Vehicle Rental Invoice Template for Easy Billing and Payment Tracking

When offering transportation services, it’s crucial to have a clear and professional way to document transactions with clients. A well-structured billing statement helps ensure accuracy, transparency, and timely payments. By using a standardized format, businesses can easily manage finances and maintain a smooth relationship with customers.

A properly designed bill captures all the essential details of the transaction, from the duration of service to additional fees, taxes, and payment terms. It acts as both a record for the service provider and a receipt for the client, reducing the risk of misunderstandings. Furthermore, an effective document not only improves financial organization but also enhances the credibility of your service.

With the right approach, creating such a billing document becomes a simple and straightforward process. This guide will show you how to craft a precise and professional document that fits your specific needs, ensuring that all necessary information is clearly presented and easily understood.

Vehicle Rental Invoice Template Overview

Creating a comprehensive billing document for transportation services is essential for both businesses and customers. A structured form allows service providers to capture all necessary details about the transaction, ensuring accuracy and transparency. The goal is to create a professional record that clearly reflects the agreed-upon terms and payment expectations, ultimately streamlining the payment process and avoiding confusion.

Such documents typically include essential information like the service duration, agreed price, additional fees, and tax details. To make this process easier, many businesses use pre-designed formats that can be customized to meet their specific needs. These forms help maintain consistency and simplify billing tasks for both the service provider and the client.

