Sage Commercial Invoice Template for Streamlined Business Invoicing

Efficient billing is a critical part of managing business finances. The ability to create clear, professional documents that accurately reflect transactions ensures smooth interactions with clients and partners. Using a structured document for financial exchanges can save time, reduce errors, and enhance overall professionalism in business communications.

By utilizing pre-designed formats, businesses can easily customize their records according to specific needs, making it possible to generate consistent and organized statements. Whether you are handling domestic transactions or working with international clients, having a reliable system in place simplifies the entire billing cycle, from creation to payment tracking.

Automating parts of the invoicing process can further increase efficiency, allowing businesses to focus on growth and other essential tasks. By leveraging modern tools, companies can integrate various features like tax calculations, payment terms, and unique branding elements into their billing documents without starting from scratch every time.

Having a solid structure for your financial paperwork not only helps keep things organized but also fosters trust with your clients, showing them that your operations are well-managed and professional. It’s a small investment that brings significant returns in terms of both time and reputation.

Understanding Sage Commercial Invoice Template

Having a structured format for financial documents is essential for any business. It not only ensures accuracy but also guarantees professionalism in communication with clients and suppliers. A well-organized billing document simplifies the entire process, from creating to tracking transactions, making it easier to manage payments and maintain records.

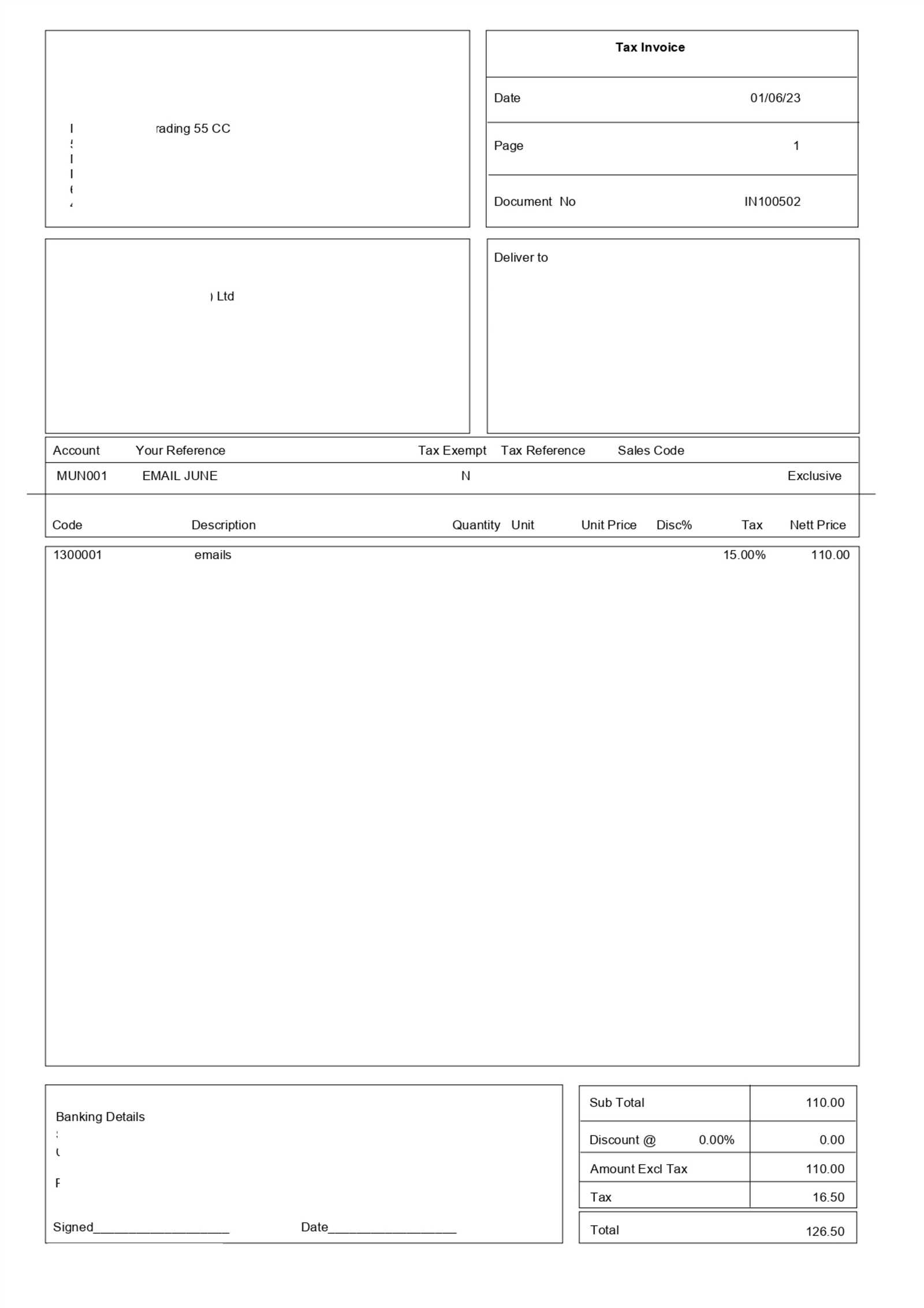

The core idea behind using a pre-designed document structure is to eliminate manual errors and save time. By filling in key fields such as client details, product descriptions, and pricing, businesses can generate polished, consistent records that can be quickly sent out for payment processing. The simplicity of the format allows for adjustments based on specific business needs, while still retaining essential components to ensure proper documentation.

Here are some key features typically found in a structured financial record format:

- Customizable Fields: Easily adjust sections like payment terms, client information, and itemized lists.

- Tax and Discount Management: Automatically calculate tax rates and apply discounts to the total amount.

