Ultimate Invoice Template for Online Shopping Success

Managing transactions in any digital marketplace requires clear and professional documentation of sales. This process not only helps in keeping track of payments but also ensures transparency and trust between sellers and buyers. Whether you are just starting or running a large-scale business, using a well-organized system can save time and reduce errors.

Customized documents that outline the details of each sale, including products, prices, and payment conditions, are crucial for smooth business operations. These records also play a significant role in maintaining legal compliance and providing a clear structure for future reference. Choosing the right format and structure can make a noticeable difference in how your business is perceived.

By opting for a pre-designed structure, entrepreneurs can easily adjust specific fields to suit their needs, saving time on repetitive tasks. These tools not only simplify financial tracking but also enhance your overall brand image, ensuring consistency and professionalism in every transaction.

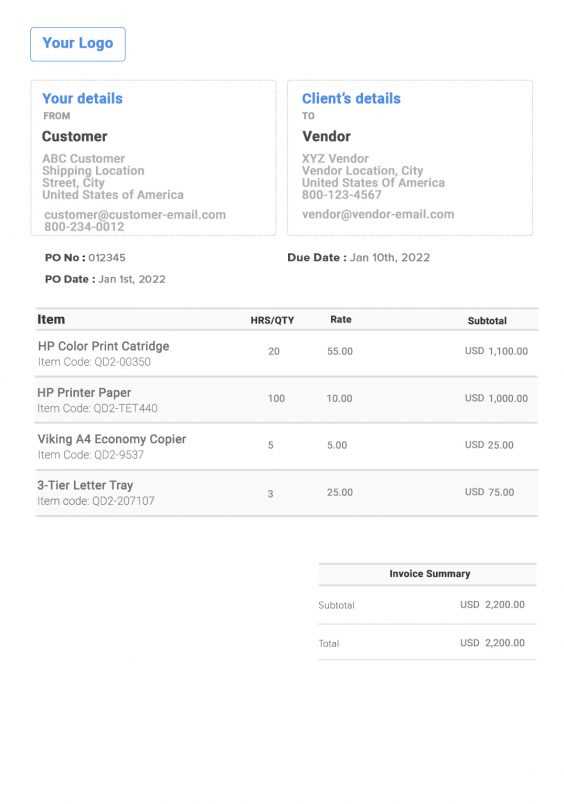

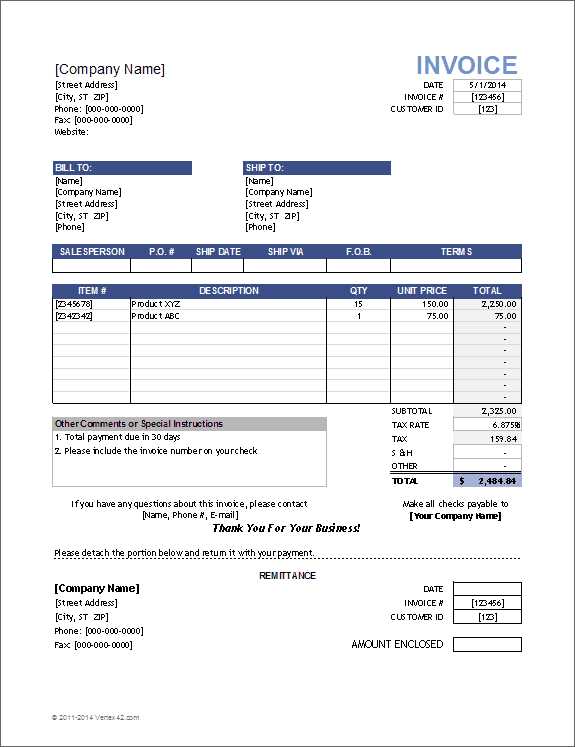

Invoice Template for Online Shopping

When running a business in the digital marketplace, it’s important to have a consistent and reliable method to document each transaction. A well-structured document not only helps you maintain a clear record of sales but also ensures your customers have all the necessary details regarding their purchase. This approach makes the entire process smoother, both for you and your clients, promoting transparency and trust.

Key Elements of a Sales Document

To ensure all essential information is included, your document should cover several key components. These elements will help you stay organized and provide your clients with everything they need to know about their order. Here are the most important aspects to consider:

| Element | Description |

|---|---|

| Product Details | Clear description of items purchased, including quantity and price. |

| Billing Information | Accurate data regarding the buyer’s contact details and shipping address. |

| Payment Terms | Conditions such as due date, payment method, and any applicable taxes or discounts. |

| Transaction Reference | A unique identifier or number to track and manage the sale. |

| Date | The exact date of purchase or transaction completion. |

Benefits of Using a Structured Document

Having a predefined structure for your sales records can save you time and effort. It ensures that no critical information is overlooked and reduces the chance of errors. Additionally, a clean and professional format can enhance your brand’s image and make your business appear more trustworthy. Clients will appreciate receiving a well-organized statement that outlines their transaction clearly, which may even encourage repeat purchases.

Why an Invoice Template is Essential

In any business, maintaining clear, consistent records of every transaction is crucial for smooth operations and customer trust. Having a predefined structure to capture transaction details ensures that nothing is overlooked and provides both parties with accurate documentation. Without this, it’s easy to miss important information, leading to confusion or even disputes.

Key Reasons to Use a Structured Format

Here are some of the most compelling reasons why having a consistent system in place is essential:

- Accuracy: A predefined structure ensures all necessary details are included, minimizing the risk of mistakes.

- Efficiency: Saves time by eliminating the need to create documents from scratch for every transaction.

