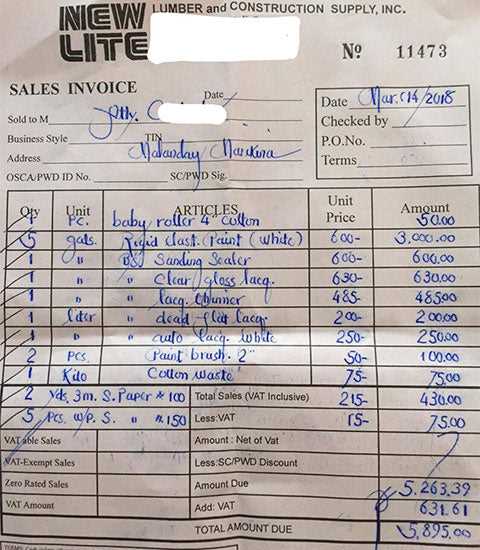

Handwritten Invoice Template for Simple and Professional Invoicing

When it comes to managing payments and tracking transactions, having a well-organized record system is crucial. A personal approach to generating billing documents can add a touch of professionalism while making it easier to maintain clarity in financial dealings. Whether you’re working for yourself or running a small business, understanding how to craft such documents by hand is a useful skill.

In this guide, we’ll explore how to design and customize your own billing records, ensuring they meet both practical needs and legal requirements. By following simple steps and incorporating essential details, you can create documents that reflect your unique style while remaining professional and clear. From adding specific charges to organizing payment terms, the possibilities are endless when you know the basics of creating these essential financial records.

Mastering this skill will not only streamline your administrative tasks but also give you more control over how transactions are recorded. Whether you’re just starting out or need a reliable method to create receipts on the go, this approach offers flexibility without the need for complex software or templates.

Handwritten Invoice Template Guide

Creating customized billing records by hand can be a simple and effective way to keep track of payments and transactions. This method not only adds a personal touch to your business but also provides flexibility when creating documents that suit your specific needs. In this section, we will guide you through the steps to design your own professional records without the use of automated tools or software. You’ll learn how to structure your documents, include all necessary details, and ensure they meet both functional and legal standards.

Key Elements to Include in Your Document

When crafting your billing documents, it’s important to ensure all the essential information is included. These records should contain the following details:

- Your business name and contact information

- Client’s name and contact details

- Unique reference number

- Description of goods or services provided

- Total amount due

- Payment terms and due date

Including these key elements ensures clarity and professionalism, while also helping to avoid misunderstandings regarding payments. The next step is to choose a layout that works best for your specific needs, whether you prefer a simple list format or something more detailed with sections for notes and additional information.

Formatting Tips for a Professional Look

To make sure your billing records look neat and professional, pay attention to the following formatting tips:

- Keep it clear and concise: Avoid unnecessary information and focus on the most important details.

- Use readable handwriting: Ensure that the text is legible, even if you are writing by hand.

- Organize information: Make use of lines, boxes, or bullet points to clearly separate sections.

- Be consistent: Use the same format for every document to create a sense of consistency.

By adhering to these formatting guidelines, you can produce well-organized records that convey professionalism and reliability to your clients. Even without relying on software, a clear and well-structured document will always stand out.

Why Use a Handwritten Invoice

In today’s digital age, relying on traditional methods for creating payment records might seem outdated, but it offers several unique advantages. Personalizing financial documents can make a stronger connection with clients and provide a more tailored approach to business transactions. While digital tools are convenient, handwritten records can enhance your business’s authenticity and add a level of trust that automated systems cannot always replicate.

Personal Touch and Client Relationships

One of the primary reasons for choosing this method is the personal touch it offers. When clients receive a document that has been carefully written by hand, it signals that you’ve put thought and effort into your business dealings. This can help strengthen your relationship with customers and give them the impression that you are more invested in the transaction. People tend to appreciate when a service provider takes time to provide something unique and customized, which can lead to better customer retention.

