Credit Card Invoice Template for Simplified Payment Management

Managing financial transactions can often be a complex task, especially when it comes to keeping track of payments made via different methods. For businesses, having a structured way to record such transactions is essential to maintain accurate records and ensure smooth operations. One efficient solution is using a structured format that simplifies the process and reduces the chances of error.

Organizing your payment records in a clear, easy-to-use format can save time and effort. By customizing the layout to suit your business needs, you can ensure that all necessary details are included, from transaction dates to amounts and other important information. This approach allows you to focus on the bigger picture while automating the administrative side of things.

Whether you are managing a small business or handling personal finances, a well-designed system for recording payments can be a game changer. It ensures consistency, improves transparency, and makes financial management more efficient.

Payment Record Format Overview

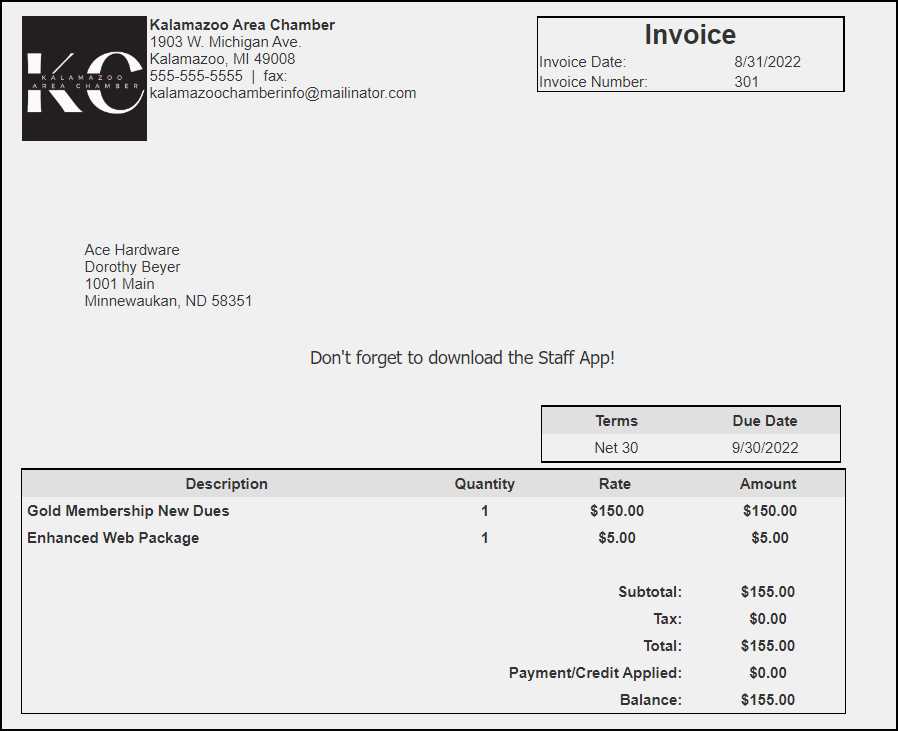

Maintaining clear and organized financial documentation is essential for tracking purchases and payments made through various methods. A structured format for recording these transactions ensures all relevant details are captured accurately, from the payment date to the total amount and the payer’s information. This systematic approach not only enhances efficiency but also helps avoid potential errors or omissions.

Having a uniform structure for payment records allows businesses and individuals to manage financial data effectively. By utilizing such a system, one can quickly generate professional records that are easy to interpret and share with others. This is especially beneficial for both accounting purposes and customer communication.

This approach simplifies the overall process, providing clarity and consistency for anyone who needs to access the payment details. Whether for personal use or business needs, a well-organized record format makes financial management significantly more efficient.

Why Use a Payment Record Format

Efficiently tracking transactions is crucial for both businesses and individuals, as it helps ensure financial accuracy and organization. Using a well-structured record format allows for the easy documentation of payment details, making it simple to verify purchases, manage accounts, and reconcile financial statements. The consistent use of such a system reduces errors and streamlines accounting processes.

One of the main advantages of adopting a standardized format is the time-saving aspect. By having a clear and consistent way to document payments, you can quickly generate reports or review past transactions without unnecessary delays. This approach can significantly enhance the overall efficiency of financial management.

Moreover, a reliable system fosters trust with clients and customers. Transparent and professionally organized records demonstrate a business’s commitment to clarity and proper financial handling, which is essential for building strong, long-term relationships.

Benefits of Customizable Formats

Having the ability to personalize your documentation system offers significant advantages. Customizable structures allow you to adjust various elements according to your specific needs, whether for individual or business purposes. This flexibility not only ensures that all necessary information is captured but also provides a tailored solution that fits your unique requirements.

