Email Template for Sending Invoice to Customer with Tips and Examples

Effective communication with clients is essential for maintaining smooth business operations, especially when it comes to financial matters. Clear, concise, and professional correspondence helps ensure that all transactions are understood and completed on time. When requesting payment for services rendered, the way you structure your message plays a key role in fostering trust and professionalism.

Having a well-crafted message is critical for conveying payment details, addressing any concerns, and reinforcing your brand’s commitment to excellence. A well-structured request not only ensures your client knows exactly what is due but also reflects positively on your business’s image.

In this section, we’ll guide you through crafting the perfect communication for requesting payment. From the tone and format to the key elements that need to be included, you’ll learn how to approach your client with clarity and professionalism while maintaining a friendly yet formal tone.

How to Create an Invoice Email

When requesting payment from clients, the way you communicate the details can greatly influence the speed and clarity of the transaction. A professional approach ensures that the recipient understands the amount due, the payment methods available, and any relevant deadlines. Structuring your message effectively helps build trust and reduces the risk of misunderstandings.

The first step is to establish a clear subject line that immediately communicates the purpose of your message. This helps the recipient identify the nature of the correspondence at a glance. Next, start with a polite greeting and ensure your message is tailored to the specific recipient, maintaining a professional yet friendly tone throughout.

In the body of the message, include essential details such as the amount due, due date, and any specific instructions or references that are necessary for processing the payment. Be concise but thorough, and always double-check for clarity. It’s also important to include contact information in case the recipient has any questions or requires assistance.

Importance of Professional Invoice Communication

Clear and respectful communication plays a vital role in maintaining strong relationships with clients, especially when it comes to financial transactions. How you present payment requests can impact not only the timely receipt of funds but also the overall reputation of your business. Professional communication ensures that both parties are aligned on expectations, which minimizes the risk of confusion and potential disputes.

Why Professionalism Matters

When reaching out for payments, clients expect a level of formality and clarity that reflects your business’s standards. A well-crafted message communicates more than just the details of the transaction; it reinforces your company’s image as organized, reliable, and trustworthy.

- Ensures that information is clearly understood

- Fosters a positive impression of your business

- Minimizes the likelihood of errors or misunderstandings

- Encourages prompt payments and smoother transactions

Consequences of Unprofessional Communication

On the other hand, poorly written or unclear payment requests can lead to confusion, delayed payments, and damaged client relationships. Lack of professionalism may also give the impression

Key Elements of an Invoice Email

When requesting payment, it’s essential to include certain key details that ensure the recipient understands the amount due, how to proceed with the transaction, and any relevant deadlines. A well-structured message provides clarity and reduces the chance of confusion, helping to establish a smooth payment process. Below are the critical components that should be included to create a professional and effective communication.

Essential Information to Include

Every message asking for payment should contain specific information to make the transaction clear and straightforward. These elements not only help the recipient process the payment efficiently but also ensure that both parties are aligned on the terms.

| Element | Description |

|---|---|

| Greeting | Begin with a polite salutation, addressing the recipient by name where possible. |

| Amount Due | Clearly state the total amount that needs to be paid, including any applicable taxes or fees. |

| Due Date | Specify the date by which the payment should be made to avoid late fees. |

| Payment Methods | Outline the available methods for making the payment (e.g., bank transfer, credit card, etc.). |

| Contact Information | Provide a way for the recipient to reach out if they have any questions or need clarification. |

Additional Details to Include

In addition to the core information, you may want to include other details to personalize the message or make the payment process easier for the recipient. These can include payment references, a reminder about any discounts for early payment, or even a thank you note for their business.

- Payment reference number (if applicable)

- Discounts for early payment

- Company contact details for questions

- Personalized closing remarks or gratitude

By incorporating these key elements, you ensure that your payment request is clear, professional, and easy for the recipient to act upon.

Choosing the Right Tone for Your Email

The way you communicate in written form can influence how your message is received. When asking for payment, it’s crucial to strike the right balance between professionalism and approachability. The tone of your message can help establish a sense of respect and trust, making it easier for the recipient to act promptly without feeling pressured or uncomfortable.

Too formal a tone might come across as distant or impersonal, while too casual can seem unprofessional or unclear. Finding the right middle ground ensures that your communication is both respectful and clear. This can help maintain positive relationships with clients, even when discussing financial matters.

Consider the nature of your relationship with the recipient when deciding on the tone. If you’ve worked together before, a slightly more informal tone may be appropriate. However, if it’s a new client or a more formal business arrangement, a more polite and structured approach is often the best choice.