Cost-Effective and Flexible Solution

Another reason to opt for this approach is the simplicity and cost-effectiveness it offers, especially for small businesses or freelancers. There’s no need for expensive software or subscription services. All that’s required is a pen and paper, making this method accessible and easy to implement. Additionally, it allows for flexibility; you can adjust the format and content as needed without being confined to the limitations of pre-designed software or digital platforms.

In short, handwritten documents provide an opportunity for small businesses to stand out and build trust while maintaining simplicity and flexibility in their financial management process. This traditional method can often have a more significant impact on clients than one might expect, leading to greater satisfaction and loyalty.

Benefits of Personalized Invoices

Using customized payment documents offers several distinct advantages for both businesses and clients. Personalizing your records not only enhances the professionalism of your transactions but also allows you to tailor the document to better suit your brand and the unique needs of your customers. This approach can help create a lasting impression, improve communication, and streamline the entire billing process.

Building Stronger Client Relationships

One of the most significant benefits of customizing your billing documents is the opportunity to strengthen your relationship with clients. When customers receive a personalized document, it shows that you are paying attention to the details and care about their experience. This attention to detail helps foster trust and loyalty, as clients are more likely to appreciate the personal effort you put into the transaction. A well-designed, unique record can stand out and make your service feel more tailored and personal.

Improved Brand Identity and Recognition

Personalized documents also provide a chance to reinforce your brand identity. By incorporating your company’s logo, colors, and specific design elements, you create a cohesive experience that extends beyond just the product or service you’re providing. This consistency in presentation helps increase brand recognition and ensures that every interaction with your business is memorable. Clients may remember the effort you put into making each transaction professional and consistent, contributing to a stronger overall brand presence.

Overall, the advantages of using customized documents go beyond just the practical purpose of recording transactions. They contribute to building a professional image, fostering client trust, and creating a lasting impact on customers that digital methods often fail to achieve.

Creating Your First Handwritten Invoice

When you’re starting out in business or freelancing, crafting your own payment records can seem like a daunting task. However, it’s a straightforward process that can help you keep your financials organized while adding a personal touch. By following a few simple steps, you can create a document that is both functional and professional, ensuring that you track payments accurately and leave a positive impression on your clients.

Essential Information to Include

To begin, there are several key details that should always be included in your records. These elements are essential for ensuring clarity and legal compliance. Here’s a breakdown of the most important components:

| Element | Description |

|---|---|

| Business Information | Your business name, address, phone number, and email address. |

| Client Information | The name and contact details of the person or company receiving the services. |

| Unique Reference Number | A specific number for each record to track payments easily. |

| Items or Services Provided | A description of the products or services, along with the quantity and price. |

| Total Amount | The total cost including taxes, discounts, or any other applicable charges. |

| Due Date | The deadline for payment to be made. |

Designing Your Record for Clarity

After including the necessary information, focus on the overall design of your document. While it doesn’t need to be overly complicated, clear organization is key. Use lines, bullet points, or tables to break up sections and make the content easy to read. Ensure that each item is clearly separated, especially when listing services or charges, to avoid any confusion.

Once all the information is written and formatted, review your document to ensure there are no errors. Accuracy is crucial for both professionalism and legal compliance. Afterward, you’ll have a clear and organized record that you can present to your client.

Top Tools for Handwritten Invoices

While crafting personalized financial records by hand is often a straightforward process, having the right tools can make the job much easier and more professional. The materials you use can improve the quality, legibility, and overall appearance of your documents. Whether you’re working on a simple transaction or creating detailed billing records for multiple clients, the right tools will ensure that your work looks polished and organized.

Writing Instruments

The foundation of any handwritten document is, of course, the writing instrument. Selecting the right pen or marker is essential for achieving clear and legible text. Here are some popular options:

- Fountain Pens: Known for their smooth flow and elegant look, fountain pens are ideal for creating professional-looking records. They are perfect for those who want to add a personal touch.

- Ballpoint Pens: These pens are reliable and easy to use. Ballpoints provide consistent ink flow and are less likely to smudge, making them ideal for quick, everyday transactions.

