UK Export Invoice Template for International Transactions

When conducting cross-border transactions, having a well-structured and clear document to accompany goods and services is essential. These documents not only provide necessary details about the products being shipped but also help ensure smooth processing through customs and payment systems. A carefully crafted document plays a vital role in avoiding delays and potential misunderstandings during international exchanges.

Businesses that engage in overseas trade need reliable documentation to guarantee accuracy and compliance with various legal and financial requirements. From detailing product descriptions to specifying payment terms, the right approach can significantly improve operational efficiency. A standardized format ensures consistency and helps businesses meet both domestic and international expectations.

Designing a document that fulfills all legal obligations while also streamlining communication between parties can be a complex task. It involves understanding what information is necessary, how to present it clearly, and ensuring that it aligns with trade regulations in different regions. The following guide will help you understand how to create the perfect document for your international transactions, making it easier to manage logistics, payments, and compliance with customs authorities.

UK Export Invoice Template Overview

When conducting international transactions, a proper document is essential to ensure clarity and compliance between parties. This document serves as a formal record of the goods or services being traded, providing both the buyer and the seller with the necessary details for payment and customs purposes. A well-structured format can simplify the process, reducing the risk of errors and misunderstandings.

For UK businesses engaged in global trade, this document is not just a formality but a key element in managing cross-border deals. It outlines critical information, such as product descriptions, pricing, payment terms, and delivery specifics, all of which are crucial for smooth business operations. Having a standardized structure helps ensure that all relevant data is included and easily accessible for both parties.

Designing this document correctly also ensures that it meets the legal and regulatory requirements of both the UK and the destination country. It is vital that the format adheres to customs and financial regulations, ensuring that shipments are processed without delays. The following section provides a detailed look at what such a document should contain and how it can be tailored to suit your business needs.

Understanding the Importance of Export Invoices

In any international transaction, having a well-prepared document that accurately reflects the details of the goods or services being exchanged is crucial. This document serves as a formal record of the transaction, ensuring that both parties are aligned on the terms and conditions of the deal. It provides essential information that facilitates payment processing, shipping, and customs clearance, making it a key element in global trade.

Without a proper document, businesses risk facing delays, disputes, or even fines, as it becomes difficult to track payments or comply with import-export regulations. By providing a clear and structured outline of the trade, such a document serves as both a receipt and an agreement, giving both the buyer and seller the security they need to move forward with the transaction.

Moreover, the document is instrumental in protecting both parties’ interests. It not only ensures that payment terms and product specifications are agreed upon but also offers a way to resolve potential conflicts should they arise. Understanding its role in the transaction process helps businesses streamline their operations, reduce errors, and improve their reputation in the global marketplace.

Key Elements of an Export Invoice

When preparing a document for international trade, it’s essential to include specific information that ensures clarity and compliance with legal and financial requirements. A well-structured document provides both the buyer and the seller with all the necessary details to facilitate smooth transactions, clear communication, and proper record-keeping.

Basic Information

- Seller and Buyer Details: Full names, addresses, and contact information of both parties involved in the transaction.

- Transaction Reference: A unique number or code that helps both parties track the deal easily.

- Date of Issue: The date when the document is generated and sent to the buyer.

Product and Financial Information

- Product Descriptions: A detailed list of the items being sold, including quantity, unit price, and total value.

- Payment Terms: Information about when and how the payment should be made, including due dates and any late fees.

- Shipping Terms: Shipping methods, delivery times, and costs should be clearly outlined to avoid any confusion.

- Currency and Payment Amount: The agreed-upon currency and the total amount to be paid.

Including these key elements ensures that the document serves as a comprehensive record of the transaction, protecting both parties in the event of disputes or misunderstandings. Properly documenting every aspect of the sale helps streamline the payment and delivery process, making the entire transaction more efficient and transparent.

