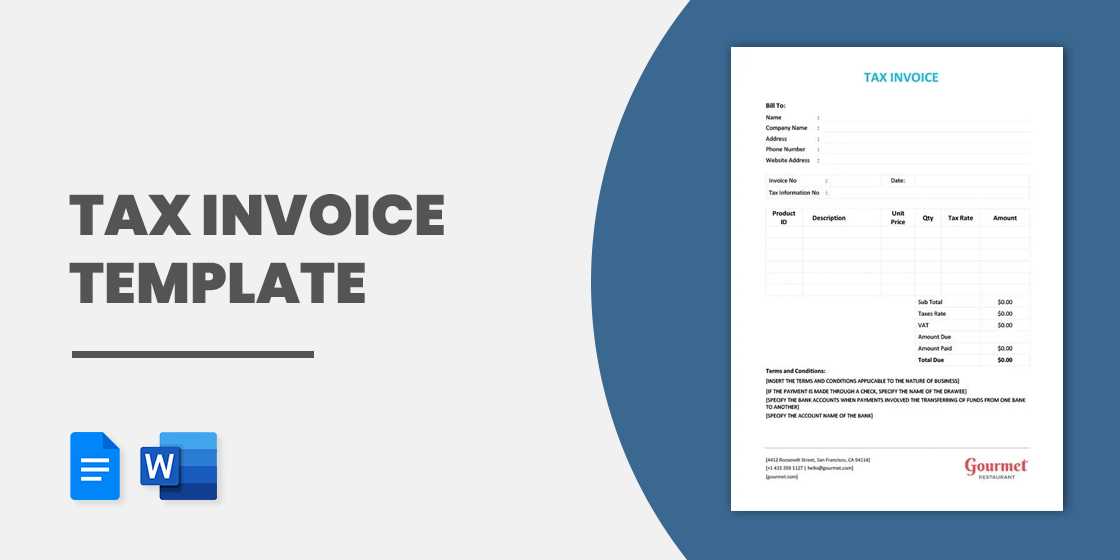

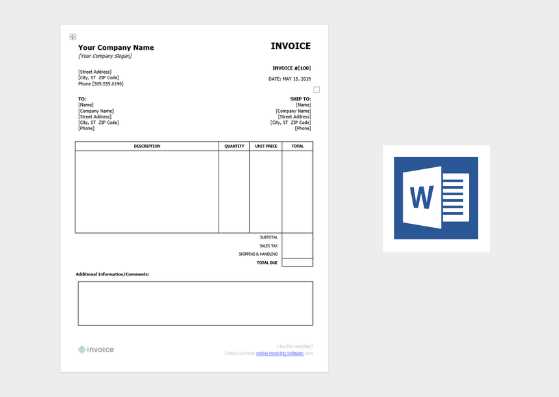

Download Free General Invoice Template in Word Format

Managing financial transactions requires a clear and organized way to present charges to clients. A well-structured document is crucial not only for clarity but also for maintaining professionalism in business operations. By using customizable templates, anyone can generate a detailed and accurate record for services rendered or products sold.

For those looking for an efficient solution, editable formats provide the flexibility to adjust details such as client information, payment terms, and itemized lists. These tools make it easier to handle recurring tasks, streamline your workflow, and ensure consistency across all billing processes.

Whether you’re a freelancer, small business owner, or large enterprise, creating accurate and easy-to-read records is essential. With the right tools, you can generate clean, professional documents without the need for complex software. A simple yet effective approach can save both time and effort while enhancing communication with your clients.

General Invoice Template Word Overview

Creating professional billing documents is essential for any business. Whether you’re an independent contractor, freelancer, or running a small business, having a clear and easy-to-use method to document transactions is crucial. By using ready-made solutions, you can simplify this process, ensuring that all necessary details are included and presented in an organized manner.

Editable formats provide users with the flexibility to modify and personalize each document according to their needs. This customization feature allows you to tailor the content based on specific services, payment terms, and client requirements, helping to maintain consistency and accuracy in your business records.