- Professional Layout: Ensure that your document appears neat and structured with space for logos and branding.

- Payment Tracking: Include fields for payment status and due dates, helping businesses monitor outstanding balances.

- Currency Options: Enable transactions in multiple currencies for international business dealings.

By using a reliable structure, businesses can create detailed records without the need for complex calculations or designs. This approach not only helps reduce errors but also makes it easy to track all essential elements of a financial exchange in one place, contributing to more efficient business operations overall.

Why Use a Commercial Invoice Template

Using a pre-designed format for financial documentation offers significant advantages for businesses of all sizes. It streamlines the process of creating accurate, consistent records and reduces the time spent on repetitive tasks. With a structured document, you can ensure that all the necessary details are included, allowing for smoother transactions and clearer communication with clients and vendors.

One of the primary reasons to adopt a standardized document structure is efficiency. By having fields already set up for key information–such as product descriptions, pricing, and terms of payment–businesses can quickly generate professional records without starting from scratch each time. This helps to save valuable time, especially when handling multiple transactions or dealing with numerous clients.

Another important factor is accuracy. With a well-defined format, the risk of missing essential details or making costly mistakes is significantly reduced. Information such as due dates, quantities, and tax rates are clearly laid out, making it easier to check for errors and ensure that everything aligns with the agreed terms.

Additionally, a structured format enhances professionalism. Clients and business partners appreciate receiving clear, organized documents that reflect attention to detail. A polished document not only conveys trustworthiness but also strengthens business relationships and improves the overall customer experience.

Overall, using a ready-made structure for financial records is a practical choice for businesses looking to improve their workflow, minimize mistakes, and present a professional image to their clients.

Key Features of Sage Invoice Template

A well-designed billing document offers a variety of features that make it easier to manage financial transactions. From simple customization options to automated calculations, these essential tools help businesses maintain consistency and professionalism in their paperwork. Understanding the key components of a structured financial record can assist in choosing the right solution to meet your company’s needs.

Here are the most important features typically found in an effective billing format:

- Customizable Fields: Easily modify sections such as client information, products or services, and pricing to fit your specific needs.

- Automated Calculations: Automatically calculate totals, taxes, and discounts based on the inputted data, reducing the risk of manual errors.

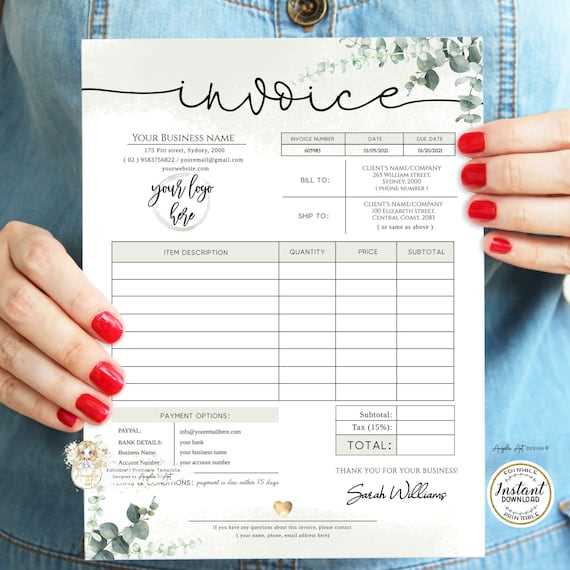

- Predefined Layouts: Choose from several clean, professional layouts that present your information in an organized and easy-to-read format.

- Payment Tracking: Include fields to track outstanding balances, payment status, and due dates to stay on top of your financial records.

- Branding Options: Add your company logo, colors, and other branding elements to enhance the visual appeal and reinforce your business identity.

- Multi-currency Support: Handle international transactions by supporting various currencies, simplifying the invoicing process for global clients.

- Legal Compliance: Ensure that all necessary legal and tax requirements are incorporated, making your records valid and compliant with local regulations.

- Easy Integration: Integrate with accounting and payment systems to synchronize data across platforms, reducing the need for manual entry.

These features help businesses create clear, accurate, and professional documents quickly and easily. By leveraging such tools, companies can improve their financial processes, minimize errors, and maintain a high level of professionalism in their client communications.

How to Customize Your Invoice Template

Customizing a billing document to reflect your business needs is a simple process that can greatly enhance its effectiveness. By adjusting key elements such as layout, branding, and content, you can ensure the document aligns with your company’s identity and meets specific transactional requirements. Here are the steps to follow for personalizing your financial records.