- Professionalism: Well-organized paperwork enhances your business image and builds credibility with customers.

- Transparency: Provides clear documentation that can be referenced at any time, fostering trust between you and your clients.

- Legal Compliance: Helps ensure that your business meets local tax and legal requirements.

How It Benefits Both Sellers and Customers

Having a reliable structure also improves the customer experience. By providing a well-organized record of their purchase, you demonstrate your professionalism and attention to detail. This transparency can lead to greater customer satisfaction and encourage repeat business. Furthermore, it helps prevent misunderstandings related to payments, products, or delivery, reducing the likelihood of disputes.

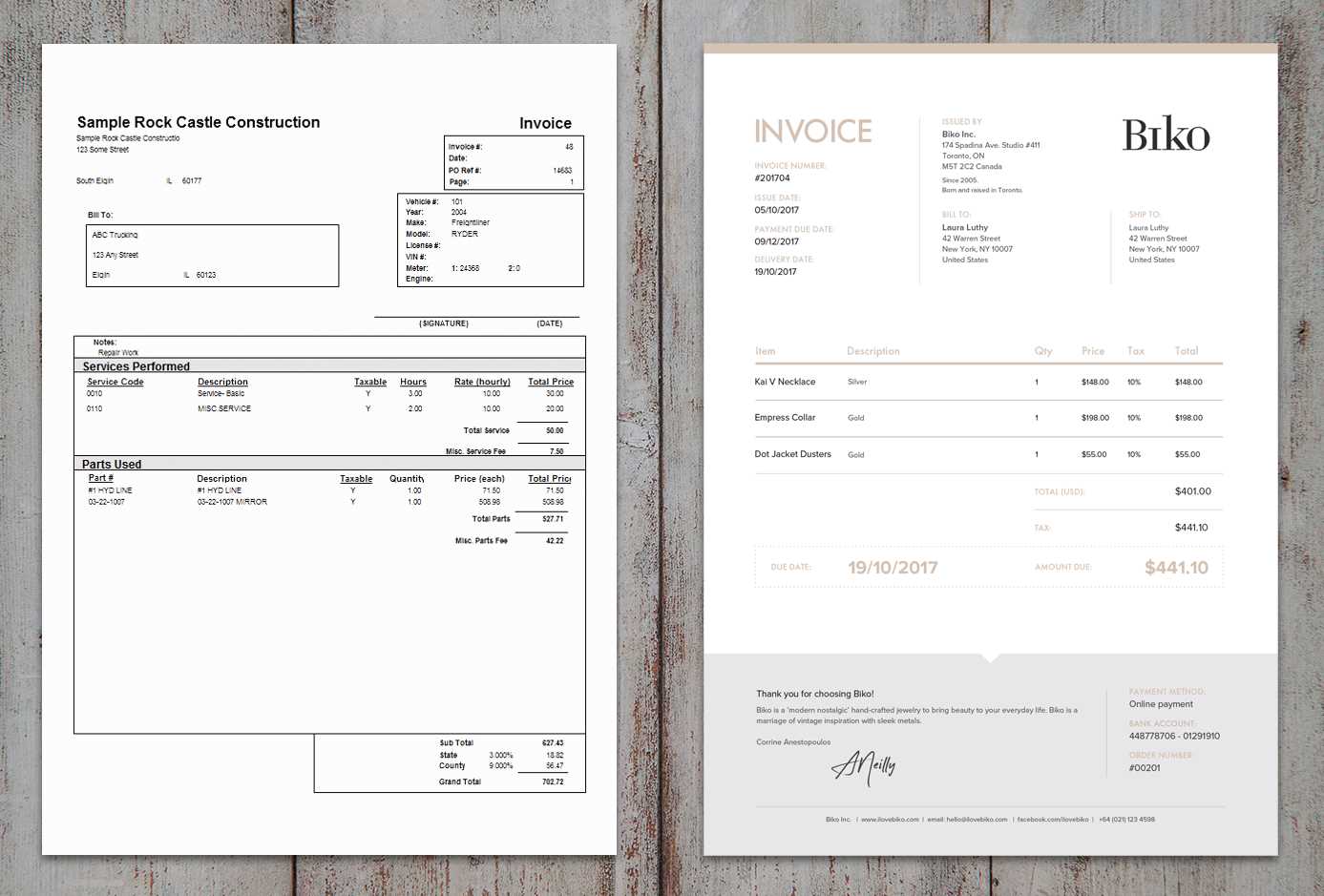

How to Choose the Right Invoice Template

Selecting the right structure to document your transactions is crucial for maintaining an organized, efficient business. A good system ensures all the necessary information is captured correctly and clearly, while also reflecting your brand’s professionalism. With so many options available, it’s important to choose one that fits the specific needs of your business and customer base.

When deciding on a structure, consider factors such as your business size, the complexity of your products or services, and how you plan to manage payment records. A simple approach may work for smaller operations, while larger businesses may require more detailed and customizable options. The key is finding the right balance between simplicity and functionality, ensuring that the system supports both your daily operations and long-term goals.

It’s also important to think about scalability. As your business grows, you may need to adjust the structure to accommodate more complex transactions or integrate it with other tools like accounting software. Look for a flexible solution that can adapt to these changes as needed.