Key Features of Editable Billing Documents

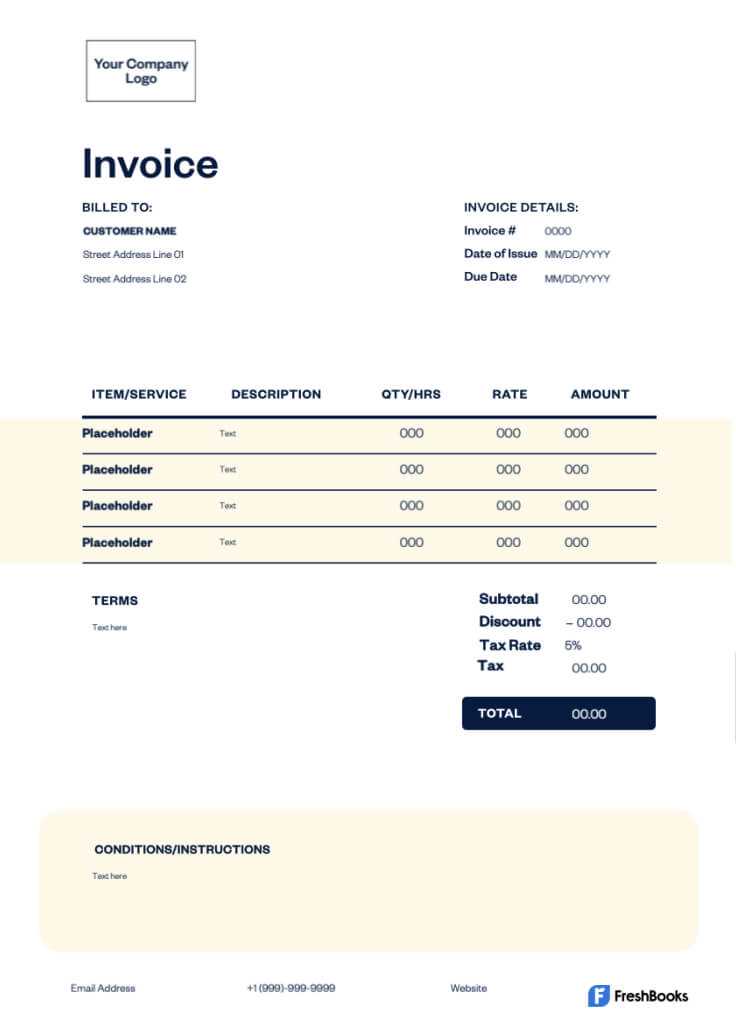

Most digital billing documents come with built-in fields that allow you to input essential details such as client names, addresses, and dates. With customizable sections, users can easily update amounts, taxes, or discounts, ensuring every entry is accurate. These tools often come with simple formatting options to enhance the document’s appearance and readability, giving it a professional touch.

Why Choose Editable Formats for Billing

Choosing an editable format for creating billing records offers numerous advantages. Not only can you make updates and changes quickly, but you can also store and reuse these documents for future transactions, which saves both time and effort. Furthermore, using familiar software tools like Microsoft applications increases accessibility and ease of use, even for those without extensive technical skills.

Why Use a Word Invoice Template

Choosing the right tools to manage your billing process can greatly impact the efficiency and professionalism of your business operations. Using an editable document format for generating payment records provides several benefits that make the process simpler, faster, and more reliable. This solution is especially useful for those who need flexibility while maintaining a polished and consistent appearance for their financial documents.

Advantages of Using an Editable Document

There are several reasons why this format is an ideal choice for creating billing statements:

- Ease of Customization: You can quickly modify details such as client information, service descriptions, amounts, and payment terms according to each transaction.

- Consistency: Templates help maintain a standardized structure across all your documents, ensuring that each record follows the same layout and design.

- Cost-Effective: You don’t need to invest in expensive software–most office applications already support these file types.

- Efficiency: Pre-designed formats allow you to focus on content instead of spending time on layout or design, speeding up your billing cycle.

- Reusability: Once you’ve set up your document format, you can easily save it for future use, making the process quicker with each new transaction.

Why Flexibility Matters

One of the key reasons to use an editable document format is the ability to quickly adapt your billing statements to changing needs. Whether it’s adding new line items, adjusting taxes, or modifying payment instructions, having full control over the document ensures that you can always produce accurate and up-to-date records.

Benefits of Editable Invoice Templates

Using a flexible, editable format to create billing statements brings significant advantages to any business. The ability to modify the structure and content of your records as needed allows for more control over how information is presented. These tools help ensure accuracy, consistency, and a professional appearance, all while saving valuable time and effort.

One of the key benefits of these customizable documents is the ease with which they can be adapted to different business needs. Whether you’re working with varying service rates, discounts, or specific client requests, editable formats allow you to tailor each document without starting from scratch.

Key Advantages of Editable Formats

- Customization: Adjust fields, add or remove items, and change layouts to match your brand’s style or specific client requirements.

- Efficiency: Quickly update details without worrying about formatting, ensuring fast turnaround times on every billing cycle.

- Consistency: Maintain uniformity in your financial records, with standardized elements like logos, fonts, and contact details across all documents.

- Cost-Effective: No need for expensive software or additional tools–many free options are available that integrate well with widely used office applications.

- Reusability: Save the document for future use, making it easy to generate new statements with minimal changes each time.

Enhanced Professionalism and Accuracy

Editable formats not only help streamline the process but also contribute to a more polished image. A clean, well-structured document reflects positively on your business, building trust with clients. Additionally, these tools reduce the risk of errors by providing preset structures, making it less likely to overlook important information such as dates or totals.

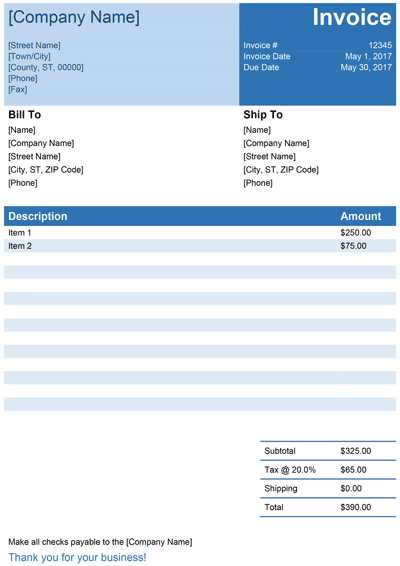

How to Customize Your Invoice in Word

Customizing your billing document allows you to tailor it specifically to your business needs. With the right tools, you can easily adjust the design, layout, and content to ensure each record reflects the unique details of your transactions. This flexibility ensures that you maintain a professional appearance while addressing the specific requirements of each client.

To customize your billing statement, start by opening your document in an editing program. From there, you can modify various sections, such as client information, itemized services, payment terms, and due dates. Adjusting fonts, colors, and logos further personalizes your document, reinforcing your brand identity.

