Free Bookkeeping Invoice Template for Easy Accounting

Managing financial transactions efficiently is essential for any business. One of the most important tasks is ensuring that you can quickly generate accurate billing documents. These documents not only help you get paid on time but also maintain clear records for your financial management and tax reporting. The process of crafting well-organized payment requests can be simplified with the right tools.

Customizable documents that can be adapted to your specific needs are the key to simplifying this task. Whether you’re a freelancer or a small business owner, having a structured system for generating billing forms helps you maintain professionalism while saving valuable time. With the right format, you can ensure that all necessary details are included, making your payment process smooth and hassle-free.

In this guide, we will explore how to create efficient and precise financial statements that meet all legal and business requirements. By utilizing the right resources, you’ll be able to focus on growing your business while handling finances seamlessly.

Bookkeeping Invoice Template: A Complete Guide

When managing your finances, it’s essential to have a well-organized method for creating and sending payment requests. Whether you’re running a freelance business or managing a small company, using a consistent structure for your billing documents can help streamline the process. A well-designed form ensures clarity, reduces errors, and improves your professionalism when dealing with clients.

This guide will walk you through the key aspects of creating effective financial documents, offering you the tools to set up and customize your own forms. We’ll explore the important features to include, common pitfalls to avoid, and how to make the process work seamlessly within your daily business operations.

Here’s what you’ll learn:

- How to create accurate and clear payment requests

- The essential details every document should contain

- How to customize your form to suit your needs

- Best practices for sending and tracking payments

By the end of this guide, you’ll have all the knowledge necessary to implement an efficient billing system that enhances your cash flow management and helps you maintain strong client relationships.

Why You Need an Invoice Template

Efficient financial management is a cornerstone of any successful business, and having a standardized format for creating payment requests can significantly improve this process. Without a structured document, it becomes easy to overlook crucial details, leading to mistakes, delayed payments, and misunderstandings with clients. Using a pre-designed form ensures that you include all necessary information consistently, saving time and avoiding errors.

A well-organized payment document helps establish professionalism and trust with your clients. It not only presents your business in a positive light but also ensures compliance with legal and tax requirements. By automating the process, you can focus more on your core business activities, knowing that your financial records are properly documented.

Here are the key reasons why a structured billing form is essential:

| Reason | Benefit |

|---|---|

| Consistency | Ensures uniformity in all client communications and reduces errors. |

| Time-saving | Eliminates the need to manually create new documents for every transaction. |

| Professionalism | Improves your image with clients and makes your business appear more reliable. |

| Legal Compliance | Helps in meeting tax regulations and avoids potential legal issues. |

| Tracking | Facilitates easier payment tracking and record-keeping. |

Using a standardized approach not only keeps things organized but also helps to ensure that your payment process is efficient and transparent, leading to smoother transactions with clients.

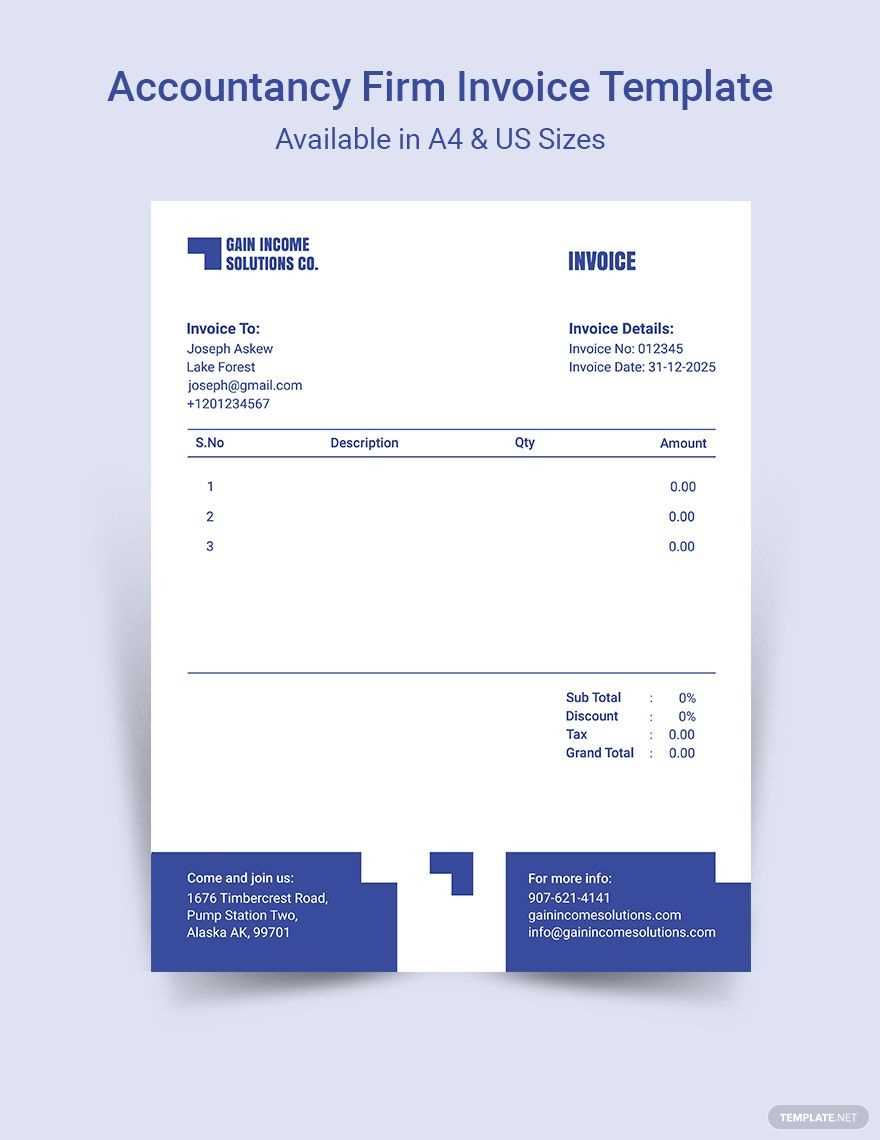

How to Choose the Right Template

Selecting the appropriate document for generating payment requests is crucial to ensure smooth transactions and maintain a professional appearance. The right format should align with your business needs, the complexity of your services, and the expectations of your clients. With various options available, it can be challenging to decide which one will best suit your purposes.

Understand Your Needs

Before choosing a ready-made solution, assess the specific requirements of your business. Do you need a simple layout for small projects or a more detailed one for larger, multi-phase contracts? Tailoring the format to fit your operational style can help prevent unnecessary confusion. Consider whether you need additional fields for discounts, taxes, or custom payment terms.

Consider Design and Functionality

The design and user-friendliness of your document are just as important as its structure. A clean, easy-to-read layout is vital for both you and your clients. Look for a format that is simple yet professional, offering enough flexibility to add your logo and contact details. Ensure the document is intuitive, with clear sections for necessary information like payment terms, service descriptions, and totals.

