QuickBooks Construction Invoice Template for Streamlined Billing

Managing financial transactions in any project-based industry can be a daunting task. Proper documentation ensures timely payments and avoids misunderstandings between contractors and clients. A well-organized system for generating and managing statements can significantly improve cash flow and streamline operations. This guide will help you understand how to simplify billing processes using a reliable solution designed to fit the needs of professionals in construction and other service-driven fields.

By utilizing a structured format to issue requests for payment, businesses can easily track charges, monitor outstanding amounts, and maintain clear records of all financial exchanges. Adopting an efficient system tailored for specific needs helps avoid errors and delays while ensuring clients are satisfied. This article will cover the benefits of using an automated approach, the key features to look for, and how to set up your documents to maximize productivity and minimize mistakes.

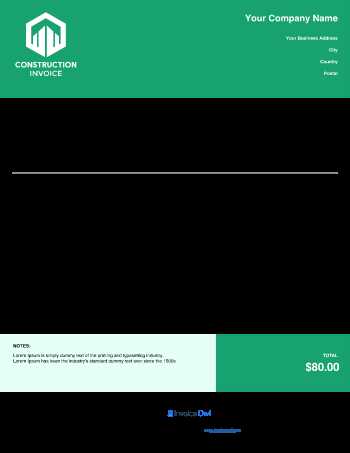

QuickBooks Construction Invoice Template Overview

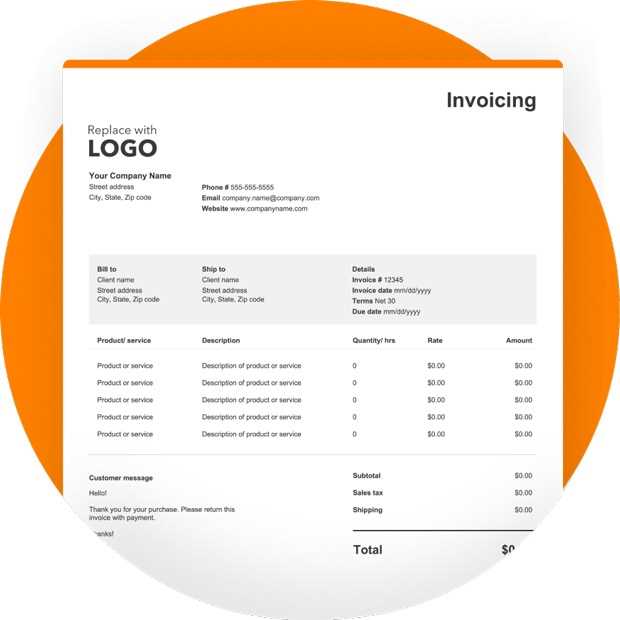

Efficient billing is crucial for businesses that operate on a project basis, ensuring smooth cash flow and professional client relations. A structured document for requesting payments not only makes the process easier but also reduces the chances of errors or disputes. With the right tools, professionals can generate clear, accurate statements that reflect all necessary details, allowing for quick and easy transactions.

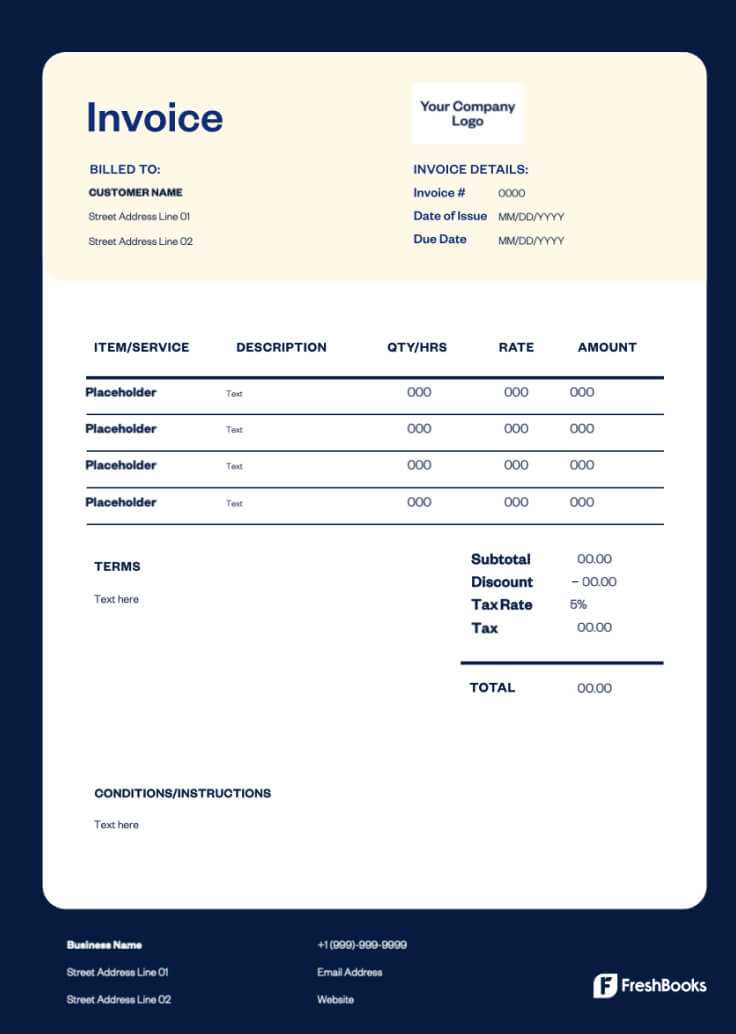

This particular solution offers a pre-designed format that simplifies creating and managing payment requests. By automating much of the process, it helps save time and reduce the need for manual data entry. Below are some of the key features of such a system:

- Customizable Layouts: Adaptable to different project types and client needs.

- Clear Structure: Ensures all relevant details, from labor costs to materials, are included.

- Automated Calculations: Automatically computes totals and taxes, minimizing errors.

- Professional Appearance: Creates documents that enhance your business’s reputation.

- Easy Payment Tracking: Helps monitor outstanding balances and payment statuses in real-time.

These features make it a useful tool for managing the complexities of billing in industries with varying project requirements. Whether you are handling multiple clients or large-scale tasks, this system allows for a more organized and efficient approach to collecting payments. The automation and customization options ensure that you can focus on delivering quality work while the financial side runs smoothly in the background.

Why Choose QuickBooks for Invoicing

When it comes to managing billing and financial transactions, having a reliable system in place is essential for maintaining professionalism and efficiency. Choosing the right tool for generating payment requests can make a significant difference in how quickly and accurately you get paid, as well as how easily you can track and organize payments. The right solution not only simplifies the process but also integrates seamlessly with other aspects of financial management.

Key Features That Stand Out

One of the primary reasons professionals choose this tool is the comprehensive set of features that support not only billing but also other financial tasks. From calculating totals to tracking expenses, this system offers a variety of functionalities that help businesses manage their finances in one place. Here’s a breakdown of the main benefits:

| Feature | Benefit |

|---|---|

| Automated Calculations | Reduces errors by automatically calculating totals, taxes, and discounts. |

| Customizable Layouts | Allows businesses to tailor documents to their specific needs and branding. |

| Integration with Financial Tools | Syncs with other accounting software, helping you manage your books efficiently. |

| Easy Payment Tracking | Offers real-time updates on payment statuses and balances, keeping you informed. |

| Professional Appearance | Generates clean, professional-looking documents that enhance client relationships. |

How It Benefits Your Business

By using this platform, businesses benefit from its ability to automate time-consuming tasks, ensure accuracy, and create a seamless workflow between project management and financial documentation. The ability to manage all your finances in one place, from generating requests for payments to tracking expenses, leads to a more organized and stress-free experience. This tool not only improves your billing process but also helps build stronger relationships with clients by offering a clear, professional service.