Follow these steps to quickly customize your document:

- Update Contact Information: Begin by replacing the default fields with your company’s name, address, and contact details. Include any necessary legal or tax information as well.

- Modify Service Descriptions: Add or edit the list of products or services you’re billing for. Include detailed descriptions and adjust pricing as needed.

- Adjust Payment Terms: Edit the payment due date, include discount information if applicable, and specify your preferred payment methods.

- Add Your Logo: Insert your company logo at the top of the document to reinforce your branding and make your statement more recognizable.

- Format for Readability: Use bold text, bullet points, and tables to organize information clearly, making it easy for clients to understand the details at a glance.

By following these simple steps, you can create a billing document that’s not only functional but also aligned with your business’s image, ensuring a professional look for every transaction.

Steps to Create an Invoice from Scratch

Creating a billing statement from scratch may seem like a complex task, but with the right approach, it becomes a straightforward process. By breaking it down into simple steps, you can ensure that each document is accurate, professional, and aligned with your business needs. Here is a step-by-step guide to help you design your own record without relying on pre-made solutions.

Essential Elements of a Billing Record

Before you start building your document, make sure to include the key elements that every record should have. These components ensure clarity and help maintain a professional appearance:

- Header: Include your business name, logo, contact information, and any necessary tax identification numbers.

- Client Information: Add the recipient’s name, address, and contact details for easy identification.

- Transaction Date: Specify the date when the service was provided or the product was delivered.

- Itemized List: Provide a clear description of the goods or services provided, with individual prices and quantities.

- Total Amount: Clearly display the total cost, including any taxes, discounts, or other fees.

- Payment Terms: Include due dates, late fees, and accepted payment methods.

Step-by-Step Process for Creating Your Billing Record

Follow these simple steps to create a professional document from scratch:

- Choose Your Document Format: Open a blank document in your preferred text editor or word processor.

- Set Up Your Header: Insert your business name, logo, and contact information at the top of the page for easy identification.

- Add Client Information: Include the recipient’s name, address, and contact details below the header to ensure accuracy.

- List Your Products or Services: Create a table or bullet-point list to describe each item provided. Include quantities, unit prices, and a brief description for each entry.

- Calculate Total: Add up the amounts and clearly display the total cost at the bottom of the document. Be sure to include taxes or discounts if applicable.

- Set Payment Terms: Specify the payment due date, accepted methods of payment, and any penalties for late payments.

- Review and Save: Double-check your document for errors or missing information, then save it in th

Free Invoice Templates for Word Users

For those who need a quick and cost-effective way to create billing statements, free customizable documents are an excellent solution. These pre-designed formats allow users to easily generate accurate and professional records without the need for expensive software. Whether you are a freelancer, small business owner, or managing a larger organization, these free resources can save both time and effort while ensuring consistency across your documents.

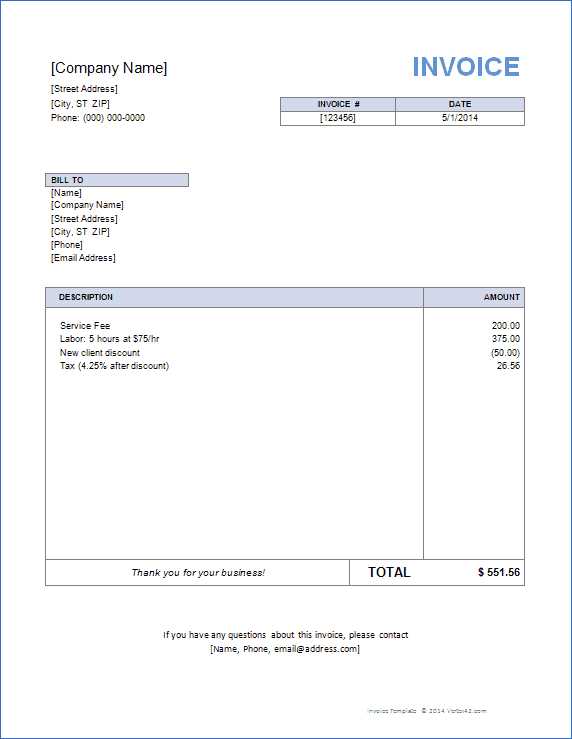

Where to Find Free Editable Billing Records

There are various online platforms that offer free, ready-to-use document designs, specifically for those using commonly available software. These resources often provide different styles and formats, catering to a wide range of business needs. From simple, clean designs to more complex layouts, you can find a document that suits your requirements. Here are some popular sources:

- Microsoft Office Templates

- Google Docs Templates

- Free Invoice Generator Websites

- Online Marketplaces for Small Businesses

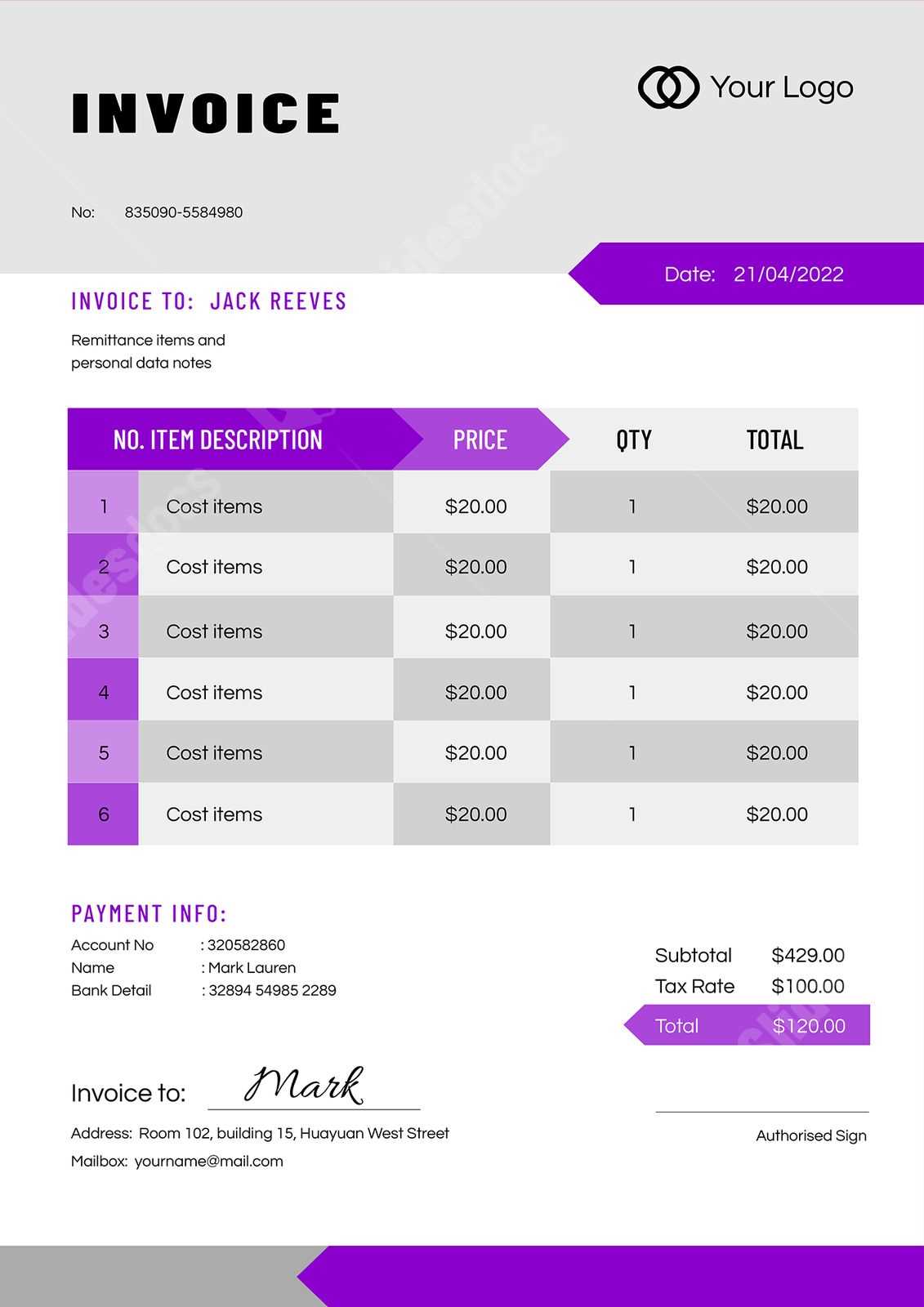

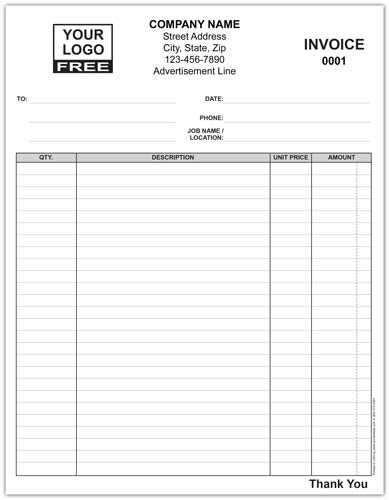

Example of a Simple Template Layout

Below is an example layout for a customizable billing record:

Item Description Quantity Unit Price Total Consulting Service 10 hours $50 $500 Software Development 5 hours $100 $500 Total $1000 This simple table layout can be easily modified to include your own services, rates, and company branding. By downloading these free templates, you can streamline your billing process and ensure that every document looks professional.

