Invoice Template for Trucking Company Streamline Your Billing Process

Managing financial transactions in the transport industry requires clear and organized documentation. For businesses that handle logistics and deliveries, creating professional records for payments is essential to ensure accuracy and timely settlements. A well-structured document helps avoid errors, facilitates smooth communication, and builds trust with clients.

With the right approach, businesses can streamline their payment process, making it easier to track services, costs, and outstanding balances. Customizable formats that suit the specific needs of each service provider can greatly enhance efficiency and reduce administrative burdens. Whether handling long-distance hauls or local deliveries, having a reliable method for issuing statements is crucial to keeping operations running smoothly.

Adopting a standardized format for these documents can save time and improve financial organization. By incorporating key details like service rates, dates, and contact information, businesses ensure that both parties have a clear understanding of the terms. This not only helps with record-keeping but also promotes quicker payments and reduces misunderstandings.

Invoice Template for Trucking Businesses

For transport and logistics providers, creating detailed records of services rendered is crucial for maintaining financial clarity. A structured approach to billing ensures that all essential information is captured in an organized manner, helping both the service provider and the client to stay on the same page regarding payment terms. An effective billing format is key to streamlining the invoicing process, ensuring timely payments and reducing the risk of errors.

Key Features of an Effective Billing Document

To meet the specific needs of logistics service providers, a well-structured document should include the following key elements:

- Service Details: Clearly outline the type of transportation or delivery, including dates, locations, and cargo specifics.

- Charges and Rates: List applicable fees for services, including base rates, fuel surcharges, or any other costs associated with the service.

- Payment Terms: Specify payment deadlines, discounts for early payments, and penalties for overdue amounts.

- Contact Information: Provide accurate contact details for both the service provider and the client for any queries regarding the document.

- Unique Reference Number: Assign a distinct number to each transaction for easier tracking and record-keeping.

Benefits of Using a Structured Billing Format

Using a standardized billing format offers several advantages for transport providers:

- Efficiency: Saves time by simplifying the creation of documents for each transaction.

- Consistency: Reduces the likelihood of errors by maintaining uniformity in the billing process.

- Professionalism: Helps create a polished, professional image that can strengthen client relationships.

- Better Financial Tracking: Facilitates easier management of accounts and outstanding payments.

Why Transport Providers Need a Structured Billing Format

In the logistics and transportation industry, clear and organized financial documentation is essential for maintaining smooth operations. A consistent approach to creating billing records helps ensure that both parties involved in a transaction–whether a service provider or a client–are aligned on payment expectations. Without a standardized system, businesses risk confusion, errors, and delays in payment processing.

Efficient billing plays a critical role in cash flow management. By using a reliable method to document services rendered, businesses can quickly track payments, reduce administrative overhead, and minimize disputes. A well-structured approach also improves accountability by providing a detailed breakdown of charges, services, and payment terms, making it easier to review and verify each transaction.

Streamlining the process with a reliable format not only saves time but also enhances professionalism. Clients appreciate clear, accurate records, which helps to build trust and ensures timely payments. Moreover, having a consistent system reduces human errors, such as missed details or miscalculations, that could potentially lead to costly issues down the line.

In the long run, a solid billing format helps businesses maintain better control over their finances, ultimately leading to smoother operations, improved client relationships, and faster revenue collection.

Benefits of Using a Structured Billing System

Adopting a well-organized system for generating financial documents can offer significant advantages to businesses in the logistics sector. By having a set structure for each transaction, companies can save time, reduce errors, and improve overall efficiency in their billing process. This streamlined approach not only ensures accuracy but also helps in maintaining professionalism when dealing with clients.

One of the primary benefits is the ability to quickly generate consistent and clear records for every service provided. This consistency fosters trust and makes the entire payment process smoother. Clients can easily understand the charges, terms, and details of the service, which leads to quicker approval and payment cycles.

Another advantage is improved financial tracking. A uniform system makes it easier to monitor outstanding payments, track revenue, and manage accounts. With detailed and organized records, businesses can more easily spot discrepancies or unpaid balances and take action swiftly to resolve any issues.

