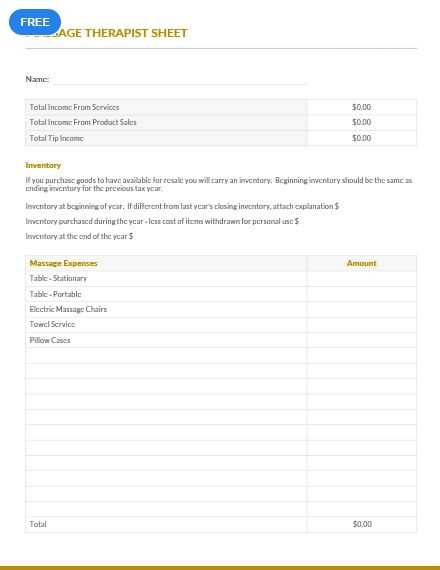

Free Massage Therapist Invoice Template for Efficient Billing

For any service provider, keeping track of payments and maintaining clear records is vital for smooth business operations. Whether you offer personal wellness services or other specialized care, having a consistent and efficient system for documenting transactions ensures that both you and your clients are on the same page regarding services rendered and amounts due.

Creating a well-organized and professional billing document not only helps with financial management but also enhances trust with your clients. By using a reliable structure, you can avoid confusion, streamline your accounting process, and ensure timely payments. This guide will walk you through everything you need to know about building a functional and customizable billing document that suits your specific needs.

Effective billing involves more than just tracking money–it’s about providing clarity, transparency, and an easy-to-understand summary of each session or service. A comprehensive system will also help you maintain a professional image and encourage long-term relationships with your clientele.

Why You Need an Invoice Template

Having a structured and consistent method for documenting services provided is essential for maintaining clarity in any business. When you have a ready-made system to record financial transactions, it not only simplifies your work but also ensures that every detail is covered, from pricing to payment terms. This helps reduce errors and misunderstandings that could arise between you and your clients.

Efficiency is one of the main reasons to adopt a pre-designed system. Without a standard format, creating new records for each client can quickly become time-consuming. With a customizable solution in place, you can streamline your billing process, making it faster and more reliable. It also allows you to focus on delivering quality service, rather than worrying about the details of documentation.

In addition, a consistent format builds professionalism and trust. Clients appreciate clear, well-organized records that provide a detailed account of services and payments. A polished, error-free document not only reflects positively on your business but also makes it easier to track and manage your finances over time.

