Best Computer Invoice Template for Word to Streamline Your Billing Process

Managing financial transactions efficiently is crucial for businesses of any size. A well-structured billing document helps ensure that payments are made on time and accurately reflect the services provided. Whether you’re a freelancer, a small business owner, or part of a larger company, having a professional tool for creating such records can save both time and effort.

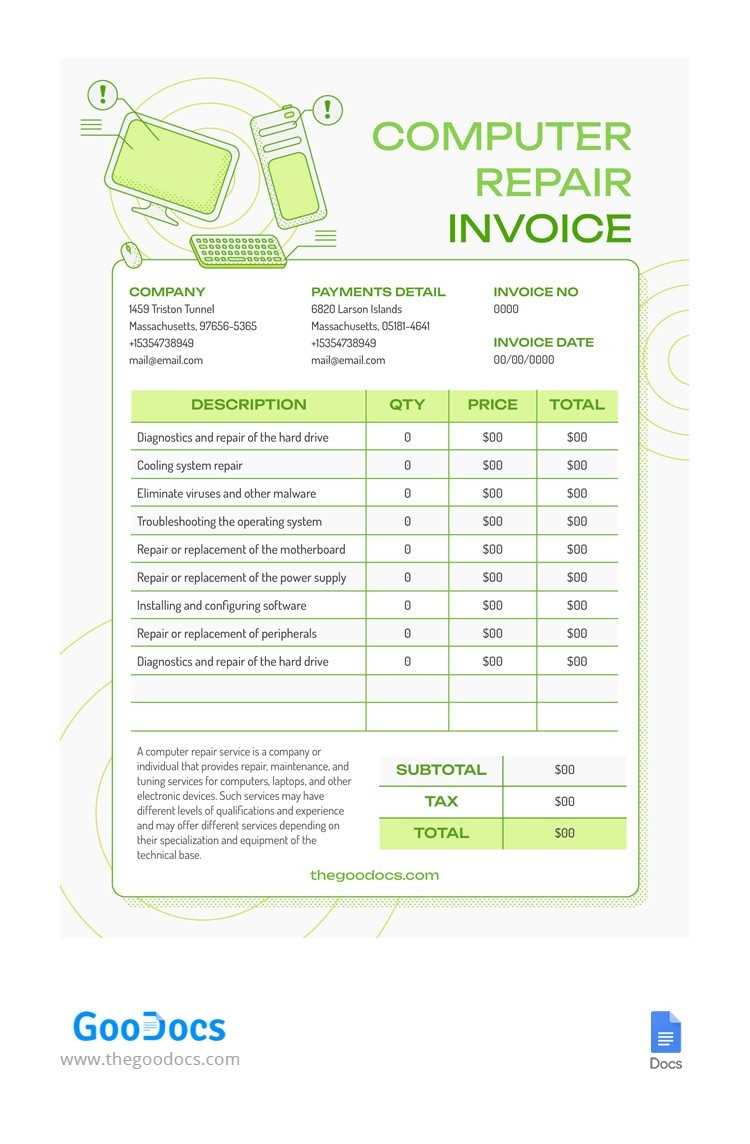

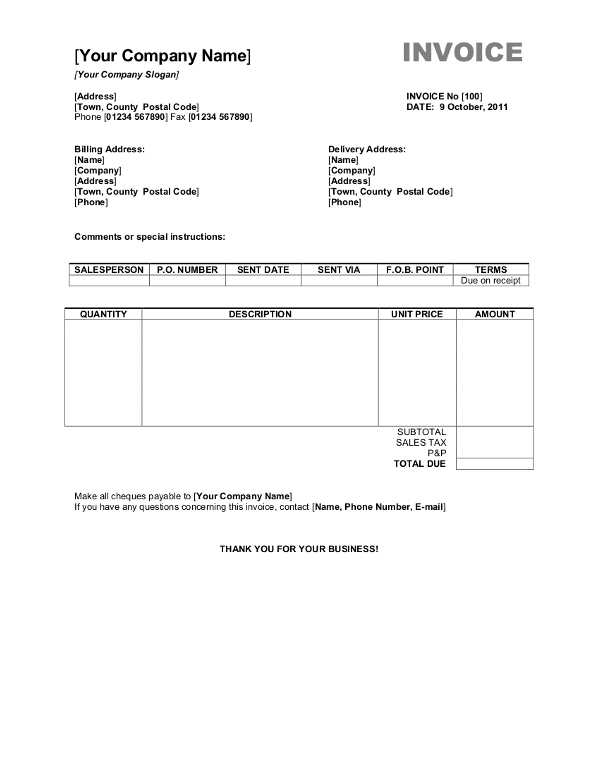

Customizable forms that allow easy modifications to suit specific business needs can simplify the entire process. From adjusting layouts to adding company logos and contact details, these tools provide flexibility to maintain a consistent and polished appearance for all outgoing statements.

Using pre-designed formats helps avoid common errors and ensures that all necessary details are included, such as payment instructions, deadlines, and client information. With these documents, generating accurate, consistent, and professional records becomes quick and easy, making it an invaluable resource for maintaining smooth operations.

Why Use a Digital Billing Document

When managing finances, efficiency and accuracy are key. Having a ready-to-use document for tracking payments and services can greatly streamline the billing process. By relying on a structured format, businesses can ensure consistency in their transactions, reducing errors and saving time on each new record.

Pre-made formats offer several advantages. They are designed to include all necessary fields, from service descriptions to payment terms, ensuring nothing is missed. Customization options further enhance their usefulness, allowing users to tailor documents to their brand or specific client needs. This eliminates the need to start from scratch with every new statement.

Using such a resource can significantly cut down on the time spent creating and organizing financial documents. With minimal effort, you can produce professional-looking statements that reflect your business’ reliability and attention to detail, while maintaining clarity and simplicity for your clients.