By focusing on your specific needs and ensuring the design aligns with your business identity, you can select a form that enhances your workflow and leaves a lasting impression on clients.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for creating payment requests offers numerous advantages that can streamline your financial processes. A standardized format not only saves time but also reduces errors, ensuring that all necessary information is consistently included. By implementing a structured approach, you can focus more on running your business while ensuring smooth financial transactions.

Here are some of the key benefits:

- Time Efficiency: Quickly generate professional documents without having to start from scratch each time.

- Consistency: Maintain uniformity in all your billing statements, ensuring that your business looks organized and reliable.

- Reduced Errors: Pre-set fields help you avoid missing essential details, such as tax rates or payment terms.

- Professionalism: A polished and consistent design creates a more positive image for your business.

- Easy Customization: Tailor the document to fit your specific needs, adding personal details like your logo and business information.

- Legal Compliance: Ensure that all necessary legal and tax information is included, reducing the risk of issues down the line.

- Faster Payments: Clear, easy-to-understand documents encourage prompt payment and reduce delays.

Overall, using a ready-made document makes the billing process more efficient, organized, and professional, helping you to manage your finances with ease and accuracy.

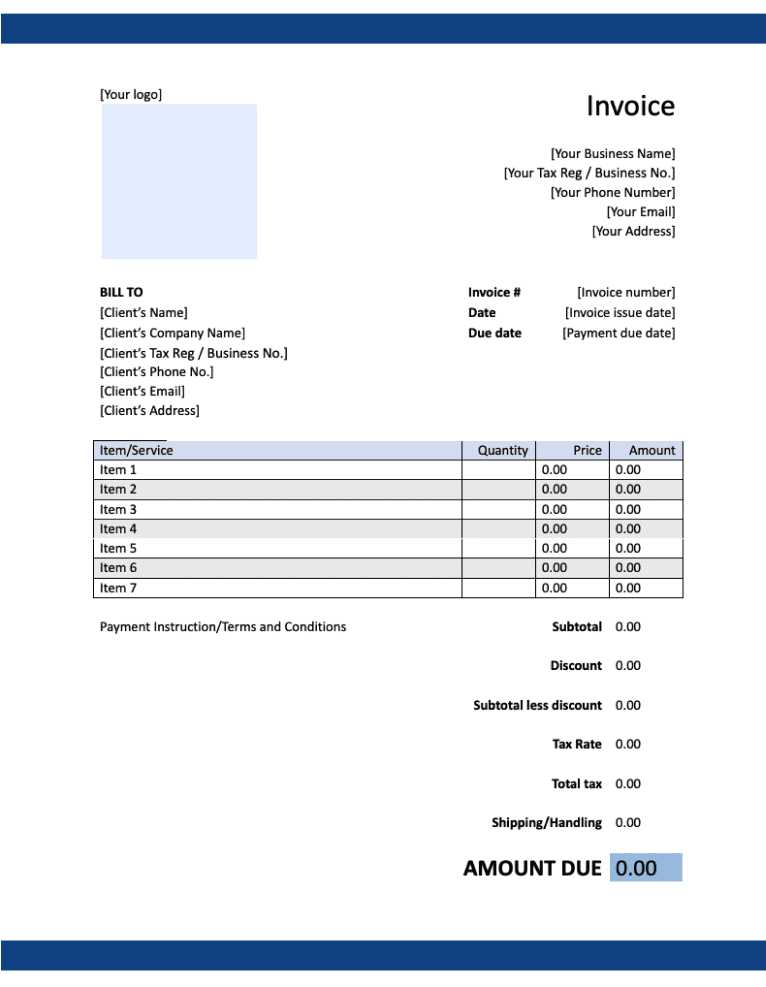

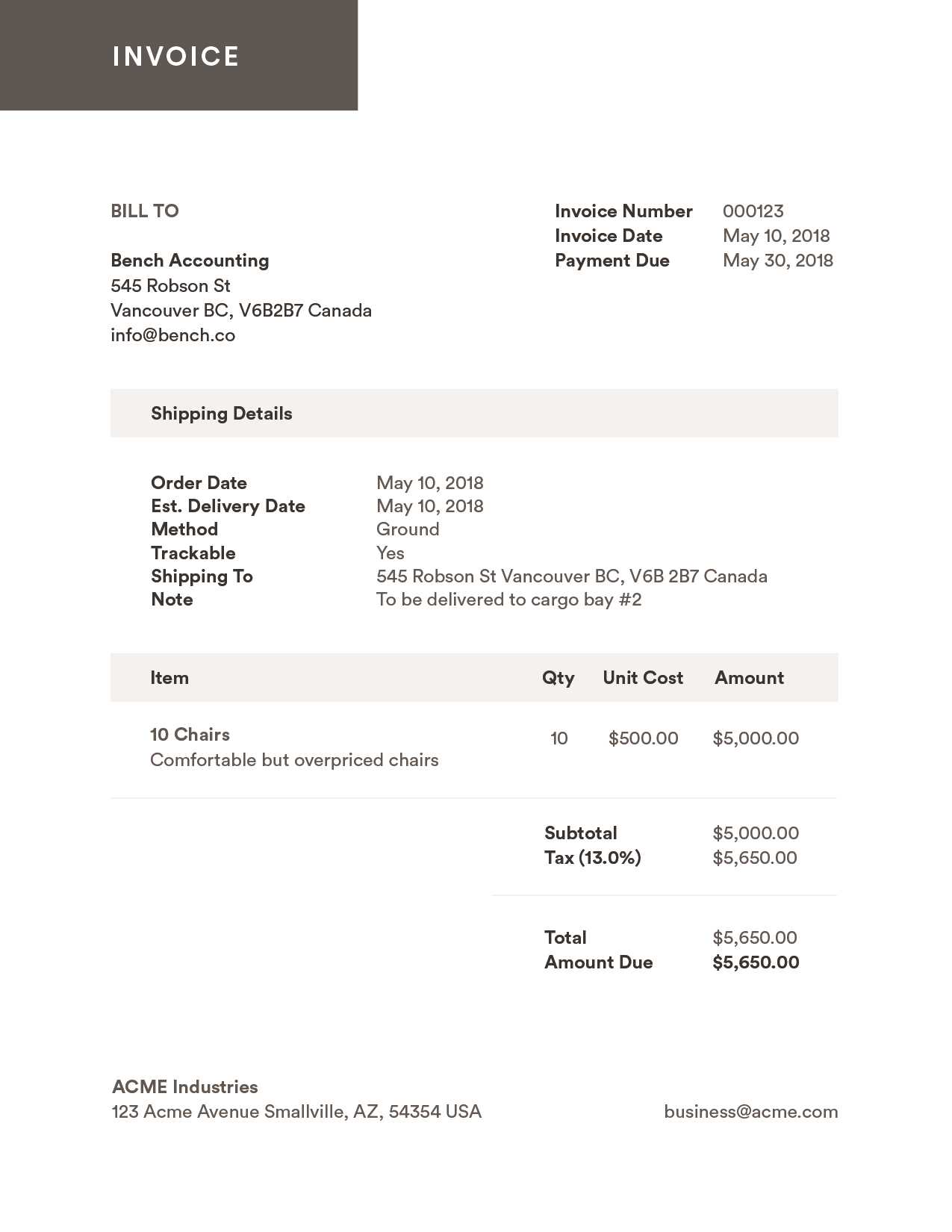

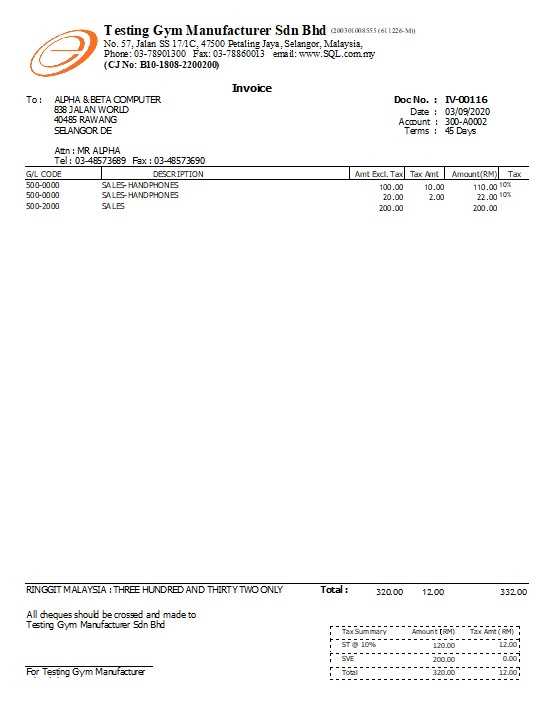

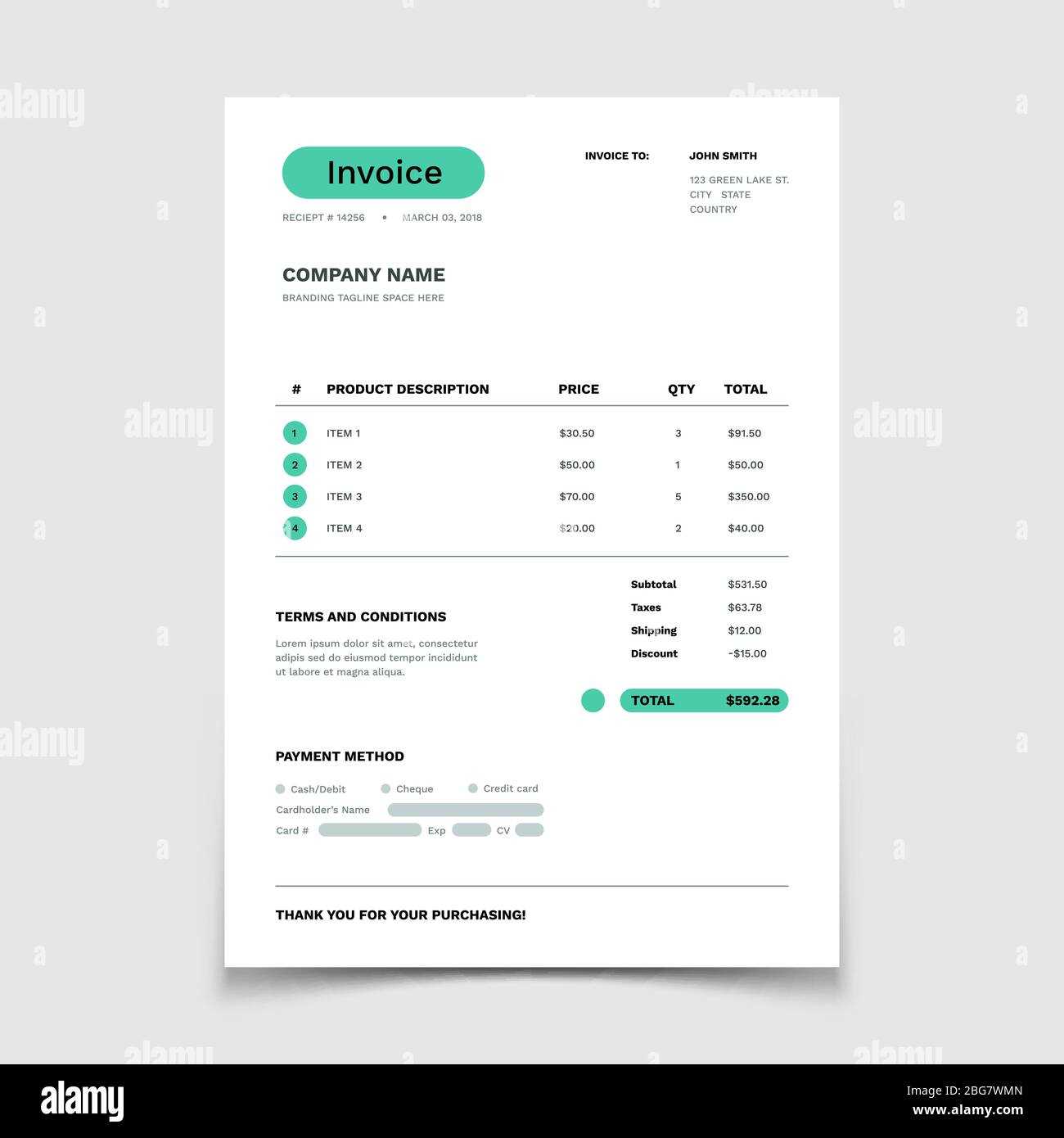

Key Elements of a Bookkeeping Invoice

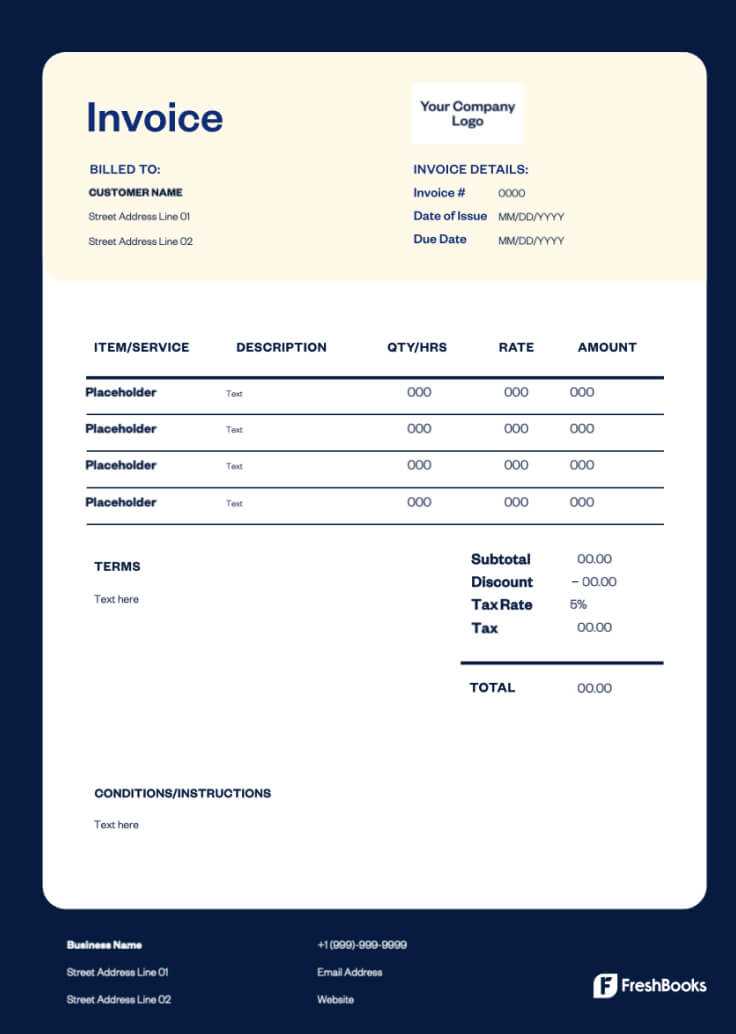

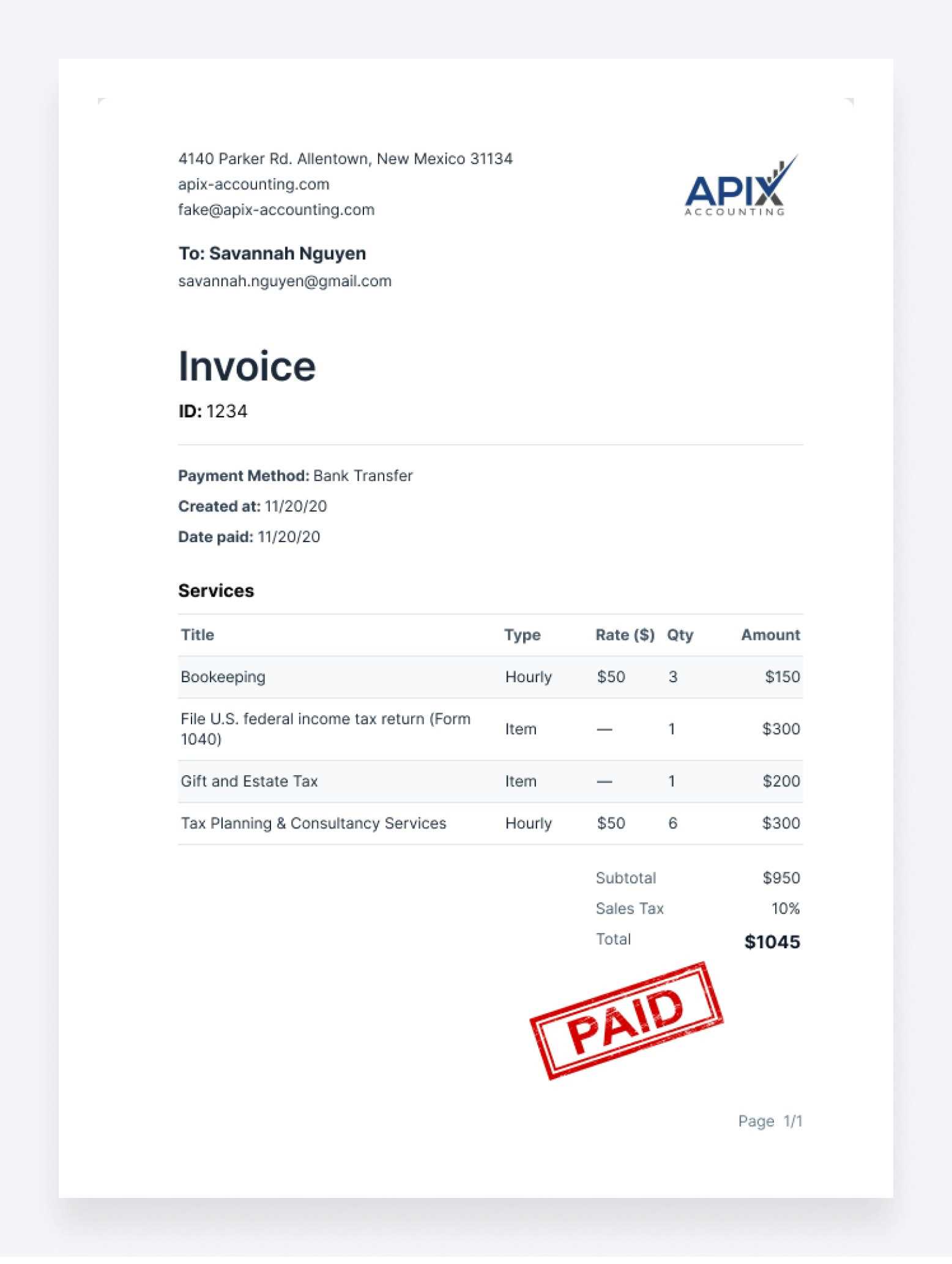

Creating a comprehensive and effective billing document requires including several key components that ensure clarity and accuracy. Every payment request should contain essential details that not only facilitate smooth transactions but also help both parties keep accurate records for accounting and tax purposes. These critical elements should be carefully structured to avoid confusion and ensure prompt payment.

Below are the key elements that should be present in any payment request document:

| Element | Description |

|---|---|

| Contact Information | Include the full name, address, phone number, and email of both your business and your client. |

| Document Number | A unique reference number for the transaction to track the payment and maintain records. |

| Issue Date | The date when the document is created, which helps track payment deadlines. |

| Due Date | Clearly state the deadline for payment to avoid late fees or confusion. |

| Description of Services | A detailed breakdown of the products or services provided, including quantity, rate, and total cost. |

| Payment Terms | Specify any discounts, late fees, or payment conditions, such as whether payments are due immediately or in installments. |

| Total Amount Due | The final amount to be paid, including taxes, discounts, and additional charges. |

| Payment Methods | List the accepted forms of payment (e.g., bank transfer, credit card, check). |

By including these key elements, you ensure that both you and your client have all the necessary information for a smooth transaction, reducing the risk of misunderstandings and delays in payment.