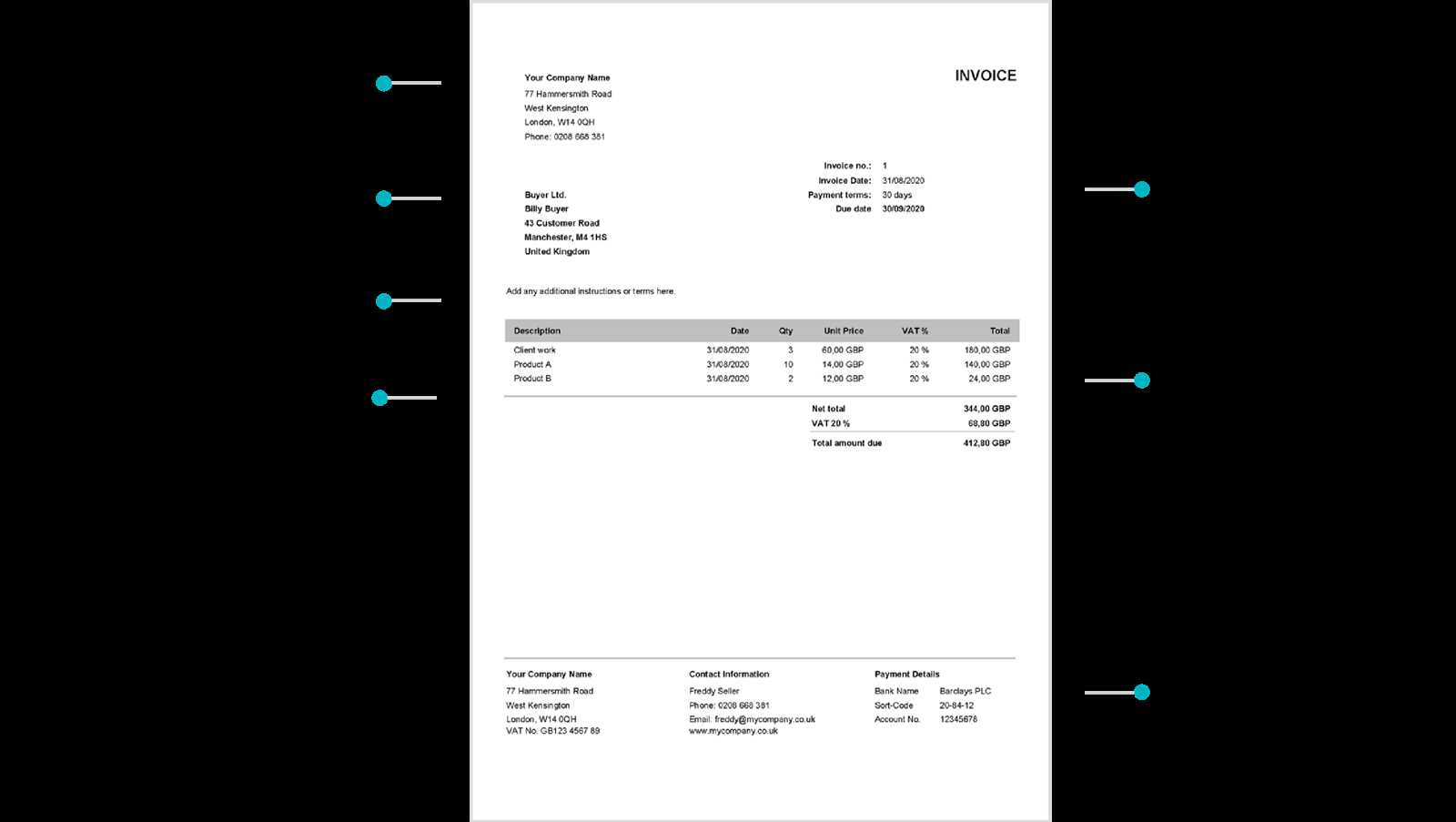

How to Create a UK Export Invoice

Creating a comprehensive document for international transactions is essential for smooth business operations. The process involves gathering all necessary details about the goods or services being exchanged, specifying terms of sale, and ensuring compliance with both UK regulations and those of the destination country. Below are the key steps for creating a professional and accurate document.

Step-by-Step Process

- Gather Essential Information: Before you begin drafting, collect all details about the buyer, seller, products, and shipping terms.

- Choose a Clear Structure: Ensure that your document includes distinct sections such as product descriptions, prices, and payment instructions.

- Specify Payment Terms: Clearly state the payment method, due date, and any applicable late fees or discounts.

- Include Shipping Details: Provide comprehensive information on delivery terms, methods, and expected arrival times.

- Double-Check for Accuracy: Verify that all the information is correct and matches the agreed-upon terms before finalizing the document.

Formatting Tips

- Professional Layout: Use a clean and consistent design with clearly defined sections for easy readability.

- Legal and Regulatory Compliance: Ensure the document includes necessary legal statements and complies with UK trade laws and international requirements.

- Include a Unique Reference Number: This helps both parties easily track and refer to the transaction.

By following these steps, you can create a reliable and detailed document that meets both your business needs and legal obligations. A well-crafted document enhances professionalism and helps avoid potential issues with payment or delivery during international transactions.

Common Mistakes in Export Invoicing

In international transactions, errors in the formal documents can lead to delays, disputes, and complications with payment or customs clearance. Many businesses, especially those new to global trade, may overlook certain details or misunderstand the requirements of these documents. It’s crucial to be aware of the most common mistakes to avoid potential issues that can affect both the efficiency and legality of the transaction.

One of the most frequent mistakes is failing to include all the necessary information. Omitting key details such as the buyer’s contact information, correct product descriptions, or agreed-upon payment terms can lead to confusion and disputes. Inaccurate or incomplete data makes it harder to process payments or shipments, which can delay the entire transaction process.

Another common error is improper formatting or lack of structure in the document. Without clear organization, it becomes difficult for the buyer, seller, or customs authorities to interpret the information quickly and correctly. A poorly organized document can lead to misunderstandings about the terms of sale, shipping methods, and payment expectations.

Other Common Mistakes

- Incorrect Payment Terms: Failing to clearly specify payment methods, due dates, and other relevant conditions can cause confusion and delays.

