Self Employed Invoice Template for Tracking Hours Worked

Managing payments efficiently is a key aspect of running a successful independent business. Whether you’re providing services on an hourly basis or working on project-based tasks, ensuring that your clients are billed correctly and on time is essential for maintaining good relationships and steady cash flow.

Designing an effective billing document involves more than just listing services provided. It’s about clear communication, transparency, and ensuring that every detail–such as time invested and the agreed-upon rates–is easily understood. This allows clients to process payments without confusion and helps freelancers stay organized.

Understanding the components of an accurate document can make the process smoother. With the right structure, you can track your work efficiently, minimize errors, and ensure timely payment for your efforts. Knowing how to create and customize this document according to your business needs is a valuable skill for any freelancer.

Document for Tracking Time and Services Provided

Creating a structured document for tracking the time and effort you’ve put into client projects is crucial for any independent professional. This document helps ensure that all work is accounted for accurately and that clients understand the breakdown of the services provided. Proper documentation simplifies the billing process and ensures that you are paid fairly for the time spent on tasks.

Key Elements to Include

When designing a document to track your time, there are several important sections to consider. Each section serves a specific purpose and contributes to the overall clarity and professionalism of the document.

- Client Information: Include the client’s name, contact details, and address for easy identification.

- Project Details: Describe the nature of the task or project to give context to the charges.

- Time Tracking: Document the exact time spent on each task, whether it’s in blocks or specific intervals.

- Rate Information: Clearly state the agreed-upon rate for your services to avoid confusion when calculating the total cost.

- Total Amount: Summarize the total payment due, based on the time tracked and rates applied.

- Payment Terms: Define the payment due date and preferred payment methods to set clear expectations.

Customizing the Document for Your Needs

One of the key benefits of this approach is the ability to customize the document according to your specific needs. You can adjust the layout, add or remove sections, and ensure that it aligns with the style of your business. Customization also allows you to accommodate different clients, ensuring that their specific requirements are met while keeping the process straightforward.

- Choose a clear and simple design for ease of understanding.

- Include your company’s branding, if applicable, to maintain a professional image.

- Consider adding extra details, such as project milestones or progress reports, for larger projects.

By following these guidelines, you can create a comprehensive document that accurately reflects your time and services, ensuring both you and your clients are on the same page regarding compensation and expectations.

Importance of Accurate Invoicing for Freelancers

For independent professionals, maintaining accurate and clear billing records is essential to ensure timely payments and avoid misunderstandings. Proper documentation not only reflects your professionalism but also helps in managing cash flow and taxes. Without a well-organized billing system, it becomes challenging to track income and ensure that clients pay for the correct services and time spent.

An error-free process also fosters trust with clients, as they are confident that the charges are justified and transparent. On the other hand, mistakes in billing could lead to delays, disputes, and even loss of business. Therefore, ensuring that all details are correctly recorded is vital for long-term success in freelance work.

Key Benefits of Accurate Billing

| Benefit | Description |

|---|---|

| Timely Payments | Clear and precise records help clients understand what they are being charged, leading to faster payment processing. |

| Professional Reputation | Clients are more likely to trust and work with professionals who provide clear and accurate billing documentation. |

| Tax Management | Accurate records make tax filing easier and reduce the risk of errors during the preparation of tax returns. |

| Prevents Disputes | Clear documentation helps avoid confusion and disagreements about charges, ensuring smoother client relationships. |

In summary, taking the time to maintain precise billing records is crucial for any freelancer looking to stay organized, build trust, and maintain long-term relationships with clients. A simple and efficient billing process contributes significantly to the smooth operation of your independent business.

How to Calculate Time Spent on a Billing Document

For freelancers, accurately documenting the time spent on each task is essential for fair compensation. It is important to track all the time invested in client projects, whether for meetings, research, or actual task execution. The key is to provide clear and reliable information about the time spent, ensuring clients are billed appropriately and you are paid for your effort.

When calculating the time to be included in a billing document, it’s important to consider both direct work and any preparatory activities related to the project. Breaking down the total time into detailed segments can help clients understand the charges better and avoid disputes later on.

Tracking Time Accurately

Manual Time Logs: Keeping a manual log of your activities is one of the most straightforward ways to track time. Each entry should include the date, task description, start time, and end time. This method allows for a high level of detail and accuracy.

Time Tracking Software: Using specialized tools can automate the tracking process, making it easier to log the time spent on specific tasks. These tools can help you categorize work by project and track your progress in real-time, reducing the risk of errors.

Formatting Time Entries for Clients

When preparing the document for your client, ensure that each segment of time is presented clearly. Here is an example of how to format time entries:

- Date: January 15, 2024

- Task: Website design adjustments

- Time Spent: 3 hours

- Rate: $50 per hour

- Total: $150

By breaking down the work into manageable parts, you can provide a transparent and well-organized document that reflects the effort you put into each task.