Increased Efficiency

One of the key benefits of using a flexible structure is the improved efficiency it brings. With a system that aligns with your workflow, generating and managing records becomes a quicker, smoother process. Customization helps eliminate unnecessary steps and simplifies the task of creating accurate documentation in a fraction of the time.

Enhanced Professionalism

Personalizing the layout and details allows for a more polished and professional appearance. Whether you’re creating records for clients or personal use, the ability to design your system ensures that the final product looks well-organized and is easy to interpret. A well-crafted document promotes trust and demonstrates professionalism.

| Benefit | Impact |

|---|---|

| Time-Saving | Faster document creation and management |

| Clarity | Clear, concise records with easy-to-read formatting |

| Customization | Personalized fields to suit your specific needs |

How to Create a Structured Document

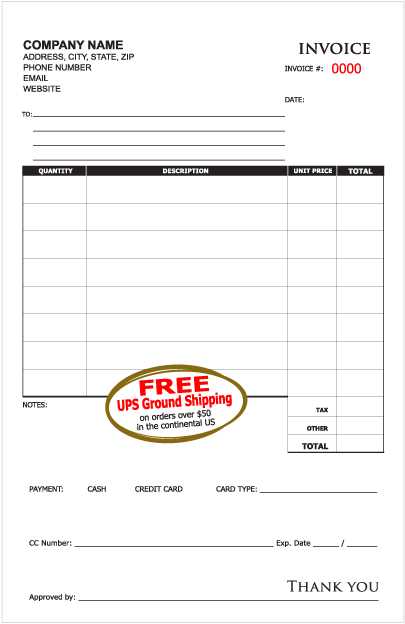

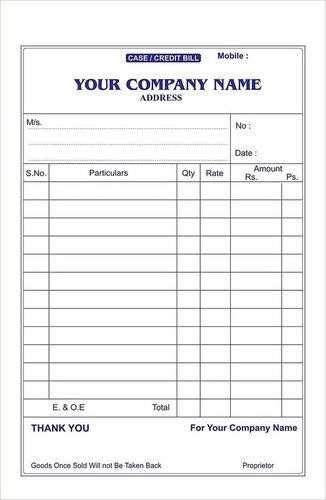

Creating a well-organized record for payments requires careful planning and attention to detail. By setting up a consistent format, you can easily track transactions and ensure that all necessary information is included. The process involves selecting the right fields, designing a layout that suits your needs, and making the document easy to read and understand.

