How to Use a Research Invoice Template for Professional Billing

Managing payments for your work can be a complex task, especially when it comes to keeping track of the details. A well-structured billing document helps ensure accuracy, efficiency, and professionalism when dealing with clients or partners. Whether you’re a freelancer, researcher, or business owner, having a clear format for your financial transactions is essential.

With the right tools, you can streamline your invoicing process, avoid common errors, and maintain a consistent approach to getting paid for your efforts. The key to success lies in organizing all necessary information in a way that is both functional and easy to understand.

Customizing a proper billing document will not only save you time but also give your clients confidence in your professionalism. Understanding what to include and how to present it can make a significant difference in how quickly you get compensated for your services.

Research Invoice Template Overview

When managing financial transactions for your projects, it’s crucial to have a document that clearly outlines the details of the work provided, the amount owed, and the payment terms. This essential tool ensures that both parties are on the same page and prevents misunderstandings. Having a standardized approach to billing simplifies the process and helps maintain professional relationships.

A well-constructed document serves as both a request for payment and a record of the agreement between you and the client. It includes important elements like contact details, a breakdown of services, and payment instructions. These features make it easy for both you and your client to track progress and resolve any issues promptly.

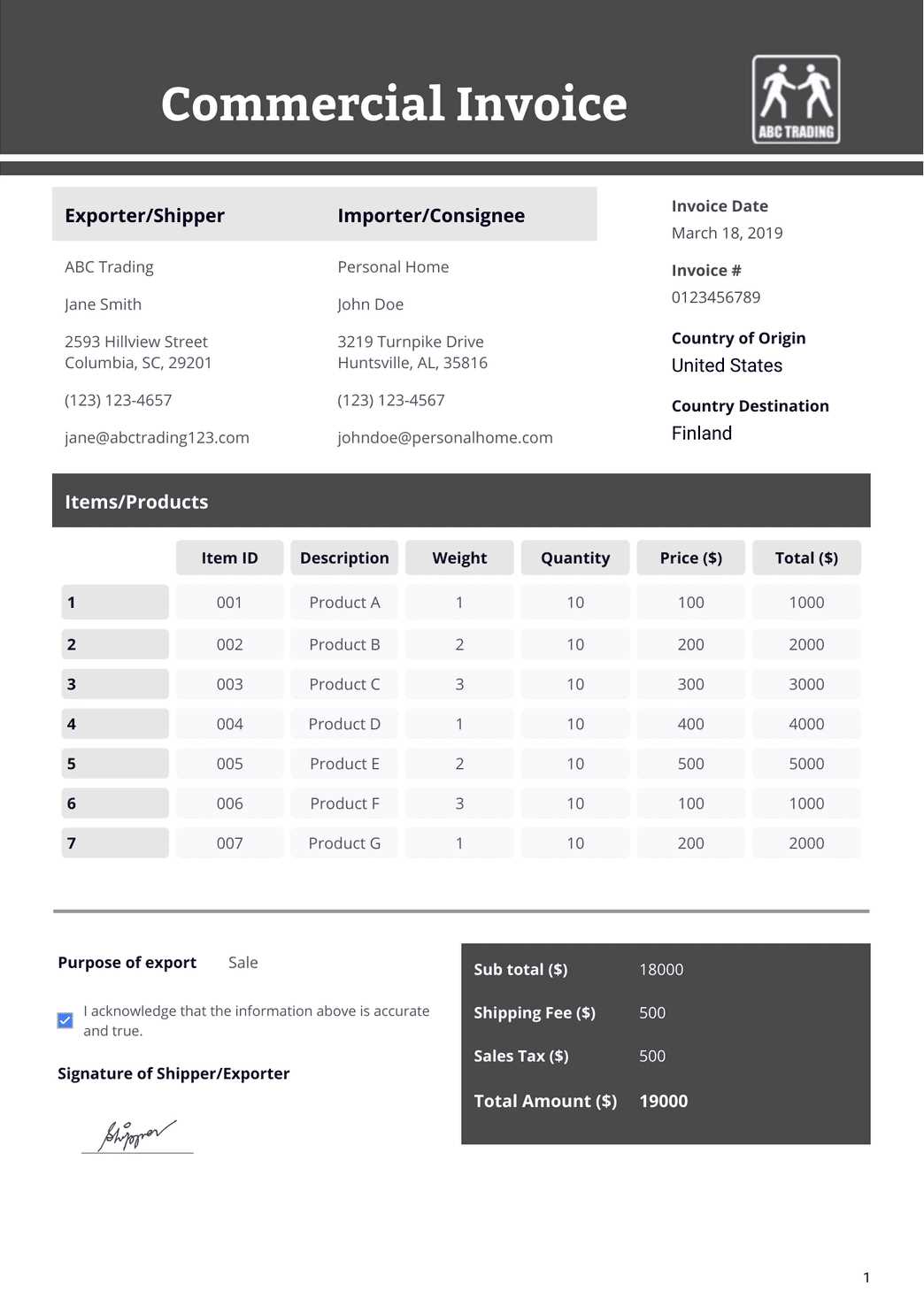

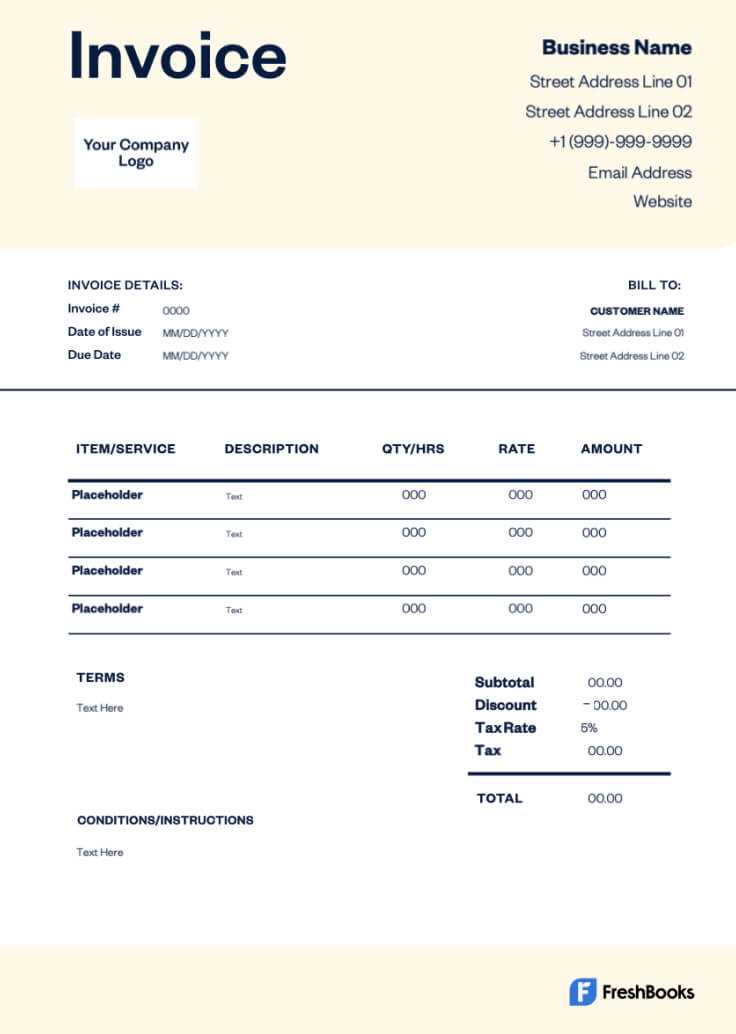

The key features of a functional billing document include:

- Header Information: Includes your contact details, client information, and any unique identifiers like a reference number or project ID.

- Description of Services: A detailed list of the services or work completed, including dates and quantities, if applicable.

- Payment Terms: Clear guidelines on when and how payments should be made, along with any late fees or penalties if applicable.

- Total Amount Due: The final cost for the services provided, with a breakdown of individual charges if necessary.

- Payment Methods: Specifies how payments can be made (bank transfer, online payment, etc.), ensuring flexibility for the client.

