Free Printable Invoice Template for Simple and Professional Billing

Managing financial transactions efficiently is crucial for any business, whether small or large. One of the most effective ways to ensure accuracy and professionalism in your billing system is by using a pre-designed document for invoicing. These tools are essential for creating consistent and clear statements that help maintain smooth communication between you and your clients.

By utilizing ready-made formats, you can save time and reduce the risk of errors. These documents typically come with all the necessary sections, making it easier to input essential details such as services rendered, payment terms, and client information. With the right approach, you can ensure that each request for payment is clear, transparent, and professional.

Moreover, adapting these tools to suit your specific needs is straightforward, whether you’re running a freelance business, a small enterprise, or managing a larger company. The ability to quickly generate accurate and visually appealing billing statements contributes not only to improved workflow but also to a positive client experience. Invest a little time in finding the right document, and it can make a significant difference in how you manage your finances and interact with your customers.

Free Printable Invoice Templates for Businesses

For any business, having an efficient system to request payments is key to maintaining cash flow and professional relationships. Whether you’re a freelancer or running a larger company, using structured documents for billing can save time and reduce errors. There are many options available that can help you generate professional-looking statements without the need for expensive software or tools. By using these ready-made solutions, businesses can ensure accuracy and consistency in every transaction.

How Ready-Made Billing Documents Benefit Small Businesses

Small businesses and startups often operate with limited resources, making it essential to find cost-effective ways to streamline operations. With the right documents, owners can quickly create professional invoices that look polished and meet legal requirements. These pre-designed forms allow businesses to focus on their core activities, like offering services or managing customers, while minimizing the administrative burden. With customizable fields for services, payment dates, and amounts, these documents are perfect for efficient billing.

Customizing Documents for Your Business Needs

While the basic structure of these documents is generally the same, they are highly adaptable. You can easily adjust the layout, color scheme, and content to match your brand identity and specific business needs. For instance, a consulting firm may require a more detailed breakdown of services, while a retail business might prefer a simpler format. By modifying the content to suit your needs, you can maintain a professional appearance without spending hours designing a new document from scratch.

Additionally, these tools are typically available in multiple formats, allowing you to print, email, or save the documents digitally. This flexibility ensures that you can meet your clients’ preferences, whether they require a hard copy or an electronic version for their records.

Why Use an Invoice Template?

Using a standardized format for billing can significantly improve the efficiency and professionalism of your financial transactions. By relying on pre-structured documents, businesses can ensure consistency in the way they request payments, which builds trust with clients and avoids mistakes. Whether you’re a freelancer, small business owner, or part of a larger enterprise, adopting these organized forms simplifies the process of tracking services, amounts owed, and due dates.

One of the main advantages of using a set format is the reduction of errors. With a clearly defined structure, all the essential details–such as contact information, payment terms, and service descriptions–are easy to include and verify. This minimizes the chance of missing critical information, which can lead to confusion or delays in payments.

Additionally, these documents often come with customizable features, allowing businesses to adapt them according to specific needs, branding, or industry standards. Whether you’re working with hourly rates, project-based pricing, or product sales, a well-organized billing statement makes it easier for both parties to review and process payments quickly.