How to Create a Billing Document in a Word Processor

Creating a professional billing record is an essential task for any business. By using a simple software program, you can quickly generate clear, well-structured documents that contain all the necessary details for your transactions. This ensures accuracy and helps maintain a professional appearance with minimal effort.

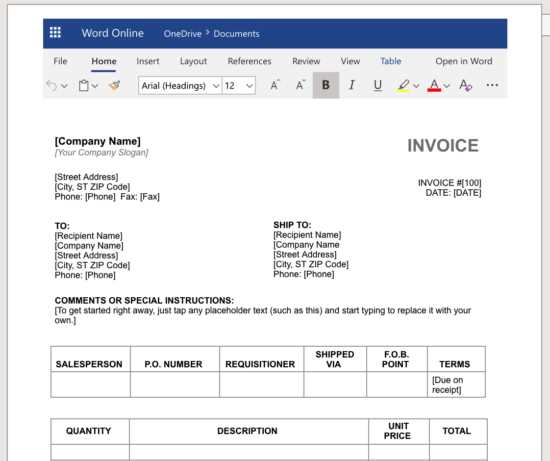

Step 1: Choose a Suitable Layout

Start by selecting a layout that fits your needs. Many word processors offer pre-designed layouts with predefined sections, such as client information, payment terms, and service descriptions. These layouts are easily customizable, allowing you to add or remove sections as needed. You can also adjust fonts, colors, and other design elements to match your brand.

Step 2: Add Essential Information

Next, include all relevant details for the transaction. At a minimum, you should include your business name, contact information, the client’s details, a description of the services or products provided, and the agreed-upon amount. Be sure to add any additional payment instructions or terms, such as due dates or penalties for late payments.

Once all the details are added, review the document for accuracy. This helps ensure that all the information is correct before sending it to your client. A properly formatted and clear document not only improves your workflow but also builds trust with your customers.

Benefits of Customizable Billing Documents

Using adjustable billing forms offers numerous advantages for businesses. These documents can be tailored to fit the unique needs of each client or transaction, ensuring a personalized and professional experience. Customization enhances the functionality of the record, allowing businesses to efficiently manage their financial interactions while maintaining consistency in their branding.

- Flexibility in Design – Customize every aspect, from layout to font style, to match your company’s branding and design preferences. This ensures that your documents always reflect a consistent and professional image.