By using such a structured approach, you not only make it easier for your client to process the payment but also maintain a professional image that can help you build long-term business relationships. The simplicity and clarity of the document make it an essential tool for freelancers, contractors, and businesses alike.

Why You Need a Research Invoice

Properly documenting financial transactions is essential for maintaining transparency and ensuring timely payments. Whether you are working on a large project or providing specialized services, having a structured method to request payment helps avoid misunderstandings and ensures that both parties are clear about the terms. It also serves as an official record for future reference.

Using a formal billing document offers several advantages, including:

- Clarity and Transparency: A detailed statement helps clients understand exactly what they are paying for, reducing the risk of disputes over services rendered.

- Professionalism: Presenting a well-structured document builds trust and conveys professionalism, which can lead to repeat business and positive referrals.

- Efficient Payment Processing: Clear terms and payment instructions make it easier for clients to process payments quickly and without confusion.

- Record Keeping: A properly formatted document provides a useful reference for both you and the client, making it easier to track expenses and income over time.

- Legal Protection: A formal request for payment can serve as legal evidence in case of payment disputes or disagreements over the terms of the work.

Having such a tool in place not only makes your job easier but also helps create a professional impression. It is a simple yet crucial step in ensuring that you are paid fairly and on time for the work you do.

Key Elements of an Invoice

A well-organized document for requesting payment should include several critical components to ensure clarity and accuracy. Each section plays a specific role in providing both you and your client with the necessary information to process the transaction smoothly. By incorporating these key elements, you can prevent errors and maintain professionalism throughout the process.

The essential components of a billing document are as follows:

- Header Information: This includes your contact details, the client’s information, and any unique reference number to easily identify the transaction.

