Free Independent Contractor Invoice Template Excel

As a freelancer or self-employed professional, managing payments and ensuring timely transactions is crucial for maintaining cash flow. Using the right tools can streamline the entire billing process, making it easier to track work completed and amounts owed. A well-organized system allows you to focus more on your projects and less on administrative tasks.

One of the most effective ways to handle your billing is by creating clear, professional documents that outline services rendered, payment terms, and due dates. With the right structure, you can avoid errors and confusion with clients, ensuring smooth financial interactions. Fortunately, there are simple, customizable solutions available that allow you to tailor each document to meet your specific needs.

In this article, we will explore how to set up such documents using a widely accessible software. We will discuss what information to include, how to format it for clarity, and how to automate parts of the process to save time. By the end, you’ll have the tools needed to create polished billing records that reflect your professionalism.

Understanding Billing Documents for Freelancers

When working as a freelancer or self-employed professional, clear and concise financial records are essential for ensuring smooth transactions. A well-crafted document that details services provided, payment amounts, and deadlines not only serves as a formal agreement but also helps in maintaining a professional relationship with clients. These records act as proof of work completed and are crucial for timely payments and tracking earnings.

Key Components of a Billing Record

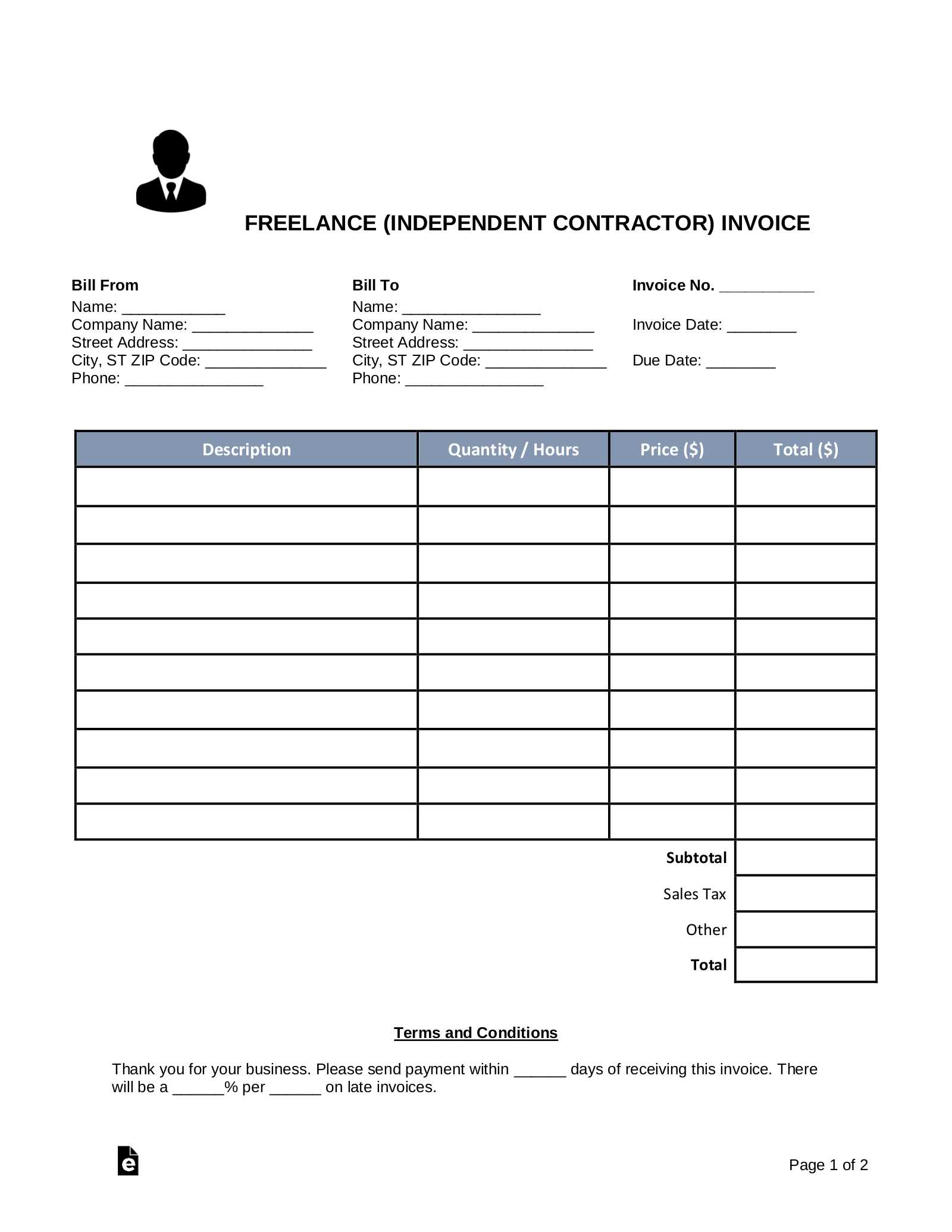

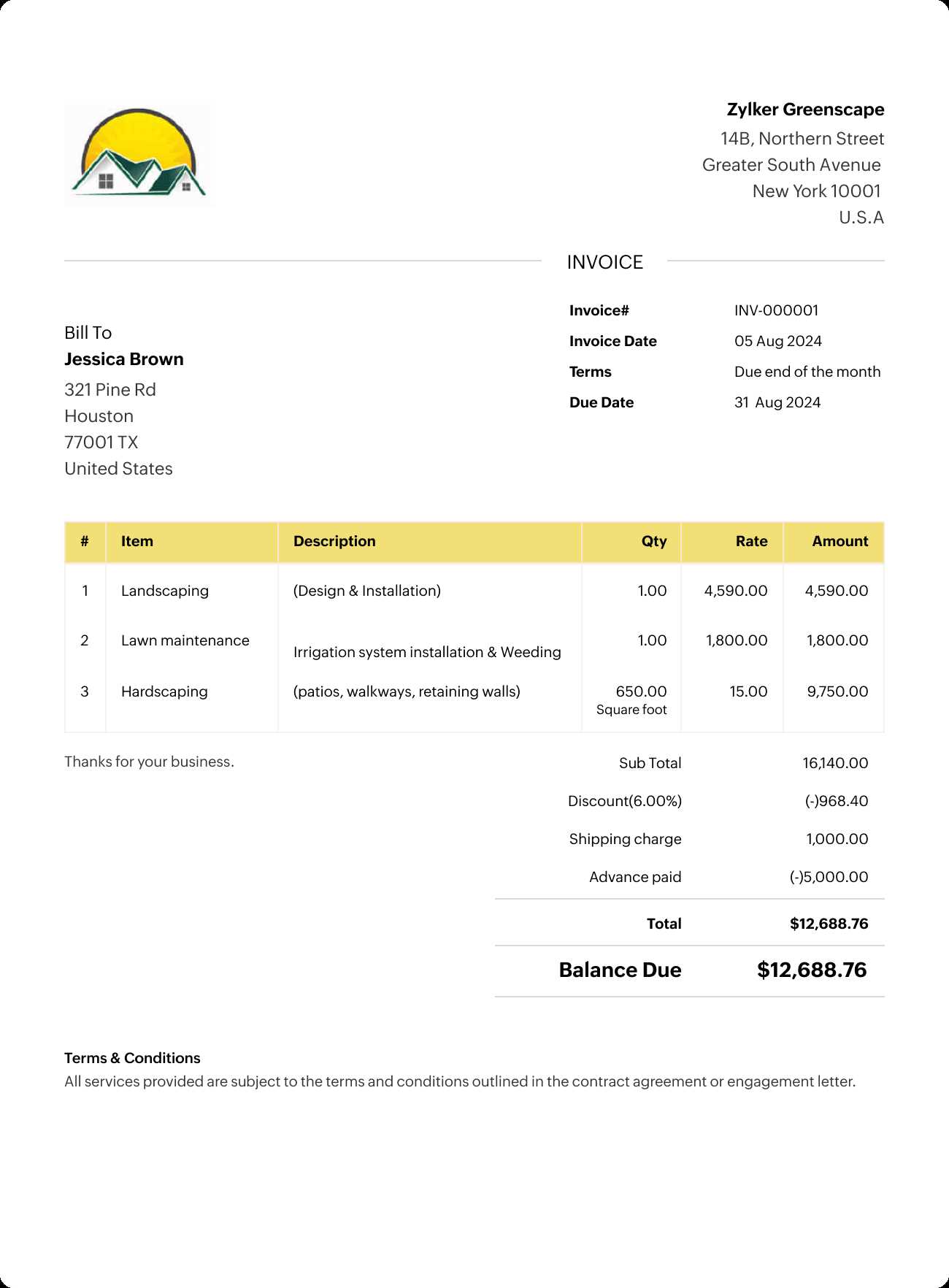

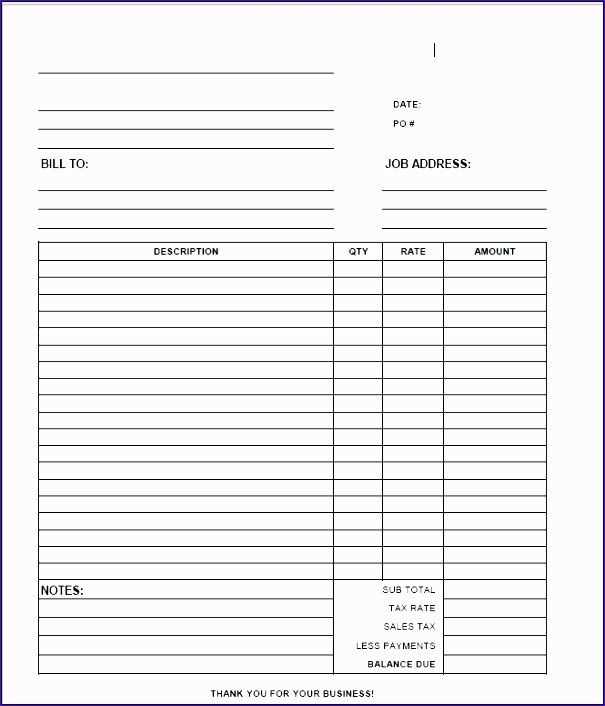

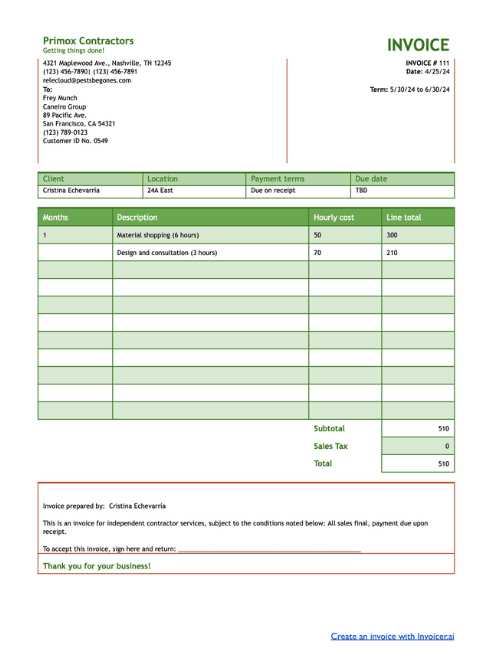

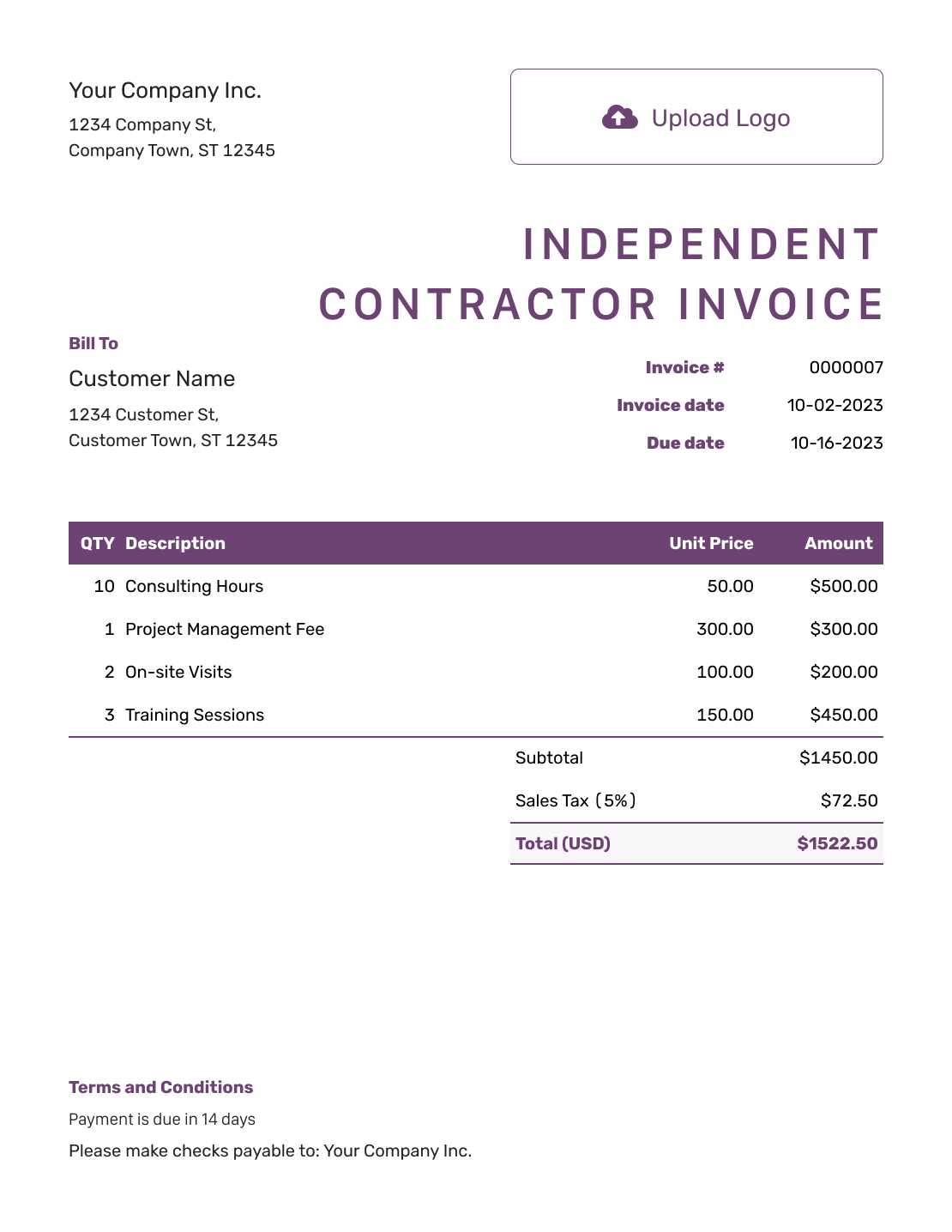

Each record should include several important elements to ensure clarity and prevent any misunderstandings. Typically, it should contain the recipient’s name and contact information, the list of services offered, the agreed-upon rates, and any applicable taxes. Additionally, payment terms and due dates should be clearly stated to avoid delays. Providing this information in an organized format helps both parties stay on track.

Why Accurate Billing Is Important

Accurate documentation not only facilitates smoother financial transactions but also helps with tax reporting and legal protection. When you present clear, itemized lists, clients are more likely to trust the process and respect the payment terms. It also reduces the chance of disputes, which can delay payments and damage professional relationships.

Why Use a Spreadsheet for Billing Documents

Utilizing a spreadsheet to create billing records offers numerous advantages that streamline the process of tracking payments and managing financial details. Spreadsheets provide flexibility, allowing for easy customization to fit the specific needs of any project or client. This tool helps professionals maintain an organized and efficient workflow, reducing errors and saving valuable time.

