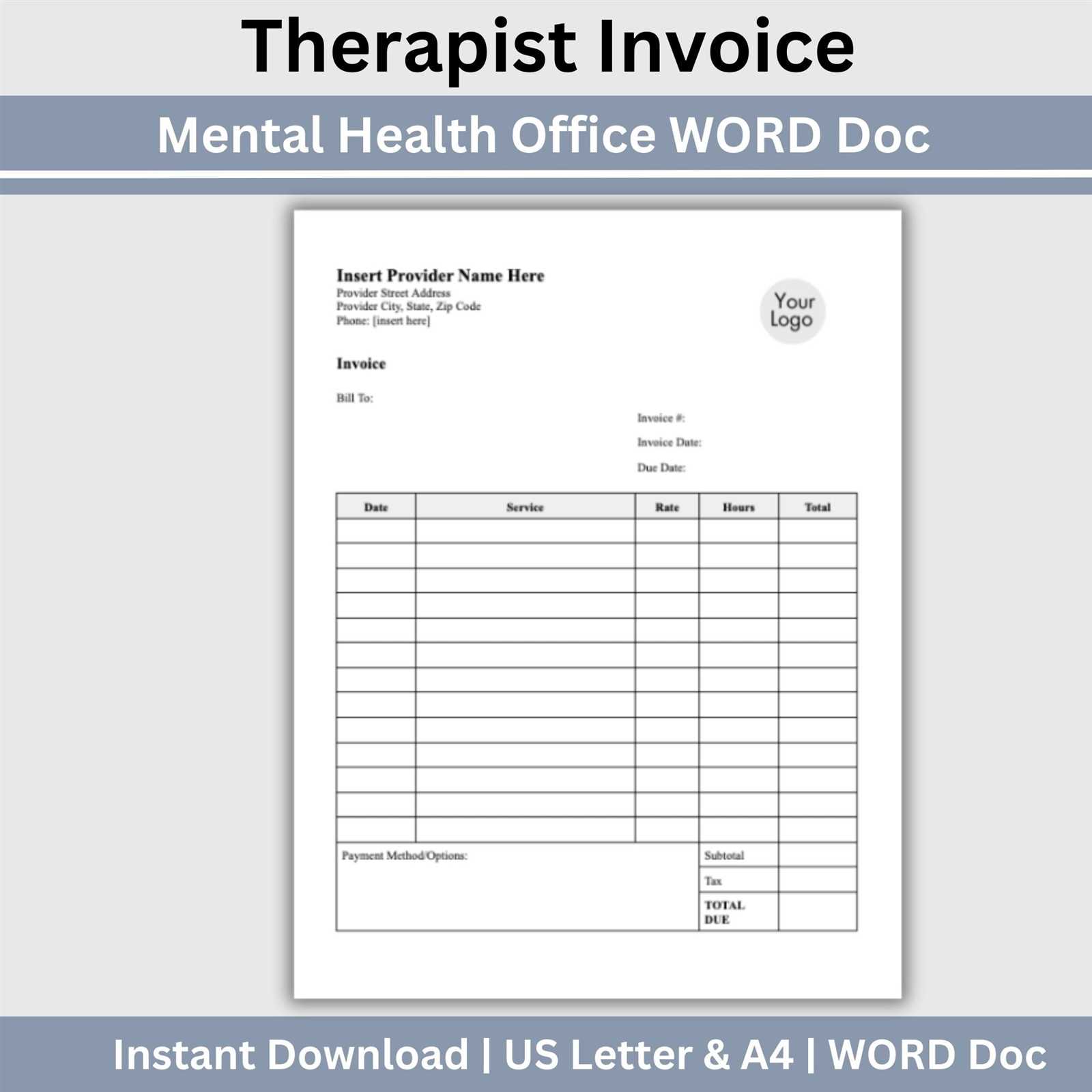

Download Free Word Doc Invoice Template

Managing business transactions often requires a well-structured document that reflects professionalism and clarity. For those seeking an easy way to handle payments, having a reliable format is essential. Customizable formats allow users to personalize their paperwork without starting from scratch.

Having a ready-to-use structure helps save time and ensure consistency across all business communications. Whether you are working with clients, vendors, or partners, a streamlined approach to generating these documents can enhance efficiency.

With the right tool, creating these business papers becomes simple and straightforward. Many options are available that cater to different business needs, making it easier to stay organized and ensure your documents meet all required standards.

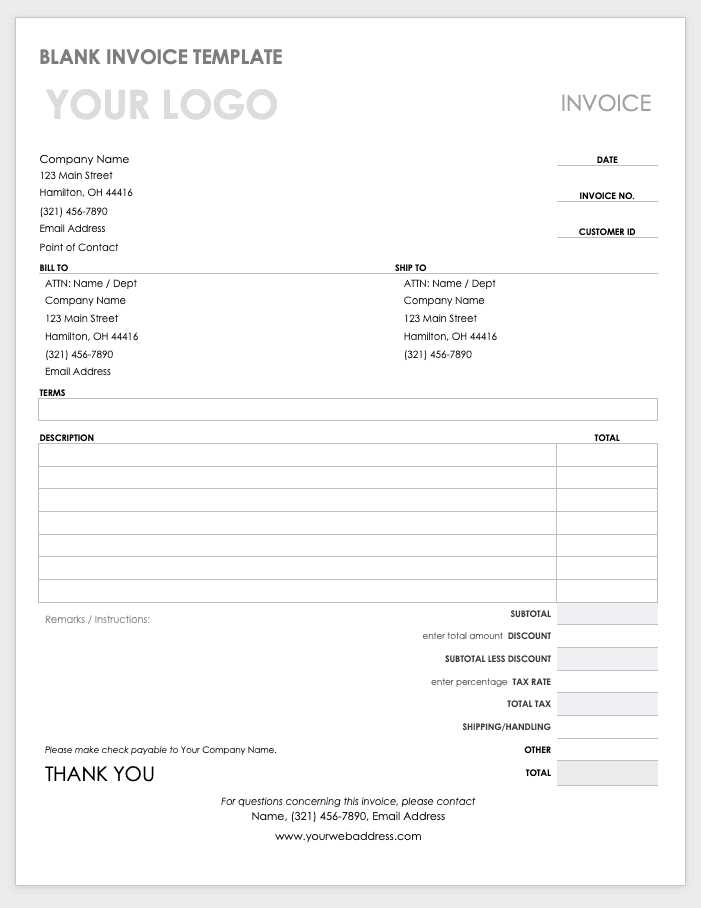

Word Doc Invoice Template Download

Accessing a ready-to-use structure for generating billing documents can significantly streamline the process. Having the right format at hand helps create accurate, professional paperwork for business transactions. Many options are available that allow easy editing and customization to fit specific needs.