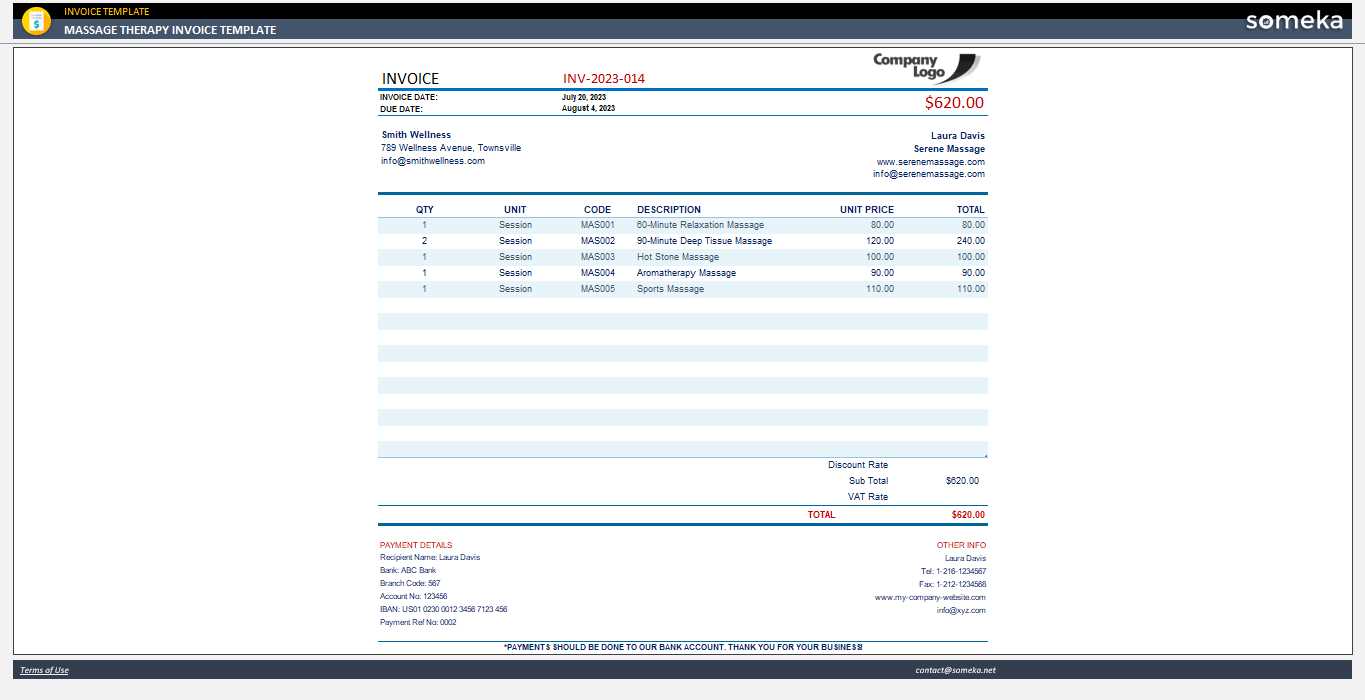

How to Create a Custom Invoice

Creating a personalized billing document allows you to cater to the unique needs of your business while maintaining a professional appearance. By customizing your records, you can ensure that all relevant details are included and presented clearly, making it easier for your clients to understand the charges and terms. Here’s a simple guide to help you get started with designing your own billing document.

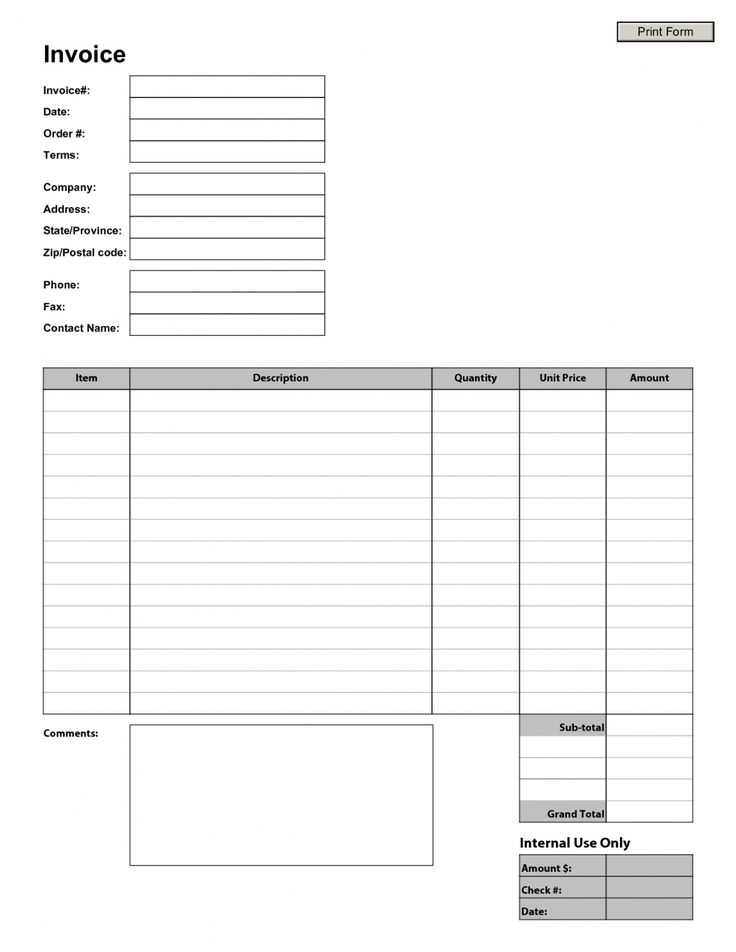

Start by organizing the essential information that needs to appear on the document. Typically, this includes your business name, contact details, a breakdown of services provided, and payment instructions. Below is a sample layout for a basic billing document:

| Item | Description | Cost |

|---|---|---|

| Service 1 | Detailed description of the service provided | $XX.XX |

| Service 2 | Additional service or item description | $XX.XX |

| Total | $XX.XX |

Once you have all the necessary components, make sure to include payment terms, such as due dates and acceptable methods of payment. Additionally, adding your business logo or any other branding elements can enhance the look and feel of the document, making it more aligned with your business identity.

Finally, save your document in an easily accessible format, like PDF or Word, so that it can be easily shared with clients. Customization helps ensure clarity, professionalism, and smooth communication regarding payments and services rendered.

