Copywriting Invoice Template for Efficient Billing

Managing payments efficiently is crucial for freelancers and businesses alike. Having a well-organized document for tracking services provided and payments due ensures smooth transactions with clients. Such a document not only simplifies the process but also promotes a professional image, enhancing trust and clarity in business dealings.

Designing a clear, structured form for requesting payment allows for the inclusion of all necessary details, from the amount charged to deadlines and terms. This ensures both parties are on the same page and minimizes misunderstandings. Whether you’re offering writing services or any other form of creative work, a proper document for this purpose is essential for maintaining a smooth workflow.

Customization is key in crafting the perfect document. Tailoring it to your specific needs allows you to incorporate elements that reflect your business style while meeting client expectations. Incorporating the right structure can make a significant difference in how your clients view your professionalism and your attention to detail.

Copywriting Invoice Template Overview

A well-organized billing document is an essential tool for anyone offering professional writing services. It acts as a formal request for payment, providing both the service provider and the client with clear details about the work completed and the amount due. The right structure ensures that the transaction is transparent, minimizing the chances of confusion or delay in payment.

For those in the writing profession, having a standardized document for requesting compensation helps streamline the business process. It includes critical information such as the service provided, pricing, payment terms, and contact details. This form of communication enhances professionalism and fosters a positive business relationship.

| Key Element | Description |

|---|---|

| Service Description | Details the type of work completed, such as article writing, blog posts, or editing services. |

| Amount Due | Specifies the total payment requested for the work completed. |

| Payment Terms | Outlines the due date for payment and any late fees or discounts offered. |

| Client Information | Includes the client’s name, contact details, and billing address. |

| Service Provider Details | Provides the provider’s business name, contact information, and payment preferences. |

What is a Copywriting Invoice?

A payment request document is an essential part of the business process for professionals who provide written content. This formal communication serves as a record of the services rendered and specifies the amount due for the work completed. It acts as a clear agreement between the service provider and the client, outlining the terms and conditions of payment.

Key Purpose of the Document

The primary function of such a document is to clearly communicate the price for services provided. It includes details like the type of content created, the hours worked, or the flat rate charged for the job. A well-structured document helps avoid misunderstandings and ensures that both parties have a clear understanding of what is expected.

Why It’s Important for Professionals

For individuals in creative professions, such as writing or editing, this document is critical for maintaining professionalism. It provides transparency and establishes trust between the service provider and the client. Without it, there is a greater risk of delayed payments or disputes regarding the scope and pricing of the work. By using a standardized form, the service provider ensures that the request for payment is clear, professional, and legally sound.

Key Elements of an Invoice

A well-structured billing document should include all the essential details that help both the service provider and the client understand the terms of the transaction. These key components ensure transparency and clarity in the payment process, preventing any confusion regarding what is being paid for and when the payment is due.

The main elements typically include a description of the services performed, the total amount due, payment terms, and contact information. Each part of the document plays a crucial role in facilitating a smooth and professional exchange between the two parties.

Why Use a Template for Invoices?

Using a standardized format for billing documents can save time and ensure consistency in every transaction. A pre-designed structure allows service providers to focus on the work itself rather than spending time creating a new document from scratch with each payment request. Additionally, it helps maintain a professional appearance, which can leave a positive impression on clients.

Having a set format reduces the likelihood of missing critical information and minimizes errors. With an established framework, all necessary details are consistently included, and the risk of confusion or dispute over terms is reduced.

| Benefit | Description |

|---|---|

| Time Efficiency | A pre-made structure allows for quick creation without the need to design a new document every time. |

| Professionalism | Consistent use of a polished format enhances the image of the service provider in the eyes of clients. |

| Consistency | Using a uniform layout ensures that all critical elements are included every time, reducing the chance of missing important details. |

| Minimized Errors | A fixed format decreases the chances of mistakes in billing amounts, payment terms, or other critical elements. |

How to Customize Your Invoice

Personalizing a billing document to suit your business needs can make a significant difference in how you present your services to clients. Customization allows you to align the structure with your branding, terms, and specific requirements, ensuring that each request for payment feels tailored and professional. By modifying key elements, you can maintain consistency while adapting the document to various client preferences and job types.