- Efficiency in Processing – Pre-designed sections can be quickly adjusted, reducing the time spent on creating a new document from scratch for every transaction. This allows for faster billing and more streamlined operations.

- Personalization for Clients – Tailor each document to include specific details relevant to the client’s needs, making them feel valued and ensuring that all necessary information is presented clearly.

- Improved Accuracy – Customizable formats reduce the likelihood of missing critical information, such as service descriptions or payment terms, which helps minimize errors in your financial records.

- Scalability for Growth – As your business grows, customizable billing forms can easily be adjusted to meet new requirements, whether you’re adding more products or services, or managing a larger client base.

By using such flexible tools, businesses not only ensure accuracy and professionalism in their financial documents but also save time and effort that can be spent on other important tasks.

Essential Features in Billing Documents

For any business, a well-organized document for tracking payments should include several key components. These elements ensure that the information is clear, complete, and easily understood by both the sender and the recipient. A comprehensive document not only supports smooth financial transactions but also builds credibility and professionalism.

Key Information to Include

- Business Details – Always include your company name, address, phone number, and email. This provides the recipient with all the necessary contact details for any follow-up.

- Client Information – Add the client’s name, address, and contact information to ensure there is no confusion about the recipient of the document.

- Itemized List of Products or Services – Clearly outline what was provided, including descriptions, quantities, and prices. This makes it easy for the client to understand exactly what they are paying for.

- Total Amount Due – The total should be prominently displayed, along with any taxes or additional charges, to avoid confusion.

- Payment Terms and Instructions – Specify the due date, accepted payment methods, and any penalties for late payments to help manage expectations and encourage timely payment.

Additional Useful Features

- Invoice Number – Every document should have a unique identifier to help track and reference it easily.

- Company Logo – Including your company’s logo reinforces branding and adds a professional touch.

- Clear Payment Instructions – Provide easy-to-follow instructions on how and where the payment should be made, including bank details or payment platform links.

Incorporating these essential features into your billing documents ensures clarity and professionalism, facilitating smoother transactions and better client relationships.

Free Billing Documents for Word Processors

If you’re looking for a cost-effective way to generate professional records, free downloadable documents are an excellent option. These pre-designed forms allow businesses to quickly create clear and organized billing statements without the need for expensive software or design expertise. Many of these resources are fully customizable, giving you the flexibility to adjust them according to your business needs.

Where to Find Free Resources

There are numerous websites offering free templates that can be easily downloaded and used with any word processing software. These resources often come in a variety of designs and formats, so you can choose the one that best suits your brand and style. Some popular platforms include:

- Microsoft Office’s official website

- Google Docs template gallery

- Other online document libraries

Why Use Free Documents?

- No Cost – These documents are free to download, saving you money on custom solutions or premium software.

- Ease of Use – Most free resources are designed with simplicity in mind, making it easy to create and manage records without technical skills.

- Customization – While these documents are pre-designed, they are fully editable, allowing you to add your company’s logo, change fonts, and update payment terms as needed.

Using free downloadable billing documents is a quick and effective solution for businesses looking to improve their financial record-keeping without additional costs or complexity.

Tips for Designing Your Billing Document

Creating a well-designed document is essential for maintaining a professional appearance and ensuring that all necessary information is easily accessible. The design of your record not only reflects your business’s professionalism but also contributes to smooth transactions and helps avoid confusion. A clean, well-structured layout makes it easier for clients to understand the details and promptly make payments.

Focus on Clarity and Simplicity

Keep your document simple and uncluttered. Use clear headings, bullet points, and sufficient white space to allow each section to stand out. This will make it easier for your clients to quickly locate important details such as the amount due, payment methods, and service descriptions.

- Choose readable fonts – Use legible fonts like Arial or Times New Roman in a reasonable size (around 10-12 pt). Avoid using too many font styles, as it can make the document look chaotic.

- Stick to a limited color palette – Use your brand colors for consistency, but don’t overwhelm the document with too many shades. A clean, professional look will be more effective.

- Include your logo – Adding your company’s logo helps to reinforce your brand identity and adds a personal touch to your document.