Key Information to Include in Your Invoice

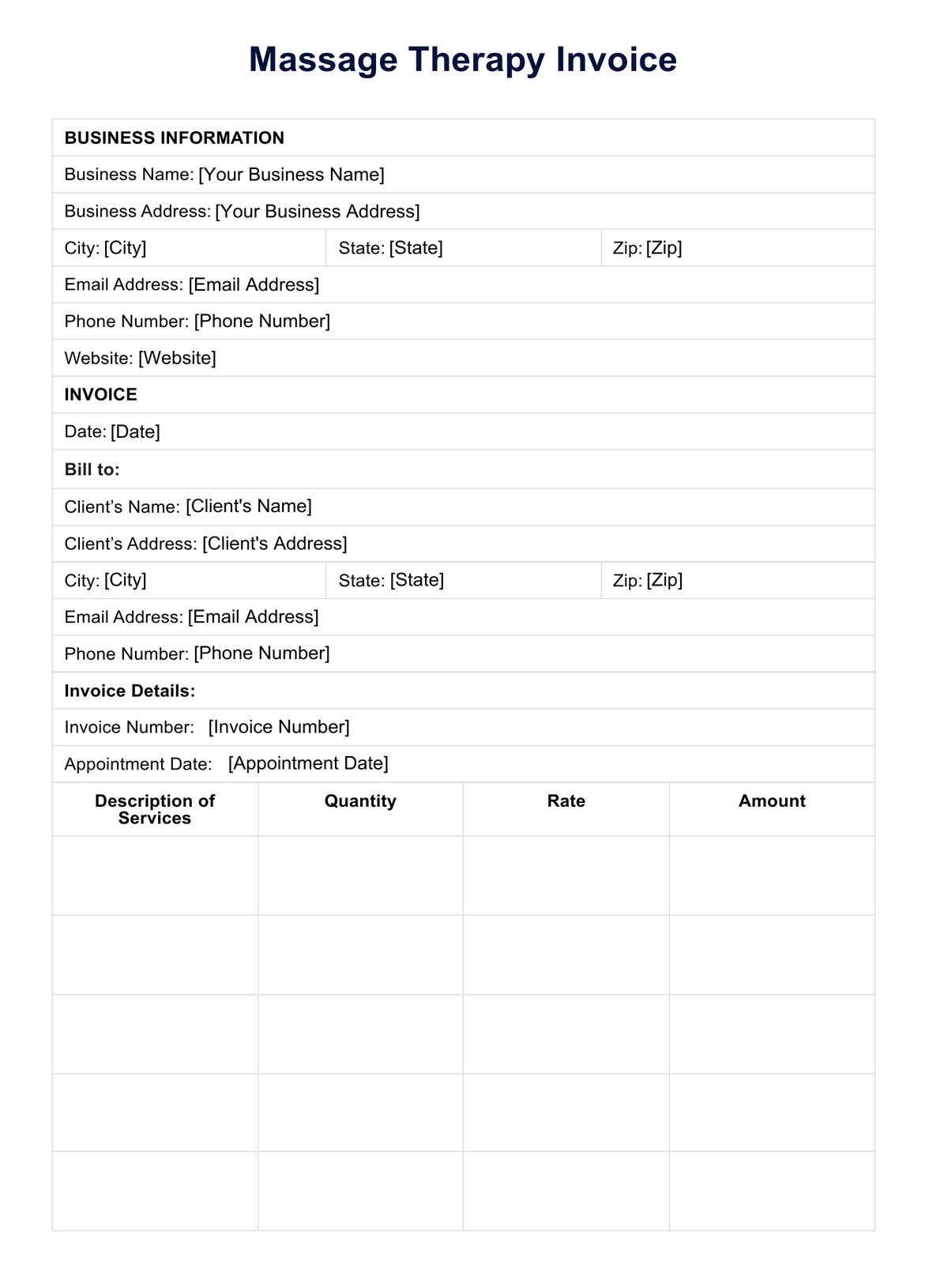

For a billing document to be effective, it must contain all the essential details to ensure transparency, prevent confusion, and make it easy for your clients to understand the charges. Every section of your record should have a specific purpose, from identifying your business to specifying the services provided. Here’s a list of the key elements you should include to make your billing clear and professional.

1. Contact Details

Your business’s contact information is crucial for identification and communication. Make sure to include:

- Your full business name

- Phone number and email address

- Business address (optional)

- Website or social media links (if applicable)

2. Service Breakdown

Clearly outlining what services were provided helps avoid misunderstandings. Include the following:

- A description of each service rendered

- The time or duration of the service (if applicable)

- The cost associated with each service

3. Payment Information

To facilitate smooth transactions, include payment-related details such as:

- Total amount due

- Payment methods accepted (bank transfer, card, etc.)

- Due date for payment

Incorporating these elements into your document will not only keep the process organized but also promote clarity and professionalism, ensuring clients understand exactly what they’re paying for and when payment is expected.

Benefits of Using an Invoice Template

Having a pre-designed system for documenting transactions provides several advantages for both business owners and clients. A consistent structure saves time, reduces errors, and ensures that all necessary details are included in each document. Below are some key benefits that come with adopting a standardized approach to billing.

1. Time Savings

One of the most significant advantages is the amount of time saved when generating records. Instead of manually creating a new document from scratch every time, you can quickly fill in the necessary details. This allows you to focus more on providing services and less on administrative tasks.

- Pre-designed sections for easy customization

- Automatic formatting, reducing the need for manual adjustments

- Fast generation of documents for multiple clients

2. Consistency and Professionalism

A standardized system ensures that every document follows the same structure, which increases professionalism. Clients appreciate receiving clear and well-organized statements, and having a reliable format helps you maintain a consistent image for your business.