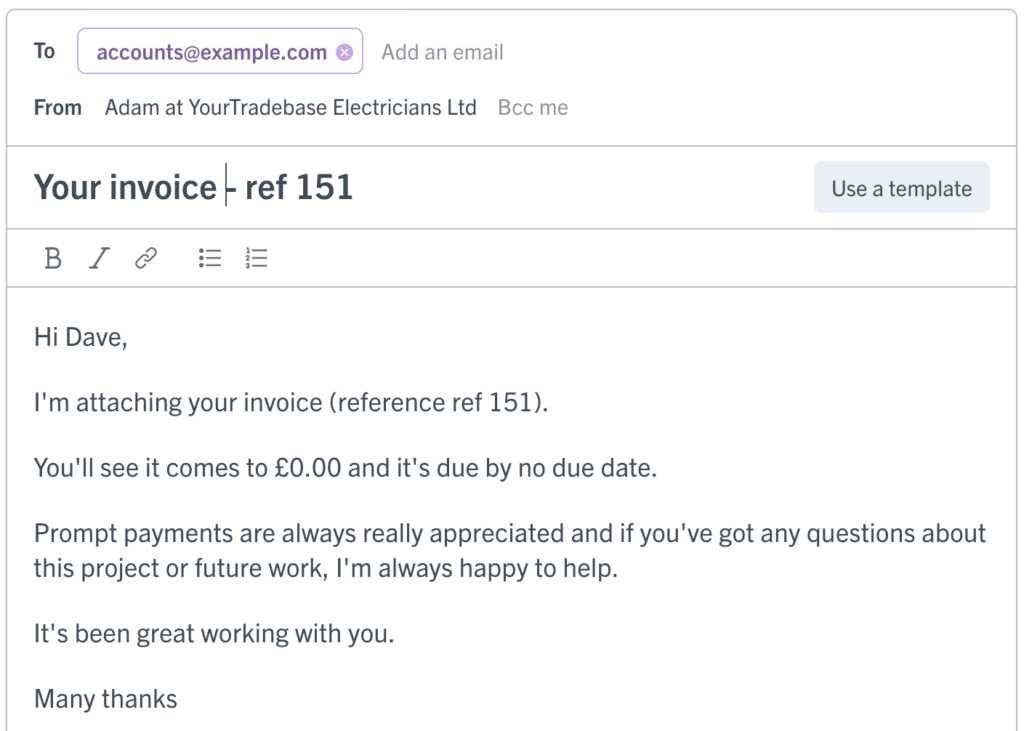

How to Format Your Invoice Email

When making a request for payment, how your message is structured plays a significant role in ensuring it is clear, professional, and easy for the recipient to act upon. Proper formatting not only enhances readability but also helps convey important information in an organized manner. A well-formatted message reduces the chances of confusion and ensures that the necessary details are easily accessible.

To create a clear and effective payment request, follow these formatting guidelines:

- Use a Clear and Informative Subject Line: Make sure the recipient immediately understands the purpose of your message, such as “Payment Due for Services Rendered” or “Outstanding Balance for Invoice #12345.”

- Begin with a Polite Salutation: Greet the recipient warmly, using their name whenever possible to add a personal touch.

- State the Purpose Early: In the opening lines, briefly mention the reason for the message, including the amount due and the payment deadline.

- Provide Payment Details: Use bullet points or a table to clearly list all relevant details, such as the amount owed, due date, and payment methods.

- Keep Paragraphs Short: Use short, concise paragraphs to make the message easier to read and to highlight key points.

- Be Clear on How to Proceed: Include specific instructions on how the recipient can make the payment, whether by bank transfer, credit card, or other methods.

- End with a Polite Closing: Conclude with a thank you message and a polite invitation for the recipient to reach out with any questions or concerns.

Proper formatting not only helps the recipient quickly understand the details but also portrays your business as organized and professional. By following these steps, you ensure that your payment requests are as effective as possible.

Including Clear Payment Instructions

When requesting payment, providing clear and easy-to-follow instructions is crucial for ensuring a smooth transaction. Ambiguity in payment details can cause delays, confusion, or even missed payments. By being specific and straightforward, you make it easier for the recipient to act promptly and correctly, helping maintain a positive and professional relationship.

To avoid misunderstandings, always outline the steps the recipient should take to complete the payment. Whether it’s providing bank details, offering a link to an online payment portal, or specifying payment reference numbers, clarity is key. The more detailed and direct you are, the less likely issues will arise.

- Specify the payment methods available (e.g., bank transfer, credit card, online payment platforms).

- Provide clear instructions for each method, including any necessary account details or payment links.

- If applicable, mention any reference numbers or order IDs that should be included with the payment.

- Include any deadlines or time frames to encourage timely payments.

- If there are additional charges, such as late fees, clearly explain how they will be applied.

By including precise payment instructions, you reduce the chance of confusion and enhance the likelihood of receiving payment on time. Ensure that your message is concise, yet comprehensive enough to leave no room for uncertainty.

Best Practices for Subject Lines

The subject line is the first thing the recipient sees, and it plays a crucial role in whether your message gets opened promptly. A well-crafted subject line should be clear, concise, and informative, making it easy for the recipient to understand the purpose of your message at a glance. With a well-thought-out subject, you increase the chances of your message being read and acted upon without delay.

Be direct and specific about the nature of the communication. Vague subject lines can lead to confusion or the message being overlooked. Additionally, avoid overly wordy or complicated phrases that might make the message seem less urgent.

- State the Purpose Clearly: Use language that immediately tells the recipient what to expect, such as “Payment Due for Services Rendered” or “Outstanding Balance on Account #12345.”

- Keep it Short: Aim for brevity. A subject line that’s too long might get cut off, especially on mobile devices.

- Include Key Information: If applicable, include reference numbers or specific dates, such as “Payment Due by November 10” or “Balance Due for Invoice #56789.”

- Avoid Being Too Aggressive: While it’s important to convey urgency, avoid using overly forceful language like “Immediate Action Required” or “Last Chance to Pay.” A polite, professional tone is always better.

By following these best practices, you ensure that your message stands out in the recipient’s inbox and encourages prompt attention to the matter at hand. A well-crafted subject line can set the tone for the entire transaction process and help facilitate a smoother payment experience.

Adding Attachments to Your Invoice Email

Including relevant documents as attachments is an essential part of requesting payment. Providing a clear and accurate record of the transaction helps ensure that the recipient has all the necessary information to process the payment smoothly. Attachments, such as detailed statements or payment breakdowns, not only make your request more professional but also provide clarity and support for any questions the recipient may have.

Types of Documents to Include

When attaching files, ensure they are relevant and useful to the recipient. Common documents you might attach include:

- Detailed Payment Receipts: If applicable, provide a full receipt that includes all items or services listed.

- Breakdown of Charges: If the payment consists of multiple components, a breakdown helps the recipient understand how the total amount was calculated.