Benefits of Using a Template

Utilizing a pre-designed format for generating financial documents offers numerous advantages to businesses. It streamlines the billing process, reduces the likelihood of errors, and ensures consistency across all communication with clients. With a well-structured document, business owners and professionals can focus on their core tasks, knowing that their payment requests are accurate, clear, and professional.

Time and Efficiency Savings

One of the primary benefits of using a structured approach is the significant time savings. Instead of creating a new document from scratch for every project or client, a pre-built format can be customized quickly to fit the specific job. This allows businesses to:

- Reduce preparation time: Pre-defined fields for important details mean less time spent on manual entry.

- Streamline workflows: Avoid starting from a blank page each time, speeding up the process of issuing documents.

- Focus on client work: Spend more time on delivering value to clients and less on administrative tasks.

Enhanced Professionalism and Accuracy

When using a standardized format, the final documents appear polished and uniform. This enhances the credibility of the business and provides a professional image to clients. Furthermore, these layouts often include automated calculations, reducing the risk of mistakes and ensuring that:

- All necessary details are included: Items like taxes, discounts, and payment terms are automatically incorporated.

- Invoices are error-free: Automatic computations ensure that totals, tax calculations, and itemized lists are correct.

- Consistency is maintained: Every document follows the same format, ensuring that clients receive the same professional experience every time.

By adopting a structured approach to generating payment requests, businesses not only save valuable time but also boost their reputation by delivering accurate and professional documents every time.

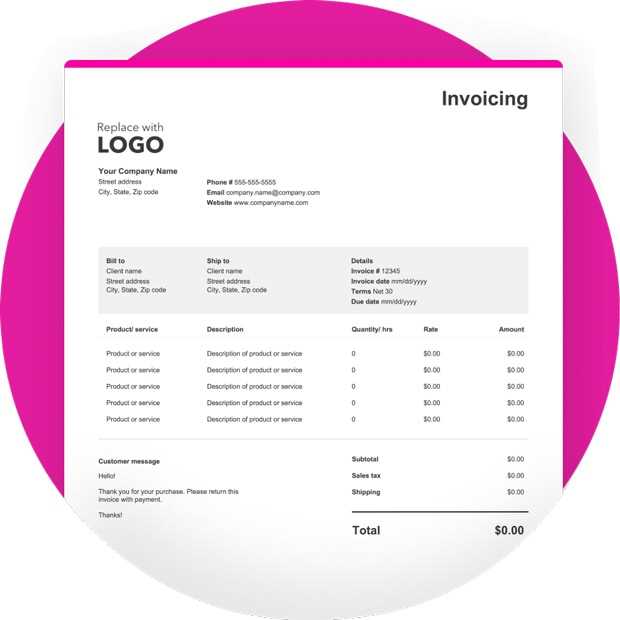

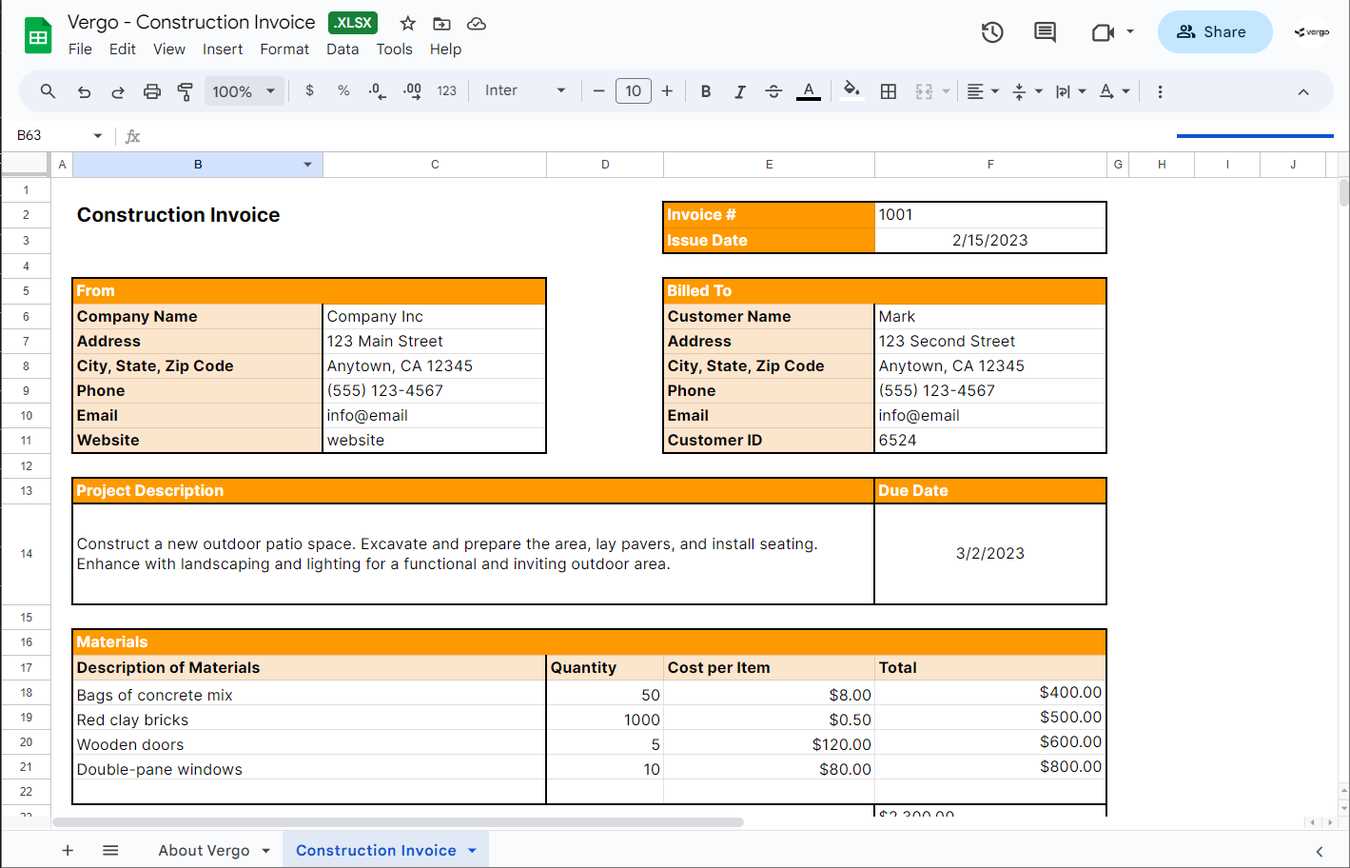

How to Customize Your Template

Personalizing your document format is key to aligning it with your business’s specific needs and branding. Customization ensures that your payment requests reflect the right information, style, and tone, creating a more professional appearance. By adjusting certain elements, you can tailor the document to suit various client types and project requirements, making it more effective and accurate.