- Establishes a professional appearance for your business

- Improves client trust and satisfaction

- Enhances the overall presentation of your services

3. Reduces Mistakes

By using a predefined format, the chances of forgetting essential details or making errors decrease. Information such as payment terms, service descriptions, and contact details are already structured, so you simply fill in the necessary data. This helps avoid miscommunication and ensures that your clients have accurate records.

- Eliminates the risk of missing important information

- Ensures clarity with properly formatted fields

- Minimizes errors in calculations and payment instructions

Adopting a system for your financial documentation brings greater efficiency and accuracy, allowing you to focus on what matters most: providing quality service to your clients.

Common Billing Mistakes to Avoid

When managing financial records, it’s important to avoid common errors that can lead to confusion, delays, or even lost income. Many service providers make small yet impactful mistakes that can affect their business operations and client relationships. By recognizing and addressing these errors, you can improve your documentation process and ensure a smoother transaction flow.

1. Missing or Incorrect Details

One of the most frequent mistakes is failing to include all necessary information. A missing service description, incorrect pricing, or inaccurate contact details can create confusion and delay payments. Always double-check your documents to ensure accuracy.

- Missing client information such as name or contact details

- Incorrect service descriptions that may cause misunderstandings

- Wrong amounts or calculations leading to payment disputes

2. Lack of Clear Payment Terms

Failure to include clear payment terms can result in delayed payments or unnecessary back-and-forth communication. Clients need to know when the payment is due and the acceptable methods of payment. Without this information, misunderstandings are likely to occur.

- Unclear due dates leading to late payments

- Vague payment instructions causing confusion for clients

- Failure to mention late fees or penalties for overdue payments

3. Using Unprofessional or Inconsistent Formats

Using inconsistent layouts or informal styles can give a poor impression to clients. A professional-looking document with a consistent structure not only boosts your credibility but also makes it easier for clients to understand the charges.

- Lack of organization in service breakdowns and totals

- Inconsistent fonts or styles that detract from the document’s readability

- Failure to include branding elements like logos or business names for identification

By avoiding these common mistakes, you can ensure that your financial records are accurate, clear, and professional. This will lead to fewer disputes, faster payments, and stronger relationships with your clients.

Different Billing Formats for Service Providers

When it comes to documenting payments for services rendered, there are various formats to choose from, each offering unique features suited to different needs. Selecting the right structure can help simplify the process for both the business owner and the client. Below, we explore several popular formats that service providers can use to effectively organize their billing information.

1. Simple List Format

The simplest and most straightforward billing format is a list-based structure. This is ideal for businesses that offer one-time services or straightforward pricing. Each item or service is listed along with the corresponding cost, with a total amount due at the bottom.

- Easy to create and understand

- Best for one-time or hourly services

- Can be used for both detailed or basic billing

2. Detailed Breakdown Format

For more complex services that may include multiple elements or time-based charges, a detailed breakdown format works well. This format provides in-depth descriptions of each service and the time spent, with costs calculated accordingly. It’s perfect for those offering a variety of services or packages.

- Lists service descriptions, time, and unit rates

- Useful for businesses offering multi-step or long-duration services

- Helps clarify complex billing situations for clients

3. Recurring Billing Format

For businesses with clients who receive regular services, a recurring billing format is ideal. This format is designed to track ongoing work and automatically apply charges on a recurring basis. It’s perfect for subscription-based services or clients with regular appointments.

- Includes details about frequency (weekly, monthly, etc.)

- Automates payment reminders

- Ensures consistent cash flow for long-term clients

4. Hybrid Format

A hybrid format combines elements of multiple formats, allowing flexibility to cater to a range of services. This format can mix a basic service list with detailed descriptions, unit rates, and recurring charges, making it highly adaptable to various business models.

- Combines the best features of multiple formats

- Flexible for different service types

- Perfect for businesses with both one-time and recurring services

Choosing the right format depends on the complexity of your services and how you prefer to structure your payments. Whichever format you choose, ensure that it aligns with your business needs and keeps things clear

How to Personalize Your Billing Document

Customizing your billing document allows you to make it more aligned with your business identity and provide a unique experience for your clients. Personalization not only enhances the professional look but also ensures that the document reflects the specific services you provide. Here are some ways to tailor your record to fit your business needs and make it stand out.

1. Add Your Business Branding

One of the first steps to personalizing your record is incorporating your business’s visual identity. This includes your logo, brand colors, and font style. By doing so, you create a cohesive and polished appearance that clients will recognize and associate with your services.

- Insert your logo at the top of the document for easy identification.

- Use brand colors for headings, borders, or text to maintain a consistent look.

- Choose professional fonts that align with your brand image.

2. Customize Service Descriptions

Modify the service descriptions to suit your business and the specific offerings you provide. A clear, detailed breakdown of what each service includes adds a personal touch and ensures your clients fully understand what they are being charged for.

- Be specific about what each service entails to avoid confusion.