- Contract or Agreement Copies: Include a copy of the terms or agreement that outlines the payment details, if necessary.

- Payment History: If the client has made partial payments, attaching a summary of previous payments can be helpful for tracking the outstanding balance.

Best Practices for Adding Attachments

While attachments are useful, it’s important to follow some best practices to ensure your files are accessible and appropriately presented:

- Use Common File Formats: PDF is the most widely accepted format, ensuring compatibility across devices and operating systems.

- Keep File Sizes Manageable: Large attachments can be difficult for recipients to open, especially on mobile devices. Compress files or split them into smaller, separate attachments if necessary.

- Label Files Clearly: Name your attachments in a clear and descriptive way, such as “Payment_Receipt_12345.pdf,” so the recipient knows exactly what each file contains.

- Double-Check Attachments: Before sending, verify that the correct documents are attached and that they open properly.

By following these best practices, you ensure that the recipient has all the information they need to make an informed and timely payment. Attachments should complement the message, providing essential documentation in a clear and professional manner.

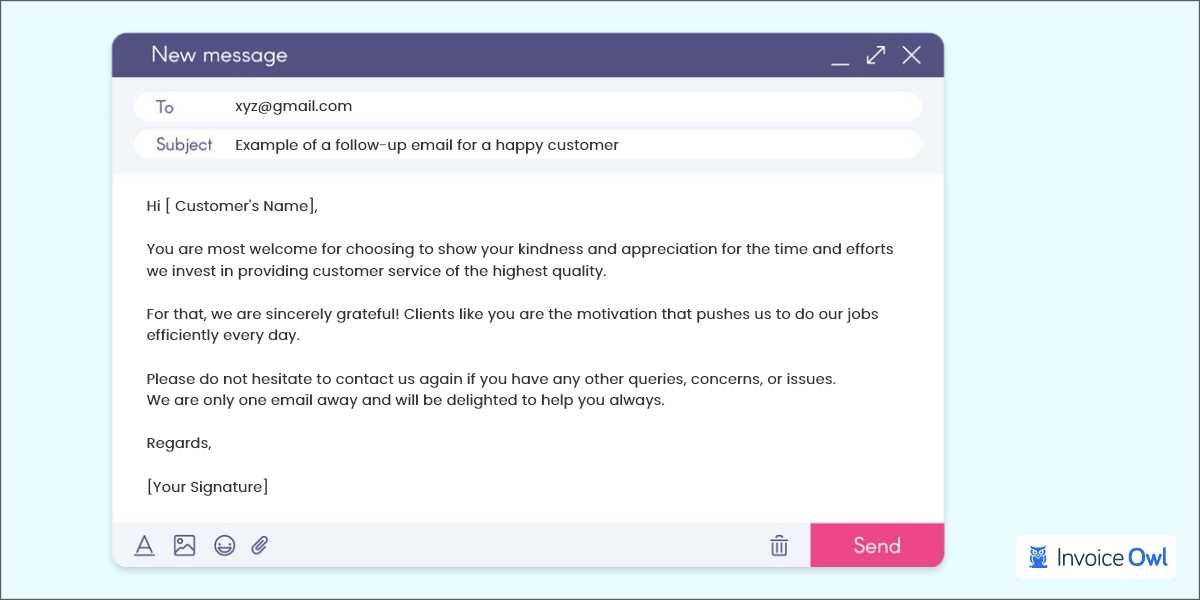

Personalizing the Email for Clients

Personalization plays a significant role in building strong relationships and ensuring your communications are well-received. When asking for payment, customizing your message for each recipient makes the interaction feel more thoughtful and less transactional. Tailoring your message to the client’s preferences, business history, and specific circumstances helps create a connection and fosters trust.

Why Personalization Matters

Addressing your recipient by name and acknowledging their past business interactions can go a long way in establishing a positive rapport. Personalized communication not only demonstrates your professionalism but also shows that you care about the client’s needs and concerns, rather than sending generic, one-size-fits-all messages.

- Use the Recipient’s Name: Always address your client by name to make the communication feel more personal.

- Reference Previous Interactions: Mention past projects or business dealings, showing that you value the ongoing relationship.

- Tailor the Language: Adjust the tone based on your familiarity with the client. For example, a formal tone for new clients and a more casual tone for long-term clients.

- Custom Payment Terms: If applicable, acknowledge any specific terms or agreements that apply to t

Setting Payment Deadlines in Emails

Establishing clear and specific deadlines for payments is essential for ensuring timely transactions. By clearly communicating when payment is due, you not only help your recipient stay organized but also set the expectation for when the payment should be made. A well-defined deadline encourages prompt action and helps avoid unnecessary delays, ensuring both parties are aligned on the timing of the financial exchange.

Be clear and direct when mentioning payment deadlines. Vague language such as “as soon as possible” can lead to confusion and delays. Instead, specify an exact date, and if necessary, include additional details such as time zones or working hours to ensure there are no misunderstandings.

- State the Exact Date: Always provide a specific date, such as “Payment due by November 10, 2024.”

- Give Ample Notice: Allow enough time for the recipient to process the payment. A common practice is to provide at least 7-14 days between the request and the deadline.

- Set Clear Consequences: If applicable, mention late fees or interest charges for overdue payments. This can help motivate timely action.

- Reiterate the Importance: Politely emphasize why it’s important to meet the deadline, such as to avoid interruptions in service or future delays.

By setting clear payment deadlines, you establish expectations upfront and reduce the chances of delayed or missed payments. A firm but respectful approach helps maintain a professional and efficient relationship with your client while ensuring your business operations continue smoothly.

How to Follow Up on Unpaid Invoices

Following up on unpaid balances can be a delicate task. It’s important to remain professional and courteous, while also ensuring that the outstanding amounts are addressed promptly. A well-timed reminder not only serves as a gentle nudge but also reinforces the expectation of timely payment. However, it’s essential to approach the situation with a balance of firmness and professionalism to maintain positive relationships with clients while ensuring your business receives the payments owed.