Adjusting the Layout

One of the first steps in customization is deciding on the layout. The arrangement of sections such as service descriptions, payment terms, and client information should be clear and easy to navigate. Ensuring clarity in how details are presented not only improves readability but also builds trust with your clients.

Adding Unique Elements

Incorporating your brand identity, such as logos, color schemes, or personalized notes, can make the document feel more aligned with your business. Adding a brief message of appreciation or reminder about future services can enhance client relations and reinforce professionalism.

Essential Information to Include

For a billing document to serve its purpose effectively, it must contain several key details that ensure both the service provider and client are clear on the terms of payment. These elements help avoid confusion and ensure that the transaction is properly documented. Including all the necessary information also helps maintain a professional image and facilitates timely payment processing.

Basic Contact Information

Start by including both the provider’s and client’s contact details. This typically includes the names, addresses, and email addresses of both parties. Having this information ensures that there is no confusion about who is responsible for the payment or where communications should be directed.

Work Description and Payment Terms

Clearly outline the services provided, including any agreed-upon pricing and payment terms. This section should detail what work was completed, how much is owed, and when payment is expected. Specific payment instructions, such as preferred methods (bank transfer, PayPal, etc.), should also be included to avoid delays.

Invoice Formatting Tips for Clarity

Proper organization and clear formatting are key to ensuring that a billing document is easy to understand. A well-formatted request helps both the service provider and the client quickly locate important information, reducing the chance of mistakes or confusion. Following a few simple formatting tips can make the document more professional and effective in conveying the necessary details.

| Tip | Description |

|---|---|

| Use Clear Headings | Divide the document into sections with bold, clear headings to guide the reader through the details. |

| Consistent Font | Choose an easy-to-read font and stick with it throughout the document for consistency and professionalism. |

| Whitespace | Ensure there is enough space between sections and information. It improves readability and keeps the document uncluttered. |

| Bold Important Details | Highlight key figures, such as the total amount due and due date, to make them stand out. |

| Bullet Points | Use bullet points for lists, such as service descriptions or terms, to improve readability and organization. |

Best Practices for Billing Clients

Establishing clear, professional billing practices is essential for maintaining positive relationships with clients while ensuring timely payments. By following best practices, service providers can minimize confusion and ensure that both parties are aligned on the terms of the transaction. Adopting a consistent and transparent approach to requesting payment can help build trust and foster repeat business.

| Practice | Description |

|---|---|

| Set Clear Payment Terms | Always define when payments are due, whether it’s immediately upon completion or within a specific number of days. |

| Issue Invoices Promptly | Send payment requests promptly after work is completed to avoid delays and ensure timely compensation. |

| Provide Detailed Descriptions | Clearly list the services provided, including the scope and pricing, to avoid confusion about what is being paid for. |

| Use Professional Language | Ensure that the language used in payment requests is professional and courteous to maintain a positive tone. |

| Track Payments | Keep a record of payments received and outstanding balances to stay on top of your finances and follow up as needed. |

How to Calculate Copywriting Fees

Determining the right pricing for written content can be a complex process, as it involves considering several factors that affect the overall cost. Professionals must assess the scope of the work, the time required, and the value provided to the client. Properly calculating fees ensures fair compensation while maintaining a competitive edge in the market.

There are several methods for calculating fees, and the right approach depends on the nature of the project and the agreement with the client. Below are the common methods used:

- Hourly Rate: Charging by the hour is common for smaller or less defined projects. This method requires tracking time spent on the task and multiplying by the set hourly rate.

- Per Word: For projects where the volume of writing is clear, pricing per word can be an effective strategy. The rate can vary depending on the complexity and subject matter of the work.

