Downloadable Doctor’s Office Invoice Template for Easy Medical Billing

Effective billing is crucial for maintaining a smooth operation in any healthcare setting. With a well-structured approach to generating statements, practices can reduce errors, enhance efficiency, and ensure timely payments. Having a reliable system in place simplifies the process, providing clear communication between healthcare providers and patients.

Whether you’re a small clinic or a large medical practice, using a standardized method for generating charges is essential. This not only helps maintain professionalism but also ensures that all necessary details are included for accurate financial tracking. By utilizing the right tools, healthcare providers can focus on patient care while leaving the administrative tasks to a streamlined, organized system.

Customized solutions make it easy to align with your specific needs, ensuring that all services rendered are correctly documented. Whether you’re handling payments directly from patients or coordinating with insurance companies, a structured document offers clarity and consistency in your billing processes. Adopting such methods can ultimately lead to better financial management and a smoother workflow.

Doctor’s Office Invoice Template Overview

Managing financial transactions in healthcare requires an efficient system to ensure accuracy and clarity. An organized structure for documenting services, charges, and payments is essential for smooth operations. This process helps avoid errors, delays, and misunderstandings between medical professionals and their patients. Having a standardized method for creating and tracking bills makes it easier to maintain financial records and ensures timely compensation for services rendered.

Benefits of Using a Structured Billing Method

Using a standardized billing system allows healthcare providers to create professional documents that are consistent, accurate, and legally compliant. A well-designed layout ensures all required information is included, such as patient details, treatment dates, and a breakdown of charges. Efficiency is greatly improved, as automated solutions can speed up the process, reducing administrative workload and freeing up time for medical staff.

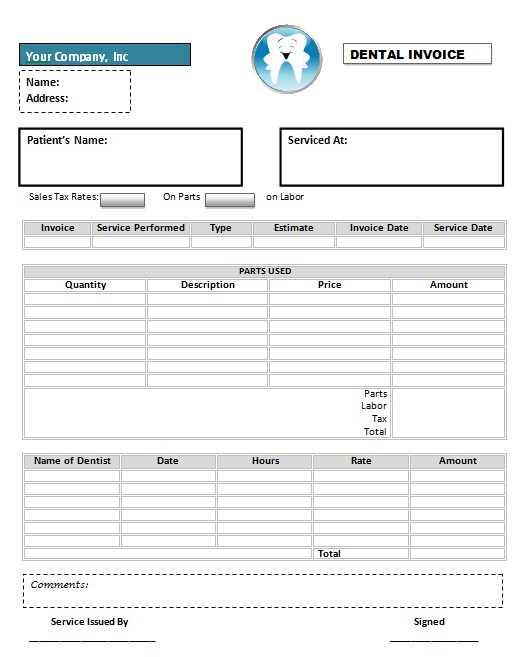

Key Elements of a Well-Designed Financial Document

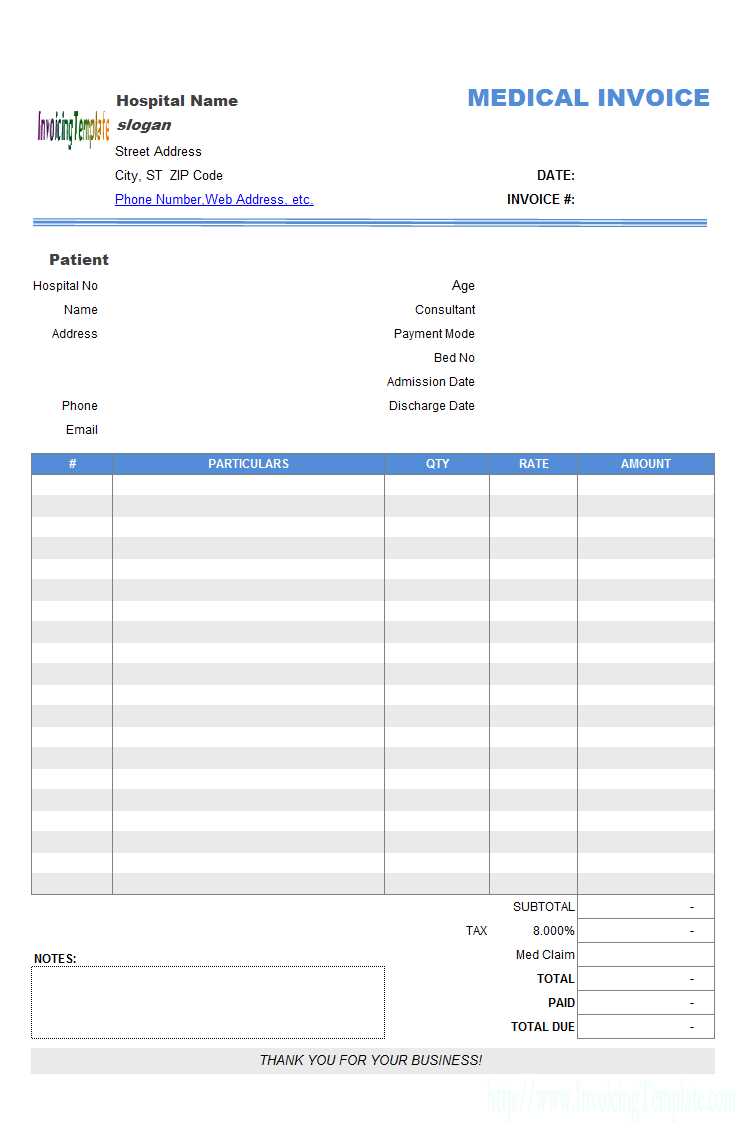

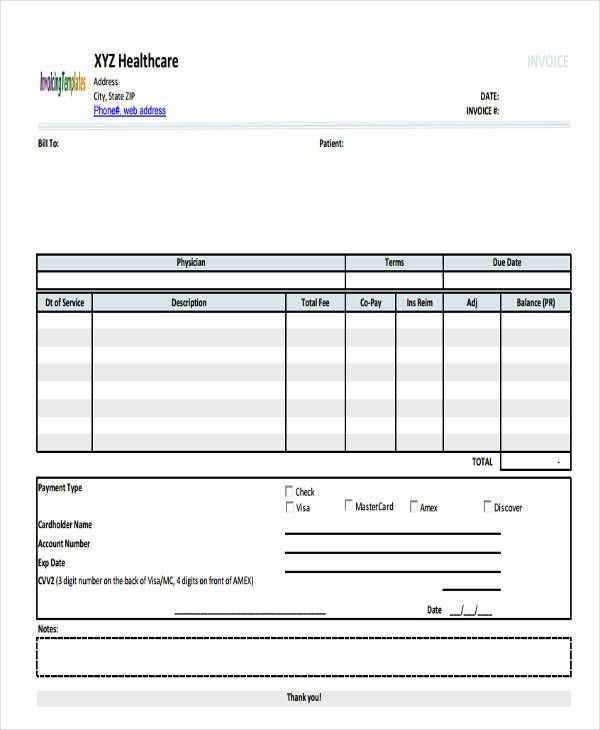

When creating a financial record for medical services, several key elements must be included. These typically feature basic contact information, a list of services provided, applicable fees, and payment terms. Additionally, it is important to include any necessary identifiers, such as patient ID numbers and transaction references. Having all these details neatly organized in a clear format ensures that both patients and healthcare providers can easily understand the charges and payment expectations.