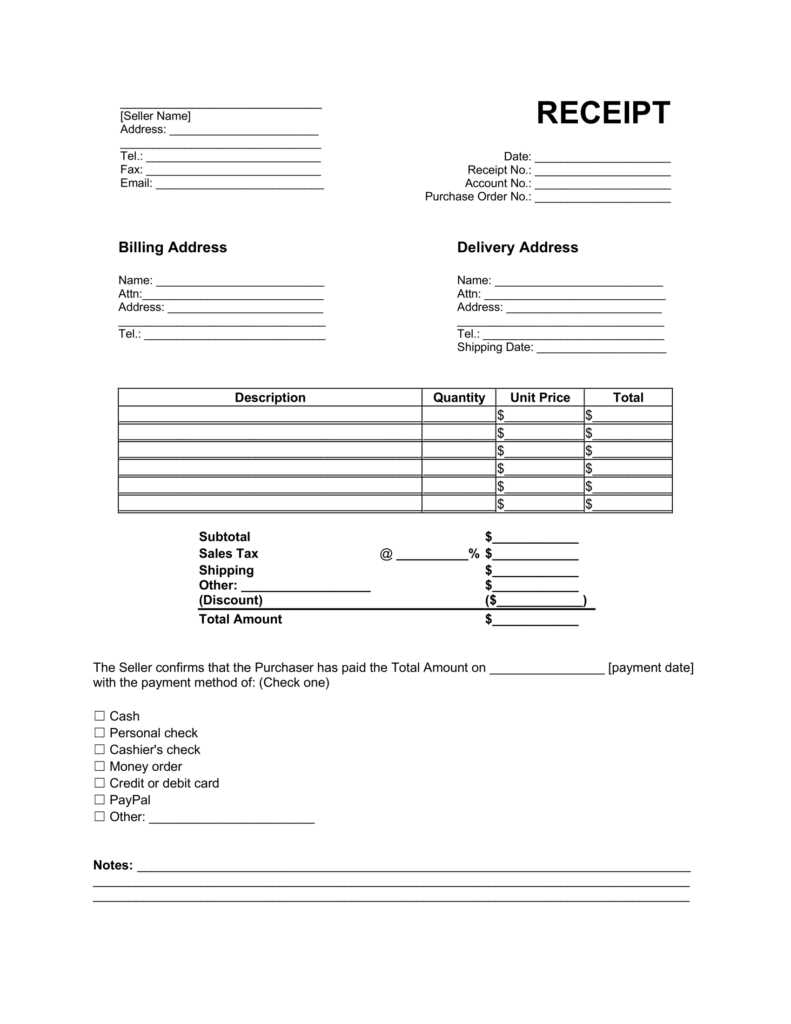

Start by deciding on the key elements that must appear in every document. Common fields include the transaction amount, date, payer details, and a breakdown of services or products. Once you have your list, consider the best way to organize these elements so that they flow logically and make the document intuitive for both you and the recipient.

Next, choose a design that is both functional and visually appealing. The layout should be clean and straightforward, avoiding clutter while highlighting the most important information. With the right structure in place, generating these records becomes a seamless process that saves time and enhances professionalism.

Essential Fields for Your Record

To ensure that your payment documentation is complete and accurate, it’s crucial to include all the necessary information. A well-structured record helps prevent errors and provides clarity for both you and your clients. Below are the key fields that should be included to create a comprehensive and professional document.

- Transaction Date: This is the date the payment was made or processed.

- Amount: Clearly specify the total amount of the payment.

- Payer Information: Include the name and contact details of the person or entity making the payment.

- Description of Services or Products: A brief breakdown of what the payment is for, including any relevant details.

- Payment Method: Indicate how the payment was made (e.g., bank transfer, online service, etc.).

- Unique Reference Number: This can be used for easy tracking and future reference of the transaction.

- Due Date (if applicable): If the payment is part of a scheduled plan, include the due date for the next installment.

Including these essential fields ensures that your records are not only clear but also comprehensive, providing all the necessary details for both you and the recipient to track and verify the payment efficiently.

