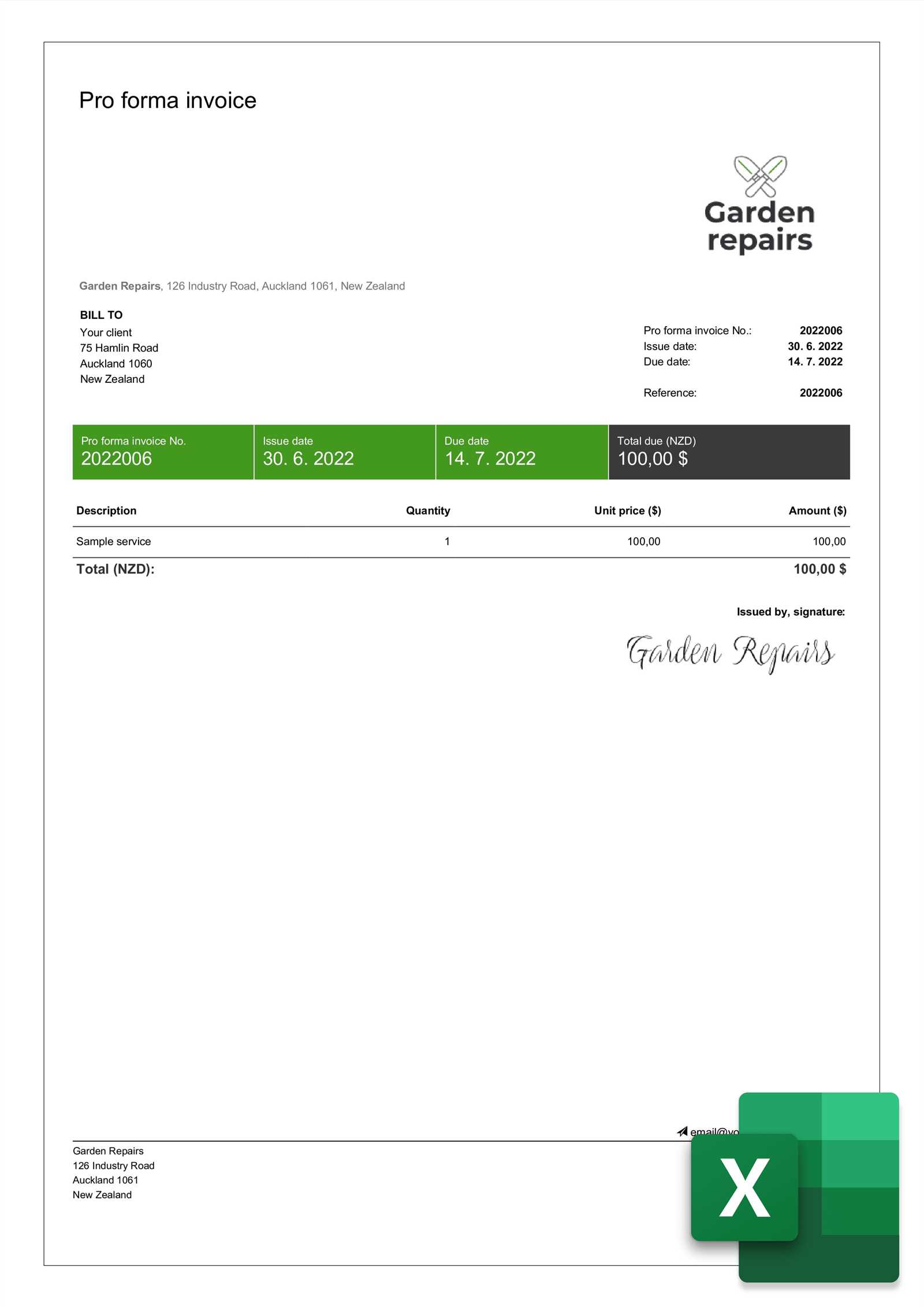

Best Invoice Template Excel for Streamlined Billing

Managing finances efficiently is crucial for any business, large or small. One key aspect of financial management is issuing accurate and clear billing documents. Having the right tool to streamline this process can save time and reduce errors, allowing you to focus on growing your business rather than dealing with administrative tasks.

With the right structure, you can design a document that meets your needs, whether you’re a freelancer, small business owner, or part of a larger organization. A well-crafted billing document is essential not just for tracking payments but also for maintaining a professional image with your clients.

In this guide, we’ll explore effective ways to create a customizable and user-friendly document that can simplify your invoicing process, ensuring you maintain clear and organized financial records. Whether you’re looking for a simple solution or a more advanced design, you’ll find practical tips to help you get started.

Best Invoice Template Excel for Your Business

When it comes to managing billing for your business, having an efficient and adaptable tool is essential. A well-structured document can make the entire process easier, ensuring accuracy and professionalism in every transaction. The right solution should not only reflect your branding but also be flexible enough to accommodate various client needs and payment terms.

For small business owners or freelancers, using a customizable document can simplify the creation and tracking of payment requests. Whether you’re providing a one-time service or ongoing work, a clear and organized structure is vital for maintaining good client relationships. Additionally, this approach reduces the risk of errors, which can cause confusion or delays in payment.

Choosing the right tool for creating billing documents helps you stay organized, save time, and reduce the manual work involved in tracking each project. It allows you to automate repetitive tasks and ensure consistency, all while giving your clients a professional impression. With the right approach, your payment requests will not only be more accurate but also easier to manage in the long run.

Why Choose Excel for Invoices

Using a spreadsheet program to generate billing documents offers flexibility and efficiency for businesses of all sizes. With a few simple adjustments, you can create a system tailored to your needs, making it easier to track payments and organize financial records. Unlike specialized software, this method provides the freedom to design your documents without restrictions or extra costs.

One of the main advantages of choosing this approach is its accessibility. Most businesses already have access to spreadsheet software, eliminating the need for additional purchases or subscriptions. Additionally, the wide range of built-in functions allows for easy customization, whether you need to calculate totals, apply discounts, or add tax rates automatically.