Why Use an Invoice Template

Adopting a standardized approach to billing brings numerous advantages to medical practices. Without a consistent system, it can be easy to miss important details or make errors in financial records, leading to confusion and delays. Using a pre-designed structure simplifies the process and ensures that all necessary information is captured correctly each time.

Here are some key reasons to implement a structured billing system:

- Efficiency: A ready-made format speeds up the billing process, saving valuable time for both administrative staff and healthcare providers.

- Consistency: Using the same format for all billing documents ensures that the presentation is uniform and professional, reducing confusion for patients and insurance companies.

- Accuracy: A pre-structured form helps ensure that no essential details, such as service descriptions or payment terms, are left out.

- Legal Compliance: A well-designed system will incorporate the necessary legal requirements, helping to avoid potential issues with payment disputes or regulatory compliance.

- Reduced Errors: Using a standard layout minimizes the chances of mistakes, ensuring that financial records are accurate and complete.

Ultimately, utilizing a pre-made structure is not just about saving time, but also about creating clear and effective communication between providers and patients. It helps ensure smooth transactions, improves financial tracking, and enhances the overall professionalism of the practice.

Key Features of Medical Invoice Templates

When it comes to creating billing documents for healthcare services, having the right features in place is essential for maintaining clarity, accuracy, and professionalism. A well-structured format ensures that all necessary information is included and organized in a way that both medical professionals and patients can easily understand. Below are the key elements that should be present in any effective billing document.

| Feature | Description |

|---|---|

| Patient Information | Clear identification details such as the patient’s full name, contact information, and unique patient ID. |

| Service Description | A detailed list of the services rendered, including dates and specific treatments or procedures performed. |

| Cost Breakdown | Individual prices for each service provided, along with any applicable taxes or additional charges. |

| Payment Terms | Clearly outlined payment due dates, accepted payment methods, and any late fee policies if applicable. |

| Provider Information | The name, contact details, and professional license number of the healthcare provider or medical practice issuing the document. |

| Invoice Number | A unique reference number to track the billing record and avoid confusion with other transactions. |

These key features help ensure that all relevant details are captured in an easy-to-read, well-organized document. By including these essential elements, healthcare providers can streamline their billing process, reduce errors, and provide a transparent and professional experience for patients.

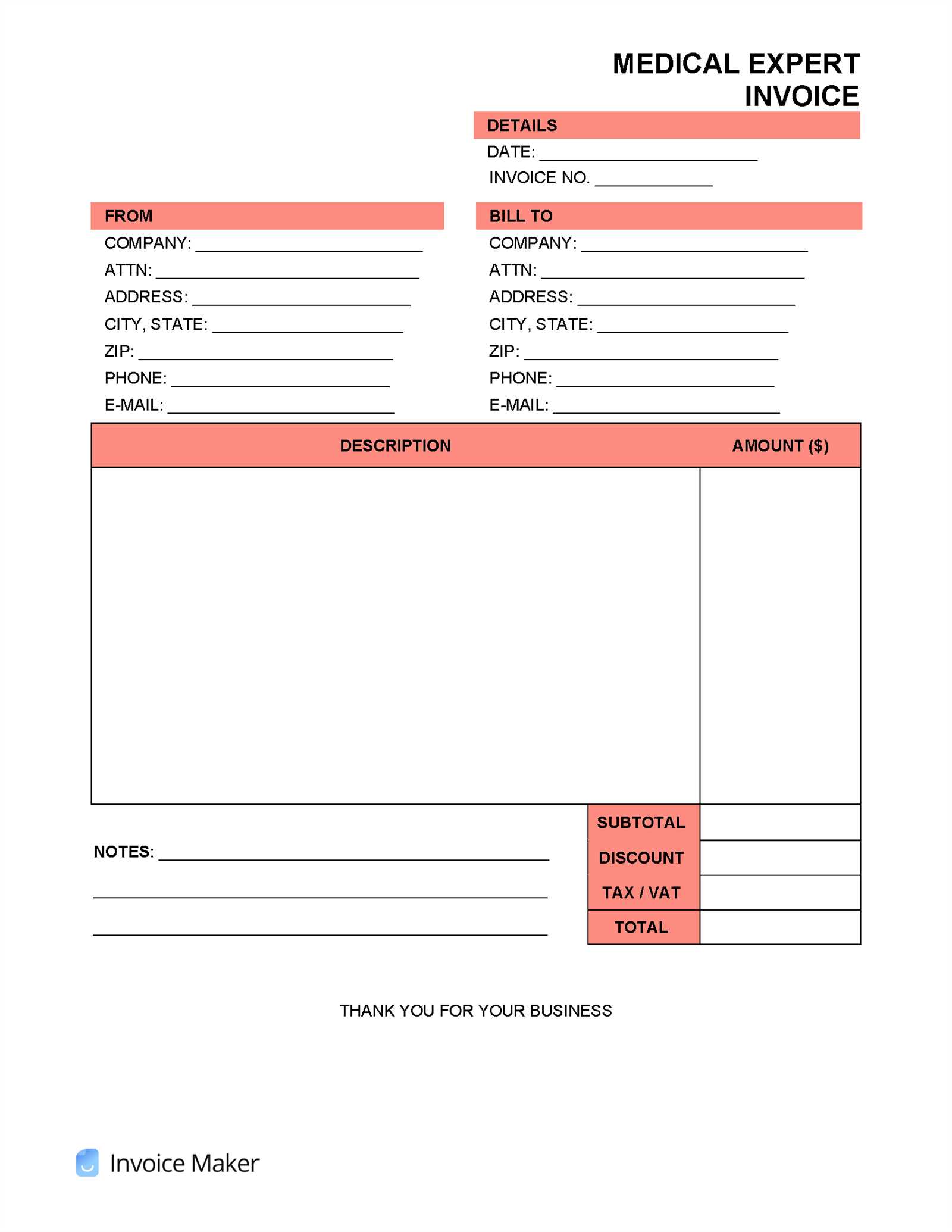

How to Create a Doctor’s Invoice

Creating a professional financial document for medical services requires careful attention to detail and accuracy. The goal is to ensure that all essential information is included, payments are clear, and both the provider and patient are on the same page. By following a clear, structured process, healthcare practices can generate effective billing records that streamline financial transactions.

Step-by-Step Guide to Creating a Billing Record

- Gather Patient Information: Ensure you have the patient’s full name, contact details, and any relevant identification numbers, such as a patient ID.

