Free Rental Invoice Template for Easy Payment Management

Managing payments from tenants can be a daunting task, especially when it comes to ensuring everything is properly documented. Whether you’re a landlord or managing multiple properties, keeping track of transactions in an organized manner is crucial. One of the easiest ways to streamline this process is by using a well-structured billing document.

Such a document not only helps in tracking payments but also ensures that both you and your tenants have a clear understanding of the financial details. With the right format, you can reduce errors, save time, and maintain transparency. These tools are designed to provide all the necessary fields, making the process smooth and professional.

Understanding how to effectively use these tools can improve your workflow significantly. By having a standard format for each transaction, you’ll eliminate the confusion that can arise from inconsistent records. Whether you’re handling one rental unit or several, implementing a consistent system for payment tracking is essential for maintaining positive relationships with tenants.

Free Rental Invoice Templates for Landlords

For property owners, having a reliable way to document financial transactions is essential for maintaining clear records and ensuring timely payments. Simplifying the billing process with a ready-made format can save valuable time and reduce the chances of errors. Fortunately, there are many options available that allow landlords to create professional documents without needing extensive accounting knowledge or software.

Benefits of Using Pre-made Billing Documents

Using a pre-designed format ensures that all necessary information is included, such as tenant details, rental period, and payment terms. This reduces the need for manual entry and ensures consistency across all transactions. Additionally, many options are customizable, allowing property owners to adjust the document to fit their specific needs and legal requirements.

Where to Find Reliable Billing Formats

There are several online resources where you can find downloadable formats that are both easy to use and fully customizable. These options range from simple, no-cost solutions to more advanced systems that can be integrated with accounting tools. The key is to choose one that fits your requirements and makes the process of tracking payments as efficient as possible.

Why You Need a Payment Record Document

Properly documenting financial transactions is vital for any property owner. Whether you’re managing a single unit or several properties, having a structured way to record payments ensures clarity and helps avoid misunderstandings with tenants. A well-organized document serves as a formal record for both parties, providing transparency and setting clear expectations regarding payment terms.

Maintaining Accurate Financial Records

Accuracy is key when it comes to keeping track of financial transactions. Without a standardized method to record payments, there’s a higher chance of mistakes, missed payments, or disputes. By using a formalized document, you ensure that every transaction is recorded in a consistent and professional manner, helping you maintain precise financial records for future reference.

Legal and Tax Compliance

Another important reason to use such a document is to comply with legal and tax requirements. Clear records of payments can be invaluable during tax season or if a legal issue arises. Having a consistent format not only helps you stay organized but also provides proof of income and expenses, which may be necessary for tax filing or other legal purposes.

How to Customize a Payment Document

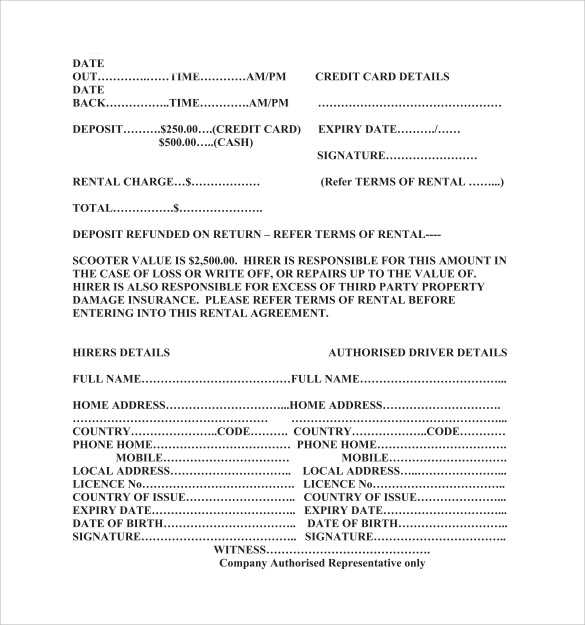

Personalizing a financial document is essential for ensuring it meets the specific needs of both the landlord and the tenant. A standard format can be adjusted to reflect various details, such as property information, payment frequency, and any unique terms that apply to the rental agreement. Customizing the document allows you to tailor it to your specific situation, making it more professional and efficient.

Adjusting Key Information

First and foremost, it’s important to input the correct details about the property, tenant, and payment structure. Include the full names and contact information for both parties, as well as the rental amount and due dates. You can also specify late fees or other charges if applicable. This ensures that the document is specific and relevant to the current transaction.

Design and Layout Considerations

While functionality is key, the appearance of the document should also be professional and easy to read. Many formats allow for simple customization of fonts, colors, and overall layout. Making sure the document is visually clear helps both you and your tenants quickly understand the terms. You can add logos, signatures, or additional notes that provide more clarity or reinforce your business’s professionalism.