Key Benefits of Using Spreadsheets for Billing

| Benefit | Explanation |

|---|---|

| Cost-Effective | No need for extra software subscriptions or purchases. |

| Customizable | Design your document to suit your unique business needs. |

| Automated Calculations | Reduce errors with formulas that calculate totals, taxes, and discounts automatically. |

| Easy to Update | Modify templates quickly for new clients or different services. |

In addition to these benefits, spreadsheets provide a level of familiarity that can make adoption easier for teams already accustomed to the software. With a straightforward interface and basic training, you can begin using your custom documents to manage your financial processes more effectively.

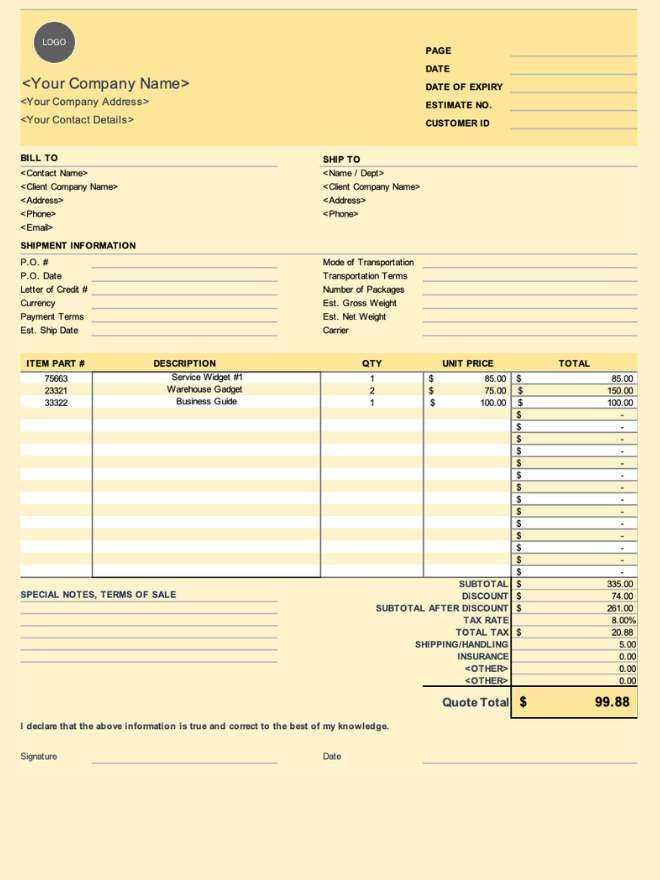

Top Features of an Invoice Template

When creating a billing document for your business, certain features can significantly enhance its usefulness and professionalism. A well-designed structure helps streamline the process, making it easier to track payments, maintain consistency, and ensure accuracy in every transaction. Key elements can transform a simple document into an efficient tool for managing financial interactions with clients.

Among the most important aspects is the ability to customize the layout to suit your brand. A professional look, including your logo and contact details, can make a strong impression on clients. In addition, features like automated calculations, clearly defined sections, and payment terms add both practicality and clarity to your documents.

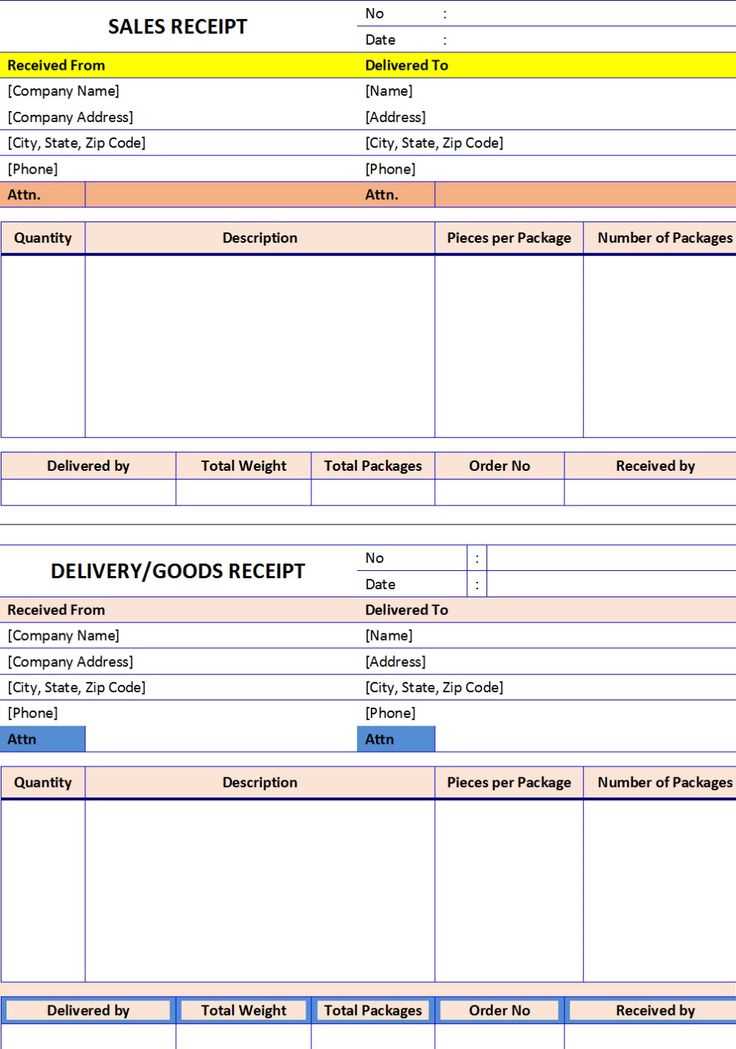

Essential Elements for Effective Billing Documents

| Feature | Explanation |

|---|---|

| Automatic Calculations | Automatically compute totals, taxes, and discounts, reducing errors. |

| Clear Itemization | List services or products with quantities, prices, and subtotals for transparency. |

| Customizable Design | Incorporate branding elements like logos and color schemes for a professional look. |

| Payment Terms and Due Dates | Clearly define payment expectations, due dates, and any applicable late fees. |

| Client Information Section | Provide space for client details such as name, address, and contact information. |

These features not only simplify the creation process but also improve the client experience, making it easier for them to understand their obligations and for you to track payments efficiently. With the right structure in place, managing financial transactions becomes more organized and effective, saving time and reducing the risk of mistakes.