- List the Services Provided: Document each treatment or consultation performed, including dates, detailed descriptions, and quantities where applicable.

- Specify Charges: Clearly outline the cost for each service or procedure, making sure to include any additional fees or taxes.

- Define Payment Terms: Indicate the payment due date, acceptable payment methods, and any late payment policies or fees.

- Provide Provider Information: Include the practice’s name, address, contact information, and any necessary licenses or certifications.

- Assign an Invoice Number: Use a unique identifier to track each billing document and avoid confusion with other records.

Additional Tips for Accuracy

- Double-check all patient and service details to avoid errors.

- Ensure that the billing document looks professional and is easy to read.

- Use automated tools to help manage and track payments if possible.

Following these steps ensures that you create a clear, accurate document that enhances communication and helps manage the financial aspects of medical care efficiently.

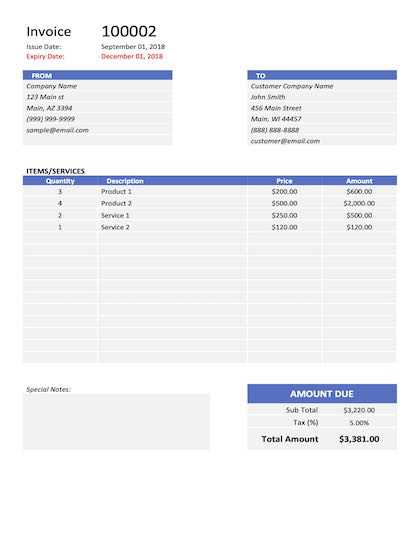

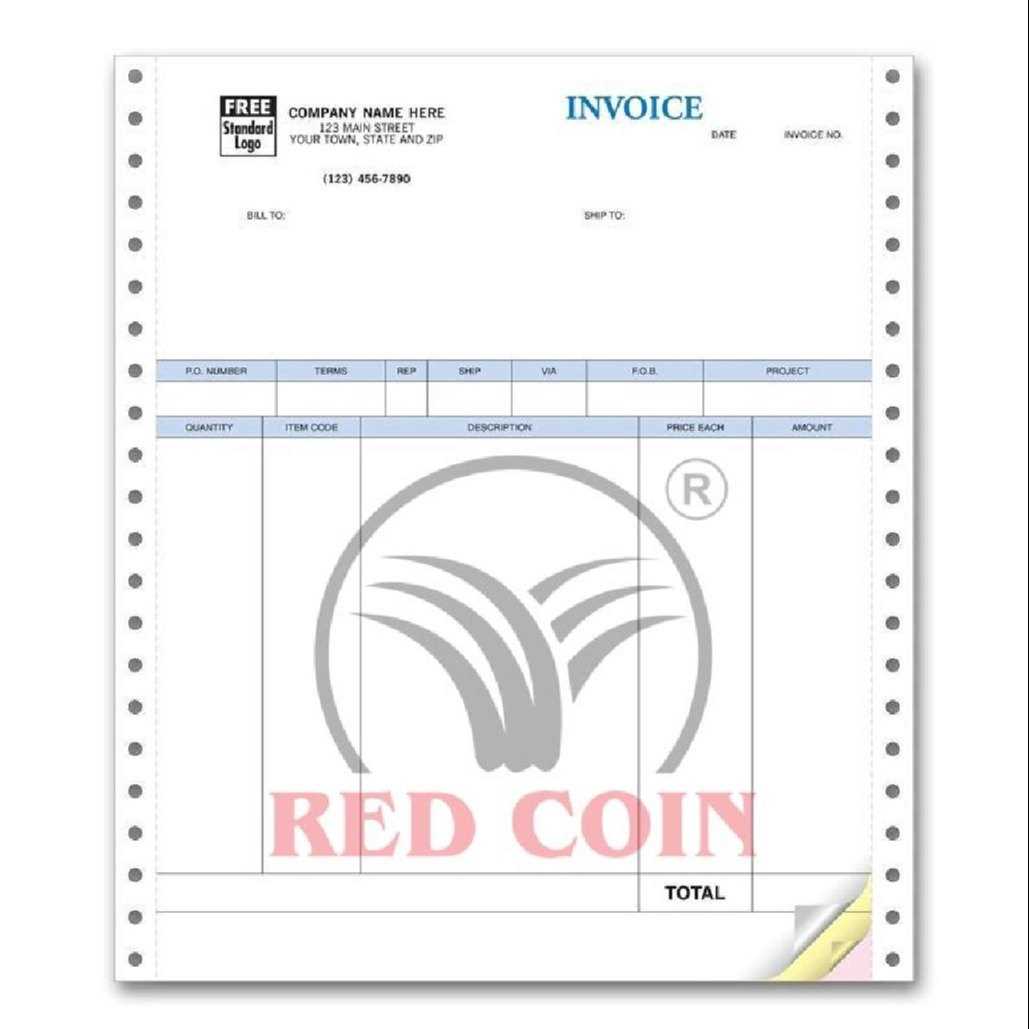

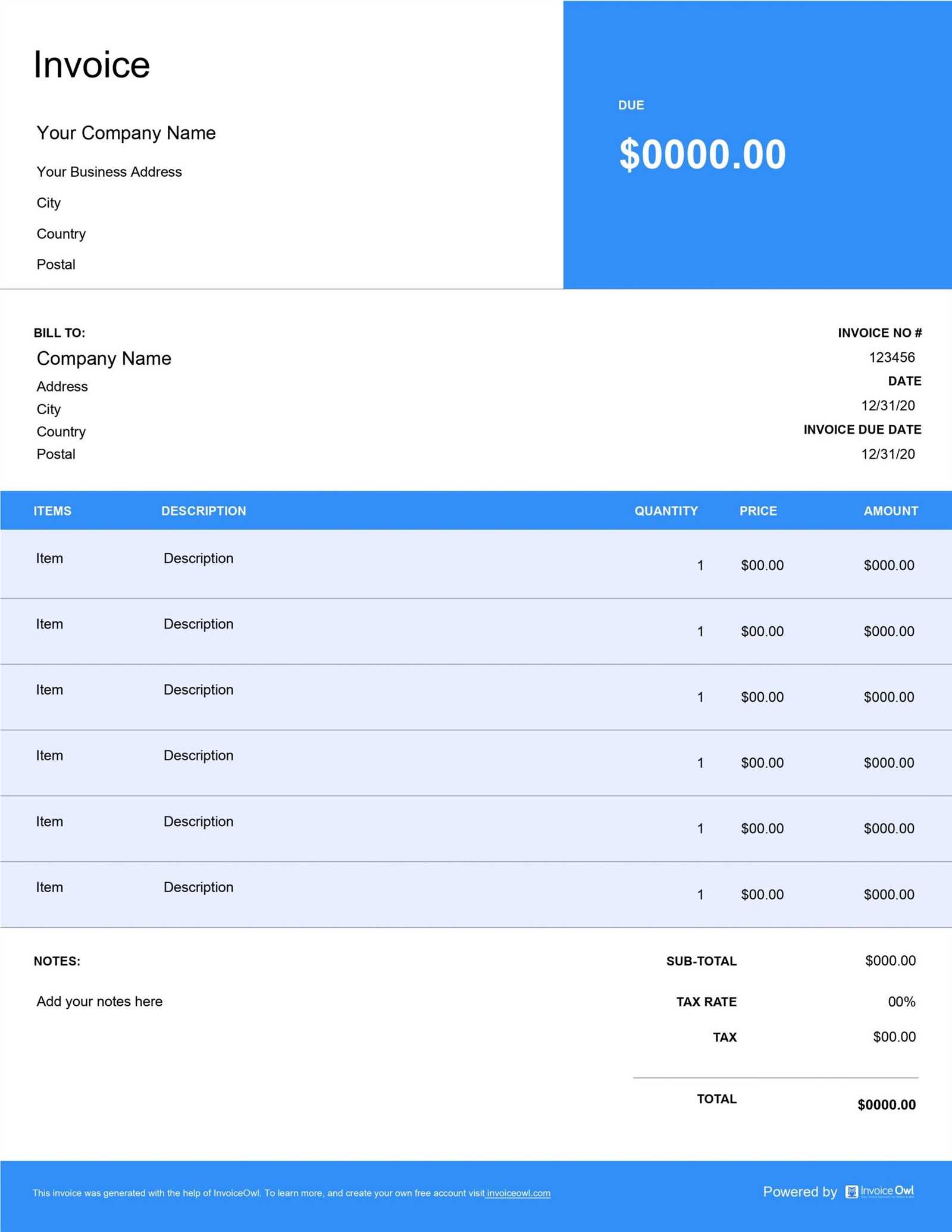

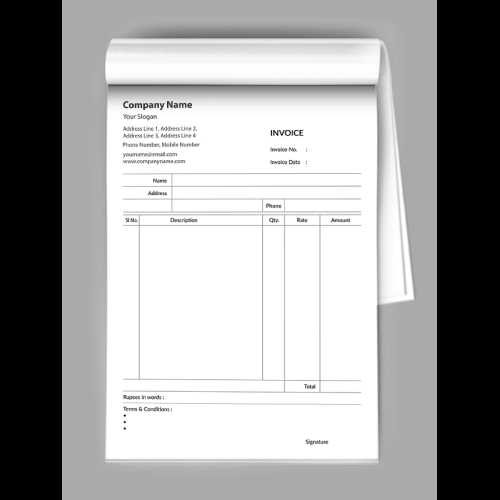

Best Formats for Doctor’s Office Invoices

Selecting the right format for generating billing documents is crucial for clarity and professionalism. A well-organized layout ensures that all necessary information is included and easy to understand. The format should not only reflect the practice’s branding but also be functional, ensuring that all parties can quickly process the details of the financial transaction. Several formats are available, and choosing the best one depends on the needs of the healthcare provider and their patients.

Digital vs Paper Formats

In today’s digital age, many healthcare providers prefer electronic records, as they are easier to manage, store, and share. Digital formats, such as PDFs, are convenient for emailing and can be customized with logos, colors, and additional features like clickable payment links. Additionally, digital billing documents can be integrated with accounting software, which streamlines the process of managing finances and tracking payments.