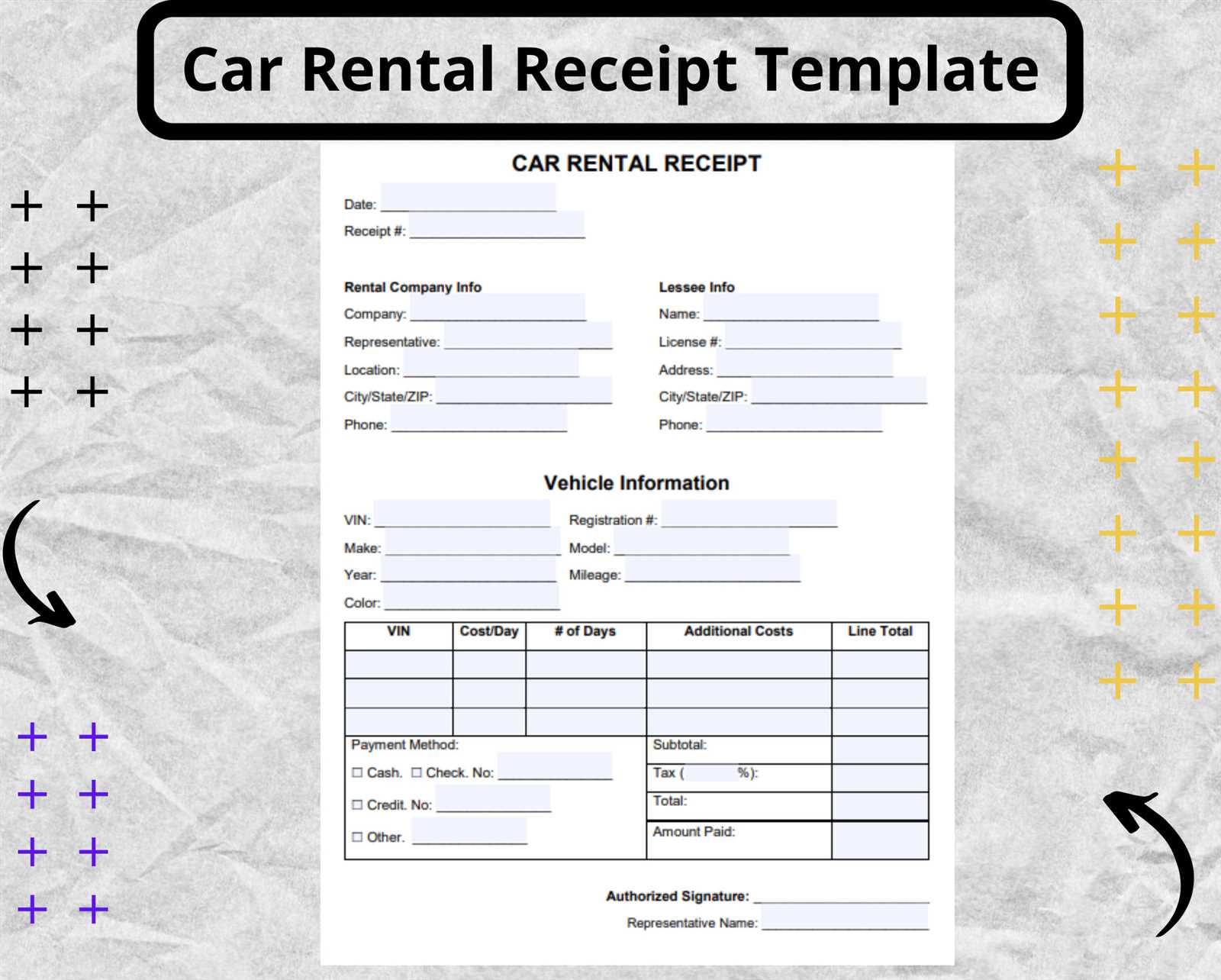

Below is an overview of the common elements included in a standard form for these types of services:

| Section | Description |

|---|---|

| Service Provider Information | Details about the business offering the service, including name, contact info, and address. |

| Customer Information | The client’s name, contact details, and address. |

| Service Description | A brief outline of the service provided, including dates and terms of use. |

| Charges | Breakdown of fees, including base rate, extra charges, and applicable taxes. |

| Payment Terms | Details regarding payment deadlines, late fees, and accepted payment methods. |

By organizing these elements in a consistent manner, the document serves as an effective tool for both the provider and the customer. It ensures that both parties have a clear understanding of the services rendered and the expected financial exchange.

Why You Need a Rental Invoice

When offering temporary transportation services, having a formalized billing document is essential for both the service provider and the client. Such a document not only helps track the financial transaction but also serves as a legal record of the agreement between both parties. It ensures transparency, reduces the likelihood of disputes, and provides a clear breakdown of costs, making the payment process much smoother.

For the service provider, a properly structured document acts as a proof of services rendered and is critical for maintaining accurate financial records. It also helps in managing cash flow, as it clearly outlines payment terms, deadlines, and any additional charges. For customers, it serves as a reliable receipt, providing them with detailed information on what they are being charged for and helping them to verify that they were billed correctly.

Without such documentation, confusion and miscommunication can arise, leading to delays or even non-payment. A clear and well-organized statement mitigates these risks, creating trust between the provider and the customer. It is a vital tool for both business operations and maintaining a professional relationship with clients.

Key Elements of a Rental Invoice

To ensure clear communication and proper payment, a well-structured billing document should include all the critical details of the transaction. These elements help both the service provider and the client easily understand the terms of the service and the expected payment. Whether for internal records or client transparency, each section plays an important role in maintaining a smooth financial exchange.

Essential Information for Service Providers and Clients

At the top of the document, it is important to include the name and contact details of both the service provider and the customer. This ensures that both parties are clearly identified and that any potential follow-up or disputes can be easily directed to the correct individual. This section typically includes:

- Service provider name and contact details

- Customer’s name and address

- Invoice number for easy tracking

Detailed Service Breakdown and Charges

One of the most important sections of the document is the detailed breakdown of services provided. This part should clearly outline:

- Service description, including duration and any additional services

- Unit price for the service provided

- Additional fees such as insurance, taxes, or late charges

- Total amount due after all charges have been added

Having these details listed out ensures both parties are on the same page regarding the financial terms, reducing the chance of confusion or disputes later on.