Additionally, a streamlined process reduces administrative workload, allowing employees to focus

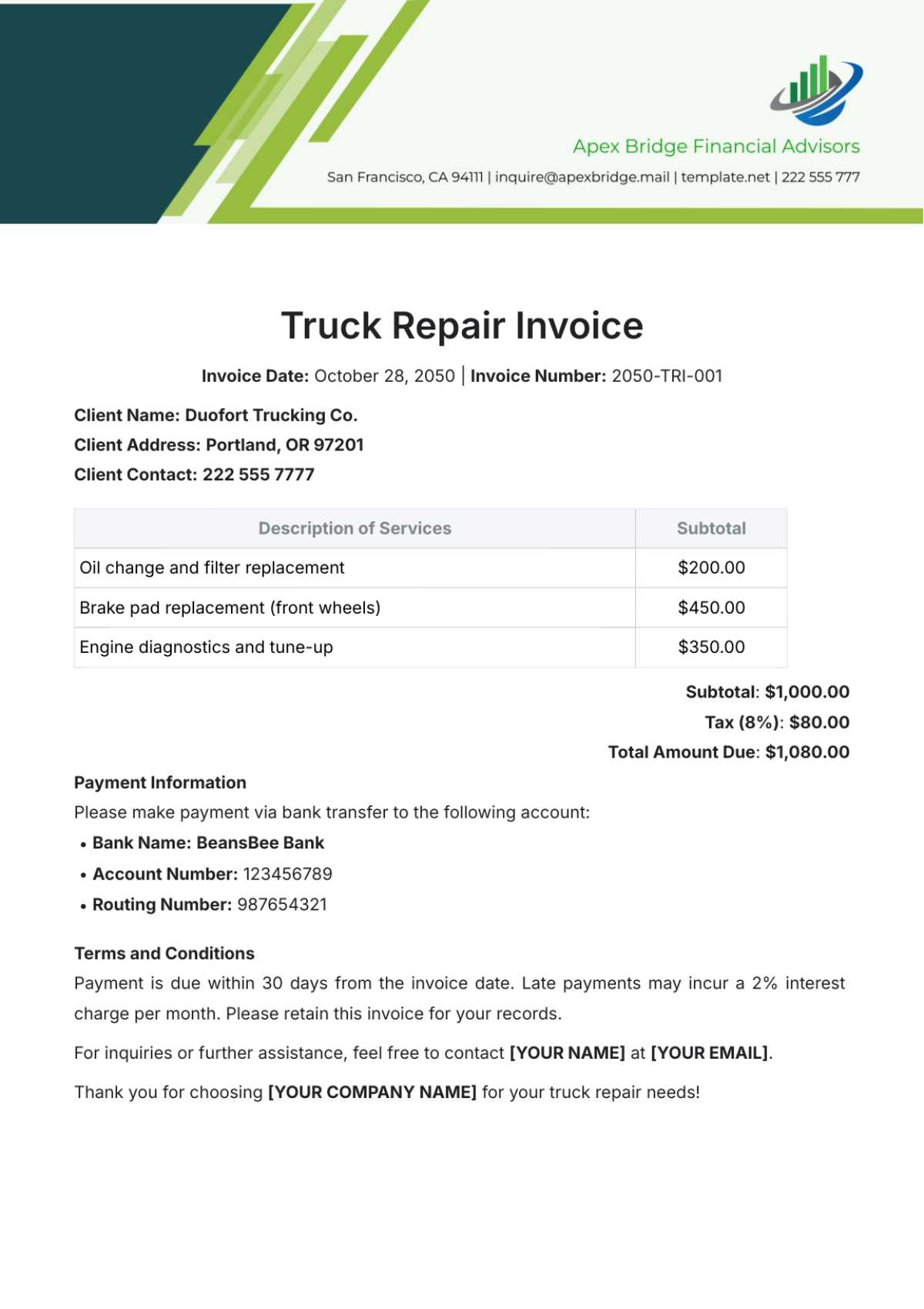

How to Create an Invoice for Transport Services

Creating a detailed billing document for transport services is a straightforward process that requires careful attention to key details. This record should clearly outline the services provided, the agreed-upon costs, and payment terms. A well-structured document not only ensures that all parties are on the same page but also helps maintain smooth financial operations. Here’s a step-by-step guide to creating a professional record for transportation services.