Steps to Personalize Your Document

Customizing your document is a simple process that allows you to make necessary adjustments to both the layout and content. Here are some essential steps to follow:

| Step | Action |

|---|---|

| 1 | Edit the Header: Include your company logo, business name, and contact details to enhance branding. |

| 2 | Modify Field Labels: Adjust section titles to fit the specifics of your industry or service. |

| 3 | Update Payment Terms: Set your preferred payment terms, including due dates, discounts, and late fees. |

| 4 | Add Custom Fields: Insert additional information like job descriptions or project milestones that are relevant to each request. |

| 5 | Adjust Color Scheme: Customize the design with your business’s colors to maintain a cohesive look with other branding materials. |

Final Adjustments and Saving

Once you’ve made the necessary changes, it’s important to review the document for accuracy. Ensure that all fields are filled correctly and that the layout is easy to understand. After finalizing your adjustments, save the new version for future use, so you can quickly generate customized payment requests without starting from scratch each time.

By following these steps, you can create a document that not only suits your business needs but also enhances your professional image when communicating with clients.

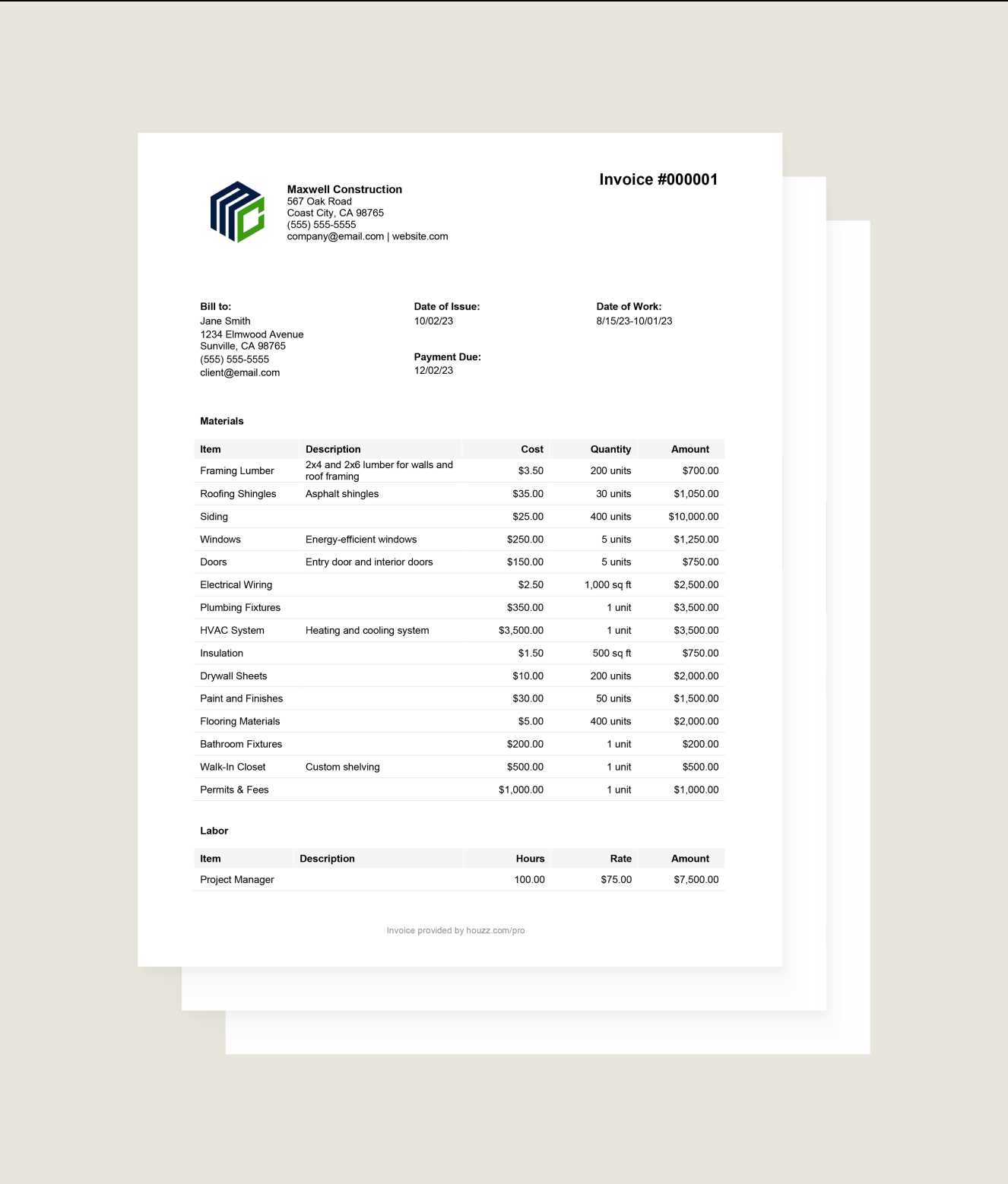

Essential Information for Construction Invoices

Creating clear and accurate payment requests requires including all necessary details that ensure both parties understand the terms of the agreement. Without the right information, misunderstandings and delays in payments can arise. A well-organized document includes specific fields that outline the services provided, costs involved, and payment expectations. Knowing what details to include ensures smooth transactions and helps maintain professional relationships with clients.

Key Elements to Include

For a complete and professional document, certain information should always be included to avoid confusion and ensure that payments are processed on time. These elements should be present in every document you generate:

- Client and Business Details: Include the business name, client name, addresses, and contact information for both parties.

- Unique Document Number: Assign a unique reference number to each document to track and manage payments more effectively.

- Itemized List of Services or Goods: Break down the work performed, materials used, and the corresponding costs. This helps clients understand what they are being charged for.

- Payment Terms: Clearly state payment due dates, any applicable discounts, and late fees to ensure clarity on payment expectations.

- Total Amount Due: Provide a final amount that includes all charges, taxes, and any additional costs that apply to the project.

- Tax Information: Include any taxes that are applicable, such as sales or service tax, and indicate the rates applied.

Optional Additions for Enhanced Clarity

While the above information is essential, you may also include additional details that further clarify the terms and help maintain transparency. Some optional elements to consider adding are:

- Payment Methods: Specify acceptable forms of payment, such as bank transfers, checks, or online payment options.

- Job or Project Number: Add a reference to the project or work order number, especially if handling multiple jobs at once.

- Notes or Special Instructions: Include any custom terms or conditions relevant to the work performed or payment terms.

By ensuring all the essential details are included, you create a comprehensive document that supports transparency and helps build trust with clients. A clear and professional payment request is key to a smooth and efficient transaction process.