How to Customize Your Invoice Template

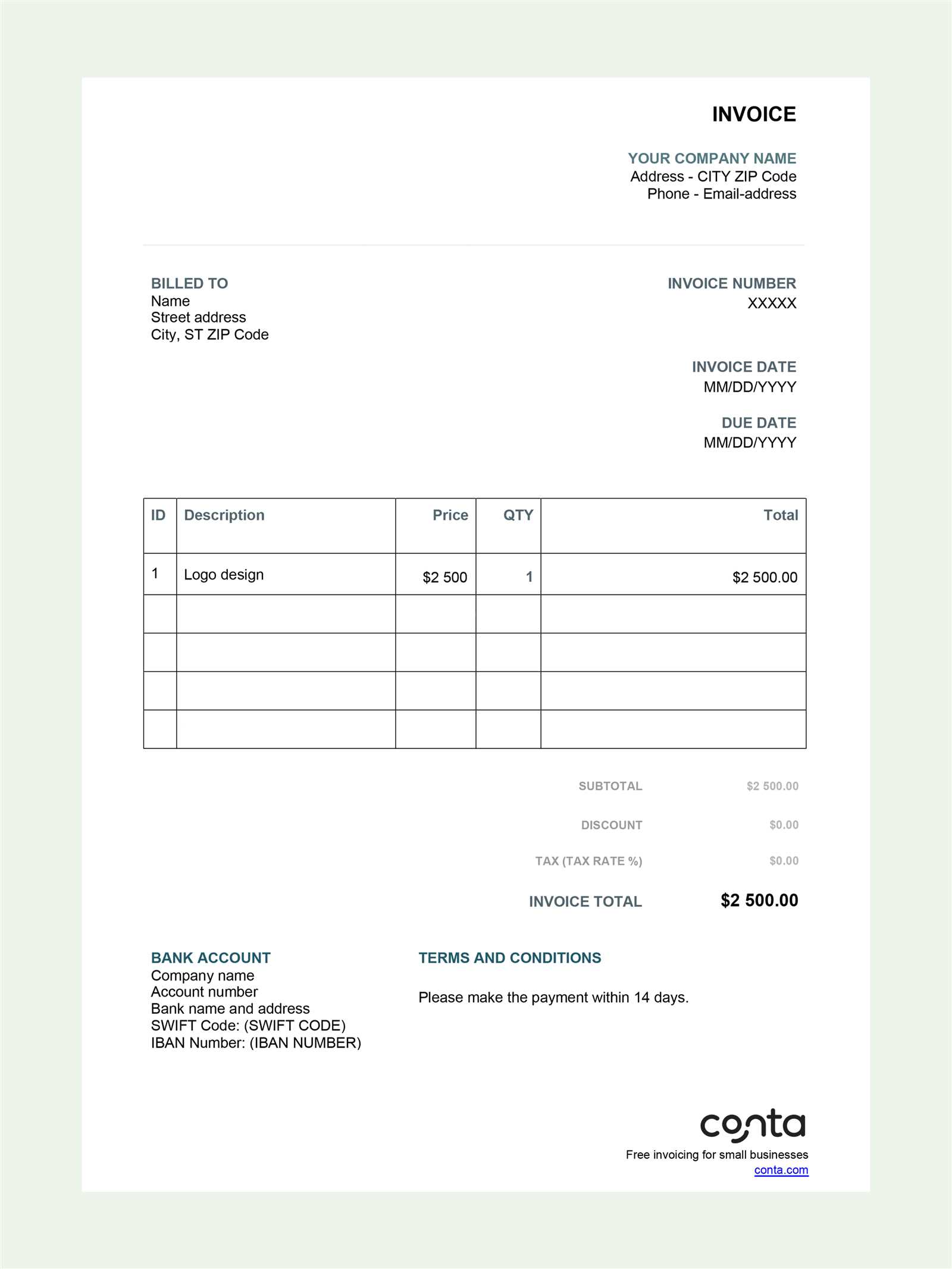

Customizing a billing document allows businesses to make it reflect their unique style, requirements, and branding. By adjusting the content and appearance, you can create a professional-looking statement that aligns with your company’s identity and meets the specific needs of your clients. Whether you’re looking to add a logo, change the layout, or include additional fields, the ability to modify these documents enhances your flexibility and ensures that every request for payment is tailored to your business.

Personalizing the Layout and Design

One of the first steps in customizing your billing form is deciding on the layout and design. You can modify the fonts, colors, and general arrangement of sections to match your business branding. If you’re a creative agency, for example, you may want a more dynamic, visually appealing document, while a legal firm may prefer a more formal and straightforward look. Adjusting these design elements makes the document more representative of your brand’s voice and adds a professional touch.

Adding Relevant Information

To make the form truly yours, you can add essential details like company contact information, payment terms, or service descriptions. These customizable fields allow you to tailor each document to the specific transaction at hand. For instance, if you’re offering a discount or have a special promotion, you can include that information directly on the document. Ensuring that all necessary data is included will help avoid confusion and make the process smoother for both you and your client.

Ultimately, customizing your billing form ensures that you maintain a professional, consistent approach to every financial transaction. The more personal and relevant the document is to your business, the more likely it is that it will leave a positive impression on your clients, promoting trust and ensuring prompt payments.

Top Benefits of Using Printable Invoices

Utilizing a well-structured document for billing offers numerous advantages for businesses of all sizes. It simplifies the entire process, ensuring that all details are clearly outlined and easily understood by both the business and the client. These forms are not only time-saving but also help maintain professionalism in financial communications, fostering better relationships and smoother transactions.

