HP Invoice Template for Simplified Billing and Professional Invoices

For any business, managing financial documents effectively is essential for smooth operations. A well-organized system for issuing payment requests can save time, reduce errors, and maintain professionalism. Whether you’re a freelancer or a small business owner, having the right structure in place is crucial for tracking payments and maintaining client relationships.

HP’s tools offer an easy way to generate professional-looking records that meet all necessary requirements. These resources allow customization to fit the unique needs of different businesses, ensuring a clean, consistent, and reliable approach to managing financial transactions. Streamlining the process can help avoid confusion and improve efficiency across various aspects of your operations.

From small-scale enterprises to larger organizations, utilizing such systems allows for quick adjustments, clear communication with clients, and accurate documentation. With the right setup, businesses can maintain compliance, avoid misunderstandings, and focus on growth while leaving the complexities of administrative tasks behind.

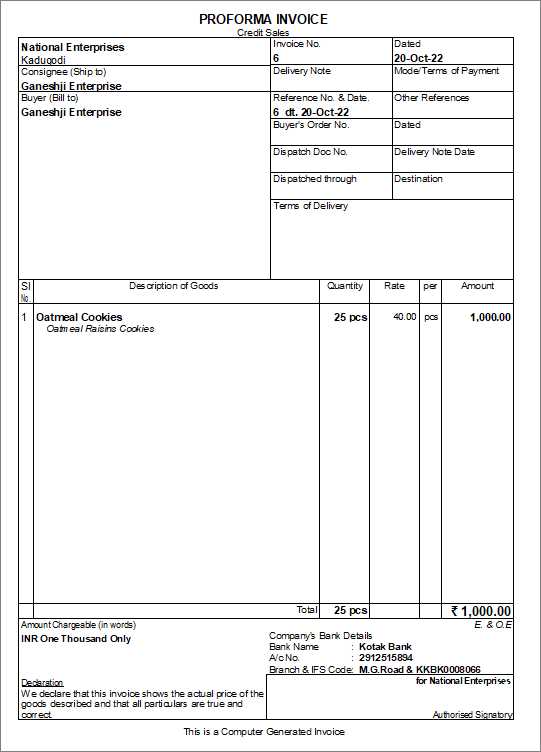

HP Invoice Template Overview

Managing financial records efficiently is crucial for any business. HP offers a streamlined solution for creating well-structured billing documents that help maintain accuracy and professionalism in every transaction. These tools are designed to simplify the process of preparing, customizing, and organizing payment requests, making it easier for businesses to manage their finances.

With a focus on clarity and ease of use, HP’s solution allows for quick adjustments and flexibility to suit different needs. Whether you’re handling a small project or large-scale operations, this system ensures that your financial documents meet all necessary standards, saving you time and reducing the risk of mistakes.

Key Features of HP Billing Documents

HP’s financial tools include a variety of features that make it easier for users to create and manage payment requests:

| Feature | Description |

|---|---|

| Customizable Layout | Modify design elements to fit your branding and business needs. |

| Easy Data Input | Quickly add client information, items, and payment terms. |

| Automatic Calculations | Auto-calculate totals, taxes, and discounts. |

| Export Options | Save documents in multiple formats for easy sharing. |

Why Choose HP for Your Billing Needs

HP’s tools are designed to meet the needs of both small and large businesses by providing an intuitive interface and flexible options. These resources help you stay organized, maintain consistent standards across documents, and improve communication with clients. Whether you’re a freelancer, contractor, or business owner, HP’s solution supports your need for accurate and reliable financial paperwork.

Why Use an HP Invoice Template

For any business, maintaining consistency and professionalism in financial documentation is essential. HP offers a powerful tool that helps businesses create well-organized billing documents quickly and efficiently. By using these resources, companies can ensure that their payment requests meet industry standards, reduce errors, and save valuable time during the billing process.

One of the main reasons to choose HP for your financial paperwork needs is the simplicity and ease of use. The system is designed with user experience in mind, allowing you to customize essential elements without complicated procedures. Whether you are managing a small project or handling multiple clients, having a structured format in place helps streamline your workflow and maintain a consistent approach across all your documents.