Ensure All Relevant Details Are Included

- Client Information – Always double-check that the client’s details are correct, including name, address, and contact information.

- Clear Payment Terms – Make sure payment instructions, deadlines, and accepted payment methods are easy to find and understand.

- Itemized List – Provide a detailed breakdown of the goods or services provided, including quantities, prices, and any applicable taxes or discounts.

By following these tips, you can create a professional, easy-to-read document that not only looks good but also serves its purpose effectively, leading to quicker payments and smoother transactions.

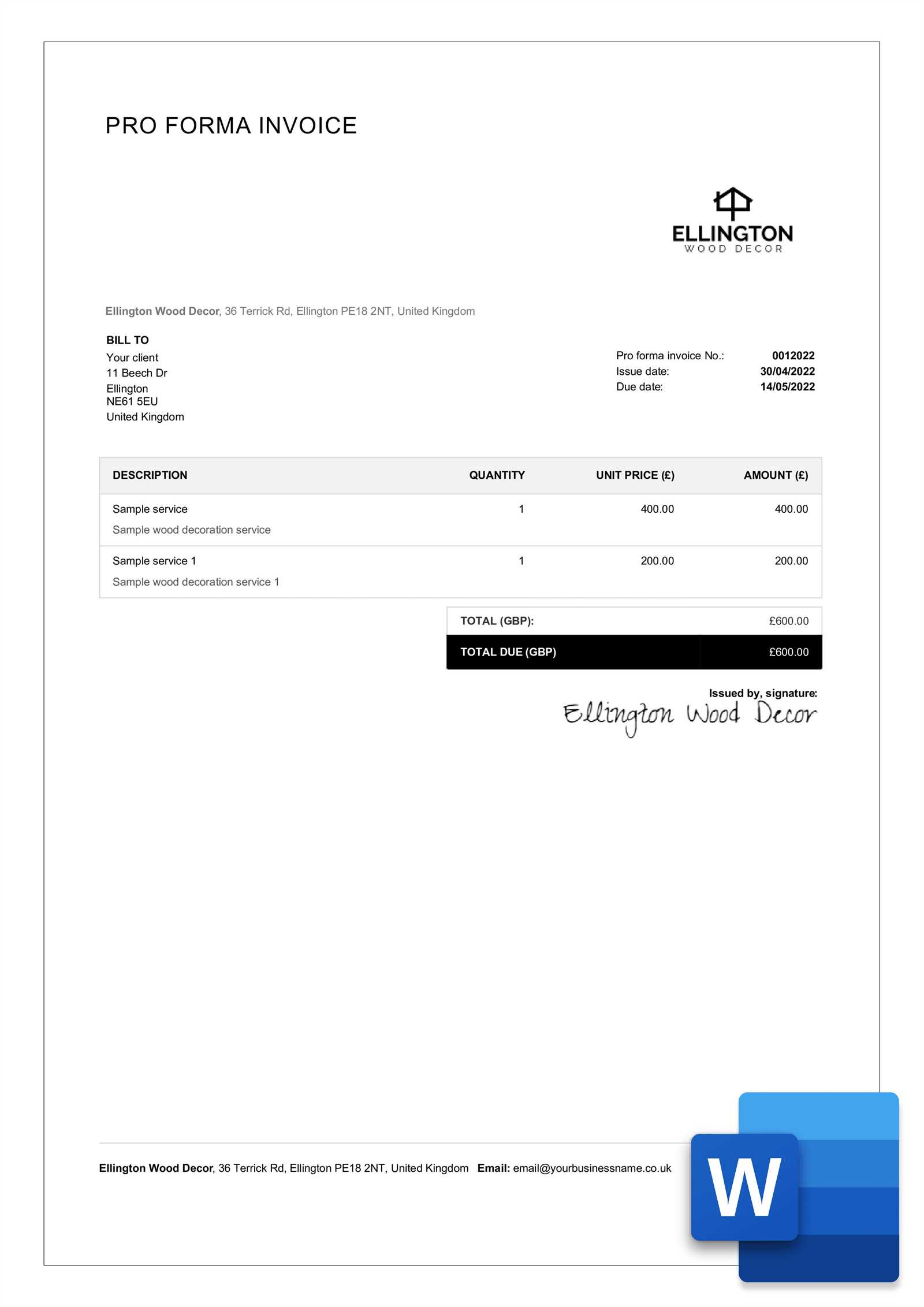

How to Add Company Branding to Billing Documents

Incorporating your company’s branding into every financial record is a great way to reinforce your brand identity and ensure consistency across all communication channels. A well-branded document not only looks professional but also enhances your company’s visibility and helps clients remember your business. Adding logos, colors, and fonts associated with your brand can make your records more recognizable and trustworthy.

Key Elements of Branding

When adding your branding to a document, focus on the following elements:

- Logo – Place your logo at the top of the document, ideally in the header area, to make it the first thing your client sees.

- Brand Colors – Use your brand’s color palette for headings, borders, and key sections of the document to create a cohesive design.

- Fonts – Stick to your company’s standard fonts to maintain consistency with other official materials.

Example of a Branded Billing Document

Here is an example of how you can layout your branding elements in a billing document:

| Element | Branding Suggestion |

|---|---|

| Logo | Place your company logo in the top left corner of the page. |

| Color Scheme | Use your primary brand color for headings, with a subtle accent color for borders or section dividers. |

| Font Style | Use the same font family used in your other marketing materials, such as Arial or Helvetica. |

| Footer | Add a footer with your company’s contact details, using smaller text but maintaining brand colors. |

By consistently applying your branding across all your financial documents, you create a professional, cohesive image that strengthens your brand recognition and builds trust with your clients.

Top Mistakes to Avoid When Creating Billing Documents