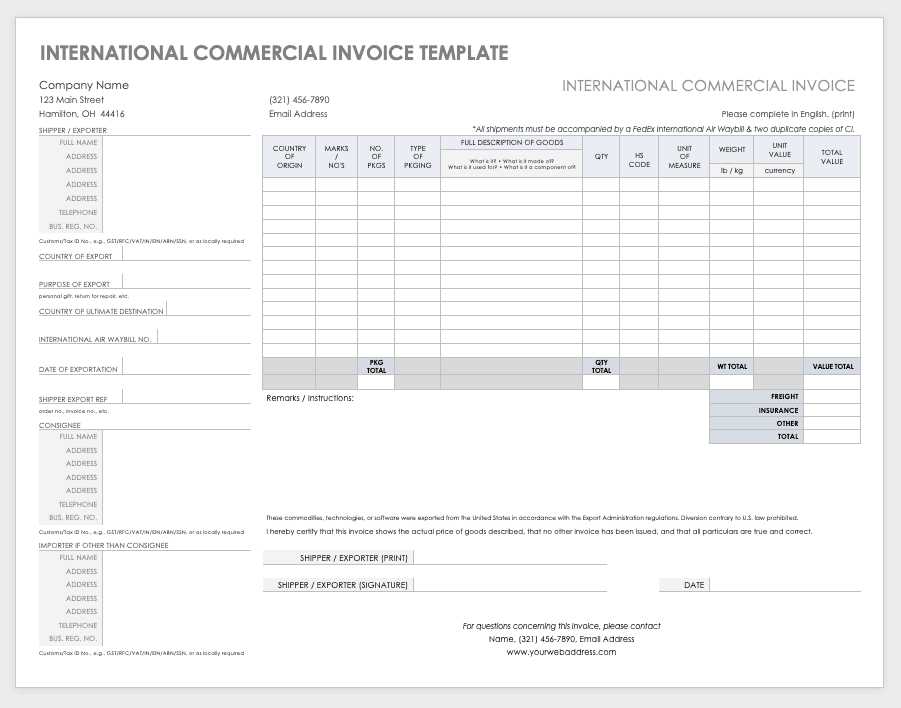

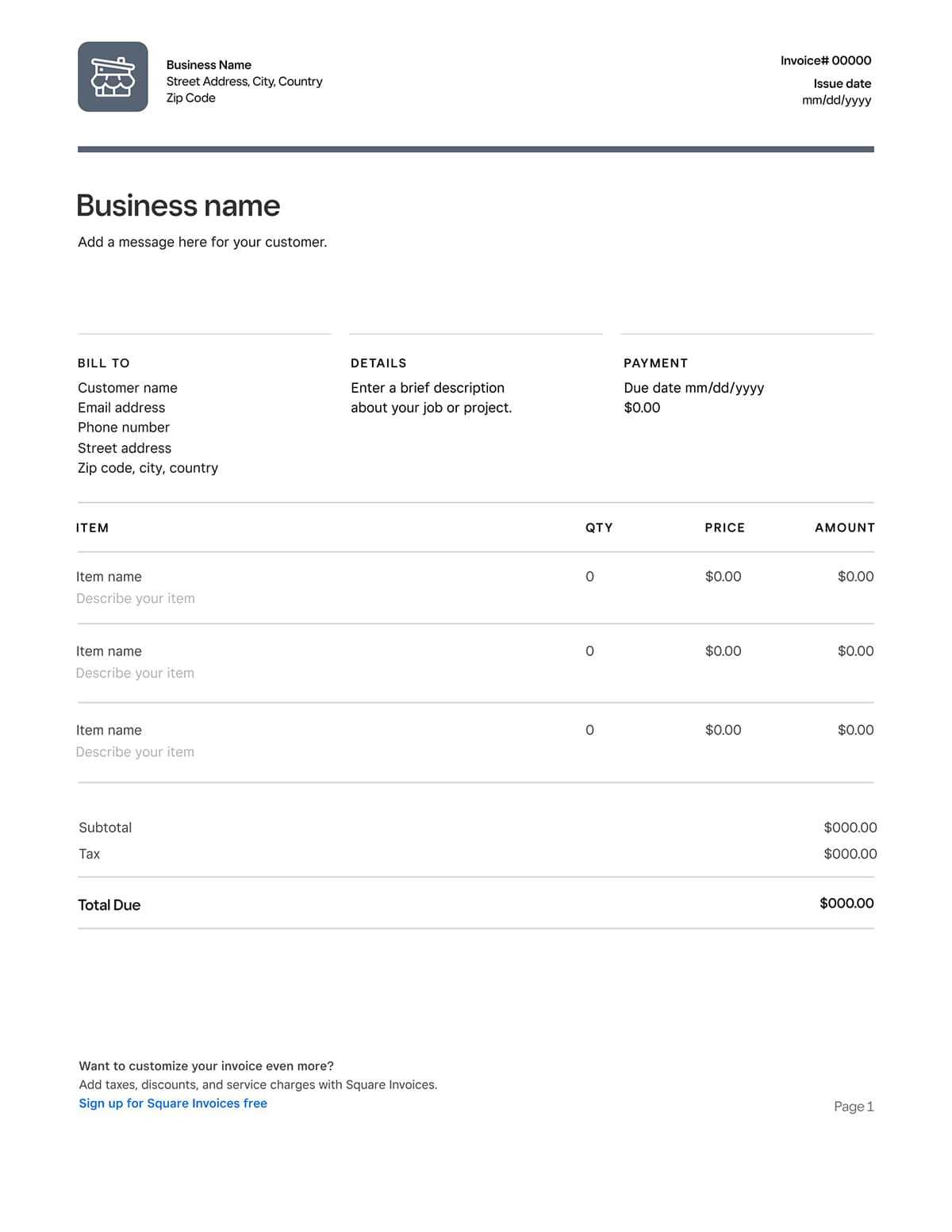

These formats are highly useful for anyone looking to save time while ensuring consistency in their paperwork. They typically offer fields for essential information such as the business name, contact details, amounts due, and payment terms, making it simple to adjust as necessary.