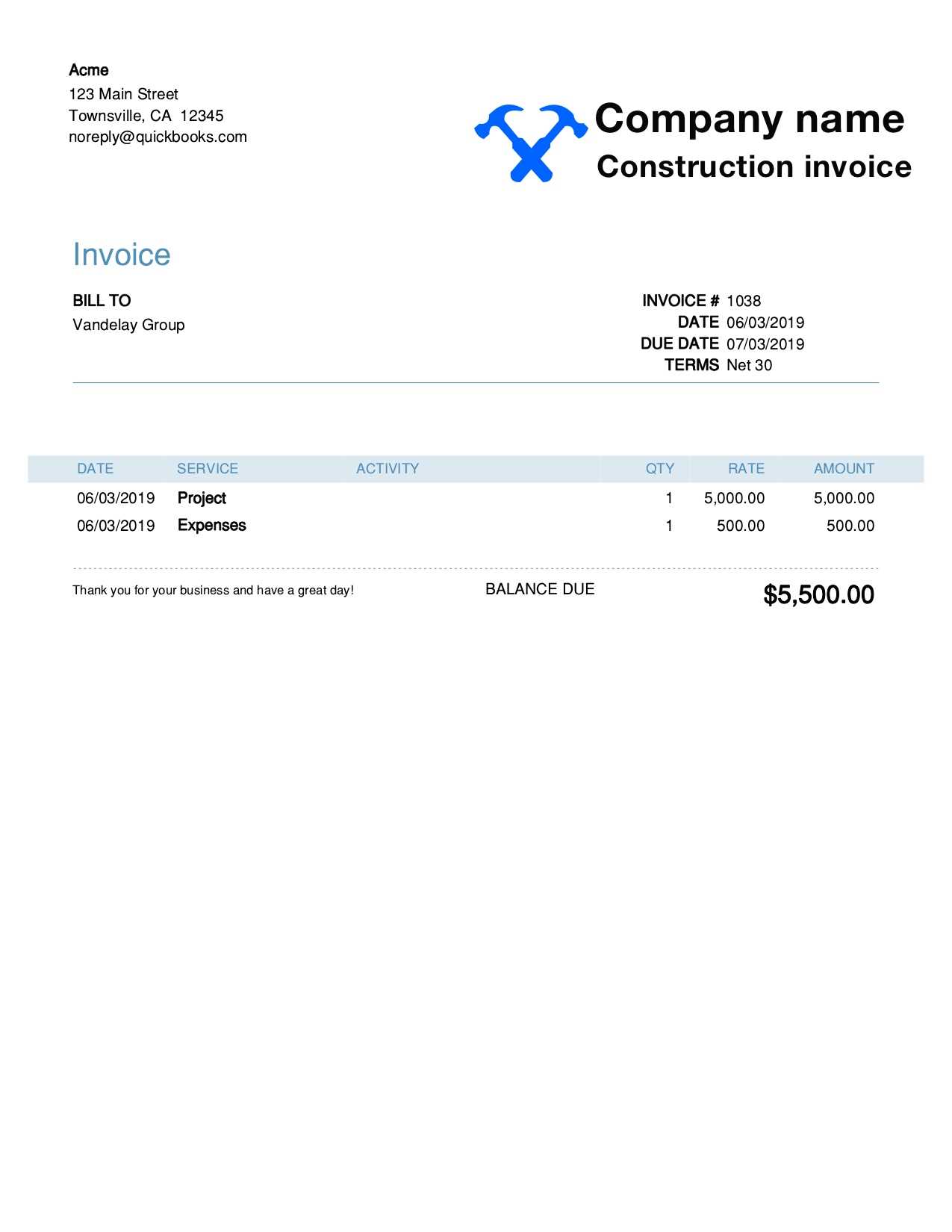

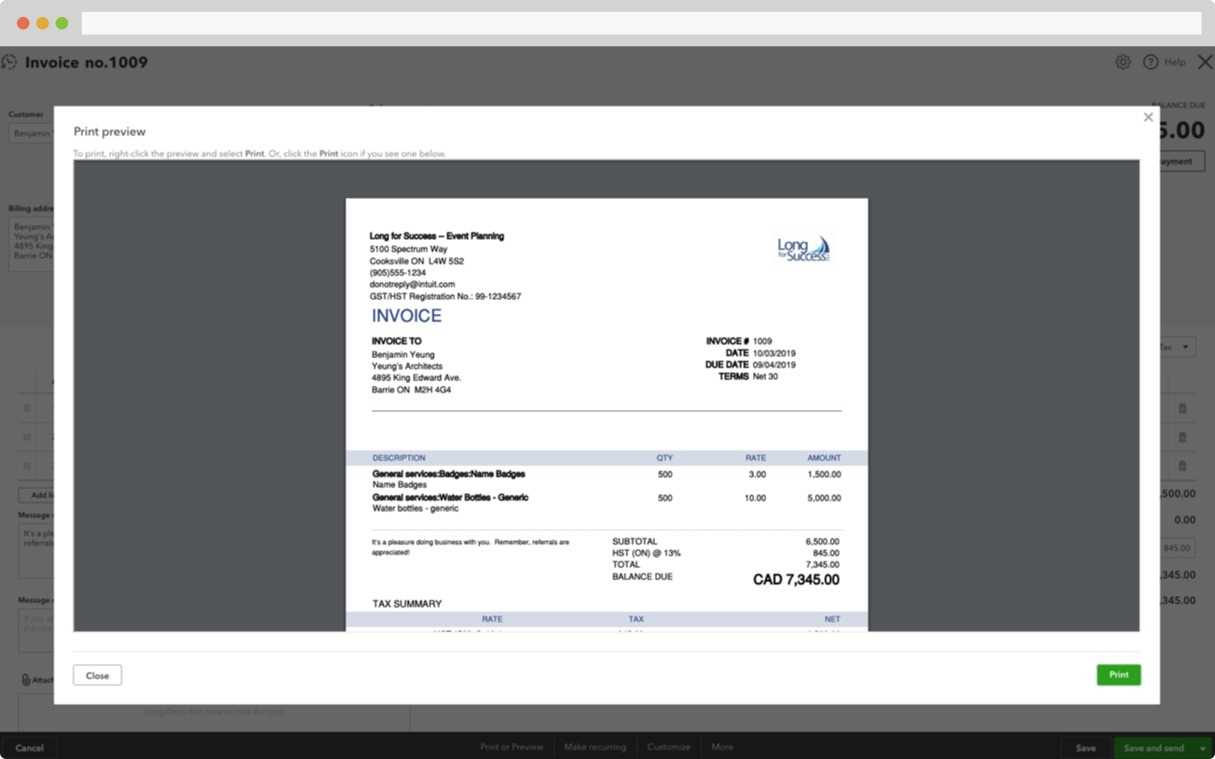

Step-by-Step Guide to Creating Invoices

Creating a clear and effective payment request is a straightforward process when you follow a structured approach. By carefully including the right details and following a logical order, you can ensure that your document is accurate, professional, and easy for your clients to understand. This step-by-step guide will walk you through the process of preparing a payment request that clearly outlines the work performed, amounts due, and payment terms.