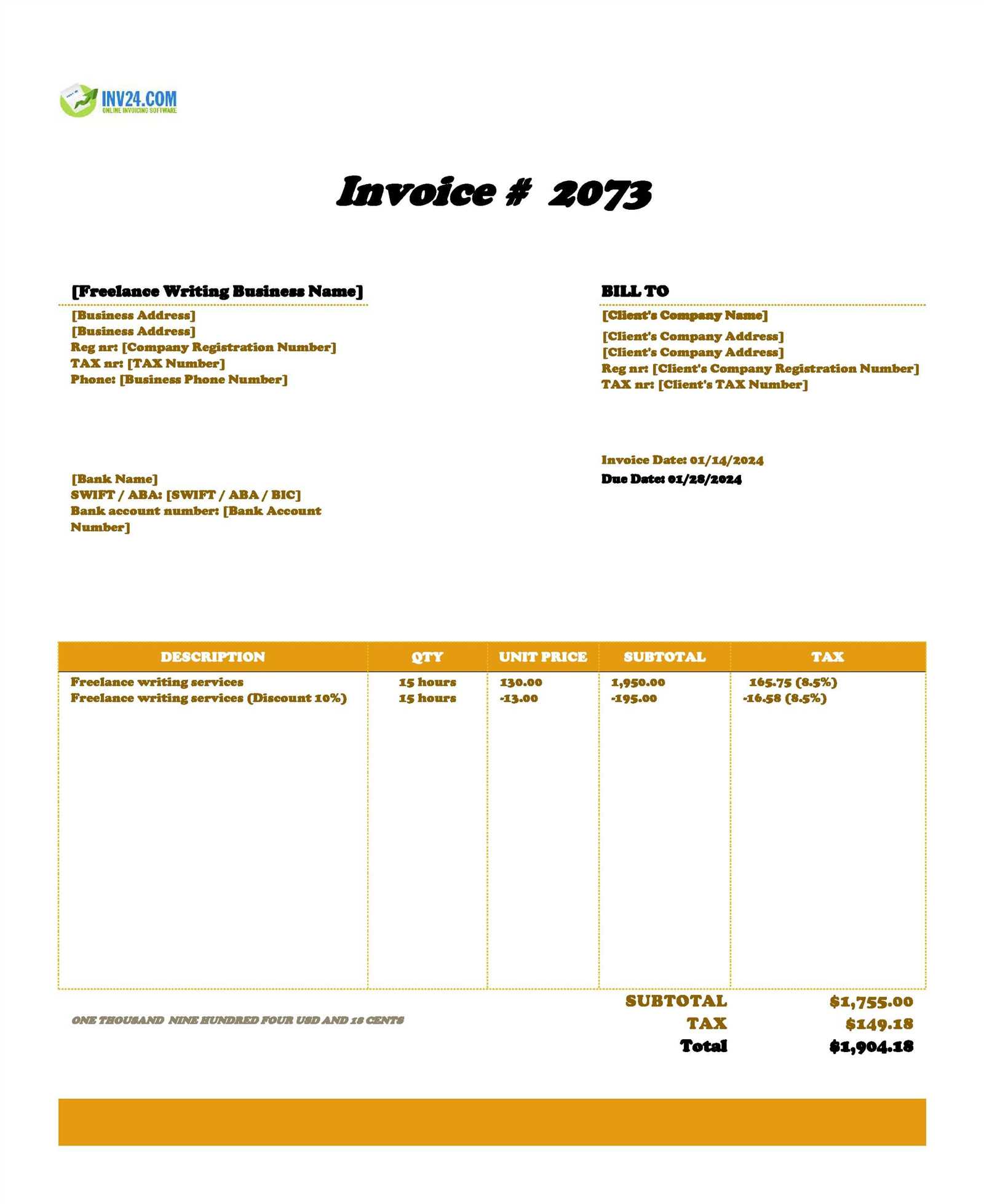

Essential Components of a Billing Document

For any independent professional, creating a well-organized document for payment collection is crucial. The structure of this document must be clear and detailed, ensuring that the client understands exactly what they are being charged for. A well-crafted document not only ensures prompt payment but also reflects professionalism and transparency in your business operations.

There are several key elements that every billing document should contain. These components are designed to provide a comprehensive overview of the work completed and the amount due, making it easier for both the freelancer and the client to keep track of the transaction.

Key Elements to Include

- Contact Information: Include your name, business name (if applicable), and contact details, as well as the client’s information. This ensures proper identification and helps in communication if there are any questions regarding the payment.

- Unique Reference Number: Each document should have a unique identifier, such as a number or code, to track and refer to it easily for future records.

- Service Description: Clearly outline the tasks or services you provided, including any milestones or specific work completed. This section provides the client with a detailed account of the work done.

- Rate and Amount: Specify your rate for the work completed, whether it’s per task or on a set fee. Then, list the total amount due based on the time or services provided.

- Payment Terms: Define the payment due date, payment methods accepted, and any late fees or discounts if applicable. This section helps set expectations and avoid delays in payment.

- Notes or Additional Information: Include any other relevant details such as project deadlines, terms, or a thank you note. This can help maintain a positive relationship with your client.

By including these components in your document, you ensure clarity and transparency for both parties. A detailed and well-organized document makes it easier for the client to process the payment and reduces the chance of misunderstandings or disputes.

