Repair Invoice Template Excel for Easy and Professional Billing

For any business that offers repair or maintenance services, managing payments and keeping track of completed jobs is essential for smooth operations. An organized system for documenting transactions ensures both professional client relations and accurate financial records. With the right tools, this process becomes simpler, faster, and more efficient, allowing businesses to focus on delivering quality services.

One of the most effective ways to handle these tasks is through digital documentation that can be easily customized to meet specific business needs. The flexibility of modern spreadsheet programs offers an ideal solution for creating detailed records that streamline financial management. These documents not only allow for precise billing but also support tracking of outstanding balances, work details, and due dates.

Utilizing such systems can significantly reduce the risk of errors and provide a clear overview of all transactions. Customization features make it possible to tailor documents to reflect unique business requirements, including tax calculations, payment schedules, and personalized service descriptions. By adopting this approach, businesses can improve workflow and enhance their professionalism with minimal effort.

How to Use a Repair Invoice Template

Managing financial documentation effectively is key to maintaining transparency and professionalism in any service-based business. With the right digital tool, creating detailed billing records becomes straightforward. This section will guide you through the process of using a customizable document for organizing transaction details and ensuring accurate payment tracking.

First, open the document on your chosen platform, which is designed to allow easy input of job-specific information. Start by entering the client’s details, including their name, contact information, and service address. Next, fill in the specifics of the completed work, such as descriptions of the services provided, materials used, and the time spent on the task.

Once the basic information is entered, move on to entering the costs associated with each aspect of the service, including any applicable taxes or discounts. The system automatically calculates totals, making it easier to generate an accurate final amount due. Additionally, including payment terms and due dates helps maintain clarity and avoid misunderstandings with clients.

After completing the document, review all the information to ensure accuracy. Save or print the file for future reference, or send it directly to your client. With this process, you can ensure that each transaction is well-documented and professionally presented, improving your overall billing efficiency.

Benefits of Excel for Invoice Creation

Using a digital tool to manage billing and payment records brings significant advantages to any business. A flexible platform allows for streamlined processes, customization, and enhanced accuracy. Among the many options available, one of the most powerful and widely used solutions is a spreadsheet program, which offers multiple features designed to simplify financial documentation tasks.

One of the primary advantages of using a spreadsheet program is its customizability. You can easily adjust the layout to suit your specific needs, whether you’re tracking labor costs, material prices, or applying taxes and discounts. This flexibility ensures that the document reflects your business structure and the details of each transaction without unnecessary complexity.

Another key benefit is the automation of calculations. With built-in formulas, you can instantly calculate totals, taxes, and other costs, reducing the likelihood of human error. This not only saves time but also ensures that the final amounts are accurate and consistent, preventing potential issues with clients or accountants.

Additionally, the ability to organize and store data efficiently in a spreadsheet offers long-term advantages. You can maintain a comprehensive record of all transactions, making it easier to track past work, monitor outstanding balances, and generate financial reports when needed. This level of organization is invaluable for businesses that need to stay on top of their financials and ensure smooth cash flow.

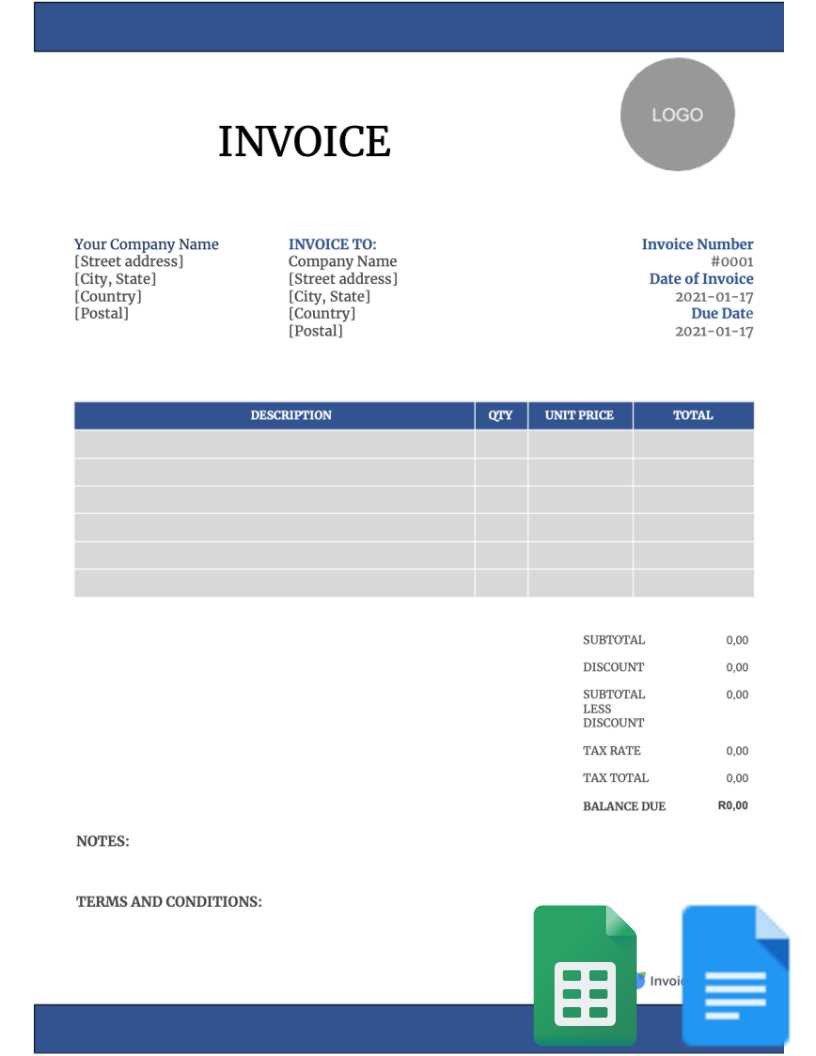

Customizing Your Repair Invoice Template

Tailoring your financial documents to fit your business needs is a key part of ensuring accurate billing and presenting a professional image. Customization allows you to add specific details that reflect your services, streamline processes, and ensure all essential information is included. Here’s how to personalize your document for maximum efficiency and clarity.

