Essential Livestock Invoice Template for Your Farming Needs

In the realm of agricultural business, managing financial transactions efficiently is crucial for ensuring smooth operations. Clear documentation not only aids in maintaining accurate records but also fosters trust and transparency between producers and buyers. This guide explores essential strategies for creating effective billing documents tailored to the needs of farmers.

Utilizing a well-structured document can simplify the process of charging clients for goods and services, minimizing misunderstandings and disputes. By incorporating the necessary details such as pricing, descriptions, and terms of sale, producers can streamline their operations and focus more on what they do best–growing and raising high-quality products.

Adopting a systematic approach to billing enhances financial management and facilitates tracking of sales and expenses. Emphasizing the importance of organization, this article will provide valuable insights and practical tips to help agricultural professionals create documents that reflect their business’s professionalism and commitment to excellence.

Understanding Livestock Invoicing Requirements

Effective billing processes are vital for maintaining a successful agricultural business. They provide clarity and assurance in financial transactions between farmers and their clients. Understanding the essential requirements for these financial documents helps ensure accuracy and compliance, fostering healthy relationships within the industry.

One of the primary aspects to consider is the inclusion of detailed information regarding the products and services provided. This encompasses specifications such as quantity, price per unit, and any applicable discounts. Additionally, clearly outlining payment terms, including due dates and accepted payment methods, is crucial for minimizing confusion and ensuring timely transactions.

Moreover, it is essential to adhere to local regulations governing financial documentation in the agricultural sector. Familiarity with these rules not only aids in compliance but also builds credibility with clients. By ensuring all necessary information is accurately presented, farmers can enhance their professionalism and improve the overall efficiency of their financial dealings.

Importance of Accurate Billing in Agriculture

Precision in financial transactions is a cornerstone of successful farming operations. Accurate documentation not only facilitates smooth exchanges between sellers and buyers but also ensures that all parties are on the same page regarding the terms of trade. By maintaining clear records, agricultural professionals can avoid misunderstandings that might otherwise lead to disputes or payment delays.

Benefits of Correct Financial Records

Maintaining precise billing practices provides numerous advantages for farmers, including:

| Benefit | Description |

|---|---|

| Improved Cash Flow | Timely payments ensure consistent income, allowing farmers to manage expenses effectively. |

| Enhanced Customer Trust | Clear and accurate documentation fosters reliability, building strong relationships with clients. |

| Reduced Errors | Meticulous record-keeping minimizes the chances of mistakes in pricing and product details. |

| Regulatory Compliance | Adhering to financial documentation standards helps meet local legal requirements. |

Consequences of Inaccurate Billing

On the flip side, inaccuracies in financial records can lead to significant challenges for farmers. Discrepancies may result in delayed payments, strained customer relations, and potential legal issues. Ensuring that all documentation is precise and comprehensive is essential for fostering a stable and productive agricultural environment.

Key Components of an Invoice Template

Creating effective billing documents requires attention to detail and an understanding of essential elements that contribute to clarity and professionalism. Each component serves a specific purpose, ensuring that all necessary information is conveyed efficiently to clients. Recognizing these crucial elements can enhance the effectiveness of financial transactions in the agricultural sector.

Essential Information to Include

A comprehensive billing document should contain several key pieces of information to facilitate smooth transactions:

- Business Information: Clearly display the name, address, and contact details of the seller to establish credibility.

- Client Information: Include the recipient’s name and address to ensure proper delivery of documents.

- Transaction Date: Specify the date of the transaction to help both parties track their records.

- Item Descriptions: Provide detailed descriptions of goods or services rendered to avoid confusion.

- Total Amount: Clearly indicate the total due, including any applicable taxes or fees.

Additional Considerations

In addition to the basic information, including payment terms and methods can greatly improve the billing experience. Outlining due dates and acceptable forms of payment helps prevent delays and misunderstandings. Furthermore, incorporating a unique reference number for each document aids in tracking and organizing records efficiently, contributing to a more streamlined financial process.

How to Customize Your Invoice

Tailoring your financial documents to meet the specific needs of your business is essential for enhancing professionalism and improving client relations. Customization allows you to create a document that not only represents your brand but also addresses the unique aspects of your transactions. By incorporating personal touches and relevant details, you can ensure clarity and effectiveness in your billing process.

Steps for Effective Personalization

Here are several key steps to help you customize your billing documents:

- Choose a Design: Select a layout that reflects your brand’s identity, using colors and logos that represent your business.

- Incorporate Your Branding: Add your company name, logo, and contact information prominently at the top of the document.

- Adjust the Layout: Organize sections to suit your preferences, ensuring that the most critical information stands out.

- Add Unique Identifiers: Include a unique reference number or code for each transaction to streamline tracking and record-keeping.

- Specify Payment Terms: Clearly outline the conditions for payment, including due dates and accepted methods.

Tools for Customization

Utilizing the right tools can greatly enhance your ability to personalize financial documents:

- Software Solutions: Use accounting software that offers customizable document templates to simplify the creation process.

- Online Generators: Explore web-based platforms that allow for easy customization and instant downloads of financial documents.

- Design Programs: Consider graphic design software for creating visually appealing documents that stand out to clients.

By following these steps and utilizing appropriate tools, you can create tailored financial documents that effectively meet the needs of your business while enhancing your professional image.

Common Mistakes in Livestock Invoicing

In the process of creating financial documents, errors can occur that may lead to complications and misunderstandings between parties. Recognizing these common pitfalls is essential for ensuring smooth transactions and maintaining strong business relationships. By being aware of frequent mistakes, individuals can take proactive steps to improve their billing practices.

Frequent Errors to Avoid

Here are some of the most common mistakes made when preparing financial documents:

- Incorrect Pricing: Failing to double-check prices can result in overcharging or undercharging clients.

- Missing Information: Omitting crucial details, such as client information or product descriptions, can lead to confusion.

- Unclear Payment Terms: Not specifying payment methods or due dates can cause delays in receiving payments.

- Inconsistent Formatting: Using different formats for dates, prices, or item descriptions can create confusion for recipients.

- Neglecting Follow-Ups: Failing to follow up on outstanding payments can impact cash flow and business operations.

Consequences of Inaccuracies

Addressing these mistakes is crucial as they can lead to various negative outcomes:

- Damaged Client Relationships: Inaccuracies may erode trust and lead to dissatisfaction among clients.

- Financial Loss: Errors in pricing or payment terms can directly impact revenue and profitability.

- Increased Administrative Work: Resolving mistakes often requires additional time and resources, diverting attention from other important tasks.

By identifying and correcting these common mistakes, businesses can enhance their billing processes and ensure a more effective and professional approach to financial transactions.