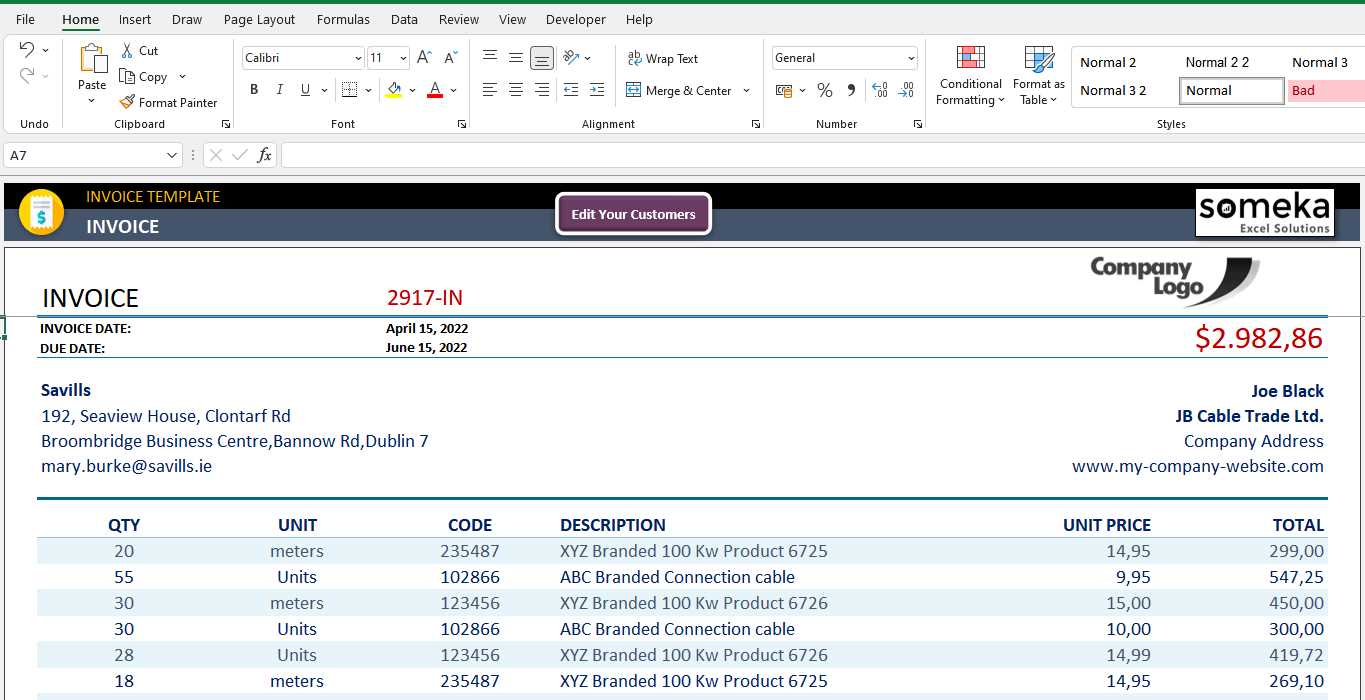

How to Customize Invoice Templates in Excel

Customizing a billing document to meet your specific business needs can greatly improve both efficiency and professionalism. By adjusting the layout, adding your company logo, or modifying the structure of the document, you ensure that it reflects your brand while also streamlining the process for better usability. The flexibility of spreadsheet software allows for easy adjustments, making it an ideal tool for creating tailored financial documents.

Here’s a step-by-step guide to help you personalize your billing document:

Step-by-Step Customization Process

- Open a Pre-designed Layout: Start with an existing document or a blank sheet. Many options come with preset fields that you can modify as needed.

- Insert Your Branding: Add your logo, company name, and contact information at the top of the document for a professional appearance.

- Modify Columns: Adjust columns to include all necessary information such as product descriptions, quantities, unit prices, and payment terms.

- Use Formulas: Implement formulas for automatic calculation of totals, taxes, and discounts to minimize manual work and errors.

- Set Payment Terms: Include clear payment instructions, such as due dates, accepted payment methods, and late fee policies.

- Save as a Template: Once you have customized the layout to your liking, save it as a template for future use. This ensures consistency across all documents.

Additional Customization Tips

- Color Scheme: Use a consistent color palette that matches your brand for headings and section dividers.

- Font Style: Choose a clean, professional font that is easy to read.

- Automatic Date and Number Generation: Set up fields that automatically generate invoice numbers and the current date to simplify the process.

- Additional Notes Section: Add a space for personalized notes to your clients, such as payment instructions or a thank-you message.

By following these steps, you can create a professional and efficient document that suits the unique needs of your business. The ability to customize not only helps you maintain a consistent look but also ensures that the document is tailored to your specific workflows, improving both accuracy and client satisfaction.