One of the main benefits is the ability to automate calculations. With the right formulas, totals, taxes, and discounts are automatically calculated, minimizing the risk of mistakes. Additionally, spreadsheets can be easily edited, allowing for quick adjustments to rates, terms, or services without needing to start from scratch. This makes the billing process faster and more accurate.

Another reason for choosing a spreadsheet is its accessibility. Most people are already familiar with the basic features of spreadsheet software, and it can be easily shared, saved, and stored for future reference. This simplicity and convenience make it an ideal solution for freelancers and small businesses that need a cost-effective, professional approach to managing their finances.

Benefits of Customizable Billing Documents

Having the ability to customize your financial records provides significant advantages, especially when dealing with diverse clients and projects. Customizable documents allow you to tailor each entry to meet specific requirements, making it easier to reflect the unique nature of each job. This flexibility not only enhances professionalism but also ensures that all necessary details are included without unnecessary complexity.

One of the main benefits is the ability to adjust the layout and content to suit different industries or client preferences. Whether it’s adding specific service descriptions, including additional charges, or adjusting the payment terms, custom billing records can be modified quickly. This adaptability helps ensure that every transaction is clear and aligned with both your and your client’s expectations.

Another key advantage is the time-saving aspect. Once a customizable format is set up, you can use it repeatedly, making the process of generating records much faster. The consistency in design and structure also enhances the credibility of your business, creating a more professional image with every document sent.

How to Create a Billing Record in Spreadsheet Software

Creating a detailed financial document in a spreadsheet program is an easy and efficient way to manage payments. This method allows you to clearly outline the services provided, total amount due, and payment terms, all in a structured format. By using simple formulas and organized sections, you can produce professional-looking records in just a few steps.

Step-by-Step Process

Start by opening a new spreadsheet and setting up basic sections, such as your business information, client details, and the list of services or products provided. Each section should be clearly labeled for easy reading. You can also include a unique identification number for each document to keep track of your records.

Formatting and Adding Calculations

Next, ensure that all items are properly aligned and easy to read. Use bold text for headings and adjust the column width as necessary. To save time, you can insert formulas to automatically calculate totals, taxes, or discounts. This will ensure that all calculations are accurate and up-to-date, reducing the risk of errors in the final document.