1. Gather Necessary Information

Before starting, make sure you have all the essential details about the job, client, and payment terms. This will ensure that your document is complete and accurate. Key information to gather includes:

- Client’s full name and contact information

- Your business name, address, and contact details

- Details of the work or materials provided

- Payment terms, including due dates and any applicable discounts or late fees

- Applicable taxes or additional charges

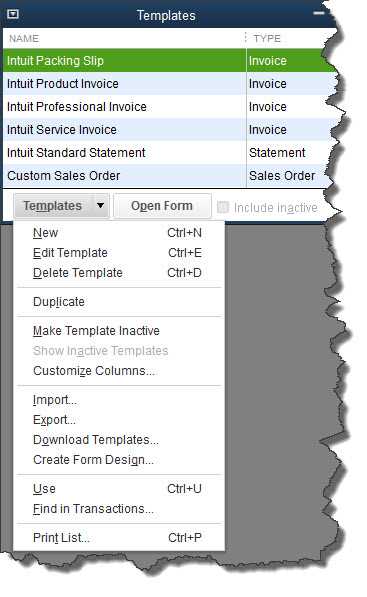

2. Select a Pre-Designed Format or Create a New One

Next, choose a pre-designed format that fits your business needs or create a custom layout that includes all necessary fields. If you are using a pre-built format, simply input your details into the corresponding sections. If you are starting from scratch, consider these key sections for your layout:

- Header with your business name, logo, and contact information

- Client details and job information

- Itemized list of services and corresponding costs

- Space for payment terms and due dates

- Final total amount due

3. Fill in the Details

Now it’s time to enter the information into the document. Follow these steps to ensure accuracy:

- Client Details: Enter the client’s full name, address, and contact information.

- Business Information: Include your business name, address, and phone number.

- Job Description: Provide a clear breakdown of the work or materials provided, including any relevant dates.

- Charges: List each item or service provided with its associated cost.

- Taxes and Discounts: Apply any applicable taxes or discounts and include those in the total calculation.

- Total Due: Clearly state the total amount that the client owes, including all taxes, discounts, and fees.

- Payment Terms: Specify the payment due date and any late fees that apply if the payment is not made on time.

4. Review and Finalize

Once you’ve filled in all the details, take a moment to review the document for accuracy. Check that all calculations are correct, the client details are correct, and there are no missing items. Double-check the payment terms to ensure clarity, and make sure your contact information is up to date. Once everything is accurate, save the document for future reference and send it to your client.

How to Track Payments Effectively

Monitoring incoming payments is a critical task for businesses, ensuring that cash flow remains steady and that outstanding amounts are promptly collected. Effective payment tracking allows you to identify any overdue balances, maintain accurate financial records, and ensure a smooth transaction process with clients. By using the right tools and methods, businesses can stay on top of their finances and avoid potential issues with late or missed payments.

To track payments efficiently, it’s important to set up a system that captures all relevant payment details, from initial charges to final settlements. Below are some strategies for keeping track of payments and ensuring you don’t miss any important updates:

| Method | How It Helps |

|---|---|

| Use of Payment Records | Maintain detailed records for each transaction, including dates, amounts, and payment methods. This provides a clear overview of what has been paid and what is still outstanding. |

| Automated Alerts | Set up reminders for upcoming payment due dates and alerts for overdue balances. Automated reminders help ensure that payments are made on time, minimizing delays. |

| Client Communication | Regularly communicate with clients to confirm receipt of payments and to address any discrepancies or questions. Clear communication helps avoid misunderstandings. |

| Reconcile Accounts | Periodically review and reconcile your financial records to ensure that all payments are correctly accounted for and that no payments are missed. |

| Use Digital Tools | Leverage software or apps designed for payment tracking to automate the process and easily track both incoming and overdue payments in real-time. |

By implementing these methods, businesses can ensure that payments are tracked accurately and efficiently. Staying organized and proactive in managing your payment records helps improve cash flow, reduce late payments, and keep clients satisfied with timely transactions.

Time-Saving Features of QuickBooks

Running a business efficiently often comes down to how well you can streamline repetitive tasks and reduce the time spent on administrative work. Automated tools can save significant time by simplifying complex processes and minimizing manual effort. With the right system, many aspects of your financial and billing workflows can be automated, giving you more time to focus on what matters most: growing your business.

The right platform offers a variety of time-saving features designed to automate common tasks and improve accuracy. By leveraging these tools, you can speed up administrative processes and reduce the likelihood of errors that might otherwise require additional time to fix. Here are some key features that can help save valuable time:

- Automated Calculations: Automatically calculates totals, taxes, and discounts, reducing the need for manual number crunching.

- Recurring Transactions: Set up recurring billing schedules for regular clients, so you don’t need to manually enter details each time.

- Bank Integration: Automatically sync your bank account and credit card transactions to streamline the reconciliation process.

- Pre-built Templates: Use ready-made documents that require only minor adjustments, saving time on formatting and content creation.

- Online Payment Options: Allow clients to pay directly from their documents, speeding up the collection process and reducing follow-up time.

- Expense Tracking: Automatically track and categorize expenses, so you don’t have to manually log every purchase or payment.

- Customizable Reports: Generate detailed financial reports with a few clicks, helping you analyze your business performance without spending hours on data entry.

These features allow business owners and managers to automate routine tasks, keep operations running smoothly, and focus on more important aspects of their work. By reducing the time spent on day-to-day management, you free up resources for growth and client engagement.