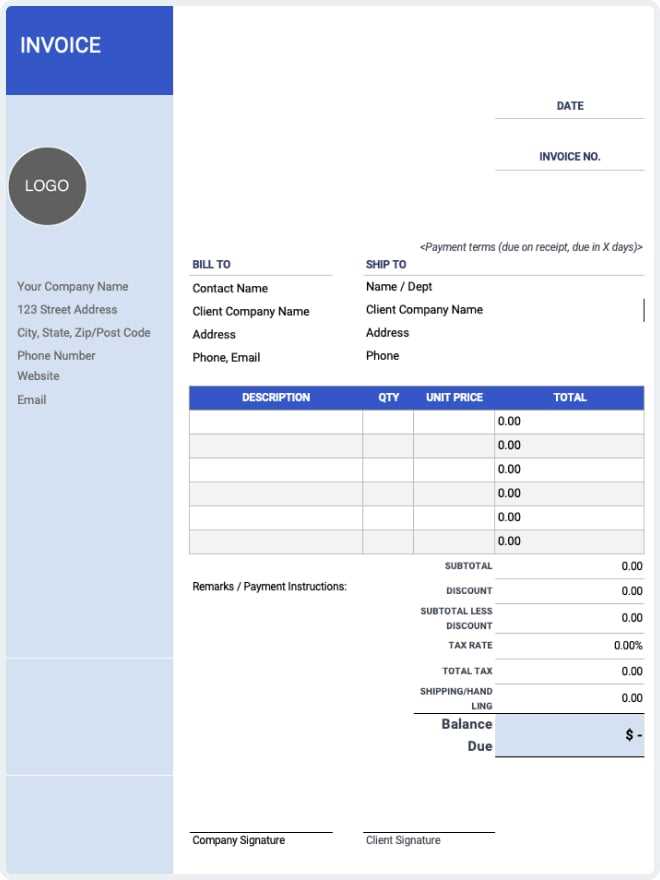

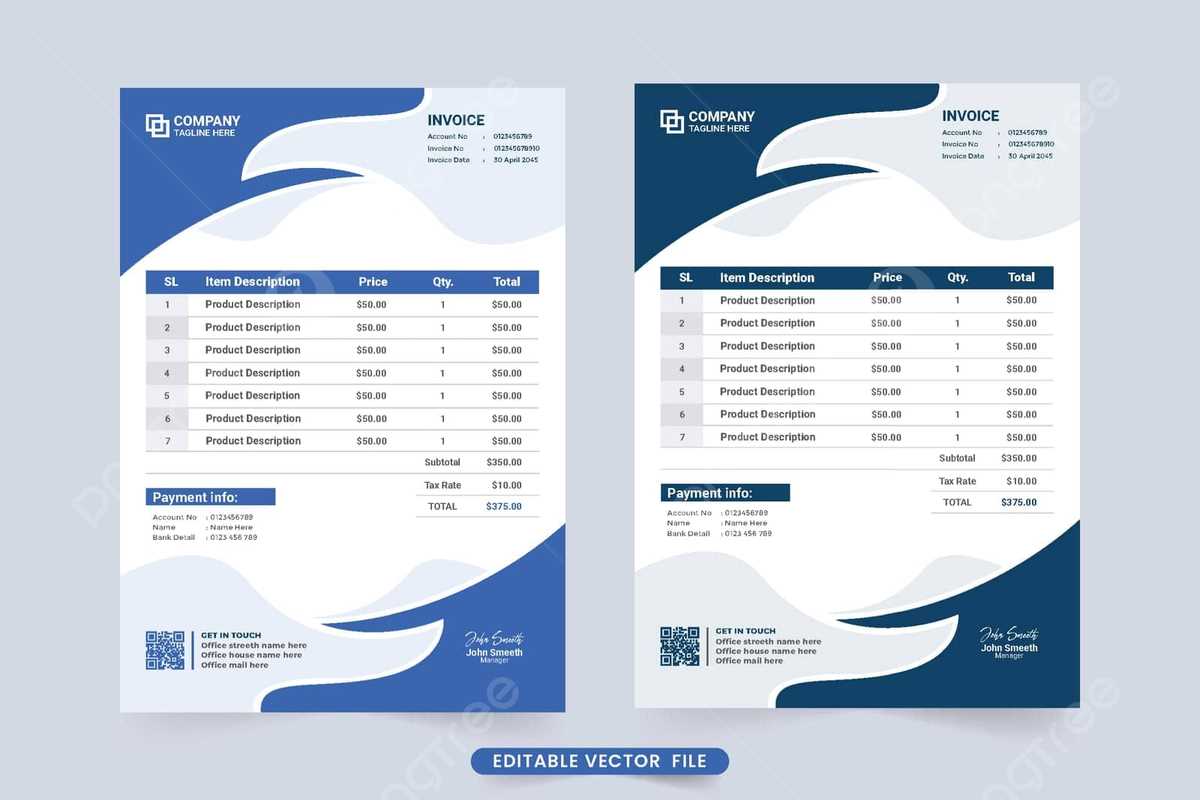

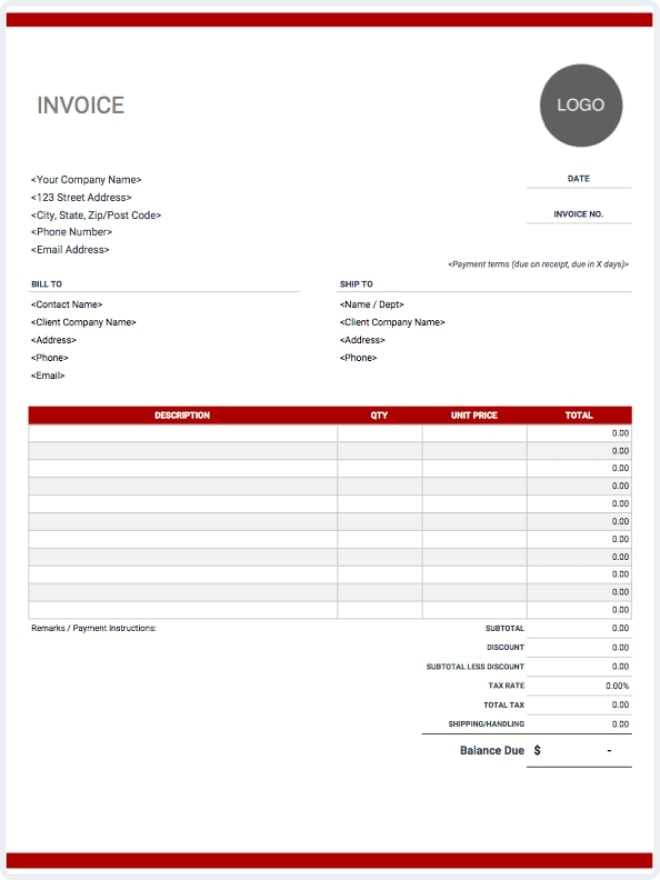

Customizing Your Bookkeeping Invoice Template

Tailoring your billing document to reflect your business’s identity and specific needs can make a significant impact on how your clients perceive your professionalism. Customization not only makes your documents stand out but also helps streamline the process of issuing payment requests. By adjusting key elements, you can ensure that every document fits your workflow and meets all legal and branding requirements.

Key Areas to Customize

There are several aspects of your document that you can personalize to better represent your brand and meet your business needs:

- Logo and Branding: Add your company logo, brand colors, and fonts to maintain consistency across all client communications.

- Contact Information: Include your business name, phone number, email, and website to make it easy for clients to reach you.

- Payment Terms: Customize your payment conditions based on your business model (e.g., deposits, late fees, discounts).

- Service Descriptions: Adjust the descriptions of your services or products to match the unique offerings of your business.

- Additional Fields: Add any extra fields relevant to your business, such as project milestones, tax rates, or account numbers.

Making It User-Friendly

While customization is essential, it’s equally important to ensure that your document remains clear and easy to understand. Avoid cluttering the layout with unnecessary details, and make sure the most important information stands out. Simple adjustments to the layout, such as clear headings, well-organized sections, and bolded totals, can help make your document both attractive and functional.