While creating financial records may seem straightforward, several common mistakes can lead to confusion, delays in payment, or even legal issues. Ensuring that your records are accurate, clear, and professionally formatted is essential for maintaining smooth operations and a good relationship with your clients. Avoiding these common errors will help improve your billing process and ensure timely payments.

Common Errors to Watch Out For

- Missing or Incorrect Client Information – Failing to include the correct details, such as the client’s name, address, or contact information, can lead to confusion and delays. Double-check client data before finalizing any document.

- Not Including Clear Payment Terms – Leaving out payment terms, such as due dates, late fees, or accepted payment methods, can cause misunderstandings and late payments. Always make sure these are easy to find and understand.

- Inconsistent Formatting – Poorly formatted documents with inconsistent fonts, spacing, or layout can make your records difficult to read and unprofessional. Keep your design clean and consistent throughout.

- Failure to Itemize Services or Products – Failing to break down what is being charged for can lead to confusion and disputes. Always provide a clear itemized list, including quantities, unit prices, and total amounts for each service or product.

- Leaving Out an Invoice Number – Each document should have a unique identifier to help both parties track and reference it easily. Missing invoice numbers can create confusion and make it harder to follow up on payments.

- Incorrect Calculation of Totals – Mistakes in math can lead to overcharging or undercharging clients. Always double-check all calculations, including taxes, discounts, and total amounts.

- Overcomplicating the Document – Including unnecessary information or overly complex language can make the document harder to understand. Keep it simple and to the point to avoid overwhelming the recipient.

How to Avoid These Mistakes

- Review Everything Before Sending – Always proofread the document for errors, inconsistencies, or missing information.

- Use a Standardized Format – Utilize a consistent format for all records to ensure uniformity and prevent omissions.

- Automate Calculations When Possible – Use software that can automatically calculate totals and taxes to minimize human error.

By a

How to Manage Client Invoices Efficiently

Efficiently handling financial records is essential for businesses to maintain smooth operations and foster strong relationships with clients. Proper management ensures that payments are tracked, deadlines are met, and records remain organized. By using the right tools and practices, you can streamline the process and reduce the risk of errors or delays.