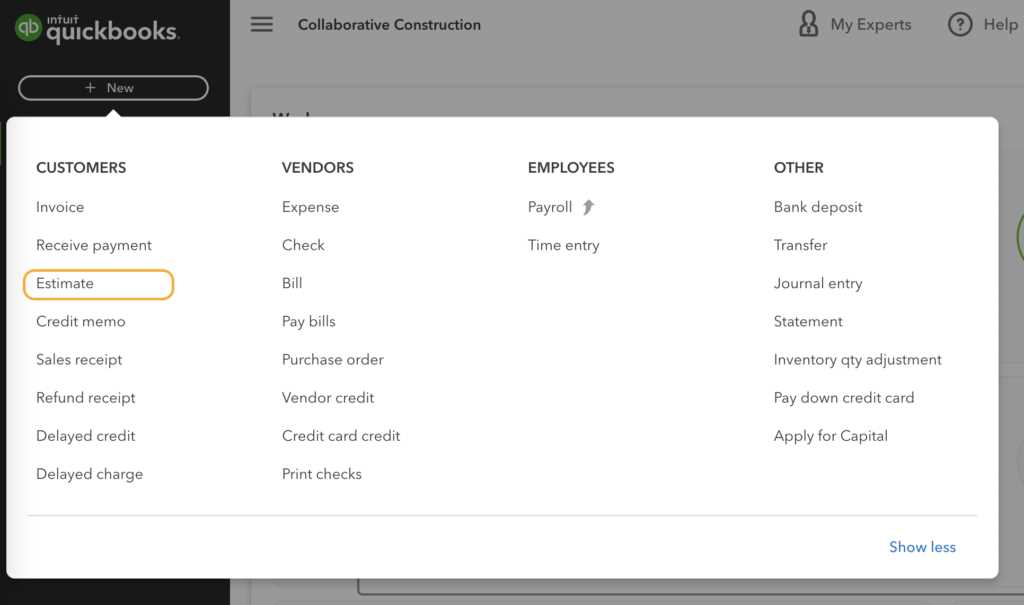

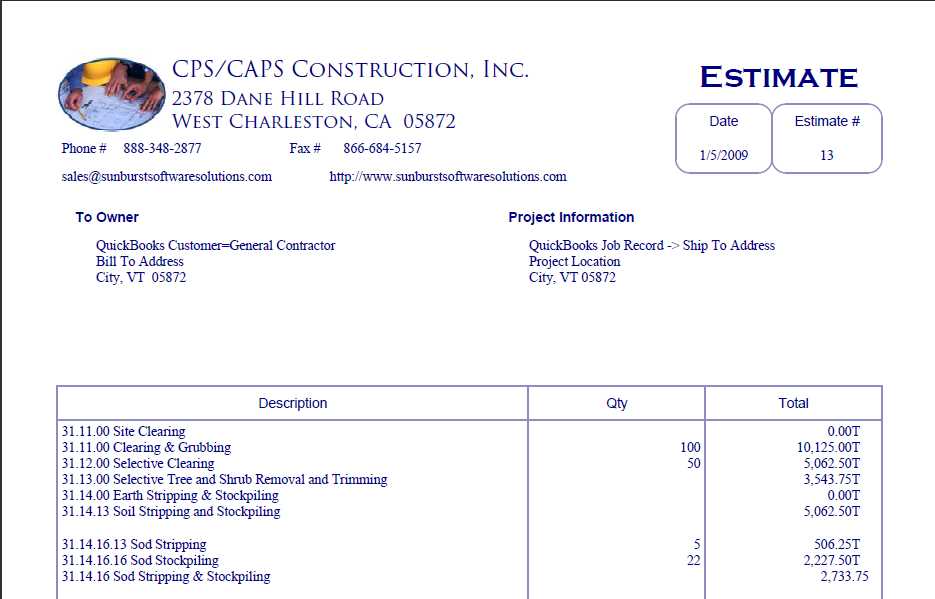

Integrating Estimates and Invoices in QuickBooks

Managing both estimates and payment requests effectively is crucial for maintaining smooth financial operations. By integrating these two essential documents, businesses can streamline their workflow, reduce the risk of errors, and ensure consistency across all stages of a project. This process allows for seamless transitions from initial proposals to final payments, ensuring that every aspect of the financial relationship is covered.

When you integrate cost estimates with payment requests, you can avoid discrepancies between what was promised and what is charged. The integration allows for automatic updates and consistency across both documents, making it easier to track progress and outstanding balances. Below are some key benefits of integrating these financial documents:

- Consistency: Ensures that the amounts, services, and terms provided in the estimate are reflected accurately in the payment request, reducing errors and confusion.

- Efficiency: Saves time by eliminating the need to manually transfer data from one document to another, automating the process of converting an estimate into a final payment request.

- Clear Communication: Helps ensure that both the client and the business are on the same page regarding expectations, prices, and terms, improving trust and transparency.

- Better Tracking: Enables businesses to track which estimates have been turned into payment requests, making it easier to monitor project progress and payments.

- Accuracy: Automatically applies any adjustments or changes made to the original estimate to the final payment request, ensuring that the client is charged correctly.

Integrating estimates and payment requests also simplifies your reporting and accounting processes. By linking these two documents, you can easily track the status of projects, client balances, and any pending payments. This ensures your financial records are always up to date and accurate.

By setting up an integrated system, businesses can improve overall workflow, save time, and reduce the administrative burden associated with managing multiple financial documents.

How to Handle Multiple Job Sites

Managing multiple work locations simultaneously can be a complex task, requiring careful coordination and organization to ensure everything runs smoothly. Tracking progress, materials, and costs at different sites demands a system that can handle diverse needs while maintaining consistency across all projects. Proper management of multiple job sites ensures that each project remains on schedule, within budget, and meets client expectations.

Organizing and Tracking Each Site

To handle several job sites effectively, it’s important to set up a clear system that differentiates each location while maintaining a unified approach to managing overall operations. Here are some tips for staying organized:

- Create Site-Specific Folders: For each project, set up dedicated folders (digital or physical) that contain all relevant information, including contracts, timelines, costs, and communication records.

- Use Job Codes or Numbers: Assign unique identifiers to each job location, making it easier to track expenses, resources, and milestones related to that particular site.

- Track Materials and Labor: Maintain a record of materials used and labor hours worked at each site, ensuring you can manage resources effectively without overspending or running into shortages.

Communicating and Monitoring Progress

Good communication is key to keeping all job sites running smoothly. Here are some strategies to improve oversight and coordination:

- Regular Site Updates: Set up a system for daily or weekly updates from each site supervisor or team lead, outlining progress, challenges, and upcoming needs.

- Centralized Reporting: Consolidate all site data into a central location for easier monitoring, comparison, and decision-making. This ensures you stay on top of costs, schedules, and deliverables.

- On-Site Meetings: Hold periodic check-ins with teams on different job sites to address concerns, clarify expectations, and ensure everything is aligned with the project plan.

By organizing and communicating efficiently, you can manage multiple locations effectively, ensuring that all projects stay on track and meet deadlines without overwhelming your team. An organized system for each site will also simplify billing and client updates, streamlining administrative tasks and improving overall productivity.

Ensuring Accuracy in Construction Billing

Accurate billing is crucial for maintaining positive relationships with clients and ensuring that your business runs smoothly. Errors in billing can lead to misunderstandings, delays in payments, and a loss of trust. It’s important to implement systems that help track costs, labor, materials, and other project details accurately, so every charge is justified and clear. By establishing a solid process for billing, you can ensure that all charges are correct and transparent for your clients.

Key Practices for Accurate Billing

To avoid mistakes and ensure accuracy in your billing process, it’s important to follow a few best practices. Here are some strategies for effective billing:

- Detailed Record-Keeping: Keep thorough records of all project-related activities, including labor hours, materials, and services provided. Accurate documentation is the foundation of a precise billing system.

- Itemized Charges: Break down the costs for each task or item. This provides clarity for the client and ensures that no charge is overlooked or misunderstood.

- Cross-Check All Information: Before finalizing any billing document, double-check the calculations, dates, and any additional charges to confirm that everything is accurate.

- Clear Terms and Conditions: Set expectations clearly in your contracts, ensuring that both you and the client understand the pricing structure, payment schedule, and any additional fees.

- Use Standardized Formats: Use a consistent structure for every payment request, ensuring that clients can easily compare and understand charges from one document to the next.

Common Billing Errors to Avoid

Billing errors can be costly and damage your reputation with clients. Here are some common mistakes to avoid:

- Omitting Important Details: Leaving out key information, like job codes or descriptions, can confuse clients and delay payments.

- Incorrect Calculations: Simple math errors can lead to overcharging or undercharging, both of which can harm your business.

- Missing Deadlines: Not submitting billing documents on time can result in delayed payments and strain relationships with clients.

- Inconsistent Terms: Inconsistent or unclear payment terms can lead to misunderstandings and disputes over what’s owed.

By paying attention to detail, cross-checking your records, and avoiding common mistakes, you can ensure that your billing process is accurate and efficient. This not only improves client trust but also helps streamline you

Managing Late Payments with QuickBooks

Late payments can create significant challenges for businesses, affecting cash flow and potentially disrupting operations. It’s important to have a system in place that helps you track overdue balances, send reminders, and follow up with clients efficiently. By using automated tools, you can stay on top of overdue payments and reduce the administrative burden of chasing down unpaid amounts, allowing you to focus on running your business.

Steps for Effectively Managing Delayed Payments

To handle late payments effectively, follow these steps to ensure that overdue balances are addressed promptly and professionally:

- Set Clear Payment Terms: Establish clear payment deadlines and communicate them to clients upfront. This helps set expectations and reduces the likelihood of missed payments.