Essential Information for Billing Documents

To ensure a smooth payment process, it’s crucial that your financial documents contain all the necessary details. A comprehensive and clear document not only helps clients understand the charges but also establishes a professional standard. Including key information will make it easier for both parties to track transactions and avoid confusion.

Here are the main components that should be included in every billing document:

- Your Business Information: Include your name, business name (if applicable), address, phone number, and email address. This ensures the client knows how to contact you with any questions or concerns.

- Client Details: Clearly list the client’s name, address, and contact information. It’s important to ensure this information is accurate for billing purposes.

- Unique Invoice Number: Assigning a unique number to each document makes it easier to track and reference past transactions, and helps with organization on both ends.

- Description of Services: Provide a detailed list of the services rendered or products supplied. Each item should have a clear description and quantity (if applicable), along with the rate charged.

- Payment Terms: Specify when the payment is due, such as “Net 30” or “Due on receipt,” and include any late fees or penalties for overdue payments.

- Tax Information: If applicable, include the tax rate or the tax amount being charged. This is crucial for legal and financial accuracy.

- Total Amount Due: Clearly highlight the total amount that needs to be paid, including any taxes or additional fees.

Including these essential details ensures your document is clear, professional, and legally sound. It helps build trust with clients and makes the payment process smoother for everyone involved.

Choosing the Right Layout for Billing Documents

Selecting the right layout for your financial records is essential for ensuring clarity and professionalism. A well-organized layout helps both you and your client easily navigate through the document, making it easier to understand the breakdown of charges and the total amount due. The design should be simple yet structured to ensure all key details are presented in an orderly fashion.

Key Considerations for Layout Design

When choosing a layout, focus on readability and logical flow. Start with your business and client information at the top, followed by a clear description of services rendered or products delivered. Grouping similar information together helps reduce confusion and makes the document easier to follow. Use bold headings for important sections like totals and due dates to draw attention to critical details.

Importance of Consistency and Simplicity

A consistent layout creates a professional image and makes your documents look polished. Avoid cluttering the page with unnecessary elements. Keep fonts and colors simple, and ensure that the spacing between sections is consistent. This will not only improve the visual appeal but also make the document more user-friendly for your clients.

How to Add Payment Terms to Billing Documents

Clearly outlining payment terms in your financial documents is essential for avoiding misunderstandings and ensuring timely payments. By specifying when and how the client should pay, you set clear expectations from the start. Including these details helps prevent delays and provides both parties with a clear agreement on the payment schedule.

Key Payment Terms to Include

When setting payment terms, there are several important details to consider. These terms help guide your client through the process and clarify the timeline for payments:

- Due Date: Clearly state the date by which payment should be made. Common terms include “Due upon receipt” or “Net 30” (payment due within 30 days).

- Late Fees: Specify any penalties for overdue payments, such as a fixed fee or a percentage of the total amount due. This encourages clients to pay on time.

- Accepted Payment Methods: List the methods of payment you accept, such as bank transfers, checks, or online payment platforms like PayPal or credit cards.

- Discounts for Early Payments: If you offer discounts for early settlement, make sure to clearly state the conditions, such as “2% discount if paid within 10 days.”

Why Payment Terms Matter

Clearly defined payment terms help maintain a professional relationship and prevent financial misunderstandings. They provide transparency, set expectations, and offer a reference point for both parties in case of disputes. Well-defined terms also protect you legally, ensuring that clients are aware of their obligations from the beginning.

Formatting Tips for Professional Billing Documents

A well-formatted financial document can make a significant difference in how your work is perceived by clients. The presentation of your records not only affects readability but also reflects your professionalism. By following a few formatting tips, you can create documents that are clear, visually appealing, and easy for clients to navigate.

1. Maintain a Clean and Simple Layout

Keep the design straightforward and avoid clutter. Use ample white space between sections to make the document easy to read. Group related information together, such as contact details, list of services, and payment terms, so that clients can quickly find what they need. A simple design with minimal distractions ensures that the focus remains on the important details.

2. Use Clear and Readable Fonts

Choose a clean, professional font such as Arial or Times New Roman. Use a font size that is easy to read–typically between 10 and 12 points. Headings should be bold or slightly larger than the body text to create a clear visual hierarchy. This makes it easier for your client to quickly identify key sections like totals, due dates, and payment instructions.

3. Include Clear Section Headings

Strong headings help guide the reader through the document. Use headings to clearly separate different sections, such as “Services Provided,” “Total Amount Due,” and “Payment Terms.” This structure allows the client to quickly locate and review each part of the document without unnecessary effort.