- Missing Tax or Duty Information: Not including applicable taxes, duties, or shipping costs can create issues with compliance, especially when dealing with international regulations.

- Inconsistent Currency Usage: Using different currencies or failing to specify the currency in which the payment is expected can lead to discrepancies in the agreed amounts.

- Failure to Track the Transaction: Not including a unique reference number makes it more difficult for both parties to keep track of the sale, which can create problems when revisiting the transaction later.

By recognizing these common pitfalls and ensuring all information is accurate and properly formatted, businesses can avoid unnecessary delays and complications in international trade, making the entire process smoother and more efficient.

Legal Requirements for UK Export Invoices

When preparing documents for international transactions, it’s essential to ensure that they comply with both UK laws and the regulations of the destination country. These legal requirements help businesses avoid complications with customs, taxes, and payment processing. Understanding the key legal aspects of creating such documents is crucial for maintaining smooth trade operations and ensuring that all transactions are fully compliant with applicable regulations.

Required Information

- Seller and Buyer Details: The names, addresses, and contact information of both the seller and the buyer must be included in the document. This ensures clear identification of both parties in case of any disputes or clarifications.

- Transaction Reference: A unique reference number or code is required to identify the transaction. This helps with tracking and verifying the deal, particularly when dealing with multiple sales or shipments.

- Product Descriptions: A detailed and accurate description of the products being sold, including their quantity, price, and any applicable discounts or terms, is essential for both the buyer and customs authorities.

Tax and Customs Requirements

- VAT and Tax Information: For UK-based businesses, it’s important to include information on VAT and other applicable taxes. If the goods are exempt or zero-rated, this must be clearly stated to ensure compliance with UK tax laws.

- Customs Declaration: The document should include any necessary customs codes or declarations required by the UK and the destination country. These codes help customs officials classify the goods for the correct tariffs and duties.

- Currency and Payment Terms: Clearly state the currency in which payment is due, as well as the agreed-upon payment method and terms. This ensures that both parties understand the financial expectations and helps avoid disputes over currency exchange or payment delays.

By ensuring these legal elements are correctly included, businesses can avoid legal complications, prevent delays, and maintain trust with their international partners. Understanding the legal requirements for such documents is key to successful global trade.

Using Export Invoices for Customs Clearance

When conducting international trade, it is essential to provide detailed documentation to ensure smooth passage through customs. Properly structured documents not only facilitate the movement of goods but also ensure compliance with the regulations of both the UK and the destination country. These documents are used by customs authorities to verify the legitimacy and details of the transaction, allowing goods to be cleared for import or export.

Accurate and complete records are critical for customs clearance, as missing or incorrect details can lead to delays, fines, or even the rejection of goods. The document must provide all necessary information that customs authorities need to assess the shipment and apply the correct duties, taxes, and tariffs. Below are some key elements that need to be included for smooth clearance:

- Detailed Product Description: A precise and thorough description of the goods being shipped, including quantity, value, and type, is essential for customs officers to classify the shipment properly.

- HS Code and Customs Classification: A Harmonized System (HS) code is used globally to categorize products for customs purposes. Including this code helps speed up the clearance process and ensures the correct duty rates are applied.

- Transaction and Shipping Information: The document should also contain clear information about the buyer and seller, shipment methods, delivery terms, and payment details, as these factors can influence the customs assessment.

- Origin of Goods: Indicating the country of origin is crucial for determining whether any trade agreements or exemptions apply to the shipment, which can affect tariff rates.

Customs authorities rely heavily on this documentation to determine whether goods are compliant with international regulations. By ensuring all necessary information is provided and accurate, businesses can avoid unnecessary delays and costs during the customs process. A well-prepared document not only accelerates the clearance process but also builds a professional and reliable reputation in international trade.

Customizing Your UK Export Invoice Template

When creating documents for international transactions, customization is key to ensuring that your records align with your business needs and comply with legal standards. Tailoring the format and content of these documents allows you to present the necessary details in a clear, professional, and efficient manner. Customizing your document not only enhances its functionality but also ensures that it reflects your business’s branding and meets specific requirements for different markets.

Personalizing the Layout and Design

One of the first steps in customization is adjusting the layout to fit your business style and preferences. A clean, professional design is important for creating a good impression, while making sure all essential information is easy to find. You can modify sections such as the header, footer, and overall structure to suit your business identity.

- Company Branding: Add your logo, business name, and contact details to ensure your document is personalized and easy for the recipient to identify.

- Section Arrangement: Rearrange the sections of your document to prioritize the most important information, such as payment terms or product details, based on your business model.

- Font and Style: Adjust the font, colors, and design elements to match your company’s branding guidelines.

Including Specific Business and Legal Information

Customization also involves including information that is specific to your industry or the type of goods or services you provide. Make sure to add any necessary legal terms, product descriptions, and customs requirements that are relevant to the transaction.

- Payment Terms and Conditions: Include payment methods, due dates, and penalties for late payment, ensuring that both parties are clear about the financial terms.