Design Tips for Clear Payment Records

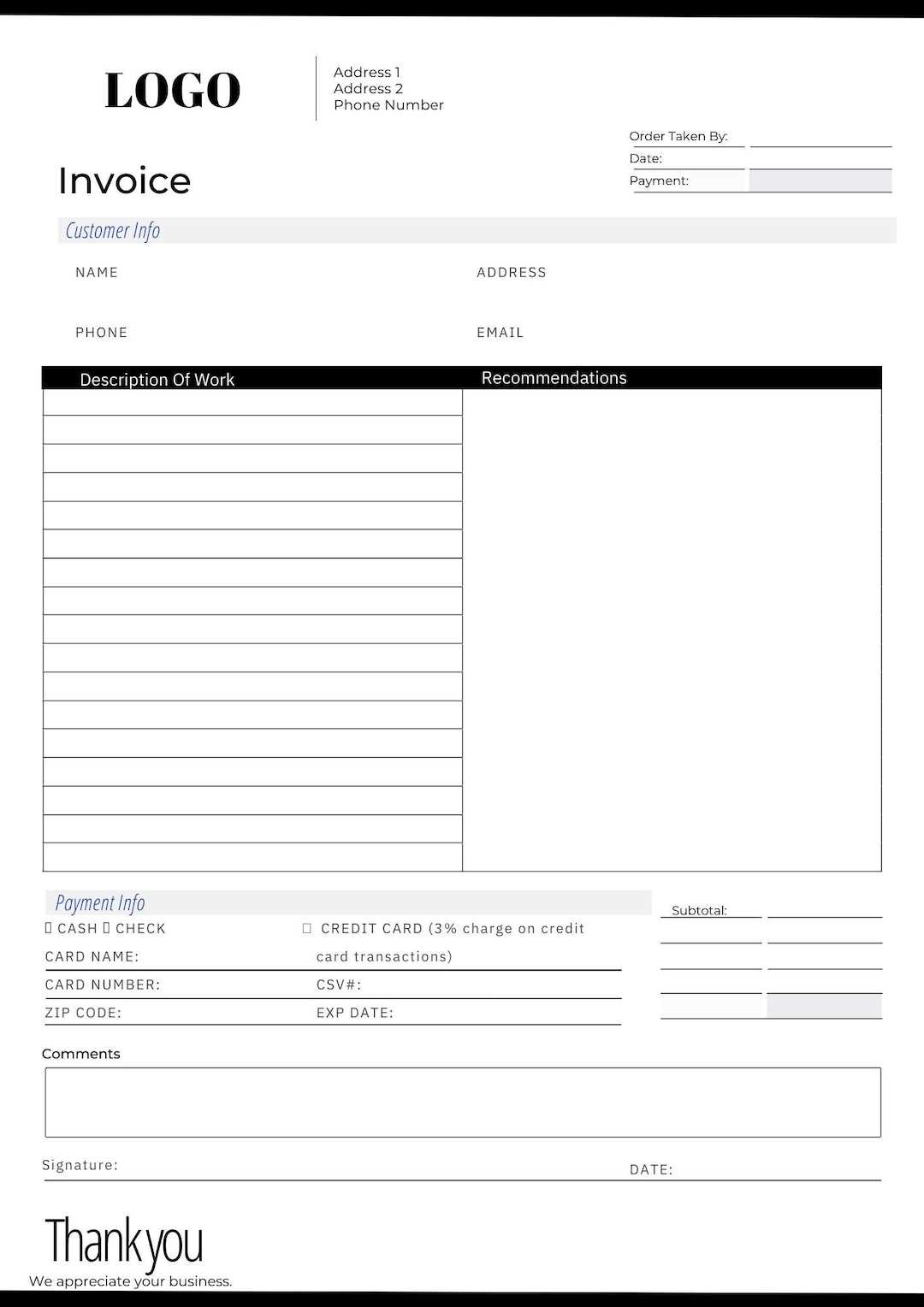

Design plays a crucial role in how easily your financial documents can be understood and processed. A clean, organized structure ensures that important details are quickly accessible and prevents confusion. By following a few simple design principles, you can create a professional-looking document that enhances clarity and improves communication.

Keep it simple and organized. Use a straightforward layout with clearly defined sections for each piece of information. Avoid unnecessary clutter or excessive text that can distract from the main details. Organizing your content logically, such as grouping related items together, helps readers quickly locate what they need.

Use clear fonts and consistent formatting. Choose readable fonts, and make sure the text size is appropriate for easy reading. Consistency in font styles, sizes, and alignment adds to the overall neatness, making it easier for anyone reviewing the document to follow along. Use bold or underlined text sparingly to highlight key details like amounts or dates.

Finally, don’t forget about white space. Giving each section enough space to breathe can prevent the document from feeling too cramped or overwhelming. A balanced use of margins and padding can greatly enhance the visual appeal and readability of your document.

Tracking Payments with Structured Formats

Maintaining an organized system for monitoring financial transactions is essential for both individuals and businesses. Using a structured format for your records simplifies the process of tracking payments, ensuring that you have all relevant information at your fingertips. This approach not only enhances accuracy but also aids in effective financial management.

By utilizing consistent formats, you can easily capture and categorize transactions. Each record should include key details such as the payment date, amount, and payer information. This uniformity allows for quick reference and comparison, making it simpler to identify any discrepancies or issues that may arise.

Moreover, integrating digital tools can further streamline your tracking process. Many software solutions and applications offer features that automatically log payments and generate reports. These tools can help visualize your cash flow, providing insights into spending patterns and outstanding amounts. Leveraging technology alongside well-structured documents can significantly enhance your financial oversight.

In summary, a systematic approach to tracking payments using clearly defined formats contributes to more effective financial management and can lead to better decision-making in both personal and professional contexts.

Common Mistakes to Avoid

When managing financial records, it’s easy to overlook certain details that can lead to confusion or inaccuracies. Avoiding common mistakes is essential for ensuring that your documentation is both accurate and professional. Below are some of the frequent errors that can compromise the quality of your records and how to steer clear of them.

| Mistake | How to Avoid It |

|---|---|

| Missing Important Details | Ensure all necessary information, such as the payment date, amount, and description, is clearly listed. |

| Inconsistent Formatting | Stick to a consistent format for dates, amounts, and other key fields to enhance readability. |

| Unclear Payment Breakdown | Provide a clear, detailed breakdown of what the payment covers to avoid confusion. |

| Ignoring Proper Record Keeping | Regularly update your records and ensure they are well-organized for easy reference in the future. |

By being mindful of these common mistakes, you can improve the clarity, accuracy, and professionalism of your financial documents, leading to better management and communication.

Integrating Payment Records with Accounting Software

Integrating your financial documentation with accounting software can significantly improve the accuracy and efficiency of managing transactions. By linking your records to an automated system, you streamline the process of tracking payments, generating reports, and reconciling accounts. This integration ensures that all information is consistently updated and easily accessible in one centralized location.