Tips for Effective Record Keeping

Maintaining accurate and organized records is essential for any business, as it supports financial stability and facilitates informed decision-making. Effective documentation helps in tracking transactions, monitoring expenses, and ensuring compliance with regulatory requirements. By implementing strategic practices, businesses can enhance their record-keeping systems for improved efficiency and reliability.

Here are several tips to optimize your record-keeping practices:

- Establish a Consistent System: Choose a standardized format for all records to ensure consistency and ease of access.

- Utilize Digital Tools: Implement accounting software or cloud-based solutions to automate and streamline record management.

- Regularly Review Records: Schedule periodic audits to verify the accuracy and completeness of your documentation.

- Organize by Category: Sort records into relevant categories such as sales, purchases, and expenses for easier navigation and retrieval.

- Keep Backups: Regularly back up digital records to prevent data loss and ensure information is always accessible.

- Stay Compliant: Familiarize yourself with legal and regulatory requirements to ensure your record-keeping practices meet industry standards.

By following these tips, businesses can create a robust record-keeping system that enhances operational efficiency and supports long-term success.

Digital Tools for Invoice Management

In the modern business landscape, leveraging technology is crucial for streamlining financial processes. A variety of digital solutions are available that can significantly enhance the efficiency of managing billing documents. These tools not only simplify the creation and distribution of financial statements but also offer features for tracking payments, managing customer information, and generating reports.

Among the most effective options are:

- Accounting Software: Comprehensive platforms like QuickBooks or Xero provide robust features for managing finances, including automated billing and expense tracking.

- Cloud-Based Solutions: Tools such as FreshBooks or Zoho Invoice enable users to access their records from anywhere, promoting flexibility and collaboration.

- Mobile Applications: Mobile-friendly apps allow for on-the-go management of billing tasks, ensuring that users can stay updated regardless of their location.

- Payment Processors: Services like PayPal and Stripe facilitate quick and secure transactions, integrating seamlessly with various financial systems.

- Document Management Systems: Software such as DocuSign helps streamline the storage and retrieval of important financial documents, ensuring easy access and compliance.

By utilizing these digital tools, businesses can enhance their operational efficiency, reduce errors, and improve overall financial management, paving the way for sustained growth and success.

