to avoid misunderstandings or delays.

- Failure to Include Itemized Charges: Provide a detailed breakdown of the services or products rendered. This helps clients understand exactly what they are paying for and prevents disputes over charges.

- Not Following Up on Outstanding Payments: Be proactive in following up on overdue payments. Having a system for reminders and escalation can help maintain a healthy cash flow.

- Inconsistent Formatting: Use a consistent format for all documents. This helps maintain a professional appearance and makes it easier for clients to understand your billing structure.

How to Avoid These Mistakes

- Review client information carefully before sending any billing document.

- Always set clear and transparent payment terms that both parties agree on in advance.

- Provide detailed, itemized lists to explain the charges in full.

- Use automated systems to track due dates and send reminders for overdue payments.

- Develop a standardized template to ensure consistent formatting and professional presentation.

By paying attention to these details, you can avoid common pitfalls and ensure a smoother billing process that fosters positive client relationships.

How to Send Billing Documents Efficiently

Efficiently sending financial documents not only saves time but also helps ensure that your clients receive the necessary information promptly, leading to faster payments. The process should be streamlined, professional, and easy to follow. By adopting a few best practices, you can improve your workflow, reduce the risk of errors, and enhance client satisfaction.

Steps for Streamlining Your Billing Process

- Use Digital Tools: Opt for electronic methods such as email or online platforms to send documents. This speeds up delivery and minimizes the chances of documents being lost or delayed in the mail.

- Set Clear Instructions: Ensure that the client understands the payment terms and any steps they need to follow to complete the transaction. Providing clear instructions can help prevent confusion and reduce delays.

- Personalize Each Communication: Tailor the document and the accompanying message to each client. This can help build stronger relationships and show attention to detail.

- Send Reminders: Keep track of due dates and send reminders for overdue payments. A gentle reminder can prompt clients to settle their bills faster without the need for escalation.

- Ensure Proper Documentation: Before sending, double-check that all required fields are filled out correctly. This includes the services provided, the amount due, and the client’s contact details. Incomplete documents can lead to confusion and delayed payments.

Tools to Enhance Efficiency

- Automated Billing Systems: Use invoicing software that automatically generates and sends financial documents to clients, reducing manual effort and minimizing human error.

- Email Templates: Create pre-written email templates for various billing scenarios, such as sending the document, following up on payment, or sending reminders.

- Cloud Storage: Store all your financial documents in cloud storage for easy access and quick sharing with clients when necessary.

By implementing these strategies, you can send billing documents in a more timely and organized manner, improving your workflow and accelerating the payment process.

Legal Considerations for Billing Documents

When creating financial documents for services rendered, it’s important to be aware of the legal aspects that govern these transactions. Clear and precise documentation not only ensures that both parties understand their obligations but also helps protect you in case of disputes. Legal considerations include contractual obligations, tax regulations, and consumer rights, all of which play a vital role in maintaining a transparent and lawful business operation.

Key Legal Elements to Include

| Legal Aspect | Description |

|---|---|

| Contractual Terms | Ensure that your terms of agreement are clearly outlined, including payment deadlines, service scope, and any penalties for late payments. Both parties should agree to these terms before services begin. |

| Tax Compliance | Make sure to include any applicable taxes, such as VAT, based on your jurisdiction. Be aware of local tax rates and ensure that all taxes are correctly calculated and documented. |

| Payment Methods | Clearly specify accepted payment methods and the due dates for payment. This avoids confusion and sets expectations for both parties. |

| Rights and Ownership | In cases where intellectual property is involved, outline who holds the rights to the work produced, including any licensing terms or usage restrictions. |

Ensuring Legal Protection

- Keep Copies: Always maintain records of the agreed terms and communications between parties to ensure you have evidence in case of a dispute.

- Use Clear Language: Avoid ambiguous terms or jargon in your agreements and documents. Clear, unambiguous language reduces the risk of misunderstandings.

- Consult a Legal Expert: If you are unsure about any legal requirements, it’s wise to consult a legal expert to ensure that your documents comply with local laws.

By following these legal guidelines, you can protect your business interests, avoid potential conflicts, and ensure that your financial transactions are both fair and legally compliant.

Creating Professional Billing Documents

Crafting well-structured billing documents is essential for any professional. These documents not only serve as a request for payment but also reflect the professionalism and reliability of your business. A well-designed document should be clear, easy to understand, and include all the necessary details to avoid confusion. By focusing on a few key elements, you can create documents that will leave a lasting positive impression on clients.

Key Elements of a Professional Document

- Branding: Include your business logo, colors, and contact details to make the document easily recognizable and aligned with your brand identity.

- Clarity: Ensure that all information is easy to read and logically arranged. This includes breaking down charges, highlighting due dates, and using consistent fonts and formatting.

- Complete Information: Include all necessary details such as client information, itemized services, payment terms, and total amount due. An incomplete document can lead to confusion and delays.