Start with a polite reminder as soon as the payment due date has passed. Often, clients simply forget, and a friendly nudge is enough to resolve the issue. If no action is taken after the initial reminder, escalate the follow-up while remaining courteous and firm in your communication.

- Send a Friendly Reminder: A gentle message a few days after the deadline can resolve the issue. Simply state that the payment is overdue and request that it be processed as soon as possible.

- Provide Payment Details Again: Reiterate the amount due, payment methods, and any necessary reference information to make it as easy as possible for the recipient to settle the balance.

- Give a Final Warning: If previous reminders haven’t been successful, send a more assertive message explaining the consequences of continued non-payment, such as late fees or suspension of services.

- Offer Solutions: If the client is experiencing financial difficulties, consider offering flexible payment plans or extensions to help them make the payment in manageable installments.

- Use a Professional Tone: Always maintain a respectful and professional tone throughout the follow-up process. Even if the situation becomes frustrating, treating your client with courtesy can help preserve the business relationship.

By following up in a timely and structured manner, you increase the likelihood of receiving payment while preserving a positive relationship with the client. Effective follow-ups are essential to keeping your cash flow steady and your operations running smoothly.

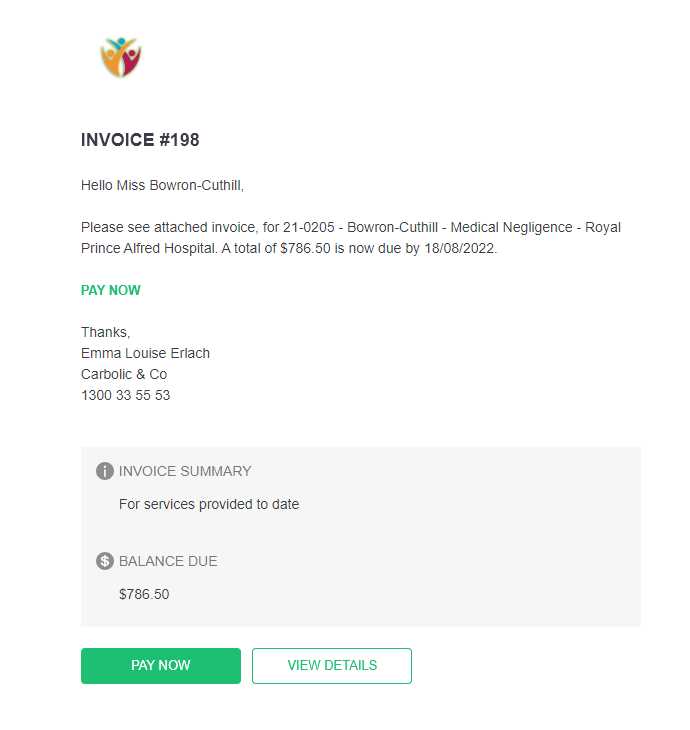

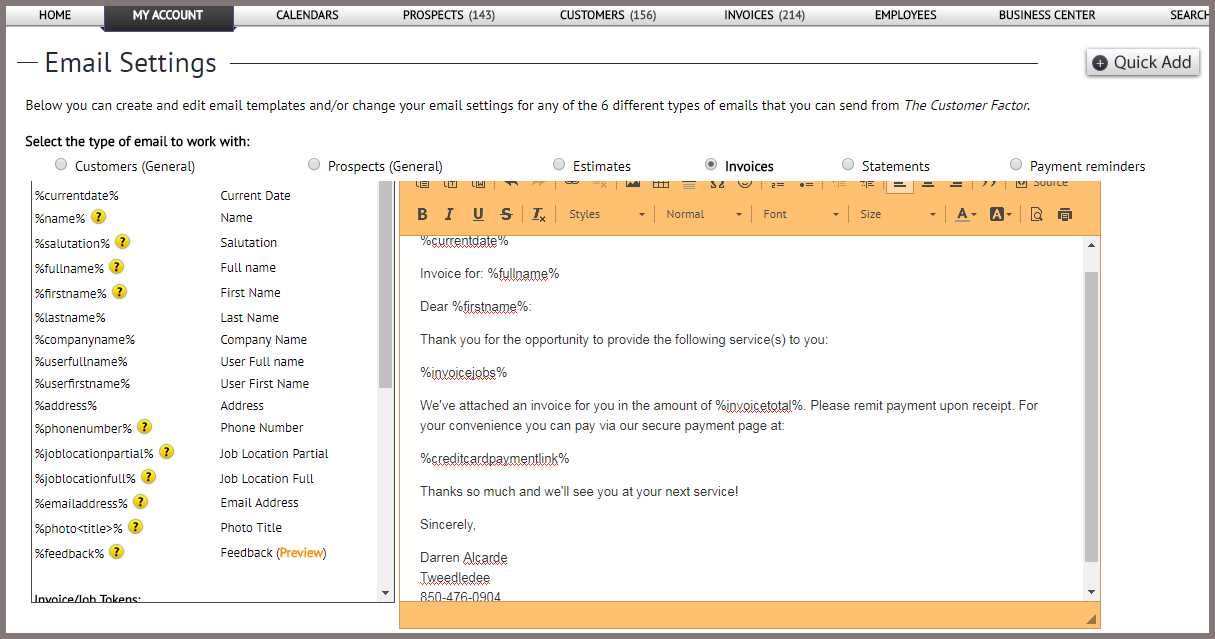

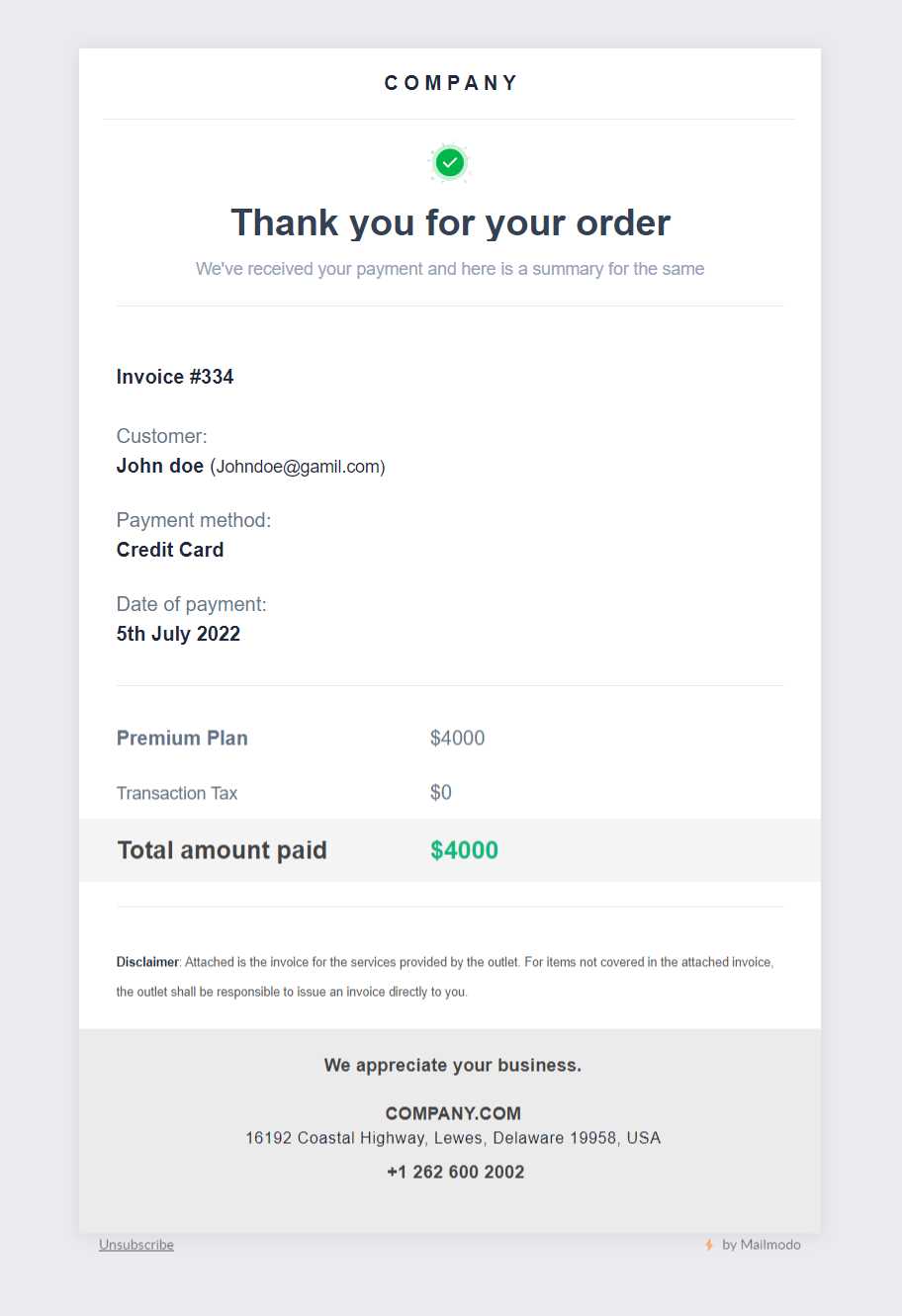

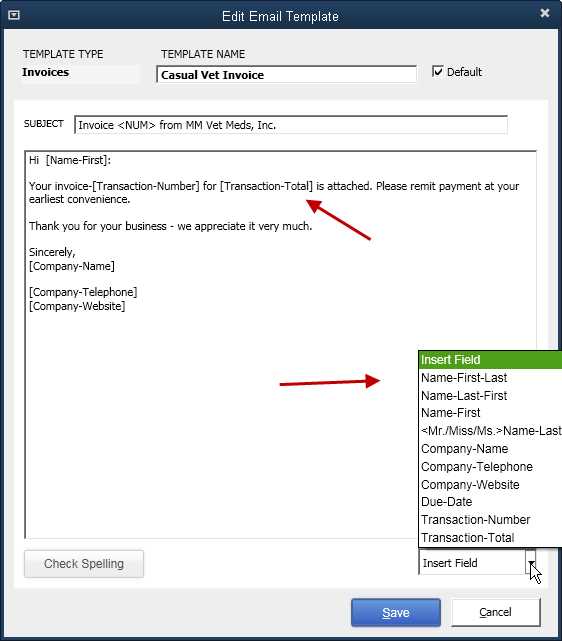

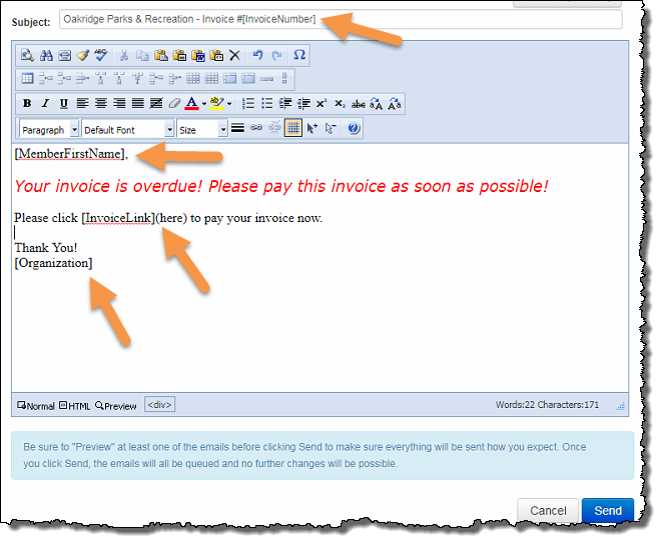

Using Professional Email Templates

Utilizing a well-designed, professional communication structure can significantly enhance your interactions with clients, especially when managing payment requests. A professional message template not only saves time but ensures that all critical details are consistently included in every communication. This consistency helps convey professionalism, ensuring the recipient understands the message and its importance clearly.