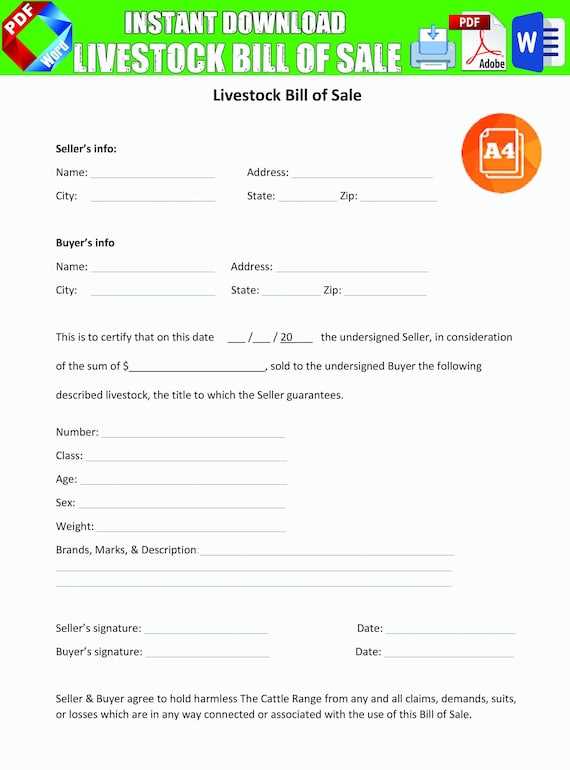

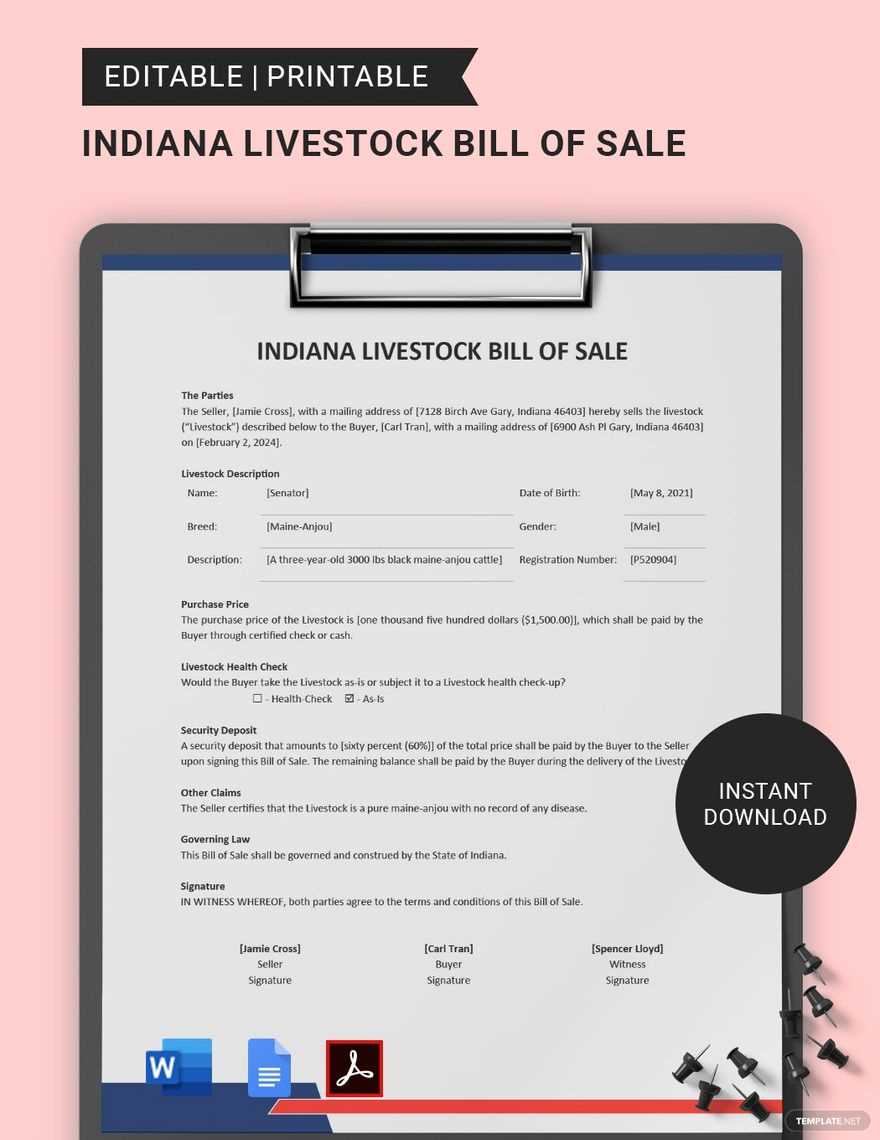

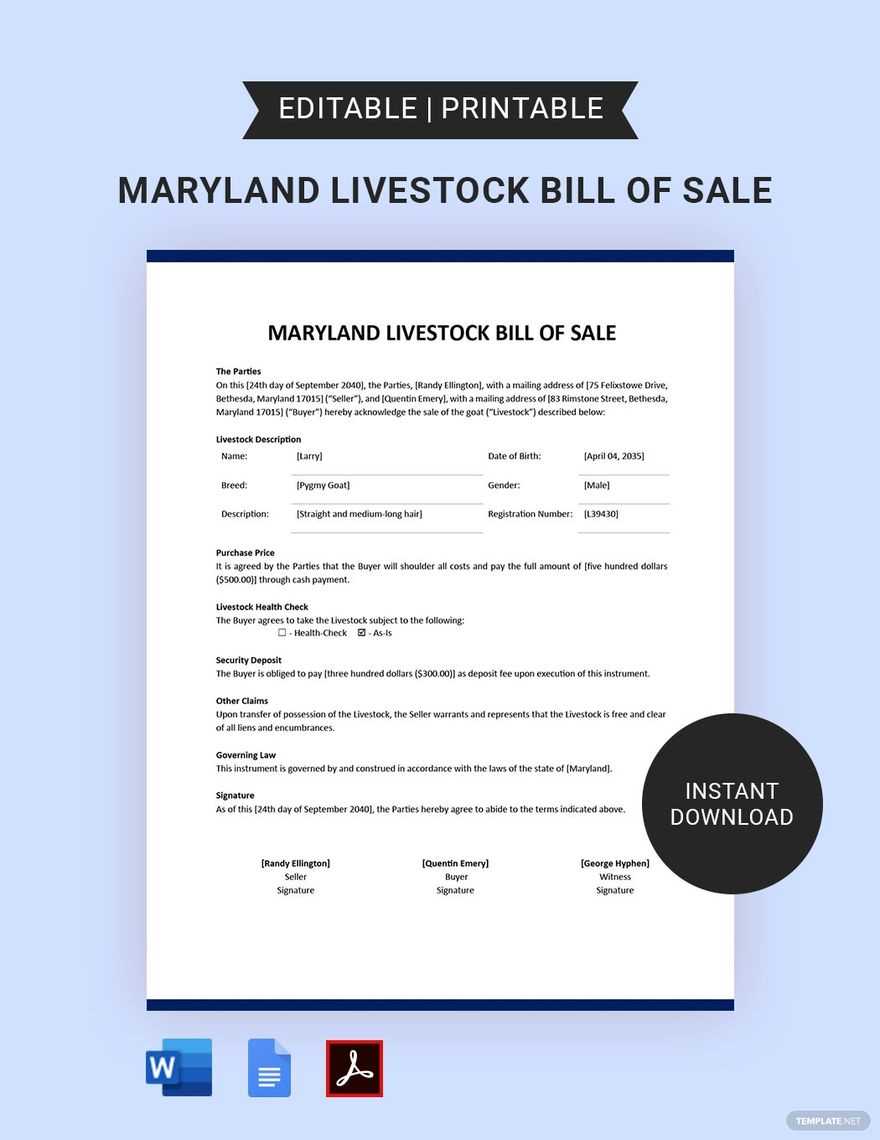

Creating Invoices for Different Livestock Types

When managing transactions in animal-related businesses, it is essential to create accurate documents tailored to the specific types of animals being traded or sold. Different animal categories come with unique pricing structures, requirements, and considerations that should be reflected in the financial documents. Understanding how to customize these records for each type ensures clarity, reduces errors, and facilitates smooth business operations.

Cattle

For cattle, it’s important to include the following details:

- Breed and Type: Specify the breed and whether the animal is for breeding, dairy, or meat purposes.

- Weight and Size: Include the animal’s weight or size, as this directly impacts pricing.

- Age and Health: Age and health status often affect the market value, so be sure to provide this information clearly.

Sheep and Goats

For sheep and goats, these are some key factors to include:

- Wool Quality: For sheep, the quality and quantity of wool may be an important pricing factor.

- Breeding Information: Include any details about the animal’s breeding history or potential for future breeding.

- Age and Purpose: Specify whether the animal is intended for meat, dairy, or fiber production.

By customizing your documents to reflect these unique aspects for each animal type, you ensure that both parties involved in the transaction have a clear understanding of the terms, reducing disputes and promoting transparency.