The following table outlines common features available in various billing formats:

| Feature | Description |

|---|---|

| Customizable Fields | Easy to modify for client details, amounts, and dates |

| Professional Layout | Structured design for clear and organized presentation |

| Predefined Sections | Sections for billing, terms, and payment methods |

| Editable Format | Simple to adjust in a text editor for personalized use |

With these features, users can easily generate personalized billing documents that meet their business needs. By utilizing such resources, professionals can maintain consistency and professionalism in all their financial correspondence.

Why Use a Word Invoice Template

Using a pre-designed format for billing documents offers numerous advantages, especially when aiming to save time and improve organization. These ready-made structures provide a framework that can be quickly adjusted to suit individual needs, reducing the effort involved in creating each document from scratch. They ensure that all necessary details are included, helping businesses maintain consistency and accuracy.

For small business owners, freelancers, and professionals, having a set layout for payments makes it easier to manage financial documentation. It ensures that no important information is overlooked and provides a polished, professional appearance to clients and partners.

The following table outlines the main reasons to consider using a prepared structure for business paperwork:

| Benefit | Description |

|---|---|

| Time Efficiency | Quick to customize, eliminating the need to start from scratch |

| Consistency | Maintains a uniform format across all documents, reinforcing your brand |

| Professional Presentation | Ensures the final document looks clean, organized, and trustworthy |

| Customization | Flexible enough to add personal or business-specific details |

| Ease of Use | User-friendly and simple to adjust without requiring advanced skills |

With these benefits, it’s clear that using a prepared structure can significantly enhance the efficiency and professionalism of your billing process.

Benefits of Customizable Invoice Formats

Customizable billing formats provide significant advantages, particularly when it comes to personalization and flexibility. They allow users to adapt essential documents to match their unique business needs while ensuring that all required details are included. Customization enhances the professional appearance of business transactions and saves time in the long run.

Key Advantages

- Personalization: Easily add your business logo, color scheme, and contact details to reflect your brand identity.

- Adaptability: Modify fields to suit different types of transactions, whether it’s for products, services, or recurring payments.

- Clarity: Organize sections to highlight important information such as payment terms, item descriptions, and amounts due.

How Customizable Formats Save Time

- Speed: Pre-set sections can be filled out quickly, reducing the need to re-enter the same information repeatedly.

- Consistency: Ensure uniformity in all documents, which is essential for maintaining a professional and reliable image.

- Automation: Many formats allow users to save default settings, further simplifying the process of creating future documents.

By utilizing customizable formats, businesses not only streamline their workflow but also enhance their professionalism and efficiency in handling financial transactions.

How to Download Invoice Templates

Accessing a pre-designed document format for billing purposes is a straightforward process. By finding the right source, you can quickly obtain a structure that suits your business needs. These formats often come in a variety of styles, allowing you to choose the one that best fits your company’s image and requirements.

To begin, look for trusted platforms that offer free or paid options. Many websites provide ready-made solutions that are easy to use and customize. These platforms typically offer various formats that cater to different industries and transaction types.

Once you’ve identified the right format, simply follow the steps to save it to your device. Most of these resources allow you to click a button to save the file, which can then be edited in compatible software, making the process quick and efficient.

After saving the document, you can begin personalizing it by adding your business information and adjusting any sections as needed. This allows you to have a professional-looking document ready to be sent out with minimal effort.

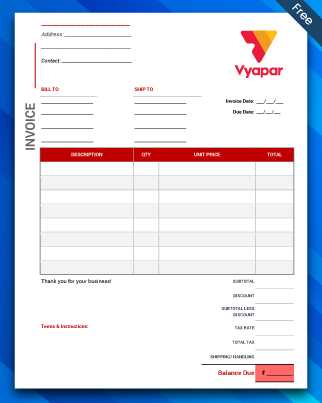

Key Features of a Word Invoice Template

When selecting a structured document format for billing purposes, it is important to understand the features that make it effective and useful. A well-designed format ensures that all necessary information is clearly presented, easy to read, and professionally formatted. These key features allow businesses to create consistent and accurate financial documents without the need to start from scratch each time.

The following are some important characteristics to look for in a billing document structure:

- Predefined Sections: These formats often include sections for essential details such as client information, payment terms, item descriptions, and totals. This ensures no important field is missed.

- Editable Fields: The ability to modify text and numbers makes it easy to tailor the document to specific transactions, adding unique details for each customer or job.