Follow these essential steps:

| Step | Description |

|---|---|

| 1. Include Your Business Details | Start by adding your company name, address, phone number, and email. This helps the client easily contact you for any inquiries. |

| 2. Client Information | List the client’s name, address, and contact details. This ensures that the billing document is personalized and correctly addresses the customer. |

| 3. Provide Service Information | Describe the services provided, including the type of transport, locations served, and the dates the services were rendered. Include any relevant reference numbers for easy identification. |

| 4. Break Down Costs | List all charges, including base fees, additional services (e.g., fuel, insurance), and any applicable taxes or surcharges. |

| 5. Payment Terms | State the payment due date, any late fees for overdue payments, and preferred methods of payment (e.g., bank transfer, check). |

| 6. Unique Invoice Number | Assign a unique number to each document for easy tracking and reference. |

Once all the necessary information is filled out, carefully review the document for any errors. A well-organized and accurate record will not only facilitate faster payments but also enhance your professionalism and client relationships.

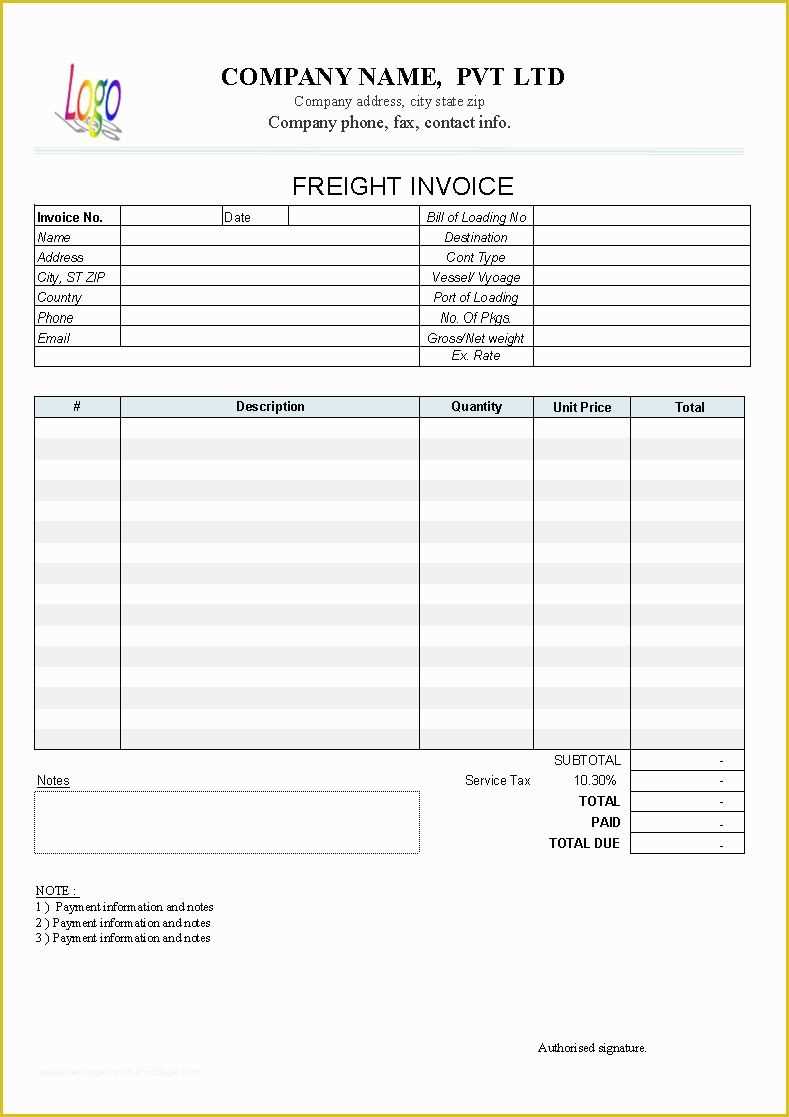

Essential Details for Transport Billing Documents

To ensure accuracy and clarity in financial transactions, certain key details must always be included in a billing document. These elements provide both the service provider and the client with a clear understanding of the charges, terms, and services provided. Including all necessary information minimizes confusion and helps maintain smooth financial operations.

Key Information to Include

- Service Provider Information: Name, address, phone number, and email of the business offering the service.

- Client Information: The client’s name, address, and contact details for easy reference.