- Send Automated Payment Reminders: Set up automated reminders that notify clients when their payment is approaching or overdue. Timely reminders encourage prompt payment without requiring you to manually follow up.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering different payment methods such as credit card, bank transfer, or online payment links.

- Establish Late Fees: Clearly outline the consequences of overdue payments, such as late fees or interest charges, in your payment terms. This encourages clients to pay on time and discourages delays.

- Track Payment Status: Regularly monitor the status of payments and track overdue amounts. This allows you to stay organized and avoid missing any important follow-up actions.

Dealing with Persistent Late Payments

If a client consistently misses payment deadlines, it’s important to take further steps to resolve the issue. Here are some strategies for dealing with persistent late payers:

- Direct Communication: If automated reminders and late fees don’t work, reach out to the client directly. A polite but firm conversation can often resolve issues quickly.

- Offer Payment Plans: For clients who are struggling financially, consider offering a payment plan or installment option to help them meet their obligations over time.

- Review Contract Terms: If late payments become a regular issue, it may be time to revisit your contract terms and make adjustments that ensure better payment compliance going forward.

By following these steps, businesses can reduce the impact of late payments, improve cash flow, and maintain better relationships with their clients. Automated reminders and organized tracking systems make it easier to stay on top of overdue balances and keep operations running smoothly.

Improving Client Communication through Invoices

Effective communication with clients is essential for maintaining strong relationships and ensuring smooth business operations. One often-overlooked but crucial tool for communication is the billing document. By providing clear, detailed, and professional billing statements, businesses can help clients better understand the services provided, the costs incurred, and any additional terms or conditions. This clarity fosters trust, reduces misunderstandings, and encourages timely payments.

Key Elements to Enhance Communication

When it comes to using billing documents as a communication tool, the information provided and how it is presented plays a crucial role. Here are several elements that can improve client communication:

- Clear Descriptions of Services: Break down each service or product with a clear description. This helps clients understand exactly what they are being charged for, preventing confusion.

- Detailed Costs and Calculations: Include itemized costs, taxes, and discounts, along with any adjustments. Transparency in pricing shows professionalism and helps clients feel confident in the accuracy of the charges.

- Payment Terms and Due Dates: Clearly state payment terms, due dates, and any late fees. Clear terms make it easier for clients to understand their financial obligations and helps prevent overdue payments.

- Personalized Messages: Including a brief message or thank-you note can add a personal touch to the document, making clients feel valued and appreciated for their business.

- Easy-to-Read Format: Organize the document in a clean, structured layout, with easy-to-read fonts and logical sections. A clutter-free format makes the document more approachable and easier to understand at a glance.

Benefits of Enhanced Communication

By improving the way you communicate through billing documents, you can experience several benefits that contribute to smoother business interactions:

- Builds Trust: Clients appreciate transparency and professionalism. Clear, well-organized documents make it easier to trust that charges are accurate and justified.

- Reduces Disputes: When clients understand exactly what they are being billed for, there is less room for confusion and disagreements over charges.

- Improves Payment Timeliness: Transparent billing terms and clear due dates can help clients prioritize payments and reduce the likelihood of delays.

- Enhances Client Relationships: Demonstrating attention to detail and clear communication shows clients that their business is valued, helping to build long-lasting, positive relationships.

By incorporating these best practices, businesses can improve client communication, create a smoother billing experience, and encourage timely payments. With better communication, the overall client experience is improved, leading to high

Common Mistakes to Avoid When Billing

Billing errors can lead to delayed payments, client dissatisfaction, and unnecessary disputes. It’s essential to avoid common mistakes that can undermine the accuracy and professionalism of your financial documents. By paying attention to detail and ensuring accuracy, you can streamline your payment process and maintain positive relationships with clients. Here are some of the most frequent mistakes that businesses should be mindful of when creating payment requests.

Key Billing Mistakes to Avoid

Understanding where mistakes commonly occur is the first step toward improving the billing process. Here are some common errors businesses make and how to avoid them:

- Failure to Provide Detailed Descriptions: Failing to break down the services or products in detail can lead to confusion. Clients need to understand what they are being charged for, and unclear descriptions can lead to disputes or delays in payment.

- Incorrect Calculations: Simple mathematical errors, such as miscalculating totals, taxes, or discounts, can create mistrust. Always double-check calculations or use automated tools to ensure accuracy.

- Not Including Payment Terms: Omitting payment terms, such as the due date or late fees, can cause confusion about when and how payments should be made. Be sure to include clear, concise payment instructions on each document.

- Inconsistent Formats: Using different formats for each billing statement can confuse clients and make it harder to track payments. Maintain a consistent format for all documents to ensure clarity and professionalism.

- Delaying Billing: Waiting too long to send out a payment request can delay cash flow and create confusion about the terms of the agreement. Send out billing documents promptly to avoid any delays in payment processing.

Consequences of Billing Mistakes

Making billing mistakes can have long-term consequences for your business. Some of the risks include:

- Delays in Payments: Incorrect or unclear documents are often ignored or questioned, leading to payment delays and potential cash flow issues.

- Damaged Client Relationships: Mistakes in billing can lead to frustration and a loss of trust, damaging your professional relationship with clients.

- Legal or Financial Issues: Repeated errors may lead to contractual disputes or even legal challenges, especially if the mistakes lead to overcharging or misunderstanding of payment terms.

By staying mindful of these common billing errors and taking steps to avoid them, businesses can improve their cash flow, build stronger client relationships, and avoid unnecessary complications. An organized, clear, and accurate billing process is key to maintaining a smooth and efficient operation.

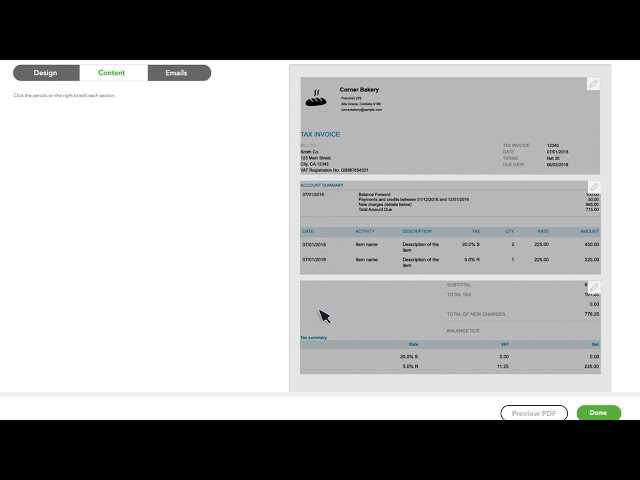

How QuickBooks Helps with Tax Compliance

Staying compliant with tax regulations is a critical aspect of running any business. Ensuring that you collect, report, and pay taxes accurately can be a daunting task without the right tools. Fortunately, accounting software solutions provide automated features to help businesses manage their tax responsibilities with ease. These tools can track taxable income, apply appropriate tax rates, and generate reports that simplify the process of filing taxes.

Key Features That Aid Tax Compliance

When managing tax obligations, there are several features in accounting software that can help you stay organized and avoid mistakes. Here are some of the most valuable tools:

- Automated Tax Calculations: The software automatically applies the correct sales tax, VAT, or other applicable taxes to each transaction based on location and tax laws, reducing the chance of errors.