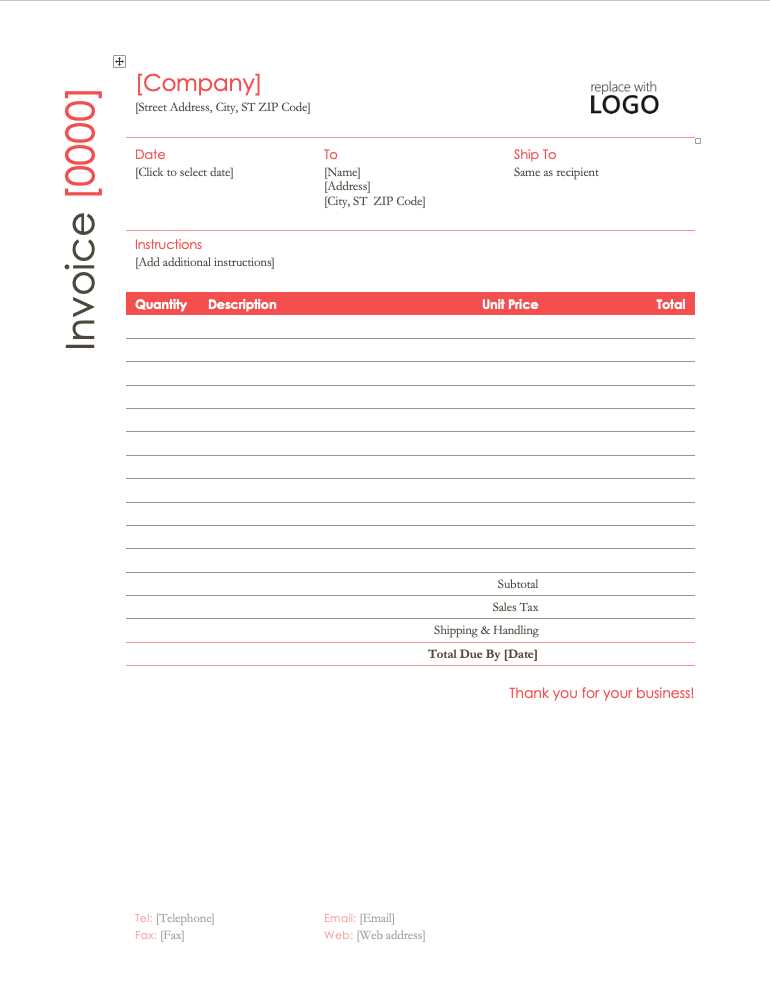

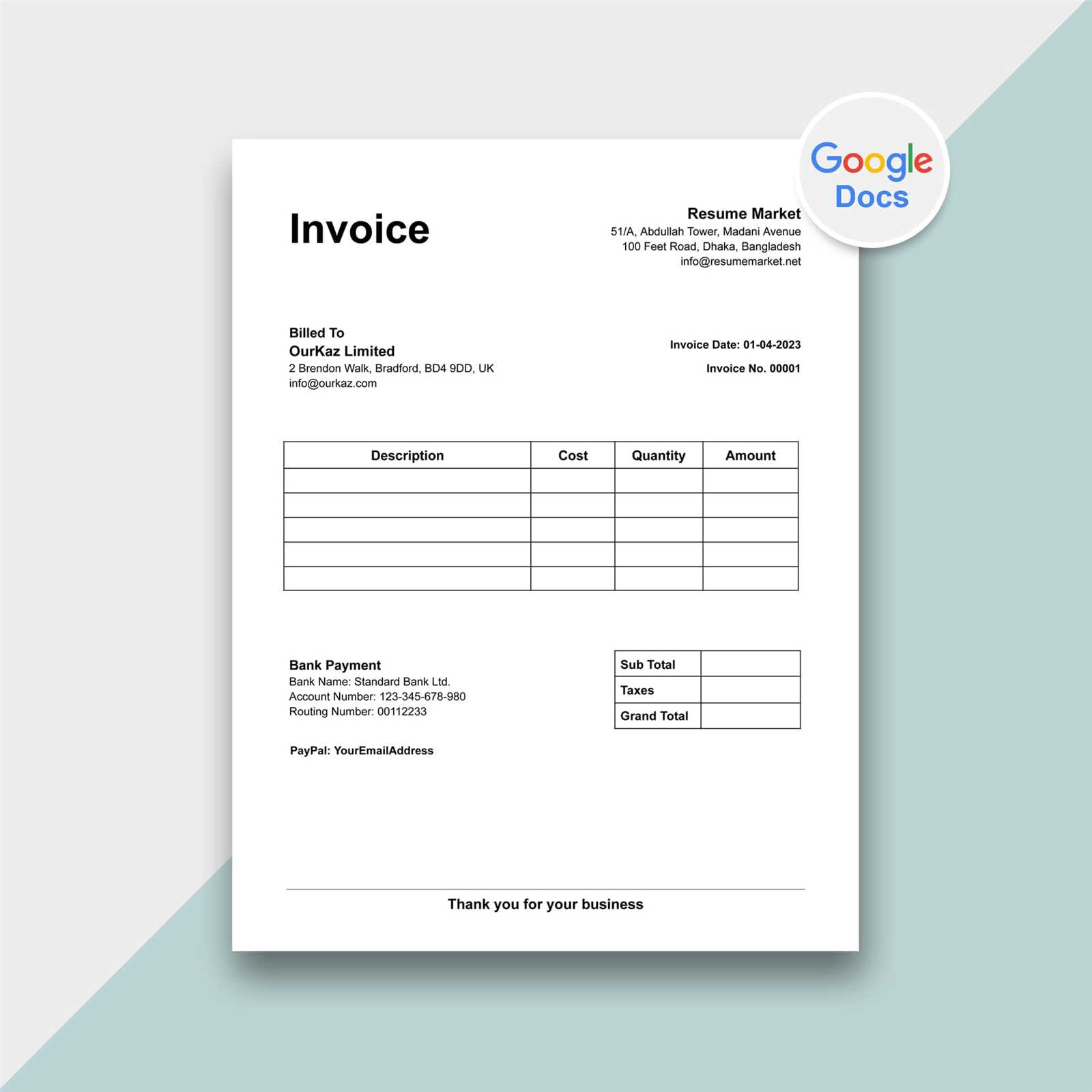

- Professional Design: Clean, organized layouts with a balance of text and white space create an appealing, easy-to-read document that reinforces a professional image.

- Customizable Branding: The option to add logos, company colors, and other branding elements allows businesses to maintain a consistent visual identity across all correspondence.

- Currency and Tax Options: Built-in options for specifying different currencies and tax rates make it easy to adapt the format for international or specific region-based transactions.