By using pre-structured messages, you avoid the risk of omitting essential information, and your correspondence appears organized and polished. Whether you’re following up on a payment, sending a reminder, or providing payment instructions, having a reusable format can streamline your workflow and reduce the time spent composing individual messages.

Benefits of Using a Professional Format

- Consistency: Using a standard format ensures that every message sent is clear, well-organized, and professional. It reflects your attention to detail and business standards.

- Time Efficiency: Templates save you time by allowing you to focus on personalizing the message rather than writing from scratch every time.

- Minimizes Errors: A pre-designed format reduces the chances of forgetting key details such as payment terms, due dates, or amounts owed.

- Builds Professional Image: A consistent, well-structured communication style projects reliability and professionalism, fostering trust with clients.

Key Elements to Include in a Professional Communication Format

- Clear Subject Line: Always include a subject line that directly reflects the purpose of the message, such as “Outstanding Balance Due” or “Payment Request for Services Rendered.”

- Personalized Greeting: Always address the recipient by name to add a personal touch and establish a connection.

- Details of the Transaction: Include a breakdown of services rendered, payment due, and any applicable reference numbers.

- Payment Instructions: Provide clear instructions for payment, including preferred methods and necessary details.

- Polite Closing: End with a respectful closing statement, encouraging the recipient to contact you with any questions or concerns.

Using professional, pre-designed communication formats helps you maintain a polished and efficient approach to managing payments, ensuring that all necessary information is provided clearly and consistently. This practice not only saves time but also strengthens the professionalism of your business communications.

How to Address Invoice Disputes

Disagreements over payment are an unfortunate reality of doing business, but how you handle them can make all the difference in preserving a positive relationship with your clients. When a client disputes a payment request, it’s important to approach the situation with professionalism, patience, and a willingness to resolve the issue. Addressing disputes calmly and efficiently helps maintain trust and ensures the matter is resolved in a timely manner.

Stay calm and objective when handling disputes. Avoid becoming defensive or confrontational, as this can escalate tensions. Instead, focus on understanding the client’s perspective and clarifying any misunderstandings. It’s essential to listen carefully and review the details of the disagreement before responding with a solution or explanation.

Steps to Resolve Disputes Effectively

- Clarify the Issue: Start by reviewing the details of the dispute. Make sure you understand the client’s concerns and the specific points of disagreement.

- Communicate Clearly: Provide a clear and concise response that addresses the disputed items. Refer to the terms of the agreement or past communications to support your position.

- Provide Documentation: If necessary, share relevant documentation such as contracts, work orders, or previous correspondence to clarify the terms of the agreement.

- Negotiate a Resolution: If the dispute is legitimate or if the client’s concerns are valid, be open to negotiating a fair solution. This might involve adjusting the amount owed, offering a discount, or providing additional information to clear up confusion.

- Follow Up: Once a resolution is agreed upon, follow up to confirm that the payment will be processed or that both parties are in agreement. Keep communication clear and maintain a record of the resolution.

By addressing disputes with professionalism and a focus on resolution, you can often turn a potentially negative situation into an opportunity to strengthen your client relationship. Timely and respectful handling of payment disagreements reflects well on your business and can help prevent future conflicts.

Common Mistakes to Avoid in Invoice Emails

When requesting payment, it’s crucial to ensure that the communication is clear, professional, and accurate. Mistakes in your message can lead to confusion, delayed payments, or even misunderstandings with your client. Paying attention to detail and avoiding common errors will help maintain professionalism and ensure the timely processing of payments. Below are some of the most frequent mistakes to avoid when composing a payment request.

Common Errors to Watch Out For

- Missing Payment Details: Omitting important information such as the amount due, payment methods, or due date can cause confusion and delay payment processing.

- Incorrect Contact Information: Always double-check the recipient’s name, company details, and any contact information to avoid sending the message to the wrong person or department.

- Unclear Payment Instructions: If the payment process is complex, ensure that the instructions are clear and easy to follow. This includes providing the correct account numbers, payment links, or methods accepted.

- Vague Subject Lines: The subject line should clearly indicate the purpose of the message, such as “Payment Request for Services” or “Outstanding Balance Due.” Avoid generic subject lines like “Reminder” or “Important,” which might be overlooked or ignored.

- Unprofessional Tone: While it’s important to remain polite, avoid being overly casual or too informal. Striking the right balance in tone helps maintain a professional relationship.

- Neglecting to Proofread: Simple spelling or grammar errors can make your message appear sloppy and unprofessional. Always proofread your communication before sending it.

- Not Setting a Clear Deadline: Without a firm deadline for payment, clients may delay the transaction. Be explicit about when payment is due to avoid misunderstandings.

How to Avoid These Mistakes

- Use a Standardized Format: Have a consistent format for your messages to ensure all necessary details are included every time.

- Double-Check Details: Verify all information before sending, such as the client’s contact info, amounts owed, and due dates.

- Be Clear and Direct: Ensure that the tone is polite but professional, and the instructions are simple and precise.