Integration provides several key advantages:

| Benefit | Description |

|---|---|

| Automated Data Entry | Automatically sync transaction details from your documents into the accounting system, reducing manual data entry errors. |

| Real-Time Updates | Ensure that your records are always up-to-date, giving you accurate insights into your financial status at any time. |

| Efficient Reporting | Generate detailed financial reports with ease, saving time and effort compared to manual record-keeping methods. |

| Better Financial Management | Maintain a more organized system, making it easier to track outstanding payments and spot discrepancies. |

By integrating your structured payment records with accounting software, you not only save time but also ensure that your financial data is accurate, organized, and easy to analyze, leading to better financial decision-making.

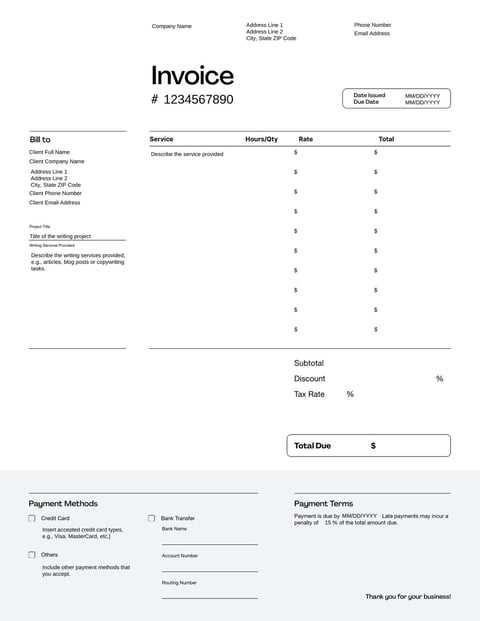

How to Format Your Payment Document Professionally

Creating a well-structured and professional document is essential for conveying trust and clarity in your financial transactions. A clean and organized layout not only improves readability but also enhances your credibility. Ensuring that your document looks polished involves attention to detail, consistency, and proper organization of key information.

Start by using a clear, legible font and maintaining consistent spacing between sections. This will make it easier for the reader to follow the document’s flow. Organize the details logically, with headings for each important section, such as payer details, payment breakdown, and due dates. Additionally, ensure that your document is aligned properly, with all sections neatly separated to avoid a cluttered appearance.

To further elevate the professionalism of your document, include your contact information and branding, such as a company logo or a business name, at the top. This gives the document a more formal and cohesive look, making it easily recognizable and reinforcing your brand identity.

By following these steps, you can create a polished, professional document that not only looks great but also communicates your financial details clearly and effectively.

Legal Considerations for Payment Records

When managing financial documentation, it’s important to ensure that all practices are in line with legal requirements. Certain legal considerations help protect both businesses and customers, ensuring transparency and fairness. These include accurate record-keeping, compliance with consumer protection laws, and clarity in terms of payment terms and conditions.

Accuracy and Transparency

Maintaining accurate records is crucial, as incorrect or misleading information can lead to disputes or legal complications. Every payment record should clearly outline the services or goods provided, along with agreed-upon amounts. Transparency in this documentation helps prevent misunderstandings and builds trust between parties.

Compliance with Regulations

It’s essential to stay informed about local regulations governing financial transactions. This may include providing specific disclosures on the payment document, such as tax information or refund policies. Businesses must also be aware of data protection laws to safeguard sensitive customer information, especially when handling payment details electronically.

By adhering to legal requirements and ensuring clarity and accuracy in your payment records, you minimize the risk of disputes and legal issues, ensuring smoother transactions and fostering long-term business relationships.

Time-Saving Features in Structured Documents

When managing financial records, efficiency is key. Certain features within structured documents can significantly reduce the time spent on manual tasks, allowing you to focus on more important aspects of your business. These time-saving functions streamline the process, automate repetitive tasks, and ensure that everything is well-organized.

Some of the most effective time-saving features include:

- Predefined Fields: Having sections for common information, such as payer details, transaction amounts, and due dates, allows for quick entry and consistency across multiple records.

- Automatic Calculations: Many digital tools can automatically calculate totals, taxes, or discounts, saving you from performing manual math and reducing the risk of errors.

- Recurring Templates: Setting up reusable formats for regular transactions enables quick generation of new records with minimal adjustments.

- Integration with Accounting Software: Syncing with accounting tools allows for seamless transfer of data, reducing the need for duplicate entry and ensuring everything is up-to-date.

- Instant Saving and Exporting: Digital formats that allow easy saving, printing, or exporting to other applications help you manage records without hassle.

These features not only save time but also improve the overall accuracy and professionalism of your financial records, making day-to-day operations more efficient and less prone to errors.

Ensuring Accuracy in Payment Documents

Maintaining precision in financial records is essential for avoiding errors, disputes, and potential legal issues. Accurate documentation helps both businesses and clients stay on the same page, ensuring that the correct amounts are billed, payments are tracked properly, and no crucial information is overlooked. Implementing a few simple strategies can significantly enhance the accuracy of your financial records.