By focusing on these key features, businesses can streamline their billing process, improve accuracy, and maintain a professional appearance in all transactions.

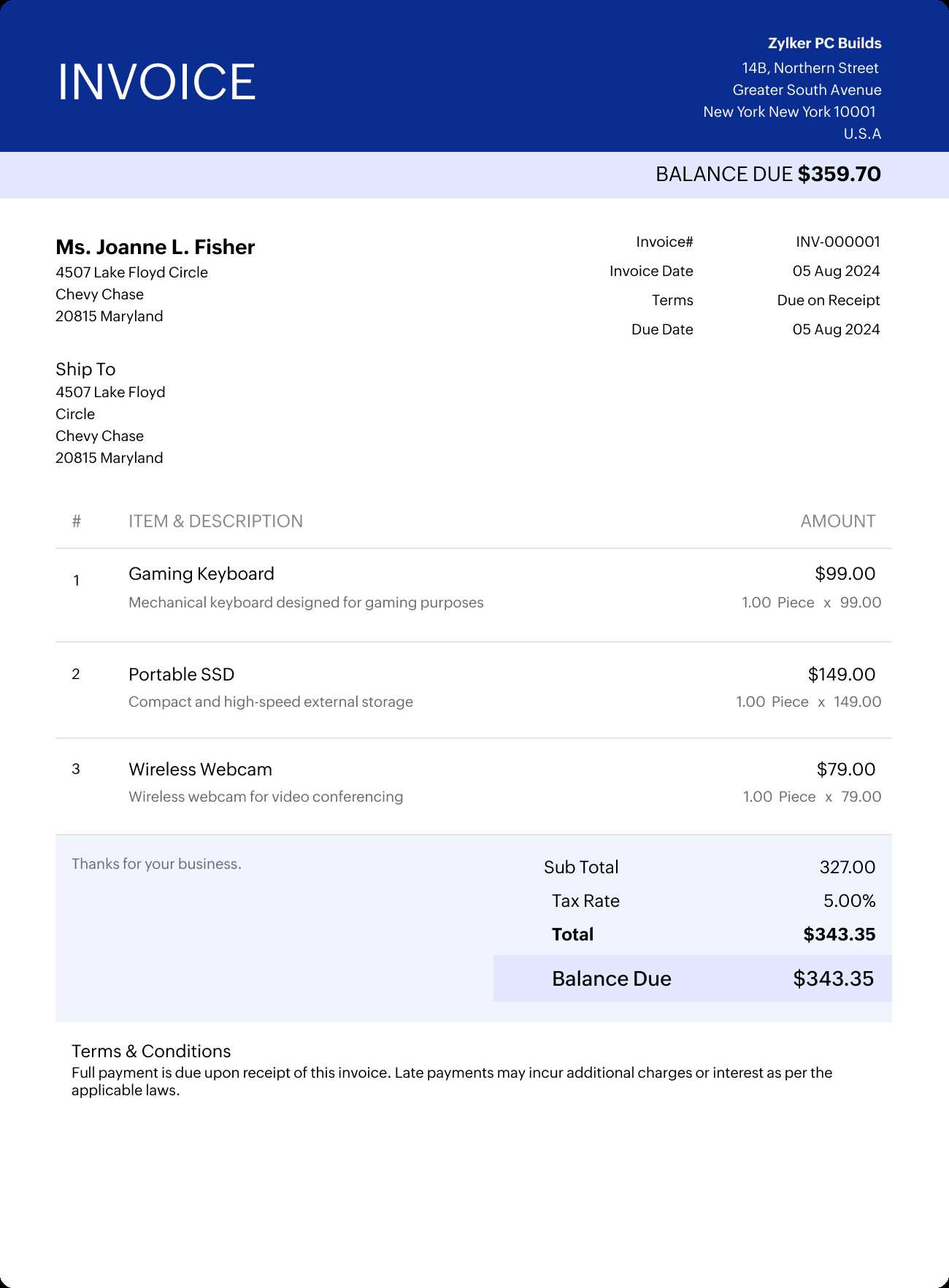

How to Customize Your Invoice Template

Customizing a pre-designed billing document format is a simple yet powerful way to ensure it fits your specific business needs. By making adjustments to the structure, you can personalize the layout, add relevant details, and tailor the content to reflect your company’s unique style. Customization not only helps maintain brand consistency but also ensures that all essential information is included in a clear and professional manner.

To begin, identify the areas of the document that need adjustment. Common customizations include adding your company logo, changing the font style or colors to match your brand, and including any specific payment terms or instructions that are unique to your business. You may also want to adjust the order of sections to better suit your workflow.

Next, focus on the content. Update the placeholders with accurate client details, such as name, address, and contact information. Modify any field that requires customization, like item descriptions, prices, and payment deadlines, ensuring that everything is tailored to the current transaction.

Finally, ensure that your document is easy to understand by keeping the design simple and well-organized. A clean, uncluttered layout will enhance readability and ensure that important details stand out. Once these changes are made, save the document for future use, making the process of creating new billing records quick and efficient.

Steps to Create Professional Invoices

Creating a polished and professional billing document is essential for maintaining credibility and ensuring timely payments. By following a structured process, you can produce accurate, easy-to-read records that reflect your business’s standards. A well-crafted document can improve client trust and help avoid confusion over payment terms or details.

Step 1: Gather Necessary Information

Before starting, collect all relevant details for the transaction. This includes client information, services or products provided, amounts, due dates, and payment terms. Be thorough to ensure all fields are completed accurately.

Step 2: Customize the Layout

Adjust the layout to include your company’s branding, such as the logo, color scheme, and contact details. This personalizes the document and strengthens your brand’s visibility. A clean, organized layout is important for readability, so prioritize simplicity and clarity.

Step 3: Fill in the Details

Ensure all required fields are filled out with precise information. Include a breakdown of services or items, the corresponding prices, and taxes. If applicable, mention any discounts or additional fees. Double-check all numbers and terms for accuracy.