- Service Description: A detailed description of the transport services provided, including the type of cargo, the locations served, and the dates of service.

- Service Date: The start and end dates for the services rendered to ensure clear timelines for the transaction.

- Cost Breakdown: A detailed list of charges, including base fees, mileage, fuel surcharges, additional services, and any taxes or extra fees.

- Payment Terms: Specify payment deadlines, accepted payment methods, and any penalties for late payments.

- Unique Reference Number: A unique identifier for the document to make it easier to track and organize payments.

Additional Considerations

- Discounts: If applicable, include any discounts offered to the client for early payment or bulk services.

- Legal Terms: Mention any terms and conditions that apply, including liability disclaimers or insurance coverage details.

- Contact Information for Inquiries: Provide a phone number or email address where the client can reach out in case of questions regarding the charges or services.

Including these essential details ensures that both the service provider and the client have a clear understanding of the transaction, leading to faster payments and stronger business relationships.

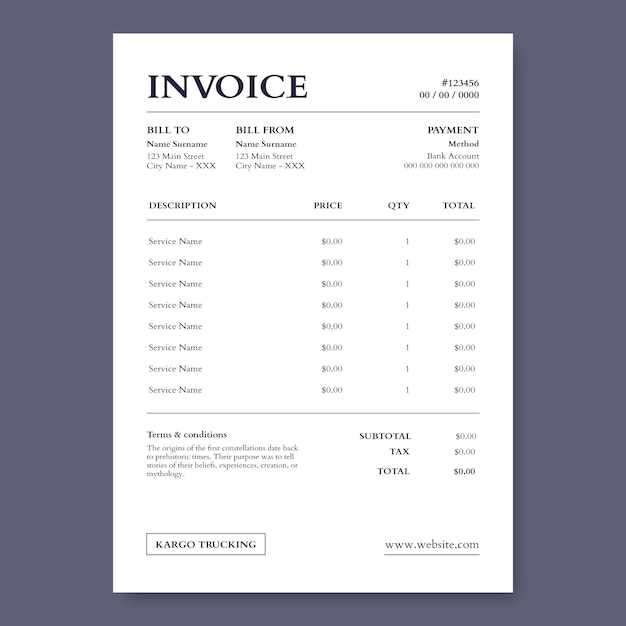

Customizing Your Billing Document for Transport Services

Personalizing your financial records is crucial for maintaining consistency and professionalism in your business transactions. By customizing the format, you can ensure that each document reflects your brand while clearly presenting all necessary details. Customization allows you to meet both your specific needs and your clients’ expectations, helping to build a stronger business relationship and streamline your billing process.

Branding is one of the first aspects to consider. Adding your logo, business colors, and font style helps create a cohesive and professional appearance. This small touch enhances the client’s experience and reinforces your brand identity.

Service-Specific Customization also plays an important role. Depending on the nature of the services you provide, you may need to adjust sections to include relevant information. For example, you can add additional fields for specific rates based on weight, distance, or handling, ensuring your documents are tailored to your operations.

Additional Features such as payment reminders or custom terms for discounts can also be incorporated. By providing clients with clear and concise instructions on payment methods, due dates, and late fees, you make the process more transparent and reduce the risk of misunderstandings.

Customizing your billing documents not only enhances professionalism but also helps maintain an efficient and organized financial system, making it easier to manage transactions and client relationships.

Common Mistakes to Avoid in Billing Documents

When creating financial records for services rendered, attention to detail is crucial. Even minor errors can lead to misunderstandings, delays in payment, and strained client relationships. By being aware of common mistakes, businesses can avoid complications and ensure smoother transactions. Below are some of the most frequent issues to watch out for when preparing financial statements.

Common Errors to Avoid

- Incorrect or Missing Contact Information: Always ensure that both your business and the client’s contact details are accurate and up to date. Missing or incorrect information can delay communication and payment processing.

- Omitting Service Details: Failing to include a clear description of the services provided, such as dates, locations, or types of cargo, can cause confusion and disputes over what was agreed upon.

- Inaccurate Cost Breakdown: Double-check that all charges, including base rates, additional services, and taxes, are correctly calculated and listed. Mistakes in the cost breakdown can lead to payment delays or rejection.