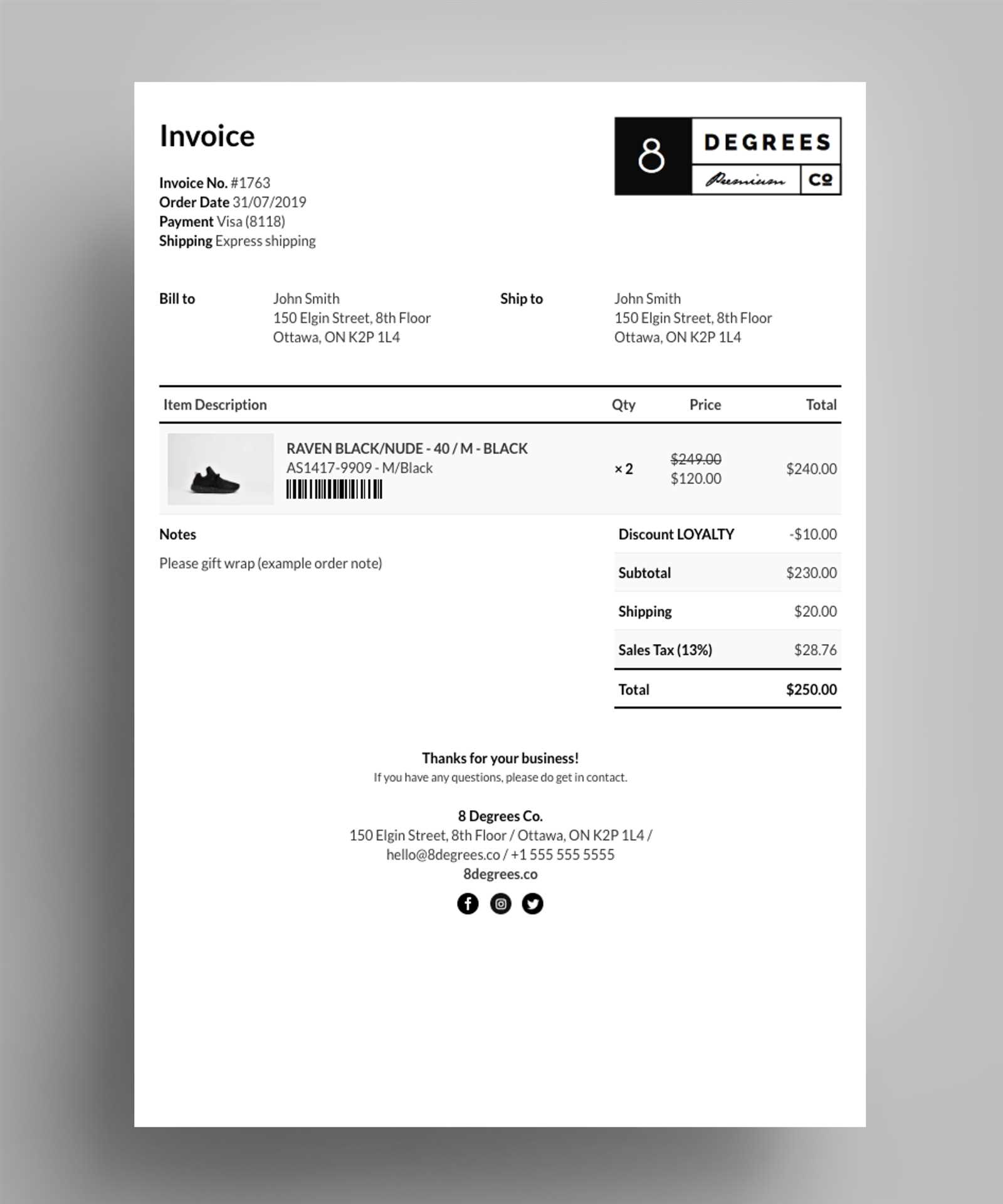

Top Features of an Ideal Invoice

When it comes to documenting transactions, having the right structure is essential. The ideal document should include key details that ensure clarity and accuracy, making it easy for both the seller and the customer to track and verify the purchase. A well-crafted structure not only helps in maintaining proper records but also enhances your business’s professionalism.

Here are some of the most important features to look for in a perfect structure:

- Clear Identification: Your document should clearly identify the seller and the buyer, with all necessary contact details included for both parties.

- Unique Reference Number: Every transaction should be assigned a distinct number to simplify tracking and avoid confusion.

- Product/Service Breakdown: A detailed list of the products or services purchased, including quantities, prices, and any applicable discounts or promotions.

- Payment Terms: Explicitly stating the agreed-upon payment conditions, such as due dates, methods of payment, and any late fees, if applicable.

- Dates: Including the date of purchase and the due date for payment is crucial for accurate record-keeping.

- Tax Information: Clear representation of any taxes applied, such as VAT or sales tax, and the relevant rates for transparency.

- Branding: Including your business’s logo and contact information not only makes the document look professional but also reinforces your brand identity.

An ideal structure combines all of these elements in a clear, organized manner, making it easy for both parties to review and confirm details. The simplicity and efficiency of the design can make a significant difference in streamlining your administrative tasks while also leaving a lasting positive impression on your customers.