- Shipping and Delivery Details: Customize this section to reflect the agreed-upon shipping methods, delivery times, and any special instructions that are pertinent to your business.

- Customs Codes and Descriptions: If applicable, ensure you include any specific codes or descriptions required by customs authorities to facilitate smooth clearance.

Customizing your document allows for better clarity, smoother transactions, and ensures that it meets all necessary legal and business requirements. By adjusting the layout and content to reflect your company’s unique needs, you can create a more efficient, streamlined process for international trade.

Different Types of Export Invoices

In international transactions, there are various types of documents used to formalize the sale of goods, each serving a specific purpose and meeting different legal or business needs. Understanding the different types of records that can be created ensures that businesses comply with regulations, address the needs of customs authorities, and maintain smooth payment processes. The type of document chosen often depends on the nature of the transaction, the relationship between buyer and seller, and the terms agreed upon.

Pro Forma Documents

A pro forma document is typically issued before the sale is finalized and provides an estimate of the goods or services to be provided. It is commonly used when goods are being shipped before full payment is made, or when the buyer requires an initial price quote for budgeting purposes. Though not a binding agreement, it serves as a preliminary bill and is crucial for obtaining import permits or applying for financing.

- Preliminary estimate: Shows expected costs but is not legally binding.

- Helps with financing: Used to apply for letters of credit or other financing options.

- Customs use: Often required by customs authorities to assess import duties before final documentation is prepared.