On the other hand, paper formats remain a reliable option for practices that prefer traditional methods or have patients who do not use digital tools. Paper billing records can be printed and mailed directly to patients, ensuring that they have a physical copy of the charges for reference.

Common Formats to Consider

- PDF: A versatile and widely accepted format that maintains consistent formatting across different devices and platforms. It can be easily emailed to patients or stored digitally for record-keeping.

- Word Documents: A more customizable option, useful for creating invoices that can be edited and adjusted based on specific needs, although not as universally accessible as PDFs.

- Excel or Spreadsheet Files: Ideal for practices that need to track large volumes of transactions or require advanced calculations. They are particularly useful for tracking payments, outstanding balances, and billing histories.

- Printed Forms: Standard paper invoices that can be filled out manually or printed from a computer, offering a straightforward option for practices with minimal digital infrastructure.

Choosing the best format depends on factors such as the practice’s workflow, patient preferences, and the level of digital integration. Regardless of the format, it is essential that the billing document is easy to read, accurately detailed, and consistent in its presentation.

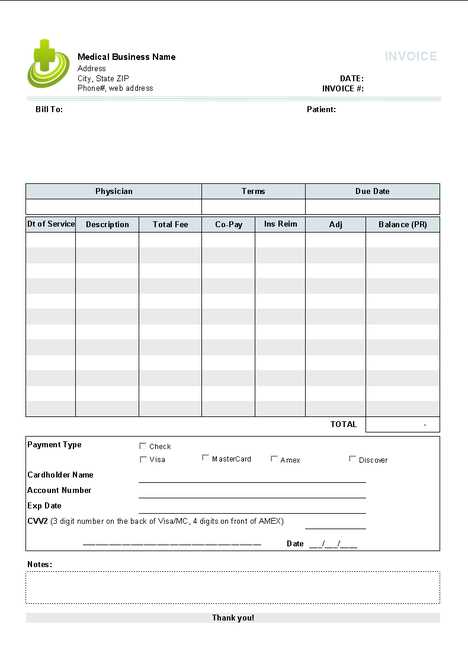

Common Information to Include on Invoices

Creating clear and accurate billing documents requires careful attention to the essential details that both the healthcare provider and the patient need. The information included on the document should be comprehensive, ensuring that there are no ambiguities regarding charges, services rendered, or payment terms. By incorporating the correct elements, the billing process becomes more transparent, reducing the risk of misunderstandings and ensuring that both parties are on the same page.

The following key details should always be present in a billing statement:

- Patient Information: Full name, contact details, and any relevant patient identifiers such as a patient ID or insurance number.

- Provider Information: The name, address, and contact details of the healthcare provider, including their professional credentials or license numbers if required.

- Services Rendered: A detailed list of the treatments or procedures provided, including dates, descriptions, and the associated costs for each service.