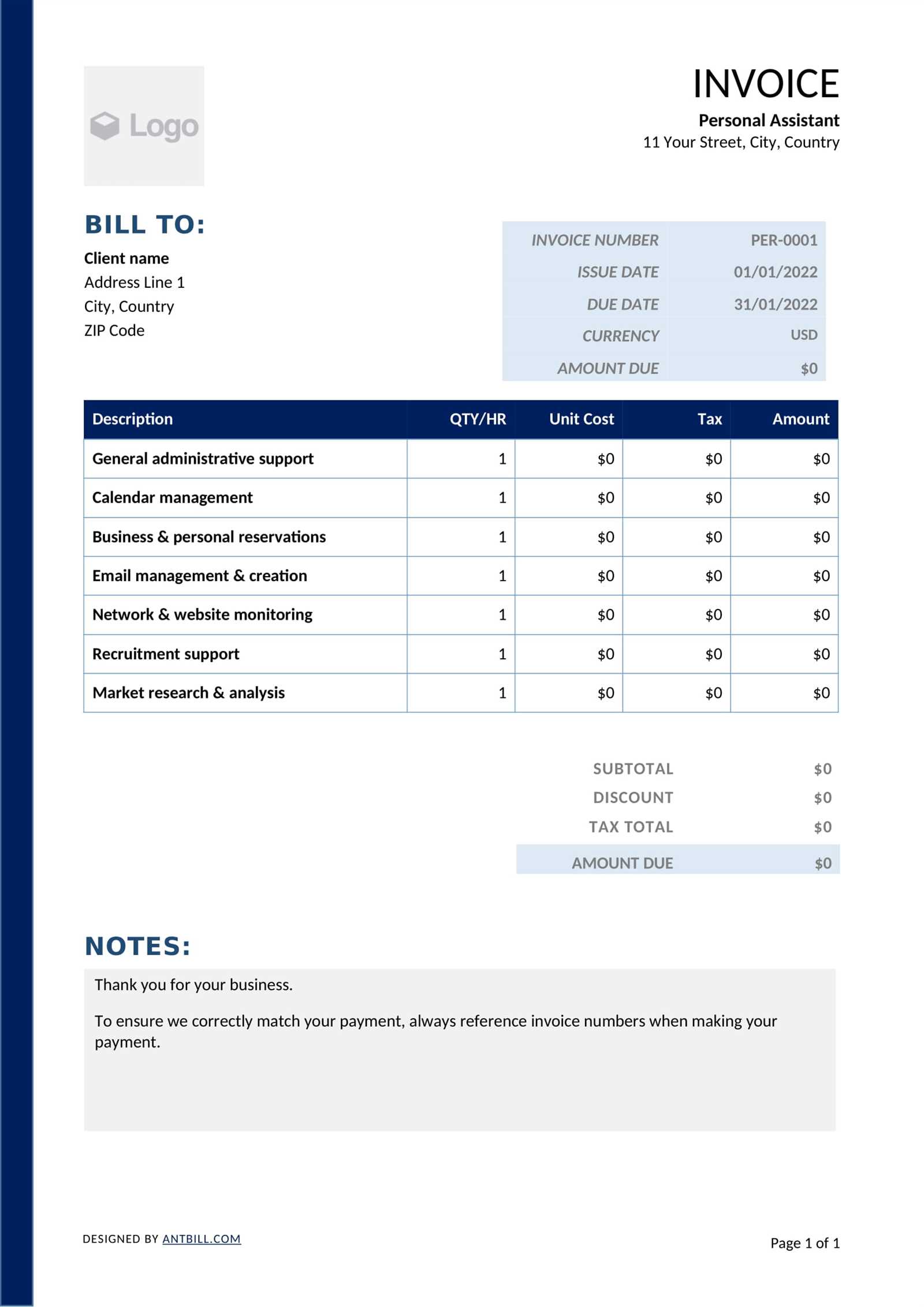

Customizing Your Invoice for Branding

Branding is a vital aspect of any business, and it’s important to reflect your company’s identity in every piece of communication, including the documents you provide to customers. Customizing your transaction records allows you to stand out, make a professional impression, and reinforce your brand’s image. A personalized document can also make the process feel more engaging and trustworthy for your customers.

Here are several ways to customize your transaction records and enhance your brand visibility:

- Logo Placement: Include your business’s logo at the top of the document. This not only enhances brand recognition but also gives the document a polished look.

- Consistent Color Scheme: Use your brand’s color palette throughout the document. This helps maintain a cohesive look across all your communications and strengthens brand identity.

- Font Selection: Choose fonts that align with your brand’s tone. Whether it’s formal or playful, the typography should reflect your business’s style and personality.

- Personalized Message: Add a thank you note or a special message at the bottom to show appreciation for the customer’s business. It adds a personal touch and can improve customer loyalty.

- Contact Information: Display your business’s contact details clearly, including your website, social media links, and customer service number, so clients can easily reach out if needed.

By personalizing your transaction records, you not only create a more professional appearance but also enhance your customer’s experience. Each interaction becomes a reminder of your brand and values, ultimately leading to a stronger connection and more repeat business.

How to Add Payment Terms to Invoices

Clearly outlining payment conditions is essential in every transaction to avoid confusion and ensure both parties understand the expectations. Payment terms define when and how the buyer is expected to pay, and including them in your documents provides a clear agreement that protects both your business and the customer. It also helps prevent delays and miscommunication regarding payments.

Key Elements of Payment Terms

When adding payment terms to your transaction records, consider the following important elements:

- Due Date: Clearly specify the exact date by which the payment is expected. This helps avoid confusion and establishes a clear deadline for the buyer.

- Payment Methods: Indicate the acceptable methods of payment, such as credit card, bank transfer, or digital wallets. This ensures that the buyer knows exactly how to complete the transaction.

- Late Payment Fees: If applicable, include any fees that will be charged if the payment is not made by the due date. This can act as an incentive for timely payments.

- Discounts for Early Payment: Offering a small discount for early settlement of bills can encourage faster payments and improve cash flow.