- Wrong Payment Terms: Clearly outline payment deadlines and methods. Failing to include specific terms, such as late fees or early payment discounts, can lead to confusion and missed deadlines.

- Missing or Duplicate References: Always assign a unique reference number to each transaction. This helps avoid confusion, simplifies record-keeping, and makes it easier to track payments.

Impact of These Mistakes

- Delays in Payment: Errors in billing can cause delays as clients may question or dispute charges, resulting in late payments.

- Loss of Professionalism: Frequent mistakes reflect poorly on your business, reducing trust and credibility with clients.

- Increased Administrative Effort: Mistakes require additional time and effort to resolve, diverting attention away from more critical tasks.

By being mindful of these common mistakes, you can create accurate, professional, and efficient billing records that help maintain smooth financial operations and positive client relationships.

How to Calculate Rates on Billing Documents

Determining accurate rates for services is essential to ensure that both your business and the client are satisfied with the financial terms. Calculating the correct amount involves more than just applying a simple fee–it requires considering various factors such as distance, cargo type, delivery time, and additional charges. Properly calculating and clearly presenting these rates helps avoid confusion and ensures transparent communication with clients.

Factors to Consider When Calculating Rates

- Distance Traveled: Charge based on the distance covered, whether it’s per mile or per kilometer. Longer trips usually incur higher rates.

- Weight of Cargo: Heavier loads may require higher fees due to additional fuel consumption and wear on the vehicle.

- Type of Goods: Fragile, hazardous, or high-value items may require specialized handling, which should be reflected in the price.

- Time of Delivery: If a delivery is time-sensitive or requires expedited service, a premium fee may be necessary.

- Additional Services: Services like insurance, fuel surcharges, or special permits should also be considered when calculating the final rate.

Example Calculation

Here’s an example of how to calculate the total cost based on distance, weight, and additional services:

| Service Detail | Unit Price | Quantity | Total |

|---|---|---|---|

| Distance (100 miles) | $1.50 per mile | 100 miles | $150.00 |

| Weight (2,000 lbs) | $0.10 per lb | 2,000 lbs | $200.00 |

| Fuel Surcharge | $50.00 | 1 | $50.00 |

| Total | $400.00 |

By breaking down the charges in a clear and transparent way, you can ensure your clients understand the rationale behind the costs. This approach also helps prevent misunderstandings and builds trust.

Best Practices for Sending Billing Documents

Sending clear and timely financial records is essential to ensure smooth business transactions and prompt payment collection. By following best practices for dispatching your payment requests, you can reduce the risk of delays, confusion, and errors. A professional and organized approach not only helps ensure timely payment but also strengthens relationships with your clients.

Key Steps for Efficient Delivery

- Send Promptly: Ensure that you send the document as soon as possible after completing the service. The quicker the client receives the billing, the sooner the payment process can begin.

- Choose the Right Delivery Method: Decide whether to send your records via email, physical mail, or a digital platform. Email is often the fastest and most convenient method, but make sure it’s secure.

- Follow Up: If payment is not received by the specified due date, follow up with a polite reminder. This can help keep the transaction moving forward.

- Provide Clear Payment Instructions: Include detailed payment instructions, such as accepted methods (bank transfer, check, etc.), your account details, and any relevant reference numbers to facilitate a smooth process.

- Maintain a Consistent Schedule: Establish and follow a regular schedule for sending financial documents to avoid delays and confusion.

Sample Billing Document Sent via Email

Here’s an example of how a well-structured email with a billing document should look:

| Section | Content |

|---|---|

| Email Subject | Payment Request for Services Rendered on [Date] |

| Email Body | Dear [Client Name], Attached you will find the billing statement for the services provided on [date]. Please review the details and let us know if you have any questions. Payment is due by [due date]. Please see the payment instructions below. |

| Attachment | Billing document in PDF format with detailed charges and payment instructions. |

By maintaining professionalism and ensuring clarity in your communications, you create an efficient and transparent payment process that encourages timely payments and minimizes disputes.

Billing Software vs. Manual Records

When it comes to creating financial records for services provided, businesses have two main options: using software solutions or relying on manual methods. Each approach has its own set of advantages and challenges, and choosing the right one depends on the needs and resources of the business. While manual records may seem simple and cost-effective, software solutions can offer greater efficiency, accuracy, and scalability.