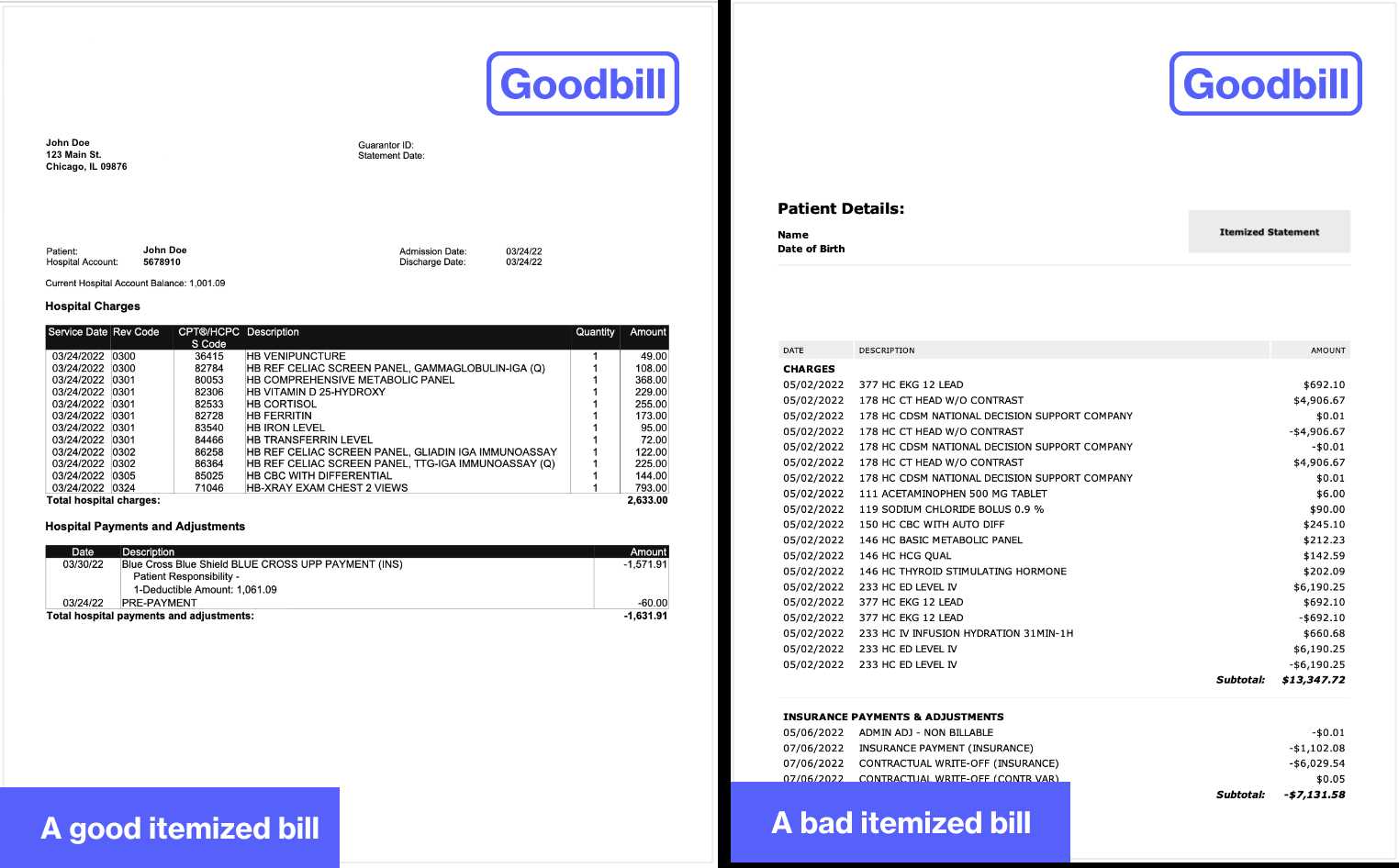

- Itemized Charges: Clear breakdown of the costs for each service, including any taxes, discounts, or additional fees applied to the total amount.

- Invoice Number: A unique reference number to help track and manage the billing record.

- Payment Terms: Clear instructions regarding payment due dates, accepted methods of payment, and any late fees or penalties for overdue balances.

- Payment Instructions: A simple, easy-to-follow guide on how the patient can settle their account, whether via online payment, check, or other methods.

Ensuring these elements are included and clearly presented will help avoid confusion and ensure timely payments. A well-organized document provides both the healthcare provider and the patient with all the necessary information to complete the transaction smoothly.

Customizing Your Doctor’s Office Template

Personalizing your billing documents can enhance professionalism, align with your practice’s branding, and streamline your financial processes. Customization allows you to add specific details that reflect your unique services and improve communication with your patients. Whether you’re creating a document from scratch or modifying an existing format, adjusting the layout and content to suit your needs can make a big difference in how your records are perceived and handled.

Here are some elements you may want to consider customizing:

| Customizable Feature | Description |

|---|---|

| Practice Branding | Add your logo, practice name, and professional details at the top to give the document a polished, branded appearance. |

| Payment Information | Customize the section that provides payment instructions to reflect your preferred methods, such as online payment options or bank account details. |

| Service Descriptions | Adjust the text to better explain the treatments provided, using terminology that aligns with your practice’s approach or the type of services you specialize in. |

| Due Date and Terms | Include your practice’s specific payment policies, such as early payment discounts, penalties for late payments, or any flexible payment plans you offer. |

| Field Organization | Arrange the sections of the document in a way that suits your workflow, highlighting the most important details first, such as total charges, patient details, and services rendered. |

By customizing these aspects, you not only make your billing process more efficient but also ensure that it aligns with your practice’s specific needs and enhances patient experience. A well-tailored document reinforces the credibility of your services and makes it easier for patients to understand and process their financial obligations.

Benefits of Using Digital Invoice Templates

Switching to digital billing records offers numerous advantages for healthcare providers. Digital formats streamline administrative tasks, reduce the likelihood of errors, and improve the overall efficiency of managing financial transactions. With the right system in place, practices can enhance their productivity, better track payments, and provide a more professional experience for their patients.

Key Advantages of Digital Billing Documents

- Faster Processing: Digital formats allow for quicker creation, distribution, and processing of billing records, reducing the time spent on manual tasks.

- Improved Accuracy: Automated features, such as pre-filled fields and calculation tools, help minimize human errors, ensuring that all details are correct and up-to-date.

- Cost Savings: By eliminating the need for printing and mailing physical documents, digital records reduce overhead costs, making the billing process more cost-effective.

- Better Organization: Digital records are easy to organize, search, and store, reducing the risk of lost or misplaced documents. Providers can quickly access patient billing histories whenever needed.

- Enhanced Security: Digital systems often come with built-in security features, such as password protection and encryption, helping to safeguard sensitive patient information.

Additional Benefits

- Environmentally Friendly: Reduces paper waste and supports eco-friendly practices by cutting down on the need for printed materials.

- Easy Integration: Digital systems can easily integrate with other accounting or practice management software, allowing for seamless financial tracking and reporting.

- Accessible from Anywhere: Billing records stored digitally can be accessed remotely, providing flexibility for practices to manage their finances regardless of location.

Ultimately, using digital billing solutions not only simplifies the management of financial records but also enhances the overall operational efficiency of healthcare providers. By taking advantage of these tools, practices can reduce administrative burdens, improve accuracy, and offer a more convenient experience for their patients.

How Templates Save Time in Billing

Using pre-designed billing formats can significantly streamline the financial documentation process. By eliminating the need to create new records from scratch with each transaction, practices can save valuable time while maintaining accuracy and consistency. A standardized approach allows staff to quickly input necessary information without having to worry about formatting or missing key details.