Top Benefits of Using Pre-made Documents

Utilizing pre-designed formats for documenting financial transactions offers several advantages, especially for property owners managing multiple tenants. These ready-to-use solutions eliminate the need to create documents from scratch, allowing you to focus more on managing your properties. By providing a consistent structure, they ensure all essential information is included and easily accessible.

Time-Saving and Efficiency

One of the most significant benefits of using pre-made formats is the amount of time saved. Instead of manually creating a new document for every transaction, you can simply customize an existing structure to suit each situation. This streamlines the process and ensures that every document is generated quickly and correctly, improving overall efficiency in managing your finances.

Consistency and Accuracy

Having a standardized document ensures that all the necessary details are included every time. This consistency helps to avoid common mistakes, such as missing payment terms or incorrect tenant information. It also makes your billing process more professional, as tenants will receive uniform, accurate documents for each payment cycle.

Simple Steps to Create a Billing Document

Creating a payment document doesn’t have to be complicated. By following a few straightforward steps, you can generate a professional and clear record for every transaction. A well-organized structure will not only save you time but also help avoid confusion or mistakes when dealing with tenants. Here’s how to get started with creating an effective payment document.

Step 1: Gather Necessary Information

Before starting, collect all the essential details you’ll need. This includes the tenant’s full name and contact information, the rental amount, the payment due date, and any applicable terms or fees. Having this information at hand ensures that the document is complete and accurate from the start.

Step 2: Choose the Right Format

Select a structure that suits your needs. You can choose a simple layout that includes all the required details or opt for a more detailed format that covers additional items such as payment history or tenant agreements. Many systems offer pre-designed structures that can be easily customized, allowing you to create a document quickly and professionally.

Essential Information for Payment Documents

When creating a payment document, it’s crucial to ensure that all relevant details are included. This not only helps avoid confusion but also ensures that the tenant understands the financial expectations clearly. A well-structured document should capture all the necessary information to facilitate smooth transactions and prevent any future misunderstandings.

Basic Details of the Transaction

Start by including the core elements of the transaction. This includes the tenant’s name and address, the property details, the amount due, and the date the payment is expected. It’s also important to include the payment period (whether monthly, weekly, etc.), along with any specific payment methods accepted, such as bank transfers or online payment options.

Additional Terms and Conditions

In addition to basic details, including terms regarding late fees, security deposits, or other charges can help clarify expectations. If there are any special conditions–such as maintenance responsibilities or penalties for missed payments–these should be clearly outlined as well. By providing this level of detail, both parties can easily refer back to the document for clarity when needed.