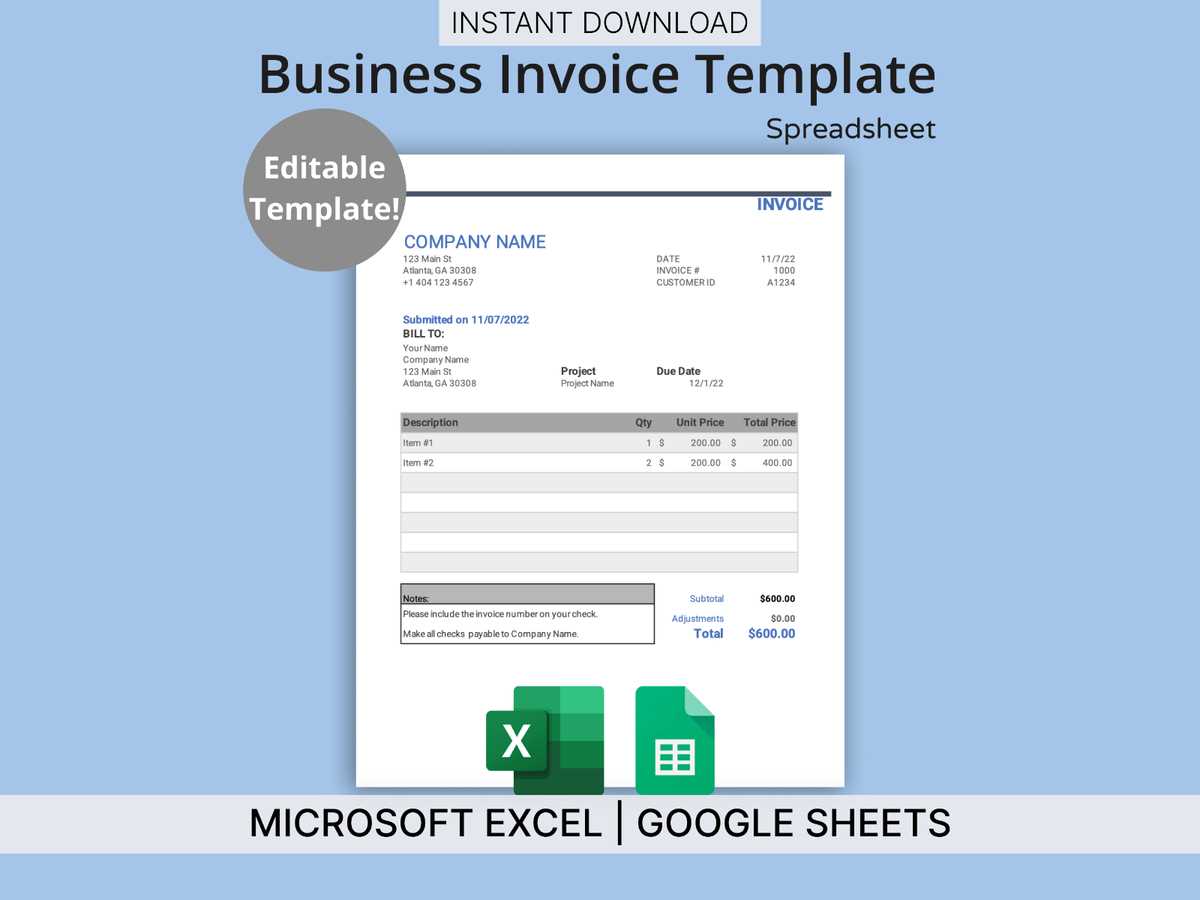

Free Invoice Templates for Excel

For many businesses, finding a reliable and cost-effective way to create billing documents is essential. Luckily, there are numerous free options available that allow you to design professional-looking financial records without spending a dime. These free resources offer a variety of customizable layouts that can suit different business types, from freelancers to larger enterprises.

By using these free resources, you can save both time and money while still ensuring accuracy and consistency in your financial documentation. Whether you’re new to managing client payments or looking for a simple solution, these free options provide a practical way to stay organized and professional without additional software costs.

Where to Find Free Templates

- Online Template Libraries: Many websites offer a collection of free billing documents that can be downloaded and customized in just a few clicks.

- Office Suite Software: Built-in options within office software often include free templates, ready to be filled with your specific details.

- Business Forums and Communities: Users often share customizable layouts designed for various industries, offering a great way to find exactly what you need.

Advantages of Free Billing Documents

- No Cost: No need to pay for expensive software or subscriptions, making it an ideal option for startups or small businesses.

- Easy Customization: These free resources often come with easy-to-use features that allow you to modify text, fonts, and calculations to suit your needs.

- Quick Setup: With ready-to-use formats, you can quickly create professional documents without spending a lot of time on design or learning new software.

By taking advantage of these free resources, you can effectively manage your financial documentation without the need for complex tools or expensive programs. With just a little customization, you’ll have a professional-looking document that suits your business and meets your client’s needs.

How Excel Templates Save Time and Money

Using pre-designed documents for financial records can dramatically improve the efficiency of managing client transactions. Instead of manually creating new forms from scratch for each billing cycle, a structured document allows you to input key details quickly, minimizing repetitive tasks. This not only saves time but also reduces the chance of errors, which can be costly for businesses.

By automating calculations and standardizing formatting, you ensure a consistent and professional approach with every payment request. Additionally, you eliminate the need for additional software or subscription costs, as these resources often come with no extra fees, helping to keep expenses low while enhancing productivity.

Time-Saving Benefits

- Pre-built Structures: Templates often come with predefined sections, such as fields for client information, amounts, and due dates, allowing you to quickly input data without worrying about formatting.

- Automated Calculations: Built-in formulas automatically calculate totals, taxes, and discounts, saving you from having to manually do the math each time.

- Quick Modifications: You can easily adjust any section of the document to reflect new products, services, or terms, making updates fast and efficient.

Cost-Saving Advantages

- No Subscription Fees: Unlike some specialized invoicing software, using a document with preset fields comes at no additional cost, allowing you to avoid recurring charges.

- Reduces Errors: By eliminating manual calculations, the risk of mistakes is greatly reduced, preventing costly errors that could affect client relationships or payment cycles.

- Efficient Record-Keeping: Standardized documents make it easier to track payments and maintain organized financial records, reducing the time spent on administrative tasks and increasing overall productivity.

Overall, using these efficient solutions helps streamline the financial process, ensuring that billing is both quicker and more accurate while keeping overhead costs down. By investing a small amount of time upfront to customize the layout, you can save a significant amount of time and money in the long run.