Time and Efficiency Savings

One of the primary benefits of using ready-to-use billing documents is the time saved in preparing payment requests. Rather than starting from scratch each time, you can quickly fill in the necessary details, such as the client’s information, services provided, and amounts due. This efficiency allows you to focus more on your core activities, whether it’s serving clients or running day-to-day operations, instead of worrying about administrative tasks.

Consistency and Professionalism

Using a standard format ensures that your documents always look professional and consistent. This helps reinforce your brand’s image and makes your communications look polished, which is especially important when dealing with clients or partners. A clear, organized layout also minimizes the risk of confusion or disputes, as all relevant information is presented in an easy-to-understand manner.

Additionally, these documents help in maintaining proper records for your business, making it easier to track payments, manage finances, and even prepare for tax season. The ability to produce and store well-organized billing statements adds to the overall efficiency and professionalism of your operations.

Common Invoice Template Features to Look For

When choosing a billing document for your business, it’s important to ensure it includes all the essential elements that will help you maintain clarity and accuracy in financial transactions. A well-designed document should contain key sections that allow for easy customization, tracking, and organization. Understanding these features will help you select the right option for your business needs.

Essential Sections for Clear Communication

One of the most important features to look for is a clearly defined layout that separates all relevant information. Key details such as the recipient’s contact information, description of services, and payment amounts should be easy to locate. The document should also include spaces for terms and conditions, as well as payment due dates. A simple and logical flow will help ensure that clients understand the billing information quickly and accurately.

Customization and Flexibility

Another important feature is the ability to customize fields according to your specific business requirements. Whether you’re working with different types of services, offering discounts, or need to break down costs into multiple categories, your document should allow you to adjust the content easily. Flexibility is crucial, as it enables businesses to tailor the format for various industries, from consulting to retail.

In addition to customization, it’s beneficial if the document includes options for adding a logo, adjusting colors, and even incorporating payment instructions or a thank-you message. These elements not only add a personal touch but also help maintain consistency in branding.

How to Choose the Best Invoice Template

Selecting the right document for billing is crucial for maintaining a smooth and professional financial process. The ideal option should suit your business needs while ensuring clarity, ease of use, and customization flexibility. With so many options available, it’s important to consider several factors that will help you make the best choice for your company.

Key Factors to Consider

- Ease of Use: The document should be simple to fill out without requiring excessive time or effort. Look for a format that allows you to input information quickly and without confusion.

- Customizability: Choose a solution that lets you easily modify the content to reflect your business’s branding, pricing structure, and specific service offerings.

- Professional Appearance: The layout should be clean and polished, conveying professionalism to your clients. Avoid overly complex designs that might detract from the clarity of the information.

- Legal and Tax Requirements: Ensure the document includes sections for necessary information like payment terms, tax rates, and legal disclaimers, which can vary depending on your location or industry.

Assessing Specific Needs

When choosing the best billing form, consider your industry’s specific requirements. For example, if you’re in a service-based business, you may need space for detailed descriptions of work performed. If you’re selling products, you’ll want clear fields for item quantities, pricing, and shipping costs. Make sure that the document can be adapted to your specific business model.

Finally, consider how the document will be used. If you need to send invoices digitally, ensure the format is easy to share via email or online platforms. If you’re printing hard copies, look for a design that fits well on standard paper sizes and remains legible when printed.

Free Invoice Templates for Small Businesses

For small business owners, managing expenses and maintaining a smooth cash flow can be a challenge, especially when it comes to requesting payments from clients. Using an organized document for billing can make the process faster and more efficient, allowing you to focus on growing your business. Luckily, there are various options available that provide cost-effective, easy-to-use solutions without the need for complex software or expensive tools.

Benefits for Small Business Owners

- Cost-Effective: Many ready-made solutions are available at no cost, helping businesses with limited budgets save money on invoicing software.

- Time-Saving: With a pre-designed document, you can quickly create and send payment requests without needing to design one from scratch every time.

- Professional Look: A clean, organized layout helps enhance your business’s image and builds trust with clients, making your requests for payment look polished and official.

- Customization: These forms are often flexible, allowing you to add your logo, adjust colors, and include relevant terms to suit your specific needs.