- Include additional notes such as special instructions, personal preferences, or treatment details.

- Offer package deals or bundle services to encourage more business.

3. Tailor Payment Terms and Policies

Including your specific payment terms and policies adds another layer of personalization and ensures that clients are clear about expectations. Adjust these sections to fit your business’s preferred methods of payment and payment schedules.

- Specify payment methods you accept (credit card, bank transfer, etc.).

- Indicate any late fees or discounts for early payments, if applicable.

- Include a thank-you message or personal note to strengthen client relationships.

By personalizing your billing document, you not only make it more professional and reflective of your brand but also enhance the client experience by providing clarity and a personal touch. Customization helps build trust and ensures your document serves its purpose effectively.

How to Handle Late Payments in Your Billing Document

Late payments can be a common challenge for businesses, but having clear guidelines in place can help you manage this situation effectively. By outlining your payment terms and consequences for overdue payments in your records, you set expectations from the start and reduce the likelihood of delays. Here’s how you can address late payments and ensure timely compensation for your services.

1. Set Clear Payment Terms

Before any payment issues arise, it’s important to clearly communicate your payment expectations. Include specific payment terms in every billing document to make sure your clients understand the timeline and methods for payment.

- Specify due dates for each transaction (e.g., 30 days after service completion).

- List acceptable payment methods (credit cards, bank transfers, checks, etc.).

- Include discounts or incentives for early payments, if applicable.

2. Implement Late Fees

To encourage timely payments, you can implement a late fee policy. Make sure to communicate the penalties clearly in your records, so clients are aware of the consequences for missing the deadline.

- Clearly state late fees in your document, including how much is charged after the due date.

- Set a grace period if you wish to provide some flexibility before imposing penalties.

- Make the late fee percentage or amount visible so clients know exactly what to expect.

3. Offer Payment Reminders

Sending reminders before and after the due date is an effective way to prompt clients to pay on time. Set up a system where you send friendly reminders about upcoming payments or overdue amounts.

- Send a reminder a few days before the payment is due to ensure clients don’t forget.

- Follow up promptly if payment is overdue, reminding clients of the due date and any penalties for late payment.

- Be professional and polite in your reminders to maintain positive client relationships.

4. Set Consequences for Continued Delays

If late payments become a recurring issue, outline further actions to protect your business. This can include suspending services, requiring upfront payments, or involving a collections agency for extended overdue amounts.

- Specify actions that will be taken if payment is not received after a set period (e.g., suspension of future services).

- Outline the process for handling non-payment, including when to escalate the issue.

- Be transparent about your process to ensure clients understand the consequences of continued delays.

By taking these steps, you can effectively handle late payments while maintaining a professional relationship with your clients. Clear communication and consistent enforcement of payment terms help minimize delays and protect your business’s cash flow.

Best Software for Creating Billing Documents

Creating professional and accurate billing records is essential for maintaining smooth business operations. Fortunately, there are several software solutions available that can simplify the process, saving time and reducing errors. These tools offer customizable features, automation, and ease of use to help you manage payments and client transactions more efficiently. Below are some of the best options for creating billing documents that meet your business needs.

1. FreshBooks

FreshBooks is a user-friendly tool designed for small business owners and service providers. It allows you to easily create customized records, track payments, and send reminders to clients. The platform also offers integration with accounting tools, making it a comprehensive solution for managing financial data.

- Easy-to-use interface with drag-and-drop functionality for creating documents.

- Automated payment reminders and recurring billing options.

- Time tracking for accurate billing on hourly services.

2. QuickBooks Online

QuickBooks Online is a powerful accounting software with robust features for creating and managing billing records. It allows for seamless integration with your financial data, helping you track payments and generate professional documents with minimal effort.

- Customizable billing formats for different types of services.

- Integration with bank accounts to automatically track payments and balances.

- Cloud-based access so you can manage records from anywhere.

3. Zoho Invoice

Zoho Invoice is a highly flexible and affordable option for businesses looking to create personalized billing records. It offers a range of features, including customizable templates, multi-currency support, and detailed reporting capabilities, making it ideal for businesses with international clients or varied services.

- Customizable templates that allow you to tailor the design and structure.

- Multi-currency support for businesses with global clients.

- Detailed financial reports to track income and expenses.

4. Wave

Wave is a free billing software solution that provides powerful tools for invoicing, payment tracking, and accounting. It’s perfect for small businesses or freelancers looking for a cost-effective option that doesn’t sacrifice quality.

- Free to use with no hidden fees or subscriptions.

- Simple and professional document creation with the ability to add a logo and customize fields.

- Automated reminders for overdue payments to help reduce late fees.

Each of these tools offers unique features that cater to different business needs, whether you’re just starting ou

What Makes a Professional Billing Document

A professional billing document is a crucial tool for any business, ensuring clear communication of charges and maintaining a positive relationship with clients. The design, structure, and content of the document should convey professionalism, accuracy, and clarity. Here’s what to focus on to create a document that reflects your business’s reliability and expertise.