Benefits of Using Billing Software

- Efficiency: Software allows businesses to generate and send billing records quickly, saving time compared to manual creation and distribution.

- Automation: With software, data such as service details, charges, and payment terms can be automatically populated, reducing the chance of human error.

- Customization: Billing software often comes with customizable fields, allowing businesses to create records tailored to their specific needs and branding.

- Tracking and Reporting: Most software includes tools for tracking outstanding payments, generating reports, and monitoring cash flow, making financial management easier.

- Security: Digital records are often more secure and easier to store and retrieve, reducing the risk of loss or damage compared to paper records.

Advantages of Manual Record Creation

- Low Cost: Creating records manually does not require purchasing or subscribing to software, making it a budget-friendly option for small businesses.

- Simplicity: For businesses with only a small number of transactions, manual methods can be straightforward and easy to use without the need for technical skills.

- Flexibility: There’s no need to learn or adapt to new software; businesses can create records exactly how they prefer with minimal setup.

- Hands-on Control: Manual creation offers complete control over the document without relying on external systems or technology.

While manual methods can be effective for smaller businesses with fewer transactions, software solutions often become more beneficial as the volume of work increases. The choice depends on the scale and specific needs of your business, but for many, switching to automated systems can significantly improve efficiency and accuracy over time.

How to Track Payments Using Billing Documents

Tracking payments is an essential aspect of managing finances, especially when dealing with multiple clients and transactions. By using clear and consistent billing records, businesses can easily monitor payments, identify outstanding balances, and ensure that their financial operations run smoothly. The right approach to tracking payments helps avoid confusion, reduces errors, and ensures timely follow-up on overdue balances.

Steps to Effectively Track Payments

- Assign Unique Reference Numbers: Each financial document should have a unique identifier (e.g., a number or code). This makes it easy to track which payment corresponds to which document.

- Include Clear Payment Terms: Always specify the payment due date, accepted methods of payment, and any late fees or discounts. This clarity helps both the business and the client understand the expectations for payment.

- Record Payment Dates: When a payment is received, document the exact date it was paid. This helps track whether payments are made on time and assists with future reconciliation.

- Note Payment Amounts: Keep a detailed record of the exact amount paid. If a partial payment is made, track the remaining balance, making it easier to follow up on unpaid amounts.

- Use Accounting Software: Using digital tools or accounting software can automate the process of tracking payments. These tools allow you to input payment details and keep records organized, reducing the chance of errors.

Methods to Monitor Outstanding Payments

- Set Up Payment Reminders: If payment has not been received by the due date, set up a system for automatic reminders or follow-up emails to encourage timely settlement.

- Create Aging Reports: An aging report breaks down outstanding payments by how long they’ve been overdue (e.g., 30 days, 60 days, 90 days). This helps prioritize follow-up efforts.

- Regularly Review Financial Records: Consistently reviewing your records ensures that all payments are tracked and that any discrepancies are addressed promptly.

By carefully tracking payments and maintaining accurate records, businesses can improve cash flow management and reduce the risk of missed or delayed payments. A well-organized system ensures financial stability and fosters trust between the service provider and the client.

How to Handle Late Payments in the Transportation Industry

Late payments are an unfortunate reality in many service-based businesses, and they can create cash flow challenges and disrupt operations. However, handling overdue payments professionally and effectively can prevent further delays and maintain good relationships with clients. By implementing a clear strategy and consistent follow-up procedures, businesses can manage late payments efficiently and minimize their impact.

Steps to Take When Payments Are Overdue

- Review Payment Terms: Before taking action, double-check the payment terms agreed upon with the client. Ensure that the due date has passed and that all terms were clearly outlined in your prior communication.

- Send a Friendly Reminder: Often, a simple email or phone call is enough to remind clients of their outstanding balance. Keep the tone polite and professional, offering assistance if necessary.

- Send a Formal Follow-up: If the payment remains unpaid after the first reminder, send a more formal notice. This document should clearly state the amount due, any applicable late fees, and a new deadline for payment.

- Offer Payment Plans: If the client is facing financial difficulties, consider offering a payment plan to ease the burden. Breaking the payment into smaller installments can encourage them to pay without straining their cash flow.