Moreover, HP’s tools allow businesses to stay professional and organized, which is crucial for building trust with clients. Accurate, clear, and error-free documentation demonstrates reliability and attention to detail, reflecting positively on your brand. Using a proven solution ensures that your transactions are properly documented and easily traceable, enhancing the overall efficiency of your operations.

Benefits of Customizable Invoice Formats

Having the ability to adjust and personalize your financial documents offers numerous advantages for businesses of all sizes. Customization allows you to tailor each record to your specific needs, helping you maintain a consistent and professional image while ensuring accuracy and clarity. With a flexible approach to creating billing documents, businesses can save time, reduce errors, and enhance communication with clients.

Branding and Professionalism

One of the primary benefits of using customizable formats is the ability to incorporate your company’s branding. By adding logos, adjusting colors, and selecting fonts that align with your brand identity, you ensure that your documents reflect your business’s professional image. This attention to detail helps build trust and leaves a lasting impression on clients, fostering positive relationships.

Efficiency and Accuracy

Personalization also streamlines the process of preparing payment requests. By setting up default fields, terms, and other necessary details, you can avoid repetitive data entry and reduce the chance of making mistakes. This automation allows you to generate documents quickly while ensuring that every necessary detail is included, leading to more efficient and accurate transactions.

Furthermore, customizable formats offer flexibility in terms of layout and content, allowing you to adjust each document to suit the particular requirements of a project or client. Whether you need to add special terms, include discounts, or list specific services, a personalized approach helps you stay organized and maintain consistency across all your communications.

How to Download HP Invoice Template

Getting started with HP’s solution for creating professional billing documents is simple and convenient. The process of downloading the necessary tools can be done quickly, allowing you to start managing your financial records efficiently in no time. Here’s a step-by-step guide on how to download and access the resources you need for creating organized and customizable payment requests.

Step-by-Step Download Process

Follow these steps to download the required files from HP’s official platform:

- Visit the official HP website or the dedicated page for business solutions.

- Navigate to the section where financial document resources are available.

- Choose the specific format or version that best suits your business needs.

- Click the download link to initiate the process.

- Once the file is downloaded, open it on your device and begin customizing it for your business.

Additional Options and Resources

In addition to downloading the files, HP also provides access to other tools and resources that can further enhance your financial documentation process. These options include:

- Integration with accounting software for seamless workflow.

- Additional formatting options for advanced customization.

- Access to templates in various file formats like PDF or Excel for easy sharing and editing.

By downloading and utilizing these resources, you can ensure that your financial documents are not only professional but also tailored to meet your business requirements.

Key Features of HP Invoice Template

HP’s solution for generating professional billing documents offers a wide range of features designed to enhance efficiency and accuracy in business operations. These tools are built to simplify the process of creating, customizing, and organizing payment requests, while providing all the necessary functionality to meet the specific needs of different users. The following are some of the key features that make HP’s offering a powerful choice for businesses of any size.

From automation to customization, these tools provide an easy-to-use interface that ensures your financial documents are both effective and professional. By leveraging these capabilities, businesses can save time, reduce errors, and maintain consistent communication with clients and partners.

- Customizable Layout – Tailor the design to match your business branding and client preferences, ensuring your documents look polished and professional.

- Automatic Calculations – Automatically calculate totals, taxes, and discounts, reducing manual errors and ensuring accurate financial details every time.

- Data Input Flexibility – Easily input essential information like client details, services provided, and payment terms with intuitive fields and options.

- Multiple Format Options – Save your documents in various formats such as PDF or Excel, making it easier to share or print them according to your needs.

- Time-Saving Features – Save frequently used details and settings for quick generation of future documents, allowing for faster processing and minimal effort.

By utilizing these features, businesses can ensure that their financial records are created with efficiency, consistency, and accuracy, making the overall process much smoother and more professional.