Step 4: Set Clear Payment Terms

Clearly define payment terms, including the total due, payment methods accepted, and deadlines. Be explicit about late fees or penalties to avoid misunderstandings later on. A clear payment section helps your clients know exactly when and how to settle the amount.

Step 5: Review and Save

Before finalizing the document, review it thoroughly for errors or missing information. Ensure all sections are completed and legible. After the final check, save the document for future reference or send it directly to your client.

Following these steps will help you create professional, accurate documents that enhance your business operations and client relationships.

Where to Find Free Invoice Templates

There are numerous platforms available that offer free ready-made billing formats, allowing businesses to quickly access and customize the structure for their needs. These resources provide a convenient way to streamline the creation of professional payment records without spending time designing one from scratch. Whether you are a freelancer, small business owner, or professional, free resources can help you get started without additional costs.

Below is a list of common sources where you can find free document formats for billing purposes:

| Platform | Features |

|---|---|

| Online Template Libraries | Provide a wide range of customizable options across different industries |

| Business Websites | Many business-focused websites offer free resources for entrepreneurs |

| Document Creation Software | Programs like Google Docs and Microsoft Office offer built-in layouts |

| Freelancer Platforms | Websites for freelancers may include free resources for professionals |

| Government or Tax Agencies | Some government websites offer free formats that are tax-compliant |

By exploring these sources, you can easily find a pre-designed format that suits your business style and needs without spending any money. This makes it easier to stay organized and professional, ensuring that every transaction is documented correctly.

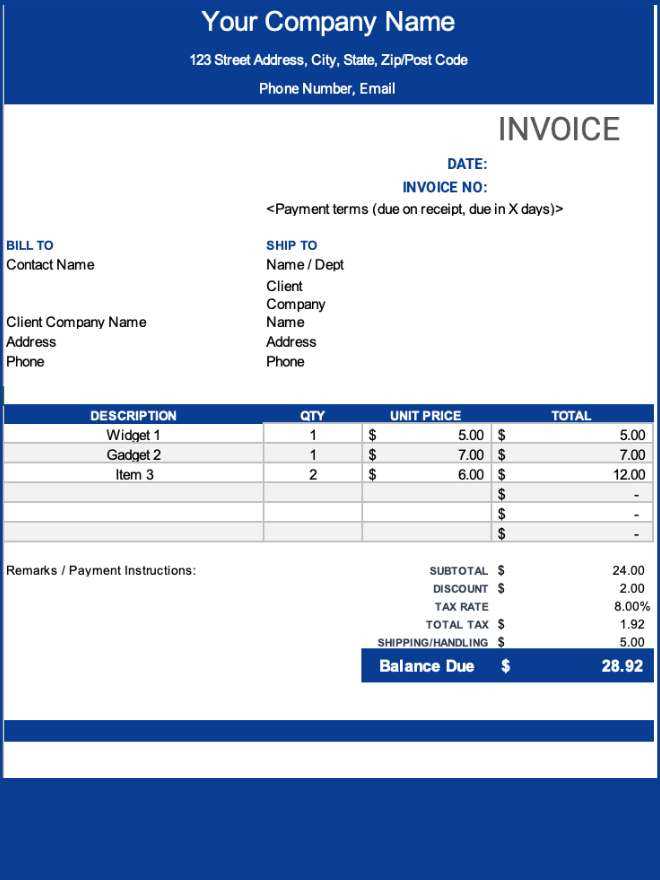

Best Practices for Invoice Design

Designing a professional billing document is crucial for making a lasting impression on clients and ensuring clarity in financial transactions. A well-designed record enhances readability, reduces confusion, and ensures that all relevant information is easy to find. Following best practices for design can help businesses create polished and effective documents that reflect their brand and maintain a high standard of professionalism.

Here are some key design principles to keep in mind when creating your billing records:

| Design Element | Best Practice |

|---|---|

| Clear Structure | Use a simple and organized layout with distinct sections for client details, services, pricing, and payment terms. |

| Branding | Incorporate your business logo, colors, and font style to maintain brand consistency and create a professional appearance. |

| Legible Fonts | Choose fonts that are easy to read, avoiding overly stylized or complicated text. Ensure proper font size for key information. |

| White Space | Allow adequate space between sections to prevent the document from feeling crowded. This enhances readability and overall aesthetic. |

| Itemization | Clearly list all products or services with corresponding prices to avoid misunderstandings and ensure transparency. |

| Payment Details | Clearly state payment instructions, including due dates, accepted methods, and late fees if applicable. |

By incorporating these design principles, you can create a billing record that is not only visually appealing but also functional, making it easier for your clients to understand and process payments promptly. A professional document can also contribute to fostering trust and long-term relationships with your customers.

How to Add Company Details to Invoices

Including accurate company information on your billing documents is essential for maintaining professionalism and ensuring clear communication with clients. It also allows for easy identification and proper documentation for financial or tax purposes. By incorporating all necessary company details, you help ensure that clients have the correct contact information and are aware of your business identity.

To effectively add company information, begin by including the most important details at the top of the document. This often includes:

- Company Name: Display your official business name prominently so that clients can easily identify who the document is from.

- Business Address: Include your physical address, or at least a mailing address, to ensure clients know where to send correspondence or payments.

- Phone Number: Make sure a phone number is available for clients who may need to contact you regarding questions or payment issues.

- Email Address: Include a professional email address for easier communication and to address any queries that might arise.

- Website URL: If applicable, add your website URL to give clients easy access to more information about your services or products.

- Tax Identification Number: Depending on your region, including your business tax ID or VAT number is essential for legal and tax compliance.

Position these details in a clear, easy-to-read format at the top or in the header section. By doing this, you ensure that your clients can immediately see the key contact information. Additionally, including company details on every document creates consistency, helps build brand identity, and provides the necessary information in case of any future communication or disputes.

Including Payment Terms in Your Invoice

Clearly stating payment terms is an essential part of ensuring a smooth transaction between you and your clients. It sets expectations on when payments are due, how they should be made, and what happens if payments are late. By including specific payment guidelines, you help prevent misunderstandings and ensure that your business maintains healthy cash flow.