Adjusting Layout and Design

The layout of your document plays an important role in making it clear and easy for clients to understand. You can modify the design to match your brand or add extra fields for specialized services. Consider the following customization options:

- Header Section: Include your company logo, contact details, and a title that clearly states the purpose of the document.

- Itemized Services: Ensure there is a section that lists each service or product provided, along with individual prices, quantities, and totals.

- Payment Information: Add your payment terms, accepted methods, and due dates for clarity.

Adding Specific Fields and Calculations

For greater accuracy and ease, you can also add custom fields and calculations tailored to your needs. This feature allows you to quickly calculate totals, taxes, discounts, and even late fees. Some useful options include:

- Service Charges: Define fixed or variable charges that are specific to each task or product.

- Discounts and Special Offers: Implement automatic discount calculations based on predefined conditions.

- Tax Calculation: Include a formula that automatically calculates applicable taxes based on the service type or location.

By customizing these sections, you can make sure each document is tailored to your business needs, increasing both efficiency and professionalism in your client transactions.

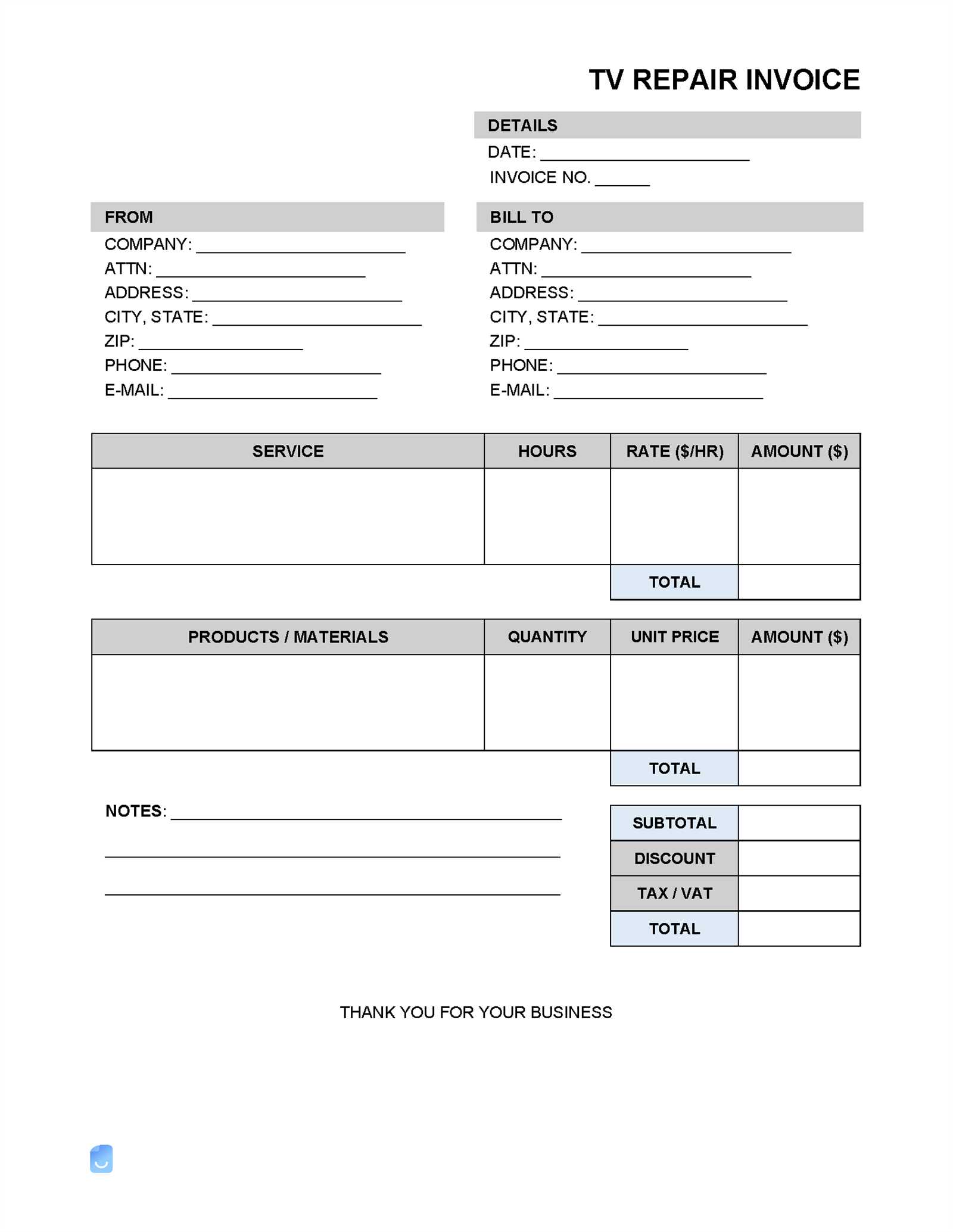

Essential Fields in a Repair Invoice

Creating a comprehensive and clear document for services rendered is crucial to ensure clients understand the details of their charges. To make sure all necessary information is included, certain fields must be present. These fields help outline the scope of the work, calculate the total cost, and ensure smooth communication between the service provider and the client.

Key Information for Client and Service Details

The first section of the document should cover both client and service-specific information. This ensures transparency and allows for easy tracking of each transaction. Include the following:

- Client Information: Name, address, phone number, and email.