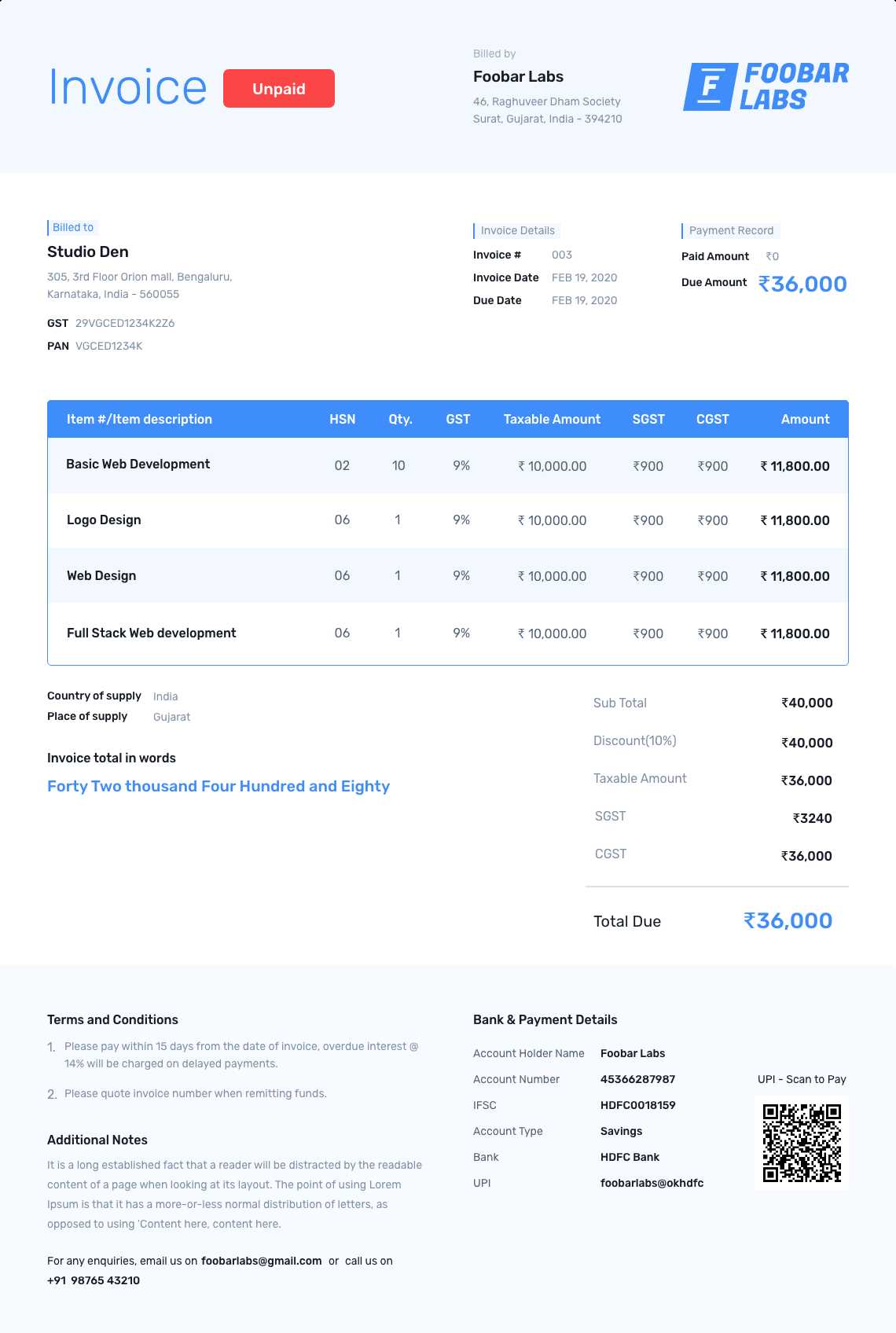

Customizing Your Billing Document for Different Clients

Each client is unique, and as an independent professional, it’s important to adapt your payment request documentation to suit their needs. Customizing this document allows you to maintain a professional approach while addressing the specific details that each client might require. Tailoring your document ensures that all relevant information is presented clearly, improving the likelihood of smooth transactions and reducing confusion.

By adjusting elements like the level of detail, payment terms, and format, you can create a document that resonates with each client while also meeting your business needs. Customization can help establish stronger relationships and increase the chances of repeat business.

Key Customization Tips

- Client Preferences: Some clients may prefer a simple summary, while others may require more detailed descriptions of the tasks completed. Adjust the level of detail to match the client’s preference.

- Payment Terms: Depending on the nature of your relationship with the client, you may offer flexible payment terms, such as discounts for early payment or different due dates for regular clients.

- Branding and Style: For clients that value aesthetics or brand consistency, consider incorporating your logo, color scheme, or specific fonts to maintain a cohesive brand image.

- Additional Information: Some clients may request extra details, such as project milestones, tax breakdowns, or specific expense reports. Be prepared to include such elements when required.

- Language and Tone: Depending on the formality of the client relationship, adjust the language to suit either a more casual or formal tone.

Examples of Customization

- For Creative Projects: Provide a more detailed breakdown of each creative task, such as design revisions or brainstorming sessions, and include milestones to track progress.

- For Ongoing Clients: Include a summary of previous work and mention any long-term agreements or retainer services to reinforce continuity.

- For Corporate Clients:

Tips for Setting Hourly Rates on Billing Documents

When determining the amount to charge for your time, it’s important to consider multiple factors that reflect both the value of your work and the expectations of your clients. Setting the right rate ensures that you are fairly compensated while maintaining competitiveness in your field. It is crucial to strike a balance between affordability for your clients and profitability for yourself.

Many independent professionals face the challenge of adjusting their rates based on experience, market demand, and the complexity of tasks. Here are some useful tips for setting appropriate rates for your services that will keep both you and your clients satisfied.

Factors to Consider When Setting Rates

- Industry Standards: Research what others in your field are charging to ensure your rates are in line with the market. Being aware of the average compensation in your industry helps you stay competitive.

- Experience and Skill Level: Consider your experience and expertise. If you have specialized knowledge or a track record of high-quality work, it’s appropriate to charge a premium.

- Client Type: Different clients have different budgets. Corporate clients may expect to pay higher rates than individuals or small businesses. Tailor your rates accordingly.