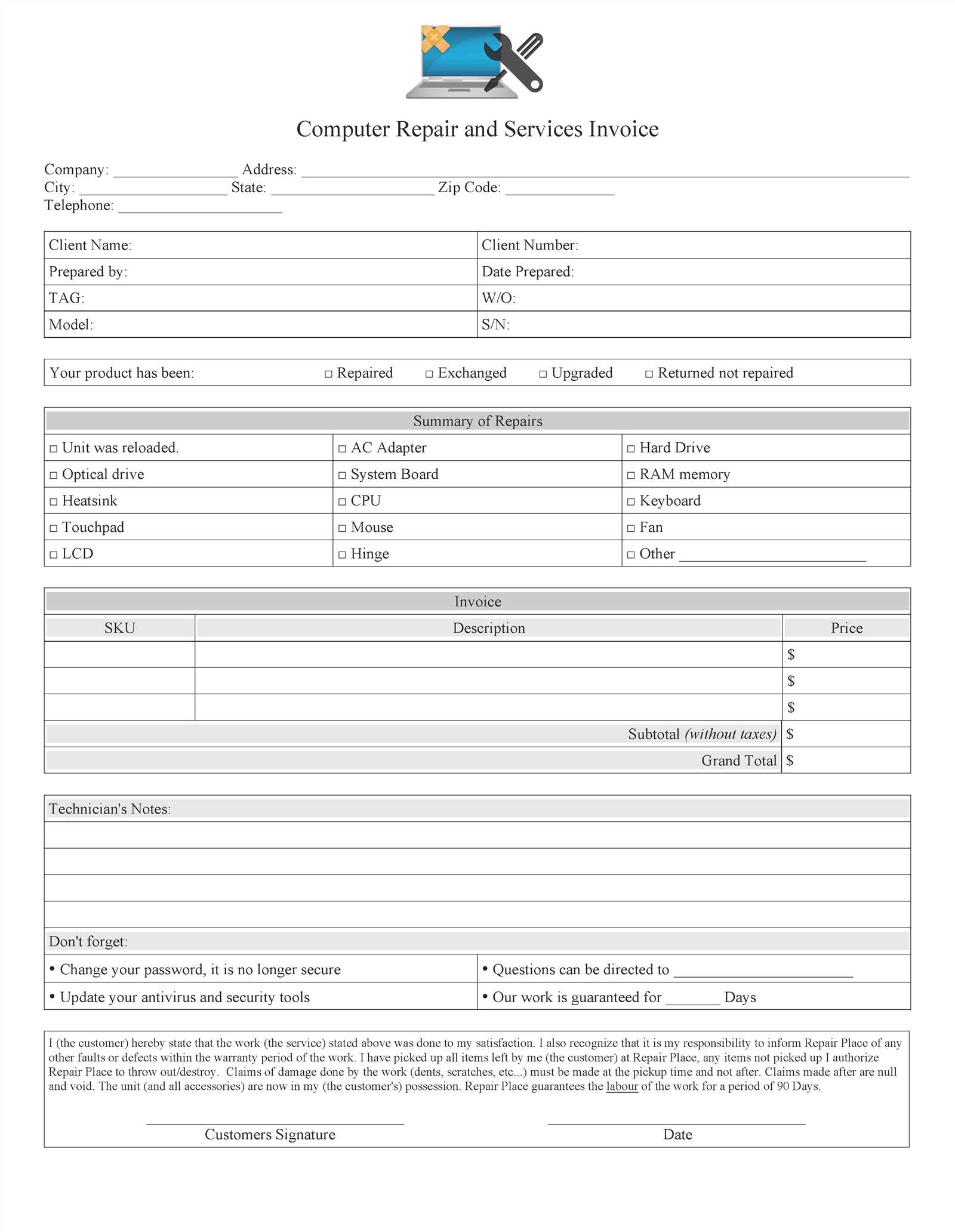

Choosing the Right Template for Your Business

Selecting the right format for creating financial documents is essential for ensuring that your business runs smoothly and looks professional. With the right tools, you can streamline the process of generating billing requests and ensure that each document reflects your brand’s identity and meets your business needs. Whether you’re working as a freelancer, a small business owner, or part of a larger enterprise, choosing the right solution can make a significant impact on your efficiency and customer relations.