- Gel Pens: Offering vibrant colors and smooth writing, gel pens can be great for emphasizing certain sections of your document, such as totals or due dates.

Paper and Stationery

The type of paper you use can make a significant difference in the overall look of your records. High-quality stationery can add a professional feel and prevent ink from bleeding through. Consider these options:

- Quality Paper: Choose thick, acid-free paper that resists bleeding and fading. This will ensure that your document lasts longer and maintains its readability over time.

- Pre-Printed Forms: If you want to save time and effort, pre-printed forms with a basic layout can be useful. You can customize them by filling in the details by hand, which ensures both efficiency and a personal touch.

Incorporating the right tools into your process not only enhances the final result but also speeds up the creation of each document. Whether you prefer using high-end pens or simply need practical paper for everyday use, these tools can help elevate your workflow while keeping your records neat and professional.

How to Design an Invoice by Hand

Designing a payment record manually allows you to have complete control over its appearance and structure. By creating a custom layout, you can ensure that the document reflects your business’s style while remaining clear and professional. Whether you’re crafting a simple receipt or a more detailed bill, the key is to balance legibility, organization, and aesthetics. Below are some practical tips to help you design your own payment document from scratch.

Choosing the Right Layout

The first step in designing your record is deciding on the layout. A clear structure makes it easier for both you and your client to read and understand the details. Start by dividing the page into distinct sections, such as contact information, item descriptions, and totals. You can use lines, boxes, or grids to separate these sections, which will create a clean and organized look. Keep the design simple and avoid overcrowding the page with unnecessary details.

Adding Essential Information

Next, you need to ensure that the key elements are present on your document. These details are vital for both clarity and legal purposes. Here are the basic sections to include:

- Header: Include your business name and contact information at the top of the page. This makes it easy for clients to reach out if they have questions or concerns.

- Client Information: Clearly list the client’s name, address, and contact details below the header.

- Description of Goods/Services: Provide a detailed breakdown of the products or services provided, including the quantity and price for each item.

- Total Amount: Clearly display the total amount due, along with any applicable taxes or discounts.

- Payment Terms: Specify the due date and any payment instructions or terms, such as late fees or acceptable methods of payment.

By organizing your record in a logical way, you make it easier for clients to understand the details of the transaction, and you demonstrate professionalism. Once all the necessary components are in place, you can focus on the final touches that make the document feel unique and polished.

Essential Elements of an Invoice

Creating an effective payment document requires including all the necessary details to ensure that both the business and the client have a clear understanding of the transaction. A well-structured document not only helps in maintaining accurate records but also ensures that payments are processed smoothly. Below, we outline the key elements that every document should have to be both professional and functional.

Key Information to Include

The following elements are essential for creating a complete and organized record. Each piece of information plays an important role in ensuring clarity and compliance:

- Business Information: Always include your business name, address, phone number, and email at the top of the document. This makes it easy for clients to contact you if needed.

- Client Information: Include the full name, address, and contact details of the customer receiving the goods or services.

- Unique Reference Number: Assign a unique number to each document to help keep track of records and payments. This number helps both parties easily reference the transaction.

- Description of Products/Services: List the items or services provided, including a detailed description, quantity, unit price, and total cost for each item.

- Total Amount Due: Clearly state the total amount due for the transaction, including any applicable taxes, discounts, or extra charges.

- Payment Terms: Include the payment due date and specify any terms such as early payment discounts or late fees. Be clear about the acceptable methods of payment.

- Notes or Additional Information: If applicable, leave space for any additional notes, such as thank-you messages or instructions for the client.

Formatting for Clarity and Organization

To ensure that your document is easily understood, it’s important to format the information logically and clearly. Use clear headings, bullet points, and lines to separate sections. This helps clients quickly locate the most relevant information. For example, the payment due date should be prominently displayed, and itemized charges should be organized in a list or table format.

- Headings: Use bold or underlined headings to separate each section, making it easy to navigate.

- Tables: Use tables to display item descriptions, quantities, and prices clearly. This makes it easier for clients to check the details of the transaction.