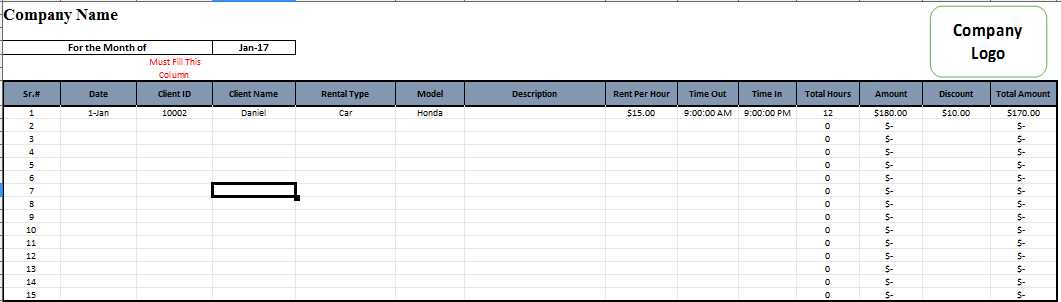

How to Customize Your Invoice Template

Personalizing your billing document is an important step to make it align with your business needs and branding. Customization not only helps ensure that all the relevant details are included but also enhances the professional appearance of your paperwork. By adjusting key sections, you can make sure that the format matches the specific services you offer and the terms you follow.

To begin, focus on personalizing the header to include your business logo, name, and contact details. This makes the document immediately recognizable and reinforces your brand identity. Additionally, it’s essential to adjust the layout to suit your preferred structure, such as placing the service breakdown or payment terms in the most logical order for your clients.

Another important aspect of customization is modifying the pricing structure and tax inclusion to match the specific rates and charges that apply to your business. Whether you charge a daily rate, a flat fee, or offer discounts for long-term use, make sure that these details are clearly outlined. You can also add or remove sections based on the nature of your service, ensuring that the final document is both comprehensive and easy to understand.

Free Vehicle Rental Invoice Templates Online

For those looking to simplify the billing process, free resources are widely available on the internet. These downloadable files provide pre-designed formats that can be easily customized to meet the specific needs of your business. They save time, reduce errors, and ensure that all necessary information is included in each document.

Benefits of Using Free Templates

Using an online document format comes with several advantages, including:

- Time-saving – Ready-to-use designs make the process faster.

- Customization – Easily tailor the layout to suit your services and branding.

- Accuracy – Pre-built sections ensure that no important details are missed.

Where to Find Free Options

There are numerous websites offering free downloadable formats. These can range from simple templates to more advanced designs with added features like automatic calculations. Below is a comparison of some popular sources:

| Website | Features | Customizability |

|---|---|---|

| Template.net | Wide selection, easy to download | Full customization available |

| Invoice-generator.com | Simple interface, quick generation | Limited customization options |

| Canva.com | Visually appealing designs | Highly customizable |

These online resources provide templates that are both professional and accessible, allowing you to create clear and consistent documents for your clients quickly.

Common Mistakes in Rental Invoices

Even with the best intentions, mistakes can happen when creating billing documents, leading to confusion, delayed payments, or dissatisfaction from clients. Identifying and avoiding common errors is essential for maintaining professionalism and ensuring smooth financial transactions. A few simple missteps can make a significant impact on the clarity and effectiveness of the document.

One of the most frequent mistakes is failing to include all relevant details. Omitting essential information, such as service dates, payment terms, or taxes, can cause misunderstandings and delays. Another common error is incorrect pricing or calculation errors. Whether due to manual entry mistakes or misinterpretation of agreed rates, inaccuracies in pricing can create disputes and affect customer trust.

Another issue to watch out for is ambiguous payment terms. If the payment due date, late fees, or accepted payment methods are unclear, clients may delay their payments or become confused about the expectations. Additionally, inconsistent formatting can make the document difficult to read or professional in appearance. Ensuring that the layout is clean and organized helps present the information in a more digestible and reliable way.