Where to Find the Best Options

There are several resources that offer high-quality documents for businesses, some of which can be downloaded and used immediately. When looking for the right solution, consider platforms that provide a variety of designs tailored to different industries, from freelance services to retail or consulting. Many online tools also allow you to edit and adapt the form to meet your unique requirements, such as adjusting the layout or adding custom fields.

In addition to downloadable files, there are many online invoicing platforms that offer basic versions of their services for free. These platforms may offer additional features for a paid upgrade, but their free plans are often sufficient for small businesses just starting out.

How Printable Invoices Simplify Billing

Using a structured document for requesting payments streamlines the billing process, making it faster, clearer, and more organized. By having a predefined layout, businesses can focus on inputting the necessary details rather than spending time designing each payment request from scratch. This method ensures that all the relevant information is consistently included, reducing errors and improving communication with clients.

Key Ways These Documents Simplify the Process

One of the main advantages of using such documents is the ability to clearly present all the necessary information in a structured and accessible format. This clarity helps both businesses and clients track due amounts and payment terms more efficiently. Here’s how the structure of a typical payment request document simplifies the process:

| Section | Purpose |

|---|---|

| Client Information | Provides essential contact details, making it easy to send the document and follow up on payment. |

| Description of Services | Clearly outlines what the business provided, helping avoid misunderstandings or disputes over the charges. |

| Payment Terms | Specifies when payment is due and any applicable late fees, setting clear expectations from the start. |

| Total Amount Due | Summarizes the total amount owed, ensuring both parties have a clear understanding of the balance to be paid. |

This simple organization makes it easier to keep track of multiple transactions, especially for businesses that handle a high volume of clients. Additionally, once the document is created, it can be easily printed or emailed, ensuring prompt delivery and clear communication.

Easy Steps to Print Your Invoice Template

Once you’ve created your billing document, printing it is a simple process that allows you to quickly send physical copies to your clients. Whether you prefer to mail hard copies or provide a printed version for in-person meetings, having a quick and reliable printing method ensures that you can maintain professionalism and efficiency in your financial dealings. Here are the essential steps to get your payment request ready for print.

Steps to Print Your Billing Document

- Review the Document: Before printing, double-check all the information on the document to ensure there are no errors. This includes client details, payment terms, and the amount due.

- Choose the Right Paper Size: Most forms are designed for standard letter-sized paper (8.5″ x 11″). Ensure that your printer settings are adjusted accordingly to avoid any formatting issues.

- Preview the Print: Use the print preview feature on your computer to check how the document will appear once printed. This step helps catch any misalignments or formatting problems.

- Set Printer Preferences: Adjust your printer settings for the best quality output. Choose a high-resolution setting for a crisp, professional look.

- Print and Inspect: Print a test copy to make sure everything looks perfect. Once satisfied, print the desired number of copies for distribution.

By following these steps, you can easily produce a physical copy of your billing document, ensuring a smooth and professional payment request process for both you and your clients. Whether sending by mail or handing it over in person, printed payment documents leave a lasting impression of professionalism and attention to detail.

Design Tips for Professional Invoice Templates

When creating a document to request payments, the design plays a significant role in ensuring it looks professional and is easy for clients to understand. A well-designed form can enhance your business’s credibility and improve the chances of prompt payment. It’s important to balance both aesthetics and functionality, ensuring that the document not only looks appealing but also effectively communicates all the necessary details in an organized manner.

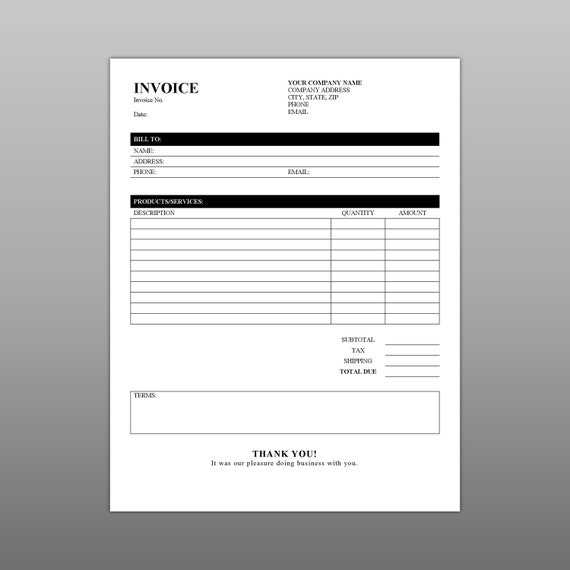

Maintain a Clean and Simple Layout

One of the key aspects of a professional document is simplicity. Avoid clutter by using a clean layout with ample white space between sections. This will make the information easier to read and allow clients to quickly locate the details they need. Consider using clear headings for each section, such as client details, service descriptions, payment terms, and totals. This organization ensures that each part of the document stands out and is easily accessible.