- Legible Handwriting: If writing by hand, ensure that your writing is clear and easy to read. This is essential to avoid any confusion or misunderstandings.

Including these essential elements will ensure that your document is professional, clear, and effective in facilitating smooth transactions. Whether you’re working with digital tools or traditional methods, organizing the content in a logical and easy-to-read manner will help maintain a positive relationship with your clients and ensure timely payments.

Handwritten vs. Digital Invoices

When it comes to creating payment records, businesses have the option of choosing between traditional manual methods or more modern, digital approaches. Each method has its own set of advantages and challenges, and the choice often depends on the specific needs of the business and the preferences of both the service provider and the client. Understanding the differences between these two approaches can help you decide which is the best fit for your operations.

On one hand, traditional manual records offer a personal touch, flexibility, and simplicity. They don’t require any special tools or software, making them accessible for those who may not have access to technology. However, they can be time-consuming, prone to errors, and difficult to store or retrieve for future reference.

On the other hand, digital tools offer efficiency, accuracy, and convenience. They allow for quick customization, automatic calculations, and easy tracking and storing of records. With the right software, businesses can also integrate these documents with other financial tools, such as accounting software or payment gateways. The downside is that they often require a computer or mobile device, and there may be a learning curve for those unfamiliar with digital systems.

Ultimately, the choice between manual and digital records comes down to factors like business size, volume of transactions, and personal preferences. Both approaches can work effectively when used correctly, but understanding the pros and cons of each will help you make an informed decision that aligns with your goals and workflow.

Common Mistakes to Avoid in Invoices

Creating a well-structured and accurate payment record is essential for maintaining clear financial communication between businesses and clients. However, there are several common mistakes that can lead to confusion, delays, or even legal issues. These errors can be easily avoided with attention to detail and proper organization. Below, we highlight the most frequent mistakes made when preparing payment documents and how to prevent them.

Key Errors to Watch Out For

Understanding these common pitfalls can help ensure that your records are professional, accurate, and legally compliant:

| Common Mistake | Explanation | How to Avoid |

|---|---|---|

| Missing or Incorrect Client Information | Failure to include the correct client name or contact details can lead to confusion and delays in payment. | Always double-check the client’s information before finalizing the document. |

| Unclear or Incomplete Item Descriptions | Vague or incomplete descriptions of products or services can lead to misunderstandings about what is being billed. | Provide clear, detailed descriptions, including quantities and prices for each item or service. |

| Incorrect Calculations | Errors in the calculation of totals, taxes, or discounts can cause confusion and delays in payment processing. | Double-check all calculations and consider using a calculator to verify accuracy. |

| Lack of a Unique Reference Number | Without a unique reference number, it can be difficult to track and manage payments, especially for larger businesses. | Assign a unique number to each document to ensure easy tracking and reference. |

| Forgetting Payment Terms | Not specifying payment terms, such as due dates or late fees, can lead to delays and disputes. | Clearly state the payment due date and any applicable terms or late fees on every document. |

By paying close attention to these details, you can avoid the most common mistakes and ensure that your records are clear, professional, and effective in facilitating smooth transactions. Taking the time to carefully check each aspect of your document helps to establish trust with clients and reduces the risk of misunderstandings down the line.

How to Organize Your Invoices

Efficiently managing your payment records is essential for staying on top of your financials and ensuring smooth transactions with clients. An organized system not only helps you keep track of what’s owed but also makes it easier to follow up on overdue payments and maintain accurate accounting. Below are some strategies to help you stay organized and ensure your records are always easy to access and understand.

Creating a Consistent Filing System

The first step to organizing your payment documents is setting up a consistent filing system. Whether you’re working with physical documents or digital files, having a clear method for storing and categorizing your records is key. Here are some tips to consider:

- Use a Folder System: For physical records, use a folder or binder to store your payment documents. Organize them by date, client, or project to make it easier to find the right one when needed.

- Digital File Organization: If you’re using digital records, create folders on your computer or cloud storage to categorize them by month, client, or service type. Make sure to use clear file names that include the client name and date for easy identification.