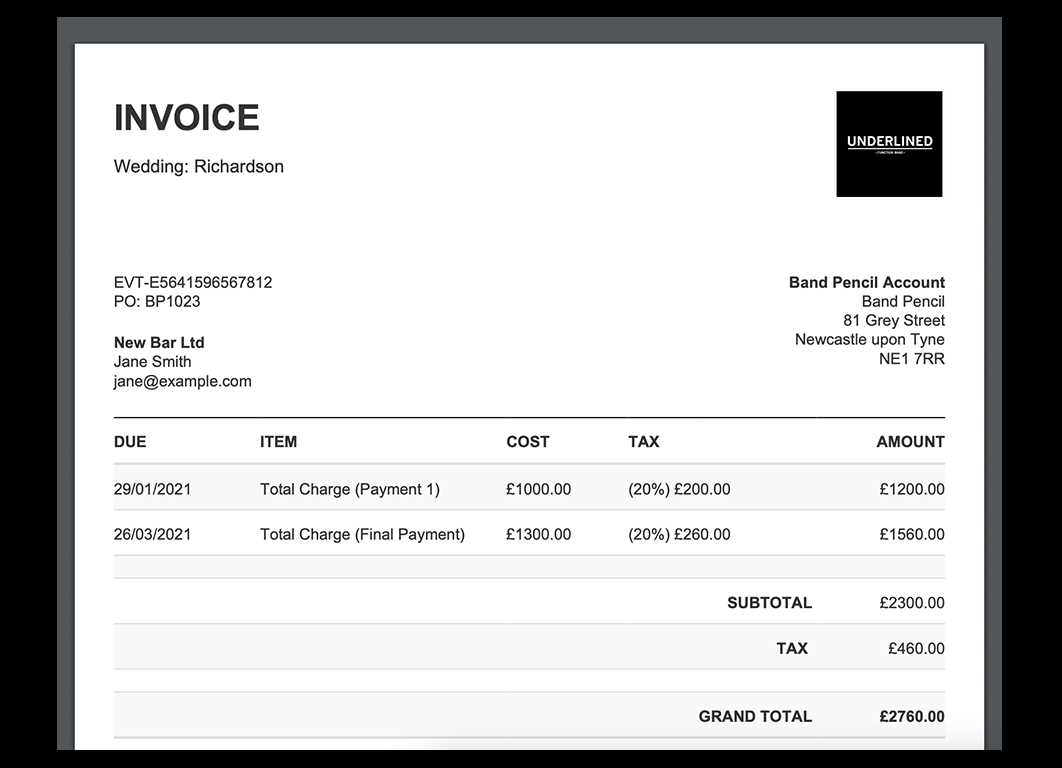

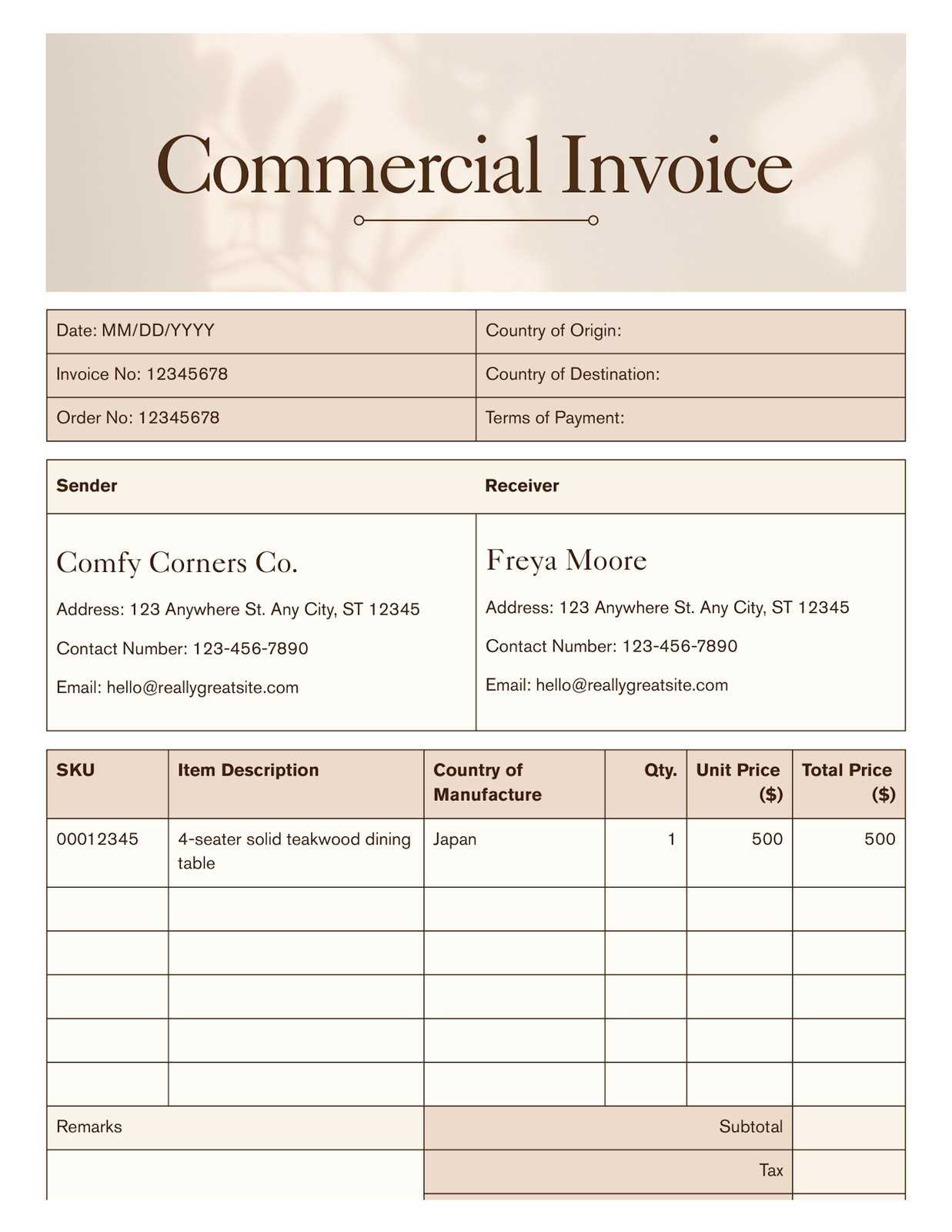

Commercial Documents

The commercial document, unlike the pro forma, is the final bill presented after the goods have been shipped or services delivered. This type of document includes all the details about the transaction and serves as a legal document for both payment and customs processing. It is essential for tax purposes and provides all the necessary information for customs clearance, such as product descriptions, quantity, price, and payment terms.

- Final transaction record: Reflects the completed sale and includes all payment terms and transaction details.

- Used for customs clearance: Contains all required information for the movement of goods across borders.

- Legal document: Serves as a proof of sale and is often required for legal or tax purposes.

Understanding the differences between these documents helps ensure that the correct one is used in each situation, improving the efficiency of the transaction and avoiding delays or complications with customs or payment processing. Depending on the needs of your business, selecting the right type of document is an essential step in international trade.

How Export Invoices Affect Shipping Costs

In international trade, the proper documentation plays a crucial role in determining the total cost of shipping. These records provide essential information about the transaction, helping logistics companies and customs authorities calculate shipping fees, tariffs, and other charges. The details included in the documentation can directly influence the overall cost, making it important for businesses to ensure accuracy and completeness.

Accurate documentation is key to avoiding unexpected fees and delays. When details such as product description, value, and quantity are clearly stated, shipping companies can more easily calculate shipping costs, ensuring that businesses are not overcharged. Incomplete or incorrect details, on the other hand, can lead to additional fees, fines, or delays in customs processing, ultimately increasing the total cost of transportation.

- Product Classification: The classification of goods determines the applicable tariffs and duties. If products are misclassified, it can result in higher customs duties or fines.

- Shipping Terms: The terms outlined in the document, such as Incoterms, specify who is responsible for various costs during the shipping process. These terms directly influence the overall cost of shipping.

- Weight and Volume: Details regarding the weight and volume of the goods affect the cost of transport. Incorrect weight or dimension estimates can lead to extra charges from shipping companies.

- Insurance and Handling: If the document includes specific insurance or handling requirements, these costs must be factored into the total shipping expenses. Inaccurate declarations may result in additional fees for the buyer or seller.