Key practices to ensure accuracy include:

- Double-checking the amounts: Always verify that the amounts entered match the agreed-upon figures, including taxes, discounts, and other adjustments. Even small discrepancies can lead to misunderstandings.

- Consistent formatting: Use standardized formats for dates, payment terms, and amounts. This helps prevent confusion, particularly when dealing with international clients or different currencies.

- Cross-referencing with other records: Regularly compare your records with bank statements or payment confirmations to ensure everything aligns. This is especially important for high-volume transactions.

- Automated calculations: Utilize software tools that automatically calculate totals, taxes, and discounts. This minimizes the risk of human error when performing manual calculations.

By following these practices, you ensure that all details in your payment documentation are correct, reducing the chance of mistakes and fostering trust between you and your clients.

Free vs Premium Payment Document Formats

When selecting a format for your financial records, it’s important to consider the differences between free and premium options. Both can help streamline the process, but each has its unique advantages and limitations. Free formats are widely accessible, while premium formats offer additional features and customization that might be valuable for businesses looking for more advanced functionality.

Advantages of Free Formats

Free formats are an excellent choice for small businesses or individuals just starting out. They often come with basic functionalities, such as pre-designed fields for amounts, payment terms, and dates. These formats are easy to find and download, and they can be used immediately without any financial investment.

- Quick access without cost

- Simple to use and understand

- Ideal for occasional or small-scale use

Benefits of Premium Formats

On the other hand, premium formats often come with more sophisticated features, such as automated calculations, customizable fields, and integration with accounting software. These formats are ideal for businesses that need more flexibility and advanced functionality in their financial documentation process.

- Advanced customization options

- Seamless integration with other business tools

- Professional design and more layout options

Ultimately, the choice between free and premium formats depends on your business needs and how complex your financial records are. If you’re running a small operation with basic documentation needs, free formats may suffice. However, if you require more detailed functionality and customization, premium options are likely a better investment.