- Separate Paid and Unpaid Records: Clearly separate records that have been paid from those that are still pending. This will help you quickly identify which payments need to be followed up on.

Tracking and Managing Your Records

In addition to organizing your documents, it’s important to have a system for tracking payments and due dates. This helps you stay on top of what’s been paid and what’s still outstanding. Consider these methods:

- Spreadsheet Tracking: Use a spreadsheet to track all your transactions. Include columns for client name, service description, amount due, payment received, and due date. This will allow you to easily track your income and spot any overdue payments.

- Set Reminders: If you’re using digital tools, set reminders or alerts for due dates. This ensures you don’t miss any deadlines and can follow up promptly if necessary.

- Use Accounting Software: For more advanced tracking, consider

How to Organize Your Invoices

Efficiently managing your payment records is essential for staying on top of your financials and ensuring smooth transactions with clients. An organized system not only helps you keep track of what’s owed but also makes it easier to follow up on overdue payments and maintain accurate accounting. Below are some strategies to help you stay organized and ensure your records are always easy to access and understand.

Creating a Consistent Filing System

The first step to organizing your payment documents is setting up a consistent filing system. Whether you’re working with physical documents or digital files, having a clear method for storing and categorizing your records is key. Here are some tips to consider:

- Use a Folder System: For physical records, use a folder or binder to store your payment documents. Organize them by date, client, or project to make it easier to find the right one when needed.

- Digital File Organization: If you’re using digital records, create folders on your computer or cloud storage to categorize them by month, client, or service type. Make sure to use clear file names that include the client name and date for easy identification.

- Separate Paid and Unpaid Records: Clearly separate records that have been paid from those that are still pending. This will help you quickly identify which payments need to be followed up on.

Tracking and Managing Your Records

In addition to organizing your documents, it’s important to have a system for tracking payments and due dates. This helps you stay on top of what’s been paid and what’s still outstanding. Consider these methods:

- Spreadsheet Tracking: Use a spreadsheet to track all your transactions. Include columns for client name, service description, amount due, payment received, and due date. This will allow you to easily track your income and spot any overdue payments.

- Set Reminders: If you’re using digital tools, set reminders or alerts for due dates. This ensures you don’t miss any deadlines and can follow up promptly if necessary.

- Use Accounting Software: For more advanced tracking, consider using accounting software that can automatically track payments, generate reports, and send reminders to clients.

By implementing a clear and consistent system for organizing and tracking your payment records, you can ensure that all transactions are handled smoothly and efficiently. Whether you choose physical filing, digital organization, or a combination of both, staying organized is key to maintaining accurate financial records and ensuring that you get paid on time.

How to Add Discounts and Taxes

Including discounts and taxes in your payment records is essential for providing accurate pricing and ensuring that both you and your clients have a clear understanding of the final amount due. Whether you’re offering special promotions, calculating sales tax, or factoring in service fees, it’s important to structure these elements clearly and logically. Below are some practical guidelines on how to properly add discounts and taxes to your documents.

Applying Discounts

Discounts can be applied in various ways, depending on the terms of your business or promotion. Offering a discount is a great way to incentivize clients to pay early or encourage larger orders. Here’s how to structure discounts correctly:

- Percentage Discount: Calculate the discount based on a percentage of the total amount before tax. For example, a 10% discount on a $100 item would be $10, reducing the total price to $90.

- Fixed Amount Discount: Subtract a specific dollar amount from the total, such as offering $20 off an order of $200. This type of discount is straightforward and easy for clients to understand.

- Conditional Discounts: Some discounts may be offered based on conditions, such as a “buy one, get one free” offer or discounts for early payment. Be sure to clearly state the conditions on the document.

Calculating and Adding Taxes

Taxes are often a necessary component in payment records, and it’s essential to ensure they are correctly calculated and displayed. The approach can vary depending on the location and tax laws. Here’s how to handle tax calculations:

- Determine the Tax Rate: Find out the tax rate applicable in your area or for your specific industry. This can vary by state, country, or product type, so it’s important to be familiar with the relevant tax laws.