Here’s how pre-made structures save time in the billing process:

- Pre-filled Fields: With customizable fields for patient details, service descriptions, and costs, the document automatically populates repetitive information, reducing the time spent on manual data entry.

- Consistency: A set layout ensures that the same information is included each time, reducing the chance of forgetting important details and avoiding the need for corrections.

- Quick Adjustments: When changes are needed, templates allow for rapid updates without the need to start over, saving time in editing and ensuring quick turnaround on new documents.

- Automated Calculations: Many templates feature built-in calculation tools, helping to automatically tally costs and taxes, further cutting down the time required for manual math and reducing errors.

- Easy Sharing: Digital formats can be quickly emailed or uploaded to billing systems, cutting down on the time it takes to print, mail, or physically hand over documents.

Ultimately, by adopting standardized structures, practices can reduce administrative workload, speed up their billing cycle, and ensure more consistent and accurate records–all of which contribute to better operational efficiency and enhanced service delivery.

Understanding Invoice Numbering Systems

Having a clear and consistent numbering system for billing documents is essential for efficient record-keeping and financial management. A well-organized numbering structure helps both the healthcare provider and the patient track payments, resolve any discrepancies, and maintain proper documentation for accounting or legal purposes. Different systems can be used, each offering specific advantages depending on the practice’s needs and volume of transactions.

The main goal of a numbering system is to create a unique identifier for each financial record, making it easier to locate and reference past transactions. Below are some common types of numbering systems used by healthcare providers:

| Numbering System | Description |

|---|---|

| Sequential Numbering | This is the simplest system where each document is assigned a number in the order it is issued. For example, the first bill is #001, the second is #002, and so on. This system is easy to implement and track. |

| Year-Based Numbering | In this system, the year of issuance is included in the number, such as “2024-001” or “2024-002.” This helps identify the timeframe of the transaction and is especially useful for annual reporting and accounting. |

| Client-Based Numbering | This system assigns a unique prefix for each patient or client, followed by a sequential number. For example, “A123-001” could be a document for Patient A123, with the sequential number indicating the order of transactions. |

| Custom Prefix Numbering | A custom prefix, such as a specific code for the service type, department, or location, can be added. For example, “CARD-001” for cardiology services. This helps categorize and identify the nature of the service provided. |

Each of these systems can be tailored to meet the specific needs of a practice. For smaller practices, sequential or year-based numbering may be sufficient, while larger practices may benefit from a more detailed system that tracks patients, services, or locations. Regardless of the system chosen, consistency is key to ensuring that every document is easily identifiable and manageable.

How to Organize Patient Billing Records

Effective organization of billing records is essential for efficient practice management and ensures that both financial tracking and patient communication are streamlined. Keeping these records well-organized not only helps to avoid errors but also simplifies audits, tax reporting, and payment collections. The goal is to establish a system that is easy to manage, scalable as the practice grows, and secure for sensitive patient information.

Key Strategies for Organizing Billing Records

To keep patient financial documents in order, it’s important to implement structured and consistent practices. Below are some of the most effective methods for managing billing records:

- Digitize Records: Storing records in digital format makes it easier to organize, search, and retrieve information quickly. Scanning paper records and using digital file storage systems or cloud-based platforms can help centralize patient billing data.

- Use a Consistent Naming Convention: Developing a standardized naming system for files allows for quick identification and easy sorting. This might include the patient’s name, date of service, or a unique patient ID number, followed by the billing document identifier.

- Organize by Patient: Keep each patient’s financial records in a separate folder, either digitally or in physical files. Within each folder, group billing documents by date or service type for easy reference.

- Separate Unpaid from Paid Records: Use a simple categorization system to distinguish between invoices that have been paid and those that are still outstanding. This helps to quickly identify which payments need follow-up or further action.

Implementing a Workflow System

Having a well-defined workflow for managing and updating patient billing records is crucial for efficiency. This might involve setting up daily or weekly routines for reviewing and processing new transactions. Assigning specific tasks to staff members–such as creating records, sending reminders, or tracking payments–can further streamline the process.

- Establish Regular Review Times: Schedule periodic checks to ensure that billing records are up to date and accurate. This helps prevent errors and ensures timely follow-up on outstanding payments.

- Automate Reminders and Alerts: Use practice management software to send automated reminders for unpaid invoices, reducing manual workload and ensuring timely collections.

By organizing patient billing records in a structured and consistent manner, healthcare practices can improve workflow, reduce administrative burden, and maintain transparency in their financial processes. Proper organization not only boosts efficiency but also fosters better relationships with patients by ensuring clarity and timely communication.

Legal Considerations for Medical Invoices

When managing financial documents in healthcare, it’s essential to ensure that billing records comply with legal requirements. Healthcare providers must understand the various laws and regulations that govern the creation, storage, and sharing of these records. Failing to meet legal standards can lead to disputes, penalties, or even lawsuits, making it critical for practices to follow proper procedures in both document creation and payment collection.

Several important legal aspects should be considered when issuing financial statements in healthcare settings. These include ensuring accuracy, protecting patient privacy, and maintaining transparency in charges. Below are key legal considerations healthcare providers must keep in mind:

| Legal Consideration | Description |

|---|---|

| Accuracy and Transparency | Ensure that all charges are clearly itemized and accurate. Misleading or incomplete billing information can lead to legal action or loss of trust. Provide a breakdown of all services rendered, including the cost of each service, to prevent confusion or disputes. |

| Compliance with HIPAA | In the United States, healthcare providers must comply with HIPAA (Health Insurance Portability and Accountability Act). This law requires that patient financial records are protected, and any billing documents containing personal health information (PHI) be handled securely. |

| Insurance Requirements | For practices that accept insurance, it is essential to follow the billing requirements set by insurance companies. These might include specific formats, codes, or documentation needed for reimbursement. Incorrect or incomplete billing may result in delayed or denied payments. |

| State and Local Laws | Billing practices may vary depending on local laws and regulations. Providers must be aware of any state-specific requirements for billing and debt collection to avoid legal complications. |

To stay compliant and avoid legal issues, healthcare providers should keep themselves informed of evolving laws and regulations. It is also wise to regularly consult with legal and accounting professionals who specialize in healthcare billing to ensure all practices and records are in line with the law.

Tips for Accurate Medical Billing

Accurate financial documentation is critical for healthcare providers to maintain smooth operations and avoid costly errors. Incorrect charges, missing details, or billing discrepancies can lead to delayed payments, audits, or disputes with patients or insurers. By following best practices and utilizing effective strategies, providers can enhance accuracy, streamline their processes, and reduce the chances of mistakes in financial records.

Best Practices for Precision in Billing

- Double-Check Patient Information: Ensure that patient names, insurance details, and contact information are accurate and up-to-date before creating any billing documents. Incorrect personal details can delay processing and lead to confusion.