- Flat Fee: A fixed rate is ideal for larger projects with a clearly defined scope. This pricing model provides clarity for both the service provider and the client, eliminating any surprises.

- Retainer: Some professionals opt for retainer agreements, where clients pay a set fee for ongoing work. This can provide a steady income stream and ensure long-term client relationships.

Additionally, when calculating fees, be sure to account for factors such as:

- Experience and Expertise: More experienced professionals can often command higher rates, especially in niche markets.

- Research and Revision Time: Don’t forget to include time spent on research, revisions, and client meetings in your pricing calculations.

- Urgency: Rush projects may require a premium rate to reflect the added pressure and time constraints.

By carefully considering these factors, professionals can ensure they are pricing their services competitively while also valuing their time and expertise appropriately.

Setting Payment Terms on Invoices

Establishing clear payment terms is an essential part of managing business transactions. Well-defined terms ensure both parties understand when payment is due and how it should be made, helping to avoid confusion and delays. Setting clear expectations from the start can contribute to a smoother working relationship and prompt payments.

When determining payment terms, consider the following important aspects:

- Due Date: Specify the exact date by which payment should be made. Common options include 7, 15, 30, or 60 days after the delivery of the service or product.

- Late Payment Penalties: Include any penalties or interest that will be applied to overdue payments. This encourages clients to pay on time and helps protect your business.

- Accepted Payment Methods: Clearly state the methods of payment you accept, whether it’s bank transfer, credit card, or online payment services.

- Deposit Requirements: For larger projects, consider requesting an upfront deposit. This ensures commitment from the client and helps cover initial costs.

Being transparent about payment terms from the outset not only minimizes potential misunderstandings but also fosters a sense of professionalism, which can enhance your business reputation and lead to better client relations.

Including Taxes and Discounts

Accurately calculating and including taxes and discounts is an important part of any financial document. These elements directly affect the total amount due and ensure transparency in transactions. When handling taxes and discounts, it’s essential to be clear and precise to avoid any misunderstandings or legal complications.

Here are some key points to consider when including taxes and discounts in your billing documents:

- Taxes: Depending on your location and the nature of the services provided, you may be required to include sales tax, VAT, or other relevant taxes. Clearly state the applicable tax rate and the total tax amount separately to provide full transparency to the client.

- Discounts: If offering a discount, ensure it is applied before taxes to avoid confusion. Specify the discount amount or percentage and make sure the client understands how it affects the total cost.

- Clear Breakdown: Always provide a detailed breakdown of taxes and discounts so the client can easily see how these adjustments impact the final price.

- Legal Compliance: Make sure your tax calculations comply with local laws and regulations to avoid legal issues.

By including taxes and discounts clearly and accurately, you can maintain transparency, foster trust with clients, and ensure compliance with relevant financial regulations.

Common Mistakes to Avoid

When managing payment requests, there are several common errors that can lead to confusion, delays, or even lost payments. It’s crucial to understand these pitfalls to maintain professionalism and ensure smooth transactions with clients. By avoiding these mistakes, you can foster stronger relationships and minimize misunderstandings.

1. Incomplete or Missing Information

Failing to include essential details can lead to delays in payment. Make sure all necessary information is present and clear to avoid confusion. Common omissions include:

- Client’s contact information

- Clear breakdown of services or products

- Accurate dates for services rendered and payment deadlines

- Applicable taxes and discounts

2. Not Setting Clear Payment Terms

Without well-defined payment terms, both parties may have different expectations regarding deadlines and payment methods. Common mistakes to avoid include:

- Not specifying due dates

- Failure to mention late payment fees

- Not clearly outlining acceptable payment methods

3. Overcomplicating the Document

Simplicity is key. Overly complicated documents may confuse clients, which could delay payment. Avoid adding unnecessary details or jargon that distract from the main points.

4. Not Tracking Payments Properly

It’s essential to keep accurate records of payments made and outstanding balances. Missing or incorrect entries can lead to discrepancies and disputes with clients.