Furthermore, providing clear and precise details can expedite the clearance process and avoid unnecessary delays. When all necessary data is included, customs can process shipments more efficiently, reducing the chances of costly holdups. Businesses that understand the importance of accurate and thorough documentation can better manage their shipping expenses and avoid unexpected financial burdens.

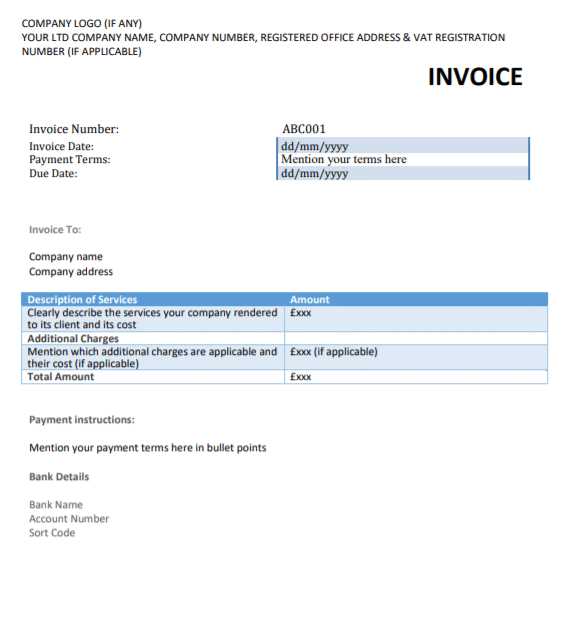

Export Invoice Template for Small Businesses

For small businesses engaging in international transactions, having a standardized document for sales is essential for maintaining consistency and ensuring compliance with legal and financial requirements. This document serves as a clear record of the transaction, detailing the goods or services provided, the terms of payment, and other critical information. Customizing a suitable document is an important step in streamlining the process and avoiding delays or complications with customs and payments.

Key Elements for Small Businesses

For small businesses, simplicity and clarity are crucial when creating these documents. A well-structured document should include basic yet essential details such as the buyer and seller’s contact information, descriptions of the goods or services, pricing, and payment terms. Additionally, small businesses should ensure that any necessary legal and tax information is included to avoid issues with customs or financial authorities.

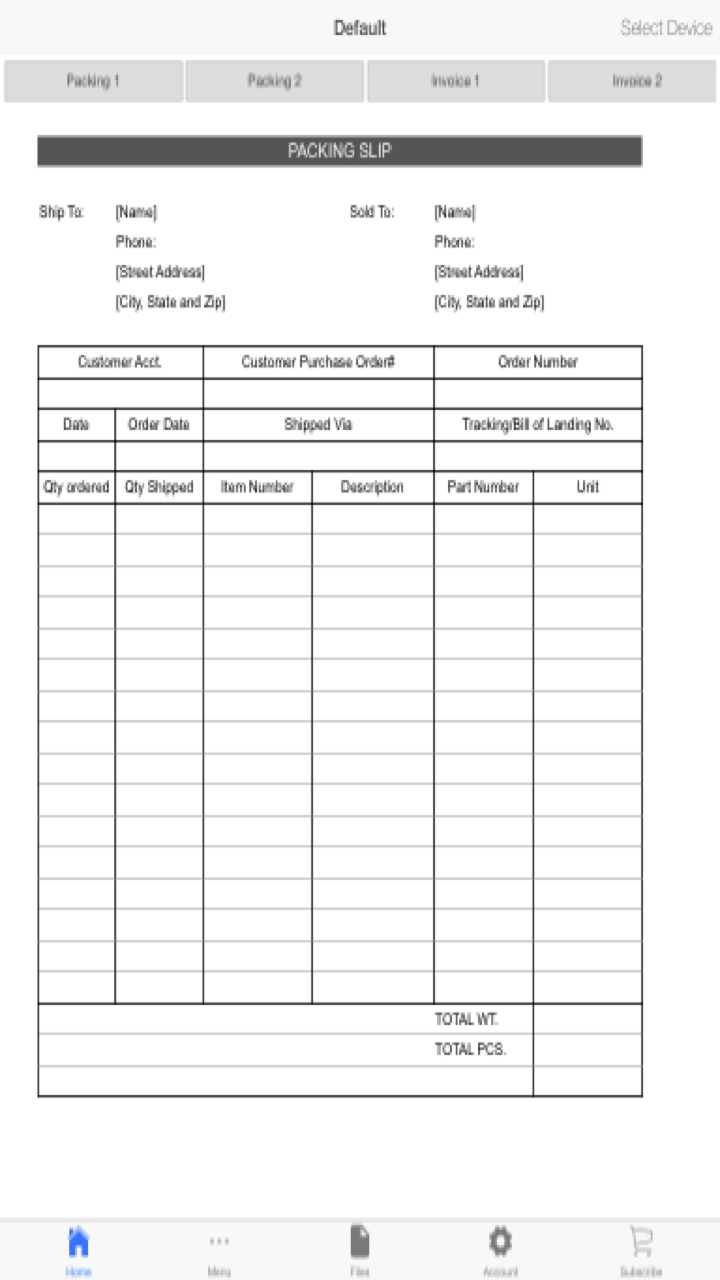

| Section | Description |

|---|---|

| Business Information | Name, address, and contact details of both the buyer and seller. |

| Product or Service Description | A clear description of the goods or services provided, including quantity and value. |

| Payment Terms | Details on the method, due date, and any penalties for late payments. |

| Shipping Information | Shipping method, delivery terms, and expected arrival date. |

| Customs Details | Any necessary codes or classifications required for smooth customs processing. |