- Use Proper Codes: Always apply the correct medical codes for services rendered, whether for diagnosis (ICD codes) or procedures (CPT/HCPCS codes). Incorrect coding can result in claims being rejected or underpaid.

- Provide Detailed Descriptions: Clearly itemize services and costs in your records. Detailed descriptions allow patients to understand exactly what they are being charged for and help avoid misunderstandings or disputes.

- Verify Insurance Coverage: Before billing, confirm the patient’s insurance coverage to ensure that the service is covered and that the correct billing format is used. This can prevent delayed payments and avoid rejections from insurance companies.

- Stay Consistent with Billing Cycles: Regularly schedule when bills are sent out and ensure consistency in the process. Delays or inconsistencies in sending statements can confuse patients and result in missed payments.

Leveraging Technology for Accuracy

- Automate Calculations: Use billing software that automatically calculates totals, taxes, and discounts. This minimizes the risk of manual errors and saves time.

- Track Payments and Adjustments: Keep accurate records of payments made, adjustments, and outstanding balances. Regular tracking helps ensure all charges are accounted for and prevents overlooking past payments or credits.

- Review Before Submission: Always take a moment to review the document before sending it out. A second check can often catch small errors or omissions that may have been overlooked during the initial process.

By incorporating these tips into daily practice, healthcare providers can ensure that their billing is accurate, transparent, and efficient. Maintaining precision not only improves financial management but also fosters trust with patients and insurers alike, ensuring smoother operations for everyone involved.

How to Handle Insurance Billing with Invoices

Billing insurance companies for healthcare services requires careful attention to detail to ensure timely reimbursement and prevent errors. Insurance billing involves more than simply creating a record of services provided; it requires specific procedures, accurate coding, and clear communication to meet the requirements of both the insurance provider and the patient. To streamline this process, it is essential to follow a structured approach for billing insurance through financial documents.

Steps to Effectively Handle Insurance Billing

- Verify Insurance Coverage: Before providing services, always confirm the patient’s insurance details, including their coverage, co-pays, and deductible amounts. This helps avoid surprises and ensures that the services rendered are covered under the patient’s plan.

- Use Correct Medical Codes: Accurate medical coding is crucial when submitting claims to insurance companies. Ensure that all services are correctly categorized with the appropriate ICD, CPT, and HCPCS codes. Using incorrect codes can lead to claim denials or delayed payments.

- Prepare Detailed Billing Statements: When billing insurance, make sure the document includes a breakdown of the services provided, the cost of each service, and the patient’s portion. Transparency is key to avoid confusion and to ensure the insurance company processes the claim efficiently.

- Submit Timely Claims: Many insurance providers have strict timelines for submitting claims. Ensure that billing records are submitted promptly, as late submissions may result in claim denials or delayed payments.

- Track Claim Status: After submission, regularly check the status of your claims to ensure they are processed. Many systems allow you to track claim status electronically, making it easier to follow up on any pending or rejected claims.

- Handle Rejections and Denials: If a claim is rejected or denied, quickly investigate the reason. It may require resubmission with additional information, or it may indicate an error in coding. Responding promptly to denials helps recover funds and avoids delays in payment.

Best Practices for Smooth Insurance Billing

- Maintain Clear Records: Keep a comprehensive record of all communication with insurance providers and copies of all submitted claims. This documentation can be useful if there is any dispute or need for follow-up.

- Automate the Billing Process: Use specialized billing software to automate the insurance billing process. Many systems offer built-in features for verifying coverage, generating claims, and tracking their status, which can reduce errors and save time.

- Understand the Payer’s Policies: Familiarize yourself with the specific billing policies and requirements of each insurance company you work with. Different insurers may have varying procedures for claim submission, coding, and reimbursement.

By following these practices and ensuring accurate, timely submission of claims, healthcare providers can effectively manage insurance billing. This not only helps improve cash flow but also reduces the likelihood of issues or delays with insurance payments, leading to a more efficient and profitable practice.

Invoice Payment Terms and Conditions

Establishing clear payment terms and conditions is essential for ensuring that both the service provider and the client understand their financial obligations. These terms outline when payments are due, any late fees that may apply, and the accepted methods of payment. Clear and transparent payment policies help prevent misunderstandings, ensure timely payments, and promote a healthy financial relationship between the practice and its patients or clients.

Here are some common elements to include in your payment terms and conditions:

- Due Date: Clearly state the due date for payment. Common terms include “Net 30,” which means the payment is due 30 days after the billing date. If payments are expected sooner, such as “Net 15” or “Due on receipt,” make that clear to avoid confusion.

- Accepted Payment Methods: Specify which payment methods are acceptable, such as credit cards, checks, or digital payment platforms like PayPal or bank transfers. This ensures that the client knows exactly how to settle the account.

- Late Fees: Outline the consequences for late payments. A common approach is to charge a fixed percentage of the outstanding amount after a certain grace period (e.g., 5% of the balance after 30 days). Specify the percentage and the period after which the late fee will be applied.

- Early Payment Discounts: Some businesses offer discounts for early payments. If applicable, mention any discounts offered for payments made before the due date, such as a 2% discount for payments within 10 days.

- Payment Plans: If your practice allows patients or clients to pay in installments, include details on payment schedules and terms. Specify the number of installments, the amount of each, and the payment due dates.

- Refund Policy: Clearly define the circumstances under which a refund may be issued, if applicable. This helps manage expectations in case of cancellations or adjustments to the services rendered.

By setting these expectations upfront, you can reduce disputes and ensure smoother transactions. Well-defined payment terms also protect your business from cash flow issues, as they create a framework for managing outstanding payments and maintaining consistent revenue.

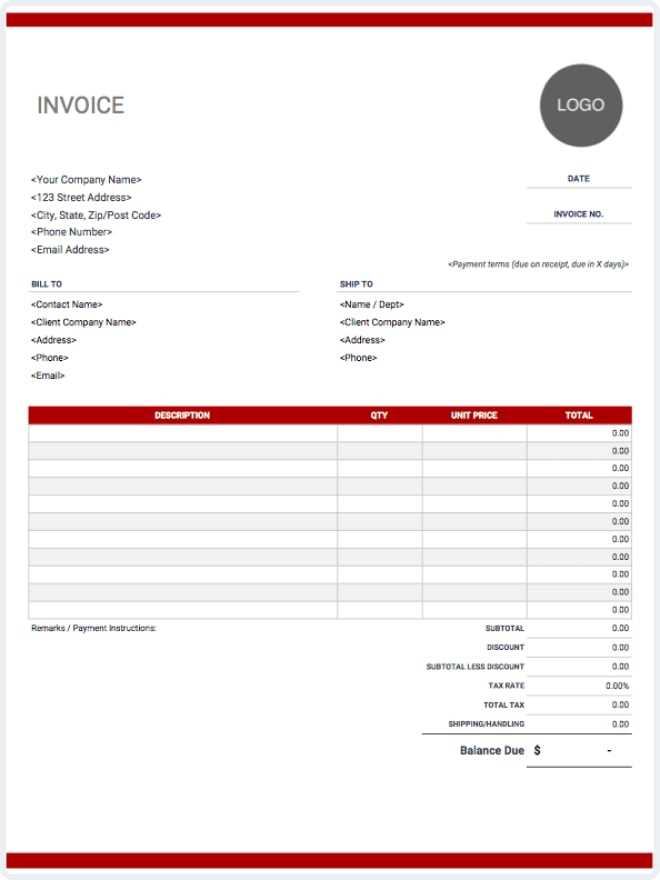

Maintaining a Professional Invoice Design

A well-designed billing document reflects the professionalism of your practice and ensures that important information is clearly communicated to clients. The layout and design of these documents not only provide a clear summary of services rendered but also enhance the overall experience for your patients or customers. A clean, professional design helps avoid confusion, fosters trust, and ensures that your financial documents are taken seriously.