Consider Your Business Type

The first step in choosing the best document format is understanding your business needs. Different industries and business models may require specific features. Here are some considerations to help guide your choice:

- Freelancers and Contractors – A simple, clean format with space for detailed descriptions of services rendered and payment terms works best.

- Small Businesses – A more customizable format with sections for itemized lists, taxes, and discounts to cater to a range of products or services.

- Large Enterprises – A more robust solution with integration capabilities and the ability to manage multiple clients and complex pricing structures.

Customization and Usability

Ease of use and the ability to personalize your documents are crucial factors in making the right choice. Look for a solution that allows you to:

- Modify the layout to reflect your brand’s colors, logos, and fonts.

- Add and remove sections based on the specific needs of each project.

- Pre-fill common fields like business information and payment terms for faster processing.

Ultimately, the right choice should simplify your billing process, save time, and provide flexibility to adapt to different client needs. Ensure that the system you choose is easy to use, integrates well with your existing tools, and meets all your documentation requirements.

How to Edit Your HP Invoice

Editing your financial document is a straightforward process with HP’s user-friendly tools. Whether you need to update client details, adjust payment terms, or modify the list of services, customizing your document to reflect accurate information is quick and easy. Below are the steps to guide you through the process of making adjustments and ensuring your document is ready for use.

Step-by-Step Guide to Editing

Follow these steps to efficiently edit your document and make any necessary updates:

- Open the Document – Start by opening the financial record you wish to modify. This can typically be done through the software or file format you’ve chosen.

- Update Client Information – Locate the section with client details and update their name, contact information, and address as needed.

- Adjust Payment Terms – If the terms of payment change, ensure you modify the due date, payment instructions, and any discounts or penalties.

- Edit Line Items – If necessary, add, remove, or modify the services/products listed. You can adjust quantities, prices, and descriptions to match the work completed or goods delivered.

- Review Calculations – Double-check any automatic calculations for accuracy, including totals, taxes, and any applied discounts.

- Save Changes – Once all updates are made, save the document in your preferred format, ensuring it’s ready for distribution to your client.

Additional Customization Options

Besides basic edits, HP’s solution allows for further personalization to make your financial document more professional and tailored to your needs. Some additional options include:

- Adding Logos and Branding – Include your business logo and select the colors and fonts that reflect your brand.

- Inserting Terms and Conditions – If applicable, add standard terms and conditions to ensure clarity and consistency.

- Custom Fields – Include special notes, project references, or any other relevant information that may be important for your client.

Editing your document is simple and intuitive, allowing you to create professional, accurate records in a fraction of the time. By following these steps and utilizing the customization options available, you can ensure each financial record is tailored to meet your business and client needs.

HP Invoice Template for Freelancers

As a freelancer, managing your financial records is crucial for maintaining professionalism and ensuring timely payments. HP’s tools provide an easy-to-use solution for creating clear and accurate billing documents that meet your specific needs. These resources allow freelancers to efficiently manage client payments, track hours worked, and include all necessary details in one organized document.

With customizable features and user-friendly options, HP’s solution helps freelancers present their services in a polished and professional manner. Whether you’re a graphic designer, writer, or developer, this system can be tailored to suit your work style and ensure smooth business transactions with clients.

Key Features for Freelancers

Freelancers can benefit from several features designed to simplify the process of creating billing documents:

- Customizable Fields – Add specific services, hourly rates, and project details to each document, ensuring it fits the unique aspects of each project.

- Time Tracking – Easily include the number of hours worked and calculate totals automatically, reducing the risk of errors.

- Simple Layout – A clean and minimalistic design that emphasizes the key details, making it easy for clients to understand your work and payment expectations.

- Recurring Billing – Set up recurring charges for ongoing projects, saving you time on repetitive tasks and ensuring that payments are received on time.

Why Freelancers Choose HP

HP’s billing solution offers convenience and reliability for freelancers who need a straightforward way to manage their financial documents. The easy-to-use platform helps you stay organized, while the customization options allow you to adjust each document according to the specific needs of your clients. With automated calculations, customizable layouts, and professional features, HP helps freelancers focus on what they do best–working with clients–while leaving the paperwork to the experts.