4. Highlight Important Information

Make sure the total amount due, payment due date, and any discounts or late fees are easy to spot. You can bold these items or place them in a separate box or section to draw attention. The goal is to make sure the most important information stands out and is easily identifiable at a glance.

5. Use Consistent Formatting Throughout

Consistency is key to maintaining a professional appearance. Ensure that the font style, size, and spacing are consistent across all sections of the document. This helps create a cohesive look and ensures that your document is polished and organized.

How to Calculate Taxes on Billing Documents

Calculating taxes on your financial documents is essential for ensuring compliance with local and national tax regulations. Whether you’re applying sales tax, value-added tax (VAT), or any other applicable tax, it’s important to accurately include these amounts in your documents to avoid errors and legal issues. The process of adding tax involves understanding the tax rate and applying it correctly to the total amount due.

1. Determine the Applicable Tax Rate

The first step is to identify the tax rate that applies to the services or products you’re providing. Tax rates can vary based on location, type of service, or the nature of the goods. For example, some regions have different tax rates for digital products, physical goods, or services. Research the local tax laws or consult with a tax professional to determine the correct rate for your billing.

2. Calculate the Tax Amount

Once you have the tax rate, calculating the tax is straightforward. Use the following formula:

Tax Amount = Total Amount x Tax Rate

For example, if the total amount of the bill is $500 and the tax rate is 8%, the calculation would be:

Tax Amount = $500 x 0.08 = $40

In this case, the tax amount to be added to the total would be $40, bringing the new total due to $540.

3. Add the Tax to the Total Amount

After calculating the tax, add it to the original amount. This will give you the total amount due, including taxes. Ensure that your billing document clearly shows both the tax amount and the final total, so clients can see the breakdown of costs.

4. Special Considerations

If you offer services in multiple jurisdictions, you may need to apply different tax rates depending on the client’s location. Some businesses may also qualify for tax exemptions or discounts, so be sure to account for any such variations when calculating tax for your documents.

Incorporating Client and Project Details

Including detailed information about the client and the specific project is essential for maintaining clear communication and a professional appearance in your financial documents. By specifying relevant details, you ensure that both you and the client are on the same page regarding the services provided and the terms of the agreement. This level of transparency can help avoid confusion and provide a clear reference in case of future questions or disputes.

Client Information

Start by listing your client’s full name or business name, along with their address, phone number, and email. This ensures that all contact details are up to date in case follow-up is needed. Additionally, it’s helpful to include a client ID or reference number, particularly if you work with multiple clients or have recurring projects. This makes it easier to track and organize your records.

Project or Service Details

For clarity, include a description of the work or services provided. Be specific about the nature of the project, including any relevant dates, milestones, or deliverables. If applicable, break the project into individual tasks or stages with corresponding costs. This will help the client see exactly what they are being charged for and help avoid misunderstandings.

Providing this level of detail also serves as a form of documentation for both you and the client. In case of any questions or future revisions to the project, having everything clearly outlined ensures that both parties can refer back to the terms that were initially agreed upon.

Saving and Sharing Your Billing Document

Once your financial document is complete, the next step is to save it in a format that is easy to access and share with your client. The method of saving and distributing your records plays an important role in ensuring that they are received and stored properly. With the right steps, you can ensure that your document is both professional and easily accessible when needed.

Saving Your Document

After finalizing your billing record, it’s important to save it in a secure and accessible format. Most spreadsheet software allows you to save your file in various formats such as .xlsx, .xls, or even .pdf. While .xlsx is ideal for future edits, saving your document as a PDF ensures that your formatting remains intact and prevents unauthorized changes. Always use a clear file name that includes the project or client name and the date for easy identification, such as “ClientName_Project_Invoice_YYYY-MM-DD.pdf.”

Sharing Your Document

When it comes to sharing, email is typically the fastest and most reliable method. Attach the saved file to an email and include a brief message outlining the details, such as the due date and payment instructions. Ensure that the file is not too large to be sent through email by compressing or zipping it if necessary. Alternatively, you can use cloud-based platforms such as Google Drive or Dropbox for easier file sharing, especially for clients who prefer accessing documents through links.

Automating Billing with Spreadsheet Functions

Automating the creation of financial documents can save valuable time and reduce the risk of errors. By utilizing built-in functions in spreadsheet software, you can streamline many of the repetitive tasks involved in generating and managing your records. With just a few simple formulas, you can automatically calculate totals, apply taxes, and even generate unique document numbers, making the entire process faster and more efficient.

Key Functions to Automate Billing

Here are some essential functions you can use to automate various parts of the billing process:

- SUM: This function helps automatically calculate the total of all the charges in a given column, saving time on manual calculations. For example, use =SUM(C2:C10) to add up values in the specified range.