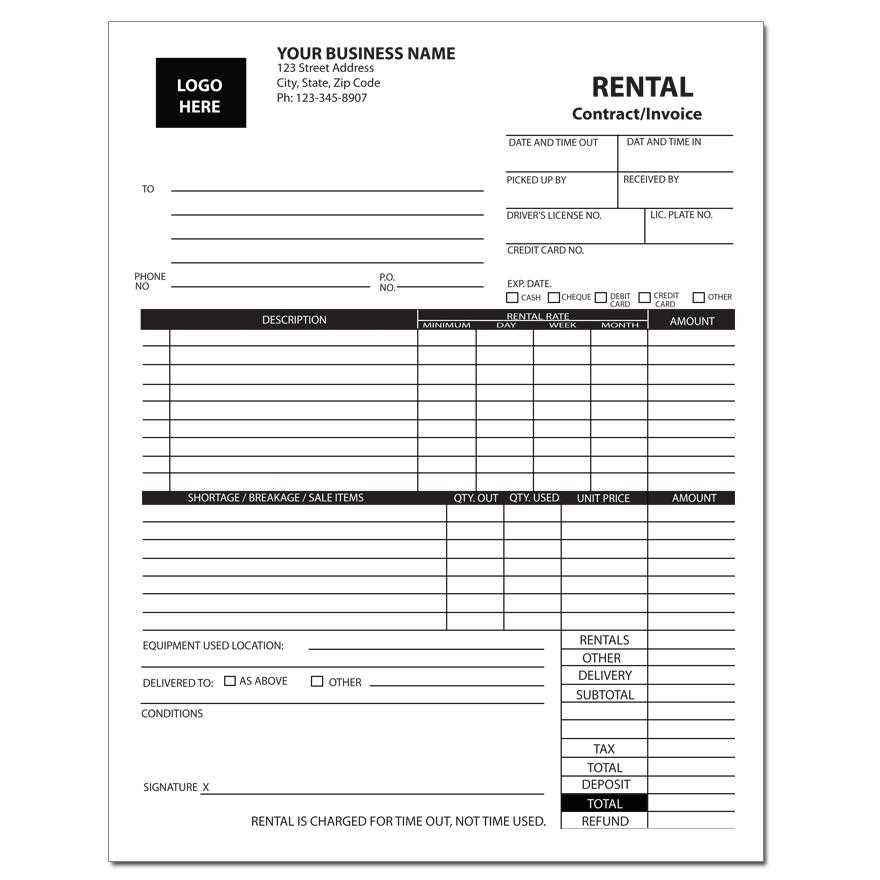

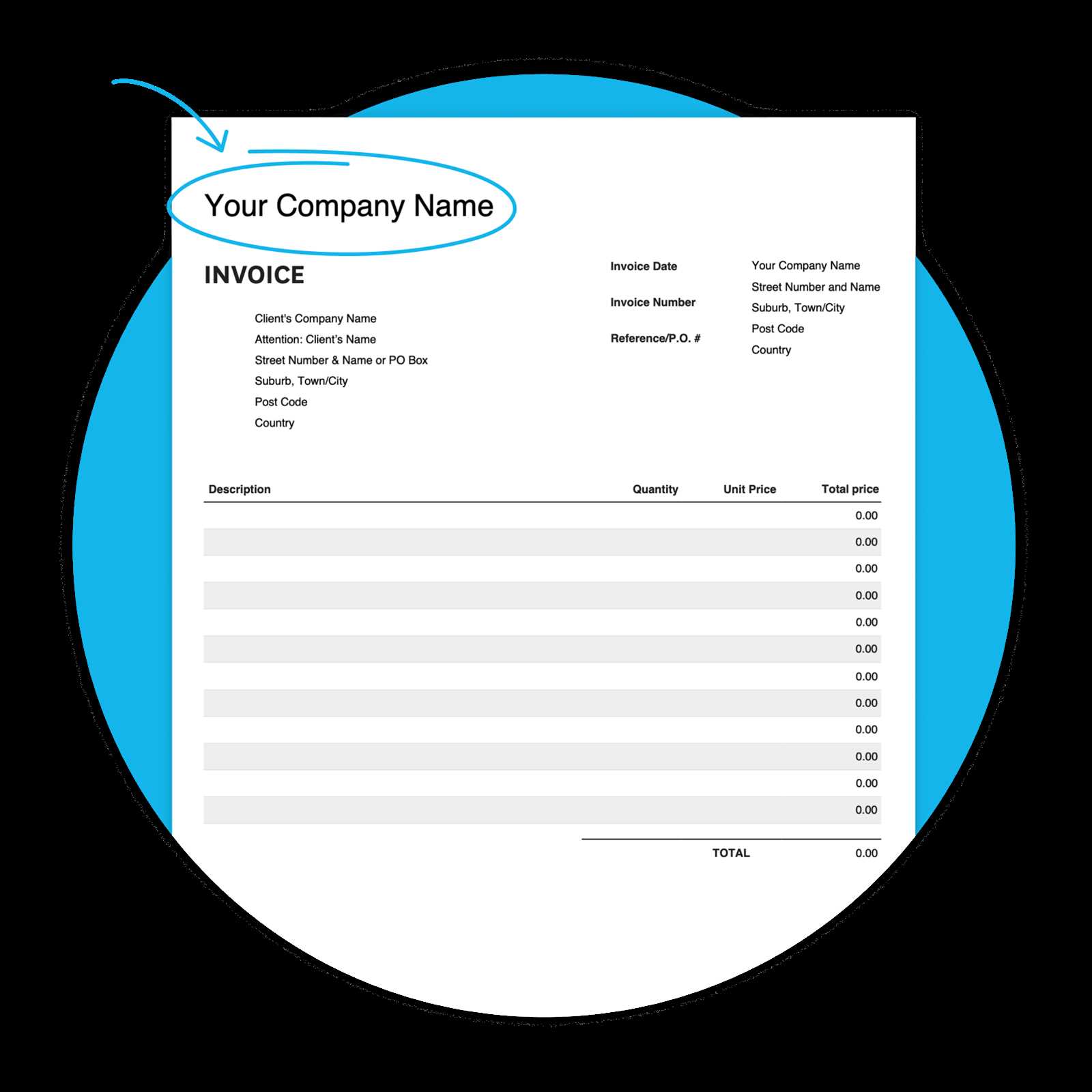

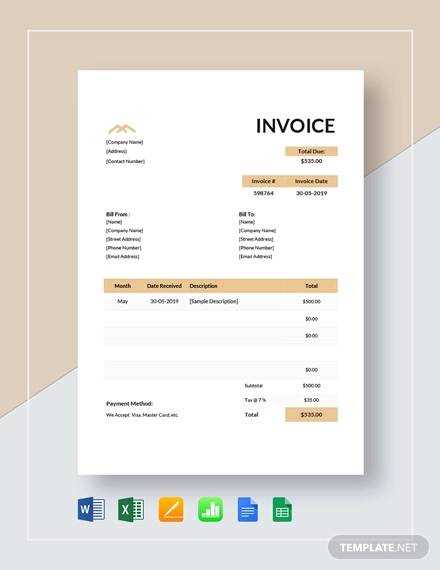

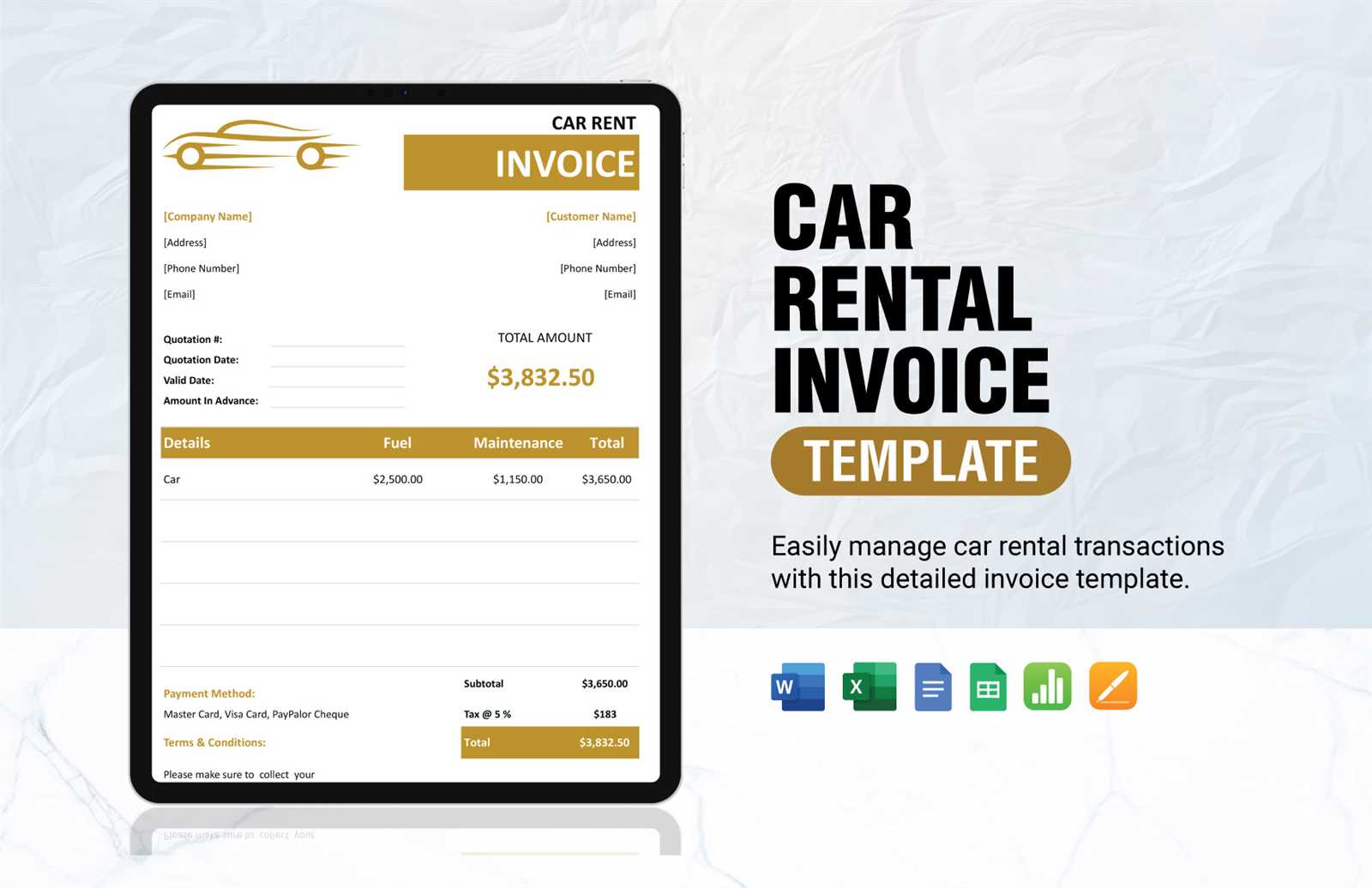

Best Free Billing Document Formats Online

There are many high-quality options available online that allow property owners to create professional and clear payment records without the need for expensive software or complex design skills. These formats are often customizable, allowing you to adjust them to your needs while ensuring that all necessary details are included. Here are some of the best resources for downloading simple yet effective documents for your business.