- Itemized List of Services: A breakdown of the tasks or services provided, including dates, hours worked, quantities, and rates, ensuring everything is transparent.

- Total Amount Due: The sum of all charges, clearly stated, with any applicable discounts or adjustments applied.

- Payment Terms: A clear outline of payment deadlines, accepted methods, and any late fees or penalties for overdue payments.

- Payment Instructions: Detailed guidance on how the client should submit the payment (e.g., bank transfer, online payment platform, etc.).

- Tax Information: If applicable, include relevant tax rates and amounts to ensure compliance with local laws and regulations.

- Additional Notes: Any extra information, such as terms of service, future work agreements, or project milestones.

Incorporating all these elements in a logical and easy-to-follow format ensures that your document serves its purpose efficiently. It not only provides clear communication but also helps establish trust with your clients.

How to Customize Your Template

Personalizing your billing document is key to making it align with your brand and the specific requirements of your work. Customization not only enhances the professionalism of the document but also ensures that all the necessary information is included in a way that suits your needs. By adjusting certain elements, you can create a document that’s both functional and visually appealing.

Step-by-Step Customization

To start, consider the following areas for customization:

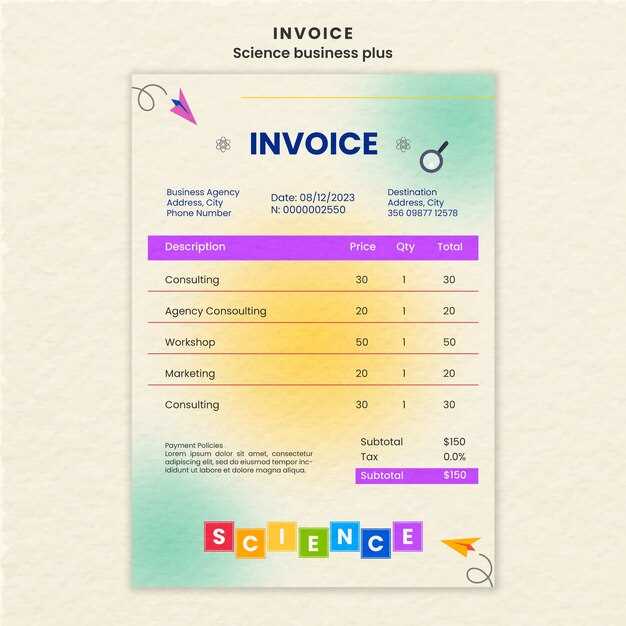

- Design and Layout: Choose a format that reflects your style. You can adjust fonts, colors, and spacing to make the document visually appealing while keeping it easy to read.

- Logo and Branding: Add your logo and other branding elements, such as company name and tagline, to make the document more recognizable and professional.

- Section Arrangement: Depending on your business, you may want to reorder the sections. For example, you could highlight the total amount due at the top or include payment instructions before service details.

- Payment Methods: Include options that suit your client’s preferences, such as bank transfer, online payment portals, or checks.

- Additional Notes: Customize the note section with your personal message or relevant reminders about payment deadlines, terms, or follow-up actions.

Best Practices for Effective Customization

While customizing, it’s important to keep these best practices in mind:

- Maintain Clarity: Ensure that all key information is easy to find. A cluttered or overly complex design may confuse your client.

- Consistency: Keep the overall style consistent with your branding and other business materials for a professional look.

- Include All Required Details: Ensure that every important section, such as service descriptions, payment terms, and amounts, is clearly included and updated as needed.

Customizing your billing document is a simple way to make it more suited to your unique business and communication style while ensurin

Choosing the Right Format for Your Invoice

When selecting a format for your billing document, it’s important to consider both functionality and ease of use. The format should not only present the necessary details clearly but also fit the way you work and interact with clients. A well-chosen format streamlines your workflow, helps ensure timely payments, and minimizes the risk of errors.

There are several formats available, each offering different features and levels of complexity. Depending on your needs, you may prefer a simple, straightforward approach or a more detailed, customized version. Here are some options to consider:

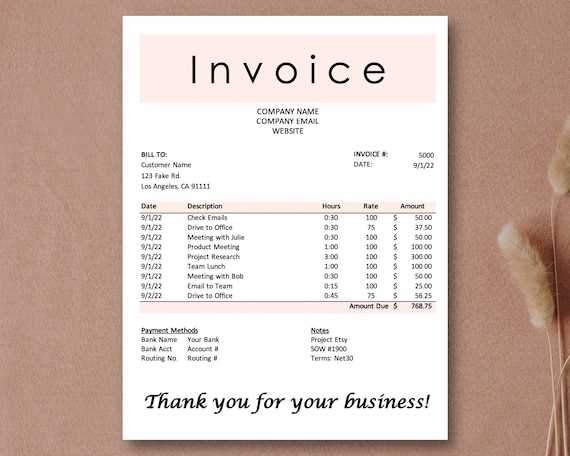

- Basic Text Format: A simple, easy-to-edit option, typically used for smaller businesses or freelancers who need to quickly generate a billing document. It works well for smaller projects with few details.