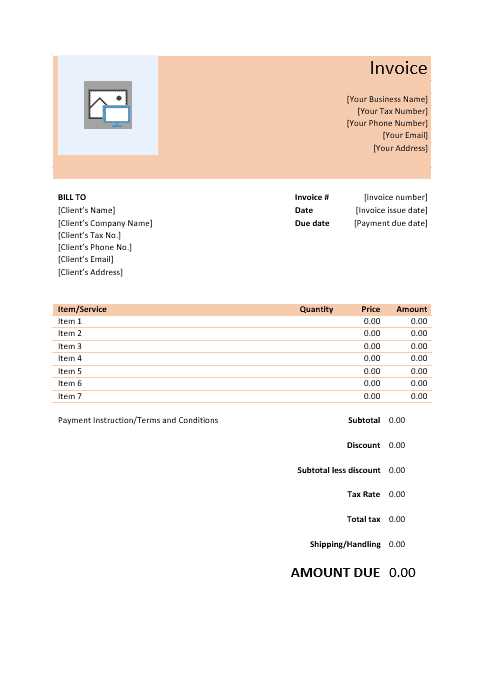

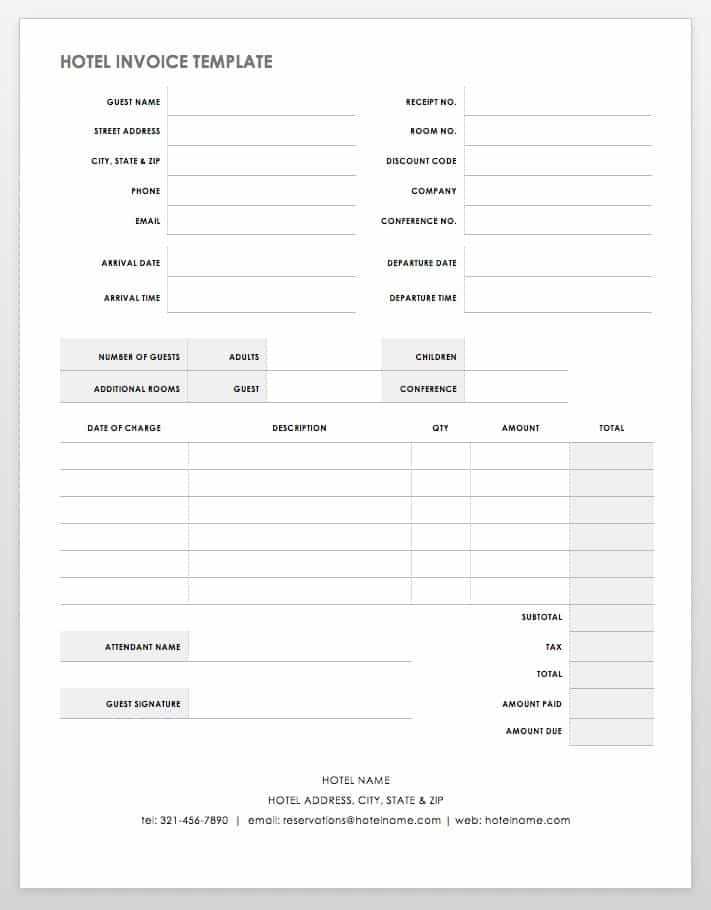

Common Features of a General Invoice

A well-structured billing document typically includes a set of essential elements that help ensure clarity, accuracy, and professionalism. These features make it easy for both the sender and recipient to understand the terms of the transaction, the services or products provided, and the total amount due. Regardless of the design or format, these components are present in most business documents of this type.

Key Elements of a Billing Record

Here are the core components that should be included in any professional billing record:

Element Description Business Details Includes the name, logo, and contact information of the company issuing the document. Client Information The recipient’s name, address, and contact details for easy identification. Unique Identifier A unique reference number for the record to track and differentiate each transaction. Transaction Date The date the service was rendered or product delivered. Itemized List A clear breakdown of the products or services, including descriptions, quantities, and prices. Total Amount The sum total of the items or services, including any applicable taxes or discounts. Payment Terms Details regarding the payment deadline, methods of payment, and any penalties for late payments. Including these essential features ensures that your billing record is both complete and professional, allowing for smooth transactions and minimizing the chance of disputes or misunderstandings.

How to Add Taxes to an Invoice

When preparing a billing statement, it’s important to account for taxes to ensure compliance with local regulations and provide accurate totals to your clients. Adding taxes to your document involves calculating the applicable rates and clearly displaying them, so that both you and the recipient understand the breakdown of costs. This process can vary depending on the tax rate, the type of service or product, and the location of the transaction.

Steps to Include Taxes in Your Billing Document

Here’s how to add taxes to your record efficiently:

- Determine the Tax Rate: Research the applicable tax rate for your region or the location of your client. This could include sales tax, VAT, or any other relevant tax.

- Apply the Tax Rate: Multiply the subtotal (the cost of the products or services before taxes) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax would be $50.

- Add the Tax to the Total: After calculating the tax, add it to the subtotal to get the final total amount due. For example, if the subtotal is $500 and the tax is $50, the final total would be $550.

- Clearly Label the Tax: Ensure that the tax amount is clearly separated and labeled in your billing record, so the client knows exactly how much they are being charged for taxes.

Example Breakdown

Here’s a sample breakdown showing how taxes would be added to a billing statement:

- Subtotal: $500.00

- Tax (10%): $50.00

- Total Amount Due: $550.00

By following these steps, you can ensure that taxes are properly calculated and clearly displayed, avoiding confusion and ensuring transparency with your clients.

Formatting Tips for Professional Invoices

When creating a billing document, presentation is just as important as accuracy. A well-formatted statement not only enhances professionalism but also makes it easier for your clients to understand the details of the transaction. Clear structure and consistent styling can help ensure that important information stands out and reduces the chance of confusion.

Key Formatting Principles

To ensure your billing documents are polished and easy to read, follow these formatting tips:

- Use a Clear Header: The header should include your company name, logo, and contact information, positioned prominently at the top for easy identification.

- Organize Information in Tables: Use tables to list products, services, quantities, prices, and totals. This makes it easy for the client to see the breakdown of charges.

- Keep the Layout Simple: Avoid cluttering the document with too much text or unnecessary elements. Focus on the essential details to maintain a clean, professional look.

- Highlight the Total: The total amount due should be clearly separated from other numbers and bolded to draw attention. Make it stand out at the bottom of the document.

- Use Consistent Fonts: Choose professional, easy-to-read fonts such as Arial or Times New Roman. Keep font sizes consistent throughout the document, with larger text for headings and smaller text for the body content.

Additional Tips for Readability

- Use White Space: Proper spacing between sections and around text makes the document feel less cramped and more visually appealing.

- Incorporate Borders or Lines: Light borders around the table or between sections help separate different areas of the document for better organization.

- Include a Footer: Use the footer to include additional terms, payment instructions, or a thank-you note, helping to close the document on a polite and professional note.