- Calculate the Tax Amount: Multiply the taxable amount by the tax rate. For example, if the taxable total is $100 and the tax rate is 8%, the tax would be $8, making the total due $108.

- Apply the Tax to the Total: Ensure that the tax is clearly displayed as a separate line item, showing both the rate applied and the total tax amount. This helps to keep the calculation transparent for your client.

By clearly indicating the discounts and taxes on your payment record, you ensure transparency and accuracy. This not only helps in maintaining trust with clients but also ensures compliance with local tax regulations. Always double-check your calculations to avoid errors and make su

Legal Requirements for Invoices

When creating a payment document, it’s important to ensure that it meets legal requirements. Depending on your location, specific regulations may dictate what information must be included to make the document valid and enforceable. Failure to comply with these legal standards could lead to complications with tax authorities, delayed payments, or disputes with clients. Below, we outline the key legal elements that should always be included in your documents to ensure compliance.

Required Information for Legal Compliance

Each payment document should include certain key pieces of information to comply with local laws. This ensures the document is both legally sound and easily understood by all parties involved. Here are the main components to include:

Required Element Explanation Unique Reference Number A unique identifier for each document is essential for record-keeping and tracking payments. This number helps both parties reference the transaction. Date of Issue The date when the document was created or issued. This helps to establish the timeline for payment terms and due dates. Seller’s Information The business name, address, and contact details of the seller. This ensures that the client can easily reach the business in case of questions or disputes. Buyer’s Information The name and contact details of the buyer or client. This ensures there is a clear record of who is responsible for the payment. Tax Information If applicable, the document must include tax details, such as the tax rate applied, the total tax amount, and the registration number for VAT or sales tax. Description of Goods/Services A clear breakdown of the products or services provided, including quantities and prices. This provides transparency and prevents misunderstandings. Payment Terms Specific terms about payment due dates, discounts, late fees, and methods of payment are essential for clarity and compliance. How to Format Your Invoice Properly

Proper formatting is crucial when creating a payment document to ensure clarity, professionalism, and efficiency. A well-structured document not only makes it easier for your client to understand the details of the transaction but also helps in maintaining organized records for your own business purposes. Below are some key formatting tips to ensure that your document is clear, professional, and compliant with best practices.

Key Formatting Tips

When preparing your document, pay attention to both the layout and the specific information included. Here are some essential formatting tips to consider:

- Clear and Readable Fonts: Use a simple, professional font such as Arial or Times New Roman in a readable size (usually between 10-12 pt). Avoid overly stylized fonts that may reduce legibility.

- Consistent Margins: Ensure that there is adequate space around the edges of the document. Standard margins of 1 inch on all sides are typically recommended for a clean look.

- Logical Flow: Arrange the sections in a logical order: business information at the top, followed by client information, details of products/services, and payment terms at the end.

- Use of Headings: Use bold headings to separate sections, making the document easier to navigate. For example, label sections like “Client Details,” “Product/Service Breakdown,” and “Total Amount Due.”

- Line Spacing: Use appropriate spacing between different sections to avoid clutter. For example, leave a space between the item list and the totals to ensure everything is easy to read.

Key Information to Include

The content of your document should be formatted in a way that allows both you and the client to easily identify the critical information. Ensure that the following items are clearly presented:

- Header with Your Business Name: At the top of the document, include your business name, logo (if applicable), and contact details. This sets the tone for professionalism.

- Client Information: Directly below your business information, clearly list the name, address, and contact information of the client or company being billed.

- Detailed Description of Products/Services: For each item or service, list a detailed description, including quantities, unit prices, and total amounts. Make sure the information is aligned properly for easy reading.

- Payment Due Date: Clearly indicate the due date for payment. This should be easy to find, often placed towards the bottom, near the total amount due.

- Clear Total Calculation: Break down the total into individual components (e.g., subtotal, taxes, discounts) so the client can see how the final amount was calculated. The total due should be highlighted or bolded for emphasis.