- Charge Late Fees: If you have specified late fees in your original agreement, apply them as a deterrent for future overdue payments. Be transparent about how these fees are calculated.

Handling Persistent Late Payments

- Personalized Follow-up: For clients who continue to delay payments, consider a more personal approach, such as a phone call or face-to-face meeting, to discuss the situation and emphasize the importance of timely payment.

- Set Clear Consequences: Let the client know that ongoing delays could result in disrupted services or even legal action. Be firm, but professional, in explaining the consequences of non-payment.

- Involve a Collections Agency: As a last resort, consider working with a collections agency to recover the funds. This step should only be taken after other methods have been exhausted.

By taking proactive steps and maintaining professionalism, businesses can effectively manage late payments and reduce the negative impact on their operations. Clear communication, firm but fair follow-up, and flexibility when appropriate can ensure that overdue balances are resolved promptly while preserving client relationships.

Legal Requirements for Billing Documents

Every business that provides services must ensure that their financial records comply with legal standards. Billing documents are not only vital for tracking transactions but also for meeting tax obligations and maintaining transparency with clients. Failure to meet legal requirements can result in penalties, disputes, and damage to a business’s reputation. It’s important to understand the mandatory elements and procedures involved in creating these documents to ensure compliance with local laws and regulations.

Different regions or countries may have varying requirements, but generally, there are common elements that all financial documents must include. These details ensure that the records are valid, professional, and can be used for accounting or legal purposes.

Essential Legal Elements

- Business Identification: The document must clearly state the name, address, and contact details of the business. This helps to identify the service provider and establish its legal presence.

- Client Information: The recipient’s full name or business name and address should be included to ensure that the billing document is correctly attributed.

- Unique Reference Number: A unique identification number or code should be assigned to each document for easy tracking and auditing.

- Description of Services: Clear details of the services provided should be listed, including dates of service, the type of work, and the total quantity (if applicable). This prevents any disputes over what was agreed upon.

- Amount Due and Payment Terms: The total amount owed must be clearly stated, along with payment terms such as the due date, accepted methods of payment, and any applicable late fees.

- Tax Information: If applicable, taxes such as sales tax or VAT should be itemized separately. The tax rate and total tax amount must be clearly stated on the document.

- Legal Statements: Some jurisdictions may require specific statements regarding payment, such as legal disclaimers about late fees, interest charges, or applicable laws in case of non-payment.

Ensuring these essential details are included in each record not only helps businesses stay compliant but also reduces the risk of misunderstandings or legal disputes with clients. By staying informed about local laws and regulations, businesses can operate with greater confidence and avoid costly mistakes.

Managing Multiple Billing Records Effectively

When dealing with multiple clients and services, managing financial documents can quickly become overwhelming. Proper organization and a systematic approach are crucial to ensure that no payments are missed and all records are accounted for. Whether you’re handling dozens or hundreds of transactions, effective management strategies can streamline the process, reduce errors, and maintain smooth cash flow.

Strategies for Effective Management

- Use Digital Tools: Digital platforms or accounting software can automate the creation, tracking, and storing of financial documents, making it easier to manage multiple records at once. These tools allow you to categorize and sort transactions based on client, service, or due date.

- Establish a Consistent System: Implement a numbering or coding system for each record to help track and reference them quickly. For example, you could assign a unique code for each client or project and include this in the document to avoid confusion.

- Set Clear Payment Terms: Ensure that all financial documents clearly outline the payment due dates, methods, and any associated late fees. Having consistent terms for all clients can reduce misunderstandings and make it easier to track overdue payments.

- Maintain Regular Follow-ups: Set up automated reminders or manually track upcoming due dates to ensure timely follow-up. Regularly check your records and reach out to clients with outstanding balances before they become overdue.

- Organize Documents by Date: Sorting financial records chronologically can make it easier to see which payments are overdue and which are approaching due dates. This organization simplifies the process of managing multiple outstanding payments.

Tips for Reducing Errors and Improving Efficiency

- Centralize Your Records: Keep all financial documents in one place, either digitally or physically, so that they are easily accessible when needed. This reduces the risk of losing important records or making duplicate entries.

- Use Templates for Consistency: While the content of the document may vary by client, using a consistent format ensures that key details are always included, helping to prevent errors and omissions.