- Service Provider Details: Your company name, contact information, and any relevant registration or license numbers.

- Service Description: A clear breakdown of the work done, including individual tasks or materials used.

- Job Number or Reference: A unique identifier for each transaction, useful for future reference and tracking.

Calculations and Payment Terms

The next important section involves the financial breakdown of the services provided. Accurate calculations and clear payment instructions help avoid confusion and ensure prompt payment. Include these essential fields:

- Unit Costs and Quantities: List the individual cost of services or parts used, along with the quantity or hours worked.

- Subtotal: The total cost of services before tax or discounts.

- Tax and Discounts: Clearly outline any applicable taxes or discounts to ensure clients understand the final price.

- Grand Total: The final amount due, including taxes, discounts, and any other charges.

- Payment Terms: Specify due dates, acceptable payment methods, and any late fees or interest on overdue payments.

Including these essential fields helps to create a professional and easy-to-understand document, ensuring that both the service provider and client are on the same page regarding charges and payment expectations.

Why Choose Excel for Invoicing

When it comes to managing financial documentation, many businesses rely on versatile tools that allow for customization, automation, and easy tracking. One such tool is a popular spreadsheet program that offers a wealth of features to simplify the process of creating and managing billing records. This platform is widely used because of its accessibility, flexibility, and ability to streamline the entire documentation process.

Customization and Flexibility

One of the main advantages of using a spreadsheet program is its ability to be fully customized to fit the unique needs of any business. Whether you’re working with varying service rates, complex pricing models, or specific tax structures, this tool allows you to tailor each document to your preferences. Key features such as adjustable fields, tables, and cell formatting enable you to create a document that reflects your branding while capturing all necessary details accurately.

Efficiency and Automation

Another compelling reason to choose a spreadsheet program is the built-in automation that speeds up the process of calculating totals, taxes, discounts, and other important values. With just a few formulas, you can instantly calculate the total amount due, ensuring that no manual calculations are required. This reduces the chance of human error and guarantees that your billing documents are both accurate and consistent, saving valuable time for your business.

Additionally, the ability to save, store, and easily update these documents in a digital format makes it easier to manage past transactions, track outstanding payments, and create financial reports. These benefits combine to offer a powerful tool that increases productivity while maintaining a high level of accuracy and professionalism.