Adjusting Key Fields

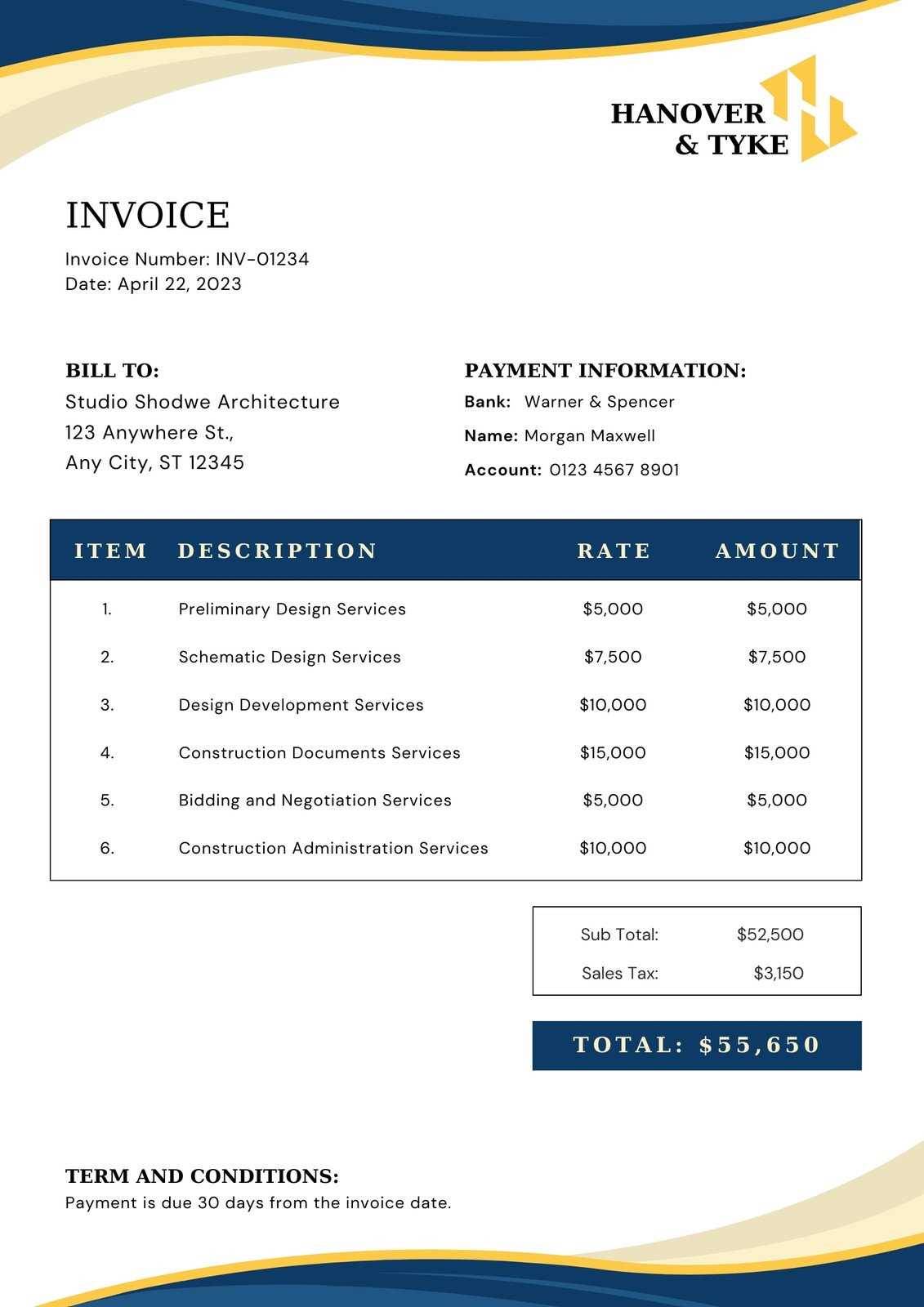

The first step in customization is tailoring the key fields to match your business information. These include:

- Business Details: Add your company name, address, and contact information. This ensures clients can easily reach you for any inquiries or payments.

- Client Information: Input client names, billing addresses, and account numbers to personalize the document for each transaction.

- Product/Service Descriptions: Specify the items or services provided, including quantities, unit prices, and totals.

- Payment Terms: Adjust terms such as payment due dates, discounts, or late fees based on your agreements with each client.

Enhancing Visual Appeal

Next, focus on improving the document’s visual presentation. A clean and professional layout will leave a positive impression. Consider these options:

- Branding: Insert your company logo, adjust the font, and use your brand colors to make the document look more professional and recognizable.

- Layout: Choose a layout that best suits your needs, whether it’s a simple list or a more complex format with detailed itemization.

- Text Formatting: Use bold or italics for emphasis on important details, such as total amounts or payment deadlines.

By making these simple adjustments, you can create a personalized, professional billing document that enhances your business’s credibility and helps ensure smooth transactions with your clients.

Benefits of Using Sage for Invoicing

Using an advanced system for generating billing documents brings a variety of benefits that can significantly improve a business’s financial processes. From automating calculations to offering greater accuracy, a structured solution makes managing transactions more efficient and professional. Here are some of the key advantages of utilizing an invoicing solution for your business operations.

- Time-Saving: Automating the creation of billing documents reduces the time spent on repetitive tasks, allowing businesses to focus on more important aspects of their operations.

- Accuracy: With automated calculations for taxes, discounts, and totals, the risk of human error is minimized, ensuring that the figures are always correct.

- Consistency: Using a pre-designed structure ensures that every document follows the same format, making your financial records organized and easier to manage.

- Professional Appearance: A polished, professional layout enhances your brand image and helps build trust with clients by providing clear and well-structured documentation.

- Easy Customization: Quickly adapt the documents to meet the needs of your business, whether it’s adjusting payment terms or adding custom fields for specific client requests.

- Integration with Other Systems: Seamlessly integrate the invoicing solution with other accounting software, making it easier to track payments and keep financial records synchronized.

- Improved Cash Flow Management: By tracking outstanding balances and due dates, businesses can more effectively manage payments and ensure timely receipts.

- Scalability: As your business grows, the solution can handle an increasing volume of transactions, providing you with the flexibility to scale without losing efficiency.

Overall, using a reliable and efficient solution for creating billing documents not only saves time and reduces errors but also helps improve cash flow management and maintain strong client relationships. These benefits contribute to smoother business operations and long-term success.

Step-by-Step Guide to Creating Invoices

Creating accurate and professional financial documents is a crucial task for any business. A structured approach helps ensure that all necessary details are included and that the document is clear, consistent, and ready for submission. Below is a simple, step-by-step guide to creating your own billing record.