By following these formatting principles, you can create documents that not only look professional but are also easy for your clients to review and understand,

Invoice Template for Small Businesses

For small business owners, managing finances and ensuring timely payments is crucial for growth and stability. A professional and efficient billing document can help streamline this process, providing clarity for both you and your clients. Using a well-organized, customizable record format is an excellent way to maintain consistency and ensure all necessary details are included without confusion.

Why Small Businesses Need a Customized Billing Document

A tailored billing solution is essential for small businesses to ensure that all transaction details are accurately captured and communicated. With a customizable format, you can easily adapt the layout, terms, and content to suit your specific business needs, whether you’re billing for products, services, or a combination of both.

Key Features of a Billing Document for Small Businesses

Here are the main components that should be included in any professional billing statement for small businesses:

- Company Details: Include your business name, logo, and contact information. This reinforces your brand identity and makes it easy for clients to reach out if needed.

- Client Information: Make sure to list the client’s name, address, and contact details to ensure the correct recipient receives the document.

- Unique Reference Number: Assign a unique reference number to each document for tracking and organization purposes.

- Description of Products or Services: Clearly list the items or services being billed, along with quantities, unit prices, and any applicable discounts or additional fees.

- Total Amount Due: Be sure to include the total cost, highlighting any taxes or shipping charges to avoid confusion.

- Payment Terms: Include clear payment instructions, due dates, and any late fee policies. This sets clear expectations for both parties.

Benefits of Using a Customized Billing Record

- Professional Appearance: A clean and consistent layout ensures that your documents are easy to read and create a positive impression.

- Time-Saving: Once your document format is set up, you can reuse it for future transactions, saving time and effort on every new billing cycle.

- Flexibility: Customizing the format allows you to add or remove sections as needed, whether you’re providing services with multiple rates or selling various products.

- Accurate Record Keeping: A consistent approach to creating billing documents helps with organization and makes it easier to track payments and outstanding balances.

With a well-structured billing solution, small businesses can ensure that all essential information is presented clearly, increasing efficiency and enhancing the customer experience. A professional document not only helps in the collection of payments but also builds trust and credibility with clients.

How to Organize Invoice Information

Organizing billing details in a clear and structured way is essential for smooth transactions and easy understanding for both you and your clients. A well-organized document reduces the chance of errors, ensures no information is missed, and helps to present a professional image. Properly arranged information makes it easier for both parties to refer to the document later, especially when questions about charges arise.

Essential Sections to Include

To ensure your billing document is clear and well-organized, it’s important to structure it in a way that highlights all key elements. Here’s a recommended order of information to include:

- Header: At the top of the document, place your business name, logo, and contact information. This ensures your client knows who issued the document and can contact you easily if necessary.

- Recipient Details: Below the header, list your client’s name, company (if applicable), address, and contact information. This confirms that the document is correctly addressed.

- Unique Reference Number: A unique identifier for the record, such as an invoice number or order number, helps track and differentiate each transaction.

- Transaction Date: Include the date when the service was completed or the product was delivered, along with any applicable due dates for payment.

- Breakdown of Products or Services: Organize this section in a clear table format, listing each item with a description, quantity, unit price, and total price for each. This provides transparency and allows clients to see exactly what they are being charged for.

- Tax Information: If applicable, include the tax rate and the amount of tax being applied, along with any discounts or additional charges (like shipping or handling).

- Total Amount Due: Clearly show the total amount payable at the bottom of the document, after taxes and discounts have been applied. This makes it easy for the client to know exactly how much to pay.

- Payment Instructions: At the bottom or in the footer, include payment methods, due dates, and any additional terms, such as late fees or early payment discounts.

Why Structure is Important

Organizing your document in a logical, consistent way makes it easier to read and reference. A clean layout reduces the chance of errors, ensures all necessary information is present, and builds trust with your clients. When the information is well-structured, clients can quickly verify details and make payments without confusion.

By following this simple structure, you can create a billing document that is not only easy to understand but also looks professional and ensures smooth financial transactions for your business.

Customizing Payment Terms in Word

Customizing the payment terms in your billing documents is an important step in establishing clear expectations between you and your clients. Payment terms define when and how a client should make payments, and including them in your document ensures that both parties are aligned on deadlines, methods, and potential penalties. Tailoring these terms to fit your business needs helps maintain smooth financial transactions and fosters professional relationships.

Key Components of Payment Terms

Here are the main elements you should consider when customizing payment conditions:

- Due Date: Clearly specify the date by which payment is expected. Common options include “30 days from the issue date” or a fixed calendar date.

- Accepted Payment Methods: Indicate the various methods your clients can use to settle the bill, such as bank transfers, checks, credit cards, or online payment platforms like PayPal.

- Late Payment Penalties: Define any penalties for overdue payments. For example, you might include a percentage-based fee for late payments, such as “1.5% per month on overdue balances.”

- Early Payment Discounts: Offering discounts for early payments can encourage faster settlement. You can specify, for example, “A 5% discount for payments made within 10 days.”

How to Include Payment Terms in Your Document

Once you’ve defined your payment terms, it’s easy to add them to your document. Here’s how to ensure they are clearly presented:

- Positioning: Place the payment terms section towards the bottom of your document, just before or after the total amount due. This makes it easy for your clients to find and reference.

- Clear Language: Use simple and unambiguous language to prevent any misunderstandings. Avoid overly complex legal terms that might confuse the client.

- Consistency: If you’re using specific terms in multiple billing documents, maintain consistency in how you phrase payment expectations to avoid confusion over time.