Incorporate Your Brand Identity

Adding elements of your business’s brand, such as your logo, company colors, and fonts, is a great way to make the document feel more personal and professional. Customizing the appearance to reflect your brand will make the document look cohesive with your overall business image, helping to build recognition and trust with your clients. However, be sure not to overdo it–keep the design elegant and straightforward, with no more than two or three colors that align with your brand’s aesthetic.

By paying attention to the design, you can ensure that your billing documents not only convey the necessary information but also leave a positive impression of your business. A well-crafted, professional document can make a significant difference in how your clients perceive your company and how quickly they process payments.

Printable Invoices vs. Digital Invoices

When it comes to requesting payments, businesses have two main options: physical documents or digital versions. Both methods have their own set of advantages and drawbacks, and choosing the right one depends largely on your business model, client preferences, and the level of convenience you’re seeking. Understanding the differences between these two approaches can help you make an informed decision on which works best for your needs.

Benefits of Using Physical Documents

- Personal Touch: Sending a printed document can add a level of formality and personalization, especially if you deliver it in person or include a thank-you note with it.

- Better for Clients Without Internet Access: Some clients prefer receiving hard copies, especially in industries where paperwork is still a primary form of communication.

- Legal and Compliance Considerations: In some industries or countries, physical copies may be required for record-keeping or tax purposes.

Benefits of Using Digital Documents

- Instant Delivery: Digital versions can be emailed or uploaded to an online portal, reducing the time spent on postage and ensuring fast delivery to clients.

- Environmentally Friendly: With no paper or postage involved, digital documents help reduce your business’s environmental footprint.

- Easy Storage and Tracking: Storing documents digitally allows for easier organization, retrieval, and management of payment records.

- Cost-Effective: By eliminating printing and shipping costs, digital methods offer a more budget-friendly option for businesses of all sizes.

Ultimately, the choice between physical and digital documents depends on your clients’ preferences and your operational needs. While physical documents may offer a more personal touch, digital documents provide speed, convenience, and cost savings that can benefit businesses looking to streamline their billing process.

How to Create an Invoice from Scratch

Creating a payment request from scratch may seem like a daunting task, but it’s a simple process once you know the necessary components. By including all the key details in an organized way, you can craft a professional document that clearly communicates the amount due and the services provided. This guide will walk you through the steps to create a clear and effective payment document, ensuring you don’t miss any important information.

Step-by-Step Guide

Start by opening a blank document in your preferred word processor or spreadsheet program. You can also use online tools that offer easy-to-edit forms. Once you have a blank canvas, follow these steps:

- Header Information: At the top of the page, include your business’s name, address, phone number, and email. This helps clients easily identify who the payment request is from.

- Client Details: Below your company’s information, include the client’s name, address, and contact details. Make sure this information is accurate to avoid confusion.

- Unique Identification Number: Assign a unique number to the payment request for easy reference and tracking. This could be a sequential number (e.g., INV001, INV002) or a custom code.

- List of Services or Products: Clearly describe the products or services you provided, including the quantity, unit price, and total amount for each item. Ensure that everything is easy to read and understand.

- Payment Terms: Specify the terms of payment, including the due date and any late fees or discounts for early payments. Be clear about when the payment is expected.

- Total Amount Due: At the bottom of the page, clearly state the total amount the client owes, including taxes, fees, or other additional charges.

- Additional Notes: If necessary, add any special instructions, thank-you messages, or other relevant details that might help the client with the payment process.

Final Steps

After you’ve entered all the necessary details, review the document for any errors or missing information. Once you’re satisfied with the content, save the document and prepare it for sending. If you’re delivering it digitally, convert it to a PDF to ensure it looks professional on any device. If you’re printing it, ensure the layout fits on standard paper sizes, and the text is legible.

By following these steps, you can easily create a clear and effective payment request that ensures timely payments and maintains professionalism in your business operations.