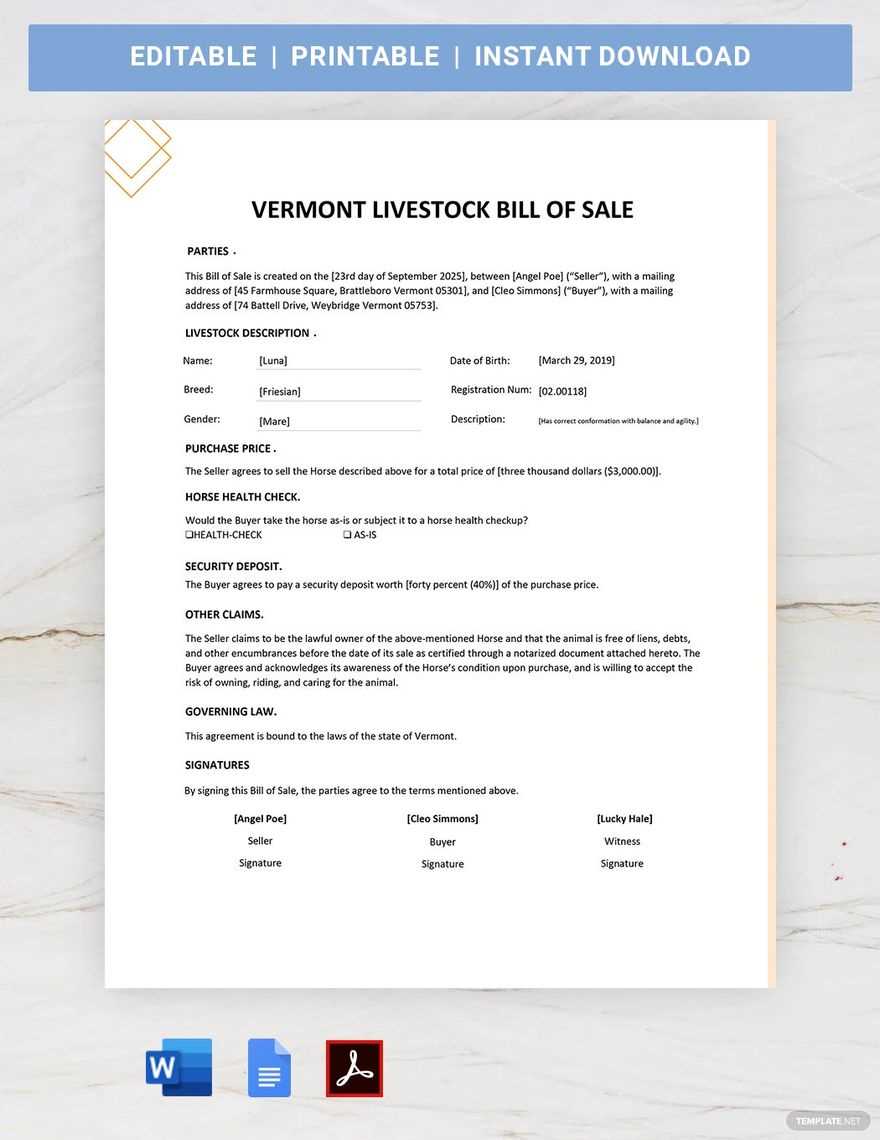

Legal Considerations for Livestock Transactions

When engaging in the buying and selling of animals, there are several legal aspects to keep in mind. These include ensuring that all agreements are documented properly, complying with local and international regulations, and addressing issues such as health certifications and ownership transfer. Understanding the legal landscape helps prevent disputes and ensures that both parties fulfill their obligations under the law.

Regulatory Compliance

It is essential to comply with both local and international laws regarding the sale and purchase of animals. Some important legal considerations include:

- Health and Safety Standards: Animals must meet health standards to be legally traded. Make sure to obtain health certificates that verify their condition.

- Veterinary Regulations: Certain regions require specific veterinary checks, including vaccinations and disease screenings, before animals can be sold or transported.

- Import and Export Laws: For cross-border transactions, it’s crucial to adhere to customs regulations and import/export laws governing animal trade.

Ownership and Contractual Terms

Clear documentation of ownership transfer and contractual agreements is key in any animal transaction. Consider the following:

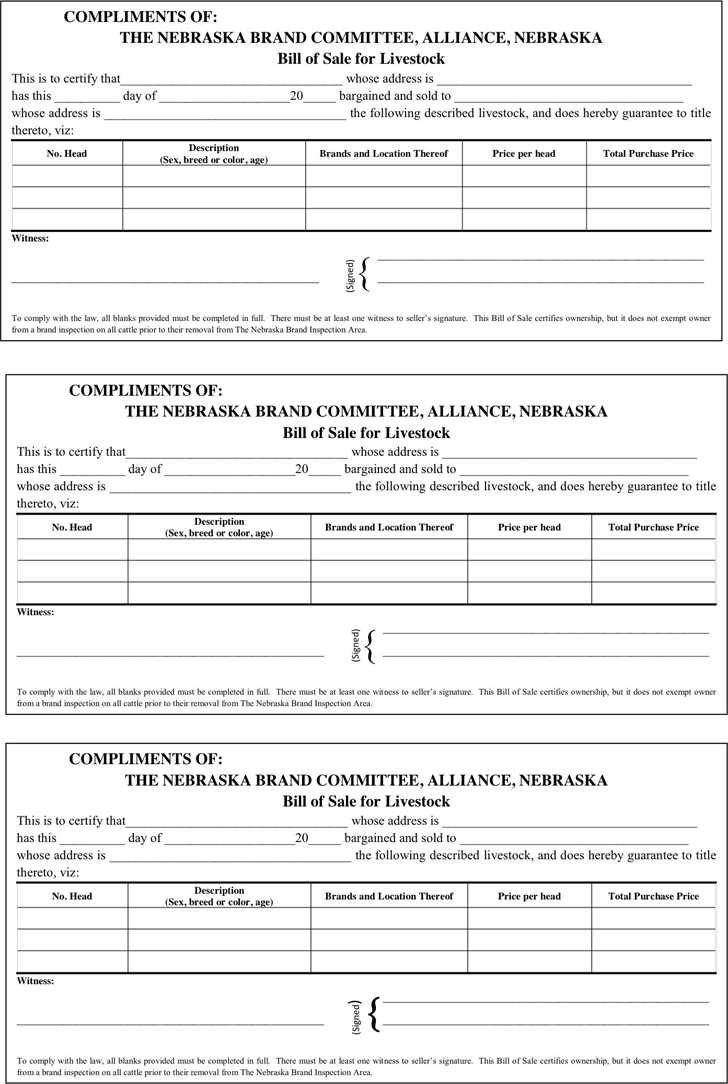

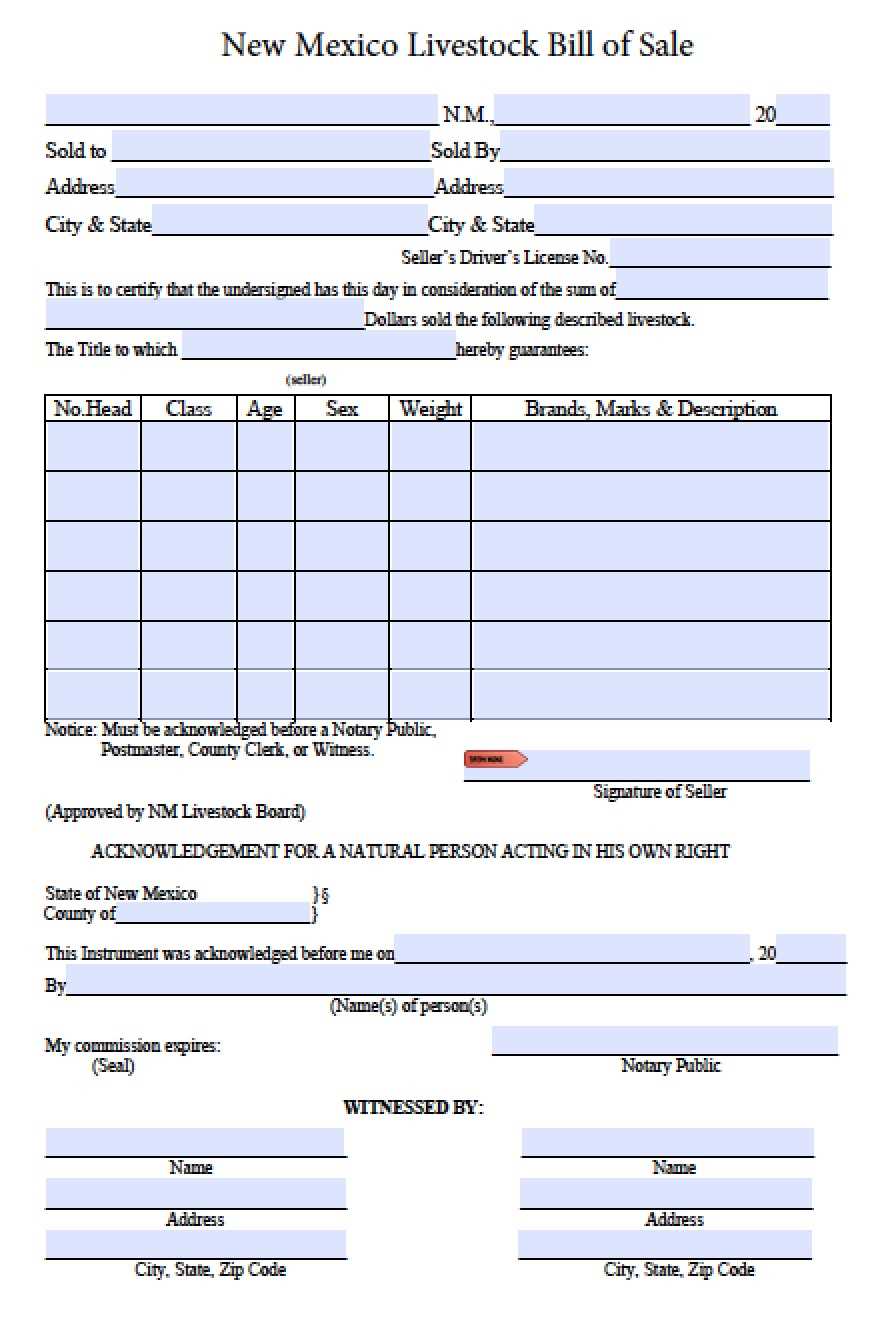

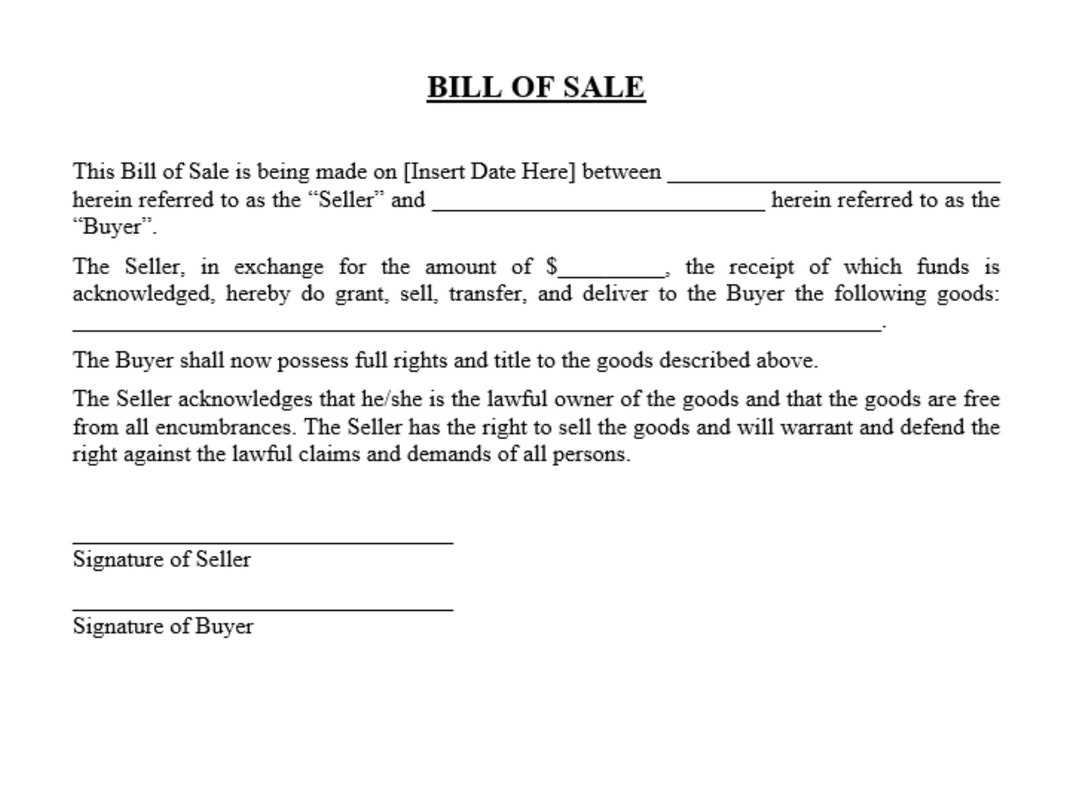

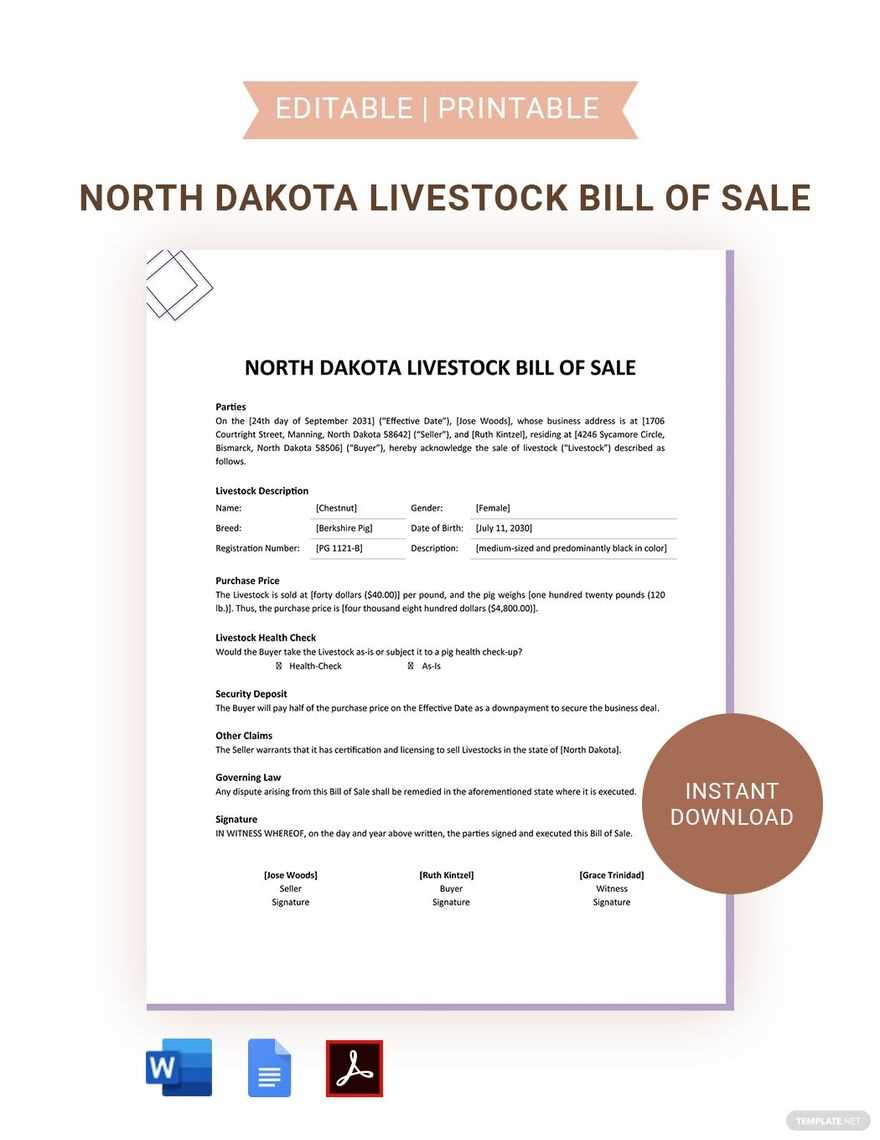

- Bill of Sale: This legal document should outline all terms of the sale, including payment details, delivery terms, and a description of the animal.

- Dispute Resolution: Include a clause that specifies how any disputes will be resolved, whether through mediation, arbitration, or legal action.

- Warranties and Liabilities: Make sure to clearly state any warranties regarding the health or quality of the animals, as well as any liabilities for issues that may arise post-sale.

By understanding and incorporating these legal requirements into transactions, businesses can avoid potential legal issues, protect both parties’ interests, and ensure smoother operations in the future.

Integrating Invoicing with Accounting Software

Integrating billing processes with accounting software offers significant benefits for businesses, streamlining financial operations, reducing errors, and enhancing overall efficiency. By linking these two systems, transactions can be tracked automatically, allowing for real-time updates to financial records. This seamless connection not only saves time but also ensures accurate reporting and compliance.

Key Benefits of Integration

There are several advantages to integrating billing with accounting systems, including:

- Time-Saving: Manual data entry is minimized as invoices and payment records are automatically updated in the accounting system.

- Improved Accuracy: Reduces the risk of human errors that may occur during manual record-keeping or entry.

- Better Financial Reporting: Automated integration provides up-to-date financial statements, aiding in more accurate budgeting and forecasting.

- Faster Payments: A unified system allows for quicker tracking of outstanding balances and overdue payments, improving cash flow management.

Steps to Integrate Billing with Accounting Software

To successfully integrate your billing system with accounting software, follow these steps:

- Select Compatible Software: Choose accounting software that supports integration with your existing billing system.

- Set Up Integration: Connect the billing system to the accounting software by configuring the API or importing necessary data fields.

- Automate Data Sync: Enable automatic data syncing so that invoices, payments, and transactions are reflected in real time.

- Test for Accuracy: After integration, run a few test transactions to ensure the system updates and tracks financial information correctly.

- Train Your Team: Ensure your team understands how the integration works and how to use the system effectively to maximize its potential.

By integrating your billing processes with accounting software, you can enhance your business’s financial management, save time, and reduce errors, allowing you to focus more on growth and customer satisfaction.

Best Practices for Timely Payments

Ensuring timely payments is crucial for maintaining a healthy cash flow and fostering strong business relationships. By implementing best practices for managing payments, businesses can minimize delays, improve customer satisfaction, and avoid financial stress. Properly structured systems and clear communication can help ensure that payments are made on time and with fewer complications.

Effective Strategies for Prompt Payments