From basic designs that are quick and easy to fill out, to more advanced layouts with built-in features for tracking payments or adding taxes, these options cater to a wide variety of needs. Many of them are available for download at no cost and can be easily personalized to match your style or business requirements.

How to Track Payments Efficiently

Efficiently managing payments is crucial for property owners to maintain a smooth cash flow and avoid any confusion with tenants. Without an organized system, it’s easy to lose track of due dates, outstanding balances, and late fees. Here are some practical methods and tools to help you track payments in an effective and streamlined manner.

1. Use Digital Tools

One of the best ways to stay organized is by using digital tools designed for payment tracking. These platforms often allow you to create records for each tenant, set up reminders for upcoming payments, and even track payment history. Some options also provide reporting features that make it easier to see the overall financial health of your properties.

- Online payment platforms: Many services allow tenants to pay directly online, which helps automate the tracking process.

- Accounting software: Platforms like QuickBooks or Xero can also be used to manage rental payments and keep a comprehensive record of transactions.

- Spreadsheets: For a more hands-on approach, you can create a custom payment tracking spreadsheet with dates, amounts, and status (paid or overdue).

2. Organize Payment Records

Maintaining a well-organized filing system is essential for keeping track of payments. Whether digital or physical, make sure each payment record is filed correctly, with clear labels for the tenant name, rental period, and payment status.

- File by tenant: Create individual folders or digital files for each tenant to store all payment records in one place.

- Sort by month or year: Organize your records by payment period to easily spot overdue amounts and track patterns over time.

- Track outstanding balances: Keep a separate list of unpaid amounts and follow up with tenants promptly to prevent delays.

3. Set Payment Reminders

Setting up automated reminders can help ensure that payments are never missed. Many property management platforms offer reminders that can be sent via email or text, prompting tenants when payments are due. If you’re managing payments manually, setting calendar reminders on your phone or computer can serve the same purpose.

Legal Requirements for Payment Documents

When creating payment records for tenants, it’s important to understand the legal requirements that govern these documents. Depending on your location, certain details may need to be included in order to comply with tax laws, rental agreements, or tenant protection regulations. Ensuring that your payment records meet these requirements not only helps you stay within the law but also provides protection in case of disputes.

Essential Information to Include

In order to ensure that your payment documents are legally compliant, you must include specific information that both you and your tenants can refer to if needed. The following details are typically required by law:

- Tenant’s name and contact information: Clearly identify both parties involved in the transaction.

- Property details: Include the address of the property being rented to avoid any confusion.

- Payment amount and due date: Clearly specify the amount owed and the deadline for payment.

- Payment method: List the payment methods accepted (e.g., bank transfer, online payment, check).

- Late fees and penalties: Outline any applicable fees for late payments or missed deadlines.

- Signature or acknowledgment: Some jurisdictions may require both parties to sign or acknowledge the document.

Tax and Record Keeping Considerations

In addition to including the necessary details, property owners must also be mindful of tax and record-keeping obligations. Many jurisdictions require landlords to maintain records of payments for a set number of years for tax purposes. Keeping accurate and organized records can help ensure you comply with tax laws and avoid potential issues with tax authorities.

- Maintain copies: Keep a copy of each document for your records.

- Track payments for tax deductions: Payment records can often be used to support deductions on property-related expenses during tax season.

- Provide copies to tenants: Ensure tenants receive copies of the payment documents for their own records.

How to Avoid Common Billing Mistakes

Billing errors can lead to confusion, missed payments, and strained relationships with tenants. These mistakes can range from simple calculation errors to more complex issues like incorrect payment terms or missing details. By following a few best practices, you can minimize the chances of these mistakes and ensure a smooth and professional billing process.

Double-Check Payment Amounts

One of the most common mistakes is miscalculating the amount owed. Ensure that the correct rent, fees, and any additional charges are included. Double-check any discounts, deposits, or prorated amounts to avoid discrepancies. Taking the time to review the total payment amount will help avoid misunderstandings with tenants.

Be Clear About Payment Terms

Confusing or unclear payment terms can lead to missed or delayed payments. Make sure that the due date, payment frequency, and accepted methods are explicitly stated in the document. If you have specific rules for late fees or penalties, outline them clearly so tenants understand the consequences of not paying on time.

Keep Consistent Records

Inconsistent or incomplete records can create problems down the line. Always ensure that each payment document includes the same key details and follows a consistent format. This not only helps avoid errors but also makes it easier to track payments over time. Regularly updating and organizing your payment records will help prevent future billing confusion.