Best Free Invoice Templates for Freelancers

Freelancers often juggle multiple clients and projects, making it essential to have an efficient and professional way to request payments. Having a ready-made document for billing can save time and reduce stress, allowing freelancers to focus more on their work. There are many customizable options available that can cater to the unique needs of freelancers, from simple layouts to more detailed designs with space for time tracking and hourly rates.

Top Options for Freelancers

When choosing a payment request document for your freelance business, consider factors such as ease of use, customization options, and the design. Below are some of the best options available:

| Document Name | Key Features | Best For |

|---|---|---|

| Simple & Elegant | Clean design, space for service descriptions and hourly rates, customizable sections. | Freelancers who prefer minimalistic and straightforward formats. |

| Detailed Time Tracking | Includes time logs, hourly rates, and total work hours. Perfect for clients paying by the hour. | Freelancers in fields such as writing, consulting, or programming who track billable hours. |

| Creative & Customizable | Offers customizable logos, fonts, and color schemes for a more personalized look. | Freelancers in creative fields like design or photography who want to showcase their brand. |

| Simple with Payment Terms | Contains clear payment terms, due date, and late fees. Great for freelancers who work with various clients. | Freelancers who need clear and concise payment terms, ideal for long-term or recurring projects. |

Each of these options provides a clear, organized structure to ensure your payment requests are both professional and easy to understand. Choosing the right one will depend on your specific needs, such as how you charge for services or your personal branding preferences.