Essential Information for Accurate Billing

For a billing document to serve its purpose effectively, it must include all the necessary details that clearly define the terms of the transaction. The accuracy of this information is crucial not only for avoiding misunderstandings but also for ensuring timely and correct payments. Incomplete or unclear records can lead to confusion, delayed payments, or disputes between the service provider and the client.

Key Components to Include

The most important aspects of a comprehensive bill include:

- Client and service provider details – Full names, contact information, and addresses help identify both parties clearly.

- Service description – A clear explanation of what was provided, including specific dates, locations, and any extra services offered.

- Cost breakdown – Detailed pricing, including base charges, additional fees, taxes, and discounts if applicable.

- Payment terms – Information about due dates, payment methods, and any penalties for late payments.

Why Accuracy Matters

Including these details ensures that both the service provider and the client are on the same page regarding the financial agreement. A clear breakdown helps to prevent errors in calculation and minimizes the chance of disputes later. Additionally, by being transparent about fees and payment expectations, both parties are more likely to trust the billing process and fulfill their obligations on time.

How to Format Your Rental Invoice

Proper formatting is key to ensuring that a billing document is both professional and easy to understand. A well-organized layout helps to convey important information clearly and reduces the likelihood of confusion. By following a logical structure, you can create a document that is not only visually appealing but also functional for both the service provider and the client.

Organizing the Document

The first step in formatting is to ensure that all key sections are in the right order. A typical structure might include:

- Header section – Include your business logo, name, and contact details at the top for clear identification.

- Client information – Place the customer’s name and contact details directly beneath the header to avoid confusion.

- Service description – List the services provided with clear dates, terms, and any other pertinent information.

- Charges and fees – Include a detailed breakdown of costs, taxes, and any extra charges.

- Payment terms – Clearly state payment deadlines, methods, and any applicable late fees.

Designing for Readability

When designing the document, make sure to use consistent fonts, headings, and spacing to guide the reader’s eye through the sections. For example, using bold text for section titles and proper spacing between each section will make the document easier to navigate. Consider adding a footer with additional details, such as your business’s legal terms or customer support contact information.

A clean and well-structured document not only ensures that the client understands the charges but also reflects professionalism, helping to establish trust and promote timely payments.

Setting Payment Terms in Your Invoice

Clearly defined payment terms are crucial for avoiding misunderstandings and ensuring timely payments. By outlining specific conditions, you set expectations for when and how the customer should make payment. A well-structured payment section reduces confusion and creates a professional impression of your business, ensuring that all parties are aligned on financial matters.

When setting payment terms, be sure to include key details such as due dates, acceptable payment methods, and any penalties for late payments. The clearer these terms are, the less likely it is that you will encounter issues with overdue balances or delayed transactions.

| Payment Term | Description |

|---|---|

| Due Date | The exact date by which payment should be made. |

| Late Fees | Percentage or fixed amount charged if payment is not received on time. |

| Payment Methods | Accepted payment methods, such as credit card, bank transfer, or cash. |

| Deposit Requirement | Amount to be paid upfront, if applicable, to secure the service. |

By including these elements in your document, you help ensure smooth and timely payments while maintaining professionalism. These terms protect both you and the customer, ensuring that everyone involved understands their obligations clearly.

Automating the Invoice Process for Rentals

Automating the billing process can significantly reduce administrative work, minimize human error, and speed up payment collection. By implementing automation tools, businesses can streamline the creation and distribution of documents, ensuring consistency and efficiency. This approach not only saves time but also allows for more accurate and timely record-keeping.

Automation tools can be integrated with your existing management system to generate and send documents to clients automatically, based on predefined triggers such as the completion of a service or the end of a contract period. These systems can calculate totals, apply taxes, and adjust for discounts or late fees without requiring manual input.

Additionally, automated systems often provide useful features like payment reminders and report generation, which further reduce the likelihood of overdue payments. By automating these tasks, businesses can focus on other aspects of customer service while ensuring that financial processes remain smooth and efficient.