Incorporating Branding into Your Template

For any business, maintaining a consistent brand identity across all communication is essential. When creating financial documents, it’s important to ensure that your documents reflect your business’s style and professionalism. HP’s tools allow for easy customization, so you can incorporate your unique branding elements into every document you create, from logos to color schemes and fonts.

Personalizing your financial documents not only reinforces your brand’s identity but also helps build trust and recognition with your clients. A well-branded document looks professional and adds a level of consistency to your interactions, making them more impactful and memorable.

How to Add Branding to Your Documents

Here are a few ways to incorporate your branding into your financial records:

- Logo Placement – Add your company logo at the top or bottom of the document to immediately identify it as coming from your business.

- Color Scheme – Customize the colors to match your business’s palette, ensuring that the document aligns with your overall brand design.

- Font Selection – Choose fonts that reflect your brand’s tone and style, whether professional, casual, or creative.

- Customizable Layout – Adjust the layout to suit your brand’s aesthetic, positioning key details like your business name and client information in an appealing way.

Why Branding Matters in Financial Documents

When your financial documents are branded, they not only look more polished but also communicate to your clients that you take your business seriously. A well-branded document can reinforce trust and create a stronger connection between you and your clients. Consistency in branding helps maintain a professional image and makes it easier for clients to recognize your work, building a solid reputation over time.

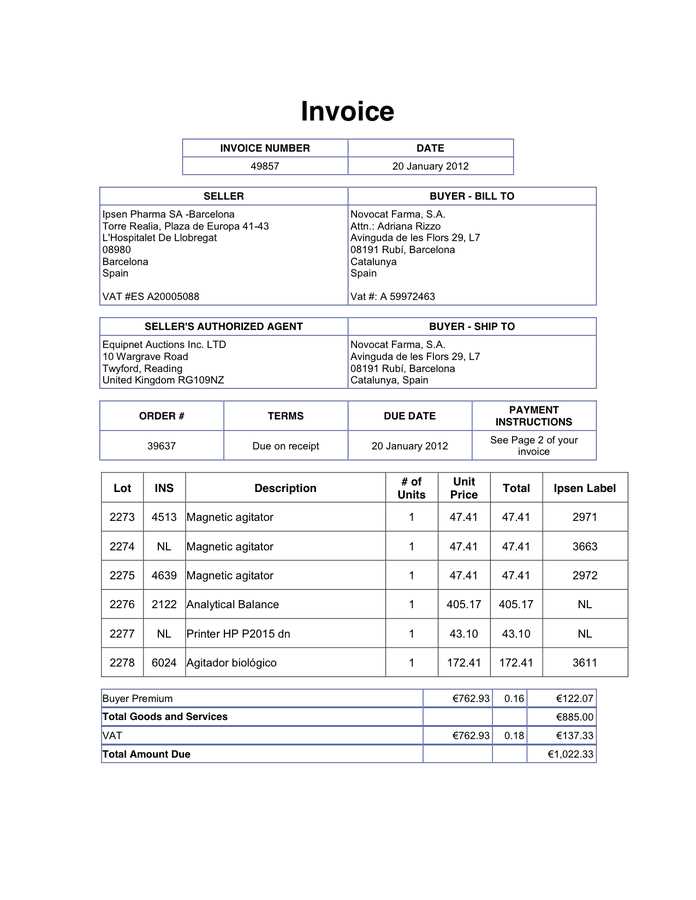

Setting Up Tax Information in HP Invoice

Accurately setting up tax details is a critical part of managing financial documents. Ensuring that tax calculations are correct helps avoid errors and ensures compliance with local regulations. HP’s tool for creating billing records provides an easy way to include tax information, automating calculations and making sure that the proper rates are applied every time.

By setting up your tax information correctly, you can save time, reduce mistakes, and streamline your billing process. Whether you’re dealing with sales tax, VAT, or other tax types, customizing the tax settings in your financial documents is a straightforward process that guarantees accuracy in all your transactions.

Steps to Set Up Tax Information

Follow these steps to configure tax details in your HP financial document:

- Open Your Document – Start by opening the document you wish to edit or create.