- Spreadsheet Format: Often used by those who manage multiple clients or projects. It allows for easy calculations and provides a consistent way to track payments. However, it may be less visually appealing than other formats.

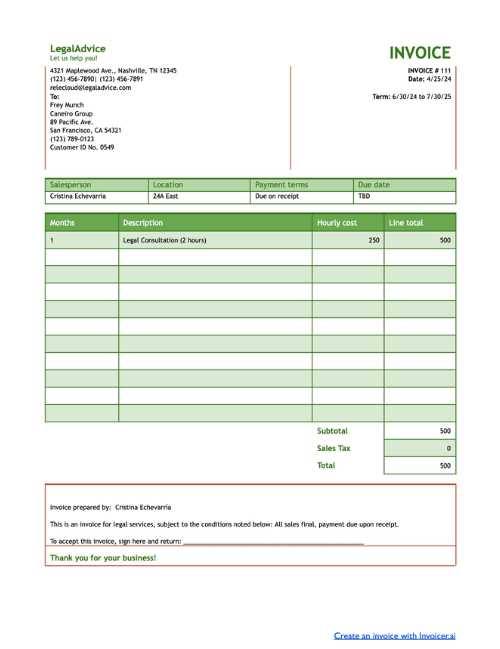

- Professional Document Template: Ideal for those who want a polished and branded look. These documents often include pre-designed sections for payment terms, project descriptions, and client details. They are great for building trust with clients and ensuring accuracy.

- Online Billing Platforms: These platforms offer an automated solution, where you can input data, and the system generates the document for you. These formats are convenient, especially for those who want to integrate with payment systems and automate follow-ups.

When choosing a format, consider the following factors:

- Client Preferences: Some clients may prefer a detailed, formal document, while others might appreciate a more basic approach. Understanding their needs can help guide your decision.

- Volume of Work: If you handle multiple projects or clients, a more organized, automated format can save you time and effort.

- Customization Needs: Choose a format that allows you to include any specific information or branding elements you need.

By selecting the right format, you can create a more efficient, professional, and accurate billing process that benefits both you and your clients.

Essential Information to Include

For your billing document to serve its purpose effectively, it’s crucial to include all necessary details that ensure clarity and prevent confusion. By providing comprehensive information, you make it easier for your clients to process the payment and for you to keep accurate records. Certain key elements are indispensable to any formal payment request.

Critical Details to Include

Here are the primary sections you should always feature in your document:

- Sender’s Contact Information: Your full name, company name (if applicable), address, phone number, and email address.

- Recipient’s Contact Information: Include the client’s full name, company name, and contact details to avoid any confusion regarding the payment recipient.

- Unique Reference Number: An identifying number for each document, ensuring easy tracking and preventing duplicates.

- Description of Work or Services: Provide a detailed description of the tasks performed or services rendered, including dates, quantities, and unit prices if applicable.

- Amount Due: Clearly state the total amount, itemized for each service provided if necessary. This should include any taxes or additional fees.

- Payment Terms: Specify when the payment is due, accepted methods, and any applicable late fees or discounts for early payment.

- Payment Instructions: Provide clear, easy-to-follow instructions on how and where to send the payment (e.g., bank details, online payment platform).

- Due Date: A clear due date for payment to ensure both parties are aware of when the funds are expected.

Optional Yet Helpful Information

While not strictly necessary, adding some additional elements can help clarify the transaction and improve the client’s experience:

- Terms and Conditions: If you have specific terms for payment or service delivery, include them to avoid misunderstandings.

- Notes Section: This can be used to provide extra context or instructions, such as thanking the client or mentioning a future project.

- Tax Informa

Common Mistakes to Avoid in Invoices

When creating a formal payment request, it’s easy to overlook certain details or make mistakes that can lead to confusion or delays in payment. Avoiding common errors ensures that your documents are professional, accurate, and easy to process for your clients. Here are some of the most frequent mistakes to watch out for.

Missing or Incorrect Contact Information: Always double-check that both your contact details and those of your client are correct. Mistakes in addresses, phone numbers, or email addresses can delay communication and lead to payment issues.

Omitting or Miscalculating Charges: Failing to itemize the services provided or making errors in calculations can cause confusion and disputes. Ensure that each service is clearly described, and double-check the math to confirm the total amount due is accurate.

Unclear Payment Terms: Not specifying when the payment is due, or leaving payment terms vague, can cause uncertainty and delay payment. Always include a clear due date, acceptable payment methods, and any late fees or penalties for overdue payments.

Failure to Include Tax Information: If applicable, be sure to include tax rates and amounts in your document. Missing this information can lead to complications for both you and your client, especially if you’re working in regions where taxes are a legal requirement.

Not Using a Unique Reference Number: It’s crucial to include a unique reference number for each document. This helps both you and your client track payments more easily and avoid any confusion over multiple transactions.