By being mindful of these common mistakes, you can ensure a smoother and more professional billing process, enhancing client satisfaction and ensuring prompt payments.

How to Handle Late Payments

Dealing with delayed payments is an inevitable part of managing finances for any business. Late payments can disrupt cash flow and cause unnecessary stress. However, having a clear strategy in place can help manage these situations professionally and efficiently, ensuring that the payment process remains smooth and the relationship with clients stays intact.

1. Set Clear Expectations from the Start

Prevention is always the best approach. Clearly outline your payment terms at the beginning of every project. Make sure your client understands the due date and any consequences for late payments. By being upfront, you can set the tone for timely payments and avoid potential conflicts.

2. Send Friendly Reminders

If a payment is overdue, it’s important to remain polite and professional. A gentle reminder can often resolve the issue without any friction. Contact your client via email or phone and remind them of the due amount and the payment terms. Keep your communication clear and respectful.

If the payment continues to be delayed, consider implementing the following steps:

- Follow-up Emails: Send a formal reminder outlining the overdue amount and any late fees that may apply.

- Offer Payment Plans: If the client is struggling financially, offer a payment arrangement to help them fulfill their obligation without causing strain.

- Implement Late Fees: Include late payment penalties as part of your terms. A small fee can incentivize timely payments and discourage delays.

- Consider Legal Action: As a last resort, if payments remain unpaid, you may need to consider legal options. Always weigh the cost and effort before proceeding with this step.

By setting clear expectations and maintaining open communication, you can reduce the chances of late payments and manage them effectively when they occur.

Creating Recurring Billing Documents

For businesses that offer services on a regular basis, setting up automated billing structures is essential to streamline operations and ensure consistent payments. Recurring payment schedules help both service providers and clients stay organized and reduce the need for repetitive administrative tasks. These documents are designed to be reused over time, with only minor adjustments needed for each cycle.

1. Setting Up Recurring Billing Schedules

The first step in creating recurring billing structures is determining the frequency of payments. Whether it’s weekly, monthly, or annually, the schedule should align with your agreement with the client. You can specify the exact amount due and any adjustments that may arise, such as price changes or additional fees.

| Payment Frequency | Billing Interval |

|---|---|

| Monthly | Every 30 days |

| Quarterly | Every 90 days |

| Annually | Every 365 days |

2. Including Essential Information

Recurring billing documents should include all the same key elements as one-time requests, but with the added detail of the recurring nature of the charges. Important details to include are:

- Client Information: Full name, contact details, and billing address.

- Service Description: A breakdown of the services provided, including any recurring charges or fees.

- Frequency of Billing: Clearly state the recurring schedule, such as “monthly” or “quarterly.”

- Start Date and Next Payment Due Date: Ensure both parties are aware of when the payments begin and when the next charge will occur.

By establishing a clear and structured recurring payment system, you can create a seamless experience for both you and your clients, minimizing administrative workload and improving financial predictability.

Digital vs. Paper Billing Documents

In today’s digital world, businesses have more options than ever when it comes to managing financial transactions. The choice between using physical or electronic records for charging clients often comes down to efficiency, convenience, and cost. Both methods have their benefits and drawbacks, depending on the nature of the business and the preferences of the clients.

Advantages of Digital Documents

Digital documents are becoming increasingly popular due to their convenience and speed. Here are some key benefits:

- Efficiency: Sending digital documents is instant, reducing the waiting time for clients to receive their statements.

- Cost-Effective: There are no printing, paper, or postage costs involved when using digital records.

- Environmental Impact: Going digital helps reduce the use of paper, contributing to sustainability efforts.

- Easy Tracking: Electronic documents can be easily stored, searched, and accessed, making them ideal for record-keeping and accounting purposes.

- Security: Digital files can be encrypted and protected with passwords, providing a higher level of security.

Advantages of Paper Documents

While digital methods are on the rise, some businesses still prefer the traditional approach. The benefits of paper documents include:

- Physical Record: Some clients feel more comfortable receiving a tangible document that they can physically keep for their records.