Key Strategies for Effective Management

Here are some essential steps for managing billing documents in a streamlined and organized manner:

| Strategy | Description |

|---|---|

| Track Payment Deadlines | Ensure that all payment due dates are clearly stated on the document and set reminders to follow up with clients as the deadline approaches. |

| Use Unique Identifiers | Assign a unique reference number to each document. This makes it easier to track payments and refer to specific transactions in your records. |

| Automate Payment Reminders | Set up automatic email reminders or notifications for clients, reminding them of upcoming or overdue payments. |

| Centralize All Documents | Store all billing records in one place, whether digitally or in a cloud-based system, to keep everything easily accessible and organized. |

| Keep Clear and Detailed Records | Maintain detailed records for each transaction, including descriptions, prices, and payment history, to avoid confusion or disputes later. |

Best Tools for Managing Client Records

- Cloud-Based Accounting Software – These tools allow for automatic tracking, invoicing, and reminders, providing a more organized approach to financial management.

- Spreadsheet Programs – For simpler tracking, spreadsheet software can help you maintain a detailed record of all transactions with customized formulas for calculations.

- Dedicated Billing Software – Specialized software can automate much of the invoicing process, from document creation to payment tracking.

By adopting these strategies and utilizing the right tools, businesses can manage their financial documents more effectively, reduce administrative work, and ensure timely payments from clients.

Improving Billing Document Accuracy

Ensuring the accuracy of financial documents is crucial for businesses to avoid disputes and maintain good client relationships. Small errors in calculations, missing details, or formatting mistakes can lead to delays in payments or dissatisfaction. By implementing a few key practices, you can improve the precision of your records and minimize the risk of errors.

One of the most effective ways to improve accuracy is by using a structured format that clearly organizes all necessary information. This includes the correct client details, service descriptions, amounts, and payment terms. Automating calculations and setting up templates with predefined fields for these details can also help eliminate common mistakes.

Additionally, it’s essential to double-check all the figures and ensure that the correct pricing, taxes, and discounts are applied before sending the document to clients. Having a second set of eyes review the record can also catch mistakes that may have been overlooked initially.

By paying attention to these details and using proper tools and processes, you can create accurate, reliable financial documents that help build trust and ensure timely payments.

How to Add Payment Terms to Billing Documents

Including clear and concise payment terms in your financial documents is essential for ensuring that both parties understand the expectations regarding payments. These terms outline when the payment is due, what methods are accepted, and any penalties for late payments. Properly defined payment terms help maintain transparency and encourage timely transactions.

To add effective payment terms, start by specifying the due date. This can either be a fixed date (e.g., “Due by December 15”) or a time frame (e.g., “Payment due within 30 days of receipt”). You should also outline acceptable payment methods, such as credit card, bank transfer, or online payment platforms. Clear instructions on how to make the payment will prevent confusion.

Additionally, consider including information about late fees or interest charges if the payment is not received by the due date. This adds an incentive for clients to pay on time and helps protect your business from overdue accounts. For example, you could write: “Late payments will incur a 2% monthly interest charge.”

Including these details not only protects your business but also fosters professionalism and reduces the risk of misunderstandings.

Using Billing Document Templates for Small Businesses

For small businesses, creating professional and accurate financial documents can be a time-consuming task. Using pre-designed forms can significantly streamline this process, allowing entrepreneurs to focus more on growing their business and serving their clients. These ready-made forms ensure that all necessary information is included, and they provide a polished look without the need for complex software or design skills.

Benefits of Using Pre-Designed Forms

Utilizing pre-made billing documents offers several advantages for small business owners:

- Time Savings – Pre-designed forms eliminate the need to create records from scratch, saving valuable time for other business tasks.

- Professional Appearance – Ready-made designs help ensure that all documents are neatly formatted and visually appealing, improving your business’s credibility.

- Consistency – Using the same format for all financial records ensures consistency across your billing and accounting practices, which helps to maintain order and clarity.

How to Customize These Forms

Although pre-designed billing documents are ready to use, you can customize them to reflect your business’s branding and specific needs. Here are a few simple adjustments:

- Logo and Branding – Add your company logo and use brand colors to make the document truly yours.

- Service/Item Descriptions – Customize the sections where you list products or services to fit your offerings.

- Payment Terms – Update the payment terms to match your business’s policies, such as due dates or accepted payment methods.