Customizing your payment terms gives your business the flexibility to accommodate your clients while ensuring that you maintain control over your cash flow. Whether you choose to offer discounts or charge penalties, clear payment terms are essential for a professional and organized billing process.

Saving and Printing Your Invoice Template

Once you’ve designed and customized your billing document, it’s important to know how to save and print it properly. These final steps ensure that you can quickly access and use your document whenever needed, while also keeping a professional appearance when presenting it to clients. Whether you’re sending the document digitally or in print, proper formatting and organization are key to maintaining clarity and professionalism.

Steps to Save Your Document

Saving your billing document correctly will make it easy to access later and help maintain the integrity of the layout. Here’s how you can save your document effectively:

- Choose the Right File Format: Save the document in a format that is both accessible and compatible with other devices. The most common formats are PDF for electronic delivery and DOCX for further editing.

- Use Descriptive File Names: Name your document in a way that’s easy to recognize and search for later. For example, use the client’s name and the date, such as “John_Doe_Invoice_September2024.”

- Organize Files in Folders: To keep your documents organized, create a folder on your computer or cloud storage where you store all your billing records. Consider sorting by year or client for easier retrieval.

How to Print Your Document

Printing a professional copy of your billing document is essential if you need to send a physical copy or retain one for your records. Follow these steps to ensure your printed version looks clean and polished:

- Check Print Layout: Before printing, preview the document to make sure the formatting looks correct. Ensure that all text, tables, and images are properly aligned and there are no page breaks in the wrong places.

- Choose the Right Printer Settings: Select a high-quality print option to ensure your document looks sharp and clear. Use good-quality paper to present a more professional appearance.

- Print Multiple Copies: If you need to send physical copies to clients or keep one for your records, print at least two copies–one for the client and one for your business archives.

By saving and printing your billing document correctly, you ensure that your records are professional and easy to manage, whether you’re using them for internal tracking or external communication with clients.

How to Avoid Common Invoice Mistakes

Ensuring accuracy in your billing documents is crucial for smooth financial transactions and maintaining a professional image. Even small errors can lead to confusion, delays, or missed payments, which can negatively affect your cash flow. By being mindful of common mistakes and taking the necessary steps to avoid them, you can improve the efficiency of your billing process and foster stronger client relationships.

Common Mistakes to Watch Out For

Here are some of the most frequent errors that occur in billing documents and tips on how to avoid them:

- Incorrect or Missing Client Information: Double-check the details of your client, such as their name, address, and contact information. Sending a document to the wrong person or with incorrect details can delay payments.

- Missing or Incorrect Payment Terms: Ensure that your payment terms are clearly defined, including the due date, accepted methods, and any penalties for late payments. Failing to outline these terms can lead to confusion and disputes.

- Errors in Item Descriptions or Quantities: Always verify that the items or services listed are described accurately and with the correct quantities. A mistake in pricing or quantity can cause frustration and delay payment.

- Omitting Tax or Discount Information: If taxes or discounts apply, make sure they are clearly listed, along with the calculations. Leaving this out can lead to misunderstandings about the final amount due.

- Not Including a Unique Reference Number: Each billing document should have a unique identifier for easy tracking. This helps you and your clients reference the transaction quickly, reducing confusion and making follow-ups easier.

How to Minimize Mistakes

To avoid these issues and ensure your documents are professional and accurate, follow these best practices:

- Review Before Sending: Always proofread your document for errors before sending it out. A second set of eyes can help catch mistakes that you might have overlooked.

- Use Templates: Utilizing a consistent, pre-designed document format can help eliminate mistakes by providing a reliable structure that you can customize as needed.

- Automate Calculations: If possible, use automatic calculations for totals, taxes, and discounts to avoid manual errors.

- Stay Organized: Keep your records organized so that you can easily access and reference previous transactions when needed, reducing the risk of repeating errors.

By being mindful of these common mistakes and following a careful review process, you can create accurate, clear, and professional documents that help build trust with your clients and ensure timely payments.

Where to Find High-Quality Invoice Templates

Finding a well-designed, functional billing document is essential for businesses of all sizes. Whether you’re looking for a simple, minimalist layout or something more detailed with additional features, there are plenty of resources available to help you create the perfect document. Using high-quality formats can save you time and ensure a professional presentation, making it easier to focus on the core aspects of your business.

Online Resources for Downloading Professional Billing Documents

There are numerous platforms where you can find a variety of customizable documents, designed to meet different business needs. Here are some trusted sources:

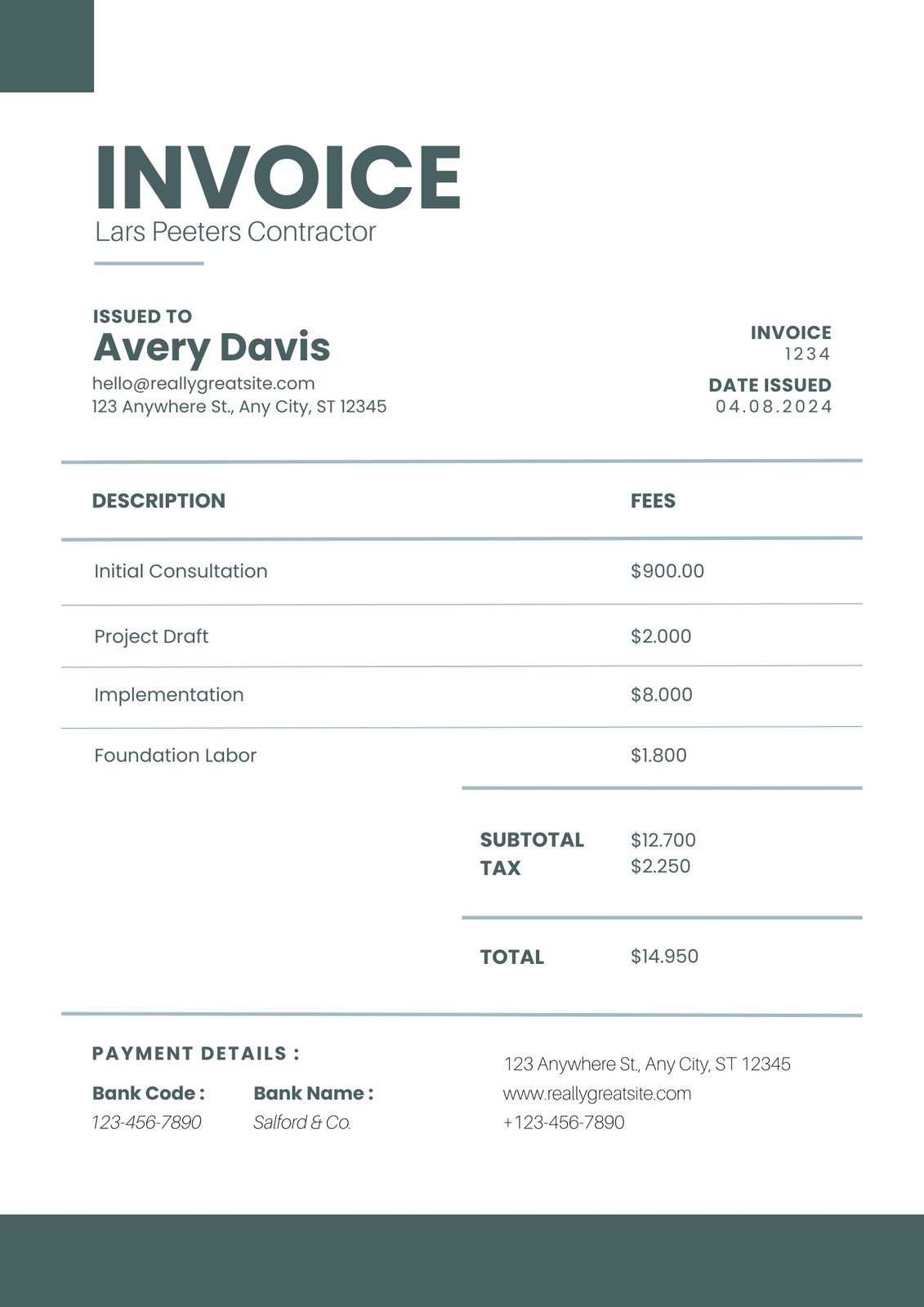

- Microsoft Office Templates: The official Microsoft website offers a wide range of free, customizable billing documents compatible with their software. These are user-friendly and cater to various industries.

- Google Docs: For those who prefer cloud-based tools, Google Docs offers many free templates that can be accessed and edited online. This makes it easy to manage your records from any device.

- Template Marketplaces: Websites like Template.net or Envato Elements offer premium templates designed by professionals. These are often more sophisticated and include features like automatic calculations or built-in branding options.

Customizing and Adapting Templates

Once you’ve chosen the right document for your business, it’s important to customize it to fit your specific needs. Most sources allow for easy edits, so you can adjust sections like the payment terms, company information, and product/service descriptions. Some platforms even offer interactive forms that let you enter details and instantly generate the document.

Whether you choose free options or premium offerings, having access to high-quality, pre-designed formats helps streamline your billing process, ensuring you maintain a professional appearance and save time.

Invoice Template Security and Privacy Tips

Ensuring the security and privacy of your billing documents is essential for protecting both your business and your clients. These documents often contain sensitive financial information, such as payment details, personal addresses, and transaction amounts, which makes them attractive targets for cybercriminals. By following a few key security practices, you can safeguard your data and avoid potential privacy breaches.

Best Practices for Protecting Your Billing Documents

Here are some crucial steps to help you maintain the security of your billing files:

- Use Strong Passwords: Always protect your files with strong, unique passwords. If you’re using cloud storage or shared accounts, ensure that only authorized personnel have access.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your accounts. This ensures that even if someone gains access to your password, they still cannot access your documents without a secondary verification step.

- Use Secure File Sharing Platforms: When sending billing documents to clients, always use encrypted, secure methods such as password-protected PDFs or trusted file-sharing services like Google Drive or Dropbox with strong access controls.

- Regularly Update Software: Keep your devices, software, and antivirus programs up to date to protect against the latest security threats. This reduces the risk of malicious attacks or data breaches.

Safeguarding Personal and Financial Information

In addition to securing your files, it’s crucial to be mindful of how you store and handle sensitive client information:

- Limit Access: Only allow authorized individuals within your company to access financial records. By restricting access, you minimize the risk of accidental leaks or intentional theft.

- Redact Sensitive Information: If you need to send partial documents for verification or consultation, consider redacting sensitive data such as credit card numbers or personal addresses to protect your client’s privacy.

- Encrypt Documents: Encrypt sensitive files before storing or sharing them. This adds an additional layer of protection, ensuring that only authorized parties can open and view the contents.

By adopting these security measures, you can confidently manage your billing documents and maintain the trust of your clients, ensuring that their personal and financial information remains safe and protected.