- Step 1: Select a Format

Begin by choosing a pre-designed format that suits your business needs. You can opt for a simple layout or one that includes more detailed sections depending on your requirements. Make sure the design is professional and easy to follow. - Step 2: Enter Business Information

Include your company name, address, and contact details at the top of the document. This ensures that your client can easily reach you if needed. If applicable, add your business registration number or tax ID. - Step 3: Add Client Details

Enter the client’s name, company name (if applicable), and address. Including the client’s contact information helps personalize the document and ensures clarity regarding who the bill is intended for. - Step 4: List Products or Services

Clearly describe the items or services provided. Include the quantity, price per unit, and any additional details like model numbers or descriptions. This section should be itemized to avoid any confusion. - Step 5: Calculate Totals

Add up the individual amounts for each item or service. Be sure to include any taxes, discounts, or additional charges, and clearly display the total amount due. Automated calculations can help avoid mistakes. - Step 6: Specify Payment Terms

Define the payment terms, such as the due date, accepted methods of payment, and any late fees or discounts for early payment. This provides transparency and sets clear expectations for the client. - Step 7: Add Additional Notes

Include any extra information that may be relevant, such as special instructions, warranty details, or terms and conditions of the transaction. This section can also be used to express gratitude or encourage future business. - Step 8: Review and Finalize

Double-check all the details to ensure everything is accurate and complete. Look for any errors in the calculations or missing information. Once satisfied, save the document and prepare it for distribution.

By following these steps, you can easily generate a clear and professional financial document that helps streamline the billing process and maintain good relationships with your clients. Consistency in creating these records will ensure smoother transactions and improve your business’s financial management.

How Sage Templates Streamline Billing

Using a pre-designed document structure can significantly simplify the billing process. By automating key aspects of creating financial records, businesses can save time, reduce errors, and ensure consistency across transactions. These structured formats are designed to handle all the necessary elements of a billing document, from client details to payment terms, with minimal effort required from the user.

Time Efficiency

One of the most noticeable advantages of using a structured document format is the amount of time it saves. Instead of manually entering information into a blank document or spreadsheet, you can quickly fill in the required fields. This eliminates the need for repetitive tasks such as formatting, calculating totals, and setting up page layouts for each new transaction.

- Pre-set Fields: Fields for client information, item descriptions, and pricing are already in place, allowing you to simply input the relevant details.

- Automated Calculations: Taxes, discounts, and total amounts are automatically calculated based on the data entered, reducing the chances of human error.

- Quick Editing: You can easily make changes to existing records, ensuring that all updates are reflected instantly without the need to redo the entire document.

Consistency and Professionalism

Consistency is key in maintaining a professional image, and using a pre-designed format ensures that each financial record follows the same structure. Clients will receive clear, easy-to-read documents that align with your business branding and enhance trust.

- Branding Integration: Customize your document with your business logo, colors, and fonts, ensuring a cohesive presentation every time.

- Uniform Layout: The document’s layout remains consistent, giving all your communications a polished and organized appearance.

- Easy Customization: Customize fields and sections as needed for specific transactions, keeping documents relevant and up to date without losing the professional format.

By using a structured system, businesses can streamline their entire billing process, making it faster, more accurate, and more professional. This leads to smoot

Integrating Sage Template with Accounting Software

Integrating a pre-designed document format with accounting software can significantly streamline financial processes. This integration allows businesses to automate data transfers, reduce manual entry, and ensure that records are synchronized across systems. By connecting your billing format to accounting tools, you can improve efficiency, minimize errors, and maintain consistency in your financial records.

The integration process typically involves syncing key data points such as payment amounts, taxes, and client information between the billing system and the accounting platform. This seamless connection ensures that all transactions are recorded accurately, without the need to duplicate efforts in both systems.

Key Benefits of Integration

Integrating your billing documents with accounting software offers several advantages that contribute to smoother business operations:

- Automatic Data Sync: Billing information such as amounts, dates, and client details are automatically transferred to your accounting system, reducing manual data entry and ensuring consistency across platforms.

- Real-time Updates: Any updates made in your billing documents are reflected immediately in your financial records, keeping everything up to date and accurate without the need for manual adjustments.

- Improved Accuracy: With data automatically populated into the accounting software, the risk of errors caused by manual input is significantly reduced, leading to more reliable financial reporting.

- Enhanced Reporting: Integrated systems can generate more comprehensive financial reports, helping businesses track payments, manage cash flow, and make informed decisions based on real-time data.

How to Set Up the Integration

Setting up the integration typically involves linking your billing system to the accounting software through an API or built-in integration feature. This process is often straightforward, with step-by-step instructions provided by the software developers. Many modern platforms offer easy-to-use integration tools that require little technical expertise.

Once connected, you can customize the flow of information between the two systems, ensuring that the data you need is captured accurately and transferred seamlessly. This integration will allow for faster billing cycles, improved accuracy in financial records, and overall better business management.

Best Practices for Invoice Formatting

Properly formatting financial documents is essential for clarity, professionalism, and effective communication with clients. A well-structured document ensures that all important details are easy to find, minimizes the risk of errors, and enhances your business’s credibility. Below are some best practices to follow when designing or formatting your billing records.