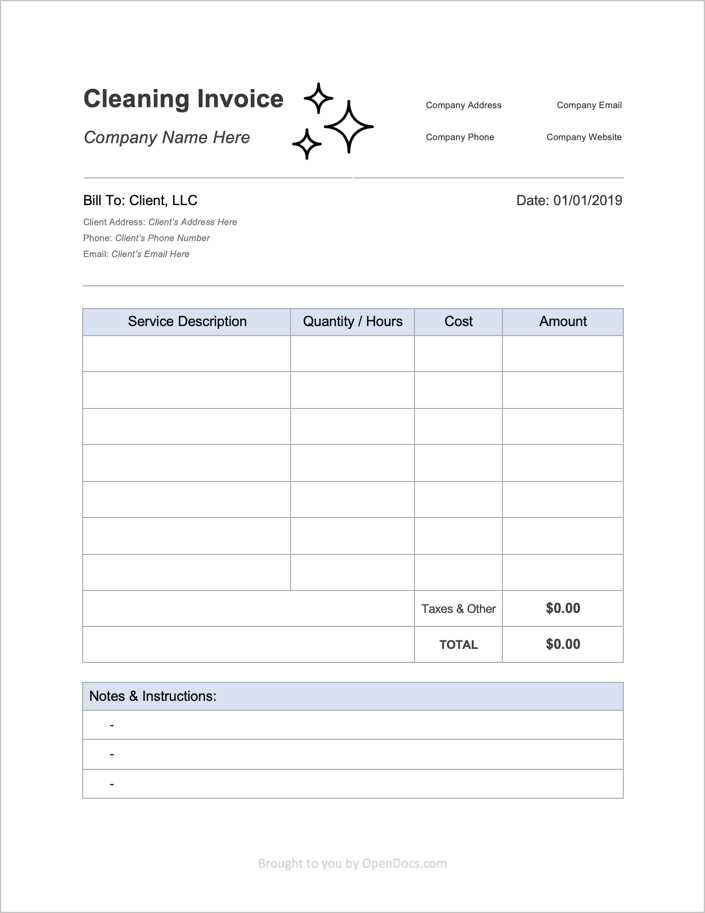

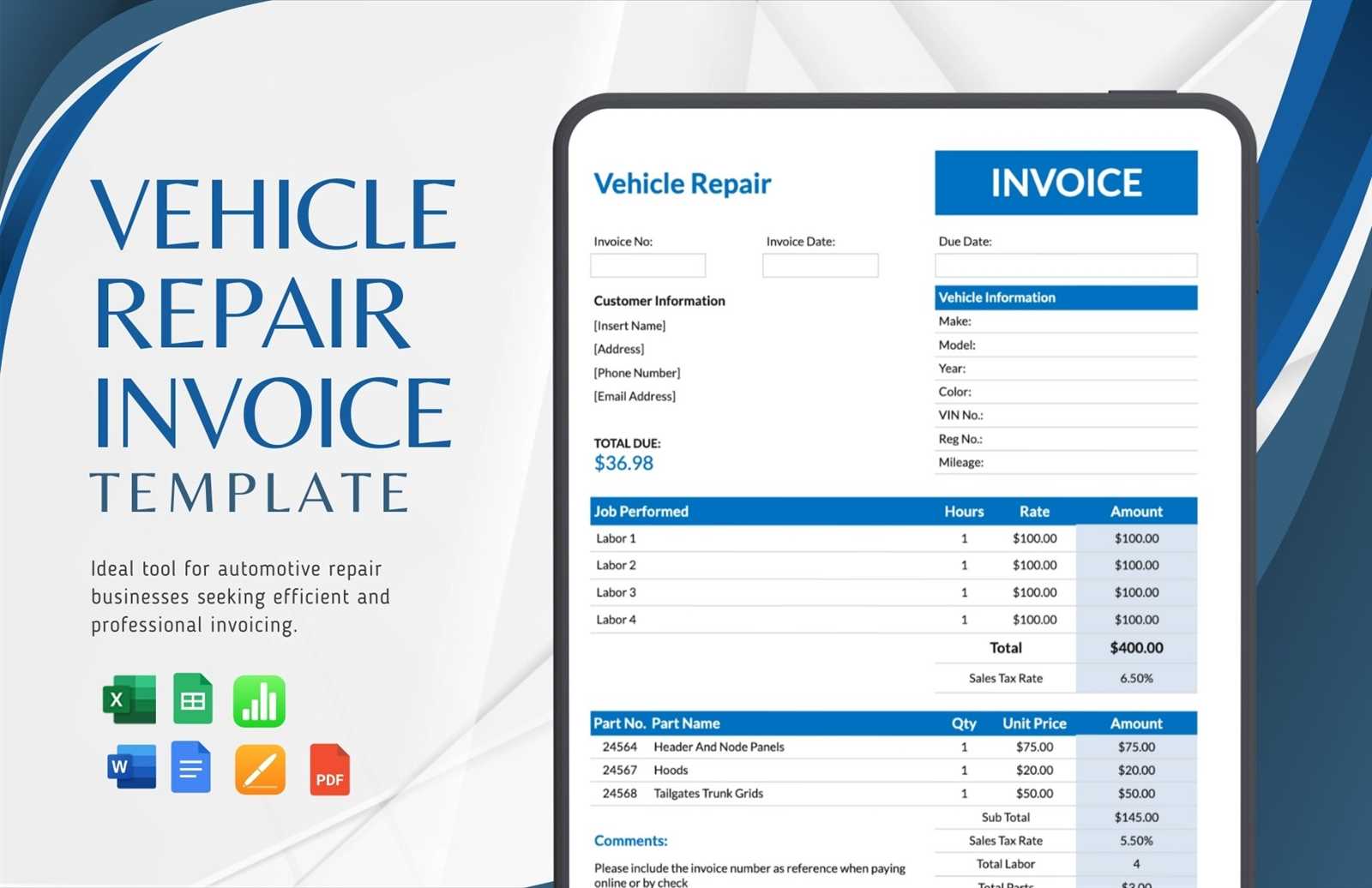

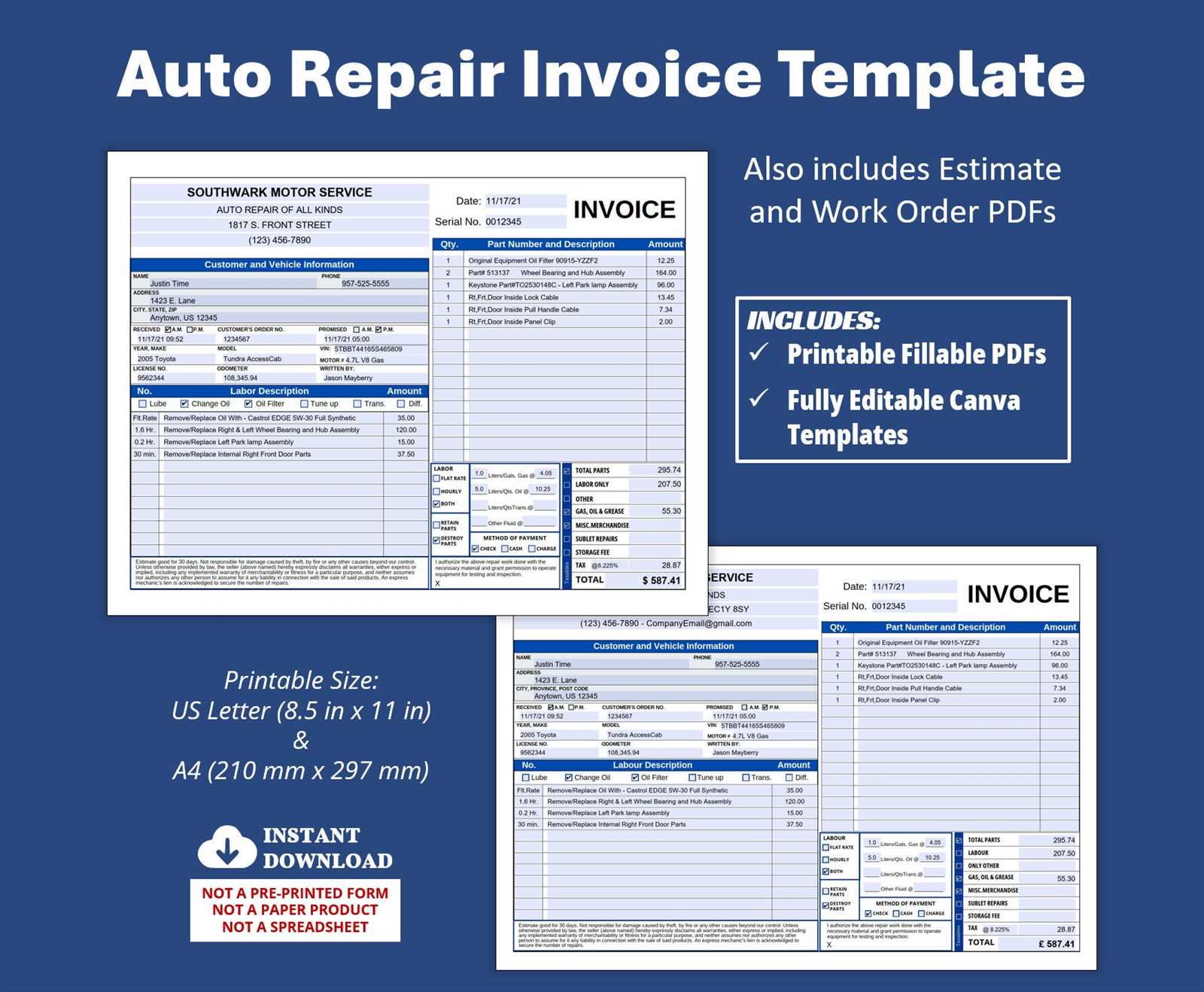

Free Repair Invoice Templates to Download

Finding pre-designed documents that you can customize for your own business needs can save you valuable time. With various free options available online, you can easily download ready-made files that fit your service and billing structure. These documents allow you to quickly generate professional, accurate records for completed tasks without needing to start from scratch.

Where to Find Free Downloadable Documents

There are numerous online resources that offer free files for businesses looking to streamline their billing process. Websites that specialize in business forms and documentation often provide ready-to-use solutions that can be tailored to specific industries. Some platforms even allow you to preview templates before downloading them, ensuring they meet your specific requirements. Consider these trusted sources:

- Online Business Platforms: Many accounting and business solution websites provide free downloadable files as part of their resource section.

- Template Websites: Numerous websites offer customizable business documents with simple and easy-to-follow layouts.

- Google Docs or Microsoft Office Templates: Both platforms offer pre-made files that you can modify based on your business needs.

How to Customize the Files

Once you’ve downloaded a document, the next step is customization. You can adjust various fields to include your company’s branding, such as logos, business information, and unique service details. Additionally, many files come with formulas pre-programmed for calculating totals, taxes, and discounts, making it even easier to generate accurate billing documents in just a few steps. Customization options may include:

- Client and Service Information: Add personalized details for each customer and job description.

- Tax and Payment Terms: Update applicable rates and payment due dates based on your business model.

- Discounts or Special Offers: Adjust pricing fields to reflect any promotions or discounts available.

By using these free files, you can ensure that your documents are both professional and tailored to your specific needs, allowing you to focus on providing quality services to your clients.

Adding Taxes and Discounts in Excel

When managing financial records, it’s essential to ensure that both taxes and discounts are applied correctly to avoid errors and maintain accuracy. By using the right formulas and settings, you can easily automate the process of calculating these adjustments, saving time and reducing the chance of manual mistakes. This section will show you how to incorporate both taxes and discounts into your financial documents seamlessly.

Adding Tax Calculations

To apply taxes to your billing document, you can use simple formulas that automatically calculate the tax amount based on the total price of services or products. Here’s how you can set it up:

- Step 1: Identify the total amount before tax. This is typically the sum of all services or items provided.

- Step 2: Create a new cell to calculate the tax by multiplying the total by the applicable tax rate. For example, if your tax rate is 10%, use the formula

=TotalAmount*0.10. - Step 3: Add the calculated tax amount to the subtotal to get the total amount due, including tax.