- Real-Time Tax Reporting: You can generate reports that show the taxes collected and owed at any given time. This allows you to keep track of your liabilities and plan for tax payments.

- Customizable Tax Rates: Tax rates can be customized according to the jurisdictions in which you operate, ensuring that you’re always charging the correct amount for services and products.

- Expense Tracking for Deductions: By tracking business expenses automatically, the software helps you identify potential deductions that can reduce your taxable income, ensuring you don’t miss any opportunities to lower your tax burden.

- Tax Filing Reminders: The system can send reminders about tax deadlines, ensuring you never miss a filing date and avoid late fees or penalties.

How Automated Tax Features Improve Accuracy

Accuracy is key when it comes to tax filings. Here’s how automated features help improve tax accuracy:

| Feature | Benefit |

|---|---|

| Tax Rate Lookup | Automatically applies the correct rate based on your location and the type of goods or services provided. |

| Taxable Income Calculation | Tracks taxable income and adjusts calculations according to your transactions, ensuring accurate reporting. |

| Audit Trails | Provides a detailed history of changes made to your financial data, offering transparency and helping in case of an audit. |

| Tax Filing Reports | Generates reports that are formatted according to tax authority requirements, making it easier to file accurately. |

By leveraging these features, businesses can reduce the risk of errors, maintain up-to-date records, and ensure they are fully prepared for tax season. With automated tax manag

Benefits of Using Digital Invoices

In the modern business world, digital documents have become an essential part of everyday transactions. Switching from paper-based billing to electronic formats offers numerous advantages that can streamline operations and improve efficiency. By adopting digital methods, businesses can save time, reduce costs, and enhance the overall experience for both the company and the client.

One of the main benefits of using digital billing methods is the speed with which transactions can be completed. Sending electronic statements allows businesses to instantly communicate billing information to clients, eliminating the delays caused by postal services. Furthermore, these electronic records are easier to track, update, and manage, making it simpler to maintain organized and accurate financial records.

Key Advantages of Digital Billing

- Time Efficiency: Digital bills can be sent in seconds, allowing for faster processing compared to traditional paper documents.

- Cost Savings: By eliminating the need for paper, printing, and postage, businesses can significantly reduce their operational costs.

- Environmental Impact: Moving to electronic billing helps businesses reduce their carbon footprint by decreasing paper waste.

- Easy Access and Tracking: Clients and businesses can quickly access, store, and review electronic billing statements from any device, providing a level of convenience that paper documents cannot offer.

- Improved Accuracy: Digital systems automatically calculate totals and taxes, reducing human errors associated with manual entries.

- Enhanced Security: Electronic records can be encrypted and stored securely, reducing the risk of fraud or loss compared to paper records.

How Digital Billing Improves Client Experience

In addition to the benefits for businesses, digital billing can significantly enhance the experience for clients. With features like online payment links, immediate receipt generation, and the ability to access documents from anywhere, customers enjoy a smoother, more convenient transaction process.

- Instant Payment Processing: Clients can pay immediately through secure online payment methods, speeding up the entire payment cycle.

- Clear and Professional Appearance: Digital documents can be customized to reflect your brand, giving your business a polished and professional appearance.

- 24/7 Availability: Clients can view their billing records at any time, providing greater flexibility and satisfaction.

By transitioning to digital formats, businesses can optimize their billing process, reduce costs, and offer clients a more efficient and user-friendly experience. As technology continues to evolve, embracing digital billing will only become more advantageous in the long run.

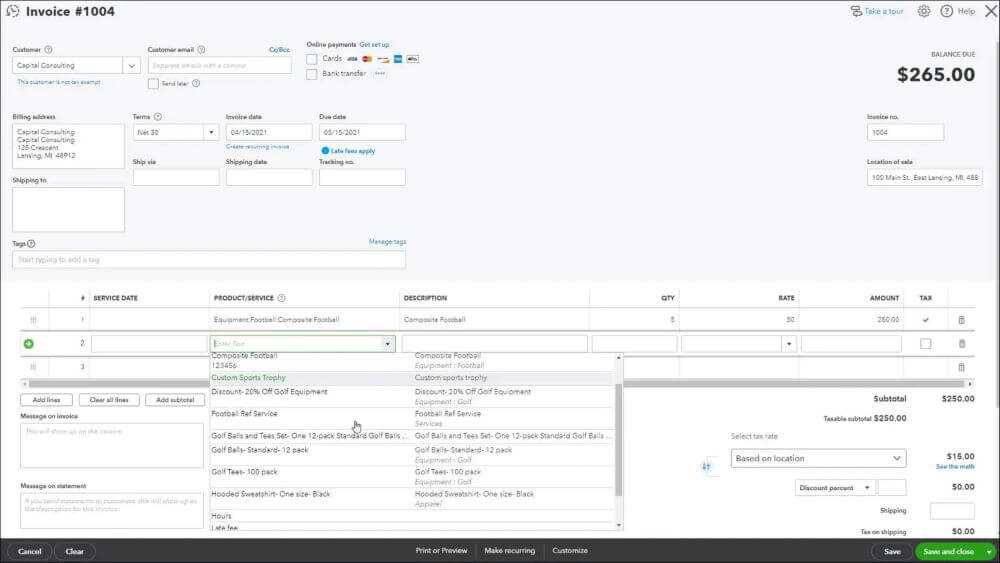

How to Automate Invoice Generation in QuickBooks

Automating the creation of financial statements is a game-changer for any business looking to streamline their processes and save valuable time. Instead of manually inputting data for every transaction, automated systems can generate accurate records with minimal effort. This approach reduces human error, ensures consistency, and helps businesses maintain an organized record of all transactions, making it easier to track payments and manage cash flow.

Steps to Set Up Automation for Billing Statements

Setting up automation for generating financial documents involves configuring specific preferences in your accounting system. Here are the key steps to follow for a smooth transition to automated billing:

- Link Your Accounts: Connect your financial accounts to your billing system. This will ensure that all transactions are automatically recorded and included in your billing statements.

- Create Recurring Templates: For businesses that deal with regular clients or recurring services, set up recurring billing templates. This will allow the system to automatically generate statements based on the agreed schedule.

- Set Payment Terms and Reminders: Configure payment due dates, late fees, and automated reminders to be sent to clients before the due date, reducing the need for manual follow-ups.

- Customize Your Billing Documents: Personalize the appearance of your financial documents with your company’s logo, colors, and payment instructions. Automation will ensure the customization is applied consistently.

- Activate Automation Features: Enable automatic generation for different types of records, such as for specific customers or projects, ensuring that the right documents are created at the right time.

Benefits of Automated Document Generation

Once automation is in place, businesses can enjoy several advantages that help with efficiency and accuracy:

| Benefit | Description |

|---|---|

| Time Savings | By eliminating the need to manually generate documents, employees can focus on more strategic tasks, saving time and boosting productivity. |

| Consistency | Automated systems ensure that all documents follow the same format, reducing the chances of errors and maintaining professional consistency. |

| Fewer Errors | Automated calculations reduce the risk of human error in figures, taxes, and totals, resulting in more accurate records. |

| Improved Cash Flow | Automated reminders and payment processing increase the likelihood of timely payments, helping maintain a healthy cash flow. |