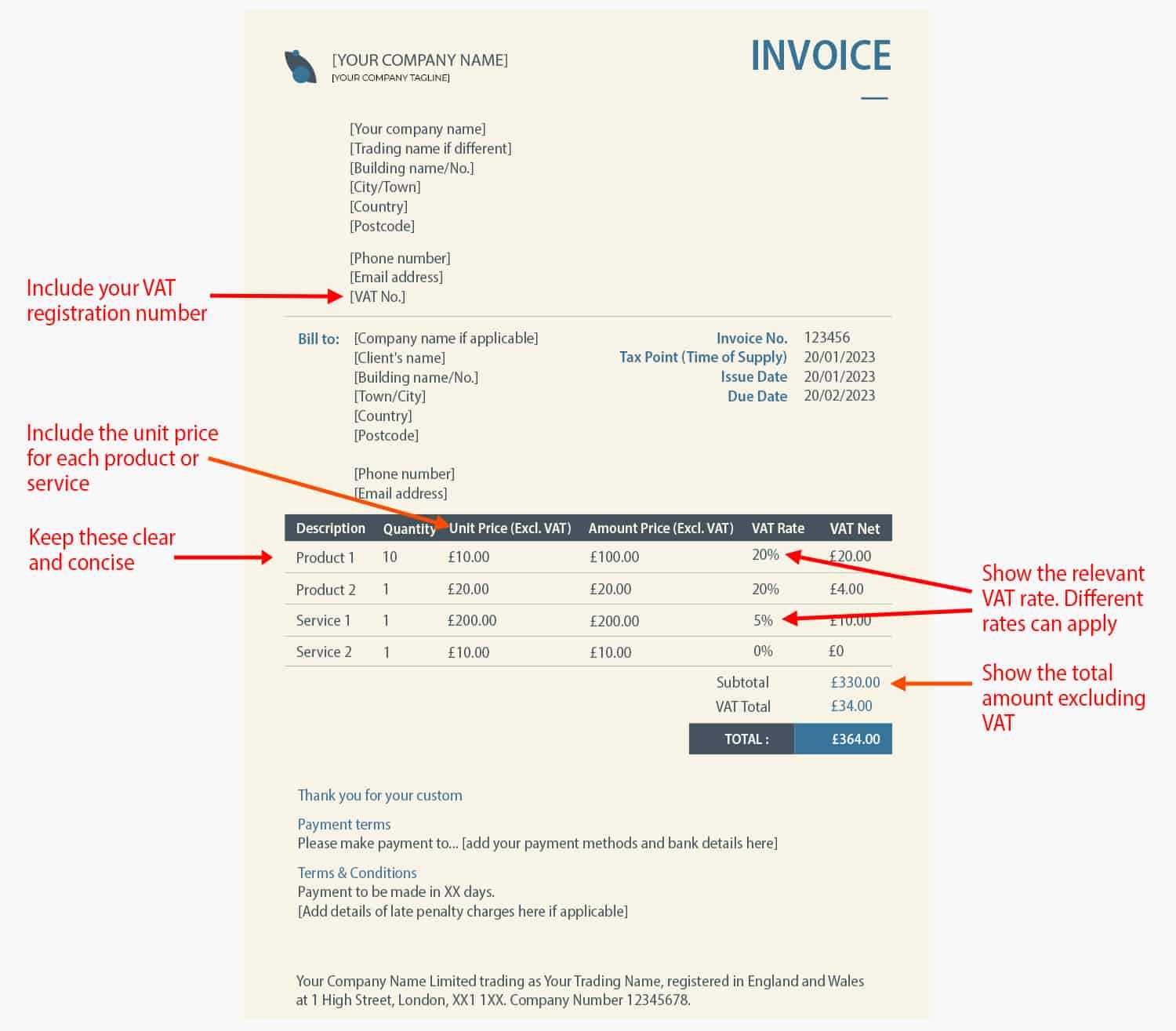

1. Clear Header Information

Always begin your document with clear, easily identifiable information at the top. This includes your business name, logo, and contact details, as well as the client’s information. A strong header creates a professional first impression and ensures your client knows who issued the document and how to reach you.

2. Organized Itemization

Ensure that the list of products or services provided is easy to read and well-organized. Use tables or bullet points to break down individual items, along with their quantities, prices, and any additional charges. This section should be clear and concise to avoid confusion.

3. Highlight Key Information

Make important details stand out by using bold or larger font sizes for totals, payment due dates, or terms of service. This makes it easier for the recipient to quickly identify the most important parts of the document.