1. Clear and Concise Information

One of the key aspects of a professional document is providing all the necessary information in a clear, easy-to-read format. Clients should immediately understand what they are being charged for, the total amount due, and the payment terms.

- Detailed service descriptions that explain what was provided and the associated costs.

- Client and business contact details, including names, addresses, and phone numbers.

- Accurate pricing with clear breakdowns for each service or product.

2. Professional Design and Branding

Consistency in design enhances the perception of your business’s professionalism. Using your brand’s logo, color scheme, and fonts helps make the document recognizable and polished.

- Incorporating your logo at the top of the document to reinforce your brand identity.

- Using a consistent layout that organizes information logically and neatly.

- Applying your brand colors and fonts to create a cohesive look and feel.

These elements not only ensure that your billing document is easy to understand but also elevate your brand’s image, fostering trust with clients. A well-organized, professional document can improve payment processes and contribute to a smoother client experience.

Tracking Payments with Your Billing Document

Effectively managing and tracking payments is essential for maintaining a healthy cash flow and ensuring timely compensation for services rendered. A well-organized billing document not only serves as a record of the transaction but also helps you monitor the status of each payment. By clearly marking payments and their status, you can quickly identify any outstanding balances and take appropriate action when necessary.

1. Include Payment Status Indicators

One of the simplest and most effective ways to track payments is by marking the status of each transaction directly on the document. Whether a payment has been made, is pending, or is overdue, this clear indication helps both you and your clients stay on the same page regarding payment progress.

- Paid: Marking an entry as “paid” confirms that the transaction has been completed and no further action is needed.

- Pending: Use this label for payments that are yet to be processed, giving clients a reminder of their upcoming obligation.

- Overdue: A red flag that alerts both parties of late payments, prompting quick follow-up and action.

2. Record Payment Dates and Amounts

When a payment is made, make sure to update your document with the date and amount received. This not only keeps your records up-to-date but also helps in balancing accounts at the end of the month or year.

- Payment Date: Always note the date when the payment was received to avoid confusion.

- Amount Paid: Record the exact amount to ensure accuracy when calculating outstanding balances.

- Payment Method: Indicate whether the payment was made by check, credit card, cash, or another method for better tracking.

3. Use Payment Tracking Software

If you deal with a high volume of transactions, utilizing payment tracking software can streamline the process. Many tools allow you to automatically update the status of payments, send reminders, and even generate reports that summarize your financials over a given period.

- Automated reminders: Software can automatically send reminders when payments are due or overdue.

- Real-time tracking: Keep track of payments as they are processed, ensuring accurate records.

- Detailed reporting: Use built-in tools to generate reports on payment history and outstanding balances.

By following these simple steps, you can ensure that your payment tracking is both accurate and efficient. This not only helps you stay organized but also encourages timely payments and reduces the risk of financial errors.

Choosing the Right Billing Document Layout

When creating a billing record, the layout plays a crucial role in ensuring clarity, professionalism, and ease of use. A well-organized document not only enhances the client experience but also helps in avoiding confusion during payment processing. Choosing the right layout involves considering factors such as readability, the amount of information to display, and the visual appeal that aligns with your business branding.

1. Keep It Simple and Clean

A clean and minimalist layout is often the most effective choice. Too many elements or a cluttered design can overwhelm your client and make it difficult for them to locate important details. Stick to a simple structure that highlights the key components, such as services provided, pricing, payment terms, and contact information.

- Limit text clutter by avoiding unnecessary information.

- Use plenty of white space to separate sections and improve readability.

- Highlight essential details such as the total amount due, due date, and payment instructions.

2. Use a Logical Flow of Information

The layout should guide the reader’s eye in a logical progression, from the basic information at the top to the details of the services or products provided. Having a well-organized flow ensures that both you and your client can quickly access the necessary information without confusion.

- Start with your contact information and client details at the top of the document.

- List services in a clear table or itemized list, showing descriptions, quantity, and price.

- End with payment details such as due date, payment methods, and instructions.

By considering these factors when choosing the layout for your billing record, you create a document that is not only professional but also practical for both you and your clients. A thoughtful design can improve communication, enhance payment clarity, and contribute to a positive business relationship.

How Often Should You Send Billing Records

Sending billing records at the right time is essential for ensuring smooth cash flow and maintaining a professional relationship with clients. The frequency of sending these documents depends on the type of services you provide, the payment terms you’ve set, and the preferences of your clients. Striking the right balance can help avoid delays while also making the payment process as seamless as possible for everyone involved.

1. Regular Services or Recurring Payments

If your business offers ongoing or subscription-based services, it’s important to establish a regular billing schedule. This ensures that clients are reminded of their financial responsibilities on a consistent basis, helping to maintain a steady income stream for your business.