Formatting Issues: An unorganized or hard-to-read document can frustrate your client and slow down payment processing. Ensure that your payment request is neatly formatted, with clear headings, bullet points, and sections for easy navigation.

Ignoring Client Preferences: Different clients may have varying preferences for receiving or processing billing documents. Some may prefer digital copies, while others may require hard copies. Understanding these preferences can prevent delays and ensure smooth transactions.

By being mindful of these common mistakes, you can create a more efficient, professional, and error-free payment request that will help build trust with your clients and ensure timely payments.

How to Automate Your Billing Process

Automating your billing process can save you significant time and effort, allowing you to focus on other aspects of your business. By streamlining repetitive tasks, you reduce the chance for errors, ensure consistency, and can even improve your cash flow by speeding up payments. Implementing automation tools and systems can make the entire process more efficient, from generating payment requests to tracking outstanding balances.

Here are some steps to help you automate your billing system:

- Use Online Billing Software: Many platforms offer automated features, such as generating payment requests, sending reminders, and tracking payments. These tools also allow for easy customization of documents, making them ideal for businesses of all sizes.

- Set Up Recurring Billing: If you provide ongoing services, consider setting up automated recurring billing. This ensures that your clients are billed on time, without the need for manual intervention each cycle.

- Integrate Payment Gateways: Link your payment request system with online payment platforms such as PayPal, Stripe, or bank transfers. This allows clients to pay directly through the document, reducing delays and streamlining the process.

- Automate Payment Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments. This helps reduce late payments without having to manually follow up with clients.

- Track Payment Status Automatically: Many billing platforms can track when a payment has been made, alerting you as soon as funds are received. This reduces the need for manual tracking and follow-ups.

- Customize Automated Notifications: Personalize your payment request system with automated thank-you notes or custom messages, which add a touch of professionalism and customer care without additional effort.

By automating the key steps in your billing process, you not only save valuable time but also create a more professional experience for your clients. With fewer manual tasks, you can focus on providing high-quality work while ensuring that payments are processed efficiently and on time.

Billing Document for Freelancers

For freelancers, having a clear and professional way to request payment is essential to maintaining strong relationships with clients and ensuring timely compensation for services rendered. A well-structured document not only helps convey professionalism but also makes it easier to track payments and manage finances. Whether you’re working on a single project or handling multiple clients, customizing a billing document can make the process more efficient.

Key Features for Freelance Billing Documents

When creating a payment request for freelance work, it’s important to include certain elements that will make the document easy to understand and process. Here are some key features to consider:

- Client and Freelancer Information: Include both your contact details and the client’s to ensure clarity about who is responsible for payment.

- Clear Service Descriptions: Provide a detailed breakdown of the work completed, including the hours worked or deliverables, with clear descriptions to avoid misunderstandings.

- Payment Amount: Clearly state the total amount due, including any applicable taxes, with an itemized breakdown for transparency.

- Due Date: Specify when the payment is due to ensure there is no confusion regarding the timeline for payment.

- Accepted Payment Methods: List the payment methods you accept (e.g., bank transfer, PayPal, check) to give your client multiple options.

- Payment Terms: Include any terms such as late fees, early payment discounts, or special conditions that may apply to your contract.

Customization Tips for Freelancers

Freelancers often work across various industries, and each project may require different billing approaches. Here are some tips for customizing your document:

- Use Your Branding: Incorporate your logo and professional brand elements into your payment request to enhance your reputation and consistency.

- Consider Project Milestones: If working on a large project, consider breaking the document into milestones with corresponding payments, so clients can pay as work is completed.

- Be Clear About Payment Deadlines: If your work is tied to a specific deadline, highlight this date clearly to help ensure timely payments.

- Keep It Simple: Avoid overcomplicating the format–clients appreciate simplicity and clarity, especially if they handle many invoices.

By personalizing your payment request, you ensure that it not only meets your business needs but also creates a seamless, professional experience for your clients. With a clear, consistent approach to billing, you can focus more on the work itself and less on administrative tasks.

Benefits of Using a Template

Using a pre-designed structure for your billing documents offers a range of advantages that can significantly streamline your financial processes. Whether you’re a freelancer or managing a small business, utilizing a consistent format ensures that you can generate professional-looking requests with minimal effort. It saves time, reduces errors, and helps maintain a polished image in the eyes of your clients.

Here are some key benefits of utilizing a pre-built structure for your payment requests:

- Time-Saving: A predefined format allows you to quickly fill in the relevant details without having to start from scratch every time. This speeds up the process and frees up time for other important tasks.

- Consistency: Using the same layout for every transaction ensures that all your payment documents are uniform. This consistency helps clients recognize your communications and reduces the likelihood of misunderstandings.

- Professional Appearance: A well-designed document can enhance your business’s professional image, making you appear more organized and reliable. This can help foster trust with clients.