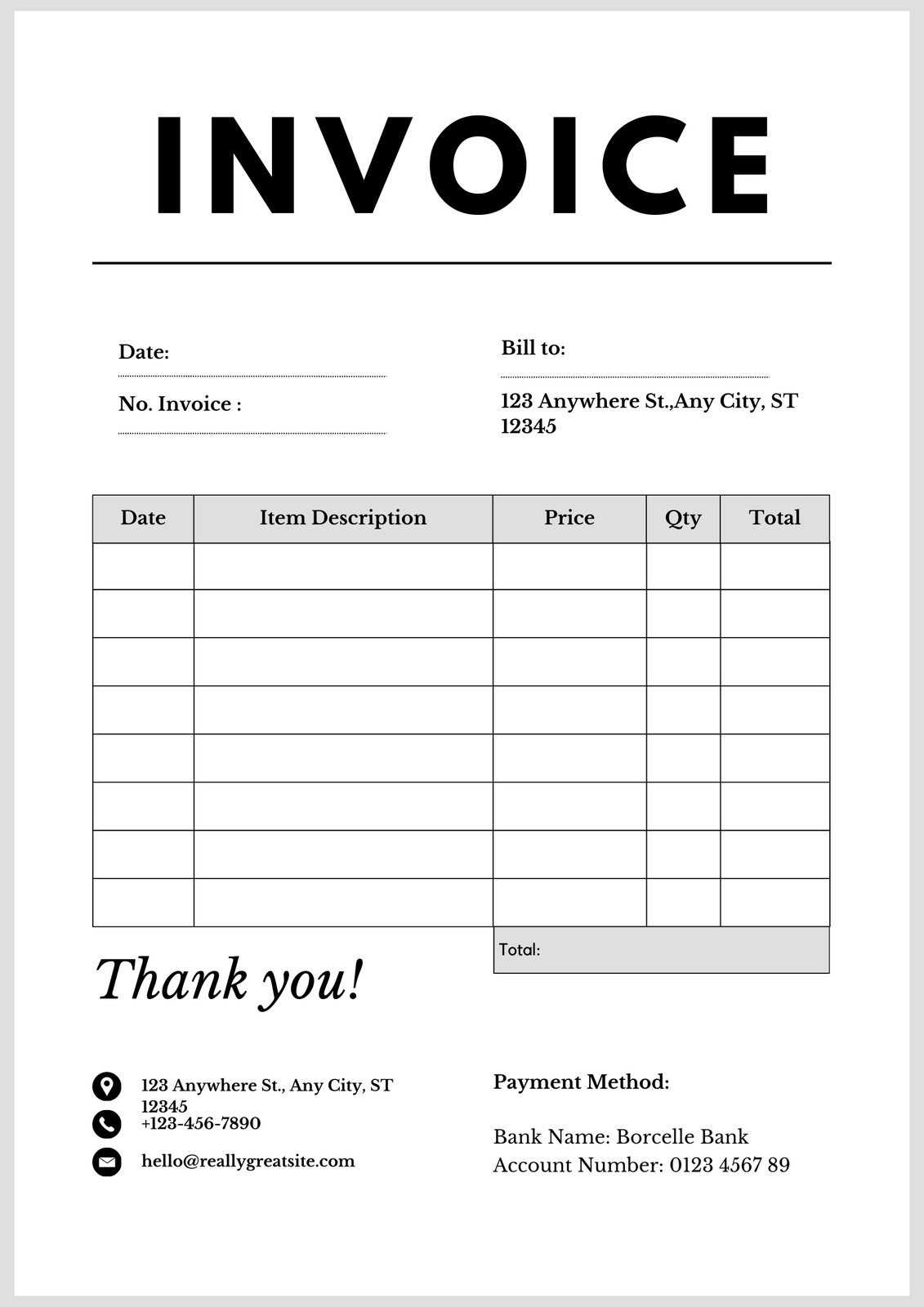

4. Use Simple and Consistent Layouts

Avoid clutter by keeping the layout simple and clean. Use consistent spacing and formatting for each section. A well-spaced document is more readable, allowing clients to easily follow the information from one section to the next.

5. Be Transparent with Payment Terms

Clearly state the payment terms, including due dates, accepted payment methods, and any late fees or discounts. Transparency in these terms helps avoid misunderstandings and establishes expectations for both parties.

6. Include Relevant Legal and Tax Information

If applicable, include any necessary tax details, legal disclaimers, or business registration numbers. This not only ensures compliance with legal requirements but also enhances the document’s professionalism.

7. Proofread for Accuracy

Before sending out the document, carefully proofread it for spelling, grammar, and numerical accuracy. Even small errors can leave a negative impression and lead to confusion or delays in payment.

By following these best practices, you can create billing records that are not only clear and professional but also help to improve client relat

Common Mistakes in Commercial Invoices

Even with careful attention, it’s easy to overlook key details when creating financial records. Small mistakes can lead to confusion, delays in payments, or even legal issues. Understanding the most common errors can help you avoid them and ensure that your documents are clear, accurate, and professional. Below are some of the typical mistakes businesses make when generating billing documents.

| Common Mistakes | Consequences |

|---|---|

| Missing Client Information | Failure to include the client’s full name, company details, or correct billing address can cause delivery issues and confusion regarding who the document is for. |

| Incorrect Item Descriptions | Listing vague or incorrect product or service descriptions may lead to disputes about what was actually purchased or delivered. |

| Unclear Payment Terms | If the payment due date, methods, or late fees aren’t clearly specified, it may result in delayed payments or confusion over when and how to pay. |

| Math Errors in Totals | Errors in calculations, such as incorrect totals or taxes, can undermine the professionalism of your business and lead to financial discrepancies. |

| Omitting Tax Information | Failing to include relevant tax details, such as tax rates or identification numbers, can lead to non-compliance and confusion for both parties involved. |

| Inconsistent Formatting | A poorly formatted document with inconsistent fonts, spacing, or alignment can appear unprofessional and make the information harder to read. |

| Not Including Unique Invoice Number | Without a unique reference number, tracking and organizing your records becomes difficult, and it can lead to confusion in case of disputes or future reference. |

By being mindful of these common mistakes and double-checking your records before sending them out, you can avoid potential issues and maintain smooth, professional transactions with your clients.

Managing Payment Terms with Sage Template

Setting clear and effective payment terms is essential for maintaining smooth cash flow and ensuring timely payments. A well-structured document allows you to clearly communicate these terms to your clients, helping to avoid confusion or delays. By utilizing an efficient document format, businesses can easily manage and adjust payment terms for each transaction, making the process more transparent and organized.

Below are some key considerations when managing payment terms within your financial documents:

| Key Consideration | Best Practice |

|---|---|

| Payment Due Date | Clearly specify the due date for payment, allowing enough time for clients to process the transaction while ensuring prompt payments for your business. |

| Accepted Payment Methods | List the payment methods you accept, such as bank transfer, credit card, or digital payment platforms, so clients know how to pay you efficiently. |

| Late Fees or Penalties | Clearly communicate any late fees or penalties for overdue payments. This encourages clients to pay on time and helps maintain healthy financial practices. |

| Early Payment Discounts | If applicable, offer early payment discounts. Specify the percentage discount and the deadline by which the payment must be made to qualify for the discount. |

| Partial Payments | If you accept partial payments, outline the terms, such as the amount due upfront and the payment schedule for the balance. |

| Currency and Tax Information | Indicate the currency in which payment is expected and include any relevant tax information to avoid misunderstandings regarding payment amounts. |

By clearly laying out these payment terms, businesses can ensure that both parties are on the same page regarding expectations, which helps build trust and promotes a smoother transaction process. Properly managing payment terms helps avoid payment delays, reduces confusion, and ultimately supports better financial management for your business.