- Currency and Tax Information: Specify the currency in which the payment should be made and mention any applicable taxes or additional charges, such as sales tax or VAT.

How to Effectively Communicate Payment Terms

It’s essential to place payment terms in a prominent and clear section of the document. This could be in a dedicated “Payment Terms” area, typically near the bottom or after the list of items or services provided. Avoid jargon and ensure the terms are easy to understand. The clearer the language, the less likely there will be misunderstandings later on.

Additionally, make sure that your customers have the opportunity to review the terms before completing the purchase. If you’re using a digital platform, include a checkbox or acknowledgment field for the customer to agree to the payment terms, ensuring mutual understanding before finalizing the transaction.

Common Mistakes When Creating Invoices

Even with a clear and structured approach to documenting transactions, mistakes can still occur. These errors may lead to confusion, delays in payment, and sometimes even strained customer relationships. Identifying and avoiding common pitfalls is essential to ensure that your records are accurate, professional, and effective in managing your business’s finances.

Frequent Errors to Avoid

Here are some of the most common mistakes businesses make when preparing transaction documents:

- Missing or Incorrect Contact Information: Not including accurate details for both the seller and the buyer can lead to confusion, especially if follow-up communication is needed.

- Omitting a Unique Reference Number: Without a distinct reference number, tracking and managing transactions becomes difficult, especially when dealing with multiple customers or large volumes of sales.

- Failure to Clearly List Products or Services: Lack of clarity regarding the items sold, including quantities and prices, can lead to disputes about what was purchased and how much was paid.

- Unclear Payment Terms: If payment due dates or accepted payment methods aren’t clearly defined, customers may not understand when or how they should settle their accounts.

- Incorrect Tax Calculations: Errors in tax rates or failing to account for taxes can lead to complications, particularly with legal compliance and customer satisfaction.

- Not Including a Date: Omitting the date of the transaction or the due date for payment can create confusion and make it harder to track payments and deadlines.

How to Avoid These Mistakes

To avoid these common errors, double-check all information before finalizing the document. Ensure that all fields are completed correctly, including contact details, product descriptions, and payment terms. If possible, use a reliable system or software to help you organize and automate the creation process, reducing the chance of human error. Also, consider asking a colleague or team member to review the document for accuracy before sending it to the customer.

By being mindful of these common mistakes and taking steps to prevent them, you can improve your transaction processes and enhance the overall customer experience.

Legal Requirements for Online Invoices

When conducting business, it is crucial to meet legal obligations related to documenting transactions. These requirements help ensure that both the buyer and seller are protected, and that proper records are maintained for tax and compliance purposes. Understanding the legal aspects of these documents is essential to avoid potential penalties and disputes.

Essential Legal Elements to Include

There are several key components that must be present in any sales record to ensure compliance with legal standards. The specifics may vary depending on the country or region, but the following are generally required:

- Business Information: The seller’s name, address, and contact details must be clearly stated, as well as the business registration number or tax ID if applicable.

- Buyer’s Information: While not always mandatory, it is best practice to include the buyer’s name, address, and contact details, especially for larger transactions or businesses operating internationally.

- Transaction Date: The exact date of the purchase or service must be included for accurate record-keeping, particularly for tax purposes.

- Unique Reference Number: A unique number assigned to each sale helps keep track of transactions and ensures that they can be easily identified in case of future disputes or audits.

- Product and Service Description: A detailed description of the goods or services sold, including quantities, prices, and applicable discounts or promotions. This helps avoid misunderstandings and provides clarity for both parties.

- Tax Details: If applicable, sales tax or VAT must be clearly itemized, including the tax rate and total amount. Some jurisdictions may require specific wording to indicate that the tax is included in the price or separately listed.

- Payment Terms: Clear payment terms, including the method of payment, payment due date, and any late fees, if relevant, should be included to protect both the business and the customer.

Region-Specific Requirements

It is important to be aware of the specific requirements in your jurisdiction. Different countries and regions may have additional regulations regarding transaction records. For example, the European Union has specific rules for VAT reporting, while in the United States, businesses may be required to meet certain requirements related to sales tax collection based on the state. Always consult local laws and tax regulations to ensure your documents meet the necessary legal standards.

By adhering to these legal requirements, businesses can ensure that the

Free vs Paid Invoice Templates: What to Choose

When it comes to creating professional documents to track transactions, one of the key decisions businesses face is whether to use a free or paid solution. Both options have their advantages and limitations, and the right choice depends on the specific needs of your business. While free solutions may seem appealing, paid options often offer more advanced features and customization that could save time and improve efficiency in the long run.

Here is a comparison of free and paid options to help you decide which is best suited to your business:

| Feature | Free Solutions | Paid Solutions |

|---|---|---|

| Customization Options | Limited customization, often with predefined layouts and styles. | Advanced customization, including the ability to modify fields, colors, logos, and layout. |

| Professional Appearance | Basic designs, which may lack a polished, branded look. | More polished and professional designs, enhancing brand credibility. |

| Features | Basic features with limited functionality (e.g., manual entry of data). | Advanced features such as automated calculations, tax integration, and support for multiple payment methods. |

| Support | Limited or no customer support; may rely on community forums. | Dedicated customer support and troubleshooting assistance. |

| Integration with Other Tools | Limited integration with accounting software or e-commerce platforms. | Seamless integration with accounting, payment processing, and other business tools. |

| Cost | Free to use with no upfront costs. | Requires a subscription or one-time payment, often with ongoing fees for updates. |

Ultimately, the choice between free and paid solutions depends on the scale and complexity of your business. For small businesses or those just starting out, free solutions may be a practical way to get started without any upfront investment. However, as your business grows and you require more customization, automation, and support, upgrading to a paid solution can

How to Automate Invoice Generation

In today’s fast-paced business environment, efficiency is key. Automating the process of generating transaction records can save time, reduce errors, and streamline your financial operations. By leveraging automation tools and software, you can ensure that each sale is properly documented without the need for manual intervention, allowing you to focus on other important aspects of your business.