- Access Tax Settings – Navigate to the settings or options menu where you can input tax details.

- Enter Tax Rates – Input the appropriate tax rates based on your location or the location of your client. You can add multiple tax rates if needed (e.g., local, state, and federal taxes).

- Apply Tax to Line Items – Ensure that taxes are automatically applied to each line item, service, or product as required.

- Save and Review – Once tax information is set up, save your changes and review the document to ensure all details are correct.

Tax Information Table Example

Here’s an example of how tax information might look within your financial record:

| Item | Price | Tax Rate | Tax Amount |

|---|---|---|---|

| Web Design Services | $500 | 8% | $40 |

| Hosting Services | $150 | 8% | $12 |

| Total | $650 | $52 |

By configuring your tax information correctly, you can ensure that your documents are both accurate and compliant wi

How to Add Payment Terms

Including clear payment terms in your financial documents is essential for ensuring smooth transactions between you and your clients. These terms outline the expectations for payment deadlines, late fees, and accepted methods of payment. HP’s tools allow you to easily customize and add payment terms to your records, ensuring that both you and your clients are on the same page when it comes to the financial agreement.

By adding detailed and professional payment terms, you can avoid misunderstandings and maintain a transparent relationship with your clients. Whether it’s setting a due date, offering early payment discounts, or specifying interest rates for overdue payments, these details help establish clear expectations from the outset.

Steps to Add Payment Terms

Follow these simple steps to add payment terms to your financial documents:

- Open the Document – Start by opening the billing document you want to modify or create.

- Locate the Payment Terms Section – Most financial document tools include a designated area for payment terms. Find this section in the document layout.

- Enter Specific Terms – Specify the payment due date (e.g., “Due within 30 days”), the acceptable methods of payment (e.g., credit card, bank transfer), and any applicable early payment discounts or late fees.

- Review Terms – Double-check your terms for clarity and accuracy. Make sure the details are precise and easy for the client to understand.

- Save and Update – Once you have entered your payment terms, save your document and ensure that it is ready for use.

Example Payment Terms

Here’s an example of how payment terms might appear in your document:

Payment Terms:

- Payment due within 30 days from the issue date.

- A 5% discount will be applied for payments made within 7 days of the issue date.

- Late payments will incur a 2% interest charge per month after the due date.

- Accepted payment methods: Credit Card, PayPal, Bank Transfer.

By clearly outlining these terms, you ensure that both you and your clients are aligned in terms of payment expectations, reducing the potential for delays and disputes.

Tracking Payments with HP Invoices

Keeping track of payments is a vital part of any business’s financial management. With HP’s invoicing solution, you can easily monitor the status of payments for the services or products you provide. This tool allows you to track which payments have been made, which are pending, and which may be overdue. This functionality helps ensure that your business runs smoothly, and that no payments slip through the cracks.

Having a clear system for tracking payment status can save time, reduce confusion, and ensure that your business maintains healthy cash flow. HP’s platform helps you keep all payment information organized and readily available, giving you a clear view of your financial standing at any time.

How to Track Payments

Here are the key steps to track payments effectively with HP’s tools:

- Update Payment Status – When a client makes a payment, update the status of the corresponding document to “Paid.” This helps you keep track of completed transactions.

- Set Payment Reminders – Use the tool to set automatic reminders for upcoming or overdue payments, ensuring you follow up with clients in a timely manner.

- Monitor Partial Payments – If a client makes partial payments, the system allows you to record and track the remaining balance, providing an up-to-date overview of any outstanding amounts.

- Review Payment History – Regularly review the payment history for each client to ensure all transactions are accounted for and accurate.

- Generate Payment Reports – HP’s solution allows you to generate detailed reports that give you an overview of your payment statuses, helping you quickly assess any late or missed payments.

Example Payment Status Tracker

Here’s how payment status tracking might look for a single transaction:

| Client | Amount Due | Payment Status | Payment Date |

|---|---|---|---|

| John Doe | $500 | Paid | October 15, 2024 |

| Jane Smith | $300 | Pending | Due October 30, 2024 |

| XYZ Corp | $1200 | Overdue | Due September 25, 2024 |