- Task Complexity: More complex tasks that require advanced skills or more time to complete should be charged at a higher rate compared to simpler tasks.

- Geographic Location: Rates can vary significantly based on where you or your clients are located. Larger cities or regions with higher costs of living often warrant higher rates.

Strategies for Setting Your Rates

- Hourly Rate: If the work is expected to fluctuate in duration, an hourly rate is often the best choice. This method ensures that you are paid for the exact time you spend on a project.

- Project-Based Fee: For well-defined tasks, charging a flat fee based on the project’s scope can be more attractive to clients, providing clear expectations on both sides.

- Retainer Agreements: If you have ongoing work with a client, consider setting up a retainer agreement that guarantees a certain amount of work each month, providing both stability and predictabilit

Tracking Billable Time Efficiently

Efficiently tracking the time spent on tasks is crucial for independent professionals to ensure they are paid for all the work completed. Properly managing time allows you to accurately reflect the effort put into each project while also minimizing errors or discrepancies that may arise when calculating payments. A systematic approach to tracking time helps prevent missed charges and enhances client trust.

There are various tools and methods available to assist in monitoring the time spent on tasks. By using effective time-tracking practices, you can ensure that every minute of work is accounted for and easily referenced when needed. Below are some strategies to streamline the process.

Best Practices for Tracking Time

- Use Digital Time Trackers: Time-tracking software or apps can automate the process, allowing you to easily log your activities, categorize tasks, and even generate reports for clients. Many tools also integrate with project management platforms for seamless tracking.

- Record Time in Real-Time: To avoid forgetting details, try logging your time as you work rather than relying on memory. This ensures accuracy and prevents gaps in your tracking.

- Set Clear Work Intervals: Break your day into specific work blocks or intervals, such as focusing on one task for 45 minutes before taking a short break. This approach helps increase productivity and gives a more structured way to monitor time spent.

- Establish a Routine: Make time tracking part of your daily routine. The more consistently you log your time, the easier it will be to maintain accurate records and spot potential issues before they arise.

- Label Tasks Clearly: Always give clear labels and descriptions for each activity, so it’s easy to distinguish between different tasks when reviewing your time log. This is especially important if you’re working on multiple projects at once.

Tools for Effective Time Management

- Time Tracking Apps: Applications like Toggl, Harvest, or Clockify can help you track time accurately and efficiently. These apps allow you to log work directly and generate reports, making it easier to integrate into your billing document.

- Spreadsheets: If you prefer a more manual approach, a simple spreadsheet can be an effective way to track time. You can create columns for the date, task, start and end times, and total time spent.

- Project Management Software: Many project management tools like Trello, Asana, or Basecamp allow you to track time directly within the platform. These tools are useful for keeping an overview of multiple projects at once.

By implementing these

How to Handle Overtime in Billing Documents

When working beyond the standard time frame, it is important to address the additional effort in a clear and transparent manner to ensure fair compensation. Handling overtime correctly in your payment documents not only helps maintain professional relationships but also ensures you are paid for all the time and effort you invest in a project. Clearly documenting extra time worked can prevent misunderstandings and disputes with clients.

There are a few essential steps to ensure that overtime is tracked, calculated, and presented in a way that is both fair to you and understandable to your clients. Let’s look at how to handle these extra charges effectively.

Steps for Managing Overtime

- Define Overtime Terms in Advance: Before beginning a project, establish clear guidelines with your client regarding overtime rates. This helps prevent surprises at the end of the project and ensures that both parties are on the same page regarding expectations.

- Track Overtime Separately: When logging extra time, make sure to distinguish it from regular work. Use a separate line item or category to track overtime hours so clients can easily see the breakdown.

- Use a Higher Rate for Overtime: If your agreement includes a higher rate for overtime, be sure to apply it correctly. This could be a fixed percentage increase or an hourly rate that reflects the extra effort involved.

- Provide Clear Documentation: Make sure to include detailed descriptions of the tasks performed during the overtime period. This helps to justify the extra time and the additional charge.

- Consider Offering Overtime Approvals: In some cases, it may be wise to get client approval before working beyond the standard scope. This ensures there are no surprises and helps maintain a transparent process.

Example of Overtime in a Billing Document

- Regular Time: 9 AM – 5 PM, Monday to Friday at $50/hour

- Overtime: 5 PM – 9 PM at $75/hour

- Overtime Calculation: 4 hours of overtime worked at $75/hour = $300

By handling overtime properly, you create clear, professional documentation that ensures both you and your clients have an accurate understanding of the time and effort involved in a project. This helps build trust and avoids any confusion at payment time.