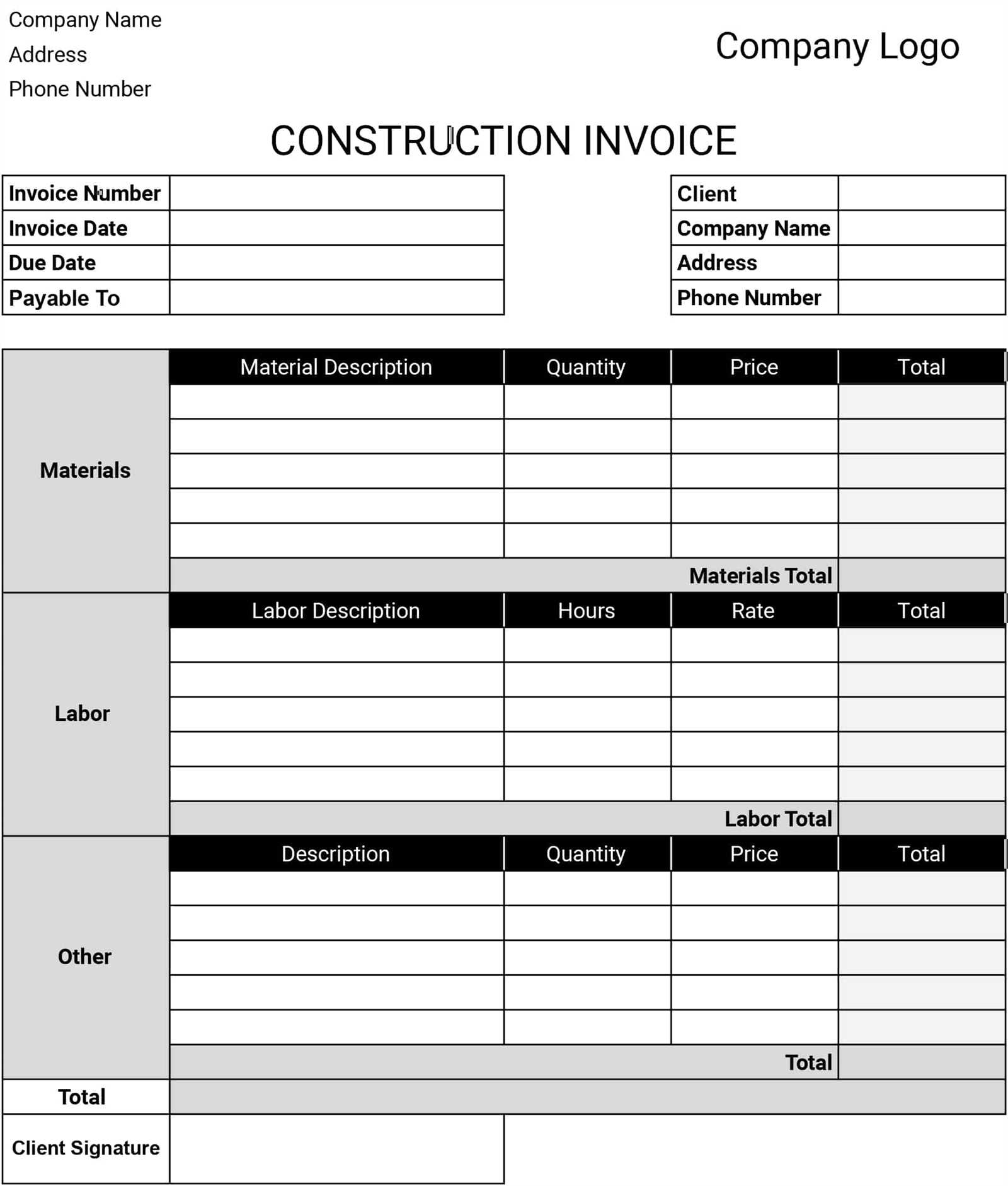

Customizing Invoice Templates for Different Services

When running a business that provides various services, it’s important to adapt your payment request forms to reflect the unique nature of each service you offer. Customization ensures that the details of the transaction are clear, and the client knows exactly what they are being billed for. Tailoring your billing documents for different types of work not only enhances professionalism but also reduces the chance of confusion or disputes over charges.

Key Customizations for Different Services

Depending on the type of service you provide, there are several elements you may need to adjust to accurately represent the work done. Here are some common customizations for various industries:

- Hourly Work: If your service is billed by the hour, it’s important to include a detailed breakdown of the hours worked. This should include the date, the number of hours worked, and the rate per hour.

- Project-Based Work: For fixed-price projects, you may want to include milestones or stages of completion. Be sure to list the specific tasks or deliverables completed and the agreed-upon price for each.

- Subscription Services: If you offer a subscription or ongoing service, make sure to clearly outline the recurring charges, payment intervals, and any relevant contract terms.

- Product Sales: When selling products, include a list of each item, its unit price, and the quantity purchased. This helps avoid confusion when billing for multiple items.

- Consulting Services: For consulting, include a section that lists the specific consultation sessions, topics covered, and the agreed-upon rate, whether it’s hourly or per session.

- Freelance Work in Creative Fields: When working on design, photography, or writing, you might want to add space for project descriptions, time spent on each phase, and any additional costs, such as licensing or usage rights.

Formatting and Visual Enhancements

In addition to adjusting the content, the layout and design should also reflect the nature of your services. For example, a professional consulting business may want a sleek, minimalist design, while a creative freelancer might prefer something more visually dynamic that highlights their portfolio or logo. Consider adding the following elements:

- Client-Specific Information: If you have long-term clients, it may be useful to personalize the document with their company logo or branding.

- Detailed Descriptions: Use bullet points or tables to break down complex services into more digestible sections, ensuring clarity for the client.

- Payment Terms & Conditions: Always include clear terms and conditions specific to your industry. For example, late fees or discounts for early payment should be noted for clients.

Top Resources for Free Invoice Templates

When managing billing for your business, having access to reliable, easy-to-use resources can save you time and effort. There are numerous online platforms offering customizable payment request forms at no cost, designed to meet a variety of business needs. These resources allow you to quickly generate professional-looking documents that align with your business style and ensure that clients receive clear, accurate payment requests. Below are some of the best places to find these useful tools.

Best Platforms for Downloading Payment Request Forms

- Microsoft Office Templates: A popular resource for users of Microsoft Word and Excel, this site offers a wide range of basic and more complex billing documents. Customization options allow you to tailor the forms to your specific needs.

- Google Docs and Sheets: Google offers a variety of templates through its Google Drive suite, making it easy to create, store, and share documents. The cloud-based system ensures easy access from anywhere.

- Canva: Known for its user-friendly design tools, Canva also offers visually appealing forms that can be easily customized. Whether you’re a freelancer or a small business, Canva’s drag-and-drop interface helps you create professional documents with minimal effort.

- Zoho: This platform provides various templates tailored for small business owners. Zoho’s options can be customized to include detailed information like tax rates, discounts, and payment terms.

- FreshBooks: While primarily a billing and accounting software, FreshBooks offers some templates for generating simple and professional payment requests, perfect for freelancers and small businesses.

- Invoice Generator: This online tool allows you to create a simple and easy-to-understand form in just a few minutes. You can generate a link to send to clients or download it directly in PDF format.