By taking the time to personalize your billing documents, you not only ensure accuracy and clarity but also enhance your brand’s image, making it easier to maintain strong relationships with clients.

How to Download Free Invoice Templates

Finding a reliable and easy-to-use billing document is a simple process, thanks to the many free resources available online. These ready-made forms can help you quickly get started with managing your financial transactions without the need to create a new document from scratch. Downloading a free version can save you both time and effort, allowing you to focus on other aspects of your business.

Here’s a step-by-step guide to help you find and download the perfect billing document:

| Step | Action |

|---|---|

| 1 | Search for reputable websites that offer free downloadable forms, such as business resource platforms or document-sharing sites. |

| 2 | Choose a format that suits your needs, whether it’s a simple layout or a more detailed version with advanced features. |

| 3 | Check the file format (e.g., PDF, Excel, Word) to ensure compatibility with your device and preferred software. |

| 4 | Download the form, saving it to a location where you can easily access and edit it when needed. |

| 5 | Open the document and customize it with your business details, logo, and other relevant information. |

Once downloaded, you can reuse the form for future transactions, making the process more efficient and consistent. Be sure to look for trusted sources that offer high-quality forms, ensuring that your documents are both professional and legally compliant.

Common Mistakes to Avoid with Invoices

Even with a well-structured document, there are several common mistakes that can undermine your billing process and cause confusion or delays in payment. By being aware of these pitfalls, you can ensure that your payment requests are accurate, professional, and prompt, avoiding misunderstandings with clients and improving cash flow.

Here are some of the most frequent errors to watch out for when creating your payment documents:

| Mistake | Impact |

|---|---|

| Missing Contact Information | Without clear details for both parties, clients may have difficulty reaching you for questions or payment issues. |

| Incorrect Payment Terms | Failure to specify payment due dates or conditions can lead to delayed payments or confusion about when money is owed. |

| Unclear Service Descriptions | Vague or incomplete descriptions can lead to misunderstandings about the scope of work and the agreed-upon price. |

| Omitting Taxes and Fees | Forgetting to include tax rates or extra charges can result in underpayment or disputes over the final amount. |

| Using Complex Language or Formats | Overly complicated wording or layouts can confuse clients and delay payment, especially for those unfamiliar with your business. |

| Not Tracking Previous Payments | Failing to include a payment history may cause confusion, especially with clients who have made partial payments or installments. |

Avoiding these mistakes will help you create a clear and efficient process for managing payments, ensuring smoother transactions and better relationships with clients.

How to Create Professional Invoices Quickly

Creating a professional billing document doesn’t have to be a time-consuming task. With the right approach, you can generate accurate and polished payment requests in a matter of minutes. A well-designed process allows you to focus on your work while ensuring that every transaction is documented properly and professionally.

Here are some steps you can take to speed up the process without sacrificing quality:

- Use a Pre-Designed Structure: Start with a ready-made format to save time. This provides a clear framework that only requires your customization.

- Automate Repetitive Details: Include commonly used information, such as your business name, tax identification number, and payment terms, in a saved document template.

- Pre-Fill Service Descriptions: If you offer regular services, create standard descriptions that can be quickly selected and inserted into each request.

- Use Simple Calculations: Ensure that your document has basic functions to automatically calculate totals, taxes, and discounts, reducing the risk of errors.

- Organize by Client: Keep client-specific details saved for easy access, such as their contact information, payment terms, and previous transactions.

- Keep It Short and Clear: Avoid unnecessary details. Make sure the layout is simple and the information is easy to understand for both you and your client.

By following these steps, you can create well-organized, professional payment requests quickly, improving both efficiency and client satisfaction.

Best Practices for Invoice Numbering

Proper numbering of your payment requests is essential for organization, tracking, and ensuring compliance with accounting and legal standards. By adopting a consistent system, you make it easier to reference specific transactions, streamline your record-keeping, and avoid confusion. An effective numbering system not only helps you stay organized but also presents a professional image to your clients.

Key Considerations for Numbering

Here are some best practices for establishing a reliable and efficient numbering system:

- Start with a Simple Sequential System: Numbering each document sequentially (e.g., #001, #002, etc.) is straightforward and ensures you don’t skip any numbers, which could cause confusion in your records.

- Use Prefixes for Clarity: If you manage multiple types of transactions, consider using prefixes to differentiate between them (e.g., “S” for services, “P” for products). This can help you easily categorize and track your documents.

- Incorporate Date Elements: Including the year or month in the numbering format (e.g., 2024-001) can be useful for organizing records by time period and improving searchability.

- Keep It Unique: Make sure each number is unique to avoid confusion with past or future transactions. Reusing numbers for different clients or projects can lead to errors in tracking payments and maintaining records.

- Avoid Gaps or Overlaps: Ensure that you don’t have skipped numbers or duplicates. This can be easily achieved with automated systems or by carefully tracking your sequence manually.

Automation for Efficiency

If you are dealing with a large number of payment requests, consider using an automated system or accounting software. These tools can automatically generate and assign unique numbers, eliminating the risk of human error and ensuring consistency across all documents.

By following these best practices, you can create a transparent and efficient numbering system that helps you stay organized and professional in all of your transactions.

Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software can save you time, improve accuracy, and streamline your entire financial workflow. By linking your payment requests with accounting tools, you eliminate manual data entry, reduce the risk of errors, and ensure seamless record-keeping. This integration can automate many tasks such as tracking payments, generating reports, and syncing financial data between platforms.

Benefits of Integration

Here are some key advantages of integrating your billing documents with accounting software:

| Benefit | Description |

|---|---|

| Time Savings | Automating the process reduces the need for manual entry and increases efficiency in managing transactions. |

| Reduced Errors | Integration minimizes human error by syncing information directly between platforms, ensuring data accuracy. |

| Easy Tracking | Automatically track payment statuses and due dates, allowing you to stay on top of outstanding balances. |

| Instant Reports | Generate financial reports in real-time, providing up-to-date insights into cash flow and business performance. |

| Compliance | Ensure that your records are properly maintained and comply with legal and tax regulations through seamless data synchronization. |

How to Integrate Your Documents with Accounting Software

To integrate your billing documents with accounting software, follow these simple steps:

- Select the Right Software: Choose a platform that supports document integration and matches your business needs.

- Upload or Sync Your Billing Files: Import your pre-designed payment forms into the software, or use its built-in templates to create new ones.

- Customize the Syncing Process: Set up the software to automatically pull and push data between the billing system and accounting platform.

- Automate Payment Updates: Enable features to automatically update payment status, generate reminders, and issue follow-up notices as needed.

By integrating your payment documents with accounting software, you can streamline your financial management, reduce administrative overhead, and ensure that all records are accurate and up-to-date.

How to Send Invoices to Clients

Once you’ve prepared a payment request document, sending it to your client in a professional and timely manner is crucial to ensuring prompt payment and maintaining a positive business relationship. The delivery method you choose can influence how quickly the client processes the request, so it’s important to select the most efficient and effective way to send it. There are several options available, each with its own advantages depending on your client’s preferences and your business operations.