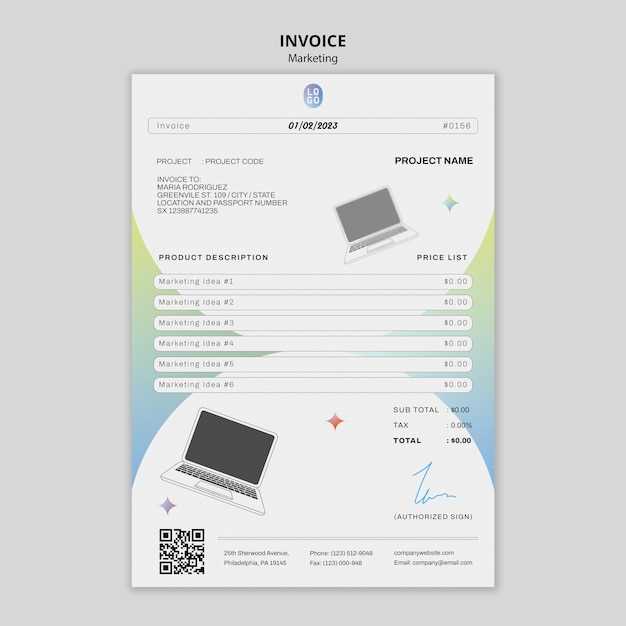

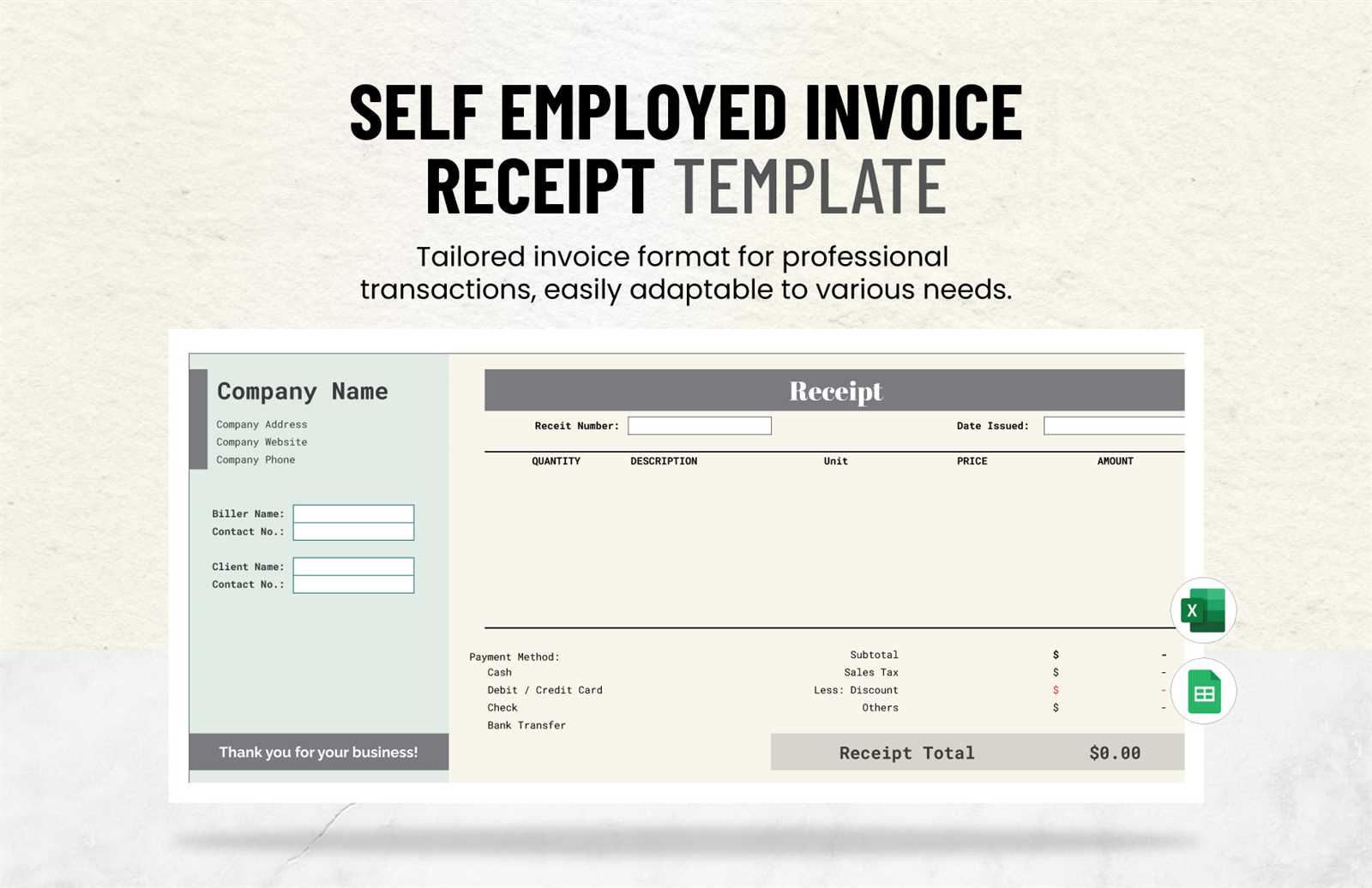

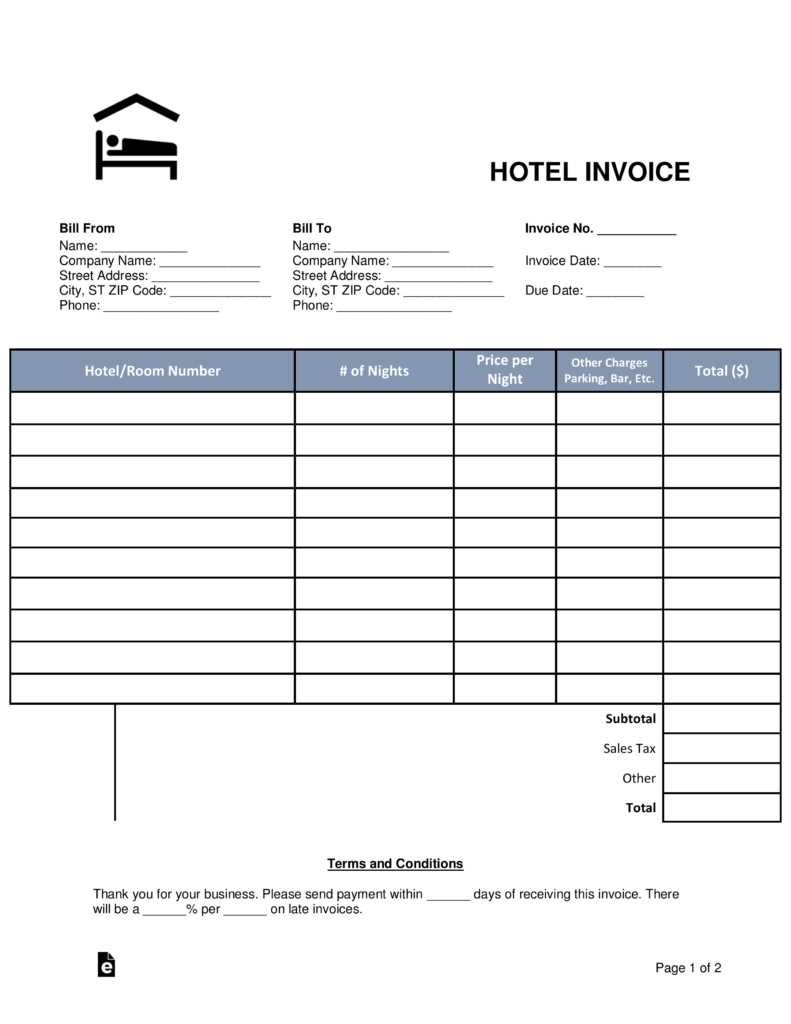

Using Formats for Different Industries

Various industries require tailored approaches to documenting transactions and financial details. Using predefined formats helps professionals in different sectors streamline their processes and maintain consistency across their records. The adaptability of these formats allows businesses to customize fields, designs, and structures based on their specific needs, ensuring all relevant details are captured efficiently.

Here are some industry-specific ways these formats are utilized:

Retail and E-Commerce

Retailers and e-commerce businesses often deal with high volumes of transactions, making it essential to use organized formats that can handle large amounts of data. These formats typically include fields for product descriptions, quantities, prices, shipping details, and taxes, helping to track sales effectively.

- Product list and details

- Tax breakdown and shipping costs

- Discounts and promotional codes

Freelancers and Consultants

Freelancers and consultants often need simple yet professional formats to document services rendered, along with payment terms and due dates. These documents provide clarity to clients about the specific work completed, payment schedules, and any additional costs incurred.

- Hourly rates or project-based pricing

- Detailed breakdown of services provided

- Payment terms and deadlines

Construction and Real Estate

In industries like construction and real estate, documentation can become quite detailed. Formats are designed to include information such as materials used, labor hours, property descriptions, and other project-specific details that must be tracked for payments and tax purposes.

- Materials, labor, and equipment costs

- Project milestones and due payments

- Compliance with regulatory requirements

Healthcare and Medical Services

Healthcare providers and medical service businesses require formats that can track treatments, appointments, and insurance details. The complexity of medical billing requires that all services provided, along with patient details, be recorded precisely for both client and insurance purposes.

- Service details and patient information

- Insurance codes and payment schedules

- Patient due amounts and payment plans

By choosing formats suited for specific industry needs, businesses can optimize their documentation process and ensure accuracy in their financial record-keeping.

How to Automate Document Generation