- Monthly: Common for subscription services or retainer agreements, where clients are billed at the start or end of each month.

- Weekly: For clients with frequent or shorter-term services, sending records on a weekly basis helps keep payments manageable.

- Quarterly: For longer-term projects or services, you may opt to send billing records every three months.

2. One-Time Services or Project-Based Work

For businesses that offer one-time services or project-based work, sending a billing document at the completion of the job is typical. It ensures that clients are promptly informed of the costs and can settle payment right after receiving the final product or service.

- Upon Completion: Send a billing record once the project or service has been completed and delivered.

- Milestone Billing: For larger projects, it may be appropriate to send records at different stages or milestones.

3. Retainer Agreements or Deposits

For ongoing work that requires an upfront deposit or retainer, it’s best to send a billing record at the beginning of the project and then again when the remainder of the payment is due. This provides clarity and ensures that both you and the client are aligned with the payment schedule.

- Initial Deposit: Send a billing record at the start to confirm the deposit received.

- Final Payment: A final billing record when the project is completed or when the remaining balance is due.

By choosing the right frequency for sending billing documents, you ensure that clients are properly reminded of their obligations while keeping your cash flow predictable and organized. Whether you bill on a recurring schedule or at the completion of a project, timely and clear comm

How to Manage Recurring Clients

Managing recurring clients effectively is essential for maintaining a stable income and fostering long-term relationships. A consistent and organized approach to handling repeat clients can ensure smooth operations, reduce administrative workload, and enhance customer satisfaction. The key to success lies in creating a seamless experience that keeps clients happy while ensuring that payments and scheduling are handled efficiently.

1. Set Clear Payment Terms

One of the most important aspects of managing recurring clients is establishing clear and consistent payment terms. Whether clients are billed weekly, monthly, or based on another schedule, it’s crucial to ensure they understand the agreed-upon payment structure from the start.

- Specify billing cycles: Make sure clients are aware of the frequency and amount of payments, whether it’s a fixed fee or variable based on services rendered.

- Offer flexible payment options: Provide multiple payment methods, such as credit cards, bank transfers, or online payment platforms, to accommodate different preferences.

- Communicate deadlines: Let clients know when their payments are due, and consider offering discounts or incentives for early payments.

2. Automate Scheduling and Reminders

For clients who require ongoing appointments or services, automation can make the process much easier. Using scheduling software or tools that send automatic reminders helps both you and your client stay on track with appointments and ensures there’s no confusion about upcoming sessions.

- Set recurring appointments: Use a scheduling tool that allows clients to book and confirm recurring sessions without having to manually schedule each one.

- Send appointment reminders: Automatically send reminders via email or text before appointments to reduce no-shows and rescheduling.

- Track client preferences: Use the software to note any specific preferences your clients have for each session, making the experience more personalized and efficient.

3. Maintain Consistent Communication

Building a strong relationship with recurring clients requires regular and open communication. Keep them informed about any changes, updates, or new services you offer, and check in periodically to ensure they are satisfied with your services.

- Follow up after services: Send a quick message after a session to thank clients for their business and ask if they are satisfied with the service.

- Ask for feedback: Regularly request feedback to improve your offerings and show clients that their opinion matters.

- Offer loyalty perks: Consider offering discounts, special offers, or perks for long-term clients to show appreciation for their loyalty.

By implementing these strategies, you can efficiently manage recurring

How to Manage Recurring Clients

Managing recurring clients effectively is essential for maintaining a stable income and fostering long-term relationships. A consistent and organized approach to handling repeat clients can ensure smooth operations, reduce administrative workload, and enhance customer satisfaction. The key to success lies in creating a seamless experience that keeps clients happy while ensuring that payments and scheduling are handled efficiently.

1. Set Clear Payment Terms

One of the most important aspects of managing recurring clients is establishing clear and consistent payment terms. Whether clients are billed weekly, monthly, or based on another schedule, it’s crucial to ensure they understand the agreed-upon payment structure from the start.

- Specify billing cycles: Make sure clients are aware of the frequency and amount of payments, whether it’s a fixed fee or variable based on services rendered.

- Offer flexible payment options: Provide multiple payment methods, such as credit cards, bank transfers, or online payment platforms, to accommodate different preferences.

- Communicate deadlines: Let clients know when their payments are due, and consider offering discounts or incentives for early payments.

2. Automate Scheduling and Reminders

For clients who require ongoing appointments or services, automation can make the process much easier. Using scheduling software or tools that send automatic reminders helps both you and your client stay on track with appointments and ensures there’s no confusion about upcoming sessions.

- Set recurring appointments: Use a scheduling tool that allows clients to book and confirm recurring sessions without having to manually schedule each one.

- Send appointment reminders: Automatically send reminders via email or text before appointments to reduce no-shows and rescheduling.

- Track client preferences: Use the software to note any specific preferences your clients have for each session, making the experience more personalized and efficient.