Stay Up-to-Date with Legal Requirements

Legal regulations regarding payment records can change, and failing to stay informed can lead to compliance issues. Regularly check local laws to ensure your documents meet any updated requirements. Keeping your documents in line with legal standards will help you avoid disputes and potential legal trouble.

Formatting Your Payment Document Correctly

Properly formatting your financial documents is essential for clarity and professionalism. A well-structured record makes it easier for tenants to understand the payment terms and for property owners to track transactions. Consistency in formatting helps prevent misunderstandings and ensures that all necessary details are clearly visible and easy to locate.

Key Elements to Highlight

When formatting your document, ensure that the most important information stands out. The following elements should be clearly marked and easy to identify:

- Tenant and property information: Include the tenant’s name, property address, and contact details at the top of the document.

- Payment amount and due date: Make sure the total amount due is clearly visible, along with the payment due date.

- Payment method: Indicate the payment methods accepted, such as bank transfer, check, or online payment.

- Late fees and penalties: If applicable, clearly list any late fees or other penalties for overdue payments.

Design and Layout Tips

The design of your payment document should be clean and straightforward. Avoid cluttering the page with unnecessary information or overly complex designs. Use a simple layout with a consistent font and size throughout the document to make it easy to read. You can also add your logo or branding to give it a professional look, but make sure it doesn’t distract from the key details.

Additionally, keep the layout balanced by spacing out sections appropriately. Organize the content into distinct sections, such as “Tenant Information,” “Payment Details,” and “Additional Notes,” to help guide the reader’s eye through the document in a logical order.

Choosing the Right Billing Software

Selecting the right software for managing financial records is essential for efficiency and accuracy. The right tool can streamline the billing process, ensure that all payment details are correctly recorded, and help manage multiple transactions with ease. With so many options available, it’s important to evaluate your specific needs to find a solution that aligns with your business practices.

Factors to Consider When Choosing Software

Before choosing a software solution, there are several factors you should consider to ensure it meets your requirements. Here are some key points to help guide your decision:

- Ease of Use: The software should have an intuitive interface that is easy to navigate, even for users without extensive technical knowledge.

- Customization Options: Choose a system that allows you to customize templates or formats, so you can tailor the documents to your specific needs.

- Integration with Payment Systems: Look for software that integrates with various payment methods, allowing tenants to pay directly through the platform.

- Automation Features: Features such as automated reminders for due payments or recurring billing can save you time and reduce the risk of missed payments.

- Security and Data Protection: Ensure the software complies with industry standards for data security, especially if sensitive financial information is involved.

Popular Software Options

There are numerous software solutions available that cater to different needs. Some of the most popular options include:

- QuickBooks: A widely used accounting software that offers invoicing and financial tracking features, with integration for payment processing.

- FreshBooks: A user-friendly solution that focuses on time tracking and billing, ideal for small businesses and independent contractors.

- Zoho Invoice: A robust, cloud-based platform that offers automation and customization options for invoicing and payment tracking.

- Wave: A free accounting software that includes billing and invoicing features, suitable for small businesses with straightforward needs.

Integrating Billing Records with Accounting Systems

Efficient financial management involves more than just creating payment documents; it also requires seamless integration with accounting systems to track income, expenses, and taxes. By linking your billing records to your accounting software, you can automate many aspects of financial tracking, reducing errors and saving valuable time. This integration ensures that all transactions are accurately recorded and that your financial data remains organized and up to date.

Benefits of Integration

Integrating billing documents with your accounting system offers several significant advantages:

- Automation: Automatically transfer payment details to your accounting software, eliminating the need for manual data entry and reducing the risk of errors.

- Real-Time Updates: With integrated systems, your financial records are updated in real time, giving you an accurate view of your income and expenses at all times.

- Improved Accuracy: Integration minimizes the possibility of data discrepancies, ensuring that your payment records match your accounting reports.

- Efficient Tax Reporting: Having all your financial data in one system simplifies tax filing, making it easier to generate reports for tax purposes.

Popular Integration Tools

Many accounting software platforms allow for easy integration with various billing and payment management tools. Here are some common options:

- QuickBooks: A popular accounting solution that integrates with a wide range of billing platforms, streamlining the process of tracking payments and managing finances.

- Xero: This cloud-based software offers integration with payment solutions and provides real-time accounting features.

- FreshBooks: Ideal for small businesses, FreshBooks integrates seamlessly with accounting tools to automate financial reporting and payment tracking.

- Zoho Books: Zoho’s platform integrates billing records and accounting features, providing a comprehensive solution for managing financials and transactions.

By choosing the right integration tools, property owners can streamline their financial processes, reduce manual work, and improve the accuracy of their financial reports. This approach helps save time and ensures your records are always up to date and compliant with tax regulations.