- IF: The IF function is useful for applying conditional rules, such as adding discounts for early payments or applying different tax rates. You can use a formula like =IF(D2

- VLOOKUP: If you have a list of client names, services, or pricing information stored separately, VLOOKUP allows you to automatically pull this information into your document. For example, =VLOOKUP(A2, Prices!A2:B10, 2, FALSE) will fetch the price for a specific service from another table.

- DATE: The DATE function helps automatically insert the current date into your document, ensuring that your records are always up to date. You can also use it to calculate due dates based on your payment terms, such as =DATE(YEAR(TODAY()), MONTH(TODAY()), DAY(TODAY())+30) to add 30 days to the current date.

Benefits of Automation

Using these functions to automate tasks not only saves time but also ensures greater accuracy. By eliminating the need for manual calculations, you reduce the likelihood of human error and ensure that your documents are consistent and reliable. Automation also makes it easier to manage multiple clients or projects, as you can reuse the same automated structure for various records without needing to start from scratch each time.

Tracking Payments and Due Dates

Keeping track of payments and their due dates is essential for maintaining a smooth cash flow and ensuring that you are paid on time. By establishing a clear system for monitoring outstanding balances and upcoming deadlines, you can avoid late payments, identify potential issues early, and maintain good financial standing with your clients. Proper tracking also helps you stay organized and on top of your business’s financial health.

How to Track Payment Status

To efficiently monitor the status of payments, it’s helpful to create a simple tracking system within your document. This allows you to quickly see which clients have paid, which are overdue, and which are still pending. Consider using the following categories:

- Paid: Mark these records with a “Yes” or a checkmark once the payment has been received in full.

- Pending: Use this category for documents that are awaiting payment, making it easy to identify outstanding amounts.

- Overdue: Highlight overdue payments with a different color or flag to quickly alert you to follow up with clients who haven’t yet paid.

Setting and Tracking Due Dates

Including clear due dates in your documents is crucial for managing payment timelines. Be sure to specify the exact due date, as well as any grace period for late payments. To stay on top of upcoming deadlines, you can create a simple list or use conditional formatting to highlight approaching or overdue due dates. Some methods for tracking due dates include:

- Calendar Reminders: Set reminders for yourself in your calendar or project management tool to follow up with clients before or on the due date.

- Conditional Formatting: Use color coding or automatic alerts in your tracking sheet to highlight due dates that are approaching or have passed.

- Regular Updates: Review your list of outstanding payments regularly, updating it with the most recent status of each document to avoid missing any follow-ups.

By tracking payments and deadlines effectively, you can stay organized and ensure timely follow-ups, reducing the risk of missed payments and strengthening your client relationships.

Common Mistakes to Avoid in Billing

While creating and managing financial documents might seem straightforward, there are several common errors that can lead to confusion, delayed payments, and even strained client relationships. Avoiding these mistakes is key to ensuring that your billing process is smooth, professional, and efficient. By being mindful of potential pitfalls, you can ensure that your documents are accurate and your clients are satisfied.

1. Missing or Incorrect Client Information

One of the most basic but critical mistakes is neglecting to include accurate client details. This can lead to confusion, miscommunication, and delayed payments. Always double-check that the client’s name, address, email, and contact number are correct. If you’re working with a business, make sure you include the business name and any relevant identifiers like tax numbers or client IDs.

2. Failing to Specify Payment Terms

Not clearly stating payment terms can cause misunderstandings and delays. Always include precise details on when the payment is due, any discounts for early payments, and any late fees for overdue amounts. Additionally, make sure that payment methods are clearly outlined, so there’s no ambiguity about how the client can settle the amount due.

3. Overlooking Taxes and Additional Fees

Failing to account for taxes or other additional charges can lead to inaccurate billing and potentially even financial penalties. Always ensure that you calculate the appropriate sales tax, VAT, or any other relevant charges and include them in the total. If there are any additional fees such as handling or shipping charges, these should also be clearly outlined in the document.

4. Ambiguous Descriptions of Services or Products

Vague descriptions can lead to confusion about what exactly the client is paying for. Always be specific about the services rendered or products delivered. Break down complex projects into detailed tasks or deliverables, and ensure each is linked to its corresponding cost. This helps the client understand the value of what they are paying for and reduces the likelihood of disputes.

5. Incorrect Calculation of Totals

Errors in calculating the total due–whether from missing items, incorrect rates, or math errors–can create significant problems. Double-check the calculations, and consider using automated formulas in your document to reduce the chances of mistakes. If you’re adding tax or applying discounts, ensure the math is correct, and that the final amount due is clearly visible.