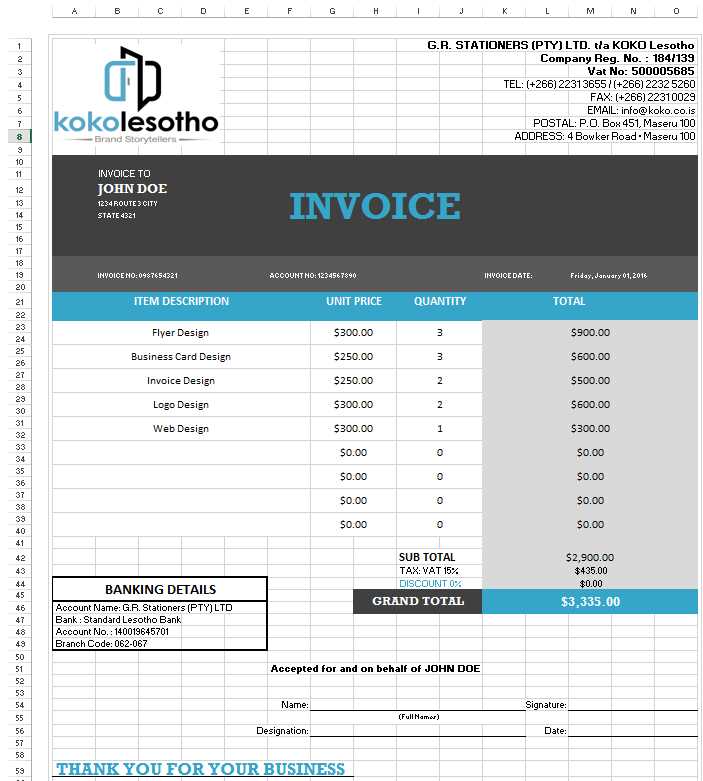

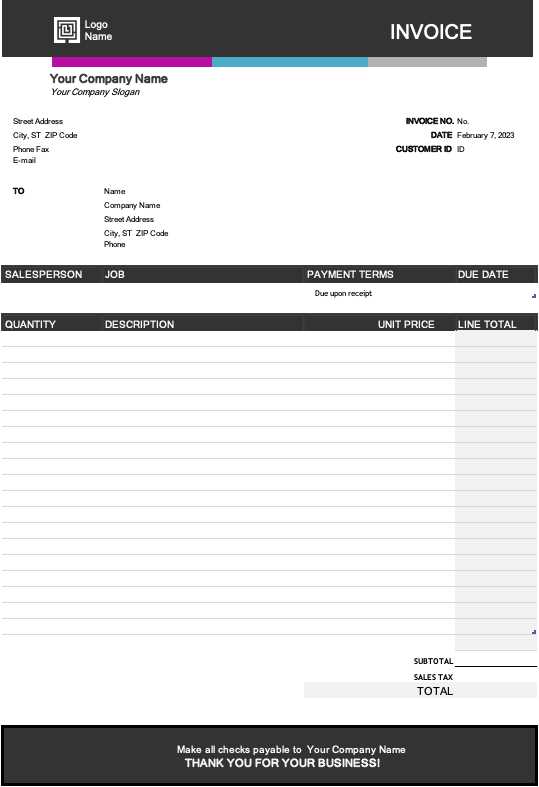

Creating Professional Invoices with Excel

Creating a polished and professional document for client billing is essential for any business. A well-structured record not only helps streamline the payment process but also reinforces the credibility of your business. By utilizing spreadsheet software, you can quickly generate documents that reflect a high standard of professionalism while ensuring all necessary details are clearly presented.

With the right design and layout, you can craft a document that aligns with your brand’s identity, including logos, color schemes, and fonts. Moreover, built-in functions and features make it simple to calculate totals, apply taxes, and track payment deadlines, all of which contribute to a seamless and efficient billing process.

Key Elements for Professional Billing Documents

- Clear Contact Information: Include your business name, logo, address, phone number, and email so clients can easily reach you.

- Itemized Breakdown: List all products or services provided with clear descriptions, quantities, and unit prices for transparency.

- Payment Terms: Specify due dates, accepted payment methods, and any late fee policies to avoid confusion later on.

- Consistent Layout: Use a clean and organized format that makes the document easy to read, with well-spaced sections and aligned text.

Designing with Brand Consistency

- Company Branding: Incorporate your company logo, color palette, and fonts to maintain a consistent look across all documents.

- Customizable Fields: Use adjustable fields for client names, services, and dates to ensure the document suits your specific needs.

- Visual Appeal: Ensure the document looks visually appealing by using headers, borders, and bold text for key information.

By focusing on clarity, consistency, and easy-to-understand formatting, you ensure that your billing documents not only look professional but also function efficiently. With a little time spent on design and setup, you can create high-quality records that help manage payments and strengthen client relationships.

Best Practices for Invoice Formatting

Creating a well-structured and easy-to-read document for client payments is crucial for maintaining professionalism and reducing the risk of confusion. Proper formatting ensures that all essential details are clear, making it easier for clients to review and process payments. The right design not only helps streamline the billing process but also enhances the credibility of your business.

Effective formatting involves careful attention to layout, fonts, spacing, and organization of key information. Whether you’re creating a one-off document or a recurring template, ensuring consistency and clarity should be your top priority. By following certain guidelines, you can create financial documents that not only look professional but also function efficiently.

Essential Elements of Proper Formatting

| Element | Best Practice |

|---|---|

| Clear Header | Include your business name, logo, and contact information at the top for easy identification. |

| Readable Fonts | Use clean, professional fonts like Arial or Times New Roman, and avoid overly decorative styles. |

| Consistent Spacing | Ensure adequate space between sections to make the document visually clear and easy to read. |

| Itemized Details | List each product or service with a description, quantity, unit price, and total amount for transparency. |

| Payment Instructions | Clearly outline payment methods, due dates, and any late fees or terms to avoid confusion. |

Organizing Key Information for Clarity

- Logical Order: Arrange details in a way that guides the client through the document easily–start with business information, followed by services/products, and finish with payment instructions.

- Highlight Important Details: Use bold or larger fonts for critical sections, such as total amounts and due dates, to make them stand out.

- Use Tables for Clarity: Organize itemized lists and totals in a table format to improve readability