Formatting your document properly ensures that the information is easily digestible, which can help avoid confusion and disputes. By maintaining a clean, professional layout, you enhance the client’s experience and build trust in your business practices.

Handwritten Invoice Templates for Small Business

For small business owners, creating clear and professional records for transactions is essential. While many rely on digital tools, there is still value in crafting a personalized, manually created record for certain situations. Whether you’re working with clients locally, managing a small shop, or handling freelance projects, having a simple and functional structure to record payments is crucial. This section explores how small businesses can effectively use handwritten documents to manage billing and ensure a smooth transaction process.

Why Use Manual Payment Records for Small Businesses

Manual payment documents offer a more personal touch and are often more accessible in situations where digital tools are not an option. For small businesses, using these can be a cost-effective and straightforward solution to keep track of sales and payments. Below are some reasons why small businesses might prefer this method:

- Cost-Effective: There’s no need for subscription-based software or fancy tools. A pen and paper or a basic word processor are all that’s needed to create a clear document.

- Quick and Easy: When dealing with local transactions or immediate payments, handwritten records can be created on the spot without waiting for software to load or templates to be filled out.

- Personalized Communication: Writing a record by hand can feel more personal, which helps build a stronger relationship with clients who appreciate the human touch.

- Simple Record Keeping: Handwritten records allow for immediate updates and don’t require technology, making them easy to manage in environments with limited access to digital devices.

How to Create an Effective Record for Your Small Business

Creating a clear and easy-to-read document for your small business doesn’t have to be complicated. Here’s a step-by-step guide to ensure you include the right information:

- Include Business Information: Start with your name, address, and contact information. This ensures the client knows who they’re dealing with and can easily reach out if needed.

- Detail Client Information: Include the client’s name and contact details to ensure clarity in communication. Make sure you have the correct spelling and details to avoid confusion.

- List Products/Services Provided: Clearly itemize what was sold or provided, along with quantities, unit prices, and total amounts. This transparency will help prevent any misunderstandings.

- Show Payment Terms: Include the due date and any payment conditions, such as early payment discounts or late fees, if applicable.

- Highlight Total Amount: Clearly display the total due, ensuring it stands out from the rest of the information. This will help the client quickly understand the amount they owe.

Using handwritten records for billing may seem old-fashioned, but it can be a very practical solution for small business owners who want simplicity and control over their transaction process. As long as the document is clear, complete, and accurate, it can serve as an effective way to manage your sales and maintain a professional image with your clients.

Best Practices for Invoice Delivery

Delivering a payment record in the right way is just as important as creating it. How you send the document can affect payment speed, client relationships, and even your business’s reputation. Whether you are sending it in person, by mail, or digitally, it’s essential to follow best practices to ensure that your documents are received in a timely, professional manner and that all necessary information is clear. Below are some tips to consider for effective delivery.

Choosing the Right Delivery Method

The delivery method you choose should depend on your client’s preferences, the urgency of the payment, and the nature of your business. Each option has its pros and cons, and knowing which one to use can help streamline the process.

- In-Person Delivery: When working with local clients or small transactions, handing over a payment document in person is a personal touch that may build stronger client relationships. It can also ensure that the document is received immediately.

- Email Delivery: For clients who are comfortable with technology, sending the document via email is fast, secure, and efficient. Ensure that the file is properly formatted and attached as a PDF or another universally accessible format.

- Postal Mail: If you deal with clients who prefer physical copies or if digital delivery isn’t an option, mailing the document is a good alternative. Always use tracked mail services to ensure the document arrives safely.

Essential Tips for Professional Delivery

Regardless of how you deliver your payment record, there are several essential practices to follow to ensure professionalism and minimize confusion:

- Be Timely: Send the document as soon as the transaction is complete. Timely delivery ensures that the client has enough time to process the payment and prevents delays in receiving funds.

- Provide Clear Instructions: Whether you’re sending the document digitally or by mail, include clear payment instructions and due dates. Make sure the client knows exactly how to make a payment and any conditions (e.g., late fees or discounts for early payment).

- Follow Up: After sending the document, follow up with the client to confirm receipt. This can be done vi