By setting up this automated calculation, the document will update the total every time you adjust the price, ensuring that tax is applied correctly at all times.

Applying Discounts

Discounts can be applied in a similar way by using formulas that adjust the price based on a percentage reduction. Here’s how to add a discount:

- Step 1: Identify the discount percentage you wish to apply (e.g., 15% off).

- Step 2: In a new cell, calculate the discount by multiplying the total amount by the discount percentage. For example, use

=TotalAmount*0.15for a 15% discount. - Step 3: Subtract the discount from the total to calculate the final amount due after the discount has been applied.

Like with tax calculations, the discount amount will automatically update when you modify the total, making it easy to maintain accuracy and keep track of savings offered to customers.

By using these simple formulas, you can easily manage taxes and discounts in your financial documents, making the billing process smoother and more reliable for both your business and your clients.

How to Track Payments with Excel

Effective payment tracking is crucial for maintaining a healthy cash flow and ensuring that all transactions are properly documented. Using a digital spreadsheet allows you to efficiently monitor received payments, outstanding balances, and due dates, helping you stay organized and avoid missed payments. Here’s how you can use a spreadsheet to keep track of your payments with ease.

Setting Up Payment Tracking Columns

To start tracking payments, create a few essential columns in your document. These columns will help you record all the necessary details about each transaction. Consider adding the following:

- Invoice Number: Assign a unique reference number to each transaction for easy identification and record-keeping.

- Client Name: Include the name of the customer for whom the service was provided.

- Amount Due: The total amount owed by the client, including any applicable taxes or fees.

- Amount Paid: The amount the client has paid towards the outstanding balance.

- Payment Date: The date on which the payment was made.

- Outstanding Balance: The remaining amount due, which can be calculated automatically using a formula.

Using Formulas for Automated Tracking

One of the benefits of using a spreadsheet is the ability to automate calculations. By using simple formulas, you can automatically calculate the outstanding balance and update your records as payments are made. Here’s how to set it up:

- Step 1: In the “Amount Paid” column, input the payment amount received from the client.

- Step 2: In the “Outstanding Balance” column, use the formula

=AmountDue-AmountPaidto calculate the remaining balance. - Step 3: As payments are recorded, the “Outstanding Balance” will update automatically, giving you an up-to-date view of the payment status for each transaction.

Tracking Payment Status

To easily monitor which payments are still pending or fully paid, you can use conditional formatting to color-code the rows based on the payment status. For example:

- Paid: If the amount paid equals the amount due, highlight the row in green.

- Pending: If there is still an outstanding balance, highlight the row in yellow or red.

This visual system makes it easy to spot overdue payments and stay on top of your finances.