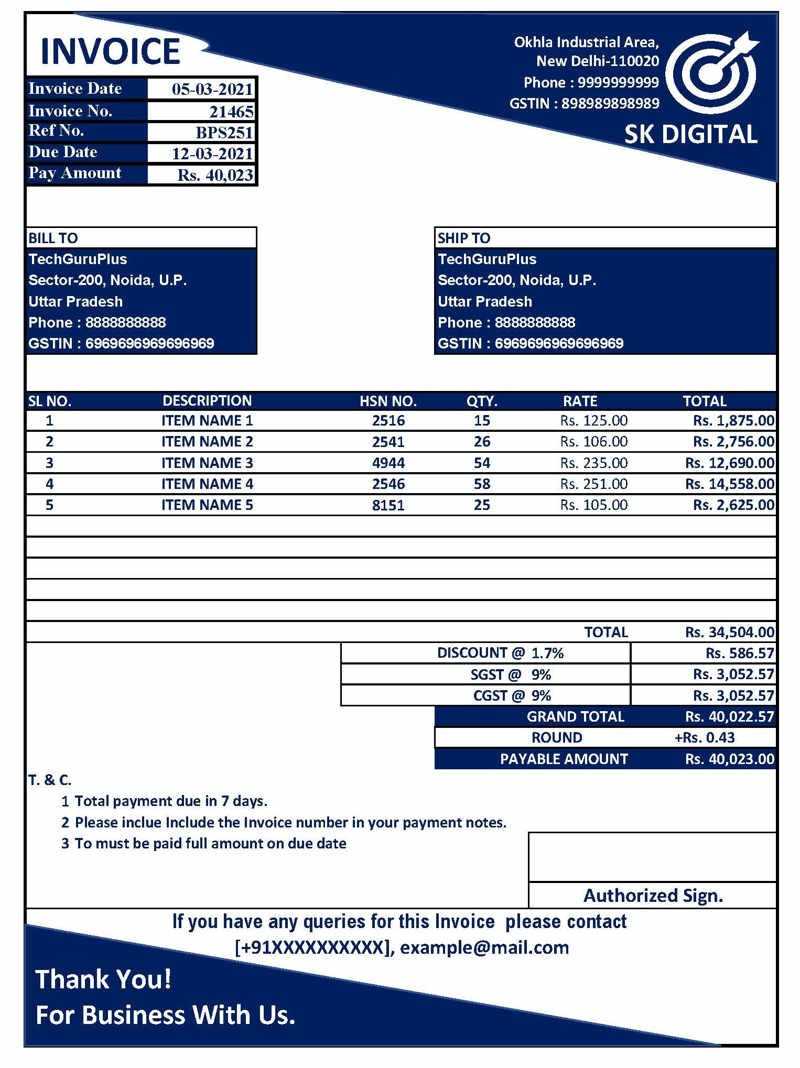

How to Add Taxes to Your Invoice

When managing client payments, it is essential to accurately include any applicable taxes to ensure compliance with local regulations and avoid issues with your finances. Adding tax amounts to your billing document is straightforward, especially if you use a system that allows for automatic calculations. Knowing how to properly calculate and display taxes helps keep your records transparent and your business in good standing.

Taxes can vary based on location, product type, and service, so it’s important to have a clear understanding of the applicable rates for your business. Once you know the correct tax percentage, you can easily include it in the total amount, making sure your clients are aware of the breakdown of charges.

Steps to Add Taxes to Your Document

- Determine the Tax Rate: Research and confirm the tax percentage applicable to your product or service in your region.

- Calculate the Tax Amount: Multiply the total cost of the items or services by the tax rate to get the correct tax value.

- Add the Tax to the Total: After calculating the tax, add the value to the subtotal to arrive at the final amount due.

- Clearly Label Tax Charges: Label the tax section clearly as “Sales Tax,” “VAT,” or “Service Tax” to avoid confusion.

Tips for Displaying Taxes Clearly

- Separate Tax Breakdown: List the tax amount on a separate line or section for clarity, ensuring it’s easily identifiable.

- Include Tax Identification Information: If necessary, add your business’s tax identification number or other relevant information to the document.

- Use Proper Formatting: Highlight the tax charge by using bold text or a larger font to ensure it’s prominent and easy to spot.

Including tax information accurately not only ensures you remain compliant with tax laws but also helps maintain trust with your clients. A transparent breakdown of charges makes it clear what clients are being charged for, and it can prevent misunderstandings or disputes later on.

Tracking Payments with Excel Invoices

Managing and tracking client payments is a crucial aspect of running any business. Ensuring that all outstanding balances are monitored and collected promptly can improve cash flow and reduce the risk of missed payments. Using digital documents allows you to keep detailed records of each transaction, which can easily be updated and accessed when needed.

With spreadsheet software, you can efficiently track payment statuses, calculate outstanding amounts, and maintain a clear history of your financial transactions. By using predefined sections for payment dates, amounts, and methods, you can automate much of the manual tracking process, saving time and reducing the chances of error.

Key Features for Tracking Payments

- Payment Status Column: Add a column to indicate whether the payment is “Paid,” “Pending,” or “Overdue” to quickly assess the status of each transaction.

- Due Date Tracking: Include a due date for each charge, and use conditional formatting to highlight overdue payments in red for easy identification.

- Automated Total Calculation: Set up formulas to automatically calculate the total amount due and remaining balance as payments are made.

- Payment Method Section: Document how each payment was made (e.g., bank transfer, credit card, cash) to ensure transparency and track payment preferences.

Organizing Payment History

- Customizable Columns: Use columns for invoice numbers, client names, and payment amounts to easily filter and sort data for analysis.

- Use of Filters: Implement filter options to sort payments by date, client, or payment status, making it easy to find specific records when needed.

- Payment Reminder Alerts: Set up reminders or notifications for due payments, helping you stay on top of upcoming deadlines and preventing delays.

By integrating these features into your document, you can effectively manage and track payments, ensuring your business stays organized and efficient. This method not only reduces the risk of missed payments but also helps you maintain clear and accurate financial records for future reference.

Using Excel for Recurring Invoices

For businesses that provide services or products on a regular basis, managing repeat transactions can quickly become overwhelming. Automating this process ensures that each billing cycle runs smoothly without the need to create new records from scratch every time. By using digital tools, you can easily set up structured documents that handle recurring charges, saving time and reducing the chances of errors.

Spreadsheet software offers various features that can help manage ongoing billing efficiently. By creating a standard layout for these documents, you can update specific fields each cycle, such as the date or any changes in pricing, while keeping the rest of the structure intact. This approach minimizes manual entry and ensures consistency in your billing process.

Setting Up Recurring Billing Documents

- Standardized Layout: Create a master document that includes all necessary sections like client details, service descriptions, payment terms, and amounts. This structure will remain the same across all cycles, only requiring updates where needed.

- Automate Calculations: Use formulas to calculate totals and apply taxes automatically, so that any changes in the services or prices are reflected without the need for manual adjustments.

- Set Date Ranges: Add a column for the billing period (e.g., “From” and “To” dates), which will automatically adjust based on the start and end of each recurring cycle.

- Reminder Alerts: Use date tracking and conditional formatting to highlight upcoming payment dates, helping you keep track of when the next payment is due.

Efficient Management of Recurring Charges

- Customizable Fields: Modify individual fields like price, quantity, or payment method for each cycle while maintaining the overall structure of the record.

- Tracking Multiple Clients: Create a separate sheet or section for each client to keep their recurring charges organized and easily accessible.

- Automate Reminders: Set up reminders or notifications within your software or integrate with calendar apps to ensure timely invoicing and payment follow-ups.

By setting up your recurring records in this way, you create a reliable and repeatable process that helps keep your finances organized and accurate. This method saves time, reduces the likelihood of mistakes, and allows you to mainta

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is essential for maintaining good client relationships and ensuring timely payments. However, even small errors in these records can lead to confusion, delayed payments, or even disputes. By avoiding common mistakes, you can ensure that your documents are clear, precise, and effective in securing prompt payment.