Here are the most common and reliable methods for sending payment requests to clients:

- Email: The most popular and convenient method. You can attach the payment document as a PDF or Word file. Make sure to write a clear subject line and a professional message in the body of the email, reminding your client of the due date and payment methods.

- Online Payment Platforms: If you use platforms like PayPal, Stripe, or QuickBooks, they often provide features to create and send payment documents directly through their system. This method allows for seamless integration with payment options and faster processing.

- Postal Mail: For clients who prefer physical copies, sending a printed version by mail might be necessary. Make sure the document is professionally printed and securely mailed, especially if it contains sensitive information like account numbers or legal terms.

- Client Portals: Many businesses have dedicated portals or dashboards where clients can log in to view and download payment requests. This method offers added convenience and allows for easy tracking of payment statuses.

- Fax: Although less common today, some businesses or clients may still prefer faxing, especially in industries with stricter regulations. Ensure that the faxed document is clear and legible to avoid any misunderstandings.

Regardless of the method you choose, always follow up to ensure that the client has received the payment request and is aware of the payment terms. Timely reminders can help ensure that your transactions are completed efficiently and that you maintain good client relations.

How to Track Invoice Payments

Tracking payments for your billing documents is essential to maintain healthy cash flow and ensure that clients fulfill their financial obligations on time. By systematically tracking payments, you can quickly identify overdue accounts, manage your finances more efficiently, and reduce the likelihood of errors or miscommunications. Whether you’re handling a few transactions or dozens, a clear and consistent tracking system is key to staying on top of your finances.

There are several methods you can use to track payments effectively. Below is a simple approach using a manual system or software tools that automatically track your records.

| Tracking Method | Description |

|---|---|

| Manual Spreadsheet | Use a spreadsheet to track each transaction, including payment due dates, amounts, and the current payment status (paid, pending, overdue). This method allows for detailed record-keeping and easy updates. |

| Accounting Software | Leverage accounting tools like QuickBooks or Xero, which can automatically sync payment data and provide real-time updates on outstanding balances. These tools often include reporting features for better insights. |

| Client Payment Portals | If your business offers a client portal, payments can be tracked directly within the system, providing both you and the client with access to real-time payment status. |

| Bank Statements | Regularly check your bank statements for incoming payments. This method can help verify that payments have been received, but requires manual matching of transactions with the corresponding request. |

To make tracking even easier, always include unique identifiers (like invoice numbers or client IDs) in your records, and update the payment status promptly after receiving any funds. Setting up automated reminders for unpaid or overdue accounts can also help you stay organized and ensure timely follow-ups.

Handling Multiple Invoice Templates for Different Services

When your business offers a variety of services, it’s essential to have different formats for each type of billing document. Each service may require unique details, pricing structures, and terms, so using the same format for all can lead to confusion and inefficiency. By creating specialized formats for each service or product, you can ensure that your clients receive clear, accurate, and professional payment requests tailored to the specific work completed.

Here are some strategies to manage multiple formats effectively:

- Organize by Service Type: Create a separate structure for each service or product category. For example, one format for consulting work, another for product sales, and a third for long-term projects. This way, you can easily select the appropriate format depending on the work completed.

- Standardize Core Information: While each document should be tailored to the specific service, certain details, such as your business name, contact information, payment terms, and tax rates, should remain consistent across all formats. This helps maintain professionalism and ensures that the basic information is always included.

- Use an Integrated System: If you are using accounting software or a management tool, make sure it allows you to set up and save multiple formats for different services. This way, you can quickly generate the appropriate document without starting from scratch each time.

- Label and Categorize Files: When storing multiple formats, keep them well-organized by clearly labeling each one based on the type of service or product it corresponds to. This will save you time when looking for the correct document and prevent errors when sending them to clients.

By adopting these practices, you’ll be able to streamline your billing process, reduce mistakes, and improve your clients’ experience, all while ensuring your financial documentation is clear, accurate, and professionally presented.