Steps to Automate the Process

Here are some steps to help you automate the creation of transaction documents:

- Choose the Right Software: Select a tool or platform that integrates with your existing sales systems, whether it’s an e-commerce platform or a CRM tool. Many of these tools offer automated generation of transaction records as part of their features.

- Set Up Data Integration: Ensure that your sales data is automatically pulled into the system. This can be done by integrating your e-commerce platform or POS system with your chosen tool, so details like product names, prices, and customer information are automatically populated.

- Define Template Settings: Configure the system to use a predefined layout that meets your business needs. Many tools allow you to customize the layout, branding, and content so that the records automatically reflect your company’s style and legal requirements.

- Enable Automatic Delivery: Set up the system to automatically send the completed document to the customer via email or through their account on your platform. This can help reduce delays and ensure that customers receive their records promptly.

- Automate Follow-Up Reminders: Many tools also allow you to send automated reminders for payments or overdue balances, ensuring that you stay on top of your cash flow and reduce the need for manual follow-ups.

Benefits of Automating the Process

By automating the creation and delivery of transaction records, you gain several benefits, including:

- Increased Efficiency: Automation saves time by reducing manual entry and ensuring that your processes are fast and error-free.

- Improved Accuracy: With data pulled directly from your sales systems, you reduce the chance of human errors in recording transaction details.

- Better Cash Flow Management: Automated payment reminders and quicker docume

Integrating Invoices with Your E-Commerce Platform

Integrating transaction documentation directly with your sales platform streamlines the entire process, from capturing order details to generating and sending records to customers. This integration reduces the chances of errors, eliminates manual data entry, and ensures that every sale is accurately reflected in your accounting system. By connecting your sales platform with automated document generation tools, you can improve efficiency and maintain consistent records across your business operations.

How to Integrate with Your E-Commerce System

Follow these steps to integrate transaction records with your sales platform effectively:

- Choose Compatible Software: Ensure that the tool or service you are using to create transaction documents can seamlessly integrate with your e-commerce platform. Many popular systems, like Shopify, WooCommerce, and BigCommerce, offer built-in integrations or third-party plugins for document generation.

- Set Up Data Sync: Establish a connection between your e-commerce platform and the documentation tool. This integration allows customer, product, and transaction data to flow automatically, eliminating the need for manual data entry.

- Customize the Layout: Once the integration is in place, customize the appearance and content of your records to match your business’s branding and legal requirements. Most integrated tools offer flexible design options.

- Automate Document Delivery: Configure the system to automatically generate and send transaction records to customers as soon as a sale is completed. This saves time and ensures prompt communication with your clients.

Benefits of Integration

Integrating your sales platform with automated transaction documentation tools offers several advantages:

- Time-Saving: Automation reduces the need for manual document creation, speeding up your entire workflow.

- Reduced Errors: Data synchronization ensures that all details, such as prices, taxes, and products, are accurate and consistent.

- Better Customer Experience: By automatically sending completed records, you improve the experience for your customers, offering transparency and timely communication.

- Streamlined Accounting: Integration ensures that all sales data is recorded properly and can be directly synced with accounting software, making financial reporting and tax filing more efficient.

Integrating your sales platform with document generation tools not only saves time but also enhances the accuracy and professionalism of your business processes, helping you maintain a seamless workflow from sale to documentation.

How to Track Invoice Payments Effectively

Managing payments efficiently is critical to maintaining a healthy cash flow and ensuring the financial stability of your business. Tracking payments systematically helps you stay on top of due amounts, identify overdue accounts, and follow up promptly. Whether you’re a small business or a larger enterprise, having a clear process for tracking payments will prevent errors, reduce administrative overhead, and improve customer relations.

Steps to Track Payments

Here are some essential practices to follow for effective payment tracking:

- Use Accounting Software: Leverage specialized software or accounting tools that automatically track payments and link them to specific transactions. Many of these tools offer automated payment reminders, making it easier to stay on top of payments.

- Create a Payment Schedule: Set clear payment terms with deadlines and communicate them effectively to your customers. Having a scheduled system for payments helps both parties know when payments are due and reduces delays.

- Monitor Payment Status Regularly: Regularly check the payment status for each transaction to identify pending, partially paid, or overdue accounts. This allows you to follow up with customers before the payment becomes a major issue.

- Issue Payment Receipts: After receiving payments, issue receipts that confirm the amount and date of payment. This helps both you and your customers maintain accurate records.

Tracking Payment Details

To keep detailed records of payments, make sure to track the following information:

Payment Detail Why It’s Important Payment Date To confirm when the transaction was completed and ensure it aligns with the agreed-upon schedule. Amount Paid To verify the exact amount received and ensure no discrepancies between the transaction and the payment. Payment Method To track how the payment was made (e.g., bank transfer, credit card, etc.), which is useful for future reference and audits. Balance Remaining To monitor how much is still owed, allowing you to q Design Tips for Professional Invoices

A well-designed document not only ensures clear communication but also strengthens your brand identity. When it comes to documenting transactions, creating a professional, easy-to-read format can enhance the credibility of your business and leave a lasting impression on your customers. From layout to typography, every design element plays a role in creating a polished, professional look that reflects your brand’s values.