Using pre-designed billing documents helps small business owners maintain a professional image, save time, and reduce the risk of errors in financial record-keeping.

Automating Billing Documents with Pre-designed Forms

Automating the creation of financial records can significantly improve efficiency, reduce human error, and save time for businesses. By using pre-designed forms and setting up automated processes, companies can streamline their billing cycle, ensuring that documents are created and sent promptly without manual intervention. This is particularly valuable for businesses with recurring transactions or a high volume of clients.

How to Set Up Automation

To automate the creation of your financial documents, follow these steps:

- Use Form Fields – Pre-designed forms often allow you to insert placeholders for customer information, amounts, and dates. By creating fields that can be easily filled in automatically, you minimize the need for manual entry.

- Integrate with Accounting Software – Many accounting systems allow you to export data directly into pre-designed forms, automatically filling in customer details, transaction amounts, and other necessary information.

- Create Reusable Document Formats – Set up a master form that includes your branding, payment terms, and layout. Each time you generate a new document, only the specific client and transaction details will need to be updated.

Benefits of Automation

Automating billing documents offers several benefits:

- Faster Turnaround – Documents are generated quickly and sent out immediately, reducing delays in the payment process.

- Consistency – Automation ensures that every document follows the same format and includes all required information, reducing the risk of missing details.

- Reduced Errors – By eliminating manual data entry, you decrease the likelihood of making mistakes, such as incorrect totals or outdated customer information.

By automating the creation of billing records with pre-designed forms, businesses can simplify their administrative tasks and improve overall efficiency.

Legal Considerations When Creating Billing Documents

When preparing financial records for transactions, it is essential to ensure that the documents comply with legal requirements. A well-crafted document not only reflects professionalism but also helps protect your business from legal disputes and ensures clarity between both parties. Adhering to the necessary regulations when creating these documents minimizes potential risks and ensures that your business remains legally compliant.

Key Legal Elements to Include

To ensure legal protection and clarity, the following elements should always be included in your financial documents:

- Company Information – Always include your full business name, registered address, and contact information. In some jurisdictions, businesses are also required to include their registration number or tax ID.

- Payment Terms – Clearly outline the due date for payment, accepted payment methods, and any applicable late fees. This helps prevent disputes and ensures that both parties are aligned on expectations.

- Tax Identification – If applicable, include your tax identification number (TIN) or VAT number. This is particularly important for businesses that operate in jurisdictions where tax reporting is mandatory.

- Accurate Descriptions of Goods or Services – Make sure that each product or service listed is described clearly and accurately, with the quantity and price outlined. This helps prevent misunderstandings and protects against claims of misrepresentation.

Complying with Local Regulations

Different countries and regions may have specific requirements regarding financial documentation. For example, businesses in the European Union are required to provide VAT information, while certain industries may have additional rules regarding what must be included in each document. Understanding and adhering to the local legal requirements is crucial to avoid penalties.

- Consult Legal Counsel – If you’re unsure about the specific legal requirements in your area, it is advisable to consult with a legal professional or accountant.

- Stay Updated on Changes – Laws and regulations related to business documentation can change. Stay informed about any updates to local or international business regulations to ensure compliance.

By paying attention to the legal considerations when creating financial records, you can avoid potential legal complications and build trust with your clients.

Best Practices for Billing Document Numbering

Establishing a clear and consistent system for numbering your financial records is crucial for both organizational efficiency and legal compliance. A well-structured numbering system helps track transactions, reduces confusion, and ensures that you can easily reference specific documents in the future. It is important to create a system that works for your business while aligning with industry standards and regulatory requirements.

Why Numbering Matters

Numbering each billing document uniquely is essential for maintaining an organized record-keeping system. It helps with the following:

- Track Payments – A unique identifier allows you to track payments, follow up on overdue amounts, and manage your accounts receivable more effectively.

- Prevent Duplication – A logical numbering system reduces the chances of issuing duplicate records, which could lead to confusion or errors in accounting.

- Comply with Legal Requirements – Many jurisdictions require businesses to follow a sequential numbering system, ensuring that all records are accounted for and properly documented.