How to Handle Late Payments on Billing Records

Dealing with late payments can be a challenging aspect of managing financial transactions. While most tenants or clients aim to pay on time, delays are sometimes inevitable. It’s important to have a clear strategy for addressing overdue payments in a way that maintains professionalism and encourages timely payment. Effective management of late payments can help minimize financial strain and preserve positive relationships with tenants or customers.

1. Set Clear Payment Terms

The best way to avoid confusion and disputes over late payments is to establish clear and transparent payment terms from the outset. Make sure that payment deadlines, accepted methods, and late fee policies are clearly communicated to tenants or clients. These terms should be included in your documents and agreed upon before any transactions take place. Having a well-defined policy helps manage expectations and provides a basis for any follow-up actions if payments are missed.

2. Send Friendly Reminders

Sometimes, people simply forget to make payments. A gentle reminder can be an effective way to prompt tenants or clients to fulfill their obligations. Set up automated reminders through your billing system or manually send an email or text reminder a few days before or after the due date. A friendly, professional tone helps maintain goodwill while encouraging prompt payment.

3. Charge Late Fees (If Applicable)

If your payment terms include late fees, it’s essential to enforce them consistently. Charging a reasonable late fee can motivate tenants to pay on time and compensate you for the delay. Be sure to clearly state the late fee policy in your original agreement and remind tenants of this when sending reminders. If you’ve already outlined late fees in advance, this step will feel more like a standard procedure rather than a penalty.

4. Offer Flexible Payment Plans

In some cases, a tenant or client may face financial difficulties that prevent them from paying the full amount on time. Offering a payment plan can be a helpful solution in such situations. Work with the tenant to set up a reasonable schedule for paying off the overdue amount, while still ensuring you get paid in full. Be sure to document the new payment terms and have both parties agree to them in writing.

5. Take Legal Action (As a Last Resort)

If repeated attempts to collect payment are unsuccessful, and the overdue amount is significant, you may need to consider legal action. Before pursuing this option, be sure to check local laws and regulations regarding late payments and debt collection. In most cases, this should be a last resort, as legal action can strain relationships and may be costly and time-consuming.

Handling late payments with a clear, consistent approach ensures that you protect your cash flow while maintaining positive relationships with your tenants or clients. By setting expectations early, sending timely reminders, and offering solutions when necessary, you can minimize the impact of delayed payments on your business.

Free Tools for Creating Payment Records

Creating accurate and professional payment records is essential for maintaining clear financial documentation. Fortunately, there are a number of free tools available that can help you generate these documents quickly and efficiently. These tools are designed to simplify the process, allowing you to focus on other aspects of property management or business operations. Whether you’re looking for basic templates or advanced features, there are options that suit different needs and levels of experience.

1. Google Docs

Google Docs offers a simple, cloud-based solution for creating professional payment documents. You can use pre-made templates or design your own from scratch. The platform allows for easy sharing and collaboration, and your records are automatically saved in the cloud, reducing the risk of losing important information. Here are some key benefits:

- Customizable templates: Choose from a variety of templates or create your own layout.

- Collaboration features: Easily share documents with tenants or team members for review and updates.

- Cloud storage: Documents are securely stored online and accessible from any device.

2. Zoho Invoice

Zoho Invoice is a versatile online tool that allows you to create and manage payment records. While it offers premium features, it also has a free plan that includes essential tools for small-scale use. Some of its key features include:

- Customizable designs: Create personalized billing records with custom fields and logos.

- Recurring billing: Automate payments for regular tenants or customers.

- Real-time tracking: Monitor payments and send automatic reminders for overdue amounts.

3. Wave Accounting

Wave is a comprehensive, free accounting software that includes tools for creating payment records. It is particularly suitable for small businesses or property owners who need both invoicing and accounting functionality in one platform. Features of Wave include:

- Professional documents: Generate and send polished payment documents with your business branding.

- Payment tracking: Keep track of payments and view financial reports in real time.

- Multiple payment options: Accept payments via credit cards, bank transfers, or other methods directly through Wave.

4. PayPal Invoicing

If you already use PayPal to receive payments, their invoicing tool is a convenient option for creating payment records. While it is designed for businesses of all sizes, the tool is simple enough for small-scale use. Key features of PayPal’s invoicing tool include:

- Simple creation: Easily generate payment requests with a

Importance of Clear Payment Terms

Establishing clear and well-defined payment expectations is crucial for any business or property management arrangement. By outlining terms such as payment due dates, accepted methods, and penalties for late payments, both parties can avoid misunderstandings and disputes. Clear terms create transparency and set the foundation for smooth transactions, ensuring that clients or tenants understand their obligations from the start.