- Credibility: Paper documents can often be seen as more formal or official, which can give an added sense of trust for certain clients.

- Accessibility: Not all clients have reliable internet access or prefer to use email for financial transactions, making paper records an important option.

Ultimately, the decision between digital and paper records depends on your business needs, client preferences, and the nature of your operations. For many businesses, a combination of both methods can provide the best of both worlds.

Using Billing Software for Writers

For freelance professionals, managing payment processes efficiently is a key part of staying organized and focused on their work. Billing software has become an essential tool for many, offering an easier way to create, send, and track payments. Whether you’re handling small or large projects, such software can streamline your financial operations, ensuring that you get paid on time without much hassle.

Benefits of Billing Software

Here are some advantages of using billing software to manage your transactions:

- Automation: Billing software automates repetitive tasks such as creating and sending invoices, reducing the time spent on administrative duties.

- Professional Appearance: With pre-designed formats, you can create polished and professional-looking payment documents that enhance your business image.

- Time Tracking: Many software options allow you to track the time spent on each project, helping you accurately bill clients for your work.

- Easy Payment Collection: Integrated payment options, such as PayPal or credit card processing, allow clients to pay easily and quickly.

- Record Keeping: Billing platforms automatically store your financial records, making it simple to track payments and manage your accounts.

Popular Software Options

Several software options are available to suit different needs and budgets. Some of the top choices for writers include:

- FreshBooks: An intuitive platform with time tracking, expense management, and customizable billing templates.

- QuickBooks: A robust accounting solution that offers invoicing, tax calculations, and detailed financial reporting.

- Wave: A free invoicing tool for freelancers, with features for creating professional invoices, tracking payments, and managing receipts.

- HoneyBook: A client management tool that integrates project management, invoicing, and payments in one platform.

By choosing the right billing software, writers can ensure a more efficient payment process, allowing them to focus on their craft rather than worrying about administrative tasks.

Legal Considerations for Payment Requests

When dealing with financial transactions and requesting payment, it is crucial to adhere to certain legal requirements to ensure that both parties are protected and that the process runs smoothly. These legal guidelines help avoid disputes and provide clear evidence of the agreement between service providers and clients. It is essential to include the necessary information and comply with applicable laws to maintain a professional and transparent business relationship.

Important Legal Elements to Include

For a payment request to be legally sound and enforceable, certain elements should be included:

- Legal Business Information: Always include your full legal name, business name (if applicable), and any relevant registration numbers or tax identification numbers. This helps establish your identity and credibility.

- Clear Payment Terms: Clearly state the agreed-upon payment amount, due date, and any late payment penalties or interest. This avoids confusion and ensures that both parties are on the same page.

- Itemized Breakdown: Provide a detailed list of the services rendered, including the price for each item or service. This ensures clarity and transparency in the transaction.

- Contract Reference: If applicable, reference any contract or agreement that outlines the terms of the work. This strengthens the legal standing of your payment request and provides a point of reference in case of a dispute.

Understanding Local Regulations

The legal requirements for payment requests can vary depending on the location of your business and your client. Different countries and regions have specific rules regarding taxes, payment deadlines, and even the format of financial documents. It’s essential to research and understand these regulations to avoid potential legal issues.

Consulting with a legal professional or accountant can help ensure that your documents meet all required standards and protect your rights as a service provider. By being thorough and adhering to legal considerations, you can minimize the risk of disputes and maintain a trustworthy relationship with your clients.