- Minimized Errors: Pre-designed structures often come with built-in fields for key information like dates, amounts, and contact details, which reduces the chances of forgetting critical elements or entering incorrect data.

- Customization: Templates are highly customizable, allowing you to add your branding, adjust sections as needed, and tailor the content to each client, while still using the same overall structure.

- Legal and Tax Compliance: Many pre-built formats are designed to include necessary legal or tax-related information, helping you stay compliant with local regulations and making the document legally sound.

- Improved Tracking: Using a template often makes it easier to keep track of outstanding payments and past transactions, as the structure ensures all key details are consistently recorded.

By incorporating a standardized format, you can ensure that your payment requests are not only efficient and accurate but also professional and legally compliant. This simple tool can have a significant positive impact on your workflow and client relationships.

Creating a Professional Look for Your Billing Document

Creating a polished and professional appearance for your payment request not only ensures clarity but also helps to establish trust and credibility with your clients. A well-designed document reflects the quality of your work and attention to detail. It is crucial to strike the right balance between functionality and aesthetics, ensuring that all essential information is clearly presented while also aligning with your brand identity.

Here are several ways to enhance the professional look of your payment request:

- Branding Consistency: Include your company logo, business name, and any other branding elements such as colors or fonts. This helps create a cohesive identity and reminds your clients of your brand’s professionalism.

- Simple, Clean Layout: Opt for a straightforward layout with enough white space to make the document easy to read. Avoid cluttering the page with unnecessary information or overly complex designs.

- Readable Fonts: Choose professional, legible fonts such as Arial, Helvetica, or Times New Roman. Avoid using too many different font styles or sizes, which can create a chaotic or disorganized appearance.

- Clear Hierarchy: Organize the document logically, with headings and subheadings that highlight important sections, such as client information, services rendered, and payment terms. This helps your clients navigate the document with ease.

- Consistent Formatting: Maintain consistent font sizes, colors, and text alignment throughout the document. This provides a unified appearance and makes the content easier to digest.

- Professional Color Scheme: Use a subtle, professional color palette. While bold colors can catch the eye, overly bright or clashing colors can look unprofessional. Stick to a limited set of complementary colors that match your brand’s style.

- High-Quality Paper (for Printed Copies): If you plan to send physical copies, print your billing documents on high-quality paper to add an extra layer of professionalism.

By focusing on these elements, you create a visually appealing, well-organized document that makes a strong impression on clients. A professional presentation not only enhances your credibility but also improves communication and payment efficiency.

How to Send Billing Documents Efficiently

Sending billing documents in a timely and organized manner is essential to ensuring prompt payment and maintaining strong relationships with your clients. Whether you’re handling multiple clients or just a few, an efficient process helps you avoid delays, reduce administrative work, and increase your professionalism. By using the right tools and techniques, you can streamline the entire process from creation to delivery.

Steps to Send Billing Documents Quickly and Effectively

Here are some best practices to help you send payment requests efficiently:

- Automate Document Generation: Use software or online platforms that allow you to automatically create and fill in billing details. This eliminates the need to manually input information for each document, saving you time and effort.

- Choose the Right Delivery Method: Opt for electronic delivery when possible. Sending documents via email or through an online payment platform is quicker and more environmentally friendly. Plus, it provides clients with immediate access to your payment request.

- Confirm Client Preferences: Some clients prefer receiving documents by mail or through secure portals. Be sure to confirm their preferred method of delivery to avoid delays or miscommunications.

- Set Up Automatic Reminders: Many online tools allow you to schedule automatic reminders for upcoming or overdue payments. This ensures your clients are always aware of their financial obligations without needing to send manual follow-ups.

- Track Delivery and Receipt: When sending documents electronically, use tools that offer read receipts or tracking features to confirm that your client has received the payment request. This reduces the risk of disputes about whether the document was delivered.

Best Practices for Follow-Up

Sending the document is only part of the process. Efficient follow-up is key to ensuring payment:

- Provide Clear Payment Terms: Always include a due date and clear instructions for payment to prevent confusion. Be sure to mention any applicable late fees or discounts for early payments.

- Send Polite Reminders: If a payment is overdue, follow up with a gentle reminder. Be polite and professional, as maintaining good relationships with clients is essential.

- Stay Organized: Keep track of when you send each document and when you receive payments. Maintaining a system for tracking deliveries and payments ensures that nothing slips through the cracks.

By following these steps, you can send billing documents more efficiently, speeding up payment processes while maintaining a professional and organized approach to managing your finances.

Tracking Payments with Your Billing Document

Tracking payments is a crucial aspect of maintaining healthy cash flow and ensuring that all financial transactions are accounted for. By incorporating effective tracking methods in your payment requests, you can stay organized and avoid confusion regarding pending payments. It helps both you and your clients to stay on the same page, reducing the risk of missed or forgotten payments.