There are several key components to include when outlining your payment terms:

- Due Date: Clearly indicate when the payment is expected. This helps clients understand the time frame for settling their balance.

- Accepted Payment Methods: Specify which methods of payment are acceptable, such as bank transfer, credit card, or online payment systems.

- Late Payment Fees: If applicable, include any charges or interest for payments made after the due date. This provides an incentive for clients to pay on time.

- Discounts for Early Payment: Offering a discount for early payment can encourage clients to pay sooner, improving your cash flow.

- Currency: If you work with international clients, clarify the currency in which payment is expected.

- Installment Options: If the total amount is large, you may offer the option to pay in installments. Make sure to specify the terms clearly.

How to Present Payment Terms

Make payment terms easy to read and understand by placing them in a dedicated section of the document. Bold or highlight important information such as the due date, late fees, and payment methods. This helps ensure that your clients don’t overlook these critical details and are aware of your expectations from the start.

Why Payment Terms Matter

Including clear payment terms not only ensures prompt payments but also reinforces your professionalism. It can help prevent disputes, improve communication with clients, and establish a consistent cash flow. Clients will appreciate knowing exactly what is expected and when, reducing the likelihood of late payments or confusion.

How to Save and Print Your Invoice

Once you’ve created a professional billing document, the next step is saving and printing it for delivery to your client. Properly saving and printing ensures that your document is preserved for future reference, as well as ready for physical submission if necessary. Whether you choose to send it electronically or print a hard copy, ensuring the final version is error-free is key.

To save your document:

- Choose the right format: Save the file in a format that is widely accessible, such as PDF, to ensure it can be easily opened by your client. PDF files maintain formatting and are universally compatible.

- File naming convention: Use a clear and logical naming system for the file, such as including the client name, invoice number, and date. This will help you easily find and reference the document later.

- Save in the right location: Choose a folder on your computer or cloud storage that is dedicated to accounting or business documents. This ensures your files are organized and easily accessible when needed.

To print your document:

- Check formatting: Before printing, preview the document to make sure everything is properly aligned and appears correctly. Pay attention to spacing, font size, and margins to ensure readability.

- Print quality: Select the appropriate print settings to ensure high-quality output. If printing a large volume, consider using a printer that can handle bulk printing efficiently.

- Double-check details: Review the document for any errors or omissions before printing it. Ensure all necessary information, such as payment terms, client details, and itemized charges, is clearly listed.

Once your document is saved and printed, you can proceed with delivering it to your client, whether digitally via email or physically by mail. Having both an electronic and a hard copy will provide flexibility in your communication and documentation process.

How to Handle Invoice Errors

Even with careful attention to detail, errors can sometimes occur when preparing billing documents. Whether it’s a simple calculation mistake or an oversight in the client details, addressing these issues quickly is important for maintaining professional relationships and ensuring timely payments. Here’s how to identify and resolve any issues effectively.

Steps to correct errors:

- Review the document thoroughly: Before sending or issuing any billing document, double-check all information. Review the items, prices, client contact details, and payment terms. Mistakes often happen during data entry or calculations, so it’s best to look over everything carefully.

- Identify the source of the error: If an error is spotted, pinpoint where it occurred. It could be a typo in the client’s name, an incorrect amount, or a missing service. Knowing the source helps prevent future mistakes.

- Communicate with the client: If an error is discovered after the document has been sent, promptly contact the client to inform them of the issue. Apologize for the mistake, and provide them with an updated version as soon as possible.

- Issue a corrected version: After identifying and correcting the mistake, send an updated copy of the billing document to the client. Be sure to clearly state that the new version replaces the previous one to avoid confusion.

- Document the error: Keep a record of the mistake and the steps taken to resolve it. This helps maintain a professional approach and ensures that similar errors are less likely to occur in the future.

Handling mistakes efficiently shows professionalism and helps foster a positive client relationship. Being proactive in addressing issues can prevent further complications and ensure smoother transactions.

Common Mistakes When Using Templates

While using pre-designed documents can save time, it’s easy to make mistakes if you don’t pay attention to the details. These errors can affect the accuracy of your documents and even lead to misunderstandings with clients. By being aware of common mistakes, you can avoid them and ensure your documents are always professional and accurate.

1. Forgetting to Personalize Fields

One of the most frequent mistakes is neglecting to replace placeholders with actual data. Many ready-made documents come with pre-filled fields such as client names, dates, and addresses. Forgetting to update these can lead to confusion or even errors in billing. Always double-check that all fields are correctly filled before finalizing the document.

2. Overlooking Formatting Issues

Another common issue is not reviewing the formatting after making changes. Pre-designed documents may have built-in formatting that doesn’t match your style or preferences. Inconsistent fonts, alignment issues, or uneven spacing can make the document look unprofessional. Make sure the layout is neat and consistent throughout the document.

3. Using Outdated Information

Sometimes, templates may contain outdated details that need to be updated regularly. For example, business contact information, payment terms, or services offered may have changed. Always verify that all information is current before issuing the document to avoid any misunderstandings.

4. Missing Key Information

It’s also easy to overlook critical details when filling in a pre-designed document. Whether it’s terms of payment, item descriptions, or unique identifiers, missing even a small detail can cause confusion. Take the time to ensure all necessary information is included before sending it to your client.

5. Not Saving a Master Copy

Another mistake is not keeping a master version of your documents. Once a document is filled out, it’s easy to forget to save the blank version for future use. Having a master copy allows you to reuse the design while making sure no information is missed when creating a new document.

By being mindful of these common errors and carefully reviewing each document, you can make the most of pre-designed solutions while ensuring professionalism and accuracy.

How to Edit Invoice Templates in Word

Customizing pre-designed documents to fit your needs is a quick and effective way to create professional-looking records for your business. Editing a document in a text editing program offers flexibility and ease of use, allowing you to tailor fields and sections to your specific requirements.