Automating the process of generating financial records can save businesses valuable time and reduce human error. By leveraging specialized software or online tools, companies can streamline the creation of these documents, ensuring accuracy and efficiency in their billing processes. Automation allows for faster turnaround, easier tracking, and seamless integration with other business systems.

Step 1: Choose the Right Software

To begin automating the generation of these records, selecting the right software or platform is crucial. Many accounting and financial management tools come with built-in features for automating document creation, allowing users to set up custom fields and workflows that meet their specific needs. Popular tools offer templates, tax calculations, and integration with payment systems, making the process much easier to handle.

Step 2: Set Up Custom Fields

Customization is key when automating document generation. You can define fields such as client information, services rendered, dates, and payment terms that will auto-populate with every new entry. This ensures that no data is missed and that all records are consistent. Many software options allow you to set up recurring billing as well, so that regular transactions are processed automatically without the need for manual intervention.

By automating this process, businesses can focus on growing their operations while ensuring all financial transactions are accurately documented and tracked.

Storing and Sharing Documents Securely

Ensuring the security of financial records is essential for protecting sensitive information and maintaining business integrity. Proper storage and secure sharing methods can prevent unauthorized access and data breaches. Businesses need reliable systems that offer both encryption and access control to guarantee that only authorized individuals can view, edit, or distribute such documents.

Secure Storage: The first step in safeguarding your financial records is to store them in a secure location. Cloud storage services that offer encryption, along with strong password protection, are commonly used for this purpose. Many of these platforms provide additional security features like two-factor authentication (2FA), making it harder for unauthorized users to access the files.

Sharing Safely: When sharing these records, it’s important to use secure methods such as encrypted emails or password-protected file sharing platforms. Avoid sending sensitive documents via unsecured channels like regular email attachments. Some platforms allow users to set expiration dates for shared files, adding an extra layer of protection by limiting how long the document remains accessible.

By implementing these practices, businesses can ensure that their financial records are stored safely and shared only with authorized parties, reducing the risk of data breaches and unauthorized access.