Why a Standardized Document is Important

For small businesses, a clear and standardized document is key to avoiding misunderstandings and delays. It provides transparency for both parties and ensures that all terms are agreed upon before goods are exchanged. Additionally, such a document is vital for customs clearance, ensuring that there are no delays due to missing or inaccurate information. By using a simple but comprehensive document, small businesses can improve their operational efficiency and reduce the risk of costly mistakes.

Managing Export Invoice Payments Effectively

Managing payments for international transactions requires a clear and organized approach to ensure smooth financial operations. A well-structured approach to handling payments can help businesses avoid delays, reduce the risk of errors, and maintain good relationships with clients. Establishing clear terms and using efficient methods to track and manage payments is essential for ensuring timely and accurate transactions.

Key Strategies for Efficient Payment Management

To manage payments effectively, businesses should adopt a systematic approach that includes clear payment terms, effective communication, and regular monitoring. The following strategies can help streamline the payment process:

- Set Clear Payment Terms: Clearly outline the payment deadlines, methods, and any penalties for late payments in the transaction agreement. This sets expectations and helps avoid confusion.

- Offer Multiple Payment Methods: Provide clients with several payment options, such as bank transfers, credit card payments, or digital wallets, to make the process more convenient for both parties.

- Track Payments Regularly: Use a system to monitor payments in real-time. Keeping track of outstanding amounts ensures that businesses can follow up with clients if necessary and avoid overdue payments.

- Communicate Regularly: Maintain open communication with clients about their payment status. If delays occur, addressing the issue early can help find a solution before the problem escalates.

Overcoming Common Payment Challenges

While managing payments may seem straightforward, several challenges can arise, especially in international transactions. Businesses need to be prepared to handle potential issues, such as delays in transfer, foreign currency fluctuations, and legal disputes. Implementing the following steps can help address these challenges:

- Establish a Buffer for Currency Fluctuations: Consider adjusting prices based on currency exchange rates or setting payment terms that account for fluctuations in the value of foreign currencies.

- Use a Payment Escrow Service: For larger transactions, using an escrow service can help secure payments and protect both parties from non-payment.

- Clearly Define Legal Recourse: Include terms regarding payment enforcement in case of non-compliance, such as outlining the steps that will be taken if payments are delayed beyond a specified period.

By implementing these strategies, businesses can manage payments more effectively, ensuring that international transactions run smoothly and that all parties are satisfied with the outcome.

Export Invoice Template for E-commerce

For e-commerce businesses engaging in international sales, having a standardized document for transactions is essential for ensuring transparency, smooth payments, and compliance with legal and tax regulations. These documents serve as formal records of sales, outlining the goods or services sold, the terms of the transaction, and any shipping details, making them vital for both business operations and customer satisfaction.

Why a Standardized Document Matters for E-commerce

For online businesses, especially those selling across borders, using a standardized document is crucial. It not only helps manage the financial aspects of transactions but also ensures that the goods or services are properly tracked and that the necessary legal requirements are met. These records are important for customs, accounting, and resolving potential disputes. Having a clear structure can improve the customer experience by ensuring that both parties understand the terms of the transaction.

Key Information for E-commerce Documents

When creating documents for e-commerce transactions, businesses should ensure they include all necessary information. Some of the critical elements are:

- Business and Customer Details: Include the name, address, and contact information of both the seller and the buyer to ensure proper communication and delivery.

- Product or Service Descriptions: Clearly list the items purchased with descriptions, quantities, and their respective prices.

- Payment and Shipping Terms: Specify payment methods, due dates, and any shipping or delivery instructions to avoid confusion.

- Legal and Tax Information: Include necessary tax IDs, any applicable taxes, and legal disclaimers required for international transactions.

By ensuring that the document contains all the relevant details, e-commerce businesses can streamline the sales process and ensure that both parties are protected and informed throughout the transaction.

Tracking International Payments with Invoices

When dealing with international transactions, it is essential to maintain a robust tracking system for payments. Having a structured record of the transaction ensures that payments are monitored, collected, and reconciled accurately. Proper tracking is particularly important for businesses that deal with cross-border sales, as it helps manage cash flow, prevent disputes, and ensure that all financial obligations are met promptly.

Key Steps to Tracking Payments Effectively

To track international payments efficiently, businesses need a clear system that encompasses various stages of the payment process. The following steps can help improve payment tracking and ensure accuracy:

- Generate Detailed Records: Each transaction should be documented with precise details, including the amount, payment method, and due dates. This allows businesses to monitor outstanding payments more easily.