Key Elements for a Professional Look

Here are some essential design tips to create a polished document that enhances both functionality and aesthetics:

- Keep It Clean and Simple: Avoid clutter. A clean, minimalist design allows the key details to stand out and ensures that the document is easy to read. Use ample white space to separate sections and guide the reader’s eyes naturally through the information.

- Brand Consistency: Include your company logo, business name, and brand colors to ensure consistency with other branded materials. A cohesive design helps build trust and reinforces your business identity.

- Clear Section Headers: Use bold, distinct headings to separate different sections, such as “Customer Details,” “Itemized List,” and “Payment Terms.” This makes it easier for customers to quickly find the information they need.

- Legible Fonts: Choose fonts that are easy to read and professional-looking. Stick to no more than two or three different fonts to maintain consistency and readability. Sans-serif fonts like Arial or Helvetica work well for digital documents.

- Use Tables for Itemized Lists: Presenting the list of products or services in a well-organized table format makes it easier for the reader to understand the quantities, descriptions, and pricing at a glance.

- Include a Call to Action: If you want your customers to take specific actions–such as making a payment or contacting you–include a clear and concise call to action at the end of the document.

Additional Design Considerations

Beyond layout and structure, there are other aspects of design to consider that can further elevate the professionalism of your transaction documents:

- Color Scheme: Use colors that are aligned with your brand. However, avoid using too many bright colors or combinations that make the document difficult to read. Neutral tones with one or two accent colors work best.

- Alignment: Proper alignment of text, logos, and tables helps create a visually appealing and balanced document. Aligning text left or centered (where appropriate) ensures clarity and avoids a cha

How to Handle Invoice Disputes

Disputes over transaction records can occur, and managing them professionally and efficiently is essential to maintaining strong customer relationships. Whether the issue is a disagreement over pricing, quantity, or a misunderstanding about payment terms, resolving disputes promptly can prevent long-term issues and preserve customer trust. Addressing conflicts with clarity, respect, and a structured approach is the key to finding amicable solutions.

Steps to Effectively Address Disputes

When you encounter a dispute, follow these steps to resolve the issue professionally:

- Listen Carefully: Start by understanding the customer’s point of view. Allow them to express their concerns without interruption and ensure that you are fully aware of the issue before proceeding with a resolution.

- Review the Details: Double-check all the relevant information, such as pricing, quantities, and payment terms. Compare the transaction with the original terms to verify if any discrepancies exist or if there has been a misunderstanding.

- Communicate Clearly: Provide a clear, calm, and detailed explanation of the situation. If there was an error on your part, acknowledge it and offer a solution. If the error lies with the customer, explain the issue politely and offer alternatives or compromises.

- Offer a Solution: Whether it’s adjusting the amount, providing a partial refund, or offering a discount on future purchases, propose a fair solution that demonstrates goodwill and aims to resolve the issue amicably.

- Document the Resolution: Once a resolution is agreed upon, document it in writing. Send a follow-up email or updated transaction record that reflects the agreed-upon adjustments or settlements.

Tips for Preventing Future Disputes

To minimize the chances of future conflicts, consider these preventive measures:

- Clear Communication of Terms: Ensure that all payment terms, prices, and conditions are clearly stated and agreed upon before finalizing any sale. Transparency from the beginning reduces the chance of misunderstandings later on.

- Maintain Accurate Records: Keep detailed, organized records of every transaction, including dates, amounts, and product details. This documentation will serve as proof if a dispute arises.

- Prevents Duplication: A structured numbering system ensures that each record has a unique identifier, which eliminates the risk of accidental duplication or overlap.

- Improves Organization: When you have a logical numbering sequence, it’s easier to organize records chronologically, making retrieval and referencing more efficient.

- Facilitates Financial Tracking: Numbered records help maintain consistency in your accounting processes, making it simpler to match payments to specific transactions and verify financial statements.

- Aids in Audits: For tax or audit purposes, a clear numbering system provides an accurate and easy-to-follow trail of all transactions, helping both internal and external auditors access records quickly.

- Enhances Customer Trust: When customers receive properly numbered transaction documents, they can be more confident in the professionalism and transparency of your business.

- QuickBooks: QuickBooks is a leading accounting software that allows businesses to manage all aspects of their financial operations. It offers automated transaction records, easy payment tracking, and detailed reporting tools. Its user-friendly interface and cloud capabilities make it a top choice for small to medium-sized businesses.

- FreshBooks: FreshBooks is a great option for freelancers and small businesses looking for a simple yet effective way to manage transaction records. It offers customizable templates, automatic reminders, and integrates with many popular payment gateways, helping businesses maintain smooth financial operations.

- Zoho Books: Zoho Books is a robust accounting software designed to help businesses automate the entire process of transaction documentation. It includes features such as multi-currency support, expense tracking, and custom reporting. Its integration with other Zoho products offers added functionality for growing businesses.

- Wave: Wave is a free, cloud-based software that offers a wide range of features for managing transactions. Ideal for small businesses, it provides tools for invoicing, accounting, and receipt scanning, all with a straightforward, user-friendly interface. Wave’s no-cost option makes it particularly attractive to startups.

- Xero: Xero is a powerful accounting tool known for its comprehensive features. It allows businesses to easily create transaction records, track payments, and manage expenses. Xero’s ability to integrate with thousands of third-party applications makes it ideal for businesses that require flexibility and customization.