Ensures Timely Payments

When payment terms are communicated clearly and early, it encourages timely settlement of bills. People are more likely to meet deadlines when they know exactly what is expected of them. By including specific due dates and outlining any applicable grace periods, you help foster an environment where prompt payments are the norm. Without this clarity, there is a risk that clients or tenants may delay payments, either unknowingly or intentionally.

Minimizes Disputes

Confusion over payment schedules or amounts can often lead to disputes, which can damage business relationships. Clearly defining payment expectations in the initial agreement helps to prevent these issues. It is especially important to specify any late fees or interest charges, as this ensures both parties understand the financial consequences of overdue payments. With explicit terms in place, disagreements are less likely to arise, and any issues can be resolved more efficiently.

Promotes Professionalism

Providing clear payment terms demonstrates professionalism and helps to build trust with clients or tenants. When terms are set out in writing, it shows that you are organized and serious about your financial arrangements. This professional approach can improve relationships and create a positive reputation for your business or property management services.

In conclusion, clear payment terms are essential for ensuring that financial transactions are smooth, transparent, and dispute-free. By clearly communicating your expectations, you help establish a solid foundation for a productive and mutually beneficial relationship with clients or tenants.

Using Payment Records for Tax Purposes

Maintaining proper financial documentation is essential not only for managing your business or property but also for complying with tax regulations. Accurate payment records serve as a reliable source of information when filing taxes, helping you track income, deductions, and any applicable expenses. By organizing and storing your payment records correctly, you can make tax season less stressful and ensure that your filings are complete and correct.

Tracking Income and Expenses

One of the main uses of payment records in relation to taxes is tracking your income. These documents provide a clear overview of all payments received throughout the year, making it easier to report your total earnings. Additionally, payment records can help you track related expenses, such as repairs, management fees, or other operational costs, which may be deductible. A well-organized system of records allows you to easily separate income from expenses, making it simpler to prepare your tax return and maximize eligible deductions.

Proof of Transactions

In the event of an audit or if you need to verify certain transactions, payment records can serve as proof of income. Having a record of all payments made or received, including the date, amount, and involved parties, can help substantiate your financial reports. Clear documentation also ensures that you can quickly respond to any inquiries from tax authorities, reducing the risk of fines or penalties due to missing or incomplete records.

In conclusion, keeping accurate and organized payment records is crucial for smooth tax filings and compliance. These documents help track your earnings, verify expenses, and ensure that your tax return is complete and precise. By using payment records effectively, you can save time and avoid complications during tax season.

How to Save Time with Pre-Designed Documents

Using pre-designed documents can significantly streamline the process of managing your financial records. By eliminating the need to start from scratch every time, you can focus on other important tasks, such as managing tenants or growing your business. These ready-made formats allow you to quickly input the relevant information, ensuring that you maintain accuracy while saving valuable time. Here are some ways that pre-designed documents can help you be more efficient:

1. Reduces Repetitive Work

One of the biggest time-savers is the ability to reuse the same document layout. Instead of manually entering the same fields over and over again, you can save a lot of time by using a pre-structured format. For example, once you set up your document layout with necessary fields like payment dates, amounts, and terms, you can simply fill in the specific details for each transaction without needing to design it each time.

- Consistency: Keep all your documents uniform, reducing the chance of mistakes.

- Efficiency: Quickly generate new records without reformatting or redesigning each time.

- Accuracy: Ensure that all necessary information is included and in the correct format.

2. Automates Data Entry

Many pre-designed document tools offer automated features that can speed up data entry. For example, some systems allow you to automatically populate certain fields with recurring details, such as client information or payment terms. This reduces manual input and minimizes the chance of errors, which in turn helps to save time and improve the overall accuracy of your records.

- Auto-fill features: Automatically populate fields like client names or payment details.

- Recurring entries: Set up templates that can be used for regular payments or invoices.

- Time tracking: Some systems offer tools to track and manage your work hours, streamlining data entry even further.

3. Allows for Quick Customization

Even with a pre-designed structure, you may need to make adjustments from time to time. Good pre-made document formats allow for quick and easy customization, whether you need to change payment terms, amounts, or any other details. This flexibility means you don’t have to start from scratch, but you can still tailor the document to meet your current needs.

- Editable fields: Easily adjust the details without affecting the overall design.

- Customizable layouts: Add or remove sections based on your specific requirements.

- Quick updates: Modify terms or client details with just a few clicks.

4. Ensures Professional Appearance

Pre-designed documents often come with professionally crafted layouts that ensure your records look polished and well-organized. This not only saves time by eliminating the need for graphic design but also ensures that your documents are consistent and presentable every time you use them. A professional-looking document helps build trust with clients and tenants, leaving a positive impression without additional effort.