To streamline the payment process and encourage timely settlements, consider adopting the following strategies:

- Clear Payment Terms: Always establish clear payment terms from the beginning of the transaction. Ensure both parties understand the due date, late fees, and payment methods.

- Early Payment Discounts: Offer discounts for early payments to incentivize clients to settle balances sooner.

- Regular Follow-Ups: Send reminders before and after the due date. Early follow-ups can prevent delays and ensure the payment is processed on time.

- Multiple Payment Options: Provide clients with multiple ways to pay, such as credit cards, bank transfers, or digital payment platforms. This flexibility can speed up the payment process.

Common Payment Processing Mistakes to Avoid

While managing payments, businesses often make several common mistakes that can delay cash flow. These include:

| Common Mistake | Impact | Solution |

|---|---|---|

| Unclear Payment Terms | Confusion can lead to delayed payments and disputes. | Ensure terms are communicated clearly and agreed upon in writing. |

| Ignoring Late Payments | Delayed payments can strain cash flow. | Implement a structured follow-up process to remind clients. |

| Lack of Payment Options | Limits customers’ ability to pay quickly. | Offer various payment methods to cater to different preferences. |

By adopting these strategies and avoiding common mistakes, businesses can increase the likelihood of timely payments and maintain strong financial health.

How to Track Payments

Efficient payment tracking is vital for maintaining a steady cash flow and keeping business operations smooth. By monitoring transactions, businesses can ensure that all payments are received on time and identify any outstanding balances quickly. Implementing proper tracking methods helps to minimize errors, reduce delays, and foster positive client relationships.

Key Methods for Payment Tracking

There are several effective ways to keep track of payments and ensure timely follow-ups:

- Manual Record-Keeping: Maintain a ledger or spreadsheet to manually log each payment received. Include the payment date, amount, and any relevant notes about the transaction.

- Accounting Software: Use accounting software that automatically records payments and updates your financial records. This eliminates the need for manual tracking and reduces human error.

- Automated Reminders: Set up automated reminders to notify clients of pending payments. These reminders can be scheduled based on your payment terms, helping ensure prompt responses.

Utilizing Payment Tracking Systems

In addition to manual methods and software tools, businesses can implement payment tracking systems to simplify the process:

| Payment Tracking System | Features | Benefits |

|---|---|---|

| Online Payment Platforms | Accept payments through digital platforms and automatically update records. | Convenient for both businesses and clients, offering quick and secure transactions. |

| Cloud-Based Accounting Tools | Track payments in real-time and access records from any device. | Increased accessibility and real-time updates enhance financial visibility. |

| Bank Integration | Automatically sync payments with your business bank account. | Streamlined payment tracking and reduced manual entry. |

By implementing these methods and tools, businesses can track payments efficiently, reduce errors, and ensure smoother cash flow management.