By using a spreadsheet to track payments, you can keep a detailed and accurate record of all financial transactions, improving both your organizational efficiency

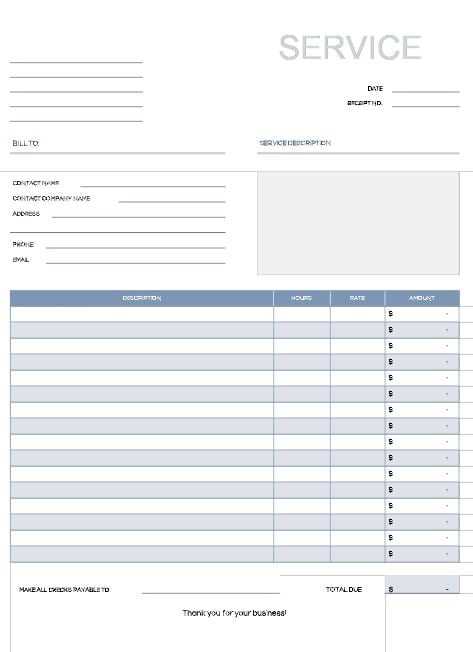

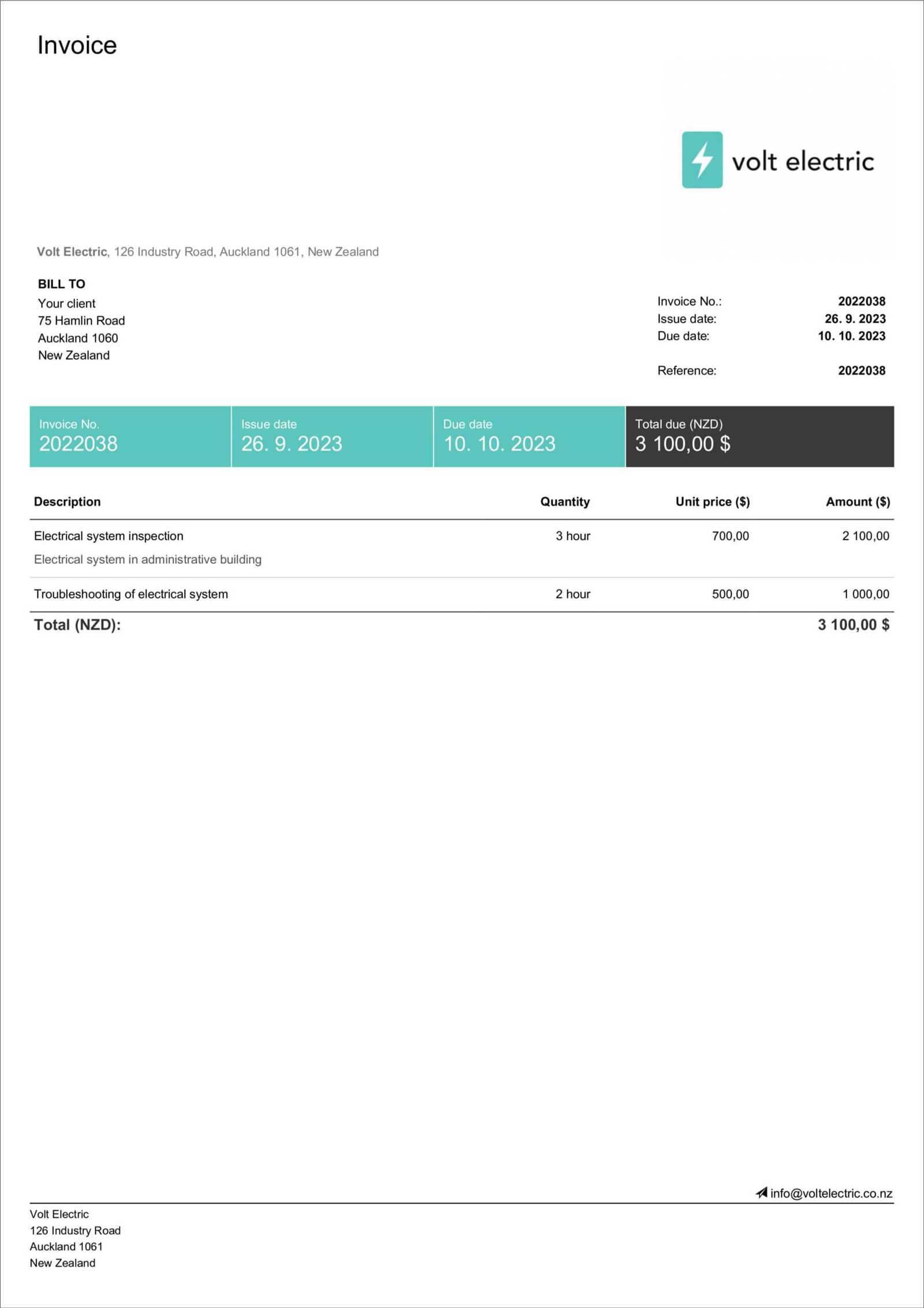

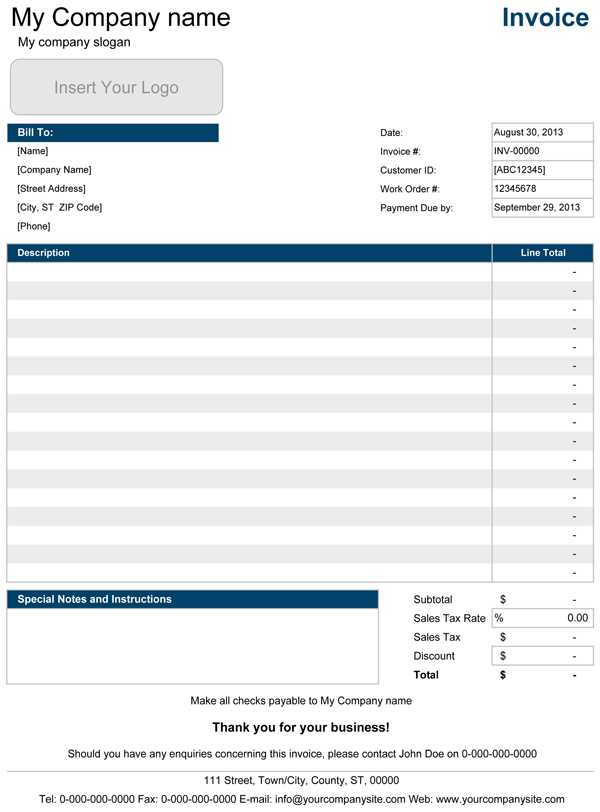

Creating a Professional Invoice Design

Having a well-designed document for billing is essential for presenting a professional image to your clients. A clean, organized layout not only makes it easier for customers to understand the charges but also enhances the credibility of your business. A visually appealing document that is easy to navigate can help foster trust and improve the overall customer experience.

Key Design Elements for a Professional Look

When designing your billing document, it’s important to focus on key elements that contribute to a polished and professional appearance. Here are some essential components to include:

- Company Branding: Include your company logo, name, and contact information at the top of the document. This gives your document a personalized touch and ensures clients know exactly who they are working with.

- Clear Section Headers: Organize your document into distinct sections, such as services rendered, payment details, and terms. Use bold or larger font sizes to distinguish each section for easy readability.

- Consistent Font and Layout: Choose a simple, professional font like Arial or Times New Roman. Avoid using too many different font types or sizes, as this can make the document look cluttered and unprofessional.

- Whitespace: Leave adequate space between sections and around text to avoid a cramped, overwhelming look. Proper use of whitespace helps the document feel clean and organized.

Design Tips for Enhanced Readability

In addition to the essential elements, there are several design tips you can use to ensure your document is not only professional but also easy to read and understand:

- Use Tables for Pricing Information: A well-organized table to list the services provided, their costs, and any applicable taxes makes it easier for clients to understand the breakdown of charges.

- Highlight Important Information: Bold or use different colors to highlight key details, such as the total amount due, payment due dates, or late fees. This makes it easy for clients to find critical information at a glance.

- Incorporate a Footer: Including a footer with additional business information, payment terms, or a reminder for clients to make payments can help complete the document and reinforce professionalism.

By following these design guidelines, you can create a professional and visually appealing document that not only looks great but also functions well to clearly communicate important payment information to your clients.

Repair Invoice Template for Small Businesses

For small business owners, keeping track of financial transactions can be challenging, especially when it comes to billing clients. A well-structured document for recording services provided is essential for maintaining organized financial records and ensuring timely payments. This section will guide you through creating an effective billing document that suits the needs of small businesses.

Small businesses often require flexibility when managing their billing process. A customizable document allows for easy updates, whether you’re offering different services, using varying prices, or needing specific payment terms for different clients. Below is an example of a simple, easy-to-use design for a small business billing document:

| Service Description | Unit Cost | Quantity | Total Cost |

|---|---|---|---|

| Service 1 | $50.00 | 2 | $100.00 |

| Service 2 | $30.00 | 3 | $90.00 |

| Total | $190.00 | ||

This simple structure includes key information such as service descriptions, costs, and quantities, as well as the total amount due. You can modify or expand the table based on your specific business needs, adding fields for taxes, discounts, or additional notes.

With this straightforward format, small business owners can easily manage their financial documentation, ensuring that clients are billed accurately and professionally while maintaining a streamlined process for internal record-keeping.

How to Include Payment Terms in Invoices

Clear and concise payment terms are crucial for ensuring that both parties in a transaction are aware of the expectations and deadlines. Including these terms in your financial documents helps avoid misunderstandings and late payments. This section outlines how to effectively add payment conditions to your billing records, ensuring smooth transactions and maintaining good client relationships.

Essential Elements of Payment Terms

Payment terms should provide all necessary details regarding the timing, methods, and conditions for payment. The following are some key elements that should be included:

- Due Date: Specify when the payment is expected. This can be a specific date (e.g., “Due by May 1, 2024”) or a time frame (e.g., “Due within 30 days of service completion”).

- Accepted Payment Methods: Clearly list all methods of payment that you accept, such as credit cards, bank transfers, checks, or online payment platforms.

- Late Payment Fees: Indicate any penalties for late payments, such as a flat fee or a percentage of the total amount due for every day or week the payment is delayed.

- Early Payment Discounts: If you offer discounts for early payments, such as “2% off if paid within 10 days,” include this in the terms to encourage timely payments.

Formatting Payment Terms for Clarity

To ensure that your payment terms are easily understood, be sure to present them in a clear and organized way. Here are some tips for formatting:

- Use Bullet Points: List the payment conditions in bullet points or a numbered list, making it easier for the client to scan the terms.

- Highlight Key Information: Bold or underline important details, such as the due date or late fee structure, to make them stand out.

- Place Payment Terms Prominently: Position the payment terms towards the bottom of the document or in a dedicated section to ensure that they are easy to locate but not buried in the middle of the content.

By including detailed and clearly formatted payment terms, you help set expectations upfront, reducing confusion and improving the likelihood of on-time payments from your clients.

Common Mistakes to Avoid in Invoices

Billing documents are essential for maintaining financial order in any business. However, making mistakes in these records can lead to confusion, delayed payments, or even lost revenue. Being aware of common pitfalls can help ensure that your documents are accurate, professional, and clear. In this section, we will highlight some of the most frequent errors and provide tips on how to avoid them.