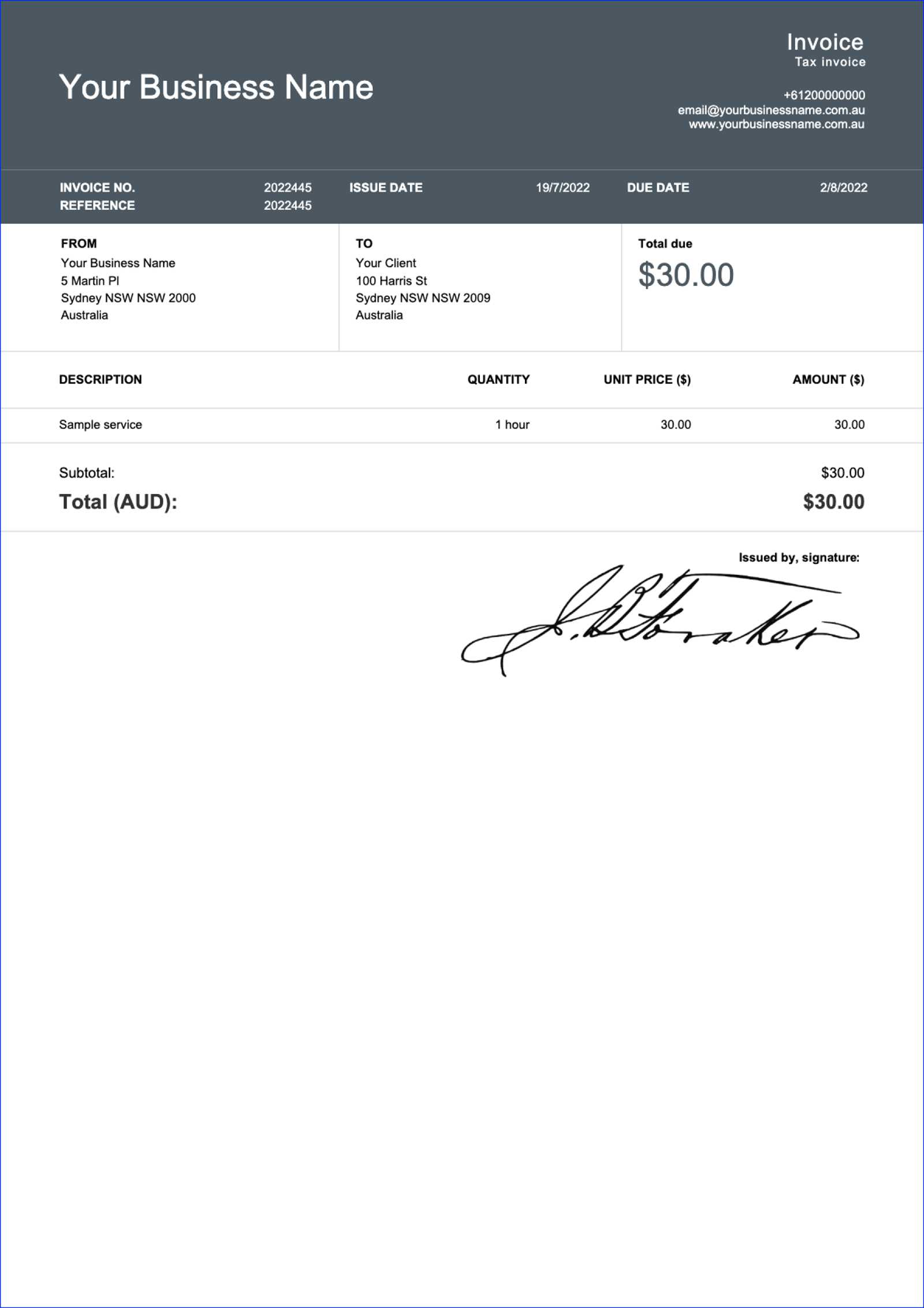

Examples of Professional Billing Documents

Having a well-structured and professional document to request payment can make a significant impact on your business’s reputation. A polished document not only helps clients understand what they are being charged for, but also promotes trust and transparency in your business dealings. Below are several examples of how a professional payment request can be organized, showcasing different styles and formats suitable for various industries.

Each example can be adapted to fit the specific needs of a business, whether you’re providing creative services, consultancy, or any other type of work. The key is to ensure that all essential details are clearly laid out in an organized, easy-to-read format.