Many issues arise from simple oversights, such as incorrect calculations, missing details, or unclear payment terms. Understanding these common pitfalls can help you produce better records and avoid unnecessary complications. Below are some frequent mistakes to watch out for when preparing billing documents.

Frequent Errors in Billing Documents

- Incorrect Client Information: Failing to include or incorrectly entering client details, such as names, addresses, or contact information, can delay payments and cause confusion.

- Missing or Incorrect Dates: Always include the correct issue and due dates. Omitting these or making them unclear can lead to misunderstandings about when payment is expected.

- Not Specifying Payment Terms: Clear payment instructions, including due dates, acceptable payment methods, and late fee policies, should always be outlined to avoid confusion.

- Unclear Item Descriptions: Be as detailed as possible when listing products or services. Vague descriptions can lead to disagreements or the need for further clarifications.

- Errors in Calculations: Always double-check the math. Even a small mistake in totaling or applying taxes can cause financial discrepancies and erode trust.

Additional Pitfalls to Avoid

- Failure to Include Tax Information: Omitting tax rates or not clearly labeling them can lead to confusion and cause clients to question the validity of the charges.

- Inconsistent Format: Inconsistent formatting, such as varying fonts or unclear sections, can make the document look unprofessional and difficult to read.

- Not Tracking Payments: Failing to keep a record of paid and outstanding amounts can lead to confusion and missed follow-ups for overdue payments.

- Not Customizing for Each Client: Using a generic template without tailoring it to each client’s specific needs or agreements may cause misunderstandings.

By paying attention to these details and regularly reviewing your financial records before sending them out, you ensure clarity and professionalism. Taking time to avoid common errors helps foster good business practices and strengthens your reputation as a reliable professional.

How to Protect Your Excel Invoices

When managing financial documents, especially billing records, protecting sensitive information is crucial to avoid unauthorized access or data loss. Safeguarding your records not only prevents fraud but also ensures compliance with privacy regulations and protects your business’s reputation. Implementing security measures in your digital files helps maintain the integrity of your documents while keeping them safe from accidental or malicious tampering.

In digital document management, it’s essential to use a combination of simple protection techniques and advanced methods to restrict access, prevent edits, and back up files regularly. By taking a few precautionary steps, you can ensure that your records are safe and easily recoverable in case of unexpected issues.

Basic Security Measures for Protection

- Password Protection: Set a strong password for your documents to prevent unauthorized access. Ensure that the password is complex and unique.

- Encryption: Encrypt your files to add an extra layer of security. This ensures that even if someone gains access to the file, they won’t be able to read its contents without the decryption key.

- Restricted Editing: Use password-based protection to restrict editing capabilities, allowing only authorized personnel to make changes to the document.

Advanced Protection Techniques

- Watermarking: Add a watermark to your financial records to discourage unauthorized copying or sharing of your documents.

- File Backup: Regularly back up your documents in a secure location, such as cloud storage or an external drive, to ensure you can recover data in case of file corruption or accidental deletion.

- Tracking Changes: Enable the “track changes” feature to monitor any edits or modifications made to your document. This will help you keep a record of alterations for auditing purposes.

By combining these strategies, you can significantly reduce the risk of unauthorized access or alteration of your financial records. Whether for personal or business purposes, implementing document protection measures is a vital step toward maintaining confidentiality and ensuring your records remain intact and secure.

Organizing Invoices for Easy Access

Efficient document organization is essential for managing your financial records effectively. Properly categorizing and storing your billing statements allows you to quickly locate and reference any document when needed, saving you valuable time and reducing stress. Whether you manage a small business or handle personal finances, having a clear, accessible filing system ensures that you can easily track payments, resolve disputes, and maintain an accurate record of transactions.

Effective organization goes beyond simply storing files in a folder. It involves creating a logical structure that makes it easy to search for and retrieve specific records. By categorizing your documents by client, date, or project, and utilizing digital tools for quick access, you can streamline your workflow and stay on top of your financial management.

Effective Strategies for Organizing Billing Records

- Create Separate Folders: Organize your records by categories such as client names, projects, or months. This system allows you to narrow down your search and find specific documents quickly.

- Use Descriptive File Names: Name your files clearly, including relevant details such as the client name, date, and the service provided. For example, “ClientName_Invoice_2024_03.pdf” makes it easier to search and identify a particular document.

- Implement a Numbering System: Assign unique invoice numbers to each billing statement. This system makes it easier to track payments and reference specific records, especially when dealing with a high volume of transactions.

- Use Cloud Storage: Store your documents on cloud platforms for secure, easy access from any device. This also provides an automatic backup in case of technical issues or data loss.

Creating a Searchable Digital System

- Tagging and Metadata: Utilize metadata tags or keywords to label each document with relevant terms like payment status, client, or service type. This allows you to filter and search for specific records efficiently.

- Folders and Subfolders: Organize your digital storage with folders and subfolders that mirror the way you categorize physical files. For example, you could have a main folder for “Clients” and subfolders for each individual client or project.

- Regularly Update and Clean Up: Regularly review and update your organizational system to ensure it remains effective. Archive old records and delete unnecessary files to prevent clutter and ensure easy navigation.

By implementing these strategies, you can significantly improve the accessibility and efficiency of your billing records. With an organized system, you will save time searching for documents, stay on top of payments, and keep your business operations running smoothly.

Invoice Template vs Custom Invoicing Software

When it comes to managing financial records and billing clients, businesses have a variety of options to choose from. One common approach is to use pre-designed forms, which are simple and cost-effective. On the other hand, custom invoicing software offers more advanced features and automation, but comes with its own set of considerations, including cost and complexity. Understanding the differences between these two solutions can help you determine which is best suited for your business needs.

Both options aim to streamline the process of creating and sending billing documents, but they differ significantly in terms of functionality, customization, and scalability. While a pre-made form is quick to implement and easy to use, invoicing software can provide more flexibility and integrate with other business systems. The right choice depends on factors such as the volume of transactions, the complexity of your needs, and your budget.

Advantages of Pre-Designed Billing Forms

- Cost-Effective: Pre-made forms are usually free or low-cost, making them an ideal solution for small businesses or freelancers with limited budgets.