Incorrect or Missing Client Details

One of the most common mistakes in billing records is failing to include accurate client information. Whether it’s the wrong contact details or an incomplete address, missing or incorrect information can cause confusion and delay payments. Always double-check the client’s name, address, and other relevant details before finalizing the document.

- Client Name: Ensure the correct name or company name is listed to avoid sending the document to the wrong person or business.

- Address and Contact Information: Verify the client’s billing address and phone number or email address to avoid sending reminders to the wrong place.

Calculation Errors

Another common mistake is miscalculating totals, taxes, or discounts. These errors can result in clients being overcharged or undercharged, leading to confusion and potentially strained relationships. It’s important to double-check all figures and use automatic calculations when possible to ensure accuracy.

- Subtotals and Total Amount: Carefully review your calculations for each line item and the final total to ensure there are no discrepancies.

- Tax and Discount Calculations: Apply the correct tax rate and any applicable discounts accurately, using formulas to automate these calculations whenever possible.

Failure to Include Payment Terms

Another frequent oversight is not specifying the payment terms clearly. Clients need to know when the payment is due, what methods of payment are accepted, and any penalties for late payments. By leaving out this important information, you risk delayed payments and confusion on both sides.

- Due Date: Clearly state the due date or payment period to avoid any misunderstandings.

- Accepted Payment Methods: Indicate the payment methods you accept, whether it’s credit cards, bank transfers, or other forms of payment.

- Late Fees or Discounts: If you have penalties for late payments or offer early payment discounts, make sure they are clearly mentioned.

By avoiding these common mistakes, you can ensure that your billing documents are professional, accurate, and clear, leading to smoother transactions and

How to Manage Multiple Clients in Excel

Managing multiple clients efficiently requires a well-organized system to keep track of services provided, payments received, and outstanding balances. Using a digital spreadsheet allows you to store and update client information easily, providing a clear overview of your business’s transactions. In this section, we will discuss how to create a structure that allows you to manage multiple clients in a simple and effective way.

By organizing your client data into a structured format, you can quickly access any relevant information. Below is an example of how to set up a system for managing client records, ensuring that all necessary details are easy to find and track.

| Client Name | Service Description | Amount Due | Amount Paid | Outstanding Balance | Payment Status |

|---|---|---|---|---|---|

| Client A | Service 1 | $100.00 | $50.00 | $50.00 | Pending |

| Client B | Service 2 | $200.00 | $200.00 | $0.00 | Paid |

| Client C | Service 3 | $150.00 | $75.00 | $75.00 | Pending |

This table format allows you to track all the essential details for each client. You can add more columns as needed, such as dates, payment methods, or notes about specific services provided. The key is to keep the data clear and accessible.

Additionally

Automating Invoice Calculations in Excel

Automating calculations in your billing documents can save time, reduce errors, and ensure consistency across multiple transactions. By setting up automated formulas, you can quickly calculate totals, taxes, discounts, and other essential figures without having to manually update each entry. This method is especially useful for businesses that handle a large volume of transactions and need a reliable way to maintain accurate financial records.

In this section, we will explore how to automate key calculations within a billing document, allowing for more efficient management of financial data and less room for human error. With the right formulas, you can streamline the process and focus more on other important aspects of your business.

Basic Calculations with Formulas

One of the most fundamental tasks in creating a billing document is calculating totals. Using simple formulas, you can automate these basic calculations:

- Subtotal: To calculate the subtotal, multiply the unit price by the quantity of each item. You can use the formula

=B2*C2, where B2 is the unit price and C2 is the quantity. - Total Amount: To find the total for all items, sum the individual subtotals. Use the formula

=SUM(D2:D10), where D2 to D10 represents the subtotal column.

Applying Taxes and Discounts

Taxes and discounts are common elements in billing documents, and automating their application ensures accurate calculations every time. Here’s how you can handle these:

- Tax Calculation: To apply tax, you can multiply the subtotal by the applicable tax rate. For example, use the formula

=D2*0.08to calculate an 8% tax on the subtotal in cell D2. - Discount Application: If you offer a discount, simply multiply the total amount by the discount rate. For a 10% discount, use

=D2*0.1and subtract the result from the total.

Final Total Calculation

Once the tax and discounts are applied, you can automate the calculation of the final amount due. The formula would look something like this: =D2 + E2 - F2, where D2 is the subtotal, E2 is the tax, and F2 is the discount. This ensures that your final total is automatically updated whenever any of the preceding numbers change.

By setting up these simple formulas, you eliminate the need for manual calculations, reduce errors, and ensure that your bill

Integrating Repair Invoices with Accounting Software

Integrating your billing documents with accounting software can greatly enhance the efficiency and accuracy of your financial management. By synchronizing billing data with accounting systems, you can automate the flow of information, reduce manual data entry, and ensure that your financial records are always up to date. This integration helps streamline operations, saving you time and effort while improving the accuracy of your accounting processes.

In this section, we will explore how to connect your billing documents with accounting software, allowing for seamless data transfer and better financial oversight. Below is an example of how you might structure the integration process.

Steps for Integration

- Choose Compatible Software: Ensure that your accounting software supports integration with the tools you are using for your billing records. Many popular accounting platforms like QuickBooks, Xero, and FreshBooks offer built-in features for importing financial data from spreadsheets or other tools.

- Exporting Data: Most accounting software allows you to import data from spreadsheets. This can typically be done by saving your billing records in a compatible format, such as CSV, which the software can then read and process.

- Map Fields: When exporting data, it’s important to map the fields correctly. For example, the “client name” field in your billing document should match the “customer name” field in the accounting software to ensure accurate data transfer.

Example of Exporting Data

Here’s an example of how you might structure your data in a table format to prepare for export into an accounting system:

| Client Name | Service Provided | Total Amount | Payment Status | Due Date |

|---|---|---|---|---|

| Client A | Service 1 | $150.00 | Paid | 2024-12-01 |