Integrating Taxes into Vehicle Rentals

Including taxes in billing documents is an essential part of maintaining compliance with local and national regulations. Properly calculating and applying tax charges ensures transparency and avoids any confusion between service providers and clients. It also ensures that businesses adhere to legal requirements while providing a clear breakdown of the total costs for the customer.

When integrating taxes into billing, it is important to know the applicable tax rates for your area and the type of service you provide. These rates may vary based on location, the nature of the service, or the duration of the agreement. Including the tax amount as a separate line item makes it easier for the client to understand how the final total was calculated and fosters trust in your pricing structure.

Additionally, businesses should clearly specify whether taxes are included in the base rate or if they will be added on top of it. Some areas may require the inclusion of specific taxes like sales tax, value-added tax (VAT), or other local levies, depending on the service offered. Failure to account for taxes correctly can result in fines or penalties, so it is crucial to ensure they are calculated and displayed accurately in all billing documents.

Handling Late Payments on Rental Invoices

Late payments can disrupt cash flow and create unnecessary stress for businesses. It is important to have a clear strategy in place for handling overdue balances to ensure that payments are received promptly. By setting expectations upfront and taking a proactive approach, businesses can minimize delays and maintain good relationships with clients.

One effective method is to specify late fees in the payment terms section of your document. Clearly stating the consequences of overdue payments, such as an additional percentage or fixed amount charged for each day the payment is delayed, can encourage timely settlement. These fees should be reasonable and compliant with any legal or contractual guidelines.

Additionally, it is helpful to send payment reminders before the due date to give clients a gentle nudge. If a payment is late, a polite follow-up email or phone call can remind the client of their outstanding balance. It is important to keep communication professional and courteous to avoid damaging the business relationship.

Finally, if payments continue to be delayed despite reminders, businesses may need to consider more formal actions, such as suspending services or taking legal steps. However, the goal is always to resolve the situation amicably and maintain customer trust, while protecting the business’s financial interests.

Tracking Rental Income Using Invoices

Accurately tracking income is essential for businesses to monitor their financial health and plan for the future. By properly documenting every transaction, companies can not only ensure that payments are received but also maintain clear financial records. This process helps in budgeting, tax filing, and analyzing the overall performance of the business.

Organizing and Categorizing Transactions

Each billing document serves as a record of a completed transaction. When organizing income records, it is essential to categorize each transaction by factors such as the service provided, the payment method, and the dates involved. This categorization helps to track cash flow effectively and ensures that all incoming funds are properly accounted for.

Utilizing Digital Tools for Tracking

Many businesses use digital tools or accounting software to manage their income. These systems can automatically record and categorize transactions from billing documents, making it easier to generate financial reports, track overdue payments, and forecast future income. By integrating your document management system with financial software, you can save time and reduce human error in tracking revenue.

Tracking income accurately through detailed records also provides insight into business trends, helping you make informed decisions and identify areas for improvement. Proper documentation helps you stay on top of finances, ensuring you maintain profitability and financial stability.

Legal Considerations in Rental Billing

When creating billing documents, businesses must be aware of the legal obligations that govern financial transactions. Properly structuring and issuing these documents ensures compliance with relevant laws and protects both the service provider and the client. Understanding these legal considerations can help avoid potential disputes, penalties, and legal complications down the line.

Key Legal Aspects to Consider

There are several important factors to keep in mind when drafting a billing document, including:

- Compliance with Tax Laws – Ensure that taxes are applied correctly according to local, state, and national regulations. This includes understanding the appropriate tax rates and ensuring they are transparently included in the total charge.

- Clear Payment Terms – Clearly define payment deadlines, late fees, and any consequences of non-payment. This is essential to avoid misunderstandings and to ensure that both parties are aware of their obligations.

- Contractual Obligations – Include all terms agreed upon in the contract, such as the scope of service, duration, and any other conditions. Billing documents should reflect the terms outlined in the agreement to avoid conflicts.

- Privacy and Data Protection – Be mindful of laws that govern the collection, storage, and sharing of personal information, particularly in jurisdictions with strict privacy laws like GDPR or CCPA.