To start, open the document that you wish to modify. Typically, these documents come with placeholders for client information, payment details, and other necessary elements. Begin by replacing any default text with your personal or business-specific details. This could include updating names, addresses, dates, or transaction summaries.

Formatting and Design Adjustments

If the document’s layout doesn’t perfectly suit your needs, you can make simple adjustments to improve its appearance. Modify font styles, sizes, or colors to match your branding. You may also adjust the alignment of text, tables, and other elements to ensure everything is properly organized and easy to read.

Adding Custom Fields

In some cases, you may need to include additional sections or information. This can be easily done by adding custom fields such as product descriptions, tax rates, or personalized terms. To do this, simply insert new text boxes or tables where necessary, making sure that your changes don’t disrupt the overall layout.

Saving and Reusing the Modified Document

Once you’ve made all your edits, be sure to save your work. If this is a document you plan to use regularly, save it as a new version to keep your original untouched. This will allow you to reuse the file as a template for future transactions, while still making any necessary adjustments for each new client or job.

By following these steps, you can efficiently edit pre-designed documents to suit your needs while maintaining professionalism and clarity in your communications.

Using Invoice Templates for Small Business

For small businesses, maintaining accurate records and sending professional documentation is essential for smooth operations. One of the easiest ways to manage financial transactions is by using pre-designed documents that can be easily customized for each client or project. These ready-to-use documents help ensure that your business maintains a consistent and professional appearance while saving time and effort.

Here are some key benefits of using such documents for your small business:

- Time Efficiency: By using a pre-made structure, you can quickly fill in the necessary details, which speeds up the process of issuing records.

- Consistency: A standardized layout helps maintain a uniform look across all your business records, promoting professionalism and trustworthiness.

- Customization: While the structure is fixed, you can easily adjust text, fields, and sections to suit your business’s specific needs, such as adding your company’s logo, adjusting pricing structures, or modifying payment terms.

- Record Keeping: These files can be saved and archived, making it easier to track transactions over time for financial planning, tax purposes, or client reference.

Using ready-made documents ensures that your small business stays organized and presents a polished image to clients. They also eliminate the need to create new documents from scratch, which can be both time-consuming and prone to error. Instead, you can focus on growing your business while knowing that the paperwork is handled efficiently and professionally.

By incorporating these customizable documents into your daily operations, small businesses can streamline their workflow, reduce errors, and build stronger relationships with clients through clear and concise communication.

How to Organize Your Invoice Files

Efficient organization of business records is essential for smooth operations and financial management. Keeping track of payment records and related documents in an organized manner not only helps with quick access but also ensures that your business remains compliant and prepared for audits or reviews. By categorizing and labeling your documents systematically, you can reduce the risk of errors, misplaced files, and wasted time searching for important information.

Steps to Effectively Organize Your Records

- Create Folders for Each Client: Organizing records by client is one of the most effective ways to ensure quick retrieval. Each client folder can contain all the relevant files for their transactions, such as contracts, payment records, and project-related documents.

- Use Descriptive Naming Conventions: When naming your files, be clear and specific. Include essential details like the client name, date, and invoice number to help identify the file quickly. For example: “ClientName_Invoice_2023-07-15.”

- Maintain Separate Folders for Paid and Unpaid Records: To avoid confusion, keep separate folders for paid and unpaid documents. This makes it easier to track outstanding payments and stay on top of overdue accounts.

- Organize by Date: Within each client folder, organizing files by date will help you keep a chronological order of transactions, making it easier to find specific documents for tax season or client inquiries.

- Back-Up Your Files: Always have a digital backup of your records. Use cloud storage or external hard drives to store your files securely and ensure they are accessible even in case of a system failure or data loss.

Best Practices for Maintaining Organized Files

- Regular Updates: Review and update your files regularly to ensure they are current and organized. Set aside time each month to go through new documents and file them appropriately.

- Use File Management Software: For even better organization, consider using digital file management systems that allow you to categorize, tag, and search your files quickly.

- Keep Hard Copies for Important Documents: While digital storage is convenient, maintaining physical copies of crucial documents may be necessary for legal or financial reasons. Store them in a secure, easy-to-access location.

Organizing your records not only improves efficiency but also provides peace of mind, knowing that all documents are stored safely and can be accessed easily whenever needed. Proper file organization is a key component of successful business management, ensuring that you are always prepared for the next step in your operations.

How to Share Invoices with Clients

Effectively sharing financial records with clients is crucial for maintaining professionalism and ensuring prompt payments. Clear communication and easy access to billing documents can help clients understand the charges and terms of payment. Whether through email, file sharing platforms, or physical copies, choosing the right method of sharing is essential for both your convenience and your clients’ ease of access.

Methods to Share Billing Records

| Method | Description |

|---|---|

| Sending billing documents via email is a quick and efficient method. Attach the file as a PDF or another secure format, and include a polite message with payment instructions. | |

| Cloud Storage | For easy access and sharing, upload your records to a cloud storage platform like Google Drive or Dropbox. Share a link with your clients so they can access the document at their convenience. |

| Direct File Sharing | For larger files or more secure transfers, use file-sharing services like WeTransfer or a secure server connection. These methods ensure that documents are delivered without the risk of size limitations. |

| Physical Copies | In some cases, clients may prefer receiving hard copies. Ensure that the records are printed clearly and accurately, and mail them using a reliable postal service or deliver them in person if appropriate. |

Best Practices for Sharing Billing Records

- Ensure File Security: Protect sensitive financial data by using encryption or password-protecting files, especially when sharing via email or cloud storage.

- Provide Clear Instructions: Include payment due dates, methods, and any other important information with your shared records. This minimizes confusion and facilitates prompt payments.

- Follow Up Regularly: After sending the document, follow up with your client to confirm receipt. This ensures they have received the necessary documents and clarifies any questions they may have.

- Use Professional Language: Always communicate in a professional manner, ensuring your tone is polite and clear. This helps maintain positive client relationships and reinforces the importance of the billing document.

Sharing financial documents with clients should be a streamlined and professional process. By choosing the right sharing method and maintaining clear com