Best Practices for Creating a Numbering System

Here are a few best practices to follow when assigning numbers to your financial documents:

- Sequential Numbering – Ensure that numbers are assigned in a continuous, sequential order without gaps. This makes tracking easier and ensures compliance with most regulations.

- Incorporate Date or Client Information – You can make your numbering system more informative by including the year, month, or client code. For example, “2024-001” or “CLIENT123-01” makes it easy to identify when and to whom the document was issued.

- Avoid Reusing Numbers – Never reuse the same number for different transactions, as this can create confusion and potentially lead to legal or accounting issues.

- Keep a Log – Maintain a log of assigned numbers to prevent accidental duplication. This log can also be useful for auditing and internal tracking purposes.

By implementing a clear and structured numbering system, businesses can streamline their financial operations, enhance organization, and ensure smoother client interactions.

How to Track Payments Using Billing Documents

Managing payments efficiently is essential for maintaining healthy cash flow and preventing any confusion or disputes with clients. When using financial records for transactions, it’s important to track payment statuses, monitor overdue amounts, and keep clear records for accounting purposes. A simple yet effective system can help you stay on top of your payments, ensuring that all outstanding balances are addressed promptly.

Steps to Track Payments

Follow these steps to efficiently track payments and ensure that you always know which accounts are settled and which are still outstanding:

- Include Payment Status Fields – When creating a billing document, add a section where you can mark the payment status (e.g., “Paid,” “Pending,” or “Overdue”). This makes it easy to track whether the client has settled the amount.

- Record Payment Dates – For every payment received, note the payment date on the document. This can help you maintain an accurate record of when the transaction was completed.

- Keep a Payment Log – In addition to marking payment status on each document, maintain a separate log or spreadsheet where you can track payments, amounts received, and the corresponding document numbers. This provides a clear overview of your transactions.

Using Reminders and Follow-ups

To ensure timely payments, consider setting up reminders and follow-up procedures:

- Set Payment Due Dates – Always specify a clear due date for payments on each document. This helps both you and the client understand the payment timeline.

- Send Payment Reminders – If a payment is overdue, send a polite reminder to the client, referencing the original document and indicating the outstanding amount. You can automate this process if you use accounting or payment management software.

- Offer Multiple Payment Methods – Providing clients with various payment options can encourage quicker payments and reduce the chances of delays.

By implementing these practices, you can easily monitor and track the status of your payments, helping to ensure timely cash flow and avoid any financial disruptions.

Exporting Billing Documents from Word to PDF

Converting your financial records into PDF format offers several advantages, including easier sharing, better document security, and maintaining the original formatting across different devices. Many businesses use the PDF format because it ensures that the document appears exactly as intended, regardless of the recipient’s software or operating system. This section will guide you through the simple steps of exporting your documents to PDF and discuss the benefits of doing so.

Steps to Export Documents to PDF

To export your financial records from a text editing application to PDF, follow these steps:

- Open the Document – Ensure your document is fully edited and formatted before exporting it to PDF.

- Select Save As or Export Option – In your application, go to the “File” menu and choose the “Save As” or “Export” option. This will give you the option to save the document in various formats.

- Choose PDF Format – From the list of available formats, select PDF. This will preserve all formatting, fonts, and images within your document.

- Save the Document – Choose the destination folder on your computer and click “Save.” Your document will be converted into a PDF and stored in that location.

Benefits of PDF Export

Exporting your records to PDF offers several key advantages:

- Preserves Formatting – PDFs maintain the exact layout, fonts, and graphics, ensuring that the document appears the same on any device or software.

- Enhanced Security – PDFs can be password-protected or encrypted, which helps prevent unauthorized access to sensitive information.

- Easy to Share – PDFs are universally compatible, making it easy to share documents via email or file-sharing services without worrying about compatibility issues.

- Professional Appearance – Sending your financial documents as PDFs ensures they look polished and professional, which is essential for maintaining a good business reputation.

By converting your records into PDF format, you can enjoy better document management, enhanced security, and more efficient communication with clients.