Effective Ways to Track Payments

Here are several strategies for tracking payments related to your billing documents:

- Include a Unique Reference Number: Each payment request should have a unique reference number. This makes it easier to track each transaction and ensures that payments are accurately matched with the corresponding request.

- Mark Paid Amounts: Always indicate the paid amount on the payment document, especially if partial payments have been made. This helps you keep a clear record of outstanding balances.

- Utilize Online Payment Systems: By integrating online payment systems with your request, you can automatically track when a payment has been made. These platforms often provide you with real-time updates on payment status.

- Use Accounting Software: Many accounting software tools can automatically track payments and provide you with an overview of what’s paid and what’s due. This saves time and ensures accuracy when managing multiple clients and payments.

- Set Up Payment Reminders: If a payment is not received by the due date, automated reminders can help nudge clients to complete the transaction. This ensures timely follow-up without extra effort on your part.

How to Organize Payment Records

To stay on top of your financials, it’s important to have an efficient system for organizing payment records:

- Create a Payment Log: Maintain a separate log or spreadsheet where you track all payment requests, amounts due, and payment dates. This can help you identify patterns and stay organized.

- Match Payments to Requests: After receiving a payment, ensure that it is linked to the correct request and reference number. This helps avoid confusion if a client questions whether a payment has been received.

- Monitor Outstanding Balances: Keep a list of all outstanding payments and their due dates. This allows you to quickly follow up on overdue payments and maintain better control over your finances.

By tracking payments effectively, you ensure that your financial records are accurate and up-to-date, making it easier to manage your business and avoid costly mistakes. A

Handling Payment Disputes with Billing Documents

Occasionally, disagreements may arise over payment terms or amounts, leading to disputes between you and your clients. These conflicts can cause delays in receiving compensation and strain business relationships if not handled properly. However, a well-structured and clear payment request can often resolve misunderstandings before they escalate. Being proactive in addressing disputes and communicating effectively is key to maintaining professionalism and ensuring fair resolutions.

Steps to Take When a Dispute Arises

If a dispute occurs, it’s important to remain calm and follow a systematic approach to address the issue:

- Review the Document Thoroughly: Before engaging in any discussions, carefully review the payment request to ensure all details are accurate, including the amount due, services rendered, and agreed-upon terms. This will help you identify any potential errors on your end.

- Open a Dialogue: Approach the client politely and ask for clarification on their concerns. Sometimes, disputes arise due to simple misunderstandings that can be easily cleared up with open communication.

- Provide Documentation: If there’s a disagreement about the work done or terms agreed upon, provide any supporting documentation that can back up your claims, such as contracts, correspondence, or previous payments.

- Stay Professional: Throughout the dispute resolution process, maintain a professional tone. Avoid getting defensive or emotional. The goal is to resolve the matter amicably while preserving the client relationship.

- Offer Solutions: Be open to negotiating a resolution. If the issue is due to a minor misunderstanding or discrepancy, offer a compromise that satisfies both parties. This can include adjusting payment terms or making small concessions if it maintains client goodwill.

Preventing Future Payment Disputes

While not all disputes can be avoided, there are steps you can take to reduce the likelihood of them occurring in the future:

- Clear Payment Terms: Ensure that your payment terms are explicitly stated in the initial agreement or document. This includes the due date, payment method, and any applicable late fees or discounts for early payments.

- Consistent Communication: Keep your clients informed about the progress of the project or service delivery. This helps set expectations and minimizes the chances of surprises when it comes time to settle the payment.

- Detailed Billing: Provide a detailed breakdown of services or hours worked, along with associated costs. Clear and transparent documents can reduce confusion and prevent clients from disputing charges.

- Use Contracts: Always use a formal contract that outlines the scope of work, payment terms, and any contingencies. This formal agreement can serve as a reference in case of any disputes.

By addressing payment disputes professionally and being transparent from the outset, you can maintain trust with your clients and ensure a smoother financial process. Resolving issues promptly not only helps secure timely payments but also builds long-term, positive relationships.

Incorporating Tax Information in Billing Documents

Including accurate tax information in your payment requests is essential for legal compliance and clear communication with your clients. Properly itemized tax details ensure that both you and your clients understand the financial obligations, helping to avoid confusion or disputes. Whether you’re charging sales tax, VAT, or any other form of taxation, it is important to include all relevant information in a transparent and accessible manner.

Key Elements of Tax Information

Here are the critical components to include when incorporating tax information into your payment request:

- Tax Identification Number (TIN): Include your business’s tax ID number to ensure that the payment request is compliant with tax regulations. This number is necessary for businesses that are required to charge tax or report income to the government.

- Tax Rate: Clearly specify the applicable tax rate. For example, if you’re charging sales tax, include the percentage of tax being applied to the total amount of the service or product.

- Tax Amount: Show the total amount of tax applied to the payment, calculated based on the rate and the cost of the services or goods. This allows clients to see exactly how much they are being charged for tax purposes.

- Breakdown of Charges: Provide a detailed breakdown that includes the base price, the tax amount, and the final total due. This transparency helps clients understand how their payment is being allocated.