Streamlining Your Billing Process

Optimizing your billing process is crucial for ensuring efficiency and accuracy in financial transactions. By automating tasks, reducing manual inputs, and utilizing appropriate tools, businesses can save time and reduce errors. A smooth billing system not only improves cash flow management but also enhances customer satisfaction by providing clear and timely statements.

Steps to Simplify Your Billing Workflow

To streamline your billing process, consider these key steps:

- Automate Repetitive Tasks: Use software to automatically generate and send bills, reducing the time spent on manual entry.

- Implement Clear Payment Terms: Set and communicate specific due dates and payment terms to your clients, ensuring transparency and reducing delays.

- Centralize Financial Information: Keep all customer data, transaction history, and payment details in one easily accessible system to avoid duplication and errors.

Tools to Enhance the Billing Process

Adopting the right tools can make a significant difference in streamlining your financial operations:

| Tool | Features | Benefits |

|---|---|---|

| Billing Software | Automates bill creation, tracks payments, and generates reports. | Reduces errors and time spent on manual processing, ensures consistency. |

| Payment Gateways | Enables secure online payments and integrates with accounting systems. | Faster transactions, fewer late payments, and improved cash flow. |

| Customer Relationship Management (CRM) System | Stores customer information, monitors interactions, and tracks billing history. | Improves customer communication and ensures accurate, personalized billing. |

By incorporating these strategies and tools, you can simplify your billing operations, reduce manual work, and improve both accuracy and customer satisfaction.

Enhancing Customer Communication on Invoices

Effective communication with customers is essential for maintaining good relationships and ensuring prompt payments. Clear and transparent billing statements help customers understand their charges, due dates, and payment instructions. By improving communication on these documents, businesses can minimize confusion, reduce disputes, and foster trust with their clients.

Key Elements for Clear Communication

To enhance clarity and customer understanding, make sure to include the following elements in your statements:

- Detailed Descriptions: Break down services or products with clear descriptions, avoiding jargon or vague terms.

- Clear Payment Terms: Specify payment due dates, accepted payment methods, and any penalties for late payments.

- Personalized Messages: Include a friendly note or reminder, offering assistance or explaining any specific details to the customer.

Best Practices for Customer Engagement

In addition to clear information, customer engagement can be enhanced by using these best practices:

- Consistency: Ensure that the format and tone of your communications are consistent across all documents, providing a professional image.

- Multiple Contact Options: Provide various ways for customers to reach you if they have questions or need clarification, such as phone, email, or chat support.

- Follow-Up: Send reminders ahead of due dates and thank customers after a payment is received to build positive rapport.

By focusing on these aspects, businesses can create a more seamless and effective communication experience for their customers, improving satisfaction and fostering long-term relationships.

Resources for Farmers

Farmers managing animal-based operations can benefit greatly from various tools, information sources, and services that streamline their day-to-day activities. These resources cover everything from financial management and regulations to best practices for animal care. Access to the right information can help improve productivity, ensure compliance, and enhance the overall efficiency of farming operations.

Financial and Business Management Tools

Proper financial management is crucial to the success of any agricultural operation. Here are some valuable resources for managing finances and business activities:

- Accounting Software: Programs designed for agricultural businesses can track expenses, revenue, and cash flow, making financial planning easier.

- Grants and Funding Programs: Many governments and organizations offer financial support to farmers, helping them invest in their operations or address challenges like equipment purchases or environmental impacts.

- Tax Assistance: Consulting with experts who understand farm-specific tax laws can help minimize liabilities and maximize tax benefits.

Animal Health and Care Resources

Animal care is at the heart of successful farming. Here are resources that provide information and guidance on animal health and welfare:

- Veterinary Services: Access to professional veterinary care and advice ensures the well-being of animals and can prevent costly outbreaks of disease.

- Best Practices Guides: Numerous agricultural organizations offer guidelines on feeding, breeding, and managing animals in a sustainable way.

- Farm Animal Associations: These associations provide a community of professionals who share advice, updates, and industry trends that can enhance farm management.

By taking advantage of these resources, farmers can stay ahead in a competitive industry, ensuring both the profitability and sustainability of their operations.