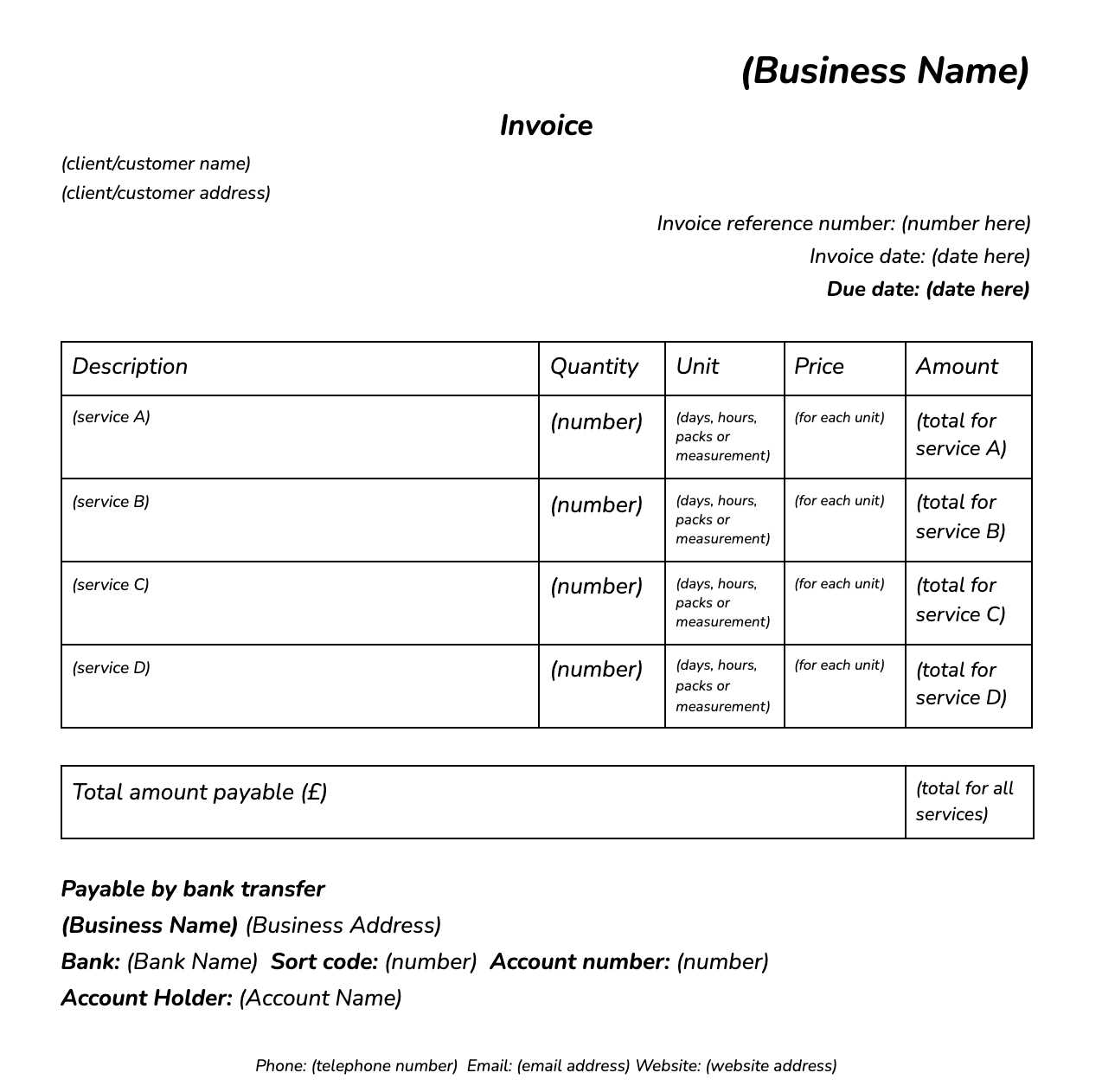

Choosing the Right Billing Document Format for Your Business

Selecting the proper format for recording and requesting payment is essential for any business, as it helps maintain professionalism, accuracy, and clarity in transactions. A well-designed document not only simplifies the payment process but also reflects your brand and enhances client trust. The right choice of structure can streamline your administrative tasks and ensure timely payments, while a poorly designed one could lead to confusion or delayed compensation.

When choosing the format to use, there are several factors to consider based on your business type, client preferences, and specific needs. Below are some key elements to consider when selecting the most suitable format for your business.

Factors to Consider When Selecting a Billing Format

- Client Preferences: Some clients may prefer a specific format or even provide their own. Always check with them before sending your billing documents to ensure compatibility.

- Professionalism and Branding: The format you choose should align with the image you want to project. A clean, well-structured document adds professionalism and credibility to your services.

- Ease of Use: Choose a format that is easy for you to complete and for your clients to understand. Simplicity can often help avoid mistakes or confusion.

- Flexibility for Different Services: If you offer a range of services, look for a structure that allows easy customization. This will help you adjust the details to fit various types of work without hassle.

- Tracking and Record Keeping: Make sure the format allows for clear tracking of past transactions. Keeping a record of what you’ve billed and when payments are due is essential for both financial management and client relations.

Types of Formats for Different Needs

- Simple Billing Format: Ideal for straightforward projects, this format contains basic details such as the total amount due, services provided, and payment terms. It’s easy to use for single tasks or short-term projects.

- Detailed Billing Document: Suitable for ongoing or complex projects, this format includes itemized charges, specific terms, and may also feature a breakdown of time spent or milestones achieved.

- Recurring Billing Structure: If you offer subscription-based services, choose a format that can automate recurring payments and reflect consistent billing intervals such as weekly, monthly, or quarterly.

By carefully choosing the right structure for your billing documents, you ensure that your business operations run smoothly, your clients understand your terms clearly, and you maintain a professional appearance in every transaction.

What to Include in the Description Section

The description section of your billing document is a critical part of the process as it provides clarity on the services rendered and helps justify the amount being charged. A well-written description not only explains what was done but also ensures that both parties are aligned on the scope of work and expectations. This section is essential for preventing misunderstandings and facilitating smooth payments.

When drafting the description, make sure to include enough detail to clearly convey the work completed, while remaining concise and professional. Below are the key components to include when filling out this section.

Key Elements to Include

- Service or Task Description: Clearly outline the specific tasks performed, including any major milestones or deliverables. Be specific about what was accomplished to avoid ambiguity.