Key Elements of a Professional Design

- Clear Branding: Include your practice or business name, logo, and contact information in a prominent place. Consistent branding helps reinforce your identity and adds a personal touch to the document.

- Readable Font: Choose a clean, legible font that ensures the text is easy to read. Avoid overly decorative fonts that can make the document appear cluttered or unprofessional.

- Logical Layout: Organize the information in a way that is easy to follow. Use headings and sections to break down services, costs, and payment details clearly. A well-structured layout makes it easier for the recipient to find key information quickly.

- Consistent Use of Colors: Use colors that complement your brand, but keep them subtle. Too many bright or clashing colors can distract from the important content and make the document appear unprofessional.

- Proper Use of White Space: Ensure that the design allows for adequate spacing between sections, text, and other elements. Proper white space prevents the document from appearing crowded, making it easier to read and understand.

Practical Tips for Improving Design

- Use a Template: If you’re not familiar with design software, using a pre-designed template can help ensure that your documents look professional while saving time. There are many options available that can be easily customized to fit your needs.

- Keep It Simple: The simpler, the better. Avoid including unnecessary details or excessive text. Stick to the essentials: a clear description of services, charges, and payment instructions.

- Highlight Important Information: Make sure the total due amount, payment terms, and due date are easy to spot. You can use bold or larger fonts to make these key pieces of information stand out.

By maintaining a professional design, you not only enhance the readability of your documents but also build credibility and trust with your clients. A well-crafted billing statement will leave a lasting impression and foster positive client relationships, all while ensuring clarity in financial transactions.

Free vs Paid Invoice Template Options

When it comes to creating billing documents, choosing between free and paid options can be a tough decision. Both types offer distinct advantages, but they also come with certain limitations. Free options may be a great starting point for small practices or businesses with basic needs, while paid solutions often provide more advanced features and customization. Understanding the benefits and drawbacks of each can help you make the right choice for your needs.

Benefits of Free Invoice Templates

- No Cost: The most obvious benefit of free options is that they come at no cost. This can be especially useful for small businesses or solo practitioners who are just starting out and may not have a large budget for administrative tools.

- Ease of Use: Free templates are often straightforward and easy to use. Many online platforms provide simple drag-and-drop interfaces that allow you to generate professional-looking billing documents quickly.

- Variety of Options: There is a wide range of free templates available, from basic text-based layouts to more sophisticated designs. With a little searching, you can usually find a template that fits your needs without paying a cent.

Drawbacks of Free Invoice Templates

- Limited Customization: Many free templates offer limited customization options. You might not be able to adjust the design as freely or incorporate advanced features like automated payment tracking or integration with accounting software.

- Basic Features: Free options often include only the most basic features, such as fields for the service description, pricing, and contact information. If you need more complex billing solutions, you may quickly outgrow the capabilities of a free template.

- Lack of Support: Free templates typically do not offer customer support. If you run into issues or need help customizing the design, you may be left to figure things out on your own.

Advantages of Paid Invoice Templates

- Advanced Features: Paid templates usually come with a range of advanced features, such as automatic calculations, tax rate integration, payment reminders, and customizable branding options. These features can save time and help streamline your billing process.

- Customization Options: Paid solutions often allow for deeper customization, meaning you can adjust the template to meet your specific branding or service requirements. Whether it’s adjusting the layout or incorporating a logo, these options give you greater flexibility.

- Better Support: With a paid option, you often receive customer service support, ensuring that you can get assistance when you need it. This can be invaluable if you encounter any issues while setting up or using the template.

Considerations Before Choosing

- Budget: While free templates are appealing because they come at no cost, consider the long-term benefits of investing in a paid solution. A paid option can offer efficiencies and features that might ultimately save you time and reduce errors.

- Specific Needs: If your billing process is straightforward and doesn’t require a

How to Track Invoice Payments Efficiently

Managing payments effectively is crucial for maintaining a healthy cash flow in any business. Whether you’re a small practice or a larger service-based business, tracking payments helps ensure that all dues are paid on time, and any issues are identified early. By establishing a streamlined process for tracking payments, you can reduce administrative workload, avoid missed payments, and keep your financial records organized.

Steps to Track Payments Effectively

- Create a Payment Log: Start by maintaining a log that tracks all payments. This can be done manually in a ledger or digitally in a spreadsheet. Include details such as the payment date, amount received, client name, and the method of payment.

- Use Software or Online Tools: Digital payment tracking tools can save time and reduce human error. Software like QuickBooks, FreshBooks, or dedicated billing platforms can automate much of the tracking process, giving you real-time updates on your financials.

- Set Up Payment Reminders: Many billing systems allow you to set reminders for clients when a payment is due or overdue. This ensures that no payment is missed and helps prompt clients to pay on time.

- Record Partial Payments: If a client makes partial payments, ensure these are recorded accurately. Keeping track of remaining balances helps prevent confusion and makes it easier to follow up on outstanding amounts.

- Monitor Payment Status: Regularly check your accounts to ensure that payments have been received as expected. Flag any discrepancies early and follow up with clients if necessary. This can help prevent overdue invoices from going unnoticed.

- Offer Multiple Payment Options: Providing various payment methods, such as credit cards, bank transfers, and online payment platforms like PayPal, can increase the likelihood of timely payments. Make sure these options are clearly communicated on the billing documents.

Best Practices for Payment Tracking

- Keep Documentation Organized: Store copies of all payment receipts, bank statements, and transaction records in an organized manner. Whether digital or paper, having easy access to this information is key for troubleshooting and reference.

- Review Statements Regularly: Set aside time to review your payment records and compare them to the statements from your bank or payment processors. This ensures that you catch any discrepancies between the two quickly.

- Automate Whenever Possible: Automating payment tracking can save you hours of manual work. Set up recurring billing and automatic reminders, or integrate your payment systems to ensure seamless tracking and minimal effort.

By adopting an efficient system for tracking payments, you can ensure smooth cash flow management and reduce administrative burdens. Whether you choose manual tracking or digital tools, consistency and organization are the keys to keeping payments on track.