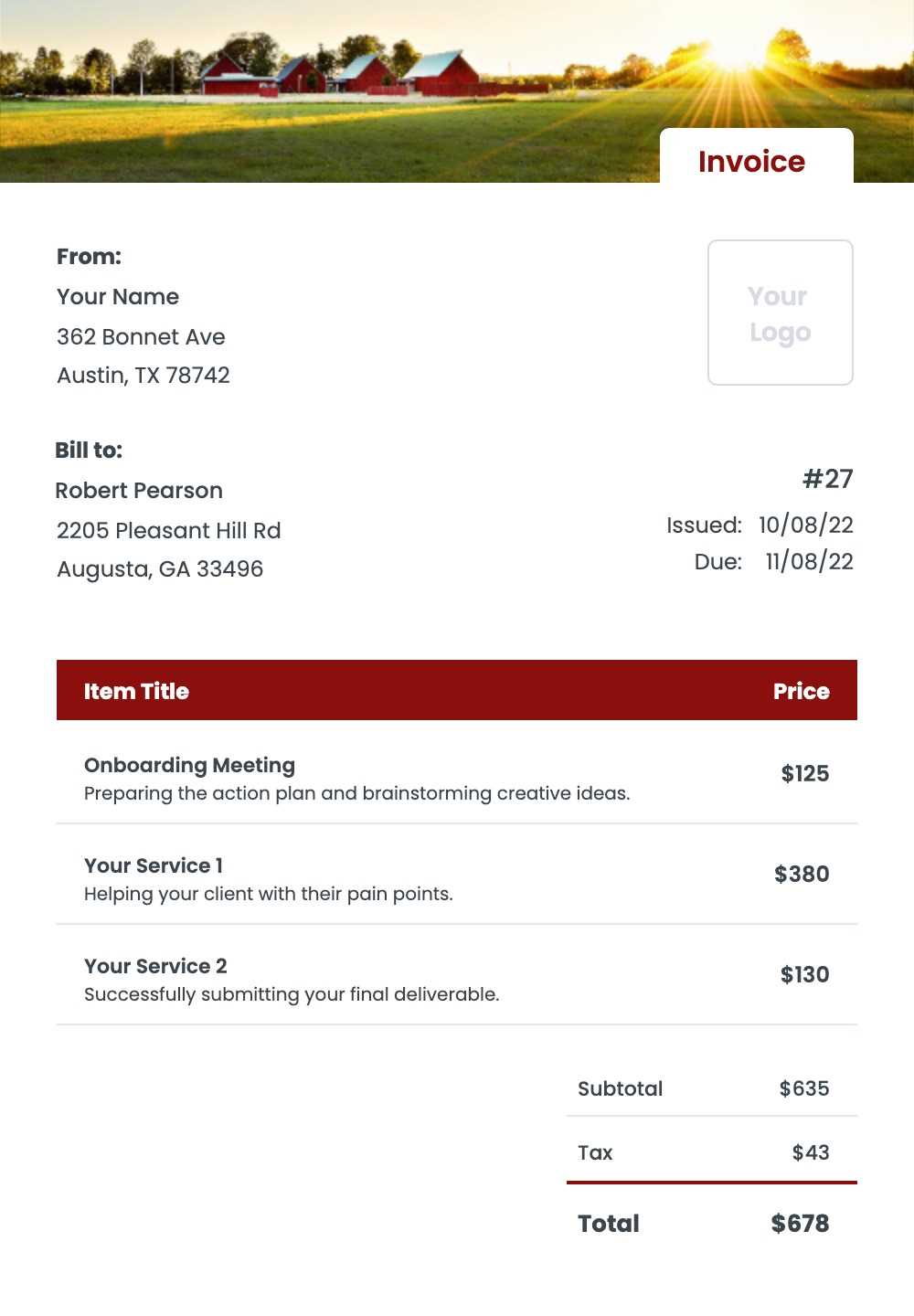

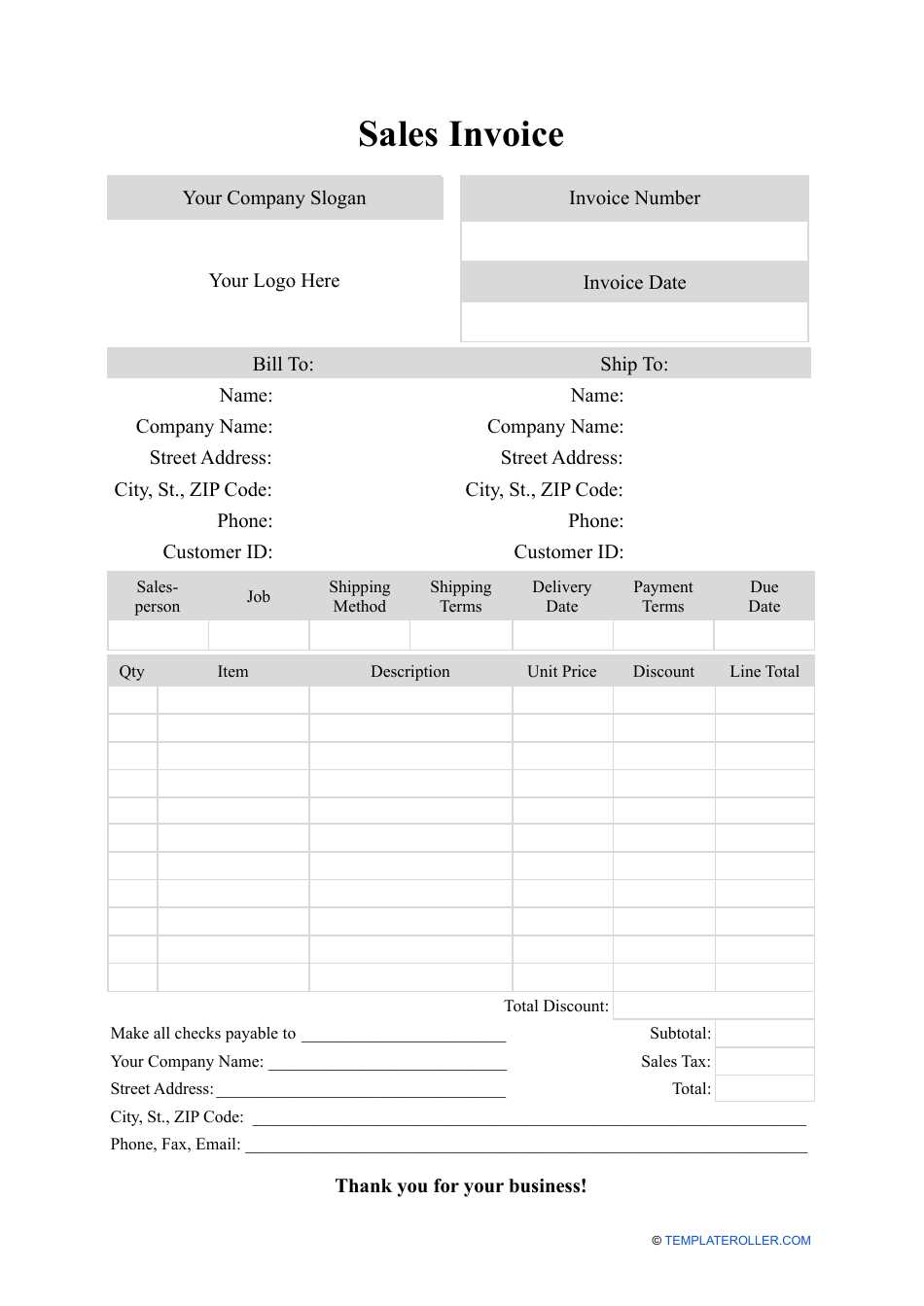

Examples of Effective Invoice Designs

When creating billing documents, the design plays a crucial role in ensuring clarity, professionalism, and ease of use. A well-structured layout not only provides all the necessary details but also enhances the overall customer experience. Below are examples of design elements that can make such documents both effective and visually appealing.

Minimalistic Design for Clarity

A minimalistic approach focuses on clean lines, ample white space, and well-organized content. This design ensures that all important details are easily readable without overwhelming the recipient with unnecessary information. Here’s an example of key elements:

| Section | Description |

|---|---|

| Header | Includes the sender’s contact details and a clear document title, such as “Statement of Account” or “Transaction Summary”. |

| Itemized List | Displays a clean, easy-to-read list of items or services provided, including unit prices and quantities. |

| Total Section | A clearly labeled total section for easy identification of the sum due. |

| Footer | Includes payment instructions and terms in a concise, unobtrusive format. |

Modern and Professional Layout

A contemporary design incorporates a bit more flair while maintaining professionalism. This design is ideal for businesses looking to convey both style and efficiency. Essential components typically include:

- Bold Color Scheme: Use of a company’s branding colors to emphasize headings or totals, making important details stand out.

- Clear Fonts: Using a mix of bold and regular fonts for differentiation, making the document easy to navigate.

- Visual Hierarchy: Strategic use of headings, subheadings, and bullet points for easy scanning of information.

With these design ideas in mind, businesses can create professional, effective, and visually pleasing billing documents that help streamline transactions and improve customer satisfaction.