- Follow Up Regularly: If payments are overdue, follow up promptly

How to Write a Polite Reminder

When following up on overdue payments, it’s essential to maintain a tone of professionalism and courtesy. A well-crafted reminder serves as a gentle prompt, encouraging the recipient to take action without damaging the business relationship. The goal is to prompt timely payment while keeping the communication respectful and friendly.

Be polite and non-confrontational in your language. A polite reminder should focus on the facts, rather than implying negligence or blame. By keeping the tone neutral and understanding, you show that you value the client while also making it clear that payment is due.

Key Elements of a Polite Reminder

- Friendly Opening: Start with a courteous greeting. Address the recipient by name and express appreciation for their business or past interactions.

- Clear Reference: Politely remind them of the original terms. Be specific about what is overdue, including the amount, the due date, and any relevant details.

- Express Understanding: Acknowledge that delays can happen. Offer understanding, and avoid making the recipient feel guilty or pressured.

- Provide Payment Details: Reiterate the payment methods and any necessary information, such as bank account details or links to pay online.

- Encourage Action: Politely request that the payment be made as soon as possible, while keeping the tone courteous and accommodating.

- Offer Assistance: If applicable, offer to answer any questions or resolve any issues the recipient may have. This shows willingness to work together for a solution.

- Kind Closing: End with a polite note, expressing gratitude for their attention and cooperation, and reinforcing that you look forward to resolving the matter soon.

By following these guidelines, you can write a polite reminder that fosters cooperation and maintains a positive relationship with your clients, while ensuring that payments are made in a timely manner.

Including Your Contact Information

Providing clear and accessible contact information is a crucial aspect of professional communication, especially when requesting payments. When recipients can easily reach you for questions or concerns, it fosters trust and ensures a smoother resolution process. Including this information in all relevant communications not only supports your professionalism but also makes it easier for clients to follow through with their obligations.

Make sure your contact details are easy to find in your message. Whether it’s a phone number, email address, or physical office address, the key is to provide accurate and up-to-date information. This allows clients to contact you quickly if they have questions about the payment or need clarification on any details.

Essential Contact Information to Include

- Phone Number: Including a direct phone number provides clients with an easy way to reach you for urgent matters. Make sure the number is monitored or provides clear instructions for leaving a message if necessary.

- Email Address: Even if you’re communicating via a different medium, it’s essential to include an email address where clients can reach you for non-urgent inquiries or further discussions.

- Office Address: If relevant, include your physical address. This can be helpful if the client needs to mail a check or send any physical documents related to the payment.

- Website or Portal Link: If you offer online payment options, provide a link to your website or client portal, where payment can be processed directly.

- Business Hours: Let clients know when you’re available to respond to inquiries, whether by phone or email. This sets clear expectations about response times.

Including this vital information helps ensure that your clients know how to reach you easily, which can facilitate a quicker resolution to any payment-related issues. Always ensure that the contact details you provide are accurate, and check them regularly to avoid confusion or miscommunication.

Legal Considerations for Invoice Emails

When requesting payment, it is essential to ensure that your communication complies with applicable laws and regulations. Legal considerations play a significant role in maintaining professional and lawful business practices. Understanding these legal aspects can protect your company from potential disputes, penalties, or complications. This section will cover key legal considerations when drafting a payment request.

Clarity and transparency are fundamental when communicating payment requests. It is vital to ensure that all terms, including amounts, due dates, and payment methods, are clearly defined and compliant with legal requirements. Failure to do so may result in misunderstandings or even legal challenges.

Key Legal Aspects to Consider

Legal Aspect Description Payment Terms Ensure that payment terms are clearly outlined, including the amount due, the due date, and any late fees or interest charges. Make sure the terms are consistent with the agreed-upon contract or service terms. Tax Requirements Confirm that any applicable taxes, such as sales tax or VAT, are clearly listed and comply with local tax laws. Failure to include taxes or incorrectly stating tax information can lead to legal issues. Legal Jurisdiction Clearly state the legal jurisdiction in case of disputes. This indicates where legal proceedings will occur and which laws govern the contract. Payment Method Compliance Ensure that the payment methods you offer comply with financial regulations, especially for international transactions, to avoid issues related to fraud or non-compliance. Consumer Protection Laws Be aware of consumer protection laws in your jurisdiction, which may require specific language or procedures to protect your clients’ rights, especially when dealing with disputes or refund requests. By following these legal guidelines, you can minimize the risk of complications and ensure that your payment requests are both clear and compliant with relevant laws. It’s always recommended to consult a legal professional to ensure that your terms and practices are up to date and legally sound.