- Tax Exemption Information (if applicable): If the client is exempt from tax, include the exemption certificate number and a note indicating the tax exemption status. This ensures the billing is compliant with tax laws and avoids future discrepancies.

Best Practices for Tax Compliance

To ensure you’re complying with tax laws and making the process smoother for both you and your clients, consider the following best practices:

- Stay Updated on Tax Laws: Tax regulations vary by region and industry, so it’s essential to keep up-to-date with any changes in tax rates or requirements. Consulting with a tax professional can help you avoid mistakes.

- Use Accounting Software: Many accounting tools allow you to automatically calculate and apply taxes based on the region and product type. This helps reduce errors and saves time.

- Include Clear Terms: Always include a statement about taxes in your terms and conditions or payment agreement, so clients are aware from the outset about the charges they may incur.

- Be Transparent: Transparency is key. Make sure clients can easily see the tax applied and understand the breakdown of charges. Avoid any hidden fees or unclear tax practices, as these can lead to disputes.

Properly incorporating tax information in your billing documents not only ensures compliance but also helps build trust with your clients. By maintaining clarity and transparency, you can avoid misunderstandings and streamline the payment process.

Tips for Timely Payments

Receiving payments on time is crucial for maintaining healthy cash flow and ensuring the smooth operation of your business. Delayed payments can lead to financial strain, unnecessary stress, and potentially strained relationships with clients. By setting clear expectations and using effective strategies, you can encourage clients to pay promptly and avoid common pitfalls that cause delays.

Effective Strategies to Ensure Timely Payments

Here are some practical tips to help you get paid on time:

- Set Clear Payment Terms: Be upfront about payment terms right from the beginning. Specify the due date, acceptable payment methods, and any late fees in your agreements or billing documents. Clear expectations reduce the chance of confusion.

- Invoice Promptly: Send your payment request as soon as the work is completed or as agreed upon in the contract. The sooner you send it, the sooner you’ll receive payment. Make sure to double-check that all details are correct to avoid delays caused by errors.

- Offer Multiple Payment Options: Make it as easy as possible for your clients to pay by offering multiple payment methods, such as credit cards, bank transfers, and online payment systems. The more options you provide, the less likely clients are to delay payments.

- Automate Reminders: Set up automated reminders to notify clients about upcoming or overdue payments. Many payment platforms and accounting tools offer this feature, so you don’t have to manually follow up on every payment.

- Build a Relationship of Trust: Establish strong, professional relationships with your clients. When clients value the work you do, they’re more likely to prioritize timely payments. Open communication can prevent misunderstandings about payment expectations.

How to Handle Late Payments

Despite your best efforts, sometimes payments still come in late. Here’s how to handle those situations professionally:

- Send Polite Reminders: If a payment is overdue, send a polite reminder. Keep the tone friendly and professional, as this can encourage your client to settle the outstanding amount without damaging the relationship.

- Offer Incentives for Early Payment: Consider offering small discounts or other incentives for clients who pay ahead of schedule. This can encourage early payments and help keep your cash flow steady.

- Enforce Late Fees: If late payments are a recurring issue, enforce late fees as outlined in your payment terms. Make sure your client is aware of these fees in advance to avoid disputes later.

- Use a Col

Legal Considerations in Billing Documents

When creating payment requests, it’s crucial to consider the legal aspects to ensure that your financial transactions are not only clear but also compliant with applicable laws. A well-structured billing document can serve as both a legal agreement and a record of the services provided, offering protection to both the service provider and the client. Understanding the necessary legal elements will help prevent disputes and ensure you maintain a professional reputation.

Key Legal Elements to Include

To ensure that your billing documents are legally sound, include the following critical information:

- Clear Payment Terms: Always specify the payment due date, the total amount due, and any applicable taxes or fees. Stating whether payment is expected immediately, within a certain number of days (e.g., Net 30 or Net 60), or upon completion of services is essential for clarity.

- Business Details: Include your legal business name, address, and tax identification number. This information ensures that your business is correctly identified and can be traced for tax and legal purposes.

- Contractual Agreement: Ensure that the terms outlined in your contract are reflected in the payment request. If there are specific deliverables or conditions tied to the payment, mention them clearly to avoid misunderstandings.

- Late Payment Fees: If applicable, include terms for late payments, such as interest charges or penalties for overdue amounts. Ensure these terms are legally enforceable by adhering to local regulations.

- Dispute Resolution Clauses: Include a clause outlining how disputes will be handled, whether through mediation, arbitration, or legal action. This can help avoid costly and time-consuming litigation in case of disagreements.

Compliance with Tax and Local Regulations

It is important to stay compliant with both local and international tax laws when issuing payment requests. Below are some key considerations:

- Sales Tax or VAT: In many regions, businesses are required to charge sales tax or VAT on services and goods provided. Make sure you apply the correct tax rate and include it in the paym