How to Handle Discounts and Taxes

Accurately applying discounts and taxes is crucial for ensuring that your financial documents reflect the correct amounts owed. Both discounts and taxes can significantly impact the final total of a transaction, so it’s essential to handle them clearly and consistently. Properly documenting these factors not only helps avoid confusion with clients but also ensures compliance with legal and financial regulations.

1. Applying Discounts

When offering discounts, whether as part of a promotion or for early payment, it’s important to clearly specify the discount percentage or fixed amount. Ensure the discount is calculated correctly and is clearly shown on the document, so the client can easily see how it affects the total cost. Discounts should be applied before calculating taxes to ensure the correct taxable amount is used.

- Early Payment Discounts: Offer a percentage reduction for clients who pay before a certain date. Clearly indicate the terms and deadlines to encourage timely payments.

- Volume Discounts: Apply discounts based on the quantity of items purchased or the total value of the order, and ensure this is reflected clearly in the breakdown.

- Promotional Discounts: If offering a limited-time discount, specify the details in the document, including any codes or conditions needed to apply the offer.

2. Handling Taxes

Taxes are an essential part of most financial transactions and must be calculated and displayed transparently. Be sure to include the correct tax rate for the region in which the transaction takes place. It’s also important to itemize taxes separately from the total cost to make it clear to the client how the final amount was determined.

- Sales Tax: Always calculate the tax based on the current rates for your jurisdiction. This should be added after any discounts are applied, unless stated otherwise by local tax laws.

- Tax Exemptions: If applicable, clearly indicate if any items or services are exempt from tax and provide the necessary documentation or justification.

- International Transactions: For international clients, ensure you account for any additional duties, VAT, or customs fees that may apply to the transaction.

By clearly outlining both discounts and taxes in your documents, you ensure transparency, maintain trust with clients, and avoid potential legal or financial complications. Always double-check the tax calculations and discount application before finalizing the document to avoid errors and discrepancies.

Tracking Payments Using Sage Invoices

Effectively tracking payments is crucial for maintaining accurate financial records and managing cash flow. A well-organized billing system not only ensures you know when payments are due, but also provides a clear overview of received payments, outstanding balances, and any discrepancies. By utilizing structured documents, businesses can easily track payments and keep their accounting records up to date.

Benefits of Tracking Payments

Keeping a detailed record of payments provides several advantages for businesses, from reducing the risk of missed payments to improving overall financial organization. Here’s how tracking payments can benefit your business:

- Cash Flow Management: Knowing when payments are received helps you plan for upcoming expenses and investments, ensuring your business operates smoothly without disruptions.

- Timely Follow-Ups: By tracking outstanding payments, you can identify clients who have not paid and send reminders or take further action, preventing cash flow gaps.

- Financial Clarity: A well-organized payment tracking system gives you an overview of your income, helping you to spot trends, plan future business activities, and generate reports with ease.

How to Track Payments Efficiently

Proper tracking requires the inclusion of payment details in your financial records. Here are some key elements to include when tracking payments:

| Element | Description |

|---|---|

| Invoice Number | Each payment should be linked to a unique reference number, which allows you to track specific transactions and confirm whether payment has been received for that invoice. |

| Payment Date | Document the date the payment was received. This helps track the timeline of payment and identify any delays. |

| Amount Paid | Record the exact amount paid to ensure accuracy in accounting. If partial payments are made, ensure that each amount is logged. |

| Payment Method | Include the payment method used (e.g., credit card, bank transfer, cash) to maintain a comprehensive financial record and address any payment-related issues. |

| Outstanding Balance | If a payment is partial, calculate the remaining balance and ensure it is updated on future billing statements or communications with the client. |

By maintaining detailed records of payments and keeping track

Using Sage for International Invoicing

Handling international transactions requires more attention to detail than domestic ones. Different currencies, tax regulations, and shipping costs all need to be accounted for accurately. Using an organized and flexible billing solution can simplify this process by ensuring that all relevant information is correctly displayed and calculated, making it easier for businesses to manage cross-border sales and streamline global payment processes.

When dealing with international transactions, it’s important to consider the following key factors:

- Multi-Currency Support: Businesses must be able to issue documents in multiple currencies, ensuring that clients from different countries can view and process payments in their local currency.

- Tax Compliance: International transactions often involve different tax rules, such as VAT or sales tax in different regions. A flexible billing system should allow you to apply the correct tax rates based on the client’s location.

- Shipping and Customs Costs: For physical goods, shipping and customs fees must be included in the final document. Accurately reflecting these costs helps prevent confusion and ensures the correct amount is charged to the client.

- Language and Locale Adjustments: Documents should be tailored to the language and locale of the client, ensuring that terms, conditions, and item descriptions are easily understood. This reduces the risk of disputes and helps build trust with international customers.

By leveraging the features of a comprehensive billing system, businesses can seamlessly handle the complexities of international transactions, ensuring compliance with local laws and providing clarity to clients worldwide. The ability to manage currencies, taxes, and other country-specific details in one place simplifies the billing process, saving time and reducing the risk of errors in global operations.

Ensuring Compliance with Sage Invoices

Compliance with local and international regulations is essential for businesses when issuing billing documents. Each jurisdiction has its own rules regarding taxes, payment terms, and record-keeping, making it vital to ensure that all required information is included in your financial documents. Failing to meet these standards can lead to legal penalties, disputes with clients, and missed opportunities for tax deductions or refunds.