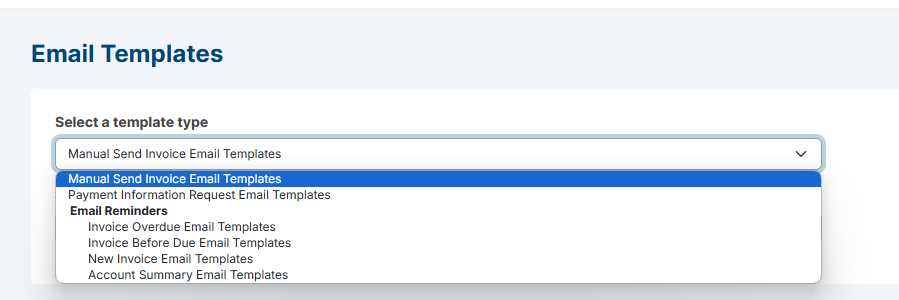

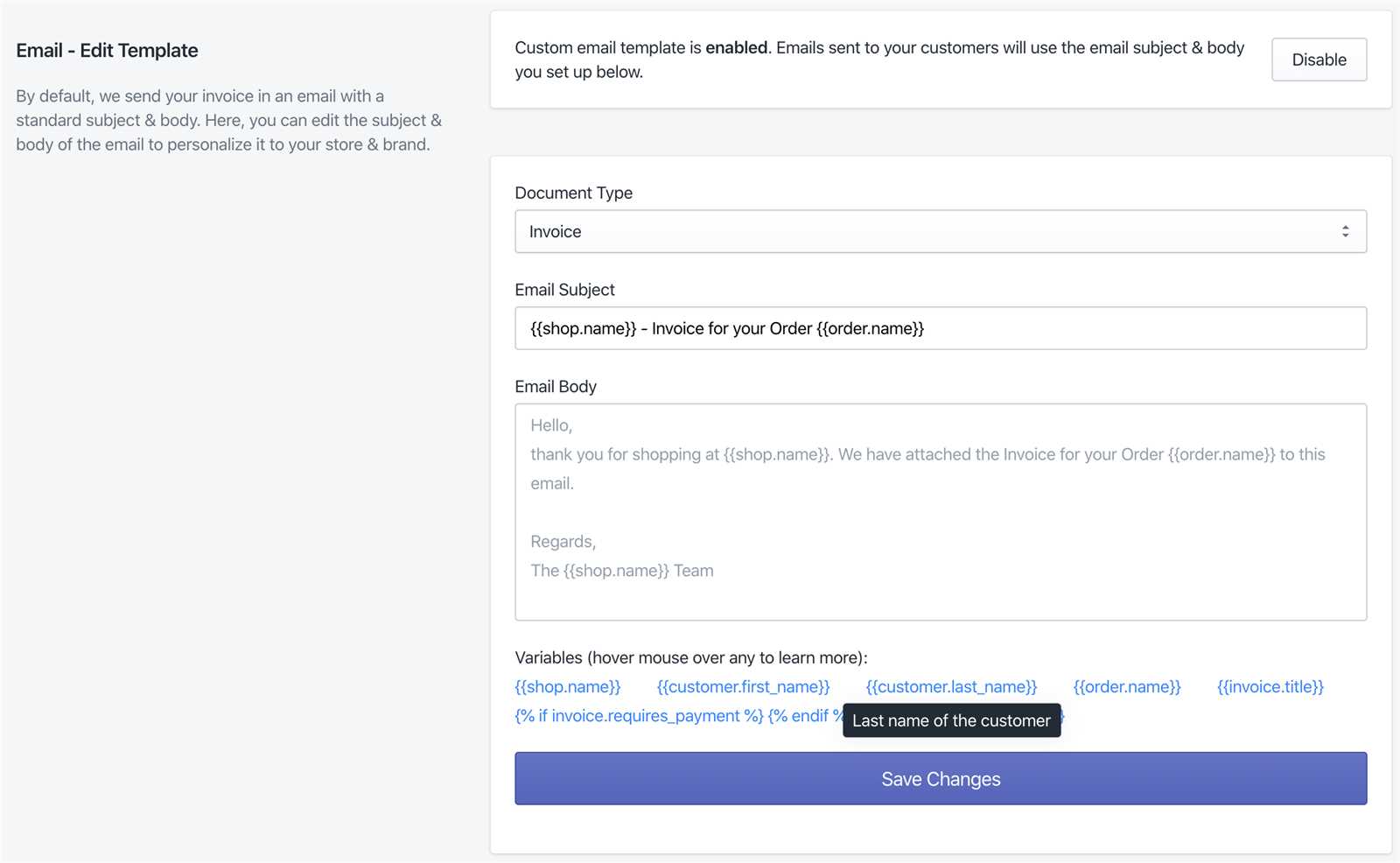

Tools for Automating Invoice Emails

Automating payment requests can save businesses time, reduce human error, and ensure timely communication with clients. By leveraging the right tools, you can streamline the process, making it easier to issue payment reminders, send payment confirmations, and track outstanding balances. Automating these tasks frees up resources and ensures consistent and professional communication with clients.

Automation tools can help you create workflows that automatically generate and send payment requests at specified intervals, customize messages with the necessary details, and even handle reminders when payments are overdue. These tools can integrate with accounting systems, providing seamless synchronization of payment data and customer details.

Popular Tools for Payment Automation

- QuickBooks: A widely-used accounting software that offers invoicing automation, recurring billing, and payment tracking. QuickBooks allows businesses to create professional payment requests and automate reminders based on the terms set in the system.

- FreshBooks: Known for its user-friendly interface, FreshBooks automates billing and reminders, making it easy to send payment requests to clients. It integrates with several other platforms to streamline accounting and payment processes.

- Zoho Invoice: This tool enables automated invoicing, recurring payments, and payment reminders. Zoho Invoice also offers customization options to tailor payment requests to specific client needs and branding.

- Bill.com: A popular tool for automating accounts payable and receivable, Bill.com allows businesses to send payment requests and reminders automatically. It also integrates with accounting software for seamless financial management.

- Xero: A comprehensive accounting solution with invoicing features, Xero offers automation tools for recurring invoices, reminders, and late payment notices. It also integrates with bank accounts and payment gateways for easy tracking of payments.

Benefits of Using Automation Tools

- Time Savings: Automation reduces the time spent on manual tasks, such as generating and sending payment requests, allowing you to focus on other important areas of your business.

- Consistency: Automated systems ensure that your payment communications are always sent on time and are consistent in tone and format.

- Reduced Errors: Automation minimizes the risk of human error in data entry, ensuring accurate payment details and reducing the chance of miscommunication.

- Improved Cash Flow: By automating payment reminders and follow-ups, you can encourage timely payments and improve cash flow management.

Using automation tools not only increases efficiency but also enhances professionalism and customer satisfaction. By choosing the right solution, businesses can ensure that their payment requests are sent at the right time, every time.