3. Maintain Consistent Communication

Building a strong relationship with recurring clients requires regular and open communication. Keep them informed about any changes, updates, or new services you offer, and check in periodically to ensure they are satisfied with your services.

- Follow up after services: Send a quick message after a session to thank clients for their business and ask if they are satisfied with the service.

- Ask for feedback: Regularly request feedback to improve your offerings and show clients that their opinion matters.

- Offer loyalty perks: Consider offering discounts, special offers, or perks for long-term clients to show appreciation for their loyalty.

By implementing these strategies, you can efficiently manage recurring clients and ensure that their experience is positive and hassle-free. This not only helps you retain valuable customers but also enhances your reputation and strengthens client trust in your services.

How to Organize Your Billing Records

Efficient organization of billing records is crucial for managing finances, tracking payments, and maintaining a professional image. A well-organized system allows you to quickly access any document, review payment status, and generate reports when needed. Establishing a clear structure for storing and managing these records helps avoid errors, ensures timely follow-ups, and simplifies tax reporting.

1. Create a System for Categorization

The first step in organizing your billing documents is to categorize them in a way that makes sense for your business. Grouping records based on specific criteria helps you quickly find what you’re looking for, whether it’s by client, project, or payment status.

- Client-based categorization: Sort records by client name or ID for easy reference.

- Service-based grouping: Organize by type of service or product provided, especially if you offer various services.

- Status-based organization: Sort by paid, pending, and overdue records to ensure timely follow-ups.

2. Use Digital Tools for Storage

With the advancement of technology, storing billing records digitally has become a standard practice. Using cloud-based tools or accounting software ensures that all records are safe, accessible, and searchable.

- Cloud storage: Services like Google Drive or Dropbox allow for secure, accessible, and shareable storage of billing records.

- Accounting software: Tools like QuickBooks or Xero can automate record-keeping, help track payments, and generate financial reports.

- File naming conventions: Use consistent naming conventions for files, including the client name, date, and document type (e.g., JohnDoe_March2024_Billing). This makes searching and sorting much easier.

3. Regularly Update Your Records

To keep your system efficient, it’s important to regularly update your records. Ensure that new billing documents are added promptly, payment statuses are updated, and any changes to client information are reflected immediately.

- Timely updates: Update the records as soon as payments are made or services are completed to ensure accuracy.

- Periodic audits: Regularly review and audit your records to ensure everything is up-to-date and accurate.

- Backup records: Always have a backup for your digital files, either through cloud backup or external storage, to prevent data loss.

By implementing these strategies, you can keep your billing documents well-organized, reduce administrative stress, and ensure that your business runs smoothly. Proper organization not only saves time but also ensures that you stay on top of your financial management.

Legal Considerations for Billing Records

When handling billing documents, it’s important to be aware of the legal requirements that govern their creation and management. These considerations ensure that your business operates in compliance with local regulations, helps protect your rights, and establishes clear expectations between you and your clients. Proper documentation is not just about tracking payments; it also plays a vital role in safeguarding both parties in case of disputes or legal action.

1. Ensure Accurate and Transparent Information

One of the fundamental legal aspects of any billing record is accuracy. The information presented on the document must reflect the actual services or goods provided, along with the agreed-upon pricing. Misleading or inaccurate billing can result in legal consequences and damage to your business reputation.

- Clearly state all charges: Include detailed descriptions of services or products, pricing, quantities, and any taxes or additional fees.

- Use clear payment terms: Specify due dates, accepted payment methods, and late payment penalties if applicable.

- Ensure correct client details: Double-check that the client’s name, contact information, and address are accurate to avoid any confusion in case of disputes.

2. Compliance with Local Tax Regulations

Depending on your location and the services provided, you may be required to collect and report sales tax or other applicable taxes. It’s crucial to ensure that your billing records comply with local tax laws to avoid fines or penalties.

- Include tax information: Clearly indicate the applicable tax rates and total tax amount on each billing record if required by law.

- Maintain tax records: Keep copies of all billing documents for tax reporting purposes and ensure that you have the necessary documentation to support your tax filings.

- Stay updated on tax laws: Tax regulations may change, so it’s important to keep informed about the latest requirements to ensure compliance.

3. Retaining Records for Legal Protection

In case of disputes or legal action, having well-organized and properly stored billing records can serve as critical evidence. These documents can help demonstrate the agreed-upon terms, services rendered, and payments made, protecting you and your business from claims of fraud or misunderstanding.

- Maintain copies: Keep copies of all billing records for a minimum of several years, as required by local regulations or tax authorities.

- Secure storage: Use both digital and physical storage methods to keep records safe from tampering, loss, or damage.

- Be mindful of privacy: Ensure that client data is protected in accordance with data protection laws, especially if you store or share sensitive information.

By understanding and adhering to these legal considerations, you can protect your business and maintain trust with your clients. Proper documentation not only meets regulatory requirements but also builds