- Duration or Timeframe: If applicable, mention the amount of time spent on each task or the timeframe within which the work was completed. This helps to contextualize the effort involved.

- Materials or Resources Used: If your work involved any materials, tools, or software, list them in the description. This adds transparency and can help justify costs for those items.

- Special Requirements or Customizations: If the work involved any customization or specific client requests, mention them in this section to highlight the unique nature of the task.

- Additional Notes: Include any relevant comments or clarifications that may help the client understand the nature of the service, such as project changes or extra tasks added.

Example Description Section

- Task: Website redesign, including new homepage layout and navigation adjustments

- Time Spent: 15 hours (5 hours for homepage redesign, 10 hours for navigation updates)

- Materials Used: Adobe XD for wireframing, WordPress for development

- Additional Notes: Client requested a mobile-responsive design, which was incorporated into the final layout.

By including these essential details in the description section, you provide your clients with a clear understanding of the work completed and create a transparent record of the services provided. This not only helps with payment processing but also builds trust and professionalism in your business transactions.

Legal Requirements for Billing Documents

When creating documents to request payment for services rendered, it’s important to ensure that all necessary legal elements are included. These requirements help establish legitimacy, protect both parties, and ensure compliance with tax laws. Missing even a single mandatory detail could result in delays in payment or legal complications.

Each country or region may have its own specific regulations regarding what must be included in a payment request, but there are common standards that should be followed in order to ensure that the document is legally binding and acceptable for tax purposes. Below are some key legal elements that should be incorporated.

Essential Legal Details

- Business Name and Contact Information: Your full name or the legal business name, along with address, phone number, and email, should be clearly stated. This establishes your identity and provides a way for the client to contact you.

- Client Information: It is crucial to include the name and address of the client receiving the services. This helps to properly identify the party responsible for the payment.

- Tax Identification Number (TIN): Including your TIN or VAT number (if applicable) is often required for tax reporting and ensures that both parties can comply with tax regulations.

- Payment Terms: Define the payment due date and the method of payment (e.g., bank transfer, check, online payment system). This section helps prevent misunderstandings regarding the timing and manner of payment.

- Clear Description of Services: Provide a concise but thorough explanation of the services provided, as this is often a requirement for audit purposes. Make sure the description is detailed enough to justify the charges.

- Amount Due: Clearly state the amount owed, along with any applicable taxes. In some jurisdictions, tax rates may need to be specified, and invoices may need to break down the cost before tax and the final total.

Additional Compliance Considerations

- Late Payment Penalties: Some legal systems require you to specify the penalties for late payments. This could include interest charges or additional fees for overdue payments.

- Currency and Locale: If working internationally, be sure to list the currency for the transaction and consider adding a note specifying the applicable country’s regulations that pertain to payment.

- Electronic Signatures: In many jurisdictions, a signature is not always required for a legal document, but having one could add an additional layer of authenticity, especially for high-value contracts.

By including these key legal elements, you ensure that your billing documents meet regulatory requirements, which can protect both your interests and your client’s. Proper documentation also helps build professionalism and ensures smooth financial transactions.

How to Organize Your Billing Documents for Tax Season

As tax season approaches, it’s crucial to ensure that your financial records are well-organized. Proper organization of your payment requests and supporting documents helps streamline the filing process, reduces the risk of errors, and ensures compliance with tax laws. The goal is to have everything ready for quick access, minimizing stress and preventing last-minute scrambling.

Here are some steps to effectively manage your financial records throughout the year so that preparing for tax season becomes a much simpler task.

Steps to Organize Financial Records

- Maintain a Dedicated Folder: Keep a separate folder, either digital or physical, where all documents related to payment requests are stored. This will allow you to quickly locate everything you need when tax time comes.

- Track Payments and Dates: Ensure that each document includes details about when payments were issued and received. A simple tracking sheet or software can help you monitor all payments and keep track of any outstanding balances.

- Sort by Client or Project: Organize your records by client or project name, as this will make it easier to reference a specific document when needed. You can use subfolders for each client to ensure a neat and clear system.

- Document All Deductions: If applicable, ensure you keep track of any business expenses that are deductible. This includes costs for materials, services, software, or other business-related expenses that may reduce your taxable income.

Helpful Tips for Efficient Organization

- Use Accounting Software: Digital tools can automate many aspects of organizing your documents. These tools help generate reports and keep track of financial transactions, making it easier to generate necessary records for taxes.

- Stay Consistent with Naming: When saving digital documents, use a consistent naming convention, such as including the client name, date, and payment reference number. This will help you locate files more quickly when needed.

- Reconcile Accounts Regularly: Periodically review your records to ensure everything is up to date. This practice prevents any surprises when you start preparing for tax filings.

By following these steps and tips, you can avoid the stress of scrambling for missing documents at the last minute. Proper organization of your records not only makes tax season more manageable but also helps you stay on top of your

Benefits of Digital Billing Documents

In today’s digital age, using electronic documents for financial transactions offers numerous advantages over traditional paper-based methods. These digital solutions streamline the process of generating, sending, and tracking payment requests, making them a valuable tool for businesses and freelancers alike. By adopting modern digital methods, you can improve efficiency, reduce errors, and maintain a more professional image.

Increased Efficiency and Convenience

- Instant Delivery: Digital documents can be sent instantly via email, which eliminates the delays associated with postal mail. This ensures that clients receive their payment requests without unnecessary wait times.

- Automatic Calculations: Many digital platforms allow you to set up automatic calculations for pricing, taxes, and totals, reducing the chances of manual errors and saving valuable time.