To guarantee compliance, businesses must consider the following factors when creating billing records:

- Tax Regulations: Different regions impose various taxes like VAT, GST, or sales tax. A billing system should automatically apply the correct rates based on the customer’s location and the nature of the transaction.

- Legal Requirements: Certain industries or regions may require specific information to be present on each document, such as business registration numbers, tax identification numbers, or even language-specific terms.

- Currency and Payment Terms: For international transactions, ensure that the currency used and payment terms meet the requirements of both parties. Include clear terms for payment deadlines, late fees, and methods of payment.

- Document Archiving: Legal obligations often require businesses to keep records of financial transactions for a specific period. Maintaining digital or physical archives ensures that documents are readily available in case of audits or disputes.

By ensuring that your billing records adhe

Saving Time with Pre-designed Templates

Creating financial documents from scratch can be time-consuming and prone to errors, especially when you need to ensure consistency across multiple transactions. Pre-designed layouts allow businesses to streamline the process by offering a ready-made structure where essential information can be quickly filled in. This not only saves valuable time but also ensures that your documents remain professional and standardized.

Here are some key advantages of using pre-designed formats:

- Consistency: Pre-designed formats provide a consistent structure for each document, ensuring that all required details are included every time without the risk of overlooking critical information.

- Speed: With a set format in place, creating a new document becomes a simple task of entering data. This dramatically reduces the time spent on formatting and allows you to focus on the content.

- Professional Appearance: Ready-made structures are often designed with a clean, professional look, which enhances your business’s credibility and fosters trust with clients.

- Error Reduction: Since the layout is already formatted correctly, there is less room for mistakes, reducing the chances of errors in calculations, terms, or data entry.

- Customization: While pre-designed formats are efficient, they can often be customized to meet specific business needs or branding, ensuring that your documents align with your unique style.

By using pre-designed formats, businesses can enhance efficiency and reduce the time spent on repetitive tasks. With less time spent formatting, you can focus more on the important aspects of your operations, such as customer relationships and strategic growth.

How to Share and Print Sage Invoices

Once your billing document is complete, the next step is sharing it with the client and ensuring you have a physical or digital copy for your records. Whether it’s for immediate payment processing or future reference, making your documents easy to share and print is crucial. The process should be quick, efficient, and professional, ensuring that clients receive their documents in a timely manner while you maintain an organized archive.

Here are some common methods for sharing and printing your financial documents:

- Email Delivery: The fastest way to send a document is via email. By attaching a PDF version of your document, you ensure that the recipient can access and save the file on their end. Email is a reliable method for sharing, especially for clients who prefer electronic records.

- Cloud Sharing: Uploading your document to a secure cloud platform allows you to send a direct link to the client. This is especially helpful for larger documents or those that need to be accessed multiple times by the client, providing both convenience and security.

- Physical Copies: For clients who prefer hard copies, printing your document is necessary. Make sure your layout is optimized for printing, with proper margins and a high-resolution design to ensure readability and professionalism.

- Print on Demand: If you frequently need to print documents, consider using a print-on-demand service. These platforms often allow you to print in bulk, ensuring consistency in quality and reducing the time spent on manual printing.

Important Tips:

- Check Format Compatibility: Ensure that the document is saved in a format that is universally accessible, such as PDF, so clients can open it regardless of their device or operating system.

- Ensure Clarity: Before sending or printing, double-check that all the necessary details are clearly displayed. Avoid clutter and ensure that terms, dates, and amounts are easily readable.

- Use Professional Branding: Customize your document with your company’s logo and contact information, ensuring a professional appearance whether the document is digital or printed.

Sharing and printing documents shouldn’t be a complicated process. By utilizing digital methods like email or cloud sharing alongside traditional printing options, you can ensure your billing documents reach clients quickly and securely, all while maintaining a professional and ef

Advanced Features in Sage Invoice Templates

Modern billing systems offer a wide range of advanced features that go beyond the basic structure of a financial document. These features can automate tasks, improve accuracy, and enhance the overall efficiency of the billing process. By incorporating sophisticated tools and functionalities, businesses can better manage transactions, streamline operations, and provide a more seamless experience for clients and internal teams alike.

Automation and Customization

One of the key benefits of using advanced document systems is the ability to automate repetitive tasks, such as calculating totals, applying taxes, or generating sequential document numbers. This reduces the risk of human error and ensures consistency across all your financial records. Additionally, these systems allow for extensive customization, allowing businesses to adjust layouts, fields, and design elements to suit their specific needs.

- Automated Calculations: Set up automatic tax and discount calculations based on predefined rules, reducing manual data entry and the potential for mistakes.

- Custom Fields: Add specific fields for extra information, such as project codes or order numbers, to ensure your documents are fully tailored to your business operations.

- Dynamic Numbering: Automatically generate unique identification numbers for each transaction to maintain organization and easily track the status of payments and accounts.

Integration with Other Systems

Many advanced systems allow you to integrate your billing records with other business tools such as accounting, CRM, or inventory management software. This creates a unified workflow where information is shared between platforms, reducing the need for manual updates and ensuring that your records remain up-to-date and accurate.

- Accounting Software Integration: Seamlessly sync billing data with your accounting system to automatically update financial records, reducing administrative work and preventing discrepancies.

- Payment Gateway Connectivity: Some systems offer integration with online payment gateways, allowing clients to pay directly through the document, speeding up the payment process and improving cash flow.

- Inventory Updates: For businesses with physical products, integrate your billing system with inventory management tools to automatically adjust stock levels based on the transactions recorded.

By leveraging these advanced features, businesses can significantly improve the efficiency, accuracy, and customization of their financial processes. The ability to automate tasks, integrate with other systems, and offer tailored solutions ensures that your billing practices are aligned with the needs of your organization and clients, ultimately saving time and reducing errors.