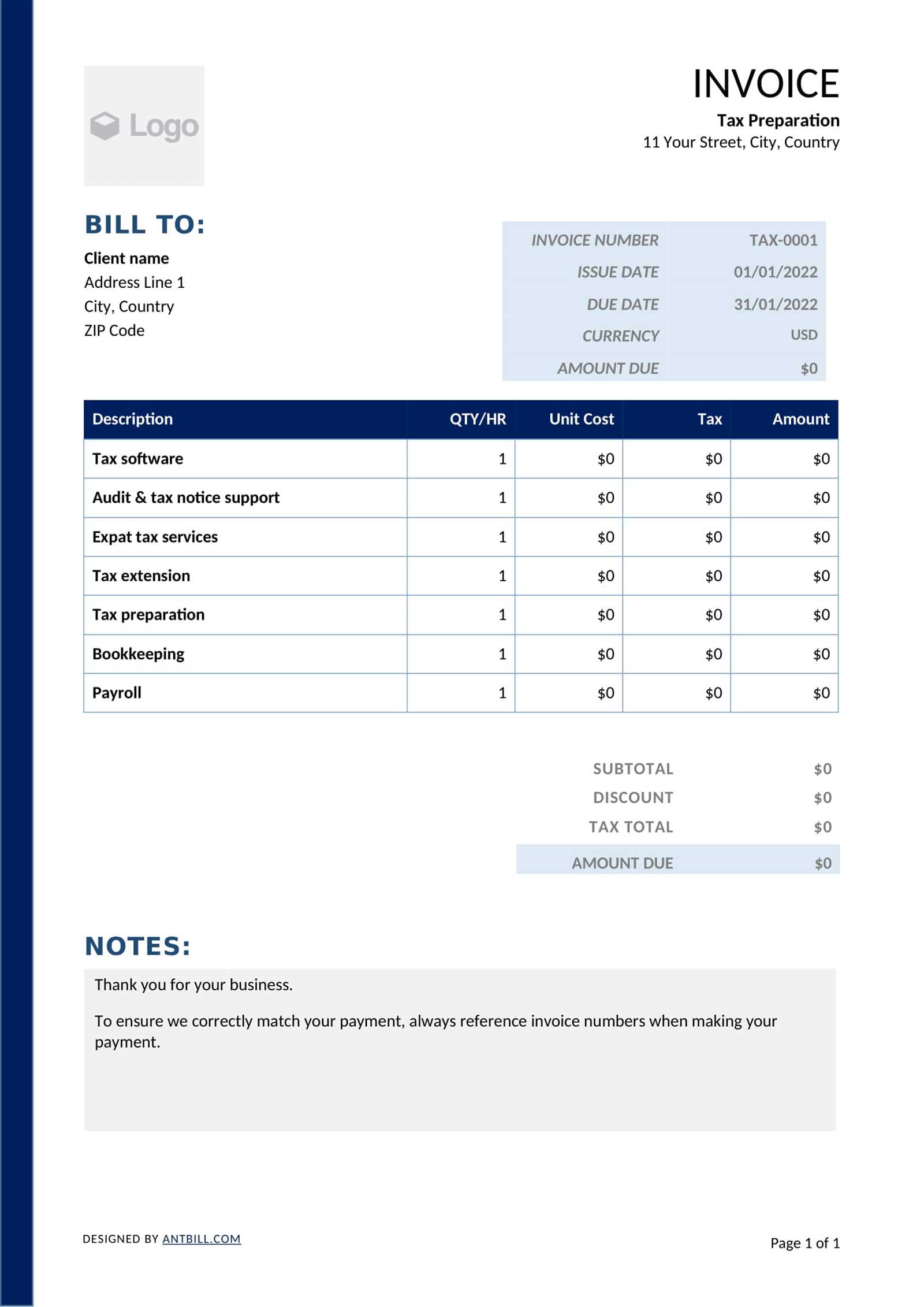

How to Format Your Bookkeeping Invoices

Proper formatting of your payment requests is crucial for ensuring clarity, professionalism, and efficiency in your financial communications. A well-structured document helps clients understand the details of the transaction, from the services rendered to the total amount due. It also streamlines your record-keeping process, making it easier to track payments and stay organized.

Here are some key elements to consider when formatting your payment requests:

- Include Essential Information: At the top of the document, include your business name, contact details, and tax identification number. Additionally, make sure the client’s name, address, and contact information are clearly visible.

- Clearly State Payment Terms: Outline the payment terms, including the due date, accepted payment methods, and any late fees that may apply. This helps set expectations and encourages timely payments.

- Use a Unique Reference Number: Assign a unique number to each document for easy tracking and reference. This is crucial for both you and your client in case there are any issues with the payment.

- Break Down the Charges: Provide a clear breakdown of the services or products provided, including quantities, rates, and any discounts. This makes it easier for clients to understand what they are being charged for.

- Summarize Totals: After listing the individual charges, include the total amount due, including taxes or additional fees. Make sure the total is clearly highlighted.

- Professional Design and Layout: Ensure the document is easy to read by using consistent fonts, spacing, and headings. A clean, professional layout not only improves readability but also enhances your business’s reputation.

By following these guidelines, you can create clear, accurate, and professional payment requests that improve your client relationships and help keep your financial records organized.

Using Invoices for Tax Purposes

Properly maintaining payment request documents is essential not only for managing your business finances but also for ensuring compliance with tax laws. These records serve as proof of income, expenditures, and any taxes owed or collected, making them critical during tax season. Accurate and well-organized documents help you avoid penalties, support claims for deductions, and substantiate your financial statements when filing taxes.

Here are several ways that payment documents can be used effectively for tax purposes:

- Proof of Income: Payment records are essential for documenting the income your business receives. Whether you’re filing as a sole proprietor or managing a corporation, these documents act as evidence of your earnings, which is crucial when calculating your total taxable income.

- Tracking Sales Tax: If you collect sales tax on products or services, it’s important to record the tax amount separately on each payment request. This will allow you to report and remit the collected tax correctly during tax filing periods.

- Deductible Expenses: For businesses that incur operational costs, payment records can help you track deductible expenses, such as materials, supplies, or labor costs. Keeping clear and organized records makes it easier to claim these deductions when filing your taxes.

- Audit Protection: Maintaining accurate and complete documentation protects you in case of an audit. In the event of a tax review, having a thorough record of all transactions can help validate your financial statements and ensure you’re paying the correct amount.

- Clear Record-Keeping: Properly formatted and regularly updated documents ensure that your financial records are easily accessible, making tax filing simpler and reducing the risk of errors when submitting your returns.

Incorporating payment request documents into your tax practices not only keeps your business compliant but also provides clarity and transparency in your financial dealings. Regularly updating and organizing your records ensures that you are prepared for tax filing deadlines and can make informed decisions regarding your business finances.

How to Protect Your Invoice Data

Protecting the sensitive information contained in your payment records is crucial for safeguarding your business and client privacy. Whether it’s your client’s contact details, payment amounts, or transaction history, all of this data must be kept secure to prevent unauthorized access, fraud, or data breaches. By adopting proactive security measures, you can ensure that both your business and your clients’ information remains protected.

Here are some effective strategies to protect your payment records:

- Use Strong Passwords: If you’re storing or sharing payment records digitally, ensure that any accounts or software systems you use are protected by strong, unique passwords. Avoid using easily guessable combinations and enable two-factor authentication wherever possible.

- Encrypt Sensitive Information: When sending payment records electronically, always use encryption to protect sensitive data. Encryption ensures that the information is unreadable to anyone without the proper decryption key, reducing the risk of exposure during transmission.

- Regularly Back Up Data: Backing up your financial records regularly can protect you from data loss due to hardware failure, cyberattacks, or other issues. Ensure that backups are stored securely, preferably in an off-site location or encrypted cloud storage service.

- Limit Access to Records: Only authorized personnel should have access to your financial data. Implement role-based access controls to ensure that employees or contractors can only view or edit the records necessary for their job duties.

- Keep Software Up-to-Date: Make sure that the software you use to store or manage payment records is up-to-date with the latest security patches. Outdated software can contain vulnerabilities that can be exploited by cybercriminals.

- Secure Physical Copies: If you maintain physical records, store them in a secure location, such as a locked cabinet or safe. This prevents unauthorized access and ensures the protection of sensitive paper documents.

By implementing these measures, you can significantly reduce the risk of data breaches and ensure that your business’s financial information remains secure and confidential.

When to Update Your Invoice Template

Regularly reviewing and updating your billing documents is essential for keeping your financial processes accurate and in line with any changes in your business or industry regulations. Over time, new services, tax rates, or business requirements may necessitate modifications to your document layout or content. Ensuring that your payment request forms are up to date helps prevent errors, miscommunications, and delays in payment collection.

Here are some key moments when you should consider revising your payment request forms:

- Changes in Pricing or Services: If your rates or service offerings change, update your billing documents to reflect the new prices, descriptions, and terms. This will help avoid confusion and ensure that your clients are charged accurately.

- Tax Rate Adjustments: When there are changes to tax laws or rates, it’s crucial to adjust the tax fields on your documents to comply with the new regulations. This ensures that your financial records remain accurate and you avoid undercharging or overcharging clients.

- Rebranding or Business Changes: If your business undergoes a rebranding or any major structural changes (such as a change in business name, logo, or contact details), your payment request forms should reflect these updates to maintain consistency and professionalism.

- Client Feedback: Sometimes, clients may suggest ways to improve the clarity or functionality of your payment requests. Listening to their feedback and implementing relevant changes can improve their experience and ensure smoother transactions.

- Software or System Updates: If you switch to new billing software or accounting systems, you may need to adapt your billing documents to integrate seamlessly with the new platform. This can include format changes or the addition of automated features.

- Legal or Compliance Requirements: Changes in industry regulations or legal requirements may necessitate specific adjustments, such as including new disclaimers, adjusting payment terms, or adding required fields like business registration numbers.

Regular updates help ensure that your payment request documents remain accurate, professional, and legally compliant. Keeping them fresh and aligned with business changes ensures smooth financial operations and positive client relationships.