- Easy Storage and Access: Storing your documents digitally allows you to access them anytime, from anywhere. You no longer have to worry about losing paper documents or struggling to find them in a cluttered filing system.

Enhanced Professionalism and Accuracy

- Consistency in Format: Digital tools provide professional-looking documents with consistent formatting, which can enhance your brand’s image. Clients will appreciate receiving clear, well-organized payment requests that are easy to read and understand.

- Trackable and Secure: Unlike paper documents, digital records are easily tracked. You can see when they have been sent, read, and even paid. This adds an extra layer of security and accountability to your transactions.

- Less Risk of Human Error: By using automated systems, you reduce the risk of making mistakes, such as calculating totals incorrectly or leaving out key details. This ensures that your billing is accurate and complete every time.

Switching to digital solutions for your payment requests is a smart choice for both efficiency and professionalism. It allows for smoother operations, better organization, and a more reliable system to manage your financial transactions.

Common Mistakes to Avoid on Payment Requests

When preparing financial documents for clients, accuracy and clarity are essential to ensure smooth transactions. Small mistakes can lead to misunderstandings, delayed payments, and even damage to your professional reputation. Here are some common errors to watch out for when creating your payment requests.

1. Incorrect Contact Information

- Missing Details: Always double-check that your contact information, such as your name, email address, and business address, is correct. Incorrect contact details can make it difficult for clients to get in touch with you if there are any issues.

- Outdated Information: Make sure that your contact information is up-to-date, especially if you’ve changed business locations or phone numbers recently.

2. Lack of Clear Descriptions

- Vague Descriptions: Avoid using vague or unclear terms. Be specific about the products or services you provided, including quantities, prices, and other relevant details. This helps clients understand exactly what they’re paying for and can prevent disputes.

- Missing Itemization: If you offer multiple products or services, list each item separately. This helps clients see the breakdown of charges and makes it easier to spot any errors or misunderstandings.

3. Failing to Include Important Dates

- Missing Payment Due Date: Always include a clear due date for the payment. This sets expectations for your client and helps avoid unnecessary delays.

- Incorrect Billing Period: If you’re billing for a specific period of time, ensure the correct start and end dates are listed. This provides clarity on the services rendered and avoids confusion.

4. Not Accounting for Taxes

- Overlooking Tax Rates: Always ensure that applicable taxes are calculated and clearly listed on the document. Failing to do so could result in the client being confused or unwilling to pay.

- Not Including Tax Identification Number: If required by law in your region, include your tax identification number on the payment request to ensure compliance and transparency.

5. Not Double-Checking Calculations

- Calculation Errors: Always double-check your math. Even small errors in total amounts or unit prices can lead to disputes and create confusion with clients.

- Not Including Discounts or Promotions: If you’ve agreed on a discount or promotional price, make sure it’s applied correctly and clearly stated.

By avoiding these common mistakes, you can ensure that your payment requests are professional, clear, and accurate. This will help you build trust with clients and maintain sm

Sending and Managing Invoices Electronically

In the modern business world, sending and managing payment requests digitally has become the standard. This method offers greater efficiency, security, and convenience compared to traditional paper-based methods. With just a few clicks, you can quickly send documents to clients, track their status, and maintain organized records for future reference.

Advantages of Electronic Document Management

- Speed and Efficiency: Sending documents via email or a secure platform ensures faster delivery compared to postal mail. This leads to quicker payments and less waiting time for both parties.

- Cost-Effective: By eliminating printing, paper, and mailing costs, electronic management reduces overhead expenses significantly.

- Organization: Digital files can be stored and categorized in folders, making them easy to retrieve when needed, especially for tax season or financial audits.

Best Practices for Sending Documents Electronically

- Use Secure Platforms: To ensure the privacy and safety of your sensitive financial information, use secure platforms for sending and receiving documents. Services like encrypted email or cloud-based applications offer reliable protection against unauthorized access.

- Track Sent Documents: Always keep track of the documents you send. Platforms with tracking features allow you to see when a document is delivered, opened, and even when a payment is made, helping you stay on top of your financial management.

- Confirm Receipt: Ask clients for confirmation when they receive the payment request, either through a simple acknowledgment email or a read receipt. This ensures no documents are lost in transit.

By adopting electronic methods for sending and managing payment requests, businesses can streamline their processes, reduce delays, and improve overall client satisfaction.

When to Issue Payment Reminders

Issuing payment reminders is a crucial part of managing financial transactions with clients. Sometimes, clients may forget or overlook the due date for their payment. By setting clear guidelines for when to follow up, businesses can maintain cash flow and encourage timely settlements without causing friction in client relationships.

Key Timing for Reminders

- Immediately After the Due Date: If the payment is overdue by a few days, it’s a good idea to send a polite reminder. This could be an email or a phone call, gently nudging the client to process the payment.

- 7-10 Days After the Due Date: For more serious delays, a second reminder should be issued. At this point, you may need to reference the terms of the agreement and emphasize the importance of paying promptly.

- 30 Days After the Due Date: If payment is still not received, a final reminder may be necessary. This communication should be more formal and may include the potential consequences of further delays, such as late fees or legal action.

Best Practices for Sending Reminders

- Be Polite and Professional: Always maintain professionalism in your reminder messages. The tone should be respectful but firm, ensuring the client knows the payment is expected but not making them feel uncomfortable.