Dispute Resolution and Documentation

In the event of a dispute, having well-documented billing records is crucial. It is important to:

- Maintain accurate and up-to-date records of all financial transactions, including service details, payment amounts, and any communications regarding billing issues.

- Ensure that your documents include clear terms for handling late payments, refunds, and other financial disputes.

- Consider including a clause outlining how disputes will be resolved, whether through mediation, arbitration, or legal proceedings.

By addressing these legal considerations, businesses can minimize the risk of future disputes, protect their financial interests, and ensure that billing processes remain transparent and compliant with the law.

How to Issue Refunds on Rental Invoices

Refunds are an essential part of any business that offers services on a temporary basis. Whether due to cancellations, service dissatisfaction, or overpayments, ensuring that refund processes are handled efficiently and professionally helps maintain customer trust and satisfaction. Proper documentation and clear communication are key elements in processing refunds correctly.

Steps to Process a Refund

When issuing a refund, it is important to follow a clear process to ensure that all necessary details are properly recorded and communicated. Below are the steps to ensure an effective refund process:

- Verify the Reason for the Refund – Confirm the reason for the refund request. This could be due to cancellations, disputes over services rendered, or billing errors. Clear documentation of the reason helps in case of future inquiries.

- Check the Terms and Conditions – Review your service agreement and refund policy to determine if the request falls within your stated guidelines. Some services may have non-refundable clauses or time-based limits for refunds.

- Calculate the Refund Amount – Ensure that the refund amount is accurate. If it’s related to overbilling, confirm the amount paid and any adjustments, including taxes, fees, or deposits.

- Issue the Refund – Once confirmed, issue the refund using the same method the customer initially used to pay. If that’s not possible, ensure you communicate alternative options for issuing the refund, such as through bank transfer or credit to another account.

Documenting the Refund

Proper documentation is crucial for tracking refunds and ensuring that both the business and the customer are on the same page. To do this effectively:

- Generate a refund confirmation document that outlines the amount refunded, the reason for the refund, and any relevant details like the refund date and transaction method.

- Keep a refund log to track all issued refunds. This log should include the customer’s information, the refund amount, and the status of the transaction.

- Notify the customer in writing about the refund processing and ensure they receive a clear explanation of the amount refunded and when to expect it.

By following these steps, businesses can ensure that refunds are processed smoothly and professionally, maintaining positive customer relations while keeping accurate records for financial and legal purposes.

Best Practices for Invoice Management

Effective management of billing documents is crucial for maintaining financial stability and ensuring timely payments. By adopting the right practices, businesses can streamline their processes, minimize errors, and improve cash flow. Proper document handling not only ensures accuracy but also boosts customer satisfaction by providing clear and professional communication.

Key Practices for Efficient Management

Implementing a few simple practices can help optimize the management of billing records:

- Standardize Document Formats – Using a consistent format for all billing documents ensures that clients can easily understand and process them. It also makes it easier for your team to track and update records.

- Use Digital Tools for Tracking – Automating the process with invoicing software or financial management systems can reduce errors and save time. These tools can help you track outstanding payments, generate reports, and store records securely.

- Set Clear Payment Terms – Clearly define payment deadlines, accepted payment methods, and any late fee policies upfront. This sets expectations for your clients and reduces the likelihood of delayed payments.

- Maintain Accurate Records – Keep detailed records of all issued documents, payments received, and adjustments made. This will help you quickly resolve any disputes and stay on top of your financials.

Optimizing Payment Follow-ups

Ensuring timely payments requires clear communication and regular follow-ups. To improve the chances of prompt payments:

- Send reminders before the payment due date to prompt customers to arrange for payment.

- Follow up promptly on overdue payments with polite but firm reminders to keep the process moving.

- Offer multiple payment methods to make it easier for customers to pay on time.

By implementing these best practices, businesses can improve their billing efficiency, enhance customer satisfaction, and ensure smoother financial operations.