Basic Service Request Document

This simple format is ideal for small businesses or freelancers who need to bill clients without too many details. It typically includes:

- Your business name and contact details

- Client’s name and address

- List of services provided with their corresponding fees

- Due date and payment instructions

While basic, this format ensures that your client can quickly review the services and understand the charges associated with each task.

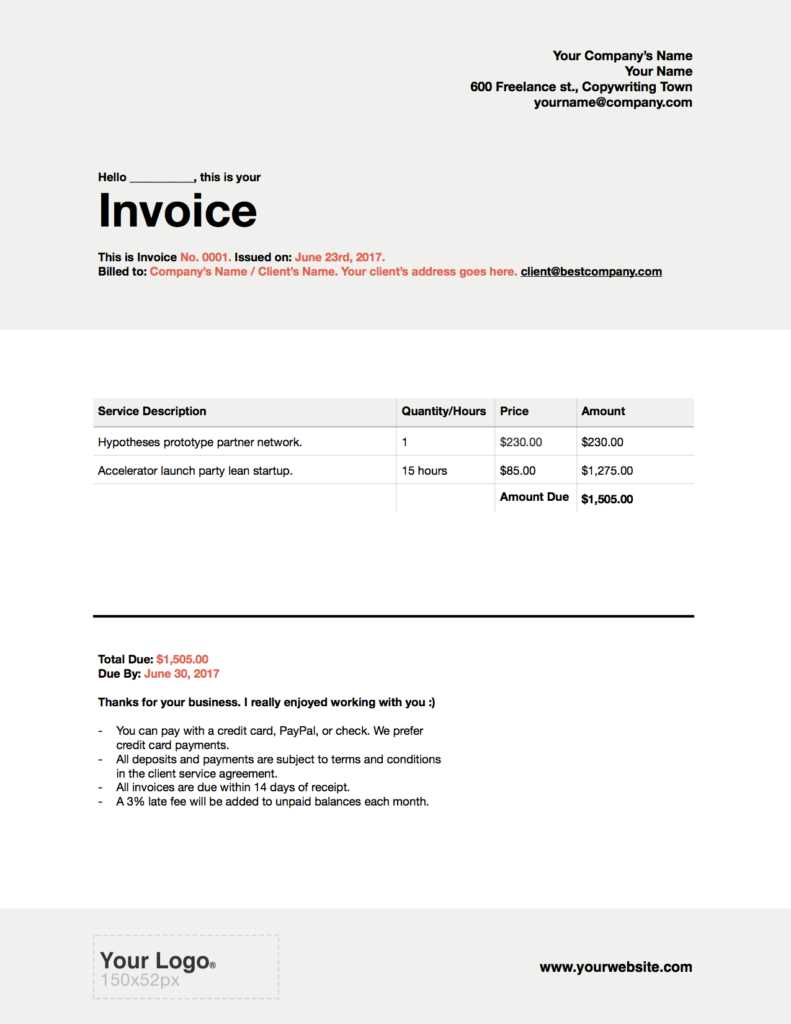

Itemized Billing Summary

For clients who prefer more detailed breakdowns, an itemized format can be more appropriate. It typically includes:

- A detailed list of services, tasks, or goods provided

- Hourly or fixed rates for each service

- Subtotals for different categories of work

- Applicable taxes and final amount due

This format provides clear transparency and is especially helpful for clients who need to know exactly what they are being charged for and why.