- Provide Payment Details:

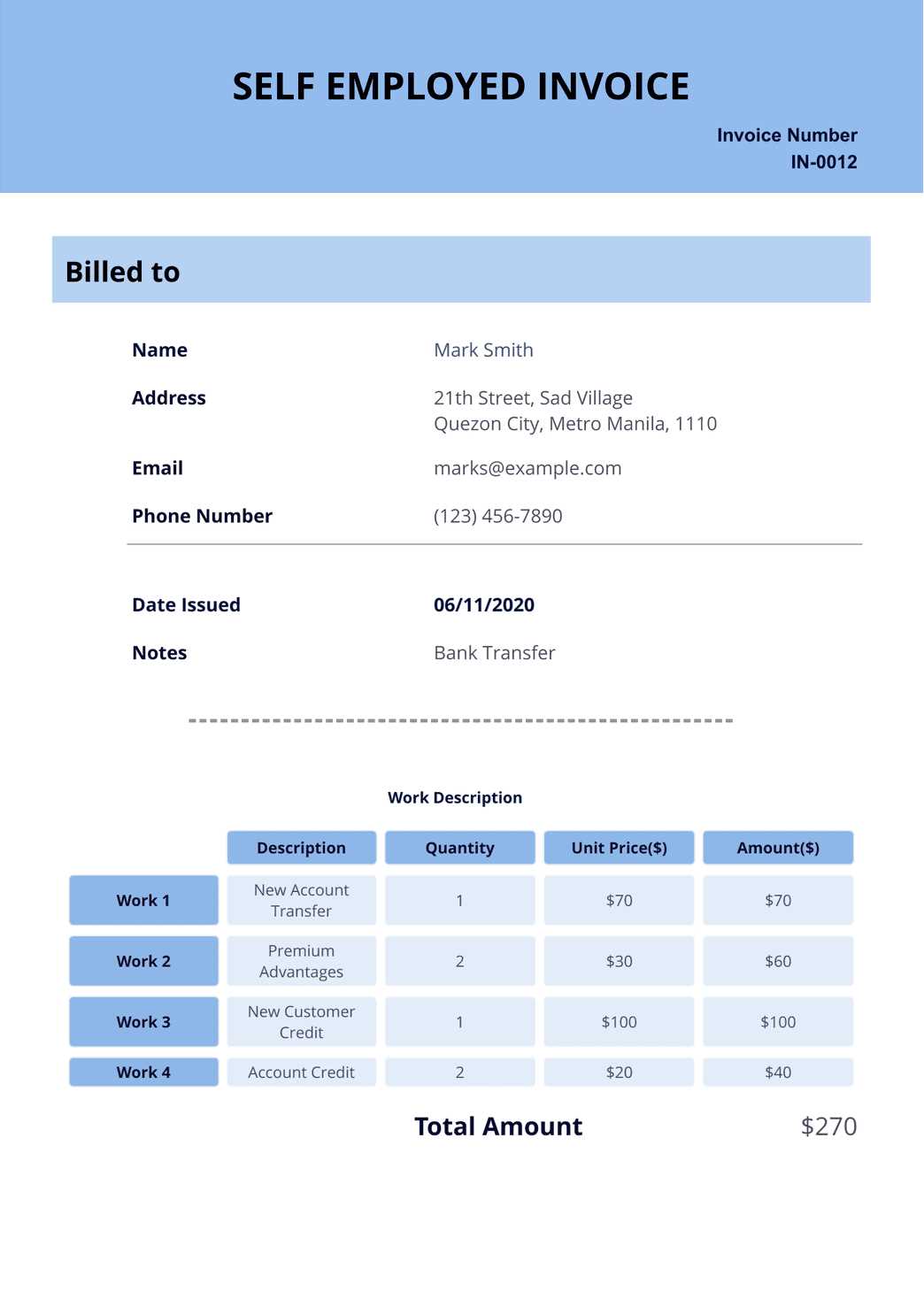

How to Keep Your Invoice Template Professional

Maintaining a professional appearance in your billing documents is essential for building trust with clients. A well-organized and clear document not only makes it easier for clients to understand what they’re paying for, but also reflects positively on your business. By following a few key principles, you can ensure that your billing statements look polished and professional every time.

Key Elements for Professional Documents

- Clear Structure: Ensure the document is easy to read by using clear sections for different pieces of information. Make sure the itemized list, payment terms, and total amount due are clearly separated.

- Branding: Include your business logo, name, and contact information at the top. This reinforces your brand identity and adds a professional touch.

- Consistent Font and Formatting: Use a clean and professional font throughout the document. Avoid overly decorative fonts or inconsistent font sizes that could make the document appear unorganized.

- Proper Alignment: Align all text and figures neatly. This includes aligning dates, amounts, and payment details in a consistent and organized manner.

- Accurate Contact Information: Make sure your contact details are easy to find. This includes your business address, phone number, and email. This will ensure clients can reach you quickly if they have questions or concerns.

Tips to Enhance Professionalism

- Use Professional Language: Keep the tone formal but friendly. Avoid slang or overly casual phrases that may reduce the document’s perceived professionalism.

- Avoid Errors: Proofread carefully for spelling and grammatical errors. Even minor mistakes can undermine the professional appearance of your document.

- Follow Legal and Tax Guidelines: Ensure your document complies with all necessary legal requirements and tax regulations, such as including the correct tax rates or reference numbers if required.

- Be Timely: Issue your document promptly. Sending it out quickly not only helps with cash flow, but also shows that you are organized and reliable.

By keeping your billing statements neat, clear, and professional, you make a lasting impression that helps you build strong client relationships and establishes your business as a trustworthy partner.