6. Not Following Up on Overdue Payments

Many businesses overlook the importance of following up with clients whose payments are overdue. Failing to track due dates and not sending timely reminders can result in delayed payments and unnecessary stress. Keep a record of due dates and make sure to follow up in a professional and timely manner if the payment has not been received by the specified date.

By being mindful of these common mistakes, you can ensure that your financial documents are clear, accurate, and professional, ultimately helping to avoid payment delays and ensuring smoother transactions with your clients.

Free vs Paid Billing Document Solutions

When it comes to managing your financial paperwork, there are many options for designing and generating professional records. You can choose between free solutions that are often accessible and easy to use, or paid options that may offer more advanced features and customization. Understanding the differences between free and paid solutions will help you determine which option best suits your business needs, depending on your volume of work, the complexity of your services, and your budget.

Free Options

Free solutions are a great choice for individuals or small businesses just starting out or those with simpler needs. These tools often include basic functions such as creating simple records, adding a list of services, and generating totals. Some of the key benefits of free solutions include:

- Cost-effective: As the name suggests, free tools are available at no cost, making them a great option for small businesses or freelancers on a tight budget.

- Ease of Use: Most free solutions are easy to use and don’t require advanced technical skills. They offer straightforward features that allow you to create basic documents quickly.

- Quick Setup: Free solutions often don’t require much time to set up, and you can start generating records almost immediately.

However, free solutions may have limitations, such as fewer customization options, lack of automation, and fewer integrations with other business tools.

Paid Options

Paid solutions offer more advanced features and a greater level of customization. These tools are typically designed for businesses that need to create a large volume of documents or require specific features like automated calculations, recurring billing, or detailed analytics. Some of the benefits of paid solutions include:

- Advanced Features: Paid options typically offer more robust functionality, including automatic tax calculations, customizable templates, and even client management tools.

- Customization: You can often fully tailor the design and layout to match your branding, ensuring that all your documents reflect a consistent and professional appearance.

- Integration with Other Tools: Many paid solutions can integrate with accounting software, payment systems, or customer relationship management (CRM) tools, streamlining your workflow.

- Customer Support: Paid tools often come with customer support options to help you resolve any issues quickly, ensuring you stay productive without delays.

However, the trade-off for these advanced features is a cost, which might be prohibitive for small businesses or individuals just starting out. In addition, some paid options may require a subscription or additional fees for ongoing use.

Choosing between free and paid options depends on the size of your business, your specific needs, and your budget. For simple tasks, a free solution may be sufficient, but if your business is growing or requires more advanced features, a

How to Protect Your Billing Data

Protecting sensitive financial data is essential for maintaining privacy and preventing unauthorized access. Whether you’re handling personal client information, payment details, or financial records, ensuring the security of these documents is crucial. Implementing the right precautions can help safeguard your business from potential data breaches and fraud while maintaining trust with your clients.

1. Use Secure Storage Methods

Storing your financial documents securely is one of the first steps in protecting your data. Whether you store your records on your computer or in the cloud, follow these practices to keep them safe:

- Encryption: Always encrypt sensitive files before saving or sharing them. This ensures that even if someone gains unauthorized access to the file, they cannot read the contents.

- Cloud Storage with Encryption: Using secure cloud storage platforms that offer end-to-end encryption adds an extra layer of protection. Ensure your cloud provider follows best practices for data security.

- Local Backup: Regularly back up your documents to an external hard drive or another secure location to ensure that you don’t lose important data in case of a system failure.

2. Implement Strong Access Controls

Limiting access to your billing documents is key to maintaining control over your sensitive information. Consider these access control measures:

- Password Protection: Always use strong passwords to protect your files and accounts. Avoid common passwords and consider using a password manager for better security.

- Multi-Factor Authentication (MFA): Enable MFA wherever possible to add an additional layer of security to your accounts, such as email or cloud storage, making it harder for unauthorized users to access your information.

- Role-based Access: If you work in a team, limit access to financial data based on roles. Only those who need to view or manage billing information should have access to it.

3. Regularly Monitor and Update Security Measures

Maintaining security requires regular monitoring and updates. Take proactive steps to ensure that your security measures remain effective:

- Software Updates: Ensure that your device’s operating system and any software you use for managing documents are regularly updated to fix any security vulnerabilities.

- Audit Your Access Logs: Periodically review your access logs to identify any suspicious activity or unauthorized attempts to access your files.

- Security Training: If you work with a team, ensure that everyone is aware of best practices for data security, including recognizing phishing atte