- Legal Compliance: Make sure the document includes any required legal information, such as tax numbers or disclaimers, depending on your location and industry regulations.

Tools to Enhance Document Design

- Customizable Software: Use billing software that offers customizable templates, allowing you to personalize your documents with ease and ensure consistency across all your invoices.

- Online Builders: Many online platforms provide tools for creating and sending documents quickly, with a range of professional design options and pre-built layouts.

- PDF Format: Save your document as a PDF to ensure it maintains its formatting when sent electronically. PDFs are universally accessible and help maintain the professional appearance of your document.

By incorporating these key elements and using the right tools, you can create billing documents that are not only functional but also project professionalism, helping to build trust and improve client relationships.

Managing Taxes on Billing Documents

Handling taxes properly on billing documents is crucial for ensuring compliance and avoiding any legal complications. Whether you are self-employed or running a small business, correctly calculating and applying taxes will not only keep you in line with tax laws but also build trust with your clients. Understanding how to manage taxes can help prevent errors, simplify the process, and ensure that the amounts you request are accurate.

Types of Taxes to Consider

Depending on your location and the nature of the service, there are different types of taxes you may need to account for:

- Sales Tax: This tax is usually applied to goods and services. Rates vary by region, so it’s important to stay informed about the current rates in your area.

- Value Added Tax (VAT): Some regions use VAT, which is a tax on the value added at each stage of production or distribution.

- Service Tax: In some cases, certain services are taxed at a specific rate. It’s important to determine whether the services you offer are subject to this tax.

- Withholding Tax: Depending on the location of your client, they may be required to withhold a percentage of the payment as tax, which is then submitted to the government.

How to Apply Taxes on Your Billing Documents

To properly include taxes on your billing documents, follow these steps:

| Step | Description |

|---|---|

| 1. Calculate Taxable Amount | First, identify the taxable amount based on the services you provided or goods sold. If you’re offering a service, make sure to calculate the cost before tax. |

| 2. Apply the Correct Tax Rate | Research the applicable tax rate for your service or product. This could vary depending on your region and the nature of the service. Ensure you use the correct rate to avoid overcharging or undercharging. |

| 3. Add Tax to the Total | Once the tax is calculated, add it to the total amount due on your document. Make sure the tax is clearly stated and broken down from the original cost. |

| 4. Provide Tax Details | Be transparent by including the tax rate and total tax amount on the document. This not only ensures clarity but also keeps you compliant with legal requirements. |

By following these steps and staying informed about tax regulations, you will be able to manage taxes effectively on your billing documents, providing a professional service and maintaining legal compliance.

Best Practices for Billing Organization

Effective organization of billing documents is key to ensuring smooth financial operations. Properly managing your records helps you maintain accuracy, avoid delays in payments, and stay on top of your financial health. The following best practices will help you keep your documentation streamlined and efficient, allowing you to focus on the work that matters most.

1. Maintain a Consistent Naming Convention

Using a clear and consistent naming system for your billing records will make it easier to track and retrieve them when needed. Here are some helpful tips:

- Include Date: Start with the date of the transaction (e.g., “2024-11-07”) to keep records chronological.

- Client Information: Use the client’s name or a specific project identifier to differentiate between various records.

- Simple Format: Keep the file names simple and descriptive. For example, “ClientName_ServiceType_InvoiceNumber”.

2. Use Folders for Organization

Storing your billing records in organized folders ensures easy access and prevents important documents from getting lost. Here’s a useful structure:

- Client Folders: Create a separate folder for each client or project to store their respective records.

- Yearly Folders: Group documents by year to help you quickly find past billing records during tax season or audits.

- Payment Status: Consider creating folders such as “Paid,” “Pending,” and “Overdue” for easy reference to payment statuses.

3. Keep a Digital Backup

Digital backups are crucial for preserving your records in case of physical damage or loss. Cloud storage solutions offer a secure and convenient way to back up your documents. Consider the following:

- Use Cloud Storage: Services like Google Drive, Dropbox, or dedicated accounting platforms allow for safe, cloud-based storage.

- Automated Backups: Set up automatic backups to ensure that your files are always updated and securely stored.

- Access Anywhere: Cloud backups enable you to access your files remotely, from any device, ensuring flexibility and convenience.

4. Track Due Dates and Payments

Having a system in place for tracking payment due dates and statuses is essential for maintaining cash flow. Consider using a simple tracking method:

- Spreadsheet System: Create a spreadsheet to record due dates, amounts, and payment status. This will allow you to follow up efficiently.

- Reminder Tools: Set up reminders on your phone or calendar to alert you when payments are due or when follow-ups are necessary.

- Integrate with Accounting Software: Use software that automates reminders, payment tracking, and reporting.

By implementing these organizational practices, you can reduce stress, stay on top of your financial obligations, and keep your workflow running smoothly. With consistent management, you’ll have a clear view of your financial standing, making it easier to make informed business decisions.