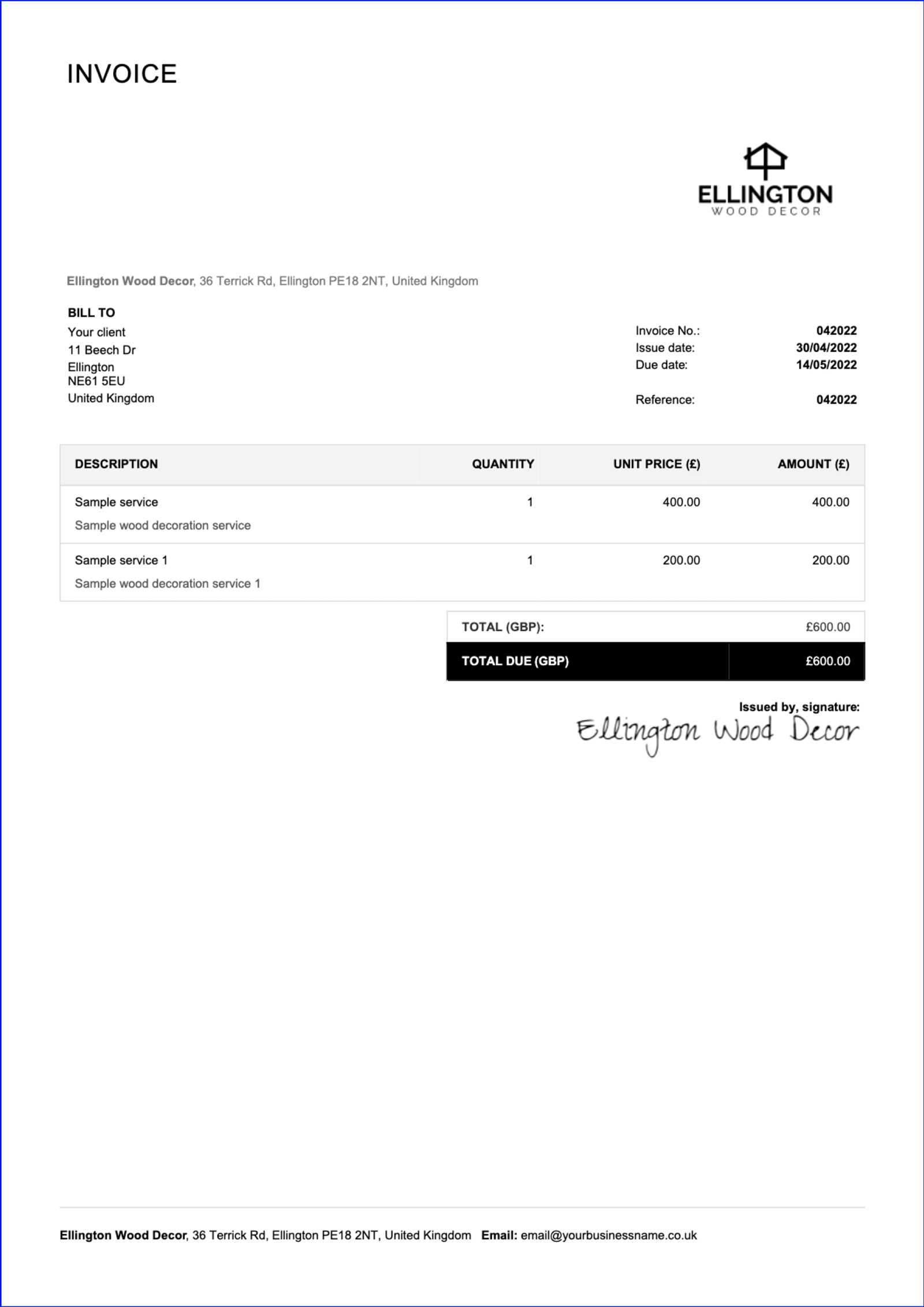

Corporate Payment Request

For larger clients or corporate contracts, a more formal and comprehensive format may be necessary. This might include:

- Contract or project number reference

- Detailed payment terms and conditions

- Specific payment methods (bank transfer, cheque, etc.)

- Legal disclaimers or tax identification numbers

This type of format offers a more corporate feel and ensures that all contractual terms are met while maintaining a professional appearance.

Regardless of the specific format you choose, it’s important to keep the document neat, consistent, and professional. This will not only ensure smooth transactions but also present your business in the best light to clients.