What to Look for in a Good Resource

When searching for the best tools to create your payment request forms, consider the following features:

- Customization Options: Choose a platform that allows you to add or modify elements to suit your business style, such as your logo, colors, or specific payment terms.

- Ease of Use: Ensure the platform is user-friendly, especially if you’re new to creating billing documents. Simplicity and straightforward design tools can save you time.

- File Format: Check whether the platf

How Printable Invoices Help with Taxes

Accurate and organized documentation is essential when it comes to tax preparation and compliance. Having detailed records of all business transactions can simplify the process of calculating income, expenses, and taxes owed. One of the most efficient ways to keep track of business activities is by using well-structured payment requests. These documents not only serve as proof of income but also help organize financial information for easy reference when filing taxes.

How They Aid in Record-Keeping

When preparing for tax season, the ability to quickly access transaction records is invaluable. By maintaining thorough and organized payment records, business owners can ensure that all income and expenses are accounted for accurately. This can help in the following ways:

- Proof of Income: Each document serves as a formal record of the services provided or products sold, making it easier to prove earnings to tax authorities.

- Tracking Expenses: For businesses that purchase materials or services to provide their own offerings, these documents can also include information on costs, helping to accurately track deductible business expenses.

- Tax Calculations: Detailed forms often include fields for sales tax, VAT, or other applicable taxes, simplifying the process of calculating how much you owe based on sales and services rendered.

Streamlining the Tax Filing Process

Organized billing records can save you a significant amount of time when filing taxes. When tax documents are requested by your accountant or tax preparer, having a complete set of records can speed up the process and reduce the likelihood of errors. Here’s how well-maintained records help streamline filing:

- Easy to Access: Well-organized records are easy to retrieve, whether you’re working with a tax professional or filing independently. This can minimize delays and reduce stress.

- Minimize Errors: A detailed, accurate account of every transaction reduces the risk of discrepancies or missing information that could trigger audits or penalties.

- Audit Protection: Clear and consistent documentation helps demonstrate that your financial activities are legitimate and well-managed, offering protection in case of an audit.

By incorporating structured payment records into your business management practices, you can ensure that your tax filing process is more efficient and less stressful. Whether you’re a freelancer, small business owner, or entrepreneur, organizing these details from the start can pay off in both time and accuracy.

How to Organize Your Invoices Effectively

Proper organization of your billing documents is essential for maintaining a smooth workflow and ensuring that all financial transactions are tracked accurately. Whether you’re a freelancer, small business owner, or entrepreneur, having an efficient system for managing these documents can help you stay on top of payments, reduce stress, and avoid missing important deadlines. With a few simple strategies, you can create a system that works for your specific needs.

Steps to Organize Your Billing Records

To ensure that your payment records are easy to access and manage, it’s important to follow a structured approach. Here are some effective steps you can take:

- Create a Clear Filing System: Start by organizing your documents by categories such as “Paid” and “Unpaid,” or by client name or service type. This way, you can quickly locate any record when needed.

- Number Your Documents: Assign a unique number or reference code to each billing document. This will help you track payments and easily cross-reference them if there are any questions or discrepancies later on.

- Use Digital Tools: Implement a digital filing system with cloud storage, so your records are safely backed up and easily accessible from any device. Tools like Google Drive, Dropbox, or accounting software can be used to store and organize these records.

- Keep Records by Date: Arrange your documents chronologically, so you can quickly find records from specific periods. This is particularly useful for tax filing and financial reviews.

Tools to Simplify Your Organization

In addition to manual filing, there are many digital tools available that can automate much of the organization process, saving you time and effort. Here are some options to consider:

- Accounting Software: Platforms like QuickBooks, FreshBooks, or Xero provide tools to automatically generate and organize your billing records. These systems also offer integrated payment tracking and reporting features.

- Cloud Storage: Services like Google Drive, OneDrive, and Dropbox allow you to upload and store your records securely. You can also create subfolders and easily share documents with clients or accountants.

- Document Management Systems: If you handle a large volume of transactions, you might consider a more robust system like Zoho Docs or Evernote to store, search, and retrieve your records quickly and efficiently.

By adopting an organized approach and utilizing the right tools, you’ll ensure that your payment records are always up to date and easy to access. This will not only save you time but will also help you maintain a clear and accurate financial picture of your business.