- Simplicity: These documents are easy to use and require little to no training. You simply input the necessary details, and the form is ready to go.

- Quick Setup: You can quickly create and start sending out billing documents without the need for installation or technical setup.

- Customizable: While basic, these forms can often be customized with your logo, business information, and payment terms to maintain a professional appearance.

Benefits of Custom Invoicing Software

- Automation: Invoicing software can automate many tasks, such as sending reminders, calculating totals, and generating recurring billing schedules, saving you time.

- Integration: Most invoicing platforms integrate with accounting, payment processing, and CRM systems, allowing for a more streamlined workflow.

- Advanced Features: Software solutions often come with additional features like tracking payment statuses, generating financial reports, and managing tax calculations.

- Scalability: As your business grows, invoicing software can scale to meet your increasing needs, offering additional functionality such as multi-currency support or team collaboration tools.

While a pre-designed form can meet the basic needs of many small businesses or solo entrepreneurs, custom software provides a higher level of efficiency and flexibility for those who require more advanced tools. Ultimately, the decision between these two options should be based on your business’s size, complexity, and specific in

Top Excel Invoice Templates for Freelancers

For freelancers, having a simple yet professional method of billing clients is crucial for smooth operations. Using ready-made documents can save time and eliminate the need for designing invoices from scratch. These customizable formats are perfect for those who want to quickly create billing statements that look polished and well-organized. In this section, we explore some of the most popular options that freelancers can use to streamline their financial processes.

Whether you’re a designer, writer, consultant, or any other type of freelancer, there are several versatile formats available that meet different needs. These documents come with pre-designed sections for client information, services rendered, payment terms, and taxes, all of which can be customized to reflect your business style and branding.

Features of Ideal Billing Documents for Freelancers

- Easy Customization: The best formats allow you to quickly modify details such as client name, services, rates, and payment terms.

- Clear Layout: A clean, simple layout ensures that clients can easily understand the charges and payment deadlines.

- Professional Appearance: Good designs enhance your business’s credibility and make your documents look polished.

- Built-in Calculations: Many options include automatic total calculations and tax inclusions, saving you time and reducing errors.

Popular Formats for Freelancers

- Basic Billing Form: A straightforward layout with spaces for client information, itemized services, and totals. Ideal for freelancers who need a no-frills, efficient solution.

- Itemized Service Breakdown: Perfect for freelancers offering multiple services, this format breaks down each task or service separately with its own price, ensuring clarity and transparency.

- Time-Based Billing Format: A specialized format for freelancers charging by the hour, with sections for time spent, hourly rates, and total hours worked.

- Recurring Payment Template: For freelancers with ongoing contracts, this option allows you to set up recurring payments, making it easier to manage long-term client relationships.

- Project-Based Format: Great for project-based work, this template includes space for milestones, payment schedules, and project-specific terms.

These formats are ideal for freelancers looking for a simple and professional way to bill their clients. The key to success is choosing the right layout that suits your working style, ensuring efficiency and clarity in your transactions.

How to Automate Invoicing with Excel

Automating your billing process can save time and reduce the likelihood of errors. By leveraging built-in features of spreadsheet software, you can streamline the creation and sending of financial documents without having to manually update every field each time. Automation can handle tasks like calculating totals, adding taxes, and even tracking due dates, allowing you to focus more on your work and less on administrative tasks.

With a few simple adjustments, you can set up your financial record system to automatically generate accurate billing statements whenever needed. This process involves setting formulas, using templates, and customizing your spreadsheet to fit your business needs. The end result is a more efficient workflow with less time spent on repetitive tasks.

Using Formulas for Calculation Automation

- SUM Function: This is one of the most basic formulas that automatically adds up the total amount for your items or services. Just input the individual amounts, and let the software do the math for you.

- Tax Calculation: You can set up formulas to calculate tax automatically based on the subtotal. For example, if the tax rate is fixed, use a simple formula like =subtotal * tax_rate to calculate the final price.

- Discounts: Similarly, you can set up a formula that automatically applies a discount to the total amount if applicable.

Using Templates and Customization for Speed

- Pre-built Templates: Start with an automated form that already includes the necessary sections (e.g., client info, itemized list, terms). These templates can help you speed up the process of creating new documents.

- Data Validation: Use drop-down menus and data validation features to standardize inputs such as service types, payment methods, and due dates, reducing errors and speeding up data entry.

- Automatic Reminders: Set up conditional formatting or reminders to automatically highlight overdue payments or upcoming due dates, ensuring nothing is missed.

By implementing these automation strategies, you can reduce the time spent on creating and managing billing documents while maintaining accuracy. Automation is an excellent way to handle recurring clients or large volumes of work with minimal effort, improving your overall efficiency.

Benefits of Using Templates for Small Business

For small business owners, time and resources are often limited. Efficient management of administrative tasks such as billing, record-keeping, and communication is crucial for maintaining smooth operations. Pre-designed forms provide a cost-effective solution to these challenges, offering a simple way to ensure consistency and professionalism in your business processes. Using these documents can significantly reduce the time spent on repetitive tasks while helping you maintain accuracy and compliance.

Incorporating ready-made solutions into your business workflow allows for quick adaptation and increased productivity. Whether you’re creating contracts, payment requests, or other forms, having a consistent structure in place means you can focus more on growth and client relationships instead of manual document creation.

Time Savings and Efficiency

- Quick Setup: Ready-to-use forms require minimal customization, allowing you to start using them immediately without having to design a new document from scratch.

- Consistency: Using predefined formats ensures that every document maintains the same structure, making it easier for clients to understand your terms and for you to track transactions.

- Automation: Many forms allow for automatic calculations and data entry, which reduces manual work and the chances of making errors.

Professionalism and Brand Identity

- Polished Appearance: These forms often come with professional designs that enhance the perception of your business, building trust with clients and partners.

- Customizable Features: Although they come pre-designed, many of these solutions allow for easy personalization. You can add your logo, adjust the layout, and tailor the language to fit your business’s brand.

- Standardization: By using the same layout for all business documents, you establish a consistent brand identity that helps reinforce your professionalism.

Ultimately, leveraging pre-designed forms in your business operations not only saves you time and effort but also helps you maintain a high level of professionalism and consistency. Whether you are managing client relationships, tracking payments, or creating proposals, these tools help keep your business organized and efficient.