- Use Payment Tracking Software: Automated tools and software can simplify the payment tracking process by providing real-time updates on the status of payments and flagging overdue amounts.

- Follow Up Regularly: Establish a routine for following up with customers if payments are not received by the agreed deadline. Sending reminders ensures that the payment process stays on track.

- Monitor Payment Methods: Track the method of payment (bank transfer, credit card, etc.) to ensure that funds are transferred correctly and promptly.

Challenges in Tracking International Payments

International payments come with their own set of challenges that businesses must manage. Some of these include currency fluctuations, differences in banking systems, and varying tax regulations. Addressing these challenges is vital to ensure smooth payment processing:

- Currency Exchange Issues: Payments made in foreign currencies may fluctuate, making it difficult to track exact amounts. Businesses should monitor exchange rates and adjust accordingly.

- Bank Processing Delays: Different banks have varying processing times for international transfers. Understanding these timeframes helps set realistic expectations for payment receipt.

- Tax Compliance: International sales may involve different tax rules in different regions. It is essential to ensure that payments are in compliance with both local and international tax laws to avoid penalties.

By implementing these practices, businesses can streamline their payment tracking process, ensuring that international transactions are completed efficiently and without error.

Benefits of Digital Export Invoices

In today’s digital age, transitioning from paper-based documentation to electronic records brings numerous advantages for businesses engaged in international transactions. Moving to a digital format not only enhances efficiency but also reduces errors and improves the overall management of financial documents. By utilizing digital systems, businesses can streamline their operations, reduce costs, and ensure quicker processing of transactions across borders.

Key Advantages of Digital Records

Digital records offer various benefits that make the management of international transactions simpler and more effective:

- Improved Accuracy: Digital systems reduce the risk of human error that often occurs with manual entry. Automated calculations and built-in checks ensure that data is entered correctly and consistently.

- Faster Processing: With digital documentation, there is no need for manual handling or waiting for physical delivery. Transactions are processed instantly, improving overall speed.

- Enhanced Organization: Storing records electronically makes it easier to categorize and retrieve documents when needed. Searching for past transactions is as simple as entering a keyword, saving time and effort.

- Cost Savings: Going digital eliminates the need for paper, printing, and physical storage, reducing costs associated with manual document handling and storage space.

- Better Security: Digital files are less prone to damage or loss due to natural disasters or physical wear and tear. Additionally, electronic systems allow for better encryption and access control to ensure that sensitive data is protected.

Digital vs. Paper-Based Records

Comparing the traditional paper-based process with the digital approach highlights the significant improvements in efficiency and effectiveness:

| Aspect | Digital Approach | Paper-Based Approach |

|---|---|---|

| Processing Speed | Instant and automated | Manual entry and delays |

| Cost | Lower costs for storage and handling | Higher costs for paper, printing, and storage |

| Accuracy | Automated calculations and built-in checks | Human error in data entry |

| Security | Encrypted and secure data storage | Prone to physical damage and theft |

| Environmental Impact | Eco-friendly with no paper waste | High paper consumption and waste |

As shown above, the digital approach to handling financial records offers superior benefits in terms of cost efficiency, speed, and security. For businesses involved in cross-border transactions, making the switch to digital documentation can be a game-changer, providing numerous advantages that will help improve overall operations and reduce errors.

Export Invoice Template Tips for UK Businesses

For businesses in the UK involved in international transactions, ensuring the correct preparation of financial documentation is crucial for smooth operations and compliance. The key to avoiding delays and ensuring accuracy lies in understanding the essential components that should be included, as well as adhering to local regulations. Here are some tips that can help UK-based companies create effective financial documents for cross-border trade.

Ensure Clear and Detailed Information

One of the most important aspects of any financial document is clarity. For businesses in the UK, providing clear and detailed information helps avoid misunderstandings and ensures smooth processing of payments and shipments. Here are a few essential details to include:

- Contact Information: Always include the full name, address, and contact details of both the buyer and seller to avoid any confusion in case of inquiries.

- Accurate Description of Goods or Services: Be precise about what is being sold. Include the quantity, price per unit, and total cost for each item or service.

- Customs Codes: Include the Harmonized System (HS) code for the products being sold to ensure smooth customs clearance.

- Payment Terms: Clearly state the agreed payment terms, including any deposits, deadlines, and methods of payment.

Stay Compliant with UK Regulations

In the UK, businesses must comply with several legal requirements when creating financial documents for international transactions. Failure to meet these regulations could lead to delays or fines. Some key considerations include:

- VAT Number: Include your VAT number on the document, as well as any relevant tax exemptions, if applicable.

- Currency and Exchange Rates: Clearly state the currency in which the transaction is taking place, and consider including exchange rates if the payment is being made in a different currency.

- Invoice Number: Assign a unique number to each document for tracking purposes and to comply with UK bookkeeping regulations.

By following these tips, UK businesses can ensure that their financial records are accurate, compliant, and easily processed by customers and customs authorities alike. The goal is to create a smooth and efficient process for both the seller and buyer, reducing the likelihood of errors and delays in international trade.