- Regularly Reconcile Accounts: Regularly compare your records with your bank statements to ensure that all payments have been properly recorded and no discrepancies have occurred.

- Automate Where Possible: Set up recurring billing for regular clients or services, so that documents are generated and sent automatically, reducing manual effort and increasing accuracy.

By following these strategies, businesses can manage a large volume of billing documents with ease, ensuring timely payments and reducing administrative stress. Whether you’re a small business or handling a more complex operation, effective management is the key to maintaining positive cash flow and good client relationships.

Incorporating Branding in Your Billing Documents

Including branding elements in your financial records is an effective way to enhance your business’s professionalism and identity. It’s an opportunity to reinforce your brand image while communicating important details to your clients. By incorporating your business’s colors, logo, and other design elements, you can create a consistent and memorable experience for your clients, even in your financial communications.

Why Branding Matters in Financial Documents

- Professionalism: A branded document conveys a sense of professionalism and attention to detail, which can help build trust with clients and strengthen your reputation.

- Brand Recognition: Consistent use of colors, logos, and fonts across all business documents helps create brand recognition. Clients will easily associate your documents with your business, making it easier for them to identify and remember you.

- Memorability: A visually appealing document stands out more than a plain one. When your clients receive a well-designed document, they are more likely to recall the service and experience you provided.

- Consistency: By incorporating branding across all communications, including financial documents, you maintain a consistent brand image, which reinforces your business’s identity and makes your communications more cohesive.

How to Incorporate Branding Effectively

- Use Your Business Colors: Incorporate your brand’s color scheme into the document. This can be done through header and footer colors, borders, and section dividers.

- Include Your Logo: Place your logo at the top or bottom of the page, ideally where it’s highly visible but doesn’t overwhelm the document’s content.

- Choose Brand Fonts: Use fonts that align with your brand’s typography style. This will help make your documents visually cohesive and contribute to the overall brand personality.

- Maintain a Clean Layout: While branding is important, it’s crucial to balance it with readability. Ensure that the design doesn’t overshadow the important financial information that your clients need to see.

- Add a Personal Touch: A short note or personalized message in your branding style can create a more personal connection with your clients, leaving a lasting impression.

Incorporating branding into your financial documents isn’t just about aesthetics–it’s an opportunity to strengthen your relationship with clients and convey your professionalism. By designing documents that reflect your brand identity, you create a consistent and polished experience that clients will appreciate and remember.

Free vs. Paid Billing Documents for Transportation Businesses

When choosing how to manage billing for services, businesses often face a decision between using free resources or investing in premium solutions. Both free and paid options offer unique advantages, but understanding the differences can help you make an informed choice based on your specific needs. Each type has its own set of features, customization options, and long-term benefits, and selecting the right one is crucial for ensuring smooth financial operations.

Advantages of Free Billing Resources

- No Initial Cost: Free resources don’t require any upfront investment, making them an attractive option for startups or small businesses with limited budgets.

- Basic Functionality: Many free tools provide essential features like service descriptions, amounts, and client details, covering the basic needs of most businesses.

- Easy to Use: Free solutions often have simple, user-friendly interfaces, making them easy to access and use without requiring significant training or technical expertise.

- Quick Setup: Most free tools are ready to use immediately, allowing businesses to get started quickly without long setup processes or complicated configurations.

Advantages of Paid Billing Resources

- Advanced Customization: Paid solutions typically offer greater flexibility, allowing you to tailor documents to your specific needs, from design elements to detailed calculations and formulas.

- Increased Professionalism: Premium tools often provide polished, high-quality templates with advanced design features that can enhance the professional appearance of your documents.

- Automation Features: Many paid options come with automation tools, such as recurring billing, reminders, and automatic calculations, which save time and reduce the likelihood of errors.

- Better Support and Updates: With a paid solution, you often receive customer support and regular updates, ensuring that the software stays current with industry standards and legal requirements.

- Integrated Accounting Features: Paid tools often offer integration with other accounting software, making it easier to manage your finances and track payments in real-time.

Choosing between free and paid resources depends on your business needs and priorities. If you’re just starting out or only have basic billing requirements, free resources can provide a quick and effective solution. However, if you are looking for greater customization, automation, and professional-grade functionality, investing in a paid option can streamline your processes and contribute to long-term business growth.