- Clear Breakdown of Charges: A detailed record clearly lists products or services purchased, their individual costs, and any additional fees or taxes. This transparency makes customers feel more in control of their purchases and helps them understand exactly what they are being charged for.

- Professionalism and Legitimacy: Issuing well-organized records conveys professionalism and a commitment to proper business practices. This builds the perception that your business is legitimate, reliable, and customer-focused.

- Improved Communication: If there is ever a discrepancy, clear documentation provides a point of reference for both you and the customer. It makes communication smoother and helps resolve issues quickly, reducing friction between both parties.

- Establishes Accountability: A transaction record creates a formalized record of the business interaction, establishing accountability. Customers feel more secure knowing that the details of their transaction are documented and can be referenced in the future if necessary.

- Data Encryption: Encrypting sensitive data ensures that even if unauthorized individuals access the records, they cannot read or manipulate the information. Use strong encryption algorithms for both data at rest and data in transit to maximize security.

- Secure Storage: Storing transaction documents in a secure environment is critical. Use cloud services with robust security measures such as multi-factor authentication (MFA) and secure backup protocols to protect stored data from unauthorized access or loss.

- Access Control: Limit access to transaction documents to only those employees or systems that absolutely need it. Implement role-based access controls (RBAC) to restrict permissions and ensure that sensitive information is only accessible by authorized individuals.

- Regular Audits: Conduct regular security audits to identify vulnerabilities in your document management system. This includes testing for potential weaknesses in both the software and the hardware used to store and process transaction data.

- Compliance with Regulations: Ensure your business complies with data protection laws such as GDPR, PCI-DSS, or other relevant regulations. These laws govern how sensitive information should be handled and stored, and non-compliance can lead to legal and financial penalties.

Importance of Numbering System

A well-organized numbering system for transaction records is essential for maintaining clarity, consistency, and efficiency in your business operations. By assigning a unique reference number to each transaction, you can ensure accurate tracking, prevent confusion, and streamline financial management. A properly structured numbering system also aids in record-keeping and provides a clear audit trail for both you and your customers.

Why a Numbering System Matters

Here are the key reasons why implementing a numbering system is important:

How to Structure Your Numbering System

To ensure your numbering system is effective, follow these guidelines:

Element Explanation Sequential Numbering Start with a simple sequential system (e.g., 0001, 0002, 0003) to ensure that each record has a unique identifier. Include Date or Year Incorporating the year or month into the number (e.g., 2024-001) helps you quickly identify when the record was created and organizes your records by time period. Customization You can also incorporate additional elements, such as customer ID or product type, into the number, depending on your specific business needs (e.g., CUST123-001). Best Software for Managing Transaction Records

When managing transactions in a digital business, having reliable software is essential for keeping things organized, efficient, and professional. The right tools can automate key processes, provide detailed reporting, and make it easy to track payments, making them invaluable for entrepreneurs and business owners. From simple solutions to advanced platforms, the best software offers flexibility, ease of use, and scalability to meet the unique needs of any business.

Here are some of the top software solutions available to help streamline your transaction management:

Each of these tools has its strengths, so choosing the right one depends on your business needs, budget, and the complexity of your financial processes. Whether you’re a freelancer or a larger organization, investing in the right software can save you time, reduce errors, and improve your overall workflow when managing business transactions.

How Transaction Records Improve Customer Trust

Clear and professional transaction documentation plays a crucial role in building and maintaining customer trust. When customers receive a well-organized, transparent record of their purchases, they are more likely to feel secure and confident in their decision to do business with you. A detailed and accurate record assures the customer that their transaction is legitimate and handled with care, reducing the chances of misunderstandings or disputes.

Why Transparency Matters

When customers see a well-structured record, they understand exactly what they are paying for and the terms of their purchase. Transparency fosters trust in the business, showing that there is no hidden agenda or unspoken fees. Here are several ways in which providing proper documentation strengthens your customer relationships:

Key Elements That Build Trust

For a record to inspire trust, it should contain the following key elements:

Element Importance Company Information Displaying your company name, logo, and contact details shows that you are a legitimate business and allows customers to easily reach you if they need assistance. Clear Itemization Listing each product or service with its price, quantity, and description reduces the chances of confusion and reassures customers that they are being charged accurately. Payment Terms Including payment terms and due dates gives customers a clear understanding of their financial obligations and helps prevent misunderstandings. Confirmation of Purchase Having a clear statement confirming the completion of the transaction reassures customers that their order has been processed successfully. In summary, providing clear and accurate transaction documentation is an essential step in fostering a trustworthy relationship with your customers. It assures them that their purchase is legitimate, that they are being charged fairly, and that you value transparency. By building this trust, you increase the likelihood of repeat business and positive word-of-mouth recommendations.

Security Considerations for Transaction Records

Ensuring the safety and confidentiality of transaction records is paramount in today’s digital business environment. These documents often contain sensitive customer and financial information, which makes them an attractive target for cybercriminals. Protecting this data from unauthorized access, theft, or tampering not only safeguards your business but also helps maintain customer trust and complies with data protection regulations.

Why Security is Crucial

Without proper security measures in place, your records may be vulnerable to data breaches, identity theft, or fraud. Sensitive customer details, payment information, and business transactions could be compromised, leading to significant financial losses and reputational damage. Here are several key security practices to consider when handling transaction documents:

Best Practices for Securing Transaction Data

Implementing the following best practices can help ensure that your business is taking all necessary steps to protect transaction records:

Practice Explanation Use Strong Passwords Make sure all accounts associated with your transaction system are protected with stron