Etsy Invoice Template for Seamless Transactions

When managing online sales, it’s essential to maintain clear and professional records of each transaction. A well-structured document not only serves as proof of purchase but also enhances trust between sellers and buyers. Crafting such a document that meets both legal and customer expectations can greatly streamline your business operations.

Having a standardized way to present order details, payment terms, and product information is key to ensuring consistency and professionalism. With the right approach, you can easily customize this essential document to reflect your brand while meeting the specific needs of each sale.

By utilizing a customizable document format, sellers can focus more on their products and less on administrative tasks, while buyers benefit from receiving clear, accurate transaction records that build confidence and facilitate future interactions.

Complete Guide to Etsy Invoice Templates

When running an online shop, having a structured way to document each sale is crucial for smooth business operations. This essential record ensures that both the seller and the buyer have a clear understanding of the transaction details, from product information to payment terms. A well-designed document can save time, increase professionalism, and help maintain accurate financial records.

Why Having a Standardized Document Matters

For online business owners, creating a standardized record that can be reused for each transaction brings several benefits. It allows for easy customization while ensuring all necessary details are consistently included. By having a ready-made structure, you eliminate the guesswork and reduce the chances of missing vital information, such as shipping costs or tax details. This consistency also creates a sense of reliability for customers, which can lead to positive reviews and repeat business.

How to Customize Your Sales Record

Customizing your document allows you to tailor it to your specific business needs. Key elements to include are the buyer’s name, the products purchased, the total amount, and any applicable taxes or discounts. Additionally, integrating your branding with your company’s logo or colors can make the document feel more personal and professional. By creating a personalized format, you not only improve efficiency but also enhance your shop’s identity.

Mastering this process ensures you remain organized, compliant with legal requirements, and professional in every transaction you handle.

Why You Need an Etsy Invoice Template

Having a standardized document for each transaction is essential for any online business. It serves as both a record for the seller and a confirmation for the buyer, helping to ensure clarity and avoid misunderstandings. A structured sales document allows you to present all relevant details in a clear and organized manner, making it easier to track orders, manage finances, and resolve any potential disputes.

Without a consistent format, sellers may overlook important information, such as payment terms or shipping details, leading to confusion and delays. By using a pre-designed structure, you can streamline your process, save time, and maintain a professional image. This document also plays a key role in legal compliance, ensuring that all necessary information is included and that both parties have a clear understanding of the terms of the sale.

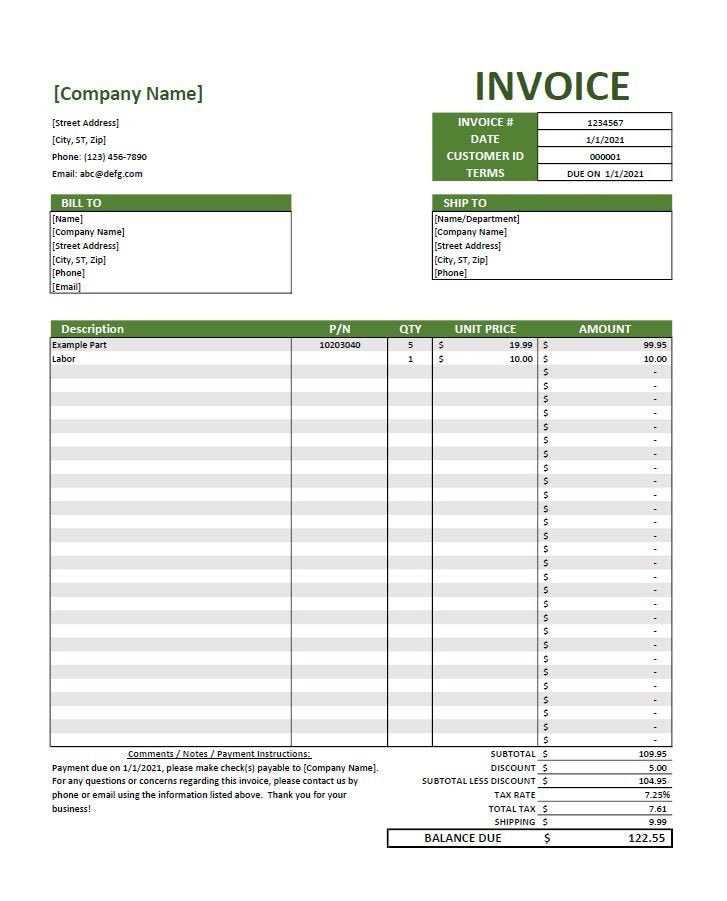

Key Features of an Etsy Invoice

Every effective sales document needs to include certain elements that ensure the transaction is clearly understood by both the seller and the buyer. These elements provide essential information, facilitate smooth business operations, and contribute to a professional and legally compliant experience. Below are the key features that should be present in every sales record.

Essential Information to Include

- Seller Details: The seller’s name, business name, and contact information should be clearly listed.

- Buyer Information: The name, address, and contact details of the buyer help confirm who the transaction is with.

- Product Descriptions: A detailed list of all items purchased, including names, quantities, and prices.

- Total Amount: The total cost, including taxes, shipping fees, and any discounts applied, should be clearly visible.

- Payment Terms: Clearly state the payment method used and any relevant deadlines or terms.

Additional Features for Clarity

- Order Number: A unique identifier for the transaction to easily reference it later.

- Shipping Information: Include the shipping address, method, and tracking number (if applicable).

- Return and Refund Policy: Briefly outline the terms for returns, exchanges, or refunds.

- Legal Compliance: Any necessary tax or legal disclaimers based on your region or type of sale.

Including these elements ensures that both parties have a clear understanding of the transaction, helping to prevent confusion and offering transparency in the sales process.

How to Create a Custom Invoice

Creating a personalized sales document that suits your business needs is an important step toward maintaining clear communication with customers. A custom format allows you to include only the relevant details specific to your transactions, making the document both functional and professional. Below is a guide on how to create a custom record for each sale, ensuring consistency and clarity in your business operations.

To begin, focus on the key components that should be included in every transaction document, such as the buyer’s information, item descriptions, and payment terms. You can also personalize the design to align with your brand, incorporating your logo or color scheme. Here’s an example of what a simple, custom format might look like:

| Detail | Description |

|---|---|

| Seller Name | Your Business Name |

| Buyer Name | Customer Name |

| Product Description | Item Name, Quantity, Price |

| Total Cost | Total Amount (Including Taxes and Shipping) |

| Payment Method | Credit Card, PayPal, etc. |

| Shipping Details | Shipping Address and Method |

This format can be easily adapted to meet your business’s specific needs, whether you sell physical products, digital items, or services. By creating a custom document, you can ensure that every transaction is clear and professionally presented, helping to build trust and encourage repeat business.

Essential Information for Etsy Invoices

For any business transaction, certain key details must be clearly documented to ensure both parties are fully informed. Including the right information in your sales records helps maintain transparency and trust, preventing any misunderstandings or confusion. A well-crafted record not only helps with financial tracking but also serves as proof of the agreement between the buyer and the seller.

There are several critical elements that must be included in every transaction document to ensure it is complete and professional. These elements cover basic business details, financial information, and shipping specifics. Below are the essentials that should never be overlooked:

- Business Information: Include the seller’s name, business name, address, and contact details.

- Customer Information: The name and address of the buyer, ensuring there is no confusion regarding the recipient.

- Product Details: A detailed description of the purchased items, including the quantity, unit price, and any special features or options.

- Total Amount: A clear breakdown of the total amount paid, including taxes, shipping costs, and any applicable discounts.

- Payment Method: Indicate how the payment was made, such as credit card, PayPal, or other methods.

- Shipping Information: Include the shipping address, delivery method, and, if applicable, the tracking number.

- Return and Refund Policy: Provide information on how returns or exchanges are handled, if relevant.

Including these key details ensures that your transaction record is both accurate and professional, helping to protect both the seller and buyer in case of any issues.

Best Tools for Etsy Invoice Templates

When creating professional transaction records, using the right tools can make the process quicker and more efficient. Whether you’re looking for customizable formats, user-friendly software, or automated systems, there are a variety of options available that help streamline this crucial task. These tools allow you to focus on your products and customers while ensuring that every sale is documented correctly and efficiently.

Below are some of the best tools to help you create customized sales documents, whether you’re a beginner or an experienced seller:

- Canva: An easy-to-use design platform that offers customizable sales document templates. With drag-and-drop features, you can quickly design a document that aligns with your brand and includes all the necessary details.

- QuickBooks: A popular accounting tool that not only helps with bookkeeping but also includes features for creating detailed and professional sales records. It automatically tracks sales and can generate customized transaction documents.

- Google Docs: A simple, free tool that allows you to create a sales document from scratch. With customizable templates available, Google Docs is ideal for those who need flexibility and ease of use.

- Zoho Invoice: A cloud-based invoicing system that provides customizable templates and automates the entire process of generating and sending transaction records. It also integrates with other business tools to streamline your workflow.

- PayPal: If you use PayPal for payments, their system can automatically generate detailed transaction documents. These can be downloaded or emailed directly to your customers.

By utilizing these tools, you can simplify the process of creating and managing your sales records, allowing you to focus more on growing your business and maintaining customer relationships.

How to Personalize Your Etsy Invoice

Adding a personal touch to your sales documents is a great way to enhance your business identity and make your customers feel valued. Personalization goes beyond just including basic transaction details–it’s about creating a document that reflects your brand’s unique style and values. By customizing your sales records, you can improve the overall customer experience and increase the likelihood of repeat purchases.

Here are some effective ways to personalize your transaction records:

- Incorporate Your Branding: Add your business logo, use your brand colors, and select fonts that align with your overall aesthetic. This helps create a cohesive experience for your customers.

- Add a Thank You Note: Include a short, heartfelt message thanking the buyer for their purchase. This personal gesture can foster customer loyalty and encourage positive feedback.

- Include Custom Fields: Customize the document with additional fields that reflect your business, such as special instructions or the date the product was made or shipped.

- Offer Discounts or Promotions: Include a small coupon or a discount offer for future purchases to encourage repeat business and show your appreciation.

- Showcase Your Social Media: Add links to your social media profiles or website. This encourages buyers to follow or interact with your brand beyond the purchase.

By personalizing your sales documents, you create a more memorable and professional experience for your customers, which can help to strengthen your brand identity and foster long-term customer relationships.

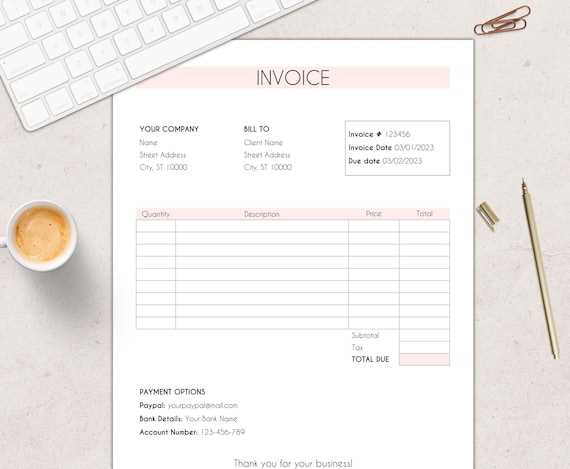

Design Tips for Professional Invoices

Creating visually appealing and well-organized sales documents is essential for making a positive impression on your customers. A professional layout not only ensures clarity but also conveys that you take your business seriously. A clean and effective design helps avoid confusion, enhances readability, and reinforces your brand identity.

Focus on Clarity and Simplicity

When designing your sales records, always prioritize readability. Here are a few tips to help achieve a clean and professional look:

- Use a Simple Layout: Avoid clutter. Stick to clear sections with enough space between them. This makes it easy for customers to find what they need without feeling overwhelmed.

- Choose a Legible Font: Select a font that is easy to read at various sizes. Sans-serif fonts like Arial or Helvetica are often a good choice for clarity.

- Limit Colors: Stick to a minimal color palette. Too many colors can distract from the key details. Use your brand colors sparingly to highlight important information.

Incorporate Branding for a Personal Touch

To make your transaction records stand out, incorporate elements that reflect your brand’s identity. This will make your documents feel more personalized and professional.

- Logo and Branding: Place your logo at the top of the page to immediately establish your business identity.

- Consistent Colors: Use colors that align with your branding to make the document feel cohesive with other customer touchpoints.

- Use a Custom Signature: If applicable, add a handwritten-style signature or a personalized message to create a more personal connection.

By combining simplicity with your unique brand elements, you create a professional, easy-to-read document that builds trust and enhances your customers’ experience.

Common Etsy Invoice Mistakes to Avoid

Creating accurate and professional sales records is crucial for maintaining a positive reputation and avoiding confusion with your customers. However, some common errors can undermine the quality and reliability of your documentation. Avoiding these mistakes will not only help you stay organized but also enhance the overall customer experience, ensuring smooth transactions.

1. Missing Key Information

One of the most common errors in creating transaction records is omitting essential details. Missing information can lead to confusion and distrust. Always make sure your documents are complete before sending them to customers. Here’s a checklist of the most important elements to include:

| Essential Information | Why It’s Important |

|---|---|

| Seller’s name and contact information | Establishes your identity and makes it easy for the customer to reach you. |

| Customer’s information | Ensures that the transaction is linked to the correct buyer and helps avoid shipping errors. |

| Product description and quantity | Clarifies what has been purchased and avoids confusion about the order. |

| Total amount, including taxes and shipping | Prevents misunderstandings about the cost and confirms the final price. |

2. Incorrect or Confusing Formatting

Another common mistake is poor formatting, which makes the document difficult to read or navigate. Use clear, consistent formatting to help customers quickly find the information they need. Avoid overcrowding the document with too much text or irrelevant details. A clean, structured layout is key to a professional appearance.

By ensuring all relevant details are included and mainta

How to Export and Send Invoices

Once your transaction records are ready, it’s important to know how to export and send them to your customers efficiently. Properly handling this step ensures that your customers receive the necessary documentation promptly and that you maintain an organized system for your business records. Exporting and sending documents can be done through a variety of methods, depending on the tools you’re using, and understanding the process will save you time and help keep your transactions running smoothly.

Here are the steps to follow when exporting and sending your sales records:

- Choose the Right Format: Most platforms allow you to export your documents in formats like PDF, Word, or CSV. PDF is generally the most professional and widely accepted format for sending official documents.

- Double-Check Your Document: Before exporting, review the document one final time for any errors or missing information. Ensure that all details are accurate, including the customer’s information and the order details.

- Export the Document: Depending on your software or platform, the export option is usually found in the settings or file menu. Follow the prompts to download the document to your computer or cloud storage.

- Send via Email: Attach the exported file to a professional email. Include a brief message thanking the customer for their purchase and confirming that the document is attached. Be sure to double-check the recipient’s email address before sending.

- Track Sent Documents: Keep a record of the documents you’ve sent, either through your email service’s sent folder or a separate tracking system. This ensures you can follow up if needed.

By following these simple steps, you can efficiently export and send your sales documents, ensuring that your customers receive the information they need in a timely and professional manner.

Invoice Template Formats for Etsy Sellers

When it comes to preparing sales records, choosing the right format is crucial for both organization and customer experience. There are several formats available, each with its unique benefits, depending on your needs. Whether you’re looking for something simple and quick or more detailed and customized, the right format ensures that your records are clear, professional, and easy to share.

Here are some common formats to consider when creating transaction documents:

- PDF Documents: One of the most popular formats for official documents, PDF ensures that your layout, design, and details stay intact across different devices and platforms. It’s a professional choice that maintains document integrity.

- Word Documents: If you prefer more flexibility for editing and customization, Word documents offer an easy-to-use format for creating and adjusting sales records. However, this format might not look as polished when shared with customers compared to a PDF.

- Excel or CSV Files: For those who want to track multiple transactions in one place, Excel and CSV formats allow you to organize your sales data efficiently. These formats are ideal for record-keeping but might require additional steps for sharing with customers.

- Online Invoicing Platforms: Some sellers use specialized platforms or tools for creating and managing transaction records. These platforms often offer built-in templates with customizable options, and many allow you to send records directly to customers via email.

- HTML Files: For those with technical knowledge, HTML offers a high degree of customization for designing transaction records. While it allows for advanced design, HTML files may require additional software for sharing and viewing.

Choosing the right format for your sales documentation depends on your preferences, the complexity of your transactions, and the professional image you wish to convey to your customers. Make sure to consider each option carefully to determine which works best for your business needs.

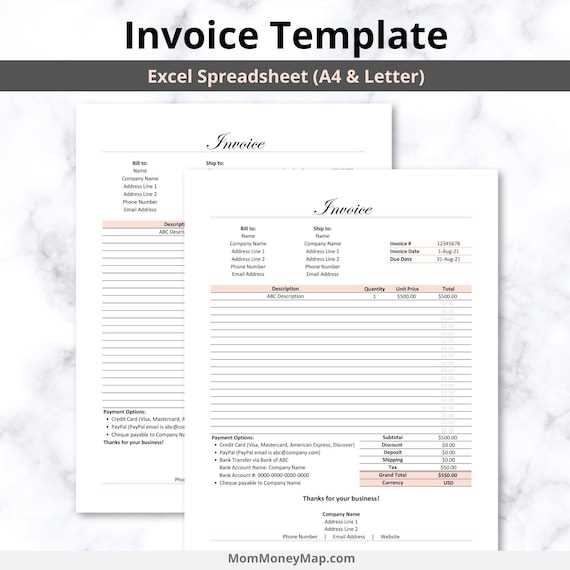

Free Etsy Invoice Templates You Can Use

If you’re looking to streamline your sales documentation process, free resources are available that provide customizable options to create professional transaction records. These ready-made solutions are ideal for sellers who need quick and easy ways to manage their sales without the need for expensive software or complex tools. Many of these options are available for download and can be tailored to suit your business needs.

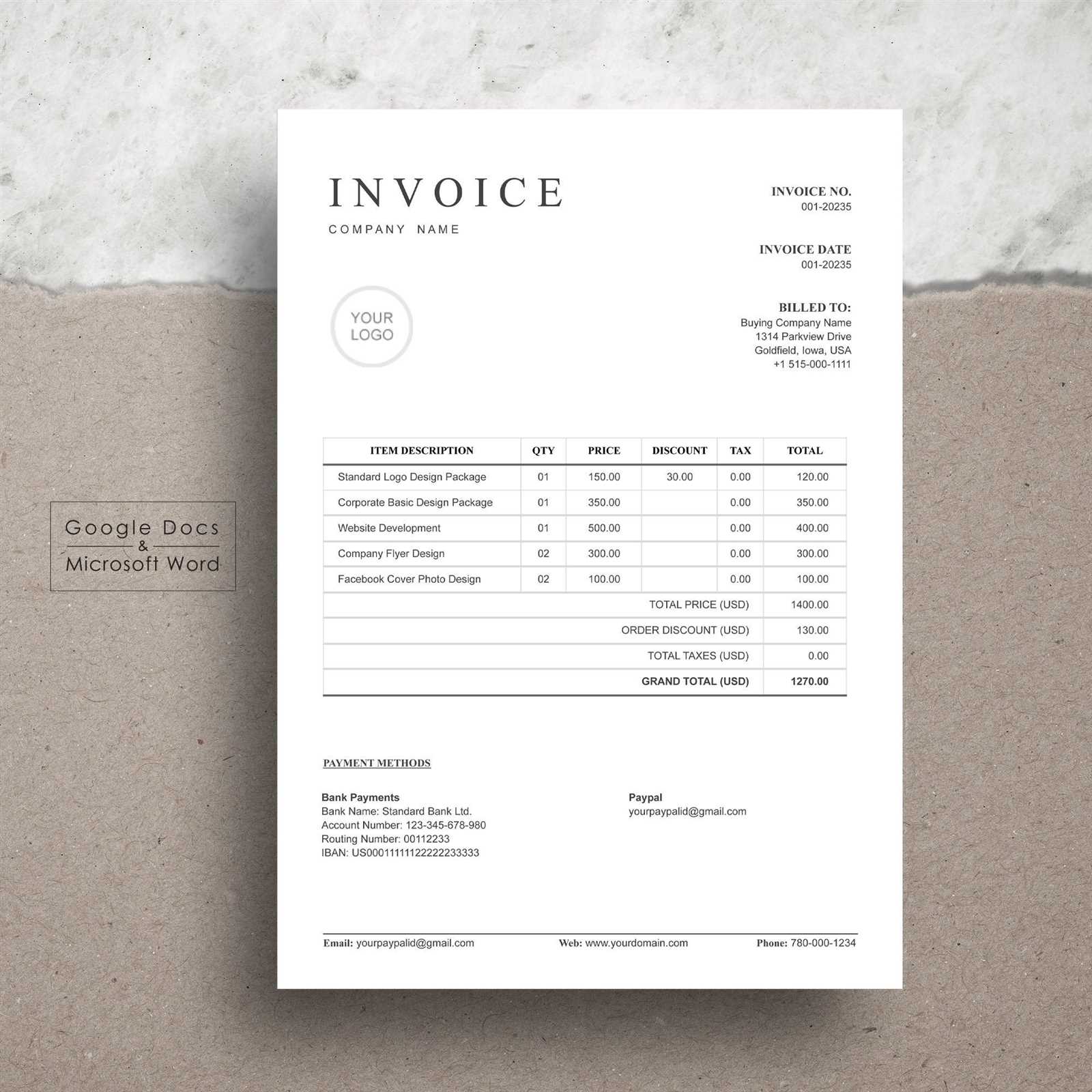

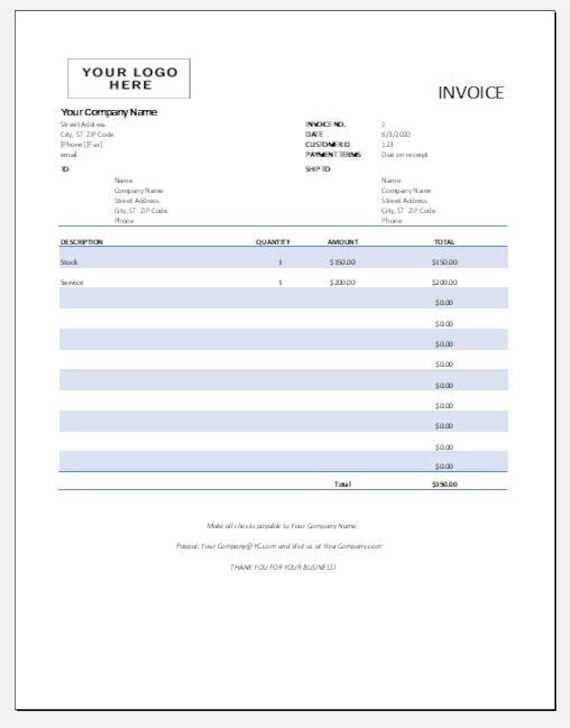

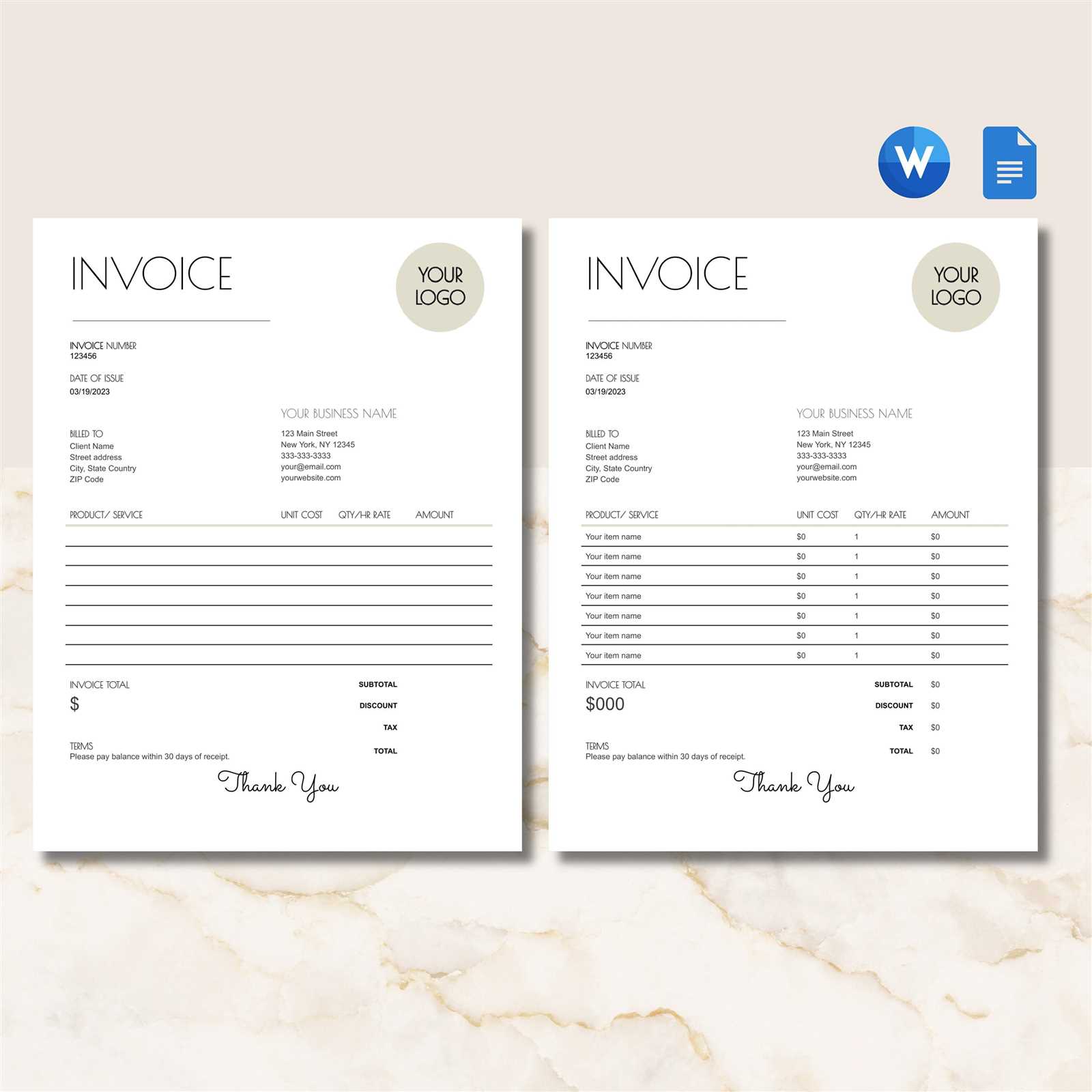

1. Pre-made Editable Document Templates

These templates are designed for those who want a simple, no-fuss solution. Available in popular formats like Word and PDF, they offer easy customization. Simply add your business details, products, and transaction information to create a professional record. Many of these templates are offered for free by various websites and can be downloaded with a few clicks.

2. Online Customization Tools

For sellers looking for a bit more flexibility, many free online tools offer customizable document options. These platforms allow you to design and modify your transaction records without needing any design skills. With drag-and-drop features, you can add your logo, adjust text fields, and even modify the layout. Once finished, these tools typically offer an option to download your work in various formats.

Using free resources can help simplify your record-keeping process, ensuring that you can focus on what matters most–growing your business and maintaining good customer relationships.

How Etsy Invoice Templates Save Time

Using pre-designed sales documentation formats can significantly streamline your business operations, saving valuable time that would otherwise be spent creating records from scratch. These ready-made solutions are especially useful for small business owners and online sellers, offering a quick way to generate professional documents without having to start from zero each time. By automating part of the process, you can focus more on other important aspects of your business, such as customer service and product development.

1. Faster Document Creation

One of the main advantages of using pre-designed formats is the speed at which you can create accurate transaction records. Instead of manually entering all the information and formatting each document, you can simply input the details into a ready-made structure. This eliminates the need for repetitive tasks and reduces the time spent on each sale, allowing you to process more orders in less time.

2. Consistency and Professionalism

By using a standardized structure for your records, you ensure that every document looks polished and consistent, which enhances your business’s professionalism. Templates often include fields for all necessary information, such as customer details, product descriptions, and payment terms. This consistency not only saves time by eliminating errors but also builds trust with your customers, who will appreciate the clarity and organization of your documentation.

Adopting these time-saving tools ensures you can manage your transactions more efficiently, giving you more time to focus on growing your business and serving your customers.

Managing Multiple Etsy Invoices Efficiently

When running a business with a high volume of transactions, handling multiple records can quickly become overwhelming. However, using organized systems and streamlined tools can help you stay on top of all your sales documents. By implementing a few key strategies, you can ensure that managing numerous transactions remains simple, organized, and stress-free.

1. Use Automated Tools to Track Orders

Leveraging automation tools can save you time and reduce the risk of errors when handling a large number of records. Many online platforms offer features that automatically generate sales documents for you after each transaction. These tools can be synced with your sales platform, allowing them to automatically fill in the required details, reducing the need for manual data entry.

2. Organize Documents into Categories

Creating a clear organizational system for your transaction records is essential for maintaining efficiency. Consider categorizing your documents based on key criteria such as date, customer, or order type. Using digital folders, spreadsheets, or cloud-based systems can make it easier to locate and manage each document as your business grows.

- By Date: Group documents by month, quarter, or year to easily access records for tax filing or audits.

- By Customer: Sort records by client name for quick reference if a customer needs assistance or a duplicate document.

- By Order Type: Separate documents based on product category or shipping method for efficient tracking.

Organizing and automating your document management system ensures that you spend less time on administrative tasks and more time growing your business.

Legal Requirements for Etsy Invoices

When managing transactions for your business, it’s essential to ensure that your sales documents comply with legal regulations. These records are not just for bookkeeping–they serve as proof of the sale, are required for tax purposes, and may be needed if your business is audited. Understanding the legal obligations related to these documents can help you avoid potential issues and maintain smooth business operations.

1. Information That Must Be Included

Most jurisdictions require that certain details appear on each sales record. This ensures that both the seller and buyer have clear and legally valid proof of the transaction. Below is a table outlining the key information that must be included in your sales records:

| Required Information | Description |

|---|---|

| Seller’s Details | Include the business name, address, and contact information. |

| Buyer’s Information | Customer’s name and shipping address. |

| Product Description | A clear description of the goods sold, including quantities and price. |

| Sale Date | The date the transaction took place. |

| Payment Details | Breakdown of total cost, taxes, and any discounts applied. |

| Transaction Number | A unique reference number for tracking the sale. |

2. Tax Compliance and Record Keeping

Depending on your location, you may be required to collect taxes on certain goods or services. It’s crucial to include accurate tax information on each sales record, as failure to comply with tax laws can result in fines or legal issues. Keeping records organized and easily accessible is also important for tax reporting purposes and to prove that your business is compliant with local regulations.

Ensuring your transaction documents meet legal standards not only helps protect your business but also builds trust with your customers by providing clear, transparent records.

How to Handle Refunds in Invoices

Managing refunds properly is crucial for maintaining clear and accurate transaction records. Whether due to customer dissatisfaction or product issues, refunds need to be documented carefully to ensure transparency and to avoid discrepancies. Properly handling these adjustments helps maintain trust with customers and ensures compliance with business practices.

1. Adjusting the Record for Refunds

When processing a refund, it’s important to update the original transaction documentation to reflect the change. This should include the amount refunded and the reason for the refund. Here are the key points to address:

- Refund Amount: Clearly state the amount refunded, whether it’s partial or full.

- Reason for Refund: Briefly describe the reason, such as “damaged product” or “customer returned item.”

- Payment Method: Include how the refund was issued (e.g., via PayPal, credit card, etc.).

- Refund Date: Mention the date the refund was processed to provide an accurate timeline.

2. Creating a Credit Note or Adjustment Document

If your system requires it, you may need to issue a separate credit note or adjustment document in addition to the refund details. This document should reference the original sale, indicate the amount refunded, and serve as an official record for the customer. This ensures that both parties have a formalized document for their records and can reconcile any discrepancies later if needed.

By accurately documenting refunds, you maintain clear financial records and help prevent future misunderstandings with your customers.

Benefits of Using Digital Invoices on Etsy

Switching to digital transaction records offers a range of advantages that streamline business operations and improve the overall customer experience. Digital formats not only simplify the process of creating and sending documents but also make them easier to manage, track, and store. By embracing electronic methods, sellers can save time, reduce errors, and enhance their business efficiency.

One of the key benefits is the ability to automate various aspects of record-keeping. With digital documents, you can quickly generate and send receipts, keeping the process smooth and efficient. Additionally, digital records are easily searchable and accessible, which makes finding specific transactions or customer details much quicker compared to traditional paper methods.

Moreover, digital records are environmentally friendly, reducing the need for printing and paper waste. This not only aligns with sustainable business practices but also helps reduce overhead costs related to materials and storage. Overall, using digital tools offers a more organized, cost-effective, and professional approach to managing sales and customer communications.

Understanding Tax Information on Etsy Invoices

When managing sales, understanding the tax components of a transaction is crucial for both compliance and transparency. Properly displaying tax-related details ensures that both sellers and buyers are clear on the amount of tax being charged and paid. In many regions, sales tax must be included in sales records, and having a clear breakdown on receipts helps avoid confusion and errors.

Tax information typically includes the total tax rate applied to the sale, the specific tax amount, and the tax jurisdiction where the goods are being sold. It is important to understand the local tax laws governing your sales to make sure that the correct rate is applied. For example, some regions require sellers to collect sales tax based on the buyer’s location, while others may have a flat rate for all transactions.

What Tax Information Should Be Included?

A comprehensive record should display:

- Tax Rate: The percentage of tax charged on the sale.

- Tax Amount: The exact value of tax added to the subtotal.

- Tax Jurisdiction: The region or authority to which the tax is being paid.

- Total Sales: The combined cost of goods sold, including taxes.

Having this information readily available not only ensures proper tax reporting but also makes the transaction process smoother and more transparent for customers. Understanding how to apply